Christmas Shopping: Where To Buy With Crypto This Festive Season

Christmas is just around the corner, which means it’s time to get your holiday shopping out of the way for good. Christmas Shopping: Where To Buy With Crypto This Festive Season

Forget The Milk And Cookies, Santa Is Accepting Bitcoin This Holiday Season

Much like Santa himself, Bitcoin is magic.

Related:

Bitcoin Is World’s Best Performing Asset Class Over Past 10 Years

Real Estate Brokerages And Retailers Worldwide Now Accepting Bitcoin

Retail Has Arrived As Paypal Clears $242M In Crypto Sales Nearly Double The Previous Record

$35 TRILLION Global Stock Market Meltdown!!!

Although he is based in the North Pole, Santa Claus spends much of his December touring the globe, making appearances at countless holiday-themed engagements in the run up to Christmas Eve. In payment for these rendezvous, Santa has long been known to accept tips in a variety of different currencies, assets and edible treats. This year, Santa adds Bitcoin (BTC) to his list of accepted payment methods.

“There are several ways that HireSanta can accept Bitcoin as payment for Santa Claus services, you can send Bitcoin directly to our Coinbase account or you can do it through Paypal, depending on how you store your Bitcoin.”

Almost a year has passed since the generous man with a belly like a bowl full of jelly put out his latest naughty and nice list. John McAfee topped the naughty list last year due to his tactical avoidance of United States authorities.

Craig Wright also showed up on the list as a likely coal recipient. Wright, who has persistently claimed to be Bitcoin creator Satoshi Nakamoto, brought several libel suits against well-known industry folks, including Peter McCormack, host of the What Bitcoin Did podcast.

2019’s nice list yielded a number of good boys and girls, including Keith Mali Chung, who returned roughly $80,000 in Bitcoin to its owner after an accidental transaction. Also making an appearance on the nice list were school-goers in Uganda who received food funded by Binance as part of an initiative from its charity wing.

With the Christmas season in full swing, crypto broker Bitcoin Suisse recently installed two holiday-themed BTC advertisements in the Zurich Main train station in Zurich, Switzerland.

And while online retail giants such as Amazon and eBay have made online purchasing wonderfully simple for the average person, they do not really cater to a growing population of individuals who are looking to use their crypto for digital payment purposes.

While a number of startups have entered this space over the last three to four years due to issues relating to market volatility, certain remaining setbacks need to be tackled before the sector can really flourish.

But setting the issues aside, here is a list of online retailers that accept not just Bitcoin (BTC), but a whole host of other popular crypto assets.

Overstock.com

Overstock.com is widely considered to be one of the best shopping destinations for Bitcoin holders. For Christmas shoppers especially, this website is an absolute treasure trove, as it allows users to purchase items ranging from television sets to furniture to golfing equipment using crypto. Not only that, even the checkout process is seamless, since all one has to do is click on the “Pay with Bitcoin” button and follow the instructions.

And while Overstock does not allow BTC payments on its mobile site, it does enable customers to use their Bitcoin in conjunction with any other valid gift cards, coupons, and credit points that they may own. Additionally, in the event of a refund, Overstock issues the exact amount of crypto per its price at the time of the transaction.

Alagoria

When it comes to making purchases from retail giants like Walmart, Home Depot and Amazon, most crypto enthusiasts have to first liquidate their coins and then process their payments in fiat. However, this holiday season, Alagoria is allowing its customers to get a 10% discount on all purchases made via HomeDepot and Walmart using cryptocurrencies.

To shop on Alagoria, customers simply need to copy and paste the URL of a product they want to buy into the search bar on the platform. They can then proceed to checkout and pay for the item using the crypto of their choice — with the conversion rate set before the payment takes place.

Once this process is done, Alagoria notifies customers of their completed orders and provides a tracking number. Most items are usually delivered within a period of three to four business days.

Lastly, the company allows customers to use discounted gift cards from Walmart and Home Depot to fulfill order payments, and even have an open buy-back offer on most gift cards from the aforementioned retailers at the moment.

eGifter

People looking to present their loved ones with premium gift cards can use eGifter, a platform that enables customers to buy a wide range of gift cards from big-name brands like Amazon, Apple, Macy’s, Adidas and GameStop. Items can be purchased using digital currencies (like BTC, BCH, Dash, LTC and ETH) and can be obtained in either physical or digital form.

Also, quite like many other retail firms today, eGifter makes use of an internal point system, wherein regular customers can collect eGifter credit every time they buy a gift card. These points can then be used during future checkouts in lieu of instant discounts and other monetary benefits.

Bitcoin Superstore

Florida-based Bitcoin Superstore is the perfect shopping avenue for people looking to make purchases from Amazon.com using their crypto savings. Even though the platform has its headquarters in the United States, it extends its shipping services to more than 50 countries across the globe.

Not only that, for couples and solo travelers looking to explore the world at this time of year, the platform enables flights and hotels to be booked through mainstream platforms such as Expedia or Priceline.

Navigating and operating Bitcoin Superstore is quite simple, as customers only have to copy and paste a product URL in the provided search column and add the price so the platform can automatically calculate the applicable sales tax and present the user with the final amount to be paid.

Bitcoin Superstore currently supports a large number of cryptocurrencies, including many popular ones. Not only that, but the website also sells a wide range of gift cards and discount coupons for merchants from industries such as electronics, travel and hospitality.

CheapAir

People looking to make a quick holiday getaway this Christmas can explore CheapAir.com, since it currently has a number of discount deals on flight tickets to destinations around the globe.

However, what makes this platform really stand out from the rest is the fact that it allows users to complete their purchases via Bitcoin. The entire process is quite straightforward and based on the digital currency’s USD value at the time of booking.

Newegg

For tech enthusiasts looking to buy the latest electronics this Christmas season, Newegg is the place to be. The website offers users with a wide range of gadgets ranging from high-end gaming laptops, desktop computers, hardware components and audio/video peripherals. Additionally, the platform also offers customers quality products from big-name brands like Microsoft, GigaByte, Corsair, AMD, Msi and Seagate amongst others.

Regarding how the payment process works, customers can proceed to initiate a BTC payment after deciding on a product by simply scanning the provided QR code and sending the amount due in crypto to the given address. After the funds have been moved, the Newegg team sends an email confirmation containing all of the purchase and delivery details.

Olodolo

Christmas shoppers looking to buy clothing, jewelry, cosmetics and fashion accessories can consider Olodolo — a platform that specializes in helping people buy items on Aliexpress using cryptocurrencies.

The checkout process is similar to that of other retailers, and delivery is available to a large number of countries worldwide. All payments are processed by a POS operator called Coinpayments, and the final price (including shipping and other associated taxes) is displayed at the end along with the three cryptocurrencies supported — Bitcoin, Litecoin and Ethereum — that a customer can choose from to complete the process with.

Forra

Forra can be thought of as the Ebay equivalent of Olodolo, as it allows customers to purchase a wide range of Ebay listings using crypto assets such as BCH, BTC, LTC and ETH. In order to ensure the security of its internal monetary transactions, Forra makes use of an escrow system and charges users a flat 3% fee on each individual purchase.

Updated: 12-27-2019

New Year 2020 Crypto Shopping Guide For Filthy Rich Hodlers

A new year heralds the opportunity for a new beginning. The start of a new life cycle. As the clock strikes midnight on Jan. 1, the year 2019 will be dealt a fatal blow by old father time, a cold-hearted act of destruction that would inspire Thanos himself.

Soon, all that will remain of 2019 will be a handful of dust. For many cultures around the world, the New Year is a time celebrated with gifts. Here’s how anyone can spend their crypto like an oligarch this festive season.

Luxury Goods

So, you’ve bought Bitcoin, managed to prevail the treacherous waters of the international crypto markets, and the only thing left now is to spend it like a high roller.

You might be worth $10 million, but what good is that if you are still sitting in your stained ironic t-shirt and moth-eaten boxer shorts? Your home office might be the domain from which you wield your fearsome financial power, but out there in the real world, appearances count. What’s the point of making fast money if you can’t dress like someone who just discovered an oil reserve in their backyard?

Lanieri is an Italian tailor with stores in most capital cities in Europe. From garish to debonair, Lanieri can suit anyone’s personal style. Most importantly, it accepts payment in crypto.

For those looking to splurge on more than just expensive threads, some retailers are more than willing to relieve investors of their Bitcoin in exchange for luxury goods. Bitdials.eu claims to be the world’s first Bitcoin-only luxury boutique. From this single website, the hotshots of the Bitcoin world can buy a Rolex Yacht-Master II at a discounted price of only 5.55 BTC (about $36,500).

When it comes to flashing the cash, it’s common knowledge that watches are entry level. One could have an average annual salary’s worth of watch glittering on their wrist, but nobody will take that person seriously if they turn up in a battered station wagon.

Nothing says small endowment, high net worth like a grossly overpriced car. Coincidentally, the Bitdials luxury goods empire emcompasses Bitcars.eu, where big players can splurge on Bentleys, Rolls-Royces, Ferraris and more. Come Jan. 1, it’ll be time to step up the car game — from 42 BTC to 200 BTC a pop — and ride into 2020 in style.

New Year is the perfect time to turn one’s life into a pastiche of MTV’s “Pimp My Ride.” Fortunately, it is becoming easier than ever to display wealth and bad taste all at the same time. From cars to wristwatches, crypto can be used to become a target most petty criminals could previously only dream of.

Capital Flight: Travel Meets Crypto

After a tumultuous year in cryptocurrency, dedicated hodlers deserve a well-earned break. What better way to cleanse the corpse-like pallor of the most committed crypto investor than a dose of winter sun?

For many years, those who had amassed their precious hordes of crypto looked to spend it anywhere they could. No matter how many doors they knocked on, there was never room at the inn — until now. Travala, a service that lets its users pay for hotel stays with cryptocurrency, partnered up with Booking.com in November this year.

Just weeks ago, the world’s crypto titans were cut down to size by the prospect of a meager hotel booking. Hotel receptionists are famously unfazed by large Twitter followings or branded Bitcoin jewelry being flashed in their face. But no longer will mere administrative procedures stand in the way of the mighty crypto elites swarming to the tourist hotspots of the world.

Although the frost could well be setting in for another crypto winter at this transformative time of year, investors with itchy feet could swap mining for the Maldives or another 90,000 destinations available worldwide.

Crypto’s spread into the travel industry is not contained to hotels alone. Though cryptocurrency’s fortunes have taken a nosedive in the twilight of 2019, it has never been easier to power flight than now.

Alternative Airlines, a travel company based in the United Kingdom, teamed up with cryptocurrency service Utrust to power payments with crypto. Aspiring millionaires should note that the Alternative Airlines service also sources flights from budget carriers — although excess emotional baggage needs to be checked-in at an additional cost.

If history is anything to go by, newly minted millionaires like other people to know just how important they are. No longer will the kings and queens of the crypto world have to slum it with the great unwashed as they queue at passport control.

Nothing will show the poor, impressionable airport staff that your wallet is shuddering with the weight of wealth more than chartering a jet with PrivateFly. They’re more than happy to accept Bitcoin so you get a chance to show the small people of the world how much of a massive baller you are.

Digital Fortunes, Analogue Learning

The festive period is rightly criticized for being overly commercial. As the New Year looms ever closer, it is time to both reflect on 2019 and set goals for the year to come. Each year, people tell themselves that they will be better, feel more fulfilled and be more productive. But how often do those paltry promises made to our naive December-selves fall through in just the first few weeks of the year?

Human beings are feckless creatures that need reinforcement to move forward. So, what better way to invest in the future of yourself or a loved one than with the most wholesome gift one can give: education. Gifting someone tuition at a university is a commitment to expanding the mind, with permanent and measurable results. Education has been the path toward a better life for hundreds of years, and you can now invest in your future with Bitcoin.

Some investors got lucky, others flew through on intuition alone. Many whales buy the dip and ride the wave all the way to the top. For investing impresarios who have learned everything there is to know about raking in the profits of cryptocurrency, it could be time to diversify that mental portfolio.

Switzerland, home to the so-called “Crypto Valley” in the canton of Zug, is famous for its welcoming approach to both cryptocurrency and the many business ventures that come with it. For those looking to fund further education as a stepping stone into one of Europe’s hotbeds of crypto innovation, a course at the Lucerne University of Applied Sciences paid for in Bitcoin could be just the ticket.

Want to study in a German-speaking environment without sacrificing that seductive capital city lifestyle? Then the ESMT Berlin business school could serve up just the education experience you’ve been craving for.

But if the varying climates of Switzerland and Germany seem too chilly for warmer-blooded investors, the University of Nicosia in Cyprus is another option — and has been accepting Bitcoin payments since 2013.

With a degree under your belt, you could not only become even more insufferable on Twitter, but also confidently correct unwitting strangers in bars and on public transport. You can frame the certificate after graduation and put it in your downstairs toilet, where visitors to the home will become humbled and refer to your wise counsel in conflict situations henceforth. Fueled by the awesome power of your cryptocurrency wealth, the first step to bending the world to your will could be taken as early as 2020.

Sats for tats

What screams rebellion more than the rejection of the global financial system as a whole? Your crypto is burning a hole in your pocket, but that pales in comparison to the renegade spirit blazing eternally in the heart. Sadly for militant crypto maximalists, undermining mainstream finance one trade at a time is slow and inconspicuous work. What’s more, if mainstream finance is sharp suits and a high-end gym membership, crypto is dad bod with a neckbeard.

So, this New Year, shave that patchy facial hair and dust the cheeto crumbs from your sweatpants, because it’s time to bridge the gap between the cypher-punk spirit and that IT technician energy. Hodlers imbued by the wild energy of crypto-anarchism can pay in Bitcoin for symbols of resistance guaranteed to turn your parents’ stomachs: tattoos. Take that, Dad.

Iconic Berlin tattoo parlor, Bitch Wedding, accepts payment in Bitcoin. Alternatively, for investors living in the U.K., I Hate Tattoos will also take payment in Bitcoin.

Nothing shows a commitment to your lifelong crypto ideals more than forever etching them into the skin. This way, you can win arguments both on the street and on Twitter. Bank staff will fear you, bouncers and security guards will nod at you with respect, and your partner will fawn over you like the tech-savvy architect of the heart you used to be.

For Christmas shoppers looking to buy electronic items (computers and laptops in particular), software, books and game titles, Forra is definitely a website worth checking out.

Updated: 1-5-2020

Who Got Gifts from Crypto Santa in 2019… and Who Got Coal

On Christmas Eve, Crypto Claus did his rounds after checking the list to see who was naughty and nice. But who got some lovely presents after making a positive impact in 2019 — and who got coal for setting the industry back? Here, we take a look at the people and businesses who have had a year to remember — and those who have had a year to forget.

The Naughty List

Some crypto players were resigned to getting coal rather early on in 2019. Right at the start of the year, John McAfee suddenly announced he was fleeing the United States after being indicted by tax authorities. This led to the bizarre announcement that he would run to become U.S. president while he was in international waters.

In the 12 months that followed,he held back on plans to reveal the real identity of Bitcoin creator Satoshi Nakamoto, told Cointelegraph that the CIA was harassing him, reasserted that Bitcoin (BTC) will hit $1 million in 2020, got arrested twice in the Dominican Republic, unveiled plans to run for the roles of U.S. president and British prime minister simultaneously, and launched an “Epstein Didn’t Kill Himself” coin.

While we’re on the topic of Satoshi Nakamoto, it’s likely that Crypto Santa was frowning furiously at Craig Wright’s antics in 2019. The controversial Australian entrepreneur has had quite a litigious year — not least because he has been trying to prove that he was the person who invented Bitcoin.

In May, he filed copyright registrations for the Bitcoin white paper with the U.S. Copyright Office, but critics maintain that this proves very little. Wright also found time to sue crypto podcaster Peter McCormack and Bitcoin.com CEO Roger Ver for libel — with Ver calling him a “fraud and a liar” in a YouTube video.

But the real showstopper this year was the bitter case that pitted him against the family of his late business partner, Dave Kleiman. Wright was accused of stealing hundreds of thousands of Bitcoins that were rightfully Kleiman’s — and a court subsequently ruled that he should pay 500,000 BTC back.

This prompted the embattled entrepreneur to challenge the ruling, questioning the judge’s power in the process. Although the two parties then embarked on extensive settlement negotiations, Wright later informed Kleiman’s estate that he was unable to finance the agreement, which was worth a whopping $4.5 billion at the time.

So… who else was in the running for Crypto Santa’s coal? Well, some would potentially be on his naughty list because of how their actions tarnished the industry’s image or slowed down its progress. There was Brad Sherman, a Democratic congressman for California who is violently opposed to crypto.

This year, he called for U.S. lawmakers to outlaw cryptocurrencies altogether for fear that they could undermine the dollar. On Libra, Facebook’s proposed stablecoin, he claimed “Mark Zuckerberg is sending a friend request to oligarchs, drug dealers, human traffickers and terrorists.” Political rivals of Sherman have claimed his “goal is essentially to try to ban the internet.”

QuadrigaCX also retains its spot on the naughty list after December 2018’s bombshell announcement that $190 million in user assets was lost when CEO Gerald Cotten died suddenly. He was the only person in possession of the keys to the cold wallets apparently being used to store the funds. Over the course of the year, it emerged that these cold wallets were mostly empty anyway, and the Canadian company was officially declared bankrupt.

Although Cotten’s widow has handed over $9 million in assets to compensate affected users, QuadrigaCX’s liabilities still run into many tens of millions of dollars. The murky circumstances surrounding the exchange’s demise have also fueled cynicism over whether Cotten is actually dead, with lawyers representing disgruntled investors asking police for the disgraced executive’s body to be exhumed.

There were countless other hacks, exit scams and incidents over 2019. Some were caused by lax security, but some — such as India’s Coinome and Koinex — blamed regulatory pressure as the country prolonged uncertainty by announcing plans to ban crypto and enforce 10-year jail terms, only to delay enshrining them in law.

The Nice List

Thankfully, Crypto Santa had plenty of presents to dish out this year, too. Some of those in line for a gift from Crypto Santa simply did a good deed — showing the world that the community can be a giving, generous place. Back in September there was the tale of Keith Mali Chung, otherwise known as the “African Bitcoin Bull.”

The blockchain educator and advocate had inadvertently received “a huge sum of BTC from an unknown sender” — believed to be worth about $80,000 at the time — and launched a Twitter appeal in a bid to return it to the sender. Thankfully, his campaign succeeded, and a man who he had done business with before came forward to be reunited with his coins.

There has also been plenty of charitable giving over the course of the year. BitPay began offering its services to the Wikimedia Foundation, the organization behind Wikipedia, so the nonprofit could accept donations in Bitcoin and Bitcoin Cash. Binance, one of the world’s biggest exchanges, launched a campaign to provide two meals a day to more than 200 students and school staff throughout 2019 in the Ugandan capital of Kampala.

Countless crypto organizations commenced fundraising drives following the Notre Dame Cathedral fire in France — including BlockShow and Binance. And it seems there really is an appetite for charitable donations in the community, with Fidelity Charitable disclosing back in August that it received more than $100 million in cryptocurrency donations since it began accepting digital currencies back in 2015.

Also on the nice list are countries that have adopted measures that provide legal clarity to crypto and blockchain users around the world. In the summer, Australia unveiled plans to exclude crypto from restrictions on cash payments, New Zealand ruled that cryptocurrencies are legal and subject to tax, and Portugal declared that Bitcoin payments and trading should be tax-free.

In the final quarter of the year, France announced that crypto gains will only be taxed if assets are converted into fiat — effectively meaning that crypto-to-crypto transactions will remain exempt. Meanwhile, the United Kingdom proclaimed that Libra has the potential to become “a systemically important payment system” if it satisfies some crucial provisions to be compliant with the law. Over in Germany, a new bill emerged that would legalize banks holding Bitcoin and other ditigal currencies from next year, prompting some to describe the country as a “crypto haven.”

As in politics, as in economics, as in global affairs, crypto and blockchain have had some celebrations and commiserations in the past 12 months. Learning lessons from 2019 could prove decisive when Crypto Santa is deciding who is on the naughty and nice list for 2020.

Updated: 12-10-2020

Crypto Gift Ideas For The Christmas Fan In Your Life

Is all this Christmas nonsense getting in the way of your crypto obsession? Well, why not combine the two?

As we find ourselves already knee-deep into December, it has become increasingly difficult to ignore that certain festive je ne sais quoi that always seems to permeate the air during this time of year — yes, even in this globally most horribilis of annuses, (whisper it) 2020.

The shops — well, those of them that haven’t been permanently shuttered, or at least forcibly quarantined, by the coronavirus pandemic that has defined much of our lives for the past 12 months — have been pumping out seasonal tunes for what already seems like an eternity.

However, take heart in the fact that it is only the sickeningly well-prepared and the terminally short-of-things-to-do who have directed more than a cursory thought toward what to actually buy anybody as a gift so far.

And fear not, because if your loved ones like a bit of Christmas with their crypto, then Cointelegraph has a whole heap of inspiring gift ideas to help you seem just as thoughtful as our overeager, underworked compatriots.

A Christmas Classic

The wallet has been a Christmas staple since the days of Charles Dickens when Ebenezer Scrooge famously received one from Tiny Tim in order to keep all his money in order — possibly.

In the crypto world, the go-to standard for keeping your tokens secure is a hardware wallet, and there are plenty to choose from. Besides, software wallets are generally free and not suitable for making you look like a generous gift-giver.

The Ledger Nano X needs no introduction and is still one of the very best hardware wallets out there. And for Christmas, Ledger is offering a free $25 crypto voucher with every Nano X sold. There are also family packs (of three wallets) on sale, and the earlier Nano S model is still available for those on a more modest budget.

Alternatively, the 29 euro ($35) Status Keycard adds a physical layer of security to the Status app and cryptocurrency wallet, which runs on Android and iOS cellphones. We first came across the Keycard in June, and the simplicity of the system is a big draw.

Transactions initiated through the app require a tap of the near-field-communication-enabled card on a smartphone in order to go through. Without the physical keycard, money simply cannot be transferred.

If you have been patiently waiting for this year’s most hyped and, reputedly, most secure hardware wallet, the Ngrave Zero, I’m afraid you are out of luck, however — at least for Christmas.

Ngrave CEO Ruben Merre confirmed that devices purchased during the project’s crowdfunding campaign are expected to ship at the end of December, with the remainder being delivered throughout January 2021. Of course, if you have a birthday coming up…

Gifts To Wrap Yourself

The humble Christmas sweater has undergone something of a renaissance in recent years.

Originally a piece of knitwear — usually bestowed by an elderly, but well-meaning, relative — so ugly that it is destined to only be worn on Christmas day itself — while said elderly relative is around to see it — it has since been embraced by certain elements of society as an ironic statement.

Talk about post-modernism gone mad.

Anyway, Hodlmoon has a range of particularly ugly sweaters for sale, combining traditional nordic elements with bold crypto logos in outlandish color schemes. Firm family favorites Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) are all represented, along with a few more esoteric choices.

Got a sibling who you can picture pledging their allegiance to Kyber Network or Polymath in knitted form? Anyone? And although emblazoned with the logos of the privacy-focused browser, the Brave sweater could equally refer to the personal qualities required of the wearer.

Be aware that these won’t appeal to all of your loved ones, but the right giftee will be over the (Bitcoin) moon with one of these. I’m even starting to soften toward the Monero sweater myself. Ahem, moving on quickly.

If Christmas sweaters are a bit in your face (on your torso?) for your chosen recipient, then perhaps they would be better disposed toward a pair of cryptocurrency socks?

Socks are ideal for those who want to identify themselves as a crypto believer while proving that they still enjoy a bit of fun as much as the next person — but only when they sit down and their pants ride up.

Also, socks make for a much cheaper novelty gift than a jumper.

Etsy seller Dytanik has a full 29 different designs available, each dedicated to a different token.

With so many for sale, it doesn’t matter if your intended beneficiary is a fully paid-up member of the XRP army, an Aave staker, a Binance Coin (BNB) trader, a Cardano (ADA) hodler, or even a Tetherer (yes, really). Whichever way one’s crypto kink lies, there is a pair of socks with which to pledge one’s allegiance — unless one happens to believe that Craig Wright actually is Satoshi Nakamoto, that is.

A bonus item for XRP heads (pun very much intended): On a much subtler level, this logoed beanie allows the wearer to express their “XRPride” while leaving the vast majority of those who see it convinced that they are simply a fan of The X Files.

A Little Light Reading

Over the past year, I have had the dubious honor of reviewing a whole host of cryptocurrency- and blockchain-related books, ranging from the excellent, like Blockland, to the laughably bad, like The Little Book of Crypto. So, you’d expect me to be able to recommend a decent bit of Christmas reading for the crypto convert — or perhaps, soon to be crypto convert — in your life, right?

But the problem with Blockland is that it was, and still is, only available as a “limited edition” hardcover preorder for $59. And although your parents may have brought you into this world and nurtured you through the best part of the first 18 years of life, $59 is a bit steep. And even then, a claimed shipping date of December gives no guarantee of a Christmas delivery.

There are planned paperback and Kindle versions on the way, and the website does state that the book is “Coming January 3rd, 2021.” So, if by some slim chance that is referring to one of the cheaper options and you celebrate Orthodox Christmas on Jan. 7, then you might be in luck.

But it’s a long shot.

The problem with The Little Book of Crypto, of course, is that you probably want to remain on speaking terms with the recipient once the gift is bestowed.

So, instead, I’m going to recommend a book I haven’t yet reviewed, as I still haven’t quite finished reading it. Cowries to Crypto is not purely about cryptocurrency but rather gives a history of money, currency and wealth throughout history, from the time when people used cowrie shells as a medium of exchange — hence the title — right up to the present day.

It is a collaboration between internationally acclaimed political cartoonist Harry Harrison and award-winning financial journalist Jame DiBiasio.

This means it has lots of nice pictures, which is somewhat of a rarity in this sort of book. It is also a very well-written, in-depth, unbiased exploration of its subject matter and will reaffirm your faith that crypto is most definitely the future of money.

However, books on crypto generally cater to those who are just beginning to take an interest in the subject. What if your better half is already a card-carrying crypto convert?

Citadel 21 is a Bitcoin culture fanzine. It is fresh, current and edgy enough to satisfy even the most hardcore crypto acolyte. It contains a curated selection of voices and opinions on the subject, with a focus on the good, the cool and the weird.

And it includes the serialized webcomic “Bulltardia,” which is hiding the 12 words of a seed phrase for a wallet containing 0.1 BTC, as if you needed any other excuse to read it.

Sure, you could read the online versions for free, but there are also some rather smart-looking limited-edition physical copies available, along with six- and 12-volume subscriptions.

Not For Trading…

In years gone by, Cointelegraph might have recommended gifting your nearest and dearest with cold, hard, actual cryptocurrency. Well, not anymore.

The problem is that crypto now comes in so many flavors that picking out the right variety comes with a veritable minefield of potential pitfalls.

Imagine buying your eccentric Uncle Derek “the wrong type of Bitcoin,” or Polkadot’s DOT for your secretly Ethereum-loving aunt — or Tron’s Tronix (TRX) token for basically anyone.

These days, it is perhaps safer to venture into the world of nonfungible tokens when looking for gifts that reside on a blockchain. If nothing else, it will make it look like you’ve made more of an effort.

When it comes to NFTs, you might want to look to the Axies of the game Axie Infinity. Not only can these cute creatures be reared, battled and bred, but with some decidedly average skill, they can even become a source of income, as I found out when writing my recent review of the game.

Just remember that you need three of them to make any money.

If only the freshest of NFTs will do, then look no further, as the BBC recently launched a collection of Doctor Who trading cards. You can buy in for under $5, and the cards will be usable in a card-battling game later next year, as Cointelegraph reported earlier.

Finally, you could always treat a work colleague to one of Cointelegraph’s very own festive NFTs. Our artists have put together a poster-sized artwork that collects all of the major cryptocurrency-related events of the year into one image.

From the coronavirus crash through the halving to the rise of decentralized finance and PayPal entering the crypto space, it’s all in there, with a little space reserved for anything that happens between now and the end of the year.

Crypto has provided a bountiful range of gifts for the Christmas lover in your life this year, so you don’t have to let all the jollity get you down. Just keep your cellphone close at hand so you can check for a Dogecoin (DOGE) pump before serving the turkey.

Updated: 12-24-2022

Xmas Dinner Table: How To Confidently Talk About Bitcoin vs Crypto This Year

Christmas dinner could get awkward for crypto advocates who were adamant about their families investing last year — We’ve compiled a small recap of what happened in Bitcoin vs crypto and the traditional economy this year.

After a lackluster rise of crypto in 2021, which saw many new crypto millionaires and several crypto startups attain unicorn status, came the dramatic fall in 2022. The industry was plagued by macroeconomic pressures, scandals and meltdowns that wiped out fortunes virtually overnight.

As 2022 comes to a close, many crypto proponents are perplexed about the state of the industry, especially in light of the recent FTX collapse and the contagion it has caused, taking down several firms associated with it.

Many who couldn’t stop talking about crypto and recommending their family to invest in it last year at Christmas dinner could see the tables turn this year, with them having a lot of explaining to do about the state of crypto today.

While as awkward as that conversation is going to be, we prepared a small recap to help ‘crypto bros and sisters’ explain what really happened to crypto in 2022 when market pundits were expecting the rise to continue throughout the year.

The Downfall Was Universal, But Crypto Turned It Into A Contagion

The start of the crypto downfall was triggered by external factors, including excessive money-printing, growing inflation, rate hikes from the United States Federal Reserve and the international conflict between Ukraine and Russia that shook investor confidence in the markets, leading to a sell-off in traditional and crypto markets.

The external market conditions, aided by the unchecked centralized decision-making process, claimed its first big player of this bull cycle in Terra. The $40-billion ecosystem was reduced to ruins within days. More importantly, it created a crypto contagion that claimed at least half a dozen other crypto players, mainly crypto lenders that had exposure to the Terra ecosystem.

The collapse of the Terra ecosystem had the greatest impact on lenders, bankrupting Three Arrows Capital and many others. Celsius paused withdrawals due to extreme market conditions, causing crypto prices to fall, and then declared bankruptcy. BlockFi had to be bailed out by FTX with a $400 million cash injection.

At the time, FTX seemed too eager to bail out several troubled crypto lenders. But, just a quarter later, it turned out FTX was not as liquid and cash-rich as it claimed to be. In fact, the crypto exchange was using its native tokens and in-house, non-existent projects as leverage against multi-billion-dollar valuations and loans.

Its sister company, Alameda Research, was found to be involved in building a house of cards that eventually came crashing down in November.

The FTX crypto exchange and its founder, Sam Bankman-Fried, have built a philanthropic outlook for the world, turned out to be outright fraud and stole customers’ funds. The former CEO was found to be misappropriating customers’ funds and was eventually arrested in the Bahamas on Dec. 11.

Bankman-Fried was extradited to the United States on charges of securities fraud and misappropriation of funds. However, the former CEO managed to secure a bail plea against a $250 million bond paid by his parents who put up their house to cover his astronomical bail bond.

While the arrest of Bankman-Fried and his trial in the U.S. have given some hope to FTX users, the chances of many customers getting back their funds are very slim as lawyers have predicted that it might take years and even decades to get the funds back.

Two back-to-back crypto contagions caused by a series of bad decision-making and the greed of a few, might not be an easy thing to explain to the family. So, own up — everyone makes mistakes in the bull market, thinking they are doing the right thing by getting their family involved.

However, one can always talk about the bright sides and the lessons learned from the mistakes, and the 2022 crypto contagion is no different.

Centralized Exchanges And Coins May Come And Go, But Bitcoin Will Stay

Terra ecosystem’s collapse was a significant setback for the crypto industry —both in terms of value and how the outside world perceives it. Crypto managed to bear the brunt of the collapse and was on its way to redemption, only to face another knock in the form of FTX.

The FTX saga is far from over but it highlighted what corruption and hefty donations can do to your public image even when you have robbed people billions of their money.

The mainstream media frenzy saw the likes of the New York Times and Forbes write puff pieces for the criminal former CEO before the charges were framed against him. Bankman Fried was portrayed as someone who was a victim of bad decisions when FTX and Alameda were involved in illicit trading from day one, as mentioned by SEC in their charges.

The FTX downfall and the crypto contagion are being portrayed by many as the end of trust in the crypto ecosystem. U.S. regulators are warning that it is only the start of the crypto crackdown, with SEC chief Gary Gensler comparing crypto platforms and intermediaries to casinos.

However, any crypto veteran will tell you that the industry has seen much worse and has always bounced back to its feet. While the collapse of the third largest crypto exchange (FTX) is definitely significant, it doesn’t come close to the Mt. Gox hack from the early days of crypto exchanges.

Mt. Gox was once the biggest external factor that cast doubt on the cryptocurrency industry, especially Bitcoin. When the exchange was hacked in 2014, it account for more than 70% of BTC transactions at the time. The hack did have a wild impact on the price of BTC at the time, but the market shot back up again in the next cycle.

Years later, the FTX collapse once again reminded users of the risks involved with centralized entities, triggering a significant movement of funds from centralized exchanges to self-custody wallets.” Self-custody wallets allow users to serve as their own bank, but the trade-off is that wallet security also becomes their sole responsibility.

Crypto users are withdrawing their funds from crypto exchanges at a rate not seen since April 2021, with nearly $3 billion in Bitcoin withdrawn from exchanges in November, moving them to self-custody wallets.

New data from on-chain analytics firm Glassnode shows that the number of wallets receiving BTC from exchange addresses hit almost 90,000 on Nov. 9. The movement of funds away from exchanges are usually a bullish sign that BTC is being “hodled” for the long term.

Every other token might look lucrative in a bull run, as evident from the last one where the likes of LUNA, Shiba Inu broke into the top 10. But today, these projects be it Terra-LUNA or meme coins are either obsolete or far from their bull run hype.

Bitcoin, the original cryptocurrency, has seen downfalls of several major exchanges over the past decade and yet has come up on top of each of those collapses in the next cycle.

This is the reason most early crypto investors and Bitcoin proponents often advocate for self-custody and hodling BTC over investing in new altcoins that might seem lucrative in a bull run, but there is no guarantee that they would make it to the next bull run.

The collapse of these centralized entities in 2022 could also prompt policymakers to eventually come up with some form of official universal regulations to ensure investor security.

The Bottom Line

The core technology of decentralization and Bitcoin, the OG cryptocurrency, is here to stay regardless of the crypto entities involved in facilitating different use cases and services on top of them. 2023 could see a new wave of crypto reforms, with more aware users who believe in self-custody rather than letting their funds sit on exchanges. Also, it’s better not to give out financial advice to anyone, especially in a bull market.

Updated: 12-16-2023

If You Held On for Dear Life, It’s a Merry Bitcoin Christmas!

Blockchain currencies didn’t just survive the collapse of FTX, they’ve been the investment of the year. Turns out, decentralized finance doesn’t need exchanges.

It’s Merry Cryptomas, everybody! Bitcoin is up 167% year-to-date. Ethereum is up 91%. If a massive crypto rally was one of your predictions for 2023 a year ago, I take my hat off to you.

Compare those returns with other asset classes. The NASDAQ is up 36%. The S&P 500 is up 19%. Gold is up 10.7%. If you were long oil or a broad basket of commodities, you are down 10%-12%.

A year ago, many of us thought — I certainly did — that it was game over for crypto and that the naysayers were going to be vindicated.

Sam Bankman-Fried had blown up. (That part didn’t surprise me.) He’s now in jail, having been convicted of seven charges of financial fraud, and his exchange FTX is long gone. The fate of rival exchange Binance hangs in the balance, following an investigation by the Justice Department.

Its founder, Changpeng Zhao, has pled guilty to money-laundering violations, stepped down as CEO and agreed to pay a $50 million fine, while Binance itself has been fined $4.3 billion.

By this time last year, the reputational storm engulfing crypto exchanges had convinced me that the entire edifice of blockchain-based finance was rotten and that I should immediately sell most of the bitcoin (BTC), ether(ETH) and other tokens I had acquired since becoming a convert to crypto back in 2017.

I was a fool. I had forgotten rule No.1 of crypto investing: Once you have bought the stuff, you should always HODL — hold on for dear life.

It is a sign of how wrong I was to SATB (sell at the bottom) that Nouriel Roubini — who a year ago was gloating at the demise of all “shitcoins” — is now (you’ve guessed it) launching his own blockchain-based “flatcoin.”

The more profound lesson of the last 12 months is that the crypto exchanges — or other custodial intermediaries — are not and never were the key to the future of blockchain-based fintech.

The starting point of it all was, let’s not forget, the dream of peer-to-peer transactions without intermediaries such as banks, and without the associated problem of state surveillance.

On reflection, there should never have been a period when crypto was dominated by exchanges, the centralizing role of which was antithetical to the original concept of decentralized finance.

The only reason the exchanges sprang up was the technical trickiness of actually exchanging crypto without an intermediary. Early adopters used a website called LocalBitcoins which functioned like Craigslist.

Users would post ads to buy or sell bitcoins, which they would settle using whatever payment method they chose. It still is tricky, as I can confirm having had my fair of anxiety attacks while using Ledger and Metamask. But it’s getting easier.

Yet the key process of on- and off-ramping to and from crypto is now almost entirely monopolized by regulated exchanges, of which Coinbase looks like the survivor and therefore winner.

Crypto remains a risky industry partly because of the centralization of the nexus between traditional and decentralized finance.

The year-long rally of BTC and ETH is telling us three things.

First, after two decades of historically low inflation, the world is witnessing so much mismanagement of fiat currencies that the appetite for crypto is bound to keep on growing.

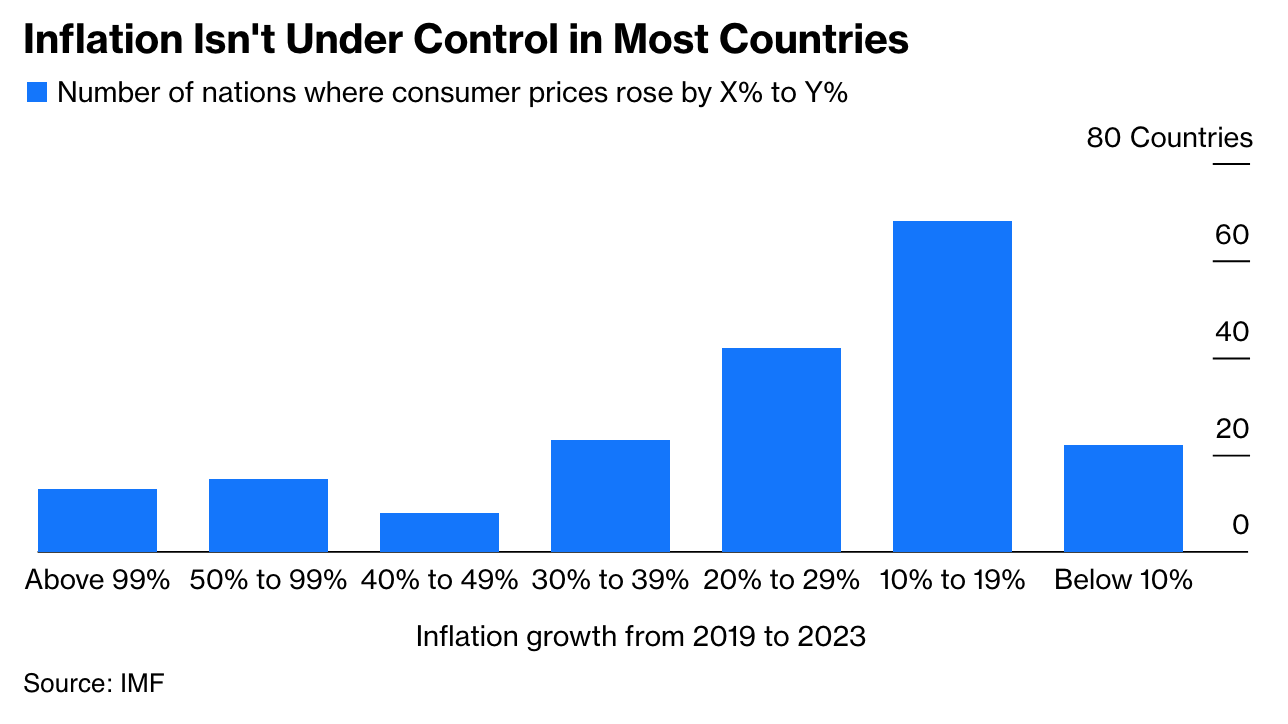

Of the 191 countries in the world for which data are available from the International Monetary Fund, only 22 have seen consumer prices rise by less than 10% since 2019.

A further 68 had four-year inflation of between 10% and 19%; 42 between 20% and 29%; 46 between 30% and 99%; and a sorry 13 have seen prices go up by 100% or more. That last group would be bigger if we had reliable data for Lebanon and Syria this year.

Prices have risen eightfold in four years in Argentina, 103 times in Sudan, 159 times in Zimbabwe and more than 5,000 times in Venezuela.

The more disastrous the inflation, the more attractive crypto becomes. The current mood in Argentina is illustrative. Last Sunday, the libertarian economist Javier Milei was sworn in as president.

Unlike crypto, this was something I got right this year: I assured my Argentine friends all year that, when the inflation rate reaches 100%, voters will choose the radical option, not the mainstream one.

Milei is radical to the point of eccentricity. He wears his hair like an aging Sixties rock star — it almost seems to have escaped from an old Yardbirds album cover.

His presidential baton has a silver engraving depicting his five English mastiffs and their names: Conan (named after his previous dog from whom all five dogs were cloned), Milton after the University of Chicago free-market economist Milton Friedman, Murray after the Austrian-influenced libertarian Murray Rothbard, and Robert and Lucas for Robert Lucas, another great of the Chicago School.

Some English-language media have erroneously lumped Milei together with right-wing populist figures such as Brazil’s Jair Bolsonaro. Milei belongs to a quite different species.

At a time of surging global anti-Semitism, he has announced his intention to convert to Judaism and chose to pay his first foreign visit as president-elect to the grave of an obscure Hasidic rabbi in Queens.

“We have no alternative to a drastic fiscal adjustment,” Milei told the crowd at his inaugural address, warning them of a coming recession. The crowd responded with “Motosierra! Motorsierra!” (“Chainsaw! Chainsaw!”) — a reference to Milei’s promise to slash public spending.

He told them: “No hay plata.” (“We have no more money.”) They cheered. His proposed plan for balancing the budget is the boldest shock therapy the world has seen since Margaret Thatcher’s first term as British prime minister.

Yet it has been explained to Milei that his cherished wish — to switch the Argentine currency to the US dollar — is not a viable option. The central bank lacks the dollars and the very mention of dollarization risks tipping the ailing currency into hyperinflation.

The result is that Argentines who get paid in pesos and save in pesos are bound to see yet more depreciation of their currency, beginning with last week’s deep devaluation.

What Wouldn’t Every Argentine Give For A Fistful Of Bitcoins At A Time Like This?

The second lesson is that crypto has evolved.

Crypto’s first bull market was almost entirely driven by belief in Bitcoin’s potential to provide censorship-resistant digital cash. It was interrupted by the first major hack of the Mt. Gox exchange in 2011, which lost about 25,000 bitcoins.

Although Bitcoin soon recovered, this era ended in 2013 and 2014, following the FBI’s closure of dark web marketplace Silk Road and the collapse of the Mt. Gox exchange, which at that time handled 70% of Bitcoin transactions.

Crypto’s second bull market began around 2016, kicked off by a mania for initial coin offerings (ICOs) launched primarily on the Ethereum network.

ICOs were speculative sales of tokens to retail investors by teams promising to build better smart-contract blockchains to compete with Ethereum.

However, once it became clear that these networks hosted very little useful activity, the industry entered yet another winter.

The 2020 bull market seemed to answer these doubts about utility, beginning with “DeFi Summer” and followed by crazes for decentralized autonomous organizations (DAOs) and nonfungible tokens (NFTs).

It appeared that crypto networks were now hosting activity from actual users, both retail and institutional, though much of it was highly speculative and risky, often involving massive leverage.

It was the excessive risk levels and poor financial engineering that caused the downfall of projects such as Terra and the blowup of funds such as Three Arrows Capital.

Today, the total value of assets locked (TVL) on DeFi smart-contract protocols remains pretty much where it was in 2022. But, according to an analysis by my Hoover Institution colleague Manny Rincon-Cruz, this hides a transition away from high-risk instruments into safer, bond-like assets.

The DeFi protocols with the highest usage during the 2020 bull market were margin-lending platforms and decentralized exchanges.

In contrast, DeFi today is mostly yield-bearing assets, which can include not only interest-bearing lending positions, but also tokenized real-world assets such as Treasury bills.

But the most important yield-bearing assets these days are liquid-staking protocols, which are simply ways for users to delegate their network tokens to validate and secure a blockchain network.

For example, users can deposit their ETH to the Lido protocol, which delegates to a network of Ethereum validators the work of building the transaction blocks on the network to earn fees in ETH, which are then passed back to the users.

(Liquid staking is roughly analogous to users of Bitcoin being able to use bitcoins to participate in bitcoin mining.) The largest liquid-staking protocols today use roughly 56% of all DeFi TVL, up from 0.1% at the start of 2021.

It is unclear what will come of this focus on yield, but it seems likely that the crypto industry in 2024 and 2025 will continue to evolve more useful — and less speculative — ways of using peer-to-peer protocols.

The third lesson of 2023 is that traditional finance continues to adopt crypto, despite the efforts of regulators and legislators to discourage it.

Among the asset managers who have filed paperwork with the SEC this year for exchange-traded BTC and ETH funds are Franklin Templeton and BlackRock, along with the first kid on the block, Grayscale, which created the initial over-the-counter traded BTC fund back in 2013.

Grayscale applied to convert its bitcoin trust into an ETF in 2017, but withdrew after negative comments from the Securities and Exchange Commission. Today, the SEC keeps extending its deadline, which suggests it cannot think of a good enough reason not to approve these ETFs.

Meanwhile, US companies holding crypto will be required to record their tokens at the most up-to-date price or “fair value,” according to a new set of crypto accounting rules issued a few days ago by the Financial Accounting Standards Board.

Adoption Is A Key Reason Why Predictions Of The Death Of Crypto Were Wrong. In The 2018 Revised Edition Of My Book “The Ascent Of Money,” I Made This Point And Should Have Stuck With It:

* Bitcoin is portable, liquid, anonymous and scarce. It is “digital gold” by design. A simple thought experiment would imply that $6,000 is therefore a cheap price for this new store of value. Around 17 million bitcoins have been mined to date.

The number of millionaires in the world, according to Credit Suisse, is 36 million.

Their total wealth is $128.7 trillion. If millionaires collectively decided to hold just 1 per cent of their wealth as Bitcoin, the price would be above $75,000 – higher, if adjustment is made for all the Bitcoins that have been lost or hoarded.

Even if the millionaires held just 0.2 per cent of their assets as Bitcoin, the price would be around $15,000.

That range has been almost exactly right. At its peak in November 2021, the price of bitcoin was $63,621. At its trough a year later, it was $15,460. The current price of $43,000 is roughly the midway point.

The trend of adoption is one you should welcome if, like me, you believe that the law-abiding citizen should not by default have his or her transactions open to government scrutiny.

We read a lot these days about the First Amendment — a feature of the Constitution recently discovered at Harvard when students adopted anti-Israeli chants — not to mention the Second, which tends to feature in Republican primary campaigns. But free speech and the right to bear arms are not the only liberties that concerned the framers.

The Fourth Amendment States:

* The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.

One of the most striking papers I read this year on any subject was “Electronic Cash, Decentralized Exchange, and the Fourth Amendment,” by Peter van Valkenburgh of Coin Center.

The assault on our Fourth Amendment rights, Valkenburgh argues, began in 1970 with the passage of the Currency and Foreign Transactions Reporting Act. This law and its subsequent amendments, along with other related statutes, have come to be known as the Bank Secrecy Act.

The BSA requires banks to keep records of cash purchases of negotiable instruments, to file reports of cash transactions with a daily aggregate amount exceeding $10,000, and to report suspicious activity that might be indicative of money laundering.

The automatic reports that US financial institutions are obliged to produce are known as Currency Transaction Reports and Suspicious Activity Reports (SARs). Banks are reimbursed for their compliance.

In the eyes of some, this legislation was obviously at odds with the Fourth Amendment. “I am not yet ready to agree that America is so possessed with evil,” wrote Justice William O. Douglas in a dissenting opinion, “that we must level all constitutional barriers to give our civil authorities the tools to catch criminals.”

But Douglas — a notably progressive figure with a strong commitment to civil liberties — was in the minority. The BSA was upheld by the Supreme Court in California Bankers v. Shultz (1974) and US v. Miller (1974), which established the principle that, if one hands over financial information to a third party such as a bank, then the information is no longer private.

Today, this third-party doctrine is being challenged because so much of our electronic data is now in third-party hands — those of the big tech companies. Since Carpenter v. US (2018), for example, the authorities require a warrant to obtain an individual’s mobile-phone location history.

Nevertheless, the BSA’s scope continues to expand, partly because cash transactions have declined as a share of total transactions, but also because of the increased surveillance mandated after the 9/11 terrorist attacks. The volume of SARs has soared from 60,000 in 1990s to 3.6 million in 2022.

The possibility created by blockchain technology of true peer-to-peer transactions poses a fundamental challenge to this regime of financial surveillance. As Valkenburgh acknowledges, Bitcoin is not truly “crypto” because identities can be derived from the ledger on which every transaction is indelibly recorded.

However, innovations such as Tornado Cash are now enabling truly anonymous peer-to-peer transactions. There is no third party involved, unless you pretend the software developers are the third party and require them to gather data on users.

Truly decentralized finance, Valkenburgh concludes, “is essential for preserving human dignity and autonomy as the world moves increasingly toward fully intermediated and surveilled payments technologies like Alipay, WeChat, or so-called Central Bank Digital Currencies. … Anonymous electronic cash and decentralized exchange software [are] the endgame for all cryptocurrency networks.”

You do not need to know Senator Elizabeth Warren or SEC Chair Gary Gensler personally to surmise that they will be vehemently opposed to this argument.

They and others are bound to call for BSA obligations to be imposed on crypto software developers as well as the individual users of that software. Yet this would surely be unconstitutional under the Fourth Amendment, as it would amount to a warrantless search and seizure of private information.

The reason the administrative state will likely win this fight is obvious. So long as there are Bankman-Frieds in this world, and terrorists who can benefit from unscrupulous crypto operators, the government will continue to argue, in effect, that the Fourth Amendment must be honored in the breach.

Yet what the government cannot do — even if JPMorgan Chase CEO Jamie Dimon wishes it would — is shut down crypto altogether and leave the dwindling number of American banks to reap the benefits of a monopoly on financial transactions.

Merry Cryptomas everybody. Hold on for dear life to whatever you’ve got. Just don’t expect the Fourth Amendment to protect you.

Updated: 12-22-2023

Bitcoin Christmas: How To Orange-Pill Your Relatives This Holiday Season

This Christmas, unwrap the mystery surrounding Bitcoin, offering a proper orange pill that promises a festive fusion of zest and joy!

Welcome to the merriest time of year, when loved ones may judge or praise you for your interest in Bitcoin or simply ask, “What is that?”

Enlighten family and friends with solid arguments to convince your curious aunt or safeguard yourself from your brother-in-law, who just got his economics degree.

In this jolly exploration, we’ll delve into the world of digital currency enlightenment and discover why Bitcoin maximalists are singing carols about the first cryptocurrency.

Keep It Light

When a family member opens a window to speak about Bitcoin at the Christmas dinner table, you should consider who your audience is. Remember, the goal is not to force someone into accepting Bitcoin but to provide accurate information and allow them to make an informed decision.

Tailoring your approach to the individual or group’s perspective and concerns can contribute to a more positive and constructive conversation.

As you may have experienced before, when asked about Bitcoin, you’ll commonly find yourself in a defensive position and bombarded with skepticism. Recognize the conditions and don’t erupt in passionate counterarguments; be patient and let the arguments do the talking.

Beforehand, prepare some analogies and real-world use cases and rehearse your argument, as it is easy to get lost.

Strong Arguments For Bitcoin

Before You Sit Down At The Christmas Dinner Table, It May Help To Know Some Of The Most Convincing Arguments For Bitcoin Ahead Of Time:

* Scarce Supply: Bitcoin’s fixed supply of 21 million coins makes it a scarce digital asset comparable to precious metals like gold. The scarcity contributes to its value proposition.

* Decentralization: Bitcoin operates on a decentralized network, minimizing the risk of government interference and censorship. This characteristic enhances its resilience as a global, borderless currency.

* Security: Bitcoin’s proof-of-work consensus mechanism ensures a high level of security, making it resistant to attacks and fraud.

* Store of Value: The narrative of Bitcoin as “digital gold” positions it as a reliable store of value, particularly in times of economic uncertainty.

* Network Effect: Bitcoin has the largest and most established network in the cryptocurrency space. This status contributes to its liquidity, recognition and overall strength.

* Censorship Resistance: Bitcoin transactions are censorship-resistant, meaning that individuals can transact without fear of their funds being frozen or confiscated. This aligns with the principles of financial freedom and privacy.

* Hodler Culture: The orange pill narrative embraces the hodler mentality, encouraging individuals to hold onto their Bitcoin for the long term rather than engaging in short-term trading. This strategy aligns with the belief in Bitcoin’s future value appreciation.

* Halving Events: Bitcoin undergoes halving events approximately every four years, reducing the rate of new coin creation. This scarcity mechanism is a bullish factor for Bitcoin’s long-term value.

* Innovation and Development: Ongoing development and innovation by the Bitcoin community, such as the Lightning Network, demonstrate the adaptability and potential for improvement within the Bitcoin ecosystem.

* Global Adoption: Bitcoin’s adoption is increasing internationally as a means of payment, store of value and investment. This trend is seen as a validation of Bitcoin’s growing importance in the financial landscape.

Bitcoin: The Next Step In The Evolution Of Money

Money has had many forms, with shells, salt and precious metals all serving as a medium of exchange. With the rise of empires, governments began issuing paper money, initially representing a claim on precious metals.

The world’s reserve currency, the United States dollar, was initially backed by gold reserves until the transition to fiat currency in 1971. U.S. President Richard Nixon permanently detached money from the gold standard, granting a new form of money in which central financial authorities could rapidly increase the money supply.

Bitcoin proponents claim that this loss of a hard standard has resulted in runaway inflation, with politicians either unwilling or unable to address the core issue.

Amid the economic crisis of 2008, which saw unprecedented government bailouts for banks engaging in risky financial behavior, the pseudonymous Satoshi Nakamoto emerged.

Like Santa on Christmas, this individual brought the gifts for the public in the form of a new evolution of money, Bitcoin.

Bitcoin: Currency Vs. Store Of Value

As stated in the white paper, Nakamoto designed Bitcoin to be a peer-to-peer electronic cash system. Since its inception, Bitcoin has been interpreted in many different ways. Its creator intends it to be a digital currency exclusively for the people.

However, Nakamoto’s vision for BTC has yet to be fully realized. The Bitcoin blockchain can become overloaded with traffic as its usage increases, delaying transaction times and spiking fees.

While Bitcoin can transfer massive wealth across borders at a fraction of the cost of the traditional financial system, in some cases, like paying for a coffee with BTC, it can be expensive due to network costs and slow due to confirmation times.

Fortunately, Bitcoin is an ever-evolving network with a strong community of developers.

There is fierce debate within the community, but the final objective of the Bitcoin developers is to offer a trustable, functional and decentralized currency that can be used for payments. Many solutions have been proposed, including layer-2 solutions.

The Lightning Network (LN) is a second-layer scaling solution for blockchain networks, enabling faster and cheaper transactions by creating off-chain payment channels.

Lightning performs all the computational operations of daily transactions in an independent network, which is connected to the main Bitcoin blockchain.

As all operational computing is done in many pockets of independent networks, the transactions won’t saturate the Bitcoin network. Once in a while, the LN would send the group of trades to the Bitcoin ledger in one transaction so they are registered.

The LN can make BTC a software capable of managing daily payments, using the Bitcoin blockchain for all its positive properties without congesting the network.

There are many upsides to Bitcoin adoption. Anybody with a cheap smartphone and internet access, or even an SMS network, can use BTC.

Micheal Saylor, the former CEO of MicroStrategy and an ardent Bitcoin proponent, considers BTC the perfect modern tool to hedge against inflation created by government-issued fiat currencies.

In one of the best orange pill displays on the Tucker Carlson Show, Saylor highlighted the elephant in the room. For Saylor, the modern middle-class cash dependency forces them to work harder to get paid in a weaker currency in a never-ending cycle.

The potential for Bitcoin as an asset is massive. Due to all its engineered properties, the markets could see Bitcoin as the new digital gold. As an ideal inflation hedge, Bitcoin may shift the markets gradually as institutional investors step in.

It could absorb part of gold’s $12 trillion market cap, as well as the combined real estate and national currencies market caps of around $200 trillion.

A positive collateral effect from this shift in the markets mentioned by Saylor would be the demonetization of utility markets as the monetization of Bitcoin becomes popular. Some speculative markets would eventually return to their original purpose.

Real estate wouldn’t be one of the first choices as a wealth preservation investment, and stocks would price in the actual value of a company instead of being investment vehicles to combat inflation or markets that absorb liquidity injections from money printing.

Bitcoin is Digital Property

In the future, Bitcoin may be a currency or the perfect store of value asset substituting gold. Around the globe, analysts are slowly but steadily grasping the deeper significance of Bitcoin: a digital property. And this may be the key feature.

Nobody has ever figured out how to transform money into digital property. Similar examples include the successful digitalization of photos, books, education, relationships and communications.

These examples are the key to the success of Amazon, Facebook, Microsoft and Apple, which monetized the ability to digitize specific sectors.

Bitcoin may have hit the bull’s eye, monetizing capital property. Its functionalities provide individuals with a new form of property rights in the digital realm.

Bitcoin offers individuals true ownership and control over their wealth without reliance on traditional financial institutions.

Society may have found something with integrity that gives people control over their lives in a world where there is a shared feeling life has gotten out of control. Santa, please pack some sats as presents.

Pro Tips For Sparking Conversations About Cryptocurrency With Your Loved Ones During The Holidays

Tis the season of joy and festivities, and you’re eager to unwrap the exciting tale of Bitcoin’s performance in 2023 to your loved ones.

The prospect of illuminating the financial horizon with this fantastic opportunity is thrilling, but you’re also mindful not to come across as overly fixated or repetitive, lest you miss the chance to share the good news and the incredible investment prospects that lie ahead.

Fear not! In the following paragraphs, we’ve got your back. We’ll show you how to gracefully navigate through the most common questions and concerns about Bitcoin, ensuring crystal-clear understanding for every member of the family. Let the holiday Bitcoin enlightenment begin!

Common Questions And Concerns About Bitcoin

Engaging in meaningful conversations about cryptocurrency, particularly Bitcoin, with your loved ones can help foster a better understanding of this emerging technology. It is an opportunity to educate and dispel misconceptions surrounding Bitcoin.

By having open and honest discussions, you can address concerns and provide valuable insights to your friends and family.

Bitcoin Price Volatility

Now, let’s tackle the elephant in the crypto room – Bitcoin’s price rollercoaster. Bitcoin’s price volatility is a topic that often arises in conversations about cryptocurrency.

It is important to convey that Bitcoin’s price is determined by market forces, similar to stocks and other commodities. Factors such as supply and demand, investor sentiment, and regulatory developments can influence its price.

Bitcoin’s limited supply is a significant factor contributing to its price volatility. Unlike traditional fiat currencies, there will only ever be 21 million bitcoins in existence.

As demand for Bitcoin increases, its price tends to rise. Conversely, if demand decreases, the price may decline. Discussing these factors can help your loved ones understand the dynamics behind Bitcoin’s price fluctuations.

The Concept Of Bitcoin Halving And Its Impact

While the concept of the Halving might be old news to seasoned crypto enthusiasts, some family members might be entering uncharted territory. To ease them into the crypto-sphere, consider kicking off with a brief rundown.

Bitcoin Halving is an event that occurs approximately every four years and has a significant impact on the supply of new bitcoins entering the market.

During a halving, the amount of new bitcoins awarded to miners for validating transactions is cut in half. This reduction in supply, combined with increasing demand, can potentially lead to increased prices.

Explaining the concept of Bitcoin halving and the Impact of Bitcoin Halving on the cryptocurrency market to your loved ones can help them understand why it is viewed as a significant event in the cryptocurrency world.

By discussing the potential impact of Halving on Bitcoin’s value, you can provide valuable insights into its long-term investment potential.

Trust us, when they catch wind of the 2024 Bitcoin Halving in the news, they’ll be grateful for the insights you’ve shared. It’s like being the cryptocurrency whisperer in the family!

Unlocking The Mysteries Of Bitcoin ETFs

Even if the concept of ETFs is more familiar, the concept of Bitcoin ETF may seem like entering uncharted waters. To paint a clear picture for your family, break it down like this: Bitcoin Exchange-Traded Funds (ETFs) are financial instruments that allow investors to gain exposure to Bitcoin without directly owning the cryptocurrency.

These ETFs track the price of Bitcoin and can be traded on traditional stock exchanges. Discussing the potential of Bitcoin ETFs can be a way to introduce your loved ones to the idea of incorporating Bitcoin into their investment portfolios.

It is also worth it to mention that Bitcoin ETFs offer some advantages, such as increased liquidity, ease of trading, and regulatory oversight. They provide an accessible way for investors to participate in the cryptocurrency market.

Finally, you can also explain the difference between Bitcoin and Bitcoin ETFs.

It’s not just about demystifying acronyms; it’s about empowering your loved ones to navigate the crypto landscape with confidence.

How Bitcoin performance impacts my financial life if I want to retire soon?

Those family members that are planning their retirement are going to be really interested in the role of Bitcoin in retirement planning and the benefits of Crypto IRAs for Retirement Investing, because instead of just holding traditional assets like stocks and bonds, a Bitcoin IRA lets them include Bitcoin in the mix. It’s like having a retirement account that moonlights as a crypto enthusiast.

So, with a Bitcoin IRA, they can potentially enjoy the benefits of Bitcoin’s growth without having to stash actual bitcoins under their mattress.

It’s a way to diversify their retirement portfolio and dip into the exciting world of cryptocurrency.

Tips for Having Meaningful Conversations About Bitcoin

Engaging in meaningful conversations about Bitcoin requires effective communication and a willingness to listen and understand different perspectives. Here are some tips to help you have fruitful discussions with your loved ones without sounding like a digital know-it-all:

* Educate Yourself: Before initiating conversations about Bitcoin, make sure you have a solid understanding of its fundamentals. Stay updated on current news and developments in the cryptocurrency space to provide accurate and relevant information.

* Choose the Right Timing: Find an appropriate time to discuss Bitcoin with your loved ones. Avoid bringing up the topic during moments of stress or when they may be preoccupied. Select a comfortable environment where everyone’s relaxed and ready to absorb some crypto wisdom.

* Be Patient and Respectful: Understand that not everyone may share your enthusiasm or knowledge about Bitcoin. Be patient and respectful of differing opinions. Encourage open dialogue, create a safe space for questions and concerns and resist the urge to shout, “To the moon!”

* Use Real-World Examples: Simplify complex concepts by using real-world examples that everyone can relate to. Relating Bitcoin to everyday experiences can help demystify the technology and make it more accessible. Remember, Bitcoin is like the superhero of money – decentralized, unstoppable, and maybe a bit caped.

* Provide Resources for Further Learning: Share reliable sources, such as reputable websites, books, or educational videos, to encourage further exploration and independent learning. Empower your loved ones to educate themselves and form their own informed opinions.

* Surprise a Family Member with the Gift of a Bitcoin Investment: It’s like handing them a golden ticket to the Crypto Express. Who needs another pair of socks when you can unwrap the potential for a thrilling journey into the world of Bitcoin? Not only will you pique their interest, but you might just spark a crypto-flame that keeps on burning long after the holiday lights dim. Get ready for the “Oh wow, you’re the coolest gift-giver ever!” reactions.

Addressing Security Concerns In Bitcoin Conversations

When discussing Bitcoin with your loved ones, it is important to address any security concerns they may have. While Bitcoin itself is secure, the responsibility lies in safeguarding private keys and using reputable platforms, such as BitcoinIRA1, for transactions and storage.

Additionally, educate your loved ones about the importance of using reputable cryptocurrency platforms for buying, selling, or trading bitcoins. Research and recommend platforms with strong security measures, such as two-factor authentication and cold storage of funds.

By addressing security concerns head-on, you can alleviate fears and instill confidence in your loved ones when it comes to engaging with Bitcoin.

Conclusion: The Power Of Open And Honest Conversations About Cryptocurrency

Engaging in meaningful conversations about Bitcoin with your loved ones can create a space for learning, understanding, and dispelling misconceptions. By providing accurate information, addressing concerns, and encouraging independent exploration, you can help your friends and family develop a well-rounded understanding of the potential benefits and risks associated with Bitcoin.

Remember to approach these conversations with patience, respect, and a willingness to listen. Each person may have their own perspectives and concerns, and it is important to create an environment where everyone feels comfortable sharing their thoughts.

So, gather your loved ones, bring out the popcorn, and let the Bitcoin banter begin. Now, go out there and spread the crypto love!

Open an account at BitcoinIRA.com to start exploring the possibilities of including Bitcoin in your investment strategy. With expert guidance and a user-friendly platform, Bitcoin IRA can assist you in navigating the world of cryptocurrencies and making informed decisions.

Updated: 12-23-2023

Bitcoin Will Close 2023 As One Of The Top-Performing Assets, Up 160%

Despite tight macroeconomic conditions and headwinds in the crypto industry, Bitcoin is up more than 160% in 2023, fueled by the excitement over ETF proposals.