Ultimate Resource On Small And Mega-Battery Innovations And Facilities

US Is Losing The Battery Race Despite Having The Right Stuff. Ultimate Resource On Small And Mega-Battery Innovations And Facilities

Raw materials? Yes. Demand? Yes. So what’s the problem?

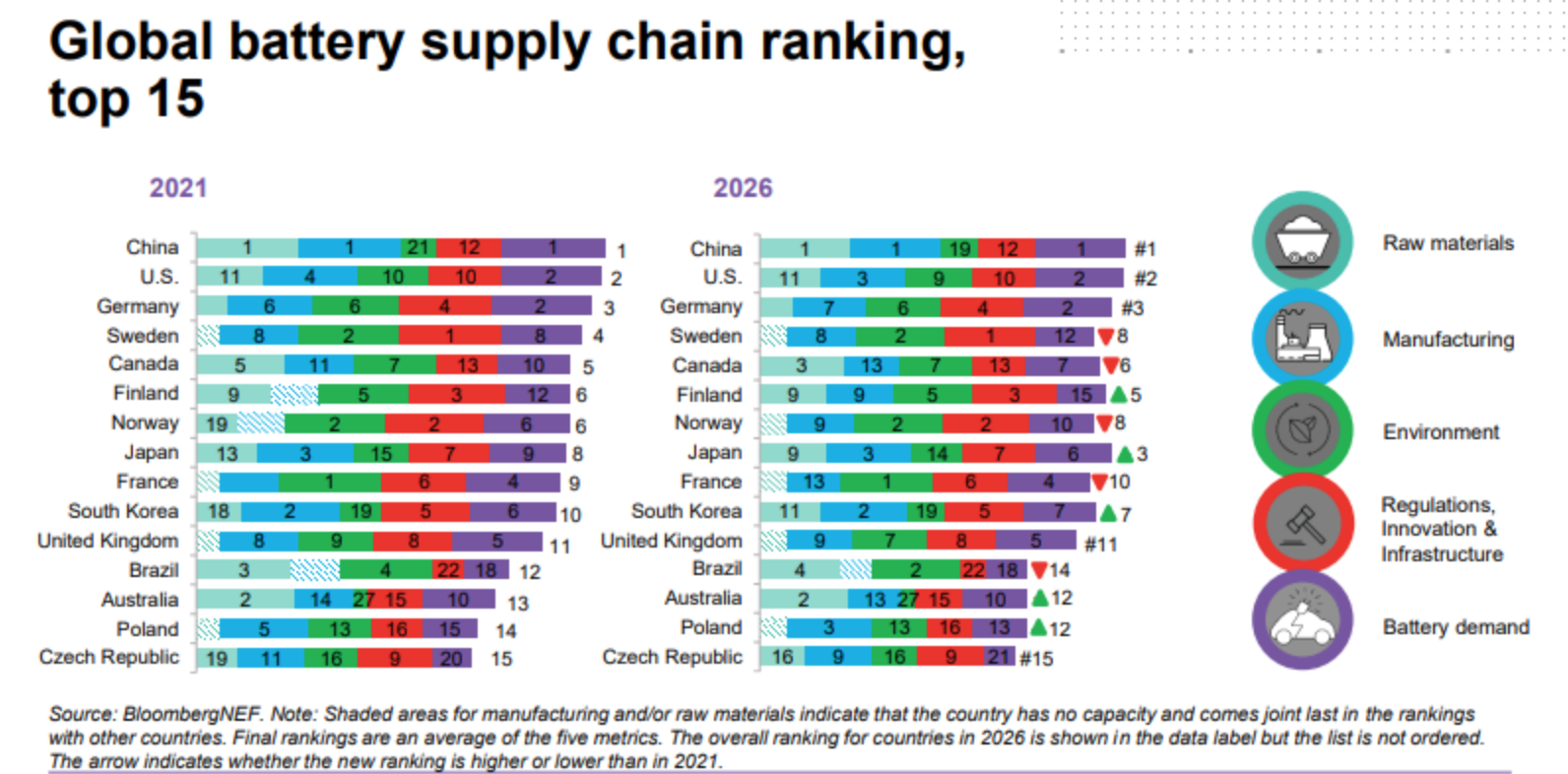

The U.S. isn’t just losing the battery race—it’s barely in the running. But it doesn’t have to be that way.

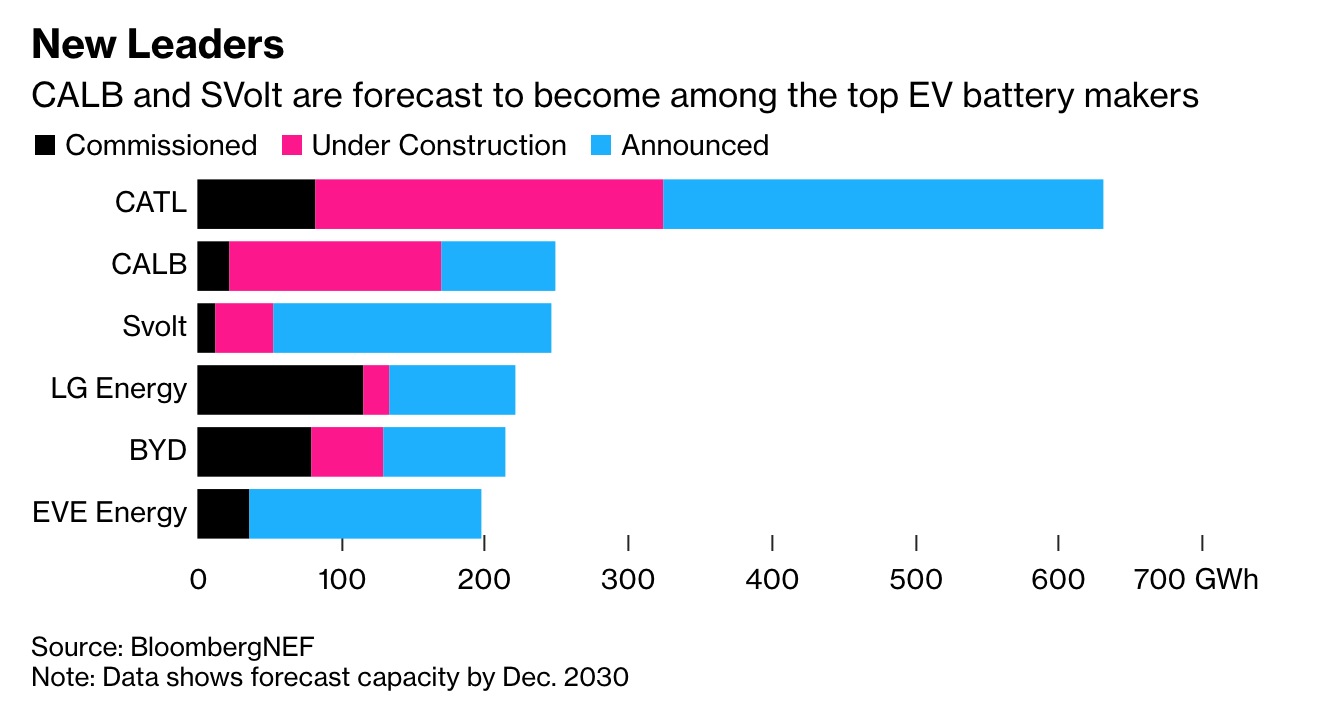

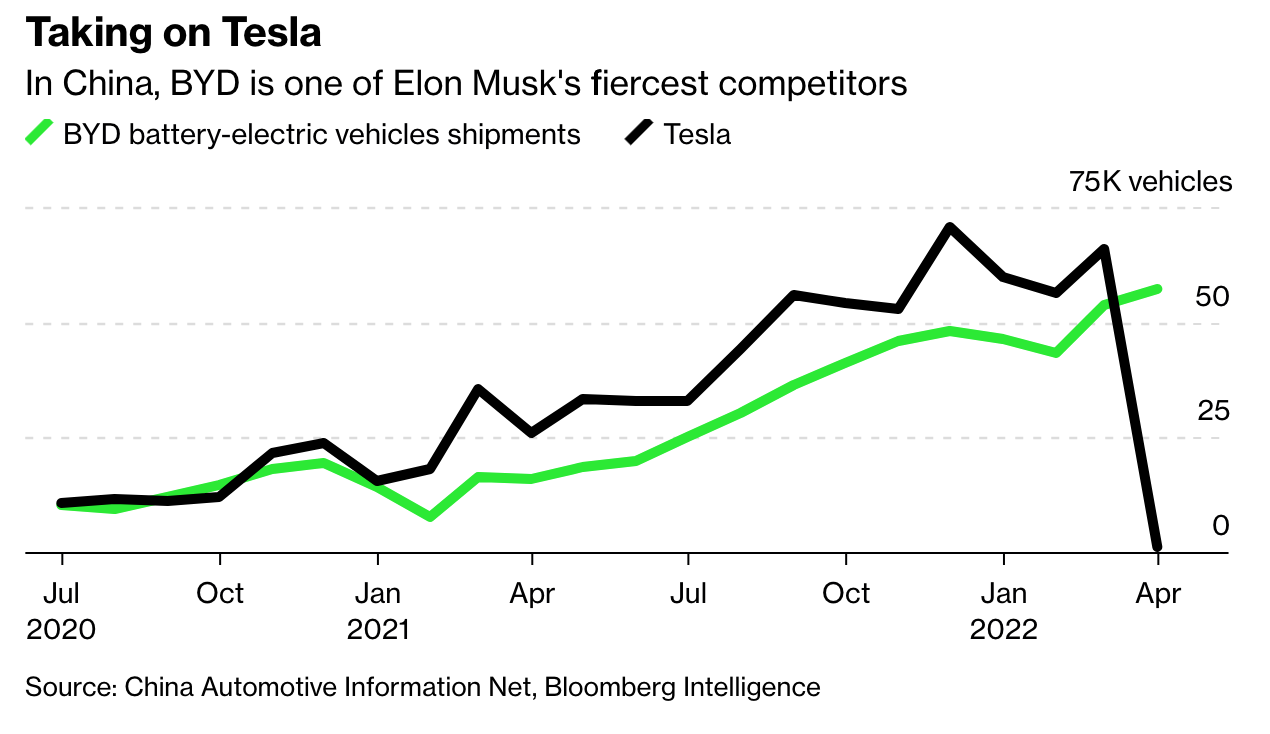

China dominates lithium-ion battery production and is building factories at breakneck speed. Europe, too, is adding battery plants as its power grid and car companies shift away from fossil fuels. Although a few factories are planned in the U.S., including Tesla Inc.’s Texas plant, BloombergNEF currently expects the country’s share of worldwide battery production to fall from 8% today to 6% in 2025.

Related:

Giant Batteries Supercharge Wind And Solar Plans (#GotBitcoin?)

California Wants Its Salton Sea Located In The Imperial Valley To Be ‘Lithium Valley’

Ultimate Resource On Hydrogen And Green Hydrogen As Alternative Energy

Things Utilities Can Do To Strengthen The Grid Includes Deploying MicroGrids (#GotBitcoin)

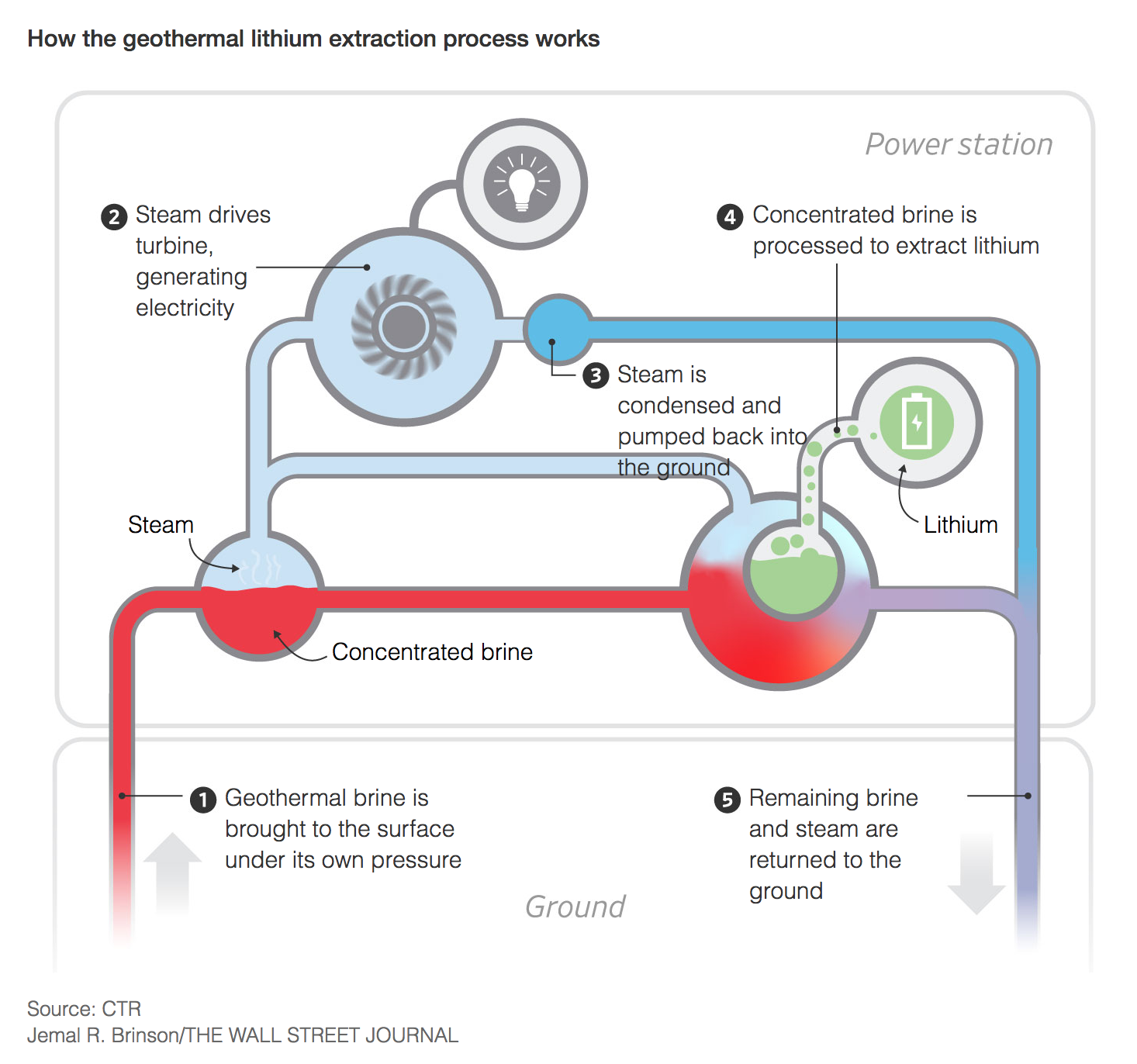

Yet the U.S. has most of the ingredients it needs for a battery-building industry. It has the raw materials, with three companies developing facilities to extract lithium from subsurface brine in the Southern California desert, while similar projects are under way in Arkansas and Nevada. It also has the demand. Utilities are plugging big batteries into the electric grid to store renewable power and protect against blackouts. And U.S. automakers are ramping up production of EVs.

The government pushed for domestic battery factories once before, under President Obama. But demand for the devices wasn’t high enough to support the factories, leading to embarrassing failures such as the 2012 bankruptcy of manufacturer A123 Systems after it received a $249 million federal grant. That’s changed.

“If we want to have a domestic supply chain for batteries in North America, now is the time you have to press the accelerator,” says Sam Jaffe, managing director of Cairn Energy Research Advisors, a consulting company in Boulder, Colo. “The conversation should be ‘mine to car,’ not just ‘battery to car.’ ”

It’s not a question of national bragging rights. Lithium-ion batteries have become a foundational technology of 21st century life, so critical that the federal government in 2018 put lithium on a list of 35 minerals essential to national security.

“It seems insane that the largest economy in the world should not be a participant in this,” says Danny Kennedy, chief energy officer of New Energy Nexus, a cleantech nonprofit that recently issued a report on the possibility of creating a domestic battery industry. “We could be the champion of that future if we engage in it now and don’t give it away.”

For U.S. automakers, there’s good reason to want batteries built here. In an era of trade turmoil, relying on imported batteries could be problematic, even if President Biden abandons his predecessor’s use of tariffs. And with car companies worldwide shifting to electrics, Detroit will need an ample supply to keep car prices low.

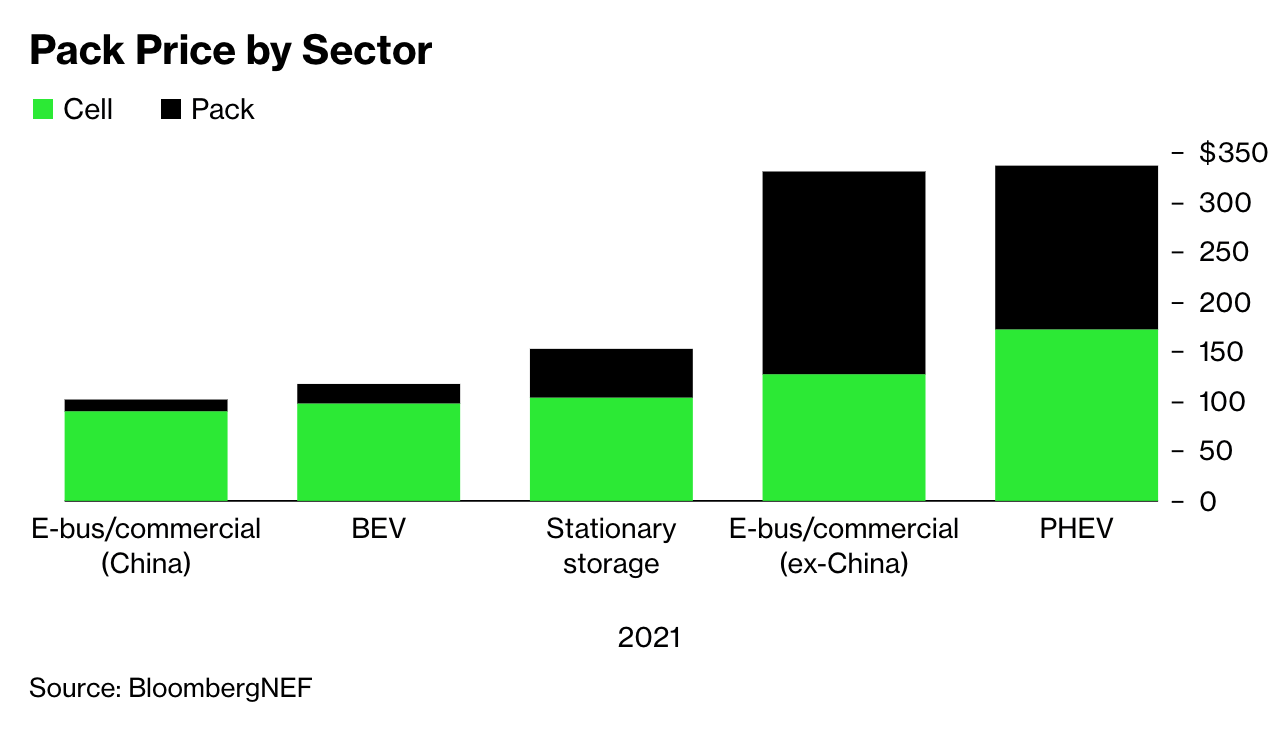

Plus, EV battery packs are big and heavy, making them expensive to ship. The pack for a compact Chevrolet Bolt, for example, weighs about 950 pounds. U.S. battery factories feeding U.S. auto plants could reduce those costs. “Think about shipping a couple million battery packs from Asia—it’s a nightmare,” says Brett Smith, director of technology for the Center for Automotive Research. “It just becomes more logistically reasonable to build it here.”

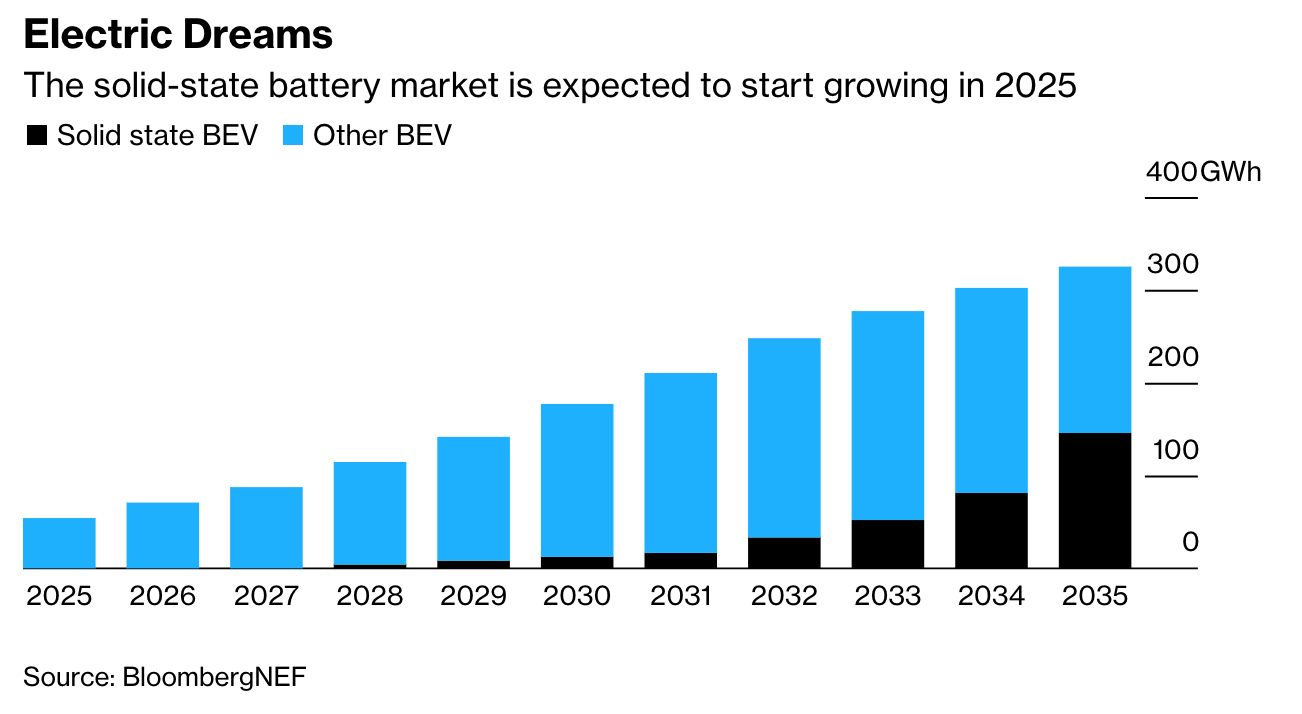

In addition to a General Motors-LG Chem battery plant under construction in Ohio and SK Innovation’s two upcoming Georgia factories, the U.S. has plenty of startups nearing production. Solid Power Inc., a battery manufacturer in Colorado, expects to support vehicle production as early as late 2025. Chief Executive Officer Doug Campbell says the country has a demonstrated ability to innovate. “The risk, though, that we face is: Can we keep those innovations at home?” he asks. “Is it going to go the way that the solar cell went?”

Updated: 10-3-2020

Battery-Free, Energy-Harvesting Perpetual Machines: The Weird Future of Computing

A new breed of computers could run forever—or at least until long after we’re gone.

In the not-too-distant future, technologists say, most computers will be tiny, ubiquitous, and won’t ever need new batteries—because they won’t have any. Their latest proof is a highly unusual Nintendo Game Boy.

Custom designed to run entirely without batteries, the hand-held gaming device is powered by small solar panels as well as the button presses of the person playing it. That’s right: Even after the apocalypse, survivors will at least have “Tetris.”

The implications of this demonstration are potentially huge, and not just for videogame junkies. In our battery-free future, carbon, moisture and light sensors that last for decades could be scattered by drones across farms; smart cities might be inundated with all-seeing, all-hearing surveillance devices; vehicles and buildings will use artificial intelligence to anticipate needs and perform simple tasks; and “implantables” in our bodies will more tightly integrate humans with everything else connected to the internet.

Nvidia Corp. Chief Executive Jensen Huang has predicted this future of computing will eventually include trillions of devices. “I hope for God’s sake they’re not all powered by batteries,” says Josiah Hester, an assistant professor of computer engineering at Northwestern University, and a co-lead on the Game Boy project.

There are many practical and environmental reasons to hope for battery-less sensors, in everything from bridges (to monitor their safety) to human bodies (to monitor our health). But battery or no, a key concern is what happens to a sensor’s data when it runs out of power.

To address this problem, the Game Boy research team upended a fundamental rule of computers: If you turn it off, you lose unsaved work. Their system, by contrast, can lose power completely, even many times a second, and the instant it gets enough power again—say, from a player impatiently mashing buttons—it picks up right where it left off.

Known as “intermittent computing,” this system relies on a still-exotic kind of memory chip. Almost every computer in history has had two separate forms of memory: volatile RAM and more permanent, but harder to access nonvolatile storage, which includes anything from punch cards and magnetic tape to hard drives and flash memory.

But these researchers are using a new type of RAM—ferroelectric RAM or F-RAM—that erases the distinction. It’s as quickly and easily accessible as typical RAM, but as persistent as any permanent storage medium. It also takes only a minuscule amount of electricity to make it work, and it doesn’t degrade over time, like flash memory does.

Jasper de Winkel, a Ph.D. candidate at Delft University of Technology in the Netherlands, and the technical lead on the batteryless Game Boy project, married this power-sipping, nonvolatile memory to a power-sipping processor from Ambiq, a 10-year-old Austin-based company that specializes in processors for smartwatches, industrial sensors and other ultralow power devices.

The total package—including the memory, processor and display—draws on average 11.5 milliwatts of power. This makes it, according to the researcher’s calculations, about 20 times more power efficient than the original Game Boy from 1989. By comparison, a typical smartphone draws 1 to 3 watts of power from its battery when in use, or around a hundred times more power.

It’s this combination of traits—never needing to reboot, using very little power, and harvesting energy from the environment—that yields a system that could be a “perpetual” computer, says Dr. Hester. The goal of perpetual computing is tiny sensors, radios and other devices that gather, process and transmit data until at last they physically break down.

Not to be confused with a mythical “perpetual motion machine,” these could be very real additions to our environment, scattered across earth and sea, providing an infrastructure of data collection that could outlive its creators.

Energy harvesting hasn’t improved dramatically in the past few decades, but “what has changed is what you can do with these very tiny amounts of energy,” says Joshua R. Smith, a professor at the University of Washington, where he heads up the Sensor Systems research group. (He wasn’t involved with the Game Boy project.)

Dr. Smith and his collaborators have demonstrated it’s possible to use the radio waves already coursing through our environment to power tiny sensors and computers. In 2005, his group was the first to show off a small microcontroller powered by radio waves beamed over a considerable distance. In one of the lab’s latest projects, the team wirelessly powered a small, batteryless video camera. In early 2021, Jeeva Wireless, a startup founded in order to commercialize the underlying technology, will release its first chip.

As enticing as this technology sounds, it will always be limited, especially compared with the ever more powerful computers we’ve grown accustomed to carrying around. It’s just physics: Tiny systems that use very little power might someday become clever in the way the genius of the invertebrate world, the fringed jumping spider, has managed to cram an impressive amount of smarts into a small body, but it’s not about to build a spider civilization and put other spiders on the moon.

“Something like your phone is probably always going to have a battery,” says Dr. Smith. “But maybe when that battery runs out, it will still be usable in a reduced-functionality mode, using energy harvesting.”

Still, with a growing array of processors and sensors that can sustain themselves on as little as a few hundred microwatts of power—less than half of the power generated by a house fly in flight—the number of possible ambient energy sources multiplies significantly.

In addition to existing ways to harvest energy, from radio waves, solar power and vibration, there are some in development that sound more sci-fi. For example, researchers at Northwestern recently demonstrated a novel thread that can turn body heat, or any thermal energy, into electricity.

The result could be, for example, a hat that powers health sensors, or a ski jacket that trickle-charges your phone. Other researchers at a variety of institutions are working on ways to produce electricity from the microbes that live in soil.

And when you combine multiple energy sources, you get a package that could go places few computers have before—like inside construction material. Researchers have previously proposed putting wireless sensors into freshly poured concrete, where they could monitor strain more or less indefinitely.

“A bridge is supposed to have a lifetime of 50 years, and in the U.S. we’ll leave it up for 200 years, because that’s how we do infrastructure,” says Dr. Hester. “Imagine getting stress and strain data at high resolution across a bridge for that entire time.”

In other words, someday we might know it’s time for a repair when the bridge itself cries out for help.

Battery Startups Work On New Ways To Power EVs, With Less Hassle

One day you may be able to charge your car while cruising down the highway.

● Britishvolt

Because of Brexit, the U.K.’s auto industry has little time to localize production of batteries. The deal reached late in 2020 requires 30% of the content of battery packs for U.K.-built cars to be sourced domestically; the regulation gets tougher in 2024. Britishvolt Ltd. is the only company so far to announce plans to start battery production in the country. —Dimitra Kessenides

● Form Energy Inc.

The company is developing what it calls “long duration” batteries, storage that could last for weeks at a time. That could enable 100% carbon-free grids, ending the need for coal and gas. —Brian Eckhouse

● Invispower

This startup promises a wireless charging system that will allow you to park your car atop a “site” and watch the battery level rise. Founder Wang Zhe also imagines installing the equipment on highways so cars can charge while in motion. The company is also planning an initial public offering in Shanghai. —Tian Ying

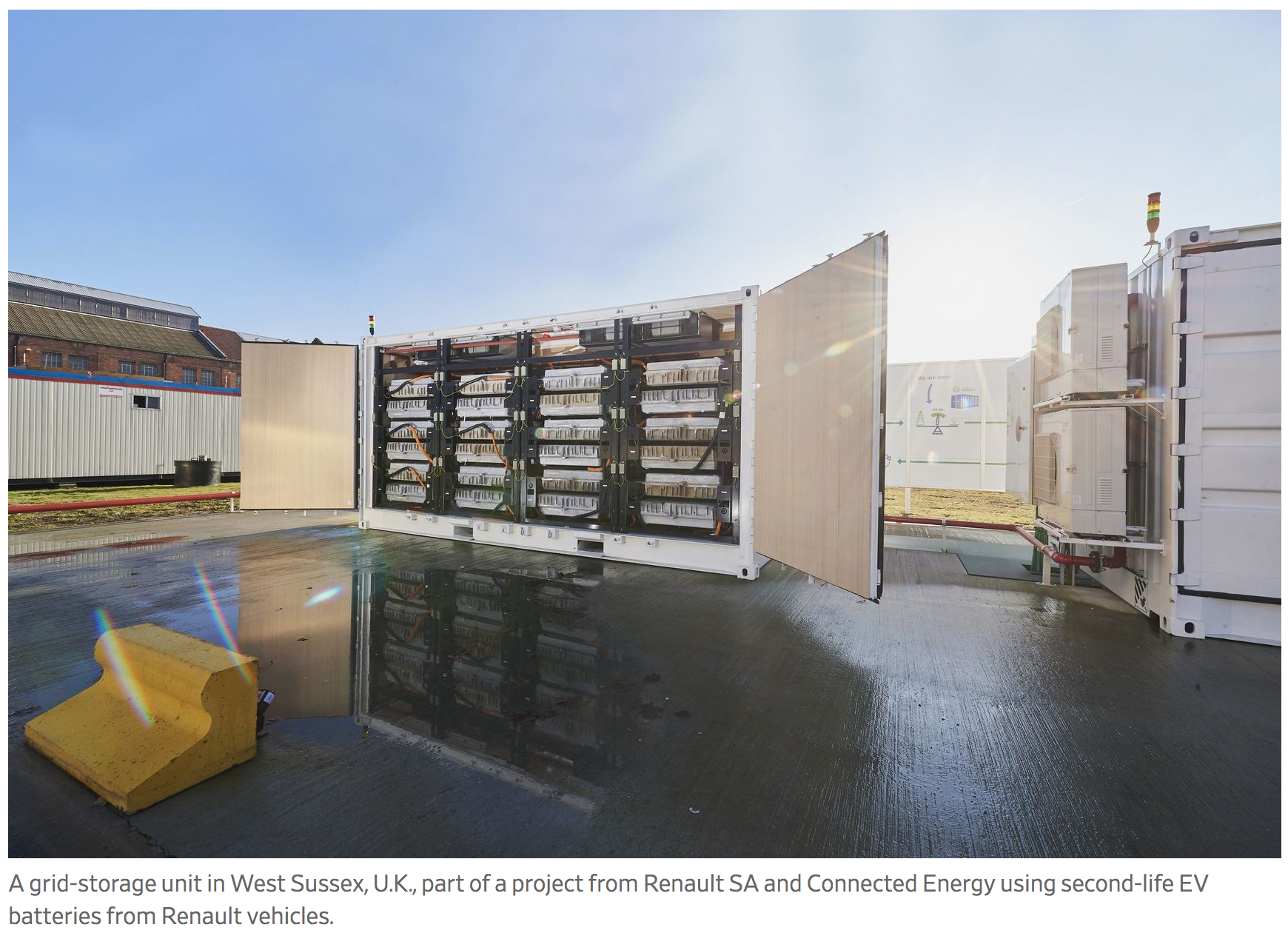

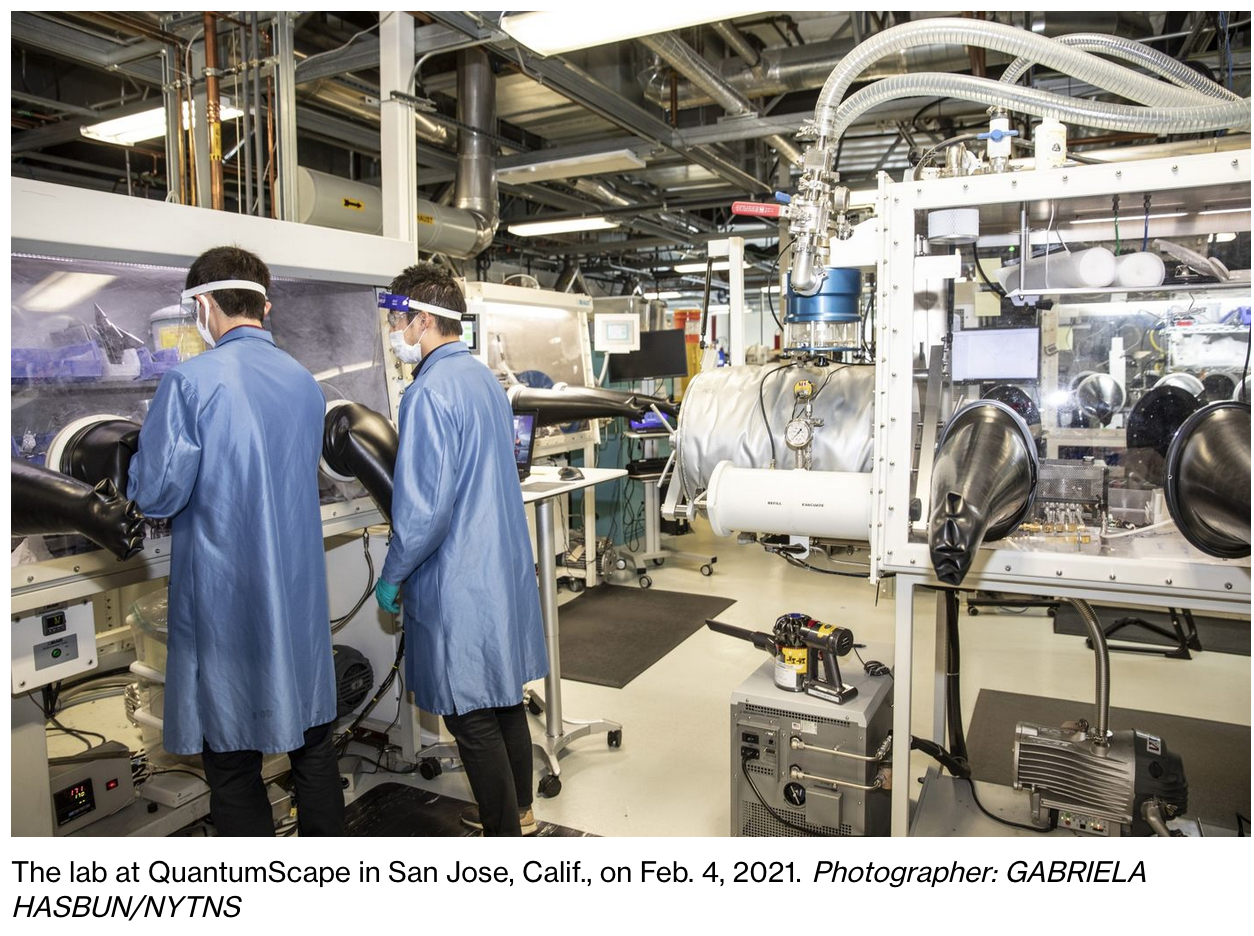

● QuantumScape Corp.

QuantumScape has a 50-50 joint venture with Volkswagen, its largest shareholder, to start producing cells in 2024. A darling of the EV industry SPAC-boom, it’s become a target of short sellers skeptical of its market value, which reached almost $50 billion in December. It’s since tumbled by more than half. —Gabrielle Coppola

● Sila Nanotechnologies

Of battery startups operating today, experts say, this one in California is the likeliest to succeed. The maker of materials for car and device batteries has a supply agreement with Daimler AG. —David R. Baker

● Solid Power

Spun out of the University of Colorado in 2014, this solid-state battery maker intends to use existing battery- or carmaking plants to produce its cells and to begin testing its auto batteries by early 2022. Investors include Ford Motor Co. and the venture arm of Hyundai Motor Co. —G.C.

● StoreDot

The Israeli company, backed by BP and Daimler, says it has designed a system that cuts EV charging times to five minutes. In December the company said it’s on track to launch samples of its EV batteries by the end of 2021.—Eddie Spence

Batteries Hidden Across New York Give The City A Backup Boost

Stashed in empty lots and installed on rooftops, microgrids in otherwise overlooked locations are the future of Big Apple power.

As a coastal city that’s seen several devastating weather events cripple its power grid, New York needs more reliable energy sources. MicroGrid Networks LLC, a clean-energy system developer, is building the infrastructure for a more resilient grid. To start, the company will bring eight projects in three boroughs online by the end of 2021, representing a $96 million investment. That covers all costs, from identifying and securing land in Brooklyn, Queens, and Staten Island, permits, and equipment for construction to operating the system and providing services. Chief Executive Officer Montgomery Bannerman says the project will deliver environmental and energy cost benefits and lots of jobs.

MicroGrid Networks, backed by SER Capital Partners, will repurpose unused spaces, including rooftops in residential neighborhoods and empty lots in industrial areas.

“Large batteries will become as ubiquitous in our buildings and businesses and neighborhoods as they currently are in our pockets.” —MicroGrid Networks CEO Bannerman

Updated: 1-26-2021

Shift To Electric Vehicles Spurs Bid To Make More Batteries In U.S.

Sila Nanotechnologies, a Silicon Valley startup, is among the latest to attract Wall Street backing.

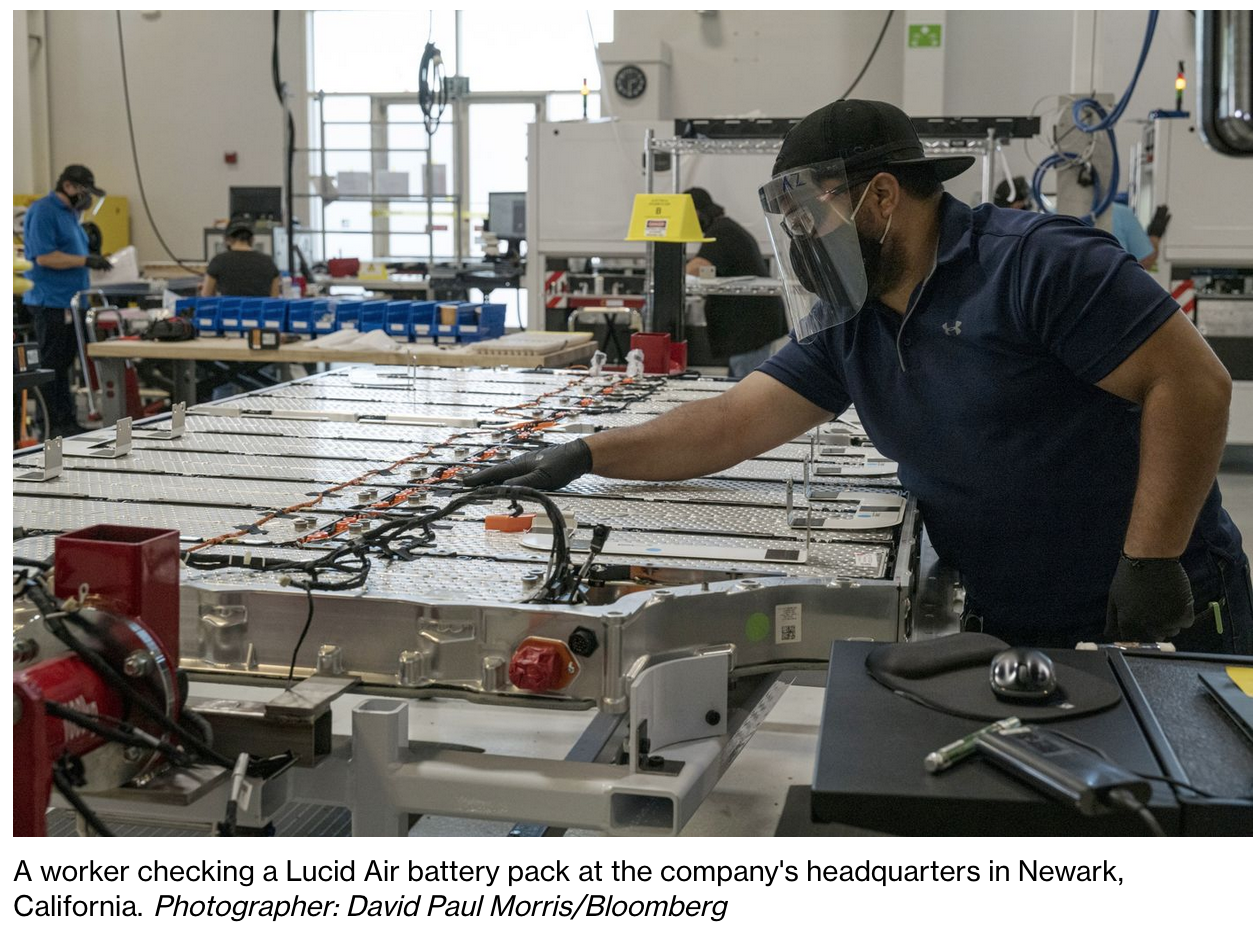

The auto industry’s quickening shift to electric cars is spurring investment in another emerging industry in the U.S.: manufacturing lithium-ion batteries for those vehicles.

China currently dominates the market for producing electric-vehicle batteries. But as auto makers spend billions to build more plug-in models in the U.S., investors are increasing their bets on companies looking to expand the supply chain for batteries and related materials in North America—a region that has long relied on imports for such components.

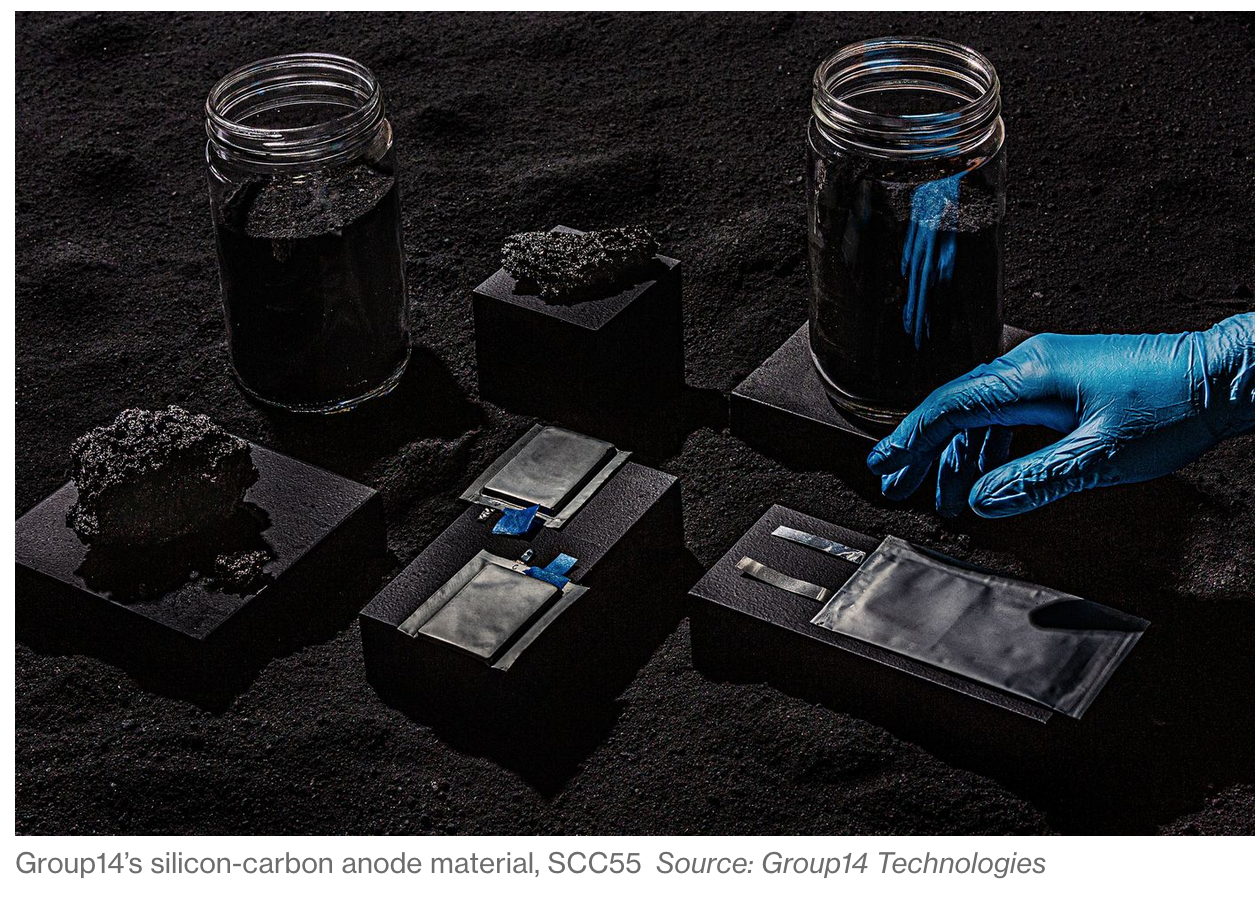

Sila Nanotechnologies Inc., a Silicon Valley startup that makes silicon anode materials used in batteries, is among the latest to attract Wall Street backing. The company said Tuesday that it has raised $590 million in new funding.

Much of that money will be used to build a factory in the U.S. for making battery materials, Chief Executive Gene Berdichevsky told The Wall Street Journal. The location hasn’t yet been selected.

Other battery-focused startups, such as California-based Romeo Power Inc. and Canadian mining firm Lithium Americas Corp. , which has U.S. operations, have also recently tapped public markets. Romeo went public late last year, while Lithium Americas said Friday that it sold $400 million of stock in a public offering intended to finance a lithium project in Nevada.

Industry executives and lawmakers say the U.S. needs to reduce its reliance on China if it wants to lower costs and remain competitive in making electric vehicles and their batteries domestically. President Biden also has made securing more of this supply chain in the U.S. a priority, as part of a broader effort to accelerate the auto industry’s shift away from gasoline.

U.S. battery-making capacity is expected to increase sharply over the next decade, rising more than sixfold from roughly 60 gigawatt hours of annualized production last year to about 383 gigawatt hours in 2030, according to Benchmark Mineral Intelligence.

Battery-manufacturing giants such as South Korea’s LG Chem Ltd. and SK Innovation Co. are building big factories in the U.S. to expand American production of electric-car batteries. LG Chem is building its factory in Ohio as part of a joint venture with General Motors Co.

Tesla Inc. is also expanding its battery-making capabilities, seeking to cut costs and shorten its supply chain by making some materials in-house.

And yet, there is currently little production in the U.S. for critical battery materials such as lithium and graphite. Those materials are needed for the anodes and cathodes that circulate ions to generate the battery’s current.

“You have a lot of stuff lining up that’s a real demand signal into the supply chains of ‘we need more, we need it local, and we need it cheaper,’ ” said John McClure, a managing director at investment bank Nomura Greentech Capital Advisors LLC.

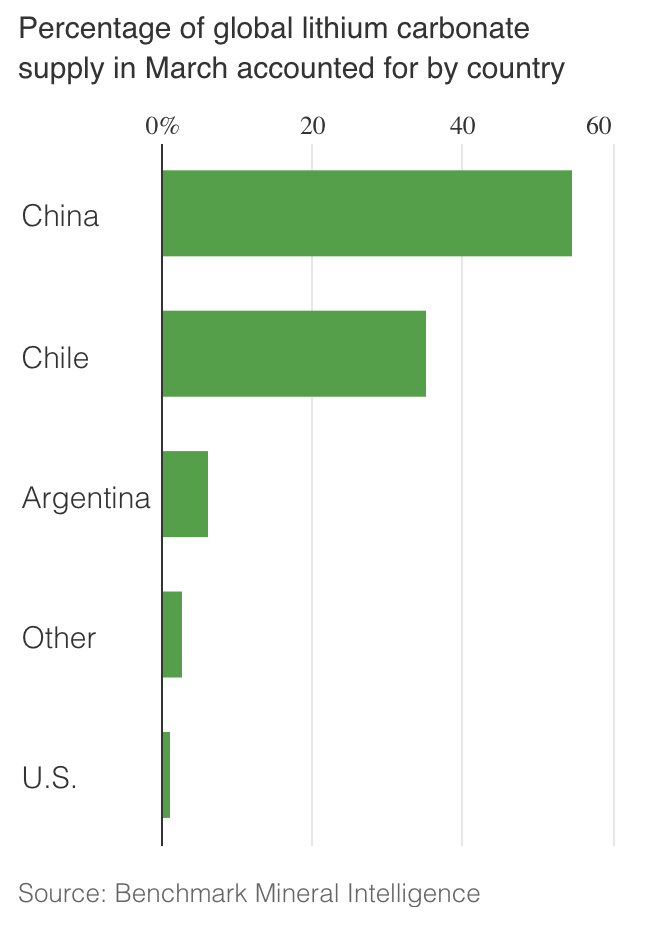

Right now, much of the supply chain is concentrated in China, which makes more than 70% of the world’s lithium-ion batteries, according to Benchmark. The country also refines and manufactures the majority of minerals and materials needed for those batteries.

Analysts are bullish that electric-vehicle sales will take off in the coming years. While today they account for about 2% of the U.S. auto market, that share is expected to grow to 10% by 2025, according to investment bank Morgan Stanley.

There are risks if consumer demand doesn’t materialize as expected. An attempt to expand U.S. battery production—mostly through government funding under then-President Barack Obama —stumbled early last decade when car companies failed to see demand for electric vehicles materialize as anticipated.

Moving more battery production to the U.S. will help car companies and their suppliers bring down costs, a step that is important for consumers to adopt electric vehicles more widely, auto executives say.

Sila, a company co-founded by Mr. Berdichevsky, who helped design Tesla’s first battery packs, is specifically looking to increase anode manufacturing in the U.S.

The decade-old company, which in 2019 received backing by German auto maker Daimler AG , has focused its research on developing silicon-based anodes. Its executives say its anodes are capable of storing more energy than the graphite ones used in today’s batteries.

This latest investment round, led by Coatue Management and T. Rowe Price Associates Inc., values the company at $3.3 billion, Mr. Berdichevsky said.

“Billions of dollars of capital really needs to go into the ground to bring a new technology like this to scale,” he said.

Sila, which is already supplying some consumer-electronics companies, is looking to build a new factory to get its anode into vehicles by 2025, Mr. Berdichevsky said. The factory, when finished, is expected to make enough materials to supply batteries in more than one million cars annually, he said.

Other anode producers are also scaling up in the U.S.

Novonix Ltd. , an Australian-listed company, has a contract to sell 500 tons of synthetic graphite, produced at its factory in Chattanooga, Tenn., to battery maker Samsung SDI Co. starting this year, the company said.

By 2025, the company hopes to increase output to 25,000 tons annually, said Chris Burns, the company’s chief executive. “We have to move faster,” he said. “People are going to need it.”

Updated: 3-9-2021

America’s Battery-Powered Car Hopes Ride On Lithium. One Producer Paves The Way

The U.S. is racing to catch up to China in mining and refining the metal, and Piedmont Lithium is at the leading edge.

The rolling hills of North Carolina’s Piedmont region are an unlikely setting for a next-generation technology transformation that has become a national priority.

Lamont Leatherman, a 55-year-old geologist who grew up here, is its unlikely instigator. A decade ago, he combed the woods near his childhood home in search of lithium, a soft, white metal he believed would be crucial to the burgeoning industry of electric vehicles.

Now, the company he helped found five years ago to explore the region, Piedmont Lithium Ltd., has deployed drilling rigs throughout the 2,300 acres it owns or controls to map out deposits. The company is preparing to launch one of the first big new lithium mines in the U.S. in decades.

Lithium is an increasingly crucial material, central to the rechargeable batteries that power cellphones and electric cars. These batteries are becoming a disruptive force in the energy sector as well. Demand, especially from vehicles, is expected to surge, and controlling the resources that power them is the 21st-century version of oil security.

For now, the U.S. remains largely reliant on China and other countries for lithium, having fallen far behind in mining and refining it. Piedmont is at the leading edge of efforts to build an American supply chain for the highly conductive, ultralight metal—and its fate will be a sign of whether the U.S. can succeed.

The modern lithium-mining industry started in this North Carolina region in the 1950s, when the metal was used to make components for nuclear bombs. One of the world’s biggest lithium miners by production, Albemarle Corp. , is based in nearby Charlotte. Nearly all of its lithium today, however, is extracted in Australia and Chile, which have large, accessible deposits of the metal.

Only about 1% of global lithium output is both mined and processed in the U.S. China, with a huge chemical industry and low costs, unearths about 10% and processes about two-thirds of what’s dug up.

Scientists say switching from fossil fuels to batteries will be crucial to reducing carbon-dioxide emissions, a key contributor to climate change. Although it’s a messy process, increasing domestic production of lithium is vital for the U.S. to support its auto industry and meet its climate goals, analysts say.

President Biden signed an executive order in late February calling for a review of supply chains for critical materials, including those needed for electric cars, such as lithium. The government has said that relying on overseas sources for these materials creates a “strategic vulnerability” to the U.S. economy.

Piedmont is still about two years away from pulling lithium out of the ground in North Carolina. Last September, it announced a deal to supply lithium to Tesla Inc. once its mine comes into operation. The company plans to spend more than $500 million to build a pair of plants to extract lithium.

“We’re going to build a big business here,” said Chief Executive Keith Phillips, a former mining banker for firms such as JPMorgan Chase & Co.

Piedmont’s U.S.-listed shares recently hit $80, up from $11 before the company unveiled the Tesla deal. The surge briefly gave the company a market value above $1 billion.

Exploration is well under way. In January, a small team of workers bored tubes hundreds of feet into the earth to map the deposits of lithium several miles north of the original mine that produced lithium for bombs. Spodumene, the mineral that contains lithium, is abundant in what’s known as the Carolina Tin-Spodumene Belt.

While Piedmont is one of the farthest along, exploration efforts by others are under way in Nevada, California and Arkansas.

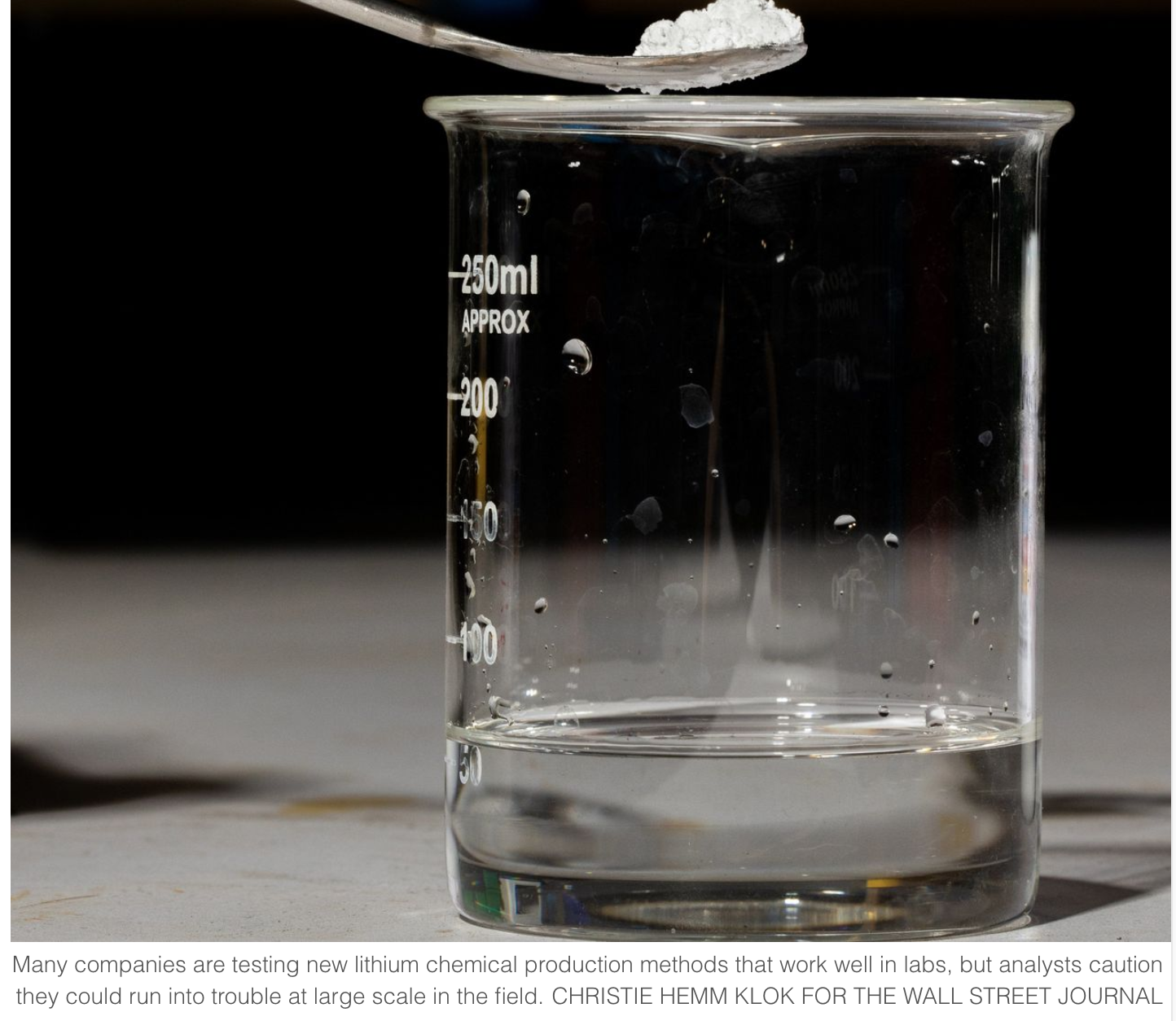

Although lithium deposits can be found all over the world, it’s difficult to turn them into the chemicals that power batteries.

Refining the metal involves large amounts of equipment and intricate chemical processes that can cause water and soil pollution without proper controls. It can take five or more years for a new lithium-mining operation to produce battery-grade materials, experts say.

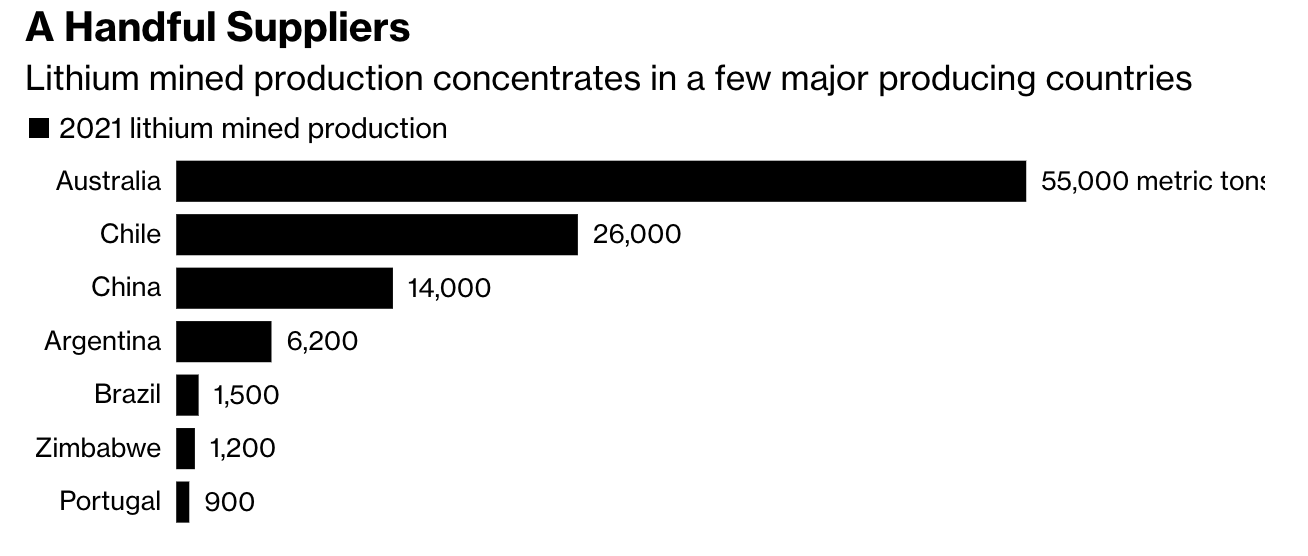

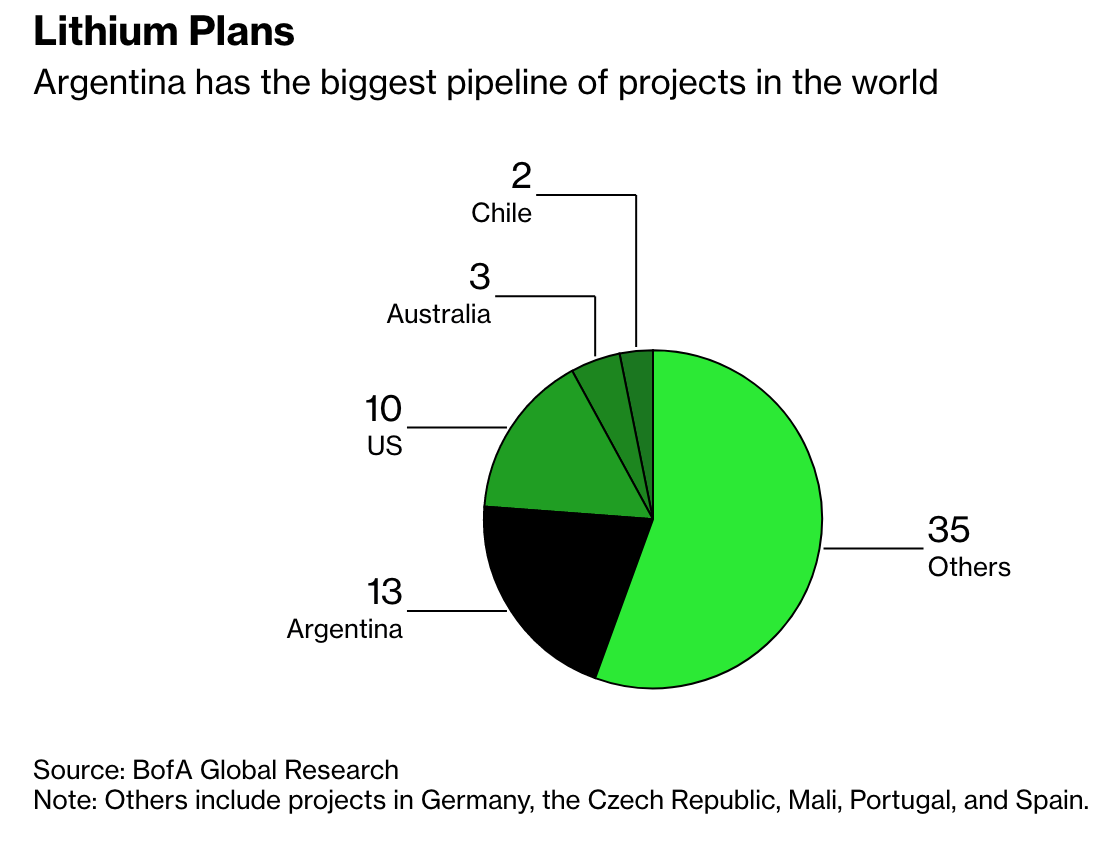

Australia was the biggest lithium producer last year, with nearly 140,000 metric tons, according to Benchmark Mineral Intelligence, which tracks products in the lithium-ion battery supply chain. Chile was the second-biggest, with almost 100,000 tons, followed by China at about 35,000.

The U.S. produced roughly 3,000 tons, but it has among the largest resources in the world, according to the U.S. Geological Survey. The trouble is that at today’s prices, much of that American lithium is too expensive to pull out of the ground.

Much of the lithium mined in the world today comes from two sources: a salty brine that’s pumped out of the ground, in countries such as Chile, and spodumene, the mineral contained in hard rocks found in places such as Australia and North Carolina. Chemical processes are then used to make the compounds that go into batteries.

Processing plants, which can cost several hundred million dollars, are about half as expensive when they’re built inside China.

The country also has looser environmental regulations for mining and chemical processing than in much of the Western world.

Piedmont is betting government support, demand from electric-car makers and a solid supply of raw materials close at hand can make its processing plants profitable. It and other lithium companies are wagering that soaring demand will push up lithium prices.

While China powers many of its plants with coal, Piedmont plans to use solar and natural gas. Like most startup exploration companies, it will likely need a deep-pocketed partner or lender to help develop the mine site itself.

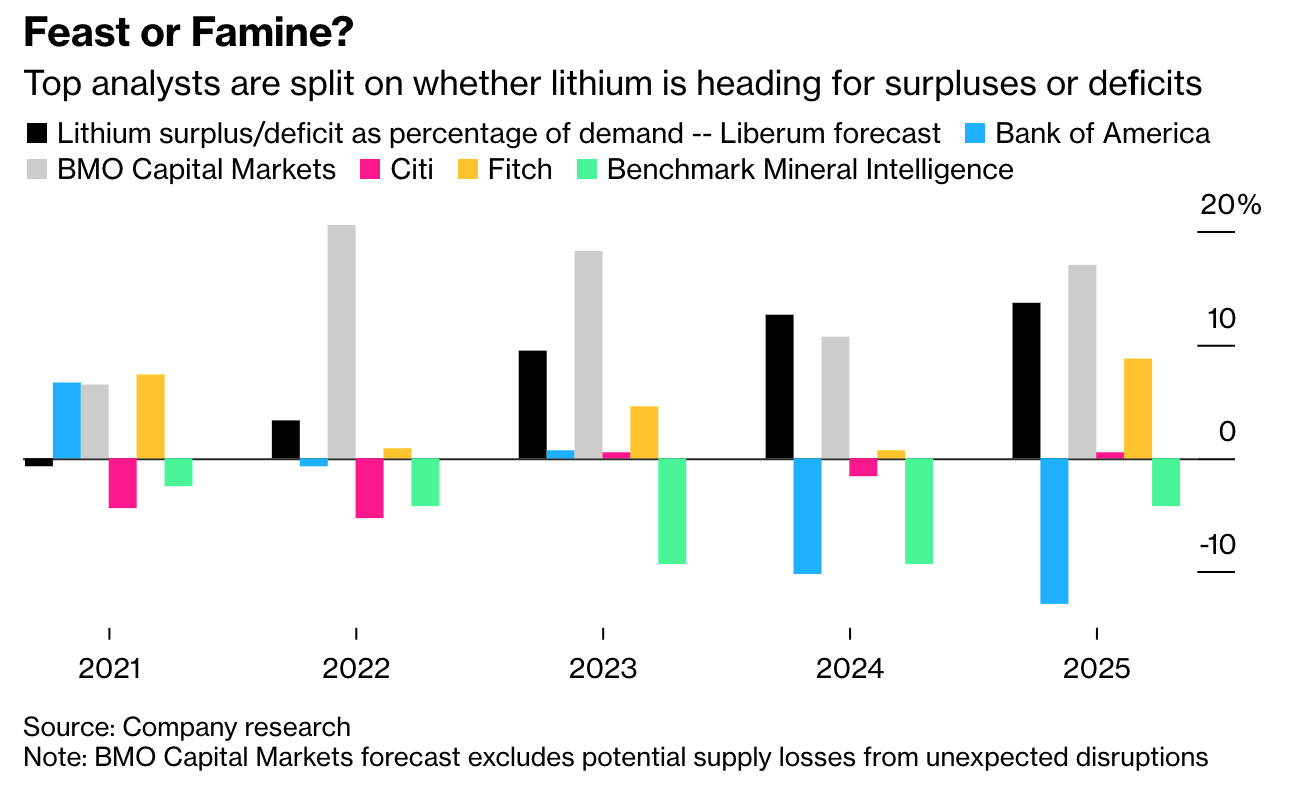

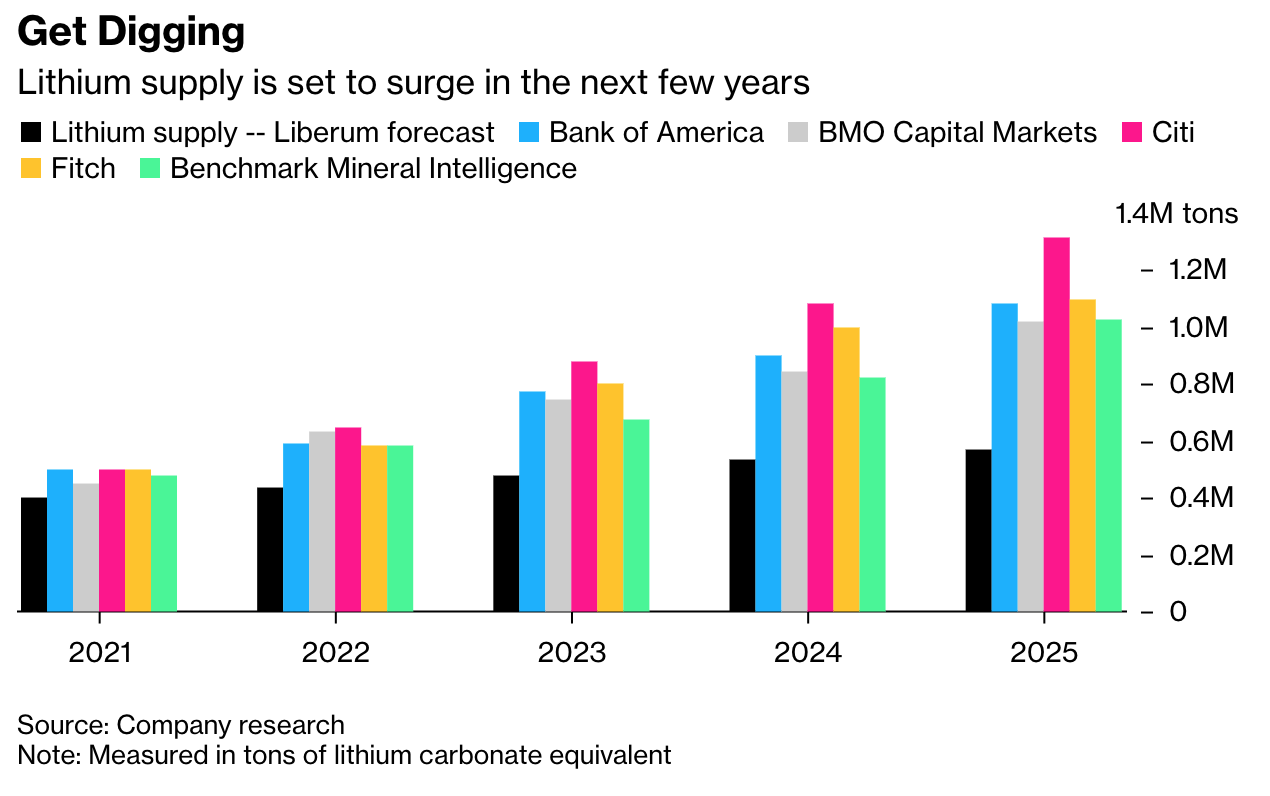

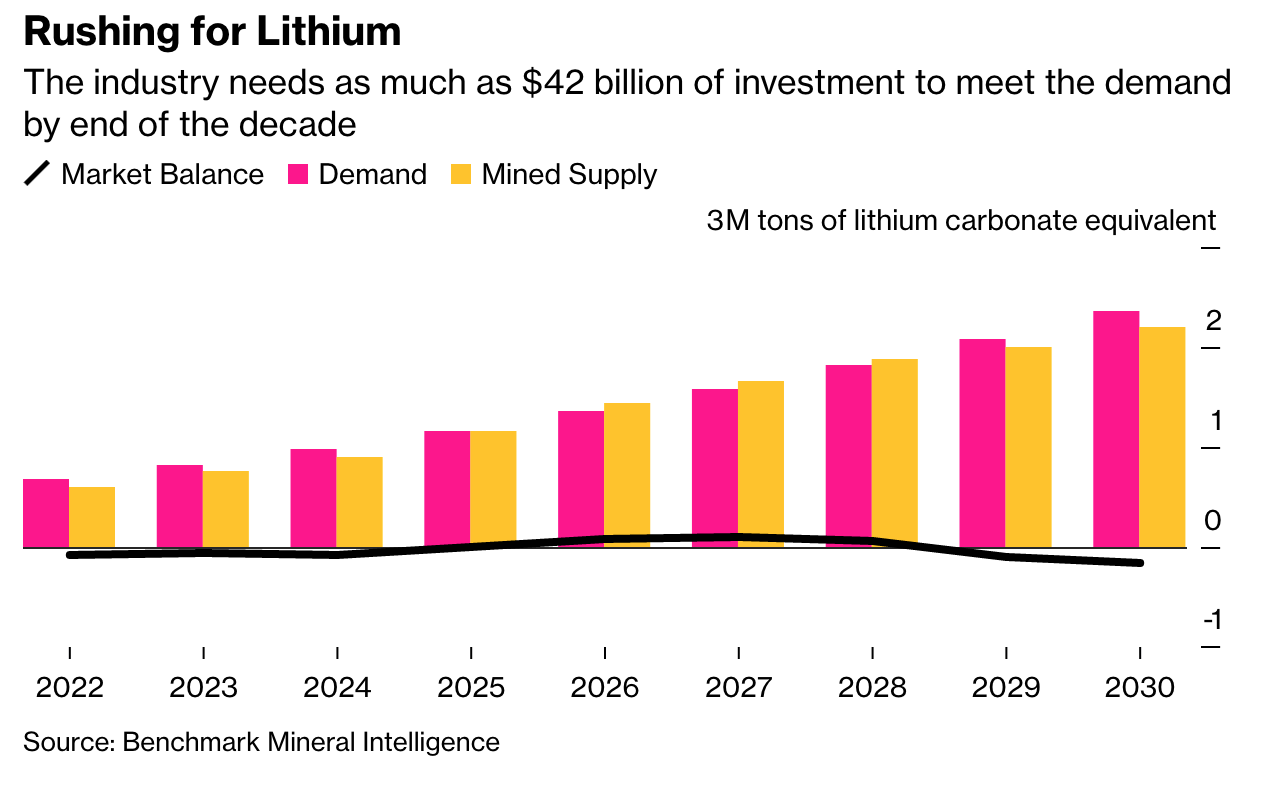

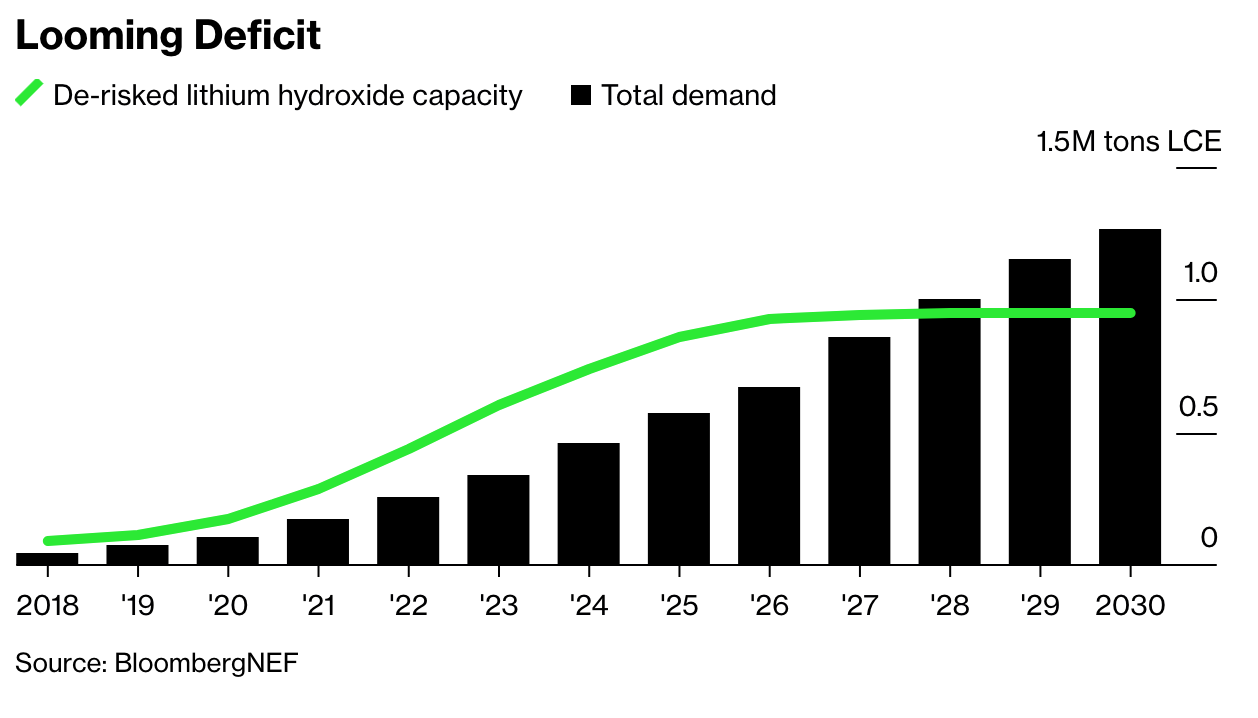

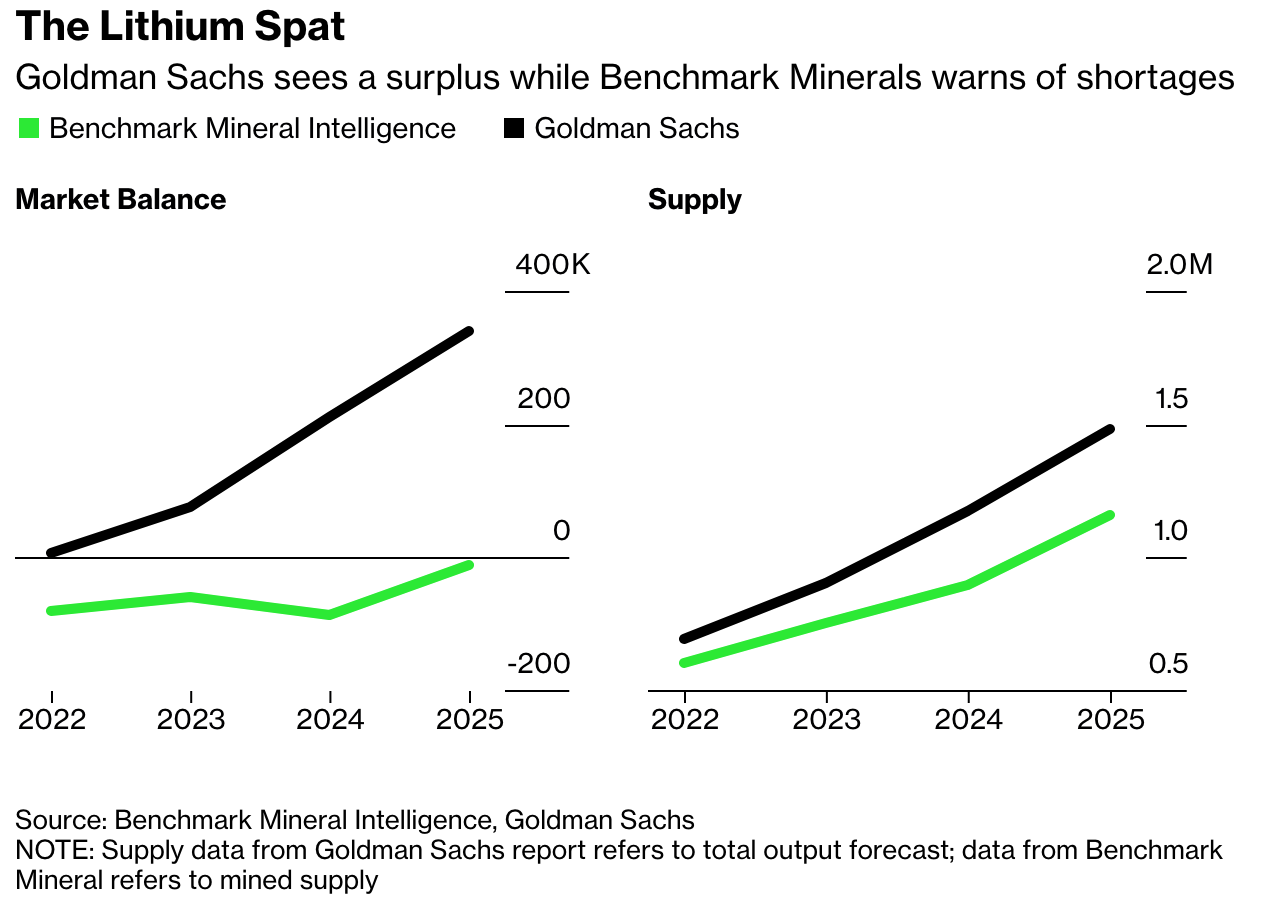

Piedmont might be one of the few new sources of lithium world-wide with enough investment to come to market in the next two to three years, analysts say. That constraint is a major reason Benchmark sees supply only doubling from this year to 2025, even as demand rises more quickly.

Once it’s operational, Piedmont expects to produce 160,000 tons a year of concentrated spodumene, yielding 22,700 tons of refined material. That could represent several times more output than current U.S. production, but still not nearly enough to meet expected demand.

Rich Veins

Piedmont got its start more than a decade ago, when Mr. Leatherman heard about a boom in lithium prices at a conference in Toronto. Prices for gold, one of his specialties, were plunging due to the global financial crisis.

Mr. Leatherman thought back to the green-striped rocks in the yard of his childhood home in North Carolina. The rocks contained rich veins of lithium. “I had no idea they were going to be special,” he said.

He obtained decades-old U.S. Geological Survey maps that detailed lithium deposits in the region. Braving ticks and snakes in the forests and hills nearby, Mr. Leatherman cracked open rocks with his hammer to expose the lithium inside.

Lithium’s boom-and-bust cycles have made it an unforgiving commodity to produce. The price soon fell, and Mr. Leatherman set aside his maps and eventually turned to blueberry farming on Vancouver Island, off Canada’s west coast. He also pursued a gold project in South Carolina.

Prices had begun to rise again when Taso Arima, an Australian with a background in coal-mining finance, contacted him in 2016. Mr. Arima had moved to the U.S. a year earlier to develop a coal project in Kentucky, but he was worried the fossil fuel faced a long-term decline.

“The writing was on the wall for coal,” said Mr. Arima, 36.

Looking to transition toward clean-energy materials such as lithium, he came upon a news article about Mr. Leatherman’s earlier prospecting work. Soon Mr. Leatherman was leading him on a tour of the area that he’d surveyed years before. Lithium-bearing rocks were just laying on the ground, Mr. Arima said.

Mr. Arima helped arrange investments through an Australian shell company, which raised several million dollars in seed capital to launch the firm.

Mr. Leatherman began meeting with nearby landowners to negotiate agreements to explore on their property. Being a local helped, he said. Now the company’s chief geologist, he splits his time between Vancouver Island and North Carolina.

In 2017, Piedmont hired Mr. Phillips as CEO, giving the company a direct line to financiers on Wall Street.

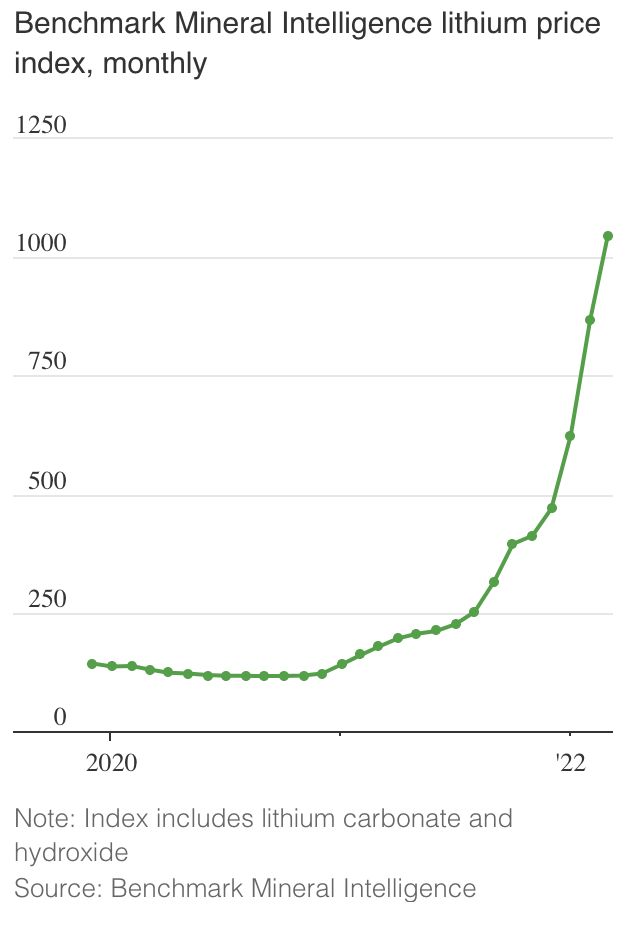

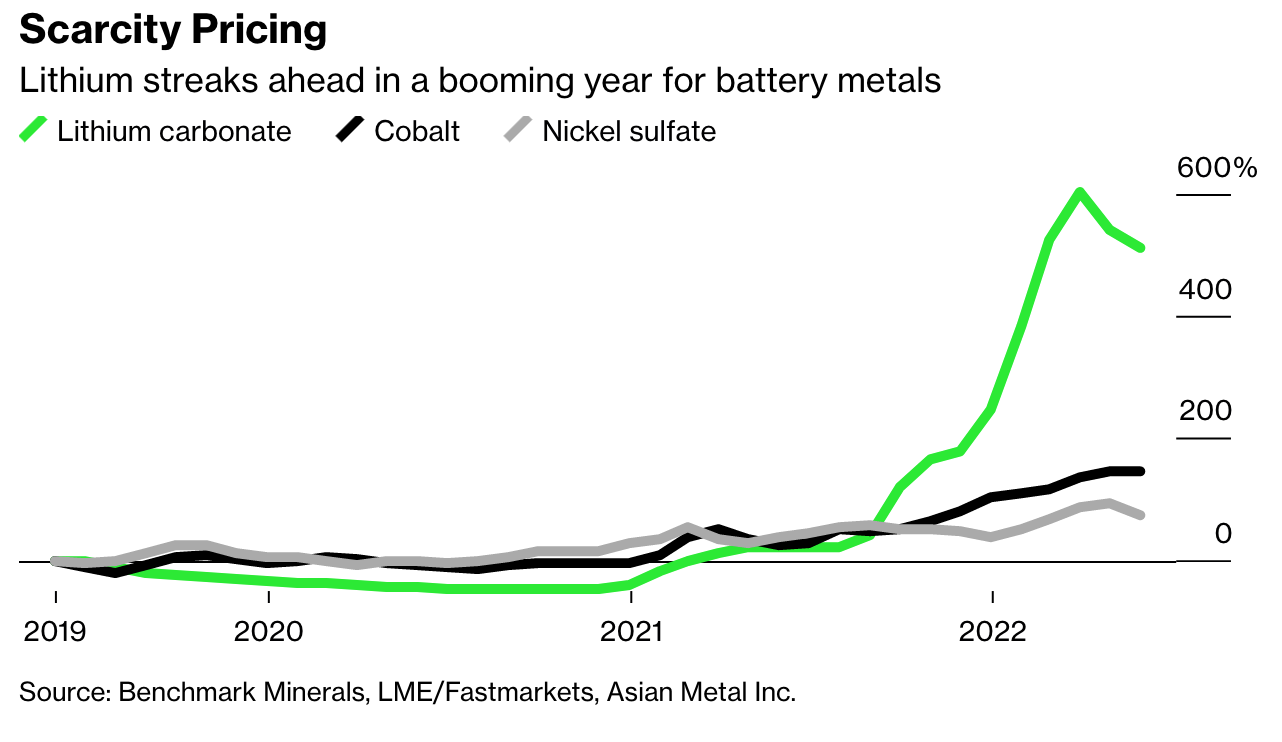

Lithium prices grew. Benchmark’s price index that tracks prices of several different lithium chemicals used in batteries peaked in early 2018. Then came the inevitable bust, as producers, lured by high prices, flooded the market.

By the end of last year, prices were down by about two-thirds. Industry analysts say that of the roughly 200 companies in the lithium business when prices peaked, nearly all of them have failed.

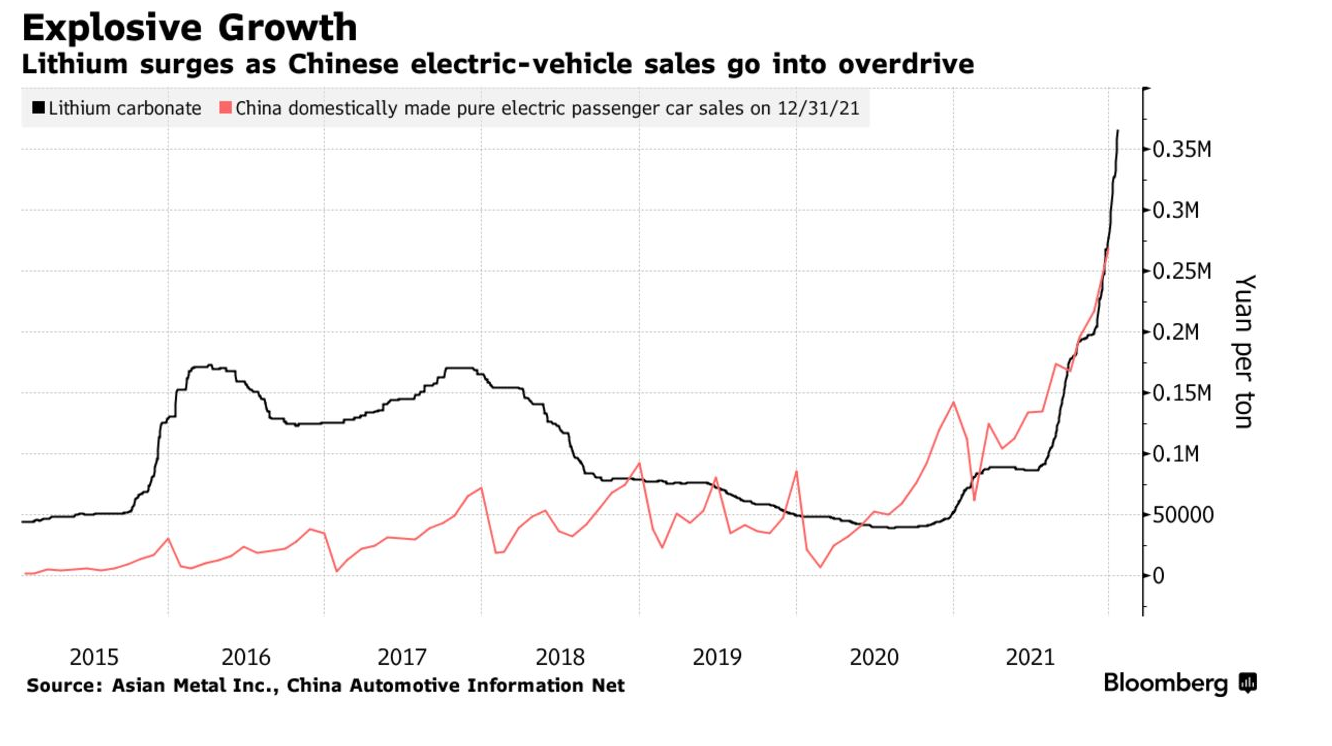

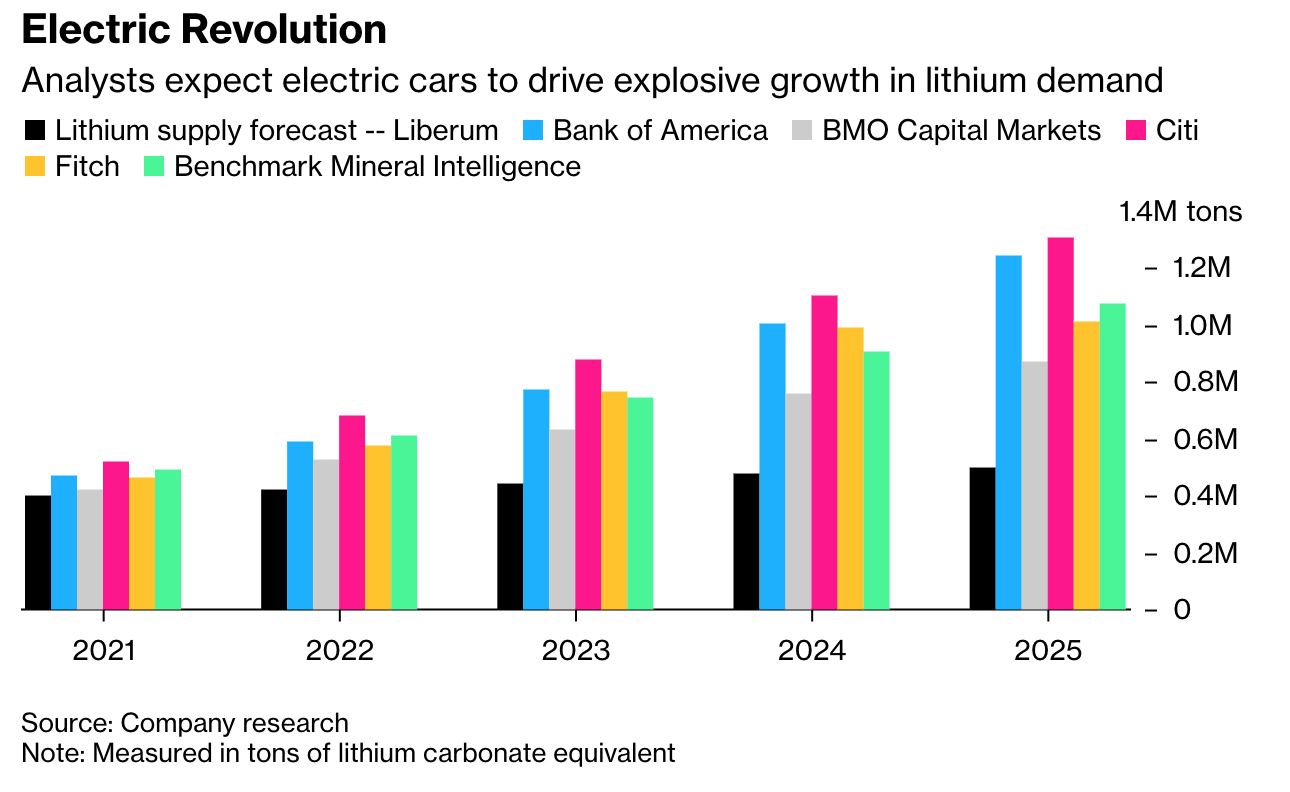

Few are predicting another bust. Analysts expect the growth of electric cars will cause lithium demand to triple in the next five years, far outpacing current supply. Lithium prices this year notched their two biggest monthly increases ever, rising about 33% from the end of 2020, according to Benchmark’s index.

Average prices for one battery chemical, lithium carbonate, have risen to around $9,000 per metric ton, from $6,000 at the end of last year, buoyed by Chinese demand. They peaked at $17,500 in 2018.

Years of low prices and weak investment in new mining projects have now set the stage for a possible scarcity, executives say.

“What we have today is this really dangerous place for the growth forecasts of the EV industry,” said Paul Graves, CEO of Philadelphia-based Livent Corp. , one of the largest producers in the world, with operations in North Carolina, Argentina and China. “There will be a massive shortage of lithium at some point.” Livent is a supplier to Tesla and recently announced a supply agreement with BMW AG .

EV Shift

For the auto industry, plentiful lithium is crucial to the shift to electric cars. Electric vehicles are expected to account for about 50% of all vehicles produced in the world by 2030, according to UBS Global Research, up from about 3% to 4% today.

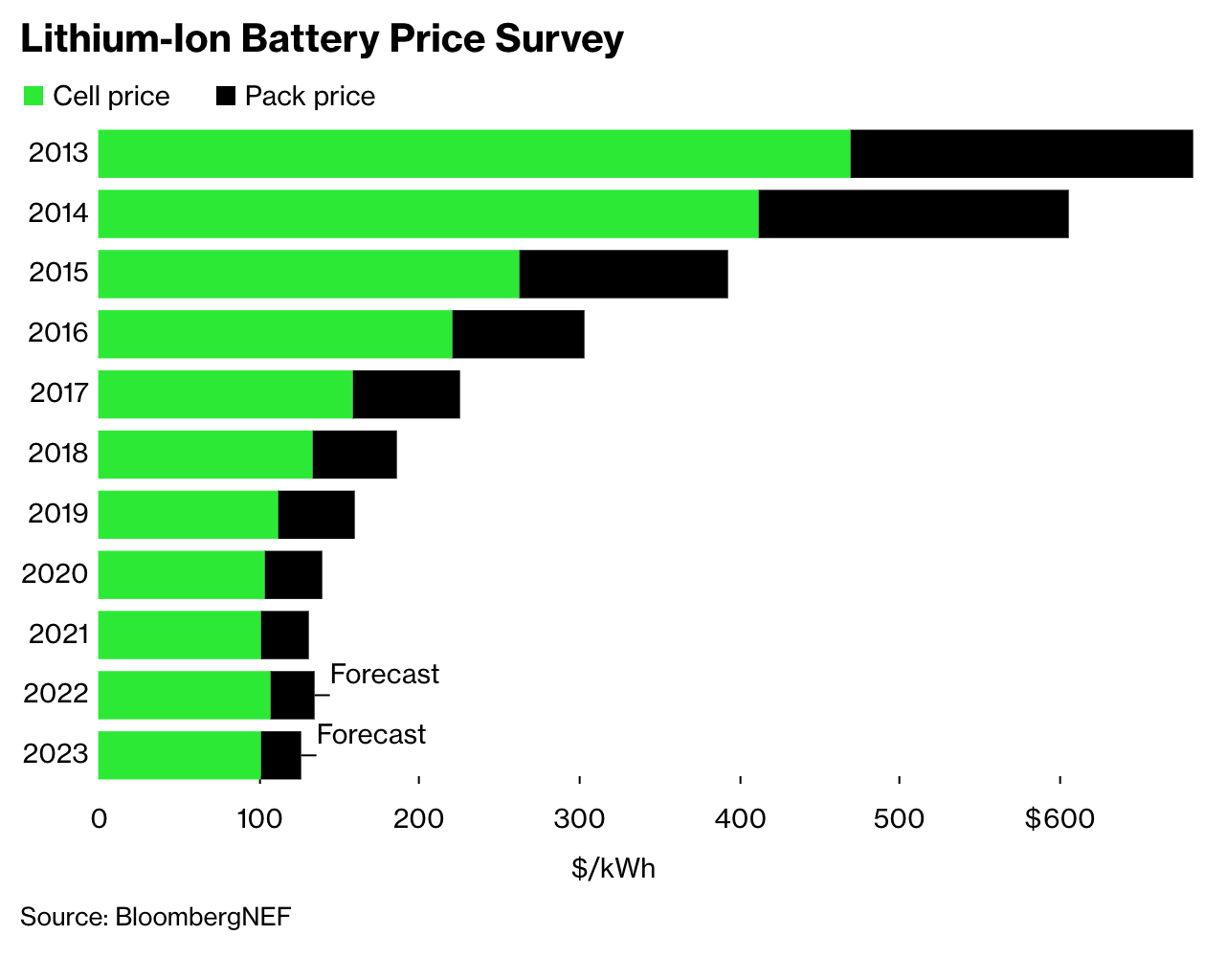

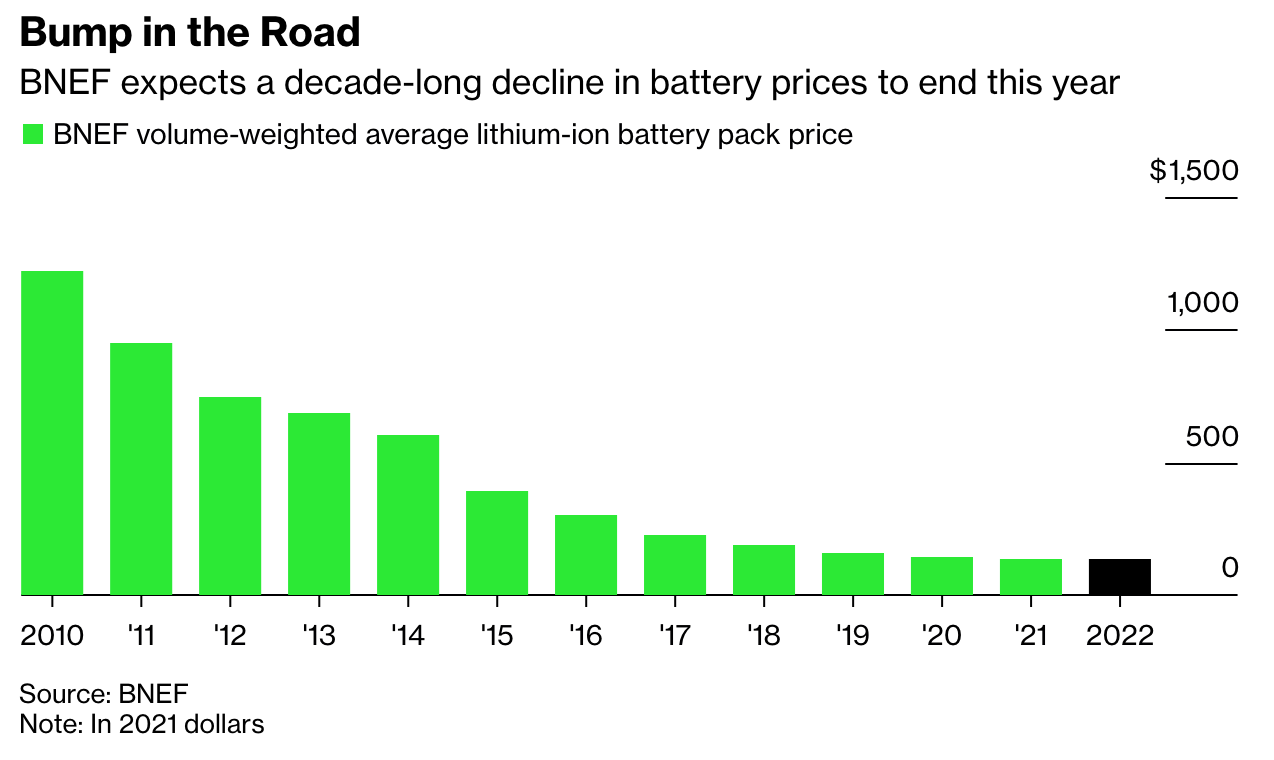

Batteries account for between 30% and 40% of the cost of most electric cars, and a surge in lithium prices could slow the decline in prices necessary to make them attractive to a swath of consumers.

To keep supply coming, Tesla Chief Executive Elon Musk last year announced an unprecedented move by an auto maker into commodities markets, including lithium. The auto maker has pledged to produce its own lithium in the Nevada desert.

Lithium Americas Corp. , a Canadian mining company, in January raised $400 million, part of which it said will help fund a Nevada project to extract lithium from clay deposits.

Albemarle said it’s considering reopening some long-mothballed lithium mining assets in Kings Mountain, N.C., but it doesn’t currently have firm plans to do so. Eric Norris, president of Albemarle’s lithium business, said the company has spent more than $30 million over the past few years to assess the area. It is investing between $30 million and $50 million to expand production at a lithium project in Nevada.

Investors including Warren Buffett’s Berkshire Hathaway Inc. and a fund run by Bill Gates are also backing companies seeking new ways to extract lithium as part of a global rush of firms trying to break into the sector.

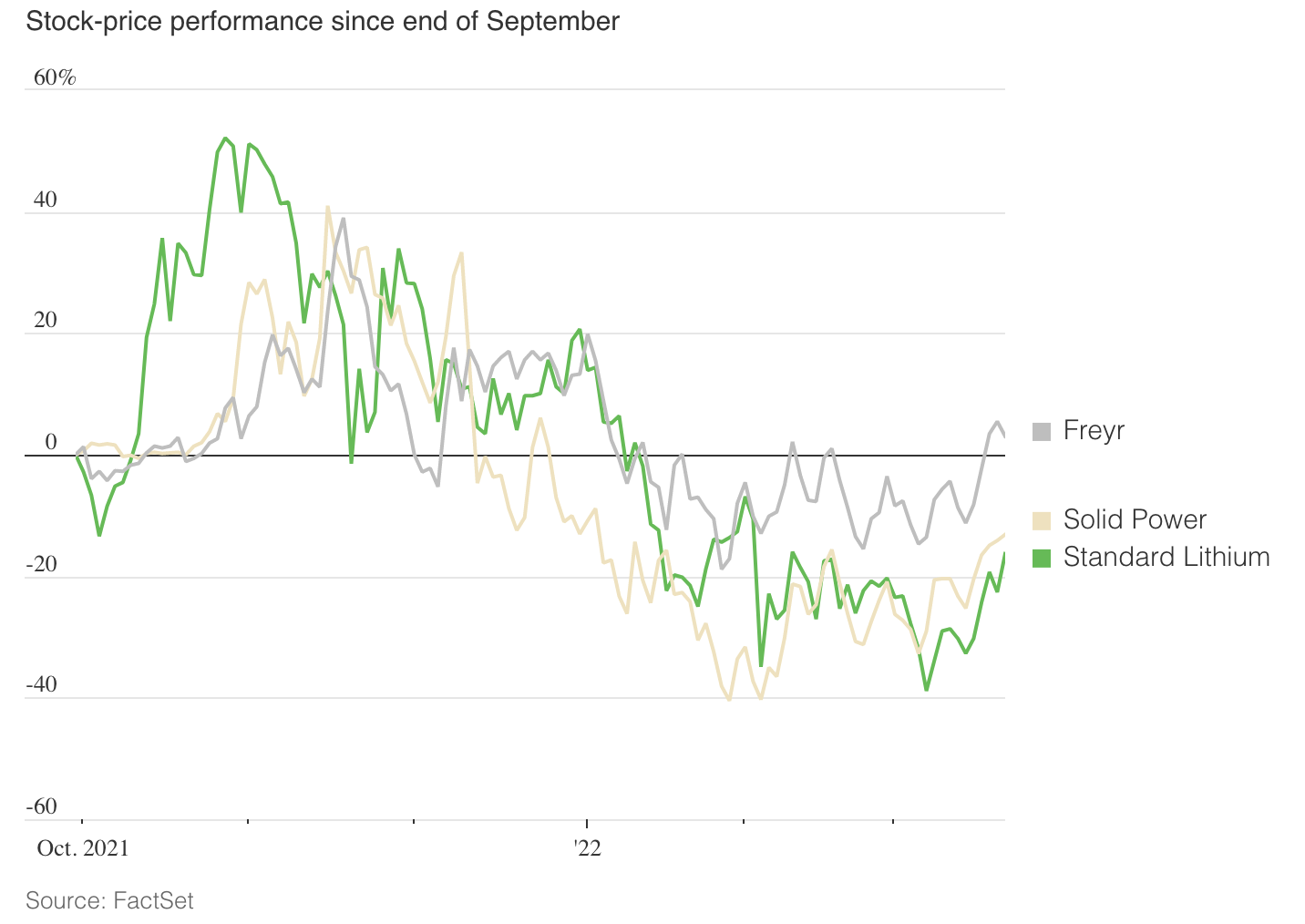

There is no public market to bet on higher lithium prices in the future like there is for commodities like oil and gold, so investors have bet on the stocks of lithium miners. Shares have been volatile lately as investors retreat from hot stocks tied to electric cars, but Albemarle has still gained about 60% since the end of September. Shares of Livent have added 80%. The market value of Lithium Americas, which is also trying to produce in Argentina, approached $3 billion in January before a recent retreat.

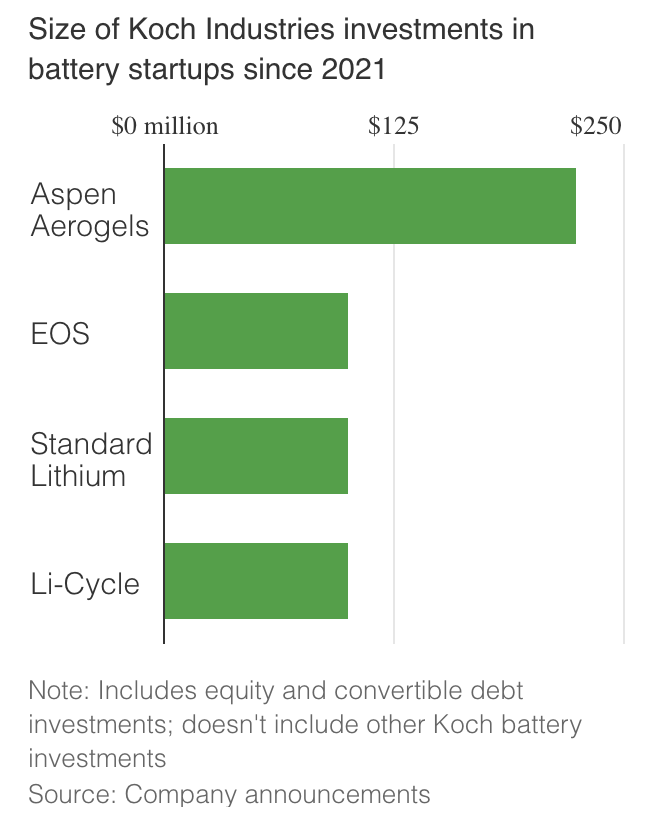

To meet expected demand, said Robert Mintak, CEO of Standard Lithium Ltd., “you’re going to need not just one success story.” The company is working with a German company to produce lithium chemicals in Arkansas, where it has a test plant already in place.

Mr. Mintak recently counted 140 lithium-ion batteries in his home from his family’s current and old electronics. He used to run a lithium firm trying to produce in Nevada that reached a supply agreement with Tesla in 2015. The company still hasn’t finished its project.

One risk to lithium miners is that demand doesn’t materialize, or a new battery technology reduces the amount of lithium needed.

“You can still paint a lot of scenarios in both directions,” said Mathew Lazarus, managing member at New York-based hedge fund Red Hook Asset Management LLC, who invests in lithium companies.

Mr. Arima of Piedmont Lithium said he isn’t concerned. As competition among nations for control of the lithium-ion battery supply chain ramps up, he expects more resources, and investors, to pour in.

“We need to do it here in America,” he said. “It’s part of our future. We can’t rely on overseas supply chains.”

Updated: 4-2-2021

California To Test Whether Big Batteries Can Stop Summer Blackouts

The state is set to become a global test case in using batteries to back up wind and solar power.

With summer’s heat approaching, California’s plan for avoiding a repeat of last year’s blackouts hinges on a humble savior – the battery.

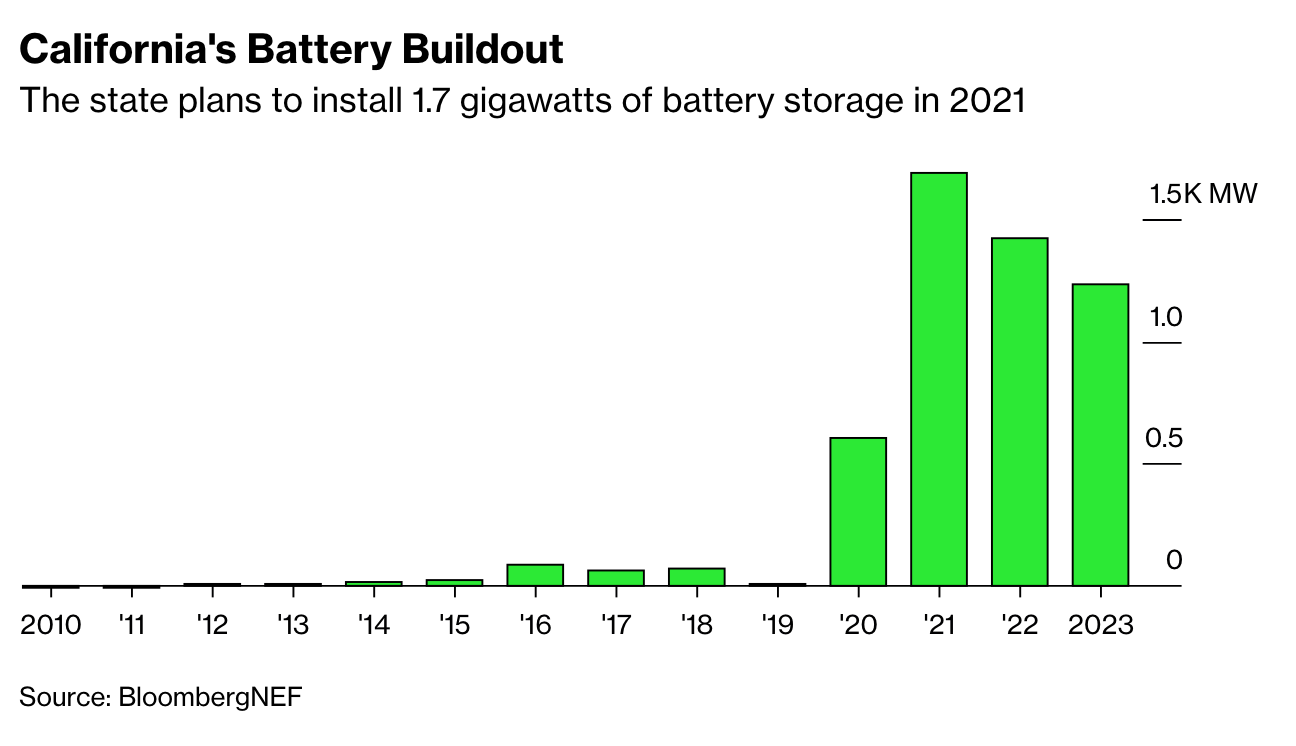

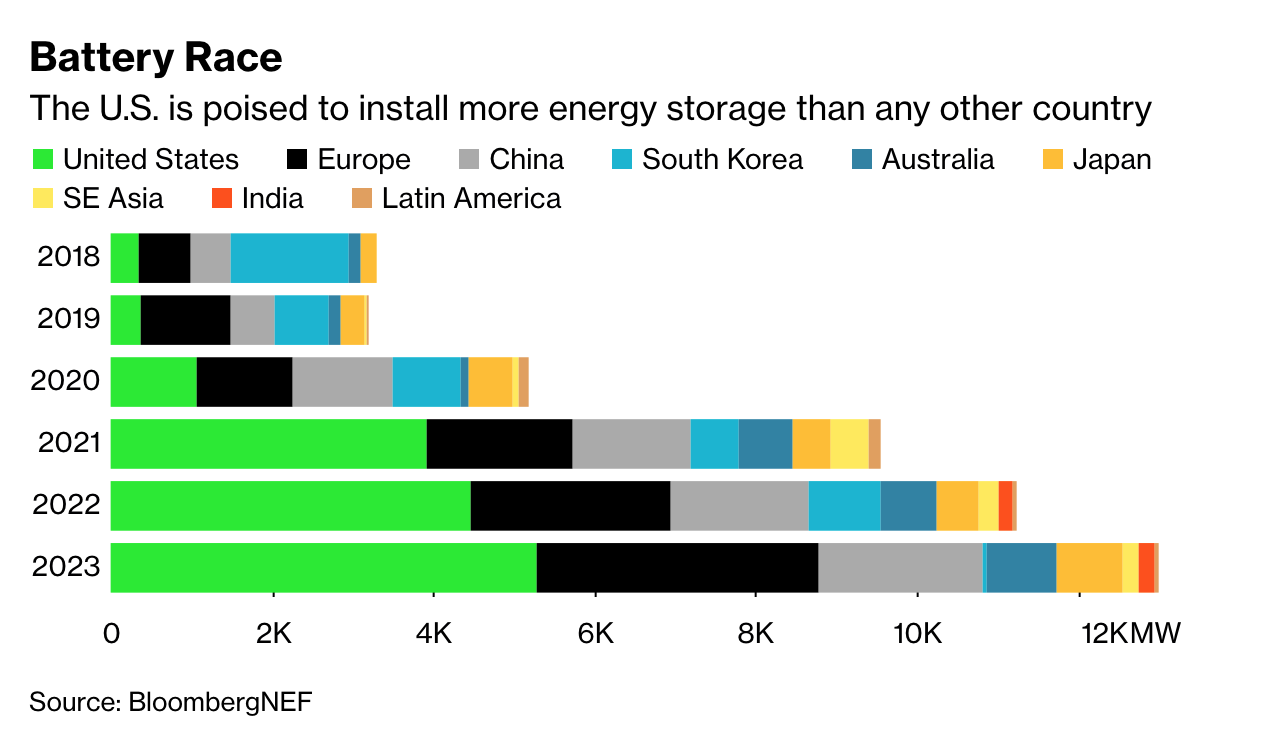

Giant versions of the same technology that powers smart phones and cars are being plugged into the state’s electrical grid at breakneck speed, with California set to add more battery capacity this year than all of China, according to BloombergNEF.

It will be the biggest test yet of whether batteries are reliable enough to sustain a grid largely powered by renewables. Last year, when the worst heat wave in a generation taxed California’s power system and plunged millions into darkness in the first rolling blackouts since the Enron crisis, many blamed the state’s aggressive clean-energy push and its reliance on solar power. Should a heat wave strike again this summer, it will be up to batteries save the day.

Their success or failure may even have implications for President Joe Biden’s ambitious plan to achieve a carbon-free electricity system by 2035 – which would require massive battery deployment and the expansion of renewable energy systems across the nation.

Biden’s long-awaited infrastructure plan, unveiled this week, includes a tax credit for grid-scale batteries, according to U.S. Energy Storage Association. They’re part of his larger effort not just to shift to renewable power but to make the aging electric grid more reliable.

“This is going to be the preview summer for batteries in California, and we want to make sure this initial chapter is as successful as possible,’’ said Elliot Mainzer, chief executive officer of the California Independent System Operator, which runs the grid across most of the state.

By this August, the state will have 1,700 megawatts of new battery capacity — enough to power 1.3 million homes and, in theory, avert a grid emergency on the scale of last year’s.

It won’t be easy. The state’s plan to eliminate greenhouse gas emissions by 2045 may require installing 48.8 gigawatts of energy storage, according to a report by three state agencies — more than five times the output of all the grid-scale batteries currently operating worldwide.

Other countries are also doubling down on batteries, with China on track to increase capacity to 222 gigawatts by the middle of the century from 1.4 gigawatts in 2019. Australia has a pipeline of grid-scale battery projects totaling more than 11 gigawatts, according to BNEF.

But batteries do have two major limitations – time and cost. Most of the battery packs now available are designed to run for just four hours at a stretch.

While that makes them a good fit for California, where electricity supplies can be strained in early summer evenings after solar power shuts down, batteries would not have prevented the multi-day outage that paralyzed Texas in February. A battery can only operate for so long before it needs to recharge.

“If batteries last four hours, then that’s not really going to do the job,” said Kit Konolige, senior analyst with Bloomberg Intelligence. “It’s still somewhat unproven, using batteries for a large portion of capacity.”

Utility-scale batteries are also more expensive than “peaker” gas plants, commonly used as back-up generation when demand is high. Following last year’s blackouts, critics lambasted the state for retiring so much inexpensive, gas-fired power under its environmental regulations.

Including construction and financing, batteries cost about $125 a megawatt-hour versus $109 for gas, according to BloombergNEF data.

Still, California sees batteries as a way to replace those peaker plants. Not only are they a lot faster to permit and build, batteries can generate income by letting owners arbitrage power prices, charging when electricity is cheap and discharging when it’s expensive. They also offer other grid services like stabilizing voltage throughout the day.

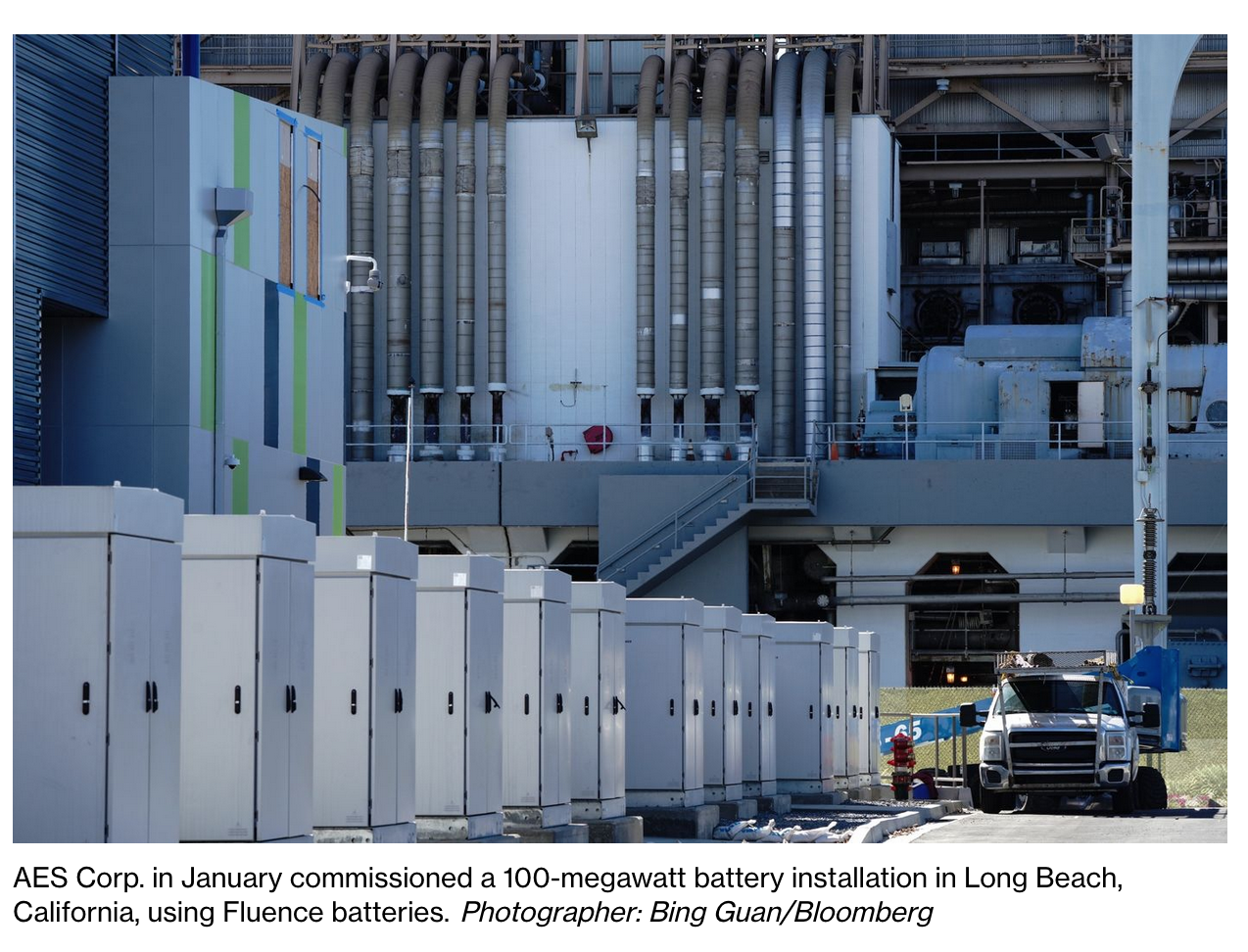

“A peaker runs for a few hours in the evening hours, and then it shuts off, and that’s all it can do,’’ said Kiran Kumaraswamy, vice president of market applications at Fluence, an energy storage joint venture of Siemens and AES Corp. “You’ve got to be able to provide that peak capacity but also optimize around how much money you can make at other times.’’

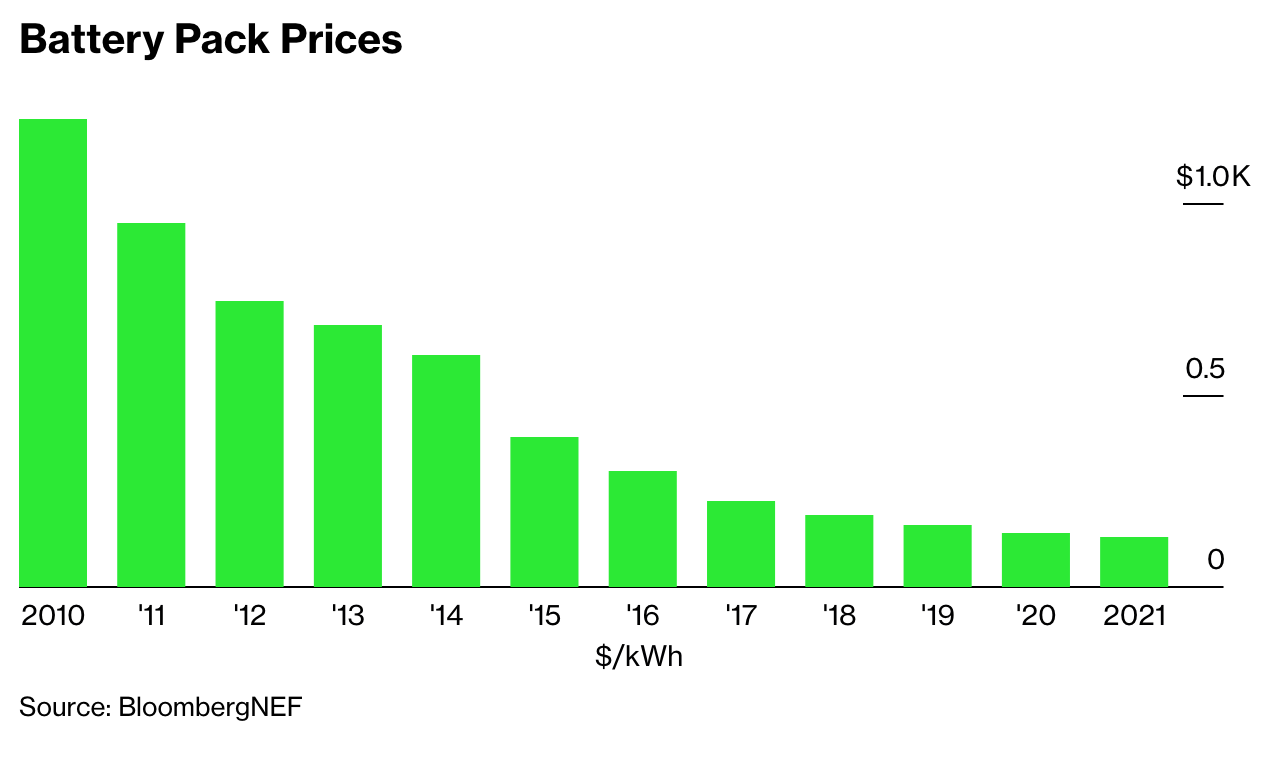

While more battery projects are coming online as the price of lithium-ion cells drops, the rollout has not always been smooth. Sporadic fires have struck grid-scale batteries, particularly in South Korea, one of the first countries to invest heavily in energy storage. But those incidents have become rare as electric utilities and power companies gain experience with the technology.

“There’s been enough deployment around the world and operating history that utilities seem to be comfortable with it,’’ said energy consultant Mike Florio, a former member of the California Public Utilities Commission. “It seems like the performance has been as expected, if not better.’’

But will batteries prevent blackouts? So far, they’ve been credited with helping prevent outages elsewhere, most notably in Australia where Tesla and France’s Neoen SA have built a 150-megawatt lithium-ion installation. That bodes well for California, where the buildout in combination with other measures should give the state enough of a cushion to prevent blackouts this summer, according to Konolige.

Just in case, the state has also delayed the planned closure of some gas plants and beefed up “demand response’’ programs that cut power when needed to some customers in exchange for a lower rate or other compensation. Public officials — including Governor Gavin Newsom, facing a likely recall election — have a powerful incentive not to get caught short two years in a row.

“It would be an ugly situation to run into something similar to last summer,” Konolige said. “To me, that’s a strong indicator that it’s unlikely to happen this year.”

Updated: 6-1-2021

Global EV Battery Sales Surge As Demand For Clean Cars Booms

Global electric-vehicle battery sales more than doubled in the first four months of the year as the switch to environmentally-friendly cars gathers pace.

Sales of EV batteries rose to 65.9 gigawatt-hours in the January-April period, from 26.8 gigawatt-hours a year earlier, SNE Research said Tuesday.

Contemporary Amperex Technology Co.’s sales almost quadrupled to 21.4 GWh, cementing the Chinese company’s position as the world’s biggest EV battery maker with 32.5% of the global market.

“Despite the hit of Covid-19 pandemic in 2020, the company’s performance has rapidly resumed,” CATL said in a statement. The firm is focused on building “long-term cooperation with international automakers,” it said. CATL won about 16% of revenue from overseas sales last year up from 4% in 2019, according to BloombergNEF.

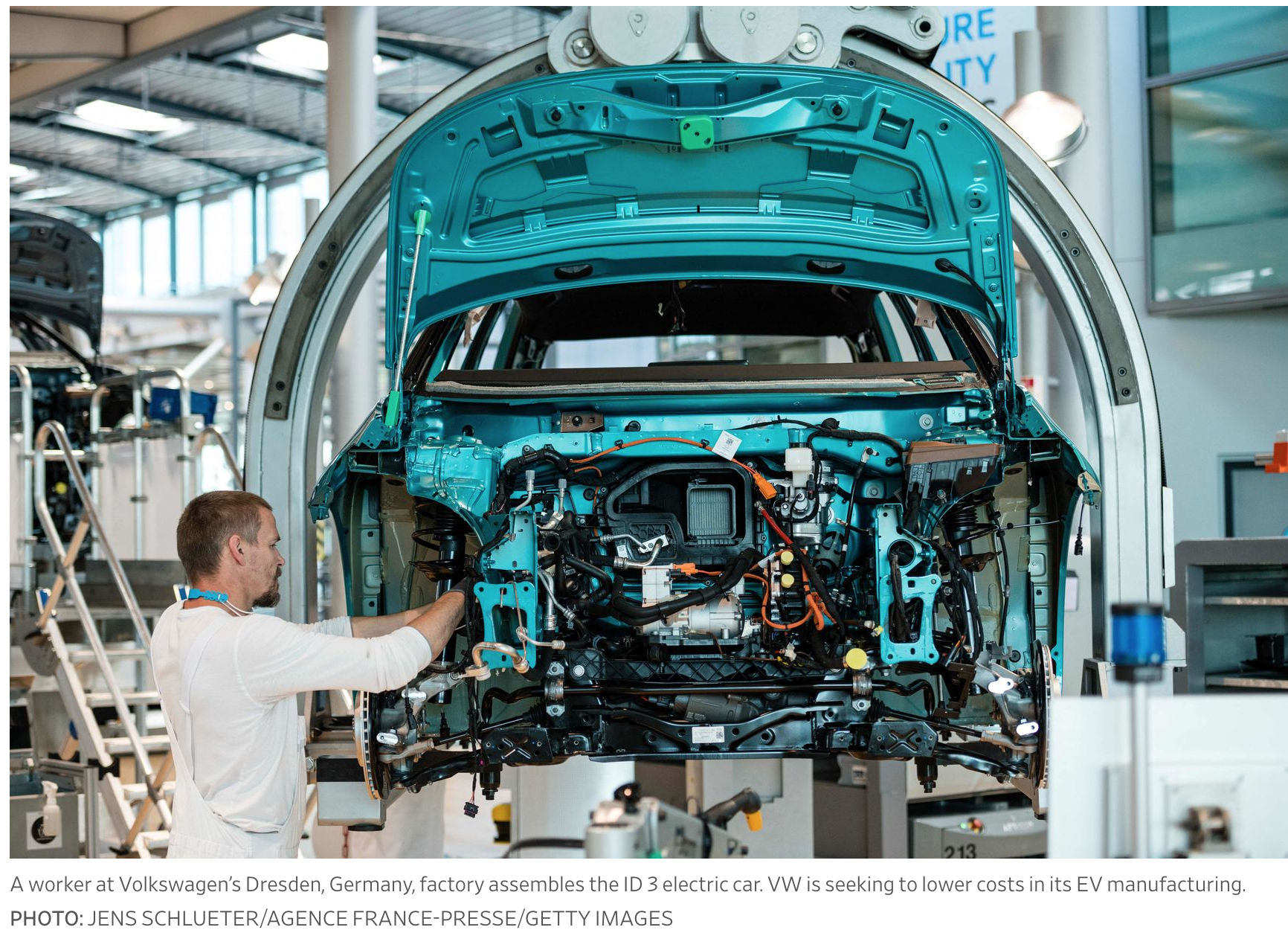

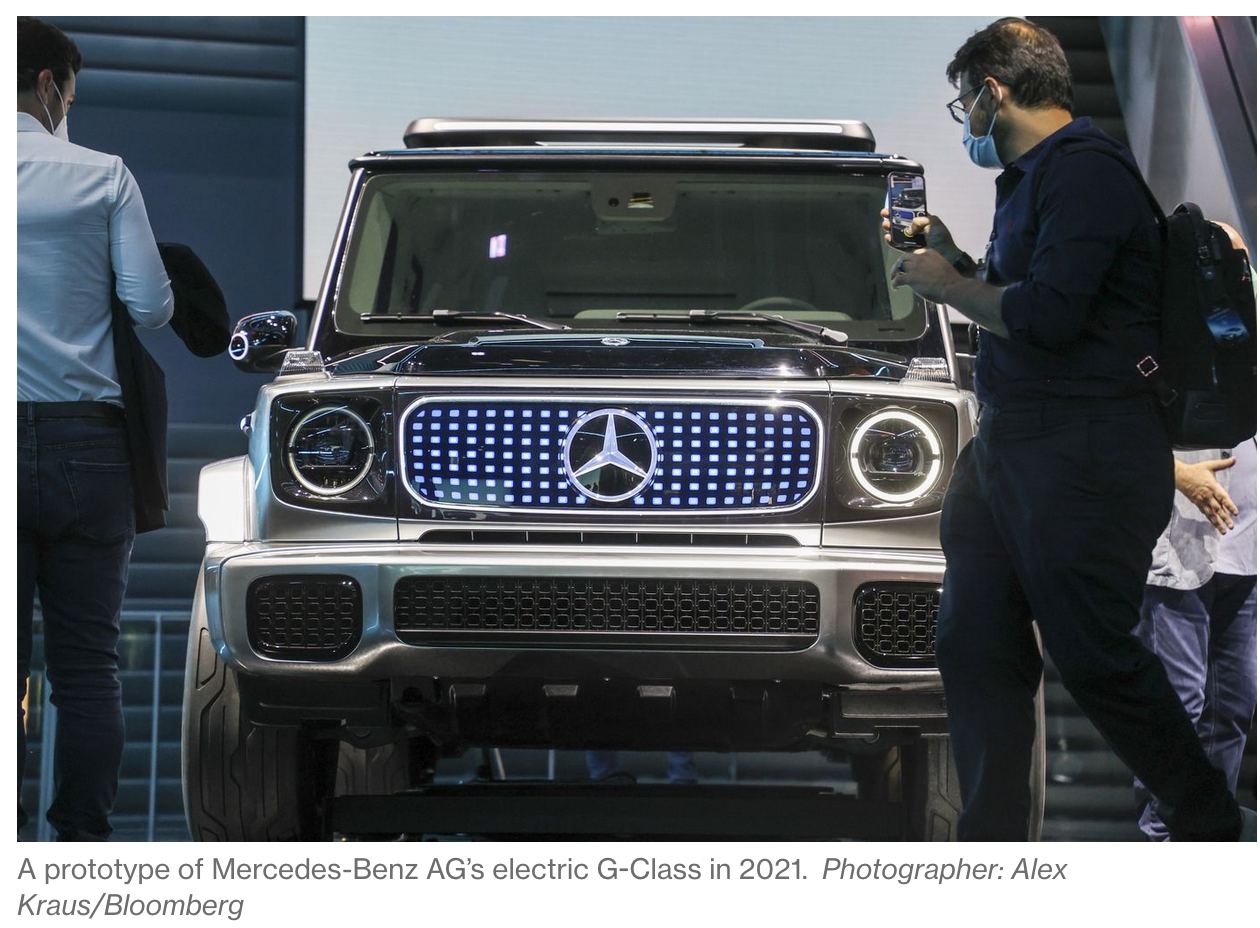

Demand for electric vehicles is increasing as countries work to reduce carbon emissions, consumers embrace cleaner automobiles and costs tumble. Automakers such as Volkswagen AG and Ford Motor Co. are plowing billions of dollars into adding more EV models to their lineups, while industry pioneer Telsa Inc. posted estimate-smashing deliveries in the first quarter.

“CATL, BYD and other Chinese makers led the market growth,” SNE said in the statement. “With the Chinese market expected to continue expanding, growth for most of the Chinese makers is expected to exceed the market average.”

EV sales in China may climb more than 50% this year alone, research firm Canalys estimates.

South Korean companies also posted strong growth, helped by rising EV demand in Europe. Sales at LG Energy Solution Co. and SK Innovation Co. more than doubled in the first four months, while Samsung SDI Co. posted 88% growth.

Updated: 6-23-2021

Proterra Eyes US Battery-Cell Facility Within Next Few Years

Proterra Inc., the electric-bus and battery maker that joined the Nasdaq Global Select Market, is planning a domestic battery-cell manufacturing facility within the next few years.

“It’s an imperative initiative for Proterra for our future growth,” Jack Allen, the company’s chief executive officer and chairman, said in an interview Tuesday at the company’s factory in the Los Angeles area. “We are committed to working with our partners to be able to bring cell manufacturing to the U.S.”

For electric-vehicle makers, success hinges in part on securing the most critical and expensive component: battery cells. A handful of companies based in China, Japan and South Korea make automotive-grade battery cells, which are key to manufacturers’ goals of bringing dozens of new electric powered vehicles to U.S. roadways.

But strained logistics, production delays and a scramble for long-term contracts have put pressure on companies to lock up a steady supplier amid a new battery arms race. The Institute for Defense Analyses, a nonprofit that examines national-security issues, said battery manufacturers have taken on an “outsized importance” and warned the U.S. hasn’t coordinated domestic supplies on the scale that Europe has.

Proterra, which has a supply agreement with LG Energy Solution through 2022, wants domestic cell production to shorten the supply chain, create jobs and help meet expected volume growth, Allen said.

“This industry is at an incredible inflection point,” he said. “We think it’s imperative to be able to accelerate that growth to have supply here.”

Proterra said in April that it projects investing $100 million to $120 million on domestic cell capacity.

The Burlingame, California-based company makes electric-transit buses and battery packs at its plant in the City of Industry in Southern California. It invested $20 million to build the battery facility within the existing bus factory, a project that was completed last year and is capable of producing 675 megawatt-hours annually, Allen said.

Now, the company, which also has a bus factory in South Carolina and does research and development in the Bay Area, is looking to replicate that facility elsewhere in the U.S.

Proterra agreed to go public in January through a merger with special purpose acquisition company ArcLight Clean Transition Corp. The company raised more than $640 million in cash from the merger.

It has delivered more than 600 electric-transit buses and produced more than 300 megawatt-hours of battery systems and installed 46 megawatts of charging systems. On Tuesday, it said Florida’s Miami-Dade County had agreed to buy 42 additional buses and install 75 chargers at three depots.

Updated: 6-11-2021

A California Startup Now Offers A Full EV Battery In Just 10 Minutes

Ample offers a replaceable battery pack made for swapping out, rather than plugging in.

On a Wednesday afternoon in May, an Uber driver in San Francisco was about to run out of charge on his Nissan Leaf. Normally this would mean finding a place to plug in and wait for a half hour, at least. But this Leaf was different.

Instead of plugging in, the driver pulled into a swapping station near Mission Bay, where a set of robot arms lifted the car off of the ground, unloaded the depleted batteries and replaced them with a fully charged set. Twelve minutes later the Leaf pulled away with 32 kilowatt hours of energy, enough to drive about 130 miles, for a cost of $13.

A swap like this is a rare event in the U.S. The Leaf’s replaceable battery is made by Ample, one of the only companies offering a service that’s more popular in markets in Asia. In March, Ample announced that it had deployed five stations around the Bay Area.

Nearly 100 Uber drivers are using them, the company says, making an average of 1.3 swaps per day. Ample’s operation is tiny compared to the 100,000 public EV chargers in the U.S.—not to mention the 150,000 gas stations running more than a million nozzles.

Yet Ample’s founders Khaled Hassounah and John de Souza are convinced that it’s only a matter of time before the U.S. discovers that swapping is a necessary part of the transition to electric vehicles.

China, which is home to roughly half of the 7 million passenger EVs on the road as of last year, has more than 600 swapping stations and is on pace to have 1,000 by year’s end, according to a tally by clean-energy research group BloombergNEF.

“They’ve already made the determination that swapping has to be a significant part of the solution,” says Hassounah, “We don’t have enough deployment yet to realize that we need this in the U.S.” Even in China, however, where the swapping industry dwarfs that of the U.S., the technology is still only a small piece of the charging infrastructure.

In the U.S. most investment so far has gone into building faster plug-in stations and batteries that can accept power quickly without overheating. President Biden has proposed a target of 500,000 public chargers by 2030. His plan, which calls for scaling and improving fast-charging networks, makes no mention of battery swapping.

Yet plug-in chargers come with limits that can’t be overcome simply by adding more. They are a burden on the power grid, expensive to build, and, even at their fastest, agonizingly slow compared to gas pumps.

Hassounah and De Souza founded Ample in 2014 and have raised about $70 million to date from investors including the venture arms of oil and gas giants Royal Dutch Shell plc and Repsol SA.

They’ve spent the last seven years studying how to swap batteries in a cheap, vehicle-agnostic way and believe they’ve finally cracked it. For now they are focusing on ride-hailing fleets, as professional drivers have the most need for fast charging.

Late last year, Ample entered a partnership with Uber to help coordinate with the the fleet management services that provide drivers with cars, insurance, and other services.

On June 10, Ample announced a separate partnership with the fleet management service Sally, which specializes in making EVs available to ride-hailing and delivery drivers. The two plan to work to together to deploy EVs and swapping stations in San Francisco, New York, Los Angeles and Chicago. Sally aims to have hundreds of Ample-ready Kia Niro EVs running in the Bay Area by the end of this summer and to begin offering swapping to drivers in New York by the fall.

Sally co-founders Nicholas Williams and Adriel Gonzalez say the company chose to work with Ample because plug-in fast-charging options degrade batteries, come with high energy costs during peak use, and are too slow. “We had a supercharging concept that would probably do it in 30 minutes, but that was really too long for us,” says Williams.

Drivers in San Francisco rent Ample-ready EVs from fleet management services, just as they would for a combustion engine car, and pay the fleet manager for their swaps at the end of each week. The fleets then pay Ample by the mile for the energy, with no upfront fees for installing stations.

The energy cost for fleets, according to Ample, is typically 10 to 20 percent cheaper than gas. “All the drivers that have used it have come over from gas vehicles,” says De Souza. “This is the first time they’re driving an electric vehicle.”

Most EV charging in the U.S. happens at private chargers in driveways and garages, where drivers can use vehicle downtime to refill batteries slowly. But convincing Americans to ditch combustions engines and go electric means competing with the convenience of gas stations. The average fill-up, according to the NACS, a trade group for convenience stores and gas stations, takes 4.5 minutes, including the time it takes to pay.

With a typical fill-up of about 12 gallons, a car that gets 25 miles per gallon can add 300 miles of range in less than five minutes. Doing the same in 40 minutes counts as ultra-fast for an electric charger. Ten such chargers on the side of a highway would need at least a megawatt connection, enough to power hundreds of homes.

Swapping, at least in theory, offers an elegant solution to the problem of re-charging EVs quickly without taxing the grid. Where an ultra-fast charger acts as a firehose, delivering a rush of energy on demand, Ample’s system works like a garden hose, constantly filling small buckets and handing them over a few at a time. So far, however, attempts at swapping in the U.S. have come to nothing.

Tesla experimented with the technology in 2013 but soon abandoned it, opting instead to build its network of “Superchargers.” The startup Better Place, which planned to sell swappable batteries in its EVs, went bankrupt that same year, after raising nearly $1 billion.

There are two basic reasons that the electric vehicle industry in the U.S. has so far opted to plug-in rather than swap out. The first is weight. Batteries are heavy. Every mile of range adds a few pounds to the weigh of an EV battery, so a car with 250 miles of range might be carrying a a pack that weighs as much 1,000 pounds.

Replacing a pack of that size is not as simple as swapping out a few D cells from a flashlight. Building a station that can handle these loads, says De Souza, typically costs around $1 million.

Ample tackles the weight problem by breaking the battery pack into pieces. The company uses a modular system of lithium-ion packs, each about the size of shoe box, and arranges them on trays. Each module holds about three kilowatt hours of power and weighs around 30 lb. Most cars take 16 to 32 modules, depending on the size and desired range.

The modules are stacked on trays four or five at a time, with a typical car holding three to five trays. The robotic arms in Ample’s stations move the trays one at a time so that they never have to carry more than about 150 pounds. The average swap takes ten minutes. Ample’s goal is to get it down to five minutes by the end of this year.

Each stations holds about ten car’s worth of batteries, all steadily re-charging as cars come and go. This allows them to deliver energy at a rate between 500 kilowatts and 1.5 megawatts per hour with a connection of only 60 to 100 kilowatts.

Ample says it can build and deploy one of its swapping stations in a footprint the size of two parking spots for tens of thousands of dollars. No digging is required because power can be taken from an overhang connection. “Give us six weeks. We can set up a whole city,” says Hassounah.

If Ample can deliver on this promise, it would undercut not only the existing swapping options, but most fast chargers as well. According to a BloombergNEF survey last year, installation costs for ultra-fast chargers, which require digging in the ground, ranged from $111,000 to $333,000 per megawatt, with hardware starting at about $30,000 per connector and running as high as $125,000.

While dealing with heavy batteries is a chore, the biggest challenge for swapping is getting automakers to change the way they build EVs. “Compatibility is a massive problem,” says Ryan Fisher, an analyst for electrified transport at BloombergNEF. “When you talk about doing it across multiple manufacturers, that becomes pretty complicated quite quickly.”

Plus, there are other ways of smoothing the peaks and valleys in energy demand that don’t require making alterations to EVs already on the road. The startup Freewire, for instance, stores power in batteries inside of its chargers, allowing them to sip power from the grid and deliver to cars quickly.

When Tesla flirted with swapping, it built a proprietary system with its own swappable packs. Swapping stations in China have largely followed the same model, with carmakers building their own networks. NIO, the industry leader, has done more than 2 million swaps at 192 stations.

BloombergNEF analysis shows that NIO’s stations are exceptionally efficient at delivering power, with an average of 1,543 kilowatt hours per day per station—33 times the rate of China’s average public plug-in connectors.

But building multiple proprietary swapping networks in the U.S. makes little sense. “It’s almost like every car company has to build their own gas stations all around the country,” says De Souza. And creating a standard battery pack for every EV is also a non-starter. Automakers are not about to forfeit control over the most expensive part of an electric vehicle and one of the main ways they differentiate themselves from the competition.

Instead of asking automakers to adapt, Ample has created a flexible system that adapts to automakers.“We’ve built an adapter plate that has the same shape as the original battery,” says Hassounah. “So for one vehicle, it’s a one adapter plate, for another, it’s a slightly different plate.”

Each plate is designed to interface with the car in exactly the same way as the original battery, with the same bolts, the same electrical connection, and same software—and meeting the same safety standards. The plate, which holds the battery trays, never leaves the car. “You just put this thing in and it works,” says Hassounah, “kind of like replacing a tire.”

Ample says it is working with five manufacturers and has so far built plates for ten models. Non-disclosure agreements prohibit them from saying which automakers, but models seen in their promotional materials include the Nissan Leaf, Kia Niro and Mercedes-Benz EQC.

The idea is for automakers to be able to offer swappable battery packs as an option in their EVs. The biggest hurdle at the moment is getting the car companies, who already struggling with supply chain disruptions, to integrate Ample into their manufacturing.

For now, Sally and Ample plan to retrofit Kia Niro’s with swappable battery packs. The hope is that if Sally and other fleet managers say they want to place orders for hundreds of thousands of Ample-ready cars, that will help push manufacturers to build them.

“It’s very much in the early stages of the industry,” says Fisher. “So the proof is in the pudding.”

Updated: 7-19-2021

A Million-Mile Battery From China Could Power Your Electric Car

The Chinese behemoth that makes electric-car batteries for Tesla Inc. and Volkswagen AG developed a power pack that lasts more than a million miles — an industry landmark and a potential boon for automakers trying to sway drivers to their EV models.

Contemporary Amperex Technology Co. Ltd. is ready to produce a battery that lasts 16 years and 2 million kilometers (1.24 million miles), Chairman Zeng Yuqun said in an interview at company headquarters in Ningde, southeastern China. Warranties on batteries currently used in electric cars cover about 150,000 miles or eight years, according to BloombergNEF.

Extending that lifespan is viewed as a key advance because the pack could be reused in a second vehicle. That would lower the expense of owning an electric vehicle, a positive for an industry that’s seeking to recover sales momentum lost to the coronavirus outbreak and the slumping oil prices that made gas guzzlers more competitive.

“If someone places an order, we are ready to produce,” said Zeng, 52, without disclosing if contracts for the long-distance product have been signed. It would cost about 10% more than the batteries now inside EVs, said Zeng, whose company is the world’s largest maker of the batteries.

Concerns about batteries losing strength and having to be replaced after a few years is one factor holding back consumer adoption of EVs. Tesla last year flagged it expected to bring into production a battery capable of a million miles of operation, and General Motors Co. last month said it is nearing the milestone. That distance is equivalent to circling the planet 50 times.

Anticipating a rapid return to growth for the EV industry, CATL is plowing research-and-development dollars into advances in battery technology. While the coronavirus outbreak will drag down sales throughout this year, EV demand will pick up in early 2021, said Zeng, who founded CATL a decade ago.

Car buyers holding back during the pandemic is creating pent-up demand that will be unleashed starting next year, led by premium models, he said. CATL’s customers include BMW AG and Toyota Motor Corp.

Zeng’s comments strengthen views that electric vehicles are set to weather the economic slowdown caused by the outbreak better than gas guzzlers. Battery-powered cars will swell to 8.1% of all sales next year in China, which accounts for the largest share of global EV sales, and to 5% in Europe, BNEF predicts.

“The pandemic may have a lasting effect throughout 2020, but won’t be a major factor next year,” Zeng said. “We have great confidence for the long run.”

Gassed

CATL struck a two-year contract in February to supply batteries to Tesla, a major boon for the Chinese company as the U.S. electric-car leader has thus far mainly worked with Japan’s Panasonic Corp. and South Korea’s LG Chem Ltd. The deal followed months of negotiations, with Tesla Chief Executive Officer Elon Musk traveling to Shanghai to meet with Zeng.

The CATL batteries are set to go into Model 3 sedans produced at Tesla’s massive new factory near Shanghai, which started deliveries around the beginning of this year. Batteries are the costliest part of an EV, meaning suppliers of those components have a chance to reap a lion’s share of the industry’s profits.

Bloomberg Opinion Column On Battery Costs

Zeng said he often shares insights with Musk, with the two exchanging text messages about developments in technology and business. CATL is strengthening its relationship with Tesla, with matters such as cobalt-free batteries on their agenda, Zeng said.

“We’re getting along well and he’s a fun guy,” Zeng said of Musk. “He’s talking about cost all day long, and I’m making sure we have the solutions.”

Zeng said Musk also requested his help in obtaining ventilators for coronavirus patients. The U.S. billionaire delivered more than 1,000 of the breathing machines from China to officials in Los Angeles in March.

Shares of CATL have advanced about six-fold in Shenzhen since its initial public offering in 2018, giving the company a market value of about $47 billion. Tesla, by far the most valuable EV maker, has a market capitalization of about $160 billion.

A “trigger point” for electric cars will occur once they overtake gasoline-powered vehicles around 2030-2035, Zeng said. That view is more ambitious than that of researchers such as BNEF, which expects the shift to take place a few years later.

CATL, which is adding a production facility in Germany, is set to make more than 70% of batteries required by BMW, an early customer, Zeng said. CATL also works with Volkswagen’s Audi unit and is cooperating with Porsche, he said.

Zeng didn’t rule out building a plant in the U.S., though he said the company has no specific plans for now.

“Our team has made achievements in competing with our global rivals in overseas markets,” Zeng said.

Updated: 7-22-2021

Startup Claims Breakthrough In Long-Duration Batteries

Form Energy’s iron-air batteries could have big ramifications for storing electricity on the power grid.

A four-year-old startup says it has built an inexpensive battery that can discharge power for days using one of the most common elements on Earth: iron.

Form Energy Inc.’s batteries are far too heavy for electric cars. But it says they will be capable of solving one of the most elusive problems facing renewable energy: cheaply storing large amounts of electricity to power grids when the sun isn’t shining and wind isn’t blowing.

The work of the Somerville, Mass., company has long been shrouded in secrecy and nondisclosure agreements. It recently shared its progress with The Wall Street Journal, saying it wants to make regulators and utilities aware that if all continues to go according to plan, its iron-air batteries will be capable of affordable, long-duration power storage by 2025.

Its backers include Breakthrough Energy Ventures, a climate investment fund whose investors include Microsoft Corp. co-founder Bill Gates and Amazon.com Inc. founder Jeff Bezos. Form recently initiated a $200 million funding round, led by a strategic investment from steelmaking giant ArcelorMittal SA, MT 0.95% one of the world’s leading iron-ore producers.

Form is preparing to soon be in production of the “kind of battery you need to fully retire thermal assets like coal and natural gas” power plants, said the company’s chief executive, Mateo Jaramillo, who developed Tesla Inc.’s Powerwall battery and worked on some of its earliest automotive powertrains.

On a recent tour of Form’s windowless laboratory, Mr. Jaramillo gestured to barrels filled with low-cost iron pellets as its key advantage in the rapidly evolving battery space. Its prototype battery, nicknamed Big Jim, is filled with 18,000 pebble-size gray pieces of iron, an abundant, nontoxic and nonflammable mineral.

For a lithium-ion battery cell, the workhorse of electric vehicles and today’s grid-scale batteries, the nickel, cobalt, lithium and manganese minerals used currently cost between $50 and $80 per kilowatt-hour of storage, according to analysts.

Using iron, Form believes it will spend less than $6 per kilowatt-hour of storage on materials for each cell. Packaging the cells together into a full battery system will raise the price to less than $20 per kilowatt-hour, a level at which academics have said renewables plus storage could fully replace traditional fossil-fuel-burning power plants.

A battery capable of cheaply discharging power for days has been a holy grail in the energy industry, due to the problem that it solves and the potential market it creates.

Regulators and power companies are under growing pressure to deliver affordable, reliable and carbon-free electricity, as countries world-wide seek to reduce the greenhouse-gas emissions linked to climate change. Most electricity generation delivers two out of three. A long-duration battery could enable renewable energy—wind and solar—to deliver all three.

The Biden administration is pushing for a carbon-free power grid in the U.S. by 2035, and several states and electric utilities have similar pledges. There is widespread agreement that a combination of wind, solar, geothermal and nuclear power mixed with short-duration lithium-ion batteries can generate 80% of electricity. The final 20% will require some type of multiday storage.

“That first 80% we know the technology pathway, and it is already cost competitive,” said Jeremiah Baumann, deputy chief of staff at the Energy Department. “We have a good sense of the technology for the final piece. The real question is which technology is going to get its cost down and get into the marketplace.”

Form’s battery will compete with numerous other approaches in what is becoming a crowded space, as an array of startups race to develop more advanced, cost-effective energy-storage techniques.

Several companies are heading to market with different battery configurations, such as solid-state designs. Some think pumped water storage or compressed air can be used more widely to bank energy. The European Union is pushing the use of hydrogen to store and generate power.

Others, meanwhile, are focusing on carbon-capture technology to make gas- and coal-fired power plants emission-free, which would reduce the need for storing energy.

Form Energy’s iron-air battery breathes in oxygen and converts iron to rust, then turns the rust back into iron and breathes out oxygen, discharging and charging the battery in the process.

“There is a Cambrian explosion of new storage technologies and in a Darwinian sense, they are not all going to survive. But the prize is huge both for investors and for society,” says Ramez Naam, a clean-energy investor who isn’t involved with Form Energy.

Previous high-profile efforts to develop better batteries have arced from hope and hype to bankruptcy. But since Form was created in 2017, it has attracted speculation and intrigue within the industry due to the track records of its founders. They include Mr. Jaramillo and Yet-Ming Chiang, a professor at the Massachusetts Institute of Technology who co-founded A123 Systems Inc., a lithium-battery pioneer.

Mr. Jaramillo earned degrees in economics and a master’s degree from the Yale Divinity School before switching to a career developing new batteries. After more than seven years at Tesla, he left in 2016 to pursue what he called “The Next Thing” on his LinkedIn page. He didn’t provide any details, but he wanted to build an inexpensive battery for the grid. He was close to signing a funding sheet for a new company when Mr. Chiang called him.

Mr. Chiang arrived at MIT as an undergraduate and joined the faculty less than a decade later. He started working on a long-duration battery in 2012 as part of a Energy Department collaboration. In 2017, he was also working on long-duration batteries and he and Mr. Jaramillo decided to together create Form Energy.

They recruited other battery-industry veterans. “The founding team has 100 years of battery experience,” says Mr. Chiang.

“We’re the alumni of a generation of failed battery companies who all came back for more.”

In early 2018, they began small-scale tests, the Ph.D. material scientist’s version of a middle-school science fair’s potato battery, using small pieces of metal wrapped in hardware-store hose clamps at the bottom of translucent measuring cups. Form tested different configurations: sulfur-iron, sulfur-air, sulfur-manganese and iron-air. By the end of the year, iron-air looked the most promising.

In 2020, as work was moving quickly, Form caught a break. It needed a critical battery component called a cathode that was impermeable to water but breathed oxygen, like a Gore-Tex jacket. An Arizona battery company, NantEnergy Inc., had spent a decade building such a membrane for a zinc-air battery. Owner Patrick Soon-Shiong, a billionaire biotechnology entrepreneur who owns the Los Angeles Times, wound down operations last year to focus on other investments.

Form bought its patents as well as its inventory of thousands of cathodes, which sit in cardboard boxes in a corner of the company’s building. “Having this piece nailed down allowed us to hit the accelerator,” said Mr. Jaramillo.

Late last summer, Form built a one-meter-tall (roughly 3.3-foot-tall) battery it called Slim Jim because it had the dimensions of a trash can of the same name. Earlier this year, it built Big Jim, a full-scale one-meter-by-one-meter battery cell.

If it works as expected, 20 of these cells will be grouped in a battery. Thousands of these batteries will be strung together, filling entire warehouses and storing weeks’ worth of electricity. It could take days to fully charge these battery systems, but the batteries can discharge electricity for 150 hours at a stretch.

In 2023, Form plans to deploy a one-megawatt battery capable of discharging continuously for more than six days and says it is in talks with several utilities about battery deployments.

Mr. Chiang, who is the company’s chief science officer, said the challenge was to figure out how to make a battery using iron, air and a water-based electrolyte.

“Chefs will tell you it is harder to make an excellent dish with common ingredients,” he said.

Updated: 7-29-2021

Top EV Battery Maker Adds Sodium To Its Recipe Book

China’s CATL, a Tesla supplier, says cheaper element could lower vehicle cost.

Contemporary Amperex Technology Co., the world’s biggest maker of electric-vehicle batteries and a Tesla Inc. supplier, said it was looking to make batteries using sodium ions, a technology that could reduce costs and lift performance.

CATL is the first battery maker in the top global tier to adopt sodium-based battery technology, which offers promise because sodium is relatively plentiful and cheap. Other major players in the automotive business such as Panasonic Corp. and LG Chem Ltd. have focused on improving battery recipes that rely on less easily mined elements such as lithium, cobalt and nickel.

Commercializing sodium-based batteries still faces challenges. CATL said the energy density of its new battery—the amount of energy it stores per unit of volume—is lower than that of an EV battery widely used in China known as lithium ferrophosphate.

Companies are racing to bring down the cost of making an electric vehicle so that it matches traditional gasoline-powered vehicles. UBS Group AG has calculated that electric-vehicle battery packs and motors cost $4,000 more to manufacture than a comparable gasoline-burning midsize sedan engine, a difference it believes will disappear by mid-decade.

CATL’s market capitalization has climbed sharply this year and stands at about $200 billion, according to FactSet, making it one of China’s most valuable companies. Investors have bought the battery maker on optimism over the EV wave. It supplies EV makers such as Tesla, Daimler AG’s Mercedes-Benz unit and Chinese car makers.

CATL, in an online briefing, said sodium-based batteries have other uses beyond EVs such as storing power on an electricity grid. It said it was in talks with potential customers and planned to put a supply chain in place by 2023.

It didn’t name the customers. Tesla Chief Executive Elon Musk has said the car maker is working on technologies to significantly lower the cost of batteries.

Lithium-ion batteries are widely used in smartphones, laptop computers and EVs despite challenges including fire risk and the cost of mining lithium in remote locations.

The cost of sodium could be a fraction of lithium and EVs could charge more quickly, said Dennis Chien, a senior analyst at Hong Kong-based investment company HSZ Group. “I think there’s a great potential that sodium-ion batteries will play an important role” in EVs, he said.

CATL and other sodium-ion battery makers still need to show they can manufacture in large quantities. “The manufacturing cost could remain high and it would lose its advantage in competition if the industrialization process isn’t moving as smoothly as expected,” Chinese securities firm Everbright Securities wrote in a recent report.

CATL researcher Qisen Huang said the company’s sodium-ion batteries charge quickly and perform well in cold weather.

Sodium ions are charged particles of the element sodium that travel back and forth between the battery’s electrodes as it stores and discharges energy.

CATL also showed images of a proposed battery pack that combines sodium-ion and lithium-ion batteries. That would be a way of maintaining good range on a single charge while ensuring the vehicle doesn’t break down in cold weather.

Updated: 8-14-2021

Berkshire’s Battery Bet Wasn’t Flashy, But It’s Working

BYD’s electric vehicles don’t have the coolness factor. Their battery technology, however, is turning heads and boosting shares.

Warren Buffett Calls It Right on EV Batteries — Anjani Trivedi

Warren Buffett gets lots of investments right with his patient and deliberate buy-and-hold strategy. And it’s becoming apparent that he’s doing it again with electric vehicles. For investors pouring money into the technology, it would be wise to consider how the Sage of Omaha has looked into the future of the sector.

The value of Berkshire Hathaway Inc.’s holdings in BYD Co. Ltd., one of China’s oldest makers of cars and automotive batteries, has skyrocketed this year: BYD’s share price is up almost 30%. Buffett has backed BYD for over a decade, holding around 22% in the Hong Kong-listed company, which now sits on a market capitalization of over HK$915.6 billion ($117.6 billion). That’s more than investor darling Nio Inc., the new-generation Chinese automaker listed in New York.

So how is that different from the rest of the EV universe, which just keeps on surging?

Updated: 9-7-2021

Toyota To Spend $9 Billion On Electric-Car Battery Plants

Japanese car maker, late to the electric-vehicle race, accelerates plans as sales grow.

Toyota Motor Corp. said it would spend $9 billion over the next decade to build factories for electric-car batteries as it gears up to sell two million electric cars annually by the end of the decade.

The world’s largest car maker by vehicle sales has been relatively late in joining the global race to produce and sell battery-powered cars. For years, Toyota said it didn’t think battery-powered cars were a good solution to climate- and pollution-related concerns because the batteries were too expensive and took too long to charge. The company viewed hybrid gas-electric vehicles, which it pioneered, as the better option.

More recently, Toyota has ramped up spending on electric cars as countries began implementing stricter emissions regulations and sales of EVs grow.

The company declined to say how many battery factories would be built but said it planned 10 production lines by 2025 and eventually around 70. A single factory can contain several production lines.

The factories will be built around the world, said Masamichi Okada, Toyota’s chief production officer. “We want to localize production as a general principle,” he said.

Toyota has said it wants about 80% of its cars to include some battery power by 2030. Most of those would be hybrids but it also intends to sell about two million pure electric vehicles annually by then, a figure that includes battery-powered cars and those powered by hydrogen fuel cells. It has said it intends to start selling a fully electric sport-utility vehicle called the bZ4X next year.

Toyota’s announcement follows similar plans laid out by its global competitors. General Motors Co. , Ford Motor Co. and Volkswagen AG have all said they plan to build their own battery factories.

Toyota’s closest competitor in terms of sales, Volkswagen, hasn’t disclosed how much it plans to spend on these factories, but VW has said that by 2030, in Europe alone it would be able to produce batteries with output of 240 gigawatt-hours of electricity annually. Toyota said its factories would produce around 200 gigawatt-hours of batteries by the same deadline.

The roughly $9 billion investment in production is part of a plan to spend around $13.5 billion overall on batteries, with the remainder going into research, Toyota said.

Toyota has been slower than some competitors to bring an electric car to the market because it wants to offer consumers a good combination of safety, price and performance, said Masahiko Maeda, Toyota’s chief technology officer.

“There’s a trade-off. If we focus on safety, then performance suffers,” Mr. Maeda said. The company is trying to build its batteries so they retain 90% of their charging capacity after a decade, a target that is still elusive, Mr. Maeda said.

For years Toyota has been researching a solid-state battery in which the electrolyte—the material through which electrons flow as they travel between the battery’s terminals—consists of solid material. Standard lithium-ion batteries in today’s electric vehicles and smartphones have liquid electrolyte.

In theory, solid-state batteries could pack more power and recharge faster because they don’t have the fire risk of liquid-electrolyte batteries. But Mr. Maeda said Toyota was still dealing with development challenges, in particular the solid-state battery’s lifespan. He said it sought to sell a car containing the battery this decade.

“We cannot be optimistic yet. There are a lot of difficulties we are facing,” Mr. Maeda said. “We are looking for the best material for solid-state batteries.”

Updated: 9-9-2021

Battery Makers Tied To Power Grid Attract Big Investors

Investment firms have committed hundreds of millions of dollars to startups developing so-called long-duration batteries.

Big investors are charging into startups touting experimental new battery technologies that would make it possible for renewable energy sources to produce most of the country’s electricity.

Deep-pocketed investment firms such as TPG, Apollo Global Management and Paulson & Co. in recent months have plowed hundreds of millions of dollars into the companies, which make what are called long-duration batteries.

Unlike mobile-phone or electric-car batteries that can deliver electricity for about four hours straight, long-duration batteries can discharge for longer periods, ranging from six hours to several days, and store far more power.

That allows them to overcome the major drawback of renewable energy: The wind doesn’t always blow and the sun doesn’t always shine. The batteries can release electricity into the power grid when customers need it, cutting dependence on fossil fuels. They can also be used as backup power sources after storms.