Bank of International Settlements Chief Reverses Stance On Crypto (#GotBitcoin)

The head of the Bank of International Settlements (BIS) has appeared to U-turn on issuing digital currencies after a fresh interview with the Financial Times on June 30. Bank of International Settlements Chief Reverses Stance On Crypto (#GotBitcoin)

Speaking to the publication, BIS chief Augustin Carstens actively endorsed the creation and issuance of digital versions of national fiat currencies.

“Many central banks are working on it; we are working on it, supporting them,” he said.

“And it might be that it is sooner than we think that there is a market and we need to be able to provide central bank digital currencies.”

The comments struck a curious note with many, coming just months after Carstens emphatically advised against issuing such digital currencies. In a speech in March, he listed various risks for banks considering doing so, arguing innovation should not come too fast.

In addition, both the BIS and Carstens himself are outspoken critics of decentralized cryptocurrencies such as bitcoin (BTC).

Last year, he described bitcoin as lacking the ability to ever function as money and directed young people to “stop trying to create money.”

“…If you look at them closely, cryptocurrencies are, in a nutshell, a bubble, a Ponzi scheme and an environmental disaster – the latter because of the high energy consumption needed to run the infrastructure for these cryptocurrencies,” he said in July.

More recently, the BIS has come out critical about Facebook’s new Libra cryptocurrency protocol, similarly due to the fact it resembles money beyond the control of a government.

Updated: 6-17-2018

Bitcoin Could Break The Internet, Bank For International Settlements Says

The Bank for International Settlements just told the cryptocurrency world it’s not ready for prime time — and as far as mainstream financial services go, may never be.

Updated: 11-11-2019

Banker Who Called Bitcoin ‘Evil Spawn’ Heads BIS Digital Currency Hub

A former European Central Bank board member will chair a new arm of the Bank of International Settlements (BIS) focusing on digital currencies and financial innovation.

In a press release on Nov. 11, the BIS confirmed Benoît Cœuré would begin chairing the Innovation Hub from January 15, 2020.

BIS Eyes Impact Of “Critical Trends”

“The Hub’s mandate is to identify, and develop in-depth insights into critical trends in technology affecting central banking; develop public goods in the technology space geared towards improving the functioning of the global financial system; and serve as a focal point for a network of central bank experts on innovation,” the release explains.

Cœuré has already presided over a dedicated working group studying stablecoins.

Both the BIS and its chairman Agustín Carstens, although publicly critical of cryptocurrencies such as Bitcoin (BTC), face a rapidly evolving financial environment. China’s central bank, the People’s Bank of China (PBoC) — one of its members — could soon become the world’s first major economy to issue its own digital currency.

Cœuré Commented:

“I look forward to bringing my expertise to the global central banking community at this time of rapid technological change. We must make the best use of innovation to support financial stability and promote financial inclusion.”

No Mention Of “Evil Spawn” Bitcoin

The Hub will operate in Hong Kong and Singapore, in addition to the BIS’ home of Switzerland.

As Cointelegraph reported, the BIS agreed to partner with the Swiss National Bank (SNB) at the Hub in early October.

“The SNB has for some time been closely following the digitalization of the financial sector and technological innovations in the areas covered by its mandate,” Thomas J. Jordan, Chairman of the Governing Board of the SNB, said at the time.

Last year, Cœuré himself described Bitcoin as the “evil spawn of the financial crisis.”

Updated: 1-27-2021

BIS Chief Blasts Bitcoin’s Viability, Prompting Blowback From Advocates

Bitcoin maximalists cried foul at the central banker’s prognostications.

The chief banker at the bank for central banks, Agustín Carstens, cast doubt on bitcoin’s long-term viability Wednesday, saying it was only a matter of time before a 51% attack brings down the world’s original cryptocurrency.

Carstens’ comments, which he delivered to the Hoover Institute, underscored his belief that bitcoin fails as a currency, a medium of exchange and a value storage mechanism, working only as a “speculative asset” and seldom as money.

He Also Issued A Dire Warning To Would-Be Bitcoin Investors: The Center Cannot Hold:

“Above all, investors must be cognizant that Bitcoin may well break down altogether. Scarcity and cryptography alone do not suffice to guarantee exchange,” he said.

Carstens then levied attacks against the attributes that have kept bitcoin running. He pointed out the “sad side effect” of bitcoin’s monstrous electricity dependence, which he said is as high as Switzerland’s where the Carsten’s organization, the Bank for International Settlements, is based. Bitcoin’s proof-of-work mechanism currently burns through reams of energy.

Carstens reserved particular bombast for what he framed as the inevitable systems failure hard-coded into bitcoin’s 21 million issuance cap. Fewer coins getting minted means fewer miners processing transactions, he said, and confirmation wait times will go up. So too will bitcoin’s vulnerability to a “majority attack.”

“So, clearly, if digital money is to exist, the central bank must play a pivotal role, guaranteeing the stability of value, ensuring the elasticity of the aggregate supply of such money, and overseeing the overall security of the system,” he said.

Bitcoiners were merciless in their rebuttal.

Jameson Lopp, chief technical officer at bitcoin storage startup Casa told CoinDesk Carstens’ arguemnt fails to stand up to bitcoin’s technical realities.

“Bitcoin becoming attackable like other networks is not likely, because it would still require a large upfront capital expense for someone to acquire the appropriate hardware. This would only make sense in a world where another SHA256 secured network came along and became far more valuable to mine than Bitcoin,” he wrote in an email.

Castle Island Ventures partner Nic Carter issued CoinDesk a point-by-point takedown of Carstens arguments, asserting that volatility does not mean something cannot be money, and that it doesn’t matter one way or another if bitcoin is money, because it is “a means to store value over time and space,” a job that Carter said bitcoin does better than gold.

Carter also said Bitcoin network’s energy dependence is a function of price and issuance, not security or necessity.

“Regardless, the energy cost is well worth paying, because the existence of a non-state monetary commodity is something that the world finds valuable,” Carter said.

Updated: 3-25-2021

Bank of International Settlements Head Says Cryptos Require More Regulation

Agustín Carstens has called for cryptocurrencies to be subject to more regulations while arguing that virtual currencies have not made a significant dent in global finance.

Agustín Carstens, general manager of the Bank for International Settlements, has called for even more crypto regulations stating that virtual currencies are a tool for circumventing financial laws.

In an interview with CNBC on Wednesday, the BIS general manager identified money laundering and terrorism financing as areas that require more robust cryptocurrency regulations.

Carstens’s comments, a common refrain among crypto critics, come despite the preponderance of established facts indicating that crypto criminality occupies a minute proportion of global cryptocurrency commerce.

According to Carstens, cryptocurrencies have a notoriety for being instruments of criminal activities due to the pseudonymous nature of virtual currency transactions.

However, blockchain intelligence firms continue to work with regulators and law enforcement agencies to provide robust crypto forensic capabilities. Indeed, the traceable nature of Bitcoin (BTC) transactions enabled U.S. law enforcement to locate and shut down a global child pornography ring back in October 2019.

Darknet narcotics vendors who adopt crypto payments are routinely apprehended and put on trial in many countries around the world.

Apart from espousing well-worn anti-crypto soundbites, the BIS general manager argued that cryptocurrencies are not a threat to the global financial establishment. Meanwhile, back in December 2019, Carstens expressed fears that private cryptos could disintermediate central banks in the global financial architecture.

Carstens added that he did not see the path forward for global crypto dominance, adding that virtual currencies are yet to make any significant progress in terms of being used as money.

The BIS executive also touched on stablecoins, stating that fiat-pegged tokens could have limited adoption cases and dismissing any overall threat to sovereign, central bank-backed fiat currencies.

Despite dismissing stablecoins, Carstens highlighted the regulatory issues associated with projects like Diem, saying that such tokens will require specialized laws to ensure that they are “fit for purpose.”

The BIS general manager has previously called for central banks to be at the helm of the evolution of digital money.

Updated: 7-2-2021

Crypto Ownership Has Nothing To Do With Distrust In Fiat: BIS Study

Cryptocurrency owners are “generally more educated than the average,” according to a new study by the Bank for International Settlements.

The Bank for International Settlements (BIS), a global financial institution owned by some of the world’s biggest central banks, is trying to dispel the theory that cryptocurrency ownership is linked to distrust in traditional finance.

On Thursday, the BIS published a paper on the socioeconomic drivers of cryptocurrency investments in the United States. Employing representative data from the U.S. Survey of Consumer Payment Choice, BIS argued distrust in fiat currencies such as the U.S. dollar has nothing to do with investor motivation to hold cryptocurrencies like Bitcoin (BTC), stating:

“Demand for cryptocurrencies is not driven by distrust in cash or the financial industry, given that there are no differences in the perceived security of cash and offline and online banking. We can thus preliminarily disprove the hypothesis that cryptocurrencies are sought as an alternative to fiat currencies or regulated finance.”

The authority stressed that cryptocurrencies are not sought as an alternative to fiat currencies or regulated finance but instead are a “niche digital speculation object.” BIS noted that from a policy perspective, the overall takeaway of the analysis is that investors’ objectives are the “same as those for other asset classes, so should be the regulation.”

The BIS paper also outlines major correlations between crypto investment choices and the level of education and income, suggesting that cryptocurrency owners are “generally more educated than the average.” Ether (ETH) and XRP investors showed the highest education level in the BIS’ analysis, while those owning Litecoin (LTC) were the least educated, with Bitcoin owners ranking in the middle.

The new report brings significant relevance that cryptocurrencies like Bitcoin pose no threat to traditional finance tools, as crypto demand is not driven by distrust in cash. A number of global authorities and institutions previously expressed concerns about Bitcoin’s ability to capitalize on global distrust in traditional finance.

In late December, Morgan Stanley Investment’s Ruchir Sharma argued that the U.S. dollar’s reign will likely end due to global distrust in traditional finance, while Bitcoin would capitalize on the lack of confidence.

Updated: 7-1-2022

Bank For International Settlements To Allow Banks To Keep 1% Of Reserves In Bitcoin

Despite its skeptical approach to digital currencies, exacerbated by the recent cryptocurrency market crash, it looks like the Bank for International Settlements (BIS) intends to extend its hand to the new asset class by allowing banks to hold up to 1% of reserves in cryptocurrencies such as Bitcoin (BTC).

Indeed, BIS’s Basel Committee on Banking Supervision (BCBS) has made the proposal for limiting the banks’ total exposures to “Group 2 cryptossets to 1% of Tier 1 capital” in its consultative document titled “Second consultation on the prudential treatment of cryptoassets,” published on June 30.

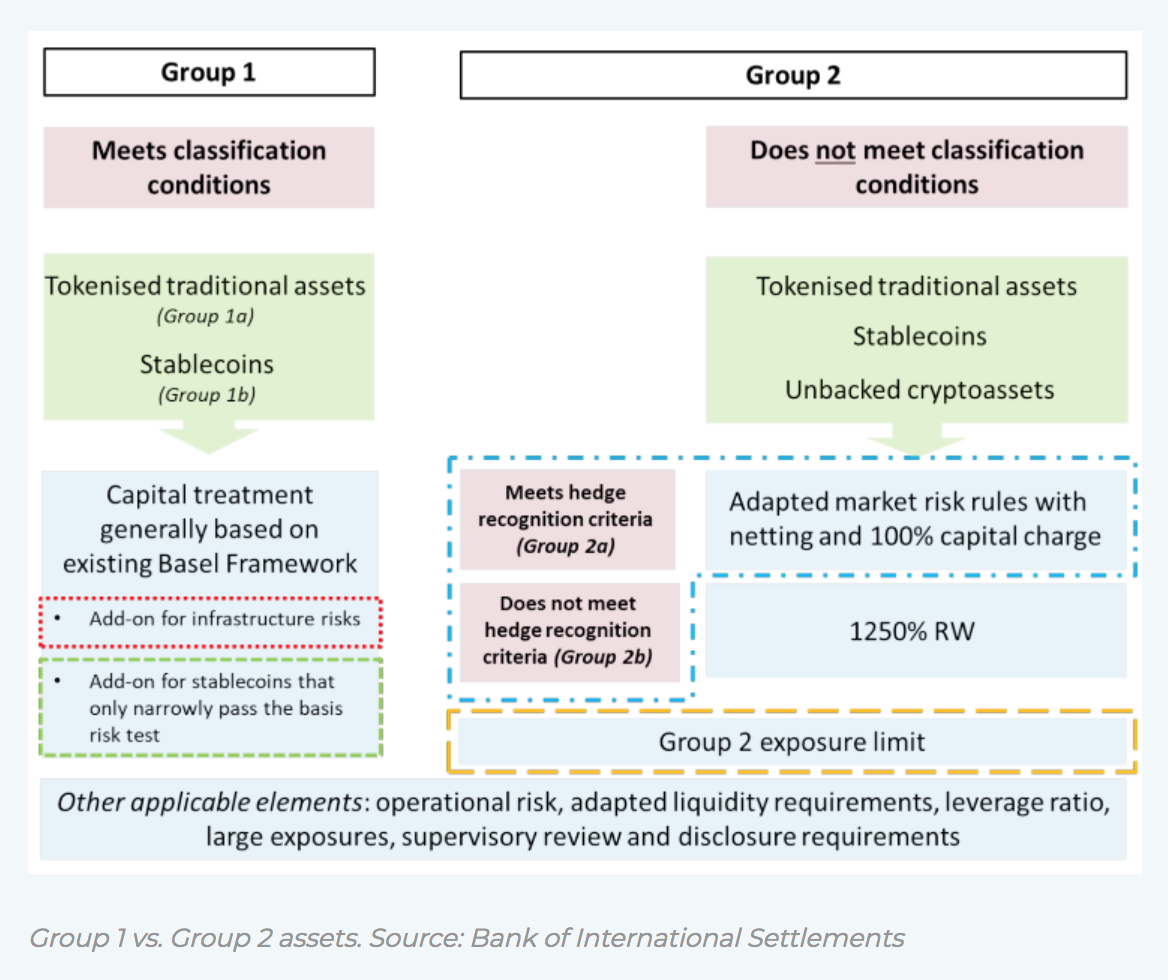

Group 1 vs. Group 2 Assets

Specifically, Group 2 refers to the assets that do not meet classification conditions and includes specific tokenized traditional assets and stablecoins, as well as unbacked crypto assets. As opposed to Group 2, Group 1 includes tokenized traditional assets and stablecoins that meet classification conditions.

According To The Document:

“Banks’ exposures to Group 2 cryptoassets will be subject to an exposure limit. Banks must apply the exposure limit to their aggregate exposures to Group 2 cryptoassets, including both direct holdings (cash and derivatives) and indirect holding (ie those via investment funds, ETF/ETN, special purpose vehicles).”

The document also specified that “a bank’s total exposure to Group 2 crypto assets must not be higher than 1% of the bank’s Tier capital at all times,” in line with the Basel Framework which includes all the BCBS’s standards. As it explained:

“The large exposure rules of the Basel Framework are not designed to capture large exposures to an asset type, but to individual counterparties or groups of connected counterparties. This would imply, for example, no large exposure limits on cryptoasset where there is no counterparty, such as Bitcoin.”

With this in mind, “the Committee proposes, therefore, to introduce a new exposure limit for all Group 2 cryptoassets outside of the large exposure rules.” Meanwhile, this provisional limit set at 1% of Tier 1 capital would be reviewed periodically.

Skeptical stance toward crypto

Notably, Finbold earlier reported on the BIS using the recent crypto market collapse to affirm its skeptical attitude towards the assets class and warn about the materialization of its predictions about the dangers of decentralized finance (DeFi).

On top of that, the global central bank body released in early June a bulletin in which it presented its view that “crypto cannot fulfill the social role of money,” listing a number of problems it perceived in the crypto and blockchain industry, including high fees and network congestion that lead to the landscape fragmentation.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.