Ultimate Resource On Pro-Bitcoin Congressmen And Senators #GotBitcoin

Bitcoin’s (BTC) plight in Congress has seen attention focus mainly on naysayers, but this week’s hearing also saw United States politicians accept it was always beyond their control. Ultimate Resource On Pro-Bitcoin Congressmen And Senators #GotBitcoin

‘Governments Cannot Stop This Innovation’

During testimony on July 17, U.S. Congressman Patrick McHenry, who represents North Carolina’s 10th District, told lawmakers directly that attempts to stop Bitcoin were futile.

Related:

Numerous Times That US Regulators Stepped Into Crypto

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress

“The world that Satoshi Nakamoto, author of the Bitcoin whitepaper envisioned, and others are building, is an unstoppable force,” he said.

McHenry runs in sharp contrast to other Congressmen making the headlines over Bitcoin, with Brad Sherman again gaining the spotlight after making dubious claims about cryptocurrency’s role in crime.

Others broadly failed to draw a distinction between Bitcoin and permissioned digital currencies, specifically Facebook’s Libra project, which formed the initial basis for the hearings.

For McHenry, however, legislation or not, Bitcoin will prevail. If it were possible to shut it down, he implied, an adversary would have already done so at some point since its 2009 inception.

“We should not attempt to deter this innovation; governments cannot stop this innovation, and those that have tried have already failed,” he continued.

Nations Coming To Grips With Crypto

As Cointelegraph reported, the Congressional hearings came as other states are currently coming to grips with the first incarnation of their regulation of Bitcoin and other decentralized cryptocurrencies.

Notably, India this week confirmed it was working on official guidelines after a scandal involving what some accepted as a draft law banning cryptocurrency outright appeared earlier.

The fallout of the document, which mandated prison sentences for Bitcoin users, resulted in billionaire investor Tim Draper calling the Indian government “pathetic and corrupt.”

Updated: 5-15-2014

Federal Election Commission Says, Bitcoiners Can Buy Politicians Just Like Those Who Use Dollars

Bitcoin Legitimacy Growing

What the decision does for Bitcoin is that it legitimizes it even further and also makes it quite difficult for the government or anyone for that matter, to discuss further, the legality of Bitcoin. Now that it can be used to fund campaigns, it has been given the okay by the US Government.

It also allows the Bitcoin community to purchase their politicians just like everyone else. Honestly, I’d rather see Bitcoin spent in other areas, but this decision is a good one for the Bitcoin community and Bitcoin in general.

More than anything, what this decision does is it solidifies the fact that spending one’s Bitcoin is a First Amendment and politically protected activity. It has been regulated by the Federal Election Commission and slowly but surely we see Bitcoin acceptance growing now to even a political level.

Imagine that they could use the Blockchain to provide for transparency in political campaign contributions far better than they can now in the traditional banking system. Further discussion is needed about the $100 donation limit but this does not appear to be much of an issue as this is the current cash limit.

As far as the anonymity issue, it is unclear exactly how they plan to enforce these laws or provisions. If you are trying to trace payments against people who are working hard and have a significant financial incentive to not be traced, that will indeed be difficult.

Look for Coinbase or another online payment processor to release a system soon that will help open the transparency of those who donate, help cap the amount donated, and also turn the Bitcoin immediately to cash so that these politicians can use it on their campaigning efforts.

USA Today Uses The Bitcoin Logo To Celebrate FEC Decision

The USA Today, the second largest newspaper in the United States celebrated the news that Bitcoin is now approved for political campaign contributions by adding a Bitcoin to its own logo. Not only was the logo from the online edition changed but so too was the logo of the paper edition which is the widest circulated print newspaper in the United States.

Currently distributed in all fifty states, The USA Today distributes papers to the District of Columbia, Puerto Rico, Guam, Canada and the United Kingdom.

The newspaper has its headquarters in the Tysons Corner area of Fairfax County, Virginia, and something tells me that someone at the USA Today must like Bitcoin.

USA Today sells for $2.00 USD at newsstands and is often found free at hotels and airports that distribute it to their customers. Auditmedia.com shows the USA Today distribution stats for the last 6 months of 2012 as having:

Circulation of 1.7 million print and digital editions and a Combined website reach of 32.2 million unique visitors & 594 million page views.

When clicked, the logo links to this article from the USA Today from May 9, 2014. The unanimous FEC decision to allow political committees to accept Bitcoin donations up to $100 worth was reported on by CCN as soon as the news broke.

All in all, this is a great decision for Bitcoin. Anytime you can see the big Bitcoin logo displayed across the front page of a newspaper that is seen by over 7 million readers daily, that is certainly a step in the right direction in regards to the continued acceptance of this quickly growing cryptocurrency.

From its taxation laws and now to its use in political campaigning, Bitcoin is certainly becoming more a part of what we do in the USA Today.

The campaign coffer of Rep. Jared Polis, D-Colo., is steadily filling with invisible money.

As of Monday night, Polis had received $1,500 in Bitcoin that 39 donors together contributed to his campaign since the Federal Election Commission on Thursday allowed political candidates to accept them in limited amounts, campaign manager Lisa Kaufmann confirmed to the Center for Public Integrity.

His website homepage now shouts in bold red letters: “Now Accepting Bitcoins!”

Polis became the first federal official to accept Bitcoin after the FEC’s less-than-crystal-clear decision, which, in part, permits candidates and political committees to accept up to $100 in Bitcoin from an individual per election.

It did not rule one way or another on whether candidates and committees may accept the Bitcoin equivalent of the $2,600-per-election federal donation limit for individuals.

Polis’ Bitcoin contributions could be a boon or bust for him. That’s because the Bitcoin market is notoriously volatile.

Consider that in late 2011, a single bitcoin traded for about $2. By late 2013, its value exceeded $1,100. Today, a bitcoin goes for about $435.

Say, a month or year from now, the Bitcoin market crashes.

The value of Polis’ Bitcoin contributions would plummet accordingly, leaving him with less spending power than if his Bitcoin contributions had been made in cash.

But if the Bitcoin market skyrockets, Polis’ campaign stands to reap significant riches.

Politics investigations in your inbox: Sign up for the Center for Public Integrity’s Watchdog email.

While the FEC may only have blessed Bitcoin contributions of up to $100 per person, candidates such as Polis are allowed to let their accumulated Bitcoin appreciate in value. An initial $100 Bitcoin donation could suddenly be worth $1,000, or $10,000, within a matter of days or weeks.

As of March 31, Polis reported about $300,000 cash on hand as he seeks a fourth term in office in a Democratic-leaning district that includes Boulder and Ft. Collins. During the first three months of the year, he raised about $159,000.

Polis’ bullish attitude toward Bitcoin is hardly surprising, given his success creating and selling Internet-based businesses during the 1990s and 2000s.

He ranks among Congress’ richest members, with the Center for Responsive Politics estimating that his wealth in 2012 potentially reached $330 million.

And in April, Polis became the first known member of Congress to purchase Bitcoin.

Bitcoin is hardly the only digital currency in circulation. Other, even more exotic formats have also popped into existence during the past several years.

But Polis has “no immediate plans to take other forms of digital currency being that Bitcoin is the only one the FEC has issued guidelines on,” said Kaufmann, his campaign manager.

He will also adhere to the FEC-prescribed $100-per-contribution limit, she said.

Several other political candidates, including Rep. Steve Stockman, R-Texas, declared prior to the FEC’s guidance that they would accept political contributions in the form of Bitcoin.

Updated: 11-1-2019

Two Pro-Crypto US Congressmen Note Bitcoin White Paper’s 11th Birthday

U.S. Representatives Patrick McHenry (R-NC) and Warren Davidson (R-OH), have encouraged Bitcoin (BTC)-powered innovation on the Bitcoin white paper’s 11th birthday.

U.S. Policymakers Should Not Attempt To Deter Bitcoin’s Tech

U.S. congressman McHenry, who represents North Carolina’s 10th District, urged that American authorities should not stifle the new technology in a tweet on Oct. 31.

According to the official, policymakers should facilitate the development of new technologies. McHenry reiterated his previous bullish sentiments about Bitcoin, stating:

“The world that Satoshi Nakamoto envisioned, and others are building, is an unstoppable force. As policymakers, we should not attempt to deter this technology, but instead ask ourselves: what are we doing to meet the challenges & opportunities of this new world of innovation?”

Bitcoin Has Big Potential In Protecting Privacy

Rep. Davidson outlined Bitcoin’s potential to protect online privacy, retweeting Cointelegraph’s article on Bitcoin’s whitepaper turning 11 years old. The congressman stated:

“Eleven years ago, this anonymous white paper opened up infinite possibilities for technological innovation and #privacy protections. It’s time the US harnesses this potential and establishes a framework for American #blockchain innovators.”

Earlier in October, Davidson suggested that Facebook adding Bitcoin to its native crypto wallet Calibra would be a “way better idea” than launching their own cryptocurrency Libra.

Unprecedented Growth

In a blog post on Oct. 31, major U.S. crypto exchange and wallet service Coinbase pointed out that Bitcoin’s adoption has been developing much faster than other transformative technologies such as email and television. The exchange wrote:

“The television set was invented in 1927 but by the end of the 1940s only 2% of American families owned one. Bitcoin, on the other hand, went from an idea in 2008, and a first transaction in 2009, to over 27 million users in the US alone in 2019, or 9% of Americans.”

According to a survey last spring, as much as 11% of the American population owned Bitcoin as of April 2019.

Updated: 11-2-2019

Former US Congressman Ron Paul Receives His First Bitcoin

Former Texas Republican congressman and presidential candidate Ron Paul received his reportedly first Bitcoin (BTC) from Bitcoin Foundation board member and Bitcoin wallet startup Ballet Crypto founder, Bobby Lee, on Oct. 28.

Ron Paul Now Owns A Gold Plated Bitcoin Wallet

Lee publicly announced the gift he had given to Paul on Nov. 2, noting that the coin has been loaded into a gold-plated Bitcoin wallet produced by his company Ballet Crypto. He added that extra care has been given to customizing the wallet to better suit the former congressman:

“It was a special serial number AA000820 to match his birthday! And he loves the #Gold color.”

The wallets produced by Lee’s company are non-electronic physical wallets meant for cold storage of cryptocurrency. Their format is similar to that of a credit card, and they feature the passphrase of the wallet under a scratchable layer.

Freedom Of Money

Paul received the gift at a lunch that took place at the Litecoin (LTC) summit 2019, also in the presence of Litecoin founder Charlie Lee, who said that all three of them share some ideals:

“We Are All #Libertarian — Personal Liberty And #Freedomofmoney.”

Paul — an outspoken critic of the Federal Reserve — is known for his advocacy of gold. With regards to Bitcoin, Paul noted in July that he’s in favor of cryptocurrencies and blockchain technology because he supports competing currencies.

Paul’s stance is also in stark contrast with the ideas of U.S. congressman Brad Sherman, who believes that cryptocurrencies — potentially competing with the national currency, i.e. the dollar — should be banned. In late October, he said:

“Cryptocurrency either doesn’t work, in which case investors lose a lot of money, or it does achieve its objectives perhaps and displaces the U.S. dollar or interferes with the U.S. dollar being virtually the sole reserve currency in the world.”

On the other hand, not all U.S. representatives share Sherman’s dollar maximalist view. As Cointelegraph reported this week, two congressmen showed support on Bitcoin’s 11th birthday, noting that the technology has created “infinite possibilities for technological innovation and privacy protections.”

Updated: 11-2-2019

How Many More Birthdays Until Bitcoin Wins?

Bitcoin just turned 11 and it’s worth looking at what this technology has achieved. First, some context.

Facebook is 14 while Twitter is 13. Linux is 28. The World Wide Web – the network you’re reading this on – is 30. TCP/IP is about 44 years old, depending on whom you ask.

If you’re into a bitcoin, you’re most likely 18 to 34 years old, according to pollsters at the Global Blockchain Business Council. And you probably joined the bitcoin party about five years ago and own some fraction of or even a full coin. Some of you own many, many more.

I’m about as old as TCP/IP. I’m part of the generation that saw computing’s evolutionary bloom. If you’re younger, you’ve gotten used to modern networking technology and you don’t remember a time when everything wasn’t done on a screen. You were there for the birth of bitcoin.

But on the 11th anniversary of the white paper’s publication, we face a question: How long must we wait until bitcoin becomes like Twitter or Linux, something you use every day? Ten years? Twenty?

Bitcoin, from the vantage point of pure adoption, has been a failure. But it remains a beacon, the best chance we have for truly shaking up the status quo and, ultimately, changing the way we interact with our fellow global citizens.

When will we be using bitcoin daily? When will the underlying technology embed itself into the fabric of our financial lives?

Shrug. We Don’t Know.

Bigger Than Belgium

A billion people use Facebook every month. On Twitter, it’s 330 million. Both services ramped up quickly but really took off in the last few years. Linux is on 98 percent of servers worldwide – that took a while but ramped up after the dot-com boom. The web is everywhere, but that took a solid 20 years to happen.

How many people use bitcoin? It’s hard to gauge on a decentralized network designed for anonymity. For a rough proxy, CoVenture Research says there are “11.2 million bitcoin addresses that hold at least .001 BTC,” or about $9 worth.

That’s a big number, more than the number of people in New York, including the outer boroughs. Of course, a single user can, and often does, control multiple addresses. Yet if anything, this estimate may be too conservative. An April 2019 survey by Harris Poll, done for Blockchain Capital, found 9 percent of Americans – 27 million people – own bitcoin.

All told, it’s safe to say that if the crypto community were a country, it would be bigger than Belgium.

But it’s not 330 million and it’s not a billion. It’s enough that the average investor and programmer will take notice and it’s enough for Hollywood to consider the topic interesting enough for an awful movie. But 11 million in 11 years is not good for bitcoin.

If bitcoin were a startup it would exist in the Valley of Death. In the startup world, an app with 11 million users is strong enough to generate some revenue but not interesting enough to attract massive investment. Bitcoin is like that. It works, but not enough to turn heads outside of a vocal minority.

So where is bitcoin going? Is 11 million enough? How many more years until we get to mass adoption?

Another shrug. Another unknown. We see the forward motion every day on CoinDesk – the various small changes that add up to a story of a platform. (Or is it a movement?)

This points to the primary problem that bitcoin and the wider crypto ecosystem has to accept. Facebook and Twitter achieved those numbers through investments far smaller than bitcoin’s $165 billion market cap. Linux and FOSS endeared themselves to developers enough that they happily contributed their time freely. The web grows by itself because it is trivial to join the party.

Bitcoin exhibits few of those traits. Bitcoin startup investment is cold. The crypto ecosystem is insular and self-involved, difficult for outsiders to join. The network grows by fits and starts, driven primarily by Number Go Up. We are in a vibrant early stage in which everyone is a pioneer and there is no clear way forward. Infighting turns developer against developer while crypto clowns hog the mainstream media’s attention. Only a small, dedicated group holds the center together.

This Is Bad For Bitcoin.

Stay Tuned

By all rights, bitcoin shouldn’t survive another ten years. All the things that made Linux and Twitter and Facebook and the PS4 and Netflix commercial successes cannot be seen in bitcoin’s rise. You can’t spin up an AI that can write Harry Potter novels on bitcoin.

Bitcoin doesn’t move the world’s financial markets the way Twitter does nor does it get the same scrutiny that Facebook does. There is no “bitcoin and chill.”

Yet It Still Exists.

You will argue that it’s unfair to compare bitcoin to all of those things. But bitcoin is both a financial instrument and a technical product. It is, like a startup, a work in progress, an alpha product that may graduate to beta with a little more time. It is a good idea that needs another summer or two to germinate.

When I first looked at Spotify, 13 years ago, I saw the future of streaming music that freed me from CDs. When I stuck a copy of Mandrake Linux into my Pentium computer in 1998 I saw a future of machines freed from paid software. When I look at bitcoin through the eyes of an uninterested programmer I see numbers and hype and scams. But when I look at bitcoin through the eyes of someone who wants to catch the next big thing, I see the possibility that one day, not too far in the future, it will make banking and commerce vastly different.

All of the other services and tools I mentioned above are reaching their apex. It’s all downhill from here. Bitcoin, to quote the Joker, is just getting warmed up.

Bitcoin is a slow burn, one that will take another five or ten years to really explode. And when it does it won’t be visible like Facebook or Netflix. It won’t be one level removed from our browsers, hiding just out of sight, like Linux. It will be ingrained in our lives, in the interaction between our money and the world. It will be the currency used between humans and robots and between robots and robots. It will become so useful that it will disappear.

Bitcoin Is 11. Where Is It Going? When Will It Win?

Shrug. We don’t know. But, compared with everything that came before it, there is little out there to stop bitcoin and a lot of energy driving it forward. It’s only a matter of time.

Updated: 12-6-2019

Known Crypto-Hater Sherman to Chair Congressional Subcommittee on Investor Protection

The anti-crypto United States Congressman Brad Sherman (D-CA) has been elected to serve as Chairman of the Subcommittee on Investor Protection, Entrepreneurship and Capital Markets.

On Dec. 5, Chairwoman of the House Financial Services Committee Maxine Waters (D-CA) announced that Sherman was elected to take up the position of Chair at the subcommittee that oversees the Securities and Exchange Commission (SEC), the New York Stock Exchange and the Financial Industry Regulatory Authority.

Sherman Vs Crypto And Maybe The Internet

Sherman, who is an American politician serving as a Democratic member of the U.S. House of Representatives since 1997, is known to be a formidable opponent of Bitcoin and cryptocurrencies in general.

Largely pro-crypto congressman and Sherman’s colleague on the Financial Services committee Warren Davidson (R-OH) recently told Cointelegraph that Sherman really doesn’t like anything in the cryptocurrency space. Davidson went on to say:

“In my view, [Sherman’s] goal is essentially to try to ban the internet. He’s like ‘we’re going to ban crypto, we need to ban crypto, the only reason to have any crypto asset is to launder money and evade taxes. Go back, rewind the tape. Every hearing on crypto, that’s Brad Sherman. He doesn’t like the space.”

Sherman has expressed opposition to any money that challenges the U.S. dollar’s role as global reserve currency. He continues to argue for an outright ban on cryptocurrency. This outspoken negative stance towards crypto earned him some criticism from Bitcoin bull Max Keiser, who said that Sherman is going to a gunfight with a knife, adding:

“He has failed to take on board exactly what the dimension of this battle is going to be […] He doesn’t understand he’s already lost.”

Crypto Could ‘Displace Or Interfere With Dollar’

In October, Sherman appeared to give unlikely weight to the idea that a disruptive financial instrument, such as cryptocurrencies, can succeed in taking power away from the dollar. He said:

“Cryptocurrency either doesn’t work, in which case investors lose a lot of money, or it does achieve its objectives perhaps and displaces the U.S. dollar or interferes with the U.S. dollar being virtually the sole reserve currency in the world.”

Updated: 9-21-2020

Wisconsin Assembly Candidate Is Accepting Bitcoin Donations Again

“Cryptocurrency is money,” argues a Wisconsin State Assembly candidate.

A candidate for the Wisconsin State Assembly is challenging a state regulator by accepting donations in cryptocurrencies like Bitcoin (BTC).

Phil Anderson, a real estate broker and entrepreneur, now accepts cryptocurrency donations for his Assembly campaign. According to an official statement by Anderson, crypto donations are available via major cryptocurrency payment service provider BitPay.

Anderson said that his campaign is accepting crypto donations despite regulatory uncertainty from the Wisconsin Ethics Commission.

Back in 2018, Anderson accepted Bitcoin donations in his campaign for governor of Wisconsin despite the WEC finding them a “serious challenge” to compliance with state law. According to the candidate, the WEC failed to arrive at a decision regarding the legal status of crypto donations in the state in 2018.

As such, the Wisconsin Assembly candidate is challenging the regulator again, arguing that the WEC “declined to interpret its own rules competently.” Anderson believes that crypto is a legitimate way to make campaign donations because “cryptocurrency is money.” The candidate promises to “push for the laws to be friendly toward cryptocurrency in Wisconsin.”

“I refuse to give in to ignorance and bureaucratic incompetence. […] People have the choice as to how they contribute, and it’s my intention to honor those choices. If my opponent or the Ethics Commission are interested in challenging me, I’m ready for a fight,” he said.

A number of political candidates for various offices in the United States have been accepting crypto as donations for their campaigns. Andrew Yang, a former presidential candidate, was accepting Bitcoin donations for his political action committee in 2019. In August, Republican Rep. Tom Emmer also started accepting campaign donations in crypto via BitPay.

11-15-2020

Incoming Senator Hopes To ‘Bring Bitcoin Into The National Conversation’

Does Bitcoin finally have an advocate at the highest levels of government?

In a clip that has been widely circulating on Twitter, the soon-to-be-senator representing Wyoming — possibly the highest ranking US official to ever speak so glowingly of the digital currency — cited her experience as a former state treasurer for why she believes in Bitcoin’s future.

“I’m a former state treasurer and I invested our state’s permanent funds, so I was always looking for a good store of value, and Bitcoin fits that bill. Our own currency inflates; Bitcoin does not. It’s 21 million Bitcoin will be mined, and that’s it, it is a finite supply. So I have confidence that this will be an important player in store of value for a long time to come.”

The Senator also appeared to brush off GMA3 host Sara Haines’ implication that Bitcoin could be used for money laundering or tax evasion, choosing not to address these charges at all.

As Cointelegraph has previously reported, Lummis is an early adopter of Bitcoin, having first picked up the currency in 2013 following a tip from her son-in-law, Will Cole, who works at cryptocurrency services firm Unchained Capital.

While some in Congress have tepidly embraced cryptocurrency, such as Florida representative Darren Soto, who accepted campaign contributions donated in cryptocurrency, few — if any — have been as vocal about their support as Lummis.

While many outlets have noted that Lummis is Wyoming’s first female representative to the Senate, many in the cryptocurrency world no doubt hope that she’ll be the first true representative for Bitcoin as well.

Updated: 12-14-2020

Senator-elect Wants To Spread Bitcoin Awareness In The US Government

Bitcoin will come to the rescue if the fiat system fails, says the incoming senator from Wyoming.

An unprecedented year, 2020 has sent the global economy into a tailspin in an effort to compensate for COVID-19-related difficulties. If the traditional system collapses, Bitcoin will become vital, according to United States Senator-elect Cynthia Lummis.

“If we reach the point where we have overspent so much that things start crashing down, the black swan event occurs with regard to any fiat currency — whether it’s ours or yours or China’s or Japan’s — that there is a backstop available to every government in the world, and that backstop is Bitcoin,” Lummis told Peter McCormack during a recent episode of his What Bitcoin Did podcast.

Government actions and media coverage around COVID-19 spiked in March, resulting in businesses’ closures and economic difficulties. Problems have since persisted in terms of economic stimulus and health matched with government COVID-19 mandates.

Hailing from the crypto-friendly state of Wyoming, Lummis wants to further Bitcoin awareness among U.S. authorities. “I really want to use my time in the U.S. Senate in part to help introduce the topic of Bitcoin,” she said, explaining her desire to:

“Increase the understanding in the Senate about Bitcoin, what it is, what it does, how it can be an asset that can grow and develop as an adjunct, so basically alongside our fiat currency, and that it should be allowed a clear path and avenue — an interstate highway in fact — to grow and develop alongside our fiat currency.”

In contrast to Bitcoin and its consistent supply, the U.S. dollar’s framework inherently includes inflation, making devaluation inevitable, according to Lummis, who owns Bitcoin herself. “I am a HODLer,” she said. “I only buy. I’ve never sold,” she added.

In line with a difficult year, the U.S. national debt has further ballooned in 2020, standing at more than $27 trillion as of publication, which concerns Lummis. “I know that there is no strategy, no plan, for the United States to begin to retire its debt,” she said. “When I entered Congress in January of 2009, we had just turned over to $10 trillion from $9 trillion in debt.”

U.S. governing authorities have doled out a number of COVID-19-related funding efforts this year, while also printing massive amounts of cash. Further pandemic-related spending talks are also currently underway, Lummis noted, positing Bitcoin as a possible solution.

In addition to a debt solution, the U.S. needs “an alternative path just in case we fail, and I see the alternative path as Bitcoin,” Lummis said, subsequently citing the asset’s store-of-value role and limited supply.

Updated: 2-3-2021

Bitcoin-touting Senator Lummis Appointed To Banking Committee

The most vocally pro-crypto Senator in the U.S. will join the committee responsible for the nation’s financial regulation.

On Wednesday night, Senator Lummis’ team told Cointelegraph that Lummis had received her committee assignments for the 117th congress.

The freshman republican from Wyoming will take her place at three committees: banking, environment, and commerce. The Banking Committee is the Senate’s front line for financial legislation and has hosted hearings with Facebook’s leadership over the Libra stablecoin, as well as, more recently, prospects for a digital dollar.

In a press announcement, Lummis noted her intention of using the appointment to the banking committee to advance digital asset legislation.

“Wyoming has been leading the way on financial innovation over the last several years. Through my role on the Banking Committee, I hope to shine a light on many of these pioneering efforts and work with federal regulators to ensure that regulation of digital assets are structured to encourage innovation, instead of stifling it.”

Lummis, who joined the Senate as of last month, is vocally pro-crypto. In a recent appearance on Anthony Pompliano’s podcast, she expressed her intention to launch a Financial Innovation Caucus.

While the House of Representatives, especially the Financial Services Committee, has long featured many members interested in cryptocurrencies and even a Blockchain Caucus, Lummis is the first Senator to be so publicly engaged in the industry.

Updated: 2-6-2021

Crypto-friendly Faces Poised For Positions In Biden Administration

The crypto industry appears to be abuzz with potential, given confirmed and possible appointments in the Biden administration.

As the United States Senate begins confirming leadership posts across commerce and the treasury, there has been meaningful momentum in the crypto community as a response.

This is due to the profiles of various individuals who have been reportedly nominated, as well as the anticipated economic measures by the coming administration — both of which are expected to nurture positive momentum for crypto growth.

While a few official appointments have been made with numerous confirmations pending, others are still at the nomination stage. Let’s take a quick loop around the swamp.

The Treasury

Confirmed with 84 votes, Janet Yellen will be at the helm of the treasury. During her confirmation hearing, Yellen outlined her support for Biden’s agenda, which includes a likely increase on taxes for the wealthy, “backing the buck” to stabilize the dollar amid attempts to undermine current value through market manipulation abroad, and ensuring the stabilization of the U.S. economy amid the current global COVID-19 pandemic.

On crypto, Yellen did not directly address her approach to regulation in the space during her confirmation hearings; however, she did mention that legitimate uses for cryptocurrency should be encouraged, such as means using these types of decentralized finance to “improve efficiency of the financial system.”

Securities And Exchange Commission

One appointment the crypto community is particularly excited about is Gary Gensler, who previously served as Commodity Futures Trading Commission chairman under President Barack Obama and as a Treasury official under President Bill Clinton.

Having previously called blockchain technology “a catalyst for change,” Gensler has been outspoken about the importance of cryptocurrencies and has gone on record to say there is a “strong case” for XRP being classified as a security.

He has also been very vocal about how blockchain technology could solve payment problems in the United States.

As the expected chairman of the Securities and Exchange Commission, Gensler will be in a prime position to rally support behind a U.S. central bank digital currency, particularly amid institutional interest for this product. Gensler would also play a significant role in broad governmental action on crypto and blockchain, such as the consideration of a Bitcoin (BTC) exchange-traded fund, and he is expected to shift sentiments in its favor.

Currently a professor of practice at the Massachusetts Institute of Technology Sloan School of Management, Gensler conducts research and teaches blockchain technology, digital currencies, financial technology and public policy.

Moreover, the departure of SEC Chairman Jay Clayton is also welcomed by crypto enthusiasts, as he was notorious for his skepticism toward the digital finance industry. With Clayton stepping aside, coupled with his anti-crypto biases, the path is open for Bitcoin ETFs to become a reality.

There’s already a line of financial institutions led by Fidelity and investment firms that have applications for Bitcoin funds in process with the SEC and will be applying pressure on Gensler when he takes office.

Office Of The Comptroller Of The Currency

Another office coming into focus during Biden’s transition is the Office of the Comptroller of the Currency. Out is Brian Brooks, former head of OCC during the Trump administration, who, prior to stepping down, announced that banks can utilize stablecoins and blockchain to process payment.

In what is being considered an “interpretive letter,” the OCC is allowing federally chartered banks to use cryptocurrencies with fairly stable prices for standard transactions. The letter also stipulates that banks can participate in validating transactions on a blockchain, setting an impressive regulatory step forward for stablecoins and creating more potential for cryptocurrencies.

Prior to stepping down from office, Brooks went on record about the importance of decentralized finance where he explained:

“This is what decentralization is about. In the world of crypto, there is no CEO. Crypto is about freedom and if you didn’t believe that freedom mattered last week, you should think about it again.”

As of early February, Biden’s transition team is expected to nominate Michael Barr as Brooks’ successor in the OCC. Prior to his tenure as an advisor at Ripple and board member at LendingClub, Barr helped construct the Dodd-Frank Act, where strict regulations were introduced to lenders and creditors to protect consumers in the wake of the housing collapse.

This unique blend of experience and credibility could be what’s needed to help push forward favorable regulation and further growth of blockchain technology and cryptocurrency in financial services.

Commodity Futures Trading Commission

The last appointment that should make investors optimistic is Chris Brummer, who is expected to become the next Chairman of the CFTC. As a member of the CFTC’s subcommittee and faculty director of Georgetown’s Institute of International Economic Law, Brummer will advise Yellen on regulatory affairs related to cryptocurrency while also potentially laying the foundation for a more expansive derivatives market for digital assets.

Updated: 2-9-2021

Crypto-friendly US Senator Invites Elon Musk To Move To Wyoming

Saying the state has “the best laws for digital assets” in the United States, Senator Lummis asked the Tesla CEO if he would consider relocating.

Following Tesla’s groundbreaking Bitcoin announcement, pro-crypto Senator Cynthia Lummis set out the welcome mat for Elon Musk in her home state of Wyoming.

Taking to Twitter yesterday, Lummis invited the Tesla and SpaceX CEO to consider relocating to “one of the most business friendly states” with “the best laws for digital assets” in the United States. The offer followed the news that Tesla had purchased $1.5 billion in Bitcoin (BTC) and would be accepting the crypto asset for payments.

Hey @elonmusk, I hear Wyoming is one of the most business friendly states in the nation and has the best laws for digital assets in the US. Ever think about relocating? https://t.co/ro2nLRIXq9

— Senator Cynthia Lummis (@SenLummis) February 8, 2021

Lummis’ press secretary Abegail Cave told Cointelegraph that the state had developed a regulatory framework that rewarded innovation, particularly in the digital asset space. She cited a number of incentives that could potentially draw the Tesla CEO to Wyoming, including having no corporate or personal state income tax.

“Tesla is all about innovation, and it’s great to see this American success story recognizing the value of digital assets,” said Cave. “Should Elon Musk or his companies ever need a new home, they couldn’t find a better place than Wyoming.”

Wyoming is becoming one of the most attractive U.S. states for crypto and blockchain firms. In September, the Wyoming State Banking Board granted crypto exchange Kraken a charter to operate as a crypto-friendly bank. The following month, regulators gave Avanti Bank & Trust the green light to receive and custody crypto in a similar fashion.

Both firms and others looking to Wyoming as a regulatory safe haven have been assisted by efforts from Caitlin Long, a former Wall Street executive and current CEO of Avanti Bank. Long, associated with the Select Committee on Blockchain, Financial Technology and Digital Innovation Technology in the state legislature, has helped enact many blockchain-enabling laws in Wyoming.

Less than a month into her first term as a U.S. senator, Senator Lummis said she will focus on legislating digital assets. Last week, she was assigned to the Banking Committee, responsible for financial regulation in the country.

Updated: 6-17-2021

US Republican Party’s Election Arm To Accept Cryptocurrency Donations

The NRCC said that it will collect all identifying data from individuals who donate with crypto.

The United States’ National Republican Congressional Committee — the body responsible for coordinating Republican electoral efforts — is introducing donations in cryptocurrencies like Bitcoin (BTC).

The NRCC announced Wednesday on Twitter that the committee will begin accepting crypto donations for election campaigns, sending its fundraising efforts “to the moon.”

https://t.co/aIisNV5BiD pic.twitter.com/F9ktKFfHAq

— NRCC (@NRCC) June 17, 2021

According to a Wednesday report by Axios news agency, the NRCC will process crypto donations using major payment platform BitPay, through which donations will be immediately converted to U.S. dollars.

The cash conversion means that the NRCC will be able to accept individual donations of up to $10,000 per year — multitudes more than the $100 maximum-value limit for transfers of actual cryptocurrencies.

The NRCC said that it will collect all identifying data from individuals who donate with crypto.

NRCC chairman and Minnesota Representative Tom Emmer said that accepting crypto is part of Republicans’ efforts to pursue “every avenue possible” for winning elections. “This innovative technology will help provide Republicans the resources we need to succeed,” he said.

Emmer has emerged as a prominent proponent for cryptocurrencies in Congress. Last year, Emmer started accepting donations for his own campaign via BitPay.

Last month, Emmer reintroduced a bill that aims to prevent the Internal Revenue Service from imposing penalties or fees on crypto taxpayers with forked assets.

Updated: 6-24-2021

Senator Cynthia Lummis Excited To Buy The Bitcoin Dip

The senator from Wyoming plans to buy more BTC if the price drops further.

United States Sen. Cynthia Lummis of Wyoming took advantage of a deeply discounted Bitcoin (BTC) price this week by adding to her holdings.

In the wake of yet another major price correction for crypto assets, Lummis told Fox News on Wednesday that she’s “excited to buy the Bitcoin dip.”

U.S. Senator, @CynthiaMLummis, “I’m excited to buy the #bitcoin dip” pic.twitter.com/OHXiA6vhxi

— Documenting Bitcoin (@DocumentingBTC) June 23, 2021

When asked about Bitcoin’s rapid price decline, Lummis said:

“I’m really excited about it because as soon as it drops a little more, I’m going to buy some more.”

Lummis compared Bitcoin’s drop to the performance of one of her favorite stocks, United Rentals. “I bought it,” Lummis said of United Rentals, “and it dropped like a rock. I held onto it, and my gosh, it’s performed beautifully over the years for me,” she said, adding:

“I see Bitcoin doing the same kind of thing because the fundamentals are good.”

Lummis is one of the most vocal advocates of Bitcoin in the U.S. Senate. Earlier this year, she launched the Financial Innovation Caucus to educate fellow lawmakers about Bitcoin and other cryptocurrencies. At the time, Lummis said she will work with the caucus to address false narratives about cryptocurrencies, including their association with money laundering and other financial crimes.

As Cointelegraph reported, Sen. Lummis attended this year’s Bitcoin 2021 conference in Miami, where she discussed the importance of encouraging crypto innovation. She was joined by Rep. Warren Davidson of Ohio in a panel titled “Bringing Bitcoin Innovation Home to America.”

After plunging below $29,000 earlier this week, Bitcoin’s price appears to have found support above $30,000 again. At the time of writing, the digital currency was up 5.5% at $33,700.

Updated: 6-1-2021

Political Campaigns Receiving Cryptocurrency As Contributions Could Be The New Trend

Many cryptocurrency advocates bite at the chance whenever they can use their BTC, Eth, or even meme coins as a way to exchange goods or services.

That’s not all though, Cryptocurrency is now even being used as contributions towards several politicians who are looking to make their way to Congress.

The most recent candidate to announce her campaign will accept Bitcoin is Aarika Rhodes who is looking to run for California’s 30th Congressional Seat.

Rhodes isn’t the only candidate accepting Bitcoin either, Laura Loomer who ran in 2020 also accepted cryptocurrency for contributions and went on record saying “Bitcoin promotes financial freedom”.

During the 2020 Presidential Campaign Democrats Andrew Yang and Eric Swalwell both accepted cryptocurrency as contributions too before dropping out of the race.

Our campaign will be accepting #Bitcoin contributions.

Stay tuned!

— Aarika Rhodes ???????????? (@AarikaRhodes) July 7, 2021

Are Bitcoin campaign contributions a fad or the future of fundraising? https://t.co/uDbEa852IO

— The Palm Beach Post (@pbpost) September 17, 2020

Cryptos R Us had more on the story:

* Aarika Rhodes, a candidate for the California 30th Congressional District in the upcoming 2022 election, has announced she will be accepting Bitcoin donations for her congressional run. The elementary school science teacher took to Twitter today to make the announcement.

* Another recent candidate for Congress, Laura Loomer of Florida, spoke to the importance of Bitcoin stating: “Bitcoin promotes financial freedom. We are telling the old power structure that we don’t need them anymore. We pave our own destiny financially, intellectually and with speech freedoms.”

* Politically savvy candidates are beginning understand the importance of an un-censorable currency and the implications it can have on a society marred by the censorious overlords in big tech and, financial system and their collusion.

* The trend begin back in 2014 when a candidate named Andrew Hemingway became the first ever Congressional candidate to accept Bitcoin for political contributions. In 2014, the Federal Election Commission deemed Bitcoin contributions legal and lawful.

“I think it goes without saying we’re going to see a lot more of this in terms of campaign contributions and campaign financing,” bitcoin is gaining currency in political campaign donations. https://t.co/qg9BNNmgg9 #18for18 pic.twitter.com/cVHUN6xgf0

— ABC News (@ABC) February 7, 2018

The Palm Beach Post covered Loomer’s campaign accepting Bitcoin:

* Somewhere among the hundreds of supporters who have contributed a stunning $1.1 million to the congressional campaign of self-proclaimed Islamophobe Laura Loomer are the donors backing the 27-year-old newcomer not with dollars but with a cryptocurrency called Bitcoin.

* Until recently, digital assets like Bitcoins were the preferred currency of far-right conservatives and die-hard libertarians. The attraction? Cryptocurrencies provide privacy and the opportunity to circumvent banks and governments, which have no power over cryptocurrencies because they do not recognize them as legal tender.

* The option to contribute to campaigns using Bitcoin has been primarily offered by candidates, like Loomer, who appealed to the Libertarian and far-right demographic.

Updated: 6-29-2021

State Of Crypto: Inside the NRCC’s Plan To Accept Crypto Donations

The NRCC will soon accept crypto donations because Republican donors requested the payment method, the campaign committee’s chair said.

The National Republican Campaign Committee (NRCC) is the first major congressional campaign group to accept cryptocurrencies in the U.S. Its chair, Rep. Tom Emmer (R-Minn.) says this move comes at donors’ request.

Political Donations

The Narrative

The NRCC is among the first major political groups in the U.S. to accept cryptocurrency donations, which could signal further acceptance of virtual assets as a value transfer tool. What’s more interesting is this adoption is being spearheaded by crypto champion Tom Emmer, a congressman from Minnesota and the NRCC’s chair. He says it’s coming from because some donors want to pay in crypto.

Why It Matters

Cryptocurrency adoption in the U.S. will be driven partly by how crypto is used, and partly by how it’s perceived. U.S. lawmakers accepting crypto for donations may have an impact on both these aspects. Lawmakers receiving crypto will become more comfortable with it, which could lead to more awareness and maybe even positive sentiment toward crypto usage during congressional hearings.

Breaking It Down

The National Republican Congressional Committee will accept crypto donations in the near future, after having announced the move earlier this month. BitPay, a payment processor four months removed from settling sanctions violation charges, will convert cryptocurrencies into fiat before sending the donations to the campaign wing.

“This is something that I was interested in doing here at the NRCC last cycle, but really what’s happened is I started to get donors saying ‘I would contribute crypto if you take crypto,’” Emmer said of the move.

Emmer’s own campaign has accepted crypto since August 2020, after working with BitPay last year.

“We’ve been talking about this ever since I’ve had this job and my campaign started accepting cryptocurrency,” Emmer said. “In fact I think Jared Polis (D-Colo.) might have been the first member of Congress to accept cryptocurrencies for his campaign, and I’m not sure why others didn’t follow suit.”

Dotting the I’s and crossing the T’s took less than a month after the final decision was made, he said.

The Federal Election Commission (FEC) has allowed political campaigns to accept crypto since 2014. Emmer said the NRCC’s team has worked with the election watchdog to ensure NRCC donations are above board.

“My understanding is that our lawyers cleared this with the FEC with ethics, that’s all been addressed. My office, we did [speak to the FEC] for my personal campaign,” he said.

Still, it’s unclear when the NRCC will actually begin accepting crypto. A spokesperson for BitPay said the committee was still being integrated.

When the feature goes live, donors can donate bitcoin, bitcoin cash, ether, XRP, dogecoin, DAI, wrapped bitcoin, USDC, GUSD, PAX and Binance USD.

These potential crypto donors want Congress to take more action on the virtual currency industry, he said.

“I’ve been engaging with this community all across the country now for more than just the last two years, and I would say with each month the engagement grows,” Emmer said.

He pointed to plans to provide financial services to unbanked individuals as one example.

“Frankly, the last administration had fits and starts in this area,” he said. “If we don’t get moving on this, you’re going to have a whole bunch of really smart entrepreneurs, and the capital that they are raising to create these opportunities, leaving the United States to start these things elsewhere.”

Updated: 6-30-2021

Senator Cynthia Lummis Backs Crypto For US Retirement Plans

Senator Cynthia Lummis wants to see crypto-assets become a normal part of the diversified asset allocations in U.S. citizens’ retirement plans.

U.S. Senator and Bitcoin proponent, Cynthia Lummis, would like to see U.S. residents turn to Bitcoin as part of a diversified strategy for their retirement plans.

Speaking during the CNBC Financial Advisor Summit on June 29, Senator Lummis stated she would like to see Bitcoin and other crypto-assets become a normal part of diversified asset allocations used for retirement funds in order to protect the from inflation.

“I’d also like to see individuals be able to use Bitcoin and cryptocurrencies of their preference that are safe, that have met the hurdles of anti-money laundering and Bank Secrecy Act,” she added.

Lummis emphasized the importance of maintaining a “diverse asset allocation” — warning of the inflation risks caused by government spending and money printing:

“The Congress spends trillions and trillions of dollars, and is flooding our economy and the world economy with U.S. dollars, there’s no way that we cannot debase the value of the U.S. dollar.”

While U.S. citizens have been able to include crypto assets in their retirement portfolios since the Internal Revenue Service first issued guidance on the sector in 2014, the practice of hodling digital assets in one’s retirement plan has remained a niche practice.

However, despite the first crypto-friendly retirement plans beginning to emerge in 2020, many analysts are skeptical of the trend.

On June 22, senior vice president at Alliant Retirement Consulting, Aaron Pottichen, told CNBC that “plan sponsors, in general, are still very unlikely to want to adopt any type of cryptocurrency into their investment line-up.”

During the interview, Lummis revealed that she currently owns 5 BTC in total, having bought her first Bitcoin in 2013 for roughly $330. Despite her Bitcoin bullishness, she emphasized that diversification is the key and not to go all-in on BTC:

“I don’t want everybody putting all their money in Bitcoin just like I don’t want everybody putting it in dollars and putting it under a mattress.”

Updated: 7-29-2021

Massive Government Spending Accelerating Crypto Adoption: Sen. Cynthia Lummis

Senator Cynthia Lummis said that inflation and massive government spending is accelerating the adoption of digital assets.

Republican Senator and Bitcoin proponent Cynthia Lummis said that massive government spending is accelerating crypto adoption.

Lummis made the comments while sharing an interview she did with “Varney & Co” on the Fox Business cable network on July 29, in which she called for a crypto regulatory sandbox and support to attract Bitcoin miners to set up in US states.

On Twitter she stated that “big gov’t spenders are (accidentally) doing far more to accelerate the adoption of digital assets than I am,” and asserted that the debasement of the U.S. dollar is driving citizens to store value in digital assets such as Bitcoin. Not that this was necessarily a good thing:

“BUT spending America deeper into a hole is a stupid, inflationary & altogether undesirable way to drive ppl to digital assets.”

“I want USD to continue as the world’s reserve currency. We need to reign in spending & support financial innovation on US soil,” she added.

During the cable TV interview, Lummis gave her thoughts on the July 27 hearing held by the Senate Banking Committee regarding the risks of crypto and offered views on the regulatory landscape moving forward.

The Senator emphasized that the first step should be “good solid definitions” that are agreed upon in legislation and called for “a regulatory sandbox where everyone understands the rules, but innovation can still occur unrestricted.”

Lummis stated that “we wanna make sure that Bitcoin can continue to serve as a good store of value,” and she appears view the asset primarily in that way. However, she did also note that if the U.S. were to follow El Salvador’s route and make BTC legal tender, it would need to be regulated under the bank secrecy act, anti-money laws and in a way that it can be “ferreted out” if it’s used illegitimately.

The Bitcoin proponent also said she wants to see the U.S. welcome and support crypto miners that are flocking to the country following the Chinese mining ban:

“We wanna make sure that these miners […] can come to places like Pennsylvania, Texas, Wyoming and elsewhere. Where they can get the energy to mine it and then once it’s produced that it can be on the blockchain in a way that enhances the non-fiat currency advantages that cryptocurrency has.”

Lummis is a Bitcoin hodler who previously stated that she was excited to buy the dip in June, and has advocated for holding BTC as part of a retirement diversification strategy. However, her pro-crypto sentiments were not shared by Democrat senator Sherrod Brown and others during the Senate Banking Committee’s recent hearing.

“After a decade of experience with these technologies, it seems safe to say that the vast majority haven’t been good for anyone but their creators,” Brown said in his opening statement.

“They claim to enable ‘transparency.’ Their backers talk about the ‘democratization of banking.’ There’s nothing ‘democratic’ or ‘transparent’ about a shady, diffuse network of online funny money.”

Updated: 8-25-2021

County Treasurer In Illinois Accepts Crypto Donation In Reelection Bid

The Lake County treasurer plans to HODL the crypto campaign donations in the hopes of a significant price rally for cryptocurrencies.

Holly Kim, a treasurer in Lake County, Illinois, has reportedly become the first political candidate in the state to accept crypto campaign donations.

According to the Chicago Tribune on Wednesday, Kim recently received a $3 Litecoin (LTC) donation from Mark Tan, founder of T Capital Coin, an investment management outfit based in Lake Forest.

The Lake County Treasurer who is up for reelection in 2022 plans to accept Bitcoin (BTC) and many of the popular cryptocurrencies including Ether (ETH), Dogecoin (DOGE), and Dai (DAI).

For Kim, accepting crypto donations opens up a “new frontier” for support from tech-savvy people, adding: “It seems to be how people want to give.”

Kim, a Democrat is also a crypto enthusiast and has reportedly tried to use her position as a former trustee in Mundelein to encourage cryptocurrency adoption in the village.

Given her interest in cryptos, the self-professed “long-time netizen” has plans to hold on to the crypto donations in the expectation of a possible price advance in the market.

Cryptocurrencies enjoyed parabolic gains at the start of the year in a continuation of the upward trend that began in Q4 2020. However, prices have declined significantly since May with many tokens over 50% of their value.

Though arguably uncommon, crypto political donations are not unheard of in the United States. Indeed, the Federal Election Commission legalized crypto political campaign contributions as far back as 2014.

Back in June the National Republican Congressional Committee — the Republican Party’s election coordinator — announced plans to begin accepting crypto donations. Former U.S. Presidential aspirant Andrew Yang also accepted crypto donations during his campaign back in 2020.

Several state and federal legislative aspirants have also accepted crypto donations, often in a bid to spur contributions from the younger more tech-savvy demographic.

Updated: 8-26-2021

Crypto-Savvy U.S. Senator Sees The Future In Wyoming

In 2013 then-Representative Cynthia Lummis first heard about a new form of currency from her daughter and son-in-law, who helped Lummis buy her first Bitcoin for $330. Eight years later the first-term Republican senator from Wyoming has become one of Capitol Hill’s most ardent supporters of cryptocurrencies and the blockchain technology that powers them.

Her state is at the forefront of trying to regulate the fast-evolving digital asset sector after the passage of a slate of crypto-friendly laws in 2018 and 2019.

Driven by curiosity about the subject and advocacy for her state, Lummis, 66, who’s combined a career in government with tending steer on her family’s ranch, regularly attends conferences and workshops on cryptocurrency and has developed a working knowledge of digital money, which initially “sounded so intangible,” she says.

(She’s also acquired four more bitcoins; their cumulative value hovered around $250,000 as of Aug. 25.) Earlier this year, in response to a cryptocurrency meme, she even donned a pair of red “laser eyes” on Twitter in support of Bitcoin’s price target of $100,000.

The value of the digital asset market: $1.6 trillion

Now Lummis aims to persuade her fellow members of Congress to emulate Wyoming’s hands-off approach toward regulating crypto, which has led several prominent companies, such as crypto exchange Kraken and blockchain platform Cardano, to move to the nation’s least populous state.

In addition to exempting digital currencies from property taxation and standardizing regulatory language, Wyoming has also encouraged crypto miners to use natural gas that’s an unwanted byproduct of oil drilling to power their hugely energy-intensive activity.

Those changes laid the groundwork for the chartering in 2019 of Wyoming’s crypto banks, otherwise known as special purpose depository institutions, or SPDI (“speedy”) banks—the first fully regulated financial institutions in the U.S. that hold cryptocurrency in addition to fiat currency.

“For a state like Wyoming, cryptocurrency provides an alternative store of value as well as the technology that diversifies our economy,” says Chris Rothfuss, a Wyoming state senator who chairs the chamber’s blockchain committee. “We needed to do something that didn’t depend on coal, oil, and gas—those were industries that were waning.”

Lummis cites Wyoming as a model for federal regulation of the $1.6 trillion market. “Wyoming in fact had so successfully innovated in this regulatory and legislative space that it was ready for prime time, in a very big way,” says Lummis, sitting on a long couch in her Senate office.

She was among a bipartisan trio of senators who tried to change a provision in the $550 billion infrastructure bill that raised taxes by requiring cryptocurrency exchanges to report information to the IRS.

Lummis, Pennsylvania Republican Pat Toomey, and Oregon Democrat Ron Wyden introduced an amendment that would have exempted crypto miners and software developers from reporting, arguing that they didn’t have enough information to comply. Critics said the amendment would create loopholes in a way that would allow tax avoidance to proliferate.

The amendment was blocked, but the effort highlights the growing political tensions around the rise of cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin, as well as stablecoins, a form of cryptocurrency pegged to another asset to reduce its volatility. Securities and Exchange Commission Chair Gary Gensler recently said at an Aspen Institute forum that the sector is “rife with fraud, scams, and abuses.”

In an interview in August with Bloomberg Businessweek, he signaled that he would use his agency’s authorities for robust oversight. “If somebody wants to speculate, that’s their choice, but we have a role as a nation to protect those investors against fraud,” he said.

The issue has scrambled party lines in Congress. Ohio Senator Rob Portman, a Republican, joined Democrats Kyrsten Sinema of Arizona and Mark Warner of Virginia in backing a separate, narrower amendment to counter the one that Lummis brought.

Democratic Senator Elizabeth Warren says cryptocurrency is the “Wild West” of the U.S. financial system and has pressed regulators to protect consumers and taxpayers. “The bigger it gets and the more it stays outside the financial system—something goes wrong, there’s a run on crypto or elsewhere in the economy—I don’t want the U.S. taxpayer to be the one that gets called on to back this up,” she said on Aug. 4 in an interview on Bloomberg Television.

The Biden administration weighed in on the Senate battle over crypto amendments in early August by supporting the one advanced by Portman, Sinema, and Warner, which it said would “ensure that high-income taxpayers are contributing what they owe under the law.” The Senate passed the bipartisan bill with the original provision intact.

Among the worries of federal regulators and lawmakers is that crypto is fueling ransomware attacks, making it possible to extort huge payments from large companies, hospitals, and city governments under the cover of near anonymity. Lummis says that cryptocurrency can sometimes be more traceable than cash.

She hopes to get legislation passed that would establish a digital asset working group with federal regulators, including representatives from the SEC and the Commodity Futures Trading Commission. She envisions a more comprehensive regulatory framework in the next three or four years, paving the way for more institutions to use Bitcoin as legal tender.

That will be an uphill climb given Congress’s lack of familiarity with crypto and its already crowded agenda, says Isaac Boltansky, a policy analyst with investment firm Compass Point Research & Trading.

“Senator Lummis is going be a persistent and loud voice with financial regulators when they come knocking, and one of the first people we’re all going to be looking to,” he says, “but I think that’s all that we should expect from her.”

Updated: 9-17-2021

Canadian Politician Says He Supports Bitcoin As Federal Election Looms

The former cabinet minister, known by some as Mad Max, has been outspoken in his criticism of vaccine mandates, mask mandates and lockdowns in Canada during the pandemic.

Maxime Bernier, founder and leader of the People’s Party of Canada, has said he supports the adoption of cryptocurrencies in the country.

In a Tuesday tweet, Bernier said cryptocurrencies are “another new and innovative way” to counter the actions by central banks, which he claimed are “destroying our money and economy.” The Canadian politician has criticized the Bank of Canada for “printing money” and called out Prime Minister Justin Trudeau for his economic policies.

Bernier, a former cabinet minister known by some as Mad Max, has been outspoken in his criticism of vaccine mandates in Canada at a time when the number of COVID-19 cases in the country continues to rise. He has also advocated for ending lockdowns and mask mandates and against the rollout of a vaccine passport system.

The politician’s remarks come before a Canadian federal election scheduled for next Monday, with the People’s Party currently holding no seats in the country’s parliament. Though many right-leaning politicians worldwide have adopted pro-crypto stances as part of their campaigns or policies once in office, the role of Bitcoin (BTC) and crypto is seemingly not a one-party issue.

Canada has often paved the way for many initiatives in the crypto space. Ethereum co-founder Vitalik Buterin is Russian-Canadian and investments firms have been able to successfully launch crypto exchange-traded funds while U.S. regulators have yet to reach a decision on the investment vehicle.

However, many Canadian lawmakers, including Trudeau, have been largely silent on the role cryptocurrencies may play in the country’s economy. Trudeau’s half-brother, Kyle Kemper, is an outspoken Dogecoin (DOGE) enthusiast whom the Canadian government once paid to speak at a blockchain conference.

Cointelegraph reached out to the People’s Party of Canada, but did not receive a response at the time of publication.

Updated: 9-30-2021

Pro-Bitcoin Congressional Candidate Aarika Rhodes for California’s 30th District Wants to Converse With Twitter CEO Jack Dorsey

California Pro-Bitcoin Congressional Candidate Aarika Rhodes Running to Unseat Rep. Brad Sherman.

A national call to ban cryptocurrencies is not limited to China. U.S. Congressman Brad Sherman (D-Calif.) wants to do the same, but his seat is being challenged by a pro-bitcoiner and congressional candidate for California’s 30th District, Aarika Rhodes. Rhodes discusses the politics of bitcoin, sharing insights into running to unseat Rep. Sherman. “I welcome a debate on bitcoin with Brad Sherman,” Rhodes said. “He’s no longer fit to serve the 30th district in California.”

“First Mover” hosts talk to Aarika Rhodes (D-Calif.), a STEM teacher and U.S. Congressional Candidate for California’s 30th District who wants to meet with Twitter CEO Jack Dorsey to discuss financial literacy in the age of bitcoin.

Pro-Crypto Senator Cynthia Lummis Discloses Up-To-$100K BTC Purchase

The lawmaker from Wyoming has been a vocal supporter of Bitcoin and blockchain technology in Congress.

United States Senator Cynthia Lummis, a Republican from Wyoming, has revealed that she purchased Bitcoin (BTC) worth between $50,001 and $100,000 on Aug. 16, according to documents filed on Thursday.

The disclosure was part of the Stop Trading on Congressional Knowledge Act, or STOCK Act, which prohibits the use of non-public information for profit. The STOCK Act was signed into law under former President Barack Obama in April 2012 and is designed to combat insider trading.

As CNBC reported, Lummis’ purchase was disclosed outside of the 45-day reporting window stipulated in the law. The reporting delay was due to “a filing error,” a spokesperson said.

Lummis made the purchase less than two weeks after she and other senators attempted to insert a pro-crypto amendment into President Joe Biden’s infrastructure bill. The bipartisan effort, which was supported by Senators Mark Warner and Kyrsten Sinema, attempted to ease the burden on cryptocurrency tax reporting for miners and wallet providers.

Controversially, Lummis’ amendment failed to make its way into the infrastructure bill that was approved by the Senate on Aug. 10. Senator Pat Toomey, a Republican from Pennsylvania, described the bill as “badly flawed” for imposing an “unworkable” tax reporting mandate on certain crypto companies.

The bill, dubbed the Infrastructure Investment and Jobs Act, has yet to be voted on by the House of Representatives due to postponed proceedings, according to the latest update on Oct. 1.

Lummis’ Bitcoin purchase is hardly surprising given her staunchly pro-crypto stance. As Cointelegraph reported, the Wyoming senator previously expressed interest in buying the dip after Bitcoin’s price flash crashed to below $30,000.

Although it’s not entirely clear whether she owned Bitcoin at the time, the senator told Fox News in June: “I’m really excited about it because as soon as it drops a little more, I’m going to buy some more.”

Updated: 10-12-2021

Texas Democratic Party Aims To Use NFT Sales For Fundraising Efforts

“We can’t wait to continue turning powerful, exclusive, behind-the-scenes moments into digital assets that help fuel progressive objectives,” said Front Row co-founder Parker Butterworth.

Front Row, a marketplace geared toward progressive organizations, has said it will be partnering with the Texas Democratic Party to pilot a program aimed at raising money for candidates and causes using nonfungible tokens (NFT).

In a Monday announcement, Front Row said it had already minted digital images of key moments related to the progressive movement and listed the NFTs for sale. Some of the featured NFTs include “wanted” posters depicting conservative Texan lawmakers fleeing the state.

Front Row said that the funds raised through its NFTs will go “directly towards political groups and individuals” but did not specify how it planned for the digital purchases to be compliant with current campaign finance laws. Under United States law, candidates for federal offices appear unable to receive more than $5,800 from a single individual for the sale of one or more NFTs.

“NFTs will become a powerful addition to any political fundraising effort, and the launch of our marketplace will give Democrats across the country a fundraising advantage that its counterparts do not have,” said Front Row co-founder Parker Butterworth, likely referring to Republicans. “We can’t wait to continue turning powerful, exclusive, behind-the-scenes moments into digital assets that help fuel progressive objectives.”

Keeping in line with progressive values, Front Row also said its blockchain platform will strive to be carbon-negative by donating a portion of the NFT proceeds to “carbon capture and reduction” causes. Though the platform is starting at the state level in Texas, it hinted at expanding to national candidates and causes.

Though many local, state and federal candidates for office in the U.S. have announced they would be accepting donations in cryptocurrency — likely in a bid to engage younger, tech-savvy voters — NFTs have largely been absent from talks in Congress.

Cointelegraph reported in August that the current 117th Congress has put forward 18 bills concerning digital assets and blockchain technology in 2021.

Updated: 10-15-2021

‘Thank God For Bitcoin,’ Senator Cynthia Lummis Says On US Debt Limit Raise

Bitcoin should be there to allow people to save in the event the government fails, Senator Cynthia Lummis said.

Amid the United States President Joe Biden signing legislation to raise the government’s debt limit to $28.9 trillion, Senator Cynthia Lummis said that Bitcoin (BTC) is a blessing of God.

Senator Lummis gave a speech to the Senate on Thursday, providing her perspective on how digital currencies like Bitcoin could potentially help countries like the U.S. address the looming crisis when the state runs out of cash.

Lummis said that one of the reasons she had become so interested in non-fiat digital currencies like Bitcoin is because they are not issued by the government and thus aren’t beholden to the debts that are “run up by governments” such as the United States.

As cryptocurrencies are not beholden to governments and political elections, they should grow and be there, allowing people to save in the event governments fail, Lummis argued:

“Time and again, presidents of both parties have run up the debt irresponsibly, with no plan to address it. So thank God for Bitcoin, and another non-fiat currency that transcends the irresponsibility of governments, including our own.”

Thank God for #Bitcoin pic.twitter.com/W9BtWZAiU4

— Michael Saylor⚡️ (@saylor) October 15, 2021

U.S. President Biden officially signed legislation temporarily raising the state’s borrowing limit on Thursday, pushing the deadline for debt default only until December. The legislation would extend the debt ceiling by $480 billion from the current national debt of $28.4 trillion.

Lummis has emerged as one of the most vocal advocates of Bitcoin in the U.S. Senate. The senator is known for accumulating significant amounts of Bitcoin, with one of her latest purchases worth between $50,000 and $100,000.

In February, Lummis launched the Financial Innovation Caucus to educate fellow lawmakers about Bitcoin and other cryptocurrencies. The pro-Bitcoin senator is also known for joining the laser-eye flash mob on Twitter earlier this year, projecting Bitcoin to reach $100,000 by the end of 2021.

Updated: 12-9-2021

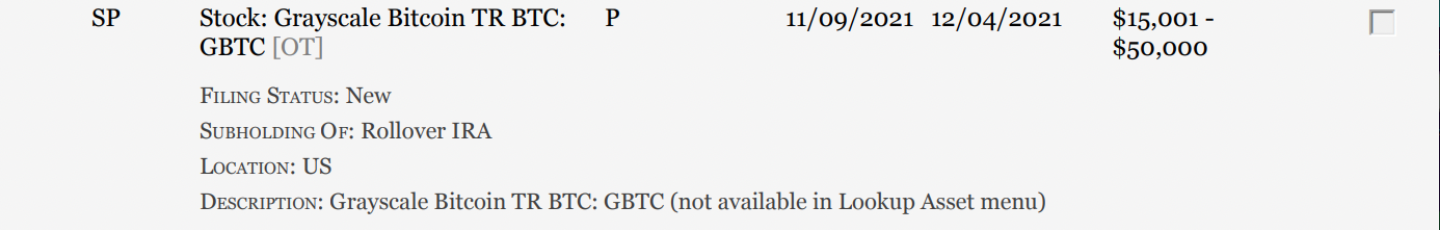

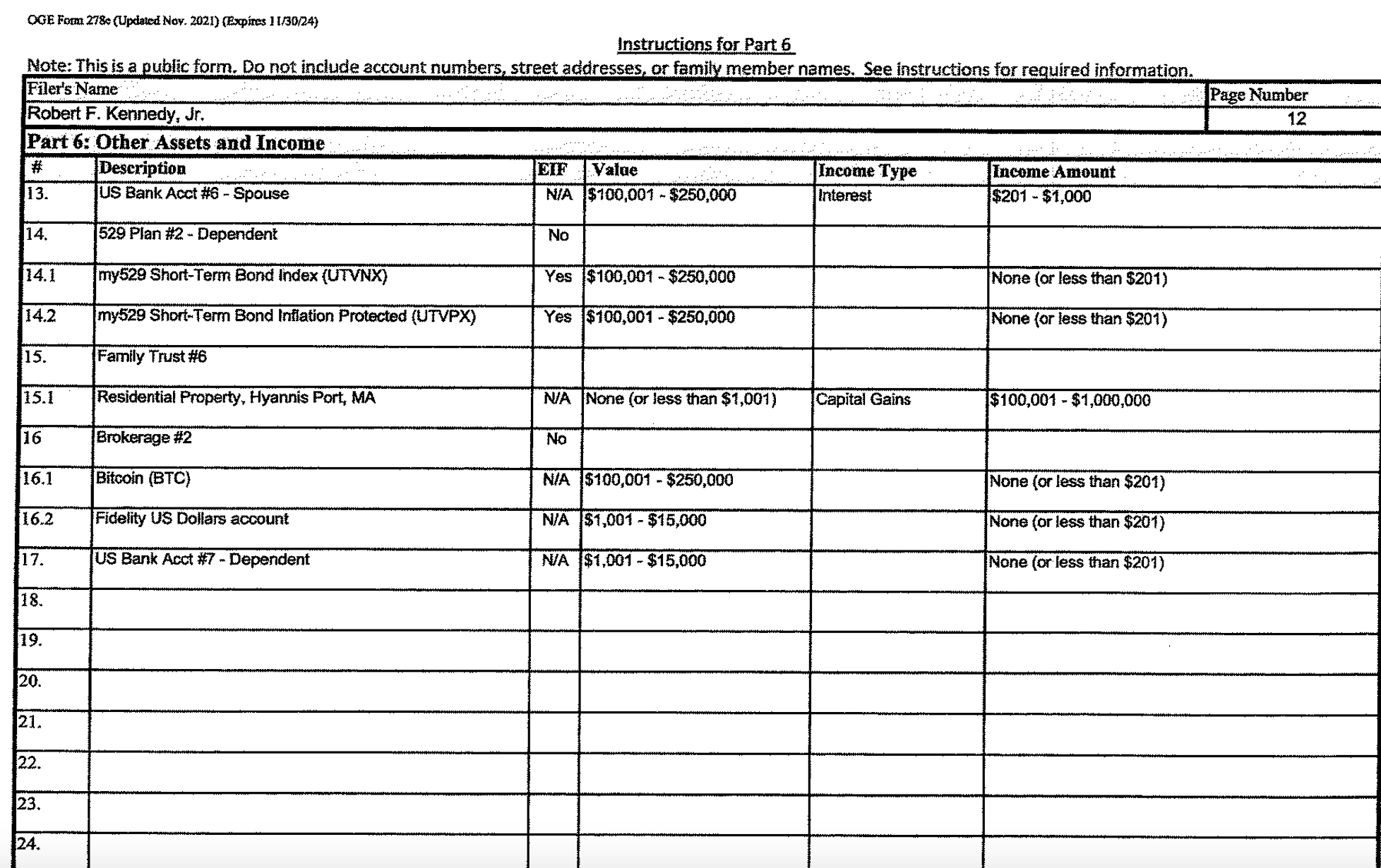

US Lawmaker Purchases Exposure To Bitcoin Through Grayscale Shares

Congressperson Marie Newman bought between $15,001 and $50,000 of GBTC in addition to up to $215,000 in Coinbase Global’s COIN shares.

Illinois Representative Marie Newman has disclosed she purchased up to $50,000 in exposure to crypto through shares of Grayscale Bitcoin Trust.

According to a financial disclosure report filed with the U.S. House of Representatives on Wednesday, Congressperson Newman bought between $15,001 and $50,000 of GBTC between Nov. 9 and last Saturday. In addition, she conducted four separate purchases of shares of Coinbase Global’s Class A stock between November and December, up to $215,000.

Members of the U.S. House of Representatives and Senate are permitted to buy, sell and trade stocks and other investments while in office but are also required to report such transactions of more than $1,000 within 30 to 45 days.

This reporting is in accordance with the Stop Trading on Congressional Knowledge Act, or STOCK Act, passed in 2012 under President Barack Obama with nearly unanimous approval in both chambers of Congress.

According to data gathered from financial disclosure reports by Bitcoinpoliticians.org, six other members of Congress currently hold cryptocurrency or some exposure to crypto assets, including Wyoming Senator Cynthia Lummis, Texas Representative Michael McCaul, Pennsylvania Representative Pat Toomey, Alabama Representative Barry Moore, New Jersey Representative Jefferson Van Drew, and Florida Representative Michael Waltz.

However, many federal judges and lawmakers have reportedly flouted the STOCK Act by not disclosing certain investments.

The disclosure report from Newman comes following members of Congress questioning CEOs of major stablecoin issuers and crypto firms in a hearing to better understand the technology and where a regulatory path may lead.

Progressive lawmaker Alexandria Ocasio-Cortez also recently spoke out on social media, saying it was inappropriate for her to hold Bitcoin (BTC) or other digital assets because lawmakers have access to “sensitive information and upcoming policy” and such investments could affect their impartiality.

Updated: 12-20-2021

Senators Now Own Bitcoin And They Are Shaping The Industry’s Rules

Sens. Pat Toomey and Cynthia Lummis, members of Senate Banking Committee, say their cryptocurrency experience gives them crucial expertise.

Sens. Pat Toomey (R., Pa.) and Cynthia Lummis (R., Wyo.) sit on the powerful Senate Banking Committee and have been advocates for a light government touch toward the growing—and largely unchecked—cryptocurrency market.

They also own cryptocurrency assets. Ms. Lummis’s roughly $250,000 of bitcoin makes her the most heavily invested U.S. lawmaker in the digital asset. Mr. Toomey has smaller holdings in crypto-related investment vehicles.

Together they are the only two senators with such investments, according to a Wall Street Journal review of public financial disclosures.

There is nothing illegal about lawmakers owning assets, including cryptocurrency, even if they are working on legislation directly related to those assets.

Ms. Lummis and Mr. Toomey, the committee’s ranking Republicans, say their experience with cryptocurrency gives them expertise on a subject that few on Capitol Hill have studied.

“Tell me what part of the economy we don’t get involved in?” Mr. Toomey said in an interview when asked about potential conflicts of interest. “Following that logic, then I guess no one in the Senate can invest in anything. That would be ridiculous.”

Others are concerned that the lawmakers’ personal investments could influence potential regulation.

“These two senators are the most vocal when it comes to favorable cryptocurrency regulation,” said Lee Reiners, executive director of the Global Financial Markets Center at Duke University and a former official at the Federal Reserve Bank of New York.

“It’s not to say they are motivated by personal financial interest,” Mr. Reiners said, “but it’s fair to question their advocacy. It’s problematic given their holdings.”

Rep. Alexandria Ocasio-Cortez (D., N.Y.), who is on the House Financial Services Committee, said on her Instagram account recently that members of Congress shouldn’t hold or trade individual stocks or cryptocurrency assets, “because we have access to sensitive information and upcoming policy.”

Although lawmakers aren’t barred from writing or voting on bills that could lead to personal financial gain, they are required to disclose their assets annually and report transactions within 45 days.

Reportable assets include real estate, stocks and, since 2018, cryptocurrency.

The Journal’s review of financial disclosures and periodic transaction reports found that in addition to Ms. Lummis and Mr. Toomey, nine House members and at least five White House officials reported cryptocurrency assets.

In most cases, the holdings account for a small share of their total wealth.

Rep. Michael Waltz (R., Fla.), who bought between $30,000 and $100,000 of bitcoin in June, said he did so in light of a surge in the price of many goods. Officials report their assets’ value within specified ranges.

“Bitcoin is evolving as an inflation hedge much like gold has been,” Mr. Waltz said in an interview.