Ultimate Resource On Portugal And It’s Treatment Of Crypto-Currencies (#GotBitcoin)

Portugal’s Tax Authority has clarified that both cryptocurrency trading and payments in crypto will not be taxed in the country, Cointelegraph en Español reported on Aug. 27. Ultimate Resource On Portugal And It’s Treatment Of Crypto-Currencies (#GotBitcoin)

The agency reportedly provided the clarification to a local crypto mining company, publishing an official ruling document. In the document, the authority states that the exchange of crypto for fiat money is free of VAT, adding that crypto users do not have to pay any income tax.

Portugal Cites A 2015 Ruling For Crypto Tax Exempt

In the official statement, the Portuguese tax authority cited a 2015 ruling by the European Court of Justice regarding the case involving major Swedish Bitcoin (BTC) portal Bitcoin.se and its moderator David Hedqvist.

As reported at the time, the court ordered that Bitcoin is a means of payment and that the exchange should therefore be exempted VAT obligations. However, the Swedish Tax Agency subsequently argued against the ruling, claiming that the court did not fully understand the matter.

Earlier Stance On Crypto

The confirmation follows a previous tax ruling by the Portuguese tax authority that cryptocurrencies are not taxed in the country. A document published by the agency in 2016 states that income from the sale of crypto in Portugal is not subject to income tax.

Earlier in 2013, the central bank of Portugal, the Banco de Portugal issued a statement citing a 2012 crypto-related paper by the European Central Bank.

The Portuguese bank raised concerns over the ECB’s Bitcoin recognition as a “phenomenon of innovation in virtual currency models,” claiming that Bitcoin cannot be considered a safe currency as it its issued by unregulated entities.

Updated: 8-8-2021

Xiaomi Denies Involvement In Shop Accepting Bitcoin In Portugal

A Portuguese shop selling products of Chinese electronics giant Xiaomi previously announced that it partnered with Utrust to unlock payments in five cryptocurrencies.

Chinese electronics manufacturer Xiaomi has denied the company’s involvement in a move by a Portuguese Xiaomi shop to start accepting Bitcoin (BTC) payments.

Mi Store Portugal, a Xiaomi retailer in the country, announced Wednesday on Facebook that it now allows customers to purchase devices using five cryptocurrencies, including BTC, Ether (ETH), Tether (USDT), Dash (DASH) and the Utrust (UTK) token.

A spokesperson for Xiaomi subsequently reacted to the news on Chinese social media platform Weibo, stressing that the Mi Store Portugal is not directly related to Xiaomi’s operations. “We are concerned about the information that Mi Store Portugal accepts digital currency payments on overseas social platforms,” the person said. The representative added that Mi Store Portugal is a “third-party authorized partner” and operates independently in Portugal.

Mi Store Portugal subsequently removed the announcement on Aug. 6, also having taken down the related information from its website, previously stating that its customers were able to select the crypto payment option at checkout.

The new payment option is enabled through a partnership with Utrust, a European blockchain technology payment platform. “Xiaomi is the second-largest phone manufacturer in the world, and now their local branch is accepting the Money of Tomorrow,” Utrust said in a now-deleted tweet published on Wednesday.

The firm did not immediately respond to Cointelegraph’s request for comment. Mi Store Portugal’s website still indicates Utrust as a payment partner alongside Visa and PayPal at the time of writing.

According to data from global industry analysis firm Counterpoint, Xiaomi surpassed global smartphone giant Apple as the second-largest mobile phone manufacturer in the world in the second quarter of 2021. Mi Store Portugal is the only official retailer of Xiaomi’s certified products in Portugal, operating under the European legislation, the company’s website notes. The firm currently has six physical stores nationwide and is in the process of expansion.

Pedro Maia, marketing director of Mi Store Portugal, reportedly said that the company’s move to accept crypto payments aligns with Xiaomi’s striving for innovation. “We are a technological, innovative, and disruptive brand. That’s why we always want to be one step ahead. We want to give the possibility to all true technology fans to buy their favorite gadgets with what is currently the ‘most technological money.’”

As previously reported, Portugal has been steadily growing as a cryptocurrency-friendly country in recent years, with the local government charging zero taxes from retail crypto trading. Earlier this year, a local energy trading firm started accepting Bitcoin as payment for electricity bills.

In contrast, China has emerged as one of the world’s biggest anti-crypto countries, renewing a nation-wide crackdown on both cryptocurrency mining and crypto trading earlier this year.

Updated: 8-20-2021

Portugal To Ease Restrictions On Size Of Groups At Restaurants

Portugal will ease limits on the size of groups that can be seated at restaurants as it takes the next step in a plan to gradually lift restrictions put in place to contain the coronavirus pandemic.

Restaurants will be able to host groups of as many as eight people indoors and 15 people in outdoor seating from Monday, Presidency Minister Mariana Vieira da Silva said at a press conference in Lisbon on Friday. That’s up from existing limits allowing groups of as many as six people indoors and 10 people outdoors. The government is also lifting capacity restrictions on public transport.

Portugal accelerated its Covid-19 inoculation campaign amid a new surge of cases in June, and more than 70% of the population has now completed vaccination, according to the government.

Updated: 5-19-2022

Portugal No Longer Considered A Crypto-Friendly Destination

* The Move May Lead To An Overhaul Of Its Tax-Free Crypto Regime

* ‘The Timetable Will Be As Soon As Possible’: Finance Minister Fernando Medina

Portugal is embarking on a major change of course as it considers levying taxes on cryptocurrencies, signaling a policy shift for one of Europe’s most crypto-friendly destinations.

The country’s lack of legislation, combined with its affordable living costs and mild temperatures has attracted a growing number of digital nomads and cryptocurrency companies in recent years. At the moment, Portugal does not tax crypto gains, unless it stems from professional or business activities.

But this could soon change.

“The government’s intention is to legislate on this matter,” Finance Minister Fernando Medina told reporters in Lisbon on Thursday. “I don’t want to commit to a deadline. The timetable will be as soon as possible, when we have a consistent proposal and after a wide public debate.”

Medina, a former mayor of Lisbon, insisted that Portugal would still be a competitive destination once the new tax rules come into force.

“Portugal will adopt a regime that is effective, that is fair, and a regime that fits within the best practices from the point of view of what are the international experiences and also the competitive position of the country,” he said.

The presence of crypto enthusiasts is palpable in Lisbon, where networking opportunities range from the annual Web Summit, one of the world’s biggest technology conferences, to weekly informal gatherings at bars.

The number of foreign residents living in Portugal rose 40% over the past decade to 555,299 people in 2021, according to Portugal’s National Statistics Institute.

Some of these residents also benefit from a flat 20% tax on their income or a 10% tax on their pensions, according to the country’s so-called non-habitual resident program.

“While there is no official explanation, some banks just tell us they don’t want to work with crypto companies,” said Guimaraes. “It’s almost impossible to start a crypto business in Portugal right now.”

Portuguese state-owned Caixa Geral de Depositos and Lisbon-based BiG are also among lenders in Portugal rejecting or closing down crypto exchange accounts, Jornal de Negocios reported earlier on Wednesday.

Updated: 8-3-2022

Portuguese Crypto Exchanges Dealt A Blow As Banks Close Accounts

* Moves Could Harm Portugal’s Burgeoning Crypto Ecosystem

* At Least Three Exchanges In Portugal Had Accounts Closed

Some of Portugal’s biggest banks are closing the accounts of digital-currency exchanges, a move that could deal a blow to one of Europe’s most crypto-friendly destinations.

Banco Comercial Portugues, Portugal’s biggest listed bank, and Banco Santander, shut down all of Lisbon-based CriptoLoja’s accounts last week, said Pedro Borges, the exchange’s co-founder and chief executive officer. The move took place after two smaller banks in Portugal also closed the company’s accounts. The lenders didn’t provide an official explanation, he said.

At least two other crypto exchanges in Portugal have also been hit by bank account closures this year. Crypto firm Mind the Coin has been unable to open an account for months after all of its accounts in Portugal were shuttered earlier this year, said Pedro Guimaraes, the company’s founder.

Rival Luso Digital Assets also had some of its accounts shut down in Portugal this year, Chief Product Officer Ricardo Filipe said.

Cryptocurrency companies globally have long struggled to open and maintain bank accounts, with large lenders citing concerns about the sector’s anti-money laundering and know-your-customer standards.

Banco Comercial said in an emailed statement that its duty is to inform the competent authorities whenever it sees “suspicious transactions,” which may also determine the termination of banking relationships with certain entities.

A Banco Santander representative said the lender acts in “accordance with its perception of risk” and that any decision to maintain an account depends on “several factors.”

“We now have to rely on using accounts outside Portugal to run the exchange,” said Borges, whose company last year was the first to receive a license from the central bank to operate in Portugal. CriptoLoja always informed authorities of suspicious operations, he said.

“All the compliance and reporting procedures have been followed,” he said.

While it is unclear if any other crypto companies have had their accounts closed this year, the moves affect three out of the five virtual coin exchanges with a central bank license and could signal a toughening environment for Portugal’s digital-assets sector.

The southern European nation became a haven for crypto enthusiasts during the Covid-19 pandemic becasue of its zero-percent taxes on digital-currency gains, affordable living costs and mild temperatures all-year round.

“While there is no official explanation, some banks just tell us they don’t want to work with crypto companies,” said Guimaraes.

“It’s almost impossible to start a crypto business in Portugal right now.”

Portuguese state-owned Caixa Geral de Depositos and Lisbon-based BiG are also among lenders in Portugal rejecting or closing down crypto exchange accounts, Jornal de Negocios reported earlier on Wednesday.

The Bank of Portugal has licensed all of the exchanges that have had their accounts closed, including Criptoloja, Mind The Coin and Luso Digital Assets.

Several large banks in Portugal have reportedly begun closing the accounts of cryptocurrency exchanges due to “risk management” concerns, suggesting a shift in Portugal’s pro-crypto position. The country’s central bank appears to have given the financial institutions the green light to take action.

Several of Portugal’s top banks recently closed the accounts of CriptoLoja, the country’s first cryptocurrency exchange to obtain a license to operate. According to a Bloomberg report, at least four domestic cryptocurrency exchanges have seen their accounts shut by BCP (Banco Comercial Portugues), Santander Bank, Caixa Geral de Depósitos, BiG and Abanca.

All the exchanges are licensed by the Bank of Portugal, which regulates domestic cryptocurrency trading platforms. Three of the exchanges were identified as Criptoloja, Mind The Coin and Luso Digital Assets, with a third requesting that their name not be published by media platforms.

The head of the Bank of Portugal, Mário Centeno, was quoted as saying that banks had complete freedom to do anything they wanted, but he promised to keep a close eye on the situation.

The Bank of Portugal’s oversight of exchanges includes ensuring that platforms combat money laundering and the financing of terrorism, and work to prevent fraud.

BCP told Bloomberg that its primary duty was to inform competent authorities if it detects “suspicious transactions,” which may lead to the termination of banking relationships with certain companies.

Cointelegraph reached out to CryptoLoja, one of the affected crypto exchanges, for comment but did not receive a response as of press time. This article will be updated when a response is received.

The closure of these accounts is seen as a blow to Portugal’s crypto-friendly approach, as authorities had previously rejected two tax proposals that might have been applied to investors making money from cryptocurrencies.

However, the government and financial sector have recently shown an increased interest in regulating cryptocurrency in line with other European Union nations.

Crypto exchanges have had trouble obtaining banking services worldwide due to their perceived risk. As reported by Cointelegraph, United States Senator Elizabeth Warren is reportedly proposing a bill that would effectively ban bank-provided cryptocurrency services.

The Iberian nation has drawn Bitcoin entrepreneurs from around Europe, particularly Ukrainians fleeing the crisis in their home country.

Around 27,000 Ukrainians lived in the Iberian nation before the military conflict with Russia, but their number has risen to over 52,000, making them the second-largest foreign population after Brazilians.

Updated: 8-4-2022

Here’s Why Portuguese Banks Are Closing Crypto Exchange Accounts

At least three exchanges have had their accounts shut despite obtaining regulatory approval to operate in the country. The reason? The banks’ fear of potential money laundering.

Portuguese commercial banks are shutting down the accounts of crypto exchanges because they want to avoid the potential for criminal activity through those exchanges.

And even though the exchanges are licensed to operate in Portugal, the banks can basically do what they want when it comes to shutting those accounts.

Last week, Portugal’s largest bank, Banco Comercial Português, and Banco Santander (SAN) closed Portuguese crypto exchange CriptoLoja’s accounts. The exchange is no longer allowed to hold any capital within those banks.

This exchange is not alone. Earlier this year, crypto exchanges Mind the Coin and Luso Digital Assets also had their accounts closed by Portuguese banks.

Portuguese banks have been closing crypto exchanges’ accounts over the past year, citing concerns about crypto exchanges facilitating money laundering and other criminal activities.

“From the corporate side it’s a nightmare. A simple payment is not as easy as if we had a bank account here in Portugal,” said Pedro Borges, the CEO of CriptoLoja. “This kind of nuisance, these kinds of measures that the banks are taking are not good for the country.”

Luso Chief Product Officer Ricardo Felipe told CoinDesk that last year national bank Caixa Geral de Depósitos gave him no reason why the exchange is no longer allowed to hold accounts with the bank.

Banco Comercial Português and Banco Santander said they closed accounts this year because of suspected fraudulent clients. Borges did not respond to questions about these specific allegations.

“We already knew that this was just a matter of time and we would need to pay attention and focus our efforts on our banking relationships,” said Felipe.

Felipe said the regulatory landscape in Portugal allows for banks to legally terminate accounts with cryptocurrency exchanges without any input from the regulator.

“Even though we do have an [anti-money laundering] regulation or license from them, it’s not something that establishes that kind of operation with the banks,” said Felipe.

Nuno Correia, chief strategy officer and founder of Portuguese cryptocurrency exchange Utrust, told CoinDesk the company hasn’t been impacted by banks closing its accounts. However, he sees the discrepancies between the regulators and the banking sector.

“The Central Bank of Portugal has a deep expertise, does deep due diligence in businesses and at the same time embraces innovation. [It is] not the same case for the banking sector itself,” Correia said.

Portuguese Regulatory Framework

Portuguese banks are regulated by Banco de Portugal, the nation’s central bank. According to local lawyer João G. Gil Figueira, the central bank grants licenses to various cryptocurrency companies operating in the country.

However, commercially independent banks are at their own discretion to allow these companies to hold accounts in their banks and can terminate them whenever they choose.

Figueira told CoinDesk that banks prefer to work with companies that may not raise concerns over money laundering or tax evasion, two crimes seen as commonly associated with digital asset lenders and brokers.

“It seems that banks do not trust their own regulator’s judgment on issuing such authorizations to operate. So it’s a mixture of banks being slow-moving, unprepared, afraid of money laundering, and preferring other low-hanging fruits in other sectors,” Figueira told CoinDesk.

Although Luso cannot hold an account with the Banco de Portugal, Felipe said he’s optimistic that European Union’s upcoming Markets in Crypto Assets bill that will go into effect in 2024 will provide regulatory clarity on the relationship between commercial banks and regulators.

The Markets in Crypto Assets law (MiCA) will provide a regulatory framework for digital asset regulation, from stablecoins to initial coin offerings, across the European Union. It will also create a common licensing regime, allowing companies to easily set up in each of the EU’s member nations.

“With MiCA, we will turn into financial institutions. We will have that safeguard of being given partner bank accounts in Portugal, even if the bank wants to conceal them,” said Felipe.

However, Figueira isn’t under the impression that MiCA will do anything to prevent banks from closing accounts in Portugal. Rather, it will work as a “passport” for crypto companies to operate between European nations.

“MiCA will not have an impact in the [anti-money laundering/know your customer rules] regard, as much as it will have an impact on consumer protection, so more so on the creation, issuance and investment in such assets.

It will not so much have a direct impact on the banking aspects and issues that we are discussing,” said Figueira.

Updated: 6-8-2023

Americans Are Leaving Portugal As Golden Visa Honeymoon Ends

Some expats are departing the country as rising home prices and bureaucratic hurdles make life difficult.

For many Americans, a love affair with Portugal blossomed over the last three years: The Iberian nation offered cheap real estate, miles of beautiful coastline and a reprieve from divisive US politics at a time when remote work was flourishing. Now, reality has settled in — and the honeymoon is over.

From language barriers and bureaucratic challenges to housing costs that have been driven higher by foreign investment, some expats say that life in Portugal hasn’t met their expectations.

The country is losing its appeal for potential newcomers, too, after pulling its golden visa program in February. Several expat services, consultants and bloggers say there’s been a decrease in the number of foreigners looking to relocate to Portugal.

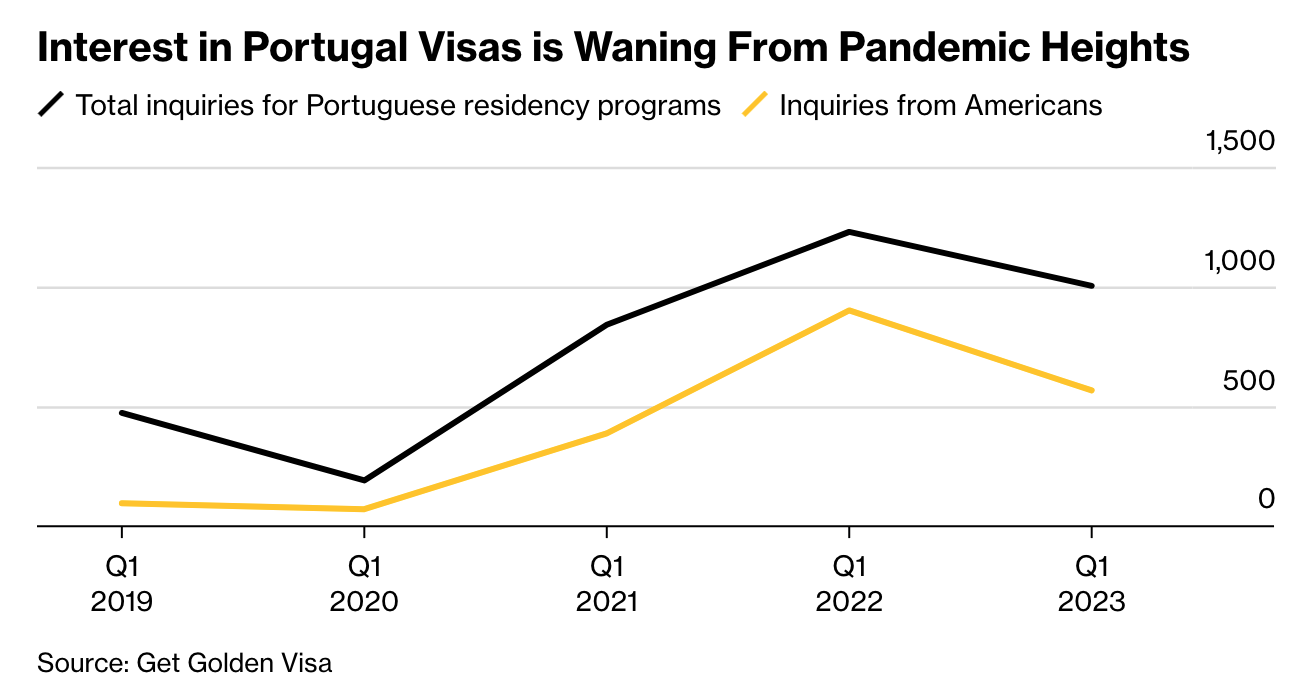

Get Golden Visa, an international residency program, recorded a 37% drop in the number of inquiries from Americans for its Portugal programs in the first quarter, and a 18% drop for all expats, compared with the same period last year.

“People who enquired last winter about moving to Portugal have for the most part not followed through,” said David McNeill, founder of consulting company Expat Empire.

It’s a significant about-face from recent years. As the work-from-anywhere revolution took hold during the pandemic, Portugal lured foreigners with its residency-by-investment program, digital nomad visas and tax savings — a flat 20% income tax for certain professionals for 10 years of residence and no tax on foreign income for non-residents.

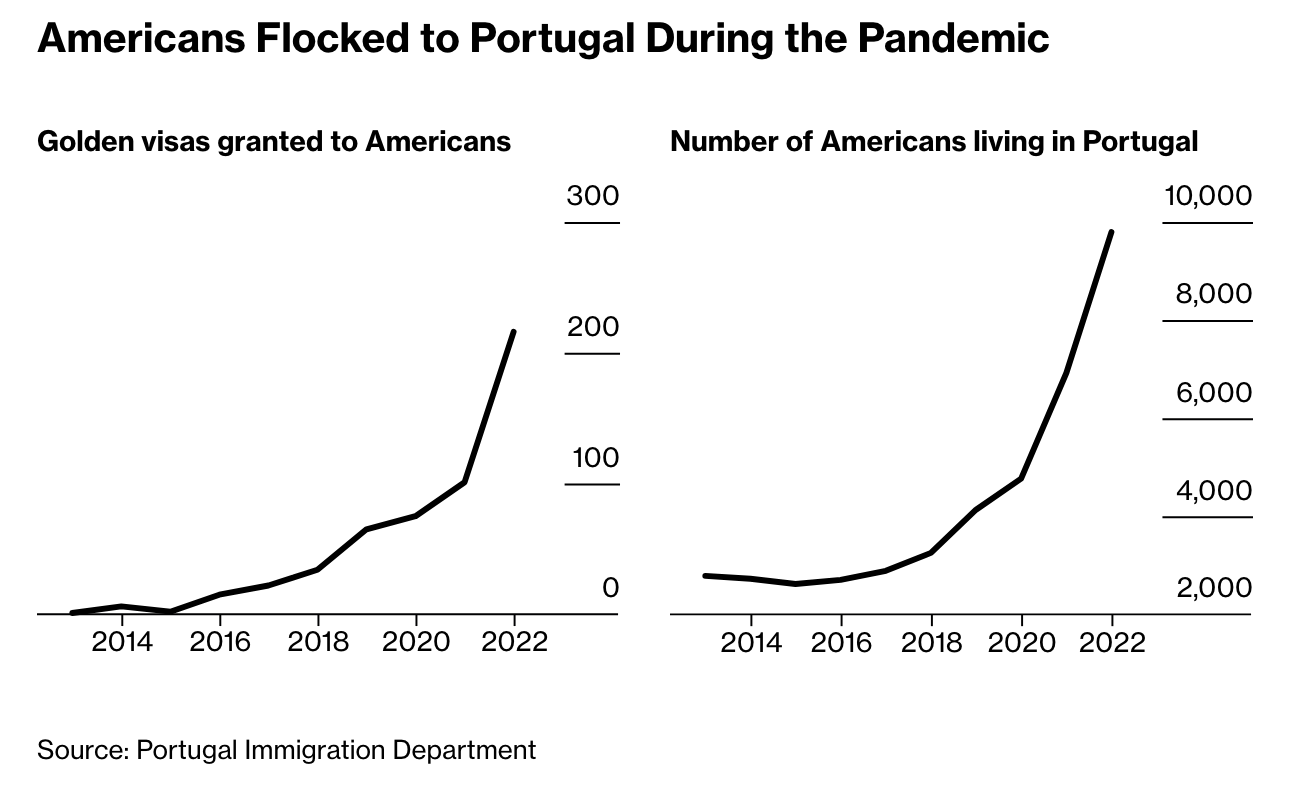

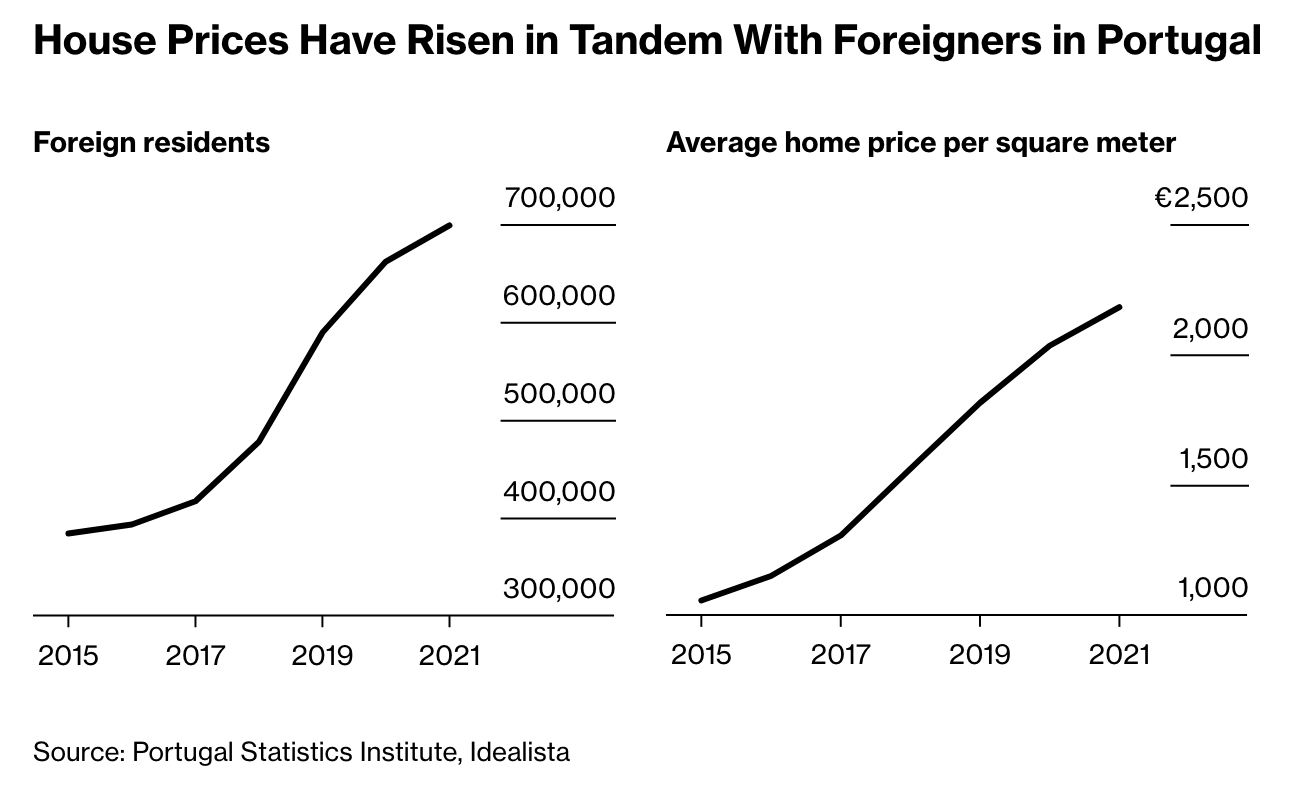

The number of foreign residents surged in recent years to an all-time high of nearly 700,000, and the number of Americans more than tripled to 9,794 between 2018 and 2022, according to official statistics.

The influx of new residents has strained Portugal’s housing supply. Home prices jumped 19% in 2022, the largest annual gain since 1991. And rent has surged too, ballooning 43% year-over-year in Lisbon to 1,693 euros, according to real estate site Idealista.

The increased cost of living is part of what’s deterring foreigners, many of whom are unable to afford real estate in their home countries and are looking for cheaper options as they head into retirement or rely on low-wage jobs.

The lack of affordable housing has also drawn the ire of some Portuguese citizens, and the government responded in February by pulling the golden visa program to slow the influx of foreign money.

The program had brought in 7 billion euros since it was launched in 2012. Americans were granted 216 golden visas last year alone, surpassing the Chinese as the top recipients of golden visas in Portugal in 2022, according to immigration statistics.

To be sure, Portugal’s digital nomad visa continues to be popular. The program, introduced last October, allows non-EU remote workers earning at least 2,800 euros a month to live in the country for up to five years.

In six months, 930 such visas were granted, according to Portugal’s immigration department, with Americans receiving the most. And the US dollar remains strong, allowing Americans to purchase property in Europe and enjoy a different lifestyle.

Many hurdles new residents complain about are ordinary, administrative tasks that most expats face when moving to a new country. Still, expats are increasingly considering other options.

Spain and France are receiving the highest volume of inquiries these days, said US cross-border tax expert Derren Hayden Joseph, as wealthy Americans look to move to more developed and better-connected countries in southern Europe.

“It comes down to the quality of life,” said Joseph. “People want good access to amenities and easy-to-figure out tax and visa systems.”

Jannik Hansen, a 33-year-old Danish blogger who first moved to Lisbon in November 2020, has experienced bureaucratic headaches. He and his partner moved outside the city — in turn, away from public transit — to save on rent, but he hasn’t been able to receive his Portuguese driver’s license despite applying two years ago. Now, they want to leave the country.

“The country was never set up to welcome this many expats at once,” he said. “A lot of people come for a year and leave after six months.”

In some cases, the turnaround is even quicker.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.