Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

World Economy Faces Debt Doom Loop, More Inequity Post Pandemic. Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

The world economy will be exiting the pandemic weighed down by much bigger debts and increased inequality that could hobble growth in the longer term.

Related:

Ultimate Resource Covering Bitcoin’s Impact In Africa And The African-American Community

Surge In Celebrities And Others Contributing To Nonprofits Focusing On Blacks

A List Of Top 10 African Women To Watch In Blockchain And Bitcoin

10 Women Who Used Crypto To Make A Difference In 2021

1 in 5 Crypto Holders Are Women, New Report Reveals

Less Than 5% Of Crypto Code Commits On Github Made By Women: Report

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency

Happy International Women’s Day! Leaders Share Their Experiences In Crypto

Scarlette Bourne Joins Our List of 2023’s Most Influential Women

Meet The Women Who Track Down And Kill Poachers

While global growth is widely expected to strengthen as more people are vaccinated, top economists at the virtual three-day conference focused on the glaring inequities that the pandemic had exposed and the fall-out from the efforts to cope with and combat Covid-19.

“We have met every crisis in the recent past with yet more aggressive central bank accommodation and yet more leverage, both public as well as private,” said former Reserve Bank of India Governor Raghuram Rajan. “The real question is: Is this a doom loop? Does it keep going until it is forced to stop?”

Global debt rose by more than $15 trillion last year to a record $277 trillion, equivalent to 365% of world output, according to the Institute of International Finance. Debt from all sectors — ranging from household to government to corporate bonds — surged, based on data from the Washington-based IIF, which is comprised of the world’s leading financial institutions.

Inequality has also increased — both within and across countries — as the pandemic has hit the poor particularly hard. In the U.S., Blacks and Hispanics have suffered proportionately more fatalities than whites, while low-wage workers in such industries as leisure and hospitality have borne the brunt of the layoffs as those better off continue to work from home.

Financial Disparity

Share Of U.S. Net Worth By Race And Ethnicity Since 2005

“The pandemic has exposed the depth of inequality and in many ways has exacerbated those inequalities,” said Joseph Stiglitz, a Nobel Prize-winning economist.

While rich countries like the U.S. have cushioned the blow to their citizens with massive amounts of government aid, poorer nations have been unable to do that. Stiglitz, a Columbia University professor, said the world’s 46 least developed nations accounted for just 0.002% of the $12.7 trillion in public stimulus spending laid out in the fight against the virus.

“In many ways we could see after this pandemic an unwinding of decades of progress toward reducing global inequality,” certainly for the poorest nations, said Harvard University professor and former International Monetary Fund chief economist Kenneth Rogoff.

Not everything coming out of the pandemic will be bad news, of course. The speed at which vaccines were developed and the rapid growth of telemedicine are developments worth celebrating.

Economist Nicholas Bloom of Stanford University has also pointed to the potential productivity gains that can be reaped from more time spent working at home — a trend he expects to persist post pandemic. Rajan, now a professor at the University of Chicago, said lagging rural America could also benefit as the well-off decamp from cramped cities for bigger homes elsewhere.

Debt Burden

Even before the pandemic, the U.S., China and many other countries were experiencing rising inequality and increasing debt. As the coronavirus crisis eases, those two tendencies could combine to present problems for the global economy.

Covid-19 has “exacerbated inequality markedly which also raises the issue of financial fragility,” said World Bank chief economist Carmen Reinhart.

Many lower-income U.S. households, for example, hold a lot of debt and could find themselves squeezed as temporary moratoriums on mortgage and rent payments end, she said.

Rajan said small businesses could also suffer after many were kept afloat in the U.S. by the Paycheck Protection Program and other government measures. “There is a large wave of potential bankruptcies,” he said.

‘Global Consequences’

The problem is even more acute for some emerging market economies and poorer nations. Indeed, Stiglitz sees the “risk of a debt crisis with global consequences.”

“Many countries were over-indebted before the pandemic and the marked declines in their incomes mean they’re going to have difficulties servicing the debt,” he said.

The U.S. and other wealthier nations though will not be immune to having to take action to rein in surging government debt once the coronavirus crisis has passed, according to former White House chief economist Christina Romer.

The U.S. budget deficit will hit $2.3 trillion in the fiscal year ending on Sept. 30 — equivalent to more than 10% of gross domestic product — following a $3.1 trillion shortfall in fiscal 2020, according to the Committee for a Responsible Federal Budget.

“When we are through the pandemic we are going to need to get our fiscal houses in order,” said Romer, who is now at the University of California, Berkeley. “We’re going to need to get our debt loads down mainly so we’ll be in a position to deal with the next crisis, pandemic, or whatever when it comes.”

White American Wealth Hits Record High On Pandemic Stocks Surge

The net worth of White Americans hit a record high last year, driven by a stock-market rebound that defied the pandemic, while other ethnic groups saw their share of the nation’s wealth decline, according to recently released data from the Federal Reserve.

Wealth held by White households rose to $98.6 trillion in the third quarter of 2020. That amounts to 84.6% of the total, the biggest share in three years.

By contrast, the portion of overall wealth held by Black Americans fell to 3.8% — down from 4.4% two years earlier — while for Hispanic Americans it dropped to 2.1%.

The shift was largely driven by stock markets. White households own almost 90% of corporate equities and mutual funds, which posted a $2 trillion jump in value during the third quarter.

Meanwhile, assets held by other groups proved more vulnerable to the coronavirus slump. Wealth held by Hispanic households in the form of business ownership, for example, slumped by almost one-quarter from a year earlier to $188 billion, the lowest since 2013.

Non-Hispanic White people account for about 60% of the U.S. population. That figure has been declining in the longer term, one reason why the White share of national wealth has dropped from 92% in 2000. White Americans are also older on average than other groups, meaning they’ve had more time to accumulate wealth.

Updated: 12-5-2022

The Biggest Black-Owned Vintner Wants To Help More Women Break The (Wine) Glass Ceiling

After building a thriving wine business, the McBride sisters are trying to improve equity in spirits and hospitality.

For almost half their lives, the McBride sisters didn’t know each other existed. Robin McBride had grown up in California and Andréa McBride-John in New Zealand, and the two only met in 1999, after the death of their father.

One of his last requests to his family was to find his daughters and tell them about each other.

The family located Andréa after a long search and invited her to visit them in Alabama. While she was there Robin called. Speaking for the first time, the sisters immediately made plans to get together—the next day, in New York.

“As soon as we met, we recognized each other immediately and hugged,” Andréa recalls. “There was an instant bond.”

Andréa began studying at the University of Southern California, and in the coming years the two met frequently. Both had grown up in areas thick with vineyards—Andréa in Marlborough, at the northern tip of New Zealand’s South Island, and Robin in Monterey, California—so wine was typically on the table and on the list of things they talked about.

One point they kept coming back to: The industry was overwhelmingly White and male, with only 1% of US wine producers owned by Black people. As Black women, they thought, they could begin to change that.

“We had a lot of pushback as to whether or not Black women even drank wine, or if Black women could run a wine business,” Robin says. “This fueled our passion and our mission.”

In 2005 they decided to jump into the business, but since they had scant experience they began slowly, importing wines from producers Andréa knew in New Zealand.

Four years later, they began producing their own vintages there, and in 2014 they formed a partnership with spirits giant Diageo to create and sell a California wine called Truvée.

“We didn’t have any wine business expertise and no capital, but we did have a lot of passion,” Andrea says. “I think we had the naivete to not fully understand what we were embarking on, so it didn’t scare us.”

The Diageo partnership lasted just two years, and in 2017, seeking greater control of the business, they formed their own label, using grapes from suppliers across California and New Zealand.

They soon introduced McBride Sisters Collection Reserve vintages, Black Girl Magic wine and She Can spritzers and coolers (delivered, of course, in cans). Deals they’ve sealed with big US supermarket chains and online retailers helped the company more than double sales last year.

For the sisters, inclusivity and equity are paramount. The McBride Sisters Wine Co. is the world’s biggest Black-owned winery. Just over half their employees are people of color, and 93% are women—including the entire winemaking team.

As the business has grown, the two have sought to give back to their community. In 2019 they launched the She Can Development Fund, which mentors women in the industry and offers scholarships and grants.

Over the past three years, the sisters have contributed over $400,000 to the fund, Meta Platforms Inc. kicked in $2 million, and other companies have helped out with smaller amounts.

In total, the fund has provided more than $3 million to 3,000 women in spirits, hospitality, consumer goods and more. “We got to a place in our business growth where we felt we can help other women,” Robin says.

The sisters have since launched various brand extensions and innovative strategies to raise their profile: a book club where titles are paired with one of their vintages, a wine club, and wine- and food-themed events across the US and Caribbean.

But while the business is thriving and anecdotal evidence indicates there are more people of color among vintners these days, they insist much more must be done before the industry can really be called diverse.

“There is definitely a generational change happening, with more women and people of color in middle management positions,” Andréa says. Adds Robin: “Success will be when the industry fully represents the world around us and isn’t dominated by one gender or race, but represents the consumer.”

Updated: 2-1-2023

Bitcoin Advocate Najah Roberts Explains Why BTC Is A Tool For Empowerment

The Agenda podcast explores the concept of financial sovereignty, Black American empowerment and the promise of Bitcoin with the revolutionary Najah Roberts.

If you ask 10 people what Bitcoin’s original purpose is, at least one person will say it’s meant to cut out the middleman, reduce the cost of transacting and empower those who might not have access to modern financial infrastructure.

While all of those boxes might be ticked, another phenomenon of financial technology, and technology in general, is that not everyone benefits equally from the revolutionary change it brings.

Of course, this happens for a variety of unique reasons, some intentional and others unintentional, but the phenomenon of technological change leaving some people behind presents a rather unique question.

How Can Bitcoin Empower Black Americans?

In this week’s episode of The Agenda — a Cointelegraph podcast that explores the promises of crypto, blockchain and Web3, and how regular people level up and improve their lives with technology — hosts Ray Salmond and Jonathan DeYoung dig deep into the topic with Najah Roberts, an activist, educator and founder of several crypto-related organizations, including Black Bitcoin Billionaire, a brick-and-mortar Bitcoin exchange and a tech-focused children’s camp.

According to Roberts, Bitcoin itself is the last great hope and opportunity for Black American empowerment; and for this reason, she has dedicated the last five years to spreading the good word of Satoshi Nakamoto and the basic tenets of financial literacy.

Bitcoin Could Be The Road To Freedom

As A Base Case For Her Raison D’etre, Roberts Explained That:

“The Emancipation Proclamation was signed over 150-something years ago. And at that time in this country, Black people in America held less than 1% of the wealth. And here we sit, in 2022, and factually, Black folks in America own less than 1% of the wealth. […] Bitcoin affords us the opportunity to have some self-sovereignty and to be able, for the first time in history, to have control of our money — because he who holds the money rules everything. And so if we are holders of our money, we’ll be able to rule our own lives. And I’m excited about that for our community.”

Roberts explained that financial self-sovereignty is paramount, especially in systems like in the United States where the tools and resources that lead to generational wealth creation have historically been denied to certain groups.

“We’ve got to get self-sovereign because nobody’s looking out for us except for us, and we got to get that in our head. And that’s what we’ve been teaching the community. So, Bitcoin is just the first stepping stone. Again, he who holds the money holds the power.

And so we want to hold our own money so we have power to do the things that we need to do, not only in our families but in our communities. Because when it boils down, everything revolves around the economics.”

Revolutions Are Not Often Televised

When asked about Bitcoin’s high volatility, the proliferation of scams in the crypto sector and whether or not it’s smart to advise people with limited financial literacy skills to invest in an emerging, risky asset like Bitcoin, Roberts hinted that the revolution would not be televised.

According to Roberts, literacy is the gateway to self-sufficiency, so her initial focus, and that of the digital underground, is to first help people understand the value of saving, regardless of how much they are able to save.

She emphasizes concepts that revolve around compound interest and dollar-cost averaging, and in regard to volatility, Roberts reminds potential investors that time in the market is more effective than attempting to time the market.

“I am not teaching our community to time the market because time in the market is better than timing the market. So, I’m teaching our community to dollar-cost average. […] Whatever it is that you are doing on a regular basis, continue to do that, but just add some satoshis to your portfolio.

So, if you’re going to Starbucks seven times a week, I’m not telling you don’t go to Starbucks — I’m saying go six instead of seven, or five instead of seven, and take that $6 from that coffee and buy yourself some satoshis.”

To hear more from Roberts, tune in to the full episode of The Agenda on Cointelegraph’s new podcasts page, Spotify, Apple Podcasts, Google Podcasts or TuneIn — and be sure to check out Cointelegraph’s other new shows as well.

Updated: 2-2-2023

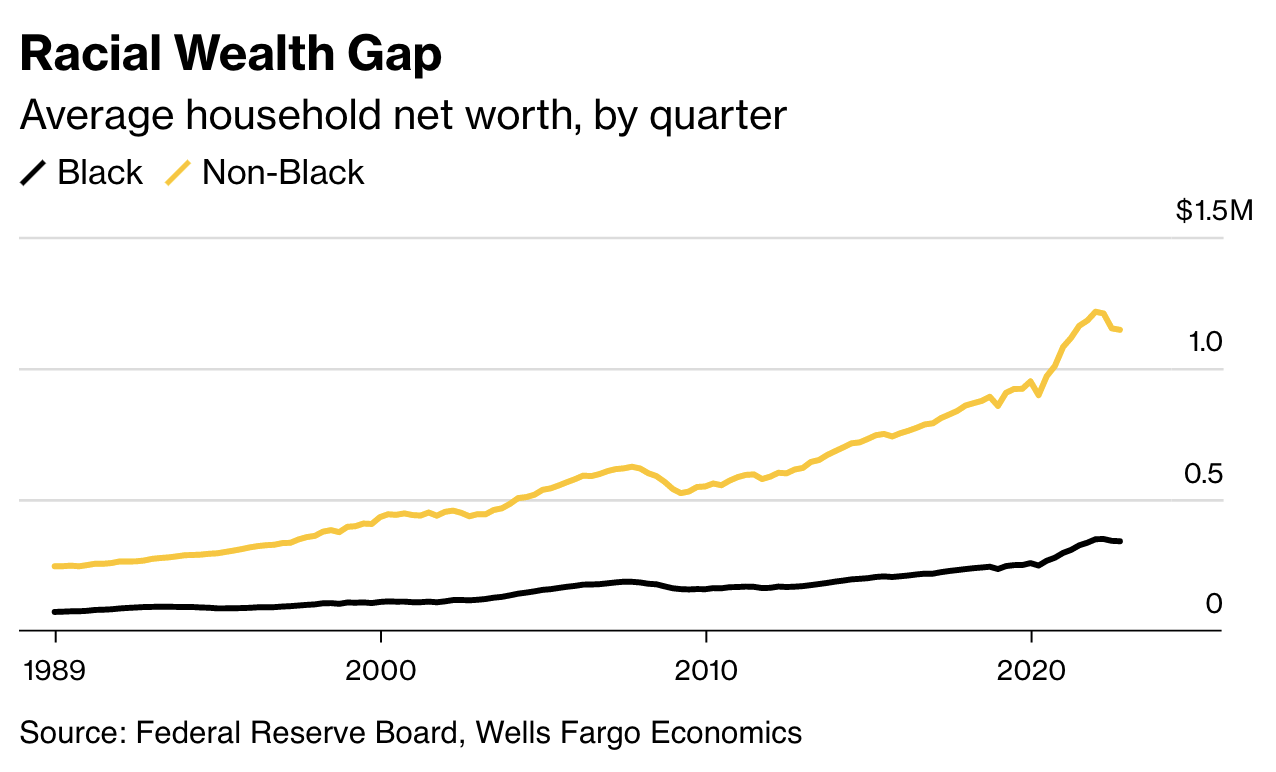

Black Families Shrink The US Wealth Gap But Still Have 70% Less

Net-worth gains for Black households have outpaced other groups since the pandemic.

Black families are closing the US wealth gap, but still lag far behind other groups in net worth.

Since the end of 2019, the average net worth for Black households rose 32% through the third quarter of last year, according to a Wells Fargo & Co. report. That compares with a 21% increase for non-Black households.

Even with recent growth, Black wealth still trails in actual dollars: about $340,000 per household on average, compared to $1.1 million for their non-Black counterparts, per the report.

The racial wealth gap — the legacy of slavery and systemic racism that excluded many African Americans from opportunities for financial advancement — could get worse for coming generations, researchers have said.

“The big takeaway is the Black and African American community has made headway relative to before the pandemic,” Jay Bryson, chief economist for Wells Fargo’s corporate and investment bank, said in an interview.

“Directionally the improvement we’ve seen in the last three years is all positive, but when you still look at the absolute levels there’s still a pretty big gap there.”

Homeownership has contributed to recent gains. Buoyed in part by low mortgage rates, the percentage of African American homeowners rose to 45.2% in the third quarter of 2022, up from 42.7% three years earlier.

It still lags far behind that of White households, however, at 75%.

Counterintuitively, a lack of asset diversification also helped bolster net worth, given the brutal losses for stocks in 2022. Corporate equities and mutual funds make up just 5% of Black household assets, compared to 24% for non-Black households.

A recession in the coming months may undo some of this progress, Wells Fargo warned. But demand for service jobs, where Black workers are typically overrepresented, could offset job losses in more sensitive sectors.

And the labor market recovery for African American workers has been much quicker in this cycle than in the wake of the Great Recession, with the group seeing above-average wage gains after being hit hard in the early part of the pandemic.

Updated: 2-15-2023

Black Women Are Banding Together To Leave America Behind. Here’s Why

Groups like ExodUS and Blaxit Global provide advice and support for women who would like to find a better quality of life outside US borders.

In 2015, Stephanie Perry left her job as a pharmacy technician on the night shift and spent 12 months traveling across Southeast Asia, Australia and parts of Europe.

“I felt like my life revolved around my work, but traveling around the world showed me that there is another way,” says Perry, who is Black and in her 40s. “You can have a full life in other countries that we don’t necessarily have in the US.”

She wasn’t alone. The past three years of Covid-19 and increased social upheaval in America have caused a small but significant exodus of Black professional women from the US in search of a better quality of life. They are packing up, some with kids in tow, starting businesses abroad and not looking back.

Michelle Wedderburn, now in her 50s, says she left Florida for San Miguel de Allende in 2018 with her now 10-year-old son primarily because she wanted to raise him to be bilingual, but also because she was concerned about school shootings in the US and the easy access to illegal drugs in South Florida. “I wanted his childhood to resemble a time when things were simpler,” she says. “Mexico provides us with this.”

Ashley Cleveland, a high-income tech professional working 60-hour weeks in Atlanta, got her third pink slip in five years in January 2020. After therapy for burnout and severe depression, the then-36-year-old realized she needed to change her environment.

“I was living in a society that did not value the mental or physical wellness of Black women,” she says. Cleveland moved to Tanzania with her daughters, age 2 and 11, before settling in South Africa a month ago.

In September 2020, Perry co-founded the ExodUS Summit, a digital platform to help women determine how to leave the US. It featured talks on planning for long-term travel, finding house-sitting opportunities abroad and turning expertise into an online business. Perry thought a dozen women might sign up for the event, but more than 3,000 registered.

In 2022 the third online summit hosted more than 4,500. A private Facebook group now includes almost 9,000 members who share relocation tips and host meetups in the US and overseas. Other groups have also formed since 2020, such as Blaxit Global.

“This is a movement,” Perry says. “I think Black women have discovered that the American dream is not necessarily possible in America.” A survey of 2020 summit attendees showed that 25% to 30% of members earned more than $200,000 a year and held graduate or professional degrees. The majority are also Generation Xers or baby boomers.

The first wave of Black women leaving the US could afford to move without needing to work, Perry explains. A second wave of working women is now looking for different ways to make money or find remote jobs. Perry and her business partner, Roshida Dowe, a former lawyer who retired early at 39 in Mexico City, offer coaching on turning ideas into online businesses and obtaining residency.

They also bring in women to teach various freelancing skills and show them how to make money in real estate and investing.

Popular relocation destinations among Black Americans include Mexico, Portugal and the Caribbean. Some have settled as far away as Bangkok. “I expect there to be a time when we look back and say this was another Great Migration,” Perry says. Many of these destinations have a lower cost of living.

Racist encounters aren’t eliminated abroad, but life can be easier thanks to the privilege that comes with being an American. “Outside of the US, money often trumps anti-Blackness,” says Dowe, though she recognizes the issue is fraught. (Whether richer immigrants are displacing local populations is a topic for another article.)

The wealth disparity between Black and White Americans has worsened in recent decades. As of 2019, Black Americans had one-sixth of the wealth of White Americans.

More than half of Black Americans also say that overcoming wealth inequality is a struggle no matter how hard they work, according to a Pulse of Black America survey. Concerns over disparate health-care treatment and voting rights are also high, the report showed.

In Mexico, Wedderburn makes money by offering move-abroad consultations and selling “relocation tours”—weeklong stays to acclimate to San Miguel de Allende. Guests go on excursions, scout neighborhoods with a real estate agent and listen to presentations from medical insurance and immigration experts.

Her guesthouse, Casa ELM, opened in 2022. She adds that she has more living space than she had in Florida, and her rent hovers around $600 a month for a three-story, three-bedroom home.

For Cleveland, the cost of living came to almost $10,000 a month in Georgia, but her budget in Tanzania—with two daughters, a full-time house helper, a driver, groceries and vacations—added up to only $2,500 a month.

Buying as a Black person in America “is not sustainable. It doesn’t shelter you from racism and White supremacy,” Cleveland says, citing recent allegations of discrimination by the Black couple who purchased Freedom Acres Ranch in rural Colorado.

“So let’s try something new. That’s really all it is,” she adds. Cleveland’s company, BrandUp Global, helps Americans expand their businesses in Africa and invest there.

Perry has settled in San José, Costa Rica, for at least the next five years. She rejects the argument that Black women are abandoning a country they worked hard to build.

“There are people who expect to magically get something from the United States that they have not gotten so far and that their parents have never gotten, and their great-grandparents,” she says.

“If what you want is a life of peace, a life of safety, a life of joy, you should have that, and it’s much easier for Black women to have that in other countries.”

Updated: 8-16-2023

The Mysterious Fall And Rise Of The Black Unemployment Rate

After a roller-coaster move this spring, it’s now essentially back to where it was in February. How much is statistical noise?

In March, the unemployment rate for Black Americans fell to 5% from 5.7% the month before. This was the lowest Black unemployment rate ever recorded in the Bureau of Labor Statistics monthly data, which goes back to 1972.

It wasn’t really an all-time low — a 1953 BLS study estimated that the Black unemployment rate had been 4.6% the previous year, and even lower during World War II — but the 1.8 percentage-point gap in March between the Black unemployment rate and the White rate of 3.2% may have been (it was 2.2 percentage points in 1952).

These milestones understandably received a lot of attention. When the Black unemployment rate fell to 4.7% in April, and the Black-White gap contracted to just 1.6 points, that received attention, too.

1. Then the Black unemployment rate jumped to 5.6% in May and 6% in June, generating headlines of a less-positive sort, while the White rate barely budged. In July, it fell back to 5.8%, pretty much where it was in February.

What are we to make of this roller coaster? Right now, the best answer seems to be “not much.”

As should be clear from the above chart, the Black unemployment rate is much more volatile than the White one. So volatile that there’s a good chance its headline-generating fall and rise this spring was just statistical noise.

There’s also a chance that it conveyed some information — maybe Black unemployment truly did bottom out in April and will continue its fitful rise in coming months, in which case it will likely be followed by an overall unemployment increase.

But it’s important to keep in mind that while even small movements in the headline unemployment rate usually convey information, month-to-month changes among subgroups often don’t.

The unemployment statistics are derived from the Current Population Survey, which the Census Bureau conducts every month on behalf of the BLS. As surveys go, the CPS is gigantic. Remember those New York Times-Siena College poll results about the presidential horse race and other topics that were released a couple of weeks ago?

They were based on the opinions of 1,329 registered voters. The CPS contacts 60,000 households every month, collecting information on about 110,000 individuals.

As a result, the estimated sampling errors are much smaller for the CPS than for political polls. The margin of error in that New York Times-Siena poll was plus or minus 3.67 percentage points.

The CPS is designed, according to the BLS, to ensure that “assuming a national unemployment rate of 6.0 percent, an over-the-month change of roughly 0.2 percentage points be statistically significant at the 90-percent level of confidence.”

In July, the error margin for the overall 3.5% unemployment rate was plus or minus 0.09 percentage points, and the cutoff for statistical significance in the change from June was 0.18 points.

It is this level of precision that allows for tools like the “Sahm rule” recession indicator, based on economist (and Bloomberg Opinion columnist) Claudia Sahm’s observation that every time since 1970 that the three-month moving average of the national unemployment rate has risen 0.5 percentage points or more above its low during the previous 12 months, a recession has occurred.

But there’s still some error even in the headline unemployment rate, which is why the Sahm rule uses three-month averages, and that error grows when one turns to smaller groups such as Black Americans, who make up 13% of the labor force.

Apply the Sahm rule to the Black unemployment rate, and you get more than 40 recessions since 1972 instead of the actual seven.

A couple of those were sustained increases that speak of the more tenuous status of Black workers, whose unemployment rose amid modest slowdowns that had little effect on the overall unemployment rate, but most appear to be statistical noise.

While error margins aren’t published alongside the unemployment rates and other jobs data from the CPS, the BLS provides the formulas and other information needed to calculate them as well as a monthly table showing whether changes in a selected set of indicators were statistically significant or not.

According to the formula, the 90% confidence-level margin of error for Black unemployment in July was plus or minus 0.34 percentage points. According to the table, the one-month, six-month, nine-month and 12-month changes in the rate were not statistically significant, but the three-month change was.

That was the change since April, when the Black unemployment rate bottomed at 4.6%. But the 90% confidence level means we should expect the margin of error to be exceeded in one month out of 10, plus all these calculations assume that the people surveyed represent an unbiased random sample of the population in question.

The BLS offers a list of 10 sources of “nonsampling error” that could also affect the accuracy of its labor market numbers, and one in particular has grown in significance in recent years: The CPS response rate is down from 90% a decade ago to around 70% so far this year.

Adjustments are made to counteract differences between respondents and nonrespondents that may skew the results, but they’re not perfect.

Paying too much heed to the error inherent in economic statistics can not only be boring but misleading, given that sampling errors are distributed along a bell curve with the actual value much likelier to be close to the reported number than at the edges of the margin of error.

My Bloomberg colleague Joe Weisenthal used to facetiously warn right before the BLS released the monthly jobs numbers that “if you tweet about revisions, margin for error or anything like that you will be blocked and reported for abuse.” I’m mostly on board with that attitude.

But when there’s a sudden, sharp break from the trend line for an already noisy statistic — one that isn’t brought on by some obvious cause such as, say, a pandemic — it is definitely worth pausing and questioning whether it’s for real.

It’s also worth doing what one can to reduce the noise by averaging data over multiple months and taking the long view. Here’s a chart that does both.

The big picture is that the Black-White unemployment gap fell to new lows just before the pandemic, and even with the increase after this spring’s record-breaking dip remains quite narrow by historical standards.

There’s a cyclical component to the gap — that is, it grows during recessions — which is why any increase merits attention as a possible harbinger of bad times, which if history is any guide would be much worse for Black workers than White ones.

But the fact that the gap is now markedly smaller than during the boom times of the late 1990s is a welcome sign of possible structural change because of reduced racial discrimination in the job market or some other cause.

2. Right now, that seems to be the main story to be found in the unemployment data for Black Americans. If all goes well, it still will be a few months from now.

Updated: 2-1-2024

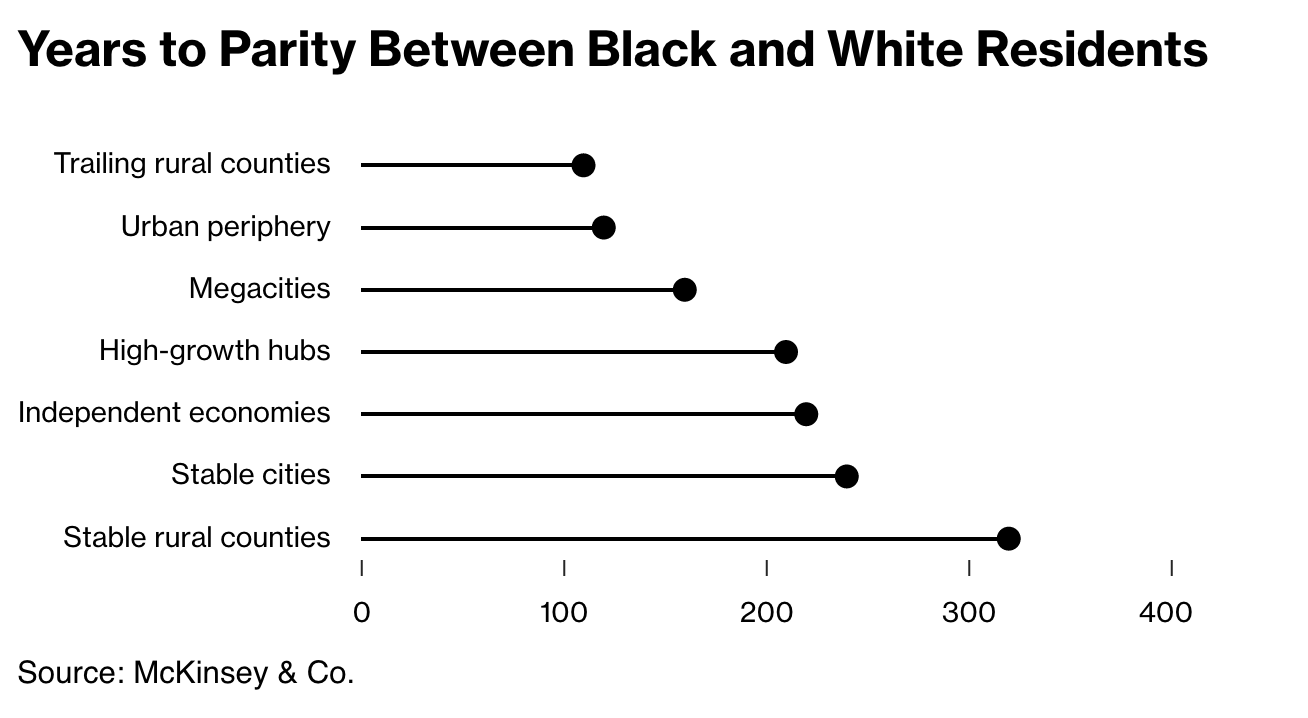

It Will Take Black Americans 320 Years to Catch Up to White Neighbors

It will take more than three centuries for Black Americans to achieve the same quality of life as their White neighbors, according to McKinsey & Co., after the racial gap widened in more than half the country in the past decade.

Based on the rate of change in quality of life metrics between 2012 and 2021, it would take roughly 320 years for Black residents in rural counties like Caddo Parish, Louisiana, to achieve parity, a new report from the consultancy shows. Even in megacities like New York and San Francisco, where outcomes overall are better for Black residents, parity would take 160 years.

“We have a really clear picture of the urgency of the situation,” said Shelley Stewart III, an author of the report and senior partner at McKinsey.

There are other sobering data points: only 48% of US counties reduced the racial gap in the past decade, no US county with a significant Black population has achieved parity, and the 37 that are close to it house just 0.1% of the total US Black population.

The study assumes that results for White residents will remain at today’s levels, but notes that those estimates are conservative because their conditions are likely to improve over time.

McKinsey analyzed 25 metrics related to quality of life, including rates of poverty and food insecurity, job opportunities, life expectancy and incarceration rates across the US, from megacities to rural areas.

The report also highlights a number of solutions that could help bridge the gap, including affordable housing in mixed-income neighborhoods, health insurance for US residents without coverage and the expansion of high-quality early childhood education programs.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.