Ultimate Resource For Bitcoin Debit And Credit (Rewards) Cards of 2023 (#GotBitcoin)

Here are the four best bitcoin debit cards in 2023. Ultimate Resource For Bitcoin Debit And Credit (Rewards) Cards of 2023 (#GotBitcoin)

Can I Double Dip And Pay My Credit Card With My Fold Card?

Yes:

* Cit allows payment via chat.

* Chase via walk-in up to 1k a calendar month.

* Amex via phone (800) 230-1284

* 5/28/21 we’ve heard yes and no.

* Capital One (If you are grandfathered in)

* Venmo CC (call in and pay)

Verizon Visa by Synchrony (call in and talk to a rep).

This is a user hack that may not last very long.

1. Revolut – Your Digital Banking Alternative

The best bitcoin debit card on the market is provided by Revolut. This might come as a surprise to some of you, considering Revolut is not thought of as a crypto company.

Since December 2017, Revolut has allowed cardholders to exchange, withdraw and pay with both bitcoin and ethereum.

Update (Feb 24, 2019): Revolut now allows users to store: BTC, BCH, ETH, LTC, and XRP.

If you’ve ever used the Revolut App you will have been impressed with its gorgeous design and sleek functionality. You can top up your account instantly using a credit card, and exchange into bitcoin just as quickly. Up to $200 a month can then be withdrawn for free anywhere in the world. Once that threshold is reached, Revolut applies a 2% withdrawal fee from ATMs anywhere in the world. If you are unhappy with the 2% fee, you can upgrade to either the Premium or Metal pricing plan. These increase the free withdrawal limit to $400 and $600 respectively.

Related:

Fold | Earn Bitcoin Rewards | Available on iOS & Android

Strike Visa Cards To Launch in US, EU, and UK Within First Half of 2021

These pricing plans are worth diving into in more detail.

For the Premium plan you can expect to pay $8.99 a month or $92 per year. For the money, you get free card delivery (usually $4.99) plus free virtual card issuance, and, of course, the increased monthly withdrawal limit. Depending on you use the card this represents good value for money.

The Metal plan is also worth checking out, because it offers 1% cashback on all your cryptocurrency purchases outside of Europe. Cashback on transactions within Europe is set at 0.1%. Naturally, this isn’t going to make you rich, but it’s a nice option to have for those of us who are bullish on crypto prices in the long term. Besides cashback, the Metal plan also offers free worldwide ATM withdrawals of up to $600.

Finally, it’s easy to see why Revolut and crypto are such a good fit. Revolut has ‘borderless cash’ baked into its DNA, making bitcoin the perfect accoutrement. For Revolut’s 2 million customers the end result is impressive. Instant access to bitcoin and ability to spend it anywhere in the world with zero fees.

This makes Revolut the best bitcoin debit card of 2019.

2. Wirex – Crypto And Traditional Currency In The Palm Of Your Hand

Second on our list is Wirex. Based in London and founded in 2014, Wirex has become one of the industries heavy-weights, thanks to a host of impressive features.

Unlike Revolut, the London based startup allows users to purchase cryptocurrency within the APP. In the case of bitcoin, users can even fund their accounts instantly, providing one of the best purchase experiences available today.

Additionally, ether, bitcoin, Litecoin, Waves and XRP are available for purchase, exchange, and withdrawal both within the APP and on the debit card. This shouldn’t give you the impression that only crypto is supported. Instead, users can buy, store and manage USD, EURO and GBP as well, making Wirex attractive to users not affiliated with crypto as well.

Crucially, Wirex also offers impressively low fees to customers. Exchanging is absolutely free, and so are both crypto and fiat transfers. Unlike Revolut, Wirex does not charge for the card delivery either, saving customers $4.99 in comparison.

That being said, Wirex does come in second place for a reason. Some of the few blemishes on this excellent service are the withdrawal limits and fees. More specifically, Wirex charges between $2.50 – $3.50 per withdrawal depending on your location. Additionally, users are constrained by a $250 daily limit on withdrawals. Add to that the monthly account fee of $1.50 as well as the maximum card balance of $10,000 and you get a worthy second place finish behind Revolut.

Updated: 4-14-2020

Wirex Payments Platform Hits 3 Million Users, Becomes Profitable

London-based crypto payment processor Wirex has revealed that it now has over 3 million active users, highlighting the popularity of its crypto-supporting visa card among customers.

Wirex is a company licensed by the U.K. Financial Conduct Authority (FCA) which allows crypto users to spend their crypto and fiat currencies using a dedicated Visa card and mobile app. The service has been rolled out in 130 countries, with the card accepted at over 46 million locations.

Speaking to Cointelegraph on April 14, Wirex CEO Pavel Matveev said that more and more mainstream users “who are not typically hardcore cryptocurrency users” were being drawn to the card over traditional bank offerings thanks to features such as “Cryptoback,” which rewards Wirex users with up to 1.5% back in Bitcoin (BTC) for each in-store transaction.

“If we compare usage before Cryptoback existed and afterwards, there is a 100% increase in the number of in-store transactions per customer after,” he said.

The increase in demand has translated into the company achieving profitability, as was publicly announced earlier this month.

The Impact Of COVID-19

Matveev noted that at a time when global restrictions to combat the COVID-19 pandemic are in full force, cashless and contactless payments systems such as Wirex’s are a secure and low-friction means for users to transfer funds across borders.

Yet the impact of profound disruptions to everyday life and economic hardship is for now resulting in users spending much less in stores at point of sale, he said.

Three key figures for online Wirex card transactions offer a stark indication of this. Matveev revealed in a comparison of the first 20 days of February vs. March that:

“1) The total volume of online transactions is 15% down in March. The average check is 5% down. 2) Amazon volume is 17% down in March. The average check is 46% down. 3) Deliveroo volume is down 25% in March. The average check is 8% up.”

Despite many having anticipated that people would be spending more online during the lockdown, himself included, Pavel said, the data for now seems to indicate that the public “prefer to spend less during the turbulent period.”

To compile the statistics, sampling was done based on 1 million random transactions during the first 20 days of each month.

Future Developments

MakerDAO’s Dai stablecoin, which Wirex has supported since February 2019, has been increasingly popular with users, Matveev noted, considering this ties in with the growth of decentralized finance — also known as DeFi.

Under the terms of Wirex’s strategic partnership with MakerDao, Wirex will soon be offering users discounts on purchases of the MKR governance token, he revealed.

Holding MKR confers voting rights on the Maker protocol, providing investors with an opportunity for hands-on involvement in the day-to-day management of Dai. The firm anticipates that this opportunity will further increase demand for the DAI stablecoin on its platform.

As reported, Wirex had last spring revealed plans to launch support for 26 stablecoins pegged to fiat currencies, including USD, EUR, GBP, HKD and SGD.

3. Cryptopay – Bitcoin Wallet & Prepaid Cards

Third on our list is Cryptopay. Founded in 2013 and headquartered in the English city of St. Albans, Cryptopay offers an impressive array of services to its huge customer base. Primary among them are the plastic and virtual bitcoin debit cards. Over 120,000 debit cards have been issued and more than 270,000 transactions are processed each month.

These remarkable statistics are understandable given Cryptopay’s ease of use and transparent fee structure. Not only can you use your Cryptopay card to shop online or at any point of sale terminal, but it allows you to easily exchange funds using a FLEX account. FLEX makes it easy to convert cryptocurrencies in a number of fiat currencies.

Similarly to Wirex, Cryptopay offers bitcoin, ether, litecoin and XRP. Interestingly, EURO, USD and GBP are all supported.

Additionally, Cryptopay falls a little short of Revolut and Wirex by charging higher fees. For the physical card, users can expect to pay €15, plus a monthly service fee of €1. On top of that, there is a 1% loading fee, as well as ATM transaction fees ranging between $2.50 and $3.50.

The limits on the Cryptopay debit card depend on whether you are verified or not. This refers to the completion of the platforms KYC requirements, which are relatively painless. Simply sign into your account and upload:

- A high quality image of your passport

- A high quality selfie of you holding your passport

- A proof of residence document issued to your name and the address within the last 3 months

Once you’ve uploaded these three documents you will become a verified user, which ensures a much better experience with Cryptopay. As an example, your daily ATM withdrawal limit is raised from €400 per day to €2,000, and the number of permitted ATM withdrawals increases from 2 to 5 per day.

4. BitPay – Load Dollars Using Your Bitcoin Wallet, Spend Anywhere

Fourth on our list is BitPay. Compared to the other bitcoin debit cards provided here, Bitpay puts a much stronger emphasis on the US market. This is in part because the company is based in Atlanta, but also because CEO Steven Pair identified the huge potential for bitcoin in the US early on. After founding the company in 2011, BitPay grew quickly aiming to become the foremost bitcoin payment service provider in the world.

In May 2016, BitPay launched its debit card which was the first bitcoin debit card available to users in all 50 US states. Encouragingly, Bitpay not only lists all of its fees, but even instructs users on how to minimize them.

This kind of customer-centric approach goes a long way, especially when coupled with BitPay’s intuitive mobile APP. Add to that, the ability to spend your bitcoin anywhere that accepts Visa, and you can see why BitPay made it onto our list.

That being said, the flaws are more glaring here than with the cards mentioned previously. BitPay, for example, has just canceled all European card holders, restricting the service almost completely to the US. Europe has plenty of alternatives, so this is not unsurprising, but the APP lacks quite a bit of functionality compared to the other cards listed.

For one thing, it is not possible to buy bitcoin in the mobile APP. Instead, you need to fund your account via another BTC wallet. Additionally, it is not possible to hold, manage or withdraw any other currency. As a result, BitPay’s service is far less comprehensive than that of Revolut or Wirex, which can hold multiple crypto and fiat currencies.

However, BitPay is a great service for US residents on the lookout for a bitcoin debit card.

Conclusion

Despite the major set back experienced in January 2018 by the demise of Wavecrest, the bitcoin debit card ecosystem has recovered. Not only that, but it has reached heights it had never known before.

The introduction of Revolut has significantly raised the bar for cryptocurrency service providers around the world. This will prove to be vital, as the ease with which cryptocurrency can be spent will play a crucial role in its long term success.

I say this because debit cards are becoming an ever more important part of our financial lives. According to a study conducted by the Federal Reserve Bank of San Francisco, consumers use debit cards for 27% of all transactions, second only to cash. As a result, it is vital that bitcoin and other cryptocurrencies can be spent using physical cards anywhere in the world.

Luckily, we have 4 excellent options.

Updated: 3-3-2020

StormX Announces Integration of StormShop For Their Mobile Users

StormX has announced the integration of StormShop for its iOS and Android users, allowing them to earn cryptocurrencies back when they shop online, as the company has announced.

The platform aims to improve the eCommerce experience for consumers and merchants, who offer up to 40% cashback in five different digital assets, including BTC, ETH, LTC, DAI and STORM.

StormShop is complemented with StormPlay’s mobile app, which has attracted more than 2.5 million users since its launch in January 2014.

StormX’s CEO and co-founder, Simon Yu, gave his input on the new mobile integration:

“We are now able to reward shoppers with some of the most secure and popularly adopted cryptocurrencies in the world when they shop online at their favorite retail stores. We are eager to continue these expansions, providing an easier entry point to cryptocurrencies for everyday consumers.”

The service offered by StormX allows the user to connect with leading companies like Samsung, Microsoft, and GameStop, along with 400 other retailers from different areas like food, travel, entertainment.

New Products Coming Soon

Speaking with Cointelegraph, Yu commented on new products that are soon to be released to the public:

“A feature we are excited to be launching soon is our StormX Rewards Program. Through it, we plan on incentivizing STORM token stakers and introduce new types of cash backs. However, more details will be announced soon.”

Furthermore, Yu assured Cointelegraph that they will soon launch Korean language support, in addition to targeting other regions like China and Brazil.

The mobile integration comes at a time when the company announced its expansion to Canada on January 14, in addition to partnering with the Litecoin Foundation for its StormPlay and StormShop services.

About StormX

StormX is a Seattle-based blockchain startup, focused on allowing users to earn money from any device. Thanks to its StormShop service, users with cryptocurrencies are rewarded when they buy through partner websites.

Updated: 3-4-2020

Uphold’s New Debit Card Lets You Pay With Bitcoin, XRP And Gold

Digital payment platform Uphold has released a new debit card, allowing users to pay with converted crypto, commodities and cash.

Uphold’s new multi-asset debit card allows United States-based participants to spend assets held in their Uphold accounts at any Mastercard compatible location, a representative from Uphold told Cointelegraph in an interview. “Anywhere globally where Mastercard is accepted, they will be able to use this debit card,” she said.

United States-based customers can now pre-order the card, which touts compatibility for 24 crypto assets, 27 fiat currencies, and four metals including Bitcoin (BTC), Basic Attention Token (BAT), Ripple’s XRP, gold, and U.S. dollars.

Uphold is a digital asset platform on which users can buy, sell, spend and hold digital assets, fiat currencies and commodities.

Uphold Is The First To Combine Asset Worlds In Debit Form

Uphold’s multi-asset debit card is the first of its kind that allows users to convert different commodities, crypto-assets and fiat currencies to spendable cash at the point of sale.

“If you toggle within the app that the debit card is connected to, you are able to spend, instantly, BAT, gold, palladium, silver USD — anything, anywhere, any time — in real time,” an Uphold representative said. “This really gives spendability across any connected asset.”

Uphold also touts no foreign exchange fees in the process. “We’re really trying to mirror and complement what our wallet already provides users, which is this anytime access to anything within our wallet,” she said. “We’re not prohibited by borders or foreign exchange fees.”

The Platform Also Supports Commodities

Although digital asset usage within such a system seems logical, one may wonder how they might go about holding and spending gold, a non-digital and somewhat clunky asset.

“We do have a partner where our users who have gold can actually order physical gold, delivered to their house,” the representative explained. She noted that each asset on a user’s Uphold account has its own wallet, and users decide which asset they would like to spend on any given purchase.

“It’s not as if you have to show up and have the physical bag of gold,” she added. “It really just gives the user the freedom to decide what asset they want to spend, versus the limitation that current cards have.”

This type of simplicity and low barrier to entry is a significant step forward in making crypto more functional and versatile.

In December 2019, the company also announced work with Salt to provide the public access to crypto-backed loans.

Updated: 3-9-2020

Bittrex Global Integrates Credit Card Support, Biteeu Launches In Aus

Bittrex global has announced the introduction of new features on its platform, including credit card support, a referral program, and upgrades to its mobile app.

Credit card support will see an initial roll-out to Bittrex Global users in the United Kingdom, Germany, France, and the Netherlands. The exchange intends to launch credit card support for all international users in the future.

Bittrex Global To Support Conditional Orders On Mobile App

Users of Bittrex Global’s mobile app will soon be able to place conditional trade orders, such as stop-limit orders for risk management.

Despite revealing a forthcoming referral program that will share trading fees, the program’s commission price structure has not been disclosed.

Stephen Stonber, Bittrex Global’s COO, indicated that exchange plans to launch additional new features in coming months:

“We are continually working on ways to provide a better experience for users. An enhanced mobile trading experience is one of our top priorities and creating this new credit card gateway is an important way of lowering the barriers to digital asset trading for new and existing customers alike.

These features are the first of many we have planned that will underline Bittrex Global’s ambition to provide the best and most secure platform for digital trading.”

Bittrex Partner Biteeu Launches Australian Exchange

On March 5, Biteeu, an Estonia-based cryptocurrency powered by Bittrex’s trade engine, announced the launch of an exchange in Australia.

Biteeu is now registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a digital currency exchange provider, and offers exposure to more than 70 cryptocurrencies to the Australian market.

Biteeu supports cryptocurrencies purchases with Australian dollars via debit card or wire transfer.

Bittrex Sees Dwindling Market Share

Despite recent efforts to attract traders with reduced trading fees, Bittrex’s share of cryptocurrency trading volume has consistently declined since the 2017 all-time high bull run.

As one of the leading platforms supporting a wide selection of altcoins, Bittrex briefly attracted cryptocurrency inflows representing 40% of the total market, according to CryptoQuant data.

As of February 2020, Bittrex’s crypto inflows represent less than 10%, with the exchange’s BTC inflows having fallen from a momentary all-time high of 88% to roughly 2%.

At the time of writing, Bittrex has a 24-hour volume of $45.6 million, ranking it as the 90th-largest crypto exchange by trade activity.

Updated: 6-1-2020

Cash or Plastic? Countries Where Crypto Debit Cards Are Fair Game

Cointelegraph examines where crypto debit cards are available and what options they offer as wider adoption starts to take hold.

As a sector, plastic cryptocurrency cards have had a bumpy ride. While for some they are the perfect way to spend those hard-stacked sats, it has evidently been a struggle for crypto companies to provide such a service. Wracked by regulation, supplier issues and the volatility of digital assets, crypto debit cards have had a rough start.

Nonetheless, crypto debit card use is growing and is considered an important development for the growth in the adoption of crypto around the world. So, in which countries are most of the crypto cards available?

Wirex

Wirex is a London-based crypto debit card provider and is often seen in the wallets of many people involved in the industry. The firm offers over 13 traditional and cryptocurrency accounts and has crypto-to-crypto, fiat-to-crypto and crypto-to-fiat capabilities. The firm is also backed by Visa, meaning that anywhere Visa is accepted, crypto can be spent.

Wirex launched its Russian service on May 19, offering customers fiat credit and debit cards. According to a press release from the company, it plans to offer customers the opportunity to buy crypto such as Bitcoin (BTC), Ether (ETH), Litecoin (LTC), XRP, Dai and its native Wirex Token (WXT) via Visa and Mastercard.

Revolut

Revolut is perhaps the best-known card provider to make forays into the crypto world. Based in London and headed by CEO Nikolay Storonsky, Revolut has 10 million customers, a third of which have traded crypto on its app, according to data released by the company.

The company recently reported a 58% dip in the average size of crypto purchases from its United Kingdom customers, citing the effects of the lockdown measures imposed in March. Two months later, the average sum is climbing back up to previous levels, having increased by 57%.

Monolith

Monolith is based in Manchester, England. It is a company that seeks to bring self-sovereignty to finance through decentralization. Monolith’s CEO, Mel Gelderman, explained to Cointelegraph the philosophy behind the decentralized finance factor in its crypto debit card offering:

“We have complete faith in DeFi and its role in ushering in the next economy. Monolith’s purpose is to make DeFi a viable choice to manage your everyday finances with ease, just as you might do now on your banking app. The diverse nature of DeFi will allow users to maximise their wealth in ways they haven’t been able to before. We take this a step further by ensuring we have no access to your money as each user wallet is non-custodial.”

The coronavirus pandemic has had an unprecedented effect on businesses, decentralized or not. Despite this, Gelderman told Cointelegraph that the flexibility offered by DeFi and crypto is particularly appealing for customers that want to be in control of their finances during the COVID-19 crisis:

“The Crypto industry is evolving into an integrated piece of daily life in terms of financial management, and debit card services are part of that. The crypto-debit card is the next step in this evolution, giving the end user a non-custodial financial platform that interfaces in a way that is no different from the current account they use daily. This mix of timing, usability, and control of funds makes this new economy more viable than ever.”

Coinbase

Coinbase is a United States-based platform that provides a variety of functions, including exchange, wallet and trading services. The company’s crypto debit card, imaginatively dubbed Coinbase Card, was launched in 2019. At first, the card was only active in six European countries, but it has since been launched in a further 10 countries with a greater variety of crypto assets.

The firm announced on Feb. 19 that it had become a principal member of Visa, meaning that it is now able to issue debit cards without the involvement of third parties, and it can now also issue cards to other crypto companies.

Bitwala

Bitwala, a blockchain-based banking firm headquartered in Berlin, offers a service where customers can convert their crypto and pay with a Mastercard debit card. The card is linked to a Bitwala bank account and is available only to EU and Swiss citizens.

Bitwala recently partnered with DeFi platform Celsius to offer an annual interest of up to 4% on Bitcoin holdings. The funds from customers using Bitcoin Interest Accounts are loaned to institutional borrowers via Celsius, earning weekly interest in BTC. Bitwala has said that DeFi is “a new way to generate wealth” and cited passive income generated from crypto holdings as an example.

Socios

Celebrity tokenization is one of the most innovative sectors in crypto finance. Socios runs a crypto sports-fan token ecosystem, offering tokenized voting platforms and a blockchain-based mobile app. The firm announced in late February that it would launch a crypto-to-fiat prepaid debit card. Alexandre Dreyfus, the CEO of Socios, explained to Cointelegraph how the project works:

“Socios Debit Card, a Fiat Debit Card that will allow Socios.com users to get a card (VISA or MASTERCARD) that will trigger rewards every time they spend money. The idea is that if you are Juventus Fan and you spend FIAT into an Adidas shop, you’ll get cashback and more Juventus Fan Tokens for example.”

Dreyfus also told Cointelegraph that tokens and payments could have an impact both for service users and sponsors in sports: “Sponsors will be able to track and generate campaigns with the teams they are sponsoring, and who have issued Fan Tokens with us.”

Binance

Crypto industry titan Binance announced in March that it would release its own debit card, with the initial testing being carried out in Malaysia. Issued by Visa, the card will be available in Southeast Asia and will later be rolled out to other regions. The internal balance of the Binance Card will be in crypto, with Binance Coin (BNB) and Bitcoin. The card costs $15 but has no monthly or yearly maintenance fees.

Paycent

Paycent is a Singapore-based crypto debit card provider. A Paycent Card costs $49 and comes in three tiers. Ruby is powered by UnionPay and has a daily spending and withdrawal limit of $5,000. Sapphire is powered by Unified Payments Interface and has a daily spending limit of $5,600 and a withdrawal limit of $1,650. Solitaire is Paycent’s option for big spenders. Powered by Mastercard, it has a daily spending limit of $13,000 and a withdrawal limit of $10,000. Its supported currencies are Paycent’s native PYN token, Bitcoin, Verge (XVG), Dragon (DRGN), Ontology Coin (ONT), DigiByte (DBG), Groestlcoin (GRS), Binance Coin, Ether, Litecoin, XRP, Dash and Steem.

Becoming Visa Principal Partners

Coinbase is leading the charge in terms of becoming a bona fide principal partner of Visa. As reported by Cointelegraph, only three further firms have publicly considered putting themselves through the grueling vetting process of becoming a partner. If Cryptopay, Crypto.com and Crypterium are successful in their applications, the firms stand to set themselves apart from all other competitors in the sector.

George Basiladze, the co-founder of Cryptopay, gave Cointelegraph an insight into the application process, saying that becoming a principal member is a long journey that requires obtaining an Electronic Money Institution license, having a Payment Card Industry Data Security Standard certification — and a lot of funding. Here’s what the firms are offering so far:

Crypto.com

Crypto.com is a payments and crypto platform that offers five different cards. The most basic is free and offers spending rewards of 1% on all transactions, while the most expensive requires a Monaco (MCO) stake of 50,000 and offers spending rewards of 5% on transactions, airport lounge access, and Spotify, Netflix and Amazon Prime access. The company recently announced the launch of its MCO Visa card. Formerly known as Monaco Card, it will be available in 31 countries throughout the region. Crypto.com claims that this makes its card offering the most accessible worldwide.

Cryptopay

Cryptopay’s C.Pay card is available to be ordered in the U.K. and Russia and can be used anywhere that Visa is supported. This means that customers can use it with the same support and security that they would normally expect from a Visa card. C.Pay customers can use cryptocurrencies to spend up to 30,000 euros in one transaction.

Virtual cards are free and prices start at 5 euros for a physical card that offers a daily load of 8,000 euros and a daily ATM withdrawal limit of 400 euros. C.Pay cards incur a monthly 1 euro management fee, a 2.50 euro domestic ATM fee, a 3.50 euro international ATM fee and a 3% foreign exchange fee, as well as a loading and unloading fee of 1%. C.Pay customers can spend Bitcoin, Litecoin, XRP and Ether.

Crypterium

Estonia-based firm Crypterium also purports to offer the most global card. Crypterium’s card gives access to over 50 million online and offline retailers, 2.5 million ATMs worldwide and is supported in 178 countries. Cards come with a spending limit of up to $13,000 per day or $60,000 per month, as well as a dedicated app.

The cards cost $25 each but don’t incur monthly costs. Crypterium’s debit cards are processed by the Chinese financial services company UnionPay. Crypterium’s Chief Operating Officer, Austin Kimm, recently told Cointelegraph that UnionPay gives Crypterium greater global reach: “Both Visa and Mastercard allow you to develop cards for particular regions like the United States, South America, Europe, etc. UnionPay, on the contrary, divides the world in two regions.”

Updated: 4-30-2021

Got Crypto? Here Are 3 Debit Cards That Let You Spend Your Stack

Crypto debit cards are growing in popularity as holders look for effortless ways to spend their assets.

As blockchain technology and the public’s awareness of cryptocurrency continues to grow, a range of new use cases a coming to market and enhancing the efficacy of legacy financial systems.

Despite its many applications, the original use case for Bitcoin (BTC) as a medium of exchange remains one of the most fundamental applications of blockchain technology and while BTC might not be the best asset to use for payments, there are service providers who have eased the process of settling transactions in other cryptocurrencies.

For now, the most widely accepted way to use cryptocurrencies for direct payments in everyday life is through the use of crypto debit cards which allow users to convert their crypto holdings into U.S. dollars. They essentially work in the same way that a prepaid debit does.

With institutions showing an increased interest in the growing cryptocurrency sector and mainstream awareness of blockchain technology at its highest level ever, crypto debits cards are increasing in prevalence as new players enter the field to try and capture a share in this growing market.

Three of the debit cards with a track record of success and attractive rewards are BitPay, Crypto.com and the Nexo Card.

Bitpay

The BitPay prepaid Mastercard has emerged as a top choice for many cryptocurrency holders thanks to its ease of use and low fees. It originally launched in 2016 as a US-only debit card and mainly functioned as a Bitcoin payments processor.

BitPay now supports eight different fiat currency options alongside support for Bitcoin, Ethereum (ETH), Gemini Dollar (GUSD), USD Coin (USDC), Paxos (PAX) and Bitcoin Cash (BCH).

Have you added your BitPay Card to @Apple Pay® yet? Easily make online and in-store purchases with crypto. #apple #applepay #bitpay #bitcoin #bitpaywallet #bitpaycard #crypto pic.twitter.com/hRp7nm6vDu

— BitPay (@BitPay) February 23, 2021

Users who wish to obtain the card must first pay a $9.95 activation fee and provide their social security and driver’s license number to gain access. Once approved, the user can load cryptocurrencies onto their BitPay wallet and then convert them to dollars to make them available on the card.

There are no transaction fees for users in the U.S., and the card has a daily spending limit of $10,000 with a maximum account balance of $25,000.

Crypto.com

For the ardent cryptocurrency fan, the Crypto.com debit card is one of the top choices due to the fact that it has a built-in native token called Crypto.com Coin (CRO) which functions as the primary currency and reward token for the blockchain.

Benefits of using the card include 100% cashback on popular streaming services like Netflix and Spotify as well as up to 8% cashback on regular purchases.

Crypto.com users can choose from a list of more than 100 of the top cryptocurrencies to fund their card by depositing them into their account and converting them into a stablecoin which is then loaded onto their debit card.

We’re excited to share news of a historic moment:https://t.co/vCNztABJoG & @Visa successfully conducted the first settlement of transactions using USDC!

— Crypto.com (@cryptocom) March 29, 2021

A huge milestone for the industry as crypto and fiat networks begin to converge.https://t.co/v70qC8n4Yy

The Crypto.com ecosystem offers five different Visa debit cards that have a tiered reward structure that increases depending on the amount of CRO that a user has staked in their account.

Tiers range from requiring a stake of 5,000 CRO for the Ruby Steel card, all the way up to needing 5 million staked CRO to obtain the Obsidian card which offers 8% cashback on all purchases. There is also a basic version of the card that doesn’t require any staking and offers 1% cashback on all purchases.

Nexo Card

A third choice that offers a different structure than most crypto debit cards is the Nexo Card and its native NEXO cryptocurrency which currently trades at $3.63.

Instead of requiring users to convert the cryptocurrency held into their accounts into U.S. dollars before use, Nexo issues an instantaneous loan based on the value of the cryptocurrency held in a users account and settles the transaction in fiat currency.

Want to #hodl your #crypto & spend at the same time?

— Nexo (@NexoFinance) April 22, 2021

Оur Instant Crypto Credit Line™ is just the thing for you.

Need more reasons? Check our blog post:https://t.co/uB0SkM4Qke

This allows users to access the value of their cryptocurrency assets without having to sell them. The loan can be repaid using either cryptocurrency or fiat through their Nexo account with the possibility of having the minimum payment paid off by the yield earned on a users staked cryptocurrency assets.

Interest rates for charges on the card are set at 5.9%, and there are no monthly or annual exchange fees. In addition to this, users receive 2% cash back in the form of Nexo tokens or BTC.

As more banks and institutions in the U.S. and around the world take a stake in the cryptocurrency sector in order to find ways to capitalize on the growing market, crypto debit cards are likely to become a more prominent fixture in legacy payment channels.

Updated: 6-22-2021

Institutional Exchange Launches Crypto Debit Card

Touted for its ability to allow users to “leverage the digital assets in their day-to-day lives,” the Bakkt Visa debit card is now available for online and in-store purchases.

Intercontinental Exchange subsidiary Bakkt has introduced a debit card allowing customers to use crypto for retail purchases.

In a Tuesday announcement, Bakkt said it had launched a fully virtual Visa debit card for both online and in-store spending. Card holders can spend Bitcoin (BTC) from their Bakkt accounts without waiting to convert the cryptocurrency to fiat.

“Imagine a Bitcoin user who sees a significant gain,” said Bakkt CEO Gavin Michael. “Now, instead of selling and waiting to transfer to a bank, they can simply walk into their favorite store, tap their Bakkt Card and buy that new item they’ve been eyeing […] the Bakkt Card untethers Bitcoin owners from their online-only past into a world with countless options to leverage the digital assets in their day-to-day lives.”

Sutton Bank, a member of the Federal Deposit Insurance Corporation, is issuing the debit cards in compliance with a license from Visa. Bakkt avoids BTC transaction fees by selling crypto to users at a price higher than that of the current market rate, which it said has been “no more than 1.5% throughout 2021.”

The debit card release follows Bakkt announcing in March that it had launched a digital asset payments application allowing customers to use BTC and other cryptocurrencies for purchases. At the time, the platform was advertised as a way “to amplify consumer spending, reduce payment costs, and bolster merchant loyalty programs.”

Many exchanges and digital asset marketplaces have launched their own crypto debit cards this year as awareness of the industry grows. BitPay announced in February that it would be offering a crypto Mastercard with support for six tokens, while the Visa card issued by Crypto.com allows users to fund their accountswith more than 100 cryptocurrencies.

Updated: 7-7-2021

BlockFi Starts Shipping Visa-Backed Bitcoin Rewards Credit Cards

Cardholders will earn a percentage back in Bitcoin instead of airline miles or other cashback rewards.

New York-based crypto loans and savings startup BlockFi launched its Bitcoin (BTC) rewards credit card today. The card is available to select approved customers on the United States waitlist.

Officially named BlockFi Rewards Visa Signature Credit Card, the card was first announced at the end of last year by Visa and BlockFi. Available to use anywhere Visa is accepted, the card allows its recipients to earn 1.5% back in Bitcoin instead of airline miles or other cashback rewards. Earned Bitcoin rewards will be transferred to cardholders’ BlockFi Interest Account.

Initial reports were saying that the card would have a $200 annual fee. But BlockFi took a U-turn on that decision in May, launching the card with no annual fee. Cardholders are eligible to earn 2% in Bitcoin on annual expenses exceeding over $50,000. For example, if a customer spends $60,000 within a year, they will receive 2% of the $10,000 expenditure in BTC.

BlockFi’s credit card also offers familiar perks for the crypto ecosystem, such as trading bonuses and a referral program. The card is issued by Evolve Bank & Trust.

Terry Angelos, SVP and global head of fintech at Visa, noted that crypto rewards programs are a compelling way to welcome users to the crypto economy, and Visa is excited to see more examples of them.

Almost everyone knows cryptocurrencies’ role in reshaping the financial space, said BlockFi co-founder Flori Marquez, adding, “This card will make it easier than ever for people to earn Bitcoin back while making day-to-day purchases.”

Visa is a known explorer of cryptocurrencies to broaden the adoption of digital currencies in general. As Cointelegraph analyzed in detail, Visa’s public affirmation of its positive stance toward cryptocurrency payments services reflects its drive to remain a leading player in the global payment network.

Updated: 7-25-2021

Crypto Credit Cards Could Be The Missing Link To Mass Adoption

Hodling is nice, but eventually, everyone wants to buy something. This is why crypto debit and credit cards are key to mass adoption.

Out of the many routes available to the mass adoption of cryptocurrencies, which includes decentralized finance (DeFi), layer-one protocols, nonfungible tokens and stablecoins, perhaps the simplest and most applicable path for the public at large is the ability to utilize cryptocurrency for everyday purchases with an integrated debit or credit card.

2021 has seen a growing number of companies offer cryptocurrency-based credit cards that give holders the chance to tap into the value of their cryptocurrencies for daily purchases, but is this just the latest gimmick being used by businesses to earn a buck or a real sign of mass adoption?

While the traditional financial sector isn’t discussed much in this newsletter because its focus is on exploring the various sub-sectors of the cryptocurrency ecosystem, crypto assets are quickly becoming a new investment class recognized by the global financial system.

Debit cards tap into crypto holdings

It’s important to clarify the differences between the card services offered by some of the largest players in the game including Crypto.com, BlockFi and Coinbase.

Debit cards like the one offered by Crypto.com allow users to convert their cryptocurrency holdings to a stablecoin that can then be transacted on Visa’s global network.

You can now top up your card with $ADA, $DOGE, $LINK, $MATIC, $UNI, along with 12 other new supported stablecoins and tokens!

— Crypto.com (@cryptocom) July 20, 2021

Available in the US, Europe, UK, Canada, Singapore and APAC.

Details https://t.co/ChXzOjfxlB pic.twitter.com/qTVsXfy4KZ

The Coinbase card and crypto debit card offered by Uphold provide a similar service, with both offering rewards for use in the form of a percentage of each purchase, paid back in Bitcoin (BTC) or another cryptocurrency, depending on the platform.

Being able to make purchases with your holdings may help bring a good use case to the cryptocurrency ecosystem, but it also goes against the “hodl” nature of many investors who subscribe to Gresham’s Law that “bad money drives out good money in circulation.”

When it comes to which money is spent and which money is saved, good money, or cryptocurrencies, in this case, will be saved while fiat currencies will be spent in daily transactions.

Crypto Credit Allows Hodlers To Continue Accumulating

Credit cards like the recently launched BlockFi Rewards Visa Signature Credit Card do not require an upfront conversion of a user’s crypto holdings to pay for transactions. Instead, it offers a credit limit with an attached interest rate.

Gemini exchange plans to offer a BTC cashback rewards card on the Mastercard network. This is another example that has taken the approach of the legacy credit system by offering rewards and charging interest on carried balances.

Users can spend fiat currencies and earn cashback rewards that are paid back in the form of Bitcoin.

Paying in dollars while stacking stats lines up more with the idea of spending bad money in daily transactions while earning more crypto, but it does require users to have fiat currencies to spend.

In the case where someone only has cryptocurrencies, they would be forced to convert some of their holdings to the accepted form of repayment and possibly incur a taxable event, depending on the laws where they live.

Currently, most of the world’s population either still uses the traditional financial system or is part of the large population of the unbanked who are outside of all systems. The injection of blockchain technology and cryptocurrency is either adding another step to the process or offering a new way into a financial network.

For die-hard crypto fans that hold as much of their wealth as possible in cryptocurrency, debit card options that allow users to spend their holdings may provide the best option.

Traditional financial system vs decentralized financial system. #defi #blockchain #crypto

— BlockchainAssets (@BAXASSETS) December 30, 2019

Credits: Financial times pic.twitter.com/1dc0jJxvm3

Since many crypto investors work jobs that still pay in fiat currencies, credit card options offer a way to use their income to make purchases while also continuing to accumulate without having to conduct the conversion to crypto themselves.

Visa and Mastercard have fully embraced the integration of cryptocurrencies and blockchain technology into their networks. Visa recently reported that its crypto-enabled cards holders spent more than $1 billion during the first half of 2021.

It’s possible that in the near future, the entire network could be blockchain-based and users will be interacting with digital currencies on a regular basis without even knowing it.

How it all plays out long-term is anyone’s guess, but the current trend of companies releasing cryptocurrency-related debit and credit cards shows no signs of slowing down. They are a tried-and-true marketing tactic used in industries large and small to help entice new users.

Updated: 8-9-2021

Alchemy Pay To Launch Virtual Crypto Cards With Visa And Mastercard Support

Crypto payment firm Alchemy Pay is planning to roll out a crypto-linked virtual card that is accepted on the Visa and Mastercard payments networks.

Hybrid crypto-fiat platform Alchemy Pay announced Monday that the company would be launching virtual crypto-linked cards accepting more than 40 cryptocurrencies such as Bitcoin (BTC).

The new cards can be linked to Google Pay and PayPal digital wallets and make payments across the Mastercard and Visa networks, as well as popular e-commerce platforms such as Amazon and eBay.

According to the announcement, Alchemy Pay has already completed the product’s development and launched beta testing in multiple key markets. The firm expects to proceed with a full roll-out of the new product at the end of 2021 or early 2022.

The new initiative has been launched in response to the growing demand for crypto-linked card transactions, allowing crypto businesses to offer a full range of services as well as to help traditional institutions integrate crypto-related solutions, Alchemy Pay said. As previously reported, Visa alone processed over $1 billion in total crypto spending in the first half of 2021.

Alchemy Pay did not immediately respond to Cointelegraph’s request for comment.

The news comes shortly after Alchemy Pay last week partnered with Binance, the world’s largest cryptocurrency exchange by trading volumes. As part of the integration with Alchemy Pay, Binance will unlock crypto payments across merchants of Alchemy Pay’s partners in 18 countries, including e-commerce giant Shopify, software technology company Arcadier, mobile payment provider QFPay and others. The new feature wi be available through Binance’s payments application Binance Pay.

As previously reported by Cointelegraph, both Visa and Mastercard have been aggressively moving into the cryptocurrency industry over the past year.

After announcing payment compatibility for Circle’s stablecoin USD Coin (USDC) in late 2020, Visa has reaffirmed its commitment to crypto payments and fiat on-ramps, outlining a particular focus on stablecoin-based integrations. Mastercard has entered partnerships with Circle and blockchain firm Paxos to enable banks and crypto companies to roll out crypto cards globally.

Updated: 8-15-2021

Venmo Credit Card Holders Can Now Trade Cash Back For Crypto

Customers can choose between bitcoin, ether, litecoin and bitcoin cash.

Venmo credit card customers can now convert their monthly cash back rewards to crypto, the unit of payments giant PayPal announced Tuesday.

* Venmo’s new “Cash Back to Crypto” feature will allow users to choose between bitcoin, ether, litecoin and bitcoin cash, the same four cryptocurrencies that are currently available on the Venmo app.

* Unlike Venmo’s normal fees for cryptocurrency purchases, which can range from $.50 to 2.3% of the transaction amount, the Cash Back to Crypto program will not have a transaction fee.

Instead, a conversion spread is baked into the monthly transaction.

* Once the purchase is complete, customers will be able to either hold their crypto or sell it on the Venmo app. The program will not support transfers to external wallets.

* “We’re excited to bring this new level of feature interconnectivity on the Venmo platform, linking our Venmo Credit Card and crypto experiences to provide another way for our customers to spend and manage their money with Venmo,” Darrell Esch, a general manager at Venmo and “head of checkout” at PayPal, said in a statement.

* The Cash Back to Crypto rollout begins Tuesday and will be available to all Venmo credit card holders in the coming weeks.

Updated: 8-17-2021

GoSats Launches Bitcoin Cashback Rewards Card In India

Users will be able to earn yield paid in BTC on all the rewards they’ve accumulated through the app.

Bitcoin (BTC) rewards company GoSats has launched a new cashback rewards card for customers in India, potentially setting the stage for wider mainstream adoption of digital assets in the world’s second-most populated country.

The new product is being introduced in partnership with the National Payments Corporation of India, also known as NPCI, which is a not-for-profit organization dedicated to promoting digital payments and settlement systems across the country. The organization was founded in December 2008 and is under the direct ownership of the Reserve Bank of India.

The GoSats rewards card, which is accessible through mobile app and browser extension, allows users to earn cashback paid in BTC while shopping at major brands such as Amazon, Starbucks and Flipkart. GoStats was built on Stacks, which provides smart contracts and apps for Bitcoin. Namely, the rewards card utilizes Stacks’ Clarity smart contracts and “stacking,” which provides users with a way to earn BTC through the STX token.

The NPCI partnership suggests that GoSats is looking to avoid any regulatory hurdles in rolling out its services. Mohammed Roshan, GoSats’ CEO and co-founder, said the partnership will enable his firm to “offer users bitcoin earning opportunities using NPCI’s existing card network,” adding:

“Beforehand, people could only get bitcoin cashback on specific brands through our app but now can earn cashback in bitcoin on every spend.”

Launched in February 2021, GoSats has accumulated over 15,000 customers in just six months, underscoring pent-up demand for digital asset services in the country. India’s history with cryptocurrencies has been volatile, to say the least. Policymakers appeared to be on the verge of banning crypto altogether, but have since softened their stance. As Cointelegraph reported in July, the Securities and Exchange Board of India is said to be working with the finance ministry to oversee crypto regulations in the country.

In the meantime, foot traffic to cryptocurrency exchanges has grown rapidly. WazirX, a Binance-owned cryptocurrency exchange operating in India, has reported over 2,600% user growth since inception. A large portion of those signups has been women from smaller cities.

Crypto credit cards and cashback reward programs are growing in popularity as digital assets continue to permeate the mainstream. As Cointelegraph recently reported, PayPal’s Venmo has created a new program that allows credit card users to automatically purchase crypto with cashback rewards.

Updated: 10-25-2021

Mastercard Plans To Allow US Partners To Offer Crypto Loyalty Rewards

Millions of loyalty rewards program users who may have never had any knowledge or use of cryptocurrencies could soon have some exposure.

Major credit card company Mastercard has announced it is preparing to integrate cryptocurrencies into its loyalty program offerings for United States-based banks, merchants and fintech firms on its payment network.

In a Monday announcement, Mastercard said it would be working with digital asset platform Bakkt to allow its customers based in the United States to buy, sell and hold digital assets through custodial wallets. The partnership will also enable cardholders to earn and spend rewards in crypto rather than using loyalty points and accruing or redeeming tokens for purchases.

“We’ll not only empower our partners to offer a dynamic mix of digital assets options, but also deliver differentiated and relevant consumer experiences,” said executive vice president for digital partnerships at Mastercard Sherri Haymond.

According to data from Colloquy Loyalty Census research conducted in 2017, U.S. consumers held 3.8 billion memberships in loyalty programs, though these numbers have likely changed following the evolving financial landscape amid the pandemic.

Mastercard also reported there were 249 million of its cards in the United States as of the end of Q1 2021. Millions of loyalty rewards program users who may have never had any knowledge or use of cryptocurrencies could soon have some exposure.

Mastercard CEO Michael Miebach said in July the company “[has] to be in this space,” in part, due to the growing interest around central bank digital currencies and crypto. In February, the credit card firm announced its roughly one billion users would be able to use crypto at its more than 30 million supported merchants. However, Mastercard has not yet clarified which tokens would be supported.

The digital assets management arm of the Intercontinental Exchange, Bakkt recently listed its shares on the New York Stock Exchange under the ticker symbols BKKT and BKKT WS. The platform has also partnered with Google to allow customers to convert their crypto balances to make fiat payments using Google Pay.

Updated: 11-18-2021

Bitcoin Cashback Plan Sends Shares In U.K. Fintech Firm Soaring

Shares in U.K. fintech firm Mode Global Holdings Plc jumped after it expanded an offer that allows consumers to earn Bitcoin as they shop.

The cashback offer will apply at more than 40 retailers next year, including Ocado Group Plc, Walgreens Boots Alliance Inc.’s Boots and Hilco Capital LP’s Homebase, London-based Mode said in a statement Thursday. The stock soared as much as 15%, the most in more than five months.

Once the increased network is activated in the second quarter of 2022, customers will have the option of being credited with Bitcoin in their Mode account, the firm said.

Thursday’s gains boosted Mode’s market value to about 39 million pounds ($53 million). The stock is down 14% since going public in October 2020.

Updated: 3-13-2022

Can Cryptocurrency Replace Loyalty Points?

A growing number of rewards programs are offering crypto instead of typical rewards points. Is a credit card that lets you earn crypto right for you? We take a look at the pros and cons of the new options.

The worlds of cryptocurrency and loyalty reward systems are merging at a rapid pace, with individuals adopting credit card rewards in the form of bitcoin (BTC), ether (ETH), stablecoins and other cryptocurrency tokens over airline miles or hotel points.

In 2021 alone, major cryptocurrency exchanges BlockFi and Gemini announced they would launch credit cards offering bitcoin rewards. Major consumer brands are also getting into the cryptocurrency rewards world. Shake Shack (SHAK) is now offering rewards in bitcoin for those who use Cash App to buy food.

Even airlines are experimenting with cryptocurrency as a loyalty reward. When Northern Pacific Airlines launches, the carrier will reward frequent flyers with its flyCoin token. The airline guarantees the value of the coin will never drop below 2 cents per coin.

It is also exploring partnerships with major crypto exchanges to allow users to buy additional coins. FlyCoin can be used to purchase free flights and airline elite status, potentially with other partners in the future.

With all the buzz around the future of cryptocurrency, will it eventually replace loyalty points as the rewards of choice for spending? More importantly, do cryptocurrency rewards offer more potential rewards than airline miles or hotel points? It depends on your financial perspective and what type of return you value the most.

What Are Loyalty Points?

In the simplest terms, loyalty points are a type of incentive program used by businesses to encourage customers to continue spending their money with them. The more you spend exclusively with one brand, the more points you can earn via their loyalty programs, which can be exchanged for items, upgraded services or experiences of value.

One of the earliest examples of a loyalty rewards program was the S&H Green Stamp program, launched in 1896 by Sperry & Hutchinson. When shopping with participating retailers (including supermarkets, gas stations and department stores), customers would earn green stamps. In turn, collectors could use these stamps for merchandise from Green Stamp stores or the mail order catalog.

The first example of a travel-based loyalty program was launched by Texas International Airlines. As flyers purchased tickets and traveled with the carrier they would get credited for the actual number of miles flown between points, which could be traded in for free flights in the future.

By 1991, credit card issuers started getting in on the loyalty program. That year, American Express (AXP) launched the Membership Miles program, offering cardholders the chance to earn flexible miles which could be used for travel across a number of airlines. Ten years later, the program remains the biggest card-based loyalty program in the world.

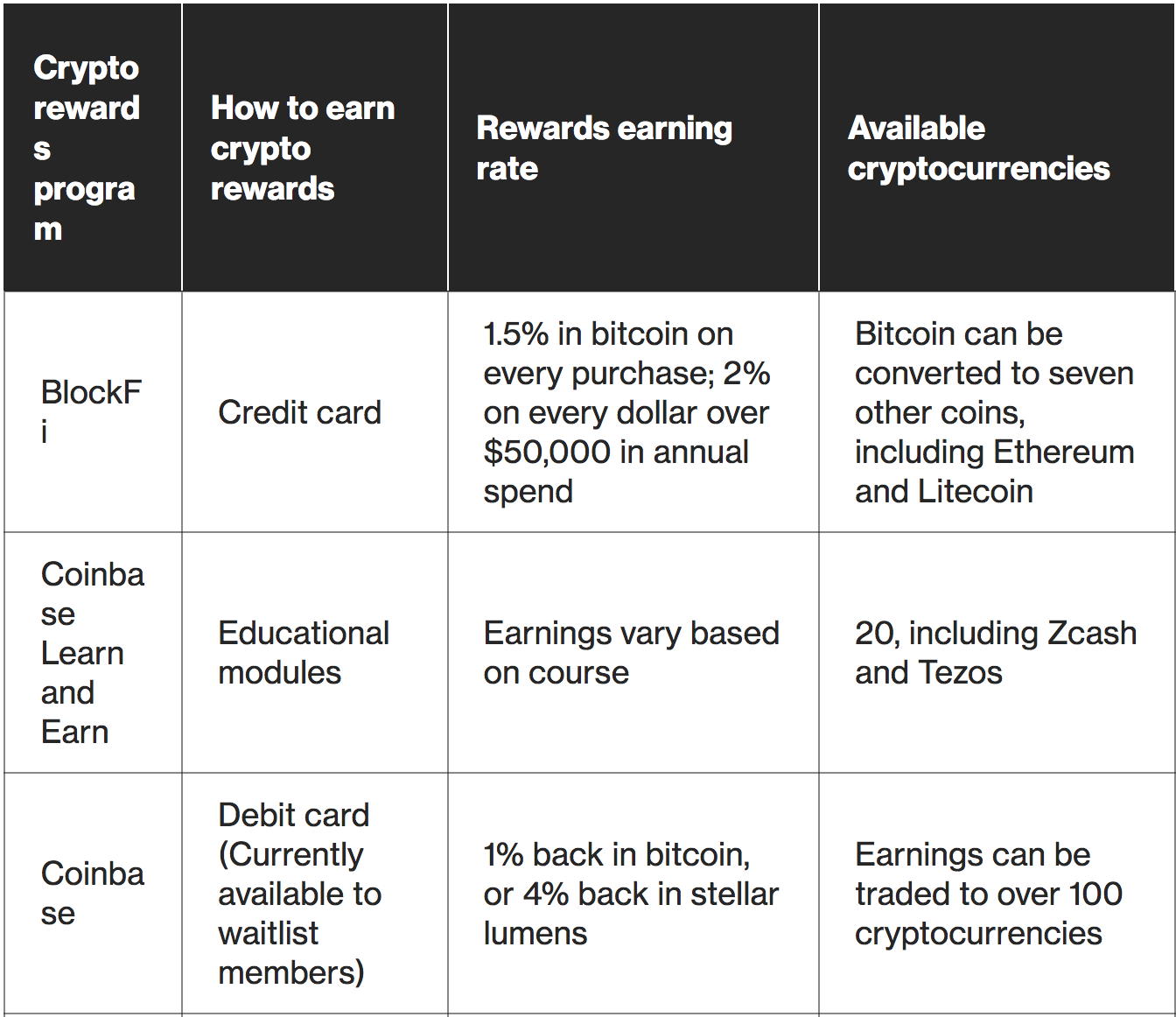

Top Cryptocurrency Loyalty Reward Schemes

There are several programs that offer cryptocurrency rewards for return customers. While some require you to spend using a credit or debit card, others allow you to earn coins just for viewing short educational modules online.

Benefits Of Cryptocurrency Versus Loyalty Points

Although loyalty points have some attributes in common with cryptocurrency, it doesn’t mean they are the same.

One of the biggest differences between crypto and loyalty points is centralization. Because cryptocurrency and crypto wallets are decentralized, the value of those tokens can fluctuate with market demand. Loyalty points will almost always have a fixed value set by the program, which can change based not on community activity, but rather what is most profitable for the company.

Furthermore, decentralization means cryptocurrency transactions are more anonymous than those in loyalty programs. Although your wallet address is logged on the public ledger, it takes a lot of investigation to link an individual with a wallet.

With loyalty points, the program or financial institution knows not only your name and address but also knows your spending habits, redemption patterns and other unique consumer information, which allows them to advertise to your tastes – or sell data to other parties.

Finally, while we can constantly track the value of cryptocurrencies in relation to fiat in real time, loyalty points often don’t have a cash value. A loyalty program user can’t go to the loyalty program and ask to redeem points for U.S. dollars, euros or other hard currencies.

Instead, once the money is spent and points are earned, they are locked into that loyalty system. If you can’t use those points, they literally hold no value.

Bottom Line: Is Cryptocurrency More Valuable Than Loyalty Points?

Although loyalty programs are not cryptocurrency today, customer attitudes towards collecting tokens and putting loyalty on the blockchain are changing. A Deloitte study determined that adopting the blockchain in loyalty programs will make them customer-friendly by reducing costs, making earning and using points a near real-time experience in a secure environment.

Moreover, the “Bakkt Loyalty and Rewards 2022 Outlook” study found 72% of loyalty program members purchased cryptocurrency at least once in the past six months, and over half said they understood the value of earning crypto-based rewards alongside loyalty points.

At the end of the day, the most valuable digital currencies anyone can earn allow them to build value over time. Before investing time and money into any rewards program, weigh the following scenarios for your personal value structure:

Can I use cryptocurrency or loyalty points to gain value over time? Many people will collect loyalty points with a goal in mind, such as free travel or earning cash-back rewards. However, those points are only good if they can be exchanged in a timely manner without paying credit card interest rates or annual fees. Before collecting loyalty points, be sure you understand how to use them and when you get the best value from them.

In comparison, cryptocurrency rewards don’t have an expiration date, can be exchanged for fiat or other tokens at any time and can be used for purchases with certain retailers.

Additionally, cryptocurrency rewards can be stacked alongside traditional programs: If you pay for your airfare with a cryptocurrency rewards credit card, you could earn crypto back alongside loyalty points. If you value simplicity with a long upside, crypto rewards may offer a better value.

Do I understand my rate of return from cryptocurrency rewards or loyalty points? Just because a credit card promises 70,000 miles, it doesn’t mean you can physically travel 70,000 miles on that airline. Rather, the rate of return from rewards points is based on how and when you use them. Using 25,000 miles for a $500 flight offers a better rate of return than using them for a $200 flight.

A cryptocurrency’s rate of return is based on multiple factors, including the market rates and communities driving value behind the token. If you earn bitcoin rewards when value is low, it could go up over time – similar to an investment. If you would rather track your rewards like a stock instead of a depreciating asset, crypto rewards could be a smarter choice.

Am I driven to use cryptocurrency or loyalty points over an extended period of time? Finding value in any loyalty program requires discipline and a clear understanding of how your spending will turn into tangible rewards.

Under traditional rewards programs, you may have to carefully break up your spending across multiple credit cards to earn enough points for a reward, or spend more than you are comfortable with to maintain elite status.

On the cryptocurrency side, earning and accruing crypto tokens means they have the potential to rise in price while the value of loyalty points ultimately remains the same until they reach expiration. Of course, this works both ways, and just as the value can rise it can also fall.

Updated: 1-5-2023

How To Buy Bitcoin With Apple Pay?

Buy Bitcoin with Apple Pay using iPhone and iOS devices on various leading cryptocurrency exchanges including Binance, Coinbase, BitPay and more.

Cryptocurrency exchanges are introducing various ways to buy Bitcoin using the Apple Pay payment method. This comes as a good move for Bitcoin adoption since the Apple Pay digital wallet accounts for more than 507 million mobile wallet downloads and a dominating market share of 43.5% in the United States mobile payments market.

This ability to now integrate and buy Bitcoin with Apple Pay paves new crypto opportunities for iPhone users. This article explains how to purchase Bitcoin and other cryptocurrencies using Apple Pay.

What Is Apple Pay Digital Wallet?

Apple Pay, introduced in 2014, is a mobile payment service for web payments using iOS and is supported by Apple products. It is most commonly used as an Apple Pay application on iPhones and Apple watches. It allows users to pay for music, movies and apps with one simple touch.

With the introduction of Near Field Communication (NFC) technology, offline stores are also now accepting Apple Pay leading to a surge in Apple Pay contactless payments.

NFC is a proximity-based wireless connectivity technology that utilizes magnetic fields to enable communication between devices when they are brought near each other. Apple Pay is supported by thousands of apps and offline stores worldwide, allowing users to purchase numerous goods and services, as well as buy Bitcoin with their iPhone and Apple Watch using NFC.

Various Ways To Buy Bitcoin With Apple Pay

While Apple does not directly have a Bitcoin or crypto integration on its devices, many popular applications and platforms facilitate transactions or transmissions of cryptocurrency. Here are the various ways to buy Bitcoin using Apple Pay.

Buy Bitcoin With Apple Pay Through Coinbase

Coinbase is a U.S.-based crypto trading and investment platform which offers a range of services and enables users to buy, sell, exchange and store cryptocurrencies.

Coinbase has been expanding its presence in the cryptocurrency space through partnerships with major giants like Visa and Mastercard for offering on and off ramp crypto trading through instant purchases with credit and debit cards.

To enable a more convenient option for iOS users, Coinbase in June 2021 introduced the purchase of Bitcoin using Apple Pay linked to a debit card. However, selling crypto and cashing out options are not available with this mode yet.

Steps To Buy Bitcoin Using Apple Pay On Coinbase

1. Login to the Coinbase account on the website or app using a device supporting Apple Pay.

2. Select Bitcoin in the cryptocurrency options.

3. Enter the amount of Bitcoin to be purchased in the “Buy BTC” option.

4. Select Apple Pay from the list of available payment methods.

5. Confirm Bitcoin purchase using Apple Pay.

It is important to note that Apple Pay will appear automatically as a payment option if a Visa or Mastercard debit card is linked to the underlying Apple Pay digital wallet. If not, ensure to do so first before following the above steps.

The limit to purchase BTC using Apple Pay on Coinbase is dependent on the sum of the debit card’s transaction limit and Coinbase limits and also subject to change as per policy, geographical region and location. One can check these limits in the Coinbase app under Settings ETH), Litecoin can also be purchased using Apple Pay on Coinbase in a similar fashion.

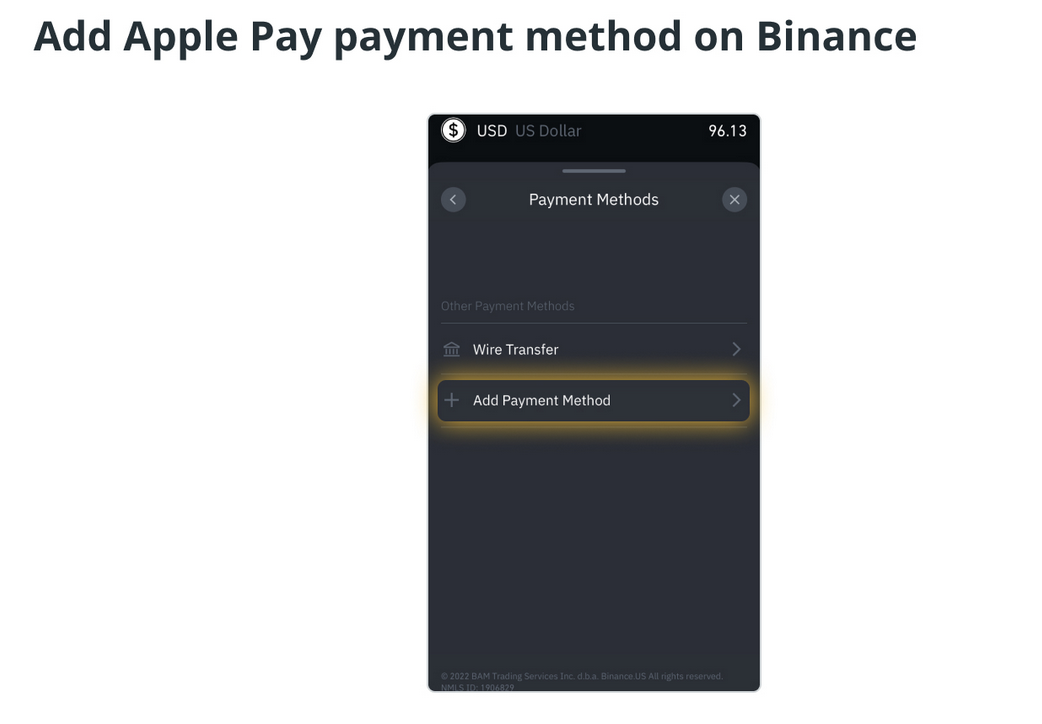

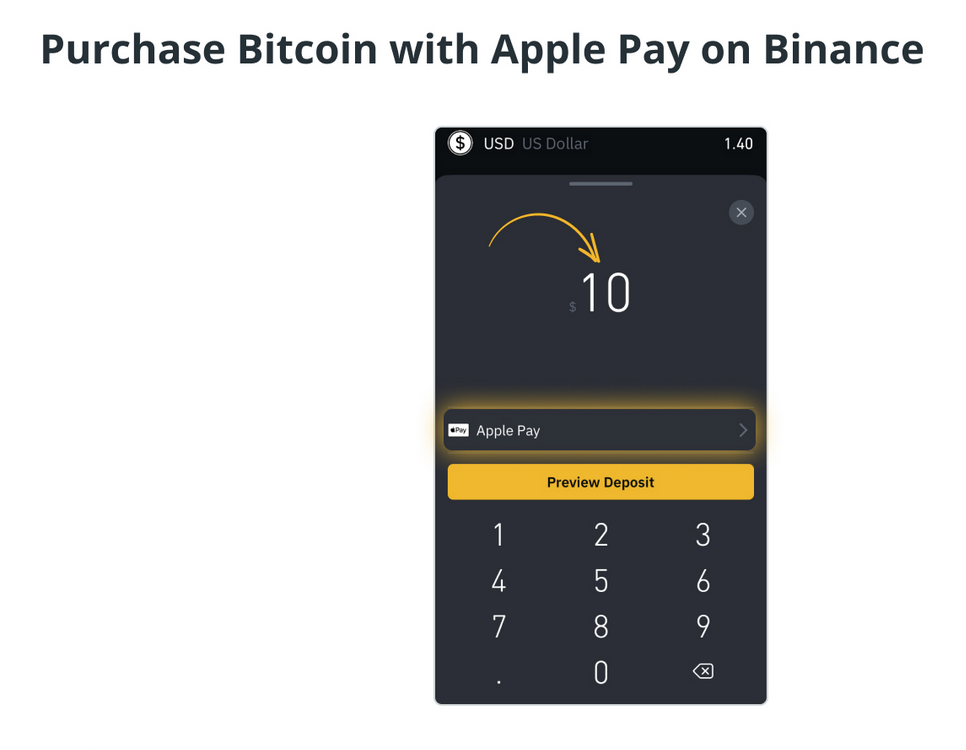

Buy Bitcoin With Apple Pay On Binance

Binance first introduced and started providing Apple Pay integration to buy cryptocurrencies using credit and debit cards only to citizens of the United Kingdom and the European Economic Area (EEA). In December 2022, Binance announced Apple Pay (for debit cards only) to deposit USD and purchase crypto for U.S. account holders.

This opens avenues to not only purchase but also make Bitcoin and crypto investments using Apple Pay on Binance.

Steps To Buy Bitcoin Using Apple Pay On Binance

1. Login to the Binance app on your iOS device.

2. Click on “Wallet,” select U.S. dollar and deposit USD.

3. Click “Add Payment Method” and add Apple Pay.

4. Add Apple Pay Payment Method on Binance

5. Enter the amount of USD and tap “Deposit.” Add Apple Pay as the chosen payment method.

6. Purchase Bitcoin with Apple Pay on Binance

7. Proceed to purchase BTC or other cryptocurrencies with this deposit.

It is important to note that Apple Pay for the U.S. will only work for debit card integrations, while for U.K. and EEA, a credit card is an additional option.

Also, there is a 3.75% fee applied to the deposit amount when using Apple Pay in the U.S. and approx 2% per transaction in the United Kingdom, subject to change as per policy. Users must ensure to check fee changes on the exchange they transact with.

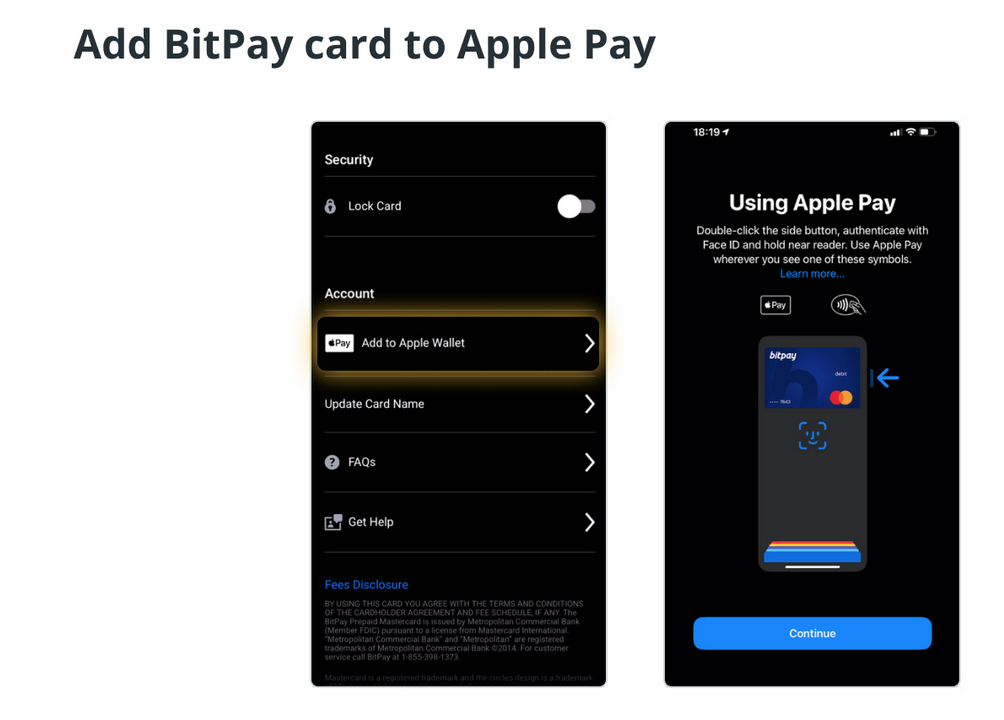

BitPay is the largest Bitcoin and cryptocurrency payment service provider based in Atlanta, Georgia. It allows businesses, merchants and institutions to accept cryptocurrency payments and convert them to fiat currencies.

BitPay gained massive popularity as it charges merchants flat 1%transaction fees in comparison to credit cards which are known to charge higher fees ranging to 3% and sometimes more.

BitPay added Apple Pay in 2021 as a payment option to allow its users to buy, exchange and shop with BTC and other cryptocurrencies using Apple Pay digital wallet. BitPay does not allow in-app crypto purchases yet, but contactless crypto purchases using NFC are possible in-store and online using Apple Pay on supported devices.

In addition to Bitcoin, BitPay also supports popular stablecoins like USD Coin and BinanceUSD (BUSD) for Apple Pay purchases. Users need to add their BitPay crypto debit card to Apple Pay and then can use Bitcoin to make purchases wherever Apple Pay is accepted globally. BitPay partnered with Simplex and Wyre to enable these Apple Pay payments.

Steps To Buy Bitcoin Using Apple Pay On BitPay

1. Login to the BitPay app.

2. Load BTC on your BitPay debit card.

3. Add the BitPay Card to Apple Pay in the BitPay App.

4. Add BitPay card to Apple Pay

5. Use the BitPay card BTC funds to make purchases using Apple Pay.

Buy Bitcoin with Apple Pay using MetaMask

MetaMask, the Ethereum cryptocurrency wallet provider, also now allows users to purchase cryptocurrencies via Apple Pay. MetaMask announced its Apple Pay support in April 2022.

Since this is not an integration with Apple directly, MetaMask users are redirected to Wyre, allowing them to make the payment via credit/debit card or through Apple Pay. Wyre is a cryptocurrency exchange that offers crypto to fiat via API and integrates with Apple Pay.

MetaMask allows its Apple Pay users a maximum daily deposit limit of $400 into their wallet and charges a gas fee as well as its own transaction fees (0.875% of the transaction amount).

Moreover, purchasing crypto through MetaMask allows users to use it across different decentralized applications (DApps) and Web3 services where MetaMask is available. However, in-store contactless purchases are still not available through this method.

Steps To Buy Bitcoin Using Apple Pay Through MetaMask

1. Login to your MetaMask account on browser or app.

2. Set up Apple Pay via the app.

3. Ensure Know Your Customer on the card connected with Apple Pay.

4. Tap “Add Funds,” click “Buy BTC” and input the amount.

5. Select Apple Pay as the payment method.

6. Authenticate and complete the transaction.

While the above four methods are quite known, there are many other wallets, exchanges and platforms where one can avail the benefits of buying Bitcoin with Apple Pay including and not limited to Exodus, Paxful, CEX.io, Lumi Wallet, Crypto.com and more.

Users must acquaint themselves with terms, conditions, fees and others before selecting their preferred method.

Should You Buy Crypto With Apple Pay?

There is no straight answer to whether or not users should choose to buy Bitcoin and other cryptocurrencies using the Apple Pay method. However, there are both benefits and drawbacks to doing so.

The positives include quick, easy and straightforward transactions. Apple Pay’s contactless payment method technology makes it a preferred payment method among millennials and Gen Z users in the United States.

Apple Pay statistics claim that its contactless payment method is accepted by 85% of U.S. retailers for fiat payments. This user preference is also reflected by the multitude of crypto platforms, exchanges and wallets that are bringing in contactless Apple Pay integrations.

However, the negatives to watch for include the threat of monetary loss due to scams, hacks and malware as well as crypto volatility which may incur frequent fluctuations in prices while making purchases. Therefore, users must make informed decisions and do thorough research before using various crypto payment methods available in the market.

Updated: 2-10-2023

Bit2Me And Mastercard Launch Debit Card With Crypto Cashback

The new debit card builds on technology already in place in the existing Bit2Me crypto card, but this time, card holders are eligible for up to 9% crypto cashback.

The merger of Web2 and Web3 tools continues as crypto-backed debit cards become more mainstream.

In an announcement on Feb. 10, Bit2Me, the largest Spanish cryptocurrency exchange, revealed its new cashback debit card in partnership with Mastercard.

The original Bit2Me card works for its users via the Mastercard network that hosts millions of businesses worldwide. This new update offers users up to 9% crypto cashback for all purchases made with the card online or in-store.

Leif Ferreira, the CEO and co-founder of Bit2Me, told Cointelegraph that the use of already known Web2 financial tools like debit and credit cards comes with the hope of greater adoption of this “revolutionary” technology

“[The] goal is that any user from anywhere in the world has easy access to the limitless world of Web3 financial services, at the touch of a button.”

The card and wallet support eight cryptocurrencies, including Bitcoin, Ethereum, Cardano, Ripple, Solana, and Polkadot along with the stablecoin Tether.

The company reportedly plans to add additional currencies throughout the year. Bit2Me is currently available to users in 69 countries around the world. However, users in the European Economic Area (EEA) are only eligible to apply for the virtual version of the card.

Bit2Me has had service expansion on its radar for some time, after its initial announcement in 2021 to offer services globally.

Back in July, the exchange was quick to jump to help 100,000 blocked crypto investors onboard onto its platform after they wereshut out from the defunct local Spanish trading platform 2gether.

Meanwhile, Mastercard has also been active in offering new services and opportunities for users and clients in the Web3 space. It has chosen at least seven blockchain and crypto startups to be a part of its fintech accelerator program in the last year.

The company also partnered with Polygon to launch a Web3 musician accelerator program, focusing on the intersection of the music industry and emerging technologies.

On Jan. 31, Mastercard announced a new effort with Binance to launch their second prepaid crypto card in Latin America.

Related Articles:

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.