Why Wall Street Is Literally Salivating Over Bitcoin

There are big opportunities for investment firms in digital currencies. But a lot hinges on market regulators. Why Wall Street Is Literally Salivating Over Bitcoin

Related:

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

The Bank for International Settlements just put crypto-assets in the highest risk category, suggesting banks will need to hold a dollar in capital for each dollar’s worth of Bitcoin on their books.

Risks abound, including regulatory uncertainty, crypto’s role in money laundering, the seeming vulnerability of wallets to getting stolen and backlash against the environmental costs of mining digital currencies. Not to mention the volatility that’s seen Bitcoin trade in a 130% range this year, leaving it currently about 40% off its April high.

Nevertheless, the potential growth for an asset class that’s exploded in recent years means the fund management community needs to be poised to meet client demand, according to a study just published by investment bank Morgan Stanley and consultancy firm Oliver Wyman.

If Bitcoin really is digital gold, then the bullion market provides a guide to its potential. Gold market capitalization has traditionally been between 5% and 15% of global gross domestic product, with about 50% of demand coming from its use as a store of value rather than a commodity. On that basis, the report argues that Bitcoin’s market cap could reach $6 trillion by 2025.

The real El Dorado could materialize if the Securities and Exchange Commission finally approves an exchange-traded fund that can buy Bitcoin in the U.S. The report’s most bullish scenario sees Bitcoin growing to $9 trillion in market cap, spawning $450 billion of higher-fee ETFs with potential annual revenues of $4.5 billion. No asset manager in the hugely competitive passive space will want to miss out on such a potential goldmine.

There are other opportunities for the investment industry to expand revenues in the coming five years, the report’s authors say. In private wealth, total assets could almost double by 2025 to $13 trillion. The chunky fees still available from assets including private equity, venture capital and real estate make that a $21 billion-a-year revenue rainmaker.

Another hot spot is in the environmental, social and governance space. A shift to “more mature” ESG strategies, including impact investing, will grow the market to $6.5 trillion from about $2 trillion. And in wealth management, the report says advances in technology will make it cheaper for firms to produce customized portfolios for a wider range of wealthy customers, even those with less than $10 million.

But it’s in the crypto arena where investment firms face the hardest choice. “There are likely significant benefits from being an early mover,” the report says.

There are also significant risks, both reputational and financial. That will probably inhibit the widespread introduction of portfolio tools based on virtual currencies, especially while regulators remain wary of being seen to legitimize the asset class.

All of which makes the SEC’s delayed decision on approving a Bitcoin ETF a key moment. If it says yes, then there’ll be a devil-take-the-hindmost rush to create a universe of investment products tied to digital currencies.

Until and unless it does, crypto is likely to remain just that bit too racy for most of the mainstream financial community.

Updated: 6-20-2021

4 Reasons Why Paul Tudor Jones’ 5% Bitcoin Exposure Advice Is Difficult For Major Funds

Major funds are probably interested in Bitcoin and altcoins, but four significant hurdles are preventing them from investing.

In an interview with CNBC on June 14, legendary investor Paul Tudor Jones sounded the alarm over advancing inflation. After last week’s consumer price index (CPI) report showed that United States inflation had hit a 13-year high, the founder of Tudor Investment advocated for a 5% Bitcoin (BTC) portfolio allocation.

When combined, the world’s 50 largest asset managers oversee $78.9 trillion in funds. A mere 1% investment in cryptocurrencies would amount to $789 billion, which more than Bitcoin’s entire $723 billion market capitalization.

However, there’s a fundamental misunderstanding on how this industry works, and this is what impedes a 1% allocation, let alone a 5% one.

Let’s investigate a few major hurdles that the traditional financial sector will have to vault before really becoming Bitcoin apes.

Hurdle 1: Perceived Risk

Investing in Bitcoin remains a significant hurdle for large mutual fund managers, especially considering their perceived risk. On June 11, The U.S. Securities and Exchange Commission (SEC) warned investors about the risks of Bitcoin futures trading — citing market volatility, a lack of regulation and fraud.

Even though several stocks and commodities have similar or even higher 90-day volatility, somehow, the agency’s focus remains on Bitcoin.

DoorDash (DASH), a $49 billion U.S. listed company, holds a 96% volatility, versus Bitcoin’s 90%. Meanwhile, Palantir Technologies (PLTR), a $44 billion U.S. tech stock, has an 87% volatility.

Hurdle 2: Indirect Exposure Is Nearly Impossible For US-Based Companies

Most of the mutual fund industry, mainly the multi-billion dollar asset managers, cannot buy physical Bitcoin. There is nothing specific about this asset class, but most pension funds and 401k vehicles do not allow direct investments in physical gold, art, or farmland.

However, it is possible to circumvent these limitations using exchange-traded funds (ETFs), exchange-traded notes (ETN), and tradeable investment trusts. Cointelegraph previously explained the differences and risks assigned to ETFs and trusts, but that only scratches the surface as each fund has its own regulations and limits.

Hurdle 3: Fund Regulation And Administrators May Prevent BTC Purchases

While the fund manager has complete control over the investment decisions, they must follow each specific vehicle regulation and observe the risk controls imposed by the fund’s administrator.

Adding new instruments such as CME Bitcoin futures, for example, might require SEC approval. Renaissance Capital’s Medallion funds faced this issue in April 2020.

Those opting for CME Bitcoin futures, such as Tudor Investment, have to constantly roll over the position ahead of monthly expiries. This issue represents both liquidity risk and error tracking from the underlying instrument. Futures were not designed for long-term carry, and their prices vastly differ from regular spot exchanges.

Hurdle 4: The Traditional Banking Industry Remains A Conflict Of Interest

Banks are a relevant player in this field as JPMorgan, Merrill Lynch, BNP Paribas, UBS, Goldman Sachs, and Citi figure among the world’s largest mutual funds managers.

The relationship with the remaining asset managers is tight because banks are relevant investors and distributors of these independent mutual funds. This entanglement goes even further because the same financial conglomerates dominate equities and debt offerings, meaning they ultimately decide on a mutual funds’ allocation in such deals.

While Bitcoin is yet to pose a direct threat to these industry mammoths, the lack of understanding and risk aversion, including the regulation uncertainties, cause most of the global $100 trillion professional fund managers to avoid the stress of venturing into a new asset class.

Updated: 8-8-2021

What Bear Market? Investors Throw Record Cash Behind Blockchain Firms In 2021

VC investments into crypto over the first six months of 2021 have already more than doubled those witnessed in all previous years combined.

Despite the recent slight recovery of the cryptocurrency market, there is no denying the fact that the crypto industry has been faced with a great deal of volatility over the last few months, made evident by the total market capitalization of the sector that dipped from $2.5 trillion to $1.18 trillion over a 45-day span earlier this year.

Through all these ups and downs, however, 2021 has continued to see an increasing amount of capital enter this fast-evolving space. For example, reports indicate that over the first half of the year alone, venture capital (VC) funds poured in $17 billion into various crypto-related startups and companies.

To put things into perspective, the above-stated figure is by far the most witnessed in any single year and is nearly equal to the total amount raised in all previous years combined. Johnny Lyu, CEO of cryptocurrency exchange KuCoin, told Cointelegraph: “Early-stage investors of cryptocurrency have already achieved profitability and have a deep understanding of the development rules of the market. This is the key reason why they are willing to invest despite market fluctuations.”

Lyu further opined that for traditional investors, the crypto industry allows them to obtain higher returns in a shorter cycle, citing the volatility of Bitcoin (BTC) as an example of the same. “When the market experiences volatility, it is the best time for investing, and investors will profit from it.”

A Closer Look At The Numbers

A hefty chunk of the aforementioned $17 billion figure comes from a single deal that saw a new cryptocurrency exchange called Bullish draw $10 billion in cash and digital assets following an initial injection by Block.one of $100 million, 164,000 BTC, and 20 million EOS tokens. Block.one led the capital raise alongside Peter Thiel, Alan Howard, Galaxy Digital and other investors.

In fact, just this one deal would have been enough to make 2021 the biggest year for venture capital investment in the crypto space, but if that wasn’t enough, the remaining $7.2 billion dollars would have equaled 2021 with 2018’s record of $7.4 billion raised, which is even more impressive considering that there are still five more months to go before the end of the year.

On the subject, Igneus Terrenus, head of communications for cryptocurrency exchange Bybit, told Cointelegraph that these numbers are not really startling since VCs are known for their voracious appetite for risk: “VCs are leveraging a relatively abundant and fungible resource — i.e., capita — to tap into something that is far scarcer and unique, which is partners and talents with whom they can build long-term value together.”

More Notable VC Activities

A little over a month ago, Silicon Valley-based venture capital firm Andreessen Horowitz announced the launch of its $2.2 billion crypto fund, with a spokesperson claiming that the company was “radically optimistic” about this space despite the price fluctuations.

“We believe that the next wave of computing innovation will be driven by crypto,” partners Katie Haun and Chris Dixon were quoted as saying.

Furthermore, it should be pointed out that Andreessen’s first crypto-focused fund went live nearly three years ago, a time when the market was at its lowest levels historically, thereby showcasing the firm’s long-term belief in relation to this yet-nascent industry.

Similarly, Fireblocks, an infrastructure provider for digital assets, revealed that it had been successful in raising $310 million in a Series D round of funding, thus bringing the company’s total valuation to a whopping $2 billion in a period of less than six months. The fundraiser was co-led by institutional giants including Sequoia Capital, Stripes and the venture arm of Thailand’s oldest bank, Siam Commercial Bank.

Solana, a project that seeks to deliver a high level of scalability and transaction speed, also recently announced that it had completed a $314.15 million private token sale, making the nine-figure total the fourth largest fundraising event in the history of the crypto industry. Some of the company’s investors include Polychain Capital, Alameda Research and Blockchange Ventures, among others.

Cryptocurrency exchange FTX too recently closed a $900 million funding round, which saw a total of 60 participants, including Softbank, Sequoia Capital, Coinbase Ventures, Multicoin, VanEck and the Paul Tudor Jones family.

As a result, the trading platform’s valuation has grown to $18 billion from $1.2 billion just a year ago, making it one of the largest cryptocurrency companies in the world.

Lastly, Dapper Labs, the team behind CryptoKitties and NBA Top Shot, secured about $305 million in new funding this March from a number of past and present NBA stars including the likes of Michael Jordan, Kevin Durant and Alex Caruso, and other investors including The Chernin Group and Will Smith’s venture capital outfit Dreamers VC.

Following the closure of this latest funding round, Dapper Labs now reportedly holds a $2.6 billion valuation.

Is More Institutional Money Incoming?

To gain a better understanding of whether more capital will continue to enter the crypto space, Cointelegraph reached out to Antoni Trenchev, managing partner at Nexo, a digital asset service provider.

In his view, the crypto-finance sector possesses enormous untapped potential, especially with digital currencies allowing for an unprecedented level of inclusion for the under-banked. He added:

“The deals we are seeing right now — like Fireblocks snapping up $310M, SoftBank investing $200M in Brazilian crypto exchange Mercado Bitcoin — are being made by billion-dollar money managers after months of boardroom discussions and a result from long-term strategic decisions rather than momentary judgment.”

Not only that, fintech firms currently seem to have an unprecedented opportunity to build upon their existing client bases by offering modern products and services that users and companies really need, especially those that can serve as hedges against inflation — fears of which are looming large on the horizon all over the world.

Simon Kim, CEO at Hashed, an early-stage venture fund, believes that VCs are just now starting to understand the intrinsic value of crypto projects as it was difficult to justify the price of tokens that most blockchain projects had created in the past years:

“Ethereum is facilitating millions of transactions through numerous DeFi services, metaverse games and NFT services built on top of the network. There are now more than 20 million monthly active user accounts using Ethereum. The intrinsic value of DeFi tokens is even more apparent than Ethereum or Bitcoin.”

He further highlighted that much like how the IT industry leaders such as Amazon and Google grew amid the dot-com bubble, many crypto projects today have a solid foundation with a suitable business model and data. “This is why VCs are now pouring their money into crypto projects. They now believe that the next Google, Amazon and Facebook could be found in the space”, said Kim, closing out.

On a more technical note, Lyu highlighted that the increasing VC investments can, in large part, be attributed to the growing number of users that have seemingly flooded into various centralized exchanges (CEXs) and decentralized exchanges (DEXs) in recent months, adding: “Some popular DEXs such as Uniswap and PancakeSwap have exceeded traffic numbers related to some leading CEXs.”

What Lies Ahead?

Despite the COVID-19 pandemic that has had the global economy in a sort of standstill over the last year and a half, reports suggest that global venture capital funding over the first half of 2021 has shattered all previous records, with the figure now standing at $288 billion.

That’s more than $100 billion when compared with the last six-month cycle record that was set during the second half of last year.

Jehan Chu, Managing Partner for Kenetic, a venture capital firm investing in blockchain companies, told Cointelegraph that the ongoing glut of capital sloshing around the world is forcing investors to take greater and greater risk in search of alpha, and despite ongoing institutional uncertainty about the future of crypto, they have no choice but to invest in the space:

“Fortunately, blockchain technology and crypto have graduated from a carnival freakshow to an inevitable future, so confidence in the underlying companies is at an all-time high. Additionally, a generation of cheap money flowing from the U.S. printing press has concentrated into the hands of investors. There has never been so much capital and the traditional gates have been eroded by partisan politics and poor financial management.”

Founding managing partner at Borderless Capital Arul Murugan believes that as more applications go live, greater infrastructure will be required to be built and as more infrastructure is built, it will attract even more applications, creating a virtuous cycle that started happening this year.

Not only that, he is of the opinion that the gap between traditional finance and decentralized finance (DeFi) is closing up with more people steering towards the crypto spectrum. Murugan opined: “Right now, crypto is less than 1% of traditional finance and people are seeing huge growth opportunities.”

Therefore, as an increasingly digitized future draws closer, the use of crypto tech will likely continue to grow, so it stands to reason that more players from the traditional finance space will continue to make their way into this burgeoning market, helping it to grow even further.

Updated: 8-12-2021

55% Of The World’s Top 100 Banks Reportedly Have Crypto And Blockchain Exposure

Over half of the 100 largest banks by assets under management are reportedly investors in major crypto and blockchain technology-based companies and projects.

Global banking giants are reportedly increasing their involvement in the emerging crypto and blockchain firms by way of early- and late-stage funding for projects and businesses in the industry.

According to research by Blockdata, a blockchain market intelligence outfit, 55 out of the top 100 banks by assets under management (AUM) have some form of exposure to the novel technology.

This involvement reportedly cuts across direct and indirect investments in crypto and decentralized ledger technology firms by the banks themselves or via their subsidiaries.

Blockdata’s research places Barclays, Citigroup and Goldman Sachs among the most active backers of crypto and blockchain firms, with JPMorgan and BNP Paribas also identified as serial investors in the emerging space.

These investments are part of a larger trend of significant backing for blockchain startups, with funding figures already doubling the amount recorded in 2020, according to a KPMG report.

The research also shows crypto custody as a major focus point for banks delving into the crypto space. Indeed, almost a quarter of the top 100 banks by AUM are either developing crypto custody solutions or are backing startups that offer custodial services for digital assets.

As previously reported by Cointelegraph, several banks in the United States, Asia and Europe are building crypto custody platforms as part of their preliminary foray into cryptocurrencies.

Blockdata attributed the growing crypto and blockchain involvement among banks to three main factors — skyrocketing profits of cryptocurrency startups, regulatory advancements, and the increasing demand among bank customers for exposure to digital assets.

Back in May, NYDIG president Yan Zhao stated that the massive revenues of crypto trading giants such as Coinbase were making banks reexamine their initial reticence toward cryptocurrency involvement.

This massive revenue potential is despite the significantly smaller teams working for these major crypto companies.

At $58.09 billion as of the time of writing, Coinbase sits on a valuation almost half that of Goldman Sachs, the 13th largest bank in the world, despite employing only about 4% of the latter’s workforce.

Updated: 8-26-2021

Asset Managers And Companies Accumulate 1.2M Bitcoin Worth $57 Billion

While asset managers have accumulated 4% of Bitcoin’s supply, private and public companies have also amassed 1% each.

Around 6% of Bitcoin’s circulating supply has been accumulated by asset managers and companies, signaling ever increasing mainstream and institutional adoption of crypto assets.

According to Buy Bitcoin Worldwide, 816,379 BTC worth $40.1 billion is currently held by 14 Bitcoin fund issuers and asset managers — representing 4% of the cryptocurrency’s supply.

Industry leader, the Grayscale Bitcoin Trust, represents more than 3% of the Bitcoin supply, managing 654,600 BTC (worth $32 billion). CoinShares’ XBT Provider ranks second with 48,466 BTC ($2.4 billion) representing 0.23% of supply. The 12 remaining issuers represent 113,313 BTC or 0.54% of thesupply combined.

The data provider also tracks 34 public companies that hold BTC on their balance sheets, which collectively command 1% of Bitcoin’s supply.

Half of all Bitcoin held by public companies is in the possession of MicroStrategy, which after adding 3,907 Bitcoin to its stash since the start of July, now holds 108,992 BTC worth $5.3 billion.

Electric vehicle manufacturer Tesla accounts for 20% of the Bitcoin held by private companies, with the firm having accumulated 42,902 BTC worth nearly $2.1 billion.

Private companies have absorbed another 174,068 BTC worth $8.5 million, cornering 0.83% of Bitcoin’s supply. Roughly 80% of BTC stashed away by private companies is held by Block.One — with the firm currently sitting on 140,000 BTC worth $6.8 billion.

Estimates vary among data providers however, with Bitcoin Treasuries tallying 1.4 million BTC on the balance sheets asset manager and companies. A further 260,000 BTC are attributed to the balance sheets of national governments.

Bitcoin’s supply will cap at 21 million BTC, with analysts estimating the final Bitcoin will be mined in the year 2140. At the time of writing, roughly 18.8 million BTC are in circulation. However access to one fifth of all Bitcoin (or more) is believed to have been lost, meaning that asset managers and companies may control an even greater share of the supply.

While large entities are gobbling up BTC, Ethereum has appeared to have been undergoing a supply shock of its own in the wake of its London upgrades that introduced a burn mechanism to the crypto asset’s fee market.

According to Watch The Burn, 97,369 Ether worth $313.5 million has been destroyed in the 21 days since London, meaning that roughly 4,637 ETH are being burned daily on average. Overall, Ethereum’s burn mechanism has resulted in 35% a net reduction in the number of newly minted Ether entering supply.

Updated: 9-1-2021

Mutual Fund Giant Franklin Templeton Eyes Bitcoin, Ether Trades With Planned Hires

The $1.5 trillion asset manager is a newcomer to crypto investing despite years of experimenting with blockchain tech.

Asset manager Franklin Templeton is staffing up to execute trades for bitcoin and ether, according to a series of job postings.

At least two crypto-focused jobs posted this week – one trader, one researcher – would join the “growing” investments team within Franklin Templeton’s Digital Assets Management division, the listings said.

“We are looking for a Crypto Currency [sic] Trader to execute trades for several strategies using the largest, most liquid listed and tradable crypto assets (e.g., BTC, ETH, etc.),” read one.

The twin gigs, which appear to mark Franklin Templeton’s first foray into bitcoin, highlight the $1.5 trillion firm’s newfound interest in crypto as an investable asset class. In late July, it backed a Galaxy Digital fund of funds that chases venture opportunities in the crypto economy.

Franklin Templeton’s planned crypto hires are far more direct, however. The roles will be tasked with executing crypto strategies, building relationships with blockchain developer communities and creating new crypto products for the mutual fund issuer and money manager.

It’s not entirely clear if Franklin Templeton’s crypto trading will be directly involved with the coins. The trading gig calls for experience in derivatives and futures markets, which could indicate a focus on trading regulated bitcoin and ether contracts – as other investment firms have done.

Franklin Templeton did not return multiple requests for comment.

The asset manager has toyed with blockchain tech since at least mid-2019, mostly as a novel feature to spice up plain-vanilla money market funds. It has also experimented with share tokenization and last year joined custodian firm Curv’s $23 million Series A.

Leadership remained skeptical of cryptocurrency as an investment through this year. In March, Chief Market Strategist Stephen Dover told the Financial Review that Franklin Templeton held no cryptocurrencies in any portfolio. CEO Jennifer Johnson said she was “no fan” of bitcoin during an earnings call in May.

Franklin Templeton Chief Financial Officer Matthew Nicholls struck a more moderate tone at the time: He told analysts the firm was “focused” on getting ready for crypto.

“Having the capability to field, let’s call it, digital assets, in general, is going to probably be important for the future,” he said.

Updated: 9-2-2021

First Crypto Fund In Japan Targets Long-Term Retail Investors

Japanese financial conglomerate SBI Holdings Inc. is aiming to launch the country’s first cryptocurrency fund by the end of November that can give individual investors a way to diversify their broader portfolio.

The fund could grow to several hundred million dollars invested in coins including Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin and possibly others, said Tomoya Asakura, who oversees asset management for Japan’s biggest online brokerage.

Investors may need to put in a minimum of roughly 1 million yen ($9,100) to 3 million yen and it will mainly be aimed at people who understand risks associated with cryptocurrencies, such as the big price swings, he said.

“I want people to hold it together with other assets and experience firsthand how useful it can be for diversifying portfolios,” said Asakura, president of SBI affiliate Morningstar Japan K.K., in an recent interview. “If our first fund goes very well, we’d like to move quickly” to make a second one, he said.

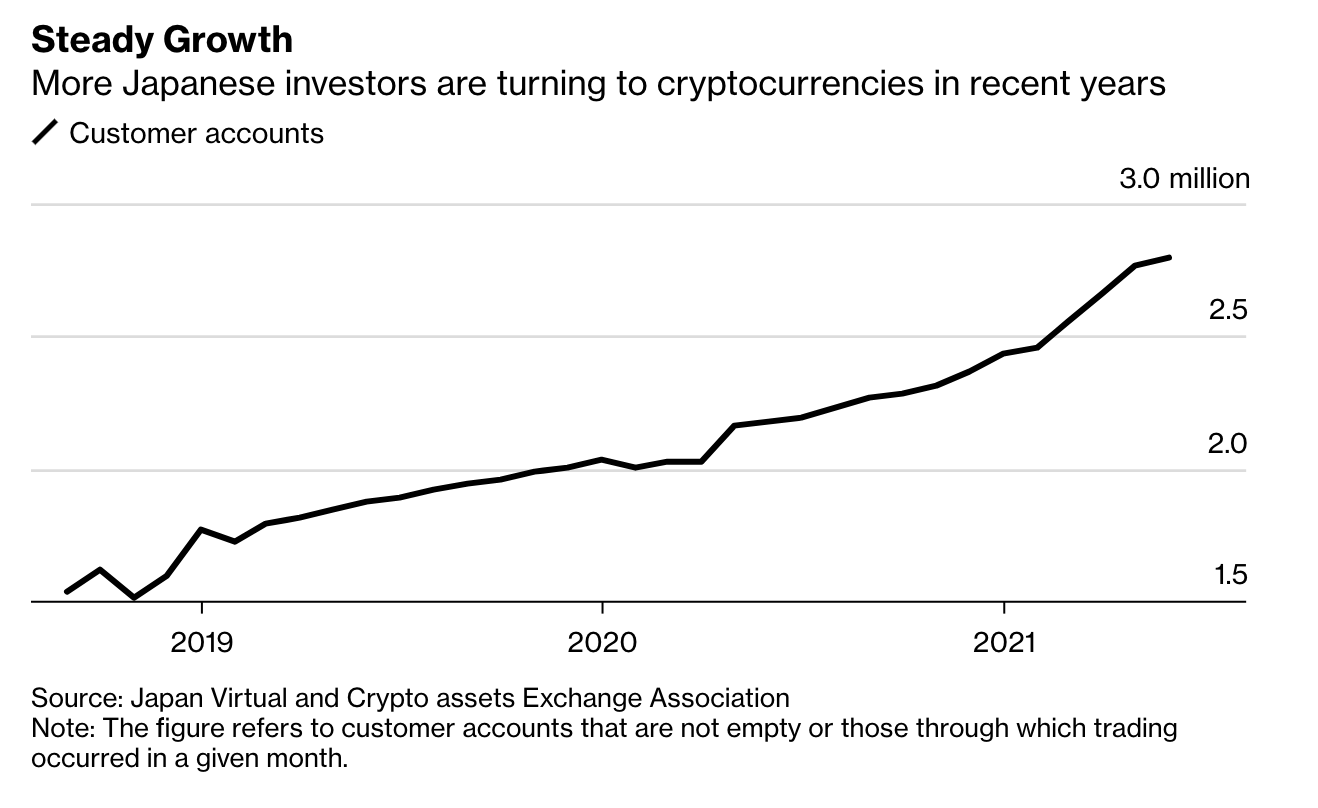

Despite tougher regulations for cryptocurrency businesses than in many other countries, digital assets are growing in popularity in Japan. Coinbase Global Inc., the U.S.’s largest cryptocurrency exchange, recently started a local trading platform and cryptocurrency transactions for the first half of 2021 more than doubled to 77 trillion yen from a year earlier, data from an exchange association shows.

It has taken SBI four years to get the fund off the ground, in part due to tighter regulations in response to hacking and other domestic scandals that forced changes from its early plans.

The Financial Services Agency, the regulator, banned companies from selling cryptocurrencies through investment trusts, a popular way of investing in Japan that SBI initially sought to use. Instead, the brokerage decided on a vehicle known as an “anonymous partnership.”

“There is an overwhelming perception that cryptocurrencies are highly volatile and speculative,” Asakura said. His job is building a “track record” showing the public and regulators that investors get a more resilient portfolio by adding cryptocurrencies because they often move inversely to stocks and other traditional investments, he said.

Cryptocurrency funds can be a “satellite” asset in a portfolio, as opposed to those considered to be “core,” that will help boost overall returns, Asakura said, without giving an expected level of return for the portfolio. SBI is open to making another fund designed specifically for institutional investors if there is enough demand, he added.

“Once people feel it firsthand,” he said, “they will understand that we aren’t recommending cryptocurrencies as a tool of speculation.”

Updated: 9-10-2021

Virginia Public Pensions Make A Direct Bet On Cryptocurrencies

A couple of Virginia public pension funds that first dipped their toes into the world of digital assets by investing in venture capital two years ago are at it again, and this time they are making a more direct bet on cryptocurrencies.

The Fairfax County Police Officers Retirement System and Fairfax County Employees’ Retirement System are planning to invest, pending board approvals, a total of $50 million in Parataxis Capital Management LLC’s main fund, which buys various digital tokens and cryptocurrency derivatives.

The outlays come on the heels of the Fairfax funds — which together manage about $7.15 billion — investing several times in Morgan Creek Asset Management funds, and, earlier this year, in crypto venture firm Blockchain Capital.

While some of these investments ended up going into coins like Bitcoin, the majority was invested into technology startups, so Fairfax considered them venture-capital investments. Parataxis, with its focus on actual coins, is different.

“We think that there’s going to continue to be volatility in crypto, and this is going to be good for value traders,” Katherine Molnar, chief investment officer for the police officers retirement fund, said in an interview with Bloomberg News. “It’s an area that’s going to grow in adoption and interest. We think that it’s inefficient enough, so we think there are some alpha opportunities to take advantage of.”

While many pension funds and endowments are exploring cryptocurrencies, few besides Fairfax have publicly announced they are jumping in. Regulatory uncertainty and high volatility of the coins have been partly responsible for the hesitancy.

But that same volatility can lead to outsized returns, which have been one reason for Fairfax’s expanded investment. Molnar’s $1.95 billion police retirement fund was planning for 2% exposure to crypto via Morgan Creek and Blockchain Capital, but at the end of June crypto accounted for 7% of assets, due to appreciation, she said.

Although Molnar couldn’t discuss exact appreciation, crypto “was not an insignificant contributor to performance” in the second quarter, she said.

While in recent months some companies such as MicroStrategy Inc. have begun investing their corporate treasuries into Bitcoin, Fairfax doesn’t want to invest into coins directly, Molnar said — partly because there are still too few data points to draw conclusions from on whether Bitcoin can be likened to gold, for example, she said.

“Three years ago we weren’t comfortable making a bet on which cryptocurrency will rise to the top,” she said. “And I am not sure we are comfortable yet doing that today.”

Parataxis was started in 2019 by Edward Chin, previously an investment banker at Michael Novogratz’s Galaxy Digital Holdings, and by Thejas Nalval, a former portfolio manager with digital-asset hedge fund LedgerPrime and head of asset management at the Element Group.

Parataxis has about $55 million in assets under management, Chin said. The two Parataxis funds invest in everything from Bitcoin to derivatives to DeFi coins such as MakerDAO. It plans to launch another fund.

“This is our first pension fund,” Chin said in an interview. “We are in conversations with a couple more, and a couple of endowments as well. It’s clear that people are trying to get exposure.”

Updated: 9-23-2021

Cambrian Says Its New Bitcoin, Ethereum Trusts Will Cut Through Volatility

The California-based asset manager said the new trusts will reduce volatility through its active management strategy.

Quantitative crypto hedge fund Cambrian Asset Management said its two new actively managed trusts, one trading bitcoin and one trading ethereum, will manage downside risk.

* The $200 million fund said in a press release on Wednesday that its management strategy will “manage downside risks and maintain substantial upside potential while seeking to defer taxable events for their investors.”

* Cambrian claims this strategy has helped its hedge funds cut downside volatility by over 70%, while delivering higher returns than a digital asset passive index in the past three years.

* Only institutional and accredited investors can buy into the trusts with an initial minimum investment of $50,000.

* The trusts will charge 4% in management fees, almost double the fees charged by Grayscale Bitcoin Trust, according to Bloomberg.

* Cambrian’s flagship hedge fund has returned 76% this year until August, Bloomberg reported, citing people familiar with the matter.

* The hedge fund was founded by executives from Winton Capital and Millennium Management, and is based in Mill Valley, California.

Updated: 10-3-2021

Beyond Bitcoin: The Future Of Digital Assets Is Bigger Than The First Crypto

While Bitcoin is the most recognizable digital asset, it’s just one asset class among many that are here to evolve financial services globally.

While change is guaranteed, the scale and scope of that change are not. For the financial industry, blockchain — the technology that undergirds Bitcoin (BTC), Ether (ETH), nonfungible tokens (NFTs) and other digital assets — has brought us to the crossroads.

What Will The Future Of Money Look Like?

We have been operating on the frontline of crypto for the past 10 years, protecting large and small investors alike while allowing them to invest in this exciting new frontier of finance. The experience we’ve gained here helps us to see what’s coming down the road.

In this historical period, a myriad of outcomes is possible but one thing is for certain: The efficacy and innovation of the technology will influence well beyond traditional financial sectors.

The Mature Digital Assets Industry Is Coming

Blockchain offers a faster, more efficient and more secure structure for financial transactions when compared with the contracts, transactions and records that currently define our economic, legal and political systems.

Harvard Business Review put it succinctly with this simile: “[The old financial structures] are like rush-hour gridlock trapping a Formula 1 race car. In a digital world, the way we regulate and maintain administrative control has to change.”

From generation to generation, technologies have updated how we complete financial transactions. The modern credit card has been around since the late 1950s, the first proper sale over the internet was completed in 1994, PayPal was founded in 1998 and went public and was sold to eBay in 2002, and Satoshi Nakamoto started the blockchain revolution in 2008.

Today, financial heavyweights are no longer standing on the sideline. And 55 out of the 100 biggest banks in the world have some form of exposure to this novel technology.

The first international regulations were handed down in Japan in 2016 after hacks against crypto exchanges, including an 850,000 BTC theft against Mt. Gox. Because the success of any financial market is based on predictability, security and general market efficiency, regulators continue to contemplate the direction and viability of their involvement with cryptocurrencies.

Regulators and businesses want to ensure that investors enjoy certain protections in any marketplace — digital or otherwise — to spark participation.

Think Federal Deposit Insurance Corporation (FDIC) for United States banks or eBay’s Money Back Guarantee. Without regulation, market participants can be exposed to long- and short-term risks.

Regulators also ensure that markets play with an equal set of rules. As Commodity Futures Trading Commission Commissioner (CFTC) Dan Berkovitz said back in June:

“It is untenable to allow an unregulated, unlicensed derivatives market to compete, side-by-side, with a fully regulated and licensed derivatives market.”

And, importantly, it’s not just regulators and governments that will decide the future — it is about us, investors, leaders and the general consumer — deciding how we want to use digital assets in the future.

Evolving Language For Useful Digital Assets

As the market matures, the cryptocurrency industry will undergo an evolution of language as well. Regulation and broad adoption will change the way the media and public perceive and talk about digital assets.

Crypto will retain its unique character as it matures — don’t expect the HODL, FUD, and “to the moon” talk to disappear — but it’s critical that a broader cohort of blockchain investors feel comfortable within the space.

It may seem like a small thing, but attention to fusing the languages of crypto and institutional finance has enabled us over the past 10 years to work with a range of institutions from neobanks, fintechs and brokers to banks, hedge funds and family offices.

The evolution of language happens in tandem with more large investors seeing blockchain’s long term value proven out over time as they begin to diversify major holdings to include crypto, thus increasing the association between these new assets and the legacy assets that have held historic value — like gold, bonds or central bank-backed fiat.

In business, you’re judged by the company you keep, so we won’t get that “hearty embrace” without adopting the language of financial services and regulators more broadly.

Nonetheless, it’s not unreasonable to imagine valuing crypto as a commodity rather than a digital currency — U.S. Federal Reserve Chair Jerome Powell told Congress in 2019 that Bitcoin was a “speculative store of value” like gold. But Bitcoin isn’t the whole story, just the most talked about.

The industry must stop focusing on one particular use case for the technology and start talking more about money, investments, financial management and smart payments.

The Industry Is Bigger Than Any One Token

We’ve discovered over the past 10 years that customers are increasingly drawn to assets that have utility and can solve complex problems.

Different Digital Currencies Have Different Use Cases. For Example:

* Tether (USDT) would work well to pay salaries because it’s tied — tethered — to U.S. dollars, thus avoiding the volatility of Bitcoin.

* Brave’s Basic Attention Token (BAT) is charting a course for the future of online content by issuing payments, in BAT, to the users of its browser for viewing ads. Those users can then tip anyone on the internet using the BAT in their digital wallet.

* And the Audius governance token (AUDIO) makes a compelling case for crypto playing a bigger part in the future of the music industry, providing security, exclusive feature access and community-owned governance to artists and fans.

Blockchain is about solving problems, not taking over the world, replacing fiat or banks, a common misconception among the general public. While BTC may be the most recognizable digital asset because it has name recognition and arrived first, it’s just one asset class among many.

So What Does The Future Look Like?

Congress opened up the doors to regulators earlier this year when the Senate passed an infrastructure bill that contained an amendment bringing new scrutiny to the crypto industry.

Investors, digital asset exchanges, smart technologists, government officials, regulators and everyone in between will benefit from a more mature marketplace that protects its consumers and values transparency, predictability and honest communication.

Likewise, the majority benefit from clarity about which digital assets hold actual value and which exist as manipulative tools to make the wealthy wealthier.

We’ve been there since the beginning and we’ve seen the ebb and flow of trends. But we’ve also seen that what survives at the end of the day is always brilliant ideas that solve the emergent problems of our time.

Yes, change is here. The mature digital assets industry has begun to emerge over the last several years, bringing with it a synergy of language that has become more sophisticated and invited a broader audience to our table.

The assets and insight that this new audience brings, in turn, will provide rich confidence across industries. That confidence will lead to the adoption of blockchain technology to unravel issues that no one ever dreamed could be addressed with blockchain.

Updated: 10-7-2021

Stockbroker Platform Public.Com Adds Crypto Trading Feature

The stock trading app is set to debut crypto trading for its users except those in the state of New York.

Public.com, a neo-brokerage outfit based in New York has announced the launch of crypto trading services for its customers.

In a statement issued on Thursday, Public revealed that users will be able to trade and store cryptocurrencies on the same app they use to manage their stock portfolios.

According to the announcement, the new crypto trading feature will be made available to users gradually over the next few weeks.

As part of the crypto trading service, Public is offering support for Bitcoin (BTC), Ether (ETH), and Dogecoin (DOGE). Other cryptocurrencies offered include Cardano (ADA), Litecoin (LTC), and Bitcoin Cash (BCH).

Stellar (XLM), Zcash (ZEC), Ethereum Classic (ETC), and Dash (DASH) complete the list of 10 cryptos to be offered by Public.

Public’s crypto trading feature is offered in conjunction with Apex Crypto. Since the latter does not hold a BitLicense in New York, the product will not be available for residents in the state.

Apex Crypto will reportedly provide execution and custody services for Public’s new crypto trading product.

Public’s foray into the crypto space could be part of the company’s plans to rival major stock trading platform Robinhood.

Back in February, Public secured $220 million in additional funding to cross the $1 billion valuation mark.

Like Robinhood, Public also offers zero-commission stock trading but has an added social media component that could leverage the emerging meme stock-fuelled retail investment frenzy.

In February, Public also jettisoned the payment for order flow (PFOF) practice that sees brokerage platforms routing orders to market makers for trade execution rather than sending same straight to exchanges.

The practice has drawn significant controversy and was a major talking point during the Gamestop saga from earlier in the year.

As previously reported by Cointelegraph, Robinhood could lose a significant revenue channel if United States regulators ban PFOF.

Updated: 10-8-2021

Crypto And Pension Funds: Like Oil And Water, Or Maybe Not?

Pension funds, the most cautious of institutional investors, are now giving the booming crypto and blockchain sector a closer look.

There are good reasons why pension funds should not invest in the crypto and blockchain space. The industry is too new, too volatile, and stultifyingly technical. Moreover, the rules and regulations to govern the sector have yet to be settled.

But the fixed-income financial instruments that pension funds typically favor — like long-term government bonds — are scarcely paying anything these days, so the traditional caretakers of employees’ retirement funds have a dilemma: Where to find investment yield in a world where inflation is looming?

It may not be entirely surprising, then, that pension funds — the most cautious of institutional investors — are now giving the booming crypto/blockchain sector a closer look.

“Family offices led the charge into crypto funds several years ago, but we’ve seen increasing interest from pensions, and there are many pensions that now have exposure to crypto,” Stephen McKeon, a finance professor at the University of Oregon and a partner at Collab+Currency, told Cointelegraph.

“We’ve seen increased interest from pensions” in the past year, added Christine Sandler, head of sales, marketing and research at Fidelity Digital Assets — part of an uptick among all institutional segments — “which we believe reflects the growing sophistication and institutionalization of the digital assets ecosystem, combined with a strong macro narrative driven by response to the pandemic.”

Pension funds tend to be “more conservative, risk-averse investors relative to other segments,” according to Sandler, and they mostly favor investments that have exhibited long-term growth and low volatility, which might arguably make them leery of the crypto/blockchain space.

An Early Adopter

One of the first United States-based pension funds to invest in blockchain firms was the Fairfax County Police Officers Retirement System, based in Fairfax, Virginia.

It tested the waters back in 2018 with an 0.5% allocation in a fund that was investing in blockchain-related enterprises, Katherine Molnar, the fund’s chief investment officer, told Cointelegraph at the recent SALT conference in New York City.

The fund raised its allocation to 1% in 2019, and in spring 2021, it added two new blockchain-related investment funds. The current target allocation is 2%, but because crypto and crypto-based companies have been rising in value, 7% of overall fund assets are now crypto-related — again, mostly “pick-and-shovel” type enterprises that support the industry — like crypto exchanges and custodians.

The pension fund can’t rebalance because it is invested in venture capital funds, Molnar explained, but in mid-September, Fairfax signaled its intent to invest $50 million with Parataxis Capital, a crypto hedge fund that invests in digital tokens and cryptocurrency derivatives. “It’s not a directional bet, but it’s not totally illiquid either,” she told Cointelegraph.

The fact that the police officers’ pension fund has invested until recently in crypto-related companies as opposed to cryptocurrencies — Coinbase rather than, say, Bitcoin (BTC) — isn’t uncommon, either.

U.S. institutional investors surveyed by Fidelity Digital indicated a greater propensity for digital asset investment products rather than direct ownership of cryptocurrencies, Sandler told Cointelegraph, adding:

“From our study, we also know that pension funds and defined benefit plans, like many other institutional investor segments surveyed, favor active management of an investment product containing digital assets.”

More pension funds may now travel this road. “We’ve started to see participation not just from the hedge fund segment, which we’ve long seen participation from, but now it’s recently from other institutions, pensions and endowments,” Michael Sonnenshein, CEO of Grayscale Investments — the largest manager of digital assets — told Bloomberg earlier this year, adding he anticipated that pension funds and endowments would drive much of his investment firm’s future growth.

Even pension-fund giants like the California Public Employees Retirement System (CalPERS) have dipped a toe in the crypto/blockchain sea.

CalPERS invested in Bitcoin mining firm Riot Blockchain LLC some years back and has since raised the stake to about 113,000 shares — worth about $3 million in early October — though that is minuscule compared with CalPERS’ $133.3 billion in equity assets under management, as of its 13F filing in August.

How Much Is Enough?

What sort of crypto allocation is appropriate for a pension fund today? Jim Kyung-Soo Liew, associate professor at Johns Hopkins University’s Carey Business School, co-authored one of the earliest academic papers on crypto and pension funds back in 2017. That paper found that a 1.3% Bitcoin allocation would be “optimal” to fully reap the cryptocurrency’s diversification benefit.

What is appropriate today? “Going forward, an institutional investor should be looking at a 10%–20% allocation,” Liew told Cointelegraph, and he expects large pension funds to be investing as much as one-fifth of their total assets in the crypto/blockchain space within the next three to five years.

98% of retirement accounts in the US can’t access #Bitcoin.

That’s $36,800,000,000,000.

What happens when they do?

— Dan Held (@danheld) October 7, 2021

“We’ll see more institutional investors,” Liew said, adding, “Their horizons are long.” Today’s $2 trillion in cryptocurrency market capitalization could swell to $20 trillion in the next three to five years, he added, assuming a favorable regulatory environment.

Asked if this doesn’t fly in the face of pension funds’ traditional conservatism, Liew answered, “Pension funds have boards; they have investment committees,” and yes, “they’re often accused of being overly conservative and wanting to understand things 100% before acting.”

From an education standpoint, it will take some time and effort to bring them along, but chief investment officers are quite intelligent as a group, and they will be able to grasp the concepts, Liew said. One problem, he allowed, “They’re not rewarded for risk-taking.”

Obstacles Remain

There may be other impediments. “One challenge is that pensions tend to require large tickets,” McKeon told Cointelegraph, “so the space had to mature a bit to accept that amount of capital. As funds continue to scale up, we expect to see more participation by pensions.” Volatility remains a concern, said Sandler, pointing to data:

“‘2021 Institutional Investor Digital Assets Study’ found that 73% of U.S. pension funds, defined benefit plans, and endowments and foundations surveyed cited volatility as the top barrier to adoption.”

U.S. pension funds and defined benefit plans still hold a fairly negative view of digital assets, according to the survey, “but I think we’ll continue to see that negative perception decrease as the market continues to mature and these investors get more comfortable with the technology, infrastructure and channels for exposure and have a more fully developed investment thesis about these assets,” she added.

As such, pension funds, like other institutional investors, are striving to find investment opportunities. As The New York Times noted, “U.S. Treasuries have been the bonds of choice for safe retirement income. But they could deliver no real return for the next decade.”

Meanwhile, on the positive side, pension funds have long horizons, and they can withstand short-term volatility. Another plus, “Crypto talent is spread uniformly around the world, and we can source that talent,” Liew added.

Fiduciary constraints won’t disappear, of course. Many pension funds represent municipalities, and they are holding many people’s late-life financial well-being in their hands. That’s a lot of responsibility. But you “can’t get a ton of reward if you don’t take on some risk,” Liew said.

A while back, the president of Molnar’s board said, “I understand the need to do this” — the police officers’ pension fund, like most institutional investors, was struggling to grow its money in a continuing low-interest-rate environment — but some officers “are off the reservation,” he claimed.

With the fund’s recent 7.25% rate of returns on its crypto investments, it’s probably safe to assume that some of those officers are back on the reservation now.

Google Pay To Support Bakkt Debit Card

The crypto exchange also chose Google Cloud as its preferred cloud service provider.

Crypto exchange Bakkt said its virtual Visa debit card is now available for use on Google Pay online and in stores.

* Cryptocurrency balances will be converted to fiat to enable transactions to occur, Bakkt said in a statement Friday.

* Bakkt’s Google Pay support follows in the footsteps of Coinbase, which rolled out Apple Pay and Google Pay support for its Coinbase Cards earlier this year.

* The Alpharetta, Ga.-based company, which last month received approval to go public from the U.S. Securities and Exchange Commission, also said it will use Google Cloud as its preferred cloud service as it develops artificial intelligence and machine-learning capabilities.

* Bakkt will build new analytics and geolocation functionality on its platform utilizing Google Cloud tools as well, Bakkt said. Insights generated will expand loyalty redemption options for customers and provide Bakkt partners with consumer behavior data.

* “This partnership is a testament to Bakkt’s strong position in the digital asset marketplace, to empower consumers to enjoy their digital assets in a real-time, secure, reliable manner,” Bakkt CEO Gavin Michael said in a press release. “Additionally, partnering with Google Cloud will enable us to continue to build a best-in-class, innovative platform that can undoubtedly scale to meet the needs of millions of users.”

Updated: 10-15-2021

Citi Loses Top Trading Executive Zhang To Crypto World

Citigroup Inc.’s Matt Zhang is leaving the bank for the world of cryptocurrencies, according to people familiar with the matter.

Zhang will start a fund that trades digital assets and makes venture investments in crypto companies, according to one of the people, who asked not to be identified discussing non-public information. Zhang is seeking to raise more than $1 billion for the fund, the person said.

A 14-year veteran of Citigroup, Zhang created the firm’s spread products investment technologies team, or Sprint, which makes bets on financial-technology companies as a way to get a first look at innovations that could reshape debt markets.

The venture has focused on technologies related to trading infrastructure, data analysis, artificial intelligence and machine learning.

Zhang was most recently co-head of Citigroup’s structured products trading and solutions division. With his departure, Chetan Vohra will become sole head of that unit and will also lead the Sprint business, one of the people said.

A Citigroup spokesman declined to comment on Zhang’s departure.

Wild cryptocurrency markets are luring many longtime banking executives away from Wall Street, where company executives have been taking a wait-and-see approach even as their clients increasingly clamor for access to the asset class.

“We’re fairly cautious around crypto as a bank,” Citigroup Chief Executive Officer Jane Fraser said at a conference this week. “We proceed with great caution on that one as to where the value is and isn’t.”

Zhang is at least the second top Citigroup executive to depart for the digital-assets industry in recent months. Christopher Perkins, the former co-head of Citigroup’s futures, clearing and foreign-exchange prime brokerage businesses, was hired in August as a managing partner and president by CoinFund, a blockchain-focused investment firm.

MSCI Warns of ‘Creeping’ Crypto Exposure In Equity Markets

Fifty-two companies with crypto exposure combine for a total market capitalization of $7.1 trillion.

MSCI warned of “creeping” exposure to cryptocurrency in equity markets by 52 companies with some degree of crypto exposure.

* The companies covered by the index provider’s research have a combined market capitalization of $7.1 trillion, Bloomberg reported Thursday.

* The roster includes firms directly involving in the buying and selling of crypto, such as exchange Coinbase, and firms with an allocation of cryptocurrency on their balance sheets, such as business-intelligence software firm MicroStrategy.

* While those two are among the most obvious examples of crypto exposure, MSCI highlighted in a blog post Wednesday that equity investors may be faced with “creeping” cryptocurrency exposure.

* “This can occur when newly listed cryptocurrency companies get added to the indexes that guide their investments, or when companies in which they are already invested, directly or through indexes, announce strategies that include bitcoin or other cryptocurrencies.”

* In particular, the governance of cryptocurrencies may present new challenges to companies and investors, given their decentralized nature.

* “At a minimum, investors may benefit from understanding how managers and directors of cryptocurrency-exposed companies are monitoring developments in these informal governance frameworks. For companies with more significant exposure, investor interests may be better served by being more actively involved,” MSCI said.

Updated: 10-18-2021

The ‘Risk-Free’ Crypto Trade Is Back In A Big Way

The closest thing to a risk-free bet has reemerged in the cryptocurrency market as traders — awaiting the launch of the first Bitcoin exchange-traded fund — bid up the price of futures.

The spread between Bitcoin futures and the digital currency’s price offers the widest annualized return in five months, according to data from FRNT Financial. That means the so-called basis trade, whereby a speculator buys Bitcoin in the spot market and sells long-dated futures to lock in the discrepancy between the two prices, has turned back on.

And it’s happening amid a price surge in Bitcoin that’s been bolstered by optimism the Securities and Exchange Commission is poised to allow the first U.S. Bitcoin futures ETF to begin trading soon.

It’s a dynamic that comes back again and again in crypto and is one that is rarely seen in other markets, according to Strahinja Savic, head of data and analytics at FRNT Financial. It’s primarily driven by individual investors, who are using futures for leverage and to make price predictions.

“Crypto is unique in that it has a much higher retail participation versus sophisticated institutional actors, who would normally drive down the exaggerated contango via arbs trades,” said Savic, referring to arbitrage. “Considering the lack of those actors’ participation, relative to other assets, BTC is prone to these aggressive contangos in bull markets — we find this kind of an opportunity to be an extremely underrated and lucrative strategy in crypto.”

Futures typically trade at a premium to spot, a development referred to as contango. Contango and backwardation are terms for curve structures that map traders’ guesses about what a given contract could be worth in the future. Contango means it’s upward sloping, while backwardation means downward.

Futures in contango indicates that the supply of Bitcoin is plentiful because there is no cap on futures open interest, says Steve Sosnick, chief strategist at Interactive Brokers. As long as enough traders post sufficient margin with a clearinghouse, any two counterparties can create a new futures contract by initiating a trade, he said.

Right now, a lot of traders might be betting that a futures-based ETF will be a big forced buyer in the market. Whatever money ends up flowing into the product will have to be employed to buy futures contracts, the thinking goes.

“There is a well-hyped new asset class that has to contractually buy these futures, and traders are adjusting and front-running accordingly,” he said. “It’s quite possible that the market got ahead of itself, which is certainly a risk in the crypto space, but there is clearly a bet being placed that fresh money will be coming into crypto via the futures ETFs.”

To be sure, more traders could look to take advantage of the spread, meaning that it could shrink, says Zhu Su from Three Arrows Capital, a hedge fund.

“You’ll have a lot of capital come in to arbitrage because it’ll get to the point where it’s very attractive. If you can get 6%, 10% on dollars there’s a lot of guys that will want to do that,” said the firm’s co-founder. “It just takes one bank or one participant with a few billion dollars to come in. If you zoom out, it’s not going to be that bad.”

Though it had broken down earlier in the year amid a selloff in crypto prices, the basis trade has been one of the most pervasive in the crypto industry. It’s been known to be widely used by hedge funds thanks to its ability to reliably produce double-digit annual gains.

“The future price is up higher than the spot market and this is where we see a lot of arbitrage plays from the big boys,” Howard Greenberg, president of the American Blockchain and Cryptocurrency Association in D.C. and cryptocurrency educator at Prosper Trading Academy, said by phone. “They’ll play that spread — they’ll buy the underlying asset at a less expensive price and then bid up the futures, and they’ll sell off into the strength of the market.”

Updated: 10-20-2021

Crypto Finserv Firm Bakkt To Soon Trade Publicly On New York Stock Exchange

Starting Oct. 18, Bakkt’s common stock and warrants will be listed on NYSE under the ticker symbols “BKKT” and “BKKT WS,” respectively.

Bakkt Holdings, the digital assets management arm of Intercontinental Exchange (ICE), has announced it will soon become a publicly traded company on the New York Stock Exchange, starting Oct. 18.

The public listing for Bakkt comes as a result of a merger with VPC Impact Acquisition Holdings, a Chicago-based special purpose acquisition company. According to an official statement, a shareholders meeting regarding the merger saw approximately 85.1% approval for the business combination:

“Upon closing, the combined company’s Class A common stock and warrants are expected to begin trading on the New York Stock Exchange (“NYSE”) under the ticker symbols “BKKT” and “BKKT WS” respectively.”

Additionally, the business combination resulted in gross proceeds of approximately $448 million to Bakkt, which it plans to reinvest in growing the company’s capabilities and partnerships.

Just last week, Bakkt announced a partnership with Google to allow the purchase of goods and services using Bitcoin (BTC) and other cryptocurrencies via the Google Pay platform. According to Bakkt CEO Gavin Michael, the partnership “is a testament to Bakkt’s strong position in the digital asset marketplace, to empower consumers to enjoy their digital assets in a real-time, secure, reliable manner.”

Back in March, Bakkt launched a payments app that allows users to make purchases via cryptocurrencies, prior to which the exchange offered BTC futures contracts exclusively to accredited investors.

Meanwhile, mainstream crypto adoption in the United States continues to see increased support from lawmakers as a new bill demands a safe harbor for certain token projects.

A new draft bill proposed by Representative Patrick McHenry, “Clarity for Digital Tokens Act of 2021,” suggests an amendment to the Securities Act of 1933 to allows projects to offer tokens without registering for up to three years.

The bill was based on an older initiative from SEC Commissioner Hester Peirce highlighting that “safe harbor could be the most groundbreaking development for the U.S. cryptocurrency market to date.”

Updated: 10-21-2021

Pension Fund For Texas Firefighters Reportedly Allocates $25M To Bitcoin And Ether

The fund is responsible for the benefits of more than 6,600 active and retired firefighters as well as surviving family members.

The pension fund for firefighters in Houston has allocated part of its $4 billion portfolio towards crypto.

According to a Thursday Bloomberg report, the Houston Firefighters’ Relief and Retirement Fund used the New York Digital Investment Group, or NYDIG, to execute the purchase of $25 million in Bitcoin (BTC) and Ether (ETH).

Public records through the Texas comptroller’s office show the pension fund held more than $4.1 billion in total net assets as of June 2020, meaning the group has allocated roughly 0.6% of its portfolio towards digital assets.

“We have been studying this as an asset class to add to our investment portfolio for quite some time,” said the fund’s chief investment officer Ajit Singh. “It became an asset class we could not ignore anymore.”

He Added:

“As more and more institutional adoptions happen, there will be more and more dynamics that develop for supply and demand. And having physical assets — actual tokens — gives us in the future the possibility of income generation potential.”

The fund is responsible for the benefits of more than 6,600 active and retired firefighters as well as surviving family members. According to the group, more than half of the fund is invested in common and private equity but also includes domestic stocks, international stocks, bonds, cash and real estate.

In June, retirement plan provider ForUsAll gave its clients the option to invest up to 5% of their portfolio assets in cryptocurrencies, saying United States citizens could be at a “disadvantage” if they are not given the option of accessing crypto assets in their retirement plans. Earlier this year, Grayscale also reported that it had seen pension funds and endowments investing actively into its funds with exposure to crypto.

Updated: 10-26-2021

$2.6 Billion Quant Hedge Fund Joins The Rush To Crypto

When Chris Taylor’s money-printing Dogecoin trade was wiped out in the $650 billion crypto crash back in May, the stakes were low. The 37-year-old was simply having fun YOLO trading from his personal account.

But now things are getting serious as Taylor helps spearhead a digital-currency initiative in his day job as senior investment partner at GSA Capital.

The $2.6 billion quant hedge fund is joining the likes of Steve Cohen and Alan Howard looking to profit from the famous volatility and inefficiencies across the now-$2.6 trillion market. That’s as long as Taylor and his fast-money peers can avoid getting crushed in the next crash.

“Our approach has always been: Let’s try to launch quickly — try to capture as much upside as we can now — because we know that at some point crypto hype will die down,” the hedge fund manager says in an interview at GSA Capital Partners LLP’s London office in Mayfair.

The 16-year-old fund is deploying the kind of systematic trades that have helped it net profits in the traditional world of stocks, derivatives and currencies. GSA started formally trading crypto assets in August, per Taylor.

The University of Cambridge-educated mathematician declined to reveal the size of capital commitments but says it’s a modest part of the firm’s International Fund, with the potential to increase if performance is strong.

GSA is in the process of hiring its first head of crypto trading and operations. Taylor will continue his work on crypto as well as longstanding duties including overseeing a trend-following strategy in traditional assets.

It’s a well-timed move, with the bull market revival lavishing easy rewards for market-neutral quant trades beloved by hedge funds like GSA. Bitcoin has rallied more than 40% this month alone to trade at records after the launch of an exchange-traded fund tracking futures on the world’s largest digital currency.

In turn, the funding rate for financing long positions in Bitcoin futures — a popular trade in bull cycles — has returned to levels last seen before the May selloff on the largest exchange Binance, Bybt data show. GSA is duly taking advantage of the discrepancy by going short the derivatives and long the spot, a classic arbitrage trade and the closest thing to a free lunch in the crypto market.

GSA, which started as the Global Statistical Arbitrage desk at Deutsche Bank AG, is also applying the quant technique to crypto futures in a bid to exploit price patterns.

That’s not to say executing systematic trades is smooth sailing. Far from it. There are no one-stop-shop prime brokers, while exchanges are nothing like their Wall Street equivalents. For instance, GSA has to put down excess collateral because platforms can liquidate positions with no warning.

As Taylor himself learned the hard way earlier this year, these liquidations can be so extreme that even profitable wagers, such as his Dogecoin position, can be closed if exchange operators are struggling to absorb the negative balances of other traders when the market crashes.

Then there’s custody. With the industry notoriously prone to hacks, many investors store their tokens in cold storage or wallets disconnected from the internet for safekeeping. Yet hedge funds still need to transfer them to exchanges for trading. There still isn’t a great solution to balance liquidity with security, according to Taylor, who’s using platforms like Twitter, Telegram and Discord to get to grips with his new gig.

“It’s interesting to be involved in something new where you feel that there aren’t a lot of people you can go to to explain how it’s done, and there aren’t existing procedures for how the operational set-up should look,” he said.

Updated: 10-29-2021

Cowen CEO Expects Institutions To Adopt Crypto In Coming Years

Institutional investors yet to touch cryptocurrencies will begin to involve themselves with the tokens more heavily in the next decade, according to Cowen Inc. Chief Executive Officer Jeffrey Solomon.

“We’re certainly seeing an up-tick in people that are interested in doing it — the ‘crypto-curious,’ I call them,” Solomon said Friday in an interview on Bloomberg Television. “We’ve seen mostly retail involvement and a little institutional involvement, but we think we’re in the very, very early stages of significant participation by institutions.”

One limiting factor is whether firms will be living up to their fiduciary responsibilities by exposing themselves to the currencies, which are known for volatility, Solomon said.

Cowen announced in May that it would offer custody services for digital currencies. Bank of New York Mellon Corp. and U.S. Bancorp are among companies that have taken similar steps, partnering with financial technology firms.

Updated: 11-2-2021

Customers Bank Veers Into Crypto With Transfer Token, $1.5B In Crypto-Related Deposits

The Pennsylvania-based bank, 0.52% the size of JPMorgan, is making a a big play for business clients from the crypto sector.

Pennsylvania-based Customers Bank has started onboarding its first cryptocurrency businesses, offering those firms use of a digital asset payments platform plus the bank’s own internal digital fiat token.

As such, Customers Bank will compete with Silvergate in California, Signature in New York and Massachusetts-based BankProv in offering crypto firms accounts, as well as a blockchain-based platform for clients to instantly send each other dollars 24/7.

The Tuesday announcement makes good on Customers’ promise to serve the crypto industry back in August of this year.

The bank, a $19.1 billion subsidiary of Customers Bancorp, said it had onboarded cryptocurrency trading firms Genesis Trading (which shares a parent company with CoinDesk), Blockfills, GSR and SFOX.

“We’re proud to be attracting these best-in-class organizations,” Customers Bank CEO Sam Sidhu said in a statement. “And are confident that we can provide the much-demanded fiat currency ‘on and off ramp’ for institutional clients in the crypto ecosystem.”

Customers Coin

The Customers Bank-branded CBIT token and a digital fiat payment system dubbed TassatPay bear some similarity to JPMorgan’s Onyx blockchain and much fêted JPM coin – despite being just 0.52% the size of the New York-based megabank.

Customers Bank, whose deposits are insured by the Federal Deposit Insurance Corporation (FDIC), announced $1.5 billion of zero-cost deposits from crypto business in its Q3 earnings report issued Oct. 28.

Sidhu said the bank’s digital fiat rails will expand to serve other verticals besides crypto.

“We see very beneficial applications for real-time B2B payments options in commercial real estate, healthcare, hospitality, insurance, accounting, alternative energy, and manufacturing supply chains,” he said.

Updated: 11-9-2021

These Publicly Traded Firms Are Pulling Institutions Into Crypto

With increasing institutional capital flow into the crypto markets, publicly listed digital asset companies offer the best crypto gateway to institutional investors.

Cryptocurrencies have quickly emerged as one of the hottest investment vehicles of the past decade, gaining traction first from retail traders, as seen in 2017, and now from institutional investors.

From being a domain of bedroom coders to a growing financial sector with over $2 trillion in market capitalization, the crypto space has seen a sudden surge in value and continues to attract huge interest from investors.

While crypto assets have proven to be valuable, volatility remains a top concern, especially for institutional players. Sure, any investor can buy some cryptocurrencies and profit from their rising value.

However, investing in established companies that are involved in the crypto and blockchain business is another way of diversifying and gaining from the overall uptake of everything blockchain and crypto-related.

This gives investors exposure to an investment vehicle with a low correlation to the volatile price swings of the crypto market.

Here is a look at some of the top publicly traded digital asset companies available to retail and institutional investors alike.

Coinbase

Coinbase’s direct listing on Nasdaq in April this year was a watershed moment for the entire cryptocurrency market. Boasting as the largest crypto trading volume for a crypto exchange in the United States, Coinbase made its debut on Nasdaq as a publicly-traded company with a valuation of close to $100 billion. Coinbase chose to go with a direct listing as opposed to the conventional initial public offering.

Founded by Fred Ersham and Brian Armstrong in 2012, Coinbase offers crypto trading services to more than 40 million retail users and about 7,000 institutions spread across the globe. While its main source of revenue has been the transaction fees on its crypto exchange, Coinbase hopes to go beyond trading to offer a debit card that allows consumers to spend their digital assets conveniently.

Coinbase also offers a cloud-based digital asset custody service, an asset loan service and a data monitoring service for digital assets on the blockchain.

Microstrategy

Microstrategy is a software company with more than 40% of its market valuation invested in Bitcoin (BTC). The company has been increasing its Bitcoin stash over the past year with an accumulative purchase of Bitcoin worth more than $5 billion at current prices.

With more than 100,000 BTC to its name, Microstrategy has gone from relative obscurity in the world of finance to a crypto giant and a well-known firm on Wall Street. The company’s CEO, Michael Saylor, a Bitcoin evangelist, routinely touts Bitcoin on social media as a revolutionary invention and has also been vocal in defense of the company’s move to invest aggressively in crypto.

Recently, MicroStrategy sold $1 billion worth of its stocks holdings to inject the proceeds in acquiring more Bitcoin. Since the company announced its debut in Bitcoin, Microstrategy’s stock price has soared by more than 400%.

Riot Blockchain

Riot Blockchain is a U.S.-based Bitcoin mining and publicly listed company that uses a multitude of specialized machines called application-specific integrated circuits to mine Bitcoin. Recently, the Bitcoin mining firm dove deeper into the business with the purchase of a Bitcoin hosting facility in North America called Whinstone US.

In a press release, Riot Blockchain’s CEO Jason Les mentioned that “with Whinstone’s preeminent infrastructure and best-in-class construction, development and operations organization, Riot is extremely well-positioned to increase the scale and scope of its operations.”

Whinstone’s energy management strategy will reportedly help Riot Blockchain manage its Bitcoin mining energy costs, enabling access to reliable and responsive power to further support the Bitcoin network.

Riot Blockchain receives its mining machines from Bitmain and hosts more than 35,000 Antminers, leading to a hash rate capacity of 3.8 EH/s.

Paypal

Although PayPal stock is not purely a crypto play, the company opened its doors to digital currencies, allowing its customers with personal accounts to buy, sell and hold several cryptocurrencies including Bitcoin. Customers on PayPal can go as far as checking out with crypto even as the company continues to test out the concept of allowing crypto on its platform.

Given that digital assets and crypto are the future of finance, PayPal’s adoption of the crypto is a move to increase the usage of its app among retail investors, as well as facilitate more transactions between customers and merchants.

Furthermore, the company’s CEO has mentioned crypto several times, adding that its crypto functionality is not a speculative move but rather a developmental one that will offer customers more choices when shopping online.

Marathon Digital Holdings

Marathon Digital is a Nasdaq-listed company that has seen its stock price rally recently due to its Bitcoin purchases and mining activities. In May this year, the company released a letter of intent to collaborate with Compute North in hosting a Bitcoin mining data center with a 300-megawatt capacity.

So far, the company has seen tremendous progress with its revenue rising by 1,444% year-over-year with a host of over 70,000 Bitcoin miners setting its hash rate to 10.37 EH/s. Given the rising Bitcoin mining energy concerns and the recent developments, Marathons Digital expects its operation to achieve carbon neutrality by up to 70%.

Marathon Digital’s balance sheet has about 18.3 % of its total valuation invested in cash and Bitcoin, and continues to purchase more Bitcoin as well as store the crypto it produces at much larger percentages. According to reports, Marathon Digital is capable of mining upwards of 50 Bitcoin per day, setting the company’s value over $5 billion.

Hut 8 Mining

Hut 8 Mining features a unique approach to Bitcoin mining with a business model that is designed with scalability in mind. Believed to be one of the most promising Canada-based mining and blockchain infrastructure firms, the company has mined 264 Bitcoin in September alone, averaging about 9.11 BTC mined per day.

The company has adopted a long-term Bitcoin hold strategy where 100% of the self-mined Bitcoin is deposited in custody as the company advances toward its goal of holding 5,000 self mined Bitcoin by the end of the year. As of Sept. 30, Hut 8 Mining has accumulated 4,724 Bitcoin in custody.

EQONEX Group

EQONEX Group is a digital asset firm offering financial advisory services. This Nasdaq-listed company has since rebranded with the inclusion of additional services such as a crypto exchange, a custody platform and a multi-venture trading service, as well as an over-the-counter (OTC) offering.