Bakkt Announces September 23 Launch of Futures And Custody

Bakkt has announced the coming launch of its much-anticipated platform for daily and monthly futures in the United States in a blog post on Aug. 16. Having received approval from the necessary regulators, the launch is scheduled for Sept. 23. Bakkt Announces September 23 Launch of Futures And Custody Platform In US (#GotBitcoin?)

Bakkt ™ Bitcoin (USD) Monthly Futures Contract

Bakkt’s physically delivered futures have been the subject of a great deal of anticipation, with the company initially announcing its launch August 2018 before being subject to repeated delays over compliance issues. Satisfying the Commodity Futures Trading Commission (CFTC) has proven particularly challenging. The company began testing in earnest on July 22, as Cointelegraph reported at the time.

Per the announcement, Bakkt has hosted numerous events in New York and Chicago — cities critical to the U.S. futures market. They have also sat down with regulators from the CFTC as well as the Securities and Exchange Commission (SEC).

Bakkt will be partnering with Intercontinental Exchange Futures U.S. and Intercontinental Exchange Clear U.S. to provide its futures contracts.

Institutional services and custody have been a growing market in crypto, with major U.S. exchange Coinbase announcing the addition of Xapo’s Institutions into its custodial operation last night. After the announcement, Coinbase CEO Brian Armstrong commented on the major rise in institutional clients for crypto services, saying:

“Whether institutions were going to adopt crypto or not was an open question about 12 months ago. I think it’s safe to say we now know the answer. We’re seeing $200-400M a week in new crypto deposits come in from institutional customers.”

Updated: 8-28-2019

Bakkt Clients Can Start Warehouse Deposits on Sept. 6

Bakkt clients will be able to start depositing their funds in the Bakkt Warehouse for physically delivered Bitcoin (BTC) futures starting Sept. 6.

Bakkt To Debut Futures Trading On Sept. 23

On Aug. 28, the much-anticipated crypto trading platform Bakkt announced on Twitter that its qualified custodian, Bakkt Warehouse, will begin offering storage of customer’s Bitcoin in early September.

Storage will start weeks before the scheduled launch of its platform for daily and monthly crypto futures in the United States on Sept. 23. The platform will enable physical delivery of Bitcoin with end-to-end regulated markets and custody.

The Bakkt Warehouse, a part of Bakkt Trust Company, was developed using the same cyber and physical security protections as New York Stock Exchange, which is also operated by Bakkt’s parent company Intercontinental Exchange.

Bakkt’s physically delivered futures have been the subject of much anticipation from the crypto community as the company faced multiple delays in launching the platform due to compliance issues.

Physically-Delivered Bitcoin Futures

A physically-delivered Bitcoin futures contract is a type of a contract where customers are given the actual cryptocurrency instead of a cash payment once the contract expires.

The fact that Bitcoin futures are physically settled on Bakkt, means that the party will receive delivery of a Bitcoin from Bakkt Warehouse when the contract expires.

In contrast, futures contracts at the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange are cash-settled and based off the price of Bitcoin at cryptocurrency exchanges.

Earlier today, Cointelegraph reported that CME’s Bitcoin futures hit a new lifetime record by netting an average daily volume of $515 million in May 2019.

Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23

Updated: 9-6-2019

Bakkt Warehouse Launches Deposits And Withdrawals As Planned

Bakkt Warehouse, a qualified custodian of crypto trading platform Bakkt, is now accepting customer Bitcoin (BTC) deposits and withdrawals.

First Physical Btc Futures On The Way

As the company tweeted on Sept. 6, Bakkt Warehouse has officially launched in accordance with the plans revealed on Aug. 28.

The launch of Bakkt Warehouse comes as the company prepares to roll out its platform for Bitcoin daily and monthly futures in the United States on Sept. 23. The platform will enable two types of physically-delivered Bitcoin futures with end-to-end regulated markets and custody, as previously reported.

According to a Bloomberg report, Bakkt will be the first platform to offer physically-delivered Bitcoin futures if launched successfully. In contrast to the existing cash-settled Bitcoin futures offered by the Chicago Mercantile Exchange and the Chicago Board Options Exchange, Bakkt’s physically-settled futures will enable clients to receive payment in Bitcoin once the futures contract expires.

Operating Structure

Once launched, trades will take place on the futures platform run by Bakkt’s parent company, the Intercontinental Exchange (ICE), while clearing will be settled through ICE Clear.

Meanwhile, custody will be operated by Bakkt Trust Company, which reportedly received a charter from the New York State Department of Financial Services to hold clients’ crypto funds in August 2019. In turn, Bakkt Warehouse will be moving Bitcoin from short positions to long positions at expiration, which will lead to the actual delivery of Bitcoin.

At press time, Bitcoin is nearling the $11,000 mark and is trading at $10,883, up 3.09% on the day, according to data from Coin360.

Bitcoin Deposited In Bakkt Warehouse Protected By $125M Insurance

All Bitcoin deposited at the Bakkt Warehouse is protected by a $125 million insurance policy, the company announced Sept. 9. Bakkt started accepting deposits and withdrawals Sept. 6, ahead of the proposed launch of its futures products on Sept. 23.

Everything Running Smoothly, And Now With Added Protection

It took Bakkt a lot of time and effort to gain regulatory certification for its upcoming daily and monthly physically-delivered bitcoin futures products. However, since approval was given things has been full-speed ahead.

Bakkt revealed a product launch date of Sept. 23, and announced that deposits in its freshly-certified custodial warehousing solution would begin on Sept. 6. Sure enough, this happened as planned.

News of the insurance policy covering client deposits, removes yet another concern for the institutional investors that Bakkt hopes to attract.

All Systems Prepared For Launch

If the launch is successful on Sept. 23, it will be the first bitcoin futures platform offering a physically-delivered product, which means institutional investors will be trading with actual Bitcoin.

Existing futures products from the Chicago Mercantile Exchange are cash-settled, whereas Bakkt clients will receive payment in Bitcoin once the futures contract expires.

Updated: 9-20-2019

Tom Lee: Bakkt To ‘Improve Trust With Institutions To Crypto’ In 3 Days

Bitcoin (BTC) and cryptocurrency will gain trust from the incoming launch of institutional trading platform Bakkt, a well-known analyst has said.

More praise for Bakkt

In a tweet on Sept. 19, Fundstrat Global Advisors co-founder Tom Lee joined the increasing number of Bitcoin figures bullish about Bakkt’s impact on the space.

The platform goes live on Sept. 23, and will first offer physical Bitcoin futures.

Investors, who have been able to deposit funds since Sept. 6, will take delivery of payouts exclusively in BTC.

The remaining days to launch have so far been characterized by lackluster progress for Bitcoin markets, which dropped below $10,000 once again. Now recovering, BTC prices could nonetheless shift considerably once more in the short term. Lee wrote:

“I am very positive on Bakkt and its ability to improve trust with institutions to crypto.”

Bitcoin Price Tanked Before BTC Futures Rollover Date

Responses generated a further theory about current Bitcoin price weakness, which centered on Thursday’s changeover day for CME Group’s own Bitcoin futures.

As Cointelegraph reported, futures expiration and rollover dates have historically exerted pressure on Bitcoin markets.

September also saw a quieter entry into futures by cryptocurrency exchange Binance. Launching last week, figures nonetheless revealed significant open interest of $150 million, even while the product was still trading in invite-only mode.

Open interest in CME’s futures dropped to a four-month low at the same time as Bitcoin’s price performance failed to excite.

Updated: 9-23-2019

Bakkt Trades 18 BTC In First 7 Hours As Bitcoin Price Falls Below $10K

18 Bitcoin (BTC) in volume has been traded since the launch of Bitcoin futures on the Intercontinental Exchange (ICE)’s Bakkt platform yesterday, Sept. 22.

The much-anticipated contracts — the first of their kind to be physically settled in Bitcoin — went live at 8 PM EST on Sept. 22 (00:00 UTC Sept. 23).

As of the most recently available data at the time of writing, 18 BTC has been traded, with a last recorded trading price of $10, 042.50/BTC.

Many crypto commentators have commented on the apparently slight volume levels, with one trader comparing the platform’s launch so far to patterns typically seen with earlier products:

“CME bitcoin futures traded $460 million on its first week. Current volume is around $700 million. The Van Eck fake ETF traded $0 on its first week.”

Cryptocurrency investor Ari Paul argued that physical delivery is likely to slow adoption, at least initially, contending that:

“Probably a more gradual scale-up since it’s physical. With CME futures, anyone with the right FCM [Futures Commission Merchant] could immediately trade on launch […] I’d think the incremental demand (beyond CME) would come from people who want to buy or sell physical for delivery, at least at first. Receiving could be instant (use FCM to convert), but I’m kind of thinking depositing physical will be gradual.”

Price And The Institutional Landscape

Despite long anticipation of the new contracts’ launch, the markets have yet to register any impact, with Bitcoin trading tepidly below $10,000 as of press time.

When it comes to the fiat-settled Bitcoin futures contracts on CME, their expiration and rollover dates have historically exerted pressure on Bitcoin markets — traders will no doubt be closely eyeing signs of potential impact from Bakkt’s product in the coming days.

Taking a wider view, Fundstrat analyst and well-known Bitcoin bull Tom Lee had tweeted on Sept. 20 that he was “very positive on Bakkt and its ability to improve trust with institutions to crypto.”

Bakkt CEO: 3 Reasons Why Today’s Bitcoin Product Launch Is a Big Deal

Following the launch of Bakkt’s Bitcoin (BTC) futures, the company listed three reasons why the event is an important milestone for the industry.

In a statement on Sept. 23, Bakkt CEO Kelly Loeffler emphasized that the successful launch of Bakkt Bitcoin Futures contracts is the first time when United States-regulated physically-settled Bitcoin futures became available.

Loeffler pointed out that the sole fact that such a product now exists may matter more than the precise details of the initiative.

Loeffler: Regulated Markets Accelerate The Adoption Of Digital Assets

Stressing that the launch of the service is an important step to bringing trusted infrastructure to digital assets, Bakkt CEO outlined the mission of the company as “expanding access to the global economy by building trust in and unlocking the value of digital assets.”

Loeffler further listed three reasons why the product matters. These include:

Reliable and regulated infrastructure;

Adoption of new digital currency-powered technology and financial instruments;

The rapid expansion of innovative methods for managing and transferring digital value.

“With operations, cybersecurity and controls, along with end-to-end-regulation demanded by investors and consumers, confidence in using digital currency — not just to invest, but to also use in transacting — will grow,” the CEO explained.

Loeffler continued:

“These are the concepts upon which we are building Bakkt. We’re starting with the basics: instilling trust through regulation and secure custody, and deploying products that are transparent and regulated to support their adoption.”

As reported, Bakkt’s physically delivered Bitcoin futures trading went live for trading on the Intercontinental Exchange (ICE) on Sept. 22 at 8 PM EST (00:00 UTC Sept. 23). Following the launch, the volume is starting to pick up with some traders comparing the platform’s launch to Bitcoin futures launched by the Chicago Mercantile Exchange in December 2017.

At press time, 29 bitcoins has been traded on the ICE’s Bakkt Bitcoin futures platform, with a last recorded trading price accounting for $9,992.

Updated: 9-24-2019

Bakkt: Futures Can ‘Possibly’ Predict Halving Impact On Bitcoin Price

The COO of institutional trading platform Bakkt appears unsure about its futures market predicting the impact of the 2020 Bitcoin halving event.

White: We Want To “Lead Price Discovery”

Speaking to CNN in an interview on Sept. 23, Adam White said that Bakkt’s newly-launched futures contracts should help the market value Bitcoin (BTC).

“We hope the Bakkt daily and monthly futures contracts lead price discovery,” he told the network.

Bakkt debuted its Bitcoin futures this weekend, trading 71 contracts on its first day. While its release was keenly awaited, the company is looking forward to increasing on-ramps for new investors who will in turn help in charting price trajectory.

Futures Predicting 2020 Bitcoin Price “Possible”

When asked whether the contracts should also forecast changes as a result of the block reward halving next May, however, White appeared less certain.

“Possibly,” He Said, Continuing:

“We think this is an important part of the futures contract — to help businesses discover what the fair market value of Bitcoin’s going to be through events like this.”

The block reward halving refers to the roughly four-yearly drop in the reward miners receive for validating each block of Bitcoin transactions. Currently, at 12.5 BTC, the reward will become 6.25 BTC next year.

As Cointelegraph reported, anticipation has run high for months about the potential for the halving to dramatically increase the price of BTC/USD. After the last halving in July 2016, a bull market took just a matter of months to begin, culminating in Bitcoin’s current all-time high of $20,000.

Updated: 9-25-2019

Bakkt’s Slow Start Doesn’t Mean Bitcoin Futures Have Flopped

Galen Moore is a member of the CoinDesk Research team. The opinions expressed in this article are the author’s own.

The following article originally appeared in Institutional Crypto by CoinDesk, a weekly newsletter focused on institutional investment in crypto assets. Sign up for free here.

It’s a lively time for bitcoin derivatives – or at least for those writing about them. For those trading them, it may be business as usual.

The Chicago Mercantile Exchange (CME) announced Friday it is preparing to offer options trades on its bitcoin futures contract. It’s a surprising move, because options volume to date rounds to zero, as a percentage of reported volume in futures and swaps.

Still, nobody in crypto has had an options counterparty as reliable as CME before.

The announcement gives CME a way to offer options without having to build much anew. Why should it? CME’s bitcoin futures market represents a tiny percentage of its overall volume.

Nevertheless, CME may be feeling a shade of anxiety about its leadership position in regulated crypto derivatives markets, with Bakkt rolling out a regulated bitcoin futures contract this week that, unlike the Chicago exchange’s, is settled in actual bitcoin rather than cash.

After all, other people in Chicago who trade a lot of bitcoin seem to think physically settled futures are important. Maybe CME’s announcement lets it steal a little of Bakkt’s thunder.

Speaking of Bakkt, its October 2019 monthly and daily contracts launched Monday. First-day volume in the monthly contract was just 71 BTC. That’s rather anemic, compared with the start of the CME product in December 2017, which isn’t necessarily apples to apples, given CME futures launched near bitcoin’s all-time highs.

The Bakkt one-day futures contract is the more intriguing product of the two. It could be anything from a CFTC-regulated fiat onramp to a duplicate of the popular BitMEX perpetual swap, if traders use its T+2 settlement to build a forward curve and continue to roll the contracts.

So far, traders aren’t. Volume in Bakkt’s one-day futures was all of 2 BTC on Monday.

Persistent Myth

The first regulated bitcoin futures came in December 2017, just before bitcoin’s price began a long slide down 83 percent from its all-time high. With volumes under $100 million, however, it would be hard to argue that futures trading brought sanity to the markets.

Instead, it’s more likely that slow demand for the new product punctured the myth of institutional demand for bitcoin exposure, pent up behind compliance departments’ insistence on a regulated product.

That myth is alive and well today among retail-focused crypto “analysts,” as a search for “bakkt volume fail” will show you. If you were around in 2017, you didn’t need time travel to know to short bitcoin on Monday: you had seen this movie before. Even the least-sober among us in 2019 recognize the obvious, that institutional investors’ interest in bitcoin is developing slowly, when it is developing at all.

For institutional investors, derivatives offer readily understood solutions to operational obstacles related to custody, investability and risk. (Regulated bitcoin futures are structured the same as futures in, say, frozen concentrated orange juice.)

Still, today the lion’s share of the volume is on unregulated exchanges that don’t operate as clearinghouses and offer leverage up to 100X.

These products could not be interesting to any regulated asset manager, but they are interesting.

Despite persistent doubts as to the reliability of their reported volumes (especially with OKEx and Huobi), bitcoin traders on the largest over-the-counter (OTC) trading desks know there is liquidity in these markets. Their hedging strategies rely on that liquidity.

Other than that, volume on these leveraged trades is probably all crypto hedge funds and, as one trader put it to me, “degenerate gamblers,” trading on their own accounts.

Bitcoin futures are structured much like orange juice concentrate futures, but everyone knows that orange juice concentrate, when mixed with more volatile things can become rather flammable. There are important qualities that set bitcoin apart from other asset categories and these qualities of the underlying are taken into account by institutional investors evaluating bitcoin derivatives.

For example, there may not be natural hedges in a bitcoin futures market. If you don’t believe that, compare global operating expenditure for gold miners to those of bitcoin miners. This isn’t Kansas.

Road Ahead

Derivatives may be gold bricks paving the road to institutional investment in bitcoin, but it’s a long way to the Emerald City. Right now, the CME futures volume is as good a guide as any to investors’ progress along that road.

You may have seen charts showing the rise in CME volumes in May. That rise also coincided with a twofold increase in the price of bitcoin. Measured in bitcoin terms, CME futures volume surged in July and is now back trading at a modest growth rate over Q1 levels.

Meanwhile, no fewer than four other startups are readying new derivatives offerings for the U.S. institutional and other regulated markets. All are focused on physical settlement.

It remains to be seen whether physical delivery will be a feature that compels market participation. It’s not always very important in derivatives built on other asset categories.

One thing appears certain: no new financial instrument is likely to “unlock” institutional demand, as most institutions are only beginning to answer the question of why they would invest in bitcoin in the first place.

First Week of Bakkt: Slow Start Unlikely To Dampen Long-Term Prospects

After more than a year spent ensuring full compliance with the United States authorities, Bakkt, the first federally regulated platform for Bitcoin (BTC) futures trading, launched on September 23.

Conceived by the global trading giant Intercontinental Exchange (ICE) and counting a solid portfolio of investors from Microsoft’s venture fund M12 to Starbucks as its backers, Bakkt offers institutional traders something brand new. The platform’s value proposition is physically-settled BTC futures contracts, combined with a sound custodial service approved by the Commodity Futures Trading Commission (CFTC).

Assuming that it is digital assets’ volatility and lack of regulatory safeguards that deters otherwise highly interested institutional investors from going big on BTC, Bakkt’s debut is a major milestone on the timeline of crypto adoption – and many in the space anticipated its debut with great excitement. However, as the first week of operation is coming to a close, the trading volumes on the platform remain meager.

Worse luck, Bakkt’s launch coincided with an immense slump in Bitcoin’s market price, leading some analysts to suspect a causal connection between the two. Does the underwhelming kickoff signify an early end to Bakkt’s aspirations of becoming a gateway for widespread, institutional adoption of crypto?

Bitcoin Meets Regulation In Bakkt Futures

The Intercontinental Exchange is a U.S. enterprise headquartered in Atlanta that operates a dozen major regulated exchanges and marketplaces around the world, including the New York Stock Exchange (NYSE) and ICE Futures Europe. In August 2018, ICE announced its plans to create a Bitcoin futures marketplace fully compliant with CFTC regulations, looking to launch it at the end of that year.

Unlike the Chicago Mercantile Exchange (CME) Bitcoin futures contracts that have been on the market since December 2017, the idea behind Bakkt is to create an instrument that would settle in actual Bitcoin upon liquidation. Whereas the value of a CME contract is delivered in cash equivalent and matched to the spot-market-based BTC price index at the time of expiration, owners of Bakkt futures get “physical” Bitcoin sent to their custodial account.

This modification could be seen as a step toward enhancing investors’ confidence in the new asset class. Presumably, as traders come to feel more serious about Bitcoin and its potential, they would prefer exposure to the actual coin rather than engaging with an instrument whose connection to the underlying asset is purely nominal.

Winning this edge over the competition, though, invoked the need for an additional operational layer: reliable custody. It would be too long of a shot to expect that conservative institutional investors would line up to buy a nebulous asset that they didn’t know how to handle safely.

This approach was bound to create additional red tape for its proponents, as it required going the extra mile to clear regulators’ rigorous requirements for entities that seek to operate as crypto custodians. Negotiations with the CFTC centered on the custodial issue stalled and dragged for several more months than ICE had initially planned.

It wasn’t until June 2019 that Bakkt secured the CFTC’s approval. Finally, on August 13, Bakkt Trust Co., the platform’s clearinghouse, obtained a charter from the New York State Department of Financial Services to operate as a custodian, marking the end of the platform’s regulatory quest.

On the day of its launch, Bakkt offered traders two types of derivatives: daily contracts, whose buyers receive their Bitcoin at the end of the same day — almost as if trading on a spot exchange — and monthly contracts, which ICE management hopes to be instrumental in longer-term BTC price discovery.

Unimpressive Debut

Amid overall high expectations further fueled by crypto Twitter and media hype, Bakkt failed to impress on the first day of trading, with a paltry 71 contracts sold and the volume picking up slowly in the following days. To make matters worse, the day after launch, Bitcoin price took its largest intraday hit since January, losing some 13% within Tuesday.

Updated: 10-1-2019

Trading Volume For Bakkt’s Bitcoin Futures Hit Just $5 Million In First Week

The Intercontinental Exchange’s highly anticipated bitcoin futures contract mustered just $5 million of total trading – and its daily product traded fewer than five contracts across its first week.

According to the exchange’s Bakkt division, set up last year by the Atlanta-based company as a new marketplace for digital assets, some 623 monthly bitcoin futures contracts changed hands last week. Both the monthly and daily contracts debuted on Sept. 23.

Each of Bakkt’s futures contracts represents one bitcoin, so the total trading volume works out to just over $5 million, based on the current price of $8,322.

By comparison, some 4,099 bitcoin futures contracts traded on Friday alone at rival Chicago-based exchange operator CME, whose market opened in 2017. And the CME’s futures contracts represent five bitcoins, for a trading volume of $165 million on the single day.

Bakkt’s daily futures contracts fared even more poorly, with fewer than five contracts trading throughout the first week.

Executives at Bakkt had touted the new contract as a milestone for the cryptocurrency industry, catering to big institutional investors that have thus far been slow to buy bitcoin and other digital assets.

According to the exchange, the new offering should appeal to institutional investors like hedge funds and other money managers because bitcoin must be delivered to fulfill the contract’s terms when the maturity date arrives. That feature has been touted as a key advantage for asset owners who want to hedge their portfolios, in contrast with the CME’s contract, which is settled via cash payments but has become popular with individual investors.

Dave Weisberger, CEO of CoinRoutes, a New York-based company that helps investors route cryptocurrency trades to various exchanges, says that bitcoin investors currently in the market already have plenty of places to buy and sell, but it’s too early to write off Bakkt’s new push, he said in a phone interview.

“It takes time for people to move from one place to another, unless there’s a cost reason or a liquidity reason,” Weisberger, a veteran of Wall Street firms Citigroup and Morgan Stanley, said in a telephone interview, adding:

“These Things Tend To Develop Slowly.”

Damon Leavell, a spokesman for Intercontinental Exchange, said in an email that there was “strong industry participation” during the first week of the new bitcoin contract.

The contract maturing in October, he said, had the “tightest bid-offer spreads in the market, which was an exciting achievement.”

Wall Street analysts look at the so-called bid-ask spread – the gap between what buyers are offering to pay and what sellers are offering to accept – as a gauge of how efficiently a market is operating.

Updated: 10-3-2019

Asset Manager Stone Ridge Files SEC Prospectus for Bitcoin Futures Fund

Another bitcoin futures product is booting up, according to a Stone Ridge Asset Management filing with the U.S. Securities and Exchange Commission.

The company filed a prospectus for a cash-settled bitcoin futures fund – dubbed the NYDIG Bitcoin Strategy Fund – with the regulator on Wednesday.

Based in New York City, Stone Ridge has some $15 billion in assets under management, serving clientele in both the United States and China. Founded in 2012, the firm offers portfolio management and advisory services.

One hundred thousand futures shares will be offered at $10 each, and have no minimum purchases. They will be limited to eligible investors as determined by Stone Ridge, the filing states.

The fund will not invest in bitcoin or other digital assets directly, but uses bitcoin as the underlying reference asset. To support the fund, Stone Ridge will purchase bitcoin futures to match the fund’s total value one-to-one along with large amounts of cash, government securities, and business securities to maintain liquidity, provide collateral as well as leverage.

The Prospectus Urges Caution While Calling Bitcoin A Speculative Asset:

“Bitcoin was developed within the last decade and, as a result, there is little data on its long-term investment potential.”

As a prospectus, the details outlined by Stone Ridge are liable to change.

Bitcoin-based financial products continue to hit the market, with physically-settled bitcoin futures platform Bakkt launched last week. While settling just over $5 million in its first week, the launch signaled the end of a regulatory gauntlet spanning more than a year.

Stone Ridge did not return questions for comment by press time.

Galaxy Digital, XBTO Just Made the First Block Trade of Bakkt Bitcoin Futures

Cryptocurrency investment fund Galaxy Digital and over-the-counter (OTC) trading firm XBTO have conducted the first-ever block trade of Bakkt’s bitcoin futures contract.

Intercontinental Exchange (ICE), Bakkt’s parent company, announced the trade Friday but did not disclose its size. A block trade is a large transaction that takes place off the open market in order to avoid moving the price too much.

The trade, which took place Tuesday, comes on the heels of a disappointing launch last week for the much-hyped Bakkt, whose on-exchange volume in its first five trading days totaled just over $5 million.

Two years in the making, Bakkt is the first live market in the U.S. for bitcoin futures that are physically delivered, meaning the buyer receives the underlying commodity.

Despite Bakkt’s inauspicious debut, Galaxy Digital and XBTO expressed confidence in the platform.

“As the digital asset class continues to mature, we view the launch of Bakkt as a foundational piece of market infrastructure,” Galaxy Digital said in ICE’s press release.

XBTO said in the release that it bought the first bitcoin daily futures last week, in addition to participating in the block trade.

Bakkt’s Bitcoin Futures Trading Volume Soars 796% In One Day

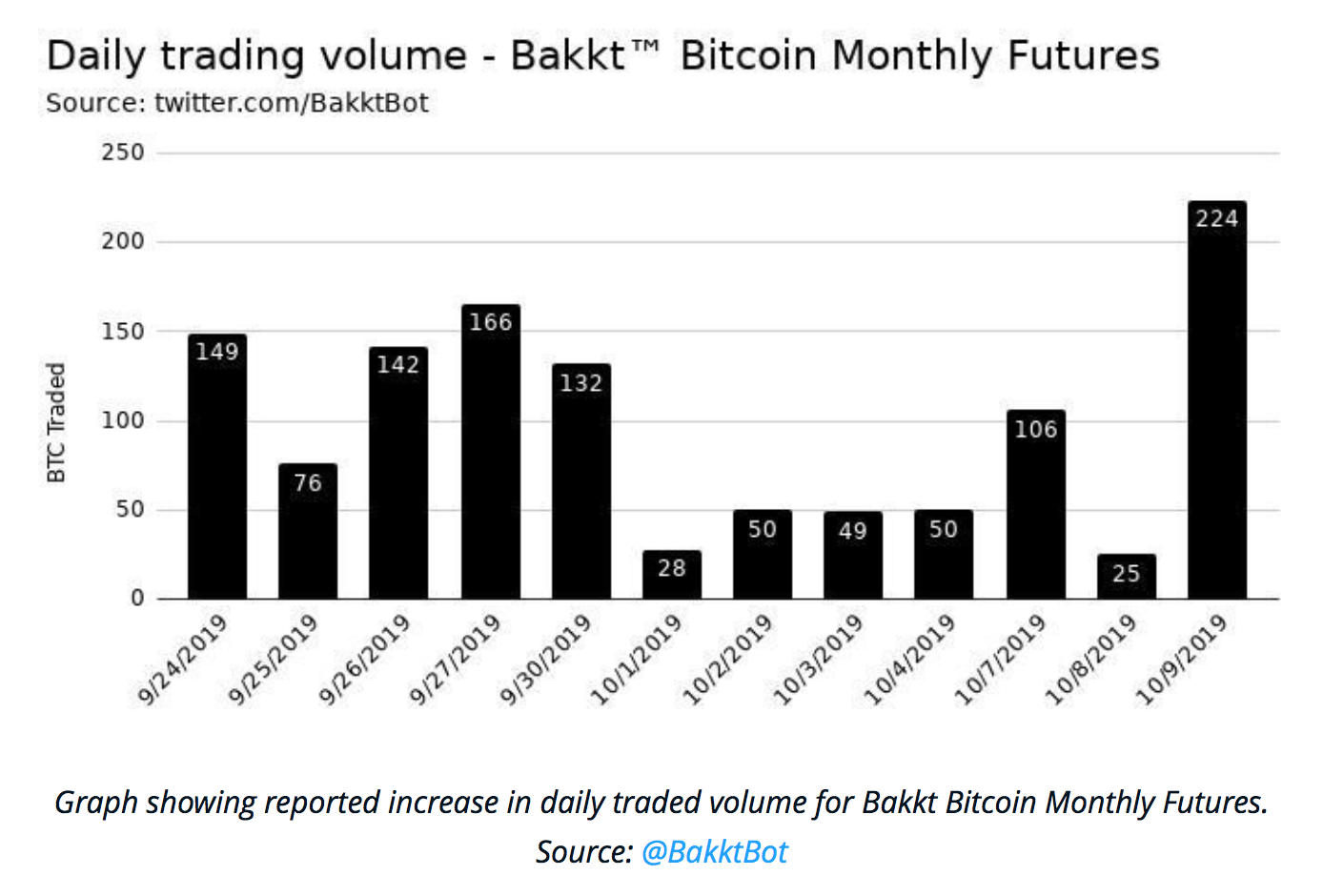

The trading volume of Bitcoin (BTC) futures on the Intercontinental Exchange’s (ICE) Bakkt platform reportedly soared to 224 contracts on Oct. 9 — 796% higher than the previous day.

According to the tracking data compiled by Twitter account Bakkt Volume Bot (@BakktBot) — which is not affiliated with Bakkt but rather with Dutch journalist and crypto author Gert-Jan Lasterie — the 224 contracts represent an apparent all-time high for the platform.

A Turnaround After Tepid Launch?

The bot’s data indicates that daily traded volumes of Bakkt’s Bitcoin monthly futures contracts soared from just 25 on Oct. 8 to 224 on Oct. 9.

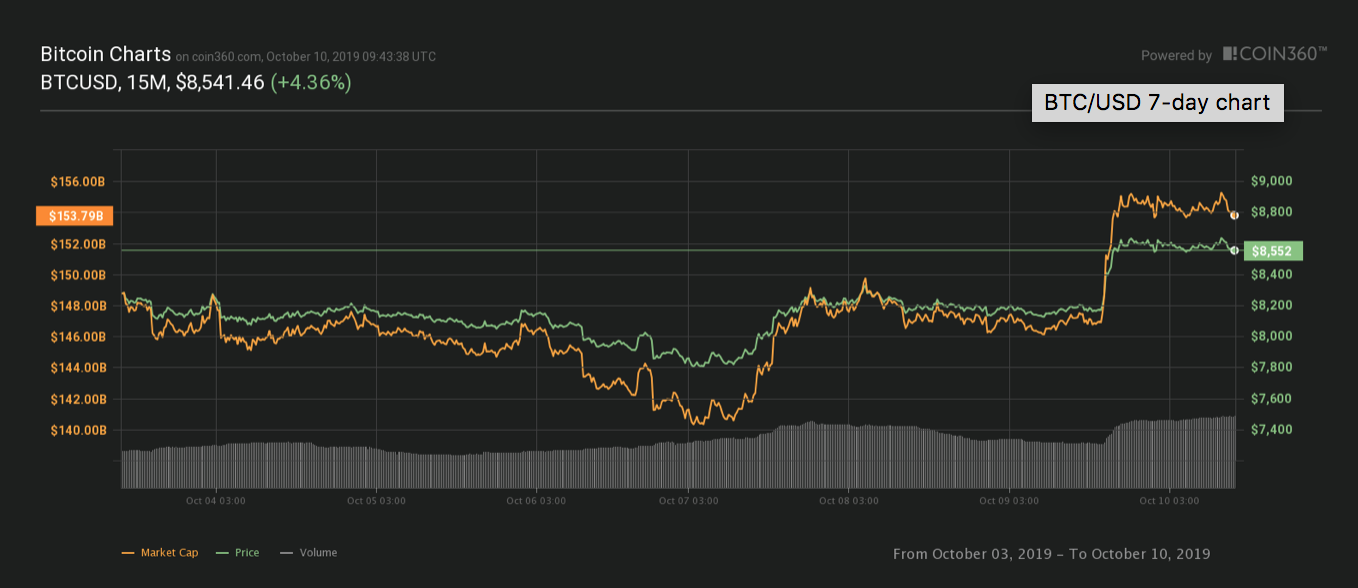

This uptick in volume was succeeded by a solid increase in Bitcoin’s price on Oct. 9 — from roughly $8,200 to $8,600 — as Coin360 data indicates.

The First Physically Settled BTC Futures

As Cointelegraph previously reported, Bakkt’s much-anticipated contracts — the first of their kind to be physically settled in Bitcoin — went live on Sept. 22.

The platform’s underwhelming volumes in its first week were immediately compared to the fiat-settled BTC futures on CME, which first launched back in December 2017.

In early October, Binance Research, the exchange’s analytics arm, went so far as to identify the sluggish volumes in Bakkt’s early days as a contributing factor to BTC/USD plummeting from near $10,000 to under $8,000.

At publishing time, ICE’s data indicates that 59 contracts were traded on the day so far, with the last one trading at $8,485.

Updated: 10-15-2019

CME Says Bitcoin Futures Gaining Interest From Big Investors

CME Group, the Chicago-based exchange operator, said its bitcoin futures contracts grew in popularity last quarter, with the number of open contracts up 61 percent from a year earlier because of growing demand from institutional investors.

Open interest, or the number of outstanding positions, rose to 4,629 contracts, up from 2,873 in the third quarter of 2018, CME said Monday in a statement. And despite the quarter’s 25 percent drop in bitcoin price, according to CoinDesk, the open interest in the CME’s contracts was down just 1 percent from second-quarter levels.

The average daily volume of contracts traded during the quarter was 5,534, up 10 percent from the year-earlier period. It was the equivalent of 27,670 bitcoin, or $289 million, according to the exchange.

“Institutional flow remained strong, with 454 new accounts added, compared with 231 added in the third quarter of 2018,” CME said. Entities holding more than 25 bitcoin, used as a proxy for large investors, rose to 47, from 45 in the second quarter and 34 in the third quarter of 2018.

CME debuted its bitcoin futures in 2017 and outlasted a rival offering from another exchange company, Cboe Global Markets, which aborted its own contract earlier this year.

But the CME faces new competition from Bakkt, a startup sponsored by Atlanta-based Intercontinental Exchange, which debuted a new bitcoin-futures contract in September, aiming to attract institutional investors who might want to make bets on the cryptocurrency.

Some 50 percent of the CME’s bitcoin-futures trading volume during the third quarter was outside the U.S., with 26 percent coming from the Asia Pacific region and 21 percent from Europe and the Middle East, according to the exchange.

Updated: 10-22-2019

Bitcoin Futures: Institutional Long Positions Value Doubled In October

One class of investors has more than doubled the value of the long positions it holds in Bitcoin (BTC) futures contracts this month.

Institutions Settle In For The Long Term

According to fresh data from analyst Skew Markets on Oct. 22, the value of institutional investors’ long positions went from below 500 BTC ($4.11 million) on Oct. 1 to over 1,000 BTC ($8.23 million) on Oct. 16.

The gains reverse a decline in institutional longs from September. The launch of Bitcoin futures from Bakkt coincided with open interest falling from around 1,300 BTC.

“For reference, institutions include pension funds, endowments, insurance companies, mutual funds & portfolio/investment managers whose clients are predominantly institutional,” Skew clarified.

What Lack Of Interest?

Bitcoin futures were thought to have taken a longer-term break from being top of the agenda for institutional investors in the face of last month’s Bitcoin price downturn.

Despite assumptions on sentiment, industry players have more recently begun to dispel the myth that interest is waning.

As Cointelegraph reported, Grayscale, the world’s largest crypto-focused asset manager, went on record to confirm that clients had steadily been pouring in funds throughout 2019.

“We see institutional investors invest with us all the time and that’s been the case for a long time now,” the firm’s director of sales and business development Rayhaneh Sharif-Askary added in an interview earlier this month.

Nonetheless, other sources have quizzed the impact of institutions on Bitcoin. This week, CoinShares chief strategy officer, Meltdem Demirors, suggested custody practices, in particular, posed questions.

Updated: 10-23-2019

Bakkt Hits New All-Time High, With Over 450 Bitcoin Futures Contracts Traded

Bitcoin (BTC) futures volumes on digital asset platform Bakkt have hit a new all-time high, with 452 BTC futures contracts traded at press time.

Per historical data from Intercontinental Exchange (ICE) — the operator of Bakkt — today the platform has traded 441 Bitcoin futures contracts for November 2019, with the last recorded trading price settling at $7,400 per Bitcoin. 11 futures contracts for December have been sold, with the last recorded trading price at $7,407.

Twitter account Bakkt Volume Bot, which carries out live tracking on the platform, indicated that the amount of BTC futures contracts is forecasted to reach 1,089 BTC by the end of the day.

EToro senior analyst Mati Greenspan also noted the contract volume surge earlier in the day. “Bakkt trading volume hits a record high. 334 BTC and counting,” Greenspan tweeted.

ICE Conducts Block Trade Of Bakkt Bitcoin Futures Contract

Earlier in October, ICE executed the first block trade of Bakkt Bitcoin futures contracts. ICE specified that the trade was executed between digital assets merchant bank Galaxy Digital and crypto investment firm XBTO, and cleared by agricultural commodities merchant ED&F Man. XBTO commented on the deal:

“Last week, we bought the first Bakkt Bitcoin Daily Futures contract and took the first physical delivery of a digital asset under existing commodity futures laws and regulations. This week, we executed the first block trade. We’re pleased to report that the launch was successful and can accommodate large trades.”

Updated: 10-24-2019

Bakkt Announces First Regulated Options Contract For Bitcoin

Bakkt announced on Oct. 24 that it will be launching the first regulated options contract for Bitcoin (BTC) futures on Dec. 9.

Bakkt Options Contract Is Certified With CFTC

According to the Bitcoin futures exchange, the key features of the Bakkt Bitcoin Options contract include capital efficiency, cash or physical settlement, European-style options, low fees, as well as instant messaging, block trades and options analytics.

A European-style option is an option contract that limits the opportunity for early execution and reduces operational burdens, the firm noted.

The new options product is based on customer feedback, explains CEO Kelly Loeffler and is designed to hedge or gain bitcoin exposure.

Bakkt adds:

“ICE Futures U.S. has self-certified the contract with the CFTC and we’re excited to leverage the benchmark futures prices and institutional-grade custody to meet the needs for a regulated options contract.”

$1.25 Fee Per Option Contract Starting In 2020

As Bakkt CEO Kelly Loeffler noted in the announcement, the Bakkt Bitcoin Options contract will be based on Bakkt Monthly Bitcoin Futures contract, a major type of Bitcoin futures contract launched alongside Bakkt Daily Bitcoin Futures on Sept. 22.

Specifically, Bakkt will be charging $1.25 per options contract starting in January 2020 after debuting the options with the fee waiver in December, Loeffler said.

The news comes just a day after Bitcoin futures volumes on Bakkt hit a new all-time high of 452 BTC futures contracts. Also on Oct. 23, Bitcoin price abruptly crashed $500 in just five minutes after trading at around the $8,000 threshold over the past week.

In early October, the Intercontinental Exchange (ICE), the governing body behind the New York Stock Exchange, executed the first block trade of Bakkt Bitcoin futures contracts.

In the recent announcement, Loeffler noted that the Bakkt Bitcoin Options contract will feature block trades by using ICE Block.

Updated: 10-31-2019

Volume of Crypto Futures Trades Is Catching Up To Spot Trading

Crypto futures trading volume now reportedly amounts to nearly 50% of the value of spot trading on crypto markets, according to Bloomberg.

13 Exchanges Analyzed

Citing volume data from 13 major global crypto exchanges, Bloomberg reported on a massive growth of cryptocurrency futures markets Oct. 31.

The analyzed exchanges include institutional digital asset platform Bakkt, the Chicago Mercantile Exchange Group (CME), Binance, Bitfinex, the Huobi Derivative Market (DM), Kraken, FTX, Bitz, Deribit, CoinFlex, Bybit, OKEx and BitMEX.

First Ever Bitcoin Futures Launched In Late 2017

Spot trading is simply buying or selling a commodity or, in this case, a crypto asset at the moment of the trade. Prior to the launch of the first Bitcoin (BTC) futures platform back in 2017, spot trading was the principal option available for crypto trades. The Chicago Board Options Exchange (CBOE) launched the first trading of BTC-based futures contracts on Dec. 11, 2017, just a week before the launch of a similar product by the Chicago Mercantile Exchange (CME).

The Bloomberg report follows a new Bitcoin futures volumes record on major digital asset platform Bakkt, which launched its service on Sept. 22. On Oct. 26, Bakkt traded 1,183 Bitcoin futures contracts worth of $11 million after hitting a previous all time record of 441 Bitcoin futures on Oct. 23.

On Oct. 29, OKEx, the world’s 5th-largest crypto exchange by trading volume, announced plans to start trading Tether (USDT) futures.

Updated: 11-1-2019

Bitcoin Needs ‘Real Use Cases’ to Become Digital Gold, Says ICE Chief

Bitcoin might become “digital gold,” but first it needs to be used more in everyday business, Intercontinental Exchange’s chief executive said.

During a quarterly earnings call Thursday, ICE head Jeffrey Sprecher said that he sees use in transactions as the prerequisite to bitcoin becoming a long-term store of value. The company’s Bakkt subsidiary, which runs a bitcoin futures market, announced this week that it is developing an app for consumers to buy goods from merchants, beginning with Starbucks.

A number of Bakkt’s employees already see bitcoin as digital gold, Sprecher said. (So, it should be noted, does much of the current bitcoin community.) To him, that’s premature.

“Because I’m old I think of [how] gold became a store of value because at one point it was a currency,” he said. “We had gold coins, it was in circulation, and over time because of the nature of its ability to spend, … it became a store of value and today, you know, in a crisis we all accept gold as a form of payment.”

Bitcoin may follow a similar trajectory, Sprecher said, citing its development and mining capabilities. He added:

“We don’t think that that that whole space will be relevant and and grow unless there are real use cases and we do … think that a use case is going to be the digital transfer of value through payments.”

But unlike bitcoin’s critics, Sprecher sees this as plausible. “It may well be that, rather than convert bitcoin to fiat currency and then use [that] fiat currency to buy goods and services, merchants and users will accept bitcoin directly,” he said.

Parties who do transact directly with bitcoin would avoid the foreign exchange costs associated with converting back and forth between fiat. Bakkt is looking to serve this market by building a digital platform to facilitate such transactions.

ICE (which also owns the New York Stock Exchange) has about 50 individuals working on payments infrastructure for Bakkt. The company is targeting an early 2020 launch date for its consumer app.

Options

Sprecher also detailed the impetus for Bakkt to launch bitcoin options, which the company plans to do in December.

Financial institutions are still wary of entering the space, with many waiting to see how regulators approach crypto first, he said. Bakkt is hoping to tackle this issue by providing a more regulated environment in the bitcoin ecosystem.

“You know, retail global retail customers have been very comfortable for whatever reason being early adopters on unregulated platforms that call themselves exchanges, but really have no particular regulatory oversight,” he explained. “We think there’s an opportunity as what we’re building out with Bakkt to bring that whole thing into a more transparent regulatory footprint and lend our expertise.”

Bakkt went live with its flagship bitcoin futures last month after more than a year of working on regulatory approvals and building out its platform. While the company initially saw low volume for its bitcoin futures contracts, trading has recently picked up.

“It just so happens that the way we’ve launched our bitcoin futures contract is that we are a source of price discovery because we’re physically delivered,” Sprecher said, meaning the contracts are paid in bitcoin rather than dollars.

“We’re not dependent on the prices that come out of these unregulated cash markets,” he said, referring to the spot exchanges that dominate the market. “We develop our own settlement price and so that lends itself very nicely to an options market where people that trade options and hedge with the underlying can have perfect hedging in one venue that they know is transparent.

“So that was the pressure to get the options out quickly,” he said.

Updated: 11-13-2019

CME Group Announces Launch Date of Options on Bitcoin Futures Product

The Chicago Mercantile Exchange (CME) Group has announced the date it expects to launch options on Bitcoin (BTC) futures in a statement on Nov. 12.

“In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME Group will launch options on Bitcoin futures (BTC) on January 13, 2020,” the company revealed in the announcement. The CME Group said that the upcoming product is still pending regulatory approval.

Contract Specifications

CME Group specified that one Bitcoin futures contract will represent 5 BTC quoted in U.S. dollars, with a block minimum of five contracts. The announcement reads:

“Option exercise results in a position in the underlying cash-settled futures contract. In-the-money options are automatically exercised into expiring cash-settled futures, which settle to the CME CF Bitcoin Reference Rate (BRR) at 4:00 p.m. London time on the last Friday of the contract month.”

CME Group’s Intentions And Expectations On Btc Futures Options

In September, CME Group revealed plans to roll out options on BTC futures by Q1 2020. At the time, Tim McCourt — CME Group global head of equity index and alternative investment products — said that the new products are intended to help institutions and professional traders manage spot market BTC exposure, and enable them to hedge BTC futures positions in a regulated exchange environment.

In October, the company said it expected to see high demand in Asia for its forthcoming BTC options product. McCourt noted that options would likely enable Bitcoin miners to more accurately hedge the costs of their production.

At the same time, McCourt also stated that CME Group has no current plans to launch physically-settled Bitcoin contracts.

Updated: 11-14-2019

Crypto Exchange OKEx Launches Bitcoin Futures Margined With Tether

Cryptocurrency exchange OKEx has launched Bitcoin (BTC) futures contracts that are margined with the Tether (USDT) stablecoin. OKEx announced the new offering in a press release on Nov. 14.

OKEx first announced its intention to launch USDT-settled futures trading with up to 100x leverage at the end of October. Now, after conducting a simulation that began on Nov. 5, the exchange listed the BTC/USDT offering on its trading platform.

The exchange previously said that offering a stablecoin-based derivatives contract will make it simpler and more efficient for traders to navigate the market and calculate risk. OKEx CEO Jay Hao commented:

“The simulation of our USDT Futures Contract was very successful, and we received positive feedback from traders in the OKEx community.”

The derivative in question is quoted and settled in USDT and each BTC/USDT contract has a face value of 0.0001 BTC and has an available value range of 0.01 to 100 times. The platform’s users can take both long and short positions on the contract.

More assets to come

In the future, OKEx will also launch USDT-margined futures for other crypto assets. More precisely, the firm announced plans to launch such contracts for EOS, Ether (ETH), Litecoin (LTC), Bitcoin Cash (BCH), XRP, Ethereum Classic (ETC), Tron (TRX), and Bitcoin SV (BSV).

As Cointelegraph reported yesterday, Bakkt announced that its Bitcoin futures trading on the Intercontinental Exchange will expand to include a cash-settled option.

Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23, Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23,Bakkt Announces September 23

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.