XRP Is The Worst Performing Major Crypto of 2019 (GotBitcoin?)

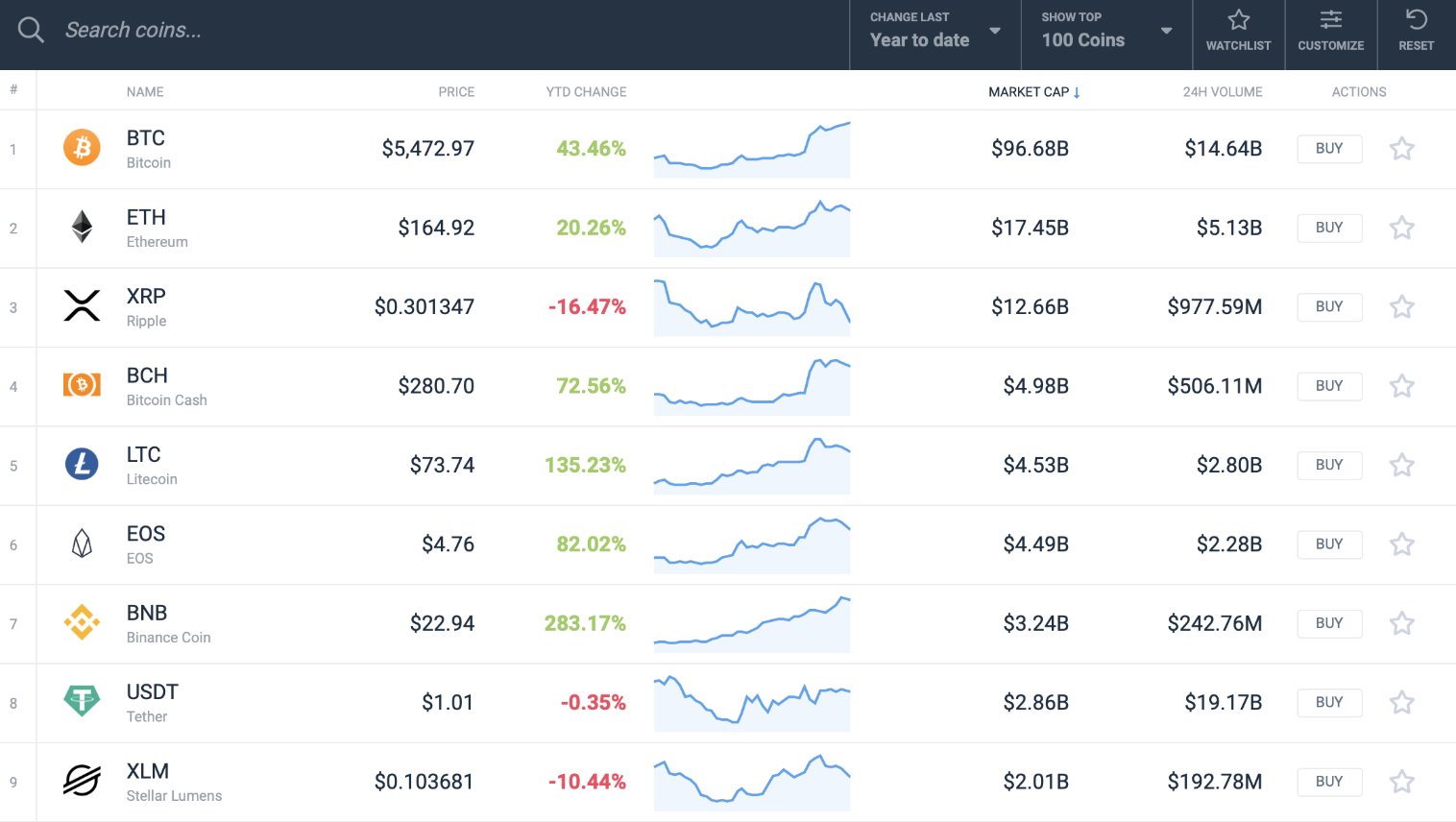

By CCN.com: Ripple’s XRP is having a disastrous start to 2019. In a year when bitcoin is storming back towards bull territory, XRP has crashed 16 percent. The third-largest cryptocurrency is now the worst-performing digital asset in the top ten. XRP Is The Worst Performing Major Crypto of 2019 (GotBitcoin?)

Ripple’s woes worsened in yesterday’s trading session as XRP’s value dropped 7 percent, plunging below the key $0.30 mark. XRP is consistently underperforming bitcoin and the broader cryptocurrency market.

XRP Crushed While Bitcoin Soars

The crypto market has staged a powerful recovery in the first months of 2019. Bitcoin has surged 43 percent this year, outperforming the stock market and every single stock in the Dow Jones Industrial Average.

Other cryptocurrencies have performed even better. Litecoin has chalked up 135 percent gains since January while EOS is up 82 percent. Crypto’s enormous 2019 success story, Binance Coin (BNB), has surged 283 percent.

XRP, however, has failed to join its peers in the epic crypto comeback. At $0.29, the cryptocurrency associated with Ripple remains stuck 92 percent below its all-time high of $3.84.

Problems At Ripple?

The lack of price action behind XRP likely lies with Ripple. The company aims to provide international remittance technology to major banks and payment providers. But despite teasing hundreds of banking partnerships, only a tiny handful are actively using the XRP token for liquidity.

Ripple CEO Brad Garlinghouse once boasted that “dozens” of banks would be using Ripple’s xRapid service, which taps XRP as a bridge currency, by the end of 2019. Thus far, only one licensed bank is using xRapid. Other clients are localized payment providers.

Simply put, xRapid and XRP liquidity is not yet the game-changer Ripple claimed it would be. Traders are coming back down to Earth after exaggerated claims.

Pressure From JP Morgan’s JPMCoin And Facebook Coin?

Ripple’s unique selling point has been weakened by the entrance of JP Morgan and Facebook in the cryptocurrency arena.

The industry mocked JP Morgan’s controversial new cryptocurrency JPM Coin when it was revealed this year, including Ripple’s CEO. But JPM Coin has likely played a part in choking XRP’s price action.

Why? Because JPM Coin threatens to do what XRP does. JPM Coin is designed to make bank transfers faster and cheaper. It could one day be used for inter-bank remittance payments, too.

At the same time, Facebook revealed plans for a cryptocurrency that would facilitate remittance payments in India. Indian remittance payments is one of Ripple’s most important markets.

In other words, Ripple and XRP just got some huge, well-established competitors.

Ripple’s Ongoing lawsuits And “Security” Confusion

Ripple is also battling a class action lawsuitover its relationship with XRP. Ripple maintains that it did not create XRP, nor does it have any direct connection with the cryptocurrency. But legal documents beg to differ.

As a result of Ripple’s close ties to XRP, many argue it should be classified as a security. The Securities and Exchange Commission (SEC) is still quiet on this issue. The confusion around XRP’s classification is likely making some investors wary of the asset.

For now, XRP lags the broader crypto market.

Updated: 1-6-2020

Ripple CEO: We Can’t Control XRP Price Any More Than Bitcoin Whales

The CEO of blockchain payment network Ripple says the company does not want to “dump” its associated XRP cryptocurrency despite selling huge amounts of it.

In an interview with CNN on Jan. 5, Brad Garlinghouse added fresh contention to the debate about Ripple’s relationship to XRP, which has gained 10% in the past 24 hours.

Garlinghouse: Ripple “Can’t Control XRP Price”

“In the XRP community, Ripple is the largest owner, and the point I have made is we’re the most interested party in the success of the XRP ecosystem,” he told the network.

On The Topic Of How Ripple Manages That Ownership, Garlinghouse Stated:

“Yes, Ripple owns a lot of XRP, we’re very interested in the success of XRP, but the accusations of us dumping, that’s not in our best interests to do that […]. We would never do that and in fact, we’ve taken steps to lock up most of the XRP we own in escrows so we can’t touch it.”

The comments jar with Ripple’s own market moves in 2019 and before. As Cointelegraph reported, the company has long been selling off XRP in bulk, with last year seeing it rid itself of more tokens than ever.

At the start of 2020, the company released 1 billion XRP, worth around $200,000, from escrow as part of a planned operation.

XRP itself meanwhile hit more than two-year lows in December, dropping below $0.20 and at one point trading 96% below its all-time high of $3.40. A recovery, including 9% gains in the past 24 hours, has since sent XRP/USD back above the $0.20 barrier.

Garlinghouse continued to surprise. Despite Ripple’s token share, he strongly denied the company could influence the XRP price.

“Oh no,” he protested when asked about the possibility, likening the situation to major Bitcoin (BTC) investors:

“Ripple can’t control the price of XRP any more than the whales can control the price of Bitcoin.”

Large XRP buyers would “hypothetically have restrictions”

Nonetheless, he said, Ripple would not respond well to other major investors owning a significant share of the XRP supply. In what appeared as a wish to nevertheless influence the market, Garlinghouse positioned Ripple as the enduring major token holder going forward.

“There are times when we work with institutional investors or might say, ‘Hey, we want to buy $10 million of XRP,’ and we would have lock-ups to prevent them from dumping on the market,” he continued.

Concluding, the executive said that such interventions were nonetheless “hypothetical:”

“We don’t want some other party buying a whole lot of XRP and dumping it on the market, and so we would hypothetically have restrictions about what they could sell and how often, and usually those are based on volume in the market.”

Updated: 1-24-2020

Ripple’s XRP Sales Saw A Historic Low In Fourth Quarter Of 2019

Ripple’s XRP sales continued to drop in the second half of 2019, with sales of the token reaching a historic low in Q4.

According to a Jan. 22 blog post by Ripple — the firm behind the third largest crypto asset by market cap — total XRP sales in Q4 2019 accounted for $13.08 million, down more than 80% from the $66.24 million reported in Q3 2019.

Ripple got rid of programmatic sales

The massive decline in XRP sales in 2019 does not appear to be unexpected though. Specifically, quarterly XRP sales were consecutively dropping in 2019 as Ripple initiated the pause of programmatic sales in mid-2019. Announcing the plans in June, Ripple was expecting that XRP sales would would fall significantly:

“In the short term, this means Ripple’s sales of XRP in Q2 2019 will be substantively lower (as a percentage of reported volume) than in the previous quarter—with our stated target of 20bps for programmatic sales of XRP volume, as reported by CoinMarketCap, likely dropping to less than 10bps. Longer term, by being more demanding about our expected standards for market structure and reporting, we hope to begin raising the bar industry-wide.”

As Ripple started to reduce the amount of programmatic sales in Q3, the company subsequently saw a notable decline of total XRP sales.

In Q2 2019, Ripple’s programmatic sales accounted for nearly 60% of XRP sales that quarter, at $144 million out of the $251 million total. In Q3, programmatic sales comprised 25% of total token sales, weighing in at over $66 million.

Finally, Q4 2019 appears to be the first quarter when Ripple has finally got rid of programmatic sales altogether, focusing solely on over-the-counter (OTC) sales. As such, total XRP sales in Q4 2019 only included OTC sales or institutional direct sales.

XRP Sales In Q3 And Q4 2019

What Are Programmatic Sales And Why Did Ripple Decide To Pause Them?

While Ripple does not explicitly define the term of a programmatic sale on its website, the company notes that such sales are associated with passive trade execution. The company purportedly decided to temporarily pause its programmatic sales as part of their effort to address the issue of misreported trading volumes on cryptocurrency markets. Ripple wrote in July 2019:

“Ripple’s programmatic XRP sales have been done with the goal of minimizing market impact. The company did this through limiting XRP programmatic sales to what it considers a small percentage of traded volume, which was executed across multiple exchanges.

Ripple relies on programmatic sales partners who mainly execute trades passively; their trading volumes do not vary based on changes in the price of XRP, but they do increase as overall XRP trading volumes increase.”

As part of the initiative, Ripple also shifted to a “more conservative volume benchmark” for XRP sales, moving away from CoinMarketCap to CryptoCompare Top Tier.

Cointelegraph has reached out to Ripple for commenting on its decision to eliminate programmatic sales, but has not received a response as of press time. This story will be updated should they respond.

Ripple Called 2019 Its Strongest Year Of Growth

The XRP price was also decreasing in 2019, dropping 42% from $0.364 on Jan. 1, 2019 to $0.183 in December, marking a two-year low.

The situation has been intensified by growing concerns over the unclear regulatory status of XRP after Ripple faced a class-action lawsuit alleging that it held an unregistered sale of securities.

On Jan. 13, the chairman of Commodity Futures Trading Commission said that the status of XRP is still unclear, while expressing confidence that Bitcoin (BTC) and Ether (ETH) are commodities. On top of that, the Coinbase-backed Crypto Ratings Council, a group of major United States’ cryptocurrency firms seeking regulatory clarity, believes that XRP is likely to be a security, based on its rankings for digital assets.

At press time, XRP is trading at $0.219, down nearly 4% over the past 24 hours, following a major downward trend on markets.

Ripple CEO Hints At IPO, Says More Crypto Firms Will Go Public In 2020

Ripple CEO Brad Garlinghouse predicts that initial public offerings (IPOs) will become more prevalent in the cryptocurrency and blockchain space in 2020.

Speaking at the World Economic Forum in Davos yesterday, Jan. 23, Garlinghouse reportedly hinted that Ripple would itself be one of those firms to seek a public flotation:

“In the next 12 months, you’ll see IPOs in the crypto/blockchain space. We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side… it’s a natural evolution for our company.”

“Natural Evolution”

An IPO refers to the process of offering the shares of a private corporation to the public in a new stock issuance. For this reason, it is sometimes referred to as “going public,” or as “floating” corporate shares to the wider market.

The cryptocurrency industry has to date focused its energies on initial coin offerings (ICO), which evolved as an alternative issuance model for still-young, innovative firms that spared them many of the cumbersome legal and regulatory processes involved in a traditional IPO.

Yet as the space matures — and arguably, in the wake of the post-boom ICO rout, which saw many offerings exposed as either outright fraudulent or simply unsuccessful — some firms are now seeking to build confidence with mainstream investors by way of public listings on traditional stock exchanges, with all of the red tape and financial disclosures that implies.

This is a trend that Garlinghouse appears to believe will consolidate itself in the near future, even as some of the industry’s largest players have thus far struggled to meet the stringent requirements of an IPO.

As an alternative to adopting a traditional flotation model, major crypto firms such as Blockstack have instead chosen to pursue compliant token sales, with the approval of the United States Securities and Exchange Commission.

Silvergate Bank — a California-based commercial bank focused on digital currency businesses — went public with an IPO on the New York Stock Exchange in Nov. 2019.

Updated: 2-1-2020

Ripple Unlocks Half Billion Tokens From Escrow As XRP Price Up 26% YTD

XRP price growth remains lackluster as February begins, despite blockchain payment network Ripple releasing 500 million tokens from its escrow.

Data from the XRP blockchain noted by monitoring resource Whale Alert on Feb. 1 confirmed a single transaction of 500,000,000 tokens worth $119.5 million left Ripple’s escrow the same day.

XRP “Rewards” Bagholders With 26% Returns

The move is the latest in a series of planned releases, which Ripple has scheduled to occur on the first of each month for 55 months.

Its aim is to provide incentives for market makers, with Ripple nonetheless remaining in control of the newly-released tokens.

During the previous release in January, XRP/USD barely reacted. Subsequently, bullish action on Bitcoin (BTC) markets took many major altcoins significantly higher.

While Litecoin (LTC) for example sealed 65% gains in January, XRP investors have been left with little more than a sense of anticipation. Versus its January lows, the token is up by a comparatively modest 26%.

Suspicions, Sell-Offs And An IPO

As 2020 began, Ripple was again at the center of controversy over its relationship with XRP.

The company owns more of the token than any other party. In a recent interview, CEO Brad Garlinghouse claimed that executives could not control the XRP supply, while also stating it would take action to stop other entities from acquiring too much of it.

“We don’t want some other party buying a whole lot of XRP and dumping it on the market,” he said.

Ripple’s XRP sell-offs for 2019 meanwhile totaled more than any other year. Around the same time, Garlinghouse hinted Ripple could conduct an initial public offering, or IPO, at some point in the next twelve months.

Updated: 4-21-2020

Ripple Files Lawsuit Against YouTube: “Enough is Enough”

Ripple Labs and its CEO Brad Garlinghouse have filed a lawsuit against Youtube for its alleged complicity in a spate of repeated “XRP giveaway” scams.

Ripple Labs filed a lawsuit against Youtube LLC in the Northern District of California on Tuesday April 21. The case seeks damages for Youtube’s failure to stop XRP (XRP) scammers and impersonators.

The plaintiffs, named as Ripple Labs and its CEO Brad Garlinghouse, are taking action against Youtube to “prompt an industry wide-behavior change and set the expectation of accountability,” according to an official company blog post.

Ripple and Garlinghouse say the scam – often referred to as “The XRP Giveaway” — has already defrauded victims of “millions of XRP valued at hundreds of thousands of dollars”.

The lawsuit lodges complaints against Youtube for: (1) Violations of the Lanham Act for Trademark Infringement; (2) Violations of California’s Statutory and Common Law Right of Publicity, and (3) Violations of California’s Unfair Competition Law.

The scam relies on spear-phishing attacks against legitimate Youtube channels, according to the filing. Using a malicious email, the attackers commandeer the Youtube channels of content creators – often those with legitimate ties to Ripple.

Viewers of the videos in question are then urged to send “between 5,000 XRP and 1,000,000 XRP” to a listed address, which promises 5x returns from the receiver.

Youtube’s Alleged Complicity

The lawsuit states that Youtube knowingly profits from the actions of the scammers, despite having the ability to stop them. The filing states:

“YouTube profits from the Scam by knowingly selling paid ads on behalf of the fraudsters who are impersonating Ripple and Mr. Garlinghouse. These ads — so-called ‘video discovery ads’ — are designed by YouTube to appear at the top of its search result page alongside organic search results.”

Ripple cites several instances where Youtube awarded verifications badges to channels which had been taken over by the scammers. Ripple claims it has filed 49 takedown demands to Youtube relating to the scam since November 2019. Another 305 complaints were filed against channels impersonating Brad Garlinghouse specifically, the document states.

The plaintiffs allege that irreparable harm has already been done to both Ripple’s brand and Brad Garlinghouse’s reputation. That harm was worsened by Youtube’s alleged “deliberate inaction,” according to the lawsuit.

“YouTube’s deliberate inaction has irreparably harmed — and continues to irreparably harm — Ripple’s brand and Mr. Garlinghouse’s reputation. YouTube’s inaction has also injured countless individuals who fell victim to the Scam. These harms will continue to grow in scope and severity absent intervention by the Court.”

The lawsuit calls for the award of any statutory, compensatory and punitive damages, and a restitution of any enrichment Youtube has received over the time period the scams were active.

Updated: 12-23-2020

MoneyGram Takes Wait-and-See Approach As SEC Sues Partner Ripple

MoneyGram has yet to see any “negative impact” on its longstanding business arrangement with Ripple from the U.S. Securities and Exchange Commission’s (SEC) lawsuit against the latter company.

“MoneyGram will continue to monitor the situation as it evolves,” a company spokesperson told CoinDesk in an emailed statement. “MoneyGram has continued to utilize its other traditional FX trading counterparties throughout the term of the agreement with Ripple.”

The SEC alleged in a case filed Tuesday that Ripple used XRP (-25.17%), the cryptocurrency two of its founders created, to conduct an ongoing, $1.3 billion sale of unregistered securities.

Ripple owns more than 4% of MoneyGram and paid MoneyGram $9.3 million in the third quarter of this year for providing liquidity for Ripple’s XRP-based cross-border settlement network. All in, Ripple has given MoneyGram $52 million for using Ripple’s on-demand liquidity (ODL) service.

On-demand liquidity through Ripple’s xRapid cross-border payment service allows companies to transfer funds from one currency to XRP and from XRP to another currency. This allows enterprises to avoid opening a bank account in countries they want to send payments to, letting them avoid holding funds there for cross-border transactions.

MoneyGram, currently the second-largest money transfer provider in the world behind Western Union, has used Ripple’s ODL to move in and out of four currencies since June 2019. At the time, CEO Alex Holmes said MoneyGram was becoming a “chief partner for cross-border settlement using digital assets.”

In the complaint filed Tuesday, the SEC seems to make a mention of MoneyGram when it alleges that “onboarding onto ODL was not organic or market-driven” but rather “subsidized by Ripple.”

MoneyGram was not identified by name in the SEC complaint though it did specify that Ripple paid the unnamed money transmitter $52 million in fees through September 2020, in an arrangement that began in 2019.

“The Money Transmitter became yet another conduit for Ripple’s unregistered XRP sales into the market, with Ripple receiving the added benefit that it could tout its inorganic XRP ‘use’ and trading volume for XRP,” the SEC alleged.

MoneyGram declined to comment further.

XRP Is The Worst-Performing, XRP Is The Worst-Performing, XRP Is The Worst-Performing, XRP Is The Worst-Performing

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.