The Ultimate Resource For The Bitcoin Miner And The Mining Industry (#GotBitcoin)

How To Build A Crypto Mining Rig In 2020 To Earn Bitcoin And Ether. The Ultimate Resource For The Bitcoin Miner And The Mining Industry (#GotBitcoin)

Mining with home rigs is back, so here’s what those interested need to know to put together their own rig at home.

It is not surprising that countries experiencing difficult political and economic situations have witnessed a boom in the purchase of GPU cards in recent months. In the region of Abkhazia, where all crypto activities have been illegal since 2018, citizens spent more than $500,000 on mining equipment over a period of six months.

Related:

Ultimate Resource On Bitcoin Mining Hashrate

Another factor that has worked to further popularize mining is strong crypto prices. Bitcoin (BTC) has risen by almost a third, while Ether (ETH), the most popular currency for mining, has added $150 to its price and the decentralized frenzy has meant that gas fees have reached unprecedented levels.

So, here’s how to design a cryptocurrency rig — and an exploration of whether it needs to be done at all, given all the associated risks.

Mining Rig Components

A cryptocurrency mining rig consists of a computer that has many graphics cards but no monitor. Computer cases are filled with GPU cards, a power-generating unit, a motherboard and a cooling system. If a monitor is connected, it can become a regular computer where a user can open a browser or play their favorite video game.

The Rig Is Connected To The Internet, And Thus, The Blockchain Network. The Network Operates By Itself To Conduct Monetary Transactions Using The Power Of The Graphics Cards. To Be More Specific, A Mining Rig Consists Of:

* An ordinary motherboard, which has the capability of linking to a number of connectors for GPU cards.

* A hard disk drive, or HDD, with 100 to 250 gigabytes of memory to house the cryptocurrency wallet, with an Ether wallet usually taking up 25 GB and a BTC wallet requiring 50 GB or more.

* Several GPU cards, which are the most important components in a rig because they are the base that defines the cryptocurrency that a user will mine, along with their future profit and its timeline.

* A power-generating unit. A rig with four GPUs often requires more than one power unit. Usually, miners have a few 750-watt units connected together.

* A power adapter for GPU cards. Video cards are connected to the motherboard using special extension cards called “risers.” There are many different types and models of risers, but the PCI-E 1x version 006 is the most popular.

* A power switch.

* A cooling system, and it’s preferable to have several coolers to provide additional airflow.

Another important detail is the frame for the rig. It is better to make a frame out of wood or aluminum. The size of the mining rig will be slightly larger than its frame due to protruding parts, adapters and a cooling system.

For example, a seven-GPU rig will be approximately 21 inches wide (53 centimeters), 12 inches deep (30 centimeters) and 12 inches high (30 centimeters).

After purchasing all the components of the rig, it’s time to design it, which is a rather easy task for a person who has experience with computer hardware. Additionally, there are plenty of guides on YouTube.

When a rig is ready, all that needs to be done is to install some software — i.e., to choose a program for mining the currency of preference. Another way is to find a mining pool, which is a popular way to mine, as it’s becoming harder to do so individually due to the rising complexity of crypto mining.

There are also some tools available such as TeamViewer, for remote control, and WatchDog, which automatically restarts the system if the program freezes.

Top GPU Cards

As a rule, one rig should include four to seven video cards — it’s a number that will not go beyond the framework of a stable operation, although there are exceptions.

Miners can connect 10 to 15 GPU cards to one motherboard, but seven is the optimal number because Microsoft’s Windows 10 operating system can detect only this number of cards. But there is a solution: specialized mining software based on the Linux kernel. In that case, the key is to choose the right motherboard, such as an ASRock Pro BTC+ series or similar.

Determining which GPU cards are best for mining is not so straightforward, as the answer depends only on the amount of money that the miner has. In general, it makes little sense to buy the most expensive, powerful GPUs for the price of two to three slightly weaker ones, as there is a greater chance the cheaper ones will bring more benefits due to their low power consumption and initial cost.

The highest income in mining is currently achieved with Nvidia GeForce RTX 2080 Ti and AMD Radeon VII cards, but it is more profitable to build a mining farm with AMD Radeon RX 580 and Nvidia GeForce GTX 1660 Super cards, as they will pay off much faster.

It should also be kept in mind that AMD RX series GPU cards can be flashed by changing the working time of the RAM, downvolting the core and overclocking. Programs such as MSI Afterburner and Sapphire TriXX can assist in making these manipulations, which will help GPU cards achieve maximum performance during the mining process.

Electricity In Question

In over 10 years, the mining industry has turned from something incomprehensible and rather cheap to a professional, high-tech venture that implies high barriers of entry, not only for the equipment but also for its maintenance.

After Purchasing Mining Equipment, Paying The Cost Of Electricity During Its Operation Becomes The Main Expense That Directly Affects Profitability. The Energy Consumption Of One Mining Rig Consists Of The Following Components:

* GPU cards, depending on the power and mining algorithm, consume between 360 watts and 1500 watts for a rig of six to seven cards.

* The motherboard, power unit, HDD and RAM consume up to 100 watts.

* The cooling system uses from 20 watts to several kilowatts when using air conditioning systems.

So, how can a miner reduce the cost of electricity? The main consumers of electricity are the GPU cards, and with the right settings, electricity consumption during mining can be reduced significantly. For example, when mining Ether, the main thing is to overclock the video memory.

The most optimal operating mode for GPU cards is setting the core voltage to about 830 to 850 millivolts for AMD cards and 650 to 850 millivolts for Nvidia cards. Lowering the voltage on the core of the card, in addition to reducing power consumption, decreases the amount of heat, which has a beneficial effect on the equipment.

Power-generating units can also use less power if they have a “gold” certificate, which means they save a large amount of electricity (about 15%) compared with power units that lack them.

Another way is to change HDDs to solid-state drives, which will increase the speed of loading the operating system and reduce the power consumption of each rig by five to 15 watts. Furthermore, modern RAM (DDR4 or DDR3L instead of DDR3) and processors can reduce consumption by another 10 to 20 watts.

A miner can also reduce consumption through slightly more complicated ways too, such as finding more economical electricity tariffs — for example, installing the rigs where there are reduced tariffs for consumers with electric stoves or electric heating and lower night-time prices.

If possible, miners can even reach out to a power plant that generates electricity to find out if it has surplus capacity. Some miners can create their own solar or wind farms and use them for mining, but not everyone can afford such an investment.

Mining In The Cloud

Keeping in mind the unstable situation in the economy, some may want to join the crypto mining community but cannot due to the high initial costs associated. Here’s where “hosted mining” can come into play, whereby cryptocurrencies are mined through a remote connection to equipment that has been rented out. Philip Salter, head of operations at Genesis Mining — a hosted mining provider — told Cointelegraph:

“Since mining is becoming more competitive, margins are shrinking and it’s harder for home miners to compete. Miners need to get every drop of efficiency they can, and that means growing the operation (economies of scale) and doing it somewhere where electricity is insanely cheap. […] Mining in the cloud seems like the only viable option for many.”

Hosted mining starts with a user choosing a provider of computational capacity. Then they enter into agreements with the company to connect to its equipment. After paying for computer capacity, miners are provided with access to remote mining of cryptocurrencies through rented equipment.

So, users only need a computer and a fast internet connection to operate. Hosted mining commissions are charged in accordance with the agreements established between the parties.

This type of mining has a number of advantages, such as not requiring start-up capital, not needing to connect equipment by yourself, no costs of maintenance and electricity, the ability to disconnect from work at any time, and not needing special technical knowledge and skills.

There are also risks in cloud mining, primarily because, like any young industry, many rogue actors seek to take over the funds of ignorant users. So, when choosing a platform, users should spend time and carefully study its history and reviews.

Also, hosted mining brings in lower income compared with mining using one’s own equipment. Nevertheless, this is a possible option for those who really want to get involved in mining because, in any case, no one will give up an opportunity for passive income, even if it’s not too significant.

Build It On Your Own

In summary, it can be said that today, mining seems to be an attractive way to make some income. If for some reason hosted mining is inconvenient, then setting up a personal rig is not too difficult. This will require an initial investment and a little time to figure out how the system operates.

Randy Ready, CEO and chief technology officer of Mining Rig Rentals — a hardware mining rental platform — believes that building your own system certainly is more interesting, adding: “I suggest going with a small rig and potentially going larger once you are familiar with mining and have a stable profit.”

Crypto mining giant Bitmain is launching two new models for its Antminer range of bitcoin mining devices, one of which is its most powerful yet.

Announced Friday, the Antminer S17e has a hash rate (mining power) of 64 terahertz per second and a power efficiency of 45 joules per TH.

The numbers compare favorably with the current most powerful model on sale. According to the Bitmain website, that’s an S17 with 53 TH/s and an efficiency rating of 45 J/TH in normal power mode.

The second new Antminer, the more budget-friendly T17e, provides a hash rate of 53 TH/s and power efficiency of 55 J/TH. This one appears to offer identical hashing power and lower efficiency to the 53 TH/s (45 J/TH) S17 model already on sale, but at a lower price point.

In Its Announcement, Bitmain Says:

“Both new models have been designed for more stable operations in the long-term to reduce maintenance costs for customers. This is made possible through the dual tube heat dissipation technology which improves how efficiently heat dissipates.”

They are also loaded with new software said to be “more secure” than previously in order to to prevent “malicious attacks.”

The new models will be sold in three batches from today till Sept. 11, and will be shipped through November.

The China-based miner maker is also saying it will compensate buyers with coupons if they should suffer a late delivery for the “e” models, “based on PPS rewards of the mining pool (electricity cost deducted).”

Updated: 9-27-2019

Bitmain To Launch Platform For Connecting Miners And Farms In October

Chinese crypto mining hardware giant Bitmain will launch a platform connecting global crypto miners with farm owners in October.

World’s First Resource To Connect Farms And Miners

The platform, dubbed World Digital Mining Map (WDMM), will be officially launched during the World Digital Mining Summit (WDMS) taking place in Frankfurt between Oct. 8 and Oct. 10, Bitmain announced in a blog post on Sept. 27.

According to the announcement, the WDMM will be the first global network to connect mining hardware owners with mining farms who will provide the available power resources to host them for a fee. In turn, network members will get access to a number of personalized services from Bitmain, including assistance with mining farm design, connections to foreign clients to host, and support with operations, purchasing, and construction.

Listing Applications During WDMS

In order to apply to be listed on the WDMM, mining farm owners will need to provide data on their current mining facilities and capacity to host other miners. Mining farm owners will be able to apply for listing on the WDMM during the WDMS event, the post notes.

Matthew Wang, Director of Mining Farm of Bitmain, stated that the WDMM will help make crypto mining more sustainable in the long term by providing a whole new way for connecting mining farms and hardware owners. Wang outlined the Bitmain’s commitment to leverage on-going support to miners throughout their hardware’s lifetime and to support the overall progress in the industry.

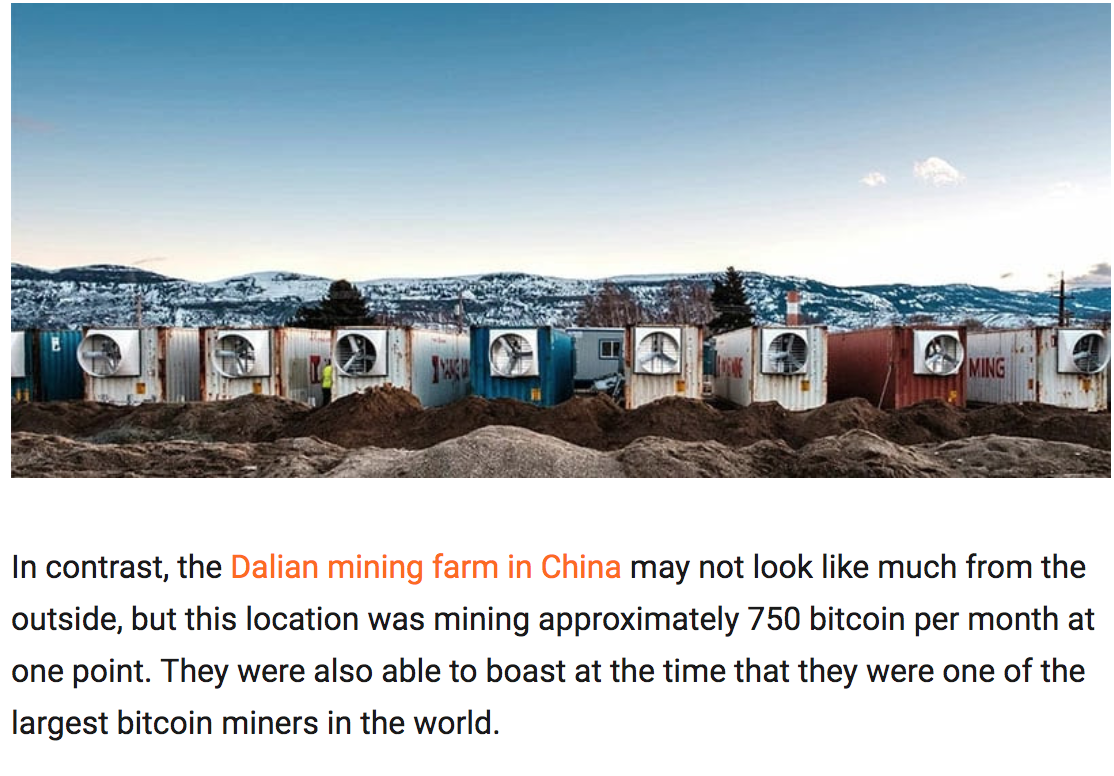

Top 10 Mining Farms

Additionally, Bitmain also plans to announce the winners of the world’s top 10 mining farms during the WDMS. According to the project’s website, winners will receive official certification and VIP tickets for the WDMS. According to the report, voting for the Top 10 Mining Farms is still open.

On Sept. 9, Bitmain launched two new Application Specific Integrated Circuit (ASIC) miners, the S17e and the T17e. According to the specifications, The S17e model has a hash rate of 64 TH/s and operates with a power efficiency of 45 J/TH, while the T17e offers a hash rate of 53 TH/s and a power efficiency of 55 J/TH.

Updated: 10-21-2019

Bitmain Launches ‘World’s Largest’ Bitcoin Mining Facility In Texas

Chinese cryptocurrency hardware manufacturer Bitmain has opened what it claims is the “world’s largest” facility for Bitcoin (BTC) mining in Rockdale, Texas.

In a news release published on Oct. 21, Bitmain revealed the project had been completed together with the Rockdale Municipal Development District and Canadian technology firm DMG Blockchain Solutions.

Pledges To Boost The Local Economy

The news release places a strong emphasis on working with the local economy of Rockdale, which is located in Milam County, east of Austin.

The facility — currently developed to a current 25MW capacity, with a 50MW facility remaining under construction — sits on a 33,000-acre site and can expand to a capacity of over 300MW in the future.

The site is reportedly owned by the Aluminum Company of America, Alcoa, and formerly served as the location for a smelter.

DMG, which is to provide hosting and management services for the Texas facility, will cooperate with Bitmain to expand the facility’s capacity and ensure the efficiency of the site’s mining operations.

Both firms will work closely to establish the facility’s on-ground team together with the local workforce commission, the Rockdale MDD.

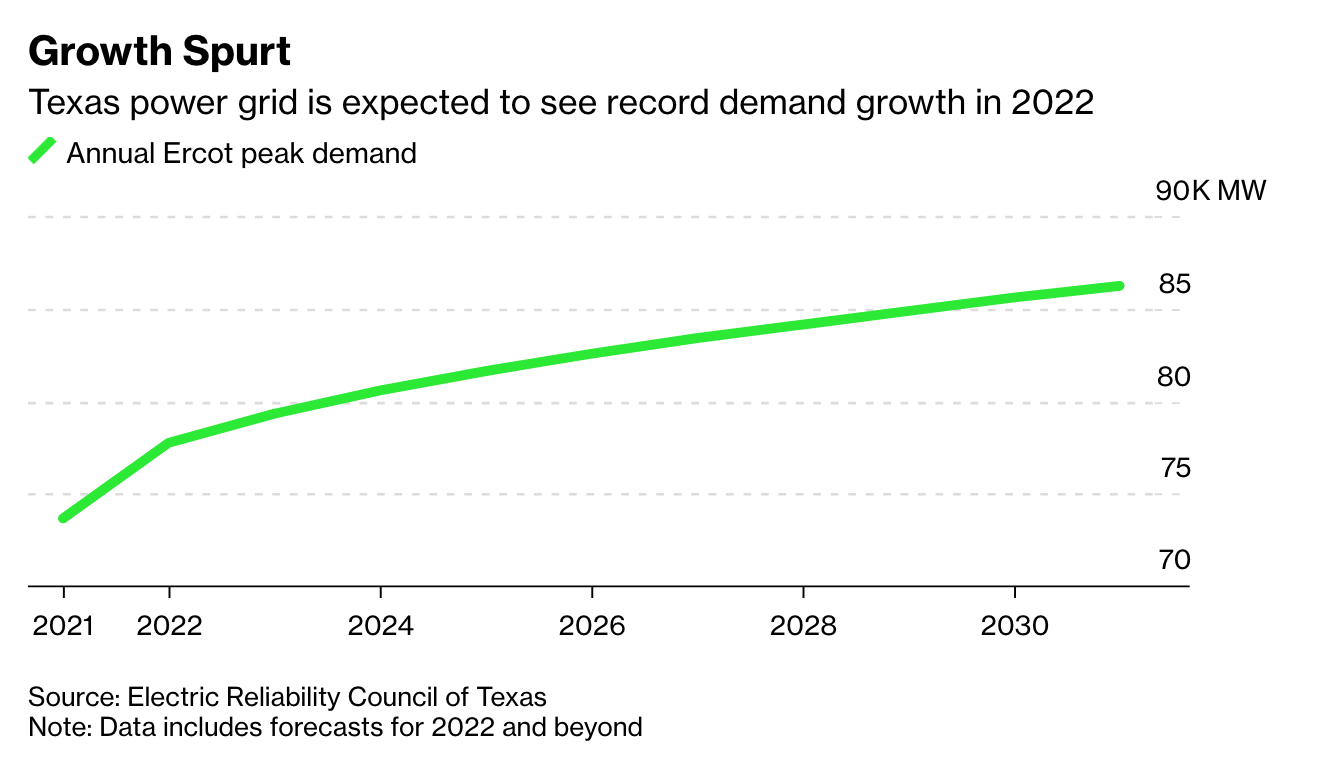

Bitmain says it is committed to seeking local Rockdale suppliers to support the ongoing construction work and will also purchase energy directly from Rockdale’s electric grid operator, the Electric Reliability Council of Texas.

Aside from supporting the local economy, Bitmain also plans to launch educational programs and training on blockchain technology and mining data center operations, together with the Rockdale school district.

“Significant” For Bitmain’s Global Expansion Plans

As previously reported, Bitmain’s plans for its Texas site was first announced in Aug. 2018.

At the time, Bitmain said it expected to create 400 local jobs in the first two years, quoting $500 million as its total planned investment into the economy over an initial period of seven years.

This January, local reports alleged that the project was being downscaled, with reports of staff layoffs and suspended operations. Adverse market conditions were thought to be the reason for the purported cooling-off.

Clinton Brown, Rockdale Lead Project Manager for Bitmain, has today said the facility’s launch is “significant to Bitmain’s global expansion plans” and that the state’s stable and efficient energy resources will be fundamental to supporting what he believes is set to be the inevitable scale of growth of the mining industry.

Updated: 10-30-2019

Bitmain Quietly Files for Deutsche Bank-Backed IPO in the US: Report

China-based mining titan Bitmain Technologies has discreetly filed an application for an Initial Public Offering (IPO) with the United States Securities and Exchange Commission (SEC).

According to an Oct. 30 report from Tencent News citing anonymous “informed sources,” German multinational Deutsche Bank is sponsoring the application. The amount sought to be raised by the offering has not been specified.

Deutsche Bank Reportedly Sponsoring The Application

Tencent News further reports that the IPO plans have been dominated by Bitmain co-founder Jihan Wu and Chief Financial Officer Liu Luyao.

To bolster chances of success, the firm has purportedly hired Zheng Hua, former Nasdaq representative for China, as a consultant to the firm.

The SEC’s review process will reportedly entail three rounds of inquiries and last an estimated minimum of 1-2 months.

A further unnamed industry source, reportedly familiar with the SEC’s listing procedures, told Tencent:

“The SEC has no biased position toward the blockchain business, but is rather concerned about professional and technical issues.”

The source claimed that the company’s connection to the Bitcoin (BTC) fork Bitcoin Cash (BCH) is likely to be the largest obstacle facing the application.

Tangled Backstory

Industry onlookers will remember Bitmain’s earlier, ill-fated attempt to file a major $3 billion IPO on the Hong Kong Stock Exchange in September 2018, which lapsed after multiple controversies this March.

This week has been another eventful week for Bitmain with Jihan Wu revealing that fellow co-founder Micree Ketuan Zhan had left the company amid signs of internal company drama.

On Oct. 28, rival Chinese mining firm Canaan Creative filed for an IPO with the U.S. SEC to raise $400 million, eyeing a listing on Nasdaq under the ticker CAN.

Earlier this month, Bitmain opened what it claims is the “world’s largest” facility for Bitcoin mining in Rockdale, Texas.

Updated: 10-30-2019

Leaked Transcript Details Power Struggle Inside Bitcoin Mining Giant Bitmain

The Takeaway:

A partial transcript of an internal meeting at Bitmain on Tuesday details a long-running power struggle that led to the sudden ousting of co-founder Micree Zhan.

The conflict between Zhan and fellow co-founder Jihan Wu came to a head in December 2018 as the company pursued a round of layoffs.

In Tuesday’s emergency meeting called by Wu, he admitted the company has had a subpar 2019, exacerbating tensions among top executives.

The abrupt dismissal of Zhan comes just one week after Bitmain filed for another IPO attempt in the U.S., according to a report by Tencent News.

A transcript of a Bitmain staff meeting reveals an ugly power struggle inside the world’s biggest bitcoin miner maker that led to the abrupt ousting of co-founder Micree Ketuan Zhan.

CoinDesk has obtained and verified a partial transcript from the hourlong meeting on Tuesday. In it, Jihan Wu, a co-founder of Bitmain who started the company with Zhan in 2013, explained to all employees why he thought it was necessary to oust his long-time partner and former co-CEO.

After stepping down from day-to-day management in December 2018, Wu returned Tuesday as chairman of the company and executive director of the Beijing Bitmain subsidiary. He immediately made his presence felt.

Earlier in the day, Wu notified staff that Zhan had been dismissed from all his roles, effective immediately. During the subsequent all-hands meeting, he described a falling-out between the two executives late last year.

“Zhan escalated what should be a disagreement on an ordinary company business decision to the level of power struggle,” Wu told the staff.

Mounting Tensions

Wu said in Tuesday’s meeting that he and Zhan have butted heads since 2015.

However, things came to a head in December 2018 when Bitmain decided on a round of major layoffs. Wu pushed for the layoffs, while Zhan initially resisted.

According to Wu, he and three other founding members of Bitmain tried to persuade Zhan to reach a unanimous decision on the layoffs, which Wu and others viewed as necessary for saving the company.

Zhan remained unconvinced, however, and tried to rally other senior and mid-level management against the layoff plan, Wu said, only to find out that most supported it.

Wu Said In Tuesday’s Meeting:

“Everyone knows in 2018, the company spent unnecessary and hasty investment everywhere on research and development projects and hiring dozens and hundreds of people without a second thought. Everyone supported the layoffs.”

Still, Zhan ordered a second meeting on Dec. 17, arguing that he should be the sole CEO and threatening to void stock-option incentives for whoever wouldn’t back him up.

In the end, Zhan’s second attempt failed, Wu said, but the two came to an agreement to both step down as co-CEOs and Bitmain moved ahead with the layoffs.

“I know Zhan is an insecure person and can be bitter. I chose to take a further step back and let him take the glory role of chairman,” Wu said in the meeting.

However, the turmoil caused serious divisions within the company and spooked Bitmain’s trading partners, at a time when the crypto market was at its bottom, according to Wu’s account.

“Right on that day, we had suppliers calling us to push for clearing accounts payable. The Bank of Beijing already agreed to give us credit lines but that got cut the next day,” Wu said, adding:

“Had it not been the bounce-back of the bitcoin price in later months … the company may not have been able to weather through the winter last year.”

Missed Opportunities

2019 hasn’t been great for Bitmain, Wu said in Tueday’s internal meeting.

Even with bitcoin’s price rebound, Wu said the company didn’t fully seize the moment.

“Our mining equipment’s market share is declining,” he said. “Our mining pools’ dominance is also declining.”

Indeed, Bitmain’s major rival miner makers including Canaan, WhatsMiner and InnoSilicon have all been able to increase sales following the market boom this year.

Meanwhile, BTC.com and Antpool, Bitmain’s flagship mining pools, lost their long-time dominant positions to Poolin – founded by former BTC.com creators – and F2Pool. Poolin and F2pool are currently the top two mining pools in the world, based on the real-time hash rate distribution.

Calls to Zhan’s mobile number, as well as subsequent text messages requesting comment, were not answered. However, a Tencent News report said on Wednesday that Zhan has already started approaching lawyers in an aim to bring a lawsuit against Bitmain.

A spokesperson for Bitmain would not comment.

‘Crazy’ Ideas

Wu and Zhan seem to have sparred over what Wu called Zhan’s “crazy” ideas – namely doubling down on the company’s artificial intelligence (AI) business, which is unrelated to bitcoin mining.

According to Wu, some of Zhan’s ideas included getting finance and accounting employees in Shenzhen to take up sales roles for AI products.

“Who will be handling our book in Shenzhen? How are we going to present the financial data for [an] IPO?” Wu asked, adding:

“Recruiting 300 fresh graduates? How many staff do we have right now? Do we have sufficient resources to train them if we recruit this many people in one shot?”

He further alleged that Zhan recently proposed investing more in a business that was already “distressed” and had burnt out the firm’s core developers who are “sick at home.”

“AI is a venture investment for Bitmain,” Wu said. “It still needs a considerable amount of investment. We have to keep making money from our main business in order to have the venture investment in AI.”

Wu Added:

“Some said inside the company, I’m the one who handles business and Zhan handles technology. I want to ask, between Zhan and I, who really has a love for the technology? Zhan doesn’t love technology, he loves that feeling of fulfilling his endless desire for power. He doesn’t love technology, he loves vanity. Folks, we have no options but to keep Zhan away from this company.”

IPO Bloodletting

According to the Tencent News report, Bitmain has already filed an application in the U.S. seeking to go public again. The confidential filing was reportedly submitted one week before what the news outlet described as Wu’s coup.

The report added that on Oct. 28, one day before Wu’s email, Zhan was still attending a conference in Shenzhen on behalf of Bitmain to promote its AI products.

Zhan returned to Beijing after the news broke on Tuesday, but has been barred from entering the company’s offices, Tencent News said.

However, a major question remains unanswered: How did Bitmain manage to dismiss Zhan from all of his roles given that he was the chairman and major shareholder?

Prior to the December 2018 shake-up, Zhan held 36 percent of Bitmain’s holding company while Wu had just 20.25 percent, according to Bitmain’s 2018 IPO filing in Hong Kong citing data from September 2018.

Other major shareholders include founding members Yuesheng Ge (4.18 percent), Zhaofeng Zhao (6.26 percent), and Yishuo Hu (4.18 percent), as well as a trust that held 18.47 percent as the company’s employee stock-option incentive.

Other major external shareholders include Sequoia China Capital (2.7 percent), Richway Investment Limited (1.17 percent) and Sinovation (1.13 percent).

Updated: 12-12-2019

Bitmain Expands In South America As Its Market Share Drops To 66%

Bitmain, the world’s largest cryptocurrency mining firm, is expanding its distribution in South America by partnering with two crypto mining consulting firms.

The Chinese mining mogul will extend its global exposure with Fastblock, which will be the primary distributor in Brazil, and Bit5ive, a Miami-based firm that will be distributing Antminers to over 30 countries in Latin, Central America and the Caribbean, Bitmain announced Dec. 12.

Quick Take On Bitmain’s New Distributors

Bit5ive provides major crypto mining services — sells, hosts and supports crypto mining hardware — since its foundation in 2013. The company will be distributing Bitmain’s products using the official distributor license in South America, Bit5ive’s CEO and co-founder Robert Collazo noted.

Fastblock, which has been providing mining consulting services since 2014, intends to bring its blockchain expertise from managing over 20 mining plants, according to the firm’s CEO and co-founder Bernardo Schucman.

Antonio Oliveira, senior vice president and CTO at Bit5ive, declined to comment on the numbers or client purchase regions in an email to Cointelegraph.

Fastblock hasn’t responded to Cointelegraph’s attempts to reach out at the time of publication. This article will be updated pending any new information.

Bitmain’s Market Share By Hashrate Reportedly Dropped From 75% To 66%

The news comes amidst new reports revealing that Bitmain’s market share by hashrate has dropped from around 70% to 66% from June to early December 2019. The data comes from the study “The Bitcoin Mining Network” by London-based digital asset manager CoinShares shared with Cointelegraph Dec. 12.

Meanwhile, Bitmain’s own estimations claim that the company’s market share accounted for 75% of the global crypto hardware market as of 2017, the report notes.

While the Chinese giant’s dominance over crypto mining market has slipped since 2017, the overall trend of growth in China has continued. As reported by Cointelegraph, Chinese Bitcoin miners now control as much as 66% of global hash rate, which is the highest recorded by CoinShares since the firm started monitoring the measure in 2017.

Updated: 12-18-2019

Canaan’s Post-IPO Stock Plunge Reveals Sales Slump, Price War With Bitmain

Cryptocurrency mining computer-maker Canaan Inc. may have picked the worst time for its initial public stock offering, which valued the company at $1.3 billion.

The stock price has declined in all but four of the first 17 trading sessions since the Hangzhou-based company’s Nov. 21 sale of $90 million of U.S. shares. It’s down 35 percent since the start of last week.

Canaan’s performance is being closely monitored in the cryptocurrency industry. It was the first big maker of data-mining computers to sell shares publicly and its valuation serves many investors as a sector bellwether. The shares have tumbled even as the price of bitcoin, the largest cryptocurrency, has been mostly stable over the past month, currently around $6,500.

Its stock price drop is taking place “as bitcoin miners face a challenging environment,” wrote research firm TradeBlock in a report last week. CoinDesk reached out to Canaan’s management but no response was received as of press time.

Industry executives say the big makers of bitcoin-mining computers, colloquially known as “rigs,” are in a sales slump. That’s a surprising development since many observers predicted a frenzy of upgrades ahead of bitcoin’s once-every-four-years mining-reward halving, expected in May. When that happens, the reward for successfully mining a new block of data will get cut in half. It’s widely expected that prior-generation mining rigs will become unprofitable for operators who don’t have access to unusually cheap electricity.

Bitmain, the dominant industry player, recently announced a series of sales incentives to move backlogged or stale inventory, including promising limited price guarantees to buyers willing to commit to bulk purchases and in some cases renting out second-tier mining rigs under profit-sharing agreements.

Hashing Out Information On Their Own

It doesn’t help that investors are flying blind: According to the data provider FactSet, the stock has attracted no analyst coverage from Wall Street brokerage firms, forcing traders to generate their own models of the company’s profitability based on publicly available crypto-industry metrics like hashrate – a gauge of the amount of computer-processing power working to confirm new data blocks on the bitcoin network.

Over the past week, the bitcoin network’s hashrate has averaged about 90 quintillion operations, or exahashes, per second. Just a couple months ago, it hit an all-time-high around 100 exahashes per second, after averaging about 40 exahashes per second at the start of the year.

Matt D’Souza, co-founder and CEO of Blockware Solutions, which brokers mining-rig purchases, says that the surge in bitcoin’s hashrate during the first eight months of the year was a sign that operators were upgrading to faster, more efficient machines – leading to an increase in the network’s collective computing power.

The upgrades continued for several months even after bitcoin’s price peaked around $13,000 in late June.

But now, D’Souza says, miners are becoming somewhat more reluctant to invest in new machines until they see signs that bitcoin prices might start rising. That’s evident from the recent stall-out in the hashrate’s growth.

“They need to be assured that they’re in an environment for long-term profitability,” D’Souza said. “That’s why some of these guys have stopped buying.”

Price Cuts

Bitmain managed to build a dominant market share in the crypto industry, partly thanks to the runaway popularity of its S9 Antminers. But those are now at risk of becoming obsolete, and in recent months Bitmain has cut prices steeply on some of its top-selling models, D’Souza said.

Mike Maloney, chief financial officer at Coinmint LLC, a private cryptocurrency mining firm, says that the ultimate prize for these manufacturers is winning the loyalty of a growing cadre of large-scale miners who can shop for rigs in bulk and negotiate contracts for cheap electricity.

“This is a trend that we’re going to be seeing in bitcoin mining,” Maloney said in a phone interview. “Bitmain is taking the lead.”

Canaan has scheduled the release of its next-generation rig, the AvalonMiner 11 series, for early next year. But that machine is expected to be less power-efficient than the Bitmain S17+ model, which is already out, said D’Souza.

According to Bitmain’s website, its top-priced S17+ model, which ships in seven days for $1,930, can produce 73 terahashes (trillion operations) per second, at a power efficiency of 40 joules per terahash.

Canaan’s top-priced model, according to its website, is the “February batch” of the AvalonMiner A1166-68T machine for $1,978, providing 68 terahashes per second at an efficiency of 47 joules per terahash. In this case, a higher efficiency rating is worse, because it indicates more power usage and thus a higher operating cost.

“They’re in a tough position,” D’Souza said of Canaan. “They need cash and that’s because they need to upgrade their hardware and stay competitive with Bitmain.”

The Risks Were Disclosed

Canaan is led and controlled by its CEO and chairman, Nangeng Zhang, who was 36 at the time of the IPO, according to an offering prospectus filed with the U.S. Securities and Exchange Commission. Nicknamed “Pumpkin,” he received a master’s degree in software engineering from Beihang University in 2010, and from September 2010 through October 2013 he was pursuing a Ph.D. degree at the Chinese university.

As early as 2013, Zhang and his team were pioneers in the use of an advanced type of microchip known as application-specific integrated circuits, or ASICS, to mine for cryptocurrencies, according to the prospectus.

The offering was structured so that Zhang would own 15 percent of the total shares outstanding but retains about 73 percent of voting rights through his sole ownership of 356.6 million of the company’s class B shares, according to the filing. The IPO valued his stake on paper at more than $213 million, but the share-price slump has already cut that figure by about $96 million.

Even as Canaan prepared for the November IPO, its revenue this year was declining, and its costs were expanding: The company’s revenue during the first nine months of 2019 was just $134.2 million, down from $378.5 million during all of 2018; operating costs rose to $57.5 million during the first nine months of this year, from $52.5 million for all of last year.

The investment bank Credit Suisse, initially hired by Canaan to lead the U.S. IPO, dropped off of the underwriting team just weeks before the share sale, regulatory filings show. According to a Nov. 20 prospectus, Citigroup led the remaining team of seven underwriting firms, which also included the cryptocurrency-focused financial firm Galaxy Digital.

According to the filings, the deal was also downsized in the final weeks before the sale from an initial maximum target of $400 million.

Canaan disclosed in the prospectus that it planned to use the proceeds from the stock offering for research and development related to new computer chips and to expand its artificial-intelligence and blockchain business globally, “making strategic investments and establishing overseas offices.”

To its credit, the company also disclosed the risks when the market turns anemic. “Excess inventories, inventory markdowns, brand-image deterioration and margin squeeze caused by declining economic returns for miners or pricing competition for our bitcoin-mining machines could all have a material and adverse impact on our business, financial condition and results of operations,” according to the prospectus.

Analyzing bitcoin-mining computer stocks remains a murky practice. Just like manufacturers of oil rigs and mining bulldozers, they face the ups and downs of commodity cycles. Or rather, cryptocurrency cycles.

German Firm Unveils Mobile Eco-Friendly Bitcoin Mining Containers

Bitcoin (BTC) mining infrastructure firm Northern Bitcoin AG has announced the completion of tests for its new air-cooled mining container, which houses 144 ASIC miners.

A press release published on Sept. 9 outlined that the highly mobile container solution has been designed as a piece of flexible and efficient infrastructure that will enable the firm to establish mining pools in countries with year-round cool locations.

Setting Up Shop Anywhere Energy Is Cheap, Sustainable

Headquartered in Frankfurt am Main, Northern AG develops and operates Bitcoin-focused mining hardware that uses renewable energy sources and aims to attain optimal efficiency and sustainability.

The press release notes that Northern AG has developed and operated a mining pool with 21 water-cooled 41-foot containers — housing 210 ASIC miners each — in Norway for over a year.

The new water-cooled container has reportedly been developed with partners in Germany and will allow the firm to extend its operations, flexibly and at short notice, to new locations across Scandinavia.

Its 20-foot design — with a capacity to house 144 ASIC miners — has a significantly higher miner density than the earlier water-cooled containers. The firm says it is focused on deploying its mobile mining solutions in permanently cool locations where sustainable energy sources such as hydropower are cheap and abundant.

As the press release notes, efficient temperature control is critical for compute-intensive Bitcoin mining operations, during which the hardware required typically generates significant heat.

Bitcoin Mining Getting More Energy-Efficient

As recently reported, fresh data from aggregator Statista has indicated that Bitcoin (BTC) energy consumption is becoming rapidly more efficient, even as the global network’s hash rate continues to hit record highs.

Energy consumption as of July 2019 was 69.79 terawatt hours per year. In July 2018, the figure was 71.12 terawatts, while hash rate was almost 60% lower than at present.

A study in June found that three-quarters of Bitcoin mining activity is powered by renewable energy sources.

Mining hardware manufacturers such as Bitmain are similarly seeking to develop new solutions with greater processing capabilities and lower energy demands.

Updated: 11-19-2019

Bitcoin Mining Firms Merge To Build World’s Largest Purported Mining Farm In 2020

German Bitcoin (BTC) mining firm Northern Bitcoin has entered a merger agreement with United States-based competitor Whinstone to jointly build what will supposedly be world’s largest mining farm.

According to a Northern Bitcoin press release published on Nov. 18, Whinstone is already building the aforementioned facility which is expected to have a capacity of one gigawatt on an area of over 100 acres in Texas. The mining farm in question will allegedly be the largest data center in North America.

A Quick Construction Plan

The first phase of the construction — which is expected to conclude in Q1 2020 — will already have a capacity of 300 megawatts. Construction is expected to be completed in Q4 2020.

The first two clients that will take advantage of the upcoming facility will reportedly be two publicly traded corporations that will use a significant portion of its capacity for Bitcoin mining. Still, after its completion, the data center will also allow for the acceleration of video rendering and artificial intelligence applications.

Northern Bitcoin is a stock-traded company founded last year that specializes in sustainable Bitcoin mining. The firm operates a mining farm on renewable energy in Norway.

The idea of placing the world’s largest mining facility in the U.S. is interesting, given that China has so far been at the forefront of the cryptocurrency mining industry and hosts many of the leading companies of the industry, such as Bitmain.

According to a recent analysis, low power costs in addition to access to cheap hardware make China a competitive destination for cryptocurrency mining operations, despite the country’s legal environment.

Updated: 11-20-2019

1 Gigawatt Bitcoin Mine Under Construction in Texas Would Dwarf Bitmain’s

Bitmain, which recently broke ground on a massive bitcoin mine at a former Alcoa plant in Texas, will have competition for that “world’s largest” mantle.

A project broke ground this month that would start at 300 megawatts and expand to 1 gigawatt by the end of next year, dwarfing Bitmain’s mine that contemplates expanding from 25 MW to 50 MW to only 300 megawatts in its largest phase.

Data center developer Whinstone US, which owns a bitcoin mine in Louisiana and has been building in the Netherlands and Sweden, assembled the Rockdale project in partnership with GMO Internet, Japan’s version of GoDaddy.

A week after the ground-breaking on Nov. 7, Whinstone US agreed to be acquired by Germany’s Northern Bitcoin, which runs a bitcoin mine in Norway on renewable resources.

In the all stock deal, Northern Bitcoin will issue 3,720,750 new shares to Whinstone US shareholders, according to Northern Bitcoin’s head of communications.

On Wednesday, shares in Northern Bitcoin (ETR: NB2) jumped 42% to €23.60, valuing the company at about €180 million.

The data center will cost $150 million to build and furnish, Whinstone estimated when it unveiled the jobs-ready project to much locale fanfare on Nov. 1.

The mine would ramp up to full capacity through 2020, with 300 megawatts of power slated to come online in the first quarter and the full 1 gigawatt scheduled for the fourth quarter.

In fact, the dueling mining projects share a common landlord. Both inhabit real estate owned by Aluminum giant Alcoa which purchased the 33,000+ acre plot of land in the 1950s and turned the area locally known as Sandow Lakes Ranch into an industrial hub.

Northern Bitcoin said two listed companies have signed on as its first clients and they “will use a significant portion of the capacity for Bitcoin mining,” but the company declined to name them.

In a joint statement announcing their merger, Aroosh Thillainathan, co-founder of Whinstone US, said the deal could “shape the future course of the global mining industry” and Mathis Schultz, CEO of Northern Bitcoin AG, said the merger “catapults” his firm launched in 2018 to the top of the pack faster than planned.

In July, Whinstone’s previous proposed merger fell through after Hydro66 Holdings Corp., a Swedish data center builder, completed its own capital raise and backed out of the deal.

Updated: 11-24-2019

Russian Oligarch Turns Soviet Plant Into a Major Bitcoin Mining Hub

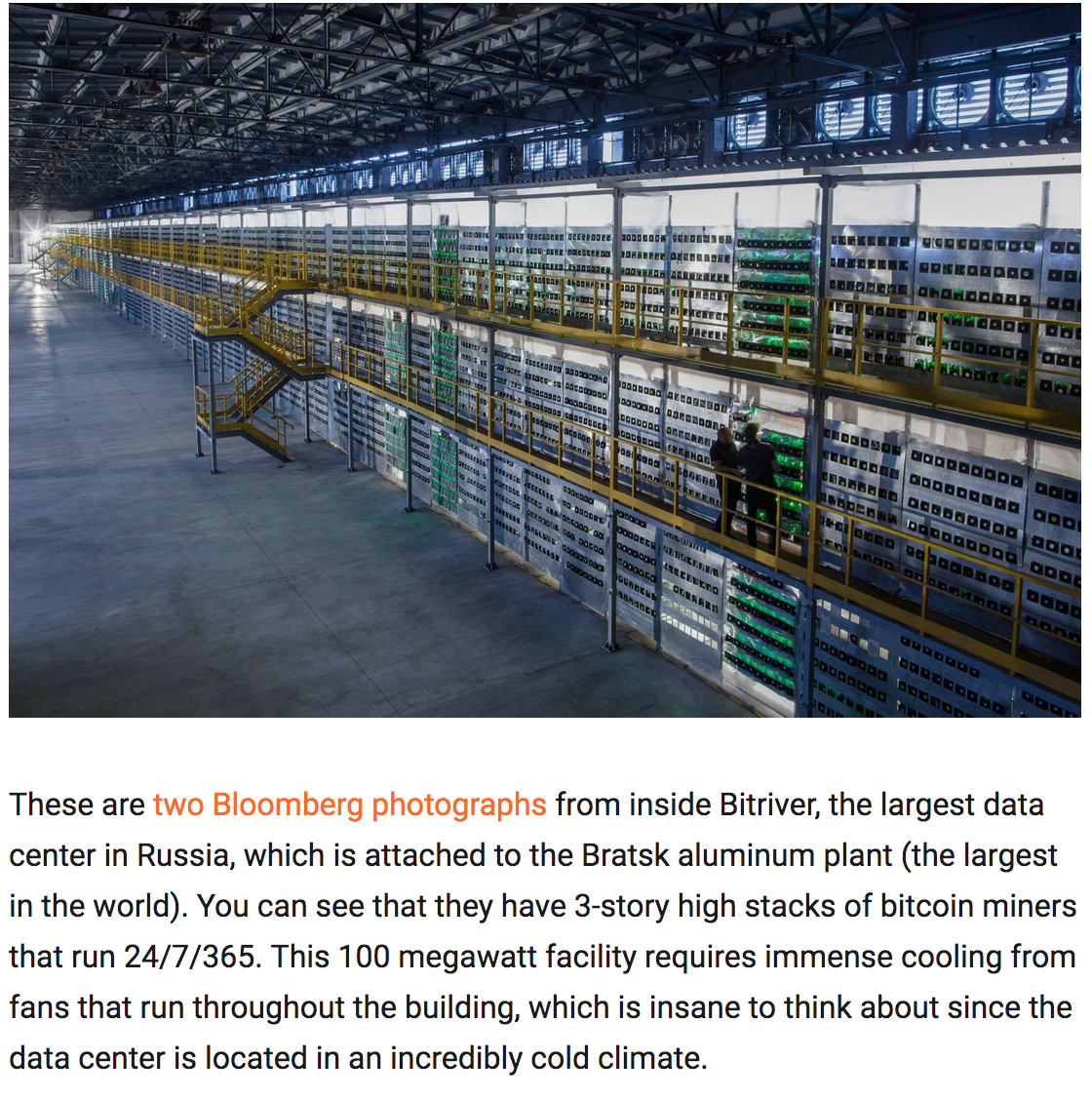

The largest data center in the former Soviet Union, BitRiver, opened about a year ago in the Siberian city of Bratsk and most of its clients use the facility to mine Bitcoin (BTC), Bloomberg reported on Nov. 24.

The data center allows cryptocurrency miners to take advantage of cheap energy in what once used to be the world’s largest aluminum smelter. The plant was built by the USSR in the 1960s with the still-active hydropower plant to power its operations.

Cold Climate, Cheap Energy

The data center’s location also benefits from a cold climate, allowing mining hardware to work at higher efficiency rates while cutting cooling costs.

Billionaire and president of the world’s second-largest aluminum company Rusal, Oleg Deripaska, is Bitriver’s biggest shareholder. He reportedly had the idea of building the data center about five years ago and directed his company Rusal alongside aluminum and power producer En+ to repurpose the facilities.

According to Bloomberg, Russian law does not recognize cryptocurrency mining. Because of this legal gray area, Bitriver does not directly engage in mining, but only provides equipment and technical services to its clients — including from Japan, China and the United States — operating like any other data center.

En+, in which Deripaska and his family own a 45% stake, supplies up to 100 megawatts of power to the facility, enough energy to sustain 100,000 homes. The plant is the largest hydropower plant in Russia and the data center allows it to constantly sell excess energy and diversify its client base.

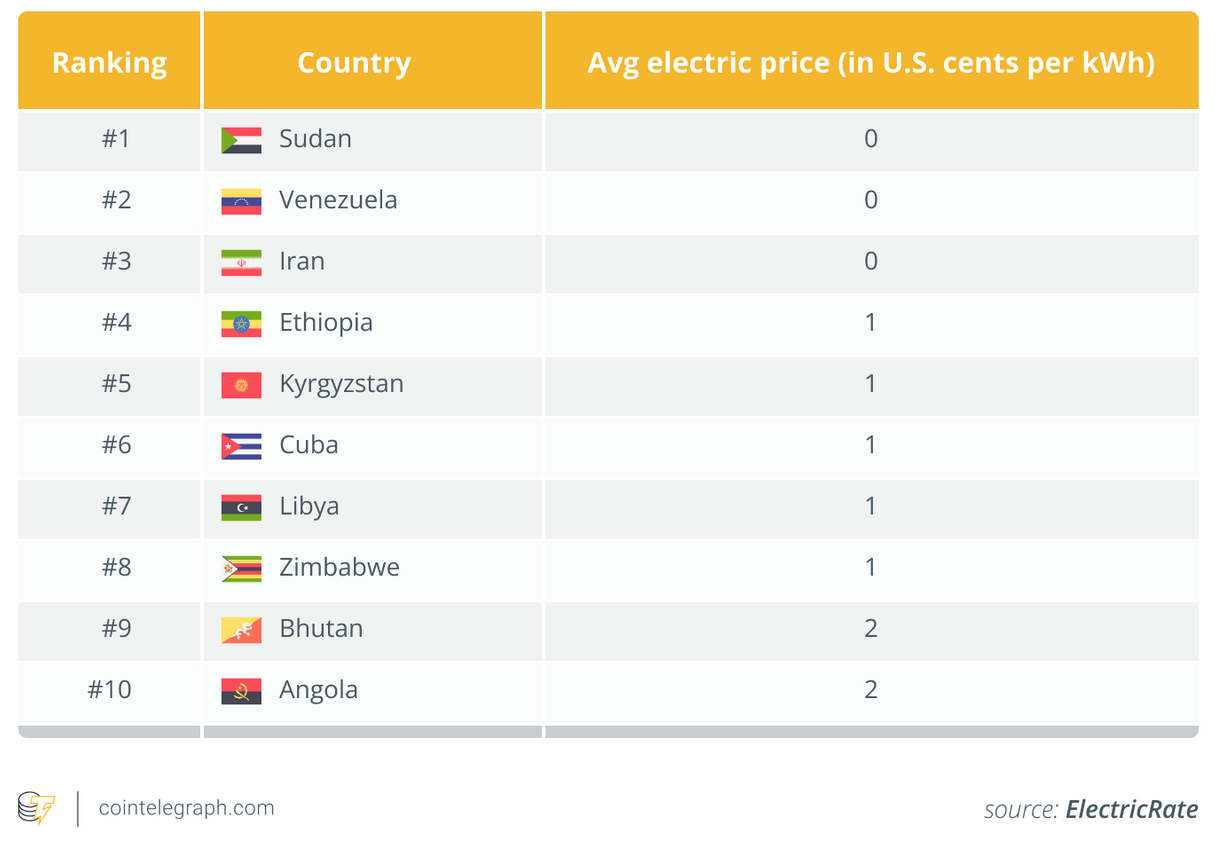

BitRiver is paying for the power 2.4 rubles per kilowatt-hour, equivalent to about $0.038 without value-added tax and sells it at 3.5 rubles ($0.055) per kWh to miners. For comparison, the average price of electricity in the United States is about $0.12 per kWh.

Bitcoin Miners Unfazed By BTC Price Drop

Bitcoin and the overall cryptocurrency market saw a significant drop in price earlier this week, as BTC briefly fell under $7,000. Still, miners are seemingly keen to continue boosting their capacity.

“There is NO miner capitulation,” commented Bitcoin entrepreneur Alistair Milne on Sunday following a rise in network hash rate and expected difficulty hike. He continued:

“They are acutely aware of the upcoming halving and are apparently unphased by the recent dip.”

As Cointelegraph reported earlier this week, German Bitcoin mining firm Northern Bitcoin has entered a merger agreement with United States-based competitor Whinstone to jointly build what will supposedly be the world’s largest mining farm.

Updated: 12-11-2019

Why Bitcoin Mining Is Being Touted As A Solution To Gas Flaring

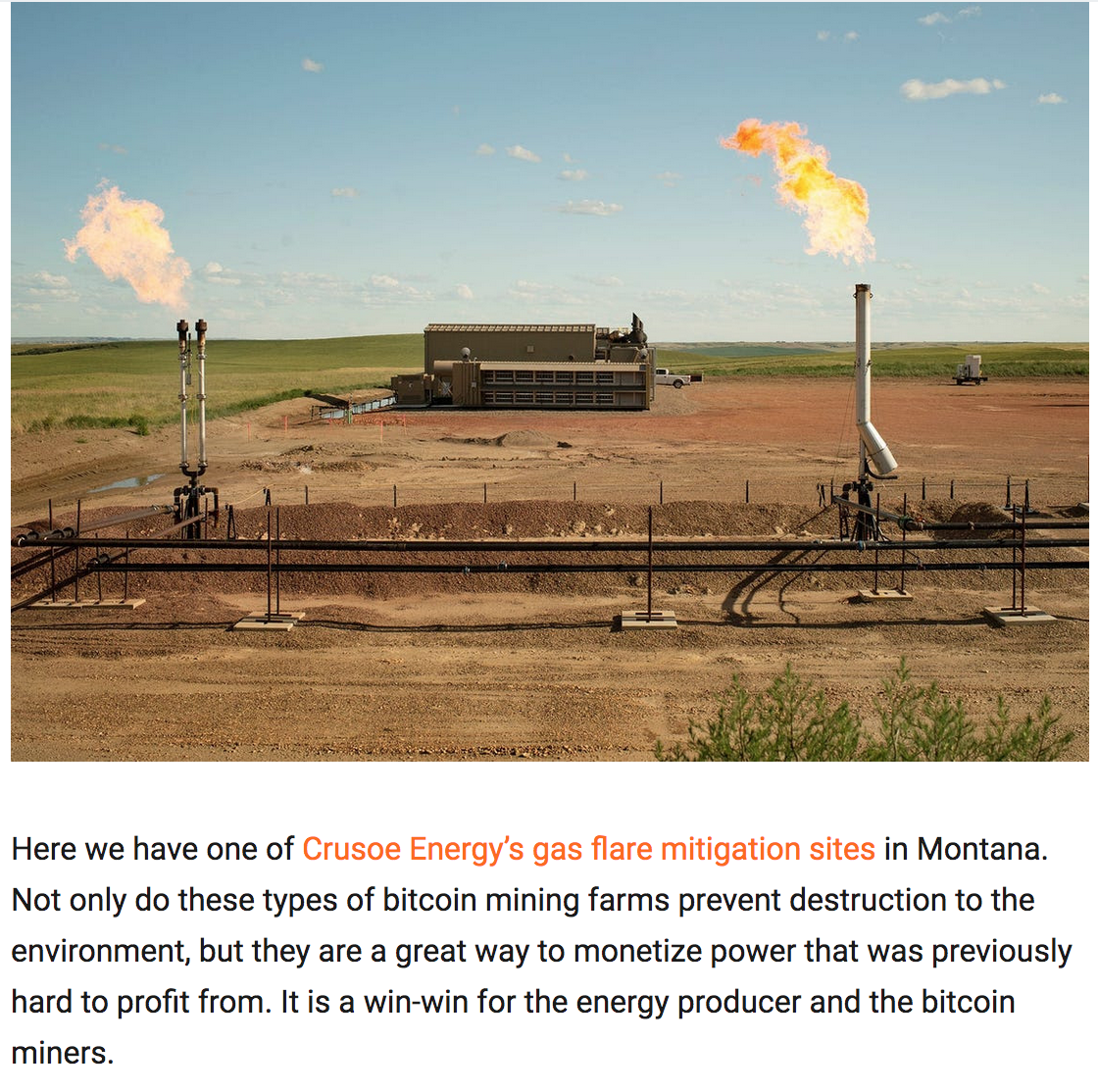

A Denver-based company that installs data centers at shale drilling sites to take advantage of excess natural gas supplies says it now has eight operations across the U.S. and plans another 30 in the first half of next year.

The centers are being touted as a way to solve the growing problem of gas flaring, where energy companies burn off excess gas. Flaring has risen to a record in Texas this year amid a lack of pipeline capacity.

Closely held Crusoe Energy Systems Inc. is harnessing some of the surplus gas at source to turn it into electricity, powering the data centers that in turn generate revenue by mining Bitcoin. The company will install 70 units next year, each with a capacity of about 1 megawatt, which would keep about 10 million cubic feet a day of gas from being flared, Chief Executive Officer Chase Lochmiller said in an interview.

“It’s a very creative way to solve an environmental and economic problem for the oil and gas industry,” said Alex Urdea, the chief investment officer of Upper90 Capital Management LLC, which has agreed to provide Crusoe with $40 million of project financing. The business model is attracting interest from large oil and gas producers, and it could eventually involve revenue sharing, he added. Crusoe also raised $30 million by selling equity to investors including Bain Capital Ventures.

Earlier this year, Crusoe raised $5 million of seed capital from investors including Winklevoss Capital Management LLC. Multiple units can be deployed at a single site to build scale. As the number of active units increases, Crusoe plans to start using some of that computing capability to develop a new artificial intelligence cloud-computing service.

Updated: 12-13-2019

Bitcoin Miner Riot Blockchain Announces Additional 1,000-Rig Purchase

Cryptocurrency mining firm Riot Blockchain announced the purchase of an additional 1,000 next-generation Bitmain S17-Pro Antminers on Dec.12. This completes the upgrade of its Oklahoma City mining facility, following an initial purchase of 3,000 units announced on Dec. 4.

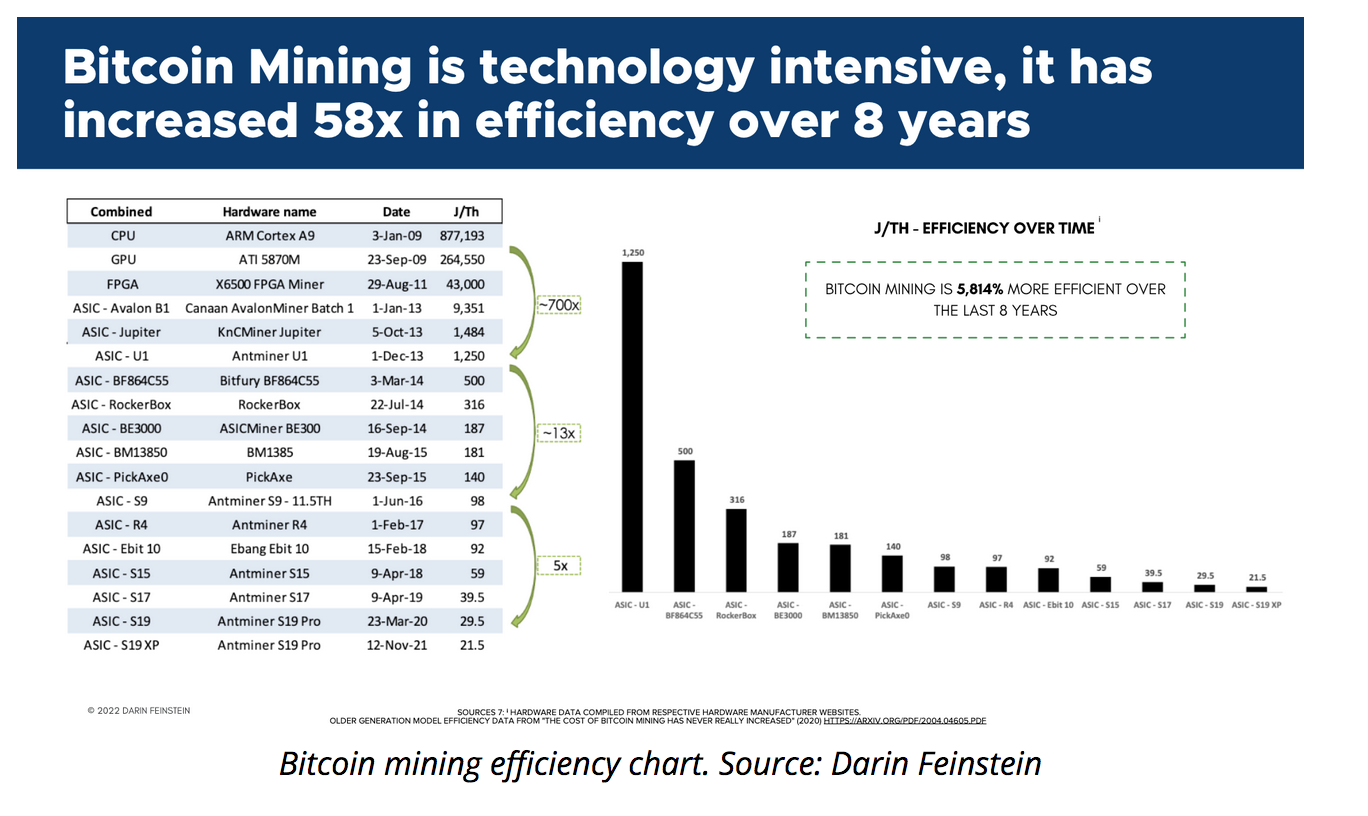

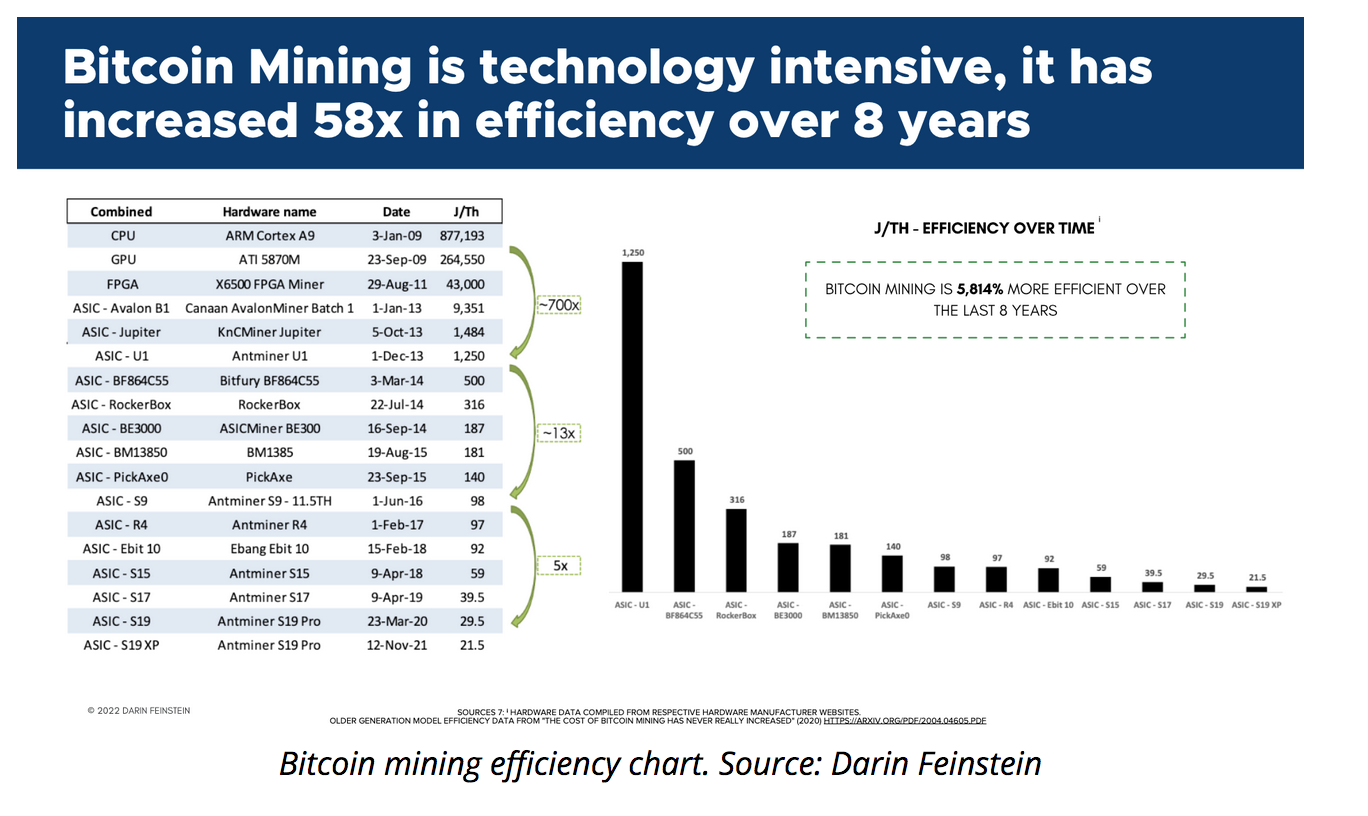

The latest generation of Application-Specific Integrated Circuit miners from mining hardware giant Bitmain represents an approximate 50% improvement in hardware power efficiency compared to the S9 Antminers currently in use by Riot.

The company anticipates that the new miners will generate 440% of the hashrate of the S9s while consuming only 220% of the power.

Riot mined over 1,820 Bitcoins (BTC) in Q3 2019, posting a gross profit margin of 14% (excluding depreciation and amortization), and hopes to increase these figures when its new purchases are deployed in Q1 2020.

Full steam ahead

Assuming full utilization of the Oklahoma City facility’s 12-megawatt available electricity supply, and deployment of the total 4,000 new miners, Riot estimates the aggregate operating hashrate will be around 248 petahash (248 quadrillion hases) per second.

Riot reportedly paid around $1.35 million dollars for the additional 1,000 S17-Pro Antminers, or approximately $1,350 per rig. The retail price listed on the Bitmain web-store is $1401 per unit, although this is unlikely to include local sales tax.

In April this year, Riot Blockchain announced its intention to launch a regulated cryptocurrency exchange in the United States by the end of Q2 2019. To date, however, this has still failed to materialize.

Updated: 1-7-2020

SBI, GMO Reportedly Sign Deal with Operator of World’s Largest Bitcoin Mining Site

The operator of what is set to become the world’s largest Bitcoin (BTC) mining facility has reportedly signed a deal with Japanese financial services giant SBI and internet provider GMO.

A Jan. 7 BNN Bloomberg report claims that the two Japanese mega-firms have agreed in principle to process cryptocurrency transactions at a new mining facility — of unprecedented scale — now being developed in Rockdale, Texas.

The facility will be operated by Whinstone Inc., a subsidiary of the Frankfurt-based Northern Bitcoin AG.

Whinstone — which has been operating since 2014 and has its own mining sites across the Netherlands, Sweden and the United States — merged with Northern Bitcoin in November 2019 as the latter geared up to construct what is being slated as “the largest data center in North America and the largest Bitcoin mining facility in the world,” on an area of over 40 hectares.

Neither SBI nor GMO immediately responded to Cointelegraph’s request for comment to confirm the partnership.

Texas: an emergent global mining hub

Northern Bitcoin AG’s new site will reportedly launch operations with an initial capacity of 300 megawatts, expected to hit 1 gigawatt by the close of 2020.

This would outstrip by almost three times the capacity of what is currently held to be the world’s largest crypto mining site, operated by China’s Bitmain Technologies Ltd. and situated on the former Alcoa aluminum smelter, also in Rockdale.

Alcoa, which closed in 2008, had been at the epicenter of the town’s once-thriving aluminum industry in the 1950s, and a key driver of population and economic growth, together with the nearby Sandow Power Plant, which shuttered in early 2018.

As per Mike McGlone, a senior commodity strategist at Bloomberg Intelligence, an inflow of large cryptocurrency miners is now flocking to Texas, drawn by its abundance of cheap and renewable energy sources, particularly wind.

Wind-power accounted for over 20% of Texas’ electricity generation in 2019 and is expected to overtake coal for the first time this year, BloombergNEF data indicates.

Alongside Northern Bitcoin AG, U.S. mining startup Layer1 — backed by Peter Thiel and Digital Currency Group — is planning to set up a proprietary power sub-station on the plains of West Texas to generate solar and wind energy for its Bitcoin mining operations.

Investors Remain Bullish

On the heels of a volatile year for the cryptocurrency markets, McGlone commented on news of SBI and GMO’s reported involvement in the new mining site, observing that:

“Bitcoin is attracting more institutional investors and with the notion of limited supply and mass adoption — Bitcoin is winning this race.”

SBI, for its part, has taken a diverse, rather than maximalist, strategy as regards digital assets: it has a history of close involvement with XRP and Ripple, recently revealing it is considering the possibility of paying shareholder dividends in the token.

It also continues to work as part of the joint venture SBI Ripple Asia, which was formed to promote XRP’s usage in Asian financial markets in 2016.

Updated: 1-9-2020

Canada’s DMG Blockchain Installs 1,000 New Bitcoin Mining Rigs For US Client

Canadian tech company DMG Blockchain Solutions has installed 1,000 new Bitcoin (BTC) mining machines at its Christina Lake mining-as-a-service facility in British Columbia.

Per a Jan. 6 press release, DMG has purchased the new miners from Chinese mining giant Bitmain, with the total power consumption of approximately 1.5 megawatts.

Initially announced in December of last year, the newly installed mining equipment will serve a U.S.-based client, whose name was not revealed in the release. DMG operates as an industrial scale crypto mine hosting company, allowing clients to mine crypto through equipment stationed at its facilities in Northwest Canada.

DMG’s Crypto Mining Developments

DMG’s COO Sheldon Bennett said that “DMG made a decision to focus on attracting large scale hosting clients as profitable crypto-mining is a function of creating cost efficiencies, and our mining facility is well suited for industrial miners.”

Last October, DMG and Bitmain entered an exploratory agreement, under which DMG has been managing Bitmain’s Texas-based facility and set up nearly 15,000 next-generation miners.

In November 2018, DMG energized its new crypto mining facility, stating that the facility would start at 60 megawatts, and can expand its capacity up to 85 megawatts. The 27,000 square foot crypto mining-as-a-service operation occupies an area of 34 acres and is ostensibly one of the biggest such operations in North America.

Since the facility uses hydroelectric power — of which there is a surplus in Canada — the operation reportedly does not affect the power needs of local residents.

Crypto Mining Proliferates

On Jan. 8, digital currency mining firm Riot Blockchain began deploying around 3,000 new units of S17 Pro Antminers purchased from Bitmain as part of the full upgrade of its Oklahoma City mining facility.

Riot anticipates that, following the deployment of all 4,000 next-generation miners, its aggregate operating hashrate at the Oklahoma City mining facility will reach approximately 248 petahash per second, representing a 240% increase in hardware power efficiency compared to its mining hashrate.

Updated: 2-12-2020

Childhood Friends Battle Over Ownership of North America’s Largest Bitcoin Mine

Just four years ago, two lifelong friends from New Orleans turned a small initial investment into the largest crypto miner in North America.

When their company, Coinmint, bought a former Alcoa plant in upstate New York, they brought hope the new economics of cryptocurrencies would revive a region that suffered with the decline of American manufacturing.

But just as they should be preparing for the impending “halving” of bitcoin in May – an era-defining moment for the industry – the four-year-old company is now grappling with an existential threat: a lawsuit filed in a Delaware court by one of its two co-founders, who is seeking nothing less than the dissolution of the company and liquidation of its assets.

The business of mining bitcoin and other cryptocurrencies using high-speed computers is humming: Bitcoin prices are up 36 percent this year alone after nearly doubling in 2019. Mining firms are scrambling to raise capital from investors to set up large-scale data centers, upgrade equipment and expand processing power. The bitcoin network is months away from its next “halving” – a once-every-four-years occurrence that some analysts say could drive prices even higher. Before that happens, the partnership that owns Coinmint may itself be halved, along with the lifelong friendship of its co-founders.

Coinmint was started in 2016 when childhood friends Ashton Soniat and Prieur Leary each put $25,000 into the cryptocurrency prospecting firm. They would go on to develop a bitcoin mine in Massena, N.Y., that is now believed to be the largest such facility in North America; it draws some 80 megawatts of power, or the same amount used by roughly 60,000 average U.S. households.

Executives with the project have been lining up financing to install another 40 megawatts worth of capacity by May. The new production would come on line just in time for the halving, which under the terms of the bitcoin network’s original protocol will cut in half the number of bitcoins awarded to miners for helping to confirm data transactions on the blockchain. If bitcoin’s price surges, mining firms could win big. If it doesn’t, they would likely see a steep drop-off in profits.

Leary, a co-founder who until recently was Coinmint’s president, filed the dissolution suit in Delaware Chancery Court in December, claiming Soniat, who serves as CEO, unilaterally moved Coinmint’s headquarters to Puerto Rico and then shut him out of day-to-day management.

In phone interviews from his home in Miami Beach, Fla., Leary, 51, said he has put a lot of time, effort and money into Coinmint and he doesn’t want his investment at risk. He said Coinmint has received purchase offers from private equity firms at valuations above $80 million, but Soniat has thus far spurned any deal.

“I believe that it’s imprudent to risk your entire business on whether the halving is priced in or not,” Leary said.

In an email, Soniat, 50, said he is prepared to defend himself against the “spurious allegations” and that Leary’s claims are baseless. Soniat said he’s poured in almost all of the additional capital needed to fund Coinmint’s development and operations, and that Leary’s stake now amounts to just 18 percent. He contends Leary was fully aware of Coinmint’s conversion to a Puerto Rican limited liability company in 2018.

Leary’s actions are “simply another misguided attempt” to “bolster his financial standing at the expense of a company in which he owns an interest,” the statement read. “Despite the distraction of the lawsuit, Coinmint has continued to focus on, and is committed to, building a world-class cryptocurrency-mining enterprise.”

The dispute comes at a critical time for the crypto-mining industry, which has evolved in recent years from being dominated by hobbyists or small operators running one or a handful of computers in their kitchens or basements. With bitcoin and cryptocurrencies now gaining momentum, the business has become the province of big-money, institutional-scale developers, requiring wholesale electricity procurement contracts, large-scale site management and heavy capital investments in state-of-the-art data centers.

In an example of the rising costs of crypto mining, Coinmint went so far as to pay $15,000 a month last year to retain a New York-based public affairs adviser, Michael McKeon of the consulting firm Mercury. McKeon was a top communications aide and campaign adviser to former New York Governor George Pataki and also worked on former New York City Mayor Rudy Giuliani’s presidential campaign in 2008.

New bitcoin mining facilities sprouting up in Texas, Washington State, New York and some Canadian provinces are becoming so large they’ve been pitched as economic development projects to create jobs for remote communities with otherwise few opportunities.

Indeed, Coinmint Chief Financial Officer Michael Maloney said in an interview the planned expansion at Massena will add about 50 jobs, in addition to the roughly 100 employees who work there now.

Yet, as with many of the projects across the nation, there’s been an accompanying backlash. Nearby residents complain of elevated electricity bills. Environmentalists warn the extra draw on power from crypto mines could lead to more emissions from fossil fuel-burning generating plants, contributing to climate change.

From Big Easy To Big Difficulty

Coinmint’s story dates back decades before bitcoin was even invented. Leary and Soniat became acquainted as teenagers living in New Orleans in the 1980s.

“We went to different schools but we were in the same circles,” Leary recalled. “We were mostly party friends. We had a group of guys that all hung around together, and he was in our group.”

Soniat pursued a career in energy trading, working for the likes of Enron, TXU Energy and Deutsche Bank before starting his own firm in 2009. Leary went into the data-center business.

When Leary called Soniat in 2016 to pitch the idea of forming a partnership to start a bitcoin mine, it seemed like a natural fit. Both men had endured acrimonious breakups in prior business ventures that ended in courtroom disputes, but the cryptocurrency venture provided new grounds for optimism.

“It made sense,” Soniat said in a phone interview from Puerto Rico. “I looked at bitcoin mining as a play on electricity.”

Following the initial $25,000 capital contribution from each of the partners, Soniat provided nearly all of the capital needed for the buildout.

“Ashton was more on the financial side,” Leary said. “I’m the guy who found the sites and made it happen.”

The first two years were good for the business, Leary said, with bitcoin prices rallying 30-fold over the course of 2016 and 2017. Soniat, who lives in Puerto Rico, donated $150,000 to the island territory’s Sacred Heart University to strengthen a scholarship program, according to a February 2017 report from the Puerto Rican business-news website News Is My Business.

That same year, the pal-partners secured a lease on 1,300 acres at a former Alcoa aluminum-smelting plant in the town of Massena in upstate New York, not far from the St. Lawrence River, opposite the eastern end of Ontario, Canada. The town has been hit hard in recent decades by factory closures.

As of the most recent census estimates, Massena had an unemployment rate of some 21 percent, more than five times the current U.S. average.

But Massena boasts natural resources that are attractive to bitcoin miners like Coinmint. The regional electricity grid draws supply from nearby hydropower plants, once prized by the smelters. Another key feature is that it’s usually cold, with an average temperature of 44 degrees Fahrenheit (6.7 Celsius).

The chilly clime increases the efficiency and reliability of the bitcoin-mining computers, typically running 24 hours a day, 7 days a week.

In mid-2018, Coinmint said it would invest as much as $700 million in the Massena facility, creating an estimated 150 jobs over the ensuing 18 months, CNBC reported at the time. The plant has the potential for upgrades up to 435 megawatts of crypto-mining capacity.

“That was the original plan,” Leary said, “but the plan didn’t go the way we thought it was going to go.”

Bitcoin’s price tumbled 73 percent in 2018, raising questions not just about Coinmint’s prospects but about the very future of cryptocurrencies. As the partners deliberated over next steps, the friendship became strained.

Coinmint got hit with a lawsuit from a landlord in Plattsburgh, N.Y., where it was operating a separate, smaller bitcoin mine from space in a strip mall. Local residents complained their monthly utility bills were soaring because the operations were sucking up so much electricity. (Coinmint recently suspended operations in Plattsburgh, at least until March.)

In August 2018, Coinmint considered launching its own digital token to pre-sell batches of bitcoin mining processing power known as “hashrate” to buyers. Each token would be equivalent to one terahash, or a trillion computations, of bitcoin mining, according to a press release at the time. The token represented a potential new source of financing, but it has never been listed on a cryptocurrency exchange. A person close to Coinmint said none of the tokens were ever actually sold.

From Leary’s perspective, the Massena project has come to a crossroads where deeper pockets are needed to fund the next phase. He said the company is low on cash reserves, even as it needs a significant jolt of new capital to fund needed expansions and upgrades. He said many of the computers at the Massena facility are older-vintage machines that could become unprofitable following the halving.

“Bitcoin mining has become a big-money business,” Leary said. “Coinmint still has a great advantage, but if you want to compete with the Chinese, you have to partner with deep pockets or you have to have deep pockets yourself.”

Soniat loaned Coinmint more than $20 million, an obligation that until recently remained on the company’s books.

“Ashton is a trader,” Leary said. “He is more aggressive and a risk taker than me. To his credit, the company wouldn’t be where it is today without taking some risks. But we’ve reached a point where it’s too big and there’s too much risk. It’s not a fun situation for me.”

Last year, a private equity firm offered to buy a stake in Coinmint at a valuation of over $80 million; a few months later, a reduced offer valued the company closer to $60 million. In addition to the bids from private equity firms, Coinmint attracted interest from Chinese investors but Soniat didn’t want to engage.

“I kept pushing to do a deal,” Leary said. “He thought they were low-ball offers.”

By November of last year, relations between the childhood friends grew so strained that Soniat sent Leary an email saying he wasn’t sure he wanted to work with him anymore.

Leary traveled to Puerto Rico for two days to meet with Soniat, but his old buddy refused to talk with him.

Eventually, Leary’s lawyer, Ben Wolkov of the Miami-based firm AXS Law Group, recommended the dissolution petition.

“It’s a case of one partner just shutting another one out unlawfully, in our view,” Wolkov said in a phone interview. “This company’s going to have to deal with the industry waters, and the halving’s a concern, having to upgrade the equipment and the capital intensive nature of that endeavor. My client’s been left out in the dark.”

Soniat “went through the roof” when he found out the suit had been filed, and he sent out emails to Coinmint employees telling them not to talk to his partner, Leary said.

Soniat said in the phone interview he’s the majority owner of Coinmint, so decisions over a sale or new financing are his to make. He added that Leary’s description of the private equity offers is “categorically false.”

Coinmint is a private company and Soniat declined to disclose financial details, but noted: “I’ve provided the vast majority of money for the growth of the company through equity injections.”

Hashing It Out – Or Not?

In the meantime, Coinmint is moving ahead with an expansion of the Massena plant. Maloney, the CFO, who previously worked for the crypto-focused investment firm Galaxy Digital, said in phone interviews the company recently started installing more cryptocurrency-mining computers at the facility and expects the additional capacity to be ready by the start of May, just in time for the halving.

Last month, Coinmint revisited the idea of selling hashpower. It turned to BitOoda, a crypto-focused brokerage firm based in Jersey City, N.J., to arrange a financial contract with an unnamed counterparty for “the purchase and sale of large blocks of physically-delivered bitcoin hashpower,” according to a Jan. 27 press release.

Similar to commodity futures, the contracts allow mining firms to hedge against the risk of price drops while raising new financing in the short term.

Terms of the contract weren’t disclosed, but Maloney said the hashpower contracts should bring in funds to support the Massena expansion. BitOoda’s CEO, Tim Kelly, said in a phone interview he has investors lined up to buy “tens of millions of dollars” of the contracts.

“It’s difficult to get a loan from a traditional financial company like a bank,” Maloney said. “They don’t understand the nature of bitcoin.”

Leary, who wasn’t consulted on the BitOoda contract, says he really just wants a court-mediated solution to the whole affair.

“These partner-friend breakups can be the most unfortunate,” Leary said. “At the end of the day, my goal is to work this out. Hopefully he’ll read this article.”

Updated: 2-14-2020

Chinese Group Looking To Buy One of Latin America’s Largest Bitcoin Mines

Rocelo Lopes, CEO of Stratum, CoinPY, and one of the leading names in the Bitcoin and cryptocurrency market in Latin America, is negotiating the sale of Brazilian-owned, Paraguay-registered mining farm CoinPY, once a leading crypto company in Latin America.

According to exclusive information obtained by Cointelegraph, the negotiation is already advanced and the entire mining plant in Paraguay will be sold to a Chinese group that already operates similar farms in China.

Chinese Miners Concerned About Tightening Regulations

The group reportedly sought out Lopes for regulatory reasons, imagining a difficult scenario in China after the launch of any Chinese central bank digital currency (CBDC) that could cause a new wave of persecution in the cryptocurrency industry.

Tightening Regulations Cause Chinese Miners To Look Elsewhere

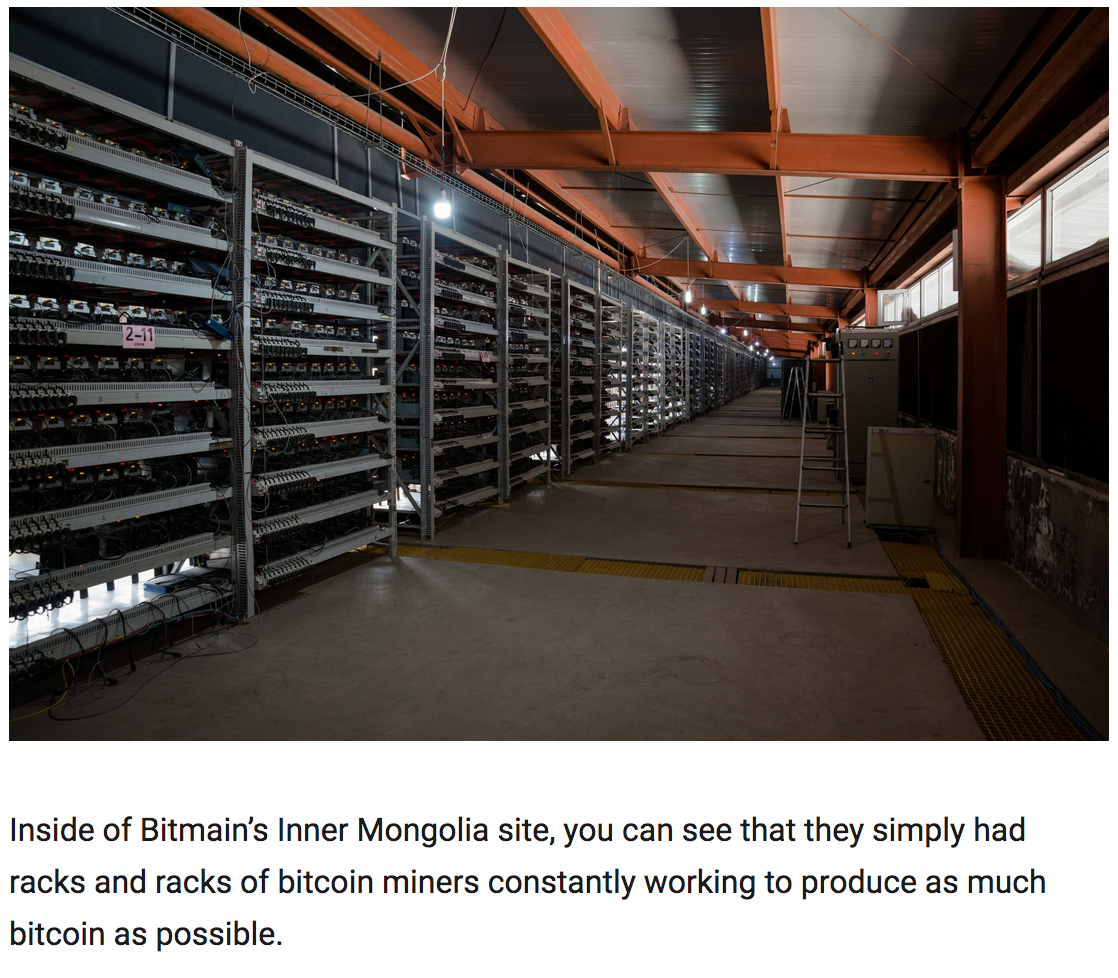

The move follows other Chinese miners looking for alternative locations to set up operations, as the world’s leading Bitcoin mining region is Sichuan. The rainy season there runs from April to September, and many miners move operations to Inner Mongolia, Xinjiang and Yunnan during the dry season to take advantage of the energy generated by thermal power companies.

Like Paraguay, countries like Kazakhstan and Uzbekistan are attracting Chinese mining companies looking to house older and less-profitable equipment like Antiminer S9, E10 and M3. In farms in China, they would stick to more cutting-edge equipment for logistical reasons.

Changes In Machinery And Management

In the case of the sale of CoinPY to the Chinese, all equipment at the Brazil-registered, Paraguay-based mining farm will have to be removed, according to sources speaking to Cointelegraph under anonymity. This way, Lopes would have until the end of February to remove all the machines he has in his space.

As CoinPY hosted third-party machines, customers have been notified of the destination they wish to give the equipment, mostly the Antminer S9. The negotiations also involve letting the Chinese consult with CoinPY for up to 8 years, which involves not only aspects of mining but governmental and regulatory relationships as well.

With the progress toward purchasing CoinPY, the Chinese would have already shipped their equipment to Paraguay and closed some plants in China. Cointelegraph asked the businessman for more details, but did not receive an answer.

While talking about Bitcoin mining on a television program, Lopes recently pointed out that mining has become more professional and that halving would permanently kill the possibility of any mining that not being done on a large scale.

As Cointelegraph reported recently, a Bitcoin mining farm in China was closed and all machines were shut down due to the Coronavirus outbreak.

Updated: 12-26-2019

Canaan’s New 5-Nanometer Chips To Escalate ASIC Arms Race With Bitmain

Chinese mining application-specific integrated circuit (ASIC) manufacturer Canaan will launch new, improved mining machines with 5-nanometer chips in Q1 2020.

Chinese industry news outlet 8BTC reported on Dec. 24 that the new ASICs will have significant advantages compared to the previous generation. The new firm’s 5nm manufacturing process is expected to improve performance, power and area scaling.

A significant development

The company expects to scale the production of this new product series faster than it did with its 7nm chips. The number of nanometers refers to the size of the features of the silicon chip, 5nm approaches what is possible with conventional electronics. For scale, 1nm is approximately equivalent to the width of two silicon atoms.

As the features in chips become smaller, it becomes possible to fit more transistors in a silicon die of the same size. At the same time, the electric current has to travel less distance in the circuit to perform a calculation, which means that efficiency is improved and the amount of heat is decreased when the features are smaller.

Canaan is one of the few cryptocurrency-related companies that managed to go public with a $90 million Initial Public Offering (IPO) held in November. As Cointelegraph recently reported, the firm’s shares have seen a 40 percent drop in value since the IPO.

Updated: 1-6-2020

Ousted Co-Founder of Crypto Mining Firm Bitmain Opposes Layoffs

Micree Ketuan Zhan, the co-founder of Bitmain who was recently dismissed by Bitmain’s current CEO Jihan Wu, has publicly opposed layoffs at the firm.

As Bitmain — the world’s largest cryptocurrency mining firm — is reportedly planning to cut its workforce by 50% before the next Bitcoin (BTC) halving, Zhan claimed that he is “firmly opposed to layoffs” in a Jan. 6 Weibo post addressed to Bitmain employees.

Zhan Argues That Bitmain Cannot Lose Its Leadership In A Highly Competitive Market

Apart from claiming that Bitmain does not need to lay off its team, Zhan argued that such a move would basically be suicide for the company. He wrote:

“To all employees of Bitmain: I am firmly opposed to layoffs! We don’t need to lay off people! We cannot play suicide!”

Zhan argued that Bitmain’s cash flow is healthy, and “there is a substantial amount of virtual cryptocurrency.” Zhan, who is Bitmain’s biggest shareholder with a reported 60% stake, outlined the company’s leading position in the highly competitive cryptocurrency mining market. He stressed that cutting Bitmain’s staff in half would just allow other mining firms to grab up Bitmain’s market share.

Bitmain Reportedly Started Cutting Staff This Morning

Meanwhile, Bitmain “staff optimization” allegedly started this morning, according to local reports on Jan. 6. Bitmain has reportedly provided its employees with a compensation plan, while some employees have signed a termination agreement. Additionally, a number of headhunters have purportedly started communicating with resigned Bitmain employees.

When reached for comment, a Bitmain spokesperson stated, “Depending on market conditions and business developments, we continue to make adjustments to our staff. As a result, we also are continuously on the lookout for new talent and welcome applicants from all walks of life.”

“Bitmain Drama”

The news brings a fresh twist in a series of events referred to as “Bitmain Drama” by the crypto community. After Zhan was dismissed by Bitmain CEO Jihan Wu in November 2019, the executive subsequently initiated court proceedings against the company in a bid to restore his voting control of the firm.

Meanwhile, Wu recently resurfaced as Bitmain CEO after both he and Zhan announced plans to step down from their co-CEO positions in January 2019.

Updated: 2-13-2020

Bitcoin Miner Canaan’s Shares Valued At $8.04 After Surging 80%

After steadily depreciating well into the last quarter of 2019, Canaan certainly rebounded slightly today.

The company was the first example of a large Bitcoin miner to go public on Nasdaq. However, after its initial public offering (IPO) on Nov 21, Canaan stock price values dropped nearly 40% within a few weeks.

Competition With Bitmain Helped Stocks Surge?

Some healthy competition may have helped the bitcoin miner to regain some traction in the market. Canaan came out ahead of Bitmain, another major China-based bitcoin miner, to become the first company traded in a US stock market. Unfortunately, this introduced Canaan to the United States with an IPO valued at under 75% of what was expected.

The mining giant’s stock took a beating from its original value $13 on the day of the launch to drop to $5.25 in mid-December. As of closing today, The Block reported Canaan’s shares are valued at $8.04, a surge of over 80% from its opening price of $4.42.

Canaan has been facing stiff competition from Bitmain and racing to develop technology to stay on top. Most recently, the company unveiled 5-nanometer chips to improve power and performance.

Updated: 2-16-2020

Bitcoin Mining Unit Manufacturer MicroBT Nibbles At Bitmain’s Market Share

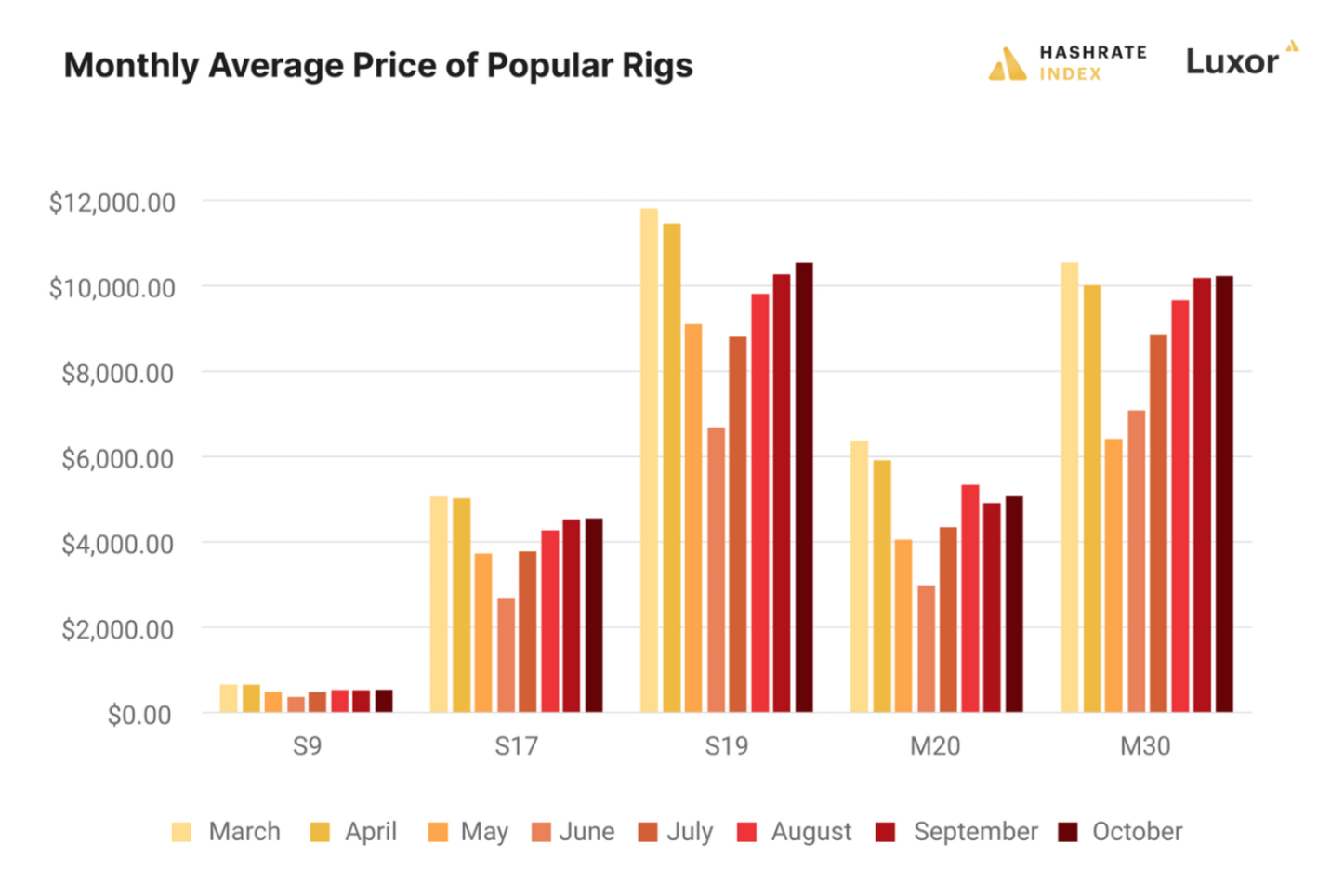

Bitcoin miner maker MicroBT has rapidly expanded market share by selling over half a million units in 2019, chipping away at rival Bitmain’s dominance.

MicroBT sold about 600,000 units of its flagship WhatsMiner M20 series last year, Vincent Zhang, sales head of the Shenzhen-based company, said in an online panel hosted by Chinese mining pool Poolin on Thursday in a WeChat group.

These products generate a computing power of about 60 terahashes per second (TH/s) on average, he said. That means the newly delivered 600,000 units may have contributed over 30 exahashes (EH/s) of hashing power to the bitcoin network in 2019. (1 EH = 1 million TH).

Amid bitcoin’s price jump throughout 2019, the network’s two-week average computing power more than doubled from just 40 EH/s around the end of 2018 to nearly 100 EH/s in December. That’d mean close to half of bitcoin’s computing power growth in 2019 may have come from equipment delivered by MicroBT.

Zhang didn’t specify the precise average unit price of these batches, as they could fluctuate depending on bitcoin’s price over the year. But the firm’s various models in its M20 product line are generally priced between $24 to $30 per terahash, meaning the firm has brought home a high nine-figure revenue in U.S. dollars for 2019.

Bitcoin’s current computing power stands at 110 EH/s. That also means MicroBT may account for around 30 percent of bitcoin mining power sold right now, making it one of the largest and fastest-growing miner makers in the world.

Situation In Flux