Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Coinbase Custody Holds $1.3B In Assets Under Custody, Expects To Hit $2B ‘Soon’. Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Coinbase Custody revealed that it holds $1.3 billion in assets under custody (AUC) and the firm expects to hit $2 billion AUC soon in a Twitter thread published on June 13.

In a series of tweets, what is evidently the official Coinbase Custody Twitter account reported that last week the company’s CEO, Sam McIngvale, and its chief information security officer, Philip Martin, visited the United Kingdom. The purpose of the visit was reportedly “to discuss the institutional cryptoeconomy with a range of prospects and clients.”

During the meeting, the firm’s representatives argued that, while many believe that there are no institutional-grade offerings in the cryptocurrency space, Coinbase Custody is in fact such an offering. The firm’s representatives stated that the company is insured, regulated and secure custodian. The thread also specifies:

“We have $1.3bn AUC and expect to hit $2bn soon. We have no intention of stopping there. […] Coinbase Custody services over 90 clients. Of those, approximately 40% are outside of the US.”

Lastly, the tweet also claims that — as cryptocurrencies mature as an asset class — financial hubs such as London are becoming centers for crypto innovation.

During an on-stage discussion at Consensus in mid-May, Brian Armstrong, CEO of Coinbase, said that its custody service had already received $1 billion in assets under management.

As Cointelegraph reported in March, the United States Securities and Exchange Commission is soliciting industry input as it potentially reconsiders existing custody rules in specific cases of digital asset trading and settlement.

In April, Hong Kong trading and asset management firm BC Group announced that it is launching an insured custody service for cryptocurrencies.

Bitcoin Surpasses 1 Million Daily Active Addresses

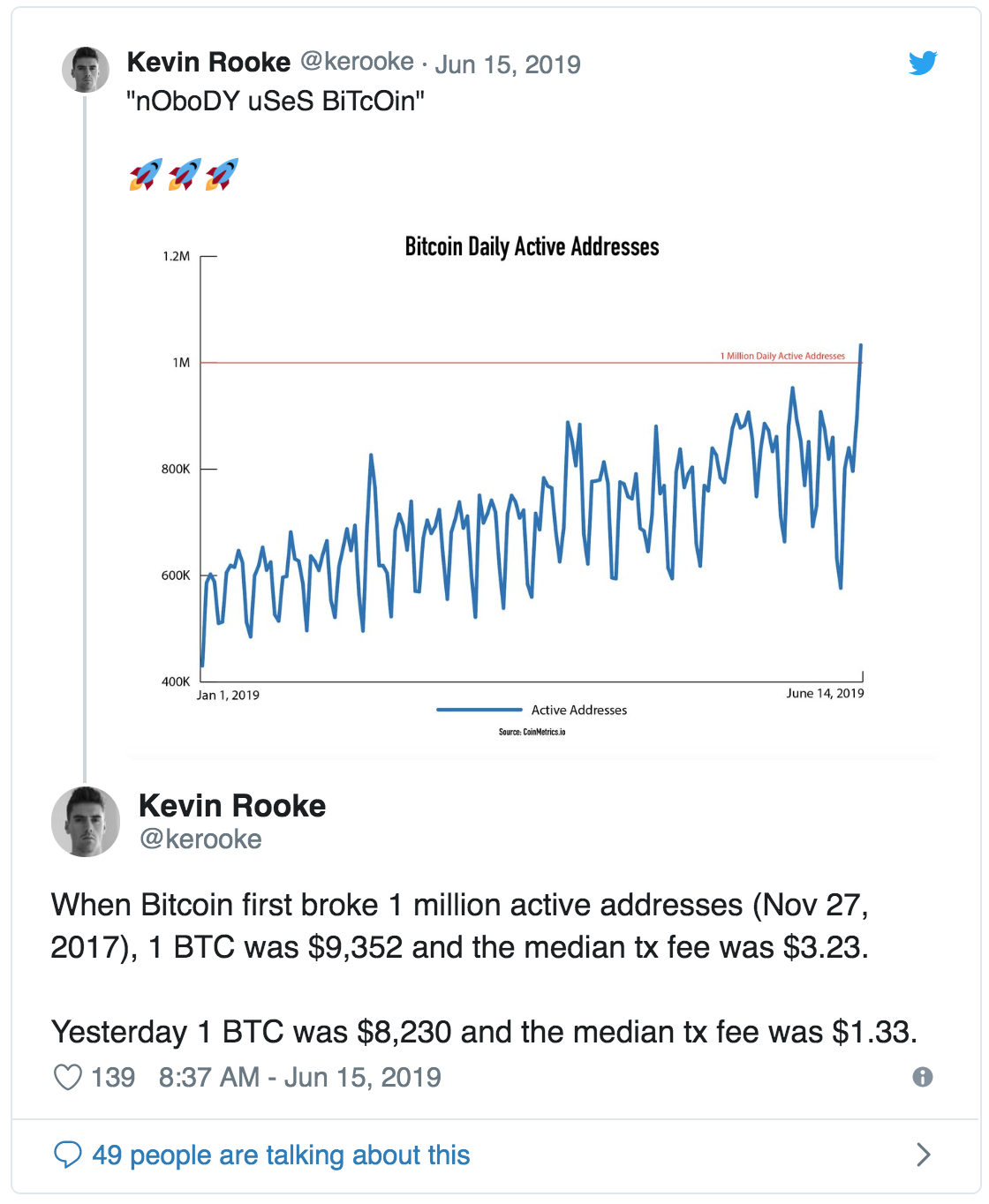

Bitcoin just passed an interesting milestone today, one we haven’t seen since November 27, 2017. According to CoinMetrics.io, there are now over a million daily active addresses, a number that is defined as the number of unique “from” or “to” addresses used per day

Kevin Rooke noticed the move and Tweeted:

While DAA doesn’t mean much in practice, it’s an important metric in that it shows actual, unique transfers separate from the various direct transfers to and from bigger exchanges. The fact that there are over a million unique addresses transacting on the blockchain is, as they say, good for bitcoin.

When Bitcoin first broke 1 million active addresses (Nov 27, 2017), 1 BTC was $9,352 and the median tx fee was $3.23.

Yesterday 1 BTC was $8,230 and the median tx fee was $1.33.

To put this number in perspective, however, we can point to Uber’s estimated 14 million rides per day or the estimated 798,877 iPhones a day Apple sold in 2017. While these are Apples to oranges comparisons, it is interesting to note that bitcoin is doing the transaction volume of some of the biggest brands in the world.

Bitcoin Addresses Worth $100,000 or More Hits All-Time-High

The number of Bitcoin (BTC) wallet addresses holding a minimum of 10 BTC — worth over $100,000 to press time — has hit an all-time high, multiple data sources reveal.

According to BitInfoCharts’ Bitcoin Rich List, as of Sept. 17, there are 157,210 addresses holding between 10 and 1,000,000 BTC.

Earlier this month, Coin Metrics’ State of the Network report had plotted the latest data historically to reveal that these mega-holders are at an all-time high for the network.

The Bitcoin Rich List reveals that the holdings of the 10-100 BTC group — split between 140,940 unique addresses — are worth in excess of $46.1 billion.

Meanwhile, among the 1,942 addresses holding between 1,000 and 10,000 BTC each, the total value of their holdings is greater than $48.2 billion.

Just 4 addresses hold between 100,000 and 1 million BTC, worth a total of $5.35 billion.

Notably, the top 4 addresses on BitInfoCharts are centralized exchange wallet addresses, meaning that each reflects assets held in custody for tens of thousands of individual users.

As Cointelegraph reported, the number five spot was just taken by a mystery 94K BTC transaction that occurred earlier this month.

In a separate chart devoted to unique wallet addresses analyzed in terms of fiat currency value alone, BitInfoCharts’ data indicates there are 2,118 wallets worth over $10 million each and 17,273 addresses with holdings worth $1 million or more.

The top 1%

Parallel to data on these Bitcoin mega-holders, XRP users have been circulating metrics for the token this week revealing that holders of 70,000 XRP or above — worth $18,900 to press time — qualify as falling within the top 1% of XRP holders.

This June, as crypto winter saw the first sign of thawing, Cointelegraph reported that Tyler and Cameron Winklevoss, founders of the Gemini crypto exchange, saw their fortune more than double to hit a combined $1.45 billion — restoring the twins’ erstwhile status as Bitcoin billionaires once again.

Updated: 10-14-2019

Growth of BTC Millionaires Now Matches Bitcoin’s Early Years: New Data

The number of Bitcoin (BTC) addresses containing more than 1,000 BTC ($8.3 million) is growing at the same pace in 2019 as before 2014, new data shows.

Woo “Super Bullish” On Wallet Trend

Uploaded to social media by Bitcoin statistician Willy Woo on Oct. 11, a chart of Bitcoin address growth by balance shows the network is now repeating a trend from its earliest years.

“The rate of growth of 1000BTC addresses now matches the early growth in Bitcoin’s network,” he summarized.

Woo was expanding on original data from blockchain analysis resource Glassnode.

According to him, fresh desire for major Bitcoin balances at vastly higher prices than five years ago speaks to wealthier individuals coming into the space.

If those generating addresses with over 1,000 BTC at that time were doing so out of technical curiosity, the incentives in 2019 are purely financial. Woo concluded:

“IMO we’re likely in a new renaissance of Bitcoin, this one is powered by capital influx of high net worth investors, while the early one was from the tech savvy who were bootstrapping the network. Super Bullish.”

Bitcoin Rich List Highs

The data suggests the trajectory of balances topping 1,000 BTC picked up at the start of 2019 after a period of flat growth, which began in late 2013 just prior to the implosion of major exchange, Mt. Gox.

As Cointelegraph reported last month, the number of addresses containing more than $100,000 has also hit an all-time high.

At press time, 3,070 address held more than 1,000 BTC each, representing just 0.01% of the total, according to BitInfoCharts’ Bitcoin Rich List. It should also be noted that many of the richest addresses — specifically the top four — belong to exchanges such as Binance, which hold Bitcoins belonging to millions of users.

Updated: 6-12-2020

Number of Active Bitcoin Addresses Could Indicate $14.7K Price Rise

A key on-chain metric that Bloomberg bets on, points to a Bitcoin bull run with possible 50% price appreciation.

June 11, the number of active Bitcoin (BTC) addresses hit 1,040,244. This is the highest number in two and a half years. Many analysts believe there may be a correlation between this metric and the market’s overall price.

Bloomberg Bets On It

Bloomberg, in its latest crypto report stated that the number of active Bitcoin addresses is a historically significant bullish indicator:

“The highest level of active addresses in about two years favors a higher Bitcoin price, if history is a guide.”

Will History Repeat Itself?

If we examine historical data and pick out all dates, when there were at least 1,040,244 active Bitcoin addresses and take the average of the price, we get — $14,700. From this, we can speculate that there is some pent up momentum waiting for the opportunity to break out.

Bloomberg’s crypto report said that they expect the price of Bitcoin to approach the all-time high of $20,000 or even reach $28,000 in 2020. Obviously, there is no way of knowing if history will repeat itself or if this correlation has broken down at some point.

Updated: 10-23-2020

Active Bitcoin Addresses At Highest Since 2017’s $20K Price Record

Active user participation in Bitcoin’s network has accelerated to levels last seen in December 2017, when the cryptocurrency printed record highs near $20,0000.

* The number of active entities, or clusters of addresses controlled by a single network participant, jumped to 388,697 on Thursday, the highest since Dec. 9, 2017, according to data source Glassnode.

* The metric has more than doubled in the past five days alongside bitcoin’s rally from $11,350 to $13,300.

* “It shows active participation in bitcoin is growing,” a spokesperson for FCA-regulated crypto index provider CF Benchmarks told CoinDesk.

* “Against the backdrop of PayPal’s announcement this week, it makes a lot of sense that interest in bitcoin is once again intensifying to heights not seen since late 2017,” the spokesperson added.

* Online payments giant PayPal announced support for bitcoin, ether, litecoin and bitcoin cash earlier this week, propelling bitcoin and wider crypto market higher.

* The cryptocurrency’s price lags on-chain metrics such as active entities and hash rate.

* While the count of active entities is closing on the record high of 411,127 reached on Dec. 9, 2017, the cryptocurrency’s price is still down 53% from the lifetime high of $20,000.

* Meanwhile, the seven-day rolling average of bitcoin’s hashrate, or the measure of the mining power dedicated to the blockchain, rose to a record high of 146 exahashes per second earlier this month.

* Continued rise in network’s usage could accelerate the price rally.

* “When there’s greater usage, there’s more demand for the cryptocurrency, and that drives the price up,” Philip Gradwell, chief economist at the blockchain intelligence firm Chainalysis, told CoinDesk.

Updated: 1-6-2021

Jump In Active Bitcoin Accounts Nears High Set Before 2018 Crash

The number of active Bitcoin accounts is approaching the all-time peak reached just before the notorious volatile cryptocurrency crashed three years ago.

Bitcoin has long had numerous dormant accounts attributed to a fierce buy-and-hold contingent, who claim the “hodl” moniker as a mantra meant to reassure nervous investors during wild price springs. With Bitcoin surging again to all-time highs, many of these anonymous accounts look to be waking up.

About 82% of all Bitcoin supply was held in accounts that have been active in the last six months as of Jan. 4, according to researcher Flipside Crypto. That’s up from 44% last February. More than 2.1 million accounts have been active in the past week — a number that was only slightly higher in December 2017. Less than 2% of accounts control 95% of all available Bitcoin supply, according to Flipside.

While the surge in activity could suggest some true believers are taking advantage of Bitcoin’s surge to take some profits, a flood of new accounts and the ever-rising price of the token also seems to indicate that newcomers are also piling in.

Zhao “CZ” Changpeng, chief executive officer of crypto exchange Binance, said that large holders have been buying more Bitcoin.

“We have seen many whales waking up and buying, and many investors who bought in 2017 near the peak finally ‘thawed’ and are active again,” Zhao said. “Compared to 2017, the biggest difference we see is that people are far more active now. If they were just testing the water in 2017, they are really moving significant portions of their net worth into crypto now.”

Bitcoin’s price more than quadrupled in 2020 amid optimism it was gaining a greater foothold among institutional investors.

“The interesting thing here is that the decrease in stagnant supply could suggest lots of hodlers were waiting for the price to increase so that they could liquidate,” said Eric Stone, head of data science at Flipside Crypto. “There is also a steadily increasing number of active addresses and more withdrawals than deposits to exchanges (and addresses withdrawing versus depositing), even as trading volume has increased on the buy-and-sell side, suggests that the current mood toward Bitcoin continues to be more bullish than the bubble in 2017.”

Updated: 1-11-2021

Bitcoin’s Active Addresses, Trading Volumes Now At All-Time Highs

Trading volumes and active addresses for bitcoin have now surpassed their previous all-time highs during the last crypto bull run in 2017, and the data has given some analysts confidence the bull market for bitcoin is not over yet.

* Data from CryptoCompare shows that bitcoin trading volumes on the eight major exchanges tracked on the CoinDesk 20 have passed $11 billion, a new all-time high from the previous record during 2017’s crypto bull market.

* “This is first and foremost a sign of how much bigger and mature the industry is, with a lot more money flowing on these exchanges,” Bendik Norheim Schei, head of research at Arcane Research, told CoinDesk. “It is great to see higher volumes, making the market more liquid and efficient.”

* The surging volume due to Monday’s sell-off came in part from newcomers to the market, according to Schei.

* “Some of this volume is definitely from new and unexperienced investors entering the market for the first time and panicking when the price starts falling,” he said. “These corrections are necessary and healthy, even in a bull market.”

* At the same time, the number of active bitcoin addresses has also broke its previous record on Jan. 8, according to data from Glassnode.

Updated: 8-6-2021

Active Bitcoin Addresses Surged 30% In Late July, Data Shows

The amount of Bitcoin held on addresses storing between 100 and 10,000 BTC has hit 9.23 million Bitcoin for the first time ever.

Amid a renewed bullish trend on the cryptocurrency markets over the past few weeks, more users have moved into trading Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization.

Data from blockchain analytics platform Glassnode shows that Bitcoin has seen a notable surge in terms of active addresses in the past week of July, with active BTC entities rising 30% from 250,000 to 325,000 active users.

According to Glassnode’s seven-day exponential moving average statistics of active Bitcoin entities, this is the biggest surge recorded after the number of active Bitcoin entities dropped 41% from 425,000 in January to below 245,000 addresses in early July. The current level of Bitcoin activity corresponds to levels maintained in July 2020, when Bitcoin was trading around $11,300, Glassnode noted.

#Bitcoin has seen a resurgence in Active Entities over the past week, rising by 30% from 250k to 325k active entities per day.

This degree of activity was sustained in July 2020 when $BTC prices were around $11.3k in Q2-2020.

Live Chart: https://t.co/jsxqAS9wdk pic.twitter.com/TWtrtLvneh

— glassnode (@glassnode) July 30, 2021

Alongside a significant uptick in active Bitcoin users, BTC investors have been accumulating larger amounts of the cryptocurrency in late July.

According to data from analytics company Santiment, the amount of Bitcoin held on addresses storing 100-to-10,000 BTC hit 9.23 million Bitcoin ($364 billion) as of Aug. 1, which is a new all-time high for this group of investors. The previous all-time high took place on April 5, just one week before Bitcoin price broke an all-time high above $64,000.

“In the last four weeks, these addresses have accumulated approximately 170,000 more BTC. This staggering pace was last matched in late December 2020, right before a massive bull run kicked off in 2021 where prices jumped from $29.0k to $40.8k in the year’s opening week,” Santiment noted.

The latest growth in Bitcoin activity comes amid the BTC steadily gaining momentum after Tesla CEO Elon Musk disclosed that his firm SpaceX owns Bitcoin on July 22. The CEO also said that Tesla was planning to resume crypto payments for vehicle purchases, citing the increasing percentage of renewable energy used for Bitcoin mining. Musk is known for being likely to contribute to Bitcoin’s price crash earlier this year, cutting BTC payments for Tesla in May due to the rapid increase of fossil fuel usage for Bitcoin mining.

Bitcoin Exceeds 1Mil. Daily, Bitcoin Exceeds 1Mil. Daily, Bitcoin Exceeds 1Mil. Daily

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.