Senator Elizabeth Warren Turns Back On Consumers To Become Pawn Of Corrupt Banksters #GotBitcoin #BitcoinFixesThis

Sen. Warren, 100+ Legislators Write White House, Treasury About Crypto And Terrorism. Senator Elizabeth Warren Turns Back On Consumers To Become Pawn Of Corrupt Banksters #GotBitcoin #BitcoinFixesThis

Related:

Your Guide To Understanding The Roots Of The Israel-Hamas War And Bitcoins Humanitarian Role

Ultimate Resource For Money Laundering, Spoofing, Market-Rigging, Etc. In Banking Industry

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

Ultimate Resource On Insider Trading

Track US Politicians Stock Trades

The letter was signed by crypto opponents and many lawmakers who had been neutral on crypto until now.

Senator Elizabeth Warren was the lead author of a letter signed by 28 other senators and 76 members of the House of Representatives about the role of cryptocurrency in financing terrorism. Signers came from both parties and included one independent, although Democrats predominate.

The letter, dated Oct. 17, was addressed to Treasury Under Secretary for Terrorism and Financial Intelligence Brian Nelson and National Security Advisor Jake Sullivan.

The authors cited a news article that claimed Hamas and the Palestinian Islamic Jihad raised over $130 million in crypto donations between August 2021 and June 2023, and very little of the donated money had been recovered. The letter said:

“That the deadly attack by Hamas on Israeli civilians comes as the group has become ‘one of the most sophisticated crypto users in the terror-finance domain’ clarifies the national security threat crypto poses to the U.S., and our allies.”

It continued: “As Congress considers legislative proposals designed to mitigate crypto money laundering and illicit finance risks, we urge you to swiftly and categorically act to meaningfully curtail illicit crypto activity.”

It then posed nine questions to the addressees, asking about the information the administration of President Joe Biden has about the funders of terrorism, what is being done about the use of crypto to finance terrorism, and what other resources the administration needs.

Warren is one of the most prominent crypto opponents in the U.S. Congress. She introduced the Digital Asset Anti-Money Laundering Act in December and reintroduced it in the current Congress. The bill was picking up support before the beginning of the conflict between Israel and Hamas, but the current hostilities have gained her allies.

“US Treasury sanctions Gaza-based crypto operator allegedly tied to Hamas. Find out how terrorist organizations used Buy Cash Money for fund transfers. Stay informed and read more on Cointelegraph: https://t.co/j1IhVDNU3o #DYOR @HRM69INU”

— Blackhat ™ (@blackhat_TM) October 18, 2023

The letter has signatures from other active anti-crypto legislators, such as Roger Marshall and Sean Casten. Senate Banking Committee Chair Sherrod Brown, who has called for crypto regulation but did not support Warren’s bill, also signed the letter.

Crypto advocates Cynthia Lummis, Kirsten Gillibrand and Patrick McHenry did not sign the letter, but many signers had no prior record on crypto. Signers Jake Auchincloss and Josh Gottheimer had previous pro-crypto voting records.

The Treasury Department released Nelson’s remarks prepared for a Deloitte Anti-Money Laundering conference on Oct. 17. Nelson said Hamas was “uniquely resourced” and “possesses well-honed methods of surreptitiously accessing the formal financial system.” Nelson referred to secret financial portfolios, shell companies, fake philanthropies and racketeering. In addition:

“We are closely monitoring how Hamas and Palestinian Islamic Jihad (PIJ) use virtual assets to raise and move funds […] and Treasury will continue to establish transparency in the virtual asset ecosystem in order to combat illicit activity by criminals, rogue states, and terrorist financiers.”

In addition, the Treasury’s Office of Foreign Assets Control announced sanctions against a “Gaza-based virtual currency exchange and its operator,” along with a number of other Hamas collaborators on Oct. 18.

Updated: 7-10-2023

Wall Street Banks Face $8 Billion In Municipal Bond Price-Fixing Claims

* BofA, JPMorgan, Citigroup Among Banks Named In Lawsuits

* Banks May Settle FCA Suits For About $1.5 Billion, BI’s Stein

After almost a decade and untold millions of dollars in legal fees, some of Wall Street’s biggest banks will finally get their day in court on allegations of price-fixing in the municipal bond market — that is if they don’t settle first.

Bank of America, Barclays Capital Inc., BMO Financial Corp., William Blair & Co. LLC, Citigroup Inc., Fifth Third Bancorp, JP Morgan Chase & Co. and Morgan Stanley are expected to go to trial in Illinois next month to face allegations they inflated interest rates on bonds to finance public works to discourage investors from returning them for cash and colluded in setting the rates.

It Is The First

of four such cases originally filed under seal in 2014 by a Minnesota financial adviser, B.J. Rosenberg, saying that the banks caused a collective $1.5 billion in damages and seeking restitution for triple that amount.

Another $6.5 billion in damages hangs in the balance in antitrust litigation in New York.

A dozen banks are defendants across the four lawsuits which also span California, New York and New Jersey. The lawsuits allege that from 2008 until relatively recently the banks — acting as remarketing agents for long-term bonds with periodic rate adjustments, called variable-rate demand obligations or VRDOs — failed to get issuers the lowest possible interest rates on securities where rates were typically reset on a daily or weekly basis to discourage investors from returning them for cash.

After a preliminary hearing on July 12, the Illinois trial filed on behalf of the state by an entity called Edelweiss Fund LLC is scheduled to begin in Cook County Circuit Court on Aug. 7.

A settlement is likely, according to Elliott Stein, a senior litigation analyst with Bloomberg Intelligence.

“One critical reason to settle is that potential damages in these cases can be tripled, so settling can mitigate the potential fallout,” said Stein in an email Friday. “Settling can also avoid bad evidence coming out or a bad outcome, which could potentially then be used in the other related cases.”

Settlement of the four False Claims Act cases could run to about $1.5 billion, Stein estimated. Barclays and Citigroup declined to comment; the other banks haven’t responded to requests for comment.

In their most recent motion for summary judgment, the banks said they exercised their judgment in setting rates for VRDOs, and that “cannot be second guessed; it is ‘conclusive’ and ‘binding.’”

They also said that since the lawsuit was unsealed in 2017, issuers “have continued to pay Defendants to perform the very remarketing services attacked” under the lawsuit with no evidence suggesting issuers are conditioning payment on any specific interest-rate standards.

In addition to the four False Claims Act lawsuits, an antitrust lawsuit was filed by Philadelphia and Baltimore in 2019 in the Southern District of New York, also alleging manipulation of VRDO rates.

The New York suit is likely to produce claims of $6.5 billion in damages with compensation sought again tripling, according to BI’s Stein.

He expects a settlement of about $1 billion, with Bank of America on the hook for the most — about $225 million.

The market for VRDO debt has been shrinking since the financial crisis when in 2008 more than $115 billion of debt was sold to refinance both auction-rate and insured floating-rate debt, as the auction market froze and insurance companies were downgraded amid the chaos.

In the early years of this century, issuers sold between $30 billion and $60 billion of VRDO debt annually. In 2022, they sold around $6 billion in such debt, according to data compiled by Bloomberg.

So far this year, issuers have sold $4.2 billion. There are currently around $128 billion in VRDOs outstanding.

Updated: 8-3-2023

Buffett-Backed Nubank (Popular Among The Country’s Bitcoin Investors) Bets On Mexico For ‘Pivotal’ Growth

* Nu Expects Growth To Jump Due To High-Yield Savings Accounts

* Focus On Building Up In Mexico, Colombia In Line With Brazil

Nu Holdings Ltd., the Brazilian digital bank that counts Warren Buffett’s Berkshire Hathaway Inc. among its biggest stockholders, is betting big that its high-yield savings accounts will stoke growth in Latin America’s second-largest economy.

Within a month of launching the product, the company had 1 million customers enrolled in its “Cuenta Nu” accounts and expects the product to be “pivotal for the growth in the number of customers,” said Ivan Canales, head of Mexico for Nubank.

Overall, the company has hit 3.2 million customers nationwide with minimal marketing expenditures, he added, with two thirds of new accounts in Mexico coming through customer referrals.

Nubank, as the company is known, has invested $1.3 billion in its operations in Mexico while still holding $2.4 billion in excess cash at the end of the first quarter. In keeping with its burgeoning

operation in Mexico, the company on Thursday opened its new country headquarters in the affluent Polanco neighborhood, complete with perks like a health center, rooftop lounge and foot massage machine.

Nubank works in a hybrid modality, with teams asked to attend only one week of every eight.

The company plans to first boost the number of customers in Mexico and later seek to increase revenue per customer. Nu is working to adapt its Brazil product offerings to the Mexican market, added Cristina Junqueira, the company’s co-founder and chief growth officer, in an interview at the new office.

“Investors are valuing many avenues of growth, one of them is growing customers, and in Mexico we’re still in the very beginning,” she said. “We just reached 80 million users in Brazil, one of two adults.

There’s nothing stopping us from getting to those levels here in Mexico, too.”

In Mexico, the unit economics are different from those in Brazil, as people don’t pay the full amount on their credit cards at the end of the month and that leads to a lot more revenue from interest, Canales added.

Updated: 10-2-2023

Rising Rates Likely Hit Bank Balance Sheets In Quarter

Lenders need to pay up to keep depositors, pressuring earnings.

A surge in interest rates likely worsened unrealized losses on bonds and loans held by U.S. banks in the third quarter, further straining their balance sheets as they face pressure to pay more to keep depositors.

Unrealized losses were a key cause of Silicon Valley Bank’s failure in March, which spurred other bank runs. That risk has ebbed.

Total deposits at U.S. commercial banks were little-changed since the end of the second quarter, according to the Federal Reserve’s latest data, although they are down 5% since their peak level in April 2022.

The higher rates are due to a robust economy, calm in the banking system and, more recently, signals by the Fed that it will likely keep rates higher for longer.

That has led to earnings pressure for many banks, now paying higher rates on deposits and other funding sources while the returns on their older, fixed-rate assets stay low. Banks are lending more at the current high rates, potentially easing that strain.

Importantly, however, the industry has stanched deposit outflows for now. “I expect unrealized losses to increase,” said Alexander Yokum, a banking analyst at the investment-research firm CFRA. “For us, solvency issues are less of a concern, but the amount of profitability is a concern.”

Yields rose dramatically in the third quarter, especially for long-dated bonds. Yields on 10-year Treasurys rose three-quarters of a percentage point to 4.57%.

Higher yields cause debt prices to fall, reducing the value of trillions of dollars in fixed-rate bonds and loans that banks hold, regardless of whether they intend to sell the assets.

In some cases, the losses were equal to or greater than banks’ equity, or the buffer they hold to absorb such hits. That led to a crisis that brought down three regional banks earlier this year.

The ensuing volatility gave banks some relief: Investors seeking safety bought Treasury debt, lowering benchmark yields and helping raise prices across debt markets, including those for banks’ fixed-rate assets.

Since then, rates have rebounded as the panic subsided. Growth in emergency borrowing has slowed under the Fed’s Bank Term Funding Program, created after Silicon Valley Bank collapsed in March to help banks with short-term liquidity needs.

The program had $103 billion of loans outstanding at midyear, but is up only slightly since then to about $108 billion. Such loans, now at a fixed rate of 5.54%, must be repaid within a year and are considered a relatively expensive source of liquidity.

U.S. banks’ unrealized losses on investment securities were $558 billion as of June 30, according to the Federal Deposit Insurance Corp. The unrealized losses were up from $516 billion three months earlier, but down from their peak of $690 billion at the end of last year’s third quarter.

More than half of such losses each quarter were on bonds classified as “held-to-maturity,” and so not included on banks’ balance sheets under the accounting rules. At the end of 2021, unrealized losses were negligible systemwide.

Part of the reason unrealized losses were down from last year is that banks have reduced their bondholdings, often letting them roll off as they mature without reinvesting the proceeds into new debt securities.

Banks’ bondholdings as of June 30 were down 12% from a year earlier, according to FDIC data.

In some instances, banks have elected to crystallize their losses by selling bonds below cost and taking the hit before matters got worse. On Friday, Royal Bank of Canada said its Los Angeles-based unit, City National Bank, would recognize realized losses in the third quarter after selling certain debt securities to another part of RBC.

In addition, RBC said it had injected fresh capital into City National Bank. RBC didn’t say how large the losses or the capital injection were, but that the losses would be eliminated at the RBC consolidated level.

It said City National reinvested most of the sale proceeds in new, higher-yielding securities.

The FDIC doesn’t publish fair-value data for loans, and only banks that are publicly traded are required to report such data. For the current 24 members of the KBW Bank Index, unrealized losses on loans were $143 billion as of June 30, up from $120 billion a quarter earlier, but down from $153 billion at year-end, according to a Wall Street Journal review of their filings.

Before this year’s bank failures, the index had included Silicon Valley Bank, Signature Bank and First Republic, which have been replaced in the index by Goldman Sachs, Morgan Stanley and First Horizon.

Updated: 10-19-2023

Hamas Crypto Funding Likely ‘Overstated’ – Chainalysis

Reports of many millions going to Hamas and other groups are based on faulty analysis, the forensics firm said.

Reports of tens of millions of dollars in crypto going to fund Palestinian operations in Israel are likely “overstated,” Chainalysis said. The forensics outfit published a blog post arguing that flows of crypto financing to Hamas and affiliated groups have become inflated far beyond reality.

While acknowledging that it was crucial to stop any financing of terror through crypto, Chainalysis said it was also important to understand how such funding actually works, lest it lead to misconceptions.

We have “seen overstated metrics and flawed analyses of these terrorist groups’ use of cryptocurrency, and feel compelled to address some misconceptions,” the company said.

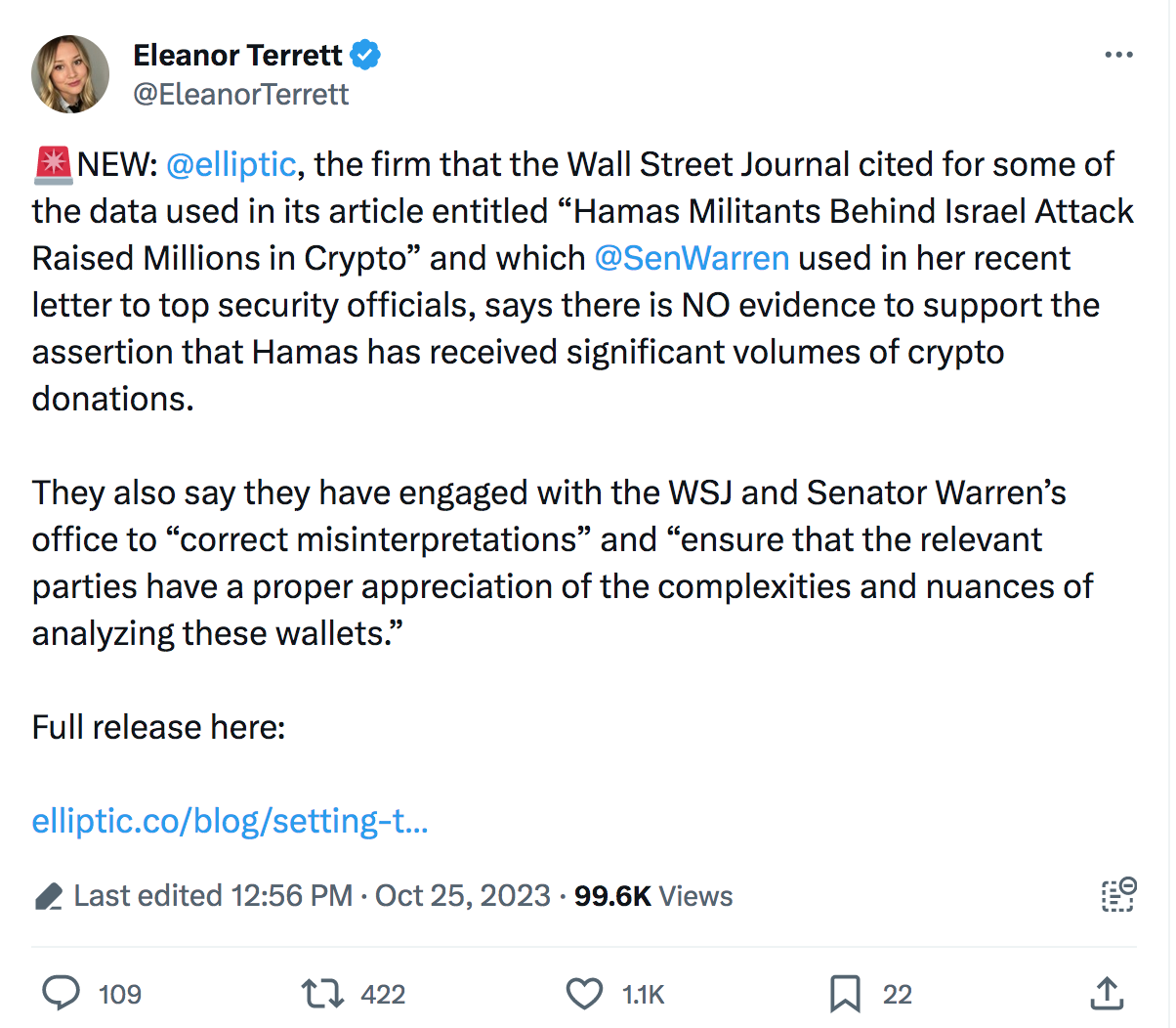

Last week, the Wall Street Journal reported that Palestinian Islamic Jihad received $93 million in crypto between August 2021 and June 2023 and that Hamas received about $41 million in the same timeframe. The report was partly based on data analysis from Elliptic, a Chainalysis competitor.

Critics of the WSJ report said the headline – “Hamas Militants Behind Israel Attack Raised Millions in Crypto” – suggested that crypto was funding the Palestinian operation directly, when it was not clear whether the flows were actually reaching terrorists.

They also noted that crypto financing, while important to stop, was small compared to state-funded support (particularly from Iran).

Hamas announced in April that it was suspending crypto fundraising because it put its collaborators at risk of capture or worse. Chainalysis states that the transparency of blockchains is bad for actors trying to operate in the shadows.

“Given blockchain technology’s inherent transparency and the often public nature of terrorism financing campaigns, cryptocurrency is not an effective solution to finance terrorism at scale.”

“It’s possible that no one understands the challenges of using cryptocurrency for fundraising better than Hamas,” the company added.

Aside from the immediate question of whether crypto is financing Hamas, it’s relevant for a live policy debate about controls the U.S. might employ around money laundering. Senators Elizabeth Warren (D-MA) and Roger Marshall (R-KS) cited the WSJ’s reporting on Hamas financing in an op-ed for the same outlet Oct. 18.

Chainalysis said the “inflated” estimates cited by the WSJ likely count all flows going to service providers suspected of involvement in terror financing. But that’s not evidence that the funds actually reached wallets controlled by terrorists.

“We have seen recent estimates related to the attacks on Israel that appear to include all flows to certain service providers that received some funds associated with terrorism financing.

In other words, those totals include funds not explicitly related to terrorism financing,” it wrote.

Chainalysis added that it’s working to produce what it thinks are more accurate estimates for crypto flows to groups behind the Israel attack.

Updated: 10-24-2023

Elizabeth Warren Uses Hamas As Her Newest Scapegoat In War On Crypto

Massachusetts Senator Elizabeth Warren is taking advantage of sensationalist claims related to Hamas’ use of crypto. Unfortunately, those claims are largely false.

Massachusetts Senator Elizabeth Warren is at it again. With mainstream press outlets, including Germany’s Deutsche Welle, running sensationalist headlines — “How cryptocurrency fueled Hamas’ terrorist attack” — Warren is using Hamas’ attack on Israel to fuel her own war on cryptocurrency.

Cryptocurrency’s role in the conflict came into focus on Oct. 10, when Israeli police froze crypto accounts used for donations to Hamas. It was not the first time. In 2021, Israel’s Terror Financing of Israel (NBCTF) seized crypto wallets linked to a Hamas fundraising campaign.

While Binance worked “closely with international counter-terrorism authorities” on the seizures, Warren led a group of more than 100 United States lawmakers in sending the Biden administration a letter asking it to crack down on Hamas and its affiliates’ cryptocurrency wallets — despite the organization’s relative struggle to raise crypto as part of its fundraising efforts.

“Congress and this administration must take strong action to thoroughly address crypto illicit finance risks before it can be used to finance another tragedy,” the letter said.

Hamas raised millions via crypto in the months leading up to their attack on Israel. @RogerMarshallMD, @RepCasten and I are leading 100+ lawmakers urging the Biden admin to address crypto-financed terrorism.https://t.co/JksREJ3Dgs

— Elizabeth Warren (@SenWarren) October 18, 2023

The lawmakers requested that the Biden administration also provide estimates on the value of crypto assets that remain in Hamas-controlled wallets, how much of Hamas’ operations are funded through crypto, and any information it has on the actors facilitating the sending of crypto to and from Hamas and other militant groups.

The U.S. Treasury Department sanctioned Gaza-based crypto broker “Buy Cash Money and Money Transfer Company (Buy Cash)” on Oct. 18, revealing it had been used for a whopping $2,000 Bitcoin transaction — a paltry sum compared to the hundreds of millions of dollars used to fund Hamas. One sanctioned wallet had $16 in it.

The treasury department has sanctioned a Hamas-linked wallet as Politico reports that “Crypto’s role in financing Hamas’ activity has emerged as a hot issue for lawmakers”

The sanctioned wallet has $16 in it and made its last transfer 18 months ago pic.twitter.com/IbsGfyZ3zl

— Conor (@jconorgrogan) October 18, 2023

“We will continue to take all steps necessary to deny Hamas terrorists the ability to raise and use funds to carry out atrocities and terrorize the people of Israel,” said Treasury Secretary Janet Yellen.

“That includes by imposing sanctions and coordinating with allies and partners to track, freeze, and seize any Hamas-related assets in their jurisdictions.”

Terrorists’ use of cryptocurrency has been dramatically overstated. The dollar remains the key tool for money launderers, with crypto playing a relatively tiny role.

Why would terrorists use blockchain when its transactions can be tracked? Beyond this, terrorists arguably have little need for crypto when they have the ability to siphon aid funds from the international community.

The United Nations spent nearly $4.5 billion in Gaza from 2014-2020, including $600 million in 2020 alone, even as Hamas reportedly turned European Union-funded water pipelines into homemade rockets.

Elliptic, a blockchain-analysis provider, suggested in a report this month that Hamas did receive cryptocurrency around the time of the attack. However, Hamas has not used crypto as a primary source of funding, instead opting to use the banking system, money service businesses, as well as informal “hawala” transfers.

This global financing network launders funds from charities and friendly nations to Hamas. Hamas started publicly seeking funds in crypto in 2019 through its Telegram channel. The group now uses payment processors to create crypto addresses and hide its cryptocurrency wallets.

The bulk of anti-terrorism efforts should not focus on terrorist use of cryptocurrency, considering the diverse ways these organizations procure funds. “There’s not one financing method for Hamas or other terrorist organizations.

They’re opportunistic and adaptive,” former CIA analyst Yaya Fanusie, now an adjunct senior fellow with the Center for a New American Security, said in an interview with CNN. “Efforts to stop them are a constant game of cat-and-mouse.”

Due to crypto’s transparent nature, it’s proven to be no secret when Hamas uses crypto, as made clear by the recent crypto freezing action. When it does use crypto,

Hamas generally receives small-dollar donations, ultimately representing a small fragment of the organization’s considerable $300 million annual budget. It’s disingenuous to state that terrorist use of crypto is a credible threat relative to the fiat-denominated funds moving through these organizations.

Warren’s anti-crypto pet project appears to be a red herring, and ultimately distracts from more fruitful conversations about how terrorist organizations actually raise funds through the traditional financial system.

Updated: 10-25-2023

‘No Evidence’ Hamas Is Raising Crypto Donations By The Millions: Elliptic

Elliptic’s statement was framed as a rebuttal to recent articles and letters circulating among the media and U.S. lawmakers this month.

Blockchain forensic firm Elliptic said there’s “no evidence” that Hamas is receiving a significant volume of cryptocurrency donations to fund its attacks against Israel.

“There is no evidence to support the assertion that Hamas has received significant volumes of crypto donations,” Elliptic said in an Oct. 25 statement. The amounts raised “remain tiny,” the firm added.

Elliptic’s statement was framed as a rebuttal to recent articles and letters written by The Wall Street Journal and United States lawmakers, which the firm said had misinterpreted data to make the case that cryptocurrency is widely used to fund Hamas’ “terrorist” activities.

As an example, Elliptic pointed to a “prominent” Hamas cryptocurrency fundraising campaign, operated by Gaza Now, a pro-Hamas news outlet, which has only raised $21,000 since the Hamas attack on Israel on Oct. 7.

Of the $21,000 raised, $9,000 was frozen by stablecoin issuer Tether, while another $2,000 was frozen after it was sent to a cryptocurrency exchange — presumably to cash out — Elliptic noted.

Setting the record straight on crypto crowdfunding by Hamas https://t.co/1tZrE1C43V

— Elliptic (@elliptic) October 25, 2023

Elliptic said it had reached out to The Wall Street Journal to correct a statement that initially claimed that over $130 million in cryptocurrency was raised by Hamas and Palestinian Islamic Jihad between August 2021 and June 2023.

The Wall Street Journal later revised the statement to say “as much as $93 million” in an Oct. 10 update.

The Wall Street Journal article had been cited in a letter written by Elizabeth Warren and over 100 other U.S. lawmakers to the White House and U.S. Department of the Treasury on Oct. 17.

Warren and other lawmakers argued that cryptocurrency poses a “national security threat” to the U.S. and its allies and that Congress and the Biden administration must take “strong action” to thoroughly address risks associated with cryptocurrencies facilitating illicit activity before they can be used to finance another “tragedy.”

However, Elliptic reiterated that its data was misinterpreted:

“Over the past two weeks, politicians and journalists have portrayed public crypto fundraising as a significant source of funds for Hamas and other terrorist groups, but the data simply does not support this.”

~20% of US Congress signed a letter based on incorrect facts. Elliptic just corrected the facts. Will @WSJ & the ~20% of Congress correct their statements now?@nic__carter, thank you for demanding truth here, and holding power accountable for misstatements of fact https://t.co/TazXQnjjgW

— Caitlin Long ⚡️ (@CaitlinLong_) October 25, 2023

On Oct. 18, blockchain forensics firm Chainalysis also posted a blog attempting to address supposed misconceptions circulating in the media. One particular wallet highlighted by the media reportedly received $82 million across seven and a half months, but Chainalysis explained that of that, only $450,000 was transferred to a known terrorism-affiliated wallet.

Meanwhile, Elliptic also noted that in April 2023, Hamas suspended cryptocurrency fundraising conducted through Bitcoin, citing a “concern about the safety of donors and to spare them any harm.”

In 2021, Israel’s National Bureau for Counter Terror Financing also began issuing seizure orders for cryptocurrency wallets tied to Hamas and worked with exchanges to freeze accounts used by them.

These events suggest cryptocurrency isn’t an ideal means to facilitate terrorism fundraising, Elliptic argued:

“This illustrates the weakness of crypto as a terrorism fundraising tool. The transparency of the blockchain allows illicit funds to be traced, and in some cases linked to real-world identities.”

Cointelegraph reached out to The Wall Street Journal for comment but did not receive an immediate response.

US Presses Gulf Allies To Help Stem Fresh Fundraising For Hamas

* US-Gulf Group Calls Special Meeting To Curb Hamas Cash Inflows

* Aim Is To Stop Hamas Building On Oct. 7 Deadly Israel Attack

The US has called on Gulf Arab states to help clamp down on a suspected increase in fundraising by the militant group Hamas following its deadly attack on Israel earlier this month.

A previously scheduled meeting of the Riyadh-based Terrorist Financing Targeting Center — a body formed in 2017 including the US, Saudi Arabia and five other Gulf Arabic states — was brought forward to Monday this week from next month, according to the US Treasury.

At the meeting, US Under Secretary for Terrorism and Financial Intelligence, Brian Nelson, urged Gulf Cooperation Council member states to share intelligence that could be used to impose sanctions unilaterally or jointly against individuals and entities. He said the aim is to stop any attempt by Hamas to leverage its Oct. 7 incursion to amass donations and other funds.

“This moment should bring a profound sense of urgency, clarity and purpose to the work that we do,” Nelson said in his prepared remarks at the meeting. “The ability to act — to cut off the financial flows that feed terrorism — is a duty we all share.”

Nelson assured his counterparts that legitimate humanitarian aid to Gaza, like food, water and medicine, would not be impacted by any new sanctions.

After the meeting in Saudi Arabia, Nelson traveled to the Qatari capital of Doha, where many of Hamas’s political leaders are based. Since its inception, Hamas has received political and financial support from the gas-rich Gulf emirate, which is also a close US ally that has been lauded by Washington for its role in mediating the release of Americans imprisoned in Iran and by Hamas in Gaza.

The Biden administration is asking its Gulf Arab allies to look as closely as possible at the operations of previously sanctioned Hamas-linked charities and entities in their jurisdictions as well as any suspicious activities by newly created ones, said a US official, who spoke on condition of anonymity due to the delicate discussions underway.

Qatari officials declined to comment. Saudi officials did not immediately respond to a request for comment.

“The UAE is committed to combating illegal financial activities such as money laundering and financing of terrorism,” a UAE official said.

Charity Connections

The US is particularly worried about Hamas’s ability to exploit connections to charities, shell companies and financial institutions in the region alongside its control of government bodies inside the Gaza Strip, according to Nelson. Washington has already imposed sanctions on 10 key Hamas members and associates based in Algeria, Gaza, Qatar, Sudan and Turkey.

Those targeted include three individuals managing assets for Hamas estimated by the Treasury last year to be worth about $500 million.

An individual described by the US as “a longtime Hamas operative based in Qatar with close ties to Iranian elements” was sanctioned for his alleged involvement in “the transfer of tens of millions of dollars to Hamas,” including its military wing the Ezzedine Al-Qassam Brigades, which masterminded and executed the Oct. 7 attack.

Talks with Gulf countries have also touched on their own banking institutions, as they could be vulnerable to secondary sanctions if any Hamas money moves through them, according to the same US official who declined to be identified.

Both the European Union and US have designated Hamas as a terrorist organization.

It’s a delicate line to tread for many Arab states, which must contend with populations often supportive of the Palestinians and sometimes Hamas. In many instances, there is also sympathy for Hamas as a legitimate resistance movement against Israeli occupation.

Crypto Fears

At the Riyadh meeting on Monday, Under Secretary Nelson said many parties, including the US, are on the lookout to block Hamas’s efforts to drum up financial support and donations through cryptocurrency. One of the entities sanctioned on Oct. 18 was a Gaza-based provider of money transfer and virtual currency exchange services, including Bitcoin.

He said the US and its allies had to “think systemically about how we can harden our financial system against those who are seeking to exploit new technologies.”

Updated: 11-5-2023

Bankers Seek Legal Cover After Backing $1.5 Trillion of ESG Debt

* Risks Are Surfacing In The Sustainability-Linked Loan Market

* SLL Business Has Mushroomed Amid A Lack Of Regulatory Controls

Bankers servicing one of the world’s biggest ESG debt markets are now actively seeking legal protections to guard against the potential greenwashing allegations that may be ahead.

In the handful of years they’ve existed, sustainability-linked loans have mushroomed into a $1.5 trillion market. SLLs let borrowers and lenders say that a loan is tied to some environmental or social metric.

But the documentation to back those claims generally isn’t available to the public, nor is the market regulated. Lawyers advising SLL bankers say the reputational risks associated with mislabeling such products are now too big to ignore.

Greg Brown, a London-based partner in Allen & Overy’s banking practice, says he’s seen a surge in clients asking for new legal clauses in SLL documentation. Such add-ons are designed to let lenders strip the “sustainability” element from a loan.

So-called declassification provisions mean bankers can just book what had been an SLL as a normal loan, should they subsequently realize the product doesn’t actually merit an environmental, social or governance label.

Rachel Richardson, head of ESG at London-based law firm Macfarlanes, says her firm’s clients are now asking for “more and more” declassification clauses.

“I would describe it as protection for lenders for greenwashing risk,” she said in an interview.

The newness of such clauses means it’s not yet clear how often clients will end up triggering them. But their introduction is an important signal.

Jamie Macpherson, senior counsel at Macfarlanes, pointed to a letter by the UK’s Financial Conduct Authority in June addressed to heads of sustainable finance.

The FCA, which noted that it does “not directly regulate this part of the market,” said then that concerns around the “integrity” of some SLLs had been “corroborated by market intelligence.” As a result, “accusations of greenwashing” may follow, the FCA said.

For SLL bankers, that means “publicizing anything that you can’t back up with good robust processes is a danger from a regulatory perspective,” Macpherson said.

The SLL market is far from transparent, and not all deals can be seen in public filings. According to data compiled by BloombergNEF, sustainability-linked loans arranged in the first three quarters of 2023 amounted to

only 40% of the level seen at the same time last year, or roughly $136 billion.

Next year, meanwhile, a large number of SLL borrowers will need to get existing loans rolled over. An estimated $187 billion

worth of SLLs will come due in 2024, according to data compiled by Bloomberg. More than 90% of that will be in the form of revolving credit facilities.

The most active SLL lenders are Bank of America Corp. and JPMorgan Chase & Co., according to league data compiled by Bloomberg. Representatives from both banks declined to comment.

“The real downside risk for lenders is, if you take your SLL book and you publicize to the world — or to your regulator — that you are now financing X-trillion-dollars of sustainable finance, what happens if someone then takes a ruler to that and actually delves down into what that means?” Brown said in an interview.

Lenders may not be as supportive of the sustainability-linked loan market in 2024 as they were during its peak during the 2021 to 2022 period, according to at least three senior bankers who have worked on SLLs and who asked not to be named discussing non-public information.

Aside from an overall retreat from debt markets due to higher interest rates, one banker pointed to an additional level of souring toward the SLL market that’s being driven by the arrival of regulatory scrutiny.

Voluntary standard setters in the industry also are trying to catch up, which means there’ll probably be stricter guidelines in future, the banker said.

Allen & Overy’s Brown said banks were increasingly seeking additional legal protections for SLLs at the end of last year. By this year, such clauses were “starting to appear almost as standard in a lot of deals,” he said.

Regulatory scrutiny “feeds into lenders taking a closer look at their ESG-related products,” he said. “Anything that has an ESG label, we need to be a bit more careful.”

The declassification clauses now being attached to SLLs can come in a variety of forms. Macfarlanes’ Richardson said triggers may be set off should borrowers and lenders fail to agree on new ESG targets, if those originally attached to a loan become irrelevant.

In some cases, a bank may decide that a borrower is facing an “ESG material adverse change,” she said.

Once a declassification clause has been triggered, banks will typically demand that borrowers stop referring to the deal as sustainability-linked. In some cases, borrowers may even be required to delete any historical references to the declassified SLL.

But that “may be impossible” if borrowers have previously listed their SLLs in public documents such as financial statements, Macpherson said.

“It’s something lawyers have been watching particularly closely from the borrower side,” he said. “Breaching that publicity clause that goes with a declassification provision is most likely going to lead to an event of default.

So it’s one place where there is actual bite in the context of the loan arrangement as most sustainability provisions don’t risk a default that could knock over financing.”

Birth Of A Market

After a timid start in 2017, the SLL market took off as banks increasingly attached sustainability claims to loans, often without having to provide public documentation to back the label.

Between 2018 and 2021, the SLL market soared more than 960% to $516 billion of annual deals, according to data provided by BloombergNEF.

Green bonds, the biggest ESG debt market, grew 250% in the same period to just over $640 billion worth of annual deals. As of last year, there was no ESG debt market bigger than SLLs, except for green bonds.

The SLL bankers Bloomberg spoke with raised concerns that some of the deals crossing their desks had questionable sustainability credentials. Some of the deals were rejected, but some were accepted for commercial reasons, they said.

They cited examples in which borrowers set themselves softer emissions reduction targets than their current net zero trajectory implied. And borrowers would allow themselves several years to meet such goals.

Examples given by the bankers include rejecting SLL pitches with health and safety targets, as these were often little more than a promise to uphold the absolute minimum requirements needed to avoid work-related injuries.

In another example, a coal company seeking an SLL wanted the environmental targets to cover just 5% of its emissions. The loan was rejected by western banks, but ultimately taken on by lenders in the company’s local market who were joined by Chinese banks.

Another banker spoke of deals in which key performance indicators were set to sustainability targets that never represented a realistic ESG risk in the first place.

The UK’s FCA has itself documented examples of potential greenwashing. In its June letter to sustainable finance heads, it noted that of the 250 SLL transactions done by one market participant in 2022, “only 30% were deemed ‘fit for purpose.’”

The FCA said it also “noted a general sentiment among banks that the ‘relationship’ may matter more than the borrower’s sustainability credentials.”

Grace Osborne, an analyst at Bloomberg Intelligence, describes the SLL market as “opaque,” which “makes measuring impact a substantial challenge.”

As a result, growing concern that such products are being used “as marketing tools for banks and a means to achieve sustainable-finance targets may create regulatory and reputation risk,” she said.

In the smaller but more transparent sustainability-linked bond market, the International Capital Market Association has set guidelines to protect investors from greenwashing that specifically require issuers to set key performance indicators that are relevant to their industry.

This year, the Loan Market Association published updated voluntary principles for SLLs. Borrowers and their banks are supposed to make sure that key performance indicators are actually “relevant, core and material.”

KPIs also should be “measurable or quantifiable,” and possible to compare with a benchmark, the LMA said. And borrowers “are encouraged” to publicly report the extent to which they’re meeting targets.

Crucially, external verification is required, according to the LMA’s updated principles, which only apply to deals struck after March 9 of this year.

“SLLs have seen meteoric growth since their inception in 2017 and, as such, market practice is in a constant state of evolution,” the LMA said in May. “Much like the SLL product itself, it is intended that these model provisions shall evolve in line with the market.”

In its June letter, the FCA said the SLL market “provides a useful transition finance tool” if done right. The regulator added that it now hopes “to encourage industry-led action that will help the market for SLLs scale with integrity.”

Updated: 11-7-2023

Bond-Market Crash Leaves Big Banks With $650 Billion Of Unrealized Losses As The Ghost Of SVB Continues To Haunt Wall Street

Crashing bond prices sank Silicon Valley Bank in March — and there’s reason to believe that what triggered the California lender’s collapse may be haunting Wall Street again.

The brutal Treasury-market meltdown has hit some of the largest financial institutions hard, dragging down the share prices of big names such as Bank of America and fueling fears that the turmoil triggered by SVB’s bankruptcy may not be over just yet.

Here’s everything you need to know about unrealized losses, including why they’re dragging on bank stocks and whether they could trigger another financial crisis.

Unrealized Losses

Treasury bonds — debt instruments the government issues to fund its spending — have been on a nightmarish run since the onset of the pandemic, with investors fretting about rising interest rates and the long-term viability of the US’s massive deficit.

BlackRock’s iShares 20+ Year Treasury fund, which tracks longer-duration debt prices, has plunged 48% since April 2020. Meanwhile, 10-year Treasury yields, which move in the opposite direction to prices, recently spiked above 5% for the first time in 16 years.

As a result of that sell-off, some of the US’s biggest banks are now sitting on unrealized, or “paper,” losses worth hundreds of billions of dollars.

That means the value of their bond holdings has plunged, but they’ve chosen to hold on rather than offload their investments.

Moody’s estimated last month that US financial institutions had racked up $650 billion worth of paper losses on their portfolios by September 30 — up 15% from June 30.

The ratings agency’s data still doesn’t account for a hellish October where the longer-term collapse in bond prices spiraled into one of the worst routs in market history.

These “losses” are not the same as debt, however, which describes actual borrowings that need to be repaid.

Bank of America is the big lender worst affected by the crash in bond prices, having disclosed a potential $130 billion hole in its balance sheet last month.

The other “Big Four” banks — Citigroup, JPMorgan Chase, and Wells Fargo — have also racked up unrealized losses in the tens of billions, according to their second- and third-quarter earnings reports.

Another SVB-style Crisis?

Silicon Valley Bank failed in March after disclosing a $1.8 billion loss on its own bond portfolio, triggering a run on deposits. Similarly, big banks’ huge unrealized losses are also sparking concern among Wall Street doom-mongers.

“‘Higher for longer’ is absurd baloney,” the market vet Larry McDonald said in a post on X Sunday, referring to the Fed signaling it would hold interest rates at about their current level well into 2024 in a bid to kill off inflation. “A 6% + Fed funds and Bank of America is near insolvency.”

It’s important to remember that BofA’s $130 billion losses are still unrealized. Unlike SVB, it isn’t officially in the red yet because it has not sold its bond holdings.

The bank’s chief financial officer, Alastair Borthwick, shrugged off the market’s worries on last month’s earnings call, pointing out that most of the bank’s fixed-income portfolio was low-risk government bonds it planned to hold until the debt expires.

“All of these are unrealized losses are on government-guaranteed securities,” he told reporters. “Because we’re holding them to maturity, we will anticipate that we’ll have zero losses over time.”

There’s still a possibility that spooked BofA customers will pull their money en masse, as they did with SVB — but that hasn’t happened. In fact, deposits are up after registering about 200,000 new accounts in the third quarter.

Some analysts also believe the worst of the Treasury-market rout is now over, with the Federal Reserve starting to signal that its tightening campaign is nearly done.

Ten-year yields have softened in recent weeks, falling from 5% to 4.6% as of Tuesday.

Banks Under Pressure

That doesn’t mean the Big Four banks can afford to just dismiss the bond rout.

In a paper published earlier this year, researchers for the Kansas City Fed concluded that paper losses could still drag down a bank’s share price: “Unrealized losses can increase equity costs as investors’ perceptions of financial health deteriorate.”

That’s been happening this year, with three of the big four banks’ stocks sliding. Predictably, Bank of America has been worst affected, with its stock down 24% over the past year and 14% year-to-date.

“Worries over unrealized losses on sovereign bond holdings are also weighing on the US lenders, to again reflect concerns over rising interest rates and whether the US Federal Reserve will ultimately tighten policy by too much for too long,” AJ Bell’s Russ Mould said in a note last week.

Unrealized losses may not be about to trigger another financial crisis — but as long as bank stocks are down, they’ll remain a concern for Wall Street’s biggest names.

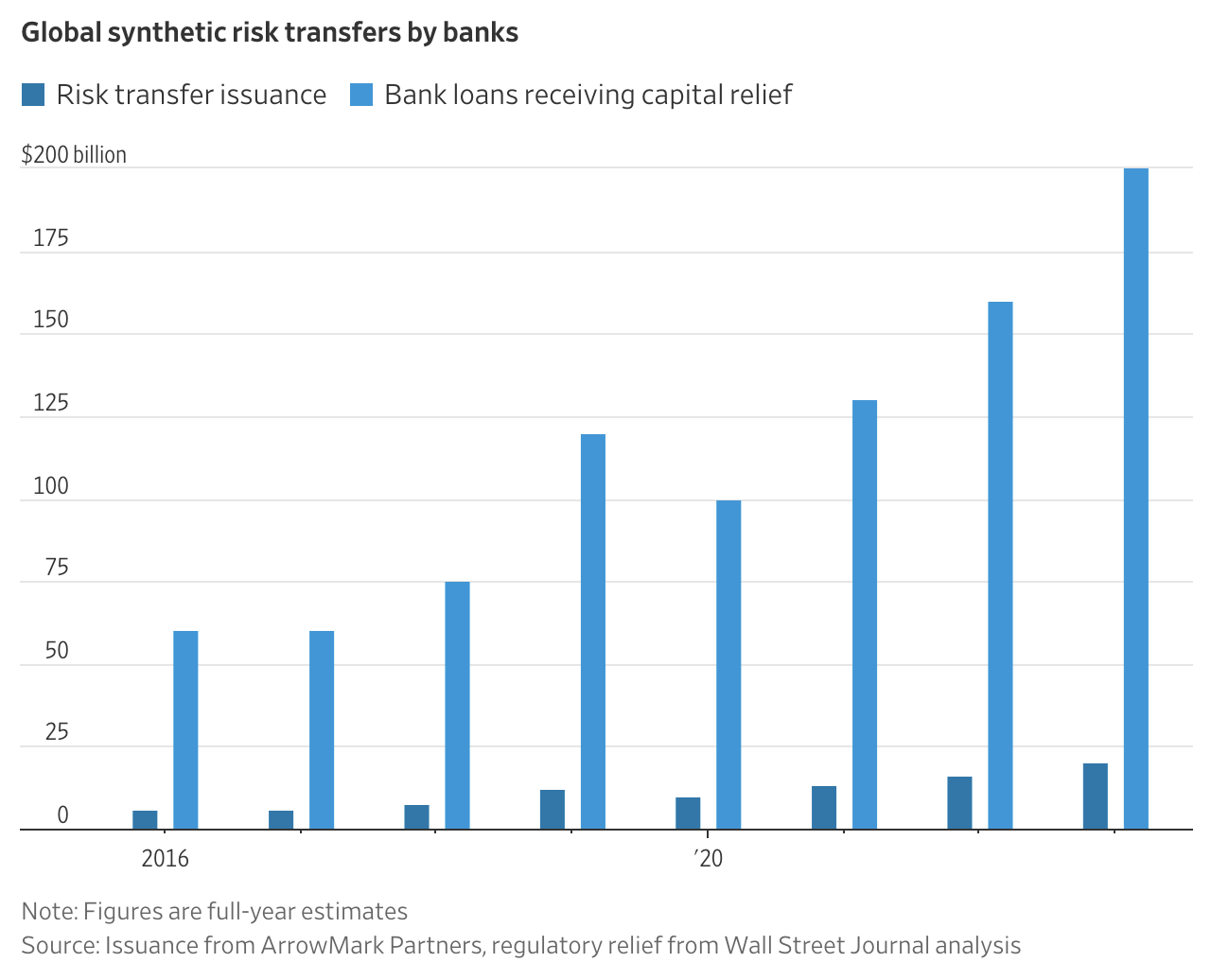

Big Banks Cook Up New Way To Unload Risk

Banks are selling risk to hedge funds, private-equity firms through so-called synthetic risk transfers JPMorgan Chase has been working on deals to cut capital charges on about $25 billion of its corporate and consumer loans.

U.S. banks have found a new way to unload risk as they scramble to adapt to tighter regulations and rising interest rates.

JPMorgan Chase, Morgan Stanley, U.S. Bank and others are selling complex debt instruments to private-fund managers as a way to reduce regulatory capital charges on the loans they make, people familiar with the transactions said.

These so-called synthetic risk transfers are expensive for banks but less costly than taking the full capital charges on the underlying assets.

They are lucrative for the investors, who can typically get returns of around 15% or more, according to the people familiar with the transactions.

U.S. banks mostly stayed out of the market until this autumn, when they issued a record quantity as a way to ease their mounting regulatory burden.

“We simply have to take it because they’re judge, jury and hangman,” JPMorgan Chief Executive Jamie Dimon said when asked about new capital regulations at an investor conference in September.

Regulators have been raising capital requirements for years, and they proposed even tougher measures after the banking panic that began in March.

Higher interest rates are eroding the value of banks’ investment portfolios, which can also eat into regulatory capital levels.

In most of these risk transfers, investors pay cash for credit-linked notes or credit derivatives issued by the banks. The notes and derivatives amount to roughly 10% of the loan portfolios being de-risked.

Investors collect interest in exchange for shouldering losses if borrowers of up to about 10% of the pooled loans default.

JPMorgan has been working on $2.5 billion worth of deals in recent months to cut capital charges on about $25 billion of its corporate and consumer loans, the people familiar with the transactions said.

The deals function somewhat like an insurance policy, with the banks paying interest instead of premiums. By lowering potential loss exposure, the transfers reduce the amount of capital banks are required to hold against their loans.

Banks globally will likely transfer risk tied to about $200 billion of loans this year, up from about $160 billion in 2022, according to a Wall Street Journal analysis of estimates by ArrowMark Partners, a Denver-based firm that invests in risk transfers.

Private-credit fund managers, including Ares Management and Magnetar Capital, are active buyers of the deals, according to people familiar with the matter.

Firms including Blackstone’s hedge-fund unit and D.E. Shaw recently started a strategy or raised a fund dedicated to risk-transfer trades, some of the people said.

The deals embody a deep shift on Wall Street, where hedge funds, private-equity firms and other alternative investment firms that buy private credit are becoming increasingly important to how finance functions.

Private-credit investment managers don’t yet have the same name recognition as the big banks, but have become formidable rivals, increasingly taking over bread-and-butter businesses such as corporate lending.

The firms have also been buying up the banks’ portfolios of mortgages and consumer loans.

Banks started using synthetic risk transfers about 20 years ago, but they were rarely used in the U.S. after the 2008-09 financial crisis.

Complex credit transactions became harder to get past U.S. bank regulators, in part because similar instruments called credit-default swaps amplified contagion when Lehman Brothers failed.

Regulators in Europe and Canada set clear guidelines for the use of synthetic risk transfers after the crisis. They also set higher capital charges in rules known as Basel III, prompting European and Canadian banks to start using synthetic risk transfers regularly.

U.S. regulations have been more conservative. Around 2020, the Federal Reserve declined requests for capital relief from U.S. banks that wanted to use a type of synthetic risk transfer commonly used in Europe. The Fed determined they didn’t meet the letter of its rules.

“Nobody knew when the impasse would break,” said Kaelyn Abrell, a partner at ArrowMark.

The pressure began to ease this year when the Fed signaled a new stance. The regulator said it would review requests to approve the type of risk transfer on a case-by-case basis but stopped short of adopting the European approach.

The Fed allowed capital relief for a new credit-linked note structure at Morgan Stanley in September and published a response to some of the questions it had received from banks about risk transfers.

Before the recent change, the Fed’s reluctance had left some banks increasingly frustrated, according to the people familiar with the transactions.

The tension grew in recent years as new rules came into effect, including a capital requirement tied to annual stress tests.

In 2022 and 2023, higher interest rates pushed down the value of bonds the banks held. That too weighed on the big banks’ regulatory capital levels.

More capital rules are on the way. This summer, U.S. bank regulators announced a proposal to further implement Basel III requirements that could increase capital charges by about 20% and penalize businesses that bring in big fees, including banks’ wealth-management and trading arms.

The Basel Endgame, as it is called in industry parlance, came out stiffer than some banks had hoped, prompting them to halt stock buybacks.

Updated: 12-11-2023

Lawyer Says Senator Elizabeth Warren Conspires With SEC Chair Gary Gensler, Violating Her Oath

Lawyer John Deaton claimed U.S. Senator Elizabeth Warren has violated her oath as a member of the Senate Banking Committee. Deaton alleges that Warren, tasked with overseeing the U.S. Securities and Exchange Commission (SEC), “conspired” with close friend and SEC Chair Gary Gensler, providing him with pre-arranged questions and suggested answers for a Senate hearing.

‘Elizabeth Warren Violated Her Oath’

John Deaton, a well-known lawyer in the crypto community, slammed U.S. Senator Elizabeth Warren (D-MA) on social media platform X on Saturday, accusing her of violating her oath as a senator overseeing the U.S. Securities and Exchange Commission (SEC).

Deaton’s post was in response to a shared Fox News video clip that presented evidence suggesting that Senator Warren coached SEC Chair Gary Gensler in preparation for a 2021 Senate hearing.

Emails obtained from Warren’s office by the Heritage Foundation Oversight Project revealed that her economic advisor sent Gensler a list of questions the senator planned to ask the SEC chair, along with suggested answers for him.

“Let me know if you’re okay with the questions as currently written,” the advisor asked Gensler. In a follow-up letter, Warren’s advisor further asked: “Let me know if it’s looking like the chair has any issues with the framing of the questions … definitely don’t want to put him in a tough spot.” During the hearing, Warren asked almost verbatim from the email.

“As A Senator, Sitting On The Banking Committee, Elizabeth Warren Violated Her Oath,” Deaton Alleged, Elaborating:

Her job is to provide and engage in actual oversight of the SEC. Instead, she conspired with her close friend Gary Gensler, not only giving him the exact questions she would ask before a hearing, but also the suggested answers to those same questions.

“That isn’t oversight — it’s fraudulent, coached testimony before Congress. She literally said that she didn’t want to place Gensler in a tough spot. Are you f’ing kidding me?” the lawyer exclaimed. “Her job is to place the chairman of the SEC in a tough spot — asking hard-hitting or ‘tough’ questions.”

Noting that Warren is “the single biggest critic of Bitcoin and crypto in the U.S. Congress,” Deaton emphasized that the Massachusetts senator sits on the Senate Banking Committee overseeing the SEC, and yet “she hasn’t asked the SEC or Gensler about [Sam Bankman-Fried] SBF’s multiple meetings with Gensler and the SEC. She hasn’t questioned why or how Gensler missed SBF’s Fraud, considering his up and close meetings with SBF.”

The lawyer further raised questions about Gensler’s numerous meetings with SBF, contrasting them with the lack of engagement with Coinbase CEO Brian Armstrong and Chief Legal Officer Paul Grewal, “despite Coinbase begging for meetings and being the largest exchange in America and also a U.S. publicly traded company.” Deaton opined:

Warren preaches against crypto every chance she can, but doesn’t ask why Gensler missed FTX, Celsius Network, Luna/UST, etc.? Why not? She found time to help kill a couple banks that worked with crypto companies. Why not focus on the source of the problem: actual fraud?

“Is she not asking certain questions because of her own ties to SBF’s parents? SBF’s father — Joe Bankman wrote Warren’s tax plan in 2016. We know without a doubt that he helped SBF create all those shell companies to avoid taxes. SBF’s mother runs a PAC [Political Action Committee] to help Democrats, like Warren, get elected,” he concluded.

Updated: 12-18-2023

Warren’s Surveillance Legislation Is Tailor-Made To Help Big Banks

Warren’s Digital Asset Anti-Money Laundering Act would shut crypto providers down, playing into the hands of the banking industry.

It seems that every time Massachusetts Senator Elizabeth Warren fails to get an anti-crypto bill passed, she introduces a new draft. She has the strategy of messaging bills — legislation introduced for the purposes of media attention and fundraising more than actual passage — down to a science.

Warren’s latest legislation, the Digital Asset Anti-Money Laundering Act, threatens to undermine crypto’s core principles of freedom and personal sovereignty.

While Warren argues that her bill is necessary to combat illicit activities, a closer look reveals its potential to stifle innovation, endanger user privacy and play right into the hands of big banks.

The bill, co-sponsored by Kansas Senator Roger Marshall, is based on the premise that digital assets are increasingly being used for criminal activities such as money laundering, ransomware attacks and terrorist financing.

While some bad actors exploit digital assets, the bill’s approach of treating all developers and wallet providers as potential criminals is not only impractical but also dangerous.

The most dangerous part of the bill is the requirement that digital asset developers comply with Bank Secrecy Act (BSA) responsibilities and Know Your Customer (KYC) requirements.

This effectively places the burden of law enforcement on the shoulders of software developers. It’s akin to requiring car manufacturers to be responsible for how their vehicles are used on the road.

The bill further seeks to eliminate privacy tools that protect crypto users from malicious actors. By cracking down on digital asset mixers and anonymity-enhancing technologies, Warren’s proposal threatens the privacy rights of law-abiding citizens.

It’s essential to remember that privacy is a fundamental right, not a privilege that can be discarded at will. A number of early Bitcoin millionaires have been kidnapped and tortured as a direct result of the transparency of the Bitcoin blockchain. Warren would leave future Bitcoiners defenseless against such threats.

While she claims to be acting in the name of national security, it’s worth noting that the big banks would benefit greatly from limiting the competition posed by cryptocurrencies. By imposing onerous regulations, the bill would make it difficult for crypto to compete on a level playing field.

But what about the argument that digital assets are being used by rogue nations and criminal organizations? While this is a valid concern, it’s crucial to distinguish between the technology itself and the actions of a few.

The same argument could be applied to cash, which has been used for illegal activities for centuries. Banning cash would be an overreaction, just as overly restrictive crypto regulations are.

Breaking: Elizabeth Warren’s latest proposed anti-crypto legislation

Sen. Warren has co-sponsored the Digital Asset Anti-Money Laundering Act of 2023.

Says the legislation aims to:

-combat the “rising” misuse of digital assets.

-close regulatory “gaps.”

-extends Bank… pic.twitter.com/cl0L95Fyaj— Carlo⚖️.eth (@DeFiDefenseLaw) December 11, 2023

One major concern is the bill’s approach to “unhosted” digital wallets, which allow individuals to bypass Anti-Money Laundering (AML) and sanctions checks.

While preventing illicit transactions is crucial, the bill’s proposed rule to require banks and money service businesses to verify customer identities and file reports on certain transactions involving unhosted wallets may have unintended consequences.

Forcing individuals to provide personal information for every transaction goes against the very principles that have drawn people to cryptocurrencies — privacy and pseudonymity.

It’s important to strike a balance between security and individual rights. Overregulation could drive users away from regulated platforms, pushing them into unregulated, more challenging-to-track environments.

Additionally, the bill’s focus on directing the United States Financial Crimes Enforcement Network to issue guidance on mitigating the risks of handling anonymized digital assets seems to misunderstand the core tenets of blockchain technology. Cryptocurrencies like Bitcoin are designed to be transparent yet pseudonymous.

Trying to eliminate this pseudonymity jeopardizes one of the key features that make blockchain secure and appealing to users.

Another significant issue is the potential overreach in extending BSA rules to include digital assets. Requiring individuals engaged in transactions over $10,000 in digital assets through offshore accounts to file a Report of Foreign Bank and Financial Accounts (FBAR) may be excessive.

It could result in unnecessary burdens on individuals who use digital assets for legitimate purposes, such as cross-border remittances or investments.

Warren’s bill is a sledgehammer approach to a nuanced problem. Rather than stifling innovation and privacy, a more balanced approach would be to target specific criminal activities and individuals.

The current AML system, which large crypto exchanges comply with, has been effective at interdicting illicit crypto usage, which is why isolated instances have been reported.

The Digital Asset Anti-Money Laundering Act is a deeply flawed piece of legislation. Warren’s bill poses a real threat to the crypto community and risks playing right into the hands of big banks.

It’s essential that we find a more balanced and effective solution that addresses the concerns without stifling the potential of this transformative technology.

Updated: 12-19-2023

Sen. Warren Hypocritically Calls Out Bitcoin Industry’s Revolving Door Of Washington Insiders

According to the Massachusetts senator, many government officials could be laying the groundwork while in public service to “audition” for positions in the crypto industry.

Massachusetts Senator Elizabeth Warren, an outspoken opponent of digital assets in the United States Congress, has called on crypto advocacy groups to answer questions regarding the industry’s use of former government officials and lawmakers.

In Dec. 18 letters to leadership at advocacy groups Coin Center and the Blockchain Association, Senator Warren cited a Politico report that certain entities within the crypto industry had a “small army of former defense, national security and law enforcement officials” aimed at stymieing regulation of digital assets.

She reiterated claims that crypto was behind the financing of U.S.-designated terrorist organizations, including Hamas — the group behind the Oct. 7 attack on Israel.

According to Senator Warren, the revolving door between the crypto industry and Washington, DC insiders suggested that many government officials could be laying the groundwork while in public service to “audition” for digital asset lobbying positions.

She referenced crypto exchange Coinbase’s Global Advisory Council, which initially included former Senator Patrick Toomey, former Representative Tim Ryan and former Representative Sean Patrick Maloney.

“This abuse of the revolving door is appalling, revealing that the crypto industry is spending millions to give itself a veneer of legitimacy while fighting tooth and nail to stonewall common sense rules designed to restrict the use of crypto for terror financing – rules that could cut into crypto company profits,” said Senator Warren.

The Massachusetts lawmaker requested the advocacy groups provide information by Jan. 14 on the number of “former military, civilian government officials, or members of Congress” employed in the industry and their compensation.

She also asked the organizations for details about any code of ethics in place to address such potential conflicts of interest.

“Sen. Warren should focus her efforts on the perpetrators, not those working hand-in-hand with U.S. law enforcement to catch bad actors,” said Blockchain Association CEO Kristin Smith in response to the letter.

1/ Tonight, I received a letter from Sen. Warren criticizing a recent letter to Congress cosigned by dozens of former US military, intelligence officers, and national security professionals.

Here’s the letter from Nov. 15: https://t.co/IFBH7m5ywU

— Kristin Smith (@KMSmithDC) December 19, 2023

Coin Center CEO Jerry Brito referred to the letter on X — formerly Twitter — as “impertinent” and a “bullying publicity stunt,” adding:

“[Senator Warren] says the public ‘deserves transparency’ but the implication of that view is that nonprofits deserve no privacy from government intrusion.”

Since the Oct. 7 attack by Hamas on Israel and reports suggesting crypto funded the group — of which at least one story was later corrected — Senator Warren seems to have stepped up her efforts in Congress to drum up support for her Digital Asset Anti-Money Laundering Act.

Who could be so brazen as to write legislation that would effectively ban #crypto?

Senator @RogerMarshallMD, the GOP frontman of the crypto ban bill, revealed the American Bankers Association wrote it. #StopCryptoBan pic.twitter.com/dHufIaXB7i— Chamber of Digital Commerce (@DigitalChamber) December 19, 2023

Though supported by many lawmakers, the legislation has received criticism from advocacy groups, which claim it would fail to address the illicit use of digital assets.

Updated: 12-20-2023

Senator Roger Marshall Reveals The American Bankers Assoc. ‘Helped Craft’ Senator Warren’s Anti-Crypto Bill

The lobbying organization for the U.S. banking industry — the American Bankers Association — was asked to help with the anti-crypto legislation, according to recent comments from the senator.

Big banks have been helping United States Senators Roger Marshall and Elizabeth Warren draft their controversial anti-crypto bill.

In a Dec. 20 video that surfaced on X (formerly Twitter), Marshall admitted that he and Warren approached the largest lobbying organization for the U.S. banking industry — the American Bankers Association (ABA) — for assistance in crafting the Digital Asset Anti-Money Laundering Act.

The Digital Asset Anti-Money Laundering Act, first introduced in December 2022, aims to bring crypto technology, such as noncustodial wallets, validators and mining pools, under strict banking regulations in the United States.

“The first thing that we did is that we went to the American Bankers Association and said ‘help us craft this.’”

Marshall also mentioned Warren’s meeting with JPMorgan CEO Jamie Dimon, who agreed that “crypto was only a tool for criminals.” The footage was sourced from a parliamentary security intelligence forum earlier in December.

In response to the video, Coinbase CEO Brian Armstrong expressed his disappointment that Warren and Marshall were now lobbying for banks. “Being anti-crypto is a really bad political strategy going into 2024,” he added.

Senators Warren and Marshall now lobbying for big banks

Being anti-crypto is a really bad political strategy going into 2024

* 52m Americans have used crypto

* 38% of young people say crypto can increase economic opportunities

* just 9% of Americans satisfied with the… https://t.co/diawa3LOX5— Brian Armstrong ️ (@brian_armstrong) December 19, 2023

Meanwhile, finance lawyer Scott Johnsson suggested that voters angry at Warren should focus on vulnerable seats that have supported her crusade this past year.

On Dec. 11, the bill gained five new senators as co-sponsors, including three members of the Banking Committee. Moreover, U.S. banking advocacy group, the Bank Policy Institute (BPI), has also backed the anti-crypto legislation introduced by Warren.

Anti-crypto commentators often claim that digital assets are mainly used for nefarious activity despite a wealth of evidence to the contrary.

Blockchain analysis platform Chainalysis showed that less than 0.2% of crypto is used for illicit purposes.

Anti-crypto advocates also often fail to acknowledge the level of criminal activity in traditional finance, with JPMorgan being one of the most heavily fined banks. The Wall Street bank has paid almost $40 billion in fines for a wide range of violations since 2000, according to Violation Tracker.

Updated: 12-29-2023

America’s Bank Regulator Needs A Lesson In Management

Reports of rampant sexual misconduct at the FDIC are symptomatic of broader organizational dysfunction.

For most of its 90-year history, the Federal Deposit Insurance Corp. has been a dull but reliable government agency tasked with closing failing banks and ensuring customer money is protected.

But this year, in the words of one Republican senator, it’s been revealed as a “Gomorrah of carnal abuse.”

That’s a problem for the FDIC, its leadership and perhaps even the banking industry.

Senator John Kennedy’s comment at a hearing earlier this month was sparked by a media report detailing sexual harassment, heavy drinking and other unprofessional behavior at the agency over more than a decade, under both Democratic and Republican leadership.

Several of the perpetrators, instead of being demoted or fired, were allowed to continue working at the agency.

After news of the scandal broke, the FDIC’s board named a special committee to conduct an independent review of the allegations and the agency’s broader workplace culture.

FDIC Chairman Martin Gruenberg, who has served on the board for 18 years and as chairman more than once, was excluded from the committee.

That hasn’t spared the agency from lawmakers’ ire. Congressional Republicans, already battling the agency over its proposals to tighten banking regulations, have demanded Gruenberg’s resignation. Democrats are pressing the FDIC and other banking agencies to detail how they will prevent such abuses.

Beyond the shocking anecdotes — unsolicited sexts, strip club visits, drunken vomiting, public urination — a close examination of the facts raises an additional concern.

A survey of FDIC employees conducted by the Office of the Inspector General in 2019 found that 8% of the respondents said they’d been sexually harassed.

(That was down slightly from 9% in a survey conducted in 2016, which also showed that the government-wide average was 14%. Apparently Gomorrah extends to other parts of the executive branch.)

How does this happen? The 2019 survey provided a clue. Almost 40% of the FDIC workers who responded said they weren’t sure how to report sexual harassment and 44% said the agency should provide more training.

When employees actually ask for more training, something has clearly gone wrong.

No organization of 6,000 employees, especially not one with about 3,000 bank examiners spread among 70 field offices, is going to completely eradicate bad behavior.

But there’s no excuse for failing to provide staff and managers with mandatory instruction that leaves them in no doubt about how to handle and report episodes of sexual harassment and other unprofessional behavior.

Government agencies are already at a disadvantage compared to the private sector when it comes to hiring and retaining talented workers. In the past two years, FDIC examiners-in-training have resigned at higher rates than before the pandemic.

A functional FDIC is essential for the safety of the banking system. Post-mortems of the three bank collapses that took place earlier this year found that FDIC’s examiners missed opportunities to take action on some of the banks and to escalate their concerns.

Along with other regulators, Gruenberg has been pushing this year for new regulations to help avert bank collapses and provide stronger protections for depositors.

But no amount of added rules will matter if the agencies responsible for enforcing them aren’t well managed and staffed with sober professionals.

Updated: 1-24-2024

FDIC Lawyer Stayed On Paid Leave For Weeks After Child Porn Arrest

Special counsel pleaded guilty Tuesday; the bank regulator began termination procedures this week.

A Federal Deposit Insurance Corp. lawyer remained on paid administrative leave for 10 weeks after he was indicted on federal charges related to the production, possession and distribution of child pornography, an agency official said.

Mark A. Black, who most recently served as special counsel at the FDIC, was indicted on Sept. 14 and arrested the next day, court records show.

Federal prosecutors said that between January 2018 and October 2021, Black was part of two online groups whose goal was to track down young girls online and persuade them to livestream themselves participating in sexually explicit conduct, which Black and his co-conspirators secretly recorded.

When he was indicted, Black, 50 years old, had already been placed on paid administrative leave. The FDIC imposed that leave after it was notified of a search warrant federal agents executed at Black’s Virginia home on June 6, the FDIC official said.

Following his indictment in September, the agency sought to remove Black, but at first struggled to reach him to serve him with legally required notice. When Black was notified, he contested the effort, the FDIC official said.

The agency opted to move forward with unpaid indefinite suspension instead to avoid any further delays if the removal effort had to be adjudicated.

On Nov. 8, the FDIC gave Black notice of a proposed indefinite suspension without pay. The unpaid suspension went into effect on Nov. 27.

Federal employment experts said that while there are bureaucratic hurdles to suspending and terminating federal employees, there are legal and regulatory provisions that allow agencies to act more swiftly if they believe an employee may face prison time.

On Tuesday, Black—who has been held without bond since his arrest—pleaded guilty to one count of conspiracy to produce child pornography and one count of coercion and enticement. He will be sentenced April 30 and will face at least 15 years in prison.

The FDIC began the process of terminating Black on Tuesday following his guilty plea, the agency official said.

Black has worked at the FDIC since 2013, beginning his career in the professional liability and financial crimes section of the legal division, where he was responsible for overseeing investigations of failed banks, among other matters.

In October 2022, he was named special counsel, where he worked closely with the general counsel, helping to prioritize and respond to requests for legal and policy advice, and acting as a liaison within the agency and externally, according to his LinkedIn profile.

Black’s salary was $243,500 in fiscal year 2022, according to payroll records. The FDIC is funded by insurance premiums paid by banks rather than taxpayer dollars.

Black’s guilty plea comes as the agency is already under scrutiny over unrelated allegations of a toxic work environment. A Wall Street Journal investigation published in November found that a sexualized, boys-club culture at the FDIC had for years driven female—and some male—examiners to quit.

In response, the agency hired an external law firm to review its workplace culture. Its inspector general is conducting its own review.

The FDIC said in a statement that it was “deeply disturbed and shocked to learn of the allegations” against Black, “and subsequently suspended his employment.” The alleged crimes were “not related to the FDIC and didn’t involve FDIC devices and systems,” the agency said.

A lawyer for Black declined to comment.

Federal labor laws and regulations grant federal employees due process rights related to terminations or suspensions, including the right to be given a certain period of notice of planned actions against them.

But the rules also include provisions allowing agencies to speed up the process in situations involving alleged crimes. The so-called “crime provision” allows an exception to the rule that employees are entitled to 30 days’ notice, if an agency has reasonable cause to believe an employee has committed a crime that may warrant imprisonment.

Under that provision, agencies can seek to remove an employee or place them on indefinite suspension within seven days. Agencies often point to criminal indictments to establish reasonable cause, but aren’t required to wait for one to invoke the provision.

“Agencies have historically been successful in getting that notice out to federal employees who have been imprisoned or jailed,” said Debra Roth, managing partner at Shaw Bransford & Roth who specializes in federal employment law. She said the rules exist to “encourage agencies to deal with a problem employee” quickly.

Among the chat room posts prosecutors cited was a post Black wrote in November 2019 in which he described himself as having “a taste for 10-12, but flexible on the lower bound to…welp … speech and the upper bound to legality,” according to the statement of facts, which Black signed as part of his guilty plea.

A minor who was friends with Black on Snapchat told prosecutors that a member of the conspiracy had told her if she didn’t send a photo, something bad would happen, “to include him telling her mom and dad.”

Updated: 1-30-2024

Citigroup Sued Over Handling of Online Scams

New York Attorney General Letitia James wants bank to pay back defrauded customers.

New York Attorney General Letitia James sued a unit of Citigroup, alleging that the bank had failed to protect its customers from online scams and then illegally denied those account holders reimbursements.

“The results are devastating,” James’s office wrote Tuesday in its civil complaint. “Consumers lose tens of thousands of dollars or more by doing nothing more than clicking on a link in a text that appears to be from a trusted source, providing information on a call with a purported representative of Citi, or answering security questions on a website that looks official.”

The suit described the experiences of several unnamed New Yorkers who lost money through scams related to their Citi bank accounts. In one instance, a bank customer lost $40,000 after clicking on a link in a text message that appeared to be from Citi.