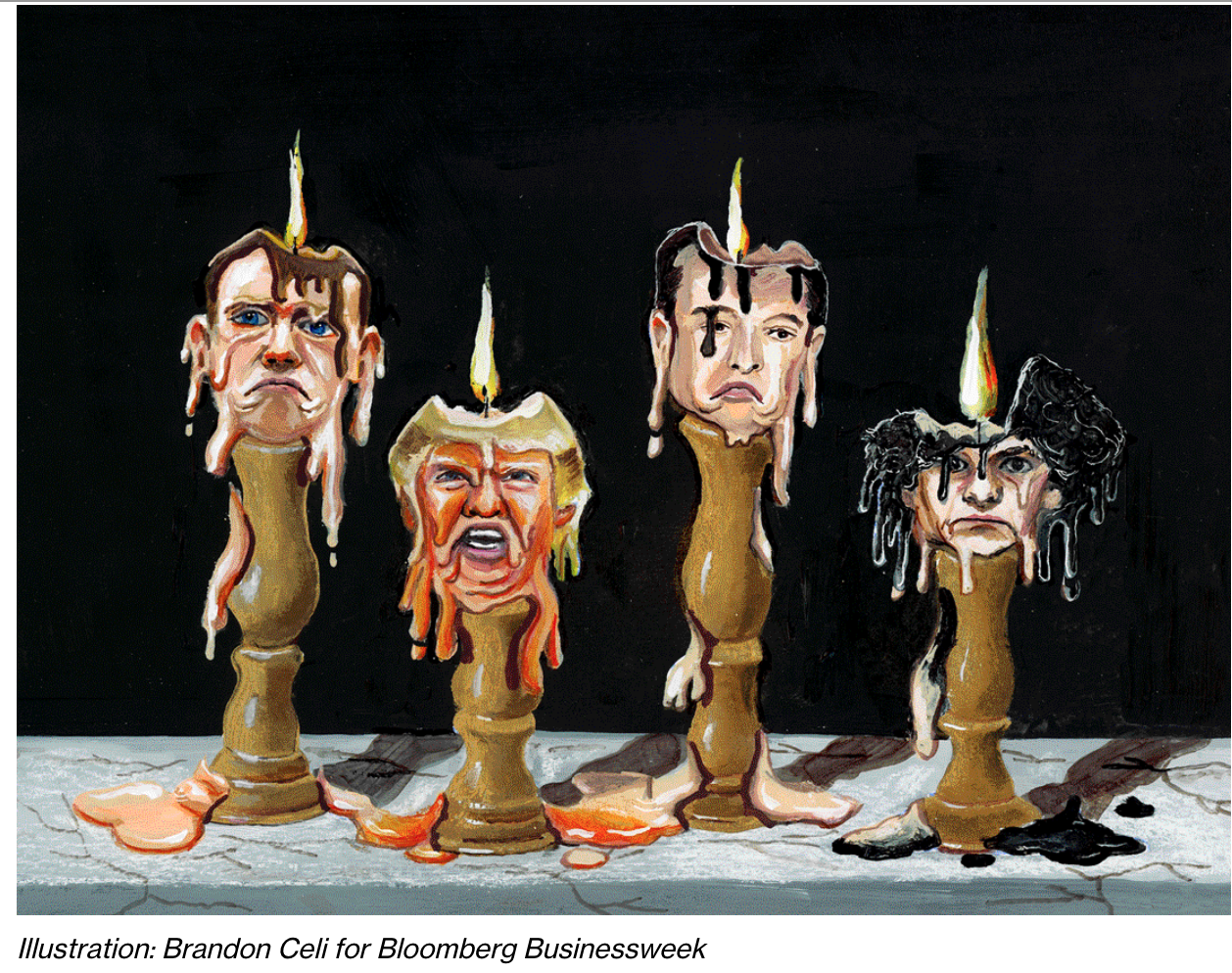

There Has Never Been A Better Time For Billionaire Schadenfreude (Malicious Enjoyment Derived From Observing Someone Else’s Misfortune)

Welcome to the Great Comeuppance for Elon Musk, Mark Zuckerberg and other titans. Enjoy it while you can. There Has Never Been A Better Time For Billionaire Schadenfreude (Malicious Enjoyment Derived From Observing Someone Else’s Misfortune)

https://www.youtube.com/watch?v=3hGuT0aypu8&list=PLU1KxUVqGmaPaz2TjqSiqico7QAGLuDG-

Musk is, somewhat infamously, frequently off-target when it comes to predictions, as anyone waiting for his years-late electric pickup truck or a ride in one of his nonexistent 600-miles-per-hour trains knows well.

He’s also missed on topics such as epidemiology (in March 2020, Musk declared that Covid cases were heading “close to zero”), personal finance (he embraced cryptocurrencies in 2021, just before they crashed) and politics (he predicted a “massive red wave” for the midterm elections ahead of an historic overperformance by Democrats).

But Musk’s forecast for the economy turned out to be pretty solid. While there’s no recession, an economic slowdown has indeed exposed a number of entrepreneurs who, for the past decade, took advantage of low interest rates, bubbles in tech and finance and a self-reinforcing media environment to convince themselves of their own genius and then to profit from their hucksterism.

Now tech stocks have nose-dived, the metaverse is floundering, crypto fortunes are crumbling, and criminal investigations are pending. Call it the Great Comeuppance—a sudden and historic opportunity for billionaire schadenfreude.

The period began in late 2021 and has been defined by persistent inflation, rising interest rates and a return to certain pre-Covid norms—among them, the belief that made-up currencies might be worthless and that there’s more to life than interacting as a digital floating torso.

The problem with Musk’s prediction was his failure to realize that these economic shifts had the potential to make him look like a fool, too.

Musk had, in case you weren’t paying attention, a very bad 2022. Over the course of the year, his net worth fell by 49%, or $133 billion—the biggest loss ever on the Bloomberg Billionaires Index.

At exactly the time that irrational gambling on the stonk market was falling out of fashion and demand for Tesla Inc.’s electric vehicles was fading, he loaded up on debt and doubled down on his own status as the meme-stock master of ceremonies by agreeing to a hastily conceived buyout of Twitter for an inflated price.

It’s been basically downhill ever since, with Twitter appearing to teeter on the verge of collapse and Musk warning of its possible bankruptcy. Tesla’s stock price is down 70% over the past 12 months.

Musk wasn’t the only overreaching titan taken down a few pegs. Mark Zuckerberg saw his net worth drop by 64%, or $80 billion, last year—itself an historic figure that’s substantially more than what had been regarded as the previous record wealth loss, Masayoshi Son’s $70 billion drop in 2000. (Son had a pretty terrible year, too, if not a record-setting one.)

Zuckerberg’s fall, like Musk’s, involved a combination of macroeconomic bad luck and an almost inexplicable flourish of self-destructive hubris. Seeing Facebook’s growth prospects diminished, Zuckerberg fixated on a novel, money-losing communication medium that for some reason involves virtual conference rooms full of cartoon avatars without legs.

Jeff Bezos experienced a similarly epic net worth drop of 43%, or $85 billion, as Amazon’s wild expansion into all manner of businesses—voice assistants, delivery robots, self-driving cars, urgent care, retail stores, etc.— gave way to mass layoffs.

And then there’s crypto, perhaps the flimflammiest investment category in an age of extreme flimflammery. Changpeng Zhao, chief executive officer of Binance, saw his net worth decline by 87%, or $83 billion, even though he’s one of the industry’s grandees and Binance is the largest crypto exchange in the world. That doesn’t mean Zhao couldn’t experience an even greater comeuppance.

The US Department of Justice has been investigating Binance for possible money laundering, and the accounting firm Zhao hired to verify his company’s assets recently suspended its crypto-related work and pulled its report on Binance from its website. Zhao has denied the money laundering allegation and said his exchange is fine. The problem, he’s said, is the accountants.

Other digital currency promoters have fared even worse. These include Alex Mashinsky (founder of Celsius, the bankrupt crypto lender), Do Kwon (creator of the failed cryptocurrency Luna who’s now an international fugitive) and Sam Bankman-Fried (recently extradited to the US on fraud charges related to the collapse of his cryptocurrency exchange, FTX). Kwon has denied wrongdoing. Bankman-Fried pleaded not guilty on Tuesday.

Even as tech’s elite loses money by the billions, the Great Comeuppance has been much kinder to the average person than 2008’s Great Recession. After the financial crisis, unemployment soared, the stock market tanked and millions of Americans lost their homes to foreclosure.

In 2022, Americans had to cope with rising prices, tech workers were laid off in large numbers and the price of a Dogecoin fell. But most of the rest of the economy has been mostly fine, with gross domestic product continuing to grow and unemployment near historic lows.

Meanwhile, the current federal funds rate, 4.33%, isn’t especially high by historical standards. It’s a testament to the flimsiness of their success that Musk, Zuckerberg and others have responded to interest rates with something close to panic.

“Fed needs to cut rates immediately,” Musk raged on Nov. 30, returning to the topic repeatedly in the days that followed. “At risk of stating obvious, beware of debt in turbulent macroeconomic conditions, especially when Fed keeps raising rates,” he tweeted on Dec. 13, seemingly forgetting his own decision to pile debt onto Twitter’s balance sheet.

The Great Comeuppance has largely, but not exclusively, been a financial phenomenon. The same forces that humbled Musk and his peers have helped erode the cultural and moral authority of the venture capitalists who financed their success.

Marc Andreessen, the innovator behind Netscape and the co-founder of the venture capital firm Andreessen Horowitz, went all in on crypto several years ago, investing in companies that have seen the value of their tokens collapse or that have come under investigation by US authorities.

Andreessen, once admired as one of the industry’s futurists, is now the industry’s get-off-my-lawn guy, raging constantly on social media about all things woke. Sequoia Capital, another leading VC, has become infamous for giving $150 million to Bankman-Fried even though he was playing video games during his pitch.

And Chamath Palihapitiya, once seen as the Valley’s social conscience, is now better known for promoting a collection of controversial and lightly regulated public offerings known as SPACs to retail investors.

His SPAC deals lost more than half their value last year. Like Musk, Palihapitiya has blamed the Fed for his troubles and has said that nobody forced the investors into those dud stocks.

The Great Comeuppance also came for American politics. Bankman-Fried, who was a major donor, has been charged with campaign finance violations in addition to wire fraud and money laundering, which threatens to destabilize candidates and interest groups that benefited from his largesse.

Peter Thiel, who rode high during a frothy investment climate for tech stocks, watched as his protégé, Blake Masters, lost a Senate election and became a punchline for the failures of candidates who’d aligned themselves with former President Donald Trump.

Early polls of the 2024 Republican presidential primary suggest that Trump’s own political future may be yet another casualty of the 2022 comeuppance. His Twitter competitor Truth Social repeatedly had to delay its SPAC merger to shore up investor support.

It’s possible, of course, that the current sense of populist vindication will prove fleeting. Musk is still worth more than $130 billion and may eventually figure out how to extricate himself from Twitter and stabilize Tesla.

Trump looks like he’s fighting for relevance today, but his $99 crypto trading cards—known as NFTs and featuring the former president posing as a hunky cowboy, a hunky astronaut and a hunky superhero, among other hunky characters—shot up in value even as they were mocked by late-night comedians.

There’s also the likelihood that the Great Comeuppance could at some point widen its reach. Most of us haven’t trolled our way into the purchase of a flailing social media company or pivoted a trillion-dollar public company into the metaverse, but many of us did waste too much time on social media, perhaps taking some unnecessary financial risks along the way (by gambling on sports or stocks or real estate).

For now, the Great Comeuppance may feel satisfying. But most of us owe at least some moral debt to reality. At some point, reality will collect.

Updated: 12-29-2022

How Elon Musk, Mark Zuckerberg And The World’s 500 Richest Billionaires Lost $1.4 Trillion In A Year

Ultra-wealthy tech founders led a wipeout in fortunes that spanned the globe, though secretive families and pro sports owners emerged relatively unscathed.

For the vast majority of the world’s wealthiest people, 2022 was a year to forget.

It’s not just the money that was lost, though it was staggering — almost $1.4 trillion was wiped from the fortunes of the richest 500 alone, according to the Bloomberg Billionaires Index. Plenty of the pain, it turns out, was self-inflicted:

The alleged fraud by onetime crypto wunderkind Sam Bankman-Fried; the devastating war waged by Russia on Ukraine that spurred crippling sanctions on its business titans; and, of course, the antics of Elon Musk, the new owner of Twitter who’s worth $138 billion less than he was on Jan. 1.

Combined with a backdrop of widespread inflation and aggressive central bank tightening, the year was a dramatic comedown for a group of billionaires whose fortunes swelled to unfathomable heights in the Covid era of easy money.

In most cases, the bigger the rise, the more dramatic the fall: Musk, Jeff Bezos, Changpeng Zhao and Mark Zuckerberg alone saw some $392 billion erased from their cumulative net worth.

It wasn’t all bad news for the billionaire class, though. India’s Gautam Adani surpassed Bill Gates and Warren Buffett on the wealth index, while some of the world’s richest families, like the Kochs and the Mars clan, also added to their fortunes. Sports franchises only became more valuable, growing increasingly unobtainable for anyone outside the top 0.0001%.

Here’s A Month-By-Month Review Of The Data And Stories That Defined A Tumultuous Year For Billionaires:

January: Warning Shots

Musk, the world’s richest person at the time, loses $25.8 billion on Jan. 27 after Tesla Inc. warns about supply challenges. It’s the fourth-steepest one-day fall in the history of the Bloomberg wealth index and foreshadows a rocky year ahead for Musk, both personally and financially.

February: Oligarch Wealth Obliterated

Russia’s richest people collectively lose $46.6 billion on Feb. 24, the day Vladimir Putin orders his army to invade Ukraine. In short order, authorities in the European Union, UK and US target Russia’s “oligarchs” and their companies with sanctions that make it next-to-impossible for the business tycoons to keep control of their assets in the West.

Superyachts are grounded, London’s ultra-luxury property market braces for a slowdown and Roman Abramovich announces he’s selling Chelsea FC of the Premier League. The wealthiest Russians go on to lose another $47 billion over the course of 2022 as the war grinds on.

March: China’s Fortunes Crushed

China’s markets go from bad to worse, erasing $64.6 billion from the fortunes of the country’s wealthiest people on March 14. They lose another $164 billion in 2022 as strenuous Covid-containment efforts, a buckling property market, heightened scrutiny of the tech industry and trade tensions with the US drag on the world’s second-largest economy. That, combined with President Xi Jinping’s populist rhetoric, has more affluent Chinese plotting to get themselves — and their money — out of the country.

April: Musk’s Twitter Gambit

Soon after revealing a 9.1% stake in Twitter, Musk offers to buy the company outright on April 14 at a $44 billion valuation. It’s a steep price, even for him. To finance the deal, he initially plans to borrow billions, leverage more of his Tesla shares and pony up $21 billion in cash, which analysts correctly predict will require offloading Tesla stock. Markets deteriorate in the coming months and Musk tries to devise an escape route, kicking off a months-long legal wrangle with Twitter. By the time the deal is completed in October, Musk’s net worth is $39 billion lower than when he made his initial offer.

May: Boehly Buys Chelsea

A group helmed by finance billionaire Todd Boehly and Clearlake Capital clinches the £4.25 billion ($5.25 billion) winning bid for Chelsea. It’s the highest price ever paid for a sports team, and it caps a frenzied two-month process that attracted more than 100 bidders from all over the world, including British billionaire Jim Ratcliffe, Apollo Global Management co-founder Josh Harris, Bain Capital co-Chairman Steve Pagliuca and Citadel’s Ken Griffin with the Ricketts family. The net proceeds from the sale, including £1.6 billion in waived debt owed to Abramovich by the team, is earmarked for charity benefiting Ukraine.

June: Waltons Win Broncos

Rob Walton, heir to the Walmart fortune, agrees to buy the Denver Broncos for $4.65 billion, setting a record for a US sports team, and underscoring the enduring appeal of owning an NFL franchise. The Walton consortium includes Rob’s daughter Carrie, her husband Greg Penner, Ariel Investments President Mellody Hobson, racecar driver Lewis Hamilton and Condoleezza Rice. The deal made Hobson and Rice the first Black women to hold an ownership stake in an NFL team. The Walton-led offer trumped those from Clearlake Capital founder Jose Feliciano, United Wholesale Mortgage CEO Mat Ishbia and, again, Harris. (Ishbia and his brother would agree to buy a majority stake in the NBA’s Phoenix Suns in December.)

July: China’s Homebuilders Crumble

Yang Huiyan loses the title of Asia’s wealthiest woman after her fortune more than halves over seven months amid China’s unfolding property crisis. Country Garden Holdings, the developer that Yang inherited from her father in 2005, benefited from a dizzying homebuilding spree in recent years. But the country’s efforts to curb real estate prices and Xi’s crackdown on consumption put a stranglehold on the sector, stalling projects and leading frustrated homeowners to quit paying mortgages on halted developments. Country Garden’s stock price — and Yang’s wealth — has yet to recover.

August: Adani Ascends

Coal tycoons sound like a relic of another era. But with the world roiled by the war in Ukraine, Adani, an Indian coal miner with a fast-expanding empire, surges past Gates and France’s Bernard Arnault to become the world’s third-richest person at the end of August. It marks the highest ranking ever for an Asian billionaire. Aligning himself with Indian Prime Minister Narendra Modi, Adani has used debt to rapidly diversify his relatively opaque conglomerate, Adani Group, into ports, data centers, highways and controversially, green energy. In September, he briefly passed Bezos to become the world’s second-richest person.

September: Zuckerberg’s Wipeout

Even in a rough year for US tech titans, Zuckerberg’s losses stand out. By mid-September his net worth has plunged by $71 billion since Jan. 1 — a 57% loss — on account of a costly pivot to the metaverse and the industry-wide downturn that’s dragged down the stock price of Meta Platforms Inc. Over the course of the year he’ll fall 19 ranks on the Bloomberg wealth index, finishing 2022 at 25th, his lowest position since 2014.

October: Covid Billionaires Collapse

The bubble of the Covid economy is deflating fast and with it, the fortunes of the so-called Covid billionaires — those moguls who minted enormous fortunes from vaccines (Moderna’s Stephane Bancel), used cars (Carvana’s Ernie Garcia II and Ernie Garcia III), online shopping (Coupang’s Bom Kim) and, of course, Zoom (Eric Yuan). The 58 billionaires whose fortunes multiplied at a blistering pace from such pandemic industries saw an average decline in the value of their assets of 58% from their peak, a far sharper fall than the other constituents of the Bloomberg wealth index.

November: $16 Billion to Zero

Bankman-Fried’s crypto exchange FTX collapses after a liquidity crunch reveals gaping holes in his empire’s balance sheet and an absence of risk controls. The 30-year-old’s $16 billion fortune is erased in less than a week. At its peak, his net worth was valued at $26 billion. The debacle taints numerous Washington politicians who took his donations, stiffs many charities, humiliates investors in Silicon Valley and beyond, and leaves some 1 million clients in limbo and wondering if they’ll get their money back. Binance CEO Zhao, known in the crypto world as CZ, has seen his net worth tumble by about $84 billion this year, while other crypto billionaires like Cameron and Tyler Winklevoss, Michael Novogratz and Brian Armstrong look to distance themselves from FTX’s collapse.

Musk is unseated as the world’s richest person by Arnault, the French luxury tycoon behind LVMH. While Arnault hasn’t been immune to the tough 2022, down about $16 billion for the year, it pales next to Musk’s losses of more than $138 billion.

How did we get here? Take a market downturn, add an impulse purchase of an unprofitable, lightning rod social-media company, mix in a heap of leverage, more supply-chain woes and an insatiable desire for attention. Easy come, easy go.

Updated: 1-9-2023

Crypto Billionaires’ Back-To-Back Deaths Spark Wild Theories Among The Community

Many blamed the deaths on the billionaires’ past, while others suspected some form of foul play and even execution.

The death of four crypto billionaires within a month has caught the crypto community’s attention. The deaths occurred under suspicious circumstances, and some of these billionaires had even raised alarms about being in danger.

4 crypto billionaires dead in the span of a month. Just before, and during the FTX collapse.

Too strange

sound … pic.twitter.com/ubtpweiJcw

— Wall Street Silver (@WallStreetSilv) January 9, 2023

The spiral started toward the end of October 2022 when Nikolai Mushegian, co-founder of MakerDAO, was found dead on a Puerto Rican beach just hours after tweeting that intelligence agencies were after him.

The next billionaire to perish was broker Javier Biosca, who was found dead on Nov. 22 in Estepona, Spain. At the time, Biosca was being investigated for the biggest cryptocurrency fraud in Spain.

On Nov. 23, Amber Group co-founder Tiantian Kullander died mysteriously in his sleep. Just two days later, Russian crypto billionaire Vyacheslav Taran died in a helicopter crash.

Apart from these four suspicious deaths, another death made headlines on Dec. 30 when Park Mo, vice president of Vidente — the largest shareholder of South Korean cryptocurrency exchange Bithumb — was found dead in front of his house in the early morning.

The four crypto billionaire deaths within a month gave fuel to several conspiracy theories among the crypto community. One user associated the string of deaths with a mafia-style hit job and said that the “crypto world is taking a page from the mafia handbook.”

Another user associated the death spiral with the “central banking hierarchy,” sarcastically saying, “I would definitely not put money on it being connected to the central banking hierarchy. There is no way. They are very trustworthy. 100% no chance.”

One user questioned the information sources but acknowledged that seeing four deaths in less than a month is suspicious. On the other hand, several Redditors speculated that they may not have actually died at all, with one writing, “I wonder how many of these are people faking their own deaths.” Another speculated that the billionaires might be living under fake names and are using their “deaths” to start a new chapter of their life.

The deaths may be a cause of concern, but the crypto ecosystem is also known for its fascination with conspiracy theories. A similar saga erupted in May 2020 when the CEO of defunct crypto exchange QuadrigaCX mysteriously died during a visit to India.

Updated: 1-10-2023

Billionaire Blow-outs Prove There’s Absolutely Zero Correlation Between Wealth And Intelligence😹😂🤣

Brady, Gisele, Patriots’ Bob Kraft Among FTX Shareholders Facing Wipeout

* FTX Implosion Could Cost Billions For Customers And Investors

* Dan Och, Peter Thiel And Paul Tudor Jones Ensnared In Collapse

Billionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Group’s sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

Meanwhile, KPC Venture Capital LLC, an entity linked to the Kraft Group, holds more than 110,000 Series B preferred shares in FTX Trading, the entity that owns its main crypto exchange, according to the court papers. The firm also owns 479,000 Class A common shares and 43,545 Series A preferred shares in West Realm Shires, the unit that owns the company’s US-based exchange.

The value of the investments couldn’t immediately be learned, but are assumed to be practically worthless. Stockholders of bankrupt companies rarely recover any of their money because US law requires creditors be repaid in order of priority, and stockholders are last in line, below those with direct claims on a company’s assets, customers and suppliers.

“At the end of the day, we’re not going to be able to recover all of the losses here,” John J. Ray III, who’s handling FTX’s restructuring, said last month.

Representatives for Brady and the Kraft Group didn’t immediately respond to requests for comment.

Brady is among a group of Wall Street and Silicon Valley elite who were stuck with FTX shares, including Tiger Global Management, the Ontario Teachers’ Pension Plan and Sequoia Capital, according to the document.

Other shareholders include trusts and entities tied to billionaires Paul Tudor Jones, the family office of Dan Och and Dan Loeb of Third Point. A trust tied to tech titan Peter Thiel is also listed.

Around this time last year, FTX Trading raised $400 million, valuing the company at $32 billion and making founder Sam Bankman-Fried one of the world’s richest people. He’s now set to face trial in October.

Updated: 1-18-2023

Evergrande Chairman, Once Worth $42 Billion, Loses 93% of Wealth

Hui Ka Yan has lost wealth and influence, including no longer being part of the Chinese People’s Political Consultative Conference.

Hui Ka Yan was once one of China’s richest and most influential titans, bridging business and high-level politics.

These days, the China Evergrande Group chairman’s fortune is considerably diminished. He’s down to about $3 billion from $42 billion, which once made him the second-richest person in Asia, according to the Bloomberg Billionaires Index.

Hui is also finding himself increasingly isolated politically, with the latest signal coming from the Chinese People’s Political Consultative Conference, an elite group comprising government officials and the biggest names in business.

Hui had been part of the political advisory body since 2008 and of its elite 300-member standing committee since 2013, but he was told not to attend the annual convention last year as his property empire became the biggest casualty of the nation’s credit crunch. Now he’s not even included on the latest list of those who’ll form the CPPCC for the next five years, which was released on Wednesday.

Evergrande didn’t immediately reply to a request for comment.

While his exclusion is striking given the position he once held, Hui has company. Shimao Group Holdings Ltd.’s Hui Wing Mau, Guangzhou R&F Properties Co. co-founder Zhang Li and Hoi Kin Hong of Powerlong Real Estate Holdings Ltd. are among the property magnates no longer part of the CPPCC.

The move reflects China’s shifting attitude toward developers, many of whom have fallen from grace amid a yearslong real estate crisis that threatens the broader economy. The new CPPCC members will head to Beijing in March for the group’s 14th National Committee to discuss everything from political and social issues to new laws and the nation’s growth.

“The CPPCC role is like an honorary reward that China gives to faithful business people to make contributions to the country,” said Willy Lam, an adjunct professor at the Chinese University of Hong Kong who has authored several books about Chinese politics. “It’s not surprising at all that property tycoons like Hui, who created trouble in the property sector with their over-leveraging, are out of the list.”

Still, Hui — a Communist Party member for more than three decades — is the most high-profile developer to feel the squeeze. His valuation on Bloomberg’s wealth list has tumbled with the latest drop a reflection of money Evergrande said its founder injected into the developer and demands from creditors. One group has demanded he put in at least $2 billion of his personal wealth.

Evergrande first defaulted on dollar bonds in 2021 and has more than $16 billion of outstanding dollar notes. After missing several self-imposed deadlines to deliver a preliminary restructuring blueprint, it proposed a restructuring plan this week with two options, people familiar with the matter said.

Its shares have been suspended for almost a year after the company failed to report 2021 results, and PwC resigned as its auditor on Monday.

Shimao, also a defaulter, has had its stock suspended since last March. R&F’s Zhang was arrested in London last month on US bribery charges and is currently confined to his five-bedroom penthouse apartment after posting a record $16 million bail. Powerlong, another casualty of the crisis, has lost more than 80% of its value from a 2021 peak.

President Xi Jinping’s “common prosperity” drive to redistribute wealth has led to crackdowns in several industries. For the real estate sector, the imposition of a strict “three red lines” policy to curb debt has exacerbated a crisis that’s affecting banks, trust firms and millions of homeowners.

China’s five richest property tycoons lost about $65 billion combined in the past two years, Bloomberg’s wealth index shows.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Ultimate Resource On A Weak / Strong Dollar’s Impact On Bitcoin

Fed Money Printer Goes Into Reverse (Quantitative Tightening): What Does It Mean For Crypto?

Crypto Market Is Closer To A Bottom Than Stocks (#GotBitcoin)

When World’s Central Banks Get It Wrong, Guess Who Pays The Price😂😹🤣 (#GotBitcoin)

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin And Gold

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Does Your Baby’s Food Contain Toxic Metals? Here’s What Our Investigation Found

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

Ultimate Resource On BlockFi, Celsius And Nexo

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

100 Million Americans Can Legally Bet on the Super Bowl. A Spot Bitcoin ETF? Forget About it!

Green Finance Isn’t Going Where It’s Needed

Shedding Some Light On The Murky World Of ESG Metrics

SEC Targets Greenwashers To Bring Law And Order To ESG

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Canada’s Major Banks Go Offline In Mysterious (Bank Run?) Hours-Long Outage (#GotBitcoin)

On-Chain Data: A Framework To Evaluate Bitcoin

On Its 14th Birthday, Bitcoin’s 1,690,706,971% Gain Looks Kind of… Well Insane

The Most Important Health Metric Is Now At Your Fingertips

American Bargain Hunters Flock To A New Online Platform Forged In China

Why We Should Welcome Another Crypto Winter

Traders Prefer Gold, Fiat Safe Havens Over Bitcoin As Russia Goes To War

Music Distributor DistroKid Raises Money At $1.3 Billion Valuation

Nas Selling Rights To Two Songs Via Crypto Music Startup Royal

Ultimate Resource On Music Catalog Deals

Ultimate Resource On Music And NFTs And The Implications For The Entertainment Industry

Lead And Cadmium Could Be In Your Dark Chocolate

Catawba, Native-American Tribe Approves First Digital Economic Zone In The United States

The Miracle Of Blockchain’s Triple Entry Accounting

How And Why To Stimulate Your Vagus Nerve!

Housing Boom Brings A Shortage Of Land To Build New Homes

Biden Lays Out His Blueprint For Fair Housing

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Cracks In The Housing Market Are Starting To Show

Ever-Growing Needs Strain U.S. Food Bank Operations

Food Pantry Helps Columbia Students Struggling To Pay Bills

Food Insecurity Driven By Climate Change Has Central Americans Fleeing To The U.S.

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Families Face Massive Food Insecurity Levels

US Troops Going Hungry (Food Insecurity) Is A National Disgrace

Everything You Should Know About Community Fridges, From Volunteering To Starting Your Own

Russia’s Independent Journalists Including Those Who Revealed The Pandora Papers Need Your Help

10 Women Who Used Crypto To Make A Difference In 2021

Happy International Women’s Day! Leaders Share Their Experiences In Crypto

Dollar On Course For Worst Performance In Over A Decade (#GotBitcoin)

Juice The Stock Market And Destroy The Dollar!! (#GotBitcoin)

Unusual Side Hustles You May Not Have Thought Of

Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

The Fed Is Setting The Stage For Hyper-Inflation Of The Dollar (#GotBitcoin)

An Antidote To Inflation? ‘Buy Nothing’ Groups Gain Popularity

Why Is Bitcoin Dropping If It’s An ‘Inflation Hedge’?

Lyn Alden Talks Bitcoin, Inflation And The Potential Coming Energy Shock

Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

What The Fed’s Rate Hike Means For Inflation, Housing, Crypto And Stocks

Egyptians Buy Bitcoin Despite Prohibitive New Banking Laws

Archaeologists Uncover Five Tombs In Egypt’s Saqqara Necropolis

History of Alchemy From Ancient Egypt To Modern Times

Former World Bank Chief Didn’t Act On Warnings Of Sexual Harassment

Does Your Hospital or Doctor Have A Financial Relationship With Big Pharma?

Ultimate Resource Covering The Crisis Taking Place In The Nickel Market

Apple Along With Meta And Secret Service Agents Fooled By Law Enforcement Impersonators

Handy Tech That Can Support Your Fitness Goals

How To Naturally Increase Your White Blood Cell Count

Ultimate Source For Russians Oligarchs And The Impact Of Sanctions On Them

Ultimate Source For Bitcoin Price Manipulation By Wall Street

Russia, Sri Lanka And Lebanon’s Defaults Could Be The First Of Many (#GotBitcoin)

Will Community Group Buying Work In The US?

Building And Running Businesses In The ‘Spirit Of Bitcoin’

What Is The Mysterious Liver Disease Hurting (And Killing) Children?

Citigroup Trader Is Scapegoat For Flash Crash In European Stocks (#GotBitcoin)

Bird Flu Outbreak Approaches Worst Ever In U.S. With 37 Million Animals Dead

Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.