What You Should Know About ‘529’ Education-Savings Accounts

Despite all the benefits of these state-sponsored, tax-advantaged accounts, many people still don’t have them. What You Should Know About ‘529’ Education-Savings Accounts

The college-savings accounts known as 529 plans can be confusing. Parents know they have tax advantages. But what exactly are those advantages? What investment options make the most sense? Which expenses qualify and which don’t?

• What Are My Options?

The 529 plans come in two basic varieties. The more common type is a 529 college savings plan, where parents, grandparents and others can invest money to be used for a beneficiary’s qualified education expenses. The less common type is a 529 prepaid-tuition program, which some states and a consortium of private colleges offer to allow parents, grandparents and others to prepay tuition at participating schools at a set price today. Some states offer both types of plans.

These plans can be used to pay for a range of college expenses including tuition, room and board, books and computer equipment, and they can even be used to pay for up to $10,000 a year in K-12 tuition. There are several investment options, and a multitude of plans to choose from. You can also transfer money in an account to other beneficiaries. There are many plans that make it easy for people to invest even small amounts, and there are many low-cost direct-sold plans available (not sold through an adviser).

• Are There Downsides?

There are more upsides than downsides, but one consideration is that you could face tax consequences and/or penalties for withdrawals that aren’t considered qualified expenses. Another consideration: Your child’s need-based financial aid for college could be reduced. (More on both of those issues below.)

Also, you won’t be able to buy individual stocks within a 529 plan, and while there are multiple investment options to choose from, you’ll still have less choice than if you were designing a portfolio on your own.

• Where Can The Money Be Used?

The money in 529 plans can be used at most colleges and universities in the U.S., for undergraduate and graduate degrees. You may even be able to use the funds to pay for certain eligible institutions outside the U.S., according to the College Savings Plans Network, a repository for 529-plan information.

• What Investment Options Are There?

There are many. People commonly choose a portfolio allocation that automatically becomes more conservative as the beneficiary approaches college age. Other options include 100% equity funds or fixed-income funds, balanced funds that maintain a set mix of stocks and bonds, and stable-value funds, designed to give priority to protection of your principal. Some states offer FDIC-insured bank options, including relatively high-yield savings accounts and bank certificates of deposit, to protect your principal.

You aren’t stuck with one particular investment, either. You can move some or all of your existing money in an account to another investment option twice each calendar year, or after making a beneficiary change. Additionally, you can select a different investment option anytime you contribute to the plan. You can also switch to a different state’s plan once in a 12-month period, though some states penalize such shifts out of their plans.

• Is There A Ceiling On How Much I Can Invest?

Each state sets its own aggregate contribution limit per beneficiary, which ranges from $235,000 to $542,000, according to Savingforcollege.com; once an account hits those limits, no more contributions can be made, but earnings can continue to accumulate. While there are no annual contribution limits, you need to be mindful that contributions are considered gifts for federal tax purposes. In 2021, you can contribute $15,000 per donor, per recipient, free of federal gift taxes. You could also make a lump-sum tax-free 529 plan contribution of $75,000 and spread it out evenly over your tax returns for the next five years, an option some grandparents use as an estate-planning tool.

• How Do I Find A Plan?

You can compare state plans on the College Savings Plans Network site or at Savingforcollege.com. Always look at your state’s plan first, to see if there may be tax or other benefits specific to state residents that make it a more attractive option. There are also adviser-sold 529 plans for those who might want professional advice on how to invest, but these are often more expensive than a direct-sold plan.

Almost anyone can participate in a 529 plan. Parents, grandparents, other relatives or family friends can own an account or contribute to one. You can even set up a 529 for your own education expenses. A trust, corporation, nonprofit or government entity can also open an account in many states. A beneficiary needs to be a U.S. citizen or resident alien with a Social Security number or federal tax identification number.

• How Could A 529 Plan Have An Impact On Financial Aid?

While there could be an impact, experts say the benefits of saving for college through a 529 plan would likely outweigh the effects it could have on financial aid. Assets in accounts owned by a dependent student or one of his or her parents are considered parental assets for federal financial-aid purposes, and typically only 5.64% of the account is considered in the Fafsa (Free Application for Federal Student Aid) calculation each year.

This is more favorable than them being counted as student assets, according to Savingforcollege.com. Distributions under this ownership structure don’t reduce college financial-aid eligibility. Assets in accounts held by grandparents will have no impact on students’ Fafsa, but distributions will be counted as student income, which will affect aid.

• What Happens If You Don’t Use All The Funds Within The Plan?

Some parents worry about what would happen if their child doesn’t wind up going to college, or if the 529 money is needed for something else. The account owner maintains control of the assets regardless of how old the beneficiary is. This means the beneficiary can be changed at any time to another family member such as a sibling, stepchild, legally adopted child, niece or nephew, aunt or uncle—so there’s little concern about the money not being portable.

You also have the option to withdraw some or all of the money for something other than qualified education expenses. You may pay a penalty for that, however. Any earnings withdrawn (but not contribution amounts) would be subject to state and federal income tax plus a 10% federal tax penalty. There also may be fees or penalties charged by the plan.

Glossary

The state-sponsored investment plans known as 529 plans get their name from Section 529 of the Internal Revenue Code. They are formally known as Qualified Tuition Programs.

Tax-advantaged: It means that money in a 529 grows (typically through their holdings of mutual funds) without federal income tax, and you don’t pay tax on withdrawals if used for qualified education expenses.

The two types of 529s are prepaid tuition plans (where you purchase future tuition at a locked-in price) and savings plans, where your money grows in the markets.

An account holder can open an account for any student or future student—known as the beneficiary. Parents and grandparents often own these accounts for the beneficiary, or contribute to ones set up by others.

A 529 is typically called an education-savings plan now, rather than college-savings plan, because the 2017 tax bill expanded the mandate to include tuition at a public, private, or religious elementary or secondary school.

Sources: College Savings Plans Network, Investment Company Institute

Updated: 6-13-2021

How To Use ‘529S’ For Wealth Transfer And School Costs. Your Questions, Answered.

Barron’s Retirement recently explored a strategy some financial advisors are recommending where clients use “529” education savings plans to transfer wealth to the next generation, and not just pay for college or private school.

Turns out, the savings vehicle has a number of features that can make it advantageous for gifts and minimizing taxes. Following up on our recent article, Barron’s Retirement has dug into reader questions about how to employ the unconventional strategy as well guidelines surrounding 529s’ use for educational purposes. Here are some answers:

How Is It Possible For A Couple To Contribute $150,000 To A 529 Plan In One Fell Swoop?

The law allows you to contribute up to $15,000 annually for each recipient. But there is a special provision that allows you to front-load five years’ worth of contributions in a single year, which amounts to $75,000. If both you and your spouse front-load your contributions, you can give $150,000 to an account benefiting a person.

And don’t forget there is no limit on how many 529 recipients you can donate to. If you want to help out six children or grandchildren in the same year, you can do it.

Can you still gift money to grandchildren after donating $15,000 to their 529 plan in a year.

If you max out your 529 contributions for an individual, you won’t be able to donate any more money to that person without exceeding the gift-tax exclusion. And if you front-load five years of 529 contributions, that means five years where you’ve already hit the gift-tax limit.

Can You Invest 529 Accounts In Bitcoin?

The plans are run by states, which generally permit only mainstream investments like mutual funds.

“I don’t think they ever will approve anything like (Bitcoin) anytime soon,” said Mark Struthers, a financial advisor near Minneapolis. “Most of these state plans are pretty choosy what they allow people to invest in.”

Can You Put Money In A 529 And Then Use It To Buy A Condo For A Child In College?

No. “It’s not a qualified educational expense,” says John Roessler, a certified public accountant and financial advisor for Kovitz, a Chicago-based firm.

However, Roessler and other experts believe it is OK to buy a condo and charge your child rent to live in it, and to pay that rent from a 529 plan. Struthers worked with a client in Duluth, Minn., who bought a home for a child at the University of Minnesota campus there. He even set up a limited liability corporation to own the house, and had the student pay rent to the corporation. The parent was careful to keep rent in line with other market rents.

Does It Matter Who Owns The 529 For Scholarship Eligibility Reasons?

It can. If parents own a 529 account, it counts in the formula for how much financial aid the student will receive. Accounts owned by grandparents don’t count. However, if a grandparent distributes money from a 529 to a student, that can affect financial aid.

The good news is there a big lag how quickly 529 distributions affect financial aid. Roessler said if grandparents wait until the January semester of the student’s sophomore year, and the student graduates in four years, 529 money shouldn’t affect financial aid.

Can A Trust Own A 529 Plan And Does This Have Advantages?

Typically they can own 529s, but you need to check the rules for your state. Andrew Hook, an estate attorney in Virginia Beach, Va., said trusts can make sense in situations where the grandparents don’t want control of a 529 to go to the parents if the grandparents should be disabled or die. It makes sense “if you don’t trust your children,” Hook said.

Can You Take Money Out Of 529 To Equal Any Scholarships And Give Them To Your Child?

Yes. You won’t owe the normal 10% penalty but you still need to pay taxes on any gains.

What Can A 529 Pay For When It Comes To Parents Who Are Home-Schooling Their Children?

Hook believes you’ll be OK if you use the 529 only to pay for qualified expenses like books or online educational subscriptions.

Do You Have To Stop Contributing When The Child Reaches A Certain Age Or Goes To College?

Nope. You can put money in a 529 for somebody of any age, including yourself.

Updated: 7-6-2021

What To Do With Leftover Money In A 529 Plan

If you saved more for college than you needed, here’s how to spend it without taking a big financial blow.

Even if you spend years socking away money in a tax-free 529 college savings plan, it may not be enough to cover four years of tuition and fees. But what if, at the end of your student’s college career, you find yourself with leftover funds?

It’s not as uncommon as you might expect. While there are no hard statistics, about 10 percent of families with 529s end up with money the beneficiary on the account didn’t need for school, according to Mark Kantrowitz, publisher and vice president of research at Savingforcollege.com, a website that provides information on 529s and allows you to compare state-sponsored plans.

The number of people using 529s is growing. Total accounts hit a record 13.6 million in the first half of 2018, and assets totaled $329 billion, double the amount in 2010, according to the College Savings Plans Network, a coalition of state-run 529 plans.

There are a few circumstances that could cause you to wind up with excess funds. Of course, it could be because your kid didn’t attend college or dropped out of school. But it could also happen if your child won a scholarship, received a family inheritance, enlisted in the military, or went to a school that ended up being cheaper than you expected. Even qualifying for education-related tax credits could reduce the amount you thought was needed.

Having more savings than you thought you needed sounds like a good problem to have, but there can be financial consequences if you use the funds for something other than qualified education expenses. You’ll pay income tax on any gains in the account and a 10 percent penalty when you withdraw the money.

Fortunately, 529 accounts are very flexible. Funds can be used tax-free for many types of schooling, not just expenses at a four-year college. And there are a number of situations in which you can access the money without incurring penalties. There’s also no time limit on using the funds.

If you have a child graduating from college this spring and find yourself with leftover 529 funds, here are ways you can spend it and minimize the financial impact.

5 Things to Know About Leftover 529 Money

1. You still have time to spend it down. As long on it’s on qualified educational expenses and within the same calendar year as graduation, recent grads can still use the money. If you have school-related expenses that you paid out of pocket, you can make a withdrawal to cover those costs. In addition to tuition and fees, you can spend 529 money on books, supplies, living expenses, computers, and other equipment, as well as internet access.

2. You can give it to someone else. If the beneficiary on the 529 account didn’t use up the money, you can transfer it penalty-free to another qualifying family member. Family is generously defined to mean other children, parents, aunts, uncles, nieces, nephews, stepparents, even first cousins. And, thanks to the 2017 Tax Cut and Jobs Act, you can also use the money on private school K-12 expenses. Or you can save the funds for a future grandchild.

3. You can save it for grad school. There is no time limit on using the funds, so if your child has career plans that require a higher level of education, whether it’s another degree or professional courses, you can use it in the future. You can use money in a 529 at any institution of higher education that receives financial aid. That includes community colleges; technical, art, or music schools; vocational and certificate programs; trade schools; and continuing-education courses. You can look up qualifying schools and programs here.

4. Check to see whether you qualify for a penalty-free withdrawal. There are several situations where leftover money is exempt from the 10 percent penalty. You’ll still owe taxes on the earnings portion of the withdrawal. But if you got scholarships during college, you can apply that amount to the balance in your 529 and get the 10 percent penalty waived. If the student or parents get an unexpected inheritance, that may also count. You can also escape the penalty if your child enlists in the military or enrolls in a military academy. If using the American Opportunity Tax Credit or Lifetime Learning Credit reduces your need for savings, that’s another situation that could qualify for a penalty-free withdrawal. There are also some unfortunate situations that fall into this category: If the beneficiary on the account dies or becomes disabled, there’s no penalty for taking the money.

5. You can take the money. If none of these strategies will help you, the tax bite might not be as big as you think if you take the money out. The withdrawal amount will be taxed at the beneficiary’s rate, which is likely to be relatively low if it’s your child. While any earnings on your investments are subject to income tax as well as the 10 percent penalty, your contributions will never be taxed or penalized because they were made with after-tax dollars.

Updated: 8-9-2021

How Do You Withdraw Money From ‘529’ Plans? (And Other Questions From Readers)

Many people use these college-savings plans. And they can be awfully confusing.

After we published an article recently about these education-savings accounts, readers swamped us with questions—about how to withdraw funds for college, the impact on financial aid and more. (The plans can also be used for some K-12 tuition, but we focus mainly on the college use.)

Here are answers to some of the most-common questions we received.

It Is Almost Time For My Beneficiary To Start College. What Do I Need To Know About Making Withdrawals?

First, make sure you’ll be using the money for qualified expenses, such as tuition, room and board, books and supplies, and computers. Expenses that don’t qualify include things like transportation, campus parking, cellphones, club fees or dues, or furnishing a dorm room, according to the College Savings Plans Network, a repository for 529 plan data.

A withdrawal can be requested several ways: online, by paper form or call center. The money can be sent directly as payment to the institution, or to the account owner or beneficiary as a reimbursement, says the CSPN’s Rachel Biar, who is also assistant state treasurer in Nebraska.

For tuition and on-campus room and board, the easiest thing to do is request that 529 money be sent directly to the college or university. But account owners can request reimbursements for eligible out-of-pocket expenses—say for the purchase of books or a computer—that they or the beneficiary incur.

The account owner has the responsibility to keep all purchase receipts for tax purposes. Plans won’t ask to see verification that you’re using the funds for a qualified expense, but the IRS might. Owners will want the receipts in case of a tax audit, Ms. Biar says.

Another important tax issue: It is essential to take a distribution within the same calendar year that you incurred the expense, says Indiana State Treasurer Kelly Mitchell.

If you pay out-of-pocket for a covered expense in October 2021 but don’t remember to reimburse yourself until February 2022, that distribution would be considered a nonqualified expense, she says. There could be state and federal tax consequences, and some plans may impose fees or penalties.

I own a 529 plan with my granddaughter as the beneficiary. What impact will the 529 have on her eligibility for financial aid? Would it be better if I just give her $10,000?

Gifts to a grandchild and distributions from a 529 owned by a grandparent both can reduce the amount of need-based financial aid a student receives, says Mark Kantrowitz, a college-planning and financial-aid expert. Each counts as income for the student.

However, as the rules now stand, starting on Jan. 1 of your granddaughter’s sophomore year, you can give her a cash gift or use a 529 distribution to pay qualified expenses for her and it won’t have an effect on her future eligibility for aid. Cash gifts and distributions are reportable as untaxed income for the grandchild on the Free Application for Federal Student Aid, or Fafsa.

But the Fafsa requires that you report the student’s income from two years earlier; so the soonest your Fafsa application could reflect that income would be two years later. Assuming she graduates in four years, there is no impact on aid eligibility, Mr. Kantrowitz says.

Another option, he says, could be to do a rollover from a grandparent-owned 529 plan to a parent-owned 529 plan after the Fafsa is filed. The parent then uses a qualified distribution to pay college costs.

This way, on the Fafsa, there’s no concern about the grandparent-owned funds affecting the student’s financial aid, Mr. Kantrowitz explains. One caveat is that the parent-owned 529 should be in the same state as the grandparent-owned 529. “This will avoid recapture of state tax breaks, since many states treat a rollover to an out-of-state 529 plan as a nonqualified distribution,” he says.

In the future, these workarounds might be unnecessary. Fafsa simplification is being phased in and, as part of that effort, a question pertaining to cash support is likely to be eliminated. This is where the untaxed income from these gifts and 529 distributions are reported, Mr. Kantrowitz says.

The simplification was originally supposed to go into effect with the 2023-24 Fafsa, which will be based on 2021 income. Recently, however, the Education Department said it would need additional time to fully implement the measures. This would mean the change affecting grandparents would be postponed until at least the 2024-25 Fafsa, which will use income from 2022, Mr. Kantrowitz says.

Can 529 Funds Be Used To Pay Loans?

The Setting Every Community Up for Retirement Enhancement Act of 2019, also known as the Secure Act, permits some 529 funds to be used for qualified education loan repayment. This includes all federal and many private loans. A lifetime maximum of $10,000 in qualified student-loan repayments can be withdrawn for a beneficiary and $10,000 for each of the beneficiary’s siblings. This limit cannot be bypassed by having multiple plans for a beneficiary, Mr. Kantrowitz says. You’ll also need to be aware of how your federal-student-loan interest deduction will be reduced.

Parents who have federal Plus loans can also pay them down using 529 funds, subject to the same limits. To do this, the parent who holds the loan would need to be named the account beneficiary, instead of the student. A beneficiary can be changed at any time to another member of the beneficiary’s family.

There could also be state-tax implications to using 529 funds to repay education loans, so check your plan’s program description, also known as a plan disclosure statement or disclosure booklet, before heading down this path.

Can I Change The Beneficiary To A Nonfamily Member?

You can open a 529 account for a beneficiary who isn’t related to you as long as the person is a U.S. citizen or resident alien with a Social Security number or federal tax identification number.

However, if you change the beneficiary after opening the account, the new beneficiary should be a family member, says Michael Frerichs, Illinois state treasurer and chairman of the College Savings Plans Network.

A change to a nonfamily member would be treated as a nonqualified distribution, which could mean federal and state income taxes, as well as a 10% penalty on account earnings. That said, there is a broad definition of who qualifies as a family member, including children, siblings, parents, nieces, nephews, children-in-law, spouses and first cousins, he says.

What Happens To The 529 Funds If The Account Owner Dies?

Generally speaking, when you open an account, you have an option to name a successor owner, which is always a good idea, Mr. Frerichs says. If there is no successor owner, your plan’s program description will detail what contingencies might apply and what actions, if any, need to be taken.

“We encourage people to name a successor owner; that is the easiest thing,” he says. But even if they don’t, “people shouldn’t be worried that it’s going to revert to the state and the beneficiary won’t have any access,” he says.

Updated: 5-27-2022

Grandparents Can Give More To College 529 Plans After Rule Change

Outside contributions will no longer be penalized in financial aid decisions after Congress made tweaks that will go into effect for the 2024-25 school year.

Grandparents who want to help pay for grandkids’ college costs are getting more bang for their buck.

Recent changes to financial aid rules mean they’ll soon be able to contribute to 529 college savings plans that they own without penalizing their grandchild’s eligibility for federal money, a limitation that’s made some grandparents think twice before opening new accounts or adding to existing ones.

“The fear that a grandparent helping their grandchild by using their own 529 plan would interfere with them getting financial aid, that worry is gone now with the new rules,” said Stuart Siegel, president of college financial-aid service FAFSAssist.

The change is part of an overhaul of the Free Application for Federal Student Aid, or FAFSA, that students and their families fill out when applying for financial assistance.

Its length and complexity have been blamed for deterring people from even seeking aid, spurring Congress to streamline the process through the FAFSA Simplification Act.

Currently, money distributed to students from grandparent-owned 529 accounts effectively reduces the recipient’s eligibility for federal financial aid by 50% of the amount withdrawn for the student.

That’s because the current FAFSA asks students to report how much they receive from non-parent sources, and then adds half that gift to what’s known as the Expected Family Contribution.

That amount is then deducted from a student’s overall federal aid eligibility.

Simplified Form

That’s changing under the new rules, which take effect in the 2024-25 school year. Among the questions being removed from the simplified FAFSA is one about outside contributions.

Grandparents, as well as godparents, aunts, uncles and other non-parent family members, will be able to contribute as much as they want into their own 529 accounts without the student being required to report any funds that are later withdrawn.

State-run 529 plans are a popular way to pay for college because of their tax benefits: Participants don’t have to pay taxes on gains or withdrawals as long as the money is used for college or certain other education expenses.

They can also be used to defray K-12 costs or, since 2019, student loan repayments.

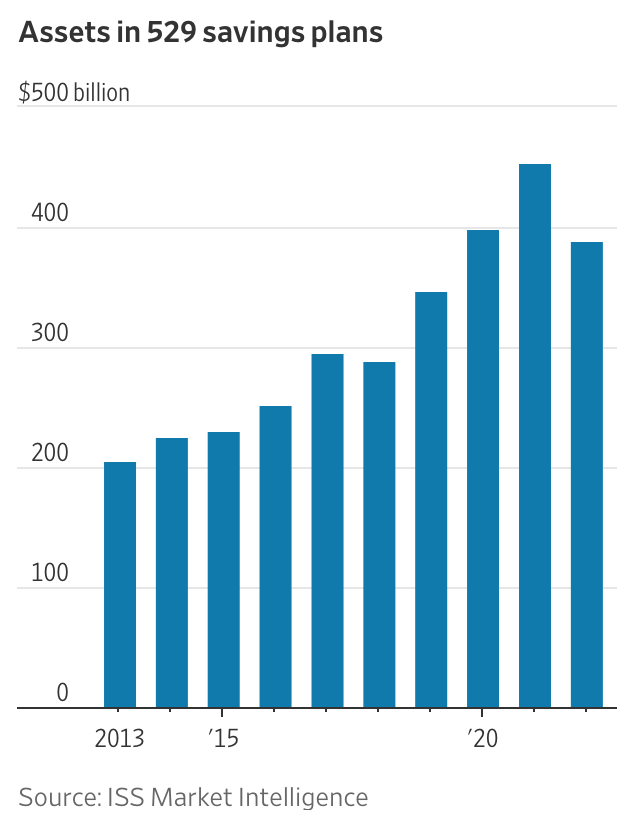

The total value of 529 plans reached a record $480 billion in the fourth quarter of 2021, up from $165 billion a decade ago, according to Federal Reserve data.

Some 37% of families with kids in college used 529 plans in 2020, with the average account holding $25,664.

Parents are the biggest contributors to 529 plans, but grandparents are often the second-largest. In North Carolina, 16% of accounts overseen by the state’s NC 529 Plan are owned by grandparents.

‘Big Deal’

“This is a big deal,” said Laura Morgan, a vice president at the College Foundation of North Carolina, a non-profit that administers the state’s 529 plan accounts. “The rising cost of education has made paying for college a family effort and this opens the door for more grandparents and other non-parents to own and manage 529 accounts.”

While many wealthy families either don’t apply or aren’t eligible for financial aid, the simplified FAFSA could be a boon to low- and middle-income students. The current form is so dense with questions about assets and income that many families never even bother to fill it out.

More than $3.7 billion of free money was left on the table last year by families eligible for aid, according to a recent study.

Richard Thigpen, who has two grandchildren in the sixth grade, is already preparing to help with their college. He’s saved about $10,000 for each in a 529 plan and looks forward to the change involving outside contributions taking effect.

“It’s been great,” he said. “This is something meaningful we can do.”

Updated: 5-5-2023

Your Child Picked A College! Tee Up Your 529 Plan

Making smart withdrawals from 529 college savings plans can be a lot harder than putting money into them.

This month kicked off with college decision day, the May 1 deadline for many high-school seniors to pick a school. It should also prompt parents to plan withdrawals from so-called 529 college-savings plans.

“There’s so much focus on putting dollars into 529 plans that people forget about taking the money out—and parents procrastinate because they’re busy,” says Mary Morris, chief executive of Virginia529, which recently held $86 billion for savers.

The 529 account is by far the most popular college-savings plan. Named after the tax-code provision authorizing them, these accounts allow savers to make contributions that can be invested and grow free of federal and state taxes.

(There’s no federal tax break on contributions, although many states offer tax breaks.) Withdrawals are tax-free when used to pay eligible education expenses.

Net assets in 529 plans were $388 billion at the end of 2022, more than double the total a decade earlier—even after withdrawals and 2022’s market losses.

Total accounts grew about 50% over the same period, to 15.1 million, according to Paul Curley, who tracks 529 data for ISS Market Intelligence.

For account owners ready to start withdrawing funds, there are details to know and traps to avoid. Above all, be sure to keep good records, especially for unusual expenses.

The Internal Revenue Service doesn’t seem to be policing aggressively, but if you get audited you need supporting materials.

In addition, recent legislation will soon allow rollovers of some unused 529-account funds into Roth IRAs.

For more information—say for K-12 withdrawals—see IRS Publication 970. Here are key points.

Eligible Schools

Virtually all accredited U.S. colleges and universities able to participate in federal student-aid programs can receive funds from 529 accounts. These funds can also be used at many trade schools, such as for culinary training. If in doubt, ask the school if it qualifies.

About 400 postsecondary schools located outside the U.S.—including colleges at Oxford and Cambridge in the U.K. and McGill in Canada—are eligible to receive 529 funds as well.

Expenses That Are—And Aren’t—Allowed

529 funds can be used to pay for tuition, fees, books, supplies and equipment, including a computer, software and internet access if they’re going to be used mainly for education. (No software for games in most cases.)

Withdrawals can also pay for room and board if the student is enrolled at least half time. Students living and eating off campus can use 529 funds for rent and grocery bills as well, up to limits that are often similar to the school’s charges for room and board.

529 funds typically can’t be used for transportation. However, special-needs students can use them for a broad array of expenses that could include transportation.

In addition, up to $10,000 of 529 funds can be used to pay student-loan debt for the named beneficiary (the student) and that person’s siblings or stepsiblings. This limit applies per individual.

So if Jane’s father decides to use $10,000 from her brother Sam’s 529 plan to pay down Jane’s student debt, then no other 529 funds can be used to pay her student debt.

Funds in 529 plans can be used for graduate as well as undergraduate expenses.

Making Payments

529 owners often pay expenses via direct transfer from the account to the school, but the plan can also send a payment to the owner or the student to reimburse expenses they pay. Don’t put off managing details like account links, as delays can occur.

IRS Reporting Of 529 Withdrawals

529 plans report payouts to the IRS on Form 1099-Q, and also send the form to a person affiliated with the account—either the owner or the beneficiary. Each payout is pro rata, and the 1099-Q will note what portion is principal and what is earnings.

Taxpayers don’t need to report 529 withdrawals on their tax returns as long as they’re tax-free.

Some 529 specialists advise taking payouts in the same tax year the expenses are incurred—so parents paying for a spring semester should withdraw 529 funds on or after Jan. 1. Others, including Ms. Morris of Virginia529, say this rule hasn’t been formally adopted by the IRS and can cause needless hassle.

Mark Kantrowitz, a college-savings specialist, says the IRS doesn’t want owners to leave funds in 529 accounts to grow tax-free for decades after education costs were incurred. “If the withdrawals are within a few months, that shouldn’t be a problem,” he adds.

Taxable Withdrawals

If a 529 payout is larger than total eligible expenses, then income tax plus a 10% penalty is often due on the earnings—but not the principal.

Say that John withdraws $30,000 from a 529 plan he funded for his son Matthew’s college costs, and the pro rata payout consists of $15,000 of principal and $15,000 of earnings. However, Matthew has only $25,000 eligible college expenses.

In that case, income tax and a 10% penalty would likely be owed on about $2,500, the earnings portion of the excess payout.

Exceptions to the 10% penalty can apply for scholarships and in other cases. Students who receive refunds of previously paid eligible 529 expenses—as happened when students left campus during the pandemic—can often recontribute them to a 529 account within 60 days and avoid taxes and penalties.

If there’s a taxable payout from a 529 plan, some states recapture tax breaks for contributions.

Combining 529 Withdrawals With Other Benefits

Tough questions often arise when a student qualifies for the American Opportunity Credit, tax-free scholarships and 529 withdrawals.

The Opportunity Credit provides a maximum tax reduction of $2,500 per student per year for four years of postsecondary education. For 2023, it fully phases out at $90,000 for most single filers and $180,000 for most joint filers.

For tax purposes, no double-dipping is allowed. Each dollar of qualified expenses can be used only once, whether it’s for the Opportunity Credit, a 529 withdrawal or a tax-free scholarship.

What’s the best strategy for coordinating benefits? The answer varies with circumstances, but Mr. Kantrowitz often recommends maximizing scholarships and the Opportunity Credit before using 529 withdrawals.

Transfers

529 owners typically can switch the beneficiary on an account without tax consequences if it’s to a family member. This term is broadly defined and includes spouses and first cousins as well as descendants and siblings.

529 owners can also leave accounts to others at death. Unlike traditional IRAs, Roth IRAs and Health Savings Accounts, these accounts can exist in perpetuity, according to Mr. Curley.

Rollovers To A Roth IRA

Last year Congress changed the law to allow rollovers of 529 funds into Roth IRAs. The provision will let 529 beneficiaries transfer up to $35,000 over time from a 529 plan to a Roth IRA if the 529 has been open at least 15 years, among other requirements.

The change will provide an out for savers with excess 529 funds. Some 529 sponsors hope parents and others will be able to do rollovers that boost their own retirement savings.

This change takes effect in January 2024, so stay tuned for IRS guidance.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin)

Kia And Hyundai To Pay $200 Million To Settle Viral Car-Theft Suit

Stock Clearinghouse Leaked Sensitive Data, Trading Firm Says #GotBitcoin

Scarlette Bourne Joins Our List of 2023’s Most Influential Women

Surge In Celebrities And Others Contributing To Nonprofits Focusing On Blacks

Israel-Gaza Conflict Spurs Bitcoin Donations To Hamas

Signal Encrypted Messenger Now Accepts Donations In Bitcoin

Melinda Gates Welcomes The Philanthropists Of The Future

Who Gets How Much: Big Questions About Reparations For Slavery

California Lawmakers Vote To Create Reparations Task Force

US City To Pay Reparations To African-American Community With Tax On Marijuana Sales

Ultimate Resource On Australia’s Involvement With Bitcoin

Famous Former Bitcoin Critics Who Conceded In 2020-23

The Latest On FBI Warrantless Searches of Americans’ Communications #GotBitcoin

America’s Spies Are Losing Their Edge

Powell Got Punk’d By Putin’s Puppets

‘What Housewife Isn’t On Ozempic?’ How A Weight-Loss Craze Is Sweeping Across America

Snoop Dogg’s Net Worth Is Almost As High As He (Usually) Is

Is It Just Me Or Is America Having A Mental Breakdown? Joker

CFPB (Idiots) Says Staffer Sent 250,000 Consumers’ Data To Personal Account #GotBitcoin

Global Bitcoin Game Theory Is Now Playing Out

Operation Choke Point 2.0 Could Be Bitcoin’s Biggest Banking Crackdown And Regulatory Battle

The US Cracked A $3.4 Billion Crypto Heist—And Bitcoin’s Pseudo-Anonymity😹🤣😂

Twitter To Launch Bitcoin And Stock Trading In Partnership With eToro

Rich Chinese Splashing Out On Luxury In Singapore

Apple Sues NSO Group To Curb The Abuse Of State-Sponsored Spyware

Harvard Quietly Amasses California Vineyards—And The Water Underneath (#GotBitcoin)

US Says China Backed Hackers Who Targeted COVID-19 Vaccine Research

Ultimate Resource For Covid-19 Vaccine Passports

Companies Plan Firings For Anti-Vaxers And Giveaways For Covid-19 Vaccine Recipients

US Bank Lending Slumps By Most On Record In Final Weeks Of March And It’s Impact On Home Buyers

California Defies Doom With No. 1 U.S. Economy

California Wants Its Salton Sea Located In The Imperial Valley To Be ‘Lithium Valley’

Ultimate Resource For Nationwide Firsts Taking Place In California (#GotBitcoin)

Flight To Money Funds Is Adding To The Strains On Banks #GotBitcoin

The Fed Loses Money For The First Time In 107 Years – Why It Matters #GotBitcoin

African Safari Vacation Itinerary (2024 Proposal)

The Next Fountain-of-Youth Craze? Peptide Injections

This Ocean Monster Offers A Potential Climate Solution

What Are Credit Default Swaps, How Do They Work, And How They Go Wrong

Cyberattack Sends Quadrillion Dollars Derivative’s Trading Markets Back To The 1980s #GotBitcoin

What Is Dopamine Fasting? Meet The Dangerous Fad Among Silicon Valley’s Tech Geniuses

Bitcoin Community Leaders Join Longevity Movement

Sean Harribance Shares His Psychic Gifts With The Public

Scientists Achieve Real-Time Communication With Lucid Dreamers In Breakthrough

Does Getting Stoned Help You Get Toned? Gym Rats Embrace Marijuana

Marijuana In Africa Is Like The Gold Rush For America In The 1800s

The Perfect Wine And Weed To Get You Through The Coronavirus Pandemic Lockdown

Mike Tyson’s 420-Acre Weed Ranch Rakes In $500K A Month

What Sex Workers Want To Do With Bitcoin

“Is Bitcoin Reacting To The Chaos Or Is Bitcoin Causing The Chaos?” Max Keiser

How To Safely Store Deposits If You Have More Than $250,000

How To Host A Decentralized Website

Banks Lose Billions (Approx. $52 Billion) As Depositors Seek Higher Deposit Yields #GotBitcoin

Crypto User Recovers Long-Lost Private Keys To Access $4M In Bitcoin

Stripe Stops Processing Payments For Trump Campaign Website

Bitcoin Whales Are Profiting As ‘Weak Hands’ Sell BTC After Price Correction

Pentagon Sees Giant Cargo Cranes As Possible Chinese Spying Tools

Bitcoin’s Volatility Should Burn Investors. It Hasn’t

Bitcoin’s Latest Record Run Is Less Volatile Than The 2017 Boom

“Lettuce Hands” Refers To Investors Who Can’t Deal With The Volatility Of The Cryptocurrency Markets

The Bitcoiners Who Live Off The Grid

US Company Now Lets Travelers Pay For Passports With Bitcoin

After A Year Without Rowdy Tourists, European Cities Want To Keep It That Way

Director Barry Jenkins Is The Travel Nerd’s Travel Nerd

Four Stories Of How People Traveled During Covid

Who Is A Perpetual Traveler (AKA Digital Nomad) Under The US Tax Code

Tricks For Making A Vacation Feel Longer—And More Fulfilling

Travel Has Bounced Back From Coronavirus, But Tourists Stick Close To Home

Nurses Travel From Coronavirus Hot Spot To Hot Spot, From New York To Texas

How To Travel Luxuriously Post- Covid-19, From Private Jets To Hotel Buyouts

Ultimate Travel Resource Covering Business, Personal, Cruise, Flying, Etc.)

Does Bitcoin Boom Mean ‘Better Gold’ Or Bigger Bubble?

Bitcoin’s Slide Dents Price Momentum That Dwarfed Everything

Retail Has Arrived As Paypal Clears $242M In Crypto Sales Nearly Double The Previous Record

Jarlsberg Cheese Offers Significant Bone & Heart-Health Benefits Thanks To Vitamin K2, Says Study

Chrono-Pharmacology Reveals That “When” You Take Your Medication Can Make A Life-Saving Difference

Ultimate Resource For News, Breakthroughs And Innovations In Healthcare

Ultimate Resource For Cooks, Chefs And The Latest Food Trends

Ethereum Use Cases You Might Not Know

Will 1% Yield Force The Fed Into Curve Control?

Ultimate Resource On Hong Kong Vying For World’s Crypto Hub #GotBitcoin

France Moves To Ban Anonymous Crypto Accounts To Prevent Money Laundering

Numerous Times That US (And Other) Regulators Stepped Into Crypto

Where Does This 28% Bitcoin Price Drop Rank In History? Not Even In The Top 5

Traditional Investors View Bitcoin As If It Were A Technology Stock

3 Reasons Why Bitcoin Price Abruptly Dropped 6% After Reaching $15,800

As Bitcoin Approaches $25,000 It Breaks Correlation With Equities

UK Treasury Calls For Feedback On Approach To Cryptocurrency And Stablecoin Regulation

Bitcoin Rebounds While Leaving Everyone In Dark On True Worth

Slow-Twitch vs. Fast-Twitch Muscle Fibers

Biden, Obama Release Campaign Video Applauding Their Achievements

Joe Biden Tops Donald Trump In Polls And Leads In Fundraising (#GotBitcoin)

Trump Gets KPOP’d And Tic Toc’d As Teens Mobilized To Derail Trump’s Tulsa Rally

Schwab’s $200 Million Charge Puts Scrutiny On Robo-Advising

TikTok Is The Place To Go For Financial Advice If You’re A Young Adult

TikTok Is The Place To Go For Financial Advice If You’re A Young Adult

American Shoppers Just Can’t Pass Up A Bargain And Department Stores Pay The Price #GotBitcoin

Motley Fool Adding $5M In Bitcoin To Its ‘10X Portfolio’ — Has A $500K Price Target

Mad Money’s Jim Cramer Invests 1% Of Net Worth In Bitcoin Says, “Gold Is Dangerous”

Ultimate Resource For Financial Advisers By Financial Advisers On Crypto

Anti-ESG Movement Reveals How Blackrock Pulls-off World’s Largest Ponzi Scheme

The Bitcoin Ordinals Protocol Has Caused A Resurgence In Bitcoin Development And Interest

Bitcoin Takes ‘Lion’s Share’ As Institutional Inflows Hit 7-Month High

Bitcoin’s Future Depends On A Handful of Mysterious Coders

Billionaire Hedge Fund Investor Stanley Druckenmiller Says He Owns Bitcoin In CNBC Interview

Bitcoin Billionaire Chamath Palihapitiya Opts Out Of Run For California Governor

Billionaire Took Psychedelics, Got Bitcoin And Is Now Into SPACs

Billionaire’s Bitcoin Dream Shapes His Business Empire In Norway

Trading Firm Of Richest Crypto Billionaire Reveals Buying ‘A Lot More’ Bitcoin Below $30K

Simple Tips To Ensure Your Digital Surveillance Works As It Should

Big (4) Audit Firms Blasted By PCAOB And Gary Gensler, Head Of SEC (#GotBitcoin)

What Crypto Users Need Know About Changes At The SEC

The Ultimate Resource For The Bitcoin Miner And The Mining Industry (Page#2) #GotBitcoin

How Cryptocurrency Can Help In Paying Universal Basic Income (#GotBitcoin)

Gautam Adani Was Briefly World’s Richest Man Only To Be Brought Down By An American Short-Seller

Global Crypto Industry Pledges Aid To Turkey Following Deadly Earthquakes

Money Supply Growth Went Negative Again In December Another Sign Of Recession #GotBitcoin

Here Is How To Tell The Difference Between Bitcoin And Ethereum

Crypto Investors Can Purchase Bankruptcy ‘Put Options’ To Protect Funds On Binance, Coinbase, Kraken

Bitcoin Developers Must Face UK Trial Over Lost Cryptoassets

Google Issues Warning For 2 Billion Chrome Users

How A Lawsuit Against The IRS Is Trying To Expand Privacy For Crypto Users

IRS Uses Cellphone Location Data To Find Suspects

IRS Failed To Collect $2.4 Billion In Taxes From Millionaires

Treasury Calls For Crypto Transfers Over $10,000 To Be Reported To IRS

Can The IRS Be Trusted With Your Data?

US Ransomware Attack Suspect Hails From A Small Ukrainian Town

Alibaba Admits It Was Slow To Report Software Bug After Beijing Rebuke

Japan Defense Ministry Finds Security Threat In Hack

Raoul Pal Believes Institutions Have Finished Taking Profits As Year Winds Up

Yosemite Is Forcing Native American Homeowners To Leave Without Compensation. Here’s Why

What Is Dollar Cost Averaging Bitcoin?

Ultimate Resource On Bitcoin Unit Bias

Best Travel Credit Cards of 2022-2023

A Guarded Generation: How Millennials View Money And Investing (#GotBitcoin)

Bitcoin Enthusiast And CEO Brian Armstrong Buys Los Angeles Home For $133 Million

Nasdaq-Listed Blockchain Firm BTCS To Offer Dividend In Bitcoin; Shares Surge

Ultimate Resource On Kazakhstan As Second In Bitcoin Mining Hash Rate In The World After US

Ultimate Resource On Solana Outages And DDoS Attacks

How Jessica Simpson Almost Lost Her Name And Her Billion Dollar Empire

Sidney Poitier, Actor Who Made Oscars History, Dies At 94

Green Comet Will Be Visible As It Passes By Earth For First Time In 50,000 Years

FTX (SBF) Got Approval From F.D.I.C., State Regulators And Federal Reserve To Buy Tiny Bank!!!

Joe Rogan: I Have A Lot Of Hope For Bitcoin

Teen Cyber Prodigy Stumbled Onto Flaw Letting Him Hijack Teslas

Spyware Finally Got Scary Enough To Freak Lawmakers Out—After It Spied On Them

The First Nuclear-Powered Bitcoin Mine Is Here. Maybe It Can Clean Up Energy FUD

The World’s Best Crypto Policies: How They Do It In 37 Nations

Tonga To Copy El Salvador’s Bill Making Bitcoin Legal Tender, Says Former MP

Wordle Is The New “Lingo” Turning Fans Into Argumentative Strategy Nerds

Prospering In The Pandemic, Some Feel Financial Guilt And Gratitude

Is Art Therapy The Path To Mental Well-Being?

New York, California, New Jersey, And Alabama Move To Ban ‘Forever Chemicals’ In Firefighting Foam

The Mystery Of The Wasting House-Cats

What Pet Owners Should Know About Chronic Kidney Disease In Dogs And Cats

Pets Score Company Perks As The ‘New Dependents’

Why Is My Cat Rubbing His Face In Ants?

Natural Cure For Hyperthyroidism In Cats Including How To Switch Him/Her To A Raw Food Diet

Ultimate Resource For Cat Lovers

FDA Approves First-Ever Arthritis Pain Management Drug For Cats

Ultimate Resource On Duke of York’s Prince Andrew And His Sex Scandal

Walmart Filings Reveal Plans To Create Cryptocurrency, NFTs

Bitcoin’s Dominance of Crypto Payments Is Starting To Erode

T-Mobile Says Hackers Stole Data On About 37 Million Customers

Jack Dorsey Announces Bitcoin Legal Defense Fund

More Than 100 Millionaires Signed An Open Letter Asking To Be Taxed More Heavily

Federal Regulator Says Credit Unions Can Partner With Crypto Providers

What’s Behind The Fascination With Smash-And-Grab Shoplifting?

Train Robberies Are A Problem In Los Angeles, And No One Agrees On How To Stop Them

US Stocks Historically Deliver Strong Gains In Fed Hike Cycles (GotBitcoin)

Ian Alexander Jr., Only Child of Regina King, Dies At Age 26

Amazon Ends Its Charity Donation Program Amazonsmile After Other Cost-Cutting Efforts

Indexing Is Coming To Crypto Funds Via Decentralized Exchanges

Doctors Show Implicit Bias Towards Black Patients

Darkmail Pushes Privacy Into The Hands Of NSA-Weary Customers

3D Printing Make Anything From Candy Bars To Hand Guns

Stealing The Blood Of The Young May Make You More Youthful

Henrietta Lacks And Her Remarkable Cells Will Finally See Some Payback

AL_A Wins Approval For World’s First Magnetized Fusion Power Plant

Want To Be Rich? Bitcoin’s Limited Supply Cap Means You Only Need 0.01 BTC

Smart Money Is Buying Bitcoin Dip. Stocks, Not So Much

McDonald’s Jumps On Bitcoin Memewagon, Crypto Twitter Responds

America COMPETES Act Would Be Disastrous For Bitcoin Cryptocurrency And More

Lyn Alden On Bitcoin, Inflation And The Potential Coming Energy Shock

Inflation And A Tale of Cantillionaires

El Salvador Plans Bill To Adopt Bitcoin As Legal Tender

Miami Mayor Says City Employees Should Be Able To Take Their Salaries In Bitcoin

Vast Troves of Classified Info Undermine National Security, Spy Chief Says

BREAKING: Arizona State Senator Introduces Bill To Make Bitcoin Legal Tender

San Francisco’s Historic Surveillance Law May Get Watered Down

How Bitcoin Contributions Funded A $1.4M Solar Installation In Zimbabwe

California Lawmaker Says National Privacy Law Is a Priority

The Pandemic Turbocharged Online Privacy Concerns

How To Protect Your Online Privacy While Working From Home

Researchers Use GPU Fingerprinting To Track Users Online

Japan’s $1 Trillion Crypto Market May Ease Onerous Listing Rules

Ultimate Resource On A Weak / Strong Dollar’s Impact On Bitcoin

Fed Money Printer Goes Into Reverse (Quantitative Tightening): What Does It Mean For Crypto?

Crypto Market Is Closer To A Bottom Than Stocks (#GotBitcoin)

When World’s Central Banks Get It Wrong, Guess Who Pays The Price😂😹🤣 (#GotBitcoin)

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin And Gold

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Does Your Baby’s Food Contain Toxic Metals? Here’s What Our Investigation Found

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

Ultimate Resource On BlockFi, Celsius And Nexo

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

100 Million Americans Can Legally Bet on the Super Bowl. A Spot Bitcoin ETF? Forget About it!

Green Finance Isn’t Going Where It’s Needed

Shedding Some Light On The Murky World Of ESG Metrics

SEC Targets Greenwashers To Bring Law And Order To ESG

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Canada’s Major Banks Go Offline In Mysterious (Bank Run?) Hours-Long Outage (#GotBitcoin)

On-Chain Data: A Framework To Evaluate Bitcoin

On Its 14th Birthday, Bitcoin’s 1,690,706,971% Gain Looks Kind of… Well Insane

The Most Important Health Metric Is Now At Your Fingertips

American Bargain Hunters Flock To A New Online Platform Forged In China

Why We Should Welcome Another Crypto Winter

Traders Prefer Gold, Fiat Safe Havens Over Bitcoin As Russia Goes To War

Music Distributor DistroKid Raises Money At $1.3 Billion Valuation

Nas Selling Rights To Two Songs Via Crypto Music Startup Royal

Ultimate Resource On Music Catalog Deals

Ultimate Resource On Music And NFTs And The Implications For The Entertainment Industry

Lead And Cadmium Could Be In Your Dark Chocolate

Catawba, Native-American Tribe Approves First Digital Economic Zone In The United States

The Miracle Of Blockchain’s Triple Entry Accounting

How And Why To Stimulate Your Vagus Nerve!

Housing Boom Brings A Shortage Of Land To Build New Homes

Biden Lays Out His Blueprint For Fair Housing

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Cracks In The Housing Market Are Starting To Show

Ever-Growing Needs Strain U.S. Food Bank Operations

Food Pantry Helps Columbia Students Struggling To Pay Bills

Food Insecurity Driven By Climate Change Has Central Americans Fleeing To The U.S.

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Families Face Massive Food Insecurity Levels

US Troops Going Hungry (Food Insecurity) Is A National Disgrace

Everything You Should Know About Community Fridges, From Volunteering To Starting Your Own

Russia’s Independent Journalists Including Those Who Revealed The Pandora Papers Need Your Help

10 Women Who Used Crypto To Make A Difference In 2021

Happy International Women’s Day! Leaders Share Their Experiences In Crypto

Dollar On Course For Worst Performance In Over A Decade (#GotBitcoin)

Juice The Stock Market And Destroy The Dollar!! (#GotBitcoin)

Unusual Side Hustles You May Not Have Thought Of

Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

The Fed Is Setting The Stage For Hyper-Inflation Of The Dollar (#GotBitcoin)

An Antidote To Inflation? ‘Buy Nothing’ Groups Gain Popularity

Why Is Bitcoin Dropping If It’s An ‘Inflation Hedge’?

Lyn Alden Talks Bitcoin, Inflation And The Potential Coming Energy Shock

Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

What The Fed’s Rate Hike Means For Inflation, Housing, Crypto And Stocks

Egyptians Buy Bitcoin Despite Prohibitive New Banking Laws

Archaeologists Uncover Five Tombs In Egypt’s Saqqara Necropolis

History of Alchemy From Ancient Egypt To Modern Times

Former World Bank Chief Didn’t Act On Warnings Of Sexual Harassment

Does Your Hospital or Doctor Have A Financial Relationship With Big Pharma?

Ultimate Resource Covering The Crisis Taking Place In The Nickel Market

Apple Along With Meta And Secret Service Agents Fooled By Law Enforcement Impersonators

Handy Tech That Can Support Your Fitness Goals

How To Naturally Increase Your White Blood Cell Count

Ultimate Source For Russians Oligarchs And The Impact Of Sanctions On Them

Ultimate Source For Bitcoin Price Manipulation By Wall Street

Russia, Sri Lanka And Lebanon’s Defaults Could Be The First Of Many (#GotBitcoin)

Will Community Group Buying Work In The US?

Building And Running Businesses In The ‘Spirit Of Bitcoin’

What Is The Mysterious Liver Disease Hurting (And Killing) Children?

Citigroup Trader Is Scapegoat For Flash Crash In European Stocks (#GotBitcoin)

Bird Flu Outbreak Approaches Worst Ever In U.S. With 37 Million Animals Dead

Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.