Is There A Big Short In Bitcoin? (#GotBitcoin)

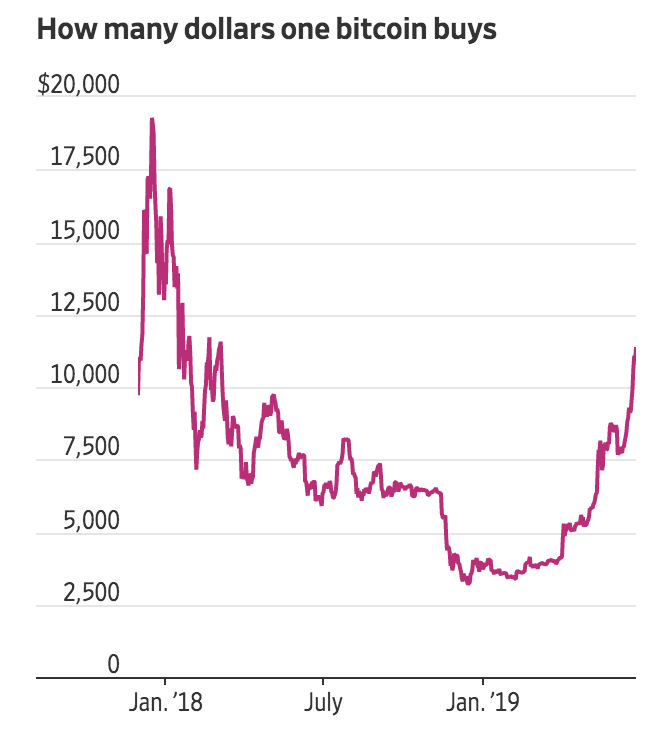

Trading activity has grown in CME’s bitcoin futures in recent months, along with the rebound in the cryptocurrency’s price. Is There A Big Short In Bitcoin? (#GotBitcoin)

Hedge funds and other big traders are betting that bitcoin will fall, even as the digital currency has risen above $10,000 on a new wave of crypto-optimism.

Related:

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

That is the picture that emerges from bitcoin futures listed on CME Group Inc., CME 0.04% the biggest U.S. exchange operator. Futures are contracts that let traders bet on whether an asset—in this case, bitcoin—will rise or fall.

Hedge funds and other money managers held about 14% more bearish “short” positions in CME bitcoin futures last week than they did bullish “long” positions, according to a recent Commodity Futures Trading Commission report.

Other large traders were even more bearish. “Other reportables”—a loose category of firms that don’t necessarily manage money for outside investors—held more than three times as many short positions in bitcoin futures as long ones, the CFTC report shows.

So who is the optimist? The report shows it is mostly small investors taking the other side of the trade. Among traders with fewer than 25 bitcoin contracts, a category that likely captures many individuals placing bets in bitcoin, long wagers outnumbered short bets by 4 to 1.

“Traditional market participants may be more skeptical of [bitcoin] than millennial day traders,” said George Michalopoulos, a portfolio manager with Chicago fund manager Typhon Capital Management LLC, although he stressed that his views were speculative and that it is hard to know what is driving the CFTC’s numbers.

The CFTC report, which came out Friday, reflected the positioning of market players on June 18, when one bitcoin could buy around $9,000. The cryptocurrency was trading at about $10,900 late Monday afternoon.

Though it comes with a lag, the weekly CFTC report offers a glimpse into how various types of traders are positioned in bitcoin futures. Commodity traders closely follow similar CFTC reports on futures like crude oil, wheat and corn for hints of what is driving the market.

The CFTC data shows that hedge funds have been short bitcoin since February, though they recently pared their bearish bets. On June 11, short bets among hedge funds outweighed long bets by 47%, a gap that narrowed to 14% the following week.

Such data don’t necessarily mean hedge funds are placing outright bets that bitcoin will drop. The short bets could also be part of hedging strategies: for instance, a fund with a portfolio of bitcoins might go short at CME as insurance against the value of bitcoin dropping.

Trading activity has grown in CME’s bitcoin futures in recent months, along with the rebound in bitcoin’s price. In May, average daily trading volume in the CME contract hit a record $515 million, the exchange operator says.

L. Asher Corson, a cryptocurrency analyst at Chicago proprietary trading firm Consolidated Trading, said traders who want to short bitcoin don’t have many choices besides CME.

One option is for them to borrow bitcoins from another trading firm, sell them and return an equivalent amount of bitcoins to that firm later—a process similar to how short selling works in stocks. But the difference is that, in the volatile bitcoin market, few firms are willing to offer that service to short sellers because of the risk of their customers defaulting, Mr. Corson said.

“CME right now is providing a unique ability for the larger players to have massive short positions with very low counterparty risk,” Mr. Corson said.

Volumes in CME’s bitcoin futures contract got a lift when a competing U.S. exchange operator that offered a similar contract, Cboe Global Markets Inc., recently discontinued it. Cboe’s last bitcoin futures contract expired last week.

But CME is set to face additional competition soon. Intercontinental Exchange Inc., owner of the New York Stock Exchange, is set to begin testing of a new bitcoin futures contract in July. LedgerX, a startup trading platform for bitcoin options, plans to launch its own futures on the cryptocurrency after the CFTC said Tuesday it had won approval to become a futures exchange. And a group of prominent financial firms, including TD Ameritrade Holding Corp. and Fidelity Investments, are backing a venture called ErisX, which plans to offer both futures and spot trading of cryptocurrencies.

Volumes in CME’s contract remain a fraction of the billions of dollars’ worth of daily activity in the bitcoin “spot” market, where actual units of the digital currency change hands. But some recent studies suggest that the size of the bitcoin spot market is inflated because of rampant fake trading at cryptocurrency exchanges.

That should prompt traders to take a closer look at CME bitcoin futures, analysts from JPMorgan Chase & Co. said in a June 14 report. As a regulated exchange, CME bars wash trading—in which traders engage in back-and-forth buying and selling to generate fake volume—and violators can be subject to both CME and CFTC fines. That makes CME’s volumes more trustworthy.

“The importance of the listed futures market has been significantly understated,” the JPMorgan analysts wrote.

Updated: 6-20-2022

First Short Bitcoin ETF To List On NYSE

The exchange-traded fund will allow investors to hedge their bitcoin exposure, which may prove particularly pertinent given the sharp downturn in crypto markets of late.

Investment product provider ProShares is set to list the U.S.’s first exchange-traded fund (ETF) allowing investors to bet against the price of bitcoin (BTC).

* The ProShares Short Bitcoin Strategy (BITI), which is designed to deliver the inverse of bitcoin’s performance, will start trading on the New York Stock Exchange (NYSE) Tuesday, ProShares announced Monday.

* The ETF will allow investors to hedge their bitcoin exposure, which may prove particularly pertinent given the sharp downturn in crypto markets of late.

* ProShares was the first firm to list a bitcoin futures ETF in October, a factor which saw the world’s largest crypto hit an all-time high of around $68,900 in the subsequent weeks. Bitcoin investors will be hoping the listing of a short bitcoin futures ETF does not have a similar effect on the world’s largest crypto in reverse.

* Bitcoin’s price dropped below $20,000 for the first time since Dec. 20 on June 18, falling as low as $17,800 the following day.

* ProShares applied to list BITI in early April, around the same time as leveraged ETF-provider Direxion filed to list a similar product. As yet there have been no updates on the status of Direxion’s application.

* A short bitcoin ETF is also already listed on the Toronto Stock Exchange by Horizons ETFs.

Updated: 6-21-2022

Short Sellers Are Having A Field Day Betting Against Crypto Stocks

* Those Traders Have Seen Average Return Of 130% This Year: S3

* Digital Assets Have Been Hurt By Less-Accommodative Fed Policy

Traders betting against stocks have generally done well this year, with bearish wagers against crypto shares proving to be a major standout.

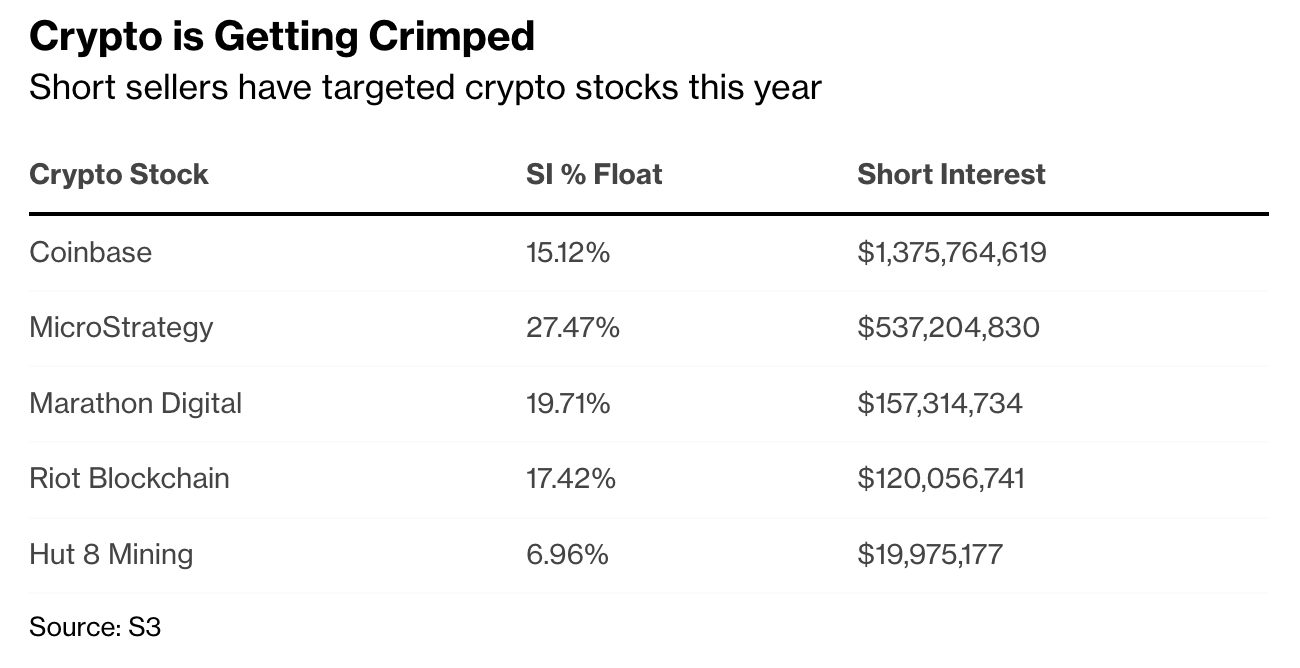

Short sellers in digital-asset stocks have gained an average of 130% in 2022, according to Ihor Dusaniwsky, head of predictive analytics at S3, a technology and data-analytics firm.

By comparison, wagers against the automobile and software sectors have returned about 50%, while retailing, media and entertainment have seen gains of about 46% each.

“None of these industries can hold a candle to short sellers in the crypto sector,” wrote Dusaniwsky in a note last week.

Digital assets have been rocked by a more restrictive Federal Reserve policy and stock volatility, while being beset by a number of hacks and scandals.

Bitcoin, the largest digital token by market value, has plunged 50% since the end of December, while Ether has shed about 70%.

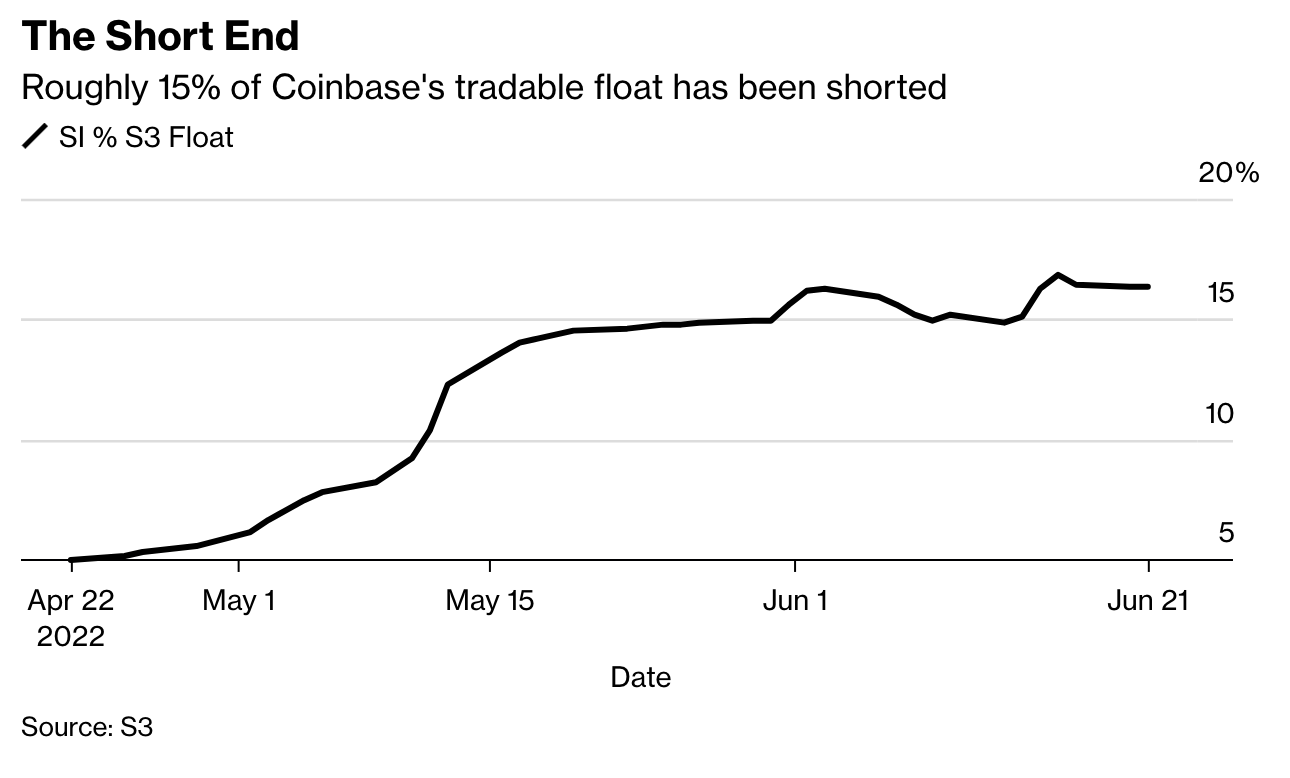

In this environment, crypto-linked shares like Coinbase Global Inc. and MicroStrategy Inc. have not fared well either. The crypto exchange is down nearly 80% this year, while shares of the software firm have slumped 66%.

Among the publicly traded crypto firms that S3 tracks, Coinbase tops the list in terms of the dollar amount shorted — about $1.38 billion — with more than 15% of its tradable float shorted, according to the data from the firm. Short interest as a percentage of shares outstanding for MicroStrategy stands above 27%, with $537 million shorted.

Many Bitcoin investors have been selling in this environment as prices continued to drop over the past few months. The coin over the weekend fell to around $17,700, the lowest level since the end of 2020.

Overall, digital-asset investment products saw outflows of around $39 million last week, with total assets under management now at their lowest since February 2021, according to data compiled by CoinShares.

Last week’s plunge in Bitcoin took the token below its 2017 peak, and the coin traded below its 200-week moving average for only the second time in its history, according to Vetle Lunde at Arcane Research. “$20,000 remains the most critical support level to pay attention to onwards,” the analyst wrote in a note.

Yet for short sellers looking to still benefit from the drawdown in crypto, it might be too late.

“With the pool of stock borrows in these names limited, due to lack of sizable ownership in the funds of the largest and most-active stock lenders on the street, prospective short sellers may be late to the party,” Dusaniwsky said.

“While the crypto stocks’ negative price momentum may not over, the ability to short stock in size may be over.”

Updated: 6-22-2022

Once-Dull Crypto Strategies Are Now Shining In The Bear Market

* Crypto Funds With No Directional Bets Are Gaining Traction

* Blocktower, Nickel Both See Increased Demand From Investors

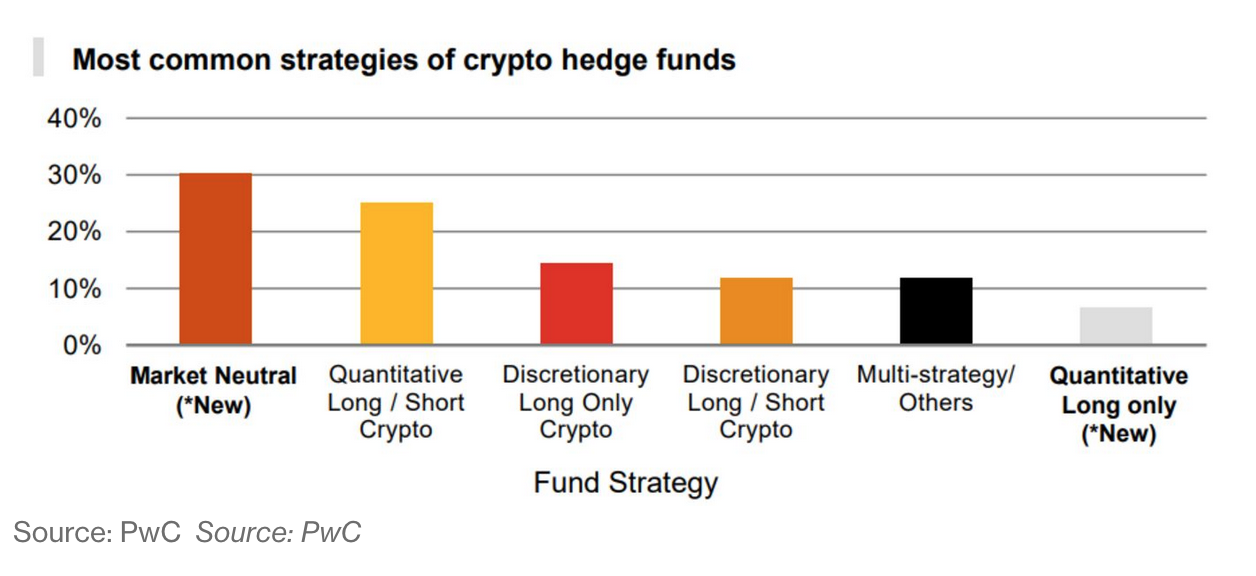

As the “to the moon” refrains quiet down, crypto is seeing increased demand from hedge funds in a trading strategy that does not take directional views on the market.

There’s no question that 2022 has been a tough year for crypto: Bitcoin’s down 50%, and digital assets have shed more than $1 trillion as central banks around the world tighten monetary policy to combat inflation.

But funds like Miami-based BlockTower Capital and Nickel Digital Asset Management, which utilize so-called market-neutral strategies, said they are still notching positive returns.

BlockTower Capital’s market-neutral fund, which manages more than $100 million, has about a 3% return so far this year. And London-based Nickel Digital, with $300 million in assets under management, advanced 0.49% in May when the collapse of Terra sent shock waves throughout the rest of the market and dragged a wide-encompassing index of digital assets down 25%.

“This strategy sometimes might not look as attractive during a bull market where Bitcoin’s up 70%,” Rahul Rai, co-head of market neutral at BlockTower and former FX trader at Morgan Stanley, said in an interview. “In a bear market especially, the strategy really stands out. We’re absolutely seeing a lot of investor demand.”

The teams behind both firms include experienced traders from Wall Street, as the strategy has long been deployed in the equity market. Ken Griffin’s Citadel, for instance, booked a 7.5% return with its market-neutral strategy as US stocks posted losses of nearly 9% in April.

Nickel Digital’s CEO and founding partner Anatoly Crachilov, who left Goldman Sachs in 2019 to pursue crypto, said that with hundreds of trading venues operating 24/7 around the world, the arbitrage opportunities to trade on price differences for the same token are abundant. It’s also a strategy that dates back to the early beginnings of crypto.

In contrast to US markets, “there are more than 400 exchanges out there and every single one of them trades Bitcoin, which means now you have multiple venues and very likely prices will be asynchronized for various reasons,” he said.

Still, Crachilov expects the annualized returns from the market’s inefficiency to come down to 8-10% over time as crypto matures. His firm posted a return of around 15% in 2021.

Since last year, the market-neutral strategy has grown into one of the most popular types of trading methods, according to an April survey by accounting giant PwC.

However, market-neutral funds, with an average return of 37% in 2021, underperformed other strategies — including certain long-only ones that notched average gains above 400%.

Olwyn Alexander, global asset and wealth management leader at PwC Ireland, said the relative performance of market-neutral funds would stand out in today’s environment compared with directional long-exposure funds.

“Directional strategies are obviously best during a bull market — if you bought Solana early on and sold it at the peak, you might have made 1,000%. It’s more about timing. Market-neutral strategies aren’t going to touch that,” said Michael Safai, co-founder and partner at proprietary trading firm Dexterity Capital. “We’ve been doing this for five years, and for us, it’s a long game, where we can always make money no matter what the market is doing.”

Though there are a number of different market-neutral strategies traders can deploy, “you’ve done pretty well if you’re in the neighborhood of 20-30%,” Safai said. “But you can do better than that if you’re clever.”

Risk-Taking

Beyond taking advantage of market inefficiencies across centralized trading venues, another crypto-only market-neutral strategy can be found within decentralized finance, a fast-growing experimental sub-sector of crypto that became popular over the past two years.

BlockTower’s Rai said his firm is actively looking for returns in DeFi, but acknowledged that DeFi faces increased criticism due to the collapse of the Terra blockchain and the billions of dollars that have been hacked in the nascent sector.

Celsius, a crypto lending platform, paused withdrawals and other activities for its users recently, after many in the market questioned the firm’s investment in DeFi.

Rai said his firm had “no material losses” through Terra’s meltdown, since it saw the warning signs early on.

“What a savvy fund manager has to do is evaluate — given the return profile — is it worth taking on these risks? And what is the risk-adjusted return?” he said. In DeFi, “these risks are uncorrelated to the broader market. A smart contract getting hacked has no correlation to what the S&P 500 is doing or what Bitcoin is doing. It’s an idiosyncratic event.”

Updated: 6-24-2022

Investors Pile Into Short Bitcoin ETF Betting On Prices To Fall

ProShares’ BITI exchange-traded fund raked in $11 million Thursday after a lackluster opening day.

Investors have piled into a recently launched bitcoin exchange-traded fund (ETF) that’s designed to profit from price declines in the cryptocurrency – to the extent that the vehicle is now the second-largest bitcoin-focused ETF in the U.S. market after just a few trading days.

* The ProShares Short Bitcoin Strategy (BITI) ETF raked in the equivalent of 544.2 BTC, or $11 million at current prices, making it the second-largest exchange-traded bitcoin fund listed in Vetle Lunde, an analyst at Arcane Research, noted.

* The fund is designed to deliver the inverse of bitcoin’s performance, meaning that the fund’s investors book a 1% profit on their investment if BTC price falls 1% (before management fees and expenses), by holding BTC derivatives. It started trading on the New York Stock Exchange on Tuesday.

* BITI’s lackluster performance on the opening day met with a shrug from analysts.

* BITI, however, saw strong inflows on Wednesday and Thursday, and had assets under management equivalent to 929 BTC, overtaking the bitcoin futures ETFs of fund providers Valkyrie and VanEck, Lunde said.

* The largest U.S.-listed bitcoin ETF is ProShares futures-based bitcoin ETF (BITO), which is far bigger than all competitors at the equivalent of 31,000 BTC in assets under management, or $651 million at current prices.

* BITI’s strong performance reflects the fragile state of the cryptocurrency market as traders weigh whether it is a good time to buy BTC and how much further its price could fall.

* “The recession reality appears to be driving markets at the moment,” Oanda senior market analyst Craig Erlam said. “I don’t see that improving in the near future, which makes current support in bitcoin around $20,000 look vulnerable.”

* On Twitter, some posters called out the launch of the short bitcoin fund as a potential bottom signal, a counterintuitive take that’s not without a logical precedent: ProShares’ announcement last October that it would introduce a bitcoin futures ETF came just weeks before BTC climbed to its all-time high of nearly $69,000 in November.

* John Freyermuth, a research analyst at Enigma Securities, said that it’s still very early to assess the product’s success. “The most risk-conscious participants are unlikely to explore these futures-based ETFs, much less one with inverse exposure to a futures index,” he said.

* Many crypto-industry executives and traders have long pined for regulatory approval of a spot bitcoin ETF, which would let stock investors gain exposure to the largest crypto asset without actually owning any, because they see the structure as superior to the futures-based funds that the U.S. Securities and Exchange Commission has approved so far.

“It’s remarkable that another derivatives-based product launched before a spot-based product,” Freyermuth said.

Updated: 6-30-2022

Bears Picked Right Stocks To Short With Declines Twice The S&P’s

* Short Sellers Sit On $300 Billion Of Paper Gains, S3 Estimates

* Hedge Funds On Track To Beat Market For First Time In 14 Years

To state the obvious, it has been a good time to be short the market. But the success of bearish traders in 2022 goes beyond luck.

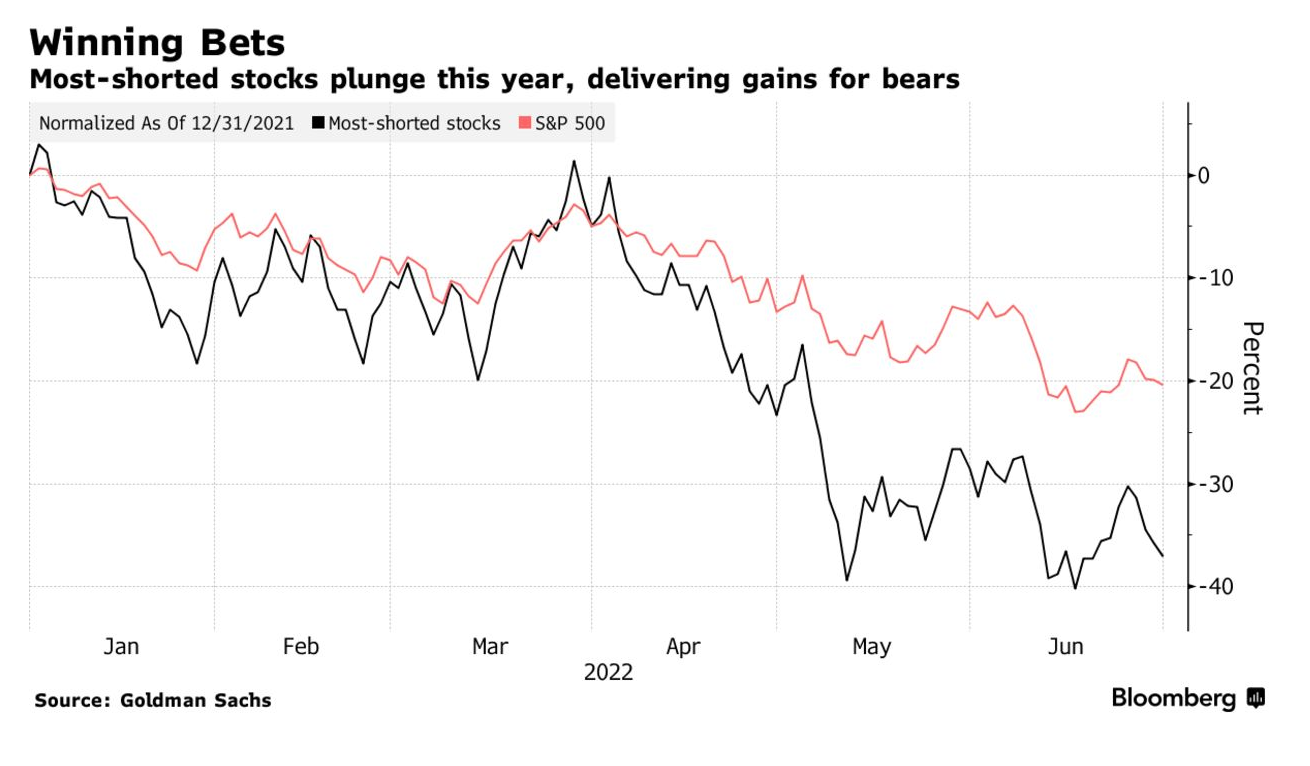

With the S&P 500 down about 20% over the six months, baskets tuned to the favorite bets of those speculating on declines are showing bigger losses.

An index of most-shorted stocks kept by Goldman Sachs Group Inc., for instance, is down 37%, suggesting the pessimists have done a particularly good job trawling for companies most exposed to the downdraft.

From Bed Bath & Beyond Inc. to Nikola Corp. and Beyond Meat Inc., profitless companies that once had no problem flying high are suddenly crashing down as the Federal Reserve embarks on the most aggressive monetary tightening in decades. Those three stocks are each down at least 50%, representing a boon to short sellers.

“A lot of high-flying stocks were bid up to silly levels,” said Michael Purves, founder of Tallbacken Capital Advisors. “They were the first to provide good shorting opportunities.”

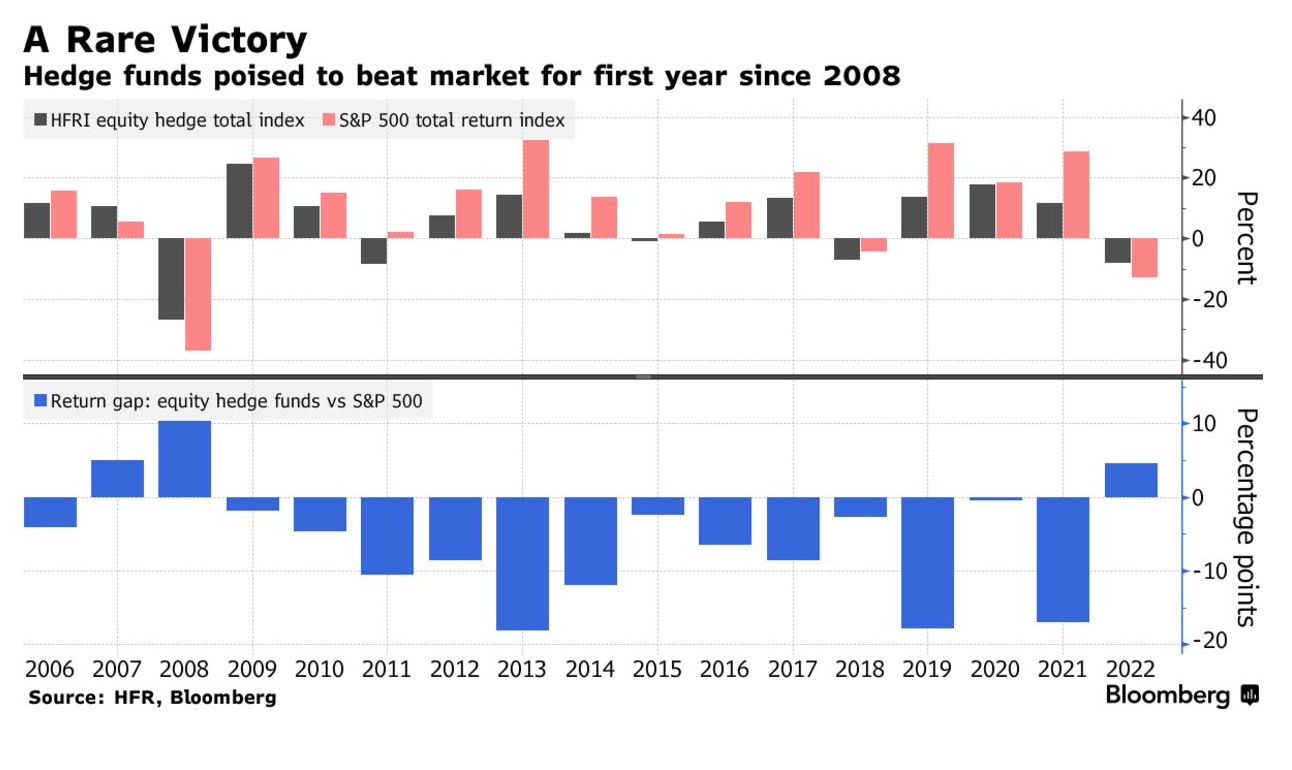

Redemption has been a long time coming in a corner of Wall Street that has been suffocated by years of mind-numbing gains in equities. The $1 trillion long-short hedge fund industry, which suffered money withdrawals for six full years in a row, saw inflows in the first quarter, data compiled by HFR show.

Across the market, short sellers now sit on an unrealized gain of roughly $300 billion year-to-date, according to an estimate from S3 Partners, a data-analytics firm.

“While the market has trended downward and shorts were making money on the downside, they were actively shorting to the tune of around $144 billion in 2022,” said Ihor Dusaniwsky, head of predictive analytics at S3. “Consumer discretionary and technology are the most profitable sectors to short.”

Before this year bears had been almost driven to extinction during relentless equity gains. Now, with the Fed pledging to fight red-hot inflation and ceding its role as bulls’ ally, short sellers are getting their moment to shine.

The windfall from betting against stocks has bolstered performance for hedge funds that usually take both bullish and bearish positions on equities. Those tracked by HFR is about 5 percentage points ahead of the S&P 500 this year through May.

It’s a stunning reversal of fate from the previous 13 years, when hedge funds trailed the market every year.

It’s “vindication of sorts,” said Matthew Tuttle, chief executive officer at Tuttle Capital Management LLC. “Obviously in an environment with the Fed pumping liquidity into the market it is hard to make money on the short side.”

“These days it is a lot easier,” he added. “Unfortunately for the shorts, markets don’t go down forever so they need to enjoy it while it lasts.”

7-1-2022

Worst Quarter In 11 Years As Bitcoin Price And Activity Plunge

Quarterly returns on Bitcoin haven’t been this bad since it was trading under $20 in the early days of Mt. Gox, but the stock market isn’t faring so hot either.

Bitcoin (BTC) has seen its worst quarterly loss in 11 years with price and activity on the blockchain both plunging over the last three months.

The second quarter ending Thursday saw Bitcoin’s price fall from around $45,000 at the start of the quarter to trade at $19,884 before midnight EST on Thursday, according to CoinGecko. This represents a 56.2% loss, according to crypto analytics platform Coinglass.

It’s the steepest price fall since the third quarter of 2011 when BTC fell from $15.40 to $5.03, a loss of over 67% and worse than the bear markets of 2014 and 2018 when Bitcoin’s price slumped 39.7% and 49.7% in their worst quarters respectively.

The past quarter saw eight weekly red candles in a row for Bitcoin and the month of June saw a drawdown of over 37%. This was the heaviest monthly losses since September 2011, which saw the price fall more than 38.5% in the month.

There are also signs that investors are keeping their powder dry — or they’ve run out of funds — during the bear market.

Activity on the blockchain is taking a dive with Bitcoin’s spot volume — the total amount of coins transacting on the blockchain — dropped over 58.5% in just nine days, according to a Wednesda analysis from Arcane Research.

But, it’s not just crypto markets in turmoil. Thanks to sky-high inflation and rising interest rates, the traditional stock market has also taken a pounding, with some calling it the “worst quarter ever” for stocks.

Charlie Bilello, CEO of financial advisory firm Compound Capital Advisors, shared a chart on Twitter showing the S&P 500 index was down 20.6% in the first half of 2022, the worst start to the year for the index since 1962 when price return was -26.5%.

The S&P was down 20.6% in the first half of 2022, the worst start to a year for the index since 1962. $SPX pic.twitter.com/OMcX7yfP5o

— Charlie Bilello (@charliebilello) June 30, 2022

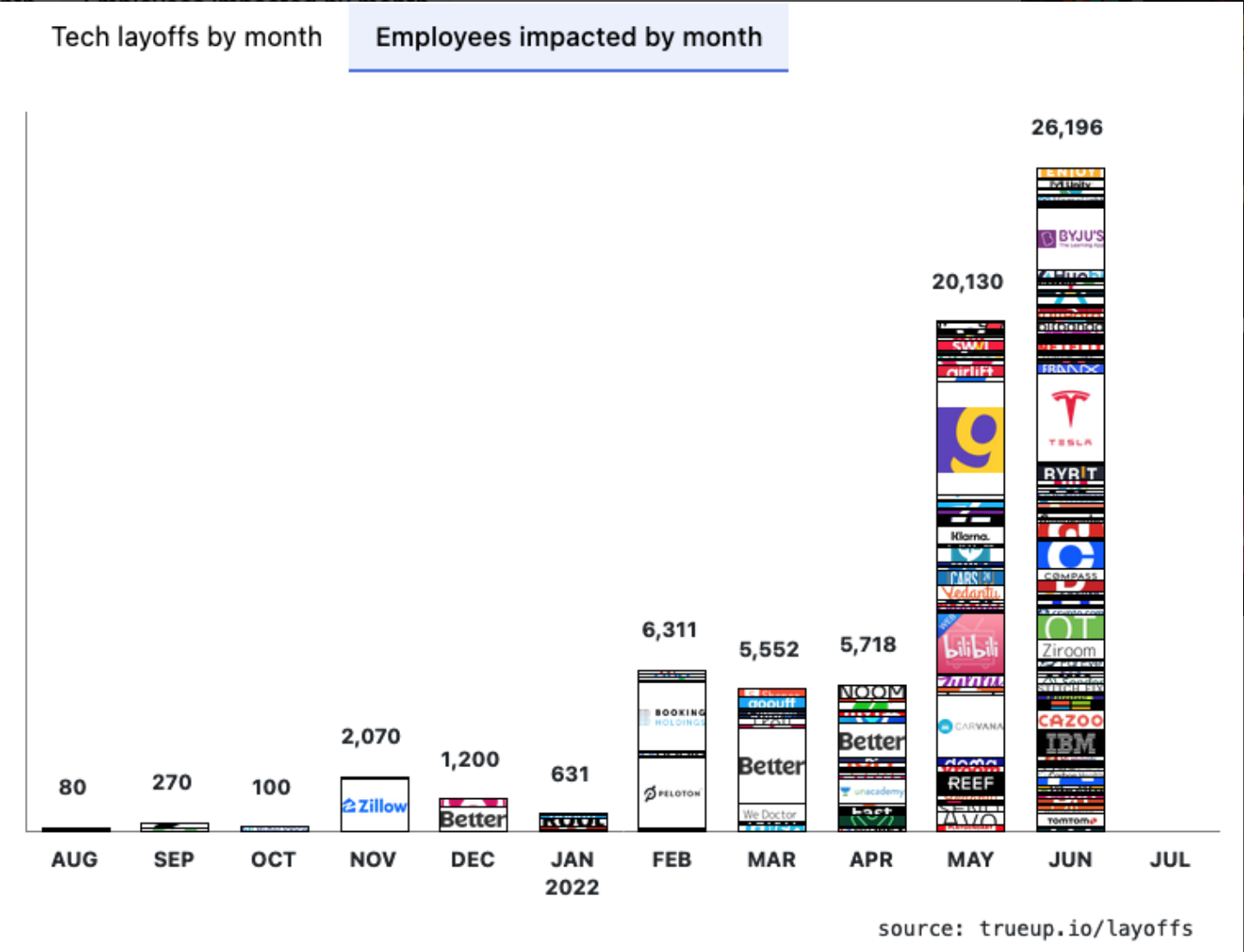

The difficult economic conditions have seen a swath of staff layoffs from crypto companies including Gemini, Crypto.com and BlockFi. Most recently, the crypto and stock trading platform Bitpanda cut its employee count by approximately 277 full-time and part-time employees.

Crypto is closely tied to the wider tech sector, and the tech-heavy Nasdaq composite index has fallen by almost 22.5% over the second quarter.

A “Tech Layoff Tracker” from technology jobs board TrueUp reveals that over 26,000 tech employees across 200 company-wide cutbacks just in June alone.

Over the quarter, 307 layoffs impacted over 52,000 staff, with one of the largest coming from Elon Musk’s Tesla, with 3,500 impacted.

Crypto exchange Coinbase is featured twice, first for its June 2 hiring freeze and job offer rescission of nearly 350 people and second for its June 14 staff layoff, affecting 1,100 individuals.

Bitcoin, Ether Futures Rack Up Nearly $200M In Liquidations On Short Squeeze

Price volatility arose as signs of looming recessions were renewed among investors, one analyst said.

Futures tracking bitcoin (BTC) and ether (ETH) racked up nearly $200 million in liquidations as volatility on Thursday saw prices break above, and then back below, resistance levels.

On Thursday, bitcoin dipped under $20,000 amid a broader fall in Eurasian markets, recovered over that level and then fell to as low as $18,650 in U.S. evening hours.

A short squeeze then saw bitcoin touch over $20,900 in early Asian hours on Friday, which was then followed by a drop to $19,400 at writing time as traders took profits.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin.

It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

Thursday’s downward move caused over $76 million in “longs,” or bets on higher prices, to get liquidation. This likely caused the short squeeze early on Friday.

Similar trading in ether futures saw the asset add more than $100 within hours as it jumped from Thursday lows of $966 to Friday morning’s $1,115. Liquidations on ether futures crossed over $100 million alone in the past 24 hours, Coinglass data shows.

Futures tracking other major cryptocurrencies, such as Solana’s SOL and Avalanche’s AVAX, saw just over $5 million in liquidations each, implying their price action was mostly spot-driven.

The volatility arose earlier this week as traders assessed fresh comments from central bankers that signaled relief from rate hikes may not occur in the coming months, as reported.

‘’Fears rattling financial markets show little sign of subsiding,” said Susannah Streeter, markets analyst at Hargreaves Lansdown, in an email to CoinDesk. “Investors (are) spooked about signs of looming recessions, while inflation stays stubbornly high.”

Fresh falls on Wall Street marked a miserable milestone with the S&P 500 tumbling in the first half of the year by 20.6%, a fall not seen since 1970 and creating a technical “bear market.” The tech-heavy Nasdaq, which has been wracked by volatility, has plummeted in value by a third this year and is on track for the biggest-ever yearly drop.

Streeter said there are concerns among investors about demand and inflation, and the Federal Reserve and other central banks will have to step on interest rate hikes to bring “red hot prices under control.”

Updated: 7-5-2022

Institutional Investors Shorting Bitcoin Made Up 80% Of Weekly Inflows

Digital asset product inflows were dominated by the $51.4 million posted by short BTC funds last week, with ETH products generating the next highest figure at just $4.9 million.

Institutional investors loaded up on a record $51.4 million worth of investment products offering exposure to shorting the price of Bitcoin (BTC) last week.

According to data from the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, there was $64 million worth of inflows for digital asset products between June 27 and July 1, with short BTC funds representing 80% of that figure.

United States-based investors accounted for the lion’s share of inflows at $46.2 million, with short-BTC investment products in solid demand after ProShares launched the first-ever U.S.-based short Bitcoin exchange-traded fund (ETF) on June 22. The ETF trades under the ticker BITI and offers shorting exposure via futures contracts:

“This highlights investors are adding to long positions at current prices, with the inflows into short-Bitcoin possibly due to first-time accessibility in the US rather than renewed negative sentiment.”

CoinShares also noted that institutional investors from Brazil, Canada, Germany and Switzerland snapped up a combined $20 million worth of crypto investment products. Sweden partially offset that figure with $1.8 million worth of outflows.

Short BTC products have now seen year-to-date inflows totaling $77.2 million, with that figure placing it behind only multi-asset products and Solana (SOL) products, which have posted $213.5 million and $110.3 worth of inflows so far in 2022.

Looking at the inflows for other digital asset products, those offering exposure to Ether (ETH) generated $4.9 million, marking the second consecutive week of inflows after a lengthy 11-week trend of shedding. However, year-to-date ETH funds are still down with $450.9 million worth of outflows.

The remainder of the inflows was spread across multi-asset funds at $4.4 million, while SOL, Polkadot (DOT), Cardano (ADA) and BTC products also posted minor inflows of $1 million, $700,000, $600,000, and $600,000, respectively.

The surge in short BTC fund inflows last week also follows from the prior week when there was $423 million worth of outflows for digital asset products, the highest amount ever on CoinShares’ records.

Notably, short BTC funds escaped the carnage that week, posting $15.3 million worth of inflows, while BTC products saw significant outflows of $453 million.

Updated: 7-6-2022

World’s First Short Bitcoin ETF Sees Exposure Explode 300% In Days

Since launching last month, the ProShares Short Bitcoin Strategy ETF (BITI) has eclipsed others in inflows.

Bitcoin (BTC) remains a popular institutional investment target in July, but the money is not betting on a bright future.

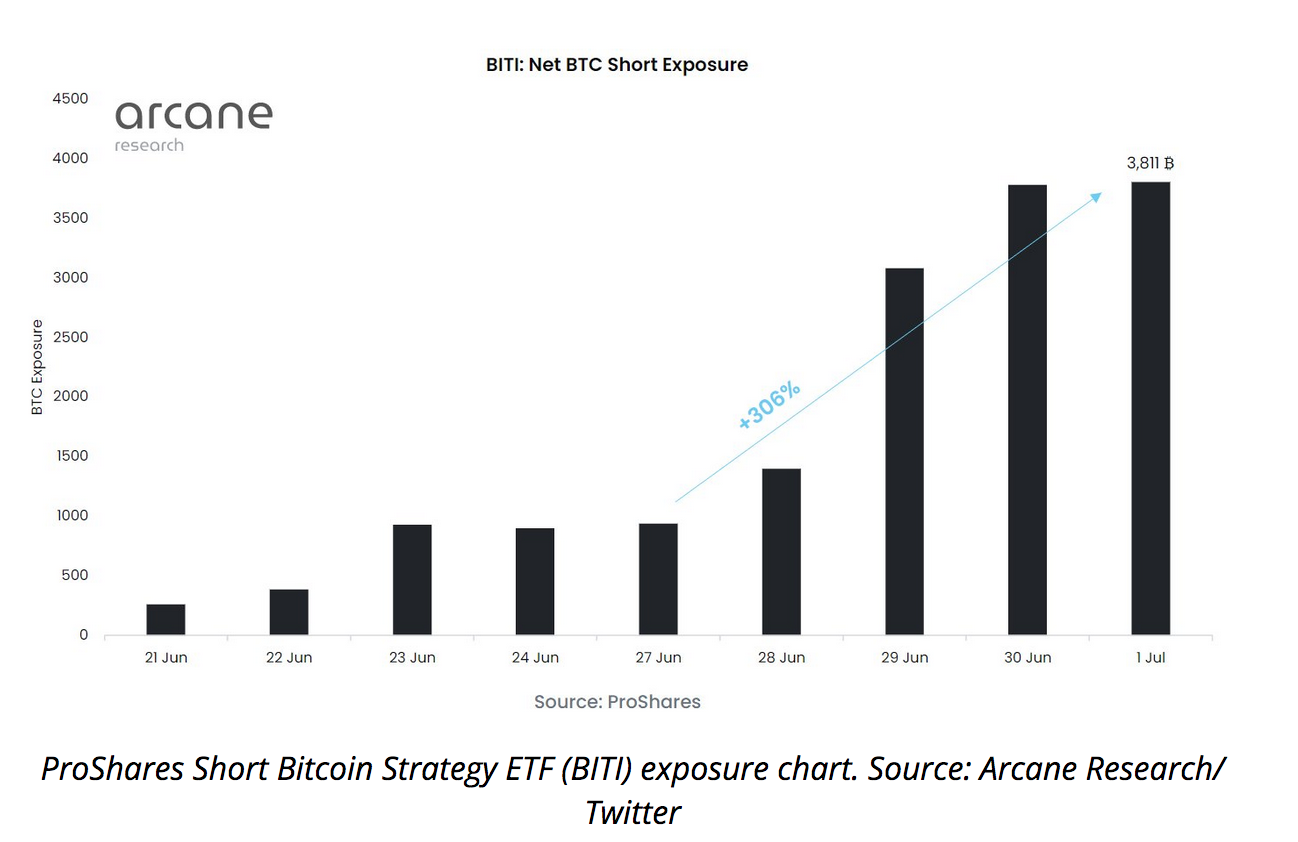

According to data from research firm Arcane Research published July 6, institutional flows focused on products offering exposure to shorting BTC in the first week of the month.

Shorting Bitcoin is the name of the game

Since launching in the United States in late June, the ProShares Short Bitcoin Strategy ETF (BITI), the first exchange-traded fund (ETF) to be “short” BTC, has proved a hit.

That trend has only accelerated in July, with short exposure jumping over 300% in days, data confirms.

“BITI, the first inverse BTC ETF, grew further last week,” Arcane summarized in Twitter comments.

“After becoming the second-largest bitcoin-related BTC ETF in the U.S. after only four days of trading, the net short exposure has grown further and increased by more than 300% last week.”

The timing for BITI in the U.S. is conspicuous in itself, coming as BTC/USD plumbed multi-year lows of $17,600.

As Cointelegraph reported, expectations among analysts remain skewed to the downside, and the BITI inflows appear to confirm that institutional sentiment is likewise.

Separate data published by digital asset investment firm CoinShares on July 4, meanwhile, put weekly inflows into Short BTC products at $51 million — easily the majority of the week’s total of $64 million.

While long BTC investments were just $20 million, CoinShares nonetheless highlighted persisting demand for such products despite shorts stealing the limelight.

The timing for BITI in the U.S. is conspicuous in itself, coming as BTC/USD plumbed multi-year lows of $17,600.

As Cointelegraph reported, expectations among analysts remain skewed to the downside, and the BITI inflows appear to confirm that institutional sentiment is likewise.

Separate data published by digital asset investment firm CoinShares on July 4, meanwhile, put weekly inflows into Short BTC products at $51 million — easily the majority of the week’s total of $64 million.

While long BTC investments were just $20 million, CoinShares nonetheless highlighted persisting demand for such products despite shorts stealing the limelight.

“This highlights investors are adding to long positions at current prices, with the inflows into short-Bitcoin possibly due to first-time accessibility in the US rather than renewed negative sentiment,” it wrote.

Testing times, meanwhile, remain for the stalwart institutional Bitcoin investment vehicle, the Grayscale Bitcoin Trust (GBTC).

After U.S. regulators rejected Grayscale’s application to convert the Trust to a Bitcoin spot ETF, the firm began legal action, a sign of the frustration facing an industry dealing with both regulatory scrutiny and declining asset prices.

The so-called GBTC premium, the difference between Bitcoin spot price and shares of GBTC, has been negative for over a year, at several points becoming a more than 30% discount.

Updated: 1-12-2023

Short Traders Suffer $200M In Losses As Ether, Cardano Lead Crypto Majors’ Gains

Crypto market capitalization has increased about 3.5% in the past 24 hours.

Traders betting on a market-wide decline were caught off guard as a broad recovery in the past 24 hours saw $200 million in shorts, or bets against price rises, getting liquidated.

The amount added to the more than $150 million in shorts liquidated earlier this week as bitcoin (BTC) and ether (ETH) broke above key resistance levels, and major tokens like XRP and solana (SOL) rose as much as 20%. Similar levels of liquidation on short trades haven’t been seen since October, data from Coinglass shows.

Ether-tracked futures experienced $110 million in both short and long liquidations, the most among all major cryptocurrencies. Bitcoin futures saw $77 million in liquidations, while avalanche (AVAX) and gala (GALA) each saw $4.5 million in losses after volatile trading on Wednesday.

Crypto exchange OKX took the lion’s share of these liquidations at over $128 million, followed by Binance at $42 million. Overall, the price surge saw crypto’s total market capitalization increase by 3.5% in the past 24 hours, CoinGecko data shows.

Bitcoin rallied above $18,000 on Thursday after pushing the threshold for the 10th time in 12 days on Wednesday. Ether rose 4.5% to over $1,400 in the past 24 hours, while cardano (ADA) added as much as 5% before retreating.

QCP Capital sees a strong breakout above $18,000 for bitcoin as a key indicator of recovery, with the next level after that at $28,000.

“Despite the mini-rally, BTC is still trading in an extremely tight falling wedge – with $18,000 the key breakout level to the top side,” the fund said in a Telegram broadcast last week. “ETH continues looking decidedly more bullish than BTC, although it too is still trading within a consolidation pattern.”

Consolidation in technical analysis refers to an asset oscillating between a well-defined pattern of trading levels. Consolidation is generally interpreted as market indecisiveness, which ends when the asset’s price moves above or below the trading pattern.

Updated: 1-14-2023

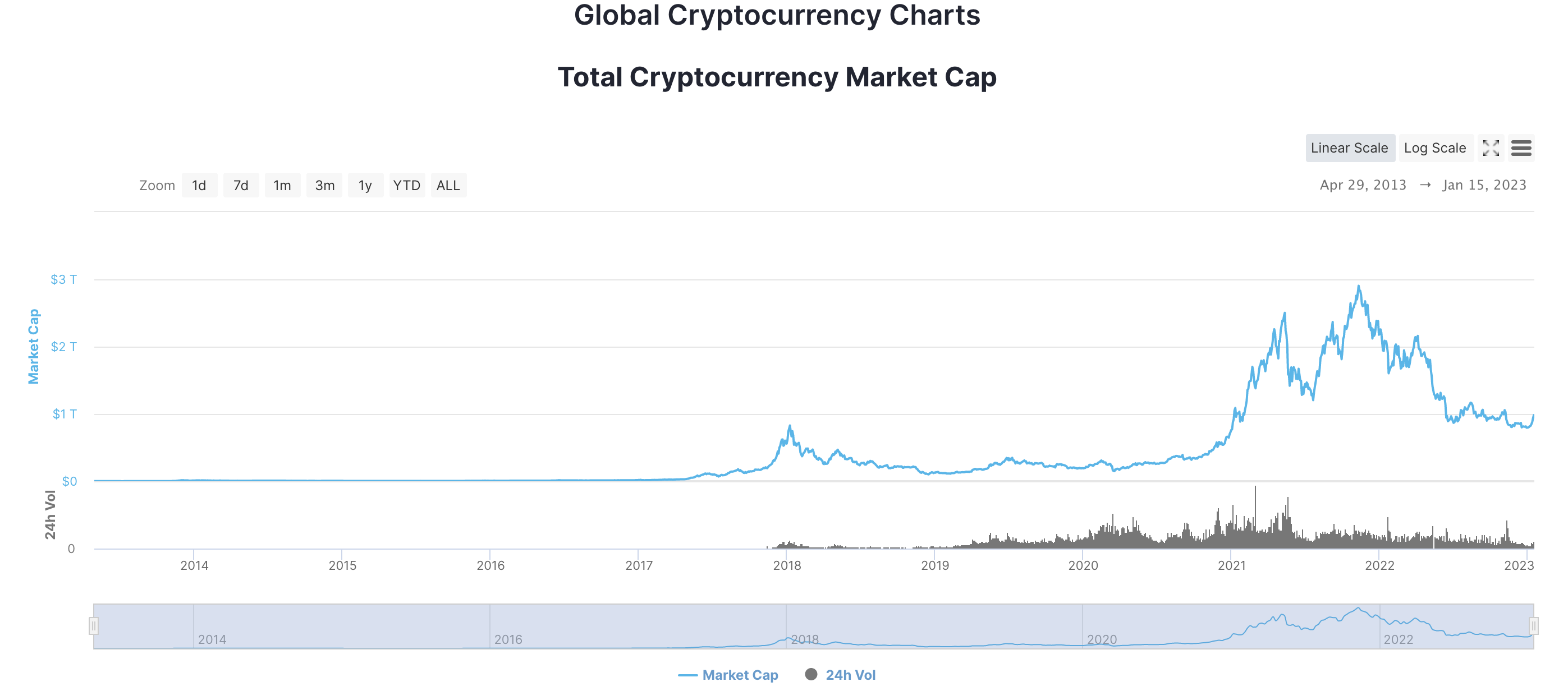

Crypto Market Cap Rises Above $1 Trillion First Time Since November

For the first time since early November, the total market capitalization of the cryptocurrency industry exceeded $1 trillion, according to data from CoinGecko.

On January 14, Bitcoin increased to over $21,000 on hopes that inflation may have peaked and reached a bottom. The biggest cryptocurrency increased up to 7.5% to $21,299 in value.

Since November 8 it hadn’t been above $20,000, and January 14 was its 11th straight day of growth. Ether, the second-largest cryptocurrency, rose up to 9.7%, and other coins like Cardano and Dogecoin also registered significant gains.

Before this most recent breakout, the price of Bitcoin had been trapped in a small range between $16,000 and $17,000 for weeks. The rising movements have surprised shorts; according to statistics from Coinglass, cryptocurrency short liquidations have exceeded $100 million in five of the last six days. The biggest amount was reached on January 14 and exceeded $296 million.

The increases coincided with consumer pricing data released last week that indicated a decline in inflation from December levels to January levels. Following that additional cooling, the Federal Reserve is on course to transition to smaller interest-rate rises, but it’s expected to keep doing so until price pressures show more certain indications of moderating.

Risky assets, such as the Nasdaq 100 stock index, which has increased for six days in a row, have benefited from this.

Following the soft CPI print, cryptoassets fared nicely, indicating that the correlation between crypto and macro is not about to disappear any time soon, as per Sean Farrell, head of digital asset strategy at Fundstrat.

The price action that has continued this week is undoubtedly positive, and barring any forced liquidations by the financially challenged crypto business DCG, there is a strong likelihood that the absolute bottom has been reached for cryptocurrency pricing.

The macroeconomic environment, which is still gloomy, has been overshadowed by the declining CPI and the news that the FTX liquidators had recovered $5 billion in cash assets, as per Hayden Hughes, chief executive officer of social-trading platform Alpha Impact. Going into the upcoming FOMC meeting later this month, the markets are moving strongly in the right direction, he added.

Updated: 1-15-2023

Bitcoin Surge Causes Over $500M In Liquidations, Highest In 3 Months

Crypto markets regained the $1 trillion capitalization mark for the first time since November.

Crypto markets surged to regain the $1 trillion market capitalization mark over the weekend amid signs of bottoming and a record number of short liquidations contributing to the uptick.

Nearly $500 million in shorts, or bets against higher prices, were liquidated since Friday to mark the highest such levels since October 2022, data from Coinalyze shows.

The liquidation figure mean over 70% of traders booked losses as exchanges closed leveraged positions due to a partial or total evaporation of the trader’s initial margin.

Crypto exchange OKX saw $256 million worth of short losses on Friday alone, the most among all crypto exchanges, followed by $125 million on Binance and $42 million on Huobi, CoinGlass data show.

Aptos’ native APT tokens saw over $10 million in liquidations in an unusual move as prices doubled over the past week.

Major cryptocurrencies are up an average of 20% since last week, CoinGecko data shows. Bitcoin surged 22% to over $21,000 on strong CPI data, ether jumped to as much as nearly $1,600, while solana jumped almost 70%, trading at $24 on Monday from just $9 in the last week of December.

The run wasn’t wholly irrational, as the underlying networks of several major tokens saw favorable fundamentals.

Strong transactional activity on Cardano and Solana may have contributed to a surge in their native ADA and SOL tokens, respectively, over the past week.

Elsewhere, the upcoming Shanghai upgrade for ether has added to its fundamentals, while Polygon is scheduled for a hard fork – a term for a network upgrade – this week, triggering a 22% rise in MATIC over the past week.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.