“Would Someone Please Buy US Treasury Bonds?” Janet Yellen #GotBitcoin

Trillion-Dollar Treasury Vacuum Coming For Wall Street Rally. “Would Someone Please Buy US Treasury Bonds?” Janet Yellen #GotBitcoin

* Post-Deal Supply Surge Will Rumble Through Stocks To Credit

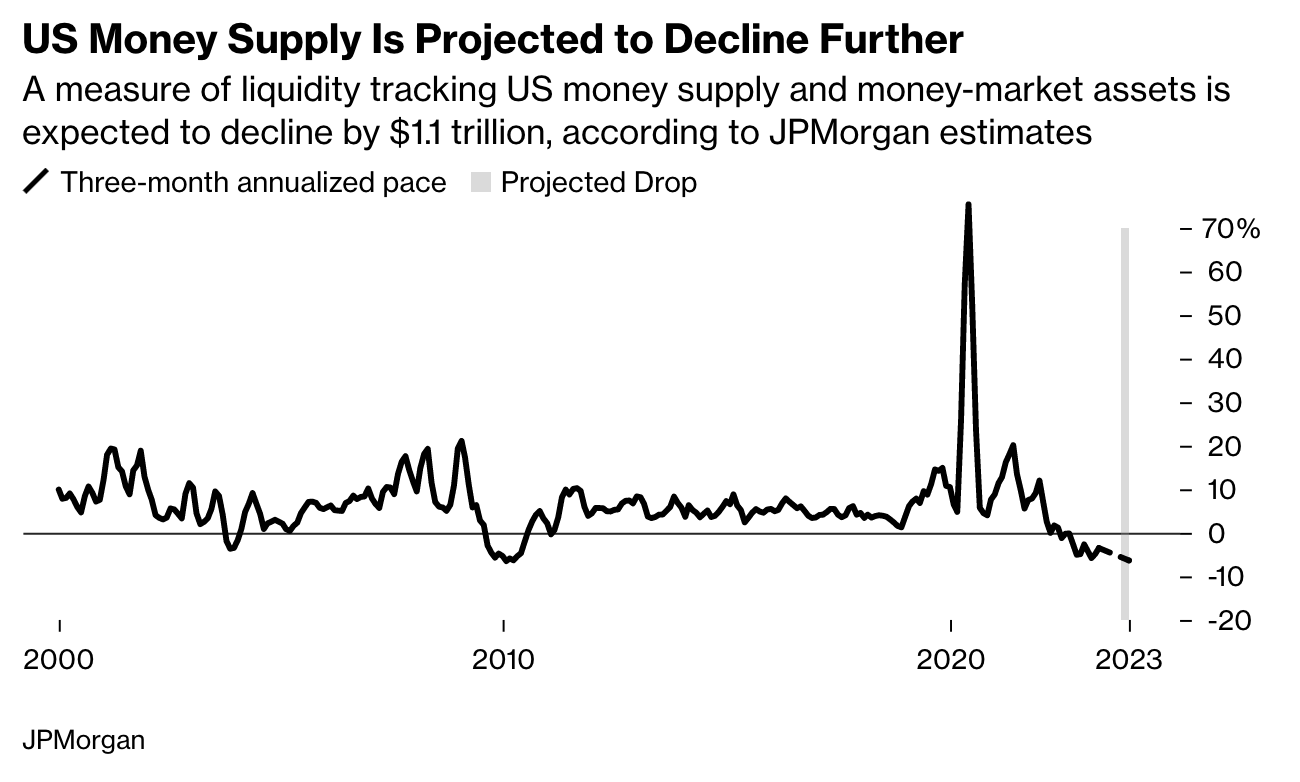

* Already-Eroded Liquidity Set To Shrink By $1 Trillion: JPM

With a debt ceiling deal freshly signed into law Saturday by President Joe Biden, the US Treasury is about to unleash a tsunami of new bonds to quickly refill its coffers.

Related:

Money Supply Growth Went Negative Again In December Another Sign Of Recession

Flight To Money Funds Is Adding To The Strains On Banks

The Fed Loses Money For The First Time In 107 Years – Why It Matters

Federal Reserve Taps BlackRock To Purchase Bonds For The Government

The ‘Cartel’ Is Back: 8 Banks Caught Rigging Government-Bonds

This will be yet another drain on dwindling liquidity as bank deposits are raided to pay for it — and Wall Street is warning that markets aren’t ready.

The negative impact could easily dwarf the after-effects of previous standoffs over the debt limit. The Federal Reserve’s program of quantitative tightening has already eroded bank reserves, while money managers have been hoarding cash in anticipation of a recession.

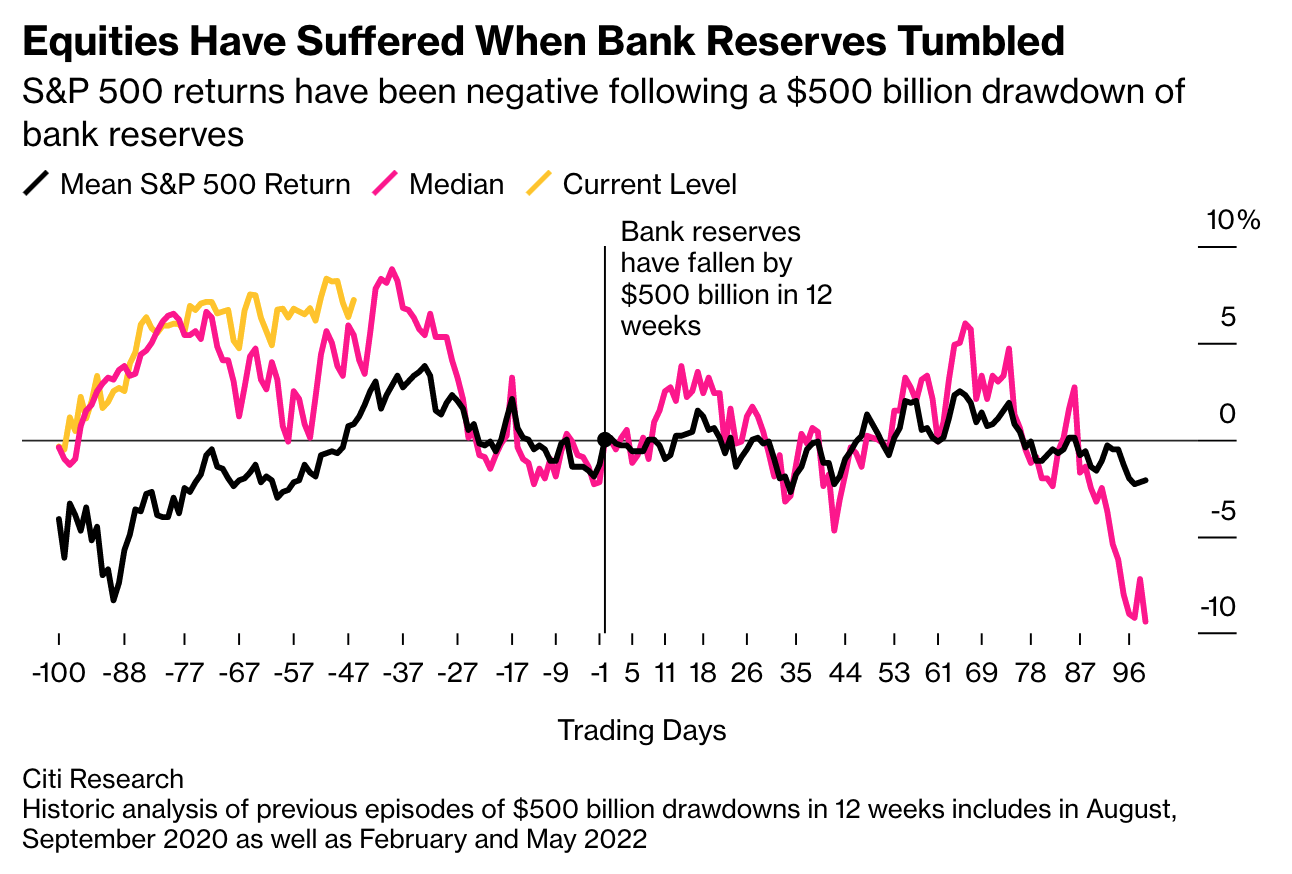

Citigroup Inc. macro strategists offer a similar calculus, showing a median drop of 5.4% in the S&P 500 over two months could follow a liquidity drawdown of such magnitude, and a 37 basis-point jolt for high-yield credit spreads.

The sales, set to begin Monday, will rumble through every asset class as they claim an already shrinking supply of money: JPMorgan estimates a broad measure of liquidity will fall $1.1 trillion from about $25 trillion at the start of 2023.

“This is a very big liquidity drain,” says Panigirtzoglou. “We have rarely seen something like that. It’s only in severe crashes like the Lehman crisis where you see something like that contraction.”

It’s a trend that, together with Fed tightening, will push the measure of liquidity down at an annual rate of 6%, in contrast to annualized growth for most of the last decade, JPMorgan estimates.

The US has been relying on extraordinary measures to help fund itself in recent months as leaders bickered in Washington. The measure brokered between Biden and House Speaker Kevin McCarthy limits federal spending for two years and suspends the debt ceiling through the 2024 election.

With default narrowly averted, the Treasury will kick off a borrowing spree that by some Wall Street estimates could top $1 trillion by the end of the third quarter, starting with several Treasury-bill auctions on Monday that total over $170 billion.

What happens as the billions wind their way through the financial system isn’t easy to predict. There are various buyers for short-term Treasury bills: banks, money-market funds and a wide swathe of buyers loosely classified as “non-banks.” These include households, pension funds and corporate treasuries.

Banks have limited appetite for Treasury bills right now; that’s because the yields on offer are unlikely to be able to compete with what they can get on their own reserves.

But even if banks sit out the Treasury auctions, a shift out of deposits and into Treasuries by their clients could wreak havoc. Citigroup modeled historical episodes where bank reserves fell by $500 billion in the span of 12 weeks to approximate what will happen over the following months.

“Any decline in bank reserves is typically a headwind,” says Dirk Willer, Citigroup Global Markets Inc.’s head of global macro strategy.

The most benign scenario is that supply is swept up by money-market mutual funds. It’s assumed their purchases, from their own cash pots, would leave bank reserves intact.

Historically the most prominent buyers of Treasuries, they’ve lately stepped back in favor of better yields on offer from the Fed’s reverse repurchase agreement facility.

That leaves everyone else: the non-banks. They’ll turn up at the weekly Treasury auctions, but not without a knock-on cost to banks.

These buyers are expected to free up cash for their purchases by liquidating bank deposits, exacerbating a capital flight that’s led to a cull of regional lenders and destabilized the financial system this year.

The government’s growing reliance on so-called indirect bidders has been evident for some time, according to Althea Spinozzi, a fixed-income strategist at Saxo Bank A/S.

“In the past few weeks we have seen a record level of indirect bidders during US Treasury auctions,” she says. “It’s likely that they’ll absorb a big part of the upcoming issuances as well.”

For now, relief about the US avoiding default has deflected attention away from any looming liquidity aftershock. At the same time, investor excitement about the prospects for artificial intelligence has put the S&P 500 on the cusp of a bull market after three weeks of gains. Meanwhile, liquidity for individual stocks has been improving, bucking the broader trend.

But that hasn’t quelled fears about what usually happens when there’s a marked downturn in bank reserves: Stocks fall and credit spreads widen, with riskier assets carrying the brunt of losses.

“It’s not a good time to hold the S&P 500,” says Citigroup’s Willer.

Despite the AI-driven rally, positioning in equities is broadly neutral with mutual funds and retail investors staying put, according to Barclays Plc.

“We think there will be a grinding lower in stocks,” and no volatility explosion “because of the liquidity drain,” says Ulrich Urbahn, Berenberg’s head of multi-asset strategy. “We have bad market internals, negative leading indicators and a drop in liquidity, which is all not supportive for stock markets.”

Updated: 10-23-2018

Foreign Buying of U.S. Treasurys Softens, Unsettling Financial Markets

Investor pullback has fueled a bond selloff and shaken a nine-year-long rally in stocks.

The erosion of demand in emerging Asian markets reflects their maturation into more stable economies.

Asian investors are proving less and less eager to buy U.S. government bonds, even as the Treasury Department prepares to sell $1.3 trillion of new debt in the new fiscal year.

Foreigners increased their holdings of Treasurys by $78 billion in the first eight months of this calendar year, according to the Treasury. That is just over half of what they bought in the same period last year.

Holdings have particularly stagnated in a number of emerging Asian economies—including South Korea, Singapore, Thailand and Taiwan—which have prized U.S. government debt as a capital bulwark since the 1997 Asian currency crisis.

Many observers assume the U.S. has no trouble finding demand for its debt in the vast pool of world-wide governments, financial institutions, mutual funds and individual investors who want to own the world’s major risk-free asset. Yet the Treasury is finding fewer buyers in some parts of the world, leaving domestic investors such as mutual funds to pick up the slack.

Much of the drop-off in demand among investors in Europe and Japan is due to the increased cost of protecting themselves from the currency risk of buying dollar-denominated debt. For emerging Asian economies, the reasons are different: Stagnant trade flows and strong reserve balances have sapped their demand for U.S. government debt, according to analysts.

The erosion of demand in these emerging markets also reflects their maturation into more stable economies where investors have a greater array of domestic investments in which to place their money.

“They don’t need to build any more buffers,” said Tim Alt, who manages currencies and bonds with U.K.-based Aviva Investors. They “have an alternative where you don’t have to recycle everything into U.S. Treasurys.”

The lack of demand doesn’t reflect a critique of U.S. fiscal policy but is more likely an indirect byproduct of U.S. trade tensions with China, according to Torsten Sløk, chief international economist at Deutsche Bank Securities.

China is the world’s second-largest economy and the region’s largest trading partner for many countries, so weakness in its currency, the yuan, also has weighed down the currencies of many of its neighbors. In other circumstances, these countries could harbor more demand for U.S. debt, but currently lack a compelling need to buy it, he said.

The Treasury data could understate demand from private investors in Asia, such as insurance companies, because they often make purchases through intermediaries in other countries, according to Brad Setser, an economist at the Council on Foreign Relations. However the most important detail about demand from the region is the lack of intervention by central banks, he said.

Since the start of June, when the U.S. first imposed tariffs on China, Korea’s currency, the won, has dropped 3.3% against the dollar, while the Singapore dollar has declined 2.7%, Thailand’s baht has fallen 2.4% and the Taiwan dollar has slipped 2%. Those moves compare with a 7.1% loss in China’s yuan.

The declines in Asian emerging markets’ currencies have helped their exports remain competitive versus China, but they also have reduced the need for them to buy Treasurys—a popular way for central banks to weaken their currencies against the dollar, Mr. Sløk said.

While it is unclear whether the reduction of Treasury purchases is a deliberate decision or simply free markets at work, the lack of demand shows trade tensions between the U.S. and China have been “spilling over” into the rest of Asia, Mr. Sløk said.

Bond Indexes Bend Under Weight of Treasury Debt

The U.S. government is selling $129 billion of notes this week, up 28% from the same series of auctions a year ago.

The surge in U.S. government borrowing is beginning to warp bond indexes, posing a challenge for investors looking for the best returns when interest rates are rising.

The problem: Treasurys tend to offer investors lower yields and produce weaker returns than other kinds of bonds, such as high-quality company debt or securities backed by mortgage payments.

Yet as the government steps up borrowing to fund last year’s tax cuts, index funds end up holding more Treasurys, squeezing out the securities that pay higher rates of interest.

The U.S. government is borrowing $129 billion this week, up 28% from the same series of note auctions a year ago. The increased borrowing means Treasurys now amount to almost 40% of the value in the leading bond market investment benchmark—the Bloomberg Barclays U.S. aggregate index—which fund managers use to gauge their success. That is up from around 20% in 2006, before the start of the financial crisis.

Some analysts said investors should consider the growing weight of Treasurys in indexes before purchasing mutual funds. Actively managed bond funds have performed better than their index-tracking peers recently, a trend some analysts credit to their efforts to pare back Treasury holdings.

Rising rates erode the value of outstanding bonds, because newly issued debt offers higher payouts. And Federal Reserve officials have penciled in additional increases into 2020.

“The value from active management is going to be more important,” said Kathleen Gaffney, director of diversified fixed income at Eaton Vance , who bought dollar-denominated corporate bonds in emerging markets because U.S. corporate yields remain low by historic measures. “You’re not going to want market risk.”

Through the first six months of this year, active managers topped indexes in five of 14 categories including municipal bonds and short- and intermediate taxable bonds, according to data from S&P Dow Jones Indices.

That is coming off a 2017 in which actively managed funds had their best year since 2012, when active managers beat passive funds in nine of 13 categories the firm then measured.

Pacific Investment Management Co.’s Total Return exchange-traded fund—a smaller, more liquid version of one of the largest actively managed bond mutual funds in the world—has posted a negative return of roughly 1.7% this year, counting price changes and interest payments. The Bloomberg Barclays aggregate index of U.S. bonds has returned minus 2%.

Should yields continue to rise, advocates of active portfolio management say investors would be better served by a human being shielding them from the parts of the bond market most likely to suffer losses versus an index which includes all bonds, without regard to their potential risks.

“This is going to be a test for active managers at how skillful they are at positioning for a higher interest-rate environment,” said Aye Soe, managing director of global research and design at S&P Dow Jones Indices.

It is a situation many expect to persist, with the Treasury Department expected to run trillion-dollar deficits for the foreseeable future. As issuance increases, funds that use the Bloomberg Barclays aggregate index as a guidepost for portfolio composition will wind up owning increasingly large amounts of Treasury debt.

Independent bond analyst David Ader predicts Treasurys will make up half of the U.S. bond market and the indexes that track it by 2028.

Still, because many individuals invest in bond funds to protect against losses in their stock portfolios, there are advantages to indexes that reflect the constituency of bond market borrowers instead of optimizing returns, said Josh Barrickman, who manages Vanguard Group’s bond index fund.

While corporate bonds, for example, offer higher yields than Treasurys, U.S. government debt tends to post high returns during periods when investors shun risk, he said.

The changing composition of bond market indexes can exert a powerful force over what resides within their bond mutual funds without their becoming aware of it, according to fund managers and analysts.

Treasury Department data shows that the category of investors that represents mutual funds bought about one half of the $2 trillion of U.S. government notes and bonds sold at auction last year. That is up from about one-fifth of the $2.2 trillion sold in 2010.

Should slowing growth lead business conditions to worsen, corporations have the option of borrowing less. Not so the U.S. government. Because legally mandated spending on unemployment insurance and other safety net programs tends to rise when growth slows, wider budget deficits and more Treasury debt could ensue.

That means many bond investors could face conditions where there is no alternative to holding a rising share of government debt.

Updated: 10-30-2019

Treasury Exploring New Debt Products, Including 20-Year Bond

Agency looks for new ways to attract investment as analysts see years of growth ahead in federal budget deficits.

The Treasury Department said Wednesday it was considering several possible new debt products as officials seek to find more ways to attract investment as budget analysts expect years of continued growth in federal budget deficits.

The agency is considering adding new bonds with maturities of 20- and 50-years as well as a new floating-rate note linked to the proposed replacement for the troubled London interbank offered rate.

The task of raising money to pay for government operations is taking on added urgency because analysts expect the U.S. to run years of trillion-dollar deficits, even as the economy is in the midst of its longest expansion on record. The government spent nearly $1 trillion more in fiscal 2019 than it took in—the highest deficit in seven years.

Years of rising budget deficits have put the Treasury on track to sell the largest amount of longer-term bonds and notes on record. Government bond analysts said that the agency needed to find new ways to attract investment now, before a potential slowdown in the future overtaxes its ability to efficiently fund operations when rising safety-net spending could lead to greater borrowing needs.

“It seems they’re getting to the upper limits of what they can raise with the current suite of products,” said Gennadiy Goldberg, a government bond analyst at TD Securities. They need both new short- and long-term securities because “deficits are only expected to increase,” he said.

Government deficits have now increased for four years in a row, the longest stretch of U.S. deficit growth since the early 1980s, a period marked by two recessions and a jobless rate near 11%.

The budget gap widened 26% in the fiscal year that ended Sept. 30, to $984 billion from $779 billion deficit the previous year, the Treasury said, as rising government outlays continued to outpace tax collection.

Treasury Secretary Steven Mnuchin said last month the Treasury was “very seriously considering” issuing a 50-year Treasury bond next year, as the administration looks to take greater advantage of low interest rates to slow soaring borrowing costs.

Should the Treasury add a 50-year security, it would be following other governments, including the U.K., Austria and Italy, which have broadened their efforts to attract capital by selling so-called ultralong bonds. Offering a 20-year bond would be a reintroduction of a security last issued in March 1986.

“In the long-run, they urgently need new securities,” said Thomas Simons, a money-market economist at Jefferies Financial Group.

A Treasury advisory committee said it expected to see “meaningful demand” from markets for a new 20-year bond, particularly from corporate pensions and insurance companies, but less so from foreign investors.

The panel said the addition of a 20-year bond “could be a positive addition to Treasury’s issuance tool-kit,” but said more discussion was needed on the expected pricing, size and sustainability of demand before making a final decision.

That group, the Treasury Borrowing Advisory Committee, or TBAC, which is composed of large financial institutions, has tended to be skeptical that selling 50-year bonds would produce lower borrowing costs for the government over time.

Those doubts are outweighed by the risk the Treasury faces from having to continually roll-over a rising quantity of short-term debt, Mr. Simons said.

The government should look to add new securities, particularly if it can broaden its investor base, at a time when the economy is still strong and before a slowdown makes the need to raise money quickly more pressing, Mr. Simons said.

“If they’re under duress and they need them, that’s a significant problem” that could make it more difficult to raise money quickly, he said.

The Treasury also said it was closely monitoring the Fed’s recently announced purchases of Treasury bills following strains in money markets last month.

“The Fed purchases are still in the early stages and at this point we’re monitoring how the purchases program will evolve and any effects on the market,” a Treasury official said Wednesday. “It would be premature to draw any conclusions at this point.”

The Fed began buying short-term Treasury debt earlier this month and said it would continue the purchases—starting at $60 billion a month—into the second quarter of 2020. That marked a turnaround for the central bank, which until August had been shrinking its nearly $4 trillion balance sheet.

The funding pressures related to shortages of funds that resulted from an increase in federal borrowing and the central bank’s decision to shrink the size of its asset portfolio.

The TBAC, warned the purchases could lead to scarcity in the T-bill market if the Treasury doesn’t change its coupon auction sizes, but it recommended keeping issuance unchanged in the current quarter.

The TBAC also said the Fed’s efforts to boost reserves—deposits banks keep at the Fed—should help control money market rates in the near term, but could prove insufficient to prevent year-end funding stress similar to that seen during the fourth quarter in recent years.

The committee expects little or no change in borrowing through the current fiscal year, but said Treasury could need to increase coupon auction sizes in fiscal 2021.

Updated: 11-15-2019

Northern Trust Testing Fractionlized Bonds on Blockchain

Custody bank Northern Trust is testing the trading of fractionalized bonds on a blockchain.

Working with Singapore-based debt markets company BondEvalue, the bank is providing asset servicing for large, high-grade bonds that will be tokenized and divided for retail investors on Hyperledger Sawtooth. These bonds are normally too large for individual investors, but the quality of the bonds is attractive.

The move shows Northern Trust’s continued interest in the technology after it developed then sold its private equities blockchain, which shortens the time to market for new high-tech private equity funds. With $124.3 billion in assets, Northern Trust is the 24th largest bank in the U.S.

“We’re building capabilities we feel will be reusable across multiple asset classes and multiple jurisdictions,” Justin Chapman, global head of market advocacy and innovation research at Northern Trust, said of the new bond pilot.

“Our focus on this initiative is to help bring the exchange to life and then we offer the highest grade asset servicing capability in that digital environment.”

Through the Monetary Authority of Singapore’s Sandbox Express, BondEvalue was given permission to launch a blockchain-based bond exchange in Singapore. Northern Trust will custody tokenized bonds and conduct transactions with the regulator’s oversight.

If the pilot is successful, the bank plans to also participate in the development of BondEvalue’s business model.

Updated: 12-26-2019

U.S. Government Sets Record for Debt Auctions

Total sum to hit $2.55 trillion; share of debt purchased by investors was largest since auction data was made public.

The Treasury Department is scheduled to auction seven-year notes later Thursday, closing the door on a record year for sales of longer-term debt in 2019.

The auction will lift the total of notes and bonds sold by the U.S. government with maturities ranging from two to 30 years to $2.55 trillion, a 26% increase from 2017, when Congress and President Trump agreed to massive corporate tax cuts.

Aggregate demand at U.S. government debt auctions has remained stable in recent years, with investors and bond dealers submitting bids totaling more than twice the amount of notes and bonds for sale. That comes even though yields on the securities have swung from multiyear highs to multiyear lows during the period.

While total demand has remained stable, some of the bidders taking away the securities at auction have changed, according to Treasury data.

The share of the debt purchased by investors was the largest since the government began releasing auction data, totaling about three-quarters of securities sold. Investors—including mutual funds, insurance companies and foreign buyers—submitted bids for more than nine-tenths of what the government raised. Bond dealers, conversely, purchased their smallest share of the debt since data became available.

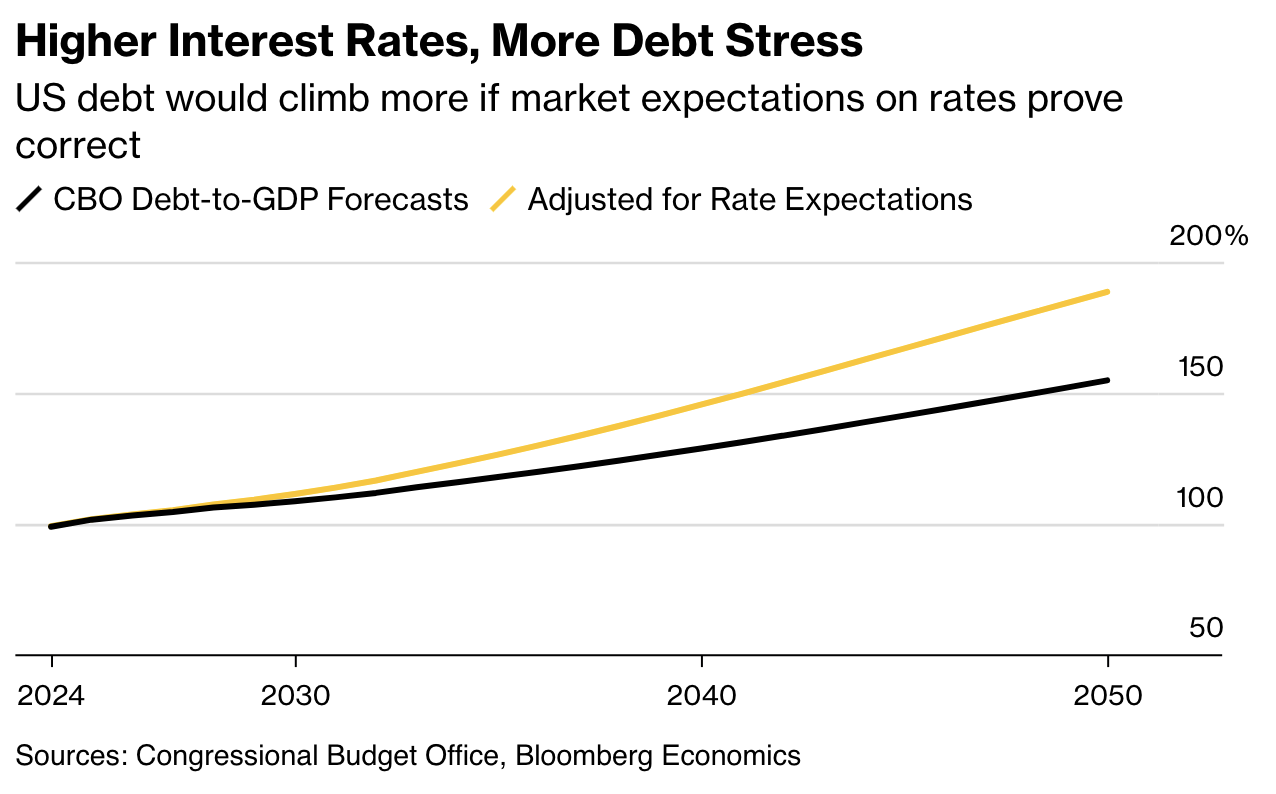

The amount of government debt is expected to rise, eventually pushing up the size of government debt auctions in coming years, as the U.S. is forecast to run trillion-dollar budget deficits for the next decade, according to the Congressional Budget Office.

The yield on the benchmark 10-year Treasury note was a recent 1.910%, compared with 1.909% Tuesday and 2.684% at the end of last year. The bond market was closed Wednesday in observance of the Christmas holiday.

The WSJ Dollar Index, which measures the U.S. currency against a basket of 16 others, rose 0.2% Thursday to a recent 90.44.

Updated: 6-4-2023

Biden Debt-Bill Signing Set To Unleash Tsunami Of US Debt Sales

* Treasury Expected To Sell $1 Trillion Or More Of New Debt

* Department Ran Down Cash To Keep Making Federal Payments

President Joe Biden’s signature of legislation suspending the federal debt ceiling has given the Treasury Department the green light to resume net new debt issuance after months of disruption.

Ever since mid-January, when it hit the $31.4 trillion debt ceiling, the Treasury has been using special accounting measures to maintain payments on all federal obligations. There were just $33 billion of those left available as of May 31.

It’s also been running down its cash balance, which dropped below $23 billion on June 1 — a level seen by experts as dangerously low given the volatility in day-to-day federal revenues and payments.

The bill Biden signed Saturday suspended the debt limit until Jan. 1, 2025, allowing the Treasury to rebuild its cash to more normal levels. Early last month, the department had penciled in a $550 billion cash-balance level for the end of June. A widening fiscal deficit also puts pressure on the Treasury to step up borrowing.

Debt auctions are now set to swell. The replenishing process — which could involve an amount well in excess of $1 trillion in new securities — could have unwanted consequences, by draining liquidity from the banking sector, raising short-term funding rates and tightening the screws on an economy that many economists see headed for a recession.

Bank of America Corp. has estimated the issuance wave could have the same economic impact as a quarter-point interest-rate hike by the Federal Reserve.

Auction announcements will offer investors guidance on how quickly the Treasury will go about stepping up issuance.

On Thursday, the department said it planned to bolster the size of upcoming three-month and six-month bill offerings by $2 billion apiece in the coming week. It has also already been ramping up its issuance of four-month debt, its newest bill benchmark.

Four- and eight-week auctions, meanwhile, have room to grow after being reduced to $35 billion each for each weekly issuance cycle.

Treasuries started the week on the back foot with benchmark 10-year yields climbing four basis points to 3.73% in Asia trading.

Extraordinary Measures

Meantime, the removal of the debt ceiling will prompt officials to undo the emergency accounting maneuvers they used to make extra funding available after the Treasury had hit the limit.

The unwinding maneuvers will have no impact on borrowing from the public, however, since the process involves issuing nonmarketable securities to certain internal funds, like the Thrift Savings Plan Government Securities Investment Fund for federal employees.

For the past several months, the Treasury had halted the issuance of those securities while continuing to collect the cash coming in to such funds.

Updated: 7-13-2023

US Racks Up $652 Billion In Debt Costs As Rates Hit 11-Year High

* Higher Interest Rates Mean Bigger Debt Servicing Costs

* US Budget Gap Widens 170% In First Nine Months Of Year

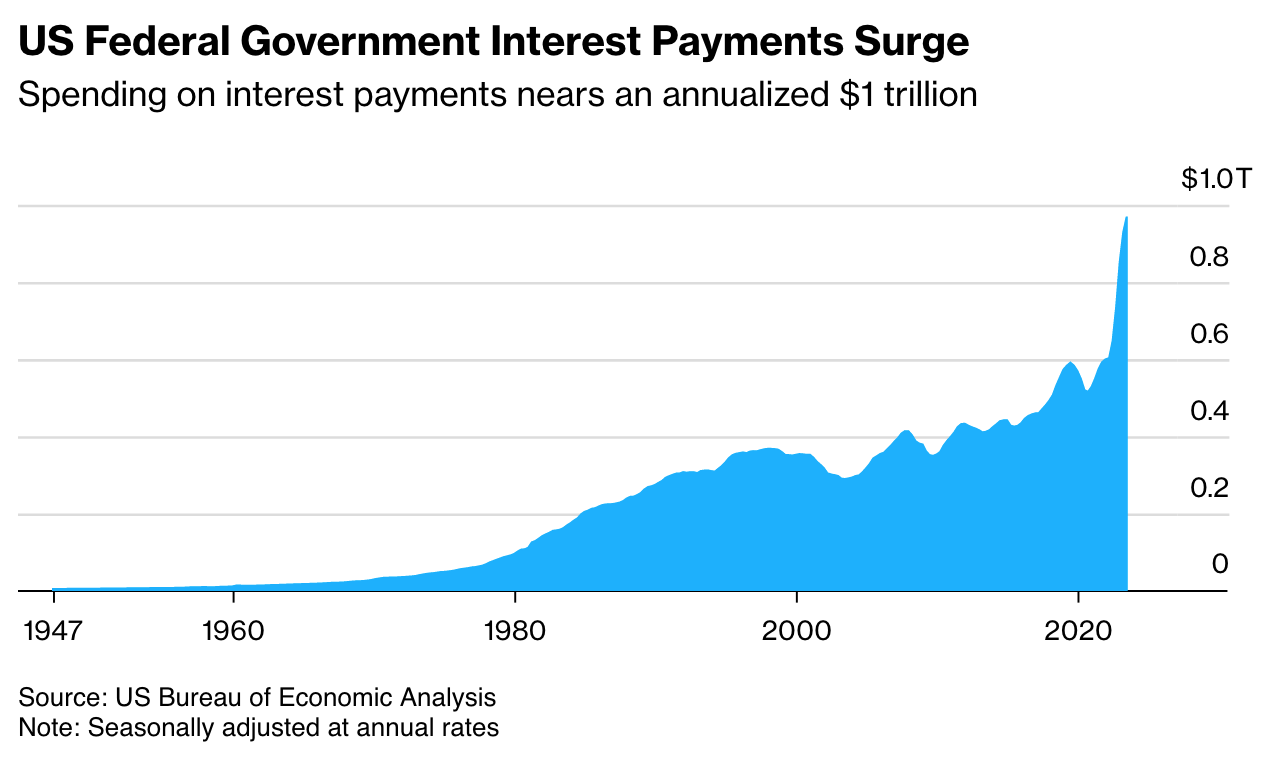

The cost of servicing US government debt jumped by 25% in the first nine months of the fiscal year, reaching $652 billion and contributing to a major widening in the budget deficit.

For the nine months through June, the federal deficit hit $1.39 trillion, up some 170% from the same period the year before, according to Treasury Department data released on Thursday.

The widening shortfall may play into Republican lawmakers’ pressure to curtail federal spending. While the GOP, which controls the House, did a deal with the Biden administration to suspend the debt limit earlier this summer, a fresh fight looms over appropriations for the 2024 fiscal year, which starts Oct. 1.

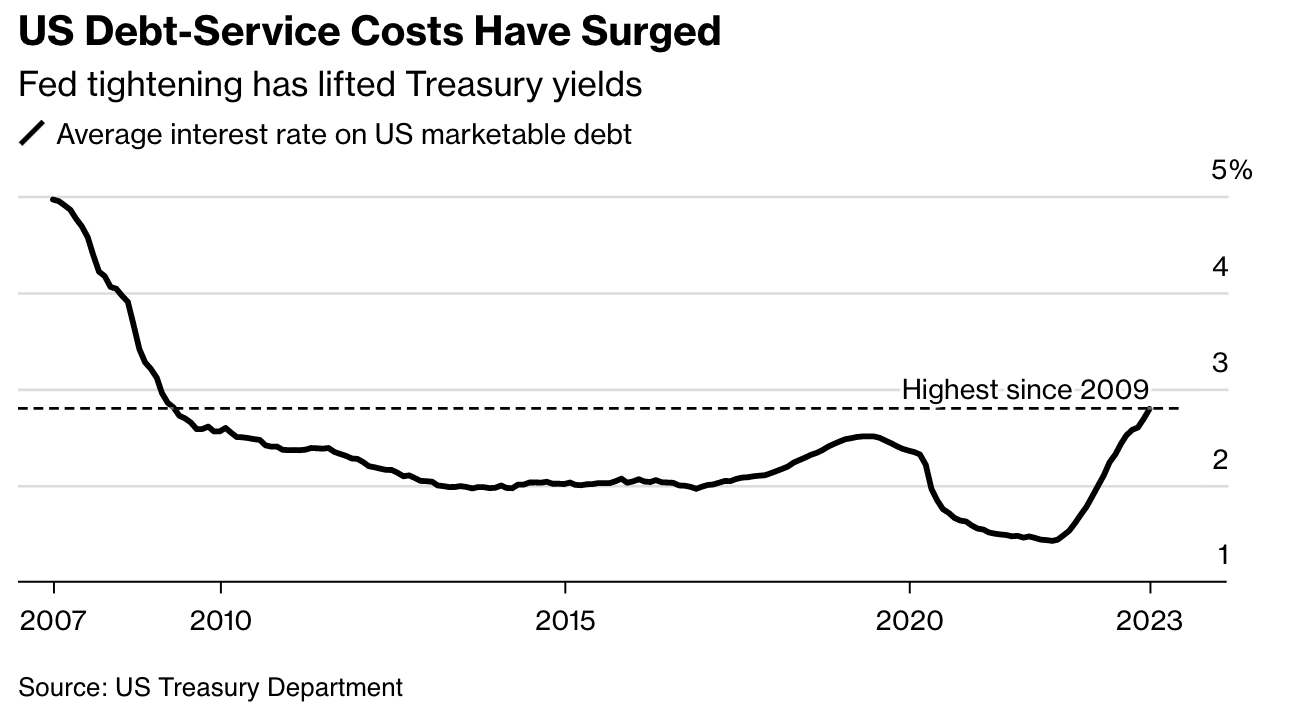

Higher interest rates have been a key driver of the deficit, with the Federal Reserve boosting its benchmark rate by 5 percentage points since it began hiking in March last year. Five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt.

The weighted average interest for total outstanding debt by the end of June was 2.76%, the highest level since February 2012, according to the Treasury. That’s up from 1.80% a year before, the department’s data show.

Revenue Hit

Still, Treasury Secretary Janet Yellen has played down concerns about higher rates. She has instead flagged that the ratio of interest payments to GDP, after adjustment for inflation, remains historically low.

Another key reason for the widening deficit this year has been a weakening in Treasury revenues, thanks especially to a reduced capital gains tax take. Last year’s slumps in stocks, bonds and other assets meant lower receipts for the government.

Inflation has also boosted a number of government spending items.

Updated: 7-31-2023

Traders Brace For $102 Billion Wave Of Treasury Bond Sales

* Treasury’s Quarterly Refunding Plan Is Due On Wednesday

* Dealers See Series Of Boosts To Debt Sales In Coming Quarters

The US Treasury is set this week to begin a ramp-up in issuance of longer-dated securities that’s likely to stretch into next year, forced by a rapidly deteriorating budget deficit and soaring interest rates.

For the first time since early 2021, the Treasury will boost its so-called quarterly refunding of longer-term Treasuries, to $102 billion from $96 billion, the consensus among dealers suggests.

While down from the record levels hit during the Covid-19 crisis, that’s well above pre-pandemic levels.

Wednesday’s announcement will likely also see debt managers hoist regular auction sizes for securities across the yield curve — with potential exceptions or smaller bumps for notes less in demand. Dealers will be on watch separately for an update on a coming program to buy back older Treasuries.

Public borrowing needs are on the rise thanks in part to Federal Reserve rate hikes that have taken its policy benchmark to a 22-year high — in turn driving up yields on government debt, making it more costly.

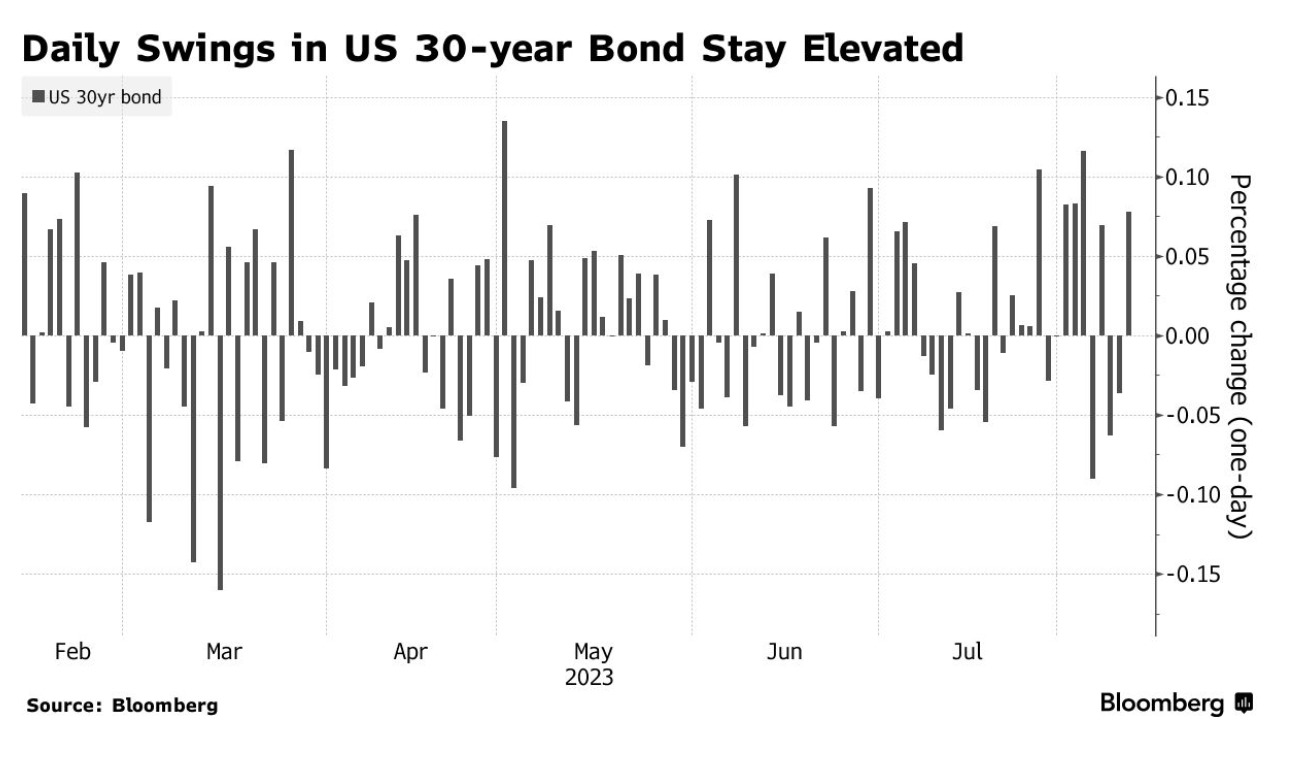

The Fed is also shrinking its holdings of Treasuries, obligating bigger government sales of them to other buyers. It all raises the risk of bigger volatility swings when the government auctions its securities.

“There’s just a lot of supply coming,” said Mark Cabana, head of US interest-rate strategy at Bank of America Corp. “We’ve been surprised by the deficit numbers, which are sobering.”

Larger amounts of debt issuance haven’t translated directly into lower prices and higher yields, as the swelling in US debt alongside historically low yields attests over the past two decades.

But bigger auction sizes contribute to the potential for short-term volatility, at a time when banks have diminished appetites for market making. That was on display in a seven-year auction on Thursday that saw buyers demand a bigger discount to absorb the securities.

What has sent yields higher is Fed rate hikes and inflation, a key dynamic widening the budget deficit. The cost of servicing US government debt jumped by 25% in the first nine months of the fiscal year, reaching $652 billion — part of a global phenomenon propelling public borrowing.

Cabana and his team forecast the Treasury will bump up sales of coupon-bearing debt — as notes that pay interest are known — not only this month, but again in the November and February debt-management policy announcements.

The Consensus Of Dealers’ Projections Shows The Following For The Upcoming Refunding Auctions:

* $42 Billion Of 3-Year Notes On Aug. 8

* $37 Billion Of 10-Year Notes On Aug. 9

* $23 Billion Of 30-Year Bonds On Aug. 10

Beyond those sales, most dealers see a lift in issuance across most maturities at a clip of $2 billion each, with many seeing smaller increases for 7- and 20-year Treasuries, which have seen bouts of poor demand.

Some dealers predict the 20-year bond will be singled out for no change in size. That security has been plagued by weak pricing and liquidity since the Treasury relaunched it in 2020.

“There should be well-distributed auction increases across the curve,” besides slightly smaller ones for the 7- and 20-year debt, said Subadra Rajappa, head of US interest rates strategy at Societe Generale SA. “It’s a one-way trajectory now for the deficit over the next 10 years, with them getting larger. Treasury wants to makes sure they are well funded for the next several years.”

The federal deficit hit $1.39 trillion for the first nine months of the current fiscal year, up some 170% from the same period the year before, showcasing the Treasury’s burgeoning funding needs. On Monday, the department boosted its forecast for borrowing in the July-to-September quarter to $1 trillion, from the $733 billion it penciled in in early May.

What Bloomberg Intelligence Says…

“Coupon Treasury issuance may be slowly increased over the next six months.

“Coupon auctions could climb by $1 billion across the curve in August, with monthly auctions rising an additional $1 billion each month through January.”

— Ira F. Jersey And Will Hoffman, BI Strategists

Meantime, the Fed is shrinking its holdings of Treasuries by up to $60 billion a month, by letting securities mature without replacing them.

Fed Chair Jerome Powell last week also signaled that the portfolio runoff could continue at some pace even after policymakers had begun cutting interest rates, suggesting a longer period than many had thought for the so-called quantitative tightening program.

Another dynamic for Treasury’s managers to consider is the share of bills, which mature in short-term spans of up to a year, in overall debt outstanding.

The Treasury Borrowing Advisory Committee, a panel of market participants including buyers and dealers, has long advised a 15% to 20% range for that ratio.

The Treasury lately has been selling a barrage of bills as it sought to rebuild its cash balance in the wake of running it down to dangerously low levels during the partisan battle over the debt limit earlier this year.

Citigroup Inc.’s team said the targeted T-bill share of debt will be among the things they’re looking for this week.

Bills, Buybacks

“Treasury needs to materially increase auction sizes at the November and February refunding,” Citigroup’s Jabaz Mathai, head of Group of 10 rates strategy also said in a note to clients. The later-quarter increases are set to be at “a quicker pace than the post-Covid issuance cycle,” he added.

Another item to watch will be any update to the Treasury’s plans for buybacks, which they first unveiled in May after months of consideration.

One of the aims of buying back older securities and issuing more of the current benchmarks is to help bolster patchy liquidity in the Treasuries market. Another is to smooth out volatility in its issuance of T-bills.

The program is set to start next year, but dealers see the Treasury as still working out the details. The department queried them about again in their pre-refunding survey questions.

US Treasury Boosts Quarterly Borrowing Estimate To $1 Trillion

* Department Had Previously Estimated $733 Billion For Quarter

* Treasury Still Restocking Cash Balance After Debt-Limit Fight

The US Treasury boosted its estimate for federal borrowing for the current quarter as it addresses a deteriorating fiscal deficit and keeps replenishing its cash buffer.

The Treasury Department increased its net borrowing estimate for the July through September quarter to $1 trillion, well up from the $733 billion amount it had predicted in early May.

The new amount, published on Monday, is a record for the September quarter and in excess of what some close watchers of the figure had expected. JPMorgan Chase & Co. had penciled in $796 billion. Lou Crandall at Wrightson ICAP LLC predicted $885 billion.

Part of the higher borrowing estimate is due to a bigger cash balance planned for the end of September. The Treasury bumped that number up to $650 billion, from the $600 billion it had anticipated three months ago. The cash stockpile — known as the Treasury General Account, or TGA — is currently about $552 billion.

Since Congress and the White House agreed to suspend the debt limit in early June, the Treasury has been ramping up its cash balance — which debt managers had run down toward zero as they made good on federal obligations without being able to increase borrowing.

Deficit Dynamics

Bond dealers have foreseen US funding needs rising over the next several quarters thanks to a deteriorating budget deficit and to the Federal Reserve’s shrinking of its holdings of Treasuries — a process that effectively forces the government to sell more to the public.

Jay Barry, head of US government-bond strategy JPMorgan, was among those expecting the Treasury to boost its quarterly financing estimate, based on “the fiscal trajectory, the outlook for the Fed’s balance sheet” and “expectations for Treasury’s cash.”

The Treasury said Monday that $83 billion of the increase in the borrowing estimate for the current quarter was due to projections for weaker revenues and higher spending.

“Extrapolating the current trend, based on historical deficit seasonal trends, would leave the deficit tracking $1.8 trillion,” JPMorgan’s Barry wrote in a recent note. The gap was $1.39 trillion for the first nine months of the current fiscal year.

Meantime, for the October through December quarter, the Treasury said it expects to borrow $852 billion, with a cash balance of $750 billion for the end of the year.

The all-time high for quarterly borrowing of almost $3 trillion was hit in April-to-June 2020, thanks to the pandemic crisis.

The Treasury on Wednesday will announce plans for its so-called refunding of longer-term securities. Dealers expect US debt managers to lift coupon-bearing debt sales across the yield curve — with potential exceptions or smaller bumps for notes less in demand.

Updated: 8-10-2023

US 30-Year Treasury Auction Signals Weak Demand To Wrap Up Week Of Big Sales

* Week Of Big Sales Indicates Market Struggling To Absorb Deals

* US 30-Year Yield Jumps Higher As Auction Trumps Inflation Data

US Treasuries came under renewed pressure, pushing yields higher, as the market struggled to absorb this week’s final leg of new debt sales.

The moves extended a volatile session Thursday, when soft inflation data for July initially pushed yields lower and fueled speculation that the market would easily accommodate the $23 billion auction of 30-year bonds at 1 pm New York time.

But even with the bonds sold for a yield of 4.189%, the highest since 2011, the amount allotted to primary dealers was the largest since February, a sign of weak demand. Afterward, 30-year yields jumped as high as 4.26% late in New York.

The sale was the biggest test of this week’s auctions, when the Treasury sold a combined $103 billion of new 3-, 10- and 30-year debt, because the long maturity securities usually appeal to select investors such as pension funds and insurers.

The size of the 30-year bond sale was $2 billion larger than last new-issue offering in May, and the market expects further increases given the expected deficits the US government is facing.

“It’s a case of refunding digestion,” and with shorter-dated Treasury yields higher, “you are getting paid to keep duration short,” said Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities. He said the sale also reflects weak summer liquidity.

Treasury yields dropped early in the trading day after the consumer price index’s advance was in line with expectations, supporting anticipation that the Federal Reserve is likely done raising interest rates.

Ten-year Treasury yields dropped as much as 6 basis points to 3.94% before reversing course and jumping back to as much as 4.11% in the late afternoon.

“The selloff feels likes a reaction to the weak auction,” said Subadra Rajappa, head of U.S. rates strategy for Societe Generale. “It caught me by surprise. Dealers had to take down a big chunk of the paper. It feels like there’s not enough of real money participation.”

But, she added, “it’s hard to draw a conclusion for an auction in August” when investors leave for vacations.

The post-auction weakness extended across the market, with yields between the five- and 10-year benchmarks higher by 9-10 basis points and at fresh session peaks at late trading in New York. Traders said the mid-section of the Treasury curve was in focus, with trades favoring under-performance in 5-year bonds.

While the bond market initially warmed to the latest CPI report, traders are still pricing in some risk of another quarter-point Fed hike later this year, with swaps for the November meeting showing a 5.42% policy rate. It’s at 5.33% now.

“The market sees the economy is now in a more disinflationary trend, but the labor market is still strong and that will keep the Fed on its toes,” said Michael Pond, head of global inflation-linked research at Barclays.

Updated: 8-11-2023

Treasury Auctions End On A Downbeat Note This Week After Soft 30-Year Sale

‘If we put all these factors into a blender, for the first time in 10 to 15 years they’re all pointing in the same way and that’s pressure on yields regardless of the inflows that come and go,’ said Gregory Faranello of AmeriVet Securities.

The Treasury market ended the week on a somewhat downbeat note after struggling to absorb Thursday’s $23 billion auction of 30-year bonds despite a record pace of investor inflows.

Demand for the auction was described by strategists and traders as “so-so,” “soft” and “weaker-than-expected.” Thursday’s disappointing sale overshadowed July’s consumer-price report and was the main reason that investors and traders sold off long-dated Treasurys that same afternoon.

The selloff in long-dated U.S. government debt extended into Friday — pushing the 10-year yield and 30-year rate to one-week highs of 4.166% and 4.271%, respectively — and comes at a time when Treasurys are on track for what BofA Securities strategists see as a record $206 billion of inflows this year. Greater inflows should be pushing yields lower, not higher, but that’s not happening. Instead, yields are rising anyway.

Demand/supply dynamics in the Treasury market have recently changed and “the balance of power seems to be shifting in favor of higher yields” at a time of “runaway” government deficits and increases in Treasury’s debt issuances, said Marios Hadjikyriacos, a senior investment analyst at Cyprus-based multiasset brokerage XM.

In a note on Friday, the analyst said that the soft 30-year Treasury auction “certainly reinforced this notion yesterday, helping to propel yields higher,” alongside commentary from San Francisco Fed President Mary Daly, who said the central bank has more work to do to get inflation down.

This week’s government auctions were seen as a key test as to whether investors could keep up their demand for U.S. government debt amid a deluge of issuance and worries about the fiscal outlook.

However, liquidity during August tends to be low so Thursday’s poorly received 30-year sale is not necessarily indicative of further trouble ahead, considering Wednesday’s $38 billion auction of 10-year notes and Tuesday’s sale of $42 billion in 3-year notes both went well, according to analysts.

On July 31, the Treasury Department released an eye-popping $1 trillion borrowing estimate for the third quarter, which was followed the next day by Fitch Ratings’ decision to cut the government’s top AAA rating. Worries about the trajectory of U.S. finances then spilled into Thursday’s 30-year bond auction.

“The technical picture of the Treasury market heading into auctions this week was weak, and it’s not terribly good right now in the long end after the 30-year sale,” said Gregory Faranello, head of U.S. rates for AmeriVet Securities in New York. “The auction wasn’t bad, it just wasn’t as strong as the three-year or 10-year sales on Tuesday and Wednesday.”

At a time when the fiscal outlook looks worrisome, Federal Reserve policy makers are raising interest rates and shrinking the central bank’s $8.2 trillion balance sheet.

In other words, the Fed, long seen as an important buyer of Treasurys which isn’t price-sensitive, “has gone away and the buyers left now are more price sensitive,” Faranello said via phone.

“If we put all these factors into a blender, for the first time in 10 to 15 years they’re all pointing in the same way and that’s pressure on yields regardless of the inflows that come and go,” he said, adding that even financial-stability issues in March weren’t enough to keep Treasury rates down.

“Ultimately, the only reasons that yields would go lower from here is weak economic data, which we don’t have, or central bank policy which changes course. The stars are aligning the other way not just here in the U.S., but globally.”

The yield awarded at Thursday’s 30-year auction was higher than what it was going into the competitive deadline, which means demand wasn’t great. In addition, primary dealers were awarded a higher percentage of the allotment than last month, meaning “people on the sidelines didn’t show up or have much interest,” said macro strategist Will Compernolle of FHN Financial in New York. The poor reception “seemed to surprise most people and I think it’s carried on into today.”

On Friday, traders and investors continued to sell off most Treasurys after July’s producer-price report surprised to the upside.

Updated: 9-18-2023

Sub-50 Cent Price On Treasury Bond Underscores Investor Pain

* Long-Term Bonds Sold During Pandemic Hit Hard As Rates Soar

* Positive Convexity Means Debt Could Be Valuable If Yields Fall

Fifty cents on the dollar is a very low price in the world of bonds. In most cases, it signals that investors believe the seller of the debt is in such financial distress that it could default.

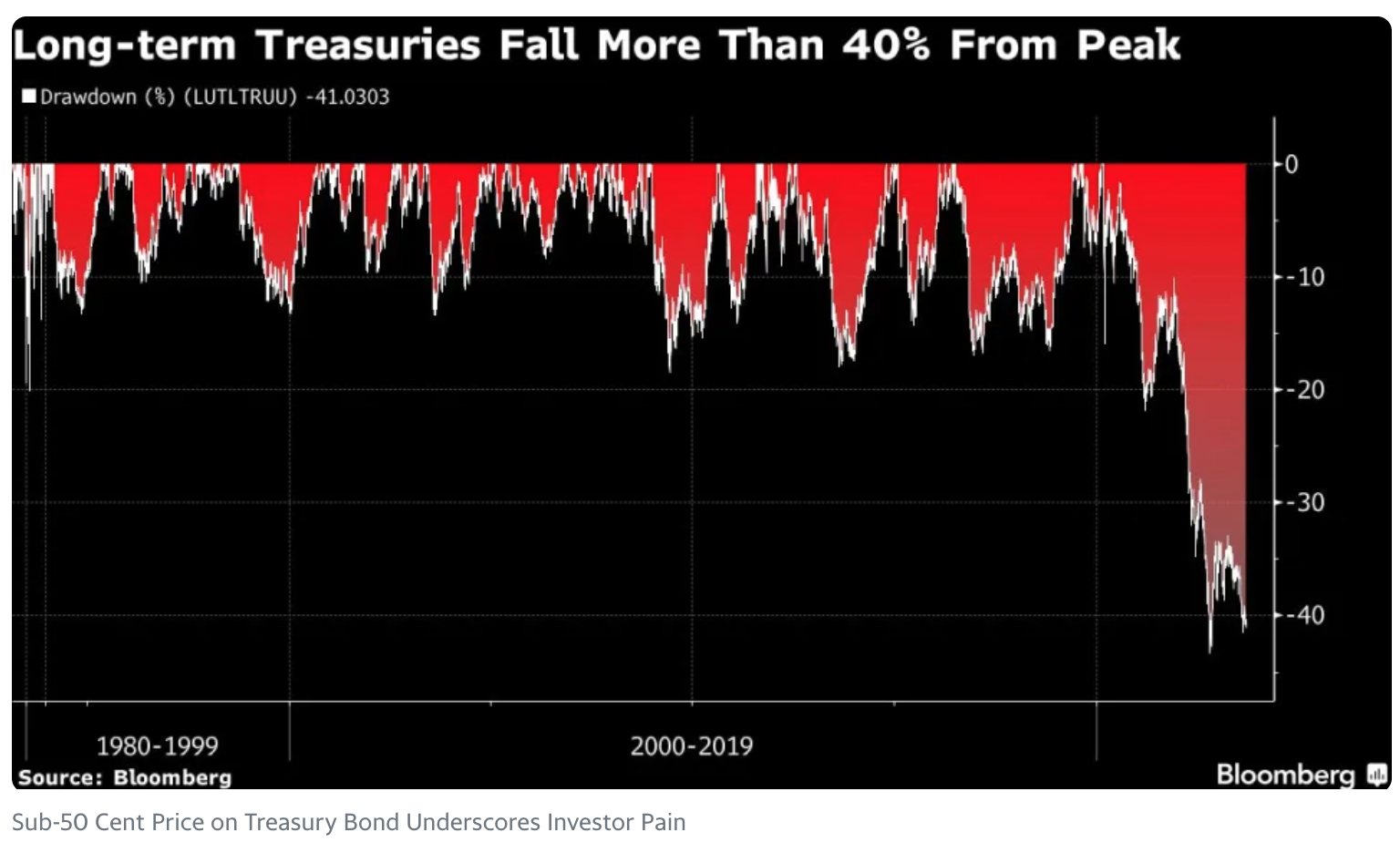

So when a US Treasury bond sank below that price Monday, it raised eyebrows. The security, due in May 2050, briefly touched as low as 49 29/32, marking the second time in the past two months it’s fallen below the 50-cent level.

The US, of course, is not in danger of defaulting any time soon. Treasuries are generally considered to be the safest government debt in the world.

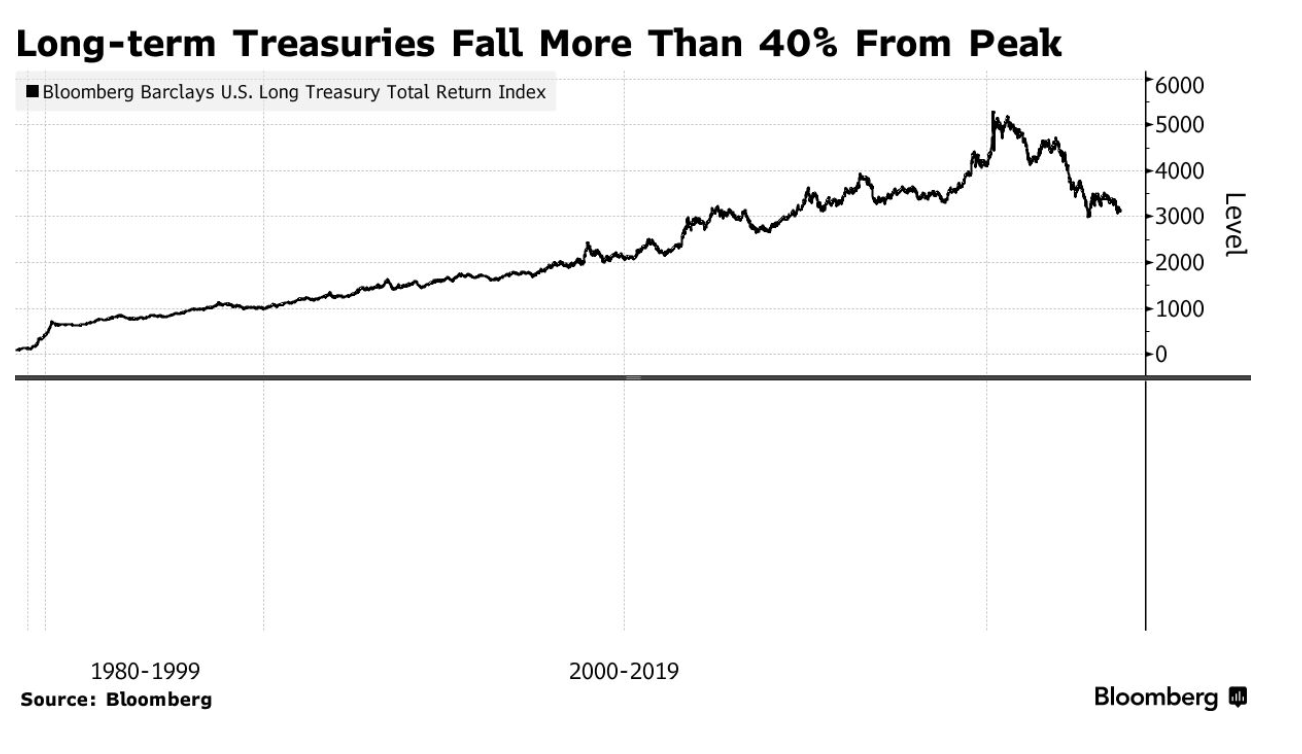

What the price does illustrate in this case is the scope of pain inflicted on investors who piled into longer-term debt at rock-bottom interest rates during the pandemic, only to then be caught off-guard when the Federal Reserve carried out the the most aggressive monetary-policy tightening in decades.

The bond due in 2050 has been hit particularly hard, given that its interest rate — 1.25% — is the lowest ever on a 30-year Treasury. Investors got over 4% on 30-year debt issued last month.

“Those bonds have below market coupons and investors need to get compensated for it,” said Nancy Davis, founder of Quadratic Capital Management.

Treasuries maturing in 10 or more years — which have the highest price sensitivity to changes in interest rates, or duration — have slumped 4% this year, following a record 29% plunge in 2022, according to data compiled by Bloomberg.

That’s more than double losses across the broader Treasury market, the data show.

Yields on 30-year bonds hit an all-time low of 0.7% in March 2020, before rising to a 12-year high of 4.47% last month. They hovered 4.4% Monday.

The Treasury initially sold $22 billion of the 2050 securities at about 98 cents (it subsequently did two so-called reopenings, adding to the amount outstanding.) Since the bond’s debut, it’s rapidly lost value as newer ones were sold with higher coupons.

The Fed is the largest investor in the debt, holding about 19%, a legacy of its bond purchasing program known as quantitative easing. Other buy-and-hold investors such as exchange-traded funds, pensions and insurance companies also dominate.

Of course, should a decline in inflation fuel a slide in long-term yields, these bonds would just as quickly turn into an outsize winner versus the rest of the rates curve.

They also have at least one other attractive property for investors. Because of the deep price discount, the securities have what’s known as positive convexity, meaning they rise in price more than they fall for a given change in yield.

For instance, the bonds would surge about 11 cents should their yield decline 100 basis points. For a similar yield increase, the bonds would only fall about 9 cents.

“They have very positive convexity, and that make them very interesting bonds, although liquidity is probably very low,” said Mustafa Chowdhury, chief rates strategist at Macro Hive Ltd.

Updated: 9-20-2023

Treasury Yields Highest Since 2007 After US Debt Hits A Record $33 Trillion

Billionaire investor Ray Dalio cautioned that the US is at the start of a “classic late, big-cycle debt crisis” characterized by a shortage of buyers for its government bills and bonds. Veteran economist Nouriel Roubini has also expressed similar concerns.

Fitch downgraded the US’s long-term credit rating in August, citing a “steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters.”

* US National Debt Has Ballooned To $33 Trillion For The First Time.

* The Federal Government Could Face Another Shutdown By The End Of September.

* Treasury Yields Topped A 16-Year High As The Fed Ends Its Policy Meeting On Wednesday.

Treasury yields hit a 16-year high on Wednesday after the US government’s debt burden hit a record $33 trillion this week.

The surge comes as the Federal Reserve concludes its September policy meeting and is expected to hold interest rates steady.

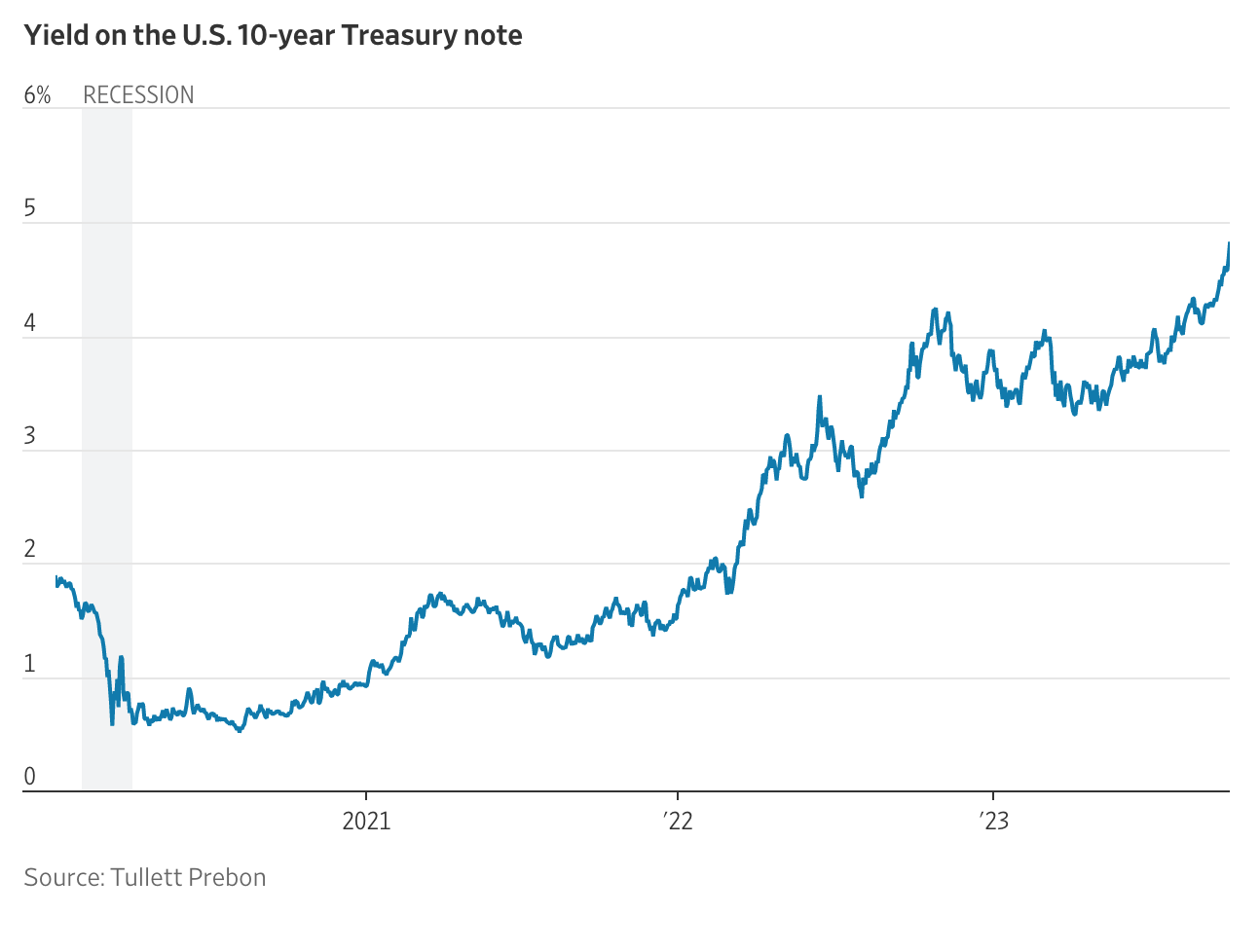

The Fed’s rate rises in recent months have increased the cost of federal borrowing, with the rate on 10-year Treasurys standing at about 4.36%, up from as low as 0.32% in early 2020.

Federal spending increased by roughly half between 2019 and 2021, which contributed to the debt record, the Treasury Department said on Monday.

It also cited tax cuts, coronavirus stimulus packages and lower tax revenues from high pandemic unemployment as other contributing factors in the spike.

The $1.58 trillion increase since the debt ceiling was lifted in June has left some experts concerned about a potential wider crisis.

These include markets commentator Larry McDonald, who last month warned of a “mind-blowing hole” in the public finances.

Meanwhile, another government shutdown looms unless Congress come to a funding agreement by September 30.

Updated: 10-4-2023

Bond Selloff Threatens Hopes For Economy’s Soft Landing

Growth prospects and concern over government debt are driving long-term interest rates higher.

A sudden surge in long-term interest rates to 16-year highs is threatening hopes for an economic soft landing, all the more because the exact triggers for the move are unclear.

The Federal Reserve has been raising short-term rates for 1½ years. Those increases are designed to push up longer-term bond yields, combating inflation by slowing the economy.

But the speed of the latest jump might be a case of “be careful what you wish for.” It comes as inflation has eased and the Fed has signaled it is nearly done lifting rates.

The yields on the 10-year Treasury note rose 0.119 percentage point Tuesday to 4.801%, the highest level since the subprime mortgage crisis began in August 2007. On Wall Street, the Dow Industrials fell about 431 points, or 1.3%, giving up all their gains for the year. The S&P 500 declined 1.4%. The technology-heavy Nasdaq Composite dropped 1.9%.

If the recent climb in borrowing costs—along with the accompanying slump in stock prices and the stronger dollar—is sustained, that could meaningfully slow the U.S. and global economies over the next year.

The swiftness of the recent rise also increases the risk of financial-market breakdowns.

The likeliest causes appear to be a combination of expectations of better U.S. growth and concern that huge federal deficits are pressuring investors’ capacity to absorb so much debt.

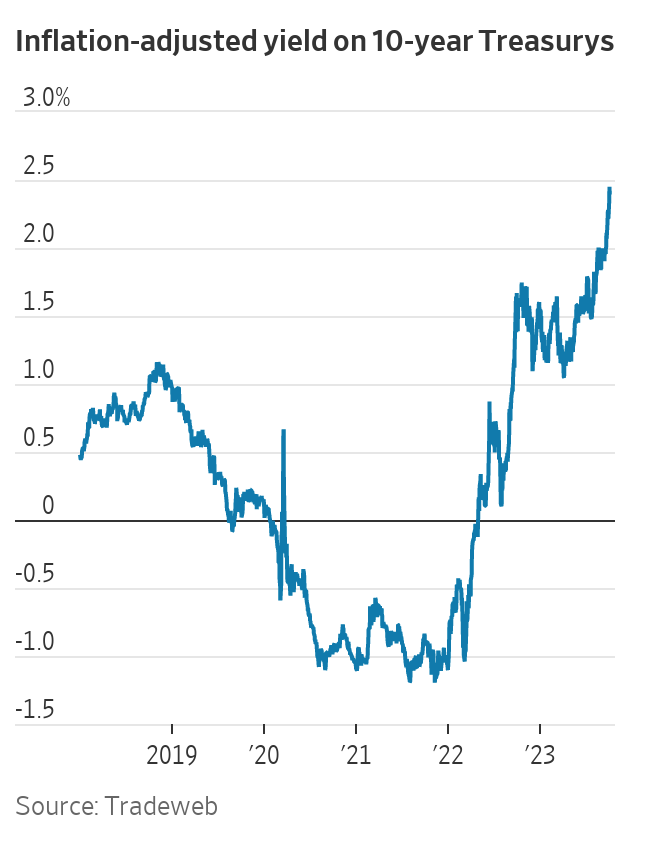

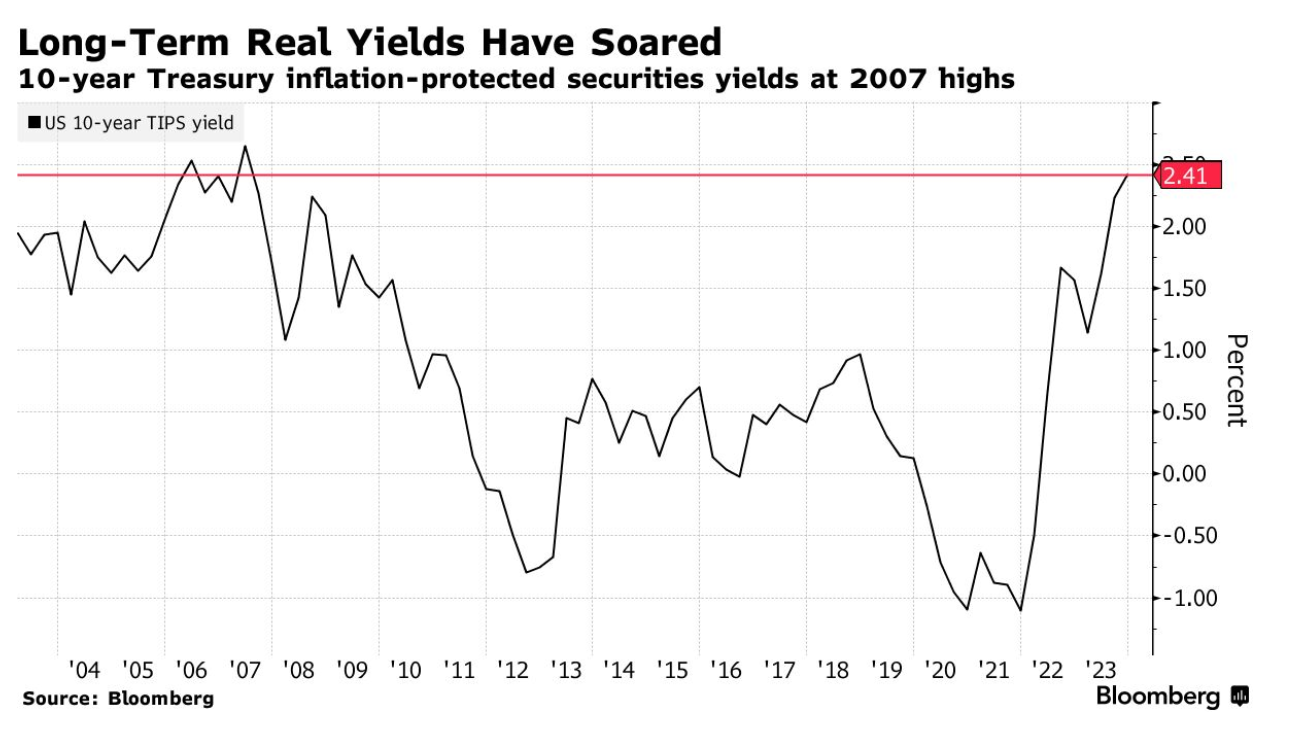

Last year’s increases in long-term Treasury yields were driven by market expectations of higher short-term rates as the Fed tightened policy and by investors’ demands for extra compensation to hold longer-dated assets because of fears of higher inflation.

But neither of those factors appears to be driving higher rates now, which is putting the focus on other influences. Those include reduced demand for Treasurys from foreigners, U.S. banks and domestic portfolio managers who have traditionally purchased government bonds as a hedge against a downturn in stocks and other risky assets.

“It’s perplexing,” said Daleep Singh, a former executive at the New York Fed who is now chief global economist at PGIM Fixed Income. “No fundamental explanation is convincing.”

Treasury Secretary Janet Yellen said Tuesday that it wasn’t clear whether bond yields would settle out at higher levels over the long run. “It’s a great question, and it’s one that’s very much on my and the administration’s minds,” she said during a moderated discussion at the Fortune CEO Initiative conference in Washington.

The lack of an obvious culprit for the latest rise in longer-dated yields suggests that the so-called term premium, or the extra yield that investors demand for investing in longer-dated assets, is rising.

That would mark an abrupt reversal following the low-inflation, low-growth environment that prevailed between the 2008-09 financial crisis and the Covid-19 pandemic.

A higher term premium means even if inflation is under control, borrowers will have to pay more than before because investors want extra compensation for the risks associated with locking up their money for longer periods.

A sustained rise in Treasury yields will be costly for the U.S. government because it would face still-higher borrowing costs on a much larger stock of its debt. The publicly held debt of the U.S. has doubled to around $26 trillion over the past eight years.

The run-up in borrowing costs is sending mortgage rates to 23-year highs, with more lenders now quoting rates above 7.5% for the 30-year fixed loan.

Higher borrowing costs could weigh on stocks and other asset prices, leading to weaker investment, hiring and economic activity.

Since the beginning of August, the S&P 500 has shed nearly 8%, while the U.S. dollar has climbed almost 5% against a basket of foreign currencies.

Economists at Goldman Sachs estimate that if the tightening in financial conditions that began in late July is sustained, it could reduce economic output by 1 percentage point over the coming year.

That could weaken the case for the Fed to raise interest rates later this year.

“We’re going to have to watch it,” Cleveland Fed President Loretta Mester told reporters Tuesday. “Those higher rates will have an impact on the economy, and we just have to take that into account when we’re setting monetary policy.”

The Growth Outlook Brightens

Investors haven’t changed their expectations in recent weeks that the Fed is nearly done raising rates. They see a rising probability, however, that the central bank holds rates at current levels through next year.

Once the Fed cuts rates, they see fewer reductions than they did three months ago.

The current run-up in bond yields gained momentum at the end of July, when the economy began to show signs of reacceleration in the midst of stronger-than-expected consumer spending.

Since then, investors and Fed officials have scrapped their projections that the economy would stumble.

Fed officials have raised their expectations for economic growth next year because “underlying momentum in the economy is quite a bit stronger than we thought…and I think that’s also what market participants are doing,” said Mester.

Fed Chair Jerome Powell acknowledged in September that interest-rate hikes hadn’t slowed the economy as much as anticipated.

Some officials believe the government’s response to the pandemic made the private sector more resilient to the effect of higher interest rates, while others have suggested that interest rates simply haven’t been high enough for long enough to meaningfully dent demand.

In the previous decade, when the economy seemed less responsive to more monetary stimulus, officials concluded that the so-called neutral rate that keeps inflation and unemployment stable over time might have fallen.

Now, some are wondering whether the opposite is occurring, leading to a higher neutral rate.

Investors are puzzling over why consumption has been strong despite the Fed’s aggressive rate increases. If it is because the neutral rate is higher, the Fed will keep rates higher for longer, justifying the recent run-up in yields.

If it is because the traditional lags of monetary policy simply haven’t kicked in, then it could be just a matter of time before the economy slows.

“More people were in the lags camp six months ago, and they’ve slowly thrown in the towel on that one,” said Priya Misra, portfolio manager at J.P. Morgan Asset Management. “They are reassessing how long the Fed will have to keep rates here.”

A New Economic Regime?

Investors are also grappling with the possibility that the global economy faces greater inflation volatility in the coming years. That would be the case if many of the forces that underpinned low inflation and low interest rates after the 2008-09 financial crisis—including globalization, favorable demographics and abundant cheap energy supplies—weaken or go into reverse.

A stronger growth outlook could weaken demand for Treasurys as the supply of securities being issued by the government is rising and as some buyers are stepping back from the market.

The Fed, for example, purchased trillions of securities between 2008 and 2014 and again between 2020 and 2022 to provide additional stimulus after driving short-term rates to zero. Officials believed those purchases would lower long-term yields in part by reducing the term premium.

The central bank ended its purchases in March 2022 and three months later began shedding those holdings passively. It has been allowing up to $60 billion in Treasury securities to mature every month this year without replacing them, which could lift the term premium.

The Fed’s asset holdings have declined by nearly $1 trillion over the past year, to around $8 trillion last week.

“What we’re seeing is a reappraisal of how the bond market prices uncertainty itself,” said Singh. “The compensation required to underwrite potentially the new structural regime with more volatile growth and inflation and fewer predictable sources of demand to absorb record amounts of government debt issuance has clearly risen.”

On Tuesday, Yellen said it was premature to conclude that the U.S. was facing a future of persistently higher interest rates. “The structural forces that led us to believe interest rates would be low—they’re alive and well,” she said.

As the Fed raised rates to tame inflation last year, bonds and stocks both fell, a departure from the traditional pattern in which investors could hedge the risk of a downturn in stocks and other risky assets by purchasing Treasurys.

Many investors had expected that as the Fed neared the end of its rate hikes, the traditional negative correlation between stocks and bonds would return.

The big surprise in the past two months is that this hasn’t happened, in part because the Fed might not cut rates as quickly or as swiftly as investors have anticipated.

A strong September employment report this Friday could add to the bond-market rout by underscoring the economy’s resilience, which would push yields higher. On the other hand, signs of weakness could halt the rise in yields.

“These types of things often take on a life of their own until they self-correct,” either through weaker economic data or “a more sinister mechanism, such as a financial stability scare,” said Singh. “Either of those two developments would mark an inflection point back towards lower yields, but we’re not there yet.”

Long Bonds’ Historic 46% Meltdown Rivals Burst of Dot-Com Bubble

* Duration Exposure Fuels Painful Losses For Long-End Investors

* Thirty-Year Yields Hit 5% Wednesday For First Time Since 2007

Losses on longer-dated Treasuries are beginning to rival some of the most notorious market meltdowns in US history.

Bonds maturing in 10 years or more have slumped 46% since peaking in March 2020, according to data compiled by Bloomberg. That’s just shy of the 49% plunge in US stocks in the aftermath of the dot-com bust at the turn of the century.

The rout in 30-year bonds has been even worse, tumbling 53%, nearing the 57% slump in equities during the depths of the financial crisis.

The extent of the losses is a stark reminder of the risk that comes with piling into longer-dated bonds, where prices are the most sensitive to changes in interest rates.

That was part of the appeal of the securities as the Federal Reserve spent the better part of a decade cutting borrowing costs to near zero.

But as the central bank has carried out the most aggressive monetary-policy tightening in decades to rein in runaway inflation, the mix of historically low starting yields, long-maturity debt and rapidly rising rates has proven to be a painful combination.

“It’s quite something,” said Thomas di Galoma, co-head of global rates trading at BTIG and a four-decade market veteran. “To be honest with you, I had never thought I would see 5% 10-year notes ever again. We got caught in an environment post global financial crisis where everybody just thought rates were going to remain low.”

The current losses in long-maturity debt more than double the next biggest slump in 1981, when then Fed Chair Paul Volcker’s campaign to break the back of inflation drove 10-year yields to almost 16%.

It also surpassed the 39% average loss in seven US equity bear markets since 1970, including last year’s 25% slump in the S&P 500 when the Fed started to lift rates from near zero.

Perhaps the single best example of the staggering pain inflicted on investors is the rout in the 1.25%, 30-year Treasury sold in May 2020. The bond has lost more than half its value since it was issued, trading at around 45 cents on the dollar.

Long-end buyers got a reprieve Wednesday from the relentless selling pressure of recent weeks. Ten-year yields initially climbed as high as 4.88% before a dramatic rally during the US session left them down about six basis points at 4.73%. Thirty-year yields topped 5% before sliding to around 4.86%.

“There’s a lot of portfolio suffering,” said di Galoma. “You’ve seen some big moves, but they don’t seem to last. This time, it’s just continuing. It’s kind of like defying gravity here.”

Updated: 10-5-2023

Bitcoin Enters ‘Quiet Bull Market’ As Safe Haven From Bond Market Turmoil, Analyst Says

Investment research firm ByteTree upgraded bitcoin’s price outlook to “bull” from “neutral” as the crypto benefits as a “safe haven” amid an equity and bond sell-off.

* Bitcoin plunged to $27,300 as its rally above $28,000 proved to be short-lived.

* BTC is in a bull market for defies market rout in equity and U.S. Treasury bond trading, ByteTree CIO says.

Bitcoin (BTC) briefly surged above $28,000 during Thursday U.S. morning hours, then dropped to as low as $27,300 as traders took the opportunity to sell the rally.

The largest cryptocurrency by market capitalization was changing hands at $27,500 recently, flat over the past 24 hours, but still outperforming the wider crypto market.

The CoinDesk Market Index (CMI), which features a broad basket of digital assets, was down 0.3%, while ether (ETH) slid 1.8% over the same period.

“In the near term, I expect the market to sell into this rally,” John Glover, chief investment officer of Ledn, told CoinDesk in an email. “In the absence of new capital flowing into digital assets, I believe that this is what this rally will be: short-lived.”

Glover expects a more durable appreciation will materialize later this year and early next year as bitcoin appears to be finished with its corrective move.

“I do believe that BTC prices will be higher in three months than they are today as technically we’ve completed the sell off and I now look for a sustained rally into Q2 2024,” he said.

Bitcoin As Safe Haven From Surging Rates

Investment research firm ByteTree upgraded its BTC market signal from neutral to bull in a report on Thursday. The crypto’s recent price action has defied a rough period for traditional financial markets, offering a safe haven from a rout in equity and bond trading.

“Bitcoin futures look good, especially when you compare them to the crisis in the bond market,” Charlie Morris, chief investment officer of ByteTree, said in the report. “It is the true safe haven from Uncle Sam’s bonds.”

He pointed out that BTC is beating the U.S. stock market at a time when surging bond yields wreak havoc on traditional markets. When interest rates peak and the bond sell-off ends, BTC will be “off to the races,” he said.

Morris noted that during BTC’s latest corrective move, the crypto held above the key $25,000 level, which capped the price between May 2022 and March 2023.” If we can hold that $25,000 level, which we probably will, BTC is very much in a bull market, albeit a quiet one,” he said.

Even if BTC is shaking off rising yields, it has remained “trapped in its $26,000 to $30,000 cage,” according to Edward Moya, senior market analyst of the Americas at forex trading firm Oanda.

“What is also preventing crypto investors from becoming more optimistic is that the bond market sell-off refuses to end and that will cripple many crypto startups,” he added.

Rising Interest Rates Mean Deficits Finally Matter

Investors ignored deficits when inflation was low. Now they are paying attention and getting worried.

The U.S. has long been the lender of last resort to the world. During the emerging-market panics of the 1990s, the global financial crisis of 2007-09 and the pandemic shutdown of 2020, it was the Treasury’s unmatched capacity to borrow that came to the rescue.

Now, the Treasury itself is a source of risk. No, the U.S. isn’t about to default or fail to sell enough bonds at its next auction. But the scale and upward trajectory of U.S. borrowing and absence of any political corrective now threaten markets and the economy in ways they haven’t for at least a generation.

That’s the takeaway from the sudden sharp rise in Treasury yields in recent weeks. The usual suspects can’t explain it: The inflation picture has gotten marginally better, and the Federal Reserve has signaled it’s nearly done raising rates.

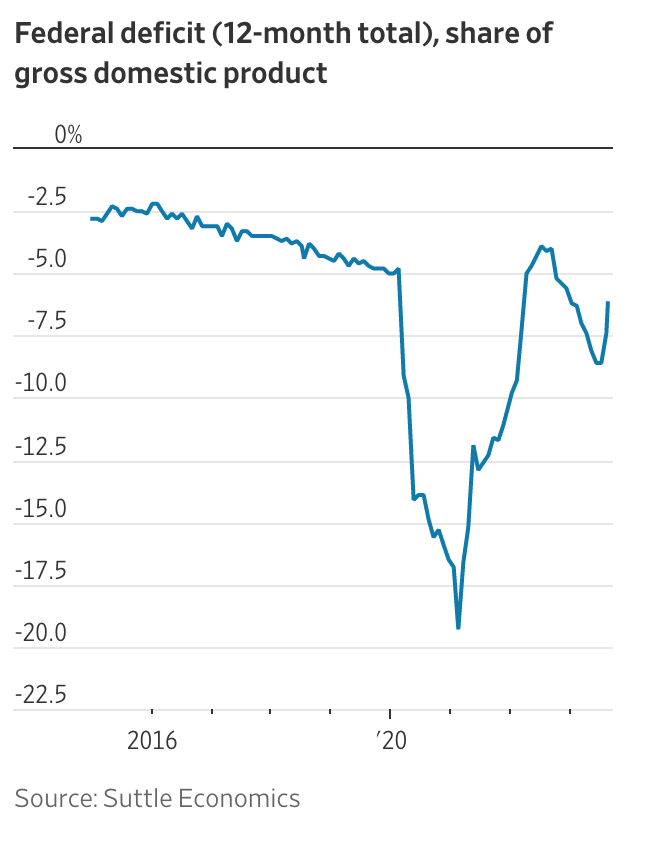

Instead, most of the increase is due to the part of yields, called the term premium, which has nothing to do with inflation or short-term rates. Numerous factors affect the term premium, and rising government deficits are a prime suspect.

Deficits have been wide for years. Why would they matter now? A better question might be: What took so long?

That larger deficits push up long-term rates had long been economic orthodoxy. But for the past 20 years, interest-rate models that incorporated fiscal policy didn’t work, noted Riccardo Trezzi, a former Fed economist who now runs his own research firm, Underlying Inflation.

That’s understandable. Central banks—worried about too-low inflation and stagnant growth—had kept interest rates around zero while buying up government bonds (“quantitative easing”). Private demand for credit was weak. This trumped any concern about deficits.

“We had a blissful 25 years of not having to worry about this problem,” said Mark Wiedman, senior managing director at BlackRock. Today, though, central banks are worried about inflation being too high and have stopped buying and in some cases are shedding their bondholdings (“quantitative tightening”). Suddenly, fiscal policy matters again.

To paraphrase Hemingway, deficits can affect interest rates gradually or suddenly. Investors, asked to buy more bonds, gradually make room in their portfolios by buying less of something else, such as equities.

Eventually, the risk-adjusted returns of these assets equalize, which means higher bond yields and lower price/earnings ratios on stocks. That has been happening for the past month.

Sometimes, though, markets can move suddenly, such as when Mexico threatened to default in 1994 and Greece did default a decade later.

Even in countries that, unlike Mexico or Greece, borrow in currencies they control, interest rates can become hostage to deficits, such as in Canada in the early 1990s or Italy in the 1980s and early 1990s.

The U.S. isn’t Canada or Italy; it controls the world’s reserve currency, and its inflation and interest rates are mostly driven by domestic, not foreign, factors. On the other hand, the U.S. has also exploited those advantages to accumulate debt and run deficits that are much larger than those of peer economies.

There’s not much sign that this has yet imposed a penalty. Investors still project that the Fed will get inflation down to its 2% goal. At 2.4%, real (inflation-adjusted) Treasury yields are comparable to those in the mid-2000s and lower than in the 1990s, when the U.S. government’s debts and deficits were much lower.

Still, sometimes bad news accumulates below investors’ radar until something brings their collective attention to bear. Could a point come when “all the headlines will be about the fiscal unsustainability of the U.S.?” asked Wiedman.

“I don’t hear this today from global investors. But do I think it could happen? Absolutely, that paradigm shift is possible. It’s not that no one shows up to buy Treasurys. It’s that they ask for a much higher yield.”

It’s notable that the recent rise in bond yields came as Fitch Ratings downgraded its U.S. credit rating, Treasury upped the size of its bond auctions, analysts began revising upward this year’s federal deficit, and Congress nearly shut down parts of the government over a failure to pass spending bills.

The federal deficit was over 7% of gross domestic product in fiscal 2023, after adjusting for accounting distortions related to student debt, Barclays analysts noted last week. That’s larger than any deficit since 1930 outside of wars and recessions.

And this is occurring at a time of low unemployment and strong economic growth, suggesting that in normal times, “deficits may be much higher,” Barclays added.

Abroad, fiscal policy has clearly begun to matter. Last fall, a proposed U.K. tax cut triggered a surge in British bond yields; the government scrapped the proposal, then resigned.

Italian yields have risen since the government last week delayed reducing its deficit to below European guidelines. Trezzi said that for the past decade the European Central Bank had bought more than 100% of net Italian government bond issuance, but that’s coming to an end.

Foreign investors, worried about inflation and deficits, have been selling Italian bonds, while Italian households have been buying, Trezzi said. “With a weakening economy, it is unclear for how long…households can offset the selloff of foreigners.”

Investors looking for U.S. political will to rein in deficits would take note that both former President Donald Trump and President Biden, their parties’ front-runners for the 2024 presidential nomination, have signed deficit-busting legislation and that both of their parties have pledged not to cut the two largest spending programs, Medicare and Social Security, or raise taxes on most households.

They would also notice that the Republican speaker of the House of Representatives was just ousted by rebels in his own party because he had passed a bipartisan spending bill to prevent the government from shutting down.

True, the rebels wanted less spending. But shutdowns, Barclays noted, represent “erosion of governance.” This isn’t how a country trying to reassure the bond market acts.

Fed’s Bid To Avoid Recession Tested By Yields Nearing 20-Year Highs

* Long-Term Real Rates Have Hit Levels Rarely Seen In 20 Years

* Policymakers Haven’t Taken Chance To Push Back: Ex-Official

The Federal Reserve may be putting its hoped-for soft landing of the economy at risk by tacitly accepting a run-up in long-term interest rates to the highest levels since 2007.

The surge — 10-year Treasury yields rose more than half a percentage point the past month to surpass 4.7% — heightens the danger in the near-term of a financial blowup akin to the regional bank breakdown in March.

Longer run, it threatens to undercut the economy by markedly raising borrowing costs for consumers and companies.

“Ultimately, the feedback effect starts to fuel fears that you’re going to have a hard landing,” said R.J. Gallo, a senior portfolio manager for Federated Hermes, with about $669 billion in assets under management.

What may have a particularly strong impact is the rise in so-called real rates, which remove the impact of inflation. Yields on 10-year inflation-linked Treasuries have soared in recent weeks to levels rarely seen over the past two decades.

Fed leadership has so far not shown much, if any, inclination to resist the rise in long-term rates. While New York Fed President John Williams suggested last week the US central bank may be finished raising rates, he also said policymakers would keep them high “for some time” to bring inflation down to their 2% goal.

“Fed officials have had a chance at various appearances — and they’ve not really taken that opportunity to push back against this,” former Vice Chair Richard Clarida said on Bloomberg Television on Wednesday.

The rise in yields “actually does some of the Fed’s job for it” by slowing economic growth and helping to contain inflation, added Clarida, who is now a global economic adviser for Pacific Investment Management Co.

For her part, Cleveland Fed President Loretta Mester said Thursday officials are watching the rise in yields, though adding that it’s not clear that the increase would be sustained.

The danger is the leg up in long-term rates does more damage than the Fed expects. The collapse of Silicon Valley Bank in March came in the wake of a rise in bond yields that was partly driven by tough talk on Fed policy by Chair Jerome Powell.

Other Headwinds

“There’s a potential near-term disruptive effect to worry about,” said Bruce Kasman, chief economist for JPMorgan Chase & Co.

The rise in rates is also occurring at a time when the economy is already facing a number of headwinds — from a resumption of student loan payments to a strike by autoworkers.

Indeed, Bloomberg Economics chief US economist Anna Wong says the US economy is probably on the verge of tipping into a recession.

Market participants have identified a variety of triggers for the surge in yields — which moderated slightly Wednesday. Among them: investor concern about burgeoning US budget deficits, slackening demand for Treasury securities from foreign investors including China and expectations that Japan will exit its ultra-loose monetary policy in coming quarters.

Some economists and investors have also cited what they see as a muddled message from the central bank regarding its stance on real interest rates.

Real Rates

“We’ve gotten conflicting signals from the Fed,” MacroPolicy Perspectives LLC founder and former central bank economist Julia Coronado said. In an environment where bond yields were already rising, that “basically just gave the market permission to keep marching higher.”

What’s puzzling investors is how exactly policymakers define real rates. Fed officials have sometimes cited gauges that are based on past inflation and sometimes those tied to prospective inflation rates.

The difference can be critical in determining the future path of Fed policy. Williams in August suggested that the Fed would cut rates

next year in tandem with an expected fall in inflation. The aim, he explained, would be to prevent real rates from rising and policy from becoming more restrictive.

But Cleveland’s Mester, who doesn’t vote on monetary policy decisions this year, suggested on Tuesday that’s not inevitably so.

“Real rates should be based on expected inflation, not necessarily current inflation,” she told reporters.

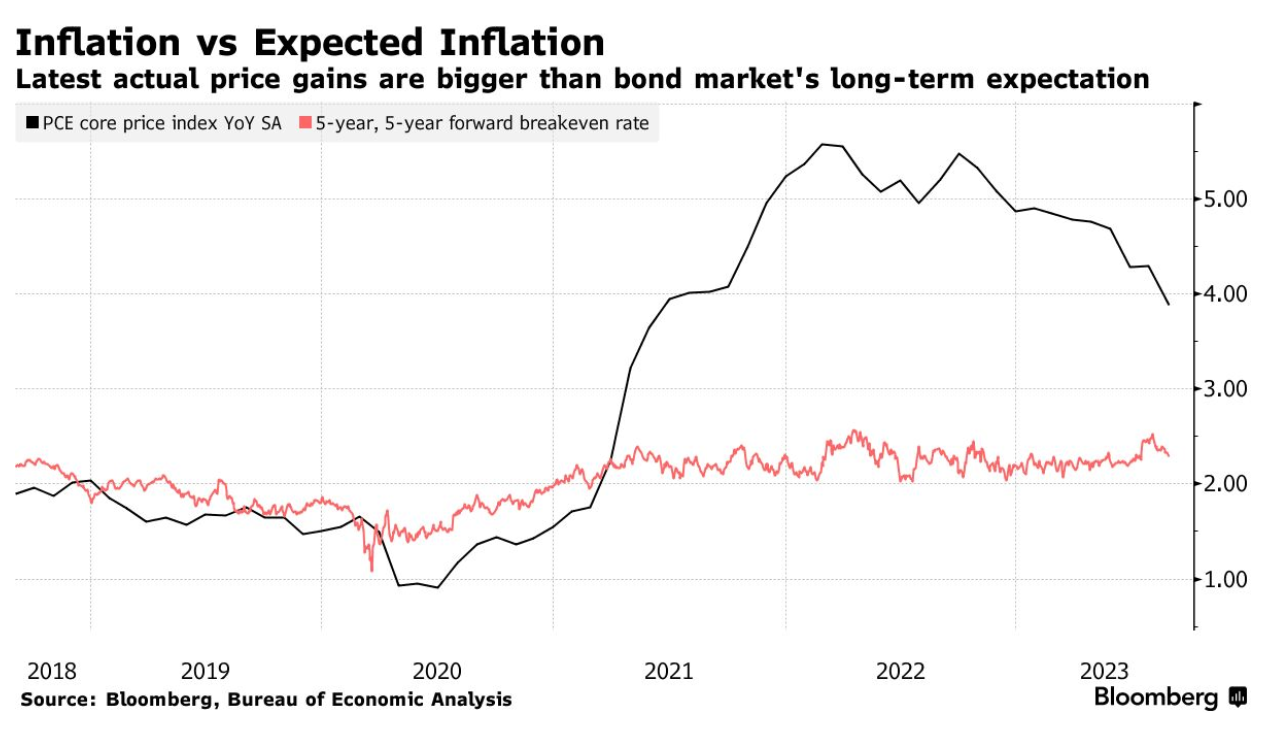

In that case, a slowdown in inflation wouldn’t automatically call for a reduction in Fed rates, unless also accompanied by an easing in expectations. The Fed’s preferred gauge of core inflation, which strips out food and energy costs, was 3.9% in August.

By comparison, a benchmark for expected inflation derived from bond market pricing indicates about a 2.5% pace over the longer term.

Neutral Rate

Powell has also muddied the waters about the so-called real neutral rate of interest — the equilibrium rate that neither spurs nor retards economic growth.

Speaking to reporters on Sept. 20, Powell mused that the neutral rate might have risen, at least temporarily, given how resilient the economy has been in the face of the Fed’s aggressive credit tightening campaign.

His comments came against a backdrop of investors already thinking so-called R-star is permanently higher coming out the pandemic, and some Fed policymakers themselves bumping up their own estimates of the equilibrium rate.

The result: Powell “put a little bit of fuel on the fire” in the bond market, said Adam Abbas, co-head of fixed income for Harris Associates, with more than $100 billion in assets under management.

Whatever the reason for the rise in long-term rates, it’s something that policymakers will need to keep their eye on in case in gets out of control.

“If the moves get extreme or persistent, it could get the Fed engaged,” Clarida said.

Updated: 10-9-2023

Treasury-Market Selloff Has Become The Worst Bond Bear Market Of All Time, According To BofA

The Tell