Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

Global Food Costs Keep Climbing In Threat To Consumer Wallets. Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

The global food-price rally that’s stoking inflation worries and hitting consumers around the world shows little sign of slowing.

Even with grain prices taking a breather on good crop prospects, a United Nations gauge of global food costs rose for a 10th month in March to the highest since 2014. Last month’s advance was driven by a surge in vegetable oils amid stronger demand and tight inventories, according to Abdolreza Abbassian, a senior economist at the UN’s Food and Agriculture Organization.

Related:

The Fed Is Setting The Stage For Hyper-Inflation Of The Dollar (#GotBitcoin)

Deutsche Bank Short US Dollar Index (USDX)

Juice The Stock Market And Destroy The Dollar!! (#GotBitcoin?)

Bloomberg: Americans Trade Depreciating Dollars For Bitcoin

Dollar On Course For Worst Month In Almost A Decade (#GotBitcoin?)

Hyperinflation Concerns Top The Worry List For UBS Clients

Food prices are in the longest rally in more than a decade amid China’s crop-buying spree and tightening supplies of many staple products, threatening faster inflation. That’s particularly pronounced in some of the poorest countries dependent on imports, which have limited social safety nets and purchasing power and are struggling with the Covid-19 pandemic.

Breakdown Of Last Month’s Food Costs:

* The FAO’S Food Price Index Rose 2.1% From February.

* Vegetable Oil Prices Jumped 8% To The Highest Since June 2011.

* Meat And Dairy Costs Rose, Boosted By Asian Demand.

* Grains And Sugar Prices Fell.

Grains prices recently climbed to multiyear highs as China imports massive amounts to feed its hog herds that are recovering from a deadly virus. Still, there are signs that tight supplies may get some relief from upcoming wheat harvests in the Northern Hemisphere.

“Generally speaking, supplies for now are adequate,” Abbassian said. “We might have reached a level whereby from now on even if we see price increases, they may be a bit more subtle” than advances seen in previous months, he said.

Inflation Has Gone K-Shaped In The Pandemic Like Everything Else

Low-income Americans bore the brunt of job losses when the pandemic arrived. Now they’re getting hit hardest by price increases as the economy recovers.

The headline consumer inflation rate in the U.S. remains subdued, at 1.7% — but it masks large differences in what people actually buy.

Some of the biggest price hikes of recent months, for example, have come in gasoline. A gallon of regular is up 75 cents since late last year –- adding more than $60 a month to the budget of someone who fills up with 20 gallons a week.

Food-price inflation is running at more than double the headline rate, and staples like household cleaning products have also climbed.

Price increases like these are causing trouble all over the world — and they tend to hurt low-income people most. That’s because groceries or gas take up a bigger share of their monthly shopping basket than is the case for wealthier households, and they’re items that can’t easily be deferred or substituted.

K-Shaped

An analysis by Bloomberg Economics, which reweighted consumer-price baskets based on the spending habits of different income groups, found that the richest Americans are experiencing the lowest level of inflation.

Those same high-earners already posted windfall gains during what’s been labeled a K-shaped recovery from the pandemic. Their net worth surged, thanks to booming stock and real-estate markets -– and they mostly kept their jobs and were able to work from home.

What Bloomberg Economics Says…

“On average, higher-income households spend a smaller fraction of their budgets on food, medical care, and rent, all categories that have seen faster inflation than the headline in recent years, and 2020 in particular.”

— Andrew Husby, Economist

The richest 10% of households captured 70% of wealth created in 2020, according to the Federal Reserve, while the bottom half got just 4%. A January study by Opportunity Insights, a Harvard research project, found that the recession was essentially over for those making at least $60,000 a year, while employment among the lowest-paid –- who earn less than half that amount –- was still almost 30% below pre-pandemic levels.

The question of who exactly gets hurt by higher prices could become more urgent as inflation accelerates. Most economists expect a pickup in the next 12 months.

The Fed, which is in charge of keeping inflation under control, says any increase will likely prove temporary. The central bank isn’t planning to use its inflation-fighting tool of higher interest rates anytime soon.

The idea behind the Fed’s new thinking is that allowing the economy to run a bit hotter — and inflation to creep a bit higher — will actually help to reduce income inequalities, because it will encourage a strong jobs market that benefits low-paid Americans the most. There’s some evidence that this is already happening in the restaurant, hotel and other service industries.

Meanwhile, the Biden administration says it will push U.S. statisticians to produce more detailed data that breaks down economic outcomes for different racial or income groups.

That initiative could have consequences for people whose incomes are tied to measures of inflation — like recipients of Social Security or food stamps. They can get squeezed when those gauges fail to accurately capture changes in the cost of living. There’s been talk in the past, for example, of pegging Social Security to an index that specifically measures the inflation experienced by older people.

‘Uneven Effects’

The distributional questions raised by higher prices aren’t just a U.S. phenomenon.

A United Nations gauge of global food costs rose for a tenth straight month in March, the longest run of increases since 2008 when the world faced the first of two food crises within a few years.

“The food price story and inflation story are important to the issue of equality,” says Carmen Reinhart, the World Bank’s chief economist. “It’s a shock that has very uneven effects.”

The problem of K-shaped inflation predates the pandemic and may have deep-rooted causes, according to Xavier Jaravel, an assistant professor at the London School of Economics.

His research has shown that a key reason why richer people experience lower rates of inflation is that there’s more competition among producers for their dollars –- leading to higher levels of innovation in the kind of goods and services bought by the wealthy, which helps keep prices down.

“One can hope that statistical agencies around the world will soon adopt new data sources and price indices to better measure inflation inequality,” Jaravel wrote in a recent paper, “and that economists will pay more attention to the distributional effects of prices.”

Updated: 8-20-2021

Why Inflation Is Scaring Latin America If Not The Fed

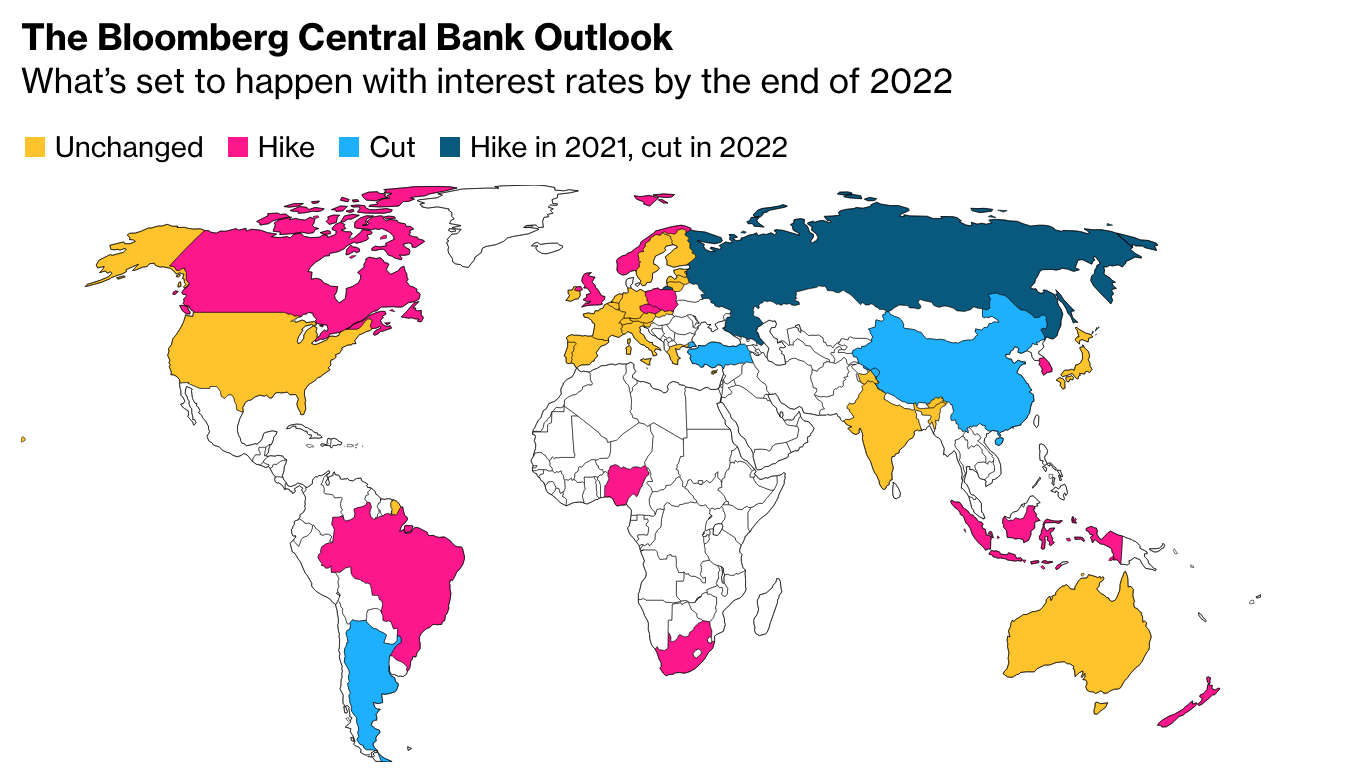

The U.S. Federal Reserve, like many other central banks, sees inflation from the reopening of economies disrupted by the pandemic to be “transitory,” and it’s not expected to raise interest rates until at least next year.

Latin America’s policy makers, by contrast, are rushing to reverse ultra-low borrowing costs. Since late June, central banks in Mexico, Peru, Chile, Uruguay and even Paraguay followed the early move by Brazil and increased rates, while many expect Colombia to follow soon.

Latin America was perhaps hit harder than any other region by Covid-19 and is experiencing a quick economic rebound that puts pressure on prices.

Other reasons for the difference, though, may have to do with the continent’s high levels of inequality, informality and political instability — together with a history of inflationary bouts deeply etched into the collective economic memory.

1. What’s Been Driving Inflation?

Around the world, prices have been rising faster than usual as the end of many pandemic-related restrictions released pent-up consumer demand that disrupted supply chains have struggled to meet. Some factors have affected Latin America in particular.

For instance, the global rally of food and energy prices has had a disproportionately large impact on the world’s most unequal region: food prices make up a greater share of inflation indexes in Latin America than in advanced economies like the U.S. That means that soaring food prices — beef is up 43% in Brazil — have played a larger role in overall inflation.

2. Are There Other Factors Specific To Latin America?

Yes. Many countries in the region are also net energy importers, and have seen surging gas prices as rising demand has led to tighter global oil markets. Recent social unrest has triggered volatility in some currencies too. There’s a strong tie between prices and currencies in Latin America, and devaluations almost immediately show up in inflation.

Meanwhile, governments face continued pressure to sustain increased social spending adopted to combat the jump in poverty caused by the pandemic. The prospect of larger deficits has both soured investors on the currency outlook and increased their inflation expectations, which often causes local businesses to raise prices more and workers to demand higher pay increases in the near-term to hedge against future inflation.

All this comes on top of being a region with a history of high inflation: It averaged over 100% annually in the late 1980s and early ‘90s, according to the International Monetary Fund.

3. How Bad Is Inflation And What Have Central Banks Done?

Here’s How Inflation Is Currently Affecting Monetary Policy In Latin America

July Consumer Prices In:

* Brazil: 9% Y/Y (Highest Since 2016)

Central Bank: Four Rate Hikes Since March Totaling 325 Basis Points To 5.25%

* Mexico: 5.8% (Near Highest Since Late 2017)

Central Bank: Two Quarter-Point Hikes To 4.5%

* Chile: 4.5% (Highest Since 2016)

Central Bank: Two Hikes, Including The Largest In Two Decades, Totaling 100 Basis Points To 1.50%

* Peru: 5% (Highest Since 2009)

Central Bank: First Hike In Five Years To 0.5%

* Uruguay: 7.3% (From 10% A Year Ago)

Central Bank: 50 Basis Point Hike To 5%

* Paraguay: 5.6% (Highest Since 2014)

Central Bank: Quarter Point Hike To 1%, The First Increase In More Than Five Years

* Colombia: 4% (Highest Since Late 2017)

Central Bank Signaled It May Soon Raise Rates

4. Why Are The Region’s Central Banks Acting Now?

They’re trying to head off the kind of deterioration in exchange rates that commonly occur in emerging economies when inflation expectations rise. Latin America is already home to four of the six worst performing currencies in emerging markets this year.

They’re also reacting to a stronger-than-expected economic recovery — the region is set to grow this year at the fastest pace since 2009. Then there’s an unsettled political backdrop, with violent protests in Colombia, a new leftist government in Peru and fears that Brazilian President Jair Bolsonaro is working to undermine elections next year.

5. What’s The Benefit Of These Hikes?

In some countries, inflation is running above the central bank’s target range, so cooling prices is also tied to the policy credibility in a region with fragile institutions. Some analysts say raising interest rates will preserve the recovery by anchoring inflation expectations, shoring up credibility and offsetting what some investors perceive as excessive stimulus.

And Wall Street sentiment is critical for Latin America, where sovereign bonds and currencies can plunge overnight at the first whiff of political turmoil or pendulum-swings in economic policy. In countries with political risk, accelerating inflation and economies doing well, “it’s about time that we start to take the foot off the accelerator,” Alberto Ramos, head of Latin America research at Goldman Sachs Group Inc., said.

6. What Are The Risks To Raising Rates In The Region?

Higher interest rates create greater debt burdens and larger fiscal deficits, which in turn can pose a threat to a long-term recovery. Rate hikes are making domestic debt more expensive at a time when the region’s debt load has spiked to the highest levels in 30 years and countries try to reel in Covid spending. That risk plays out in the decisions by central bankers: policy makers have been divided in Mexico, Colombia and Uruguay on whether to raise rates.

A third wave of Covid cases from the delta variant, now circulating in the region, could derail a recovery. “There is some reluctance in the region to have a very strict tightening of monetary policy,” says Alejandro Cuadrado, head of Latin America currency strategy at BBVA in New York. “The transmission channel of monetary policy is weak in most cases.”

7. Why Don’t Rate Increases Have An Immediate Impact In Latin America?

Latin America’s economies are notable for high levels of informal jobs — all-cash, low-wage gigs at companies that typically don’t qualify for loans.

This portion of the labor force — and employers — is expected to grow even more in the recovery from the pandemic, putting more of the economy out of the formal financial system.

And over half the region’s adult population didn’t have a bank account before the pandemic. With so much activity off the books, rate hikes don’t have the immediate impact in Latin America that they often do in the U.S. or Europe.

8. What Are Banks Signaling About The Next Steps?

That more rate increases are on the horizon. Brazil’s central bank already forecasts another 100 basis-point rate hike in September with Colombia following soon after. BBVA’s Cuadrado sees most Latin American central banks continuing to raise rates this year.

The notable exception is Argentina, which doesn’t follow an inflation targeting system, and isn’t planning to boost rates any time soon despite 52% inflation. Policy makers in Buenos Aires worry a rate hike could actually accelerate inflation because higher interest payments would increase the amount of money in circulation.

Updated: 8-24-2021

U.S. Food Suppliers Are Having Trouble Keeping Shelves Stocked

Some of the largest U.S. food distributors are reporting difficulties in fulfilling orders as a lack of workers weighs on the supply chain.

Sysco Corp., North America’s largest wholesale food distributor, is turning away customers in some areas where demand is exceeding capacity. The company also said prices for key goods such as chicken, pork and paper products for takeout packaging are climbing amid tight supplies. In particular, production has slowed for high-demand, labor-intensive cuts like bacon, ribs, wings and tenders, Sysco said.

“There are certain areas across the country that are more challenged by the labor shortage and our volume of orders is regularly exceeding our capacity,” Sysco Chief Executive Officer Kevin Hourican said in a letter to clients earlier this month. “This has, unfortunately, led to service disruptions for some of our customers.”

An analysis from DecaData, which tracks retailer transactions with shoppers and manufacturers, shows that retailers are bumping up against manufacturer capacity as they stockpile ahead of the holiday season. In July, the incidence of suppliers limiting or putting a cap on orders from customers was more than double what it was in January, its data show.

Another major distributor, United Natural Foods Inc., is having trouble getting food to stores on time. The company said the labor shortages, as well as delays for some imported goods like cheese, coconut water and spices, are causing the problems.

“We anticipate additional supplier challenges in the short term with gradual improvement through the fall and winter,” a United Natural Foods representative said. The company’s top priority is to support customers “by working diligently to recover and bring their shelves back to normal inventory levels as quickly as possible.”

U.S. companies across industries are reporting a dearth of workers amid sweetened unemployment benefits, stimulus payments and a pandemic that has reduced the appeal of in-person employment. Houston-based Sysco is aggressively hiring warehouse workers and truck drivers and offering referral and sign-on bonuses along with retention money for current staff.

The entire food sector is seeing “massive labor shortages,” said Benjamin Walker, senior vice president of sales, marketing and merchandising at Baldor Specialty Foods, a New York distributor. “Service levels are the lowest I’ve seen in my 16-year career, and it doesn’t seem like it’s going away anytime soon.”

Finding truck drivers is “next to impossible,” he said, while freight costs are rising daily. The company’s orders are arriving late and consequently facing delays in being sent to customers. On the outbound side, on-time deliveries are still above 50% but have fallen from the usual rate of more than 90%.

“We all thought it would be over by now. It’s just one thing after another,” he said. “This is going to be the norm for a while.”

Updated: 8-25-2021

Brazil Inflation Speeds Up With More Key Rate Hikes In Sight

Brazil’s consumer prices rose more than expected as the central bank readies its fifth straight interest rate hike in efforts to tame above-target inflation.

Prices rose 0.89% in mid-August from a month prior, more than all estimates in a Bloomberg survey that had a 0.83% median forecast. It was the highest mid-month print for August since 2002, the national statistics institute reported on Wednesday. Annual inflation sped up to 9.30%.

The central bank has lifted borrowing costs by 325 basis points this year and signaled it will do so again in September. Consumer prices have been propelled by commodity costs, rising electricity bills and a reopening economy. Recent political tensions are also helping keep 2022 inflation forecasts above target.

What Bloomberg Economics Says:

With headline inflation flirting with double-digits and underlying inflation running hot, Brazil’s central bank remains under pressure to accelerate its move to a tight policy. For now we project it will deliver the 100bps hike pledged in its latest communication, but another upside surprise in the full August inflation print or an unconvincing 2022 budget proposal could prompt the monetary authority to raise the Selic by more and increase the tone in its communication.

— Adriana Dupita, Latin America Economist

Swap rates on the contract due on January 2023, which indicate investors expectations for monetary policy, rose three basis point to 8.45%. It was the most traded in Sao Paulo on Wednesday. The real gained 0.7% to 5.2098 per dollar in late afternoon trading.

Electricity Prices

Higher housing costs, due to a 5% surge in electricity, represented the main driver of this month’s print, rising 1.97% from mid-July. Brazil’s regulated energy price rate has been at its highest level since July due to the most severe drought in decades.

Transportation rose 1.11% due to higher fuel and gas prices, while food increased 1.02%, according to the statistics institute. On the other hand, airplane tickets, which had surged over 35% in the prior month, decreased 10.9%.

Analysts surveyed by the monetary authority have raised both their 2021 and 2022 inflation forecasts for five straight weeks. The central bank targets annual inflation of 3.75% and 3.5% for this year and next, respectively.

President Jair Bolsonaro is growing uneasy about Brazil’s inflation in the run-up to general elections next year, but his complaints about rising prices don’t mean he plans to interfere with the central bank, according to five people close to him including cabinet members.

Updated: 8-25-2021

We Need To Talk About The Great Mayonnaise Inflation Mystery

Mayonnaise is no stranger to controversy. France and Spain have duelled over who can claim credit for the mother of cold sauces. At the same time, the fat-laden filling has been attacked by public health officials, described as the “devil’s condiment,” and criticized as being synonymous with the pedestrian palates of Middle America. At Katz’s Deli in New York, customers are warned to “ask for mayo at your own peril.”

Now mayonnaise is at the heart of a new debate, one that has the potential to be even more divisive than whether or not it deserves to accompany pastrami. As inflation ticks to the highest level in more than a decade, the slimy spread has been caught up in a highly emotive argument over recent price increases and who’s to blame for them.

The great mayoinflation controversy began humbly enough with a local news report focused on the impact of food inflation on nearby restaurants.

“I am paying $200 more a week in mayonnaise,” the owner of The Sherwood, a self-described “neighborhood restaurant” in Winston-Salem, North Carolina, told NBC affiliate WXii earlier this month.

The comment was soon picked up by the official Twitter account of the North Carolina Republican Party, which tweeted the $200 stat with a quip about “Bidenflation.” Soon the tweet was smeared across social media as people pointed out that based on official inflation rates — the Consumer Price Index (CPI) was 5.4% year-on-year in July — the restaurant would have to be going through gallons of the stuff in order to be spending an additional $200 a week.

But The Sherwood is not alone in pointing out the higher cost of mayo. Burger King “can see significant inflation across all regions on protein and oils,” according to one of the company’s internal commodities report from earlier in the year. Meanwhile, Unilever — the owner of the Hellmann’s mayonnaise brand — has also warned that raw material costs are rising sharply.

So just how bad is inflation in the sandwich spread? And what can mayo prices actually tell us about current dynamics behind price increases and how they’re measured?

It’s time to dive in deeper than the filling on an egg salad sandwich.

It might seem natural to reach for the most high-profile inflation measure available when trying to figure out what’s going on with mayo prices.

While the Personal Consumption Expenditures (PCE) Index remains the Federal Reserve’s preferred gauge given its breadth and use of business surveys, CPI tends to grab the headlines since it’s used as the basis for social security payments and inflation-linked Treasuries (TIPs).

The great thing about CPI — and one of the reasons it has does get so much attention from the market — is that it contains dozens of smaller indexes and individual items. So why use headline CPI of 5.4% to measure mayo inflation when you can get something much more granular? You can find mayonnaise as an entry-level item in CPI called “mayonnaise, salad dressing, and sandwich spreads.” That falls into the broader index of “other fats and oils including peanut butter.”

“The index is running at 5.8% year-on-year as of July vs 2.4% last July, but if you look at the chart, it’s seen much bigger spikes in the past,” says Omair Sharif, founder and president of Inflation Insights and an upcoming Odd Lots guest. “Frankly, I’m surprised this restaurant is still in business given the mayo shocks in 2009 and 2012.”

So while mayo prices have been rising since the Covid-19 pandemic, they’ve experienced far more intense rates of change before.

But perhaps the consumer surveys aren’t doing a particularly good job of showing mayonnaise prices. We can try to augment our understanding by using some alternative data. Sites like Keepa.com track the cost of items on Amazon.com, but even they show prices remaining relatively stable for the most popular brands of mayo in recent months.

It’s possible, as one Twitter user pointed out, that the restaurant is using a very specific supplier that may be experiencing idiosyncratic price increases due to specific bottlenecks or shipping issues. But since The Sherwood isn’t the only business to have complained about mayoinflation in recent months, it’s worth taking a look at mayo prices from the viewpoint of a producer rather than a consumer.

Here we have to look at yet another inflation index — the Producer Price Index, or PPI. While CPI looks at costs from the perspective of consumers, the PPI examines prices as experienced by producers.

The PPI manufacturing index for “Mayonnaise, Dressing & Sauce” is currently running at a record 144.6. But since PPI is measured in a very different way to CPI, that 144.6 works out to year-on-year inflation of 2.3% — hardly astronomical and a far cry from the 5.8% figure in CPI. What accounts for the discrepancy?

Here it’s important to point out that we can get even more granular in PPI by stripping out as many non-mayo sauces as possible. The “Mayonnaise, Dressing & Sauce” category includes things like vinegar, cider, prepared dressing and pourable salad dressing — none of which is relevant to the mayoinflation question.

Instead, we can take a look at “Mayonnaise, salad dressings other than pourable, & sandwich spreads” which gets us much closer to a purer gage. That PPI index is running at 143.9, which translates to a year-on-year rate of 4.8%

But we can get more specific than even that PPI item; enter the PPI commodity code. As Sharif explains, the basic difference between industry and commodity codes in PPI, is that the former represents the price received by the industry — in this case those who manufacture mayo — as a whole for their output, while the latter reflects price received for mayo regardless of the industry that produced it.

“It’s just a different classification system,” says Sharif. “Now, I don’t know who else is producing mayo for sale to wholesalers/retailers besides the good folks in the mayo manufacturing industry, but I have a call out to the relevant analyst.” [We will dutifully update if we hear more.]

So finally, we arrive at the PPI commodity index for “mayonnaise, salad dressings and sandwich spreads,” which comes in at 5.45% and correlates well with the 4.8% PPI industry code.

So now that we’ve nailed down the extent of mayoinflation from a variety of indexes, it’s time to ask why prices are increasing at all? Here we come to the dark secret of the light-colored condiment: its main ingredient.

Famous brands of mayonnaise from Kraft to Hellmann’s to Duke’s and Miracle Whip, all list their primary component as the viscous oil made from soybeans. Some might argue that the predominance of soybean oil in mayonnaise means that most of the stuff we buy in jars is very far removed from early conceptions of the condiment, which called for a mixture of olive oil, eggs, salt and garlic or lemon juice. That debate is beyond the scope of this study.

Suffice to say that the amount of soybean oil in mayo means the sauce’s cost is often influenced by the overall fortunes of the soy market, and the price of soybean oil on the Chicago Mercantile Exchange has almost doubled over the past year.

But it’s hard to trace those higher prices to easy monetary policy or a particular presidential administration. Instead, a big driver of soybean oil has been China importing more feed as it rebuilds its pig herd following African Swine Fever and a global shortage of oilseeds that’s been exacerbated by bad weather.

In many ways, higher mayonnaise prices now reflect the confluence of not one but two pandemics. African Swine Fever destroyed as much as a third of China’s pig supply. As the country’s farmers rushed to rebuild hog herds, soybean producers struggled to keep up with the sudden spike in demand for feedstock, which pressured soy prices higher.

Meanwhile, the Covid pandemic and stay-at-home orders helped boost demand for sandwich spreads in the U.S., with Unilever recognizing the condiment’s outstanding contribution to its earnings in the second quarter of last year. Bad weather in South America and Canada has been pressuring soybean oil prices upwards since then.

For now it seems producers are absorbing some of the higher input costs that go into making the miracle that is America’s most popular sandwich spread.

All of which points to a wider point about inflation. We tend to talk about it from a macro perspective, as a cohesive whole. But the measure is ultimately a collection of individual prices, each of which tell their own idiosyncratic story of supply and demand.

Updated: 8-31-2021

Eurozone Inflation Hits Decade High As Bottlenecks Bite

Jump in inflation will test the European Central Bank’s readiness to let the economy run hot.

Inflation in the eurozone hit its highest level in almost a decade in August amid signs that shortages of semiconductors and other important manufacturing components are pushing up the prices paid by consumers.

Broad consumer prices were 3% higher in August than a year earlier, a pickup from the 2.2% rate of inflation recorded in July and the sharpest rise since November 2011.

The European Central Bank aims to keep inflation at 2%, but last month explicitly said it would leave its key interest rate steady if a period of inflation running above that goal appeared likely to be “transitory.”

Inflation rates have picked up around the world in recent months, largely driven by rising energy costs as a rebound in demand proves stronger than oil and other energy producers had anticipated. But there are signs that shortages of key parts such as microprocessors are also pushing consumer prices higher, threatening a lengthier period of stronger inflation.

“Clearly, risks that inflationary pressures prove more sustainable are on the rise,” wrote Fabio Balboni, an economist at HSBC, in a note to clients.

The jump in inflation comes as ECB rate-setters prepare for their next policy announcement on Sept. 9. They have said the leap in inflation is likely to prove to be the temporary result of shortfalls in the supply of a narrow range of goods and services that will ease as economies around the world reopen more fully.

That is a view shared by many U.S. policy makers. Federal Reserve Chairman Jerome Powell reaffirmed Friday the central bank’s plan to begin reversing its easy-money policies later this year and staked out a position that calls for more patience around when to raise rates. U.S. inflation is higher than it is in the eurozone, reflecting the stronger economic recovery.

Economists think ECB policy makers may slightly trim their bond purchases to reflect a strengthening economic recovery, but will otherwise reassure eurozone households and businesses that borrowing costs won’t soon rise.

“We expect that the ECB will continue to communicate that monetary policy will remain loose for long to avoid any premature tightening of financing conditions,” said Silvia Ardagna, an economist at Barclays.

In forecasts to be released next week, the central bank is expected to predict slightly higher inflation this year, but continue to see the pace of price rises slowing in 2022 and 2023, with the inflation rate once again settling below target. That suggests that the central bank may not raise its key interest rate—which has been below zero for more than seven years—until 2024.

ECB policy makers last month overhauled their policy framework to give themselves room to let the economy run hotter than in the past. The eurozone economy suffered a larger drop in output than the U.S. in 2020 and was once again in recession around the turn of the year.

In the second quarter of 2021, the eurozone’s economy was still 3% smaller than it was at the end of 2019, while the U.S. economy had returned to its pre-pandemic size. But the eurozone economy grew faster than its U.S. counterpart in the three months through June and should return to its pre-pandemic size by the end of this year.

ECB policy makers want to aid the recovery by reassuring households and businesses that they won’t repeat the mistakes of a decade ago, when their predecessors raised their key interest rate before the recovery from the global financial crisis had put down deep roots. What followed those rate increases was 18 months of economic contraction and a long period of very low inflation rates.

Now, policy makers believe they are on strong ground in seeing the pickup in inflation as the economy reopens as temporary. Part of the recent acceleration in price rises is down to tax changes in Germany, the eurozone’s largest member. In July 2020, the government there cut value-added tax to aid the economy, but those cuts were reversed at the start of this year. So prices now are being compared with artificially lower prices a year ago, exaggerating the strength of inflationary pressures.

There are risks to the ECB’s new patience. One is that the problems manufacturers are facing in securing raw materials and parts will prove longer lasting than initially anticipated. In a number of Asian countries where many of those parts are made, the spread of the Covid-19 Delta variant is threatening fresh delays.

“It looks like bottlenecks are going to be more persistent than expected,” said ECB chief economist Philip Lane in an interview with Reuters published last week.

The August inflation figures may carry a warning, since they recorded a sharp acceleration in the rate at which prices of manufactured goods are increasing, to 2.7% from just 0.7% in July.

“This could be a sign that rising input prices and supply problems are starting to put some upward pressure on consumer prices,” said Jack Allen-Reynolds, an economist at Capital Economics.

By contrast, prices of services rose by just 1.1% over the year, and energy costs continued to drive much of the pickup in inflation, with prices rising 15.4% over the year, up from 14.3% in July.

The other risk is that eurozone workers will come to expect inflation to settle above the ECB’s inflation target, and demand higher pay rises to compensate. So far, there are few signs that this is happening. According to a survey by the European Commission released Monday, households in August expected prices to rise faster over the coming 12 months than they did in July, but at a pace that remained modest by historic standards.

Updated: 9-3-2021

Goldman Sachs Sees Peru Accelerating Pace of Interest Rate Hikes

Goldman Sachs Group Inc. expects Peru’s central bank to accelerate the pace of interest rate hikes, increasing borrowing costs to 1% next week amid deteriorating inflation expectations and political uncertainty.

The central bank led by Julio Velarde on Sept. 9 is most likely to boost the key rate by 50 basis points, double the pace of its August’s increase, Goldman’s chief Latin America economist Alberto Ramos wrote in a research note. He gives a 20% probability to a milder, 25 basis-point hike and a 15% probability to an increase bigger than 50 bps.

“Inflation expectations deteriorated significantly,” Ramos wrote in the Friday note. “Broad risk management considerations fully justify a faster and more front-loaded monetary policy normalization path.”

Peru lifted its benchmark rate last month by a quarter percentage point to 0.5%, the first increase in five years after inflation accelerated faster than expected and political turmoil with the arrival of the government of President Pedro Castillo sank the currency. Lima consumer prices rose almost 5% in August compared to a year ago, the fastest increase in more than 12 years.

What Every Investor Should Understand About Stagflation—but Often Doesn’t

Many people remember lessons, or think they do, about the 1970s economy. But the comparisons aren’t that simple.

The prospect that inflation’s recent spike may be more than transitory, coupled with the possibility the economy will grow slowly, has raised the specter of the “stagflation” era of 50 years ago.

But be careful about making investment decisions based on what happened in that era—marked by a combination of stagnant growth and higher inflation. While the general outlines of the stagflation era are widely known, there are many misconceptions about how particular asset classes fared.

Many investors equate the decade of the 1970s with stagflation, but it is more precisely defined as lasting from 1966 through 1982, according to Edward McQuarrie, a professor at Santa Clara University’s Leavey School of Business who has reconstructed U.S. stock-market history back to 1793.

“The mid-1960s are when the inflation that we associate with the 1970s actually began, and the ills we associate with the 1970s didn’t end until 1982,” he says.

Over this 17-year period from 1966 through 1982, inflation was much higher than in the postwar period up until then, and real GDP growth was much smaller. The consumer-price index averaged 6.8% annualized, for example, four times the 1.7% rate over the 1947-1965 period. Real GDP grew at just a 2.2% annualized rate between 1966 and 1982, less than half the 4.5% annualized rate over the 1947-1965 period.

All this had an impact on financial markets, but not in the ways some people think. Here are some common misconceptions about the impact on bonds, stocks and commodities.

Bonds

The bond market may be where the greatest misconceptions are centered.

That’s because interest rates skyrocketed along with inflation from 1966 to 1982, and we all “know” that bonds lose value when interest rates rise. In fact, however, intermediate-term Treasurys produced an annualized total return of 7% for the 17 years through the end of 1982, according to data from Ibbotson Associates. They even slightly outperformed inflation.

Bonds can do this well in a rising-rate environment because of the dynamics of so-called bond ladders—portfolios of bonds with a fixed duration target. A bond’s duration is related to the number of years left until it matures; it measures its sensitivity to changes in interest rates.

Most bond mutual funds and exchange-traded bond funds aim to maintain a fairly constant average duration of the bonds they hold, which they achieve by constantly reinvesting in a longer-dated bond the proceeds of ones that have matured. The higher yields of those newly purchased bonds eventually will make up for the capital losses incurred by previously owned bonds.

This means that, if you hold on long enough, you need not fear higher interest rates. Your long-term return from investing in a bond ladder (or typical bond index fund) will be close to its initial yield.

That may provide little solace today, given how low interest rates are. But notice that you would find bonds unattractive not because of the risk of stagflation, but instead because their current yields are so low.

How long must you be willing to hold your bond fund to immunize yourself from higher interest rates? According to a formula derived by Martin Leibowitz, managing director at Morgan Stanley, you must hold it for one year less than twice the fund’s duration target.

This formula helps to explain why long-term Treasurys performed so poorly between 1966 and 1982: Assuming they had an average duration of 20 years, the required holding period would have been 39 years, more than twice as long as the stagflation era.

If your desired holding period is in the neighborhood of 10 to 15 years, therefore, and you want to take advantage of this formula, you must stick with a bond ladder or bond fund with a duration target of around five to seven years. Intermediate-term bonds, in other words.

Stocks

The stock market performed exceptionally poorly in the 1966 to 1982 period. The Dow Jones Industrial Average, for example, first rose above the 1000 level in January 1966, but spent most of the next 16 years below that level. It didn’t rise above 1000 for good until late 1982.

To be sure, stocks’ total return was higher than suggested by the Dow, since dividend yields were much higher in that era than now. The S&P 500, for example, produced an annualized return of 6.8% from 1966 through 1982.

Even so, the S&P 500’s return over this 17-year stretch merely equals inflation and slightly lags behind that of intermediate-term bonds. Prof. McQuarrie says that this period is one of the longest in the U.S. since 1793 “where stocks returned close to nothing in inflation-adjusted terms.”

We need to be careful extrapolating this dismal performance to a future stagflation era, however.

That’s because investors in the 1960s and 1970s may have acted irrationally in believing that inflation made equities less valuable. That at least was the famous argument made in the late 1970s by Franco Modigliani, now deceased, a finance professor at the Massachusetts Institute of Technology who would go on to earn a Nobel Prize in economics in 1985.

He argued that stock-market investors were suffering from “inflation illusion” in failing to understand that stocks are a good long-term inflation hedge.

To be sure, future investors might be equally irrational if and when we enter another period of stagflation. Notice, however, that this is a far different bet than an argument based on companies’ net worth, relying on psychology rather than fundamental balance-sheet analysis.

Commodities

Conventional wisdom teaches us that commodities are the best inflation hedge. But to support this belief, you will need to look elsewhere than their performance during the 1966-1982 period.

That’s because agricultural commodities dominated this asset category in the stagflation era. In the early 1970s, cattle futures represented more than 50% of the S&P GSCI index, one of the most widely followed benchmarks for the performance of commodities. Those who naively extrapolate this index’s returns from those early years to a future stagflation era may be surprised to learn that cattle today represent only about a 5% weight in the index.

In fact, according to Campbell Harvey, a finance professor at Duke University, and Claude Erb, a former commodities fund manager at TCW Group, it isn’t clear we should even view commodities as a coherent asset class. We should instead analyze the inflation-hedging potential of each individual commodity on its own. The researchers found that less than half of commodities they studied were significantly correlated with inflation.

Take gold, which many consider to be the paradigmatic inflation hedge. Bullion did indeed skyrocket in the 1970s, from $35 an ounce when it began to be freely traded in 1971 to over $800 an ounce in 1980. But Prof. Harvey and Mr. Erb argue that gold currently may be significantly overvalued, relative to inflation.

They say gold’s fair value relative to inflation is currently below $1,000 an ounce, compared with the current $1,829. So it wouldn’t be a surprise if gold were to fall in price even if we enter another stagflation era.

Updated: 9-5-2021

Egypt’s Soaring Rates Attract Inflows But Carry Risks, S&P Warns

Egypt must find a way to pay less on its debt if it’s to weather a potential increase in global interest rates, S&P Global Ratings warned in a report on Sunday.

Egypt has the highest differential between its key policy rates and inflation among more than 50 economies tracked by Bloomberg, making its bonds and bills a favorite among international investors hungry for yield. Foreign holdings in the North African nation’s notes stand at more than $28 billion, an important buffer as tourism awaits a full recovery from the coronavirus pandemic.

But the world’s highest real interest rates also come with an elevated fiscal cost and leave Egypt vulnerable to significant outflows if rates in the developed world rise — particularly if the U.S. Federal Reserve tapers its quantitative easing policies faster than expected, S&PGR credit analyst Zahabia Gupta wrote in the report.

“Egypt’s interest-to-revenues ratio and its interest payments as a percentage of GDP are among the highest of all rated sovereigns,” according to Gupta. “A potential path for Egypt to lower its interest bill is to increase investor confidence in its economic model such that investors cut the risk premium they require on Egypt’s government debt.”

Updated: 9-7-2021

Robusta Coffee Extends Rally To Four-Year High On Crop Woes

Robusta coffee climbed to a fresh four-year high and arabica rose on concerns that heat and dryness will further threaten crops in Brazil.

Futures have advanced this year as drought and then frost hit crops in top coffee producer Brazil, while supply worries in Vietnam and Colombia have also supported prices. Dry weather and high temperatures will likely worsen crop stress in Brazil’s arabica regions this week, according to Somar Meteorologia.

“It is still uncertain how much the flowering and crop will suffer from the severe frosting in key arabica-growing areas of Brazil. This is also lending support to the robusta price,” Commerzbank AG analyst Michaela Helbing-Kuhl said by email. Plus, the Covid-19 pandemic “and the container shortage will be hindering shipments from Vietnam for the foreseeable future,” she said.

Robusta rose 1.3% to $2,109 a ton in London, after earlier reaching the highest since August 2017. Arabica gained 1.7% to $1.9635 a pound in New York as the market reopened after Monday’s holiday, snapping a four-session loss.

Colombia’s coffee output in August dropped 16% from a year earlier, the nation’s coffee growers federation said, citing logistics issues.

In other soft commodities, raw sugar fell 0.4% to 19.55 cents a pound, while cocoa advanced 0.6% in New York.

One Stat That Shows The Huge Inflationary Impact Of Used Cars

By now you probably know that used cars saw a huge surge in prices over the last several months, putting significant upward pressure on official inflation gauges. The general contours of the story are well-known. Demand for cars has been off the charts.

The rental-car companies dumped a bunch from their fleets when the pandemic hit, and then had to rush to buy cars back. And the persistent chip shortage has meant that the supply of new cars has been severely crimped.

Last week we published our “Odd Lots” interview with Omair Sharif, a veteran inflation watcher and now the founder of the independent shop Inflation Insights. Sharif takes a bottoms-up approach to measuring and forecasting inflation. Instead of using macro variables, like the unemployment rate or Fed policy, he examines CPI item by item and then adds up all the numbers.

Anyway, as you can read in the transcript, Sharif does a great job showing how the future of CPI will be a push-pull tension between rent prices (which make up a huge share of the overall basket, but which are still moving up slowly) versus used cars (which make up a small share of the basket, but which moved up at blazing speed).

Here’s The Key Part:

Joe: So if we’re talking about something like buying apples or buying milk or buying gasoline, everybody buys those things every day or every week, all the time. With rent, not only do very few people actually sign a new lease every month, but also many of the new leases that people actually sign are with their current landlord. And so they probably don’t get the full market rent because those don’t adjust as fast.

And so, you know, looking at this, OK, this is one of the big questions right now. We know that headline inflation has come down a little bit, used cars seem to have stopped going up. That’s a big factor. But everyone’s like, OK, OER (owner’s equivalent rent) is coming, OER is coming. We see the market rent on some places like Zillow and so forth.

Those are shooting up. Why don’t you sort of just explain the theory, what are you actually seeing in practice when you look at the data and how much is rent and other attempts that the CPI or these indices use to capture shelter, how much upward pressure are they going to put on the measures in the months and years ahead?

Omair: Yeah, so we have seen both of these measures, both rent and OER, actually bottom out over the course of the last several months, and you’re starting to see price increases in the major metro areas. And so even, you know, places like New York, Los Angeles, Chicago, San Francisco, which are still down pretty sharply year over year, it looks like on a monthly basis, they’ve finally kind of begun to stabilize a little bit.

And, you know, it’s important to kind of understand when you talk about the CPI that a lot of these rent indices, what really matters is where these so-called Class A cities, which are, you know, the big ones with populations over two and a half million, what they’re doing.

Because the weights on these cities is incredibly large. So if you looked at just three of them — New York, Los Angeles, Chicago — that is 20% of the entire rent index from just those three metro areas. So where they go matters quite a lot for the overall index, but we are starting to see these places stabilize and move up.

But I think there’s something to keep in mind here about, you know, this whole story about shelters coming, and now we are just going to go up. And so on. Number one, people again are looking at these private market rent data and they’re seeing 7%, 8% growth.

We’ve never seen anything like that in CPI. I’m hard-pressed to think, you know, we’ll see anything like that over, let’s say the course of the next year. Will rent go up? Yes. But, you know, don’t forget before the pandemic, we were running around three and a half percent.

We’re about two and a half percent right now on rent and OER combined. So, you know, even if you move up a full percentage point over the course of the next year, you’ll be kind of right back where you started in early 2020

But let’s assume for a moment that we move up to four and a half percent. So another two percentage points from where we are today. What that basically means is you’re looking at overall core inflation rising by roughly about another 80 basis points. You know, rent’s got about a 40% weight. You go up two percentage points, that’s about 80 bps on the Core CPI.

Now that sounds like a lot, but you mentioned used cars earlier. They’re adding over 130 basis points to the Core CPI right now on a year-over-year basis.

That’s almost certainly going to come off. So even if OER goes up and rent goes up a couple of percentage points over the course of, let’s say the next year, 18 months, that’s almost certainly going to be offset to a great extent by a lot of these things that we’re seeing now that we continue to think of as transitory, but that’s going to offset a lot of the upward pressure you’re going to get from shelter, I think over the course of the next 18 months.

So it’s kind of important to keep that in perspective, because again, four and a half percent is really where we’ve peaked in the past. And even if we get a bit higher than that, you know, year-over-year 40% on used cars is not going to stick. You know, that’s going to potentially more than offset what we see at shelter.

The emphasis in the italicized part is mine. Even if owner’s equivalent rent were to accelerate at a pace that’s well above pre-crisis trends, it still wouldn’t counteract a reversal in the jump we’ve seen from used cars alone.

Updated: 9-10-2021

Charting The Global Economy: Inflation Drumbeat Remains Steady

Price pressures continue to build in developed countries and emerging markets that include those in Latin America, where there are limits to what central bank rate hikes can achieve.

In the U.S., economists are adjusting their inflation forecasts higher and trimming consumer spending and growth projections. A similar trend is playing out in the U.K. as supply chain disruptions hinder factory output.

Natural gas prices are undergoing a historic surge, and it’s bad news for everyone from ceramic makers in China to customers of patisseries in Paris.

Port congestion is worsening during one of the calendar year’s two peak seasons for global shipping demand.

U.S.

The rapid spread of the Covid-19 delta variant, higher inflation and persistent supply challenges are prompting economists to downgrade U.S. growth prospects for the remainder of the year. At the same time, economists raised estimates for the closely followed consumer price index for each quarter through the middle of 2022.

Job openings rose to a fresh record high in July, illustrating the lingering staffing shortages that are making it challenging for businesses to meet demand. After shedding millions of workers from payrolls last year, the rapid snapback in economic activity has left many businesses severely short-staffed.

Europe

The U.K. economy barely grew in July, suggesting the recovery from the coronavirus recession is rapidly leveling off as consumer spending weakens and supply disruptions hamper production.

The European Central Bank’s new staff forecasts showed a stronger near-term outlook for prices and growth in the euro area, though still insufficient to fulfill its mandate. Inflation will average only 1.5% in 2023, below its 2% target.

Europe is heading for a bruising battle over austerity as governments set out their positions on how to address huge debt loads and help their economies work past the deep Covid-19 recession.

Asia

Despite the disruption of the pandemic and political protests of recent years, Hong Kong’s economic growth is expected to catch up with rival financial hub Singapore’s this year for the first time since 2008.

Emerging Markets

When it comes to raising interest rates to cool off pandemic inflation, Latin America’s central banks have been near the front of the global pack. They’re also among the worst-equipped for that task.

Russia’s international reserves jumped to a record $618 billion, boosted by a $17.5 billion inflow from the International Monetary Fund’s global issue of its reserve currency. Amid Western sanctions, President Vladimir Putin has made boosting savings a major priority, controlling spending and salting away revenue from oil exports.

Shortages And Rising Costs Have Reached A Tipping Point For Manufacturers

Late summer doesn’t appear to have been as booming for industrial companies as CEOs and investors had hoped.

It’s a shift from the three months ended in June, when most manufacturers were still riding the recovery, allowing them to boost their guidance even as supply-chain bottlenecks and rising costs curtailed their momentum at the edges.

In fact, of the 24 industrial companies tracked by RBC analyst Deane Dray that provided 2021 outlooks, all but four took a more optimistic view after the June quarter than they did three months earlier.

While no manufacturer would say navigating component shortages and soaring costs was easy, on the whole companies found a way to manage those challenges. This often meant relying on creative workarounds such as rerouting ships or redesigning products.

But those measures could only go so far. A series of updates this week suggests relentless inflation and supply-chain challenges have become too intense to steer around and that these forces will weigh on third-quarter results in a more significant way.

PPG Industries Inc. and Sherwin-Williams Co. both slashed their outlooks for the current quarter this week. The two paint makers have been aggressively raising prices, but commodity, transportation and labor expenses are rising so quickly and sharply that they are struggling to keep up.

PPG said raw-material inflation was trending as much as $70 million higher in the third quarter than what it had anticipated as recently as July.

To help offset the increased costs, Sherwin-Williams announced a 4% surcharge on customers in the Americas through the end of the year, on top of existing “significant” price hikes. While demand is still strong, the companies can’t get the commodities they need to fill customer orders.

In the case of PPG, its own supply chain isn’t the only hurdle; customers are also having to curtail production (and thus paint orders) because of shortages elsewhere, particularly for semiconductors. In total, PPG expects to lose out on as much as $275 million of sales this quarter because of the disruptions.

The same issues are bedeviling homebuilder PulteGroup Inc. and data-center equipment provider Vertiv Holdings Co.; they also cut their outlooks this week because they simply can’t get their hands on enough raw materials.

In some cases, Vertiv can’t procure critical parts “at any price.” (Vertiv also agreed to buy E&I Engineering Ireland Ltd., a maker of electrical switch gear and power distribution systems, for as much as $2 billion, including performance-based payouts.)

General Electric Co. kept its guidance intact but warned this week of “sustained pressure” on revenue and profit margins at its health-care unit because of a limited availability of chips, resins, workers and shipping services. The industrial giant expects the operating environment to stay challenging at least through the first half of 2022.

Supply-chain problems and rising costs aren’t the only pressures. These companies employ thousands of people and require a myriad of ancillary services where inflation pressures are also becoming more notable.

Union Pacific Corp., for example, is facing rising steel and lumber costs to repair and maintain its tracks but its employee health-care bills are also more bloated, as are the prices charged by the janitorial services that clean its office buildings and the contractors that mow its lawns, Chief Executive Officer Lance Fritz said in a video interview with Bloomberg News reporters and editors.

The key question is whether logistics disruptions are simply delaying sales until 2022 or if rising prices will start to turn off some customers. Fastenal Co., a distributor of factory floor odds and ends whose results are often a good bellwether for the broader industry, reported slowing sales growth for the manufacturing sector in the month of August.

Is it just a blip that reflects production challenges and slightly tougher comparisons or something more serious?

Many industrial companies were already in their third round of pandemic price increases as of July, but the cost relief they had hoped for isn’t materializing and pressures are instead getting worse in some categories. “Do you actually go for the fourth price increase?

Because the fact of the matter is, you run the risk of demand destruction in the short term, and that’s not good,” Dover Corp. CEO Richard Tobin said on the company’s latest earnings call in July. I wonder how he feels now. We’ll found out when he presents next Tuesday at the Morgan Stanley Laguna conference alongside a who’s who of the industrial sector. Stay tuned.

Bigger Grain Stockpiles Signal Relief For Global Food Inflation

The U.S. lifted its estimates for stockpiles of the three major crops — corn, soybean, wheat — both on the domestic balance sheet and globally.

The bigger ending-stocks estimates could be good news for consumers. The massive rally in grain prices earlier this year was one of the key factors driving global food inflation.

If bigger supplies help keep prices tamer, food costs could start to stabilize. That would be a big boon to countries that import staple crops like wheat, especially with the pandemic-driven spike in hunger still gripping many poorer regions of the world.

Updated: 9-12-2021

Short-Lasting Inflation Depends On Long-Lasting Goods

The Fed blames rising inflation on an unusual jump in the price of durable products like cars and electronics, which it says won’t last.

For decades, Americans have enjoyed falling prices for cars, electronics and furniture.

Until the Covid-19 pandemic, that is. For the past year, prices for durable goods have been rising—and not just by a little. Whether those prices come back down is a key part of the puzzle facing the Federal Reserve as it plots how to handle an unexpectedly strong burst of inflation.

Federal Reserve Chairman Jerome Powell has argued for a while that the higher inflation is largely driven by temporary factors unique to the pandemic. In a speech hosted by the Federal Reserve Bank of Kansas City in late August, Mr. Powell offered more details on his thinking.

He singled out the sudden rise in durable goods prices—in contrast to the more modest rise in services prices—as evidence that inflation is bound to fall back to the Fed’s 2% goal.

First, a bit of history. Overall consumer prices—which combine services and goods—climbed by an average of 1.8% a year in the past 25 years leading up to the pandemic. That rise was driven by faster-rising costs for services, which grew an average 2.6% a year over that time.

Prices for durable goods—items designed to last at least three years—have done the opposite—falling an average of 1.9% a year between early 1995 and early 2020, according to the Fed’s preferred inflation gauge, the Commerce Department’s price index for personal-consumption expenditures.

Mr. Powell cited several forces driving down prices for durable goods. One is globalization: Competition from other countries, in particular emerging markets with lots of low-wage workers like China and India, has stoked competition for American producers and led some to outsource production. As a result, costs for parts and products have fallen.

Another is technology. New software and more advanced machinery have enabled factories to make products in fewer hours with fewer people, reducing their own costs and ultimately translating into lower prices for consumers. More efficient shipping has also cut costs.

By contrast, prices have persistently risen for services—the bulk of consumer purchases, including haircuts, doctor’s visits and tax preparation. Because they are by default labor intensive—a barber can still only cut one person’s hair at a time—those industries haven’t raised productivity as much as factories.

The pandemic has flipped this dynamic, with durable goods becoming a big driver of inflation. In July, overall consumer prices rose 4.2% from a year earlier, according to the Commerce Department. Prices for durable goods rose 7%. That was twice as fast as the 3.5% gain in prices for services.

Durable goods prices accounted for 1 percentage point of the latest inflation rate, Mr. Powell said. The overall effect of rising durable-goods prices was even larger on “core” inflation, which excludes food and energy prices.

Excluding durable goods, core inflation in the 18 months through June, which smooths out a temporary dip and rebound in some prices during the pandemic, was 2.2%, not far from its 12-year average of 2%, according to the Fed.

What happened? According to Mr. Powell, it’s no mystery: Unique forces caused demand for durable goods to rise far more quickly than supply.

Demand rose for two reasons: The government put a lot of money in the hands of consumers, through multiple stimulus packages. And households, stuck at home and with fewer opportunities to travel, dine out and visit museums, shifted spending toward durable goods, many of which could be delivered with no human contact.

Researchers at the Cleveland Fed found that these two factors—the stimulus and the shift away from services caused by lockdowns—contributed equally to the rise in spending on durable goods.

Households have boosted spending on sofas, cars and kitchen appliances. Businesses, short of workers and caught off guard by the surge in demand, have struggled to ship supplies and make products fast enough. A global chip shortage disrupted shipments of laptops and printers, along with cars. Labor and equipment shortages caused delays of furniture deliveries.

Other figures show the pandemic’s effect on prices that had long experienced deflation. Consider used cars, which are the bulk of all car purchases.

Their prices peaked in 2001, then declined. By February 2020, they had fallen 14% from their all-time high, according to the Labor Department’s consumer-price index, a separate inflation gauge.

Then in the summer of 2020, used-car prices started rising, sharply. In the year through July, they were up a staggering 42%. Of the dozens of major product prices tracked by the Labor Department, only gasoline rose faster.

Computers followed a similar trajectory. Before the pandemic, prices had fallen rapidly for two decades. Then, during the pandemic, they started rising. In June 2020, they rose on an annual basis for the first time ever. In July, they shot up 3.7% from a year earlier.

Or look at furniture. Between January 2000 and January 2020, prices fell 16%. Since February 2020, they have risen 7%.

Mr. Powell argued that once shortages, supply bottlenecks and demand ease, prices will drop, or at least stop rising so steeply.

That may already be happening. Durable goods prices rose just 0.3% in July from a month earlier, down from 1% growth in June and 2% in May. Used-car prices also grew much more modestly, and furniture prices fell for the first time since January.

“As supply problems have begun to resolve, inflation in durable goods other than autos has now slowed and may be starting to fall,” Mr. Powell said in his Kansas City Fed speech. “It seems unlikely that durables inflation will continue to contribute importantly over time to overall inflation.”

He added that he believes the secular forces that had driven down prices for durable goods in the past—globalization and technology—won’t go away.

There are risks that inflationary pressures will be deeper and longer-lasting than Mr. Powell suggests. Gasoline prices—a nondurable good—rose just as fast as used-car prices in the year through July. Food price growth around the globe is accelerating and could persist, JPMorgan Chase said in a note last week.

Services inflation may also pick up. Home prices and rents, one of the largest components of consumption, are rising quickly. Employers in labor-intensive service businesses are facing higher labor costs that they may have to pass along in prices. Also, shipping networks could shift.

Companies could decide to buy parts from other countries, or within the U.S., where labor costs are higher, which could lead to higher prices in the long run.

Mr. Powell’s outlook on durable goods—and, thus, on inflation—is a bet that the world after the pandemic will look largely the same as the world before it.

Updated: 9-13-2021

Bitcoin Eyes US Inflation Report, Potential Dollar Liquidity Squeeze

Bitcoin’s mid-May crash happened after U.S. reported inflation at three-year highs.

Bitcoin’s immediate bullish trajectory has weakened following the last week’s double-digit price drop. The cryptocurrency’s near-term prospects hinge on Tuesday’s U.S. inflation report.

The leading cryptocurrency by market value is trading 3% lower on the day at $44,500, having dropped 11% last week. That was the biggest single-week percentage decline since May.

According to Coinbase Institutional, bitcoin’s immediate bullish outlook has weakened, courtesy of last week’s slide, and the cryptocurrency could consolidate between $44,000 and $48,000 for the time being.

Some chart experts fear a deeper drop as the price structure now looks similar to the one observed after bitcoin’s double-digit slide in the second half of April.

An extended sell-off could materialize if the U.S. consumer price index (CPI) figure for August, scheduled for release at 18:00 UTC on Tuesday, prints above 5% annualized. That could speed up the Federal Reserve’s plans to begin scaling back its liquidity-boosting asset purchases.

Bitcoin’s mid-May slide from $58,000 to $30,000 happened after official data released on May 12 showed the U.S. CPI at a three-year high and triggered taper fears. The sell-off also coincided with China’s crackdown on cryptocurrencies and concerns regarding the negative environmental impact of cryptocurrency mining.

“Inflation remains the key as usual – specifically when base effects will end & CPI prints begin to reflect the true year-on-year picture for the Fed,” QCP Capital said in its Telegram channel. “Arguably, the worst of the base effects have now run its course [as seen in the chart below]. If inflation still remains above 5% from here, the hawks will surely start expressing worry.”

Several Fed members have already turned hawkish, signaling a willingness to begin scaling back asset purchases, or tapering, this year.

Some observers are concerned that a possible taper would lead to a substantial drop in the dollar liquidity in the fourth quarter, and could coincide with the U.S. Treasury issuing more bonds to rebuild its coffers (the Treasury General Account, or TGA) after the debt ceiling is lifted.

According to the Wall Street Journal, the U.S. government could run out of cash and hit the debt ceiling between mid-October and mid-November. The Fed is expected to begin tapering around the same time.

“The U.S. Treasury will likely quickly rebuild the cash balance after a debt ceiling suspension as the new ‘equilibrium level’ of the TGA seems to be around USD 800bn. This is a net liquidity withdrawal of almost USD 600bn compared to the current scenario, which cannot be seen as good news for risk appetite,” analysts at Nordea Bank said in the weekly research note published on Friday.

Bitcoin and other traditional market risk assets have soared in the past 18 months, thanks to the liquidity deluge brought on by the Fed’s stimulus program, and so a liquidity squeeze due to a Fed taper and U.S. Treasury actions could weigh on asset prices in general, and especially on bitcoin because capital in crypto markets is mercenary and tends to overreact, according to Messari’s Mira Christanto.

Top investment banks foresee market risk aversion strengthening in the weeks ahead. According to the Australian Finance Review, Morgan Stanley expects U.S. stocks to decline by as much as 15% by year’s end, while Bank of America foresees a 6% drop.

A stock-market decline could add to bearish pressures around bitcoin. “The world still sees bitcoin as a risk-on asset,” Charles Edwards, founder of Capriole Investments, tweeted. “Almost every bitcoin correction in 2021 has correlated with an S&P500 correction of -2% or more.” The S&P 500 fell by 1.69% last week alongside bitcoin’s 11% decline.

Updated: 9-14-2021

N.Y. Fed Says U.S. Consumers Expect 4% Inflation To Stick Around

Inflation expectations among U.S. consumers over the medium term rose to the highest level on record in the Federal Reserve Bank of New York’s surveys, according to the latest edition published Monday.

Consumers said they expect inflation at 4% over the next three years, up 0.3 percentage point from a month earlier.

The median expectation for the inflation rate in a year’s time also rose by 0.3 percentage point to 5.2% in August, the tenth consecutive monthly increase and a new high in the series, which goes back to 2013.

The Fed survey showed that Americans are expecting higher rates of price increases for items like rent and food that make up a big chunk of the consumer-price basket, and can’t easily be substituted.

Economists surveyed by Bloomberg expect slightly lower rates of inflation. The latest poll, published on Sept. 10, forecast an average increase in prices of 4.3% this year and 3% in 2022.

Meanwhile, expectations that wages will keep pace with the acceleration in prices are starting to cool. The median one-year-ahead expectation for earnings growth dropped 0.4 percentage point to 2.5%, with respondents over the age of 40 largely driving the decline.

Still, overall expectations for household incomes rose by 0.1 percentage point to 3%, a new series high.

Updated: 9-14-2021

General Mills Will Raise Consumer Prices, And McCormick Might, Too

Supply chain, labor shortages and Hurricane Ida are all named as factors.

Grocery budgets will have to be flexible as Credit Suisse analysts turn their attention to food companies and the price hikes that are likely soon.

General Mills Inc. was downgraded to neutral from outperform as higher costs and unexpected labor shortages take a toll. Credit Suisse cut its price target to $63 from $68.

“Our sense is that this will lead to another pricing lag and more margin compression in the back half of [fiscal 2022] when the company’s hedges roll over and the full impact of inflation flows through,” analysts wrote.

Even with these issues analysts say General Mills’ e-commerce and category management are strong and its pet business is an advantage.

General Mills brands include Cheerios cereal, Muir Glen organic foods and Progresso soup.

The company’s shares were up 0.3% in Monday trading; the stock is down 6.2% over the past three months.

Credit Suisse anticipates that McCormick & Co. will also have to raise prices.

“Labor shortages at packaging and ingredients suppliers have increased costs and caused delays,” analysts led by Robert Moskow wrote.

“Similar to TreeHouse Foods, management said that they view labor inflation at their suppliers as a structural issue that is likely to require more price increases for consumers in 2022.”

Treehouse makes private-label food and beverage items for grocers, foodservice providers and others.

McCormick is also feeling the effect of Hurricane Ida, which hit the New Orleans area and, Credit Suisse says, could impact production of the company’s Zatarain’s brand.

Credit Suisse rates McCormick stock outperform with a $100 price target, down from $104.

McCormick stock has tumbled 11% to date in 2021 and is down 4.7% over the past three months.

Key US Inflation Gauge Slips To Slowest Pace In 6 Months, Bitcoin Rises

Core CPI, which excludes energy and food prices, rose 0.1% last month, the slowest pace since February.

The U.S. Labor Department said consumer prices rose 0.3% last month, falling short of the 0.4% increase expected by economists.

The consumer price index rose 5.3% over the past 12 months, below economists’ average prediction of a 5.4% increase. Core CPI, which excludes food and energy prices, rose 0.1% last month, lower than economists’ expectation of 0.3% growth and the slowest increase the U.S. has seen in six months.

Bitcoin’s price rose $690, or 1.5%, to $46,501 since the CPI report was published at 8:30 a.m. ET (12:30 UTC).

The soft inflation report may encourage the U.S. central bank to keep its stimulus program, known as “quantitative easing,” or QE, longer than expected. Many cryptocurrency investors speculate that QE could weaken the dollar, pushing up the value of bitcoin, which has a capped supply.

Bitcoin is also still seen on Wall Street as a speculative asset, and the bet is that more investors will be forced to seek such investments as QE suppresses returns in traditional bond markets.

While August’s lower-than-expected numbers may be regarded as a positive sign for transitory inflation, they could also be a sign of increasing macroeconomic uncertainty as COVID-19 variants fill hospitals even in highly vaccinated countries. Airline fares fell dramatically, and decreasing hotel prices weighed on the shelter index.

”At the margin, the recent data will dampen some of the more excitable inflation forecasts in the markets and at the Fed,” Ian Shepherdson, chief economist for the forecasting firm Pantheon, wrote to clients in an email.

On A Month-Over-Month Basis:

* Used-Vehicles Prices Declined By 1.5%, Continuing July’s Trend Of Supply-Side Inflation Wearing Off, When Prices For Used Autos Increased By Only 0.2%.

* Airline Fares Declined Sharply By 9.1%, Compared With July’s Decrease Of 0.1%.

* Shelter Rose 0.2%, Compared With A 0.4% Increase In July.

* The Food Index Increased By 3.7%, Compared With July’s 0.7% Increase.

* The Energy Index Increased By 2% With The Gasoline Index Rising By 2.8%.

Inflation Eased In August, Though Prices Stayed High

Consumer-price index rose 5.3% from a year before as supplies and labor continued to drive up prices.

Inflation cooled slightly in August but remained strong, as a surge in Covid-19 infections slowed economic growth and pandemic-related shortages of labor and supplies continued to drive up prices.

The Labor Department said last month’s consumer-price index rose a seasonally adjusted 0.3% in August from July, slower than the 0.5% one-month increase in July, and down markedly from June’s 0.9% pace. Prices eased for autos, with used vehicle prices dropping sharply, and hotel rates and airline fares declined in August from July.

The CPI measures what consumers pay for goods and services, including groceries, clothes, restaurant meals, recreation and vehicles. On an annual basis, price pressures eased slightly. The department’s consumer-price index rose 5.3% in August from a year earlier, down from the 5.4% pace in June and July, on an unadjusted basis.

The so-called core price index, which excludes the often volatile categories of food and energy, climbed 4% from a year before, they estimate, compared with 4.3% in July.

Price growth driven by used vehicles eased in August. The recovery of travel-related prices also reversed as the spread of the Delta variant of the Covid-19 virus depressed demand, particularly for travel. Airline fare prices declined 9.1% from July, while rental cars and trucks dropped 8.5%.

“We could see further declines in virus sensitive components in coming months,” said Laura Rosner-Warburton, senior economist at MacroPolicy Perspectives, “although lingering supply chain issues will likely produce continued upward pressure on goods prices, including used cars.”

Gasoline prices picked up 2.8% in August from July, a faster pace than the prior month. Restaurant prices rose 0.4%, while grocery prices climbed 0.4%, both categories rising at a slightly slower monthly pace than in July. Among the supermarket items that jumped the most were salad dressing, which increased 4% in August from July, and bacon, up 3.3%.