FTX (SBF) Got Approval From F.D.I.C., State Regulators And Federal Reserve To Buy Tiny Bank!!!

“The fact that an offshore hedge fund that was basically a crypto firm was buying a stake in a tiny bank for multiples of its stated book value should have raised massive red flags for the F.D.I.C., state regulators and the Federal Reserve…It’s just astonishing that all of this got approved.”, Camden Fine, A Bank Industry Consultant. FTX (SBF) Got Approval From F.D.I.C., State Regulators And Federal Reserve To Buy Tiny Bank!!!

The tiny bank known as Moonstone was an idea that FTX could offer crypto-yield programs in a way that would bypass Securities and Exchange Commission regulations.

► FTX And The Curious Case of Farmington State Bank

► One Nation Under Blackmail Book

► SBF Hires Ghislaine Attorneys

► SBF Under Investigation For Crashing Terra

► Protos FTX Farmington Investigation

► SBF Plans To Launch Stablecoin

► Plot To Take Over Cryptocurrency

~~~~~

– Timestamps –

0:00 Intro

3:04 FTX, Alameda, Epstein

7:18 Farmington State Bank

11:43 Moonstone, Tether

16:06 CBDC, WEF Connections

21:02 Was Sam A Puppet?

FTX executives discussed using Moonstone to offer interest-bearing crypto accounts.

When Jean Chalopin applied to buy a tiny bank in Washington state nearly three years ago, he made modest promises to bring not-so-new innovations such as ATM cards to a place with few local banking options.

Related Articles:

Ultimate Resource For Tokenized Securities And Blockchain Stock-Settlement Network

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

Ultimate Resource For Money Laundering, Spoofing, Market-Rigging, Etc. In Banking Industry

Probes Reveal Central, US-Based, International Banks All Have Sticky Fingers

Major Banks Suspected Of Collusion In Bond-Rigging Probe

Some Merrill Brokers Say Pay Plan Urges More Customer Debt

Deutsche Bank Handled $150 Billion of Potentially Suspicious Flows Tied To Danske

Wall Street Fines Rose in 2018, Boosted By Foreign Bribery Cases

U.S. Market-Manipulation Cases Reach Record

Ultimate Resource On Insider Trading (Congress, Senators, Corporate America)

Farmington State Bank’s business plan wouldn’t change, Mr. Chalopin, a onetime TV and film producer who co-created the “Inspector Gadget” cartoon, assured federal regulators in documents viewed by The Wall Street Journal.

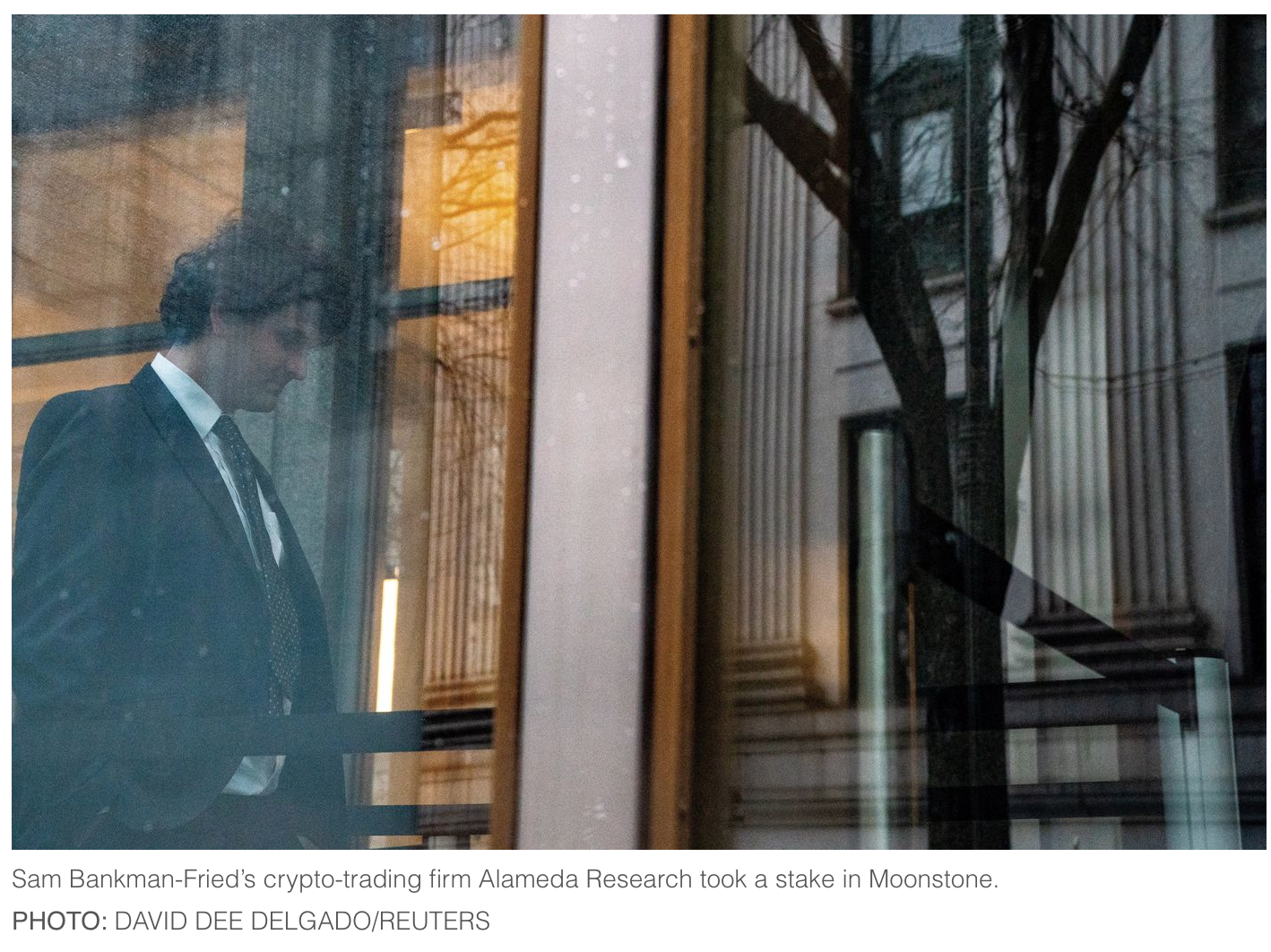

But it wasn’t long before the bank got a new name, Moonstone, and new target customers in the high-risk cryptocurrency and cannabis industries. It also got a new shareholder: Sam Bankman-Fried’s crypto-trading firm, Alameda Research LLC.

Alameda paid $11.5 million for a stake in Moonstone at a roughly $115 million valuation, which was 37 times the $3.1 million Mr. Chalopin paid for the bank 18 months earlier. Executives from Mr. Bankman-Fried’s crypto exchange, FTX, discussed using the bank to offer interest-bearing crypto accounts and lend out depositors’ digital assets, according to people familiar with the matter.

Mr. Bankman-Fried’s crypto empire collapsed in November, thrusting the little-known bank into the spotlight. Lawmakers are pressing for information about whether Alameda used FTX customer funds to pay for its stake in the bank. Mr. Chalopin, a pair of Democratic senators noted in a letter to banking regulators in December, chairs Deltec International Group, the crypto-friendly Bahamian bank with close ties to FTX.

Last week, the new management team steering FTX through bankruptcy asked a judge to approve a subpoena for records related to Moonstone from Mr. Bankman-Fried and other FTX insiders.

The Justice Department in early January seized about $50 million that an FTX entity held at Moonstone—about 77% of the total deposits the bank reported holding at the end of 2022. Moonstone said it is getting out of crypto and cannabis and returning to its community-banking roots.

“It’s still the same bank, it just has a cloud over it,” said Todd Lobdell, a Farmington resident and former director of the town’s public works department.

Mr. Chalopin began laying the groundwork to buy Moonstone in the fall of 2019.

It had $8.4 million in assets at the time, largely in the form of loans to farmers in an area where lentils are the cash crop. Its president, Tanya Thygeson, was a lifelong resident of the bank’s eponymous hometown. She rose from teller and has held roles as a town paramedic and librarian, according to a local press report on her 2018 promotion.

After leaving show business, Mr. Chalopin had found a second act in banking. A native of France, he eventually settled in the Bahamas and amassed a roughly 47% stake in Deltec, according to the purchase application filed with the Federal Reserve. By early 2020, Deltec had established itself as one of the leading banks to crypto companies, including Tether Holdings Ltd., the issuer of the tether stablecoin.

Farmington would be his next target. A company owned by Mr. Chalopin agreed to buy the bank for $3.1 million in cash. When asked to list “any significant anticipated changes in services or products” that would result from the transaction, “not applicable” was his lawyer’s answer in the April 2020 application to the Fed.

“Applicant does not intend to change the business plan of the Bank,” the lawyer wrote.

Moonstone would later say that it had pursued an “innovative startup business model” to serve crypto and cannabis businesses since its 2020 acquisition. The bank quickly brought in a new executive team and board members from companies such as fintech startup Revolut Ltd. and crypto exchange Gemini Trust Co.

The application doesn’t reflect confidential discussions the buyers had with regulators or amendments to its business plan following the acquisition, a person close to Moonstone said.

Moonstone’s parent company announced the Alameda investment in March 2022. Dan Friedberg, FTX’s chief regulatory officer, served as a liaison between the two companies, people familiar with the matter said. A lawyer based in Seattle, Mr. Friedberg had worked for local banks before pivoting to blockchain and becoming an early adviser to Mr. Bankman-Fried.

Alameda was attracted to a Moonstone plan to offer a payments network that would let crypto companies send dollars between Moonstone accounts, people familiar with the matter said. Other crypto-friendly banks, including Silvergate Capital Corp., already offered similar networks.

But the primary motivation for Alameda’s investment in Moonstone was an idea that FTX could offer crypto-yield programs in a way that would bypass Securities and Exchange Commission regulations, people familiar with the matter said. Such programs allow investors to earn interest on their crypto by depositing their digital assets into a common pool. The assets in the pool are then lent out to borrowers, typically sophisticated trading firms that use the crypto to fund various trading strategies.

The SEC has sought to block similar crypto-lending programs offered by companies such as BlockFi Inc. on the grounds that they are unregistered securities. Certain bank-issued investment products are exempted from having to register as securities because banks are subject to a regulatory regime separate from the SEC.

FTX executives were looking at ways to structure a crypto-yield program that Moonstone would legally be able to offer under this exemption, the people said. No such program ever launched, and several companies offering similar crypto-yield programs have gone bust in recent months, leaving millions of depositors uncertain whether they will get their money back.

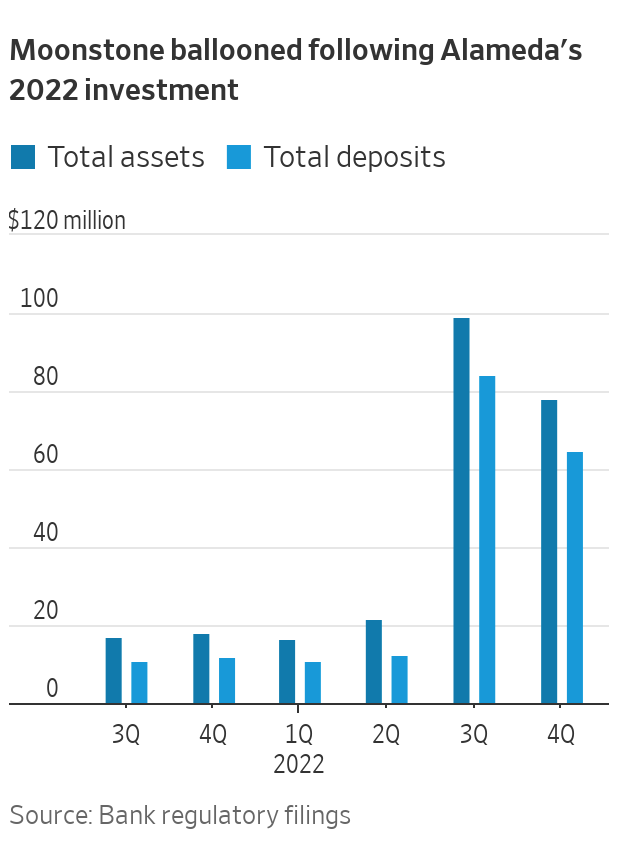

After Alameda’s investment, Moonstone ballooned. Deposits grew to $84 million by Sept. 30 from $12 million at the end of 2021, according to regulatory filings, thanks in large part to FTX. Assets grew to $99 million from $18 million over the same period.

Moonstone’s balance sheet was conservative, despite the riskiness of its client base. Around two-thirds of its assets as of Sept. 30 were excess bank reserves that it lends to other banks. Still, Moonstone reported a net loss of $3.7 million that quarter, worse than the $537,000 loss from a year earlier.

After FTX and Alameda collapsed, Moonstone sent a notice to its local customers assuring them that their money was safe, Mr. Lobdell said. Yet the bank also explained that it was going to launch its own cryptocurrency.

Moonstone later distanced itself from its shareholder and largest depositor. The bank placed a hold on FTX’s account, citing “an attempt by potentially unauthorized persons to withdraw the funds.”

Moonstone never launched a payments network. In January, the bank said it was going back to basics, and the old Farmington name, citing the “impact of recent events in the crypto assets industry and the resultant changing regulatory environment relating to crypto asset businesses.”

FTX And The Curious History of Farmington State Bank

Since FTX’s collapse, a tiny bank in rural Washington has come under heavy scrutiny for the role it may have played in the crypto exchange’s fraudulent activities. Ed Berger and Whitney Webb investigate the history of the bank and unearth some troubling connections.

In late November, Protos began demystifying the mysterious ties of the bankrupt and fraud-riddled cryptocurrency exchange FTX to “a small bank in rural Washington,” known as Farmington State Bank.

Given that it has only 3 employees and is one of the smallest banks in the entire United States, Protos noted that “the fact that [this bank] somehow finds itself embroiled in the largest cryptocurrency fraud in history is puzzling, disconcerting, and totally out of place, to say the least.”

While the Protos piece sheds some light on Farmington State Bank and its recent transformation into FBH Corp. and Moonstone Bank, there is more to the story.

Despite being a small, rural bank, Farmington/Moonstone, since at least 1995, has had ties to some of the most covert and criminal offshore financial networks of the modern era, with connections to intelligence-linked financial fraudsters of considerable notoriety.

In this Unlimited Hangout investigation, we pick up where Protos left off and begin lifting the curtain behind the FTX financial labyrinth in an effort to piece together the networks behind the elaborate crypto Ponzi scheme.

This is critical work, as the FTX bankruptcy proceedings have been oddly manuevered so to avoid revealing who aside from Sam Bankman-Fried, the disgraced CEO and face of FTX, had control of the exchange and its subsidiaries.

The network behind Farmington/Moonstone, the subject of this piece, is the first of many threads tied to FTX that we hope to pull on in the coming weeks and months.

Archie Chan Finds Farmington

Farmington, a sleepy rural town in Washington state, saw its once promising economic fortunes turn to dust during the Great Depression of the 1930s.

The Great Depression had also crushed the first iteration of Farmington State Bank, originally founded in 1887, and a new bank of the same name was created in May 1929. Much of Farmington State Bank’s history is hardly noteworthy.

Joining the bank in 1973 was C. Wayne Wexler, who served as the bank’s president for over a decade. Throughout the 1970s, the bank held around $1.5 million in deposits, which grew modestly during the 1980s to around $3.5 million.

Around 1995, Farmington, for reasons still unknown, attracted the attention of a British citizen residing in Hong Kong named Archie Chan. According to a 2010 interview given by Farmington’s then-president, John Widman, Chan bought the bank in 1995 “when he was looking for a chartered Washington bank that might become a platform for international banking.”

Though this never came to pass, Chan’s connections suggest that his interests in the small, rural bank may have been manifold.

Chan acquired Farmington through a holding company registered in the British Virgin Islands (BVI) called Farmington Finance Corporation. The lawyer who aided him in setting up the corporate structure for the new Farmington organization was David K.Y. Tang, who – among other things – is a member of the Council on Foreign Relations (CFR).

Tang, whose careers in law and business spans Seattle, Hong Kong and Beijing, also served a stint as chairman of the Federal Reserve Bank of San Francisco—the central bank branch that has technical legal oversight of Farmington.

According to a different Protos investigation, this same component of the Federal Reserve system “took over regulatory duty for [Farmington/Moonstone] earlier this year, but seems to have glossed over Moonstone’s for-profit foreign interests.”

Though it remained under BVI jurisdiction, annual reports from Farmington State Bank reveal that Chan’s Farmington Finance Corporation maintained its offices in the Jardine House in Hong Kong. That property is owned by the interests of Jardine Matheson Holdings.

That company is the successor to Jardine Matheson & Co, one of the largest foreign trading companies in the Far East for much of the 19th century which was extensively involved in entrenching British political and economic influence in Hong Kong. It also played a key role in the opium trade.

Notably, Archie Chan has claimed to be “a member of one of the oldest and most prominent Hong Kong families,” suggesting a potential familial link to the power networks of early colonial Hong Kong, where Jardine Matheson was particularly prominent. Later, Chan’s Farmington Finance Corporation relocated to St. George’s House, also in Hong Kong.

Further investigation into Chan reveals that he was, until relatively recently, the executive director of Glorious Sun Enterprises. Glorious Sun Enterprises is the main company of its parent organization, the Glorious Sun Group.

The latter began as a textile concern in Hong Kong in the mid-1960s, later expanding into the fields of finance, real estate and other ventures during the 1980s. It now boasts property holdings in Hong Kong, China, Singapore, Canada and the United States.

Chan’s association with the Glorious Sun business complex has been long-running. According to SEC filings, he became the company secretary of Glorious Sun Enterprises Limited in February 2005, and then joined the corporate board as a director in August of that same year.

However, over two decades before this, Chan had been acting as the group’s primary “business consultant”, a position that required him manage the various partnerships and subsidiaries that made up the fledgling empire’s vast reach.

Documents submitted by Glorious Sun to the SEC state that he would act as a director in various joint-ventures where Glorious Sun controlled 50% of more of company stock. Chan, in other words, was Glorious Sun’s chief business agent at the time that he purchased Farmington State Bank.

Glorious Sun Enterprises is mostly held by Glorious Sun Holdings Limited, followed by Advancetex Holdings. Other shareholders include members of the Yeung family, some other executives and the Texas-based Dimensional Fund Advisors LP.

Both Glorious Sun Holdings Limited and Advancetex were registered at the address 263 Main Street in Road Town, the capitol city of the British Virgin Islands (BVI).

This is location of CCS Trustees Limited, a corporate services firm that handles the legal registration for business seeking to set up holding companies or subsidiaries in offshore tax havens like BVI. CCS Trustees itself seems to have a focus on Hong Kong-oriented business, and even maintains a subsidiary called Cayman-Hong Kong Corporate Services Ltd. CCS’s founder, William Au-Yang, sits on the board of the New Media Group, a Hong Kong-based telecommunications firm.

According to SEC filings from 2007, Glorious Sun’s principal bankers include the Hongkong and Shanghai Banking Corporation (more commonly known as HSBC) and Standard Chartered Bank.

The former has had a historically close-knit relationship with Jardine Matheson: the two have engaged in joint-ventures with one another, while members of the controlling family of Jardine Matheson, the Keswicks, have often held leadership positions at HSBC.

Standard Chartered, meanwhile, is closely tied to the Inchape family, a fixture of the British ruling class with numerous concerns in global shipping and manufacturing.

When it comes to dealing with stock issuance and other business affairs in the United States, Glorious Sun retained the services of the Bank of New York (now BNY Mellon), a banking institution with a notorious history of involvement in organized crime-linked money laundering and capital flight.

Glorious Sun itself has maintained a strong presence in New York City, where it has been an active player in the world of Manhattan real estate.

Their New York-based activities have included partnerships with Polylinks International, a consortium of leading Hong Kong families that has invested heavily in the real estate markets in New York, San Francisco, London, and elsewhere. Polylinks is best known for its 1994 deal—which Glorious Sun did not participate in—with Donald Trump.

When the future president found himself saddled with a number of debts and was unable to pay what he owed for the construction of his troubled Riverside South project, Polylinks stepped in and effectively took control of the development. In 2005, portions of Riverside South were sold to the Carlyle Group.

A Deeper Look At Glorious Sun

The chairman of Glorious Sun is entrepreneur and billionaire Charles Yeung. Hailing from China’s Guangdong province, Charles and his brother, Yeung Chun-fan, founded Glorious Sun as a small-scale operation in the 1960s. Today, the brothers own the majority Glorious Sun through the fairly complex structure of holding companies mentioned above.

They are significant stakeholders in Glorious Sun Holdings and in Advancetex Holdings, which has larger stock holdings in Glorious Sun’s various corporate units.

The rapid success of Glorious Sun propelled the Yeung brothers—Charles in particular—to the heights of not only economic, but political power in Hong Kong.

He served on the Provisional Legislative Council, a special legislative body set up during the handover of Hong Kong from the United Kingdom to the People’s Republic of China. This is illustrative of Charles Yeung’s position within the “pro-business, pro-Beijing” wing of Hong Kong’s ruling class.

He has also been affiliated with the One Country, Two Systems Research Institute think-tank and with the Hong Kong Progressive Alliance, a business-led political party that has had ties to liberal factions in the Communist Party of China. Yeung has also been active in the Democratic Alliance for Betterment and Progress of Hong Kong, which absorbed the Hong Kong Progressive Alliance in 2005.

Charles Yeung also appears to have maintained a presence in Macao, the former Portuguese colony that, since the late 1990s, has been one of China’s special administrative regions.

The economies and banking systems of Macao and Hong Kong have been closely intertwined: for decades, the city was known as one of the world’s premier zones for the (then-illicit) gold trade, which was heavily fueled by Hong Kong banks and their international partners— with HSBC being one particularly notable example. Important gold smuggling institutions in Macao included Seng Heng Bank.

For many years, the controllers of Seng Heng were a small syndicate that included Ho Yin, a gold smuggler with close ties to the Chinese Communist Party, and Cheng Yu-tung, the founder of Hong Kong’s New World Development Company.

New World would later be involved with the Polylinks consortium that took control of Donald Trump’s Riverside South real estate project.

In the early 1980s, Ho Ying, Cheng Yu-tung and their partner, Lu Daohe, sold Seng Heng to Arkansas political kingmaker—and seasoned traveler in the worlds of international commerce and intelligence operations—Jackson Stephens, as well as his close friend and banking partner, Mochtar Riady.

This purchase curiously took place the same year that Stephens and Riady took control of Worthen Bank in Arkansas, an entity closely connected to Little Rock’s Rose Law firm and the rising political fortunes of the Clintons.

As for Seng Heng, Stephens and Riady unloaded the bank in 1989 to STDM. This company, founded by Hong Kong-Macao billionaire businessman Stanley Ho, held a monopoly over Macao’s gambling industry. Ho himself has been haunted by numerous accusations of association with organized crime elements that operate in Macao’s underworld.

This is where Charles Yeung re-enters the picture. When STDM purchased Seng Heng from the Stephens-Riady syndicate, it maintained 100% ownership and placed its own directors and executives on the bank’s board.

In 2007, a major stake in Seng Heng was sold to the Industrial and Commercial Bank of China (ICBC).

Due to the wariness that various businesses showed when it came to dealing with Seng Heng, largely due to its reputation as a “casino bank”, ICBC set out to revamp the bank’s image.

It dispensed with a handful of the old directors—figures like Stanley Ho, however, stayed on with the board—and replaced them figures that exemplified a new corporate ethos. Charles Yeung was one of ICBC’s new appointees.

Yet Cheung himself had been plagued with accusations of involvement with money laundering, particularly as it related to Glorious Sun’s operations in the Philippines. Glorious Sun set up a manufacturing base there in 1976, which grew into the Philippines’ second largest apparel exporter by 1983.

This shift, which was part of Glorious Sun’s efforts to move its manufacturing out of Hong Kong in search of lower costs, happened alongside a thaw in the China–Philippines relationship.

For much of the Cold War, the government of Filipino president Ferdinand Marcos was stalwartly anti-communist, and maintained close ties to the PRC’s rival, the Kuomintang (KMT) or Nationalist Chinese. Likewise, Marcos closely collaborated with the pro-KMT “China Lobby” in the United States.

According to Sterling and Peggy Seagrave, the roots of the thaw can be traced to an arrangement, made in the context of the Nixon-Kissinger overtures to China, to bolster foreign currency reserves in Chinese-owned banks by the infusion of gold and other metals and cash held by the Marcos family.

A documented trail exists showing that, during the 1970s, an incremental but steady flow of capital was deposited into various banks in mainland China and in Hong Kong.

Glorious Sun was accused of participating in the smuggling of Filipino wealth abroad as it was pilfered by the Marcos family through a complicated series of transactions and orders between the Philippines and Hong Kong.

A legal complaintfiled with the Philippines’ Supreme Court charged that Yeung and other Glorious Sun executives “acted as fronts or dummies, cronies or otherwise willing tools of spouses Ferdinand and Imelda Marcos… in the illegal salting of foreign exchange.”

They purportedly did this by “importing fabrics from only one supplier… at prices much higher than those being paid by other users of similar materials”. Other documents from this case show that Archie Chan was also identified as a participant in the scheme.

In the end, Glorious Sun was acquitted of any involvement in “dollar salting” (i.e. the movement of capital out of the country without the approval of the Philippines’ central bank)—but it was under peculiar circumstances.

Other case filingsnote that “the court held that the documentary evidence relevant to this allegation [against Glorious Sun] was INADMISSABLE for being mere photocopies”.

That Glorious Sun, and Archie Chan, would have connections to the Marcos family and their financial schemes is significant as other key players that enabled those schemes intersect with the Jeffrey Epstein-Ghislaine Maxwell network explored in One Nation Under Blackmail. One of Marcos family’s main accomplices was none other than arms dealer and intelligence asset Adnan Khashoggi.

Key to Khashoggi’s murky finances in the 1980s was Jeffrey Epstein, who – for an unspecified period – was hired by Khashoggi for the purposes of either finding or hiding large sums of “looted” money (Epstein likely helped Khashoggi with both).

Another top “financial adviser” to Imelda Marcos was actor George Hamilton, who – in the early 1990s – was a confidant and vacation companion of Ghislaine Maxwell right up until she publicly aligned herself with Jeffrey Epstein shortly after her father’s death in 1991.

Glorious Sun may have additional ties to this network via Mast Industries, a Hong Kong-based export-import firm with a specialty in textile goods sourced from elsewhere across Asia.

During the early 1970s, Leslie Wexner contracted with Mast to supply fabrics to be used for his corporate flagship, The Limited. By the end of the decade, Wexner purchased Mast and it became a major subsidiary of his corporate empire.

While this is currently no evidence that indicates that Glorious Sun used the services of Mast Industries (though it would not be surprisingly, given its status as one of Hong Kong’s major apparel companies), there are nonetheless connections between the two companies.

During the late 1970s, Mast Industries formed a joint-venture called Sinotex, with the Crystal Group Limited, yet another Hong Kong-based apparel manufacturer.

A review of the affiliations of the Crystal Group’s founder, Kenneth Lo, shows that he moves in many of the same circles as Glorious Sun’s Charles Yeung (for example, both are honorary vice-chairmen of the Hang Seng University of Hong Kong).

The head of the Crystal Group’s intimates division, meanwhile, is Lo Wing Sing Eddie, who had previously served as the managing director of Glorious Sun’s major subsidiary, Jeanwest.

Aside from Glorious Sun and the Yeung family, Archie Chan has another connection that is worth noting. In 2009, Chan was made a Knight Commander of the Royal Order of the Kingdom of Poland.

His sponsor was Paul Kan Man-Lok, a Hong Kong technology-focused businessman who had previously “been honored by Queen Elizabeth and numerous Heads of State for his humanitarian service.”

Paul Kan is the founder and chairman of Champion Technology Holdings. Like Glorious Sun and Chan’s Farmington Finance Corporation, Champion Technology has made use of holding companies set up in the Road Town, BVI.

Kan’s Champion Technology has maintained a long-standing relationship with the People’s Liberation Army (PLA), the PRC’s primary military organization. The PLA has been an active player in the worlds of Chinese and Hong Kong business, operating both overt and covert fronts for both the acquisition and development of cutting-edge technology.

As recounted in a 1997 Forbes article, Kan found himself partnering with the PLA in the late 1980s, when he hoped to set up a Champion Technology division in China dedicated to radio paging technology.

“The bureaucrats at the Ministry of Posts & Telecommunications dithered”, the article recounts, “but companies owned by the military jumped at the chance… Kan… now has paging franchises in dozens of cities across China, mainly through partnerships controlled by local units of the PLA.”

Changing Hands

As noted last week by Protos, Archie Chan is alleged to have essentially done nothing with Farmington State Bank from 1995 until relatively recently. However, his connections suggest that there may have been more to his use of the bank, or at the very least his Farmington Finance Corporation, than meets the eye.

In 2020, Chan sold the bank to FBH Corporation, which was incorporated in 2019 and whose chairman is Jean Chalopin, a “seasoned entrepreneur” who went from playing a major role in children TV programming in the 1980s and 1990s to the largest shareholder of Deltec Bank and Trust and, subsequently, its chairman.

It remains unknown if Chalopin knew Chan prior the sale and how or why Chalopin became interested in the tiny, Washington-based bank.

Shortly after Farmington was sold to Chalopin’s FBH Corp., Chalopin joined Farmington’s board of directors. Notably, Deltec Bank and Trust, where Chalopin is chairman, was described by Protos as “one of the main banks for both Alameda Research [FTX’s trading arm that played a central role in its collasep] and Tether.”

As noted by investigative journalist Nicola Borzi, Deltec ties back to the network behind the extreme corruption and insider trading of Kidder Peabody and Drexel Burnham Lambert in the 1980s (the connections of which to shadow banking and Jeffrey Epstein are detailed in One Nation Under Blackmail) as well as to intelligence-linked figures like Armand Hammer. More on the FTX-Deltec Bank connections will be discussed shortly.

Chan sold Farmington to a company based in Baltimore called GUVJEC Investment Corporation, of which Chalopin is president, GUVJEC, however, was originally created by Robin Trehan, a self-described banking and fintech advisor whose focus is on “is on bringing blockchain tech to the masses by integrating the fintech industry and traditional banking.”

His LinkedIn says he has been a partner of Chicago-based Credit Capital Funding for decades. However, Trehan is a Senior VP of Deltec International, the parent company of Deltec Bank and Trust. Trehan oddly excludes this from his LinkedIn profile.

Trehan and Chalopin are listed as executive officers of FBH Corp., according to SEC filings from earlier this year, in February. Listed as directors of FBH are Noah Perlman and Gary Rever (referred to in filings as A. Gary Rever).

Perlman at the time of FBH Corp’s incorporation was Chief Compliance Officer of the crypto exchange Gemini.

He is now Gemini’s Chief Operating Officer, a position he has held since 2020. Notably, the implosion of FTX caused some problems for Gemini, which temporarily halted withdrawals from its “Gemini Earn” program due to fallout tied to the FTX bankruptcy.

The FTX implosion had affected the main lender of that Gemini program, Genesis. Past reports suggestthat Perlman was involved in Gemini’s 2021 decision to partner with Genesis. Again, like Trehan, Perlman excludes any mention of his role at Moonstone from his LinkedIn profile.

Soon after its purchase by the Chalopin-led FBH Corp, Farmington “pivoted to deal with cryptocurrency and international payments,” but encountered problems moving money. It resolved these issues by seeking Federal Reserve approval and became part of the Federal Reserve System in June 2021.

In March of this year, Farmington State Bank trademarked the name Moonstone Bank and adopted that name three days later. Four days after that, on March 7, FTX’s trading arm, Alameda Research, invested $11.5 million into FBH Corp/Moonstone Bank.

At the time, Chalopin stated of the investment that “Alameda Research’s investment into FBH Corp and Moonstone Bank signifies the recognition, by one of the world’s most innovative financial leaders, of the value of what we are aiming to achieve.

This marks a new step into building the future of banking.” It still remains unknown what this multi-million dollar investment was for, though Moonstone’s Chief Digital Officer Janvier Chalopin, the son of Jean Chalopin, told Protos that the investment was “seed funding … to execute our new plan of being a tech-focused bank.”

The exact same day that this significant investment was announced, Ronald Oliveira was installed as Moonstone’s Chief Executive Officer, until he left Moonstone in August for reasons that are still unclear.

Part of the confusion relates to an incongruity between claims from Moonstone executives about the reason for Oliveira’s departure (that he had gotten a job “opportunity he couldn’t refuse”) and what Oliveira has publicly written about his work since leaving the bank (that he is now working as a self-employed consultant).

Prior to joining Moonstone, Oliveira had been the US CEO for Revolut, “a global fintech headquartered in the UK.” The press release which discusses both the investment and Oliveira’s new role at Moonstone states that Oliveira had “engineered Revolut’s official public entry into the US.”

Revolut was created by NJF Capital in 2015 to be a “leading digital alternative bank.” NJF Capital was founded and is run by Nicole Junkermann, a former model and close, intimate associate of sex trafficker and financial criminal Jeffrey Epstein.

Junkermann was allegedly involved in major aspects of his sex blackmail activities, including the sex blackmail of two sitting US senators in the early 2000s, and later played a key role in intelligence-linked firms that Epstein had funded, such as Carbyne 911.

It is unknown if the Alameda investment in Moonstone had influenced the decision to hire Oliveira or vice versa, though neither is outside the realm of possibility.

This is partially because the controversial stablecoin Tether also banks with another Chalopin-directed bank, Deltec Bank and Trust. A recent investigation by Revolver News detailed the ways that Tether has shown signs of itself being a Ponzi Scheme, not unlike FTX. The investigation also noted that the stablecoin’s co-founder, Brock Pierce, boasts connections to Jeffrey Epstein.

Pierce, a former child actor in Disney films, had previously been a co-founder and an executive at Digital Entertainment Network (DEN), where he and other executives were accused of sexual assault.

The case against Pierce was dropped after Pierce paid a considerable sum to one of the plaintiff’s lawyers. However, his co-defendant Marc Collins-Rector, the other co-founder of DEN, was indicted on criminal charges.

When Collins-Rector was arrested by Interpol in 2002, the Spanish villa he shared with Pierce was found to contain rifles, machetes and child pornography. DEN, during its brief existence, produced a program that was described as a “gay pedophile version of Silver Spoons.”

As for Tether itself, not everyone believes it to be a Ponzi Scheme, as suggested by the aforementioned report published by Revolver News. For instance, Marty Bent, a well-known bitcoiner who runs TFTC.io, told Unlimited Hangout that Tether was able to quickly process $10 billion in withdrawals following the collapse in price of the TerraUSD/Luna cryptocurrencies this past May.

This would suggest that Tether does indeed have the reserves at Deltec Bank and Trust that it claims to have. Bent suggested that Tether, instead of being a Ponzi Scheme, was “extremely high risk” and at the mercy of US regulators and other financial authorities.

It has since been reported that Sam Bankman-Fried of FTX is now under investigation for the potential role played by FTX, Alameda Research and the aforementioned Genesis Trading in the manipulation of TerraUSD/Luna prices earlier this year, leading to the crash in their value in May.

In addition, as noted by Dirty Bubble Media, Tether’s previous banking partner prior to the Chalopin-led Deltec, Crypto Capital, was caught laundering money for drug cartels (something the aforementioned HSBC has also been caught doingon a massive scale).

In addition, Dirty Bubble Media noted that Tether’s leadership has also paid large fines for lying about the state of their reserves, which are ostensibly held by Deltec. Furthermore, Tether’s CFO and CEO were involved “in one of the largest VAT tax evasion schemes in European history.”

As previously mentioned, Alameda Research was also considerably involved with Chalopin’s Deltec Bank and Trust, as were other companies tied to the FTX web of companies and Sam Bankman-Fried. These connections between the FTX web and Deltec existed at the time of Alameda’s mysterious investment into FBH Corp/Moonstone Bank.

Documents produced by John Ray, the newly-appointed CEO of FTX following its bankruptcy, revealed that FTX and affiliated companies/subsidiaries had a total of 17 accounts at Deltec. Most of these accounts were associated with Alameda Research and West Realm Shires Services, both of which were ultimately controlled by Sam Bankman-Fried.

Those 17 accounts were held in a variety of currencies according to reports, including US dollars, euros, Swiss francs, Canadian and Australian dollars and the British pound sterling. Rumors circulated in recent weeks that FTX’s connections to Deltec had enabled the latter to acquire Ansbacher, another Bahamas-based bank, earlier this year. However, Deltec has vigorously denied the allegations.

Deltec has also, notably, declined to comment on any details of their relationship with entities controlled by Sam Bankman-Fried or tied to FTX. The Deltec-Tether association and the Deltec-FTX/Alameda association seem to be suggestive of a pattern for the Chalopin-led Deltec.

Those associations also seem suggestive as to why Chalopin would seek to acquire Farmington/Moonstone Bank from someone like Archie Chan.

Regardless of the real story behind Farmington’s transformation into Moonstone and Alameda’s decision to invest in the bank shortly thereafter, the amount of deposits held by the bank jumped considerably after these developments. As noted by Protos, after “consistently report[ing] deposits hovering around $10 million for decades,” the bank reported $84 million in deposits in the third quarter of 2022. $71 million of those deposits were from just four new accounts.

The Protos report concludes the following:

“No one is able to ascertain what the $11.5 million investment from Alameda Research was for, no one can explain why a small, rural bank in southeastern Washington state would be used to move millions of dollars by Alameda, and no one can fully explain the connections between Farmington, Deltec, FTX/Alameda and Tether. Not to mention, it remains unclear how a Bahamas-based company like FTX, with ongoing investigations by top financial watchdogs, was able to purchase a stake in a federally approved bank.”

These points were also raised by the New York Times, which quoted Camden Fine, a bank industry consultant as saying:

“The fact that an offshore hedge fund that was basically a crypto firm was buying a stake in a tiny bank for multiples of its stated book value should have raised massive red flags for the F.D.I.C., state regulators and the Federal Reserve…It’s just astonishing that all of this got approved.”

Moonstone And The “Bridge” To CBDCs

Just a few weeks before the implosion of FTX, in late October, Moonstone Bank partnered with a little known company called Fluent Finance in order to “accelerate crypto adoption by issuing US+ stablecoin.”

That partnership is described as allowing “Fluent and Moonstone Bank to connect the traditional financial system to the emerging Web 3 economy.”

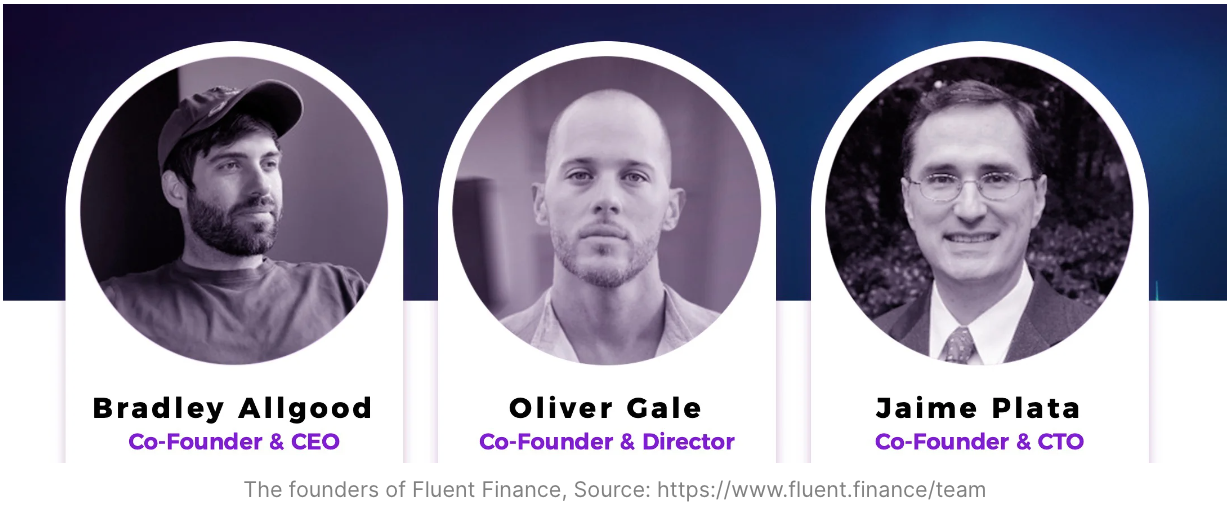

Fluent Finance has three co-founders: Bradley Allgood, Oliver Gale and Jaime Plata. Though Allgood is often put out as the face of the company, it is Gale and Plata who merit the most attention.

Oliver Gale is the self-described “inventor” of the Central Bank Digital Currency (CBDC), as he was the mastermind behind the Eastern Caribbean Digital Dollar. Gale reportedly left the program due to its “ideological shift” toward a “permissioned blockchain” model that affords central banks unprecedented control over the money it prints.

However, today, Gale, despite his pro-privacy posturing, is “not entirely against CBDCs, provided they run on infrastructure that doesn’t endanger their users.”

Articles have noted Gale’s influence on major CBDC policy papers that have the backing of the world’s most powerful financial institutions and central bankers, such as those published by the CBDC think tank. Jaime Plata has worked as a “strategic advisor” to the Eastern Caribbean Central Bank, where he collaborated on Gale’s digital dollar project by helping the bank “replace their Core banking application, integrate CBDCs and a real time gross settlement system.”

Fluent Finance’s US+ stablecoin is designed to act “as a technological bridge, connecting legacy [e.g. existing] banking systems and digital finance.” It is openly promoted as being compatible with CBDCs and as having “built-in digital identity standards.”

It is certainly interesting that two banking interests tied to Jean Chalopin, Deltec and Moonstone, both have intimate partnerships with dollar-based stablecoins, Tether and now US+.

If Tether is set to unravel in the wake of FTX’s collapse, as some believe, US+ seems designed to be the “trustworthy” counterpart meant to herd the “legacy” financial system into the CBDC era, where central banks will have total control.

However, this could have been a move aimed at fulfilling Sam Bankman-Fried’s ultimate ambitions for FTX, which was to turn FTX into the “everything exchange” and the “everything app.” In other words, FTX aimed to be the main force in the fintech space globally.

While such dreams have been shattered in the wake of FTX’s implosion, the exchange’s efforts to expand into every asset class invariably led to its expansion through a labyrinthian network that is still only beginning to unravel.

However, as this investigation has endeavored to show, the connections revealed by pulling on the single thread of its relationship with Farmington State Bank reveal that the corrupt actors and entities in this story extend far beyond Bankman-Fried and FTX.

Updated: 5-8-2024

Crypto Exchange FTX Is The Rare Financial Blowup That Will Repay Victims In Full

“This is historic,” Thomas Braziel, an investor in distressed debt and crypto assets said. “That’s got to be the highest return of all time” for creditors in a bankruptcy.

Once viewed as a near-total loss for customers, FTX’s assets have rebounded since its 2022 bankruptcy filing.

Defunct crypto exchange FTX said it will have more than enough money to fully repay its millions of swindled customers with interest, an outcome that seemed unthinkable when it collapsed into bankruptcy in 2022.

FTX said in court papers Tuesday that it will have $14.5 billion to $16.3 billion in cash after liquidating its cryptocurrency holdings and other investments, more than enough to cover the roughly $11 billion that customers and nongovernment creditors are owed.

That customer money has been trapped since November 2022, when Sam Bankman-Fried ceded control of FTX to a new management team that filed it for bankruptcy, beginning one of the largest-ever efforts to recover misappropriated funds.

The management team found enough funds for FTX’s creditors thanks to a rally in cryptocurrency prices and the sale of stakes the company acquired—with users’ money—in speculative crypto projects and other technology ventures.

The bankruptcy process gave FTX the time it needed to find buyers and fill in the nearly $9 billion balance-sheet hole it entered chapter 11 with.

If approved in court, the repayment plan would make FTX the rare case of financial fraud that compensates its victims in full, and relatively quickly.

By way of comparison, account holders at Bernard Madoff’s firm have waited more than a decade and a half for their stolen money to trickle back after his 2008 arrest for operating a Ponzi scheme.

Aside from FTX’s millions of individual customers, some of Wall Street’s biggest investment firms are among the winners. They bet that, when FTX filed for bankruptcy, many of its customers would want to—or need to—cash out their claims against the exchange rather than wait years to see how much they might recover.

Asset managers including Oaktree Capital Management, Attestor, Canyon Capital, Farallon Capital Management and Silver Point Capital hold more than $3 billion in customer claims they bought, court filings show. The firms didn’t return requests for comment.

Soon after FTX filed for bankruptcy, customer claims could be purchased for as little as 3 cents on the dollar, said Thomas Braziel, an investor in distressed debt and crypto assets whose firm has bought claims from FTX customers.

Customers who sold their claims for pennies on the dollar may have seller’s remorse. FTX said Tuesday that 98% of its users are now expected to recover 118% of their account balances.

FTX previously said it would be able to pay its millions of users more or less in full for the amounts they had in their crypto trading accounts when the company filed for chapter 11. On Tuesday, it said it wouldn’t only cover those account balances in full but also would pay 9% interest to most users, dating back to the bankruptcy filing.

U.S. prosecutors called FTX a massive fraud and charged Bankman-Fried and other former executives with fraud. Bankman-Fried was sentenced in March to 25 years in prison for stealing billions of dollars from customers.

The bankruptcy plan filed Tuesday marks the first time FTX confirmed it expects users to recover their funds in full.

Driving the turnaround in users’ fortunes was a rebound in cryptocurrency prices. A large portion of FTX’s assets are tied to the volatile market for digital assets, many of which have risen in value since the bankruptcy filing—especially solana, a token closely tied to Bankman-Fried that has multiplied sevenfold since the bankruptcy filing.

Some customers have complained, however, that they’re being repaid in cash—not the crypto they deposited—based on the values in their frozen FTX accounts. That means they have missed out on the asset appreciation in cryptocurrencies as prices roared back after 2022’s meltdown.

Saul Ewing bankruptcy lawyer Candice Kline said being paid in full in bankruptcy differs from being made whole in an economic sense.

“Actual market value, time value of money beyond some interest, and opportunity cost will still hound creditors digesting this good news,” she said.

In addition to the recent bull run in prices of bitcoin, ether and solana, customers and investors can thank the rising value of FTX’s venture-capital investments and its success in finding and clawing back assets that were transferred out of the company shortly before its bankruptcy filing, said Erin Broderick, a lawyer for a group of FTX claim holders.

For instance, FTX sold most of its stake in Anthropic, an artificial intelligence startup backed by Google and Amazon.com, for $884 million this year—267% above the original purchase price.

Brigham Young University law professor Brook Gotberg said valuing claims in bankruptcy isn’t always straightforward, and that it depends on what type of relationship a company has with its customers.

“If the claim is just for the dollar value of the cryptocurrency at the time of the bankruptcy filing, then the FTX creditors will be paid in full,” she said. “If the claim is for the cryptocurrency itself, then the FTX creditors aren’t getting their full value.”

Holders of FTX’s proprietary FTT token—another Bankman-Fried creation—won’t receive anything under FTX’s plan. Nor will the exchange’s equity owners—which include Sequoia Capital, the Ontario Teachers’ Pension Plan and SoftBank Group—and FTX’s various celebrity backers who include NFL quarterback Tom Brady and model Gisele Bündchen.

Under Bankman-Fried’s leadership, the company spent customer money on “bad or illiquid investments, vanity projects, celebrity endorsements, political donations, and lavish personal expenditures,” FTX’s court papers said on Tuesday.

Hard assets recovered for customers since the bankruptcy include luxury real estate in FTX’s former home of the Bahamas as well as two private jets. The company explored, then abandoned, plans to reboot its crypto exchange.

Prosecutors said Bankman-Fried’s theft of customer funds caused $10 billion in losses, drawing comparisons to Madoff. After FTX’s bankruptcy, Bankman-Fried argued that customers could be made whole.

Ahead of his sentencing, Bankman-Fried claimed that FTX was “solvent at the time of the bankruptcy petition” and that “the harm to customers, lenders and investors is zero” because of the likely outcome of FTX’s chapter 11 case.

John J. Ray III, the turnaround specialist who assumed control of FTX from Bankman-Fried, said in response that the company’s asset-recovery effort since 2022 “does not mean that things were not stolen.”

“What it means is that we got some of them back,” Ray said in a March filing in Bankman-Fried’s criminal case. “And there are plenty of things we did not get back.”

U.S. District Judge Lewis Kaplan said that whether customers recovered their money didn’t weigh into his sentencing decision for Bankman-Fried, who has appealed his conviction and sentence.

FTX Crypto Fraud Victims To Get Their Money Back — Plus Interest

Bankruptcy lawyers representing customers impacted by the dramatic crash of cryptocurrency exchange FTX 17 months ago say that the vast majority of victims will receive their money back — plus interest.

The news comes six months after FTX co-founder and former CEO Sam Bankman-Fried (SBF) was found guilty on seven counts related to fraud, conspiracy, and money laundering, with some $8 billion of customers’ funds going missing.

SBF was hit with a 25-year prison sentence in March, and ordered to pay $11 billion in forfeiture. The crypto mogul filed an appeal last month that could last years.

Restructuring

After filing for bankruptcy in late 2022, SBF stood down and U.S. attorney John J. Ray III was brought in as CEO and “chief restructuring officer,” charged with overseeing FTX’s reorganization.

Shortly after taking over, Ray said in testimony that despite some of the audits that had been done previously at FTX, he didn’t “trust a single piece of paper in this organization.”

In the months that followed, Ray and his team set about tracking the missing funds, with some $8 billion placed in real estate, political donations, and VC investments — including a $500 million investment in AI company Anthropic before the generative AI boom, which the FTX estate managed to sell earlier this year for $884 million.

Initially, it seemed unlikely that investors would recoup much, if any, of their money, but signs in recent months suggested that good news might be on the horizon, with progress made on clawing back cash via various investments FTX had made, as well as from executives involved with the company.

We now know that 98% of FTX creditors will receive 118% of the value of their FTX-stored assets in cash, while the other creditors will receive 100% — plus “billions in compensation for the time value of their investments,” according to a press release issued by the FTX estate today.

In total, FTX says that it will be able to distribute between $14.5 and $16.3 billion in cash, which includes assets currently under control of entities including chapter 11 debtors, liquidators, the Securities Commission of The Bahamas, the United States Department of Justice, among various other parties.

While the reorganization plan will need approval from the relevant bankruptcy court, the intention, they say, is to resolve all ongoing disputes with stakeholders and government, “without costly and protracted litigation.”

It is worth noting here that creditors won’t benefit from the Bitcoin boom that has emerged from the crypto industry since FTX went belly-up. At the time of its bankruptcy filing, FTX had a huge shortfall in Bitcoin and Ethereum — far less than customers believed it actually owned.

As such, the appreciation in value of these tokens won’t be realized as part of this settlement.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Joe Rogan: I Have A Lot Of Hope For Bitcoin

Teen Cyber Prodigy Stumbled Onto Flaw Letting Him Hijack Teslas

Spyware Finally Got Scary Enough To Freak Lawmakers Out—After It Spied On Them

The First Nuclear-Powered Bitcoin Mine Is Here. Maybe It Can Clean Up Energy FUD

The World’s Best Crypto Policies: How They Do It In 37 Nations

Tonga To Copy El Salvador’s Bill Making Bitcoin Legal Tender, Says Former MP

Wordle Is The New “Lingo” Turning Fans Into Argumentative Strategy Nerds

Prospering In The Pandemic, Some Feel Financial Guilt And Gratitude

Is Art Therapy The Path To Mental Well-Being?

New York, California, New Jersey, And Alabama Move To Ban ‘Forever Chemicals’ In Firefighting Foam

The Mystery Of The Wasting House-Cats

What Pet Owners Should Know About Chronic Kidney Disease In Dogs And Cats

Pets Score Company Perks As The ‘New Dependents’

Why Is My Cat Rubbing His Face In Ants?

Natural Cure For Hyperthyroidism In Cats Including How To Switch Him/Her To A Raw Food Diet

Ultimate Resource For Cat Lovers

FDA Approves First-Ever Arthritis Pain Management Drug For Cats

Ultimate Resource On Duke of York’s Prince Andrew And His Sex Scandal

Walmart Filings Reveal Plans To Create Cryptocurrency, NFTs

Bitcoin’s Dominance of Crypto Payments Is Starting To Erode

T-Mobile Says Hackers Stole Data On About 37 Million Customers

Jack Dorsey Announces Bitcoin Legal Defense Fund

More Than 100 Millionaires Signed An Open Letter Asking To Be Taxed More Heavily

Federal Regulator Says Credit Unions Can Partner With Crypto Providers

What’s Behind The Fascination With Smash-And-Grab Shoplifting?

Train Robberies Are A Problem In Los Angeles, And No One Agrees On How To Stop Them

US Stocks Historically Deliver Strong Gains In Fed Hike Cycles (GotBitcoin)

Ian Alexander Jr., Only Child of Regina King, Dies At Age 26

Amazon Ends Its Charity Donation Program Amazonsmile After Other Cost-Cutting Efforts

Indexing Is Coming To Crypto Funds Via Decentralized Exchanges

Doctors Show Implicit Bias Towards Black Patients

Darkmail Pushes Privacy Into The Hands Of NSA-Weary Customers

3D Printing Make Anything From Candy Bars To Hand Guns

Stealing The Blood Of The Young May Make You More Youthful

Henrietta Lacks And Her Remarkable Cells Will Finally See Some Payback

AL_A Wins Approval For World’s First Magnetized Fusion Power Plant

Want To Be Rich? Bitcoin’s Limited Supply Cap Means You Only Need 0.01 BTC

Smart Money Is Buying Bitcoin Dip. Stocks, Not So Much

McDonald’s Jumps On Bitcoin Memewagon, Crypto Twitter Responds

America COMPETES Act Would Be Disastrous For Bitcoin Cryptocurrency And More

Lyn Alden On Bitcoin, Inflation And The Potential Coming Energy Shock

Inflation And A Tale of Cantillionaires

El Salvador Plans Bill To Adopt Bitcoin As Legal Tender

Miami Mayor Says City Employees Should Be Able To Take Their Salaries In Bitcoin

Vast Troves of Classified Info Undermine National Security, Spy Chief Says

BREAKING: Arizona State Senator Introduces Bill To Make Bitcoin Legal Tender

San Francisco’s Historic Surveillance Law May Get Watered Down

How Bitcoin Contributions Funded A $1.4M Solar Installation In Zimbabwe

California Lawmaker Says National Privacy Law Is a Priority

The Pandemic Turbocharged Online Privacy Concerns

How To Protect Your Online Privacy While Working From Home

Researchers Use GPU Fingerprinting To Track Users Online

Japan’s $1 Trillion Crypto Market May Ease Onerous Listing Rules

Ultimate Resource On A Weak / Strong Dollar’s Impact On Bitcoin

Fed Money Printer Goes Into Reverse (Quantitative Tightening): What Does It Mean For Crypto?

Crypto Market Is Closer To A Bottom Than Stocks (#GotBitcoin)

When World’s Central Banks Get It Wrong, Guess Who Pays The Price??? (#GotBitcoin)

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin And Gold

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Does Your Baby’s Food Contain Toxic Metals? Here’s What Our Investigation Found

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

Ultimate Resource On BlockFi, Celsius And Nexo

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

100 Million Americans Can Legally Bet on the Super Bowl. A Spot Bitcoin ETF? Forget About it!

Green Finance Isn’t Going Where It’s Needed

Shedding Some Light On The Murky World Of ESG Metrics

SEC Targets Greenwashers To Bring Law And Order To ESG

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Canada’s Major Banks Go Offline In Mysterious (Bank Run?) Hours-Long Outage (#GotBitcoin)

On-Chain Data: A Framework To Evaluate Bitcoin

On Its 14th Birthday, Bitcoin’s 1,690,706,971% Gain Looks Kind of… Well Insane

The Most Important Health Metric Is Now At Your Fingertips

American Bargain Hunters Flock To A New Online Platform Forged In China

Why We Should Welcome Another Crypto Winter

Traders Prefer Gold, Fiat Safe Havens Over Bitcoin As Russia Goes To War

Music Distributor DistroKid Raises Money At $1.3 Billion Valuation

Nas Selling Rights To Two Songs Via Crypto Music Startup Royal

Ultimate Resource On Music Catalog Deals

Ultimate Resource On Music And NFTs And The Implications For The Entertainment Industry

Lead And Cadmium Could Be In Your Dark Chocolate

Catawba, Native-American Tribe Approves First Digital Economic Zone In The United States

The Miracle Of Blockchain’s Triple Entry Accounting

How And Why To Stimulate Your Vagus Nerve!

Housing Boom Brings A Shortage Of Land To Build New Homes

Biden Lays Out His Blueprint For Fair Housing

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Cracks In The Housing Market Are Starting To Show

Ever-Growing Needs Strain U.S. Food Bank Operations

Food Pantry Helps Columbia Students Struggling To Pay Bills

Food Insecurity Driven By Climate Change Has Central Americans Fleeing To The U.S.

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Families Face Massive Food Insecurity Levels

US Troops Going Hungry (Food Insecurity) Is A National Disgrace

Everything You Should Know About Community Fridges, From Volunteering To Starting Your Own

Russia’s Independent Journalists Including Those Who Revealed The Pandora Papers Need Your Help

10 Women Who Used Crypto To Make A Difference In 2021

Happy International Women’s Day! Leaders Share Their Experiences In Crypto

Dollar On Course For Worst Performance In Over A Decade (#GotBitcoin)

Juice The Stock Market And Destroy The Dollar!! (#GotBitcoin)

Unusual Side Hustles You May Not Have Thought Of

Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

The Fed Is Setting The Stage For Hyper-Inflation Of The Dollar (#GotBitcoin)

An Antidote To Inflation? ‘Buy Nothing’ Groups Gain Popularity

Why Is Bitcoin Dropping If It’s An ‘Inflation Hedge’?

Lyn Alden Talks Bitcoin, Inflation And The Potential Coming Energy Shock

Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

What The Fed’s Rate Hike Means For Inflation, Housing, Crypto And Stocks

Egyptians Buy Bitcoin Despite Prohibitive New Banking Laws

Archaeologists Uncover Five Tombs In Egypt’s Saqqara Necropolis

History of Alchemy From Ancient Egypt To Modern Times

Former World Bank Chief Didn’t Act On Warnings Of Sexual Harassment

Does Your Hospital or Doctor Have A Financial Relationship With Big Pharma?

Ultimate Resource Covering The Crisis Taking Place In The Nickel Market

Apple Along With Meta And Secret Service Agents Fooled By Law Enforcement Impersonators

Handy Tech That Can Support Your Fitness Goals

How To Naturally Increase Your White Blood Cell Count

Ultimate Source For Russians Oligarchs And The Impact Of Sanctions On Them

Ultimate Source For Bitcoin Price Manipulation By Wall Street

Russia, Sri Lanka And Lebanon’s Defaults Could Be The First Of Many (#GotBitcoin)

Will Community Group Buying Work In The US?

Building And Running Businesses In The ‘Spirit Of Bitcoin’

What Is The Mysterious Liver Disease Hurting (And Killing) Children?

Citigroup Trader Is Scapegoat For Flash Crash In European Stocks (#GotBitcoin)

Bird Flu Outbreak Approaches Worst Ever In U.S. With 37 Million Animals Dead

Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.