Ultimate Resource On President Joe Biden’s $1.3 Trillion Infrastructure Program

Why U.S. Infrastructure Costs So Much. Ultimate Resource On President Joe Biden’s $1.3 Trillion Infrastructure Program

The Plan Started Simply, As Many Plans Do: The Massachusetts Bay Transportation Authority would extend one of its light rail lines from Cambridge to Boston’s northern suburbs. It was estimated to cost less than $500 million when planning began in earnest in 2005.

Related:

Ultimate Resource For Biden’s Infrastructure Plans And It’s Impact On The Crypto-Currency Industry

China Outspends US When It Comes To Building The World’s Infrastructure

The Future of Water Is (And Toilets) Recycled Sewage, You’ll Drink It And You’ll Like It😹😂🤣

The Future of Power Is Transcontinental, Submarine Supergrids

Electric Vehicle Infrastructure Push Brings Cyber Concerns

Trump’s LACK Of Infrastructure Investment Is Putting American’s Lives At Risk

Cost of Infrastructure Fixes Is Going Up While Trump Procrastinates

Trump Administration To Try Again To Fulfill Infrastructure Pledge

And it would provide transit access to some of the region’s most densely populated neighborhoods that didn’t already have it.

Then things veered off track. By 2015, state lawmakers temporarily canceled the Green Line Extension (GLX) after costs had ballooned to a staggering $3 billion; progress resumed after an internal audit and management overhaul that reduced the price tag by several hundreds of millions.

These escalating costs were not an anomaly. Mile for mile, studies show the U.S. spends more than all but five other countries in the world on public transit, and more on roads than any other country that discloses spending data.

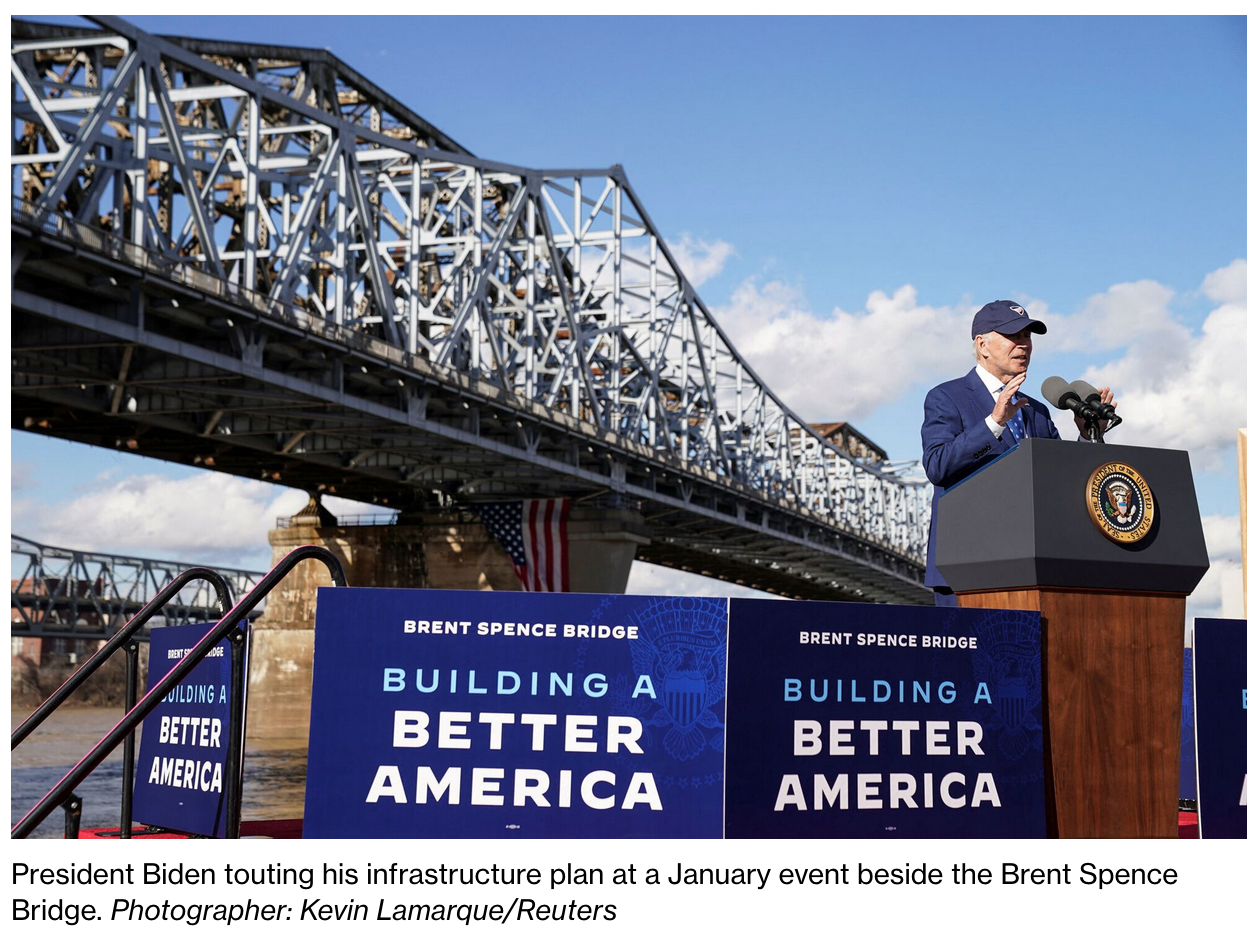

Now, as the U.S. prepares to spend some $1.3 trillion on public works projects under President Joe Biden’s new infrastructure law, the lessons of how a once-modest transit expansion metastasized into one of the most expensive rail projects in the world are worth recounting. Otherwise, if history is a guide, the U.S. may not get much of a return on its investment.

“If we don’t bring costs under control, this generational investment will yield much less than what a generational investment should yield,” said Eric Goldwyn, an assistant professor at New York University’s Marron Institute of Urban Management and co-investigator of the Transit Costs Project.

Since 2020, Goldwyn and his colleague Alon Levy (both of whom have been CityLab contributors) have been interrogating a question that has plagued journalists, economists, government accountants and even project leaders themselves: Why does building infrastructure cost so much in the U.S. compared to other parts of the world?

Research doesn’t point to a single particular cause. Instead, a confluence of factors have contributed, from lack of expertise and ineffective project management, to processes for citizen input.

“It’s death by a thousand paper cuts,” Goldwyn said of a case study of the Green Line Extension he led with Levy and Elif Ensari, an NYU transportation and land use research scholar.

Goldwyn and Levy have focused their research on urban rail projects because they tend to be large and distinct, whereas road projects tend to consist of numerous, smaller efforts. And with transportation generating 30% of U.S. greenhouse gas emissions, mostly from private vehicles, there is an existential urgency to build more public transit.

Yet the extraordinary expense of construction is a significant barrier to that need. The first phase of the Second Avenue Subway in Manhattan, the most expensive subway project in the world, cost $2.5 billion per mile, nearly five times the cost of a similar extension in Paris.

While tunneling underground in New York City is bound to cost more than most projects, comparatively modest undertakings in other U.S. cities are still much more expensive than they ought to be:

In 2013, Portland’s 7-mile Milwaukie light rail extension cost more than $200 million per mile, as much as a full subway system would cost in many European cities, according to Levy.

And costs tend to rise as projects proceed, beyond the rate of inflation: In Los Angeles, the third phase of the Purple Line extension is set to cost twice as much as the first, based on current projections.

The Anatomy of A Cost Overrun

In their case study of the GLX, Goldwyn, Levy and Ensari found that there was no single cost center that spiked the project’s price tag. Instead, spending swelled across three problem areas: over-design, inefficient project management and misaligned politics.

The first was the most visible. In the original 2005 plan, the stations were envisioned as open-air platforms with wheelchair ramps, estimated at $535,000 each.

But that cost increased nearly a hundred-fold over the course of design, the NYU team found, as bespoke features such as a bigger station footprint, redundant elevators, fancy landscaping and additional street grading were tacked on.

More wiring and communications systems were also needed to network the larger station.

In interviews with the researchers, planners and officials described the challenge of saying no to requests for add-ons, both from the public and from agency brass. “We could have been stronger at holding the line on some stuff,” said one quoted in the report.

MBTA’s dearth of staff capacity and project management expertise was a thornier issue.

Despite GLX being Boston’s costliest rail project in history, only a handful of dedicated staff members were working on managing it at any given time, the researchers found. Stretched thin and lacking institutional knowledge about the nuances of rail construction in metropolitan Boston, the agency struggled to maintain budget oversight with contractors and to resolve issues and requests in a timely manner.

Meanwhile, the number of consultants ballooned, with plans calling for more than twice the number of supervisors normally required for construction crews.

Finally, the politics of public input added time and expense to the project, particularly in the form of a bike-pedestrian path that was included late in GLX plans, thanks to an active base of supporters who advocated for it at meetings.

Whether or not the addition was a good idea, its arrival after the project’s original scope had been locked in came with more costs: It required reopening engineering plans to add extra ramps and support walls, and excavating a wider trench, the researchers found.

The Difference In Istanbul

Contrast all of these issues with a city like Istanbul, where the M5, an 18-mile subway line, was built in seven years and for just $630 million.

While labor costs and environmental regulations between the U.S. and Turkey certainly differ, those alone don’t account for the delta in price, said Ensari.

The more salient explanations come down to expertise and politics. Whereas Boston might only build one new transit line every few decades, Istanbul builds dozens.

That fosters greater expertise within public agencies as well as competition among contractors for construction bids, which drives prices down.

And unlike in the U.S., there’s greater acceptance in Istanbul of the irritations that come with the building of a major new public amenity, and fewer opportunities for residents to butt in.

“People are desperate for transit in Istanbul,” Ensari said. “Real estate prices increase when these lines are being built. So people are willing to endure the disruptions.”

Costs escalate with highway projects for similar reasons, minus the lack of know-how. Leah Brooks, an economist and public policy professor at George Washington University, has studied the rapid escalation in U.S. road-building costs since the 1960s and found America’s sky-high per-mile spending to be partly the result of its wealth as a country — the richer it became, the fancier highways it built (think noise walls and stylized overpass architecture).

More Cost, Fewer Projects

The other major factor is what Brooks terms the “rise of the citizen voice.” The 1970s brought a wave of federal and state legislation (the National Environmental Policy Act being the most prominent) that gave residents and activists a greater say in public decision-making. While these new laws surely brought some benefits — particularly to project neighbors — they also added time and expense.

Given that the U.S. ranks 13th in transportation infrastructure quality globally, those added costs don’t seem to have yielded better roads. “I find it hard to believe we’re building better highways than countries in western Europe,” Brooks said — or, she added, that the U.S. is taking better care of the environment.

When projects are exorbitantly costly, it inhibits future construction — it means three bridges will be built instead of ten, or five miles of subway instead of fifteen, experts say.

Solutions are not obvious: Dialing back citizens’ rights to participate in public projects would seem politically unfeasible.

Brooks agreed with the NYU team that one place to start would be with greater transparency by transportation agencies around costs and budgets, and providing clearer information to the public about the trade-offs that come with adding expensive amenities or limiting construction hours.

“If we can’t discuss things in this very straightforward fashion, we are lost regarding public participation and understanding the scale of megaprojects,” Goldwyn said.

Romic Aevaz, a policy analyst at the Eno Center for Transportation who led another recent study on transit construction costs, suggested that federal officials offer more guidance to transit agencies that apply for funding — for example, by assessing whether more staff is required to handle the project.

Agencies could also invest in better training on how to handle contracts, project delivery timelines and regulatory reviews.

Hearing less-experienced transit officials talk about federal environmental protocols, Aevaz said, “was like a murder mystery where everyone is talking about these really complex dynamics.” The infrastructure law includes some provisions to streamline permitting processes, but it remains to be seen how they’ll affect timelines and costs.

In Boston, the MBTA did manage to scale back the cost of the GLX after it was paused and retooled in 2015. John Dalton, a program manager who was brought in to oversee the relaunched GLX project, says that in the wake of the original cost escalation, “we’ve been pretty militant about budgetary management.”

To streamline spending, the stations are now closer to the basic design that was originally proposed, and the number of internal staff devoted to the project has grown more than tenfold.

The complete Green Line is set to officially open in 2022 — 17 years after planning began — at an estimated price tag of $2.3 billion, including $700 million in sunk costs.

The irony of America’s exorbitant infrastructure spending is that, as a portion of GDP, the country trails behind its peers. So while the U.S. spends more per mile on infrastructure, it’s not building that much — in part because of the extraordinary price.

The country is likely to get a lot less infrastructure than $1.3 trillion would suggest, Goldwyn said.

Asked whether the Biden administration is accounting for excess costs as it distributes funding, Kerry Arndt, a press secretary for the U.S. Department of Transportation, said that the agency was looking at the problem.

“USDOT is establishing a cross-functional working group to find best practices for megaproject delivery domestically and internationally,” which it will share with stakeholders, she said.

Yet more buck for less bang feeds into a vicious cycle: Fewer projects mean less expertise among agencies and — at least when it comes to public transit — less public familiarity with the kinds of projects the country needs, raising the chances that neighbors will protest.

“Maybe my grandparents got it, but I have not lived with seeing the benefits of a whole new subway line arriving in my city,” said Goldwyn. “If people understood what those were, perhaps they’d have less reason to complain.”

Updated: 1-11-2022

How U.S. Infrastructure Plans Shrank In Ambition

President Biden’s $1.2 trillion infrastructure law departs from the sweeping national build-outs of the 20th century, but we still need big visions to meet the future.

When we think about the big infrastructure plans of America’s past, we think of large-scale maps with grandiose plans. The seminal U.S. interstate highway map that emerged from the Eisenhower administration, for example, governed decades of coast-to-coast road construction.

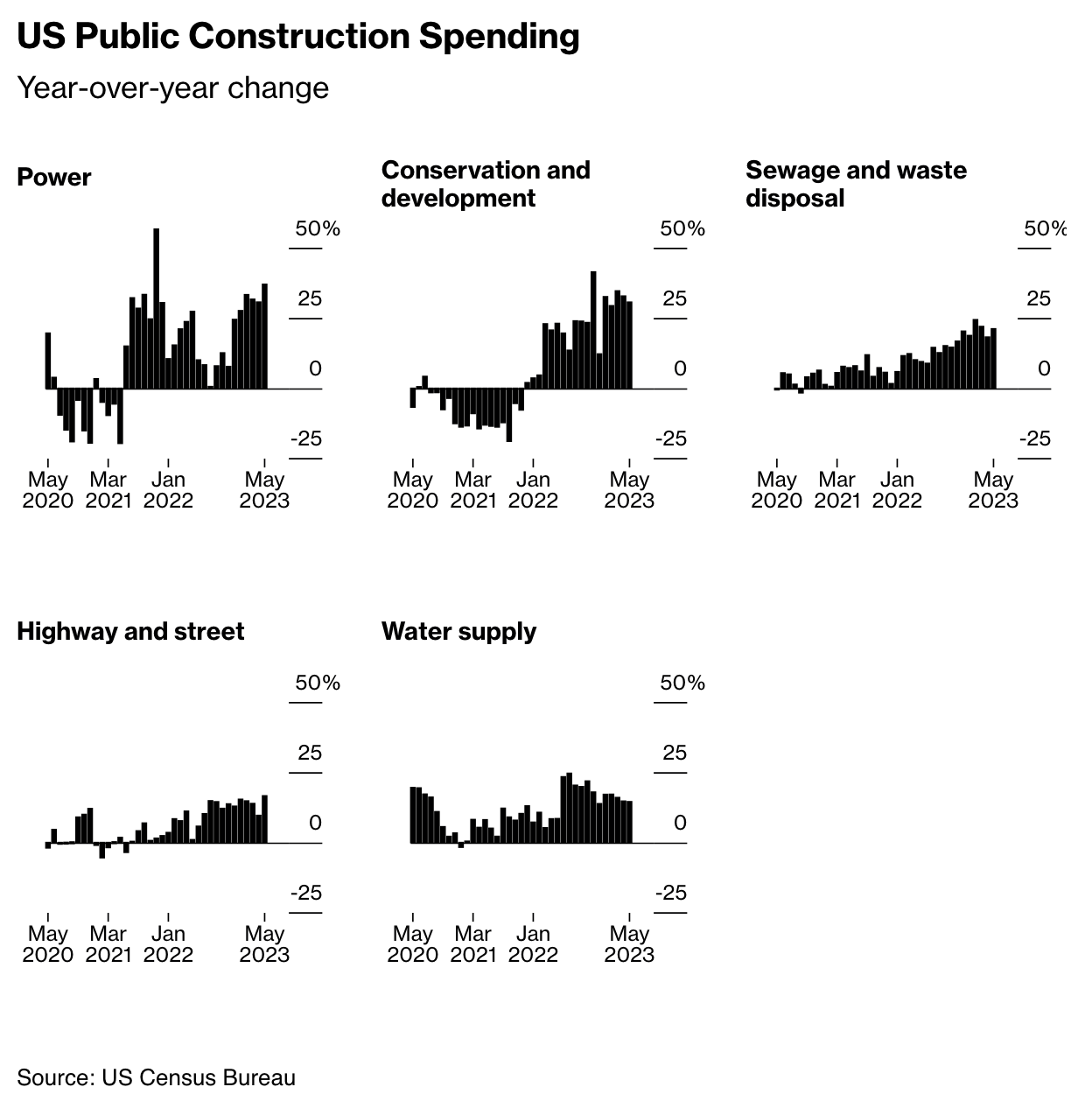

The Infrastructure Investment and Jobs Act, which President Joe Biden signed into law in November, is different. Its $550 billion in new infrastructure spending will be more about rehabilitating what we have than building more.

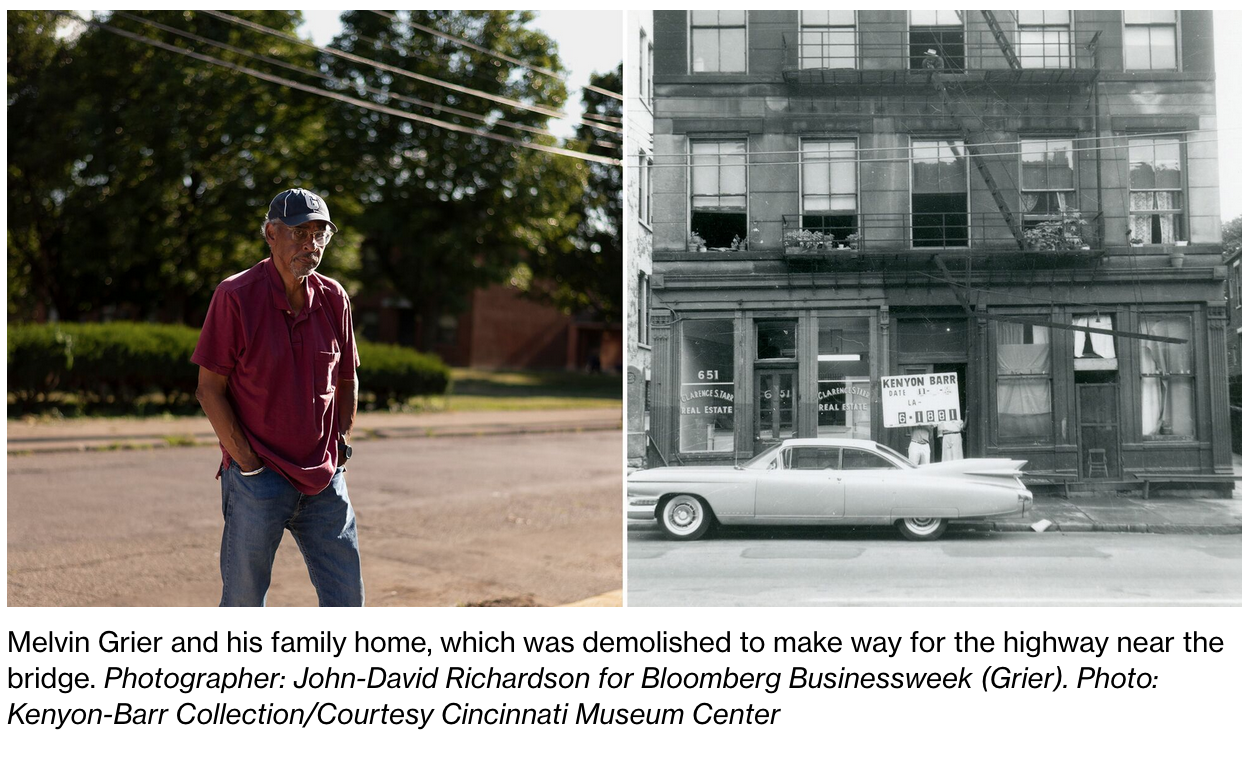

In a small way, the bill also seeks to tackle the destructive and tragic impacts of earlier infrastructure building, nodding to the need to address damage to communities of color that had been divided by projects like urban expressways.

This marked difference in approach can be explained partly by the country’s enormous and aging existing infrastructure base. Much of it is now between 50 and 90 years old, and bringing it up to a state of good repair will require vast investment.

But that’s not the only reason. Over the past half century, the focus of infrastructure planning has zoomed in, shifting from the national to the regional to the neighborhood level.

That has meant less of the kind of sweeping destruction that had been caused by the highways, dams and other infrastructure of decades ago — projects whose builders swept aside local and environmental concerns, and whose burdens fell disproportionately on marginalized communities.

But a growing country — and rapidly growing metropolitan areas — need both upgraded and expanded infrastructure. The need is a vision for a future that is at once economically competitive, socially equitable and environmentally sane.

Big ambition, vast destruction

As a transportation historian, I look back to how the U.S. built the foundations of its modern industrial age.

The first major American infrastructure projects, like the national railroad network built in the 19th century, were piecemeal, developed in most cases (with exceptions like the transcontinental railroad and Erie Canal) without comprehensive planning by the government or the private operators who largely built them.

The national railroad network was cobbled together from dozens of small railroads, centered on individual regions, states, or even towns.

That changed with the New Deal, which began an embrace of large-scale comprehensive government planning that would last for decades.

For the first time, the federal government sought to plan on a national level, with vast hydroelectric and flood control projects on major rivers, and an enormous rural electrification program.

New Deal projects became symbols of the country’s economic revival and of economic development in previously depressed regions, from the Hoover Dam to the Blue Ridge Parkway.

After the Second World War, the federal government’s role in infrastructure ramped up further. In 1956, at the initiative of President Dwight Eisenhower, who had been impressed by the Autobahn highway network in occupied Germany, Congress passed the Federal Aid Highway Act.

It provided 90% federal funding for a vast national network of free expressways.

Initially it was intended to provide for interstate travel, as its name suggests. The states, however, saw their greatest travel needs being more local— transporting commuters from new auto-oriented residential suburbs to shopping and work.

New beltways were planned to allow interstate travelers to bypass city centers and became major nexuses of office park and shopping mall development.

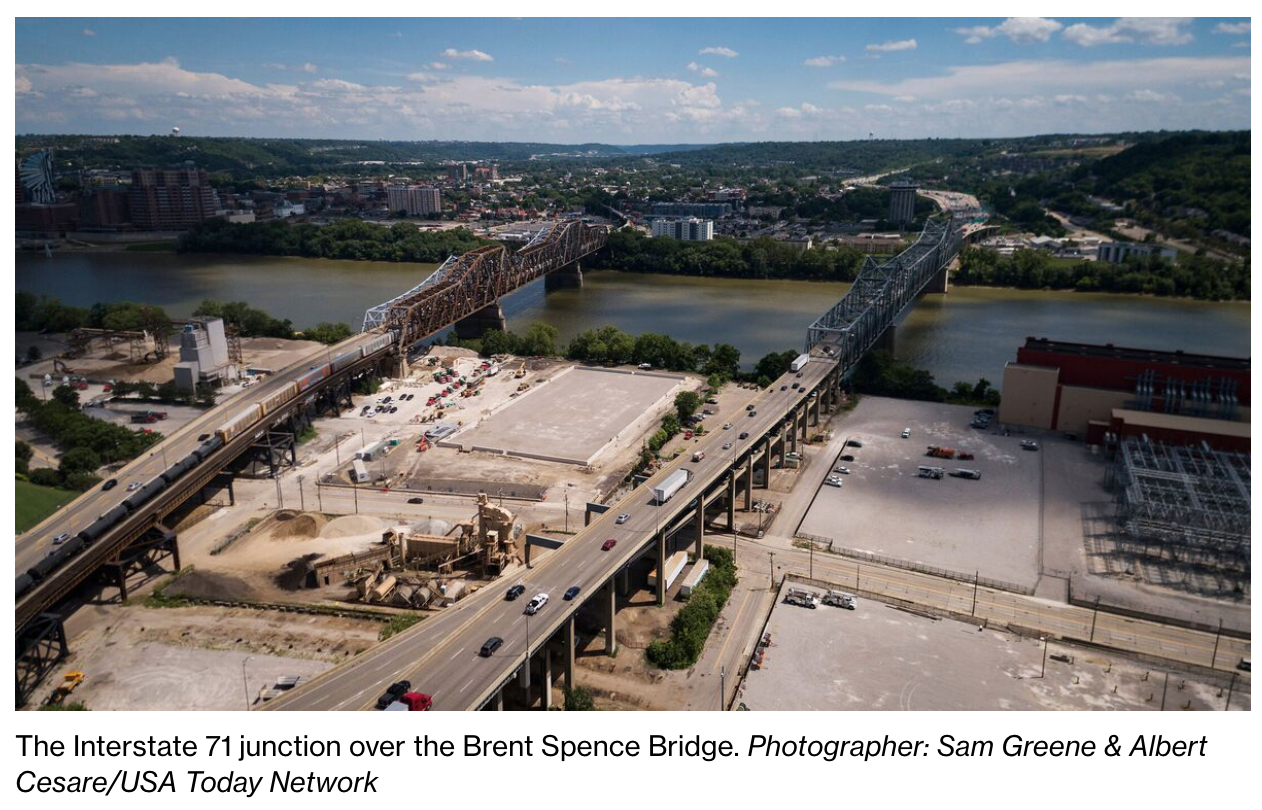

Yet this phase of regional infrastructure planning brought destruction, especially from urban expressways, that reverberates to this day. Their traffic was almost entirely composed of suburban commuters traveling to downtown workplaces.

Carving wide highway rights-of-way tore through dense urban neighborhoods. Clearing the way for this tidal wave of cars left many American downtowns little more than parking lots and office towers.

The devastation from this highway construction, however, was highly concentrated in low-income communities — disproportionately communities of color.

This was the era of urban renewal — less euphemistically, slum clearance — a time when urban leaders wrongly believed that demolishing poor communities, often without any effort to produce substitute housing, would solve social problems.

Wealthy white neighborhoods, like Georgetown in Washington, D.C., were able to often quietly veto highway projects that would have disrupted their communities. But Black and brown neighborhoods had far less success in fighting the demolition of thousands of homes and businesses.

In Detroit, I-75 infamously decimated a Black community on the eastern side of downtown, including a vast, destructive and arguably overbuilt interchange on the edge of downtown.

What united all of these projects was their large-scale approach to planning. Neighborhoods, let alone individual homes, were seen as collateral damage in the achievement of an idealized infrastructure network on a regional or national scale.

Famously, Robert Moses had an enormous model of New York City built as a planning tool. (It is now housed at the Queens Museum.)

Every major city had its infrastructure plan, presented with colorful maps zoomed out to encompass the entire city and its suburbs. Individual neighborhoods were too small to discern.

The vast federally funded infrastructure programs of the 20th century were not just about highways, and not just about cities. Just as grandiose was the dam-building program, which turned most major American rivers into a string of reservoirs.

Administered by the Bureau of Reclamation and the Army Corps of Engineers, it had multiple objectives: water for irrigation, hydroelectricity and flood control.

Yet this required the creation of enormous reservoirs that drowned farmlands, scenic river valleys, sacred grounds for Native Americans, and even entire towns — to say nothing of dams’ impacts on species and ecosystems that depended on leaving rivers intact.

Planning Scales Down

By the 1960s, attitudes were beginning to change. While the wealthy had long managed to avoid the full impact of such construction, middle-class communities began to have success in their own highway revolts.

An organization including Jane Jacobs defeated Robert Moses’ plans for an expressway through Soho and other Lower Manhattan neighborhoods.

New Orleans residents managed to defeat plans for a Vieux Carré Expressway alongside its French Quarter. In the 1970s, communities of color were also having success organizing against projects in cities like Detroit, Baltimore, Washington and Atlanta.

Soon expressway stubs and ramps to nowhere, intended to connect with canceled highways, were a common feature of the urban landscape.

There were legal and judicial shifts at work. Instead of residents’ concerns being blithely dismissed as impeding progress, governments codified requirements for community consultations as part of the preparation of environmental impact statements (though these consultations were often pro forma).

Project opponents increasingly used litigation to stall projects until they were abandoned.

Even urban highway plans that sought to mollify opponents by putting roads underground or pairing them with major park projects were soon felled by a combination of community opposition, high costs and recognition of their limited traffic-alleviating benefits.

Since the 1980s, no new expressways have been built, or even seriously proposed, in most Northeastern cities. In the booming West, construction persisted a little longer, but even in the highway mecca of Los Angeles, there hasn’t been a new urban freeway since I-105 was completed in 1993.

Dams were largely stopped too: Glen Canyon Dam on the Colorado River became a potent symbol for the environmental movement, and would prove to be one of the last big federal water projects of its kind.

Though some new urban highway projects are still underway — and taking down Black and brown homes in the process — the scale of construction is a tiny fraction of what was happening from the 1960s to ’80s.

Today, discussions often focus on removal of some of the most damaging infrastructure built in the postwar boom, from dams along the Snake and Colorado rivers to urban expressways like I-81 in Syracuse.

As neighborhood concerns increasingly became the focal point of planning, the giant regional and nationwide infrastructure planning maps gradually disappeared. New York City has not had a comprehensive highway or transit plan since the 1960s.

Even transit plans increasingly focused on smaller-scale, less disruptive, but generally slower and lower-capacity light rail and streetcar projects, which supplanted plans for the types of elevated and underground metros built in Washington, the Bay Area and Atlanta in the 1960s and ’70s.

Since the 1990s, the gas tax has not kept up with inflation, greatly diminishing federal highway funding and contributing to a decline in maintenance, let alone expansion. Federal funding for new dams, once the pinnacle of pork to be secured by powerful members of Congress, is next to nonexistent.

At the same time, the cost of construction has skyrocketed, even adjusted for inflation. This has often been blamed on the procedural obstacles that officials must overcome in this era of greater attention to environmental and residential concerns.

Yet the simple lack of experience within public agencies also plays a role — when there are multi-decade gaps between major projects, that expertise largely atrophies.

What $1.2 Trillion Will Build — And Can’t

Now that the $1.2 trillion bill has passed, what will a return to big infrastructure spending in this neighborhood-oriented era look like? Firstly, we are unlikely to see a comeback of the big colorful maps of yore.

Given today’s construction costs, even the IIJA’s high headline funding amount won’t go far when spread across a vast country.

And there is simply no appetite for the destruction that is often needed for that type of national or regional construction, especially among communities of color that have historically borne the brunt.

Sadly, even the promise to right some of the wrongs of earlier infrastructure projects was slashed from $20 billion in the initial proposal to $1 billion in the final bill.

The latter figure will scarcely be enough to pay for a single pedestrian bridge in each major city across the country. Redressing that damage in a meaningful way will have to wait for future legislation.

New York City, which developed its infrastructure much earlier than most of the country, found itself in a similar position way back in the 1950s.

As the city emerged from the Depression and Second World War, it had ambitious plans to expand its city-owned subway network. In 1951, state voters passed a $500 million exemption from the city’s debt limit so that it could borrow to pay for them.

But the city soon realized that the parlous state of maintenance — especially on lines that had been taken over by the city from bankrupt private operators — meant that state of good repair needed to take precedence over expansion. Plans like the Second Avenue Subway were postponed as the money was poured into keeping the system running.

This is the most likely scenario for this new infrastructure bill. Though dreams of new bridges and subways and Amtrak links may make headlines, the reality of the IIJA will be far more prosaic: thousands of repavings, rebuildings and replacements scattered across the country.

Once it’s done, the infrastructure network will look very much like it does today, but with fewer potholes. The American Society of Civil Engineers, though not a disinterested source, estimated the national funding gap needed to achieve state of good repair as still standing at $2.59 trillion over 10 years.

The vast majority of this money will go to filling holes in dams — both figurative and literal.

This may seem disillusioning, but it shouldn’t. Keeping the country’s infrastructure functioning for the next generation is critical to keeping the nation functioning.

Yet big maps and big plans can still serve to inspire, and more infrastructure is undoubtedly needed in a country that is still adding millions of residents each decade.

The U.S. is alone among large countries in its failure to build substantial high-speed rail networks in its densest corridors, leaving crowded airports and highways the only viable alternative. Some metropolitan areas are adding hundreds of thousands of residents every decade, all of whom will be moving on transportation infrastructure built decades ago.

Since building new urban highways is just about impossible, we need large-scale transit systems that can swiftly and efficiently move hundreds of thousands of riders a day.

We need a national, reliable network of electric vehicle charging stations, environmental infrastructure to adapt to climate change, and electric grids that can transmit large amounts of renewable energy from areas of surplus generation, like the Great Plains, to areas of high demand like the Northeast and Midwest.

All of these require the kind of large-scale investment and comprehensive planning that has faded away. We must hope that this infrastructure investment is not a one-off, and that future plans successfully balance the two scales — meeting very real large-scale regional and national needs, without sacrificing the communities where people make their home.

Updated: 1-19-2022

U.S. Army Plans $14 Billion For Ports, Waterways And Climate Help

* Corps Gets $22.8 Billion Supplemental Funding In Fiscal Year

* Army Commits $4 Billion To Expand Capacity At Key Ports

The U.S. Army plans to invest more than $14 billion upgrading ports and waterways, and helping coastal communities deal with extreme weather and natural disasters.

More than 500 projects across 52 states and territories are planned to improve decades of underinvestment and neglect that have left infrastructure vulnerable to climate change, the White House said in a statement Wednesday.

The U.S. Army Corps of Engineers will use about $4 billion of the $22.8 billion in supplemental funding from the Bipartisan Infrastructure Deal and the Disaster Relief Supplemental Appropriations Act to address commercial-navigation improvements at coastal ports and on the inland waterway, it said in a separate statement. Another $5 billion will go toward “improving community resilience in the face of global climate change,” it said.

Ports have been a focus of the White House as the U.S. supply chain struggles under record demand for imports by American consumers. The Army’s plan to repair outdated infrastructure and expand port facilities for larger ships is part of the Biden administration’s plan to tackle logistics bottlenecks that have helped contribute to the hottest inflation in almost four decades.

About $3 billion from the disaster-relief legislation will go toward qualifying flood and storm-damage reduction, with half of the amount going to projects in four states that suffered damage from Hurricane Ida, the Army said.

Its plan also sees a record $1.1 billion going toward the South Florida Ecosystem Restoration program that will improve Everglades’ ecosystem.

Updated: 2-2-2022

Stonepeak Raises $14 Billion North American Infrastructure Fund

* Total Is Almost Double Amount Raised By Firm’s Previous Fund

* About 40% Is Already Committed, According To Stonepeak

Stonepeak, the alternative-investment manager focused on infrastructure and real assets, said it raised $14 billion for its fourth flagship fund, exceeding an earlier target of $12 billion.

The total is almost double the amount raised by the firm’s third flagship fund, which closed with $7.2 billion in commitments in 2018. Stonepeak, which now has $46 billion in assets under management, will seek to make infrastructure bets across North America, particularly in sectors including transport and logistics, communications and energy transition.

“The strong interest in our fourth flagship fund reflects the outstanding investment results achieved for our partners together with our reputation for responsible stewardship of critical infrastructure assets,” Mike Dorrell, Stonepeak’s chairman, chief executive officer and co-founder, said in an emailed statement.

Stonepeak said it has already committed about 40% of the latest fund’s capital, including transactions signed by Astound Broadband, Delta Fiber, Emergent Cold LatAm, Rinchem and Seapeak, which was previously known as Teekay LNG.

The fund’s limited partners include more than 150 investors from 23 countries, New York-based Stonepeak said. Among them are the Washington State Retirement System, Oregon Public Employees Retirement System, New York State Common Retirement Fund and Teachers’ Retirement System of the State of Illinois, according to data compiled by Bloomberg.

Infrastructure, viewed by many investors as a source of stable returns, may overtake real estate as the largest real asset class, with projected collective assets under management of $1.87 trillion by 2026, according to data provider Preqin.

In fact, 47% of investors surveyed by Preqin said they plan to increase their long-term allocation to infrastructure. The median current allocation for sovereign wealth funds to the sector is 7.3%, according to Preqin.

Updated: 2-4-2022

Macquarie Seeks To Raise $7 Billion For Americas Infrastructure Fund

Macquarie Group Ltd.’s asset-management arm is planning to raise at least $7 billion for a new fund dedicated to making infrastructure bets in the Americas, according to people with knowledge of the matter.

The Australian firm is set to formally begin fundraising for the vehicle, known as Macquarie Infrastructure Partners VI, in coming months, said the people, who asked not to be identified discussing private information. A Macquarie spokesman declined to comment.

Macquarie raised $6.9 billion in July for Macquarie Infrastructure Partners V, exceeding a $5 billion target, and said it would primarily focus on transactions in the communications, transportation, waste management, energy and utilities sectors.

So far, MIP V’s investments include a 50% stake in a portfolio of Massachusetts hospitals; an investment in LRS, a waste and recycling company; RailUSA, the operator of Florida Gulf & Atlantic Railroad and Grenada Railroad; and telecommunications provider Cincinnati Bell.

Investors in MIP V include the Teachers’ Retirement System of the State of Illinois, the North Dakota State Investment Board and the New Mexico State Investment Council, according to data compiled by Bloomberg.

Spurred by investor demand for stable returns that aren’t correlated to whipsawing markets, infrastructure-focused funds are collectively expected to raise more capital than any other alternative-asset class in the next five years, according to data provider Preqin.

As part of that growth, infrastructure-related assets under management may overtake real estate by 2026, Preqin said.

Updated: 2-18-2022

Brookfield To Target $25 Billion For Biggest Infrastructure Fund

* The Fund Would Rival Record Amount Sought By Ogunlesi’s GIP

* Capital Targeting Sector Seen Reaching $1.87 Trillion By 2026

Brookfield Asset Management is seeking to raise $25 billion for its fifth flagship infrastructure fund, its largest on record.

The firm has already begun marketing the fund, which may exceed the target, according to a person familiar with the matter. A spokesman for the Toronto-based Brookfield declined to comment.

Brookfield’s $20 billion fourth infrastructure fund has committed about 75% of its capital for investment, the company said in a statement

earlier this month. Brookfield Infrastructure Partners, the firm’s publicly traded subsidiary, made several acquisitions in recent months, including Australia’s AusNet Services Ltd. and Inter Pipeline Ltd., which operates assets across Western Canada.

Investors continue to pour money into infrastructure funds, lured by the promise of stable, recurring returns. Adebayo Ogunlesi’s Global Infrastructure Partners also plans to raise $25 billion for a new flagship fund, Bloomberg reported last week.

The amount of capital targeting the sector is forecast to grow to $1.87 trillion by 2026, up from $864 billion at the end of 2021, according to data provider Preqin.

Brookfield Infrastructure, which oversees $112 billion of assets, is seeking to invest in utilities that can benefit as the world moves toward a carbon-free environment, and also sees opportunities in data centers, fiber optics and telecom towers.

The firm is raising money for other strategies.

Brookfield Super-Core Infrastructure Partners, a perpetual fund that invests in low-risk assets, will grow to $10 billion from $6 billion this year, the person said. The firm also started raising money for its third infrastructure credit fund, which is expected to bring in as much as $5 billion.

Separately, Brookfield plans to deploy its own capital for an infrastructure secondaries business that eventually will be open to institutional investors, the person said.

Updated: 5-17-2022

Here’s How To Get Infrastructure Funds To Smaller Cities

A coalition of nonprofits is starting the Local Infrastructure Hub to help mayors of small and medium-sized U.S. cities compete for $1 trillion in federal funds.

When President Joe Biden signed a $1 trillion bipartisan infrastructure bill into law six months ago, it was hailed as a historic investment in America’s physical needs and an opportunity for transformative impact on challenges like climate change and racial wealth equity.

But whether the money is allocated to the most deserving and important projects that move our nation forward will depend in no small part on whether cities and towns of all sizes, from all regions, submit strong applications for the aid. And that is easier said than done.

Over the next 24 months, local governments will be sorting through roughly 400 programs that are designed to aid everything from ports and parks to rural broadband and green buildings, all of which impact the wellbeing and livelihood of communities across the country.

But the fact is many cities and towns don’t have the staff to identify all the funding that may be available to them. And, once they figure out which funding they are actually eligible for, they don’t have the capacity to complete the necessary applications.

The nation’s largest cities have entered and won these kinds of funding competitions before. Their internal experts and community partners will ensure they are positioned to receive a significant share of the available funds. Smaller cities and towns, though, need help.

Getting federal funding is a bit like applying for financial aid to go to college. It helps to have guidance counselors who can identify opportunities, support applicants as they articulate their ambitions and play up their strengths, and help dot the i’s and cross the t’s on final applications.

Mayors have never had that kind of support. But they will now.

Today, with a $50 million initial investment, we are launching a first-of-its-kind support center to help mayors and local leaders secure the funds they need for the projects they want to get off the ground.

We call it the Local Infrastructure Hub. It’s the product of a first-of-its-kind partnership among multiple allies: the National League of Cities, U.S. Conference of Mayors, Urban Sustainability Directors Network, the African American Mayors Association, and Results for America, as well as Bloomberg Philanthropies and other foundations including the Emerson Collective, Ford Foundation, and the Kresge Foundation.

The Hub will connect America’s local leaders to experts who can bring clarity and direction to what can be a dizzying application process. Through webinars and a range of robust technical assistance packages, Hub experts will help showcase innovations and provide communities with the cutting-edge knowledge they need to compete for federal funds.

The Hub will also encourage communities to continue to think big and take on tough challenges. For instance, visionary local leaders see the opportunity to leverage these dollars around climate change and racial wealth equity, and the Hub will support them in advancing ambitious projects that tackle those priorities.

Mayors are on the front lines of nearly all the big challenges facing the nation, from the pandemic and opioid crisis to climate change and economic development. Most are pragmatists, not ideologues, who work across the aisle to get things done. We are joining forces to help mayors of all political stripes make the most of this rare opportunity.

Small and mid-sized cities account for over 25% of the U.S. population. To build a stronger economy and spur job growth more broadly across the country, we need them to help lead the way.

In recent years, many places that suffered the loss of manufacturing jobs have experienced a renaissance as they were forced to reinvent. Now they have a chance to win federal support to help accelerate their comebacks. The Local Infrastructure Hub will help them do it.

Updated: 6-20-2022

Labor Shortage Stymies Construction Work As $1 Trillion Infrastructure Spending Kicks In

Contractors dangle an array of benefits—from signing bonuses to housing allowances—to attract and retain workers.

WASHINGTON—Construction projects across the U.S. are running short on labor just as $1 trillion in federal infrastructure money starts to kick in, leading companies to get creative in their quest to attract and retain workers.

In Southern states, contractors advertise sunny weather and 12 months of work on help-wanted websites in the frostier Northeast and Midwest, where highway construction goes dormant during the winter months. Project managers in remote areas are luring employees with signing and referral bonuses and per diems for housing, knowing they won’t be able to find enough workers locally.

Central Florida Transport, one of the state’s largest aggregate haulers, created a full-time driver advocate position to help its truck drivers with tasks that are tough to do during a busy workday, such as scheduling healthcare appointments or finding a loan broker.

“We wanted to do whatever possible to help solve their problems because we can’t afford to lose any drivers,” said Myron Bowlin, the company’s vice president.

Historically low U.S. unemployment, the economic rebound from Covid-19 and about $600 billion in transportation-specific funding expected from the roughly $1 trillion bipartisan infrastructure law have combined to exacerbate existing employee shortages in the construction industry.

Associated General Contractors of America, which represents more than 27,000 construction companies, said publicly funded transportation projects are routinely coming in at least 20% higher than government officials anticipated because of added labor costs, as well as inflationary factors such as higher prices for fuel and raw materials.

“The severity of the labor shortage means you’re paying workers more and your construction schedules are longer, both of which are big drivers in overall cost,” said Brian Turmail, the industry group’s vice president of public affairs and strategic initiatives.

Moody’s Analytics projects that the bipartisan infrastructure law’s peak impact will be in the fourth quarter of 2025, when there will be about 872,000 more jobs as a result of all the projects across the country.

The higher labor costs could sap some of the value from what has been President Biden’s signature legislative achievement. Administration officials are working to address the workforce shortages, including hosting a “talent pipeline challenge” last week to develop workforce training programs for jobs in construction as well as broadband and electric-vehicle charging infrastructure.

“A lot of my lifetime, the big constraint on infrastructure work has been just a lack of funding and a failure to invest,” Transportation Secretary Pete Buttigieg said. “We got the funding. Now we have got to make sure that we have the raw materials, the technical capacity and the workforce to actually get it done.”

Industries from food service to software development have been pinched for workers as the pandemic ends and the economy revives. Infrastructure, which includes specialty trades such as welding and heavy machinery operation, has an extra set of challenges.

The workforce is on average older and retiring, while younger potential workers are reluctant to sign up for jobs they consider dirty and dangerous, which may not always offer the same flexibility or pay to work from home or an air-conditioned office, said Joseph Kane, an infrastructure researcher at the Brookings Institution.

Average hourly wages for craftworkers, those considered production and nonsupervisory, climbed 6.2% in March from a year earlier, according to the Bureau of Labor Statistics and data from Associated General Contractors of America cited in a report by FMI Corp., a management consultant specializing in the built environment. That is the fastest rate since 1982.

Construction wages are rising slightly faster than in other sectors, said Priya Kapila, a partner at FMI who analyzes compensation and rewards.

“The wage pressure, especially among the building trade, is a function of a constrained supply.” Ms. Kapila said. “That has led companies to say, ‘What else can we do?’”

Ramon Gaanderse, chief information officer at Tucson Asphalt Contractors, said his company has had some success in attracting employees from colder climates.

“We like to say to workers in those areas, ‘Come down here where your hourly rate lasts all 12 months, not just eight,’” he said. “It’s the difference between eating ramen for four months and steak and lobster year-round.”

In the remote Outer Banks and western mountains of North Carolina, bridge-builders are offering signing bonuses and housing allowances as they seek out skilled tradespeople, lures once unthinkable when the adage of the construction industry was “Workers go where the work is.”

Jason McCormack has worked for Flatiron Construction Corp. for 13 years and is the site superintendent on a $60 million conversion of a state highway into an interstate in tiny Wilson’s Mills—about two hours from where he lives with his wife and two teenage daughters near Winston-Salem, N.C.

He said he likely would have found a different construction job if Flatiron hadn’t agreed to a housing allowance, money that enables him to stay in a hotel near the project a few nights a week.

Jim Schneiderman, Flatiron’s mid-Atlantic vice president, said the company has had to absorb the extra employee costs to complete state transportation contracts, bringing down its overall profit margin.

“We learned our lesson and will be building in those higher labor costs accordingly for future work,” he said. “Everyone I talk to in the industry has had this same realization.”

Individual companies stealing talent from each other through bidding wars doesn’t advance Mr. Biden’s overall goal of tackling America’s longstanding infrastructure needs, said Ananth Prasad, president of the Florida Transportation Builders’ Association.

“We need to have a conversation as a country about how we support a qualified workforce to do the things we want to do,” he said.

Florida recently dedicated $1 million to an advertising campaign meant to boost the ranks of infrastructure employees. Some ads specifically mention starting wages of up to $25 an hour.

Officials also are looking to apprenticeship programs run by unions and partnerships between private companies and community colleges and high schools to develop skilled workers.

In Chattanooga, Tenn., a local chapter of Associated General Contractors of America teamed up with the local community college and public school district to redevelop a 30,000-square-foot building as a Construction Career Center.

Local contractors and instructors who will work out of the building hope to get the students’ attention by displaying their shiny new pickup trucks on site.

“When you see a sea of [Ford] F-150s and 250s in the parking lot, that’s kind of eye-opening,” said Leslie Gower, chief executive officer of AGC of East Tennessee, which will work out of the new facility. “It’s indicative of the lucrative careers that await when they graduate.”

By emphasizing that these are high-paying jobs that don’t require a college degree, contractors can draw in more women and people of color, groups that have been historically underrepresented in the construction industry, Mr. Buttigieg said. “We will only be able to get this level of work done if we leave no talent on the table.”

For Now, It’s Triage: The infrastructure work is already arriving, and companies must try to lure the best employees available.

More companies are trying to improve their workplace culture to keep employees happy and clocking in. Large firms including Turner Construction have enhanced their wellness programs to tackle illness, injury and substance abuse among workers, and contractors are making sure their job-site break trailers are comfortable.

Central Florida Transport was experiencing nearly 100% turnover among its drivers last year when officials at the family-owned company based outside Orlando in Coleman realized they needed to make changes. For the first time in its 30-year history, the company began offering 401(k) retirement plans.

And the company doubled its human-resources staff, assigning one employee as a driver advocate to monitor and improve attendance.

But the advocate quit this spring. Since then, Central Florida Transport’s human resources department has fulfilled some of those driver advocacy duties. “We’ve been looking for a new person for at least six weeks,” said, Mr. Bowlin, the company’s vice president. “Like every other position, it’s hard to fill.”

Updated: 7-19-2022

Most US Cities Plan To Use Infrastructure Aid On Roads And Bridges

* In Survey, 82% Of Cities Said Their Funds Will Go To Roads

* Drinking Water Projects Also Score High On The Priority List

Most US cities will pour their share of the federal infrastructure spending package into fixing crumbling roads and bridges, prioritizing motor vehicle infrastructure over other projects like public transit, airports and railways.

About four in five cities said they plan to spend their money on local roads, bridges and major projects, with 56% prioritizing road safety, according to a survey of 153 localities conducted by the National League of Cities and Polco. About 60% said they would use funds from the Infrastructure Investment and Jobs Act on water projects.

A little more than a third of the municipalities said they would spend their money on broadband Internet access. About 26% said they’d put the money toward public transportation, while a little more than a quarter cited electric vehicles, buses, and ferries.

Just 13% identified airports as a spending priority. Ports and waterways and passenger and freight rail came in at the bottom with less than 10% each.

The focus on roads and bridges comes as the American Society of Civil Engineers says the US needs nearly $2.6 trillion over ten years to bring the country’s infrastructure into good repair.

In March 2021, the society gave the U.S. a grade of C- across 17 infrastructure categories, with some of the lowest grades appearing in roads, transit and water.

The Infrastructure Investment and Jobs Act, signed in November by President Joe Biden, provides $550 billion in new cost-shared federal funds to municipalities, meaning states and cities must shoulder a portion of project costs themselves.

To match federal funding, around a third of survey respondents said that they will tap into special reserves, state funds and municipal bonds.

Nearly half reported that they plan to utilize local recovery funds from the American Rescue Plan, a $1.9 trillion stimulus package that allocated $350 billion in aid to states and cities during the height of the pandemic.

“These once-in-a-lifetime investments from the Bipartisan Infrastructure Law allow communities across the country to tackle infrastructure upgrades and badly needed infrastructure projects to improve the lives of residents,” said the league’s Executive Director Clarence E. Anthony.

“From coast to coast, from the biggest cities to the smallest towns, local governments are leading the way in rebuilding and strengthening our nation’s infrastructure.”

Updated: 8-12-2022

A Coalition of Tech Founders Bets Big On Public Infrastructure

The new Upside Tech Alliance combines four startups that are seeking to solve problems like the water crisis in Jackson, Mississippi.

Silicon Valley companies have a bad rap for serving up a bunch of widgets and gadgets for cities that don’t often meet residents’ most dire needs. A group of founders from the technology and venture capital worlds are looking to break that mold by converging their companies’ services to focus on an area that’s been savagely overstressed with underinvestment: public infrastructure.

This week marks the launch of the Upside Tech Alliance, an umbrella group of four companies working on desperately needed urban fixes, often with an emphasis on climate justice.

Aclima creates applications that can track air pollution at the block level, BlocPower develops systems for building electrification, Bitwise Industries trains and places people for jobs in the digital tech workforce, and Promise sets up systems for flexible utility payment plans between low-income residents and city agencies.

The alliance is governed by executive director Michelle DePass, a former EPA administrator who worked most recently as chief executive officer of the Oregon-based Meyer Memorial Trust foundation, which has an $800 million endowment.

Each of the founders identifies as a person of color and shares a mission of redirecting the tech industry toward focusing on the public sector’s most critical needs, particularly at the local level.

“Remember that moment when Flint happened, and folks said, ‘Well, we didn’t know that this could happen?’” says DePass. “If you had been paying attention to the problems of infrastructure, we knew that this was a crisis waiting to happen at any place and space in our country at that time, and it’s only increasing and gotten worse. The raison d’etre for Upside Tech Alliance is because these are companies that want to step ahead and bring tech solutions for the public good in ways that government systems are not prepared to do at this point in time.”

The alliance is made possible in part by a two-year commitment from venture capitalists Mitch Kapor and Freada Kapor Klein, the founding partners of Kapor Capital, which invests in tech companies and startups with a public good or social impact mission. They are providing the core support for the alliance’s staff and infrastructure in that time period.

Their arrival happens to coincide with a time of great municipal catastrophe — think the Jackson, Mississippi, water crisis — but also an abundance of federal funding. Between the Infrastructure Investment and Jobs Act, the Inflation Reduction Act and additional Covid relief resources, there are billions of dollars in the pipeline for cities facing real or impending disaster to tap.

But recalcitrant state governments have blocked many cities from accessing such funds. Some cities also lack the staffing or expertise to make sure they meet all the criteria for the grants, loans and tax credits.

The UTA companies aim to offer their pooled services to cities while helping them to navigate the process of securing funding. The question is whether they will be able to free up enough resources that actually cover the needs of the cities and communities and keep them sustainable.

“What we’re looking for when we’re talking to mayors and looking for partners are leaders who want to apply the latest greatest technology on behalf of serving their constituents at scale,” says Donnel Baird, the CEO and founder of BlocPower.

The eight-year-old company’s Civilian Climate Corps has trained more than 1,500 people to work in solar installation and other green construction. “We try to talk to as many cities and states and counties as possible looking for leaders who want to be on that cutting edge of technology on behalf of the public good.”

While the alliance formally launches this week, the companies involved have already been partners on some projects: In July, New York announced that Aclima would be conducting a block-by-block audit of local air pollutants and greenhouse gases across the state, with priority for areas that have historically been overburdened with pollution — a task it is carrying out with the help of a locally trained workforce assembled by BlocPower.

“We’re mapping every single block of nearly every major urban area across the state,” says Davida Herzl, Aclima’s founder and CEO. “That’s a huge undertaking that technology enables us to accelerate to understand pollution at the hyperlocal level.”

In August, the city of Newark, New Jersey, picked Promise to pilot a new mobile application that will help residents who are behind on their water and sewer bills to set up flexible payment plans to clear their balances and avoid shutoffs.

The city was able to recover more than $600,000 in outstanding debt commitments in the program’s first five days. So far, the city has 400 residents signed up and has collected $1.5 million in outstanding debt through this system.

“Their outreach has been awesome,” says Newark water and sewer utility director Kareem Adeem.

Opportunities in Jackson

The eventual goal of the alliance is to bring together the services of all member companies to tackle a range of challenges. Jackson’s water crisis provides a prime example.

The breakdown of the city’s water system was the result of a confluence of several crises happening to the city at once: aging water plants suffering from long-deferred maintenance; the flight of capital, tax revenue and workers from the city over decades to cover that maintenance; the inability to collect revenue from remaining residents — many of them low-income — due to unpaid utility bills; and the damage from flooding fueled by climate change.

Baird says he sees opportunities for BlocPower and Bitwise Industries to train students from Jackson’s many universities to help assess and fix the city’s water infrastructure needs, while helping the city save money on energy use by electrifying and greening its buildings.

Promise has the platforms that could help Jackson with its water utility woes. Aclima could conduct a block-by-block emissions audit to help the city reduce its role in greenhouse gas emissions.

The alliance could also help the city pinpoint a plan for direct funding from the federal government to avoid what happened after Hurricane Katrina and the BP oil spill, when the state jammed up and redirected allocations.

“The point is, how do you get federal money down to the people of Jackson,” says Baird. “Part of what happens is our software platform provides enough detail on the infrastructure investment opportunities that we can actually build a model and a detailed blueprint for infrastructure need, and then submit that directly to the Biden administration without jumping through a bunch of hoops with the state.”

In addition to their support for the alliance, Kapor and Kapor Klein have seeded or propelled each of the member companies. In aggregate, the combined investment from Kapor Capital, Kapor Center Foundation and personal assets into the four companies exceeds $20 million to date. The investors see the combined group as a possible model for how Silicon Valley interacts with the public sector.

“There are Jackson, Mississippis all around the country — we don’t know all of them yet,” the Kapors said in a statement to CityLab. “The four companies launching the Upside Tech Alliance are primed and ready to work with governments, piloting and launching programs together that will ensure equality, economic opportunity, and climate resilience.”

Updated: 3-17-2023

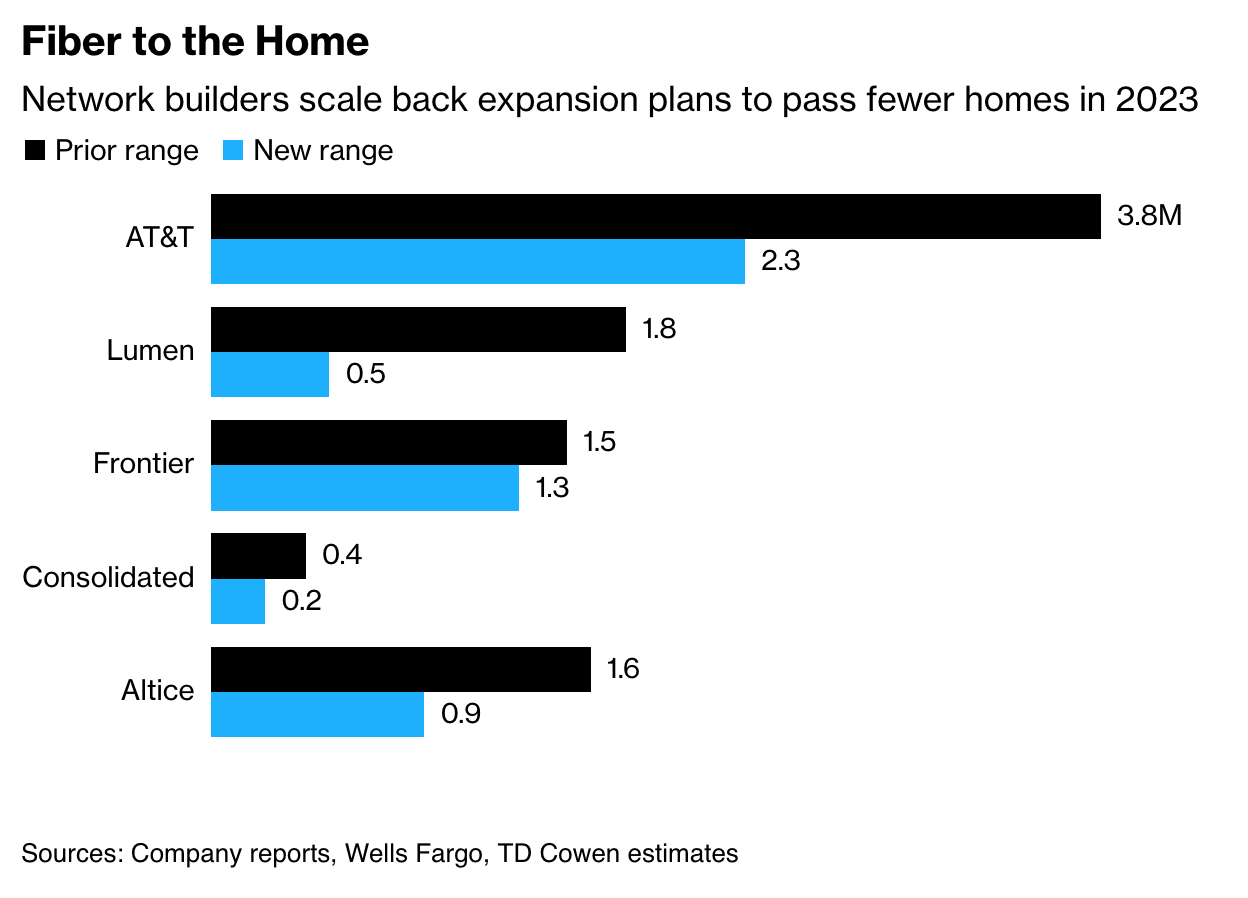

Verizon, AT&T Scale Back Fiber Rollout For Fast Internet Amid Slowing Economy

* Phone Companies Trim Spending Plans For Network Expansion

* End Of Low Interest Rates, Slumping Demand Lead To Cutbacks

Higher costs and a slowing economy are hobbling efforts to deliver lightning fast fiber-optic internet service across the US, leading AT&T Inc., Lumen Technologies Inc. and Verizon Communications Inc. to scale back their expansion plans.

Verizon expects to extend fiber past about 50,000 fewer homes this year than last, executives said

in recent days. Lumen has hit the “stop button” to find a more profitable strategy, and even AT&T, which realigned itself around fiber and 5G wireless, has slashed the number of homes it plans to reach by 39% this year.

The largest US fiber network builders are hitting the brakes as signs of an economic slowdown mount, including rising interest rates and fewer home purchases. The shrinking aspirations follow years of optimism around the potentially life-changing capacity of fiber and billions of dollars in federal infrastructure money for broadband expansion.

The trigger may have been “hawkish commentary” from the Federal Reserve,” said Gregory Williams a telecom analyst with TD Cowen. “This sent the entire market reeling and reassessing capital allocation plans.”

Deploying fiber isn’t cheap and it usually takes years to see a return on that spending. Running a fiber-optic line through a typical residential neighborhood costs about $1,000 per home. Connecting a home is at least another $1,000 on average.

Higher interest rates, inflation and economic worries have made that a risker proposition.

“Times have definitely changed, said Tammy Parker, an analyst with GlobalData. “When carriers were flush with cash and interest rates were low, it was easy to adopt a strategy of ‘build it and the customers will come.’”

What Bloomberg Intelligence Says:

High costs for labor and capital, along with slowing home sales, are denting the pace of telecoms’ fiber rollouts.

— Geetha Ranganathan, Senior Analyst

Lumen, a regional landline operator previously named CenturyLink, went through a major restructuring last year, selling assets, eliminating its dividend and replacing top management.

When Kate Johnson, a former senior executive with Microsoft Corp., took over as chief executive officer in November, one of her first major moves was to pause its Quantum fiber-to-the-home efforts.

The team needed a “more focused build target” to get “proper returns,” Johnson told investors in January.

Like other telecom companies, Monroe, Louisiana-based Lumen wants to emphasize deeper penetration of existing territories instead of a land grab for new markets.

There was “a little bit of a gold-rush mentality,” Chief Financial Officer Chris Stansbury told investors this month. “People are pulling back on their build plans,” reassessing costs and revenue potential.

Market Bandwidth

A big question the companies are confronting is whether consumers are really clamoring for more broadband. Aside from low-income and rural areas, the market is pretty well served.

“Broadband growth has been slowing since the pandemic lockdown peak,” analyst Williams said. “Some of that is due to lower rates of home buying and some is due to market maturation. The thinking is if you didn’t get broadband during the pandemic, you likely never will.”

Last year, nearly all of the industry’s broadband subscriber growth was captured by T-Mobile US Inc. and Verizon through a less expensive, easy-to-install wireless service beamed into homes. The competition hurt Comcast Corp. and Charter Communications Inc., which added their fewest internet customers in more than a decade.

Fiber and cable companies responded by beefing up their services, promising multigigabit speeds versus the 100 megabits per second or more offered by the invading wireless providers.

“To attract customers without having to lower prices, carriers are supplying more capacity and higher speeds,” said Jean-Pascal Crametz, a broadband pricing analyst with Oncept Consulting Group and Ph.D from Stanford University.

But, he notes, even if everyone in your house is watching HD video or playing games, “there’s only so much capacity that a home can consume. Nobody really needs more than 100 megabits of speed.”

Ultimately, the competition between existing broadband providers and the new contenders supplying wireless home internet service will mean lower prices for consumers.

Still, carriers need new customers who are willing to pay for more expensive plans to help justify the growing costs of building broadband networks.

There’s going to be a bit of a chill in the broadband market if customers start tightening their belts, GlobalData’s Parker said.

“Many fiber projects that would have gotten the green light just a year ago may not see the light of day for several more years, if ever,” she said.

Updated: 6-8-2023

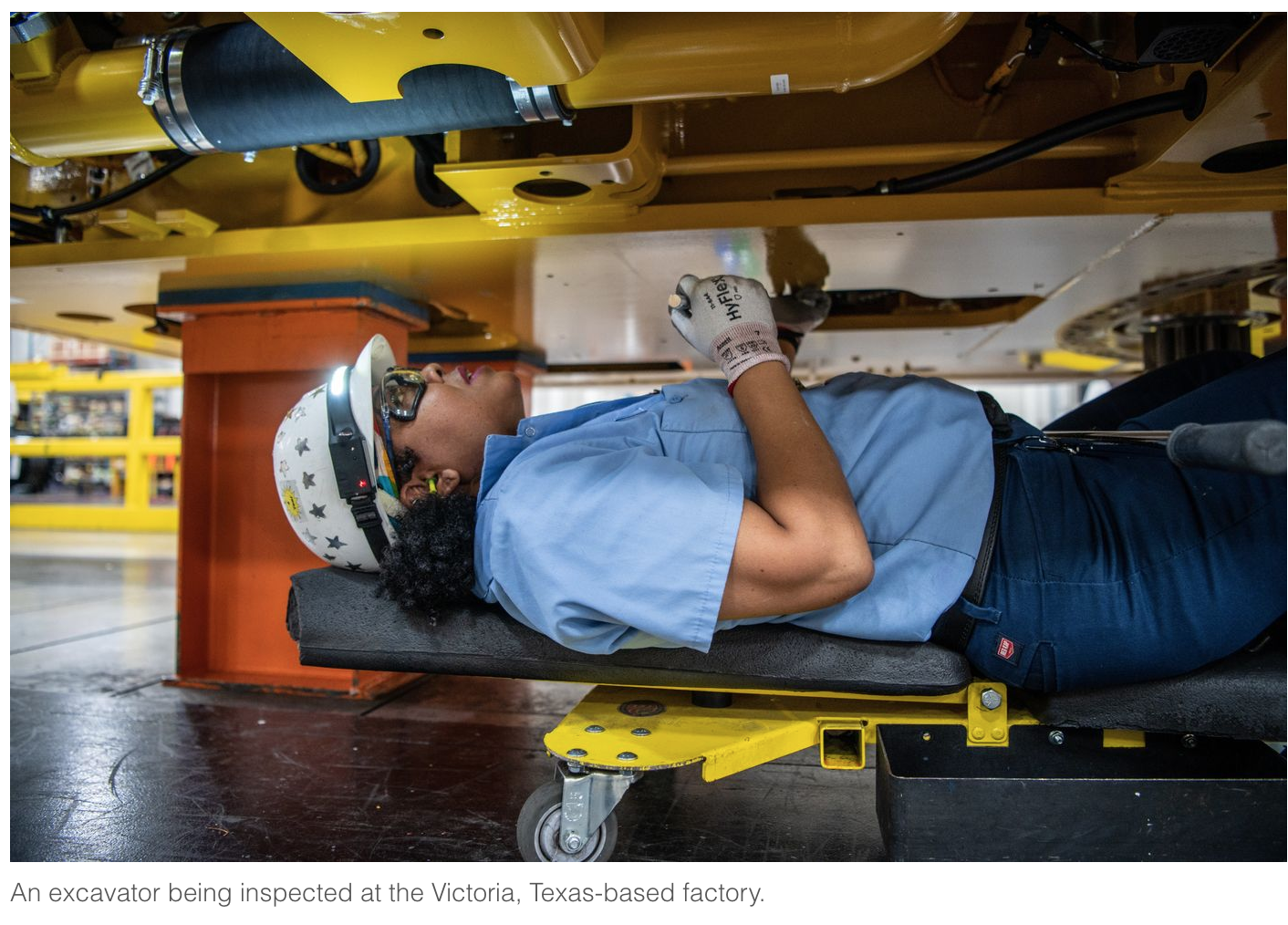

Construction Boom Fuels Surge In Excavator Sales

Deere, Caterpillar, CNH broaden their lineups; ‘it’s easier to invest in pieces of equipment than to hire people’.

Construction excavators are tearing through the equipment market.

Companies including Deere, Caterpillar and CNH Industrial are expanding or upgrading their models of the earth-moving machines that function as jack-of-all-trades at construction sites. Building and infrastructure projects are driving historic demand for excavators.

Sales of excavators in North America last year rose 23% over 2021 to 41,320 machines, the second-straight year of record sales, said Off-Highway Research.

The London-based consulting firm projects sales will rise another 5% this year, boosted by federal spending on battery plants for electric vehicles, road and bridge repairs and other nonresidential construction.

Excavators, especially small models, increasingly are replacing backhoes and front-end loaders that traditionally have been used to dig holes or move piles of dirt, construction company executives said.

Rising excavator demand also is being fueled by labor shortages, according to contractors, as older, higher-skilled workers retire or leave for other jobs.

“It’s easier to invest in pieces of equipment than to hire people,” said Caitlan Knox, who started HardKnox Rocks & Excavating near Phoenix with her husband six years ago.

The company, which has five employees, mostly does home demolition and landscaping work with a small Caterpillar excavator. HardKnox rents larger excavators for specific jobs, and Knox said she is in the market to buy more.

For manufacturers such as Deere, Komatsu and Caterpillar—the biggest seller of excavators in North America—excavators have become the sales engines in their equipment lineups. Excavators represented more than half of all construction equipment sold worldwide in 2022, according to Off-Highway.

Global sales last year were 52% higher than a decade ago at 635,104 machines. Large excavators range in price from about $200,000 for a 20-ton model to more than $900,000 for a machine above 70 tons.

Deere, best known for its green and yellow farm equipment, is counting on a revamped lineup of large excavators to drive higher sales for its $12.5-billion construction equipment business in the coming years. Deere and Japan’s Komatsu have been battling for second place in the North America excavator market behind Caterpillar.

Deere said last year that it intends to end a decadeslong joint venture for building large excavators with Japan’s Hitachi for Deere-brand excavators in the U.S., Canada and Brazil.

Deere executives said that they plan to tap expertise acquired through Deere’s 2017 purchase of Wirtgen Group, a German paving equipment maker, to improve Deere’s excavator line.

“It’s the most important piece of equipment in earth-moving construction,” said Ryan Campbell, president of construction and forestry equipment for Deere. “You can do just about anything with them.”

For its new excavators, Deere redesigned an excavator platform it uses in China. Deere said it would start testing its new excavator this year but hasn’t announced when it would begin selling them.

CNH Industrial, which also makes Case and New Holland farm equipment, is trying to resuscitate sales of Case’s construction brand with a big expansion of its excavators. Since the fall, the company has rolled out seven new models, including two battery-powered miniexcavators.

Equipment makers anticipate small electric excavators weighing a few tons or less to attract buyers sooner than large excavators, where the heavy workload demands on the machines would require more frequent charging of the batteries.

“They have to be versatile,” said Terry Dolan, vice president of Case North America.

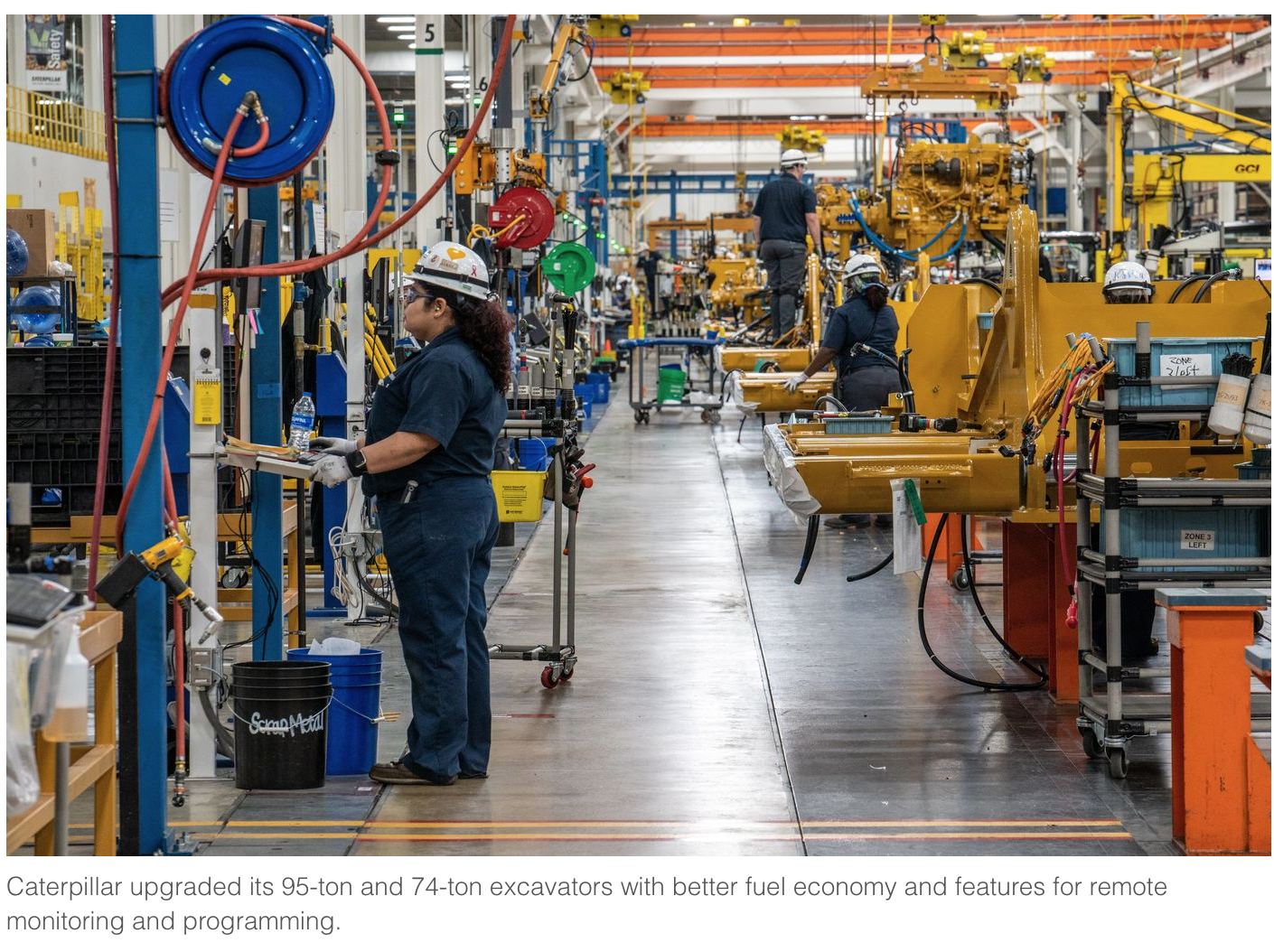

Texas-based Caterpillar said it upgraded its 95-ton and 74-ton excavators two years ago with better fuel economy and features for remote monitoring and programming of machines on a job site. The two heavyweight models are used in construction and mining duties.

Tom Frake, senior vice president for excavation, said Caterpillar has been able to devote more research and development spending to improving excavator performance in recent years, after having spent heavily for more than a decade to comply with stricter regulations on diesel-engine exhaust.

“We’ve been able to focus more on helping customers be successful,” he said.

The first excavators appeared in Europe during the 1950s, but Japanese equipment makers, led by Komatsu and Hitachi, perfected the machines’ complicated hydraulics during the 1960s and started exporting them in the 1970s.

Excavators weren’t widely used in China until the early 2000s. China is now the world’s largest market, with Sany Heavy Industry, XCMG Group and LiuGong Machinery the leading domestic brands.

Excavators are more in demand, particularly among equipment-rental companies, partly because less experienced operators can get the hang of an excavator faster they can learn to drive a bulldozer or other types of machinery, said Andrew Ryan, North America president for LiuGong.

“If you’re a rental business, you want to have something that’s easy to operate and you can apply it to a lot of different jobs,” he said.

The gangly, hydraulically controlled boom on the front of an excavator gives it dexterity on a job site that other machines can’t easily match. With their steel-tooth buckets or other attachments, the machines can dig, tow, lift and demolish.

They are able to reach down into holes, scoop up a bucket-full of dirt and then empty it into a dump truck.

Brett Nielsen, president of Whitaker Construction in Utah, said the company has 110 excavators. The machines are particularly effective for underground pipeline projects where the machines can dig a trench and lift large-diameter steel pipe.

“We’re using excavators a lot of times in place of cranes,” he said. “We use them a lot for hoisting.”

Updated: 6-16-2023

Steve Eisman Says His Big Bet Now Is On US Infrastructure

Where the ‘Big Short’ legend is going long.

Steve Eisman, the money manager who famously bet against frothy US mortgages just before the housing bubble burst in 2008, now sees value in a different type of American spending: infrastructure.

In an interview with the Odd Lots podcast conducted as part of the Bloomberg Invest summit, the Neuberger Berman Group LLC senior portfolio manager says he’s betting on companies that stand to benefit from billions of dollars worth of government spending, as the Biden administration ramps up investments in everything from domestic manufacturing to a decarbonized energy grid.

In fact, he sees the grid specifically as the biggest theme in the coming years.

“The biggest story is going to be the grid. The grid is absolutely crucial and, I mean, the estimates of improving the grid in the United States are, — you know, everybody’s got a different estimate — but it’s like $200 billion, $300 billion,” Eisman says. “I mean, it’s unbelievable numbers.”

He sees the electrification of consumption — including the move to things like electric vehicles and induction stoves — as putting huge strains on existing infrastructure, which will necessitate further investment.

“There’s this new rule that came out from the governor that says every single new building in New York state has to have an electric oven. Well, if we could snap our fingers and just do that, there’d be a blackout immediately,” Eisman said.

While he’s reluctant to name specific companies in his portfolio, he cites Quanta Services, Inc. as the type of stock that can massively re-rate when a new regime hits the market.

The company installs wiring for major utilities and has already seen its stock soar from about $40 per share at the start of 2020, to $185 currently.

“So we’ve owned a company for a while called Quanta, we have it in most of our portfolios,” Eisman says. “Quanta, prior to all this grid stuff, used to sell at 10, 11, 12 times earnings.

But because all the stuff involving infrastructure, the opportunities for the company have been enormous, so the stock has been revalued. How often does that happen? Not that often. But you know, when you have the potential to do something like that, you go all in.”

Beyond simply the electrical grid itself, Eisman sees a big opportunity, with big money behind it, in general infrastructure.

“The infrastructure stuff in the United States is pretty pathetic,” Eisman said. “The issue really is at this point that to actually do something with federal government money takes a long time. Now, whether they can shorten the time, that’s very important. But it’s more of a time issue, I think, at this point than a competence issue.”

When it comes to financials and real estate — the two sectors through which Eisman made his name — the money manager said he feels that while banks may face earnings pressures in the coming months as they struggle to attract and maintain deposits, the financial system isn’t facing anything near a crisis on the scale of 2008.

“We’re not having a banking crisis, we’re having a crisis of certain banks,” Eisman said. “The last war was credit quality and capital, which that problem was solved. The problem with Silicon Valley was that the correlation between all their depositors was essentially one.”

As for commercial real estate, another area in deep distress, Eisman is skeptical of good opportunities despite the plunge in values. “You know, Blackstone and Brookfield — I mean, these are not small companies — have given back the keys for some of their pretty good buildings because they know the debt’s gonna come due in a few years.”

And if the most serious players in the space are walking away, per Eisman, then that’s a pretty big tell. “They know what the cash flow’s gonna be and they can’t support the cash flow. So they’re giving the keys back.”

Updated: 6-18-2023

America Can Fix Its Highways Much Faster, If It Wants

The expedited reconstruction of a collapsed interstate in Philadelphia raises the question: Why can’t America do this for everything?

The collapse of a section of Interstate 95 in Philadelphia, smack dab in the middle of the densest region of the US, is an obvious disaster for the nation’s transportation network.

But the demolition work, which began within hours, is already ahead of schedule, the repair work will be expedited, and a temporary roadway will get cars moving before the repair is fully complete. And all of it is being livestreamed, for anyone who wants to keep an eye on things.

Given the generally glacial pace of infrastructure projects in America, it’s hard not to be impressed by the overall speed of this process. It naturally raises the question: Why can’t America do this for everything?

The answer, unfortunately, is that delay is a policy choice — one governments at various levels have opted for over the past half century, regularly prioritizing community input and litigation avoidance over the goal of getting something done quickly.

Contrast the I-95 bridge-rebuilding with another idea for moving cars more quickly through a northeastern megalopolis: congestion pricing for New York City. This was championed by then-mayor Michael Bloomberg in 2007-2008 and had the support of US Transportation Secretary Mary Peters.

It died due to opposition from suburban representatives in the New York State legislature, who vetoed a neighboring jurisdiction’s ideas about how to manage its own roads.

Now the politics have changed and the city has a go-ahead for the program. But that came only after a multi-year environmental review to ascertain whether fewer traffic jams and more people riding mass transit was good or bad for the environment.

With the I-95 reconstruction in Philadelphia, there will be no such review — in part because rebuilding a highway is obviously bad for the environment. No study is required. But as it turns out, people like having functional highways even more than they care about air quality, so everyone is comfortable brushing off the review.

Most environmental objections to congestion pricing — or to bike lanes in California — are in bad faith, which makes them harder to overcome. (It’s not as if there are legitimate environmental concerns that can be addressed.) But even for relatively uncontroversial highway programs, an emphasis on speed has been the exception rather than the rule.

As Zachary Liscow and Leah Brooks have shown, per-mile highway construction costs tripled between the 1960s and 1980s, with no increase in construction workers’ wages. What went wrong? They finger two culprits.

One is that the level of “citizen voice” in the process increased dramatically — wider ranges of stakeholders were given more opportunities to raise objections, making it harder for planners to insist on the most cost-effective routes and timetables.

The other is that Americans got richer and bought more cars, so demand for highways remained strong no matter the cost. The interaction of these two factors led to a cost explosion.

It’s tempting to say that the high priority placed on the I-95 project by Governor Josh Shapiro of Pennsylvania and other relevant officials accounts for the speedy process. But often the investment of political capital has the opposite impact.

When a governor or mayor or senator lets it be known that a big project is a signature initiative, others see it as an opportunity. So they demand that the project come with some upgrades to nearby parks, or more noise-reduction barriers, or that the route be changed.

The point is that once a project becomes a must-do, it gets an endless list of nice-to-have side benefits no matter what the impact on cost or timeline.

A classic example comes from the project to extend one line of the MBTA, greater Boston’s mass-transit system. As originally conceived, it was a pretty simple extension of an existing light-rail line into an existing railroad trench that needed to be widened, accompanied by some brand-new stations. But over the course of the planning process, the project kept expanding.

Besides widening the trench and adding new tracks, there was the matter of continuing bike/pedestrian path parallel to the trench. And it wasn’t enough for the new stations to be similar to the existing stations; they had to be signature architectural works with custom landscaping.

Eventually a new governor came in, said it was too much money, and told them to rework the project to be cheaper. Lo and behold, they did — returning to something like the simpler early vision. So while the new line doesn’t have as many community benefits, the community does have a new mass-transit line.

If the governor had been more committed to the project, the community might have called his bluff and refused to settle for less.

On one level, this MBTA story, the I-95 rebuild and initiatives such as Operation Warp Speed or the speedy delivery of military hardware to Ukraine paint an optimistic picture of state capacity.

There are clearly people in government who know how to get things done. On another level, that very fact is a reminder that there is no quick fix for the problems of cost bloat and delay.

To put it bluntly: Bringing in a new guy — whether it’s an “art of the deal” president or a US transportation secretary from McKinsey — won’t necessarily speed things up. Because the delay comes not from government incompetence but from the great mass of citizens who demand more voice, more procedure, more consultation and more review.

Of course, it’s possible to do things more quickly. All it would require is copying the process — or, rather, lack of process — currently unfolding in Philadelphia.

Updated: 6-26-2023

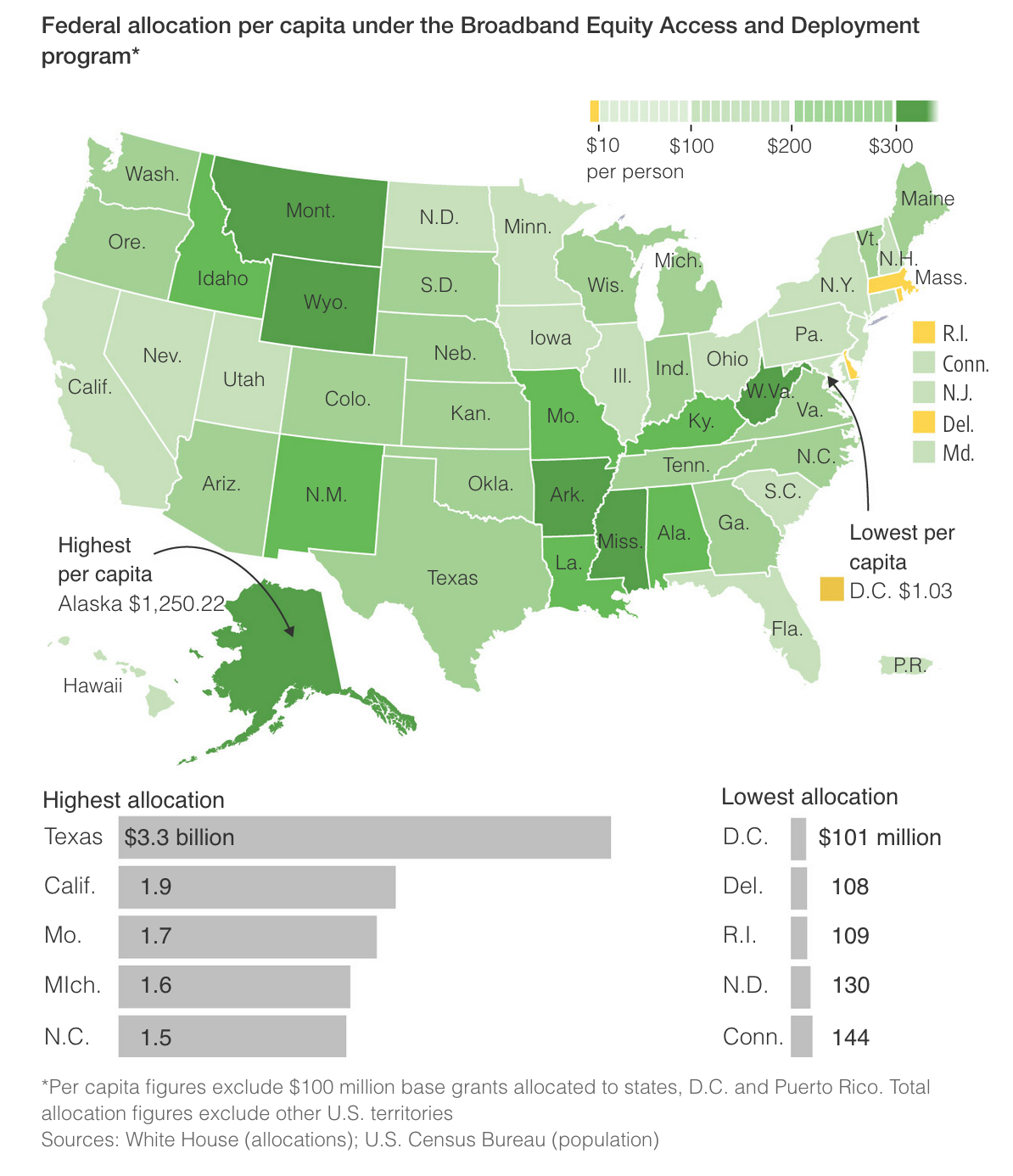

Texas, Rural States Reap Big Grants From $42.5 Billion Broadband Fund

Biden administration officials announce money available under high-speed internet expansion authorized by 2021 infrastructure law.

The White House on Monday kicked off a flood of new funding for state governments to spend on internet projects from the $1 trillion infrastructure law passed in 2021.