Famous Former Bitcoin Critics Who Conceded In 2020-24

Publicly recanted! Luminaries who came to terms with crypto in 2020-23. Famous Former Bitcoin Critics Who Conceded In 2024

Bitcoin may never be a widely used medium of exchange, but it has become a useful store of value, former critics concede in 2024.

Humans, being only human, tend to hang on to their cherished beliefs — even in the face of overwhelming contradiction. That’s why recantations — that is, public acts of refuting a previously held opinion — are so rare.

This year, however, has presented several notable changes of heart where Bitcoin (BTC) and other cryptocurrencies were concerned — abetted, perhaps, by BTC’s climb to record price levels. Here are eight of the year’s more memorable turnarounds.

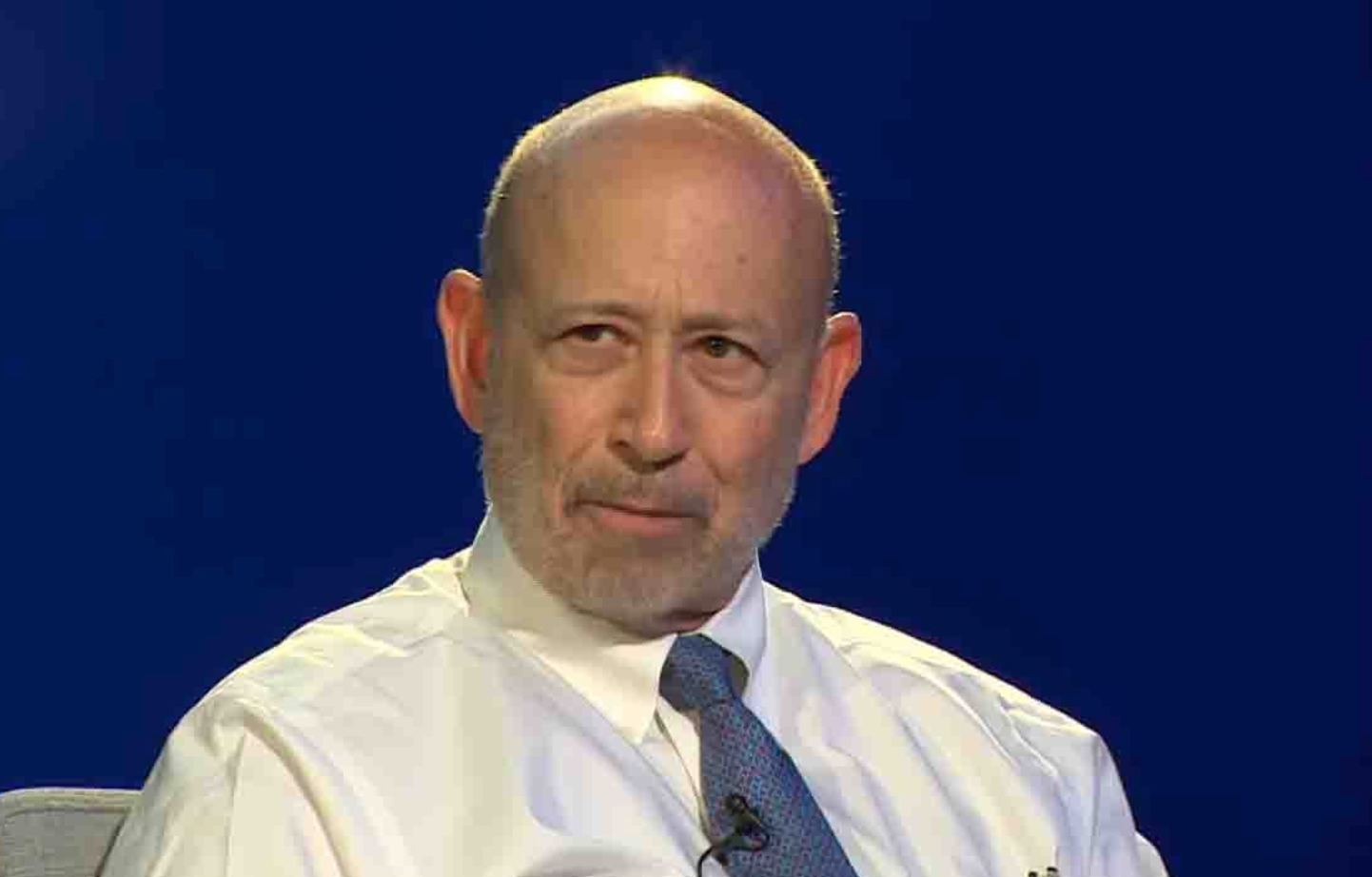

Nouriel Roubini, Economist

Crypto’s most ferocious critic recanted in 2020. Roubini, an NYU professor of economics who gained fame by predicting the 2007–2009 housing bubble, has in recent years heaped scorn on cryptocurrencies and blockchain technology in general.

What He Said In 2018: Part of Roubini’s testimony for the United States Senate went viral: “Crypto is the mother of all scams and (now busted) bubbles.” He also called blockchain “the most over-hyped technology ever, no better than a spreadsheet/database” — and this was just the title of his testimony.

In his Senate visit, Roubini compared Bitcoin “to other famous historical bubbles and scams — like Tulip-mania, the Mississippi Bubble, the South Sea Bubble.”

He noted that Bitcoin’s price increases had been two or three times larger than that of previous bubbles, followed by “ensuing collapse and bust as fast and furious and deeper.” At the time, Bitcoin was somewhat in the doldrums, selling at about $6,300.

What he said recently: In a Nov. 6, 2020 interview, Roublini admitted that Bitcoin — selling at about $15,500 at the time — might qualify as a “partial store of value,” primarily because of its algorithm that limits supply to 21 million BTC. Of course, Roubini also declared that Bitcoin “is not scalable, it’s not secure, it’s not decentralized, it’s not a currency,” and that it would be made irrelevant or “crowded out” within three years by central bank digital currencies.

Still, everything is relative. The professor’s partial pullback prompted economic historian Niall Ferguson to comment: “If I were as fond of hyperbole as he [Roubini] is, I would call this the biggest conversion since St. Paul.”

Updated: 2-14-2021

Don’t Fall For The Bitcoin Bubble, Even The Flintstones Had A Better System, Warns Economist Nouriel Roubini

Cryptos cannot protect investors from tail risks, says the Stern School of Business, NYU economics professor.

More than two years after warning U.S. lawmakers that cryptocurrencies are “the mother of all scams and bubbles,” economics professor Nouriel Roubini remains a hater.

“Since the fundamental value of bitcoin is zero and would be negative if a proper carbon tax was applied to its massive polluting energy-hogging production, I predict that the current bubble will eventually end in another bust,” Roubini wrote in an opinion column for the Financial Times on Wednesday.

Since his October 2018 warning, bitcoin BTCUSD, 3.53% has surged more than 600% and is currently hovering at $45,000, up nearly 60% so far this year. A recent leg higher briefly took bitcoin to $48,000 on Tuesday, sparked by a $1.5 billion investment from electric-car maker Tesla TSLA, +0.55%. The company also referenced plans to accept future payments in bitcoins.

Acknowledging Tesla, Roubini said bitcoins are still “barely used by legitimate companies.” He also harked back to the last bitcoin bubble of 2017-18, when the cryptocurrency went from $1,000 to $20,000 then back to $3,000.

And don’t even refer to cryptocurrencies as “currencies,” as almost nothing is priced in them, he said. “They are not a scalable means of payment: with bitcoin you can do five transactions per second while the Visa network does 24,000.”

Then there is the volatility, which can wipe out profits within hours and the fact that relying on cryptocurrency tokens marks a return to the Stone Age, a dig he’s made before. Invoking that “modern Stone Age” cartoon family, he said even the Flintstones “had a more sophisticated monetary system based on a benchmark” — shells.

Crypto, he says, is “only a play on a speculative asset bubble, worse than tulip-mania, as flowers had and still have utility. Its store of value against tail risks is unproven. And worse: some cryptos, dubbed “‘shitcoins,’ are financial scams in the first place or debased daily by their sponsor,” said the professor of economics at New York University’s Stern School of Business and chairman of Roubini Macro Associates.

And cryptocurrencies won’t “decentralize finance, provide banking services to the unbanked, or make the poor rich,” because the mining of bitcoins, for example, is mostly controlled by oligopolistic miners, in far-flung places such as Russia, China or Belarus.

Neither will bitcoin nor its rivals provide that safe haven investors are looking for — hedges against inflation, weak currencies and tail risks amid loose monetary policy, financial crisis and geopolitical stress. “Gold, inflation-based bonds, commodities, real estate and even equities are all reasonable candidates,” Roubini wrote.

No doubt bitcoin has plenty of fans out there, including billionaire investor Mark Cuban, who described some crypto assets as digital stores of value in a January blog post.

Updated: 12-25-2020

Biden And Yellen Will Crack Down On Crypto ‘Criminal Cesspool’ — Nouriel Roubini

In his latest ill-fated tweet, “Dr. Doom” Roubini spells out the death of cryptocurrency again, just as XRP gains 35% and Bitcoin aims for new all-time highs.

Bitcoin (BTC) naysayer Nouriel Roubini believes that incoming U.S. president Joe Biden will go much further than Donald Trump in controlling cryptocurrency.

In a fiery Twitter debate on Dec. 24, Roubini, who is known for both his dislike of crypto and his ability to call market bottoms by mistake, called the sector a “cesspool.”

Roubini to pro-Bitcoin lawyer: “You are delusional”

Roubini was responding to Jake Chervinsky, a lawyer studying the fallout from the recent news that U.S. lawmakers were demanding that stablecoin payments implement on-chain Anti-Money Laundering and Know-Your-Customer (AML/KYC) identification processes.

Chervinsky argued that the idea currently had “exactly zero chance” of becoming an enforceable law. Rather, it represented the “personal views” of Steven Mnuchin, the Treasury Secretary under Trump soon to be replaced by Biden’s pick, Janet Yellen.

“You are delusional,” a visibly irate Roubini retorted.

“Biden’s team, starting with Yellen who was my boss at CEA, will crack down on this criminal tax evading & AML-KYC-TFC-evading crypto/shitcoins cesspool much more than Mnuchin. Get a life as you have become a crypto hired gun cheerleader/enabler.”

Bitcoin and altcoins refuse to die this year

Cryptocurrency skeptics have been buoyed this week by news that U.S. regulator the Securities and Exchange Commission (SEC) had decided to file a lawsuit against blockchain payments network Ripple. The largest investor in the fourth-largest cryptocurrency, XRP, Ripple saw a 60% drop in the value of the token once the news became public.

At the same time, commentators noted that Bitcoin had barely reacted to the legal challenge. In the long term, however, surveys have shown that many remain concerned about the potential for government bans to impact Bitcoin’s success.

Proponents argue that this is impossible. The most effective way of reducing demand for a fully-decentralized asset, they claim, is for governments to reintroduce free markets on a sound monetary standard such as gold — an unlikely eventuality.

“Bitcoin can’t be easily banned,” Saifedean Ammous, author of “The Bitcoin Standard,” summarized last year.

“If people want to use it, they’ll find a way. If you want to stop it, you want to undermine the incentive to use it. Nothing would do that like a free market in banking based on a gold standard.”

Meanwhile, the outlook for Roubini if he continues his current lambasting of Bitcoin and altcoins looks bleak. As data shows, his outbursts have almost exactly matched local price lows for BTC/USD, making the economist an accidental bellwether for those looking to enter the market to profit.

Fellow detractor Peter Schiff has a similar track record when it comes to Bitcoin itself.

Updated: 5-20-2021

Bitcoin Bloodbath: Nouriel Roubini Slams Institutional Investors Of ‘Fomo’

American economist Nouriel Roubini on May 19 criticised the institutional investors who invested in volatile pseudo-asset ‘Bitcoin’ which according to him has no intrinsic value. He also sought that those investors be fired on the spot.

The following reaction by the New York University’s Stern School of Business professor comes amid reports of cryptocurrency Bitcoin down by almost 20 percent over the past 24 hours and down to $36,900.

Cryptocurrency bloodbath underway; Bitcoin now down almost 20% over past 24 hours

“Bitcoin falls more than 40% from its peak in less than one month. Which institutional investors are reckless enough to invest in such a risky and volatile pseudo-asset with no intrinsic value? They should be fired on the spot if undertaking such a reckless speculative gamble!” Nouriel Roubini wrote on Twitter.

Bitcoin falls more than 40% from its peak in less than one month. Which institutional investors are reckless enough to invest in such a risky and volatile pseudo-asset with no intrinsic value? They should be fired on the spot if undertaking such a reckless speculative gamble!

— Nouriel Roubini (@Nouriel) May 19, 2021

This is not the first time the economist has said against cryptocurrency. Roubini on February 23 had said that retail investors with “fear of missing out” are going to get crushed by investing in Bitcoin during its latest run higher, reported Yahoo Finance.

“We have, like in 2017, hundreds of thousands of retail suckers that are having FOMO (fear of missing out) going into this asset class. And they are going to buy it at peak like it happened in December of 2017 when it was $20,000 and fell to $3,000 by the end of the next year. So, it’s the same phenomenon — just people are moving in because of FOMO, feeding the bubble, manipulation, eventually, they’ll get crushed,” Yahoo Finance reported Roubini as saying.

The NYU Stern professor of economics had even argued that Bitcoin’s surge is driven by “massive manipulation,” not a rush into a hedge against inflation.

In December 2020, Nouriel Roubini dubbed Bitcoin and other cryptocurrencies as “sh-tcoins,” which according to him have no place in retail or institutional investor portfolios.

“First of all, calling it a currency — it’s not a currency. It’s not a unit of account, it’s not a means of payment.…it’s not a stable store of value. Secondly, it’s not even an asset,” Roubini said.

Among others who have spoken openly on the recent downfall of bitcoin’s value include Capital Mind founder Deepak Shenoy. He compared the market cap downsize to half of RBI’s forex assets. “Bitcoin’s market cap is down some $300 billion+ in a week. That’s like half of RBI’s forex assets,” Shenoy wrote on Twitter.

Here’s What Monk Entertainment Founder Viraj Seth Wrote:

Every Time Bitcoin Hits An All-Time High:

“Wish I could’ve bought more”

Every time Bitcoin goes down:

“Yeah let’s wait for it to go down more”

Average life cycle of a HODLer.

— Viraj Sheth (@viraj_sheth) May 19, 2021

Expressing his views on cryptocurrency and bitcoin, founding partner of Mobius Capital Partners — Mark Mobius — had said on May 18 that he doesn’t like is cryptocurrency and called it a “very risky area.”

Mobius had said that it’s difficult to predict the direction of cryptocurrency prices and questioned how easy it is to convert bitcoin and other cryptocurrencies into “real money” that people can spend, reported CNBC. He continued to share his disagreement with suggestions that bitcoin could replace gold as a hedge against inflation.

“I can’t have a crypto ring whereas I can have a gold ring —that’s the real difference,” CNBC quoted Mobius as saying.

“It’s a completely different situation and I don’t know understand why people say that bitcoin can be like gold, it’s completely different. Gold is gold and it’s something physical, whereas bitcoin is not,” he added.

The following decline in the two most traded cryptocurrencies were sparked last week by Elon Musk’s reversal on Tesla taking bitcoin as payment, followed by other tweets that caused confusion over whether the carmaker had shed its holdings of the currency.

Apart from this, China’s announcement on Tuesday that it is banning financial institutions and payment companies from providing services related to cryptocurrency transactions, coupled with a warning to investors against speculative crypto trading, seemed to have exacerbated the selling.

Stanley Druckenmiller, Investor

Investor and hedge fund manager Stanley Druckenmiller — the man who “broke the Bank of England” along with George Soros in 1992 by betting against the British pound — appeared to abandon his previous crypto skepticism in 2020.

What He Said Then: “I look at Bitcoin as a solution in search of a problem,” Druckenmiller told the Economic Club of New York in June 2019. “I don’t understand why we need this thing. […] I wouldn’t be short it, I wouldn’t be long it. […] I don’t understand why it’s a store of value.”

What he says now: In November 2020, worried about the United States Federal Reserve’s Covid-related stimulus efforts, Druckenmiller told CNBC that he now likes Bitcoin as a hedge against inflation, perhaps even more than gold:

“It has a lot of attraction as a store of value both to Millennials and the new West Coast money. […] It’s been around for 13 years and with each passing day it picks up more of its stabilization as a brand. […] Frankly, if the gold bet works, the Bitcoin bet will probably work better because it’s thinner, more illiquid and has a lot more beta to it.”

Updated: 5-13-2021

Billionaire Druckenmiller Says Ledger-Based System Could Replace USD Worldwide

Billionaire Stanley Druckenmiller thinks some kind of crypto-derived ledger system may replace the U.S. dollar as the world’s reserve currency in the future.

Billionaire hedge fund manager Stanley Druckenmiller has forecast the possibility of a crypto-derived ledger system overtaking the U.S. dollar as a global reserve currency.

The hedge fund boss noted that if there were to be a U.S. dollar replacement it “would be some kind of ledger system invented by some kids from MIT or Stanford or some other engineering school that hasn’t even happened yet, that can replace the dollar worldwide.”

He made the comments in an interview with CNBC’s Squawk Box. Druckenmiller noted that crypto is often promoted as a hedge against inflation, which has become more relevant of late:

“Well, you probably don’t remember this joke, but five or six years ago, I said that that crypto was a solution in search of a problem. And that’s why I didn’t play crypto the first wave because we already have the dollar. What do we need to look for?”

But he went on to add that ongoing financial stimulus was an issue: “Well, the problem has been clearly identified. It’s Jerome Powell and the rest of the world, central bankers. There’s a lack of trust. So sort of groping for an answer for a central case.”

Druckenmiller reportedly invested in Bitcoin earlier this year and told Squawk Box that it’s unlikely that he believes it’s Bitcoin will be usurped by other cryptocurrencies as the top store of value asset:

“It’s going to be very hard to unseat Bitcoin, as a store of value asset, because it has a 14 year old brand, it’s been around long enough, and obviously, there’s a finite supply.”

Druckenmiller noted that while Ethereum is leading the way when it comes to building smart contracts, he does not see it dominating everyday transactions. He believes that the next generation of developers is likely to improve on current blockchain technology leaving current solutions behind.

“The quality of the competition that’s going to come against the incumbents in this space is going to be brutal,” he said. “That’s why I think it’s just too early to call who is going to be the winner when it comes to the payment system, commerce, that kind of stuff.”

Druckenmiller doesn’t see alternative fiat currencies taking over from USD however because “Europe is a complete mess,” and “Who’s going to trust the Chinese?”

Larry Fink, CEO of BlackRock

More institutional investors began to notice crypto in 2020. Larry Fink, CEO of BlackRock, the world’s largest asset manager, told the Council on Foreign Relations in December regarding Bitcoin: “Many people are fascinated about it, many people are excited about it.” His remarks came less than two weeks after Rick Rieder, BlackRock’s chief investment officer of fixed income, told CNBC that “Bitcoin is here to stay. […] Bitcoin will take the place of gold to a large extent.”

What he said in 2017: Speaking at a meeting of the Institute of International Finance shortly after BTC reached its all-time high above $5,800 in October 2017, Fink said: “Bitcoin just shows you how much demand for money laundering there is in the world. […] That’s all it is. It’s an index of money laundering.”

What he says now: In his dialog at the Council of Foreign Relations, Fink said, “We look at it as something that’s real,” adding that among three topics discussed recently on BlackRock’s website — COVID-19, monetary policy and Bitcoin — the hits for each topic were 3,000 on COVID, 3,000 on monetary policy, and 600,000 on Bitcoin. “What that tells you is that Bitcoin has caught the attention and the imagination of many people,” said Fink, adding that BTC was still untested and comprised a very small slice of overall asset markets.

Niall Ferguson, Economic Historian

Ferguson, senior fellow at the Hoover Institution at Stanford University, is one of the world’s best-known economic historians. Author of The Ascent of Money, he has been weighing in on crypto as far back as 2014 — and not always favorably.

What he said in 2014: Digital currencies are a “complete delusion.”

What he says now: “Bitcoin and China are winning the COVID-19 monetary revolution.” That, at least, was the headline he wrote in an opinion piece for Bloomberg in late 2020, which had as a subheading: “The virtual currency is scarce, sovereign and a great place for the rich to store their wealth.”

To be fair, Ferguson backpedaled on his “Crypto is a delusion” remark in early 2019, and even joined a blockchain project, Ampleforth, that year. However, his recent screed suggests he has gone even further now — reconstituting himself as a fully fledged Bitcoin bull. “Bitcoin is gradually being adopted not so much as a means of payment but as a store of value,” he wrote.

Two features were particularly attractive, in Ferguson’s view: Bitcoin’s limited supply (“Built-in scarcity in a virtual world characterized by boundless abundance”) and its sovereignty (“users can pay without going through intermediaries such as banks. They can transact without needing governments to enforce settlement”).

Jim Cramer, Financial Media Pundit

When Bitcoin went on a tear back in December 2017, CNBC’s Jim Cramer was unimpressed. “Bitcoin’s not going to replace gold anytime soon,” he assured viewers. Three years later, Cramer has recalibrated. Maybe he was living too much in the past, he confided to Anthony Pompliano in a Sept. 15 podcast: “I have to start recognizing that maybe I am using a typewriter.”

What he said: “Sooner or later, this thing [Bitcoin] is going to run out of steam,” Cramer predicted in a 2017 Mad Money segment titled, “Is Bitcoin the New Gold Alternative?” outlining five reasons he was suspicious of BTC: 1) No one knows who invented it; 2) No one knows how much the creator(s) kept for themselves; 3) The network lacks transparency; 4) It has no government support; and 5) It is based on nothing but software, which can be hacked.

What he says now: “It’s perfectly logical to add crypto to the [inflation hedge] menu,” along with real estate, art masterpieces and gold, Cramer told Pompliano while voicing his concerns about recent COVID-related stimulus activity that might be inflating the United States dollar. What Cramer liked about Bitcoin “is the scarcity of it. […] My kids when they get my inheritance won’t feel comfortable with gold [but they] will feel comfortable with crypto.”

Dan Schulman, CEO of PayPal

In late October, PayPal Holdings Inc. announced that it would allow users to buy, sell and hold Bitcoin, Ether (ETH), Bitcoin Cash (BCH) and Litecoin (LTC), as well as use these cryptocurrencies for payment at its 28 million merchants globally. This marked a new leaf for the giant payments firm and its CEO, Dan Schulman.

What he said in 2018: Crypto’s volatility “makes it unsuitable to be a real currency that retailers can accept,” Schulman told TheStreet in 2018. “I think you need to separate out the Bitcoin or cryptocurrencies as currencies and the underlying protocol called blockchain.”

What he says now: “There’s no question that people are flocking to digital payments and digital forms of currency,” Schulman told CNBC.

So, how can Schulman’s and PayPal’s new stance be explained? In 2020, PayPal was reportedly feeling some heat from another payments firm, Square, which for several years has allowed BTC purchases through its profitable Cash App unit.

Indeed, only two weeks before PayPal’s Oct. 21 crypto announcement, Square declared that it had purchased $50 million in Bitcoin for its corporate treasury. By comparison, PayPal and Schulman had been more cautious regarding cryptocurrencies.

With the COVID crisis, however, the use of cash has “declined precipitously — something like 40–70%,” the PayPal CEO told Squawk Box co-anchor Andrew Ross Sorkin in November. As noted, PayPal will allow customers to use crypto as a funding source for transactions in any of its merchant sites as of early 2021, but the firm will first convert the crypto into fiat currency before paying retailers.

PayPal, not retailers, in other words, will be assuming the crypto’s price volatility risk.

Izabella Kaminska, Financial Journalist

On the matter of Bitcoin, “financial journalists, too, are capitulating,” noted Ferguson. In late November, “the Financial Times’s Izabella Kaminska, a long-time cryptocurrency skeptic, conceded that Bitcoin had a valid use-case as a hedge against a dystopian future.”

What she said in 2016: Writing in the Financial Times, which she joined in 2008 and for which she is the editor of FT Alphaville, Kaminska declared: “What is clear is that thus far the technology which was supposed to be revolutionizing finance and making it more secure (oddly, by skirting regulations) is looking awfully like the old technology which ran the system into the ground.”

What she says now: “Was all the trouble of creating it [Bitcoin] really worth while? Surprisingly, for a long-term critic, I’m going to say yes,” Kaminska wrote in a Nov. 24, 2020 FT piece.

What changed? Not Kaminska’s fundamental view of the cryptocurrency, at least. BTC remains “an intrinsically volatile and inelastic form of money” and is unlikely to ever become a widely used form of currency. “Yet there is one scenario that changes everything: a world in which no government is prepared to stand up for true civil liberties or free enterprise,” she wrote.

Such a scenario seemed far-fetched only a year ago, but with the COVID-19 crisis, it’s now at least imaginable. For a future “in which the world slips towards authoritarianism and civil liberties cannot be taken for granted […] Bitcoin’s anonymous security acts as a hedge against the worst of dystopian realities” — that is, as a sort of doomsday contingency system — and for that, “I am glad someone created Bitcoin.”

Ray Dalio, Hedge Fund Founder

What he said in 2017: “Bitcoin is a bubble,” Dalio told CNBC. He claimed the token’s volatility makes it a poor store of value, and a holder would be hard-pressed to spend it anywhere. “Bitcoin is a highly speculative market.”

What he says now: In his Dec. 8 Reddit “Ask Me Anything” session, Dalio opined that Bitcoin might now serve effectively as a “diversifier to gold,” given BTC’s limited supply and its mobility — unlike real estate, for example. Like some other investors who have reversed their positions on crypto recently, Dalio was worried about the “depreciating value of money” in the post-pandemic global economy.

Gaining Traction As A Store Of Value

Indeed, if there is one thread running 2020’s recantations, it’s fear of inflation in the wake of economic stimulus measures taken by governments to avoid post-COVID economic collapse. Bitcoin may or may never become a useful medium of exchange, but it has clearly gained traction as a store of value, as its former critics now concede.

Updated: 1-28-2021

Ray Dalio Does 180 On Bitcoin, Calls It ‘One Hell Of An Invention’

The founder of Bridgewater Associates admits Bitcoin and cryptocurrencies could be a viable hedge against inflation.

Ray Dalio, the famed founder of Bridgewater Associates, called Bitcoin (BTC) “one hell of an invention,” adding that he’s considering digital-asset investing for clients wishing to protect against currency debasement.

In a note to clients that was obtained by Bloomberg News, Dalio called Bitcoin’s store-of-value characteristics an “amazing accomplishment” and one of the few “alternative gold-like assets at this time of rising need for them.”

He Said:

“To have invented a new type of money via a system that is programmed into a computer and that has worked for around 10 years and is rapidly gaining popularity as both a type of money and a storehold of wealth is an amazing accomplishment.”

Bridgewater Associates is the world’s largest hedge fund, with assets under management of roughly $160 billion. The firm is trusted by institutional investors and other high-net-worth individuals to produce steady returns regardless of the market environment.

Like other hedge fund managers, Dalio has been critical of Bitcoin in the past. In November 2020, he criticized BTC for its excess volatility, claiming that it could never be an effective medium of exchange or store of value. He quickly retracted his statement as Bitcoin’s price surged toward new all-time highs.

“I might be missing something about Bitcoin so I’d love to be corrected,” he said in a Nov. 17, 2020 tweet.

I might be missing something about Bitcoin so I’d love to be corrected. My problems with Bitcoin being an effective currency are simple… (1/5)

— Ray Dalio (@RayDalio) November 17, 2020

In his note to clients, Dalio admitted that Bitcoin has succeeded in “crossing the line” from a speculative idea to an asset with real value. He indicated that Bridgewater is focused on providing alternative stores of value via alt-cash funds that can protect investors from currency devaluation.

“Bitcoin won’t escape our scrutiny,” he said.

Dalio Expects To Soon Offer Alt-Cash Fund, Says ‘Bitcoin Won’t Escape Our Scrutiny’

“Bitcoin looks like a long-duration option on a highly unknown future,” the Bridgewater Associates founder said.

Citing the need to deal with the “devaluation of money and credit,” the founder and co-chairman of the world’s largest hedge fund said he expects the firm to soon offer an alt-cash fund and a storehold of wealth fund and said, “Bitcoin won’t escape our scrutiny.”

* Calling bitcoin “one hell of an invention,” Bridgewater founder Ray Dalio appears to have warmed a bit further to the largest cryptocurrency, saying it or its rivals could fill the growing need for alternatives to gold.

* While still expressing concern that bitcoin could be hacked and that governments could ban it should it become too successful, the legendary hedge fund manager bestowed praise on the cryptocurrency in a daily newsletter, saying, “I greatly admire how Bitcoin has stood the test of 10 years of time, not only in this regard but also in how its technology has been working so well and has not been hacked.”

* But even with his latest comments and his recent agreement to deliver a keynote at CoinDesk’s Consensus conference in late May, Dalio is far from a full-on bitcoin convert. He said his fund ran some “what-if” scenarios on bitcoin including what would happen if governments decided to ban it.

* Those scenarios, Dalio said, “paint a picture that is highly uncertain. That is why to me bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn’t mind losing about 80% of.”

* Dalio repeated his recent statement that he’s eager to be corrected about bitcoin and learn more.

Updated: 3-24-2021

Hedge FUD Manager: Ray Dalio Says ‘Good Probability’ Of A US Bitcoin Ban

The U.S. could repeat its 1930s ban on gold ownership but for Bitcoin.

As the Bitcoin correction deepens, the fear, uncertainty, and doubt has returned, with billionaire hedge fund manager Ray Dalio adding a whole bunch more of it.

In an interview with Yahoo Finance’s editor-in-chief on March 24, the founder of the $150 billion hedge fund Bridgewater Associates stated that there is a “good probability” that the U.S. government could ban Bitcoin just as it did with gold ownership in the 1930s.

That happened because government leaders at the time did not want gold to compete with fiat money and credit as a store of wealth, Dalio added.

“They don’t want other monies to be operating or competing because things can get out of control. So I think that it would be very likely that you will have it, under a certain set of circumstances, outlawed the way gold was outlawed.”

The billionaire hedge fund manager and philanthropist, who called Bitcoin “one hell of an invention” and compared it gold in January, pointed out that India’s government is already trying to ban Bitcoin and cryptocurrency trading in general. He added that he is not an expert but asserted that it can be tracked and the government can work out who is dealing with it.

However, there was a little light at the end of Dalio’s gloomy outlook when he acknowledged BTC has stood the test of time as an asset class.

“Bitcoin has proven itself over the last 10 years, it hasn’t been hacked. It’s by and large, therefore, worked on an operational basis. It has built a significant following. It is an alternative, in a sense, storehold of wealth. It’s like a digital cash. And those are the pluses.”

On March 16, Dalio stated that the U.S. government could target those ditching the dollar for Bitcoin as it becomes “inhospitable to capitalism” in preparation for “shocking” tax changes to tackle the national debt crisis.

The comments come as Bitcoin’s correction continues to deepen as signs that the bull market is entering its latter stages have emerged on-chain. BTC has corrected by 13.5% from its all-time high of $60,100, to current prices of around $52,000.

Updated: 5-12-2021

Bridgewater Founder Ray Dalio Raises Inflation Concerns Over Federal Spending

Hedge-fund manager says Biden’s economic plans risk devaluing U.S. dollar but largely dismisses claims that federal jobless aid is slowing recovery.

Ambitious government spending raises the risks of inflation and a devaluation of the U.S. dollar, Ray Dalio, founder and co-chairman of Bridgewater Associates, said Tuesday during The Wall Street Journal’s Future of Everything Festival.

Mr. Dalio said the Biden administration’s economic agenda, which includes the $1.9 trillion Covid-19 relief bill signed in March and a proposal for $2.3 trillion in infrastructure spending, risks creating a bubble with too much money flowing into the economy. He also predicted there wouldn’t be enough demand from bond buyers to purchase new government debt, which would lead the Federal Reserve to continue its expansionary policies.

“The big issue is the amounts of money that have been produced and put into the system,” Mr. Dalio said. Such risks have to “be balanced carefully. Productivity is the key” to keeping the economy from overheating, he said. Mr. Dalio said he has spoken with Biden administration officials but declined to elaborate.

He described current stock-market valuations as a bubble, though not one driven by debt.

“There’s two types of bubbles,” Mr. Dalio said. “There’s the debt bubble when the debt time comes back and you can’t pay for it, and then you have the bubble bursting. And the other kind of bubble is the one where there’s just so much money and they don’t tighten it as much, and you lose the value of money. I think we’re more in the second type of bubble.”

Less concerning, he said, are the enhanced federal unemployment benefits that some business leaders and lawmakers have criticized as overly generous and discouraging Americans from returning to the workforce. While those payments “have been greater than the benefits, in some cases, of working,” he said that ending the $300-a-week supplemental payments before September, when they are set to run out, amounted to “splitting hairs.”

Mr. Dalio, who has spoken often about the investing opportunities available in China, pushed back on the idea that human-rights concerns, such as the Chinese government’s crackdowns on pro-democracy activists in Hong Kong and its repression of Uyghurs, a largely Muslim ethnic minority group, should keep investors away from the country.

“I don’t really understand, and I don’t study the human-rights issues. I follow what the laws are on those particular things,” he said, adding that there are human-rights concerns in the U.S. as well. “Would I not invest in the United States because of those?”

Mr. Dalio, who helped build Bridgewater into the largest hedge-fund firm in the world, is known for promoting algorithms and software to automate elements of both trading and workplace culture. But the applications of advanced technologies remain limited, he said, adding that artificial intelligence is currently striving for the intelligence level of “a five-year-old.”

While automation tools can raise productivity, he said, such technology “also has implications for jobs and employment, and that system has not been worked through.” Those issues are policy questions, not ones for individual companies to try to solve, he said.

“Can you make the pie grow well and then divide it well so that it provides equal opportunity? That’s a policy question which hasn’t yet been taken on.”

Asked about Robinhood Markets Inc.—the popular online brokerage that many individual investors recently used to trade GameStop and other shares, squeezing hedge funds in the process—Mr. Dalio said the trading app had, on the whole, changed the world of investing for the better.

“It’s information. It allows you to play the game. And there’s nothing like doing it in amounts you can afford,” he said. “It’s a real plus, but it has some drawbacks, too.”

Updated: 5-23-2021

Ray Dalio, Wall Street’s ‘Oddest Duck,’ Shares The Bitcoin Mind

Much of Ray Dalio’s investment philosophy may already sound familiar to the hardest of hard-nosed bitcoiners.

Much of Ray Dalio’s investment philosophy may already sound familiar to the hardest of hard-nosed bitcoiners. It’s a point worth raising, considering Dalio’s long-standing view that bitcoin is bubble-prone and a possible target for government sanctions.

The founder of what’s regularly called the world’s largest hedge fund by assets, Bridgewater Associates, which runs algorithmic strategies for mega-corporations, sovereign wealth funds and state pension plans, takes a macro view of global finance. And much of its success, Dalio says, lies in the founder’s heterodox view of money and credit.

“Most of what people think is money is really credit, and it does disappear. As implied by this, a big part of the deleveraging process is people discovering that much of what they thought was their wealth isn’t really there,” Dalio wrote in a 2008 blog post, titled “How the Economic Machine Works and How It Is Reflected Now,” during the height of the financial crisis and updated in 2011.

Bitcoiners, by contrast, in the extreme, believe fiat money – or money that has value because it’s backed by state authority – is illusory. Bitcoin is a monetary framework created as an alternative to a system where the Federal Reserve can print endlessly and private banks can increase the money supply by issuing loans. Bitcoin is a machine with brakes.

Dalio saw how the economic machine could malfunction. As early as 2006 he diagnosed a financial system buoyed by money printing and reliant on highly-leveraged positions for returns. Debt exceeded income. His firm calculated there was some $839 billion in bad debt in the U.S. that could implode, a figure he took to the U.S. Treasury Department in early 2007 as an unheeded siren’s song.

What’s more, Dalio figured that heavily indebted countries only had one way out of the hole: printing more money to finance their public and private debts. Beyond devaluing the currency, money printing would drive down interest rates and force investors into safer, hedge assets.

“Bitcoin won’t escape our scrutiny.”

“There hasn’t been a case in history where they haven’t eventually printed money and devalued their currency,” he told the New Yorker in 2011. (A sentence that could have been uttered by crypto doyen Meltem Demirors.)

Bridgewater’s flagship Pure Alpha fund (named for the rate money earns above normal market returns) positioned itself defensively ahead of the 2008 crisis. It went long on Treasury bonds, shorted the dollar and bought gold and other commodities.

When the housing market collapsed, Bridgewater did more than weather the ensuing crisis. Pure Alpha returned about 9.5% in 2008, 45% in 2010 and 23% in 2011 – years when the average hedge fund may have been in the red. Its assets under management (AUM) doubled to $100 billion in 2011 from $50 billion at the beginning of the meltdown.

Dalio wasn’t alone in his views about monetary excess. Around the same time Bridgewater was shorting the dollar, Satoshi Nakamoto was coding Bitcoin. Its first block contained Bitcoin’s mission statement: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Lo and behold, the world’s first digital, hard-capped financial network.

Once called “Wall Street’s oddest duck,” Dalio’s heterodox views have maintained his fund’s prime position. The $150 billion fund routinely beats market expectations in an industry where higher funds are hardly guaranteed. (It should be said, Dalio isn’t always bearish on the U.S. dollar.) Meanwhile, bitcoin, a whole other financial beast, was the best-performing asset of the past decade, with annualized returns of 230%.

What Then Might Explain The Odd Duck’s Pessimism On Bitcoin?

Dalio, who declined to comment for this article, considers himself a “hyperrealist,” or someone determined to understand the underlying mechanisms driving the world. He reads history, is skeptical of emotionally tinged thinking and sees evolutionary patterns across society. Investing, like wild game hunting, is a risky, zero-sum business – but one for which you could prepare to gain an edge.

His “Principles,” a book of about 300 hard-learned lessons and aphorisms, sometimes called the “Tao of Dal,” advocates for “radical transparency.” Every Bridgewater recruit is to read and internalize the message: the world is comprehensible, and some people can be more right than others. Meetings are recorded and reviewed. Underlings, reportedly, are encouraged to speak up against their supervisors – just not behind their backs. (Dalio famously punched his first real boss in the face.)

It’s this commitment to the truth-finding process that may have opened Dalio’s eyes to bitcoin. He turned to Reddit and Twitter to get lessons in finance. In the past several months, Dalio has gone on record saying there are inflationary forces afoot and the traditional financial system is edging on bubble territory. And despite previously saying bitcoin failed as an inflation hedge, he now says that “bitcoin won’t escape our scrutiny” for a new alt-cash fund.

Updated: 5-25-2021

Ray Dalio: ‘I Have Some Bitcoin’

The billionaire hedge fund boss sees an inflationary future where “cash is trash” and BTC catches on as a store of wealth. He still doubts governments will tolerate it.

Concerns about a looming global debt crisis have taken the world’s top hedge fund manager from doubting bitcoin (BTC) to dabbling in it.

Bridgewater Associates founder Ray Dalio said the U.S. dollar is on the verge of devaluation on a level last seen in 1971 and that China is threatening the greenback’s role as the world’s reserve currency. In such an environment bitcoin, with its gold-like properties, looks increasingly attractive as a savings vehicle, said Dalio, whose firm started 2021 with $101.9 billion in assets under management, making it the world’s largest hedge fund.

“Personally, I’d rather have bitcoin than a bond” in an inflationary scenario, Dalio said during an hour-long conversation with CoinDesk Chief Content Officer Michael J. Casey.

Now, his interest is more than hypothetical or academic.

“I have some bitcoin,” Dalio volunteered in the middle of the interview, recorded on May 6 and to be broadcast Monday during Consensus by CoinDesk 2021.

Dalio joins fellow billionaire Stanley Druckenmiller in not only expressing pessimism about the dollar but taking a position in bitcoin. Broadly, the traditional finance world has gone from ignoring or shunning to tentatively embracing cryptocurrencies, some looking to profit from their day-to-day volatility, others seeking a haven from inflation as governments swelled money supplies during the coronavirus pandemic.

Bridgewater’s chief financial officer, John Dalby, recently left the storied firm to join NYDIG, the bitcoin custodian and prime brokerage that facilitated insurance giant MassMutual’s $100 million crypto buy.

After expressing skepticism about the cryptocurrency as recently as November, Dalio began to show a change of heart this year. “There exists the possibility that bitcoin and its competitors can fill that growing need” for an alternative store of value, he wrote in January.

Dalio’s off-the-cuff remark to CoinDesk about owning “some” BTC represents the closest thing to an endorsement from him to date. Nonetheless, in the same conversation, he reiterated his concern that governments, fearing competition from bitcoin to state monetary systems, could crack down on its owners.

“Bitcoin’s greatest risk is its success,” Dalio cautioned.

The Debt Cycle

More than a decade ago, on the heels of the 2008 financial crisis (and during the nascent stages of Bitcoin), Dalio began studying the rise and fall of the three most recent global reserve currencies: the Dutch guilder, the British pound, and the U.S. dollar, he recounted.

As Dalio sees it, currency supremacy moves in three “cycles” that may occur simultaneously: the creation of debt and financial assets; an “internal cohesiveness clash cycle” (“as the wealth gaps grow and the value gaps grow – and political groups grow – you have a greater amount of conflict”); and the rise of another great power to challenge the existing top currency.

Whether a currency can withstand such cycles depends on the strength of the economy behind the global reserve currency.

The U.S. dollar is currently in the midst of the first cycle, where “debt and credit create buying power,” said Dalio, who is co-chairman and co-chief investment officer at Bridgewater.

Yet, these are short-term “stimulative” and long-term “depressants” because such things as government debts will eventually have to be paid back, he warned. Nonetheless, those debts are issued, but it gets increasingly difficult.

“All of those financial assets are claims on real stuff, real goods and services,” Dalio said. “And when the pile becomes very big, and the incentives for not holding that are no longer there, you have a problem.”

That happened to the U.S. once before, Dalio noted. After the 1944 Bretton Woods agreement, global exchange rates were tied to the dollar which, in turn, was backed by gold. However, in the 1960s federal spending skyrocketed due to an expansion of entitlement programs at the same time the U.S. was boosting its defense spending to battle the Soviets in the Cold War as well as pay the escalating costs of the Vietnam War.

The higher debt eventually caused a depletion of America’s gold reserves from about 20 metric tons in the late 1950s to under 10 metric tons by 1970. Sensing the situation was no longer tenable, President Richard Nixon took the U.S. off the gold standard in 1971. The dollar has been a “fiat” currency ever since.

The current situation now resembles 1971, Dalio warned.

“As you look at the budgets, and you look ahead, we know we’re going to need a lot more money, a lot more debt,” he said.

“You need to borrow money? You have to print that. You need more money? So, taxes go up and that produces a dynamic. Now I can keep going on about what happens in that dynamic. It may be capital controls. … I painfully learned in 1971 that it causes stocks to go up. It causes… gold, bitcoin, real estate, everything to go up, because it’s really going down in dollars. And that’s the part of the cycle we’re in.”

Looming Inflation

A major narrative surrounding bitcoin and other cryptocurrencies is that they serve as an inflation hedge, or at least will benefit from fiscal and monetary stimulus.

As governments around the world continue their attempts to stave off economic crises with more spending, much has been made about the prospects of inflation. In the 12 months ending April, the annualized inflation rate for the U.S. was 4.2%, well higher than the Federal Reserve’s 2% long-term target, though a large part of that was because the rate is being compared to April 2020, a month where many of the world’s economies ground to a halt.

There are two types of inflation, Dalio said: one caused by supply and demand, where labor demand is high and capacity is low, forcing prices up; and monetary inflation due to a devaluation of the currency.

As money gets pumped into the economy, it intertwines the two inflation types.

“We will have a hell of a lot of demand because we put all that money in cash all over the place,” said Dalio. At the same time as the money supply has increased, yields have fallen to lows as investors snap up bonds and other assets such as real estate.

“It’ll change the amount that is in the hands of individuals, and so on,” he said, “and that’ll move on because cash is trash. I mean, I’d say that because it’ll have that negative real return.”

It is that second, monetary type of inflation that will ultimately hold sway, according to Dalio. That could be good for assets such as real estate, stocks and cryptocurrencies, but only up to a point.

“As those prices rise – like a bond – their future expected returns go down,” he said. “As they come closer to the interest rate … then there’s no longer the incentive to buy those things. And you could have trouble. It becomes very difficult to tighten monetary policy, because the whole thing falls apart. Everything’s interest rate-sensitive.”

The central bank then has to resort to more money printing, he added, and that could eventually lead assets to have a negative real return despite nominal increases, as was seen in the 1970s.

China As Capital Competitor

Coming in to fill the vacuum of the dollar’s decline is China, which has done some fiscal stimulus and relatively muted monetary stimulus since the start of the pandemic.

The world’s most populous country is also being helped by loosening restrictions on foreign investment into the country, Dalio said.

“In 2015, only 2% of Chinese markets were open to foreigners. Now it’s over 60% [but] if you look at the relative pricing, and so on, it’s a whole different story because they’re not doing quantitative easing,” he said. “They still have an attractive bond market.

They have attractive capital markets that are more open. And as they’re more open, big investors – institutional investors, central banks, and so on – view themselves as underweighted there,” meaning their holdings in China are insufficient, relative to the returns they can generate.

A capital market drawing in investments can translate into added strength to the Chinese renminbi.

“When you buy a Chinese financial asset, like buying an American financial asset, you have to buy their currency. So it’s supportive to their currency and it’s also supportive to their assets,” said Dalio. He said China gains the capacity to bill and lend in its currency when there are capital inflows. “China has been very reticent to do that [so as] not to disrupt the system. But you’re seeing more of the internationalization of the renminbi. It has appeal for borrowers and lenders. … That dynamic is really following the same arc of monetary systems and empires pattern.”

Neutral Reserve Currency?

With one currency (the dollar) possibly on the wane while another (the renminbi) possibly ascendant, there is the chance a neutral cryptocurrency such as bitcoin could act as gold did in previous centuries.

While he suggested a diversified portfolio could include the oldest and largest cryptocurrency by market cap, there are risks many may not be considering, according to Dalio.

“One of the great things, I think, as a worry is the government having the capacity to control almost any of them, including bitcoin, or the digital currencies,” he said. “They know where they are, and they know what’s going on.”

Governments may start to worry should bondholders sell their bonds in favor of bitcoin. “The more we create savings in [bitcoin], the more you might say, ‘I’d rather have bitcoin than the bond.’ Personally, I’d rather have bitcoin than a bond,” Dalio said, chuckling. “And then the more that happens, then it goes into bitcoin and it doesn’t go into credit, then [governments] lose control of that.”

Such a situation could lead those governments to crack down on bitcoin holders.

One indicator, Dalio said, is the relative value of bitcoin versus gold. Excluding government reserves and jewelry uses, the value of gold is roughly $5 trillion, he estimated, about five times that of bitcoin. “It’s about 80/20 right now in the world, so that’s something I’d watch, too. But I think those things probably are going to rise relative to bonds.”

There is one scenario where rising debt can be overcome, and that’s through productivity. And while that’s harder to measure than before, it will hinge on technology, he said.

“The world is going to change at an incredibly fast pace,” Dalio said. “Whoever wins the technology race, wins it all, economically, and militarily. … That’s what the next five years looks like.”

Bridgewater’s Ray Dalio Says He Prefers Bitcoin To Bonds

Ray Dalio, founder of Bridgewater Associates, said he would rather own Bitcoin than a bond.

Should cryptocurrencies continue to gain traction, investors might decide to invest in them rather than government bonds, Dalio said in a recorded interview that was presented Monday at CoinDesk’s Consensus 2021 conference. The result is that governments lose control over their ability to raise money.

Dalio has been bearish bonds for some time, saying in March that the economics of investing in bonds “has become stupid” because they pay less than inflation. Even with that view, a large percentage of the $151 billion his firm manages is in U.S. Treasuries and other government bonds.

“I have some Bitcoin,” Dalio said in the interview, which was recorded on May 6, according to CoinDesk. He didn’t say how much he owned.

Dalio also said that Bitcoin’s “greatest risk is its success.”

The hedge fund manager has previously called Bitcoin “one hell of an invention” and that he found it challenging to put a value on digital assets since investing in Bitcoin means recognizing the potential to lose about 80%.

Dalio said in January he was considering cryptocurrencies as investments for new funds that would offer clients protection against the debasement of fiat money.

Bridgewater Associates has struggled to make money in its main macro fund. Last year, its Pure Alpha II fund lost 12.6% and it is up 4% this year through April. Overall, Bridgewater manages $73 billion across its macro strategies.

Updated: 12-21-2020

Cat Got Your Tongue? Bitcoin Critics Wither In 2020

Why have Bitcoin critics been so silent in 2020?

Bitcoin (BTC) has had an interesting year, recovering from major sell-offs to eventually skyrocket to new all-time highs.

However, Bitcoin’s performance and cryptocurrencies increased adoption worldwide have still failed to bring some observers into the crypto camp.

Yet compared to other bull run years like 2017, 2020 has seen much less crypto criticism, with a number of Bitcoin naysayers appearing to have somewhat softened their stance towards digital assets.

As we look back on crypto in 2020, Cointelegraph has noted some of cryptocurrency’s biggest critics.

“Bitcoin Has No Future”: Russian Politician Anatoly Aksakov

Date Of Quote: Oct. 23, 2020

Bitcoin Price That Day: $12,900

Anatoly Aksakov, a member of the Russian State Duma and a major representative of Russia’s crypto-related legislation efforts, was a noteworthy cryptocurrency critic in 2020.

The official is confident that the global adoption of payments in crypto like Bitcoin would result in a “destruction of a financial system.” In October 2020, Aksakov predicted that decentralized cryptocurrencies like Bitcoin have no future, arguing that central bank digital currencies, or CBDCs, are the future of the financial system.

While it remains to be seen what comes of Aksakov’s prediction about Bitcoin, some of his previous comments show that he isn’t exactly a prophet. In a May 2020 live stream talk with Maria Butina, Aksakov said that crypto mining “is becoming a thing of the past” due to Bitcoin’s third halving cutting the miner block reward from 12.5 BTC to 6.25 BTC.

“[Crypto mining] is not profitable anymore, and as far as I understand, this business is poised to disappear in future,” Aksakov argued. Despite this doom prediction, Bitcoin miners have come into some money over the course of 2020, with Bitcoin miner revenue surging to pre-halving levels as of early November.

In keeping with Russian authorities’ constant game of ping pong in regulating crypto, Aksakov regularly changes his stance on the industry. In early December, Aksakov called cryptocurrencies a “highly profitable business,” and stressed the need to legitimize it by recognizing crypto as property.

A member of Russia’s State Duma, Aksakov is also chairman of the National Banking Council at Russia’s central bank. In mid-October 2020, the Bank of Russia officially released its plans on the development of Russia’s CBDC, the digital ruble.

“Nothing Is Priced In Bitcoin Or Any Other Cryptocurrency”: Nouriel Roubini

Date Of Quote: Nov. 7, 2020

Bitcoin Price That Day: $14,900

Nouriel Roubini, a professor of economics at New York University’s Stern School of Business, is one of the world’s biggest crypto critics, often referred to as “Dr. Doom” in the crypto community.

Known for his claims that “cryptocurrency as a technology has absolutely no basis for success,” the award-winning economist has stayed firmly critical of crypto and Bitcoin in 2020 despite admitting that BTC “maybe is a partial store of value” in late 2019.

On Nov. 7, 2020, Roubini argued that cryptocurrency itself is a “misnomer,” because a currency needs to provide a unit of account. Roubini continued to bash Bitcoin, criticizing its apparent limited scalability:

“Nothing is priced in Bitcoin or any other cryptocurrency. You have to be a single numerator, and with so many tokens, you don’t have a single numerator. You have to be a scalable means of payment, and with Bitcoin, you can make only five transactions per seconds.”

At the same time, Roubini admitted Bitcoin’s potential function as a store of value. “It’s maybe a partial store of value, because, unlike thousands of other what I call shitcoins, it cannot be so easily debased because there is at least an algorithm that decides how much the supply of Bitcoin raises over time,” Roubini noted.

Bitcoin Is “The Biggest Bubble I’ve Seen”: Peter Schiff

Date Of Quote: Oct. 28, 2020

Bitcoin Price That Day: $13,200

Peter Schiff, a millionaire broker and CEO at Euro Pacific Capital, is another famous Bitcoin naysayer, criticizing Bitcoin as early as 2013. Also referred to as a “gold bug” in the crypto community, Schiff is also one of the world’s biggest proponents of gold investment.

Over the course of 2020, Schiff delivered multiple negative and controversial remarks about Bitcoin, predicting that gold will moon while Bitcoin will crash in the near future.

On Oct. 28, 2020, While Gold Plunged To Yearly Lows Against Bitcoin, Schiff Argued:

“If you measure the size of asset bubbles based on the level of conviction buyers have in their trade, the Bitcoin bubble is the biggest I’ve seen. Bitcoin hodlers are more confident they’re right and sure they can’t lose than were dotcom or house buyers during those bubbles.”

On Dec. 4, Schiff said that Bitcoin’s past performance does not guarantee its future success but rather “assures its future failure.”

Despite regularly criticizing Bitcoin, Schiff has not stayed away from the world’s largest coin completely. In January 2020, Schiff claimed that he lost access to his crypto wallet, noting that having BTC “was a bad idea.”

In August 2020, the gold advocate told people on Twitter to send BTC to his 18-year-old son, Spencer Schiff. “Since so many of you Bitcoin guys are ribbing me because my son bought Bitcoin, why not really rub it in by gifting him some as a belated birthday present,” Schiff wrote.

“I Can Trade Bananas Easier As A Commodity Than I Can Trade Bitcoin”: Mark Cuban

Date Of Quote: April 24, 2020

Bitcoin Price That Day: $7,500

Mark Cuban, a billionaire investor and owner of the NBA’s Dallas Mavericks, is another major crypto sceptic, calling Bitcoin a bubble back in 2017. While admitting that crypto could be a “reliable financial instrument,” Cuban did not stop criticizing Bitcoin in 2020 over its supposed complexity.

In an April 24 interview with Morgan Creek Digital’s Anthony Pompliano, Cuban reiterated his long-running stance that Bitcoin is too complicated to use. “It’d have to be completely friction-free and understandable by everybody first, and then you can say it’s an alternative to gold as a store of value,” he said.

Cuban stated that Bitcoin is a questionable means of exchange due to its apparent lack of fungibility for goods and services without converting into fiat currencies:

“I can trade bananas easier as a commodity than I can trade Bitcoin, and I can still eat that banana before it goes bad, and get all my potassium for my workout.”

Despite his criticism of Bitcoin, Cuban still owns a tiny bit of crypto. The billionaire investor claimed to have about $130 dollars in Bitcoin as of April 2020. Back in 2017, Cuban recommended investing up to 10% in cryptocurrencies like Bitcoin.

Updated: 1-5-2021

Mark Cuban Says He’ll Run For President If BTC Hits $1M

As president of the United States, the Dallas Mavericks’ owner says he would give away Bitcoin to every citizen.

Responding to a tweet from billionaire Chamath Palihapitiya, Mark Cuban said he would run as a U.S. presidential candidate, under a specific set of circumstances.

“I’ll run if BTC gets to $1m AND we can get commitments to donate 350 BTC to the Treasury each of the 4 yrs so that we can give 1 satoshi to every citizen each yr, that they must hold for 10 years,” the Shark Tank star tweeted on Tuesday.

Cuban’s response came after Palihapitiya said the present political framework needs fixing, forecasting “a viable third political party in the US by 2030.” Cuban subsequently questioned the whole concept of political parties. In turn, Palihapitiya said the U.S. would likely not need such parties if Cuban runs for office.

Cuban has spoken about Bitcoin several times over the past two years. Some of his most recent comments include a stance on the asset as “a store of value like gold that is more religion than solution to any problem,” and that “no matter how much BTC fans want to pretend that it’s a hedge against doomsday scenarios, it is not.”

At the core, Cuban’s overall view of Bitcoin is not too far off from the industry’s outlook on the coin. Both Cuban and crypto industry gurus see the digital asset as a store of value similar to gold.

Cuban has, however, previously called for greater user simplicity for the asset, as well as touching on several other points over the years. In contrast, crypto pundits see Bitcoin solving a plethora of issues, instead of simply acting as another store of value.

Updated: 1-11-2011

Mark Cuban Says Crypto Is ‘Exactly Like The Internet Stock Bubble’

But the statement wasn’t without a few bullish predictions for Bitcoin and Ethereum.

Billionaire entrepreneur Mark Cuban says the cryptocurrency market is “exactly” like the dot-com bubble of the late-1990s and early 2000s. His statement seems to signal that digital-asset valuations may implode once investor exuberance runs out.

“Watching the cryptos trade, it’s EXACTLY like the internet stock bubble. EXACTLY,” Cuban tweeted on Monday before offering a silver lining to crypto enthusiasts.

Watching the cryptos trade, it’s EXACTLY like the internet stock bubble. EXACTLY. I think btc, eth , a few others will be analogous to those that were built during the dot-com era, survived the bubble bursting and thrived, like AMZN, EBay, and Priceline. Many won’t

— Mark Cuban (@mcuban) January 11, 2021

Although the internet bubble didn’t end well for the vast majority of dot-com stocks, several rose from the ashes to form legitimate companies, Cuban said. Amazon, eBay and Priceline immediately came to mind.

In Cuban’s view, Bitcoin (BTC), Ethereum (ETH) and “a few others” will likely follow a similar trajectory as their value proposition and use cases continue to grow.

Cuban’s seemingly positive outlook on the top two cryptocurrencies came even as he dispelled all the narratives surrounding monetary debasement and fiat currency. These are “just sales pitches,” he said, arguing that crypto valuations are based only on supply and demand.

As during the dot-com bubble “the experts” try to justify whatever the pricing of the day is. Crypto , much like gold , is a supply and demand driven All the narratives about debasement, fiat, etc are just sales pitches. The biggest sales pitch is scarcity vs demand. That’s it

— Mark Cuban (@mcuban) January 11, 2021

Cuban hasn’t quite gotten his story straight on Bitcoin. He once argued that bananas are a better medium of exchange than BTC and said the digital asset will act more like a collectible than a financial instrument.

But just last month, he praised Bitcoin’s monetary policy by arguing that public companies should “commit to not issue new shares of stock” ever. He was, of course, referring to Bitcoin’s capped supply of 21 million units hardwired into the code.

Crypto assets were in the spotlight again on Monday after the total market shed over $200 billion peak-to-trough. Zooming out, the total market capitalization has appreciated fourfold over the past year, with Bitcoin recently hitting all-time highs of around $42,000.

Updated: 1-12-2021

Mark Cuban Is More Into Crypto Than He’s Previously Let On

“I still have crypto from the early days of Coinbase. I’ve never sold anything.”

The billionaire who once said he prefers bananas to Bitcoin is now tossing around crypto terms on social media like an experienced HODLer.

In Twitter threads that were likely precipitated by his recent comments comparing crypto to the internet stock bubble of the late 1990s, Mark Cuban interacted with several high-profile crypto figures including Gemini co-founder Tyler Winklevoss, Gokhshtein Media founder David Gokhshtein, Tron CEO Justin Sun and others. The Dallas Mavericks owner discussed the issues surrounding supply and demand, the costs of moving crypto, and decentralized finance, or DeFi.

Just remember WITH DeFi, as with all derivatives, the RISK NEVER LEAVES THE SYSTEM. One segment collapses, they all face risk of collapse. https://t.co/47DsVwIJTF

— Mark Cuban (@mcuban) January 12, 2021

He debated Winklevoss over the nature of Bitcoin (BTC) and Ether (ETH), with the Gemini co-founder referring to the cryptocurrencies as networks, not assets like stocks. Cuban argued that the digital assets “trade more based off the narratives of sellers and supply and demand than any intrinsic value” and require users to convert the tokens to fiat to realize that value.

You are making my point. Supply and Demand is the ONLY thing that values BTC. As far as balance sheets and debasement, we disagree. One of the challenges of sovereign BSs is valuing IP, intangibles and cost based assets. But maybe you can tell me why inflation is minimal ? https://t.co/3ujTVFhlSx

— Mark Cuban (@mcuban) January 12, 2021

“My only mistake on Bitcoin in particular was underestimating your ability,” said Cuban, referring to Winklevoss. “You get credit for this, to create a narrative and generate demand for it. You are the King of Get Long and Get Loud for BTC and that’s not a bad thing.”

In addition, the Mavericks owner admitted to HODLing some crypto “from the early days of Coinbase,” seemingly around 2012 when the exchange was founded. This statement is somewhat at odds with one he made in 2019 after the Mavericks offered basketball fans the opportunity to pay for merchandise and tickets in BTC. At the time, Cuban estimated that the sales brought in $130, saying that was “all of the Bitcoin” he owned.

I don’t think people realize I try to test and use all this stuff and have for years. I still have crypto from the early days of coinbase. I’ve never sold anything

— Mark Cuban (@mcuban) January 12, 2021

The billionaire has been more outspoken about crypto and blockchain this year, around the same time Bitcoin was in the middle of a price rally leading it to an all-time high of more than $42,000. Last Tuesday, Cuban said — seemingly as a joke — that he will run for president of the United States if the price of Bitcoin reaches $1 million and officials agree to distribute the crypto asset to all American citizens.

Though the price of Bitcoin is more than $35,000 at the time of publication, Cuban’s statement gives the crypto asset around three years to rise roughly 3,000%. While such a feat is theoretically possible, it is probably unlikely.

Updated: 2-2-2021

Mark Cuban Talks Bitcoin HODLers And Blockchain Stocks In Recent AMA

“Stocks will be on the blockchain in the future,” predicted the billionaire.

Jumping on the r/Wallstreetbets subreddit for an “ask me anything” session recently, Dallas Mavericks owner Mark Cuban shared his thoughts on GameStop shorts, general investing and various crypto-related topics. The billionaire said “the game is changing” when it comes to stocks but encouraged the Redditors to look at Bitcoin (BTC) investors for guidance.

“BTC HODLers are a great example to follow,” said Cuban. “Many bought at the highs in 2017 and watched it fall by 2/3 or more. But they held on because they believed in the asset. The same applies to stocks. When I buy a stock I make sure I know why I’m buying it. Then I HODL until I learn that something has changed.”

A Bitcoiner himself, Cuban said his crypto portfolio includes Aave’s LEND, SushiSwap’s SUSHI, Ether (ETH), BTC and Litecoin (LTC). Last week, crypto sleuths were able to find at least two wallets connected to Cuban with more than 1,000 ETH, staked Aave and SUSHI. Upon being found out, Cuban admitted he had his “share of shitcoins.”

The Dallas Mavericks owner went on to say he believed decentralized finance and nonfungible tokens have the potential to explode in the next decade, “But there will be a lot of ups and downs along the way.” In addition, the billionaire said the infrastructure surrounding investments may even change:

“Stocks will be on the blockchain in the future, and that will make the markets much more efficient, transparent and available to the small investor.”

Cuban has been more active speaking about crypto since the winter as the Bitcoin bull run began and many media outlets began reporting on the ecosystem more often. Earlier this month, he compared crypto markets to the dot-com bubble of the late 90s and even said he would consider a presidential run if the price of Bitcoin hits $1 million.

However, many of the billionaire’s views on crypto are in line with participants in the industry. Cuban has referred to Bitcoin as a store of value like gold and recently suggested Redditors in the r/Wallstreetbets community have a better grasp on investments than the “slow” and “stale” practices of Wall Street investors.

“I think social investors have an opportunity to change stocks the way social was used to build crypto,” said Cuban on the Reddit AMA.

“I Don’t Think Digital Currencies Will Succeed In The Way People Hope They Would”: Ray Dalio

Date of quote: Nov. 7, 2020

Bitcoin price that day: $15,500

In a Nov. 7 interview with Yahoo Finance, Ray Dalio, American billionaire hedge fund manager and founder of Bridgewater Associates, claimed that he doesn’t see digital currencies like Bitcoin succeeding the way other people do. He also expects global authorities to “outlaw” Bitcoin if its price goes too high.

Dalio also criticized Bitcoin for not being an effective medium of exchange and a store of value, stating:

“Theoretically, Bitcoin is good, but there are three basic things: a currency has to be an effective medium of exchange, a storehold of wealth, and the governments want to control it […] I today can’t take my Bitcoin yet and buy things easily with it.”

Dalio Subsequently Admitted That He “Might Be Missing Something” About Bitcoin:

“I can’t imagine central banks, big Institutional investors, businesses or multinational companies using Bitcoin […] If I’m wrong about these things I would love to be corrected.”

Dalio has significantly softened his stance to Bitcoin, claiming that it could be a diversifier to gold on Dec. 8. The hedge fund veteran previously called the top cryptocurrency a bubble back in 2017.

Less People Criticized Bitcoin And Crypto In 2020

Despite a select number of well-known critics bashing Bitcoin in 2020, it appears that the seminal cryptocurrency has drawn less public skepticism than in previous years.

Prominent naysayers like Warren Buffett, Bill Gates and Donald Trump have largely remained silent about Bitcoin and crypto this year. Nobel Prize winning economist Paul Krugman, who predicted a “total collapse” of Bitcoin in 2018, refrained from commenting as well.

According to data by major Bitcoin-themed website 99bitcoins, 2020 has been the year with lowest Bitcoin “obituary” rate since 2013.

Only seven cases of “Bitcoin death” were reported in media monitored by 99bitcoins, compared to 41 “obituaries” in 2019, and 93 in 2018.

The biggest year for Bitcoin deaths was 2017, the last year in which Bitcoin saw a major bull run before 2020.

Whether one looks at Bitcoin’s withering critics, the growing interest of major banks and financial institutions in cryptocurrency, or the meteoric bull run this year, one thing seems clear: crypto is here to stay.

Updated: 5-20-2021

‘Cultish’ Bitcoin Comments By Nobel Prize Winner Strike At Heart Of BTC

Paul Krugman’s harsh comments touched on core development issues within the Bitcoin community.

Long-time cryptocurrency critic and Nobel Prize-winning economist Paul Krugman said in a string of tweets on Wednesday that Bitcoin (BTC) could very well survive indefinitely, but only as a fundamentally useless cult.

Krugman’s harsh words were prompted in response to Wednesday’s market plunge which saw numerous coins lose close to 50% in value, and resulted in close to $1 trillion in value departing the global market cap before a recovery bounce brought some of that sum back.

“I don’t write much about Bitcoin because there aren’t any fundamentals to discuss,” tweeted Krugman, who wrote about Bitcoin as early as 2013 in his New York Times blog, calling it “evil” at the time.

“BTC isn’t a new innovation; it’s been around since 2009, and in all that time nobody seems to have found any good legal use for it. It’s not a convenient medium of exchange; it’s not a stable store of value; it’s definitely not a unit of account,” continued Krugman, taking aim at the two use-cases generally attributed to Bitcoin: a means of payment, and a store of value.

While the crypto faithful may be quick to defend Bitcoin against any and all attacks (perceived or real), Krugman’s critique chimes with many figures in the cryptocurrency space who believe Bitcoin’s utility has been hamstrung in recent years by ill-conceived and misguided development decisions.

For example, Bitcoin’s average transaction fee rose to as high as $62.77 in late-April — a single statistic that causes Bitcoin’s attributed reputation as a day-to-day currency to dissipate before our eyes. This is largely because the Bitcoin block size is still limited to 1MB (third-party applications increase this figure somewhat), despite it being capable of much higher transaction throughput.

The block size debate caused a rift in the Bitcoin community in 2017 and saw a big-block faction break away to form Bitcoin Cash (BCH). Bitcoin Cash increased the foundational protocol’s block size to 8MB and then 32MB in pursuit of achieving the vision of peer-to-peer electronic cash laid out by Satoshi Nakamoto in the original whitepaper.

Bitcoin developers’ refusal to raise the block size was followed by a narrative shift in which Bitcoin was rebranded as “digital gold” — a store of value, and not something to be used as a transactional currency.

This shift was reasoned as necessary because increasing the block size to include more transactions would mean the blockchain would grow larger and demand more hard drive space from node operators over time.

Opponents of the digital gold vision argue that hard drive space is something growing cheaper by the day, and would not pose an obstacle to would-be miners or node operators. Indeed, since 2015 alone the average cost of hard drive space per gigabyte fell from $0.038, to the current price of $0.021 witnessed at the time of publication.

The 400GB Bitcoin blockchain could fit 25 times over onto a consumer hard drive that can presently be purchased for around $200.

And while analysts claim Bitcoin will eventually find price stability at some point in the future, that day has not yet arrived.

Recent price volatility is an obvious reminder of this, as is the ever-constant flow of large sums of BTC to centralized exchanges, as whales constantly look to capitalize on market fluctuations.

Krugman said the perceived value of Bitcoin rested on the illusion that it was a technological solution to the impending collapse of the fiat system, something he suggested was a libertarian folly.

“Its value rests on the perception that it’s a technologically sophisticated way to protect yourself from the inevitable collapse of fiat money, which is coming one of these days, or maybe one of these centuries,” Krugman said, adding, “Or, as I say, libertarian derp plus technobabble.”

Krugman signed off on a week of drama in the crypto space by extending a barbed olive branch to the Bitcoin crowd. Krugman suggested Bitcoin’s longevity was assured, but only because new members would constantly be recruited to its “cult.”

“But I’ve given up predicting imminent demise. There always seems to be a new crop of believers. Maybe just think of it as a cult that can survive indefinitely,” he said.

Updated: 3-9-2021

Billionaire Investor Mark Cuban To Talk Crypto On Blockchain & Booze Tonight

Billionaire investor Mark Cuban is set for a virtual sit down to discuss what he finds exciting in the crypto space, perhaps over a few beers. And it’s live on Cointelegraph’s Twitter feed.

Cuban is expected to talk about his fascination with decentralized finance and nonfungible tokens, and his views on the most imminent and compelling use cases for blockchain technology.

The billionaire investor recently joined a group of National Basketball Association franchise owners exploring the adoption of the novel tech in the NBA.

Register For The Event Free!

According to host Adam Levy of blockchain venture studio and fund Draper Goren Holm, the billionaire investor will also touch on his recent Dogecoin (DOGE) interest, as well as other projects on his investment radar.

Cuban recently adopted DOGE as a payment option for Dallas Mavericks merchandise. Earlier in March, the NBA franchise owner tweeted that Dogecoin’s price could reach the $1 mark on the back of sales of “Mavs merch.”

Cuban’s more positive statements about crypto in recent times appear at odds with his prior position where on one occasion he expressed his preference for bananas over Bitcoin (BTC).

These days, he is more likely to be found praising cryptocurrencies, including Bitcoin. Cuban recently disagreed with noted “gold bug” and BTC skeptic Peter Schiff, calling Bitcoin living technology while referring to gold as being dead.

Commenting on Cuban’s scheduled appearance on Blockchain & Booze, Adam Levy, the show’s host, stated: