Ultimate Resource For Grayscale Bitcoin Trust Involvement In The Crypto-Industry (#GotBitcoin)

Digital asset management fund Grayscale Investments’ Bitcoin Trust (GBTC) is up almost 300% on the year, data from Morningstar via the Wall Street Journal (WSJ) reveals. Ultimate Resource For Grayscale Bitcoin Trust Involvement In The Crypto-Industry (#GotBitcoin)

As of July 9, the investment instrument is yielding a 296% appreciation YTD — a stratospheric increase as compared with mainstream investments reflected in the S&P 500 (18.7%) and Global Dow (12.9%) over the same time period.

As of the end of June, a WSJ report had indicated that the fund’s dizzying returns had secured its spot as the best-performing fund in the market. The trust purchases bitcoin (BTC) directly and trades its shares on the over-the-counter (OTC) exchange OTCQX, as the report noted at the time.

WSJ further underscored the fact that the fund’s meteoric performance is not unprecedented — during bitcoin’s historic winter 2017 bull run, the GBTC reportedly reflected a 1,391.44% appreciation over the course of the year to date.

Grayscale — which is owned by Digital Currency Group Inc. — revealed to the WSJ that the GBTC’s assets under management as of June 28 had hit $2.56 billion, accounting for the lion’s share of Grayscale’s total $2.69 billion worth of assets.

Those seeking to receive a primary issue of the trust fund must hold accredited investor status and invest a minimum of $50,000 held in shares for at least a year before resale on OTCQX.

Alongside its flagship trust, which launched in September 2018, Grayscale has rolled out a series of single crypto asset funds — among them ethereum classic (ETC), zcash (ZEC) and litecoin (LTC) — as well as diversified offerings, such as its Digital Large Cap Fund.

As a Grayscale report published earlier this year revealed, institutions accounted for 66% of investments, with 88% of new inflows coming into GBTC — a trend the company characterized as the “return of the Bitcoin maximalist.”

Yesterday, the firm announced it was resuming private placement of shares in GBTC, with one share currently representing 0.00097876 BTC.

In May, Grayscale had reported that out of its total $2.1 billion in assets under management, $1.97 billion were in its Bitcoin Trust.

That same month, Grayscale’s research indicated that bitcoin had gained 47% between May 5–31 at a time of intensifying United States-China trade tensions, making it the best-performing asset of the period — in stark contrast to the Chinese yuan’s faltering.

Updated: 10-16-2019

Grayscale: Q3 Saw Record High Inflows, Growing Institutional Interest

Digital asset management giant Grayscale registered over $254 million in total investment into its products in the third quarter of 2019.

In its Digital Asset Investment Report for Q3 2019, Grayscale provided details on the inflows into its products for the period from July 1, 2019 through Sept. 30, 2019.

The third quarter of the year marked the highest demand for the company’s offerings since its establishment, resulting in $254.9 million of inflows. The figure shows a threefold quarter-on-quarter increase, from $84.8 million last quarter.

The quarterly inflows into Grayscale Bitcoin Trust amounted to $171.1 million, wherein July was the month with the highest level of inflows during Q3. As reported in July, Grayscale Bitcoin trust outperformed indices in the first half of 2019, up almost 300% on the year at the time.

Domination of institutional investors

Institutional investors were the major contributors to the company’s products both in Q3 and year-to-date, with 84% and 83% respectively. Worth noting, total investments into Grayscale products from Jan. 1, 2019 through Sept. 30, 2019 amounted to $382.3 million, while the figure over the past 12 months is $412.3 million.

Previously, Grayscale’s director of sales and business development Rayhaneh Sharif-Askary stated that institutional investors are constantly piling into the space in 2019. Sharif-Askary said:

“You know, it’s really funny, I get asked this a lot — there’s this rhetoric in the media about when are institutional investors going to get involved, when are they going to start investing, and it’s so funny because it’s ironic. We see institutional investors invest with us all the time and that’s been the case for a long time now.”

Ahead Of Conquering The Market

On Oct. 14, Grayscale Investments was approved by the United States Financial Industry Regulatory Authority (FINRA) to publicly quote its Grayscale Digital Large Cap Fund on over-the-counter markets. This purportedly enables the first publicly quoted security based on a selection of digital currencies in the U.S.

In August, Cointelegraph reported that Grayscale was going to move almost $3 billion worth of its digital currency holdings to American major crypto wallet provider and exchange Coinbase. Coinbase Custody would then serve as custodian of the underlying assets for the company’s products.

Updated: 11-20-2019

Grayscale: 84% of Q3 Interest Came From Non-Crypto Hedge Funds

Grayscale’s Michael Sonnenshein contends that the asset manager’s recent Form 10 filing with American regulators would be “a milestone” for the crypto industry if it’s approved.

Sonnenshein — managing director at the world’s largest digital asset manager, Grayscale Investments — made his remarks during an interview with CNBC on Nov. 20.

Hedge Funds After Digital Asset Exposure

Earlier this week, Grayscale filed a registration statement on Form 10 for its publicly traded Bitcoin (BTC) fund Grayscale Bitcoin Trust (GBTC) with the United States Securities and Exchange Commission (SEC).

If approved, the trust would become the first cryptocurrency investment vehicle to attain the status of a reporting company by the SEC. In his interview with CNBC, Sonnenshein noted the robust institutional interest in cryptocurrency access products. Even just in Q3 2019, he said:

“84% Of Inflows Were From Non-Crypto Hedge Funds That Want Digital Asset Exposure.”

GBTC has been trading since May 2015 and Sonnenshein noted that “if we just look at the last 3-month trading volume, it’s tripled year-over-year,” regardless of Bitcoin’s performance on the spot markets.

Regarding the significance of the SEC potentially giving the green light to Grayscale’s Form 10 filing, Sonnenshein said:

“You have a lot of companies that want to have exposure to the space, but then you start to ask, who at the company is going to have the keys? Who at the company is going to do the due diligence and the ongoing compliance?”

Aside from compliance benefits, he emphasized the importance of creating a family of products that “look and feel like many of the other instruments these institutions use.”

Halving, Not Institutions, Will Drive Bitcoin’s Price

The takeaway, he suggested, is that if Form 10 is deemed to be effective, we’ll see for the first time “greater access for institutions who need an SEC reporting company to be able to invest” and “quicker liquidity options, so that investors can divulge their holdings after six, as opposed to twelve, months.”

Regarding any potential impact on Bitcoin’s price, Sonnenshein discarded the institutional investor adoption narrative and emphasized instead Bitcoin’s forthcoming halving — and consequent diminishment of supply — as a factor that has historically shown itself to have a positive impact on the asset’s price.

As reported, Grayscale’s regulatory foray follows a record year for the trust, which saw inflows of $254 million in total investment into its products in the third quarter of 2019.

Updated: 1-16-2020

VC Giant Grayscale Investments Reports Record-Breaking Year

Venture capital firm Grayscale Investments banked a stellar 2019 to surpass the $1 billion mark in total investments.

By The Numbers

In a comprehensive eighteen-page report, the firm touted a record Q4 in 2019. It raised $225.5 million into its investment products, lifting the year’s inflow to $607.7 million after back-to-back quarterlies over $225 million, possibly signaling a larger market trend.

71 percent of the year’s inflow sprung from institutional investors. Managing director Michael Sonnenshein told Cointelegraph:

“We saw record-breaking investment into Grayscale’s family of products, illustrating continued demand from investors for digital currency access products and with a majority of investment coming from institutions, it’s clear that we’re experiencing institutional adoption.”

Existing clients amassed 75% of capital raised. 36% of Grayscale clients now use multiple company products. The company saw its client base grow by 24%.

Grayscale Investors Love Bitcoin

Grayscale Bitcoin Trust, which Cointelegraph first reported on last year, led 2019’s investment demand with $471.7 total — $193.8 million of it raised in Q4, another historical high for the New York-based firm.

Signaling a shift among traditional institutions, communications director Marissa Arnold told Cointelegraph, “As the largest digital currency asset manager, we feel that our numbers are indicative of broader market sentiment and institutional flows into digital currency.”

As younger investors continue finding Bitcoin and other digital currencies safer investments, especially as Bitcoin enjoys a slight surge, this may be the case.

Projecting The Larger Crypto Market, Arnold Added:

“The asset class is experiencing increased validation from legacy companies like Fidelity and CME, signaling to institutions and the investment community as a whole that crypto as an asset class is here to stay.”

Updated: 1-21-2020

Grayscale’s Bitcoin Trust Is Now Open To More Investors As SEC Reporting Company

Grayscale Investments’ bid to register its Bitcoin Trust as an Securities and Exchange Commission (SEC) reporting company has succeeded.

The trust became the first publicly-traded bitcoin investment vehicle on an over-the-counter market in May 2015, and Grayscale filed a Form 10 to the SEC in November, opening the trust up to investors currently restricted from participating in non-regulated vehicles. The Form 10 filing was automatically deemed effective 60 days after it was filed.

The trust’s shares are now registered under the Exchange Act of 1934, making the Grayscale Bitcoin Trust the first cryptocurrency investment vehicle to become a reporting company. The trust now has to publicly file its quarterly and annual reports as 10-Qs and 10-Ks with the SEC and publish updates on unscheduled material events and corporate changes.

The new status also reduces the statutory holding period for accredited investors from 12 months to six months.

Updated: 4-16-2020

Grayscale Now Holds 1.7% of Bitcoin Supply After Record $500M Quarter

Almost 2% of the world’s Bitcoin (BTC) supply is now under the control of a single company: Grayscale and its Bitcoin Trust (GBTC).

In its latest quarterly report on April 16, Grayscale revealed that GBTC now contains 1.7% of the circulating supply of Bitcoin.

Bitcoin Investors Shun “Risk-Off” Mood

In terms of assets under management as a proportion of the total cryptocurrency market cap, Grayscale controls 1.2% of the world’s crypto.

The Bitcoin ownership figure is up 0.1% since the end of 2019, underscoring the fact that the huge market uncertainty sparked by coronavirus has yet to reverse Grayscale’s fortunes.

Overall, Grayscale’s ten crypto funds attracted over $500 million in investments, making it its best quarter on record.

“Quarter-over-quarter inflows more than doubled to $503.7 million, demonstrating demand is reaching new peak levels, even in a ‘risk-off’ environment,” the report summarizes.

As Cointelegraph reported, institutional investors have appeared to weather the coronavirus storm with particular resilience. Activity across Bitcoin futures markets, for example, bounced back from March lows within weeks.

In terms of investment in Q1 2020, Grayscale meanwhile said that hedge funds made up the vast majority of cash, at 88% of the total.

“The mandate and strategic focus of these funds is broadly mixed and includes Multi-Strat, Global Macro, Arbitrage, Long/Short Equity, Event Driven, and Crypto-focused funds,” the report adds.

Institutional Sentiment In Flux

Despite mixed opinions as to the impact of vast swathes of institutional investors handling Bitcoin, either directly or indirectly, a survey this week suggested that users no longer see the sector as the main threat to Bitcoin price stability.

Instead, macro factors including coronavirus are the main area of concern, the roughly 10,000 responses to the survey by stock-to-flow creator PlanB revealed.

Previously, futures markets in particular formed the center of speculation over price manipulation.

Updated: 4-18-2020

What Does Grayscale’s GBTC Falling Premium Tell Us About Bitcoin Price?

The premium on Grayscale Bitcoin Trust shares has dropped despite the recent recovery in the Bitcoin price. Is this a bearish sign?

Grayscale’s Bitcoin Trust shares (GBTC) are currently trading at $7.49 per share, a 15.81% premium of Bitcoin. GBTC is the first publicly quoted security “solely invested in and deriving value from” Bitcoin and since listing it has been known to trade at a high premium, having hit a 2020 high of 41.42% on Feb. 18. The premium is usually accentuated when prices are high.

The GBTC-BTC premium has dropped by over 30% since February this year, following Grayscale’s registration as a reporting company with the United States Securities and Exchange Commission as well as another private placement of its shares in February.

The Bitcoin price (BTC) is currently sitting at $7,058, having rallied by 21% in the last month. Although a pullback is still possible, Bitcoin price has recovered from the March 13 crash, and the reduced premium between GBTC and BTC is yet another bearish sign for Bitcoin as market sentiment continues to point toward extreme fear among investors.

Low Institutional Appetite?

The falling premium between GBTC and the Bitcoin price can be interpreted as a sign of reduced appetite from institutional investors who, according to Grayscale, make up 80% of its client base for the Bitcoin Trust.

This perspective could be further backed by the lowered volumes in the CME regulated futures market which in March saw a 44% decrease from the previous month. This is despite volumes increasing in unregulated derivatives markets and in spot markets alike.

However, Grayscale has seen increased interest from institutional investors having reported investments reaching a record-breaking $171.7 million during a single month of private offerings in 2019. While the coronavirus and the Black Thursday crash may have shaken the market, Grayscale currently manages $2.1 billion in assets for GBTC and other developments like Qi3’s Bitcoin fund show that there is still institutional demand to be filled.

There are other factors to consider in order to understand the GBTC-BTC premium and why it seems to be dropping ever lower. While the premium is generally accentuated or decreased in bullish or bearish markets, the dynamic of the GBTC premium may be changing permanently.

Increasing Liquidity For GBTC

GBTC offers periodic private placement rounds that are available to accredited investors. In previous offerings, investors had a 1-year lockup period during which shares could not be sold since the products were not registered with the SEC.

After this period, investors could sell shares in over-the-counter markets, given that Grayscale does not provide a redemption service for the underlying native asset.

This system creates a liquidity cycle and increases selling pressure one year after each private placement event. Coinmetrics co-founder, Nic Carter, pointed this out in a January tweet. Carter wrote:

“I’d be willing to bet that the GBTC premium will be crushed to single digits on the week of July 15 2020 and October 21 2020.”

However, while Carter’s observation holds true, the date may come sooner than expected as Grayscale’s registration as a reporting company with the SEC would grant its products a reduced lockup period of 6 months. This could possibly result in increased liquidity and reduced premiums.

Hedge Funds And Risk-Free Arbitrage

Although GBTC is also available to retail investors, Grayscale’s recent report shows that overwhelming interest comes from institutional investors, particularly hedge funds.

According to Keegan Toci, Partner at Vertical Ascent Capital Management, accredited investors have an excellent opportunity to short GBTC at a premium, buying it back at a discount for the NAV price in which private placement events are priced.

The selling pressure created by arbitrage, along with the possibility for early liquidity provided by the SEC registration and negative sentiment in the market have created the perfect storm for GBTC’s falling premium.

The “Days Of High Premiums Are Over”

While the premium in GBTC has usually increased after private placement events and especially during Bitcoin price rallies, it’s possible that the GBTC and Bitcoin price will see a narrower gap from now on. As new options for institutional investors appear in the market, competition may drive these premiums down.

According To Nic Carter:

“I find it extremely plausible that in a flat market 100s of millions in sales of GBTC (look at the subscription volume) would crush the premium. plus, there’s many other ways to get exposure to BTC than GBTC these days. days of high premium are over.”

As options for institutional exposure to the Bitcoin price continue to widen, one thing seems to be clear: the infrastructure required for the long-awaited institutional boom continues to become more robust and diverse.

Although the coronavirus has instilled fear in investors, Bitcoin may hold true as a store of value, much like gold, and the upcoming halving may jumpstart yet another bull rally for Bitcoin and pave the way for increased institutional interest.

Updated: 4-23-2020

Institutional Investment Builds in Q1 2020, Sentiment Toward Crypto Funds Changing

As Grayscale reveals it holds 1.7% of all Bitcoin in circulation, institutional investors seem to be gaining more confidence in Bitcoin.

A recent report by Grayscale, a cryptocurrency venture capital company, revealed the firm now holds roughly 1.7% of all of Bitcoin’s supply in its Bitcoin Trust (GBTC). Having seen the biggest quarter yet, Grayscale’s share of Bitcoin increased by 0.1% in 2020 despite current market uncertainties brought about by the COVID-19 pandemic.

Rayhaneh Sharif-Askary, Grayscale’s head of investor relations, told Cointelegraph that “the majority of capital invested into our products comes from institutional investors.” He elaborated:

“We saw 88% of the $503.7M in capital invested into our family of products come from institutional investors this past quarter. Our recent conversations with investors reinforce the idea that now, more than ever, investors are going to be looking for ways to build resilient portfolios. Moreover, the implications of the current, unprecedented monetary policy are causing previously skeptical investors to take another hard look at the asset class.”

While the Bitcoin Trust is the most popular among the company’s family of products, the increased inflow was experienced across the board, with Bitcoin (BTC) and all other altcoin-based trusts seeing around half a billion dollars in investment — double that of Q3 and Q4 2019. In Q1 2020, approximately 38% of Grayscale’s investors entered multiple Grayscale products in order to diversify their crypto holdings.

The Grayscale Bitcoin trust received around $389 million in investment throughout the quarter, which means that if GBTC was an exchange-traded fund, it would be among the 5% of year-to-date inflows. Moreover, GBTC is also one of most-traded OTC securities and has received the title of one of the most active securities in terms of trading volume in 2019, which further signals demand among institutional investors and traders.

While GBTC also targets retail investors, institutional players make up the overwhelming majority of capital inflow. Institutional investors represented 88% of the investment capital generated in the first quarter of 2020, most of which are hedge funds.

Has Institutionalization Arrived?

Grayscale was the first regulated crypto product to hit the market, having been launched in 2013. Since then, the company has expanded into a number of altcoin-based funds. However, the supply of options for institutional exposure has continued to grow, especially over the last couple of years.

Exchange-traded products like the physically-backed Bitcoin ETPs from Amun AG and from WisdomTree — both of which are currently trading in the Switzerland SIX stock exchange — are an example of readily available exposure for institutional players.

Most recently, 3iQ has announced the launch of its Bitcoin close-end fund on the Toronto Stock Exchange, which leverages price indexes by CryptoCompare and VanEck Europe subsidiary MVIS and custody services by Gemini. Cameron Winklevoss, Gemini’s president, recently told Cointelegraph: “This mirrors the growing appetite that institutional and retail investors alike are demonstrating for incorporating crypto assets into their larger portfolios.”

Exposure to derivative products has also become widely available for institutional investors in the last month through the Chicago Mercantile Exchange’s Bitcoin futures and options contracts as well as Bakkt’s physically-settled Bitcoin futures and LedgerX’s regulated derivatives products.

It’s important to note that the interest and volume on these paper markets is miniscule when compared to unregulated activity. According to Jonathan Hobbs — chartered financial analyst, author of The Crypto Portfolio and the chief operating officer at Ecstatus Capital — institutional demand is already here, but the challenge is finding compliant products that can satisfy their standards. Hobbs told Cointelegraph:

“As time goes by more traditional hedge funds, fund of funds and family offices are starting to see that Bitcoin and digital assets can offer them diversification. The main challenges for them lie in having digital investment products that will pass their compliance checks. Over the last few years we have seen the digital space mature considerably, with several infrastructure improvements that are making Bitcoin more accommodating to professional investors.”

Market Sentiment Among Institutional Investors

Grayscale’s results are impressive and show that institutional investors are looking to gain exposure to Bitcoin and other digital assets even during the current climate, where uncertainty and fear are becoming the norm. However, given the current state of affairs, Bitcoin is left for those with a higher risk appetite. Matt D’Souza, CEO of Blockware Solutions and digital currency hedge fund manager, told Cointelegraph, “Markets turn on a dime. If you’re not in when the opportunity presents, you’re too late.” He then added:

“While some institutional investors may be looking to bet on Bitcoin on the basis it could theoretically do well in a crisis, managers for the most part want cash which is by far the safest option. Managers that have been around for a long time understand how to last. It’s because their investors are in the stay rich business, not the get rich. This environment warrants capital preservation. As risk appetite comes back into the market I expect Bitcoin to be one of the best opportunities.”

In fact, while compliant offers for BTC are on the rise, data shows that, as of late, regulated derivatives have been losing ground both in terms of volume and open interest in contracts. This trend is observed only in regulated markets, while unregulated derivatives products had their biggest month yet in March in terms of trading volume.

This may suggest that institutional investors who are betting on Bitcoin are doing so as part of a longer-term strategy, given the increased interest in passive products like GBTC but decreased interest for CME’s futures and options.

This trend may soon pivot as large players enter the field. For example, Renaissance Technologies’ Medallion Fund — a hedge fund with $10 billion worth of assets under management — has recently received approval from the United States Securities and Exchange Commission to offer products and services involving the CME-regulated Bitcoin futures market to its clients.

Regulation Is Key

While institutional interest and offerings both seem to be on the rise, there is still a lot of uncertainty when it comes to Bitcoin. There are many aspects in play, from the technology to monetary policy (especially with the upcoming halving), and most importantly, regulation. Bitcoin is still threading uncharted territory when it comes to compliance, and research shows that news involving clear regulatory updates increase demand for Bitcoin.

Grayscale Bitcoin Trust has become an SEC-reporting security, which shows that regulators are willing to work with companies in the industry. According to Sharif-Askary, this type of collaboration is helping drive the industry forward. Hobbs told Cointelegraph that regulators seem “eager to engage, especially from an educational perspective.” He went on to add that Grayscale Bitcoin Trust becoming regulated by the SEC is a vital step:

“This means that the Trust is held to the same reporting and disclosure standards as stocks and ETFs that trade on national exchanges such as NYSE and Nasdaq. It also reinforces that there are ways to proactively work with regulators, within the existing regulatory frameworks.”

What About A Bitcoin ETF?

While the long-awaited Bitcoin exchange-traded fund is still nowhere to be seen, it seems that institutional demand is already here. While the cryptocurrency industry still needs to make adjustments to ensure more transparency and compliance, it seems that the right steps are being taken. In the meantime, regulated alternatives to the Bitcoin ETF continue to increase.

The latest attempt at a Bitcoin-related ETF was made by Wilshire Phoenix. The proposal was rejected by the SEC, who cited lack of a surveillance-sharing agreement with a significant market for the underlying asset or a novel demonstration of the market’s inherent resistance to manipulation.

Nevertheless, companies in the space are pushing toward a more transparent market. Crypto data forensics companies are working alongside service providers and regulators to create a more transparent market, which will play a big role in the approval of an ETF. However, according to Hobbs, this may not be as significant as the community thinks:

“With crypto products such as the CME Bitcoin Futures, the Grayscale BTC Trust in the U.S. and the Wisdom Tree Bitcoin ETP, there are already options for institutions to get passive ‘buy and hold’ Bitcoin exposure without having to buy it directly. Also, not all institutional investors who want to go digital are looking for passive Bitcoin exposure, which is what you get with an ETF. Many of them are looking for regulated digital quant funds like Ecstatus Capital which can trade Bitcoin long and short.”

Whether 2020 becomes the year of the Bitcoin ETF is unclear, but one thing is certain: Compliant options exist and are becoming increasingly available. With or without an ETF, regulation is the key to advancing the industry, and if the industry continues to mature, an ETF may be just another milestone on Bitcoin’s road to mass adoption.

Updated: 5-20-2020

Grayscale’s Bitcoin Holdings Pass $3 Billion, Growing 76% Year-on-Year

American digital asset management fund Grayscale has continued to grow, with its total assets under management hitting $3.8 billion.

Grayscale, a major digital asset management fund, has continued to grow this year, with its total assets under management, or AUM, hitting new highs.

According to a May 19 tweet, Grayscale’s total AUM hit $3.8 billion, surging over 80% from $2.1 billion in May 2019.

Bitcoin trust continues to gain momentum

Grayscale’s Bitcoin (BTC) trust has continued to lead other cryptocurrencies in the fund, accounting for $3.36 billion, or 89% of the firm’s total AUM. The value of Grayscale’s Bitcoin investment trust surged 76% from last year’s $1.9 billion. At the same time, Grayscale’s Bitcoin trust’s share saw a small drop, slipping from 94% in May 2019.

The massive value spike of Grayscale’s Bitcoin trust comes amid a significant increase of BTC price year-on-year. As of press time, Bitcoin trades at $9,745, up around 30% from $7,600 one year ago.

According to the data, Grayscale Ethereum (ETH) Trust is now the second-largest trust among the total 10 trusts in the fund. Grayscale ETH trust accounts for $289 million and is followed by Grayscale Ethereum Classic (ETC) Trust, which holds $73 million.

Created by Digital Currency Group in 2013, Grayscale is a major global crypto investment fund. The fund is regulated by global authorities like the United States Financial Industry Regulatory Authority and Securities Exchange Commission. Grayscale reportedly became the first digital asset trust that started reporting to the SEC in January 2020.

In April 2020, Grayscale reported that the firm was holding about 1.7% of all of Bitcoin’s supply in its Grayscale Bitcoin Trust. At the time, the firm also said that it saw its biggest quarter ever despite the economic crisis fueled by the COVID-19 pandemic.

Updated: 5-28-2020

Grayscale Is Now Buying 1.5 Times The Amount of Bitcoin Being Mined

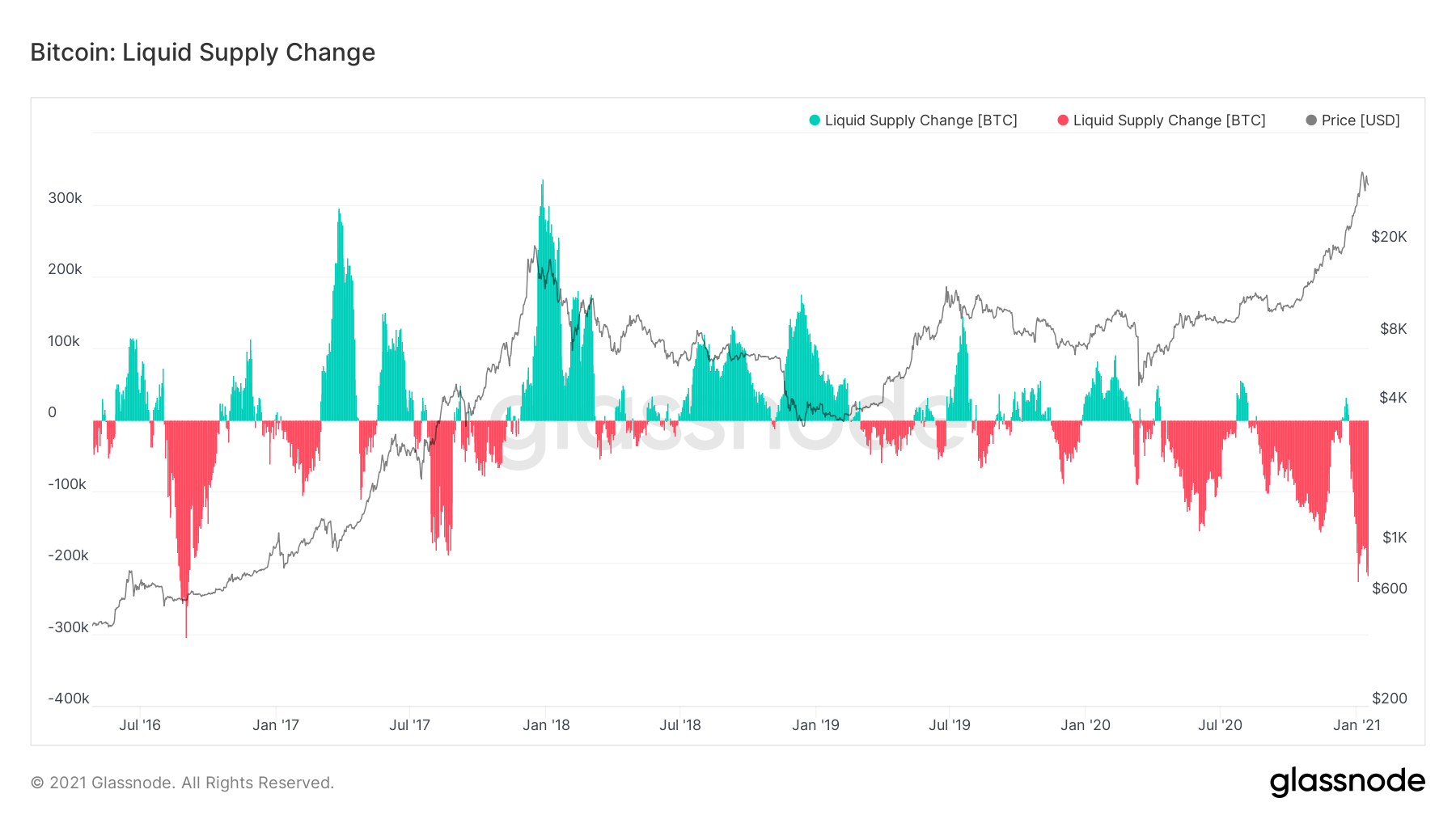

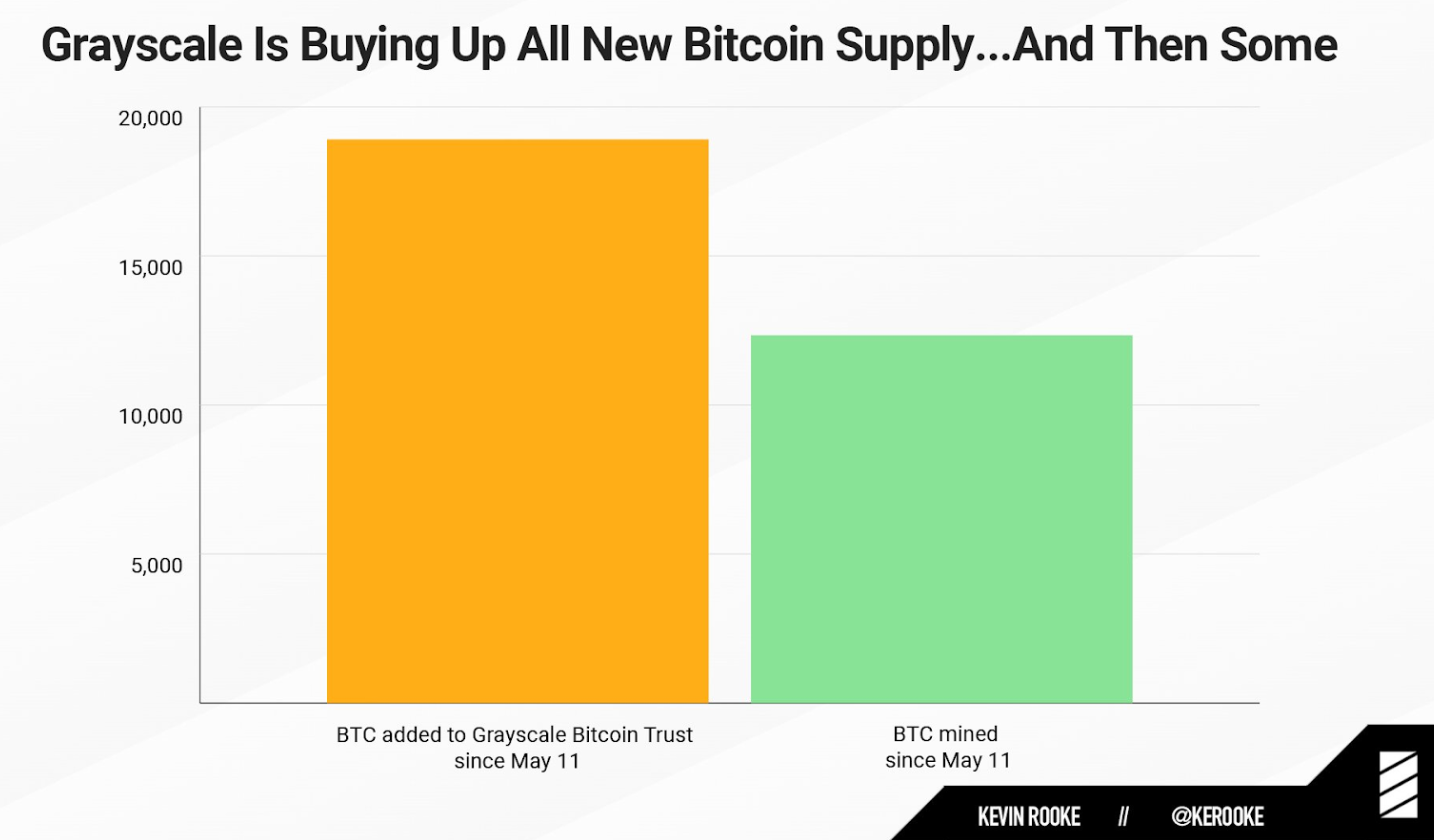

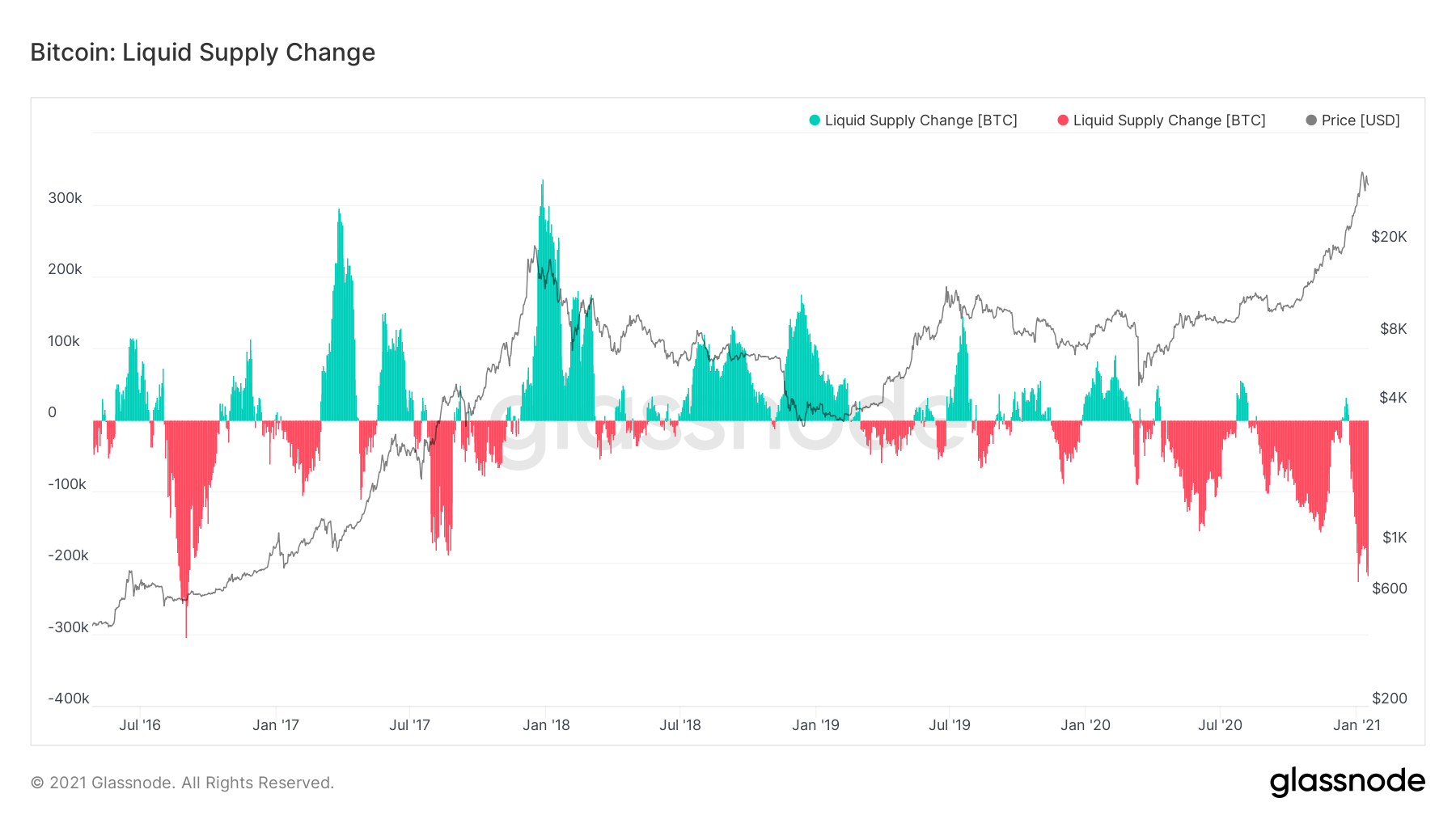

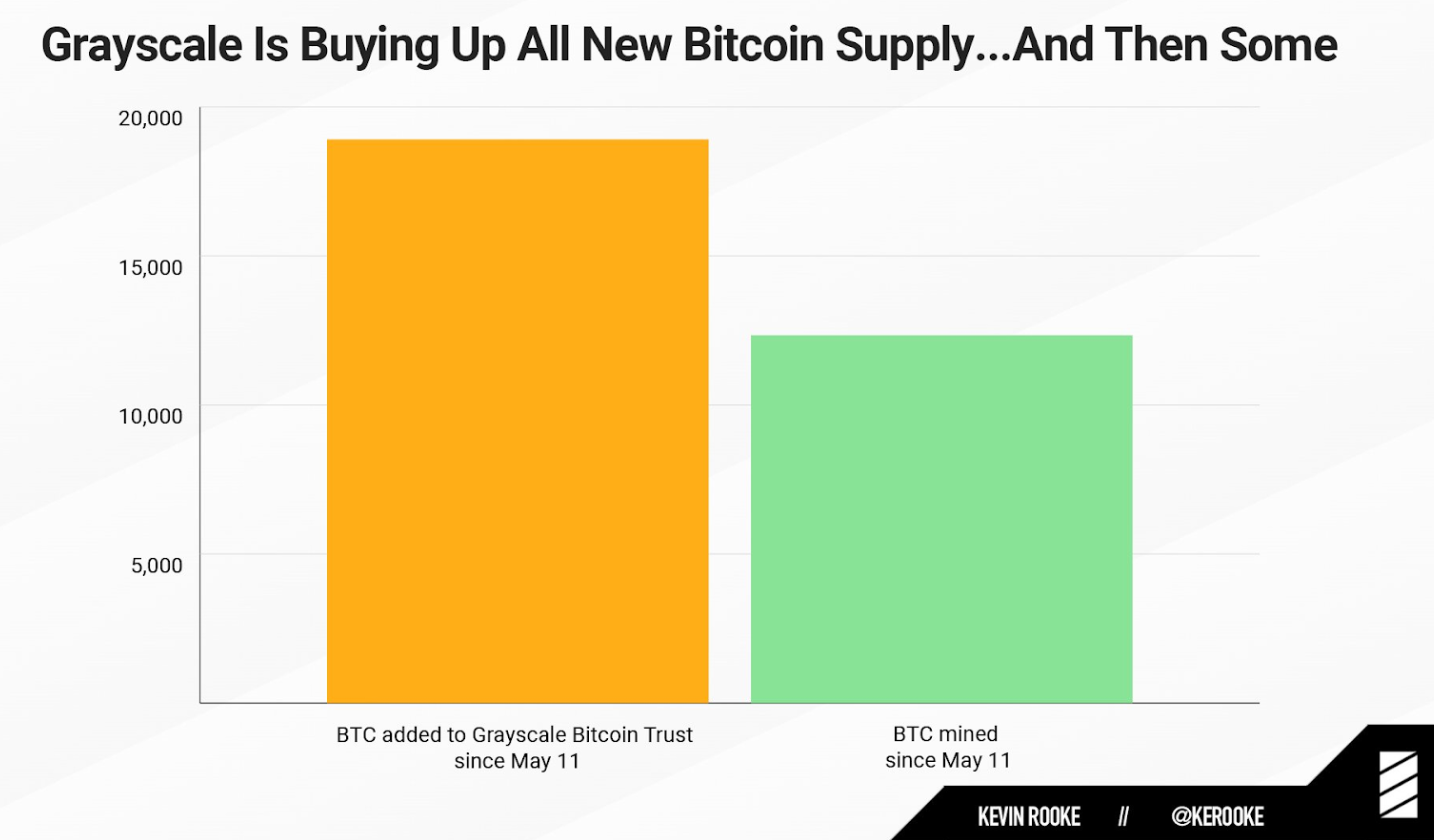

Independent researcher Kevin Rooke estimates that Grayscale has ramped up its Bitcoin accumulation to a rate equivalent to 150% of the new BTC created since the halving.

Crypto fund manager Grayscale Investments is accumulating Bitcoin at a rate equivalent to 150% of the new coins created by miners since the May 11 block reward halving.

According to data published by independent crypto researcher Kevin Rooke, Grayscale has added 18,910 BTC to its Bitcoin Investment Trust since the halving, while only 12,337 Bitcoins have been mined since May 11.

Binance CEO Changpeng Zhao reposted the chart, commenting: “There isn’t enough new supply to go around, even for just one guy”.

Grayscale Absorbs BTC Supply

Last week, Rooke estimated that Grayscale had been buying Bitcoin at a rate equal to between 33% and 34% of new supply during the first quarter of 2020, having accumulated 60,762 BTC over 100 days.

During the quarter, Grayscale also saw average weekly investment into its trust reach $29.9 million — comprising an 800% gain year-over-year.

In response to Rooke’s tweet publishing the figures, Grayscale founder Barry Silbert commented: “just wait until you see Q2.”

Rooke’s latest data indicates that Grayscale is now purchasing nearly double the number of coins per day on average — with Rooke’s post-halving estimate equating to 1,112.35 BTC per day, up from 607.62 BTC during Q1.

Grayscale Sounds Off On CBDCs

In a recent report published by Grayscale, the firm sought to rebuke analogies comparing Bitcoin to central bank-issued digital currencies (CBDC).

“CBDCs are sometimes viewed as synonymous to, or as replacements for, digital currencies like Bitcoin, but they represent a meaningful departure from the decentralized protocols inherent to many cryptocurrencies,” the report stated.

“CBDCs attempt to upgrade payment infrastructure while Bitcoin is an attempt to upgrade money. If CBDCs gain traction, they may actually bolster the value proposition for Bitcoin and other digital currencies,” Grayscale added.

The report echoed the sentiment of economist John Vaz, who recently told Cointelegraph that CBDCs comprise “a kind of rearguard action being fought by the central banks because they don’t like cryptocurrency”.

“Central bank digital currencies are probably more about tracking money than providing benefit,” Vaz observed.

Updated: 5-31-2020

Crypto Funds In Demand, Institutions See Bitcoin As Alternative Hedge

Grayscale Investments has been gobbling up Bitcoin in recent months, and most of its investors are institutions — but other funds are doing it, too.

While the theater world has Waiting for Godot, the crypto sphere has its own drama: Waiting for the Institutional Investor. Recently, there have been some promising sightings. Grayscale Investments has been buying up Bitcoin (BTC) at a great rate in recent months.

Indeed, since the May 11–12 rewards halving event, the fund has been accumulating BTC at a rate equivalent to 150% of all the new Bitcoin mined, Cointelegraph reported on Thursday. The firm now has $3.2 billion in assets under management, or AUM, in its Grayscale Bitcoin Trust. Significantly, more than 90% of new inflows are from institutional players, according to the company.

Grayscale may not be alone in attracting institutional attention. Eric Ervin, the president and CEO of Blockforce Capital, an asset management firm that operates in the crypto space, told Cointelegraph: “We are seeing more institutional interest. I think this would be true regardless of the halving or the QE taking place, even more so given the unprecedented fiscal and monetary global stimulus.”

Lennard Neo, the head of research at Stack Funds, told Cointelegraph that institutional investors have been looking for alternative solutions not just to provide returns but also to protect their existing portfolio from further downside risks, explaining:

“Similar to Grayscale, Stack has seen an uptick in investors’ interest — almost double that figures of pre-crash in March — in Bitcoin […] I would not say they are ‘gobbling up BTC’ blindly but cautiously seeking traditional structured solutions that they are familiar with before making an investment.”

Paul Cappelli, a portfolio manager at Galaxy Fund Management, told Cointelegraph: “We’re seeing increased interest from multiple levels of investors — wealth channels, independent RIAs and institutions.” The recent BTC halving came at an interesting time — amid the COVID-19 outbreak and the growing unease about quantitative easing. He noted: “It clearly demonstrated BTC’s scarcity and future supply reduction as concerns deepened around unprecedented stimulus by the Fed with the CARES Act.”

Goldman Sachs Raises Doubts

Not all are knocking at Bitcoin’s door, though. In a May 27 presentation to investors, Goldman Sachs, the storied investment bank, listed five reasons why cryptocurrencies are not an asset class, which included Bitcoin, noting: “While hedge funds may find trading cryptocurrencies appealing because of their high volatility, that allure does not constitute a viable investment rationale.”

Crypto’s denizens reacted combatively. Referencing the quality of Goldman Sachs’ recent Bitcoin research, Gemini’s Tyler Winklevoss declared in a tweet: “Today, Wall Street is where you end up when you can’t make it in crypto” — and he followed up on May 28 with: “Day after Goldman Sachs says don’t buy bitcoin, bitcoin is up +$500.” Mati Greenspan of Quantum Economics wrote in his May 27 newsletter: “Regardless of what Goldman Sachs sell-side analysts have to say, it’s quite clear that institutional interest has been picking up lately.”

On the matter of investment suitability, a recent Bitwise Asset Management research report made the case for adding Bitcoin to a diversified portfolio of stocks and bonds, noting that on average, “a 2.5% allocation to bitcoin would have boosted the three-year cumulative return of a traditional 60% equity/40% bond portfolio by an astonishing 15.9 percentage points.”

Overwhelming The Market?

In the roughly two-week period since the BTC rewards halving, which reduced miners’ block reward from 12.5 BTC to 6.25 BTC, 12,337 Bitcoin were mined as reported by researcher Kevin Rooke on May 27. During that same period, Grayscale’s Bitcoin Trust purchased 18,910 Bitcoin — about 1.5 BTC for every Bitcoin created. This has raised some questions about the overall BTC supply.

Binance CEO Changpeng Zhao commented on Rooke’s findings in a tweet: “There isn’t enough new supply to go around, even for just one guy [i.e., Grayscale].” Greenspan, for his part, told Cointelegraph: “It seems like institutional players are gradually becoming a much larger part of this small market.” Might they overwhelm the market? “Whales have always been an issue,” he opined.

As noted, Grayscale Investments reported $3.2 billion in AUM in late May. To put this in context, the total AUM of crypto hedge funds globally increased to over $2 billion in 2019 from $1 billion the previous year, according to the 2020 PricewaterhouseCoopers–Elwood Crypto Hedge Fund Report. Most crypto hedge funds trade Bitcoin (97%), followed by Ethereum (67%), with the vast majority of investors in crypto hedge funds (90%) being either family offices (48%) or high-net-worth individuals (42%).

This is an imperfect comparison, though, because the PwC–Elwood report only tracked hedge funds and excluded crypto index funds — including passive/tracker funds like Grayscale’s, which basically track the price of BTC. As PwC’s Global Crypto Leader Henri Arslanian told Cointelegraph, it “goes up or down solely based on the price of BTC and not due to the skills or activities of the fund manager.” It also excluded crypto venture capital funds that make equity investments in crypto firms. Still, the comparison suggests something of the magnitude of Grayscale’s BTC commitment.

When contacted by the Cointelegraph, Grayscale Investments declined to provide any specific details about its recent BTC buying spree, or why other institutional investors might be snapping up BTC. “We’re not going to talk about momentum following the halving until mid-July when we’ll publish our Q2 numbers,” a spokesperson said.

But Michael Sonnenshein, the managing director of Grayscale Investments, told Cointelegraph that investors have typically tried to shield their portfolios from market shocks or during times of uncertainty with fiat currencies, government bonds and gold:

“All three are facing issues this time around. Bitcoin has emerged as an alternative hedge, operating independently of the dramatic monetary policies enacted by central banks.”

Other Factors

The halving is the most dramatic and immediate recent BTC event, but industry sources mostly cited other reasons for the recent institutional attentiveness. Stimulus packages, like the $3-trillion coronavirus relief package passed by the United States House of Representatives on May 15 — and attendant fear of inflation — is chief among their concerns. David Lawant, a research analyst at Bitwise Asset Management, told Cointelegraph:

“In our view, institutional interest was on the rise since the beginning of the year, but it really took off after the unprecedented government response to the COVID-19 crisis.”

Neo cited rising geopolitical tensions, like those between the U.S. and China, which have put “further stress on an already weakened economy, and in turn, increased Bitcoin’s appeal.” Arslanian told Cointelegraph:

“We are continuing to see increased interest from institutional investors. But more than the halving, it’s the availability of institutional-grade offerings, from regulated crypto funds products to regulated custody and many offerings that are making this possible.”

The participation of hedge fund icons like Paul Tudor Jones has to be factored in as well. Jones’ recent letter “making the case for Bitcoin as his preferred hedge against what he calls ‘the great monetary inflation’ has significantly reduced career risk for many of his peers considering an allocation to Bitcoin,” Lawant told Cointelegraph. In a May investment report, Cappelli wrote:

“Not only has institutional infrastructure progressed, but as the world changes important players are entering the space. The most successful hedge fund of all time, Renaissance Technologies, recently announced their intention to trade bitcoin futures.”

Attracting Notice

Lawant believes that: “In the lenses of mainstream investors, I think that 2020 is the year in which Bitcoin moved from being a venture capital bet to a macro hedge.”

What’s more, the halving event had some impact, too, as Arslanian believes that more attention has been brought to how Bitcoin works, adding: “The fact that this happened as the world is going through record quantitative easing from central banks also brought attention on how money is created and the role that it plays in society.” People who were otherwise ignoring this asset class are now starting to take notice, added Ervin. He continued:

“Like any disruptive technology or asset class, first the explorers and pioneers, then slowly more people enter, before finally the technology ‘crosses the chasm’ and reaches mainstream adoption and investment. I would say we are in the very early days.”

To summarize, global unemployment has been soaring, and economic stimulus is clearly on the minds of governments and central banks. The European Commission’s recently proposed $826-billion virus recovery plan was just the latest instance. Quantitative easing may be necessary under these unique circumstances, but it set off inflation alarm bells among some institutional investors.

The halving event may not have persuaded financial institutions to invest in Bitcoin, but it did remind them, once again, that BTC, unlike fiat currencies, has a fixed supply (21 million BTC). Given the world’s inflation anxieties, is it surprising that institutional players might throw some hedge fund money Bitcoin’s way?

Updated: 6-5-2020

Grayscale Is Buying Up More Than Just Bitcoin

22% of crypto fund manager Grayscale Investments’ purchases have been Ether throughout 2020 so far, totaling $110 million worth of accumulation.

While great attention has been paid to the recent enormous accumulation activities of the Grayscale’s Bitcoin Investment Trust, or BIT, the crypto fund manager has also been aggressively growing its Ether (ETH) stash.

Speaking on a recent episode of the Coinscrum markets podcast, Grayscale’s director of investor relations, Ray Sharif-Askary, revealed that $110 million worth of ETH has been purchased by the firm during 2020 so far.

Institutional Investors Diversify With ETH

As such, Grayscale’s purchases are equal to 0.4% of Ethereum’s total market cap in the past five months. Sharif-Askary noted that over 38% of Grayscale’s current clients now hold more than one crypto asset, up significantly from roughly 9% as of 12 months ago.

“It is encouraging to investors […] diversify within the digital currency asset class, just like they would with any other traditional asset class,” she stated.

Over the same period, Grayscale has purchased $390 million in Bitcoin (BTC), equal to 0.2% of the market’s capitalization. The firm is reportedly buying BTC at a rate equal to 1.5 times the quantity of new Bitcoin created through mining.

Grayscale Ethereum Trust Explodes

Grayscale’s Ether accumulation has coincided with a dramatic year-to-date (YTD) performance for shares in the Grayscale Ethereum Trust, which have increased nearly 800% with the market’s last recorded trade closing for $210.

Within the last 24 hours, the trust briefly tested $250, offering YTD returns of 995% to investors who purchased shares at the start of January.

Institutions Seek Inflation Hedge Amid Uncertainty

Sharif-Askary attributed Grayscale’s enormous crypto accumulation to institutions seeking a hedge fledge against inflation in response to U.S. monetary policy amid the COVID-19 crisis.

“From a border perspective, COVID-19 and the policy implications especially have really set the stage for Bitcoin to become seen as a store of value asset. […] Institutional investors are taking active long positions in digital assets through our products, and it’s because they are looking for an asset that is scarce and that can be used as an inflation hedge in a world where we are faced with unprecedented monetary stimulus.”

“We’ve never seen demand like this before for our products,” she added.

Updated: 6-11-2020

Three Arrows Capital Now Holds More Than 6% of Grayscale’s $3.6B Bitcoin Trust

Three Arrows Capital, a crypto fund management firm based in Singapore, has acquired a significant stake in the Grayscale Bitcoin Trust (GBTC), according to a new filing with the U.S. Securities and Exchange Commission (SEC).

The firm filed a schedule 13D disclosure to the SEC on Thursday after accumulating 21,057,237 shares, or 6.26%, of the trust for an amount valued over 20,000 bitcoin (BTC) or around $192 million, according to a filing dated June 10. (Grayscale is a subsidiary of Digital Currency Group, CoinDesk’s parent firm.)

A Schedule 13D form or beneficial ownership report is required when a person or group (firm) acquires more than 5% of any class of a company’s shares. The information must be disclosed to the SEC within a 10-day period from the date of the transaction under current regulations.

Grayscale Investments is the world’s largest digital currency asset manager with its flagship product, the Grayscale Bitcoin Trust that was set up in 2013. As of June 11, the trust holds approximately 365,000 bitcoin worth $3.6 billion, according to Grayscale’s website.

“Grayscale is one of the most professional and beneficial companies in the crypto ecosystem. We enjoy working with their team and are proud to be the first investor to file a Schedule 13D/G with the SEC for over 5% ownership,” said Su Zhu, CEO and co-founder at Three Arrows Capital.

On January 21, GBTC became an SEC-compliant reporting company after filing a Form 10 with the SEC. Also known as the General Form for Registration of Securities it is used to register a class of securities for trading on U.S.-based exchanges. A company with over $10 million in total assets under management is required to file a Form 10 with the SEC.

Updated: 1-4-2021

The firm bought 38,888,888 shares issued by Grayscale’s Bitcoin Trust (GBTC) at $34.10 per share. The interesting thing is that each share is redeemable for actual bitcoin at the rate of 0.001 BTC.Although it is unclear whether Three Arrows made the purchase under the directions of a specific client, the large buy currently stands as the biggest one-off purchase. Nonetheless, Three Arrow’s position represents 6.1% of GBTC’s holdings. Speaking on the recent development, co-founder of Three Arrows Capital, Kyle Davies, said:

We continue to enjoy working with the Grayscale team and look forward to investing more in the crypto ecosystem.

Grayscale has been making the headlines for several weeks now. The crypto asset management firm currently stands tall as the largest in the world with its total asset under management sitting at over $20 billion.

Grayscale’s rise to prominence in less than a year is an indication that investors are interested in digital assets.

Updated: 6-25-2020

At This Rate Grayscale Will Own 3.4% of All Bitcoin By January

Grayscale Investments has added 19,879 BTC to its Bitcoin Trust in the last week, purchasing Bitcoin faster than the tokens can be mined.

Grayscale Investments has purchased almost half a billion dollars in Bitcoin since the May block reward halving, and this week bought BTC around three times faster than miners could produce blocks.

According to a June 25 tweet from crypto analyst Kevin Rooke, the investment firm bought 19,879 Bitcoin (BTC) — $184 million worth — in the last week for its Bitcoin Trust, bringing its total number of coins to roughly 400,000.

Unbelievable.

Grayscale added 19,879 BTC to their Bitcoin Trust since last week (53,588 BTC since the halving).

Bitcoin miners only produced 7,081 BTC since last week (39,544 BTC since halving).

That’s almost 400,000 BTC under management for $GBTC pic.twitter.com/aMtSGHZnz2

— Kevin Rooke (@kerooke) June 25, 2020

Rooke stated that not only is Grayscale buying massive amounts of the cryptocurrency, but it’s now doing so at a rate roughly 280% of the new Bitcoin mined. Twitter user Hodlonaut pointed out:

“Grayscale *alone* has taken all BTC mined + 14,000 more BTC off the table since the halving.”

Grayscale Is Cornering The Market

At the moment, there are 18.415 million BTC in circulation, with the rest presumed lost. Grayscale has bought 53,588 BTC in total since the May 11 halving, equating to an average of 1,190 BTC per day. If it keeps buying at this same daily rate it will own 3.4% of the world’s BTC supply (625,069 BTC) by January 2021 — and 10% by the time of the next halving in 2024.

Grayscale founder Barry Silbert suggested in May that the fund would be ramping up its purchases in the second quarter and it appears he’s a man of his word.

The investment firm announced that it had $4.1 billion in assets under management as of June 25, which means Grayscale’s value has nearly doubled from $2.1 billion in May 2019.

Stocking Up On Ether Too

Grayscale’s Ethereum Fund (ETHE) owns $396 million in Ether. Cointelegraph reported that Grayscale had purchased $110 million worth of Ethereum (ETH) in 2020 as of June 5.

However, while ETHE shares surged over 800% in early June with trades testing $250, they crashed by 50% just days later before settling near $100.

Updated: 7-15-2020

New Grayscale Report: Digital Assets Fund Adds $905M In Record Quarter

Grayscale Investments Q2 report shows a record $905 million inflow as institutions continue to move into Bitcoin, Ethereum and other digital assets.

Grayscale Investments has just released its quarterly report which shows that institutional demand for Bitcoin and other digital assets is still on the rise despite the lack of action from Bitcoin price (BTC). The report shows that Grayscale had yet another record quarter for its digital asset products with $905.8 million dollars invested over that time period.

The nearly $1 billion inflow means Grayscale almost doubled its previous high of $503.7 in the first quarter of 2020. Out of the total amount of funds accrued by Grayscale, Bitcoin continued to lead the pack with 82.92% or $751.1 million invested in Grayscale Bitcoin Trust (GBTC).

Institutional Investors Lead The Pack

Institutional investors continue to be the leading demographic of Grayscale’s digital asset trusts. Currently they account for 84% of investment in the second quarter of 2020.

However, Grayscale saw a significant increase in new investors which represented 57% of the Grayscale investor base during the quarter.

While the percentage of new investors has increased, they only accounted for $124.1 million of the inflow into the Grayscale digital asset products.

Institutions Are Jumping Into Altcoins

While new investors made up a large percentage of the investment coming into the Grayscale products, returning institutional investors also expanded into other assets. This is likely due to the record-low volatility currently seen in the Bitcoin price.

Currently, around 81% of investors have diversified their portfolio into alternative digital assets. The report reads:

“While long volatility was the winning trade in 1Q20, volatility was subdued in 2Q20 as risk assets steadily recovered. In 2Q20, digital assets outperformed most indices, and Zcash, Ethereum, and Stellar led the way returning 72%, 62%, and 62%, respectively.”

The Grayscale Ether trust (ETHE) has seen a significant increase in inflows, having received a record-breaking $135.2 million in investment during this quarter.

This accounts for around 15% of the total inflow into Grayscale’s investment products, which may be the higher premiums in ETHE and the arbitrage opportunity it creates for institutions and accredited investors. Data also shows that while Bitcoin volumes have been dwindling, Ether’s have been rising.

Updated: 7-18-2020

Grayscale Hasn’t Bought A Single Bitcoin In Over 3 Weeks

For several months, Grayscale was buying more Bitcoin than was being mined, but this trend came to a screeching a few weeks ago.

Given the rate at which Grayscale usually buys Bitcoin, it seems like the cryptocurrency fund management company was trying to buy every single Bitcoin in existence. But this pattern ground to a halt more than three weeks ago and hasn’t picked up again since.

Grayscale Bitcoin Trust Fund (GBTC) would typically file a Form 8-K with the Securities and Exchange Commission (SEC) on a weekly basis, declaring its latest Bitcoin acquisitions. But the last time such a report was filed was June 25, when the company disclosed the purchase of almost 20,000 BTC. According to its second quarter report, GBTC was raking in an average of $57.8 million a week in investments.

A Grayscale spokesperson told Cointelegraph that the halt in BTC purchases is temporary, and is due to an administrative quiet period:

“There was an administrative quiet period for the Grayscale Bitcoin Trust private placement. The Trust is now open for subscription as of Friday, July 10 at 4:00pm ET.”

In any case, Grayscale has not issued any SEC disclosures about new Bitcoin acquisitions since then.

Grayscale Is Indicative Of Institutional Interest In Bitcoin

It is important to note that GBTC is not a hedge fund that buys assets on the expectation of profiting from them later.

Instead, it buys Bitcoin whenever investors buy its shares. Currently, each share corresponds to 0.00095891 BTC.

In the second quarter, 84% of the investments into Grayscale came from the institutional investors, mostly hedge funds. Thus, this reversal is indicative of the institutional interest in the asset. The company itself was boasting of its prowess, buying more Bitcoin than was being mined:

“After Bitcoin’s halving in May, 2Q20 inflows into Grayscale Bitcoin Trust surpassed the number of newly-mined Bitcoin over the same period. With so much inflow to Grayscale Bitcoin Trust relative to newly-mined Bitcoin, there is a significant reduction in supply-side pressure, which may be a positive sign for Bitcoin price appreciation.”

Why Did Institutional Investors Stop Buying?

There are at least a couple of possible explanations to this sudden pullback. One is seasonal — July tends to be a slow time for investment activity. Many asset managers travel or take vacation. Another reason could be that Bitcoin hasn’t done much in the last few months.

While its rapid recovery in the wake of Black Thursday attracted a lot of attention from investors who were getting hammered in traditional markets, and were troubled by the uncertainty from unparalleled stimulus packages. But starting in early May, Bitcoin has been stuck in an “undecided” mode. There are plenty of less-mysterious assets that can do the same thing.

Updated: 7-20-2020

Grayscale CEO: US Regulators Can’t Shut Down Bitcoin

Grayscale CEO Barry Silbert believes the United States is past the point where regulators have the support to ban crypto assets like Bitcoin.

Barry Silbert, CEO of cryptocurrency investment firm Grayscale Investments and Digital Currency Group, believes the United States is past the point of no return for banning Bitcoin.

In a Grayscale investor call on July 16, the CEO said he was “cautiously optimistic” about the chances of regulations in the U.S. improving or at least not getting worse for the cryptocurrency.

“For the first time ever, we are past the ‘ban bitcoin’ perceived risk,” Silbert said. “There’s enough support in DC from policy makers and regulators that Bitcoin has a right to exist and ultimately you can’t shut it down.”

The CEO said relationships with regulators are much better off due to the effort made by groups including the Blockchain Association — a group speaking out in favor of many blockchain and crypto companies in front of the SEC — and Coin Center, a non-profit crypto advocacy group.

“As an industry, we’re just much better off than we’ve ever been from a relationship perspective out in DC. [These two groups are] educating policy makers around the benefits of this technology in this asset class. The catastrophic regulatory policy risk that maybe would have existed previously in DC is behind us.”

Institutional Demand For Bitcoin

Cointelegraph has reported that Grayscale reported a substantial increase in the inflow of cryptocurrencies for Q2 2020, which totaled $905.8 million. This was up from $503.7 million in Q1.

Updated: 7-28-2020

How Grayscale Investments Sells Bitcoin To Financial Advisors

At a webinar targeting financial advisors, Grayscale’s managing director preached the value of Bitcoin and warned against physical representations of the asset.

In a webinar hosted by InvestmentNews, Grayscale Investments’ managing director, Michael Sonnenshein, and financial consultant, Tyrone Ross Jr., educated financial advisors about the benefits of crypto investments.

Grayscale offers ten crypto related investment products with its Bitcoin Trust, or GBTC, being by far the largest. Currently, it holds close to 400,000 BTC, though lately, the demand for the product has subsided.

Physical Representations Of Bitcoin Called Into Question

Quite a bit of time was spent on some well known aspects of Bitcoin, like its finite supply and instant settlement capabilities. Sonnenshein also informed the audience that physical representations of the asset are not real:

“And one thing that’s certainly important for you all as advisors and in the investment community is that you oftentimes will see physical adaptations or representations of Bitcoin. But there is, in fact, no tangible Bitcoin.”

Wealth Transfer To Millennials

Sonnenshein drove home that the millennial generation purportedly have quite an appetite for Bitcoin. A few surveys were cited:

“There have been some other studies done by Bankrate and Edelman, and ETF Trends, where we’ve actually seen that millennials are either five times more likely to invest in Bitcoin <…> [or] the percentage of the younger generation are really allocating towards cryptocurrency or expect to be doing so in the near term.”

Regulatory Clarity

Another important theme was regulation. Sonnenshein acknowledged that in the past, the lack of regulatory clarity was preventing investors from entering the space, but in his opinion, this is no longer a valid excuse:

“But we’ve come to the conclusion that that can really no longer be an excuse for investors.”

He noted that the IRS has designated Bitcoin as property and the Commodity Futures Trading Commission’s guidelines have allowed for the robust futures markets and even the Federal Reserve comparing it to gold.

Seashells, Coinbase & Solid Planning

Ross chimed in by explaining to the audience that it does not matter if they believe Bitcoin to be seashells, what matters is that they give sound financial advice to their clients:

“I don’t care whether you think it’s seashells or whatever, that’s fine. But at least when the client comes to you, hey, I own some at Coinbase, you can give them a very articulate answer as to why that’s nonsense or to why it’s something that you want to continue to articulate in the broader scope of a financial plan or quarterly fair financial plan.”

Accredited Investors Can Buy Direct Without The Premium

Sonnenshein answered one of the community’s existential questions about the GBTC — why is there such a high premium over the BTC spot price? He explained that accredited investors can purchase newly issued shares of GBTC directly from Grayscale at the net asset value. The premium is dictated by the supply and demand for GBTC on secondary markets. He further noted that Grayscale’s crypto products allow investors to gain exposure to digital assets without having to deal with the entry barriers like wallet management.

Updated: 8-6-2020

Grayscale Ethereum Trust Files To Become An SEC-Reporting Company

Grayscale Ethereum Trust files to become an SEC reporting company amidst the Ethereum bull run.

On August 6, Grayscale Ethereum Trust filed to become an SEC-reporting company.

Amidst the Ether (ETH) bull run, Grayscale Investments voluntarily decided to make its Ethereum Trust an SEC reporting company. The company’s best-known investment product is a Bitcoin Trust that holds around 400,000 Bitcoin (BTC), worth nearly $4,744,800,000 as of press time.

Additionally, its Ethereum Trust currently has 1.9 million ETH in its possession, valued at approximately $746 million. As with other Grayscale products, Coinbase is acting as a custodian.

Grayscale noted that the filing is under review. If approved, it would be the second cryptocurrency investment vehicle to attain such status:

“The filing is subject to SEC review; if the Registration Statement becomes effective, it would designate Grayscale Ethereum Trust as the second digital currency investment vehicle to attain the status of a reporting company by the SEC, following Grayscale® Bitcoin Trust as the first.”

This would likely present the Trust in a more favorable view to potential institutional investors.

81% Of Returning Institutional Investors Invest Beyond Bitcoin

In today’s Medium post, Grayscale pointed out that the demand for its Ethereum Trust in the second quarter of 2020 accounted for almost 15% of all inflows:

“This past quarter alone (2Q20), we saw the average weekly investment into the Grayscale Ethereum Trust hit $10.4 million, amounting to record quarterly inflows into the Trust to the tune of $135.2 million.”

In a statement to Cointelegraph, Grayscale emphasized the increased willingness to diversify beyond Bitcoin for the returning institutional investors. In the last quarter, 81% of these investors diversified their holdings beyond Bitcoin, an increase from 71% over the trailing 12 months.

Updated: 8-10-2020

Grayscale With $3.7 Billion Worth of Digital Assets Under Management. Set To Launch Crypto Ad Campaign On CNBC, MSNBC, FOX, And FOX Business

How Will This Affect Your Portfolio?

1. Up

2. Down

3. Sideways

Grayscale Investment, the world’s largest crypto asset fund manager is bringing bitcoin (BTC), ether (ETH) to people’s television.

A Well-Timed Campaign?

In a recent tweet, Barry Silbert, the founder and CEO of Digital Currency Group, the parent firm of Grayscale Investment, Genesis Trading, and crypto publication Coindesk stated that Grayscale is set to kick-start a national ad campaign this week with a TV ad on popular business news channels such as CNBC, MSNBC, FOX, and FOX Business.

The ad campaign is widely being viewed as a catalyst that could fuel the mainstream demand for cryptocurrencies as the market continues its bullish momentum.

Notably, the ads will be aired on business and finance-centric TV channels such as CNBC, MSNBC, and FOX Business, among others, that have a total reach of more than 6.5 million people. Grayscale would want to capitalize on the exposure to such a mammoth audience by on-boarding both young and old individuals onto the bitcoin bandwagon.

As previously reported by BTCManager, a recent report by JPMorgan opined that while gold has for long been the de facto haven asset for the “Baby Boomer” generation, millennials seem to show affinity toward bitcoin.

Another survey report earlier this year released by Los Angeles-based iTrustCapital hinted that more investors are flocking toward digital assets and gold in the wake of the COVID-19 pandemic compared to traditional investment vehicles.

The aforementioned bullish findings, coupled with the US Federal Reserve’s unending printing of the dollar are a testimony to the growing confidence digital assets such as bitcoin enjoy among people looking to park their wealth in safe assets.

On the contrary, however, skeptics continue to berate the world’s premier cryptocurrency.

Earlier this year, goldbug and vocal bitcoin critic Peter Schiff bashed bitcoin saying the pioneer digital coin has no intrinsic value and current BTC holders will suffer huge losses.

Making Bitcoin Mainstream

Grayscale’s upcoming bitcoin ad campaign will be the latest shot in the arm for the industry-wide endeavor that seeks to bring the mainstream populace a step closer to digital assets.

As previously reported by BTCManager, LibertyX, US’s leading bitcoin ATM installer had launched the “Bitcoin on Every Block” campaign to enable the country’s residents to seamlessly buy BTC with cash at 20,000 retail stores and pharmacy chains.

Updated: 8-12-2020

Grayscale Bitcoin Trust Saw Surge In Investor Interest After March

Grayscale’s Bitcoin Trust issued almost twice as many shares, but arbitrage could have played a role.

The Grayscale Bitcoin Trust, an investment tool that aims to provide an indirect exposure to Bitcoin (BTC) for investors in traditional markets, reported a significant increase in how many shares it issued between Q2 and Q1 of 2020.

According to an Aug. 7 filing with the Securities and Exchange Commission, the trust issued more than 87 million shares in Q2 2020, compared to the total of 133 million shares issued for all of 2020.

The trust issued almost 90% more shares in the second quarter of 2020 compared to the first. This also represents more than a six-fold increase compared to the first half of 2019, when only 23 million shares were issued.

Net assets increased by $1.6 billion in Q2 2020 to a $3.5 billion total. About half of this growth came from the appreciation of Bitcoin held by the trust, amounting to 386,720 BTC as of June 30. At current market prices, it would be worth $4.4 billion.

Grayscale is often criticized for the impossibility in redeeming the trust’s shares. Some institutions and accredited investors are able to purchase shares at their true value as determined by how much Bitcoin the trust is holding. However, doing so requires a minimum six months waiting period as the shares in the trust are locked up.

The GBTC trust has consistently traded at a significant premium over its net asset value, meaning that investors are overpaying to gain indirect exposure to Bitcoin.

In addition to the lock up period that limits potential arbitrage plays, some noted that there is no mechanism to balance the trust’s share prices should they trade at a discount.

According to yCharts, the premium generally stays around 20%. However, it saw considerable dips to 10% in April and July of 2020, potentially signaling the presence of arbitrage traders. However, given that the premium returned to mean values, it is unlikely that arbitrage accounts for the entirety of the trust’s growth.

Some of these issues may explain community excitement for a Bitcoin ETF. In addition to potentially trading on well-known exchanges, exchange-traded funds also see a daily arbitrage of their share price compared to the value of its assets, ensuring that their prices track their underlying assets.

Cointelegraph previously reported that Grayscale’s Ethereum Trust trades at even higher premiums.

Updated: 8-13-2020

Interest In Grayscale Crypto Products Not Easing Up, Not Just BTC Now

Grayscale’s exponential growth demonstrates institutional demand for Bitcoin and other digital assets.

Grayscale Investments, the largest digital asset management firm in the world, has been showing exponential increases in investment to its cryptocurrency products.

The total sum of assets under management grew by $1 billion in less than two weeks in July, as a Twitter update showed. Additionally, according to the latest documentation, the number of shares Grayscale issued between the first and second quarters of 2020 increased by 90%.

Considering that in its Q2 update, the firm revealed it had gathered around $900 million throughout the entire quarter, the interest in Grayscale’s products seems to be growing at an exponential rate.

At the time, the firm held over $5.2 billion worth of cryptocurrency collectively, with Bitcoin leading at $4.4 billion. In total, the firm received $1.4 billion in the first half of 2020.

The levels of investment in the Grayscale funds are also exceeding those of late 2017, despite the Bitcoin price not being nearly as high. This is generally thought to be one of the best indicators for institutional interest in digital assets, given that no Bitcoin Exchange Traded Fund has been approved so far.

Demand Not Just For Bitcoin

While Bitcoin is by far the most popular product in the Grayscale family of investment products, other assets have also grown significantly, with Ether (ETH) being the second-biggest gainer.

Grayscale has also recently filed a Registration Statement on Form 10 with the United States Securities and Exchange Commission for the Grayscale Ethereum Trust, designating it a SEC reporting company if validated.

This shows a growing institutional demand for Ether, which is also signaled by growing derivatives volume. This interest is likely powered by the growing activity in the decentralized finance sector and stablecoins.

Grayscale investors have also shown interest in diversifying into several cryptocurrencies by investing in the firm’s Grayscale Digital Large Cap Fund. The fund is the fourth public offering from Grayscale, provides exposure to multiple crypto assets, and is available for over-the-counter share trading. Rayhaneh Sharif-Askary, Grayscale’s head of investor relations, told Cointelegraph:

“In the first half of 2020, Grayscale saw $1.4B in capital invested into the private placements of its family of products. Demand for alt-coins on the rise Demand for products ex-Grayscale Bitcoin Trust is up 35% Q-over-Q and 81% of returning institutional investors in 2Q20 have now allocated to multiple products (an increase of 71% over T12M).”

Shares of Bitcoin Cash and Litecoin are the fifth and sixth public offerings from Grayscale and have recently received permission from the U.S. Financial Industry Regulatory Authority to make both funds available for public OTC trading.

Grayscale Premium And Arbitrage

While Grayscale’s inflows are certainly a sign of institutional interest, also backed by other data sets like CME’s Bitcoin futures Open Interest, some worry these inflows may be exacerbated by accredited investors taking advantage of the premium between the underlying asset and the fund’s share price.

Michael Sonnenshein, managing director at Grayscale recently confirmed that accredited investors can still purchase GBTC at the price of Bitcoin:

“Those asking… YES, the Grayscale #Bitcoin Trust private placement is available for eligible accredited investors to purchase shares at the Trust’s daily NAV. We accept investments in both cash and $BTC.”

According to Grayscale’s latest filing with the U.S. Security and Exchange Commission, the number of shares sold increased 90% from the first quarter of the year to the second, which equates to the fund issuing over 87 million shares.

It’s also worth noting that Grayscale shares are traded at a premium that fluctuates, and in July, it reportedly decreased to 10%. According to crypto technology company Amun AG, investors (likely retail) have bought Grayscale Bitcoin Trust shares over the last year at a market price 22% above its net asset value on average.

Therefore, dips in the premium could have invited arbitrage traders to step in and purchase the shares, suggesting another reason why Grayscale’s products are in high demand.

Lanre Jonathan Ige, a researcher at Amun AG, told Cointelegraph that the premiums exist “due to the lack of the ability to create shares on a daily basis (or redeem shares) like in the case of ETPs/ETFs.” He added:

“There’s untapped demand for Bitcoin in the US market from those with tax-advantaged accounts like retirement accounts whose only option in BTC (some may not properly even understand the drastic premium for GBTC) so they maintain the demand for GBTC which boosts the premium.

Smart investors are able to (of sorts) generate yields equal to the GBTC premium with knowledge the premium is unlikely to fall; or even hedge GBTC exposure by also shorting GBTC when they’ve created new shares.”

Institutional Trading Picking Up

Nevertheless, the exponential growth for institutional money flowing into Bitcoin and other digital assets can also be observed through other metrics, namely through the derivatives activity in the CME and Bakkt futures markets — both of which have recently posted record numbers both in open interest and volume.

Other options for institutional investors are also emerging everywhere. Lanre Jonathan Ige told Cointelegraph that the lack of viable options is one of the reasons for the aforementioned premiums, but new options are starting to appear:

“People don’t buy the native asset because many less sophisticated investors aren’t familiar with Coinbase/Kraken and want to invest through brokers they understand and keep the rest of their wealth in.

GBTC can be accessed through some brokers that have access to the OTCQX market. Buying Bitcoin through such a wrapper would allow an investor to benefit from many tax advantages in the same way investing in 21Shares’ suite of ETPs likely would.”

As Bitcoin continues to establish itself in the public eye as a more reliable asset class, awareness seems to be paying off. Grayscale fosters education for institutions by promoting Bitcoin to financial advisors along with many other strategies. Similarly, Fidelity has also dubbed Bitcoin as an insurance plan for economic turmoil, and Goldman Sachs recently stated that the Bitcoin price may rise alongside gold’s as demand for viable stores of value grows.

Not only is Grayscale promoting crypto education to financial advisors, it is also trying to bring crypto awareness to the masses, having recently debuted an advertising campaign on CNBC, MSNBC, FOX and FOX Business in order to “brrring crypto to the masses.”

The 30-second video ad, however, received heavy criticism from some in the Bitcoin community for not mentioning Bitcoin and focusing too much on the history of money rather than digital assets. Furthermore, some also criticized the mentioning of controversial forks like Ethereum Classic and Bitcoin Cash and even the quality of the ad itself.

In the midst of the ongoing pandemic and a depreciating dollar, it’s only a matter of time until we see a Bitcoin ETF that could be a real game changer for Bitcoin, according to Grayscale’s managing director, Michael Sonnenshein. For now, the closest thing to an ETF is the GBTC fund, which, if it were an ETF, it would be one of the most sought-after in the United States.

Updated: 8-14-2020

Grayscale Investments Enjoys Its Best Week Ever After National Ad Blitz

Grayscale Investments had its best fundraising week in history following an ad blitz on a number of major television networks. According to the company’s CEO Barry Silbert, Grayscale netted $217 million in investments in the days following the campaign.

The firm’s Bitcoin Trust Fund was the biggest contributor to the success, adding 14,422.01411512 Bitcoin (BTC) at a value of $167,932,466, according to an SEC filing. The firm is currently holding 409,131 BTC, essentially removing it from circulation.

Meanwhile, Galaxy Digital took out a full page ad in the Financial Times last week.

Updated: 8-17-2020

Grayscale Brings Altcoins To Over-the-Counter Trading

The company also happened to clear a Nasdaq and NYSE listing requirement in the process.

Grayscale Investments, the asset manager behind the world’s largest Bitcoin trust, announced that its Bitcoin Cash Trust and Litecoin Trust are eligible for deposit at the Depository Trust Company, the largest securities depository in the world.

The Depository Trust Company (often shortened to DTC) was founded in 1973 and is based in New York. It holds securities worth $54.2 trillion as of July 31, 2017.

By clearing the bar to deposit here, Grayscale also happens to meet a requirement for being listed on major stock exchanges like the New York Stock Exchange and the Nasdaq.

Grayscale announced on August 17 that shares from the firm’s Bitcoin Cash Trust will be available on over-the-counter, or OTC, markets under the BCHG ticker. The Litecoin Trust’s shares will use the ticker LTCN.

Updated: 10-12-2020

Grayscale’s Ethereum Trust Granted SEC Reporting Company Status

Grayscale Investments’ Ethereum Trust on Monday became a Securities and Exchange Commission (SEC) reporting company, a move that increases the trust’s transparency – and potentially its liquidity.

* The Ethereum Trust will begin regularly disclosing how much money is flowing through its passive ETH investment vehicle, according to SEC filings.

* Accredited investors who hold the trust will be able to sell after only a six-month lockup instead of the usual 12.

* “We’re seeing interest from investors who have become more comfortable with digital currencies through bitcoin exposure, and are now looking at how else they can diversify within the asset class,” said Grayscale’s managing director, Michael Sonnenshein.

* The trust is Grayscale’s second crypto vehicle with shares registered under the Exchange Act of 1934, after its Bitcoin Trust became effective as a reporting company in January.

* Grayscale is part of Digital Currency Group, CoinDesk’s parent company.

Updated: 10-22-2020

Grayscale Adds A ‘Cool $300M’ In A Day And $1B This Week

“Added a cool $300 million in AUM in one day,” boasts Grayscale CEO Barry Silbert.

Crypto fund manager Grayscale Investments has increased its assets under management (AUM) by $1 billion in the space of a week.

According to an update posted to Grayscale’s Twitter account on Oct. 22, the investment firm currently has $7.3 billion in assets under management (AUM). That’s a billion-dollar increase on the $6.3 billion AUM Grayscale reported on Oct. 15. Each report is delayed by 24 hours so it refers to the previous day’s figure.