Some Governments Turn Against Deep-Sea Mining In The Face Of Increase In Demand For Metals

A UN-affiliated organization meets this week to negotiate regulations that could allow seabed mining to begin as soon as 2024, despite warnings from scientists about a potential environmental catastrophe. Some Governments Turn Against Deep-Sea Mining Inspite Of Increase In Demand For Metals

As battery makers scramble to procure cobalt, nickel and other metals to meet rising consumer demand for electric cars, governmental opposition to strip-mining the seabed for minerals is mounting.

Related:

Giant Batteries Supercharge Wind And Solar Plans

Ultimate Resource On Small And Mega-Battery Innovations And Facilities

California Wants Its Salton Sea Located In The Imperial Valley To Be ‘Lithium Valley’

Ultimate Resource On Hydrogen And Green Hydrogen As Alternative Energy

Things Utilities Can Do To Strengthen The Grid Includes Deploying MicroGrids

French President Emmanuel Macron, meanwhile, expressed his opposition to seabed mining in June at the United Nations Ocean Conference in Lisbon, Portugal.

UN members states must “create the legal framework to stop high sea mining and to not allow new activities putting in danger these ecosystems,” Macron said on the sidelines of the conference on June 30.

The pronouncements are striking, observers say, because those nations are members of the International Seabed Authority, the UN-affiliated organization created to regulate deep-sea mining.

Three of the countries — Chile, Fiji and France — sit on the ISA Council, the organization’s 36-nation policymaking body that is meeting for the next two weeks in Kingston, Jamaica, to negotiate regulations that could allow mining to begin as soon as 2024.

Matthew Gianni, a longtime ISA observer and a founder of the Deep Sea Conservation Coalition, said in an email that he expects other nations to join the call for a moratorium.

“Countries are finally recognizing the concerns expressed by scientists regarding the likely damage to the environment, fisheries, migratory species, biodiversity and ecosystem services such as carbon sequestration if deep-sea mining is permitted to go forward,” said Gianni, whose Amsterdam-based alliance represents more than 100 environmental groups and other non-governmental organizations.

Pradeep Singh, an ocean governance scholar at the University of Bremen in Germany who studies the seabed authority, said the push for a moratorium by ISA member states “is a turning point in the negotiations” over deep-sea mining.

“These calls for a pause or moratorium certainly do question the legitimacy” of seabed mining, Singh said in an email.

Ambassador Gina Guillén Grillo, who serves as Costa Rica’s permanent representative to the ISA and a delegate to the Council, said, “My country has many concerns regarding the push for starting the mining phase so soon.

There is basically no information on the flora, fauna and ecosystems in the deep sea and seabed.”

“We have to remember that the seabed and its resources belong to humankind, so member states might also decide they don’t want to mine,” she added in an email. “They might instead wish to explore the potentiality of the amazing biodiversity for medicine, space aeronautics, cosmetics, fire resistance, etc.”

Google and automakers BMW, Renault, Volkswagen and Volvo have pledged not to use deep-sea metals for the time being, and 623 marine scientists and policy experts have signed a petition advocating a pause in seabed mining.

The ISA did not respond to a request for comment on the calls for a moratorium.

The UN Convention on the Law of the Sea treaty established the ISA in 1994 to regulate deep-sea mining in international waters for the “benefit of mankind as a whole” while ensuring “effective protection of the marine environment.”

“This obligation is absolute, we cannot disregard it,” said Guillén Grillo. “We need time, resources for marine scientific research and for the whole international community to become involved.”

The ISA consists of 167 member states and the European Union. The US is not an ISA member as it has not ratified the treaty but participates in the organization’s proceedings as an observer.

Since 2001, the ISA has issued exploration contracts to state-backed enterprises, government agencies and private companies to prospect for minerals over more than 500,000 square miles of the seabed in the Atlantic, Indian and Pacific oceans.

Still, ISA has yet to approve mining regulations. Once it does, those contractors can apply for an exploitation license to start mining. Each mining contractor must be sponsored by an ISA member nation and pay it and the ISA royalties on the minerals mined.

Mining contractors have argued that deep-sea mining will have less of an environmental impact than terrestrial mining and is necessary to provide the metals needed for a transition to a fossil fuel-free future.

The ISA Council had spent years working on mining regulations when in June 2021, Nauru, a small Pacific island nation, upended negotiations by triggering a clause in the Law of the Sea treaty that requires the seabed authority to approve mining regulations within two years.

Nauru is the sponsor of a subsidiary of The Metals Company, a Canadian-registered mining venture. If the ISA does not approve regulations by July 2023, it may be compelled to provisionally issue a mining license to The Metals Company under whatever environmental protections for the seabed are in place at the time.

Before Nauru triggered the two-year rule, The Metals Company had told potential investors it expected to begin mining in 2024, according to US securities filings. The company had also estimated it will earn $95 billion from one area of the Nauru concession over 23 years of production.

It said it expects to pay 7.6% of those revenues in royalties to Nauru and the ISA. The company’s share price declined to a 52-week low of 79 cents on Friday before closing at 88 cents.

“I don’t think a moratorium will become a reality,” Gerard Barron, chief executive officer of The Metals Company, said in a statement. “It would only curtail the deep-sea research the environmental NGOs are calling for and which TMC is undertaking in collaboration with leading independent research institutions.”

“Last year alone we spent tens of millions of dollars on our science program and research teams clocked more than 170 days at sea carrying out studies that help us all better understand the deep-sea environment, in order to protect it,” he added.

The company holds ISA contracts to prospect for minerals in the Clarion-Clipperton Zone, a vast expanse of the Pacific Ocean between Hawaii and Mexico.

The CCZ holds billions of polymetallic nodules, potato-sized rocks rich in cobalt, nickel, manganese and other minerals that formed over tens of millions of years at depths of 13,000 feet.

The Metals Company has been testing prototypes of mining systems to collect nodules on the sea floor and transport them to a surface ship. If mining proceeds, Southern California ports are likely to serve as base of operations for some mine sites in the Pacific.

Scientists estimate that the nodules are habitat for half of the larger species in the CCZ. A study published July 7 in the journal Science found that industrial noise from a single mine in the CCZ could affect marine life within a 310-mile radius, adding to research documenting potentially harmful impacts of mining. Most species in the CCZ are new to science and up to 75% remain to be discovered, according to researchers.

“Part of the problem is that we don’t really know how sensitive these deep-sea species are to noise pollution but we do know they live in a very quiet environment generally,” said deep-sea scientist Craig Smith, a co-author of the paper and an emeritus professor at the University of Hawaii.

Smith, a leading expert on the CCZ, said the potential ecological consequences of noise from mines that would operate around the clock for 30 years have been largely overlooked by regulators and mining companies .

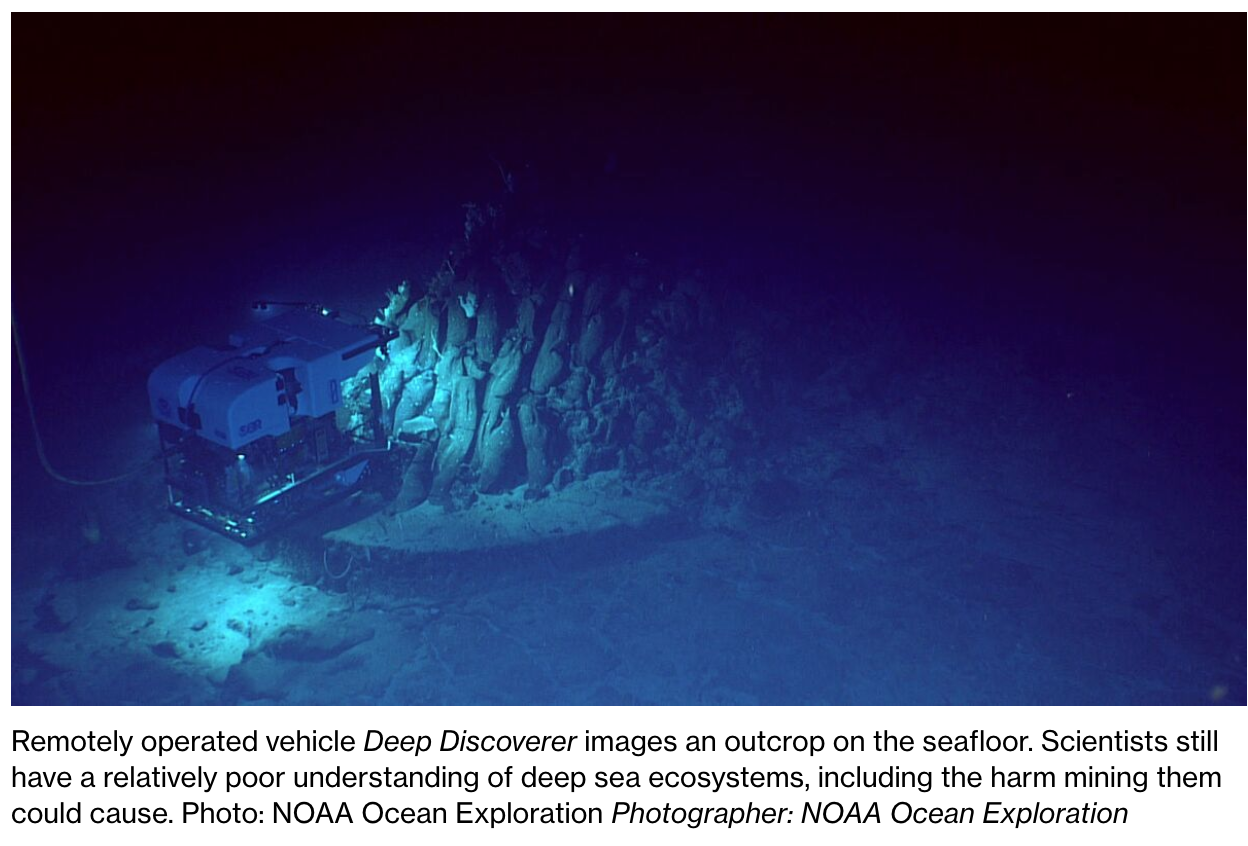

An exhaustive review of all available research on areas of the deep sea targeted for exploitation released in March concluded that a lack of scientific knowledge about those ecosystems precludes effective management of mining.

The authors of the paper published in the journal Marine Policy included prominent scientists and four members of the ISA committee that writes mining regulations.

Some member nations have long complained of a lack of transparency at the ISA while scientists, environmental groups and former ISA staffers have accused the organization and its administrative arm, the Secretariat, of being too close to the mining companies it regulates.

Those issues are likely to arise over the next two weeks at the ISA Council meeting in Jamaica, where a move to a smaller venue will limit attendance by outside observers and at least one journalist has been denied credentials to cover the conference.

Andrew Thaler edits the DSM Observer, a trade publication that covers the deep-sea mining industry and the ISA. Before the Covid-19 pandemic, he said DSM Observer reporters had regularly attended ISA conferences in Kingston.

But Thaler’s request for press credentials for this week’s meeting was denied because the ISA determined that his publication was not a “bona fide” media organization, according to an email denying accreditation.

“It does not seem that the Secretariat is particularly interested in engaging with media at the current moment,” said Thaler.

The ISA did not respond to a request for comment on media outlets denied access to the meeting.

Updated: 11-7-2022

More Governments Are Turning Against The Rush To Mine The Deep Sea

At least 10 countries that are members of an international body regulating ocean mining want to pause the practice because of a lack of scientific data on its environmental impact.

As world leaders gather at the United Nations climate summit in Egypt this week, another international meeting is underway in Jamaica to decide the fate of the planet’s oceans.

The UN-affiliated International Seabed Authority is convening in Kingston to fast-track regulations that could allow the mining of fragile and biodiverse deep sea ecosystems for valuable metals as soon as 2024.

But as the ISA Council, the organization’s policymaking body, concluded its first week of meetings on Friday, a growing number of countries were calling for a halt to the rush to enact mining regulations by July 2023, a deadline established last year.

Among the Council’s 36 member states, Germany, France, Spain, Costa Rica, New Zealand, Chile, Panama, Fiji and the Federated States of Micronesia last week demanded a “precautionary pause” or a moratorium on mining due to a lack of scientific data on the areas of the seabed targeted for exploitation.

On Monday at COP27 in Egypt, French President Emmanuel Macron called for an outright ban on deep sea mining.

Meanwhile, Brazil, the Netherlands, Portugal, Singapore, Switzerland and other Council members also indicated they would not approve any mining contracts until sufficient environmental protections for unique deep ocean ecosystems are in place, regardless of the July deadline.

Some nations, however, including the United Kingdom and Norway, expressed confidence that the regulations could be finalized by the deadline. China cautioned against focusing “single-handedly on only the protection of the environment.”

“Given the amount of work still before us…the likelihood that the regulations and standards and guidelines will be finalized by July 2023 is close to zero,” Ambassador Hugo Verbist, head of Belgium’s delegation, told the Council on Friday. “Uncertainty, especially legal uncertainty, is the last thing anyone needs as far as deep sea mining is concerned. The stakes for mankind are too high.”

Panama’s representative, Roger R. González, told the Council on Monday that his country “would not support any system that puts the protection of the marine environment on a second level.”

“We need to ensure future generations are not harmed,” he added. “We need to make decisions based on science and have a clear vision of our intergenerational responsibility.”

A comprehensive review of available research on areas of the deep ocean set for exploitation, published in March in the journal Marine Policy, concluded that a lack of scientific knowledge about those ecosystems precludes effective management of mining. The paper’s authors included prominent scientists and four members of the ISA committee that writes mining regulations.

Mining companies have argued that deep-sea mining will have less of an environmental impact than terrestrial mining and is necessary to provide the metals for electric car batteries and other green technologies needed to combat climate change.

Pradeep Singh, an ocean governance scholar at the University of Bremen in Germany who studies the ISA, said the organization’s charter requires the Council’s 36 member nations to reach a consensus for mining regulations to be approved.

“The presence of one formal objection would result in a deadlock,” Singh said in an email. He’s attending the Council meeting as a representative for the International Union for Conservation of Nature, an accredited ISA observer.

The ISA, which includes 167 member nations and the European Union, was established in 1994 by the United Nations Convention on the Law of the Sea treaty to regulate mining in international waters while ensuring the protection of the marine environment.

Over the past 21 years, the ISA has issued exploration contracts to state-backed enterprises, government agencies and private companies to prospect for minerals over more than 500,000 square miles of the seabed in the Atlantic, Indian and Pacific oceans.

Each mining contractor must be sponsored by an ISA member nation, which is responsible for ensuring compliance with environmental regulations.

The mounting resistance among ISA member nations to fast-tracking regulation comes as investigations by Bloomberg Green, the Los Angeles Times and the New York Times have revealed the closeness of the ISA Secretariat, the organization’s administrative arm, to the mining companies the Authority regulates and the influence some of those companies exert over small Pacific island nations that sponsor their contracts.

Until last year, the ISA Council had been slowly negotiating regulations that would allow mining to proceed.

Then in June 2021, Nauru, a Pacific island nation with a population of 8,000, triggered a provision in the Law of the Sea treaty that requires the ISA to complete regulations within two years.

Nauru is a sponsor of a subsidiary of The Metals Company, a Canadian-registered company formerly known as DeepGreen that also holds mining contracts sponsored by two other small Pacific island nations.

If the ISA does not approve regulations by July 2023, it may be required to provisionally approve The Metals Company’s application for a mining license under whatever environmental protections are in place at the time.

Nauru triggered the two-year rule after The Metals Company told potential investors it expected to begin mining in 2024, according to US securities filings. The Metals Company’s shares closed at 85 cents on Friday.

The company recently completed a test-mining operation in a region of the Pacific Ocean between Hawaii and Mexico called the Clarion-Clipperton Zone.

It sent a robot more than 10,000 feet (3,000 meters) below the sea to collect 3,600 metric tons of polymetallic nodules, potato-sized rocks rich in cobalt, nickel and other minerals.

The nodules, which scientists estimate are habitat for half of the larger species in the CCZ, were transported through a riser to a surface ship.

At a July Council meeting, some nations objected to The Metals Company’s environmental-management plan for the test mining, with Germany saying it “included only rudimentary environmental data.” The plan was revised and ISA Secretary-General Michael Lodge informed the Mining Company that the mining could proceed.

The United States is not a member of the ISA, as it has not ratified the Law of the Sea Treaty, but the country participates in the organization’s meetings as an observer. US delegate Gregory O’Brien told the Council on Friday that, “It is difficult to see how there would be measures in place to ensure effective protection for the marine environment from harmful effects” of mining by July 2023.

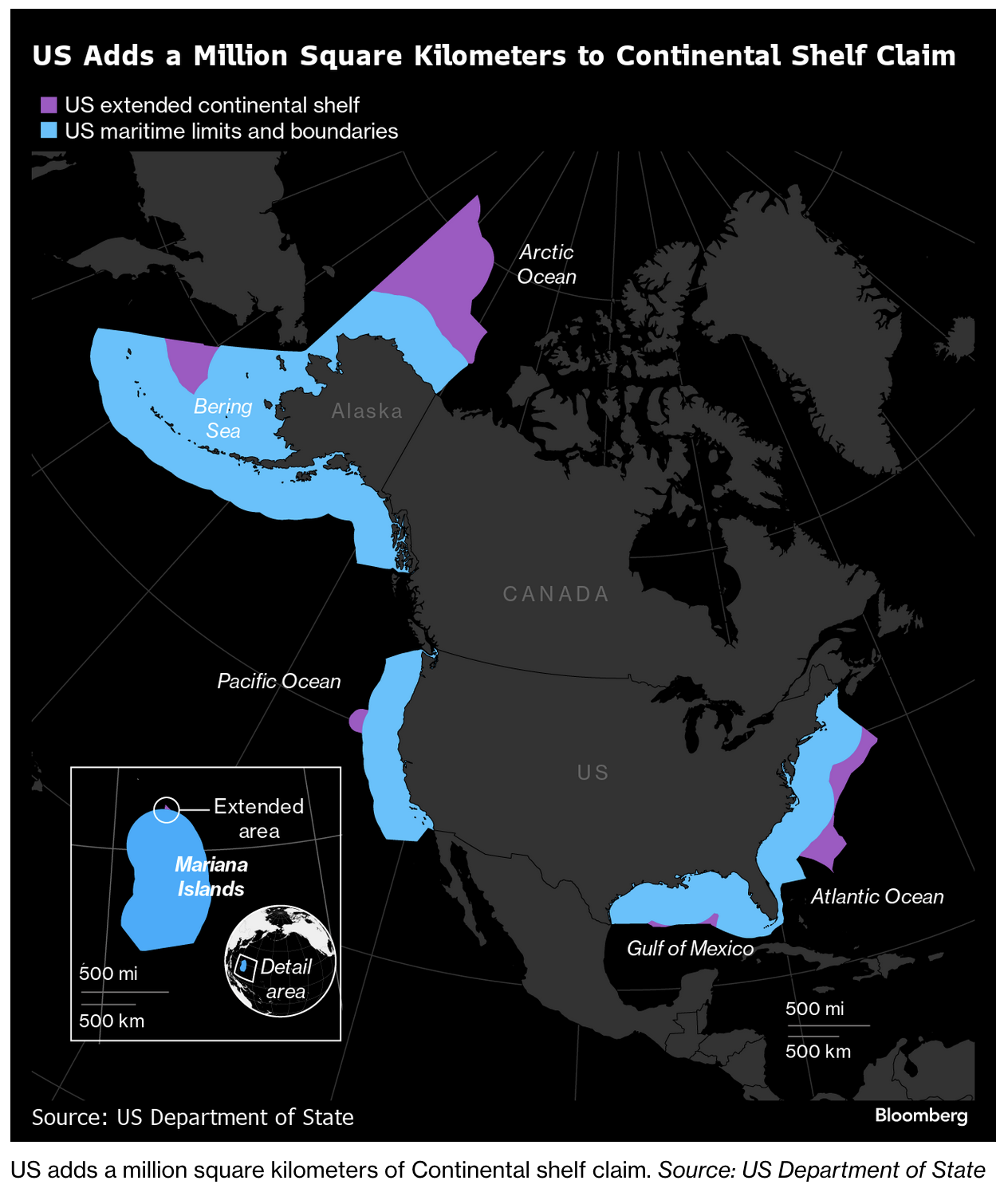

“The United States’ Exclusive Economic Zone and continental shelf are immediately adjacent to the Clarion Clipperton Zone,” he said. “A broad range of interests, including those of our indigenous communities that rely on an accessible and sustainable marine environment, have the potential to be directly impacted by negative impacts and effects from exploitation activities.”

France was even more dismissive of the 2023 deadline. “France does not consider the bound by any timeline, including the two-year rule,” Ambassador Olivier Guyonvarch told the Council. “No exploitation contract can be authorized by the Authority as long as the legal framework that sufficiently protects the environment will not be in place.”

In a phone interview from Jamaica, Matthew Gianni, a longtime ISA observer and a founder of the Deep Sea Conservation Coalition, said the past week made clear that a growing number of countries would not vote to approve any mining contracts after July 2023 without strong environmental regulations.

“It is becoming more and more obvious that states are going in a direction toward conservation and science,” said Gianni, whose Amsterdam-based alliance represents more than 100 environmental groups and other non-governmental organizations.

Updated: 11-10-2022

France Puts Future of Deep Sea Mining In Doubt

The country’s call for an international ban on mining fragile ocean ecosystems disrupts negotiations to allow exploitation of the seabed to begin by 2024.

Citing climate change, France on Thursday called for an international ban on deep sea mining, upending negotiations by a UN-affiliated organization to allow the exploitation of unique ocean ecosystems for valuable metals to begin within two years.

“As the effects of climate change become increasingly threatening and the erosion of biodiversity continues to accelerate, today it does not seem reasonable to hastily launch a new project, that of deep seabed mining, the environmental impacts of which are not yet known and may be significant for such ancient ecosystems which have a very delicate equilibrium,” French Ambassador Olivier Guyonvarch told the International Seabed Authority at a meeting of its policymaking Council in Kingston, Jamaica.

The United Nations Convention on the Law of the Sea treaty established the ISA in 1994 to regulate mining in international waters while at the same time ensuring the protection of the marine environment.

After years of negotiations to develop mining regulations, ISA member nation Nauru in 2021 triggered a provision in the treaty that requires the Council to approve those regulations within two years.

Otherwise, the Council may be compelled to provisionally approve an application for mining by The Metals Company, a Canadian-registered seabed mining venture sponsored by Nauru, a tiny Pacific island nation. Nauru, like other ISA member states that sponsor mining contractors, would receive royalties from any seabed mining.

Over the past two weeks, a growing number of member states of the ISA, which includes 167 countries and the European Union, have called for a “precautionary pause” or moratorium on mining due to the lack of scientific data on fragile and biodiverse deep ocean ecosystems targeted for exploitation.

Among the countries demanding a pause are Germany, France, Spain, Costa Rica, New Zealand, Chile, Panama, Palau, Fiji and the Federated States of Micronesia.

Meanwhile, Brazil, the Netherlands, Portugal, Singapore, Switzerland and other Council members have indicated they would not approve any mining contracts until sufficient environmental protections for the seabed are in place, regardless of a July 2023 deadline to adopt regulations.

Then on Monday at the COP27 climate summit in Egypt, French President Emmanuel Macron advocated a complete ban on deep sea mining. Guyonvarch, the head of France’s delegation to the ISA, formally proposed such a ban at Thursday’s Council meeting, saying the world had changed since the ratification of the Law of the Sea Treaty.

At the time, the deep sea was widely considered a muddy, lifeless abyss, albeit one rich in cobalt, nickel and other metals potentially worth trillions of dollars.

Scientists now believe the seabed set to be mined is among the most biodiverse places on the planet, with a role in the global climate that remains little understood.

“When the ISA was created…almost 30 years ago now, the challenges that we face today, the urgency of climate action and the collapse of biodiversity and its ecosystem services, were not the same,” said Guyonvarch.

France’s call for a ban drew rebukes from other ISA members. The Cook Islands, which sponsors a mining company, asked whether France would relinquish its seat on the 36-member Council and give up the two mining contracts it sponsors. “We hope France will reconsider its position,” Cook Islands’ delegate said.

Representatives from Norway, Singapore, Poland, Canada and other countries also questioned France’s position and reiterated their support for the development of mining regulations.

Other nations, including Costa Rica, Chile and Germany, welcomed France’s statement as reinforcing their own call for a pause in the rush to adopt mining regulations.

“The link between climate change and the ocean is clear,” said Clement Yow Mulalap, the representative for the Federated States of Micronesia. “As a small developing island state, my country is particularly concerned about the cascading changes on the marine environment from climate change.”

Updated: 1-5-2023

Regulations Set To Be Issued This Year Will Determine Course of Deep-Sea Mining

The Metals Co. is an early mover in the field for deep-sea exploration for battery metals, but warns of a coming funding crunch.

Deep-sea mining for battery materials has gained significant interest over the past year, but 2023 is set to be a key turning point—both for the practice itself and the companies that are leading the campaign to exploit the ocean floor.

Mining of the deep sea could be licensed worldwide as early as July of this year, despite worries that one of the world’s last largely untouched habitats could face significant harm from doing so.

For startups such as Canadian miner the Metals Co., the approval could determine whether or not it can attract future investment.

The International Seabed Authority, a United Nations observer organization, is drawing up a regulatory framework for deep-sea mining based on data collected from explorations conducted by TMC and other ventures to inform its decisions.

However, the prospect of such mining is coming under criticism. Most recently, French President Emmanuel Macron specifically called for the prohibition of seabed exploitation during November’s United Nations COP 27 climate change conference in Egypt.

Previously, Germany, New Zealand and multiple Pacific nations have also called for moratoriums.

The ISA is expected to meet member nations in March, when deep-sea exploration and its regulations are expected to be discussed.

TMC started conducting pilot testing in September 2022 to determine whether deep-sea mining would harm the environment. It holds three exploration licenses to harvest polymetallic nodules, or rocks, from the seafloor to extract battery metals that can be used for electric vehicles.

For most mining companies, exploration licenses usually are a significant step in attracting funds, but the lack of clarity around the legality of deep-sea mining is creating a barrier. One of TMC’s major investors, Norway’s Storebrand AS A, pulled out of the firm last month, citing concerns about environmental destruction of the seafloor.

TMC warned in November that if it didn’t raise sufficient funds, it might “be forced to delay our exploration and/or exploitation activities or further scale back our operations, which could have a material adverse impact on our business and financial prospects.”

TMC shares are also at risk of delisting from the Nasdaq, which would limit them to over-the-counter trading, an additional hurdle to the company’s ability to tap cash through loans or stock sales.

To avoid delisting, TMC shares must trade above $1 for 10 consecutive business days by June 5. Its share price closed at 72 cents on Tuesday, putting its market cap just above $192 million. Gerard Barron, chairman of TMC, calls the delisting notice a nonevent that could be easily solved by consolidating its shares.

TMC hasn’t shown a profit since it went public in 2021 and held $66.9 million of cash as of Sept. 30, 2022, according to Securities and Exchange Commission filings. It spent $46.8 million during the first nine months of last year.

At its current spending rate and without a fresh infusion of cash, the company would have roughly a year’s worth of capital on hand, said Dmitry Silversteyn, a senior research analyst at Water Tower Research LLC.

TMC filed a shelf registration statement with the SEC in September, indicating its intent to raise more money. The company would prefer to raise capital from investors and strategic partners rather than dilute shareholders, Mr. Barron said.

TMC only raised a fifth of its fundraising ambitions when it went public in 2021 via a merger with a special-purpose acquisition company.

However, strategic partner Allseas Group SA, which built TMC’s exploratory shipping vessel, did agree in November to take a $10 million payment in TMC common shares, rather than in cash.

TMC remains key but not imperative to the lobbying push to change or confirm regulations on mining of the deep sea, industry participants said. “To be clear, TMC is a catalyst in this scenario, but the drive to open up the deep sea to strip-mining isn’t only coming from them,” Emma Wilson, policy officer at environmental campaign group the Deep Sea Conservation Coalition, said.

As of mid-November, TMC, through its subsidiary Nauru Ocean Resources Inc., has collected 4,500 metric tons of polymetallic rock from the Clarion-Clipperton Zone of the Pacific Ocean and lifted 3,000 metric tons that contain nickel, cobalt and manganese to the surface, the company said.

TMC doesn’t plan to refine the nodules itself and is looking to sell them, once permitted.

Updated: 3-22-2023

Deep Sea Mining Just Lost Its Biggest Corporate Backer

As activists accuse International Seabed Authority leadership of pushing ocean mining without due diligence, Lockheed Martin is exiting the nascent industry.

A growing number of countries are calling to delay plans to strip-mine the seabed for metals to make electric car batteries as US defense giant Lockheed Martin Corp., the biggest corporate player in deep sea mining, exits the nascent industry.

Last week’s sale of Lockheed’s UK Seabed Resources subsidiary to Norwegian startup Loke Marine Minerals was announced just as the United Nations-affiliated organization tasked with regulating deep sea mining kicked off a conference in Jamaica.

The International Seabed Authority (ISA) is meeting to hit a July deadline for approving regulations that would allow unique deep ocean ecosystems to be mined as soon as 2024.

Tensions at the conference are rising as scientists, lawyers and activists charge the Authority’s administrative arm, known as the Secretariat, with pushing a pro-mining agenda.

Last week, some of the ISA’s 167 member nations accused ISA Secretary-General Michael Lodge of overstepping his role as a neutral administrator.

As the conference got underway, the UK’s delegate also revealed Lockheed’s effective withdrawal from the industry, with the sale of UK Seabed Resources for an undisclosed price. “Following a detailed analysis of the business it was clear that there was a better owner for our UK Seabed Resources (UKSR) business,” a Lockheed Martin spokesperson said in an email.

Lockheed’s interest in deep sea mining dates to the 1970s, and its British subsidiary has held ISA licenses since 2013 to explore the seabed for cobalt, nickel and other metals. (The company retains US licenses, issued decades ago, to explore for minerals in the Pacific Ocean.)

Lockheed’s sudden departure from deep sea mining — just as the industry reaches the possible cusp of commercialization — leaves no Western mining contractor with pockets deep enough to finance the billions of dollars needed to launch a seabed mining operation.

The ISA conference is taking place amid rising demand for cobalt, nickel and other metals used to make batteries for electric cars, and comes less than two weeks after 193 nations reached agreement on a landmark treaty to protect marine biodiversity in international waters.

Pressure to delay or ban implementation of seabed mining centers on the lack of scientific knowledge about deep sea ecosystems targeted for exploitation.

On Thursday, UK delegate Gavin Watson told the ISA Council, the organization’s 36-nation policymaking body, that his country would not support “the issuing of any exploitation licenses for deep sea mining projects unless and until there is sufficient scientific evidence about the potential impact on deep sea ecosystems systems.”

Amid the growing strain, multiple accredited ISA observers said Secretariat staff on Monday threatened them with expulsion for taking photos and video of the conference proceedings and ordered them to delete files from their phones.

Accredited observers also include the US, the Holy See and other nations that are not ISA member states.

“There was an ISA staff member positioned above the observers all day to essentially police our behavior, which was certainly very unnerving,” said Diva Amon, a deep sea scientist representing the Deep Ocean Stewardship Initiative at the meeting.

Amon, a longtime participant at the ISA, was the 2018 recipient of a research award from the secretary-general.

Arlo Hemphill, Greenpeace USA’s lead for deep sea mining and ocean sanctuaries, said he was approached by a Secretariat staffer as he charged his phone.

“This woman came over to me and said, ‘I was told you were filming.’ I said I wasn’t and then she told me if I was caught filming, she would rip my badge off and remove my credentials,” said Hemphill, who has attended six ISA meetings. “It felt very authoritarian.”

Duncan Currie, an international lawyer and representative of the Deep Sea Conservation Coalition, an accredited ISA observer, said he witnessed Secretariat staff ordering observers to put down their phones.

A video reviewed by Bloomberg Green shows Secretariat employees standing behind a group of observers and then approaching them when they appeared to be taking photos.

An ISA spokesperson said in a statement that only journalists are permitted to shoot photographs and video at ISA proceedings. The policy they cited, however, refers only to accredited media, not observers.

On Sunday, The New York Times published a March 16 letter that a German government minister sent to Lodge, objecting to what she characterized as his improper interference in delegates’ discussions of alternatives to approving mining licenses should regulations not be in place by July.

“In the past, you have actively taken a stand against positions and decision-making proposals from individual delegations,” wrote Franziska Brantner, Germany’s minister for economic affairs and climate action. All ISA member states “must be able to trust that the Secretariat will respect its duty of neutrality. “

Lodge replied the next day. “This is untrue and I reject such a baseless allegation,” he wrote in a March 17 letter to Brantner posted by the Times.

The ISA spokesperson said the Authority “is fully committed to protecting the marine environment and regulating economic, exploratory and scientific activity in the deep sea,” adding:

“The role of the Secretariat is not to pass judgment on the position of member states, but to facilitate negotiations and ensure that discussions are informed by the best available science.”

But the Secretariat has at times appeared less than neutral. The organization created a video and coloring pages for children about deep sea mining so they can “learn about the deep sea, its incredible creatures, its environment and the work of ISA to explore and protect it.”

And souvenirs for sale at the ISA meeting in Jamaica include “nodule bracelets,” a reference to polymetallic nodules set to be mined on the seabed. Scientists estimate polymetallic nodules are the habitat for half of the larger species found in the region of the Pacific Ocean targeted for mining.

Costa Rican Ambassador Gina Guillén Grillo on Monday tweeted that, “Member states should drive the International Seabed Authority: decisions must come from them & must not be pushed by those who have only administrative duties. Mining the seabed cannot be rushed because of the economic interests of a few.”

The ISA was established by UN treaty in 1994 to regulate the industrialization of the seabed in international waters and to ensure the protection of the marine environment.

Since 2001, the Authority has issued exploration contracts to state-backed enterprises, government agencies and private companies to prospect for minerals over more than 500,000 square miles of the seabed in the Atlantic, Indian and Pacific oceans.

As part of that process, each mining contractor must be sponsored by an ISA member nation, which is responsible for ensuring compliance with environmental regulations.

But investigations by Bloomberg Green, the Los Angeles Times and The New York Times have revealed the closeness of the Secretariat to the mining companies the Authority regulates, as well as the influence some of those companies exert over small Pacific island nations that sponsor their contracts.

In speeches, Lodge has downplayed the potential environmental impact of seabed mining and decried what he describes as inaccurate media coverage of the ISA. In 2020, he threatened to sue Radio New Zealand for defamation for referring to him as “cheerleader” for the seabed mining industry.

The ISA Council had spent more than six years laboriously deliberating regulations that would allow mining to move forward, with a non-binding 2020 target for completing them.

Then in June 2021, Nauru, a Pacific island nation with a population of 8,000, invoked a provision in a UN treaty that requires the ISA to finish regulations within two years.

Nauru is a sponsor of a subsidiary of The Metals Company, a Canadian-registered venture formerly known as DeepGreen that also holds mining contracts sponsored by two other small Pacific island nations.

If the ISA does not approve regulations by July, it may be required to provisionally approve The Metals Company’s application for a mining license under whatever environmental protections are in place at the time.

That prospect has prompted France, Germany, France, Spain, Costa Rica, New Zealand, Chile, Panama, Palau, Fiji and the Federated States of Micronesia to call for a moratorium or pause on deep sea mining.

Brazil, Belgium, the Netherlands, Portugal, Singapore, Switzerland and other countries have indicated that they would not approve any mining contracts until adequate environmental protections for the seabed are enacted.

“The ocean’s health, people and natural ecosystems are already reeling from pollution, overfishing, acidification and extreme weather events,” said Hinano Murphy of French Polynesia, one of the indigenous representatives from the Pacific who addressed the Council on Monday. “With a ban on deep sea mining, however, we see the chance to stop the needless damage before it starts.”

Updated: 5-25-2023

Thousands of New Species Discovered In Ocean Area Targeted By Deep-Sea Miners

Ninety percent of seafloor animals found are new to science, including shrimplike arthropods, worms and sponges.

A remote area of the Pacific Ocean seafloor contains mineral-laden nodules that could power electric-vehicle batteries, wind turbines and consumer electronics.

However, researchers recently discovered that 90% of the marine creatures living near the potato-size nodules are new species, challenging the idea that the vast mining area is an ecological wasteland.

Researchers from the Natural History Museum London analyzed samples of bottom-dwelling animals collected on expeditions to the 2.3 million-square-mile area, known as the Clarion Clipperton Zone, which lies halfway between Hawaii and Mexico.

Of the 5,578 species found in the zone, between 88% and 92% are new to science, according to the paper, published Thursday in the journal Current Biology.

While it isn’t unusual to find new animals when looking in an unexplored area of the ocean, the large number was a surprise, according to Douglas McCauley, associate professor of ocean science at the University of California, Santa Barbara, who wasn’t involved in the study.

“It is a pretty big deal in terms of shedding light on new forms of life on the planet,” McCauley said. “They are not describing the underwater equivalent of the Eastern lowland gorilla. They are describing gorillas for the first time.”

Countries have been vying for a piece of the mineral-rich area of the Pacific Ocean. The International Seabed Authority, a United Nations-affiliated agency that regulates access to seafloor mining in the zone, has already granted 17 contracts to explore for nodules in the zone.

Mining proponents have said the seafloor is relatively barren and won’t be damaged as much as mineral-rich areas on land.

Adrian Glover, an author of the study and merit researcher at the museum, spent several months at sea collecting samples earlier this year.

At an average depth of over 3 miles, the seafloor in the zone is too dark to sustain plants, but a variety of animals thrive there, including arthropods, which are shrimplike invertebrates with segmented joints, and spiny invertebrates like sea urchins, sea cucumbers, worms and sponges.

Researchers used remotely operated vehicles with retractable arms to sample the muddy world, as well as wooden boxes they dragged along the bottom.

Glover said he found a reddish-green worm that lives inside the nodules, as well as 2-inch-long glass sponges that attach themselves to the outside. Neither animal had been seen previously by scientists. Glover said while the abundance of animals was less than in other parts of the globe, the diversity was off the charts.

“It doesn’t rival coral reefs or rainforests for diversity,” Glover said. “But it is actually higher than soft sediments along the continental shelf, which is just totally bizarre.”

Glover said new marine invertebrates are valuable because they can contain unusual chemical compounds that could potentially be turned into anticancer, antifungal or antiviral drugs.

The research on biodiversity of marine life in the zone will be reviewed by the seabed authority, according to Glover. The authority didn’t immediately respond to a request for comment.

Delegates to the authority are devising new rules to oversee deep-sea mining, which must be approved before companies can apply for a license.

The authority has granted exploration contracts of the mining area to several nations including China, Russia, Korea, France, Germany, the U.K. and India, many of whom are partnering with commercial firms, according to the ISA website.

Vancouver-based The Metals Company, in partnership with the island nation of Nauru, tested its pilot collection system in 2022, collecting around 3,000 metric tons of nodules, according to a company spokesman.

Environmentalists have called for a ban on mining the nodules, which contain nickel, copper, manganese and cobalt. Some car makers say they won’t use electric-vehicle batteries made with seafloor minerals.

Gerard Barron, chief executive of TMC, said that his firm is testing undersea tractor-like harvesters to collect the nodules and that the operation would cause less damage than existing mines that destroy rainforests in places like Indonesia, a leading producer of nickel.

“Never do we suggest there will be no impact, but we have to figure out how we can mitigate it and then we have to look at the alternatives,” Barron said. “A lot of engineering effort has gone into minimizing our impact as our robots drive along the ocean floor.”

Barron said only a portion of the zone will be opened to mining. Once the agency approves the new rules, Barron said he hopes to be operating in late 2024.

Updated: 5-3-2023

Shipping Giant Maersk Drops Deep Sea Mining Investment

Maersk is selling its stake in The Metals Company, the latest big name to divest itself of its seabed mining interests.

Shipping company A.P. Moller-Maersk is selling its stake in deep-sea mining firm The Metals Company, even as the legal process to allow seabed mining approaches its final stages.

Maersk told The Wall Street Journal that it now holds an interest of less than 2.3% in TMC and is in the process of selling all of its shares. The shipping company held more than 9% of TMC in 2021, according to data from FactSet and has been an investor in the company since 2017.

TMC is one of the biggest proponents of deep-sea mining and is the most active company within the space, being the first to complete pilot testing. In June 2021, the company along with the Republic of Nauru set in motion talks for deep sea mining to be legalized when it applied to the UN-backed International Seabed Authority to mine in the Pacific Ocean.

It triggered a rule that required the ISA to establish a code that would allow mining of deep-sea resources by July 2023, even if, as is expected, no code will have been agreed upon.

The practice has garnered attention because of the potential to harvest battery metals such as cobalt and nickel from rocks on the seafloor. Seabed mining raises the prospect of additional supplies to alleviate expected shortfalls while proponents also argue it could mitigate concerns from other sources, such as humanitarian issues with cobalt mining in the Congo and environmental issues with nickel mining in Indonesia.

Maersk said it entered into a contract with TMC five years ago, under which it would provide shipping services to the company. Maersk said direct payment from TMC wasn’t possible at the time and so payment for the contract was provided in the form of shares that it is in the process of selling.

TMC said in 2022 that Maersk didn’t have a vessel suitable for TMC’s mining operations, so the miner instead signed a contract with engineering firm Allseas Group. “We remain good friends [with Maersk] and grateful for their important contribution in getting this industry moving in the right direction,” TMC Chief Executive Gerard Barron said.

In March, Lockheed Martin sold UK Seabed Resources, which holds the licenses for two seabed exploration contracts in the Pacific Ocean. Norway’s Loke Marine Minerals purchased UKSR for an undisclosed fee.

TMC and other deep-sea mining firms have come under fire over worries that the practice will harm the seabed environment. TMC had previously said it aimed to start seabed mining in the second half of this year but is now willing to wait until a mining code has been finalized, which is also the Republic of Nauru’s official position.

TMC’s stock, listed through a SPAC on the Nasdaq exchange, has lost more than 90% of its value since going public in 2021. It currently trades at roughly 82 cents. In December of last year, the company received a delisting notice from Nasdaq after it had traded below $1 for more than 30 days.

The notice was removed in February after the stock traded above $1 for 10 days, but a fresh one was issued in April for the same reason as in December.

The ISA and member states previously met in March of this year and failed to come to an agreement as to what the terms of seabed mining should be and how it should be regulated, with worries over royalty-payment splits and environmental harm of key concern.

The next meeting has been set for late July with another scheduled for October.

Updated: 6-20-2023

Norway Opens Door For Deep-Sea Mining Of Copper And Other Critical Materials

Push to recover deposits proceeds in the face of growing opposition and environmental concerns.

The Norwegian government on Tuesday opened the door for deep-sea mining in its waters, despite opposition from environmental groups and a growing list of nation states arguing to ban the practice.

The government said it was proposing parts of the Norwegian continental shelf be opened for deep sea mining and other commercial seabed mineral activities.

It added that environmental considerations would be safeguarded and extraction would only be permitted if the industry could demonstrate “sustainability and responsible practices.”

Deep-sea mining has attracted growing opposition, both in Europe and the rest of the world, over concerns that it could significantly damage marine ecosystems.

However, companies and countries are scouring the planet to find and secure additional sources of metals and minerals critical for the energy transition, including cobalt, manganese and nickel.

To date deep-sea mining has focused on the extraction of seabed nodules—tennis-ball sized pieces of rock which contain manganese, cobalt and nickel, all of which are used in electric-vehicle batteries.

So far much of the attention has centered on the Clarion Clipperton Zone in the Pacific Ocean: An area of water between Mexico and Hawaii that contains millions of tons of nodules.

Companies looking to extract these nodules, such as Norway’s Loke Marine Minerals, say that harvesting them provides an alternative supply of the minerals needed for renewables, while avoiding the harm to indigenous civilizations or rainforests caused when mining the minerals on land.

In Norway however, the focus will be on seabed crusts on the country’s continental shelf. The target crusts contain copper, zinc and cobalt, as well as some rare-earth elements, according to the Norwegian Petroleum Directorate.

“We need minerals to succeed in the green transition,” said Terje Aasland, Norway’s Minister of Petroleum and Energy in a statement. “Seabed minerals can become a source of access to essential metals, and no other country is better positioned to take the lead in managing such resources sustainably and responsibly. Success will be crucial for the world’s long-term energy transition,” Aasland added.

Currently, deep-sea mining in international waters isn’t yet legal, but it is expected to become so this year. Next month, the International Seabed Authority—a U.N. observer organization tasked with creating rules and regulations covering the practice—is expected to meet in Jamaica to agree the regulations on deep sea mining. Rules around environmental harm, royalties and taxes are all being considered.

Deep-sea mining remains controversial, with a number of NGOs and national governments calling to ban the practice or at least obtain a moratorium to further investigate its environmental impacts.

“To forge ahead and unleash deep-sea mining in the Arctic would be criminal. Norway talks about leading the world, but they clearly didn’t get the memo of the growing opposition to this industry.

Companies at the forefront of the green transition are already calling for a halt to this destructive industry, as are citizens and governments from Europe to the Pacific,” said Louisa Casson, Stop Deep Sea Mining senior campaigner at Greenpeace International.

Countries including France and Germany have also called for moratoriums on deep-sea mining, while last month a report found that when researching the pacific seabed, 90% of the more than 5,000 marine creatures found living in the Clarion Clipperton Zone were new species.

Companies including Maersk and Lockheed Martin have also been divesting their deep-sea mining investments.

Updated: 7-11-2023

A Showdown In Jamaica Is Deciding The Fate Of The Deep Ocean

A United Nations regulatory body faces tough choices as resistance to mining the seabed for battery metals grows.

In June, the United Nations approved a landmark treaty to preserve ocean biodiversity, seeming to augur a transformation in how countries and corporations do business on the high seas.

But as the UN-affiliated International Seabed Authority (ISA) meets in Kingston, Jamaica, this week, it will be writing rules for deep sea mining that threatens the very ecosystems in need of preservation.

The ISA’s annual meeting comes at a pivotal moment for seabed mining, which has the potential to become a trillion-dollar industry as the transition to electric vehicles spurs demand for metals like cobalt and nickel, found in the deep ocean.

On July 9, a deadline passed for the ISA to enact regulations for deep sea mining.

The group’s 167 member nations (plus the European Union) are now obligated to accept license applications from companies that want to begin mining, even in the absence of environmental safeguards.

How the ISA will respond to applicants is a key question for the coming weeks. The Authority could also consider a proposal from Chile, France, Palau and Vanuatu to prohibit the approval of any mining licenses until regulations are enacted.

The ISA, which has a permanent staff of 52 people and an annual budget of around $10 million, is convening amid an intensifying geopolitical showdown over seabed mining.

A growing number of ISA member nations in Europe, Latin America and the Pacific are calling for a moratorium or pause on mining due to a dearth of scientific knowledge about deep ocean ecosystems and seabed mining’s impact on them.

As the ISA meeting opened on Monday, member nation Canada, an industrial mining giant, joined the call for a moratorium.

Meanwhile, pro-mining member states that include China, Russia, Norway, Japan and South Korea are pressing the ISA to complete the regulations and begin issuing licenses.

With global attention focused on an international organization that long operated in obscurity, here’s what you need to know about the ISA, seabed mining and who stands to profit from industrializing the world’s last untouched wilderness.

What Is The International Seabed Authority?

The 1982 UN Convention on the Law of the Sea (UNCLOS) established the ISA to regulate the exploitation of the seabed in international waters, and to ensure the effective protection of the marine environment.

At the time, the seabed, which is estimated to harbor the world’s largest reserves of minerals, was thought to be a largely lifeless abyss.

The ISA was created to avoid repeating the colonial exploitation of terrestrial minerals such as gold and copper, which enriched the West and left a legacy of environmental devastation and poverty in developing nations.

To that end, UNCLOS declared the seabed to be the “common heritage” of humankind. Royalties and other benefits from deep sea mining must be shared among ISA member nations, with preference given to developing countries.

UNCLOS established an Assembly consisting of all ISA member nations as the organization’s decision-making body. A 36-nation Council formulates policy and in turn delegates much of that work to a Legal and Technical Commission (LTC).

The LTC consists of 41 experts appointed by member states to draft regulations, review mining applications and make recommendations for their approval. The LTC deliberates behind closed doors and it takes a two-thirds vote of the Council to reject such a recommendation.

When the ISA began operating in 1994, mining for minerals 13,000 feet (4,000 meters) below the surface of the ocean remained commercially and technologically unfeasible. ISA meetings were sparsely attended and rarely made headlines.

In the organization’s early years, it concentrated on writing regulations to govern the exploration of potential mining sites.

Since 2001, the ISA has issued 31 exploration contracts to private companies, state-backed enterprises and government agencies to prospect for cobalt, nickel and other minerals over more than 500,000 square miles (1.3 million square kilometers) of the Atlantic, Indian and Pacific oceans.

All mining companies must be sponsored by an ISA member state, which must maintain “effective control” over the contractor and is responsible for ensuring its compliance with environmental regulations. Sponsor states can in turn collect royalties and fees from their contractors.

Since 2017, the ISA has been slowly developing a complex “Mining Code” meant to include environmental standards, a formula for sharing mining royalties and inspection and compliance procedures for policing industrial activity that would occur thousands of miles from shore and 2.5 miles below the ocean’s surface.

Where Would Deep-Sea Mining Take Place?

The ISA has issued exploration contracts to prospect for minerals on underwater mountains called seamounts and at hydrothermal vent fields, which spew superheated sulfide-laden fluids that have laid down mineral deposits over eons.

But most mining companies are focused on polymetallic nodules, potato-sized rocks rich in cobalt, nickel and other metals.

Nodules cover the sea floor by the billions in a region of the Pacific Ocean called the Clarion-Clipperton Zone, which lies between Hawaii and Mexico. Over tens of millions of years, minerals precipitated from seawater and accumulated around shark teeth and other objects.

Scientists estimate that nodules are habitats for half of the larger animals in the Clarion-Clipperton Zone.

Why Is There A Rush To Mine The Seabed?

In 2021, ISA member Nauru — a South Pacific island nation of 8,000 people — invoked the “two-year rule,” a UNCLOS provision that required the ISA to complete the mining code by July 9, 2023, or accept applications under whatever regulations exist at the time.

Nauru is the ISA state sponsor of The Metals Company (TMC), a Canadian-registered venture formerly known as DeepGreen. Nauru triggered the two-year rule shortly after TMC, which also holds exploration contracts sponsored by two other small South Pacific island nations, told potential investors that it expected to begin mining by 2024.

More recently, the company said it expected to file an application to begin mining by the end of this year. A 2021 investigation by Bloomberg Green raised questions about TMC’s business practices and revealed the company’s leverage over its state sponsors.

In US securities filings made before TMC went public in 2021, the company estimated the cost of a single deep sea mining operation and an onshore processing plant at $10.6 billion, with annual operating costs of $1.8 billion after 2030.

For much of the past year, TMC shares have traded under a dollar. They closed at $2.77 on Monday, giving the company a $770 million market cap.

Who Is Interested In Mining The Seabed?

While a number of companies hold exploration contracts, few are actively preparing to begin mining should the ISA approve regulations.

GSR, a subsidiary of Belgian dredging giant Deme, holds an ISA exploration contract and, like TMC, has tested a prototype of a mining machine that collects polymetallic nodules on the seabed.

US defense giant Lockheed Martin’s interest in deep sea mining dates to the 1970s and its British subsidiary had held ISA licenses in the Clarion-Clipperton Zone since 2013. But in March, Lockheed abruptly exited the nascent industry when it sold its seabed mining subsidiary to a Norwegian startup.

China holds five exploration contracts, the most of any ISA member. Japan has tested seabed mining prototypes in its territorial waters.

Why Is Deep Sea Mining Controversial?

In a 2022 peer-reviewed study, a team of leading deep sea scientists conducted an exhaustive review of available research and found “no or next to no scientific knowledge” for most of the seabed targeted for mining.

The researchers, who included four members of the ISA Legal and Technical Commission, determined that the effective regulation of deep sea mining is not currently possible.

A separate peer-reviewed paper published this May determined that the areas of the Clarion-Clipperton Zone set for mining are home to more than 5,000 species, nearly all of them unknown to science.

According to ISA documents, some mining contractors have repeatedly failed to conduct sufficient environmental baseline research on the areas targeted for mining, as required by their exploration contracts.

Such data is crucial to implement effective environmental regulations. A 2019 National Geographic investigation found that over a 16-year period, some contractors had collected only a single biological sample for every 4,000 square miles of their 29,000-square-mile areas.

Investigations by Bloomberg Green, the Los Angeles Times and the New York Times have revealed the closeness of the ISA Secretariat, the organization’s administrative arm, to the mining companies the Authority regulates, including TMC.

What’s The Argument In Favor Of Deep-Sea Mining?

Mining proponents argue that exploiting the seabed would be far less damaging to the environment and society than terrestrial mining that destroys rainforests, pollutes waterways and employs children as laborers.

TMC portrays deep sea mining as crucial to fighting climate change by obtaining metals to make electric car batteries, wind turbines and other green technologies.

What Is The US Position On Deep Sea Mining?

The US is not an ISA member nation, as it has not ratified UNCLOS, but it is an accredited observer that attends Authority meetings. At the March 2023 ISA Council meeting, a US representative said mining licenses should not be issued until regulations are in place.

What Happens Now?

The ISA Council meets from July 10 through July 21 and will spend most of its time trying to reach agreement on mining regulations. The Assembly meets July 24 to July 28.

A particularly thorny issue is the amount of royalties mining companies will be required to pay the ISA and how they would be distributed to member states for resources that belong to all countries. A big question is when and whether any delegation will formally move to bring a moratorium or pause on deep sea mining to a vote.

Canada Joins Nearly 20 Nations Calling For Halt To Deep-Sea Mining As Negotiators Meet To Agree Rules

Proponents say seabed can provide a less destructive source of nickel, manganese and other battery materials needed for energy transition.

Canada is the latest country to come out against deep-sea mining, the controversial practice of harvesting battery metals from the seafloor, just as nations gather to start agreeing rules around the practice.

This week, delegates of the International Seabed Authority—a United Nations observer organization that regulates deep-sea mining in international waters—are descending on ISA headquarters in Kingston, Jamaica, to hash out the regulations around deep-sea mining over the next two weeks.

Canada, Ireland and Switzerland have all recently joined calls—by nearly 20 countries—for a moratorium or at least a pause on deep-sea mining.

They join green groups in raising concerns over its environmental impact. However, proponents say the practice is a relatively less destructive new source of the materials critical for the energy transition. Norway recently opened the door to deep-sea mining in its waters.

“The Government of Canada is committed to the responsible and sustainable management and use of ocean resources. This requires the advancement of strong environmental, social and governance principles, and an adherence to science-based policy and decision-making,” Global Affairs Canada said on Monday.

“The Government of Canada has been clear: seabed mining should take place only if effective protection of the marine environment is provided through a rigorous regulatory structure, applying precautionary and ecosystem-based approaches, using science-based and transparent management, and ensuring effective compliance with a robust inspection mechanism,” the agency said.

Canada’s intervention comes as some regulations around the practice near agreement. According to ISA Secretary-General Michael Lodge, it is likely we will see some form of agreement on the rules around how deep-sea mining is policed during the current ISA session which lasts two weeks.

“With regards to inspection and enforcement, most inspections—for what I see—will rely on a system of modern technologies (including) remote sensing, autonomous underwater vehicles,” he said.

Lodge added that there has been “a lot of progress on that particular issue,” and that a working group which has been headed up by Norway is “something close to a deal.”

While there is an expectation that rules on inspection and enforcement will be agreed in July, people familiar with the matter say that a full mining code won’t likely be established until the October ISA meeting.

Sticking points include royalties, environmental standards and benefits sharing, which are still far from being agreed upon, they said.

Deep-sea mining in recent years has garnered attention because of the possibility of recovering battery metals such as manganese and nickel from the seafloor.

With demand for metals rising and current supplies expected to fall short of what will likely be required to fuel the energy transition, its proponents say the practice offers an alternative source of metals that can avoid destruction of terrestrial habitats such as rainforests and harm to indigenous settlements.

In 2021, The Metals Co. , a prospective deep sea miner, and Nauru started the clock for the ISA to create a mining code within two years by triggering the so-called two-year rule which compels the international organization to consider a mining application filed after the deadline, even if a mining code hasn’t been agreed.

That time period expired this year on July 9, meaning that any company can in theory put in an application with the ISA to mine the seafloor.

TMC said that its sponsoring state Nauru wouldn’t support the submission of an application to mine until the conclusion of the July meetings, and that the company has a strong preference to wait to submit an application until a full set of regulations are in place.

Some other early supporters of seabed mining, including Maersk and Lockheed Martin, have been selling their deep-sea mining investments.

Deep Sea Mining Threatens $5.5 Billion Tuna Industry, Study Finds

Climate change is driving tuna toward toward the Clarion-Clipperton Zone, a region of the Pacific Ocean targeted for the mining of valuable metals.

Scientists expect climate change to increasingly drive tuna into the path of potential deep sea mining operations.

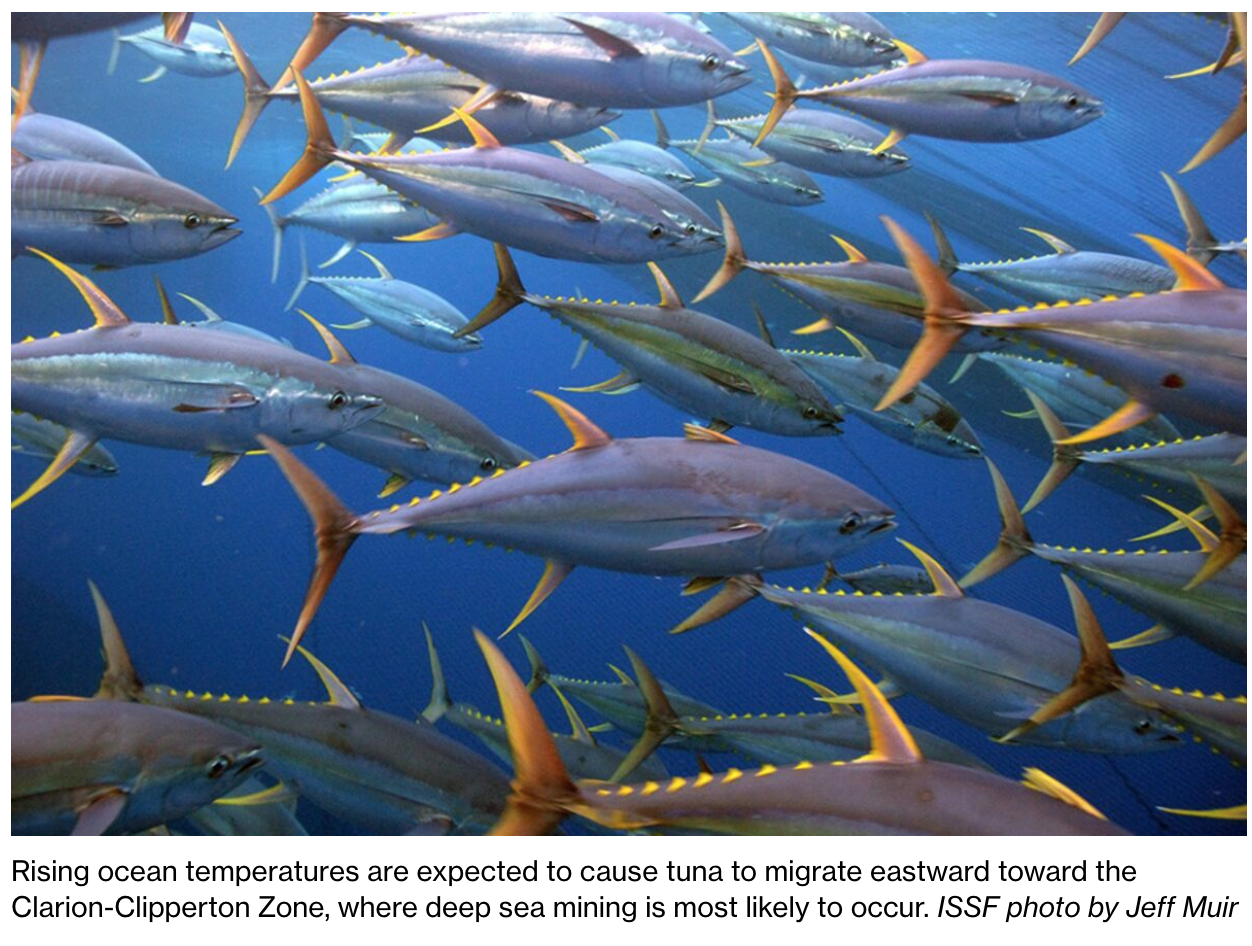

In a peer-reviewed paper published Tuesday in the journal Nature npj Ocean Sustainability, researchers analyzed climate models to predict that the biomass of bigeye, skipjack and yellowfin tuna species will increase by an average of 21% by mid-century in the Clarion-Clipperton Zone, a vast region of the Pacific Ocean between Hawaii and Mexico that is targeted for the mining of valuable metals.

“These projected increases in overlap indicate that the potential for conflict and resultant environmental and economic repercussions will be exacerbated in a climate-altered ocean,” the study states.

The paper builds on previous research forecasting that rising ocean temperatures will cause tuna to migrate eastward toward the end of the Clarion-Clipperton Zone, where mining is most likely to occur.

If mining proceeds, it could damage the $5.5 billion Pacific tuna industry in several ways, according to the researchers. Mining companies plan to send giant robots to the ocean floor — 13,000 feet (4,000 meters) down — to suck up polymetallic nodules, potato-sized rocks rich in cobalt, nickel and other metals.

Mining would spawn sediment plumes that could spread over hundreds of feet or more. Once the nodules are transported to the surface and processed, another plume of mining waste would be released back into the ocean.

“That could potentially be at depths that would impact the breathing and feeding of tuna and the prey that they rely on for food, increase their stress hormone levels and have other consequences,” said Diva Amon, the study’s lead author and a deep sea scientist at the University of California at Santa Barbara.

Tuna health could also be harmed by the release of toxic metals during mining, while noise and light from around-the-clock extraction operations could affect their breeding and migration patterns.

The study’s publication coincides with this week’s meeting of the International Seabed Authority (ISA), the UN-affiliated organization that regulates deep sea mining.

The ISA is drafting regulations that could permit mining operations to begin as soon as 2024 in the Clarion-Clipperton Zone, but a growing number of its 167 member nations (plus the European Union) are calling for a moratorium or pause on seabed mining.

On Tuesday, the Global Tuna Alliance, a consortium of retailers and supply chain companies, joined six other seafood industry groups in also calling for a pause.

The scientists say their findings underscore the need for the ISA to consider potential impacts on tuna fisheries. The organization does not currently require mining companies to take those impacts into account, and does not factor them into its own regional environmental management plans.

The ISA has not yet issued regulations governing the depth of mining waste discharges. The paper noted that deep-diving tuna live as much as 500 meters beneath the surface, while their prey can be found at 1,500 meters.

“Discharging below that would be a better situation for tuna,” Amon said. “But it’s going to be more costly and technically challenging for deep sea mining operations, and mining contractors may not be incentivized to do that.”

Grantly Galland, a project director with the Pew Charitable Trusts’ international fisheries program, said regional fisheries management organizations — known as RFMOs, they are in charge of tuna populations in the Pacific — have not considered the consequences of deep sea mining.

“It’s definitely not on their radar and really has not come up at a single meeting I’ve been to recently,” Galland said. He expects the new paper to change that, and to perhaps encourage RFMOs to join the ISA as accredited observers so officials can make their views known.

“Mining in areas like this one that are home to sensitive ecosystems and valuable fisheries should not be allowed unless we have the scientific knowledge to be reasonably certain that wildlife and fisheries can be protected from these new activities,” Galland said.

Updated: 7-18-2023

Explorer Victor Vescovo Says Deep Sea Mining Numbers Don’t Add Up

At a global meeting on seabed mining policy, the ocean adventurer and investor warned of “extraordinarily high” financial risks.

As the International Seabed Authority (ISA) meets in Jamaica this week, deep sea explorer and private equity investor Victor Vescovo flew to Kingston on Monday to make the business case against mining the ocean for valuable metals.

“I didn’t come here because I’m a raving ocean environmentalist. I’m not,” Vescovo told Bloomberg Green at a side event hosted by environmental group WWF. “I’m first and foremost an industrial private equity guy. I did the math and deep sea mining just doesn’t work, as the risks are extraordinarily high.”

Vescovo in 2019 became the first person to venture to the deepest trenches in the world’s five oceans, including piloting a submersible nearly 7 miles down to the Challenger Deep. He is also the co-founder of Texas private equity firm Insight Equity Holdings.

The policymaking Council of the United Nations-affiliated ISA, the organization charged with regulating the nascent industry, has been meeting in Kingston for the past two weeks.

It comes at a pivotal moment for seabed mining, which proponents say has the potential to become a trillion-dollar industry as the shift to electric vehicles raises demand for metals found in the deep ocean, like nickel and cobalt.

But a growing number of ISA member nations are calling for a moratorium or pause due to a lack of scientific data on the ecosystems targeted for exploitation.

In a talk at the WWF event, Vescovo, sporting a gray ponytail and a black suit, said the technological and financial uncertainties of mining metals thousands of miles from shore and miles below the surface of the ocean have been grossly underestimated.

“It’s an article of faith among these mining companies that they’re going to make tons of money, that it’s ‘just picking rocks up off the seafloor,’” he said. “There’s no ‘just’ anything when you’re at 4,000 meters in the ocean. It is an act of God to do anything at 4,000 meters.”

Vescovo said he was surprised the logistical challenges had not received more attention. “Everything breaks. Everything is difficult,” he told the gathering, which included ISA member state delegates. “You’re talking about sustained heavy mining operations in depths that exceed the depth of the Titanic.”

Mining has not yet commenced, but the ISA’s 168 member nations (plus the European Union) are under pressure to complete regulations to allow it to proceed. On July 9, a deadline to enact regulations passed.

That means the ISA is now obligated to accept license applications from companies that want to begin mining, but left unresolved is whether it has to act on any submissions before regulations are in place.

The tiny Pacific island of Nauru had triggered the deadline on behalf of The Metals Company (TMC), a Canadian-registered venture it sponsors, so it could obtain an ISA license to mine polymetallic nodules — potato-sized rocks rich in cobalt and nickel that cover the Pacific seafloor by the billions.

The Metals Company went public in a SPAC in 2021. At the time, it estimated capital costs of a single deep sea mining operation and an onshore processing plant at $10.6 billion, with annual operating costs of $1.8 billion after 2030.

The company’s shares closed at $1.98 on Monday, giving it a market cap of $556 million.

Vescovo said that inflation will only add to mining’s high costs. “In the last few years, we’ve had the highest inflation rate since the 1970s so the cost structure of The Metals Company or anyone else doing deep sea mining has gone up by at least 15%, if not more for offshore services,” he said.

“The capital cost of the equipment that’s going to be needed to go down there and operate has also, if you just look at the Producer Price Index, gone up by 15 to 20%, as well.”

Salesforce Chief Executive Officer Marc Benioff on Tuesday called on corporations to join WWF’s campaign for a moratorium on deep sea mining. BMW, Volvo, Volkswagen and Google previously pledged not to use seabed minerals.

TMC Chief Executive Officer Gerard Barron said in a statement that the abundance and high grade of metals in polymetallic nodules creates “very attractive economics.”

“We will happily rely on our engineering partner Allseas for subject matter expertise, as they’ve been operating in the deep sea for 37 years, laying pipe in extreme, 24-7 production environments for the offshore oil and gas industry,” he said. “WWF are obviously out of arguments if the best they can do at their sponsored ISA event is put Mr. Vescovo in front of the assembled crowd as their expert.”

Mexico’s delegate to the ISA Council, Marcelino Miranda, was at the WWF event and told Vescovo, “Nobody in the Council is in favor of destroying the ocean.” Miranda added, “I wonder whether we are fighting the wrong enemy because actually the enemy right now of the ocean is global warming. Fossil fuel fuels are the real danger, not an industry that doesn’t exist yet.”

Vescovo acknowledged that electric vehicles are important. “But do you need to destroy thousands or tens of thousands of square kilometers of the deep sea floor to do it, just as an experiment to figure out if it’s going to work?” he said. “I’ve been down there.

I’ve seen the polymetallic fields and there is no way to extract polymetallic nodules from the seafloor without utterly annihilating the bottom of the seafloor. It cannot be done.”

Updated: 7-21-2023

Deep-Sea Mining Authority Targets 2025 For Regulations

The United Nations-affiliated group has given itself a timeline for setting rules and oversight for companies that want to strip mine the ocean floor for key minerals.

The International Seabed Authority (ISA) on Friday reached an agreement that gives the United Nations-affiliated regulator breathing room to finish rules for strip-mining deep ocean ecosystems for valuable metals before it must consider issuing mining licenses.

At its annual meeting that stretched into Friday evening, the ISA’s 36-member policymaking Council said it would work “with a view” to adopting regulations in 2025.

The agreement came after hours of closed-door negotiations at the organization’s Kingston, Jamaica, headquarters on the last day of a two-week meeting.

The Authority missed a deadline on July 9 to enact regulations to allow mining of the seabed for minerals used to make batteries for electric vehicles and other key components of the clean energy transition.

That means it must accept license applications from mining companies. The ISA has issued 31 licenses to mining contractors to explore the seabed in international waters for minerals but none are yet allowed to start mining.

But the question of whether it must act — and how — on any submissions in the absence of environmental safeguards has divided the Council. A growing number of the Authority’s 168 member nations (plus the European Union) are calling for a moratorium or pause on deep sea mining due to a severe lack of scientific knowledge about the seabed ecosystems targeted for exploitation.

Tensions at the Authority have been rising since 2021 when Nauru, a South Pacific island nation of 8,000 people, invoked the “two-year rule,” a provision of the ISA’s charter that required the ISA to complete the mining code by July 9, 2023, or accept mining applications under whatever regulations exist at the time.

Nauru is the ISA state sponsor of The Metals Company (TMC), a Canadian-registered venture formerly known as DeepGreen, that has told investors it expects to begin mining in 2024.

The island nation’s delegate at the meetings, Margo Deiye, expressed disappointment at the compromise reached Friday evening, saying the language was vague and did not set a firm deadline for enacting mining regulations.

Since 2017, the ISA has been slowly developing a complex “Mining Code” that involves establishing environmental standards, a formula to share mining royalties and the creation of inspection and compliance procedures to police industrial activity that would occur thousands of miles from shore and 2.5 miles below the surface of the ocean.

Updated: 7-31-2023

In the Race To Mine The Seabed, China Takes A Hard Line

A meeting of the UN-affiliated agency that regulates deep-sea mining ended with most nations refusing to accept mining applications until regulations exist.

In an international showdown that is pitting China against dozens of other nations, one company’s quest to strip-mine the seabed for valuable metals has hit a roadblock.

Friday marked the conclusion of three weeks of tense meetings at the International Seabed Authority (ISA), a United Nations-affiliated organization that regulates the nascent deep-sea mining industry.

The ISA’s 36-nation policymaking body, known as the Council, convened at its headquarters in Kingston, Jamaica, to discuss whether the organization will act on any mining applications it receives from companies.

Its conclusion was ‘not yet’: Most delegations said they wouldn’t approve any applications until the ISA puts mining regulations in place. The session ended with an agreement to work “with a view” to adopting such regulations in 2025, but didn’t set a binding deadline.

The summit’s final days were characterized by a clash between China, which favors seabed mining, and a growing alliance of countries calling for a moratorium or pause due to a lack of scientific knowledge about the deep ocean ecosystems being targeted.

While a legal framework for mining has been in the works since 2016, tensions among the ISA’s 168 member nations (and the European Union) started rising in 2021.

That’s when the Pacific island nation of Nauru kicked off a contentious countdown by triggering a rule requiring regulations be enacted within two years. The ISA missed that deadline on July 9, 2023, one day before the Council meeting. Technically, that means it must start accepting applications.

Nauru is the ISA state sponsor of The Metals Company (TMC), the Canadian-registered firm most immediately impacted by the irresolution at this month’s summit.

All mining companies must be sponsored by an ISA member state, which is obligated to ensure their compliance with regulations and can in turn collect royalties and fees.

Nauru invoked the two-year provision shortly after TMC executives told potential investors they expected to begin mining in 2024 for minerals used in EV batteries.

When TMC went public in 2021, securities filings show it expected to earn $95 billion from one area of its Nauru contract area over 23 years and estimated it would pay 7.6% of those revenues in royalties to Nauru and the ISA.