A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio

When the market is up, it’s really easy to look like you know what you’re doing. With equities in the 8th year of a bull market, many investors and shareholders may feel this way. It’s been a fantastic run — the S&P 500 is up over 250% from its market low during the bottom of the Great Recession. A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

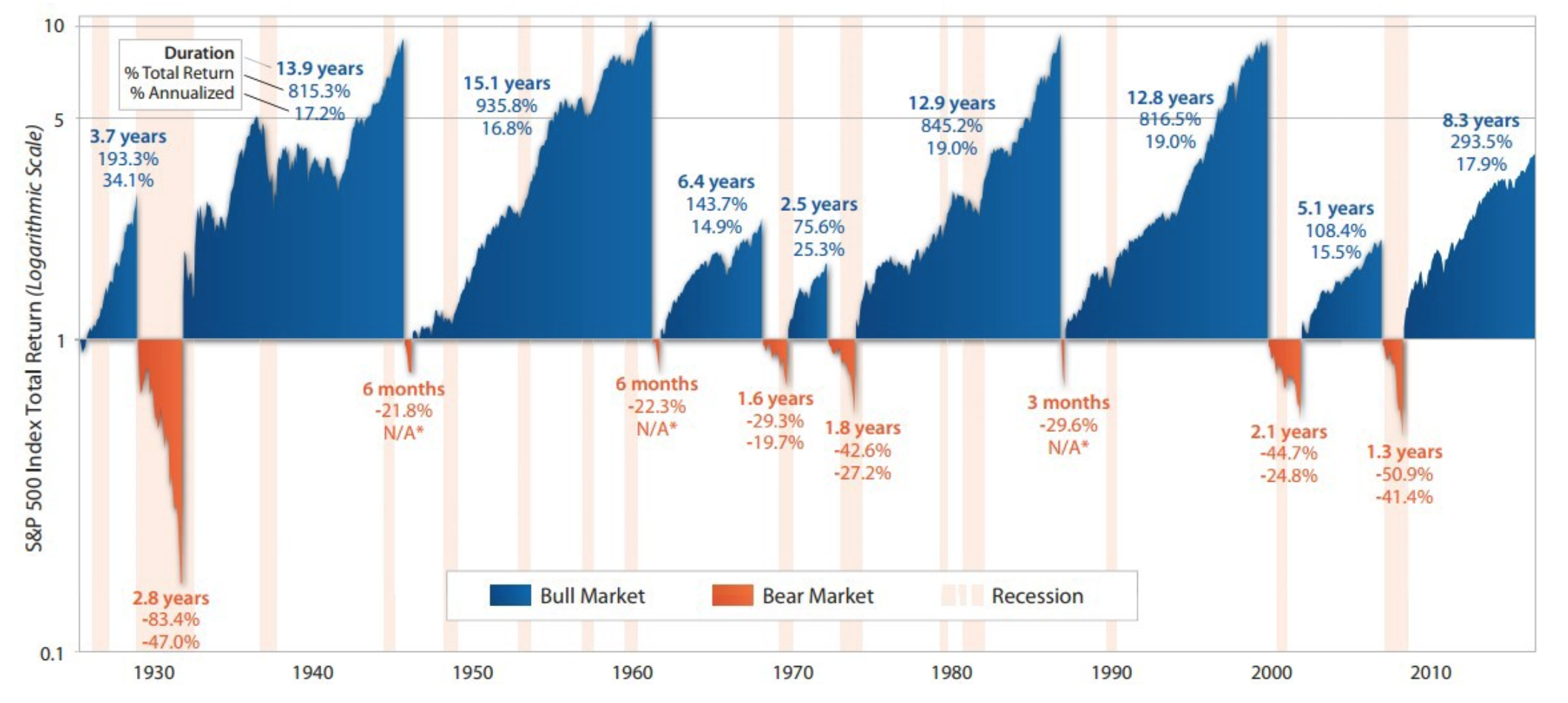

Historically, the average bull market in U.S. equities lasts around 9 years, and has a cumulative average return of 450%+.

But we know from history that these bull markets don’t last forever.

At some point, a macro down-cycle comes around, sending asset prices tumbling. Yet, predicting down-cycles can be very difficult. When fundamentals erode, bullish investor sentiment can still maintain price levels.

Related:

Millennials Are Still Catching Up From The Last Recession. Now They Face a New One.

Federal Reserve To Let Inflation Run “Hot” Going Into Next Recession (#GotBitcoin?)

Recession Gives Rise To Hand-Me-Down Inc. And Sneakerheads (#GotBitcoin)

If You Didn’t Get The Memo IMF Says Global Recession Is Underway, Worse Than 2009 (#GotBitcoin?)

BoE Warns UK Set To Enter Worst Recession For 300 Years (#GotBitcoin?)

China’s Economy Booms While U.S. Continues Decline Into Recession

By studying the historical trends, we can make an educated guess on where we are in the current cycle:

At just over 8 years into the current bull market, and with historical bull runs around 9 years on average, we are statistically likely to see a down-cycle within the next few years.

Some traditional metrics support the view that asset prices are nearing peaks. High cyclically adjusted price-to-earnings ratio (CAPE) and price-to-book (PB) ratios are two examples. CAPE and PB are far from perfect as predictive metrics, but still can tell us about where we may stand in the cycle.

Weathering The Storm

The last two US-based recessions originated from exploding asset bubbles. These bubbles caused systemic damage across the economy, affecting many asset classes. The Dot-Com Bubble and Great Recession seem obvious when looking back today. Yet, they doomed many professional and amateur investors at the time.

Investors can hold store of value or counter-cyclical assets to combat down-cycles.

Counter-cyclical investments are useful because they may rise while other assets are falling. These opposite movements can help offset losses that occur during a down-cycle.

The downside of counter-cyclical investments tends to be losing gains from riskier assets that have higher returns during normal economic conditions.

We’ve already looked at some of the merits of Bitcoin as a store of value asset. Here, we will take that a step further with a prediction:

If Bitcoin can be a store of value, it will be counter-cyclical and grow in value in the next global recession.

Nowadays there are great investors basing their capital on mainly digital proof of their wealth in stocks and holdings they own.

Bitcoin is young (born 2009) and only recently developed significant global trading volume. Because of that, we don’t have data on how it performs during something like the Great Recession. However, we can make an educated guess in two ways:

(1). By analyzing other counter-cyclical assets we think have similar qualities

(2).A priori — making judgments based on what we fundamentally know about Bitcoin

Good As Gold

Gold is the de facto store of value asset globally. Investors often seek the precious metal during times of economic or political turmoil. They view it as a safe haven and difficult to manipulate by central authorities.

Gold and Bitcoin arguably have much in common. Understanding gold’s performance in recent recessions could be useful for Bitcoin’s outlook. It could be predictive of how Bitcoin might behave in a similar situation.

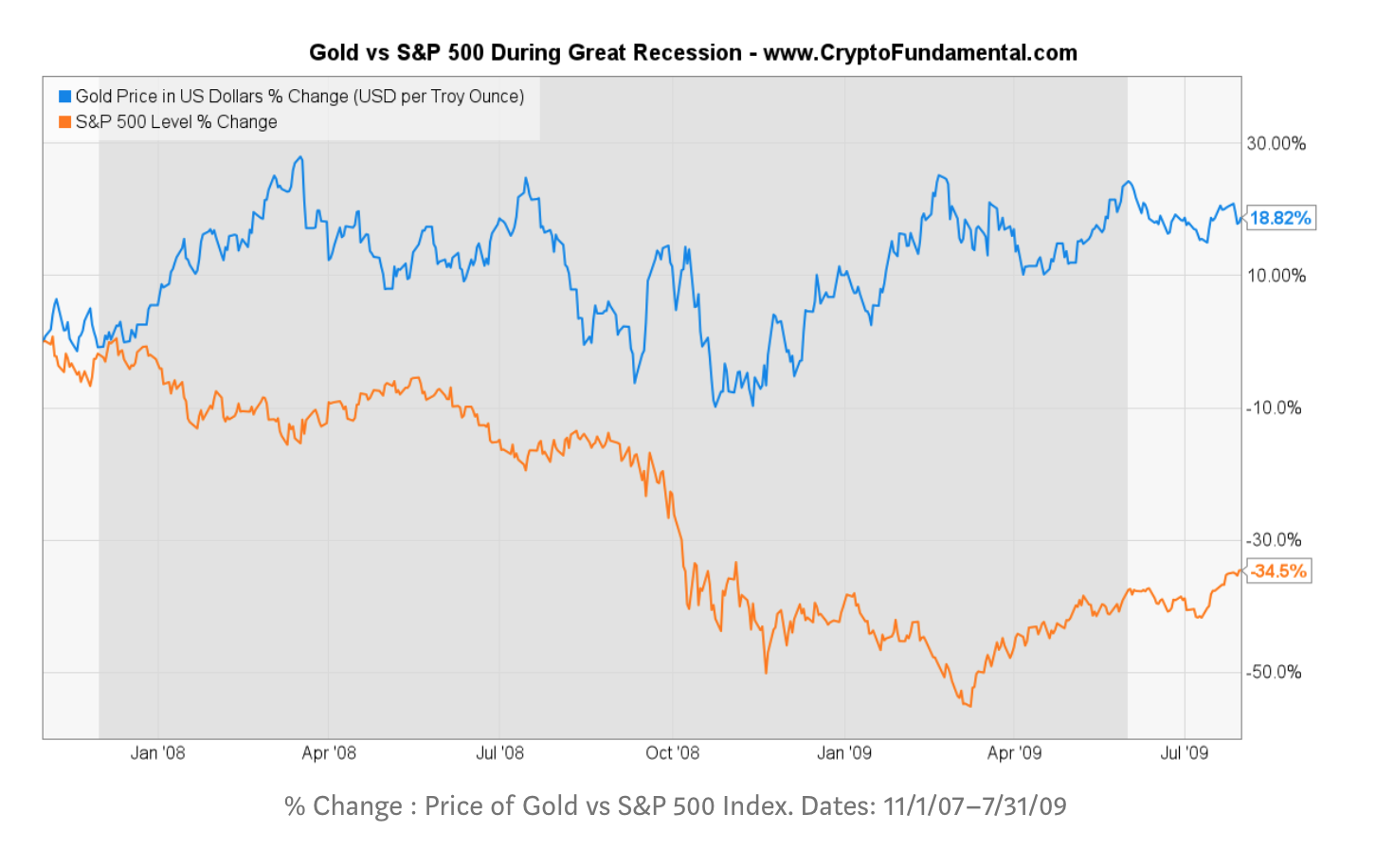

The Great Recession

When equities fell during the Great Recession, the price of gold rose as investors flocked to safety. Between November 2007 and July 2009, gold was up ~19%, while equities declined by ~35%.

In the immediate afterglow of the Great Recession, gold prices maintained similar price increases as rebounding equities, fueled by further macroeconomic turmoil (European Sovereign Debt Crisis).

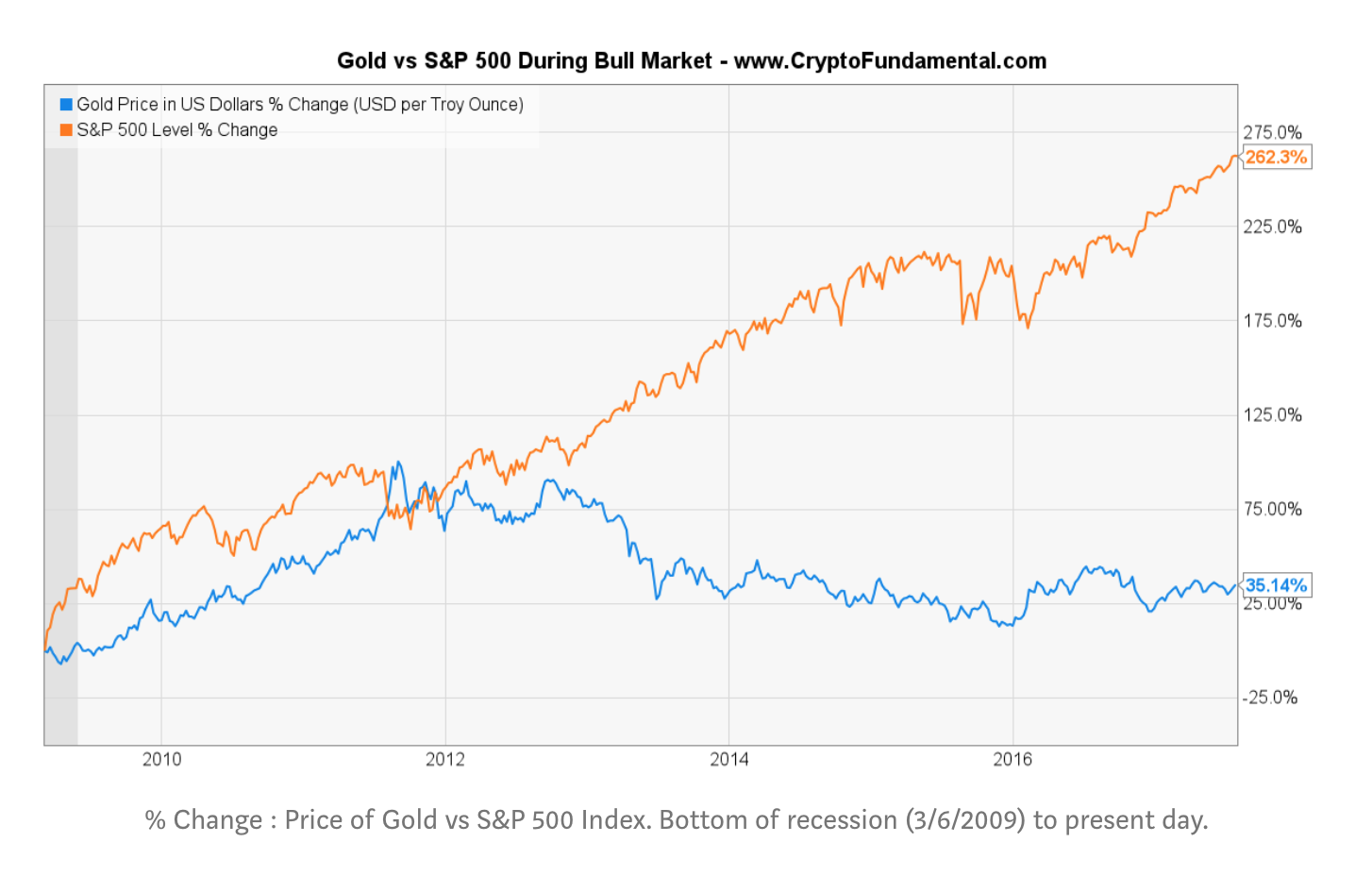

Yet, held true to its counter-cyclical form. Gold started significantly underperforming equities as the market and investor confidence improved. More recently, gold actually lost value as equities soared.

From the bottom of the recession on March 6th to the present day, the S&P 500 increased ~262% versus just 35% for gold prices.

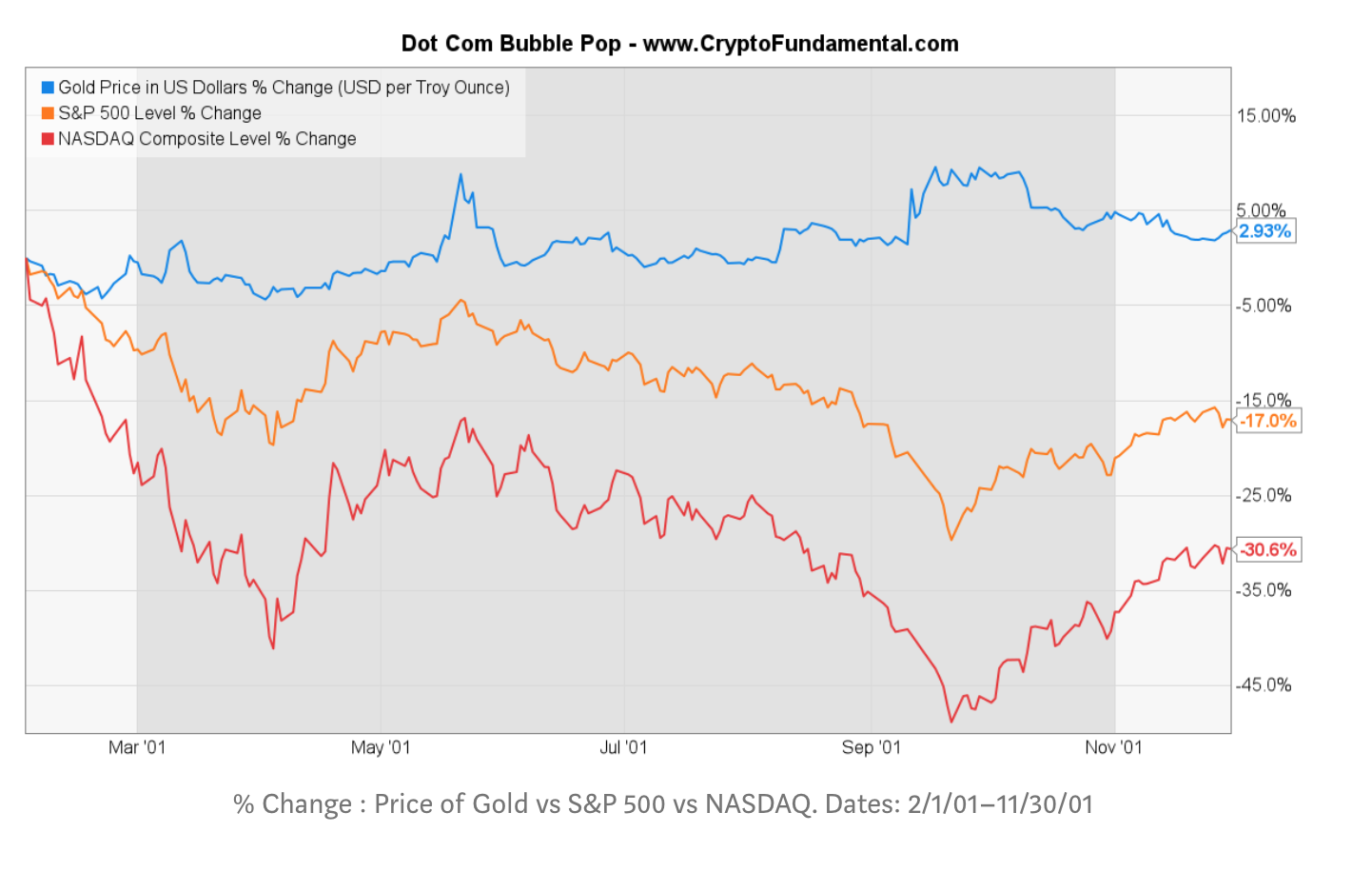

The Dot Com Bubble

Gold’s movement was less dramatic during the shorter and less widespread Dot Com Bubble. Yet, it still exhibited counter-cyclical traits even then. Gold prices were roughly flat while equities (especially technology) declined meaningfully.

Bitcoin’s Correlations (Or Lack There-of)

Based on gold’s historical counter-cyclical movements, if Bitcoin was correlated with gold, we could feel pretty good about also calling Bitcoin counter-cyclical.

But Bitcoin and gold are not currently correlated in their movements.

In fact, Bitcoin is not correlated to any non-cryptoasset right now. Kevin Lu, over at his blog Signal Plot, put together some great graphs illustrating the correlations between Bitcoin and other assets:

Bitcoin’s lack of correlation makes it a possible hedge for portfolios with securities that are correlated (e.g. stocks). Modern Portfolio Theory (MPT) is what much of modern investing is based on. MPT asserts that holding uncorrelated assets can be useful to raise returns without higher risk.

The fact that Bitcoin both appears to move independently from other assets (lacks correlation) and has growth upside makes it a very interesting candidate for long-term investment.

It is likely that Bitcoin’s lack of correlation is driven primarily by two factors:

* It’s young, and hasn’t had time to develop stronger correlations with more traditional assets

* There isn’t a huge amount of institutional money trading and investing in Bitcoin (yet). Once this happens, it will almost certainly become more correlated with other assets, including gold.

Risks To The Predictions

There are multiple risks that could influence whether Bitcoin is counter-cyclical:

Bitcoin loses stability and becomes perceived as less safe

So far, Bitcoin has survived exchange hacks, competing hard forks and network upgrades. This resilience is a solid case for it continue being a store of value asset.

Yet, Bitcoin could theoretically destabilize due to successful forks, hacks or other reasons. That could cause investors to lose confidence in the asset as a safe haven.

Without the store of value quality, Bitcoin likely wouldn’t be counter-cyclical.

Degree of likelihood: Unlikely, but possible

Bitcoin Becomes Overvalued Prior To A Recession

Due to extreme interest, Bitcoin’s price could rise to very high level before a recession. If its value was too high, investors might view Bitcoin as part of the risky, overvalued asset pool. This might cause investors to sell Bitcoin positions along with traditional asset classes.

Degree Of Likelihood: Neutral, Definitely Possible

Another Crypto-Asset Takes The Store Of Value Crown

Several other cryptoassets have promising outlooks. Some are in position to be safe haven assets, especially if Bitcoin loses stability in the future. Some of the notable candidates include:

* Litecoin (LTC), which is similar to Bitcoin in many ways (“silver to Bitcoin’s gold”). LTC tends to implement scalability / network changes faster

* Ethereum Classic (ETC), which has smart contract functionality with a fixed supply of tokens. ‘Regular’ Ethereum, despite lacking a fixed supply, could also become a store of value due to its large potential utility value.

* Other interesting projects in the space: Dash (DASH), Monero (XMR), Zcash (ZEC)

Degree of likelihood: Unlikely, but possible

Summary Thoughts

(1). We are roughly 8 years into the current bull market. We are statistically likely (but not guaranteed) to see a recession in the short to medium term.

(2). Bitcoin is already considered a store of value asset by many, and will increasingly be viewed that way by institutional investors

(3). Bitcoin will likely be counter-cyclical in the next recession, rising in value as equities and correlated assets drop

(4). Bitcoin is currently not correlated with other asset classes, making it a potentially attractive way to hedge traditional assets

(5). Bitcoin will develop stronger correlation with other assets as institutional players enter the market. In the next recession, it will likely increase its correlation with gold

(6). In my view, Bitcoin makes a lot of sense as part of a diversified, long-term portfolio that seeks to perform in all economic conditions

- ‘Time for Plan ₿,’ Says VanEck Exec as Negative Yield Bonds Hit $15 TrillionAccording to Deutsche Bank, 27% of global bonds traded are now negative yield, so expected to pay out less than their initial cost.Negative Yield Bonds Dwarf Bitcoin Market CapThis represents $15 trillion worth of debt. Or as VanEck digital asset director, Gabor Gurbacs, commented Aug. 14, this is 75 times the total Bitcoin market cap.“It’s Time For Plan ₿!” He Adds.Whilst currently this phenomenon is limited to certain European countries and Japan, all eyes are on the U.S. Federal Reserve to see if it follows the trend.

Meanwhile, ex-chairman of the Fed, Alan Greenspan, told Bloomberg on Tuesday that there is no barrier to Treasury yields falling below zero. This prompted Bitcoin perma-bull, Max Keiser to tweet that “Bitcoin has no top because fiat has no bottom.”

Lend The Government $100 And Get $90 Back

Global economic uncertainty around unchecked quantitative easing, trade wars, deflationary technology and political instability has driven more and more investors towards negative yielding bonds.

The total value of such bonds has risen to $15 trillion dollars, almost tripling since Oct. 2018. Countries such as Switzerland, Sweden, Germany, France, the Netherlands and Japan, are all issuing bonds with negative interest rates.

Whereas historically, the government would pay you interest for lending them the money instead of spending it, people are now paying for these safe-havens for their wealth.

Faced with negative yield from government bonds as one safe haven investment, investors must surely look to alternatives such as gold and increasingly Bitcoin as the technology is now over a decade old.

As Cointelegraph reported earlier this month, former Goldman Sachs executive Raoul Pal makes thinks the world is fast approaching a currency crisis and that Bitcoin will thrive in the next financial crisis due to its borderless, deflationary and apolitical properties.

Updated: 10-31-2019

Bitcoin and Stocks Break 2019 Reverse Correlation Trend — Chart Data

In many ways, Bitcoin (BTC) and the crypto markets as a whole live somewhat independently from traditional markets. The global crypto space never sleeps, operating at all hours of the day on a global scale.

Traditional market price movements and conditions, however, may still have an impact on Bitcoin. If the economy is healthy, seeing rising prices for traditional market indices such as the S&P 500, it makes sense that people might be more willing to take risks by putting money into Bitcoin, an asset that is still speculative at this point in its history.

Crypto-Twitter has hosted many discussions on Bitcoin’s potential reaction to an overall market recession, which the digital asset has not yet truly seen since its creation in 2009. The jury is still out on how the asset and its surrounding blockchain industry might react to such a scenario.

Comparing Daily Charts: S&P 500 And Bitcoin

Comparing Bitcoin’s price with the S&P 500 index over the last two years shows some interesting data.

A major benchmark of traditional finance, the S&P 500, takes the 500 biggest public companies in the United States and averages their stock prices into an index, providing a single price that reflects the overall market performance.For the most part, over the course of 2018 and 2019, Bitcoin and the S&P 500 acted surprisingly opposite to each other, with the exception of two instances when the two markets seemingly flowed together.

Several comparisons can be made between the S&P 500 and Bitcoin over the course of 2018 and 2019.

Starting in 2018, between Jan. 26 and Feb. 8, both prices suffered a steep decline before bouncing in similar fashions.Between February and September, the S&P and Bitcoin rode opposite trends. The traditional market index gradually rose to new all-time highs while crypto’s largest asset trended down, dropping more than 40% between March and September 2018.

On Sept. 21, the S&P hovered around all-time high levels while Bitcoin fluctuated near $6,000 support during a time of low volatility. At this point, Bitcoin was nowhere near its yearly high above $17,000, which the digital asset hit in January 2018.

The S&P saw the bottom of a correctional period around Christmas, which was similar to Bitcoin’s market state this time, although Bitcoin saw a big drop earlier — from $6,000 to nearly $3,000 — in November 2018, and did not bounce with exuberance like the S&P.

Instead, BTC bottomed out with consolidation and low volatility until April 2019.

Bitcoin Soars 70% In May 2019 As Stocks Correct

The S&P was back near its all-time price highs by May 1, 2019. Meanwhile, Bitcoin was in the early stages of its uptrend — a trend that would eventually more than double the digital asset’s price.

During the month of May, the two market products acted strikingly opposite to each other. The S&P faced a rather bold correction, just over 7% to the downside as Bitcoin rose more than 70% in the same time period.

The inverse correlation between continued into July, with the S&P posting new all-time highs once again around July 26, while Bitcoin was consolidating after its 2019 high near $13,900.This pattern was also displayed in late July as well, with a sharp Bitcoin bounce while the S&P saw a notable decline.

On the whole, since August 2019, the S&P stayed in an upward trend, while Bitcoin has seen an overall downward trend until recently, in what may be the start of a potential bullish reversal.

Is Bitcoin an alternative investment?

Since May 1, 2019, Bitcoin and the S&P 500 have been inversely correlated for the most part, particularly when it comes to sizeable moves. Recently, however, the S&P has hit record levels, coinciding with Bitcoin’s historic 42% daily price gain on Oct. 25 and, therefore, undermining the summer’s reverse correlation patterns.

As Bitcoin is often pitched as a borderless, decentralized and alternative digital asset, it should, in theory, act independently of traditional markets. Buyers of Bitcoin, however, often need cash to pay for Bitcoin, which is ultimately affected by politics and traditional markets, leading to a correlation between the two worlds.

Not Everyone Buys Bitcoin As A Hedge Narrative

Bitcoin as a hedge to government currencies and traditional markets is a hot topic these days, particularly in light of the recent economic unrest in countries like Lebanon.

Since May 2019, the charts above show Bitcoin as a potential hedge against the S&P 500, which in many ways represents the overall state of traditional financial markets.

This inverse correlation, however, was not as consistent in 2018. Anthony Pompliano, the co-founder of asset management firm Morgan Creek Digital, has spoken on the topic of Bitcoin as a hedge. In August 2019, Pompliano said:

“Central banks bought more than $15 billion of gold in the first 6 months of the year. They are trying to hedge their risk to the U.S. dollar. Wait till they find out about the non-correlated, asymmetric upside profile of Bitcoin. Every central bank will be buying Bitcoin.”

Fundstrat managing partner and Bitcoin permabull, Tom Lee, holds the opposing view, however, arguing that BTC/USD moves with traditional markets. In a Sept. 12, 2019 tweet, Lee said:

“Unpopular opinion, Bitcoin won’t make a new high until S&P 500 makes a new high. BTC has been range bound because macro trendless. Confirmed by our Bitcoin Misery Index falling from 66 (50 now). Since 2009, best years for Bitcoin is when S&P 500 >15%.”

Comparing charts from the S&P and Bitcoin shows compelling — but certainly not conclusive — evidence for the Bitcoin hedge narrative. It is also important to consider the many other factors that might affect correlation data, such as central bank policy, inflation, etc.

For example, as Cointelegraph reported earlier this month, the United States Federal Reserve has added $210 billion to the market over the past two months — an amount greater than Bitcoin’s entire market cap of $167 billion — and one that could make deflationary assets such as gold and Bitcoin attractive to investors.

- Updated: 11-20-2019

Bloomberg Panel: Bitcoin More Attractive During Times of Global UncertaintyJohn Pfeffer, founder of Pfeffer Capital, together with Travis Kling, founder and CIO of Ikigai Asset Management and Charles McGarraugh, head of markets for Blockchain, discussed Bitcoin (BTC) in the context of Brexit, trade wars and geopolitical uncertainty.On Nov. 20, the panel of three sat down for an interview with Bloomberg’s Alastair Marsh at the Future of Digital Assets briefing in London, where they took a closer look at the idea that Bitcoin becomes more attractive as an investment during times of global uncertainty.

Bitcoin the ultimate store of value?(1:20) Charles McGarraugh started off the conversation by agreeing to the idea that BTC does indeed become more appealing during threats of recessions and general global times of uncertainty. “I totally buy into that idea,” he said.(3:12) John Pfeffer continued by saying that BTC is poised to become digital gold. “Sooner or later that is going to happen,” Pfeffer said, pointing out that if BTC were already considered today’s digital gold, the upside of BTC would not be the same, as it would be worth at least one or two orders of magnitudes more. He added:“We think of [BTC] in our portfolio as it goes into our venture portfolio. […] It is a venture that aspires to become digital gold, and is showing great promise of doing that. Because it hasn’t done that yet […] there is a lot of upside, but also downside.”

(5:35) Travis Kling gives perhaps the most direct answer when he says that Bitcoin is a risk asset, one with specific investment characteristics “that become increasingly more attractive the more irresponsible monetary and fiscal policy is from central banks and governments globally,” adding:

“Investors in BTC today aren’t investing in Bitcoin as a store of value today, we’re speculating that it may become a store of value because it has the characteristics to be a good store of value.”

(11:00) Kling further points out that if the United States was still on the gold standard, and was balancing its budget every year instead of spending a trillion dollars more than they collect, “we might not need Bitcoin so much.” However, as Kling puts it, “that ain’t the world we’re living in.”

US national debt growth is not sustainableIn November, the head of the United States Federal Reserve Jerome Powell noted that currently, U.S. national debt is growing faster than nominal GDP. He admitted that the current economic policy is not sustainable, but that it is not its job to fix it. “Ultimately in the long run that’s not a sustainable place to be,” he said.

U.S. debt has now topped $23 trillion, which adds up to $70,000 per head of the population, or more than $1 million for every Bitcoin that will ever exist.

Updated: 3-11-2022

Recession Risks Are Piling Up And Investors Need To Get Ready

* Bond Yields, Price Crunch And Fed Pivot Point To A Downturn

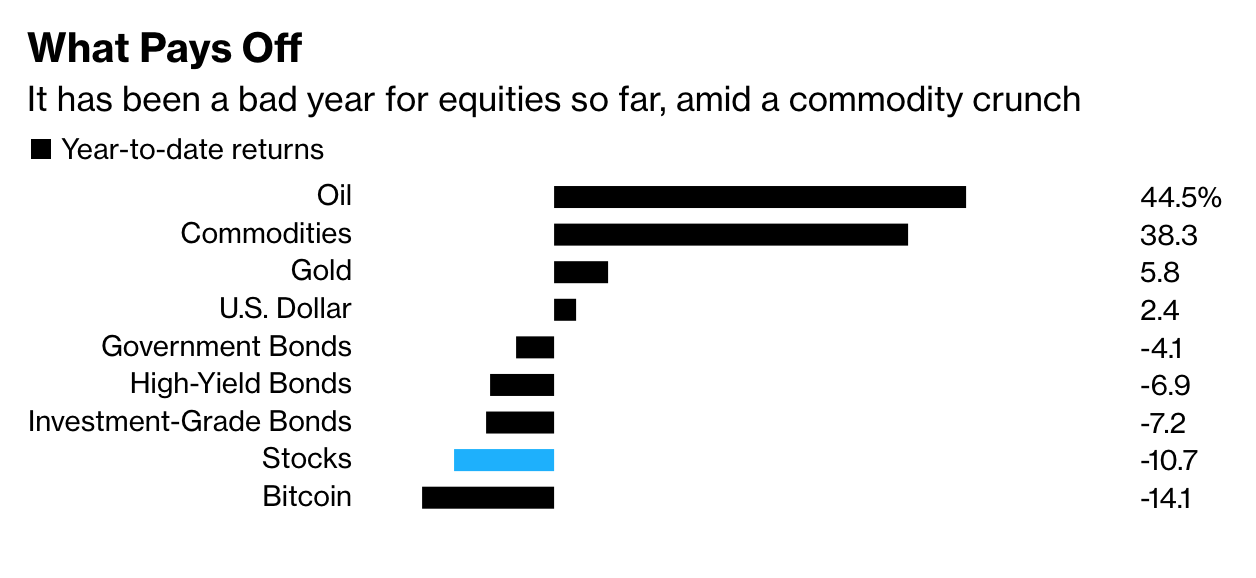

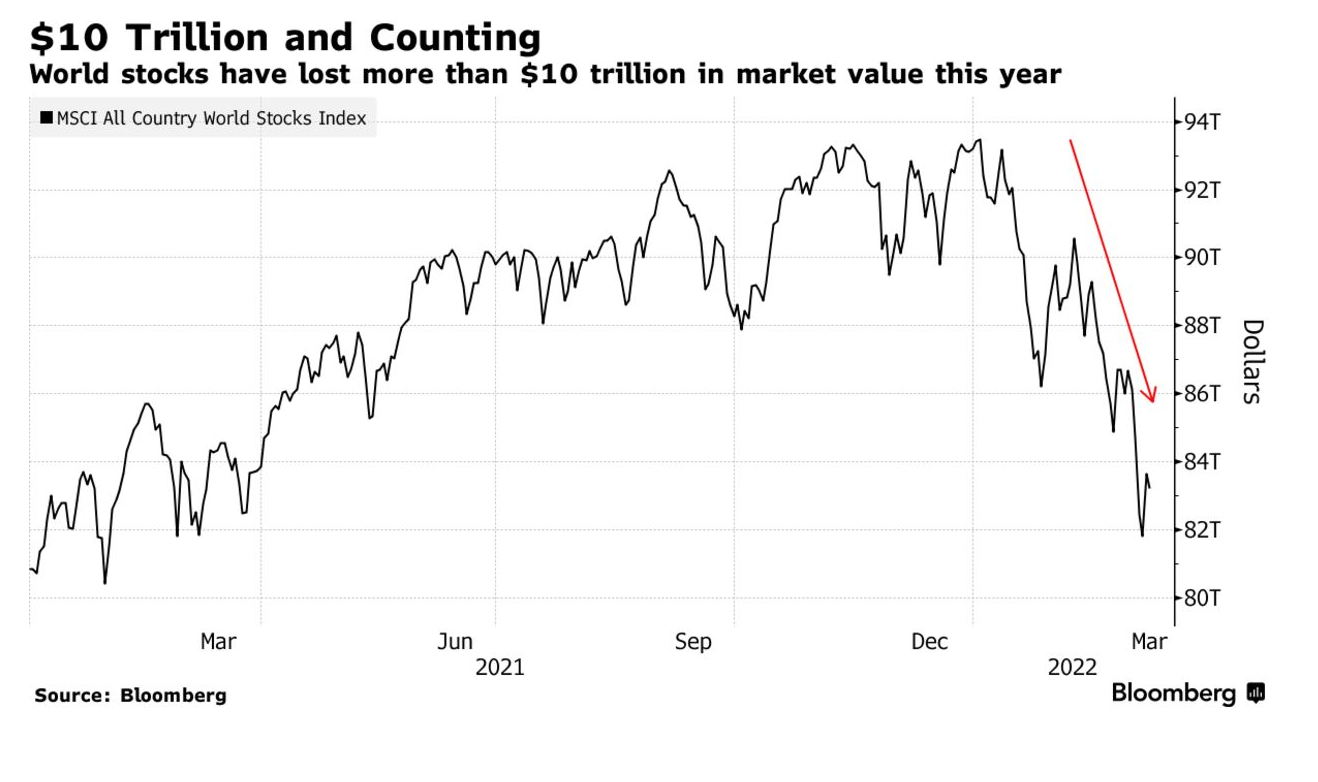

* Strategists And Fund Managers Offer Insight On How To PrepareEven after one of the worst starts to an equity trading year in history, the market upheaval might just be getting started.

Ominous signs are piling up that more turmoil is still coming, as key indicators point toward a potential recession. That could deepen the market rout triggered by the Federal Reserve leading a hawkish shift among central banks and war in Ukraine.

The U.S. Treasury yield curve has collapsed to near inversion — a situation when short-term rates exceed those with longer tenors, which has often preceded a downturn. In Europe, energy costs have climbed to unprecedented levels, as sanctions against Russia exacerbate a global commodity crunch.

“Over time, the three biggest factors that tend to drive the U.S. economy into a recession are an inverted yield curve, some kind of commodity price shock or Fed tightening,” said Ed Clissold, chief U.S. strategist at Ned Davis Research. “Right now, there appears to be potential for all three to happen at the same time.”

Food prices are already past levels that contributed to uprisings in the past, and the outbreak of a war between Russia and Ukraine — which combined account for 28% of global wheat exports and 16% of corn, according to UBS Global Wealth Management — only adds to risks.

Meanwhile, the Fed is unlikely to intervene to prevent sell-offs, according to George Saravelos, Deutsche Bank’s global head of currency research. That’s because the root cause of the current spike in inflation is a supply shock, rendering the playbook used to fight downturns for the past 30 years all but useless.

The probability of a U.S. recession in the next year may be as high as 35%, according to economists at Goldman Sachs Group Inc., who cut the bank’s growth forecasts due to the soaring oil prices and the fallout from the war in Ukraine. Bank of America Corp. said the risk of an economic downturn is low for now, but higher next year.

With a sharp and widespread economic slowdown looming over the horizon, here’s a guide on how to prepare based on conversations and notes by fund managers and strategists.

Europe Exodus

While the year started with bullish bets on European stocks, that’s ancient history now. Record inflation, a surprisingly hawkish pivot by the European Central Bank and Vladimir Putin’s attack on Ukraine have changed everything, and a mass exodus from the region’s stocks is in full swing.

Strategists across asset classes see the Old Continent as the most exposed to risks stemming from the war, not least due its geographical proximity and its energy dependence on Russia.

“For euro zone, there is a high probability of recession if the situation doesn’t normalize quickly,” said Christophe Barraud, chief economist at Market Securities LLP in Paris. The risks include the confidence shock from the war, the hit to household consumption from higher food and energy prices, and the amplified supply chain disruptions caused by the conflict, he said.

Even enthusiastic bulls, like UBS Global Wealth Management, have downgraded euro-area equities. Amundi SA, Europe’s largest asset manager, said Friday that a temporary economic and earnings recession on the continent is now possible.

The silver lining is that much of the bad news for Europe may now already be accounted for, revealing pockets of opportunity. Bank of America Corp. strategists lifted the region’s cyclical versus defensive stocks, as well as carmakers.

“The recent underperformance leaves them more realistically priced,” they said.

Commodity Havens

Miners and energy are the only sectors that have weathered the rout in European equities so far, and that’s likely to continue — unless price rises destroy demand in the process.

“The energy sector in equities is one of the areas that provides shelter,” Nannette Hechler-Fayd’herbe, global head for economics and research at Credit Suisse Group AG told Bloomberg TV. “In the best case, growth is picking up and energy is supported by that. In the worst case, it is prices that continue to increase and energy sector continues to be supported as well.”

In the emerging landscape, the U.K. has been touted as a potential haven because of an abundance of commodity stocks in the FTSE 100 index. While MSCI’s benchmark of global stocks has slumped 11% this year, Britain’s large-cap gauge has lost a mere 3%.

Energy and materials firms, along with the traditionally-defensive sectors of health care and utilities, account for a combined 58% of the FTSE 100 — index members like Shell Plc and Glencore Plc have risen amid fears of a supply squeeze. The figure drops to about 31% for MSCI’s world benchmark.

Opaque industries such as agricultural chemicals are also doing well, and the ongoing tightness in fertilizer markets due to the war in Ukraine could bode well for companies like Yara International ASA, OCI NV, Mosaic Co. and Nutrien Ltd.

Food staples and retailing in the U.S. have also historically outperformed during stagflationary periods, UBS strategists Nicolas Le Roux and Bhanu Baweja wrote in a note.

Booze And Chocolate

To be sure, not all yield-curve inversions, tightening cycles and commodity spikes lead to economic contractions. But the risks are there, and investors seeking to take cover should act — though it may already be too late.

The U.S. market anticipates the start of recessions by an average of seven months and bottoms by an average of five months before the end of a recession, according to CFRA data going back to World War II.

By the time the National Bureau of Economic Research tells us we’re in a recession, “it’s the time to buy,” said Sam Stovall, chief investment strategist for CFRA.

And if you are unsure what to buy amid the market uncertainty, Greenmantle’s Dimitris Valatsas recommends a house.

“The historical evidence from the last global inflationary period during the 1970s is clear,” he said. “In real terms, across major economies, housing outperforms every other major asset class, including equities.”

But to keep a foothold in equity markets, it’s worth keeping an eye on purveyors of creature comforts and what people can’t do without such as must-have technologies, like Microsoft Corp.

When crisis hits, “consumers typically go for little pleasures,” said Edmund Shing, chief investment officer at BNP Paribas Wealth Management. “Buying new cars or smartphones suffer, while booze and chocolates tend to benefit.”

-

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Leave a Reply

You must be logged in to post a comment.