Ultimate Resource On A Weak / Strong Dollar’s Impact On Bitcoin

Bitcoin Dips As US Dollar Surge Dampens BTC Price Performance. Ultimate Resource On A Weak / Strong Dollar’s Impact On Bitcoin

Despite a strengthening yuan, the world isn’t close to abandoning the greenback.

The premise that the dollar is the world’s safe haven is a constant in this ever-changing world. It’s certainly proving true this year.

Related:

How Will Bitcoin Behave During A Recession? (#GotBitcoin)

(1). Light To Moderate Recession (Liquidity Crisis)

(2.) Sovereign Debt Crisis / Currency Crisis

US Witnesses The De-dollarization of The Global Economy

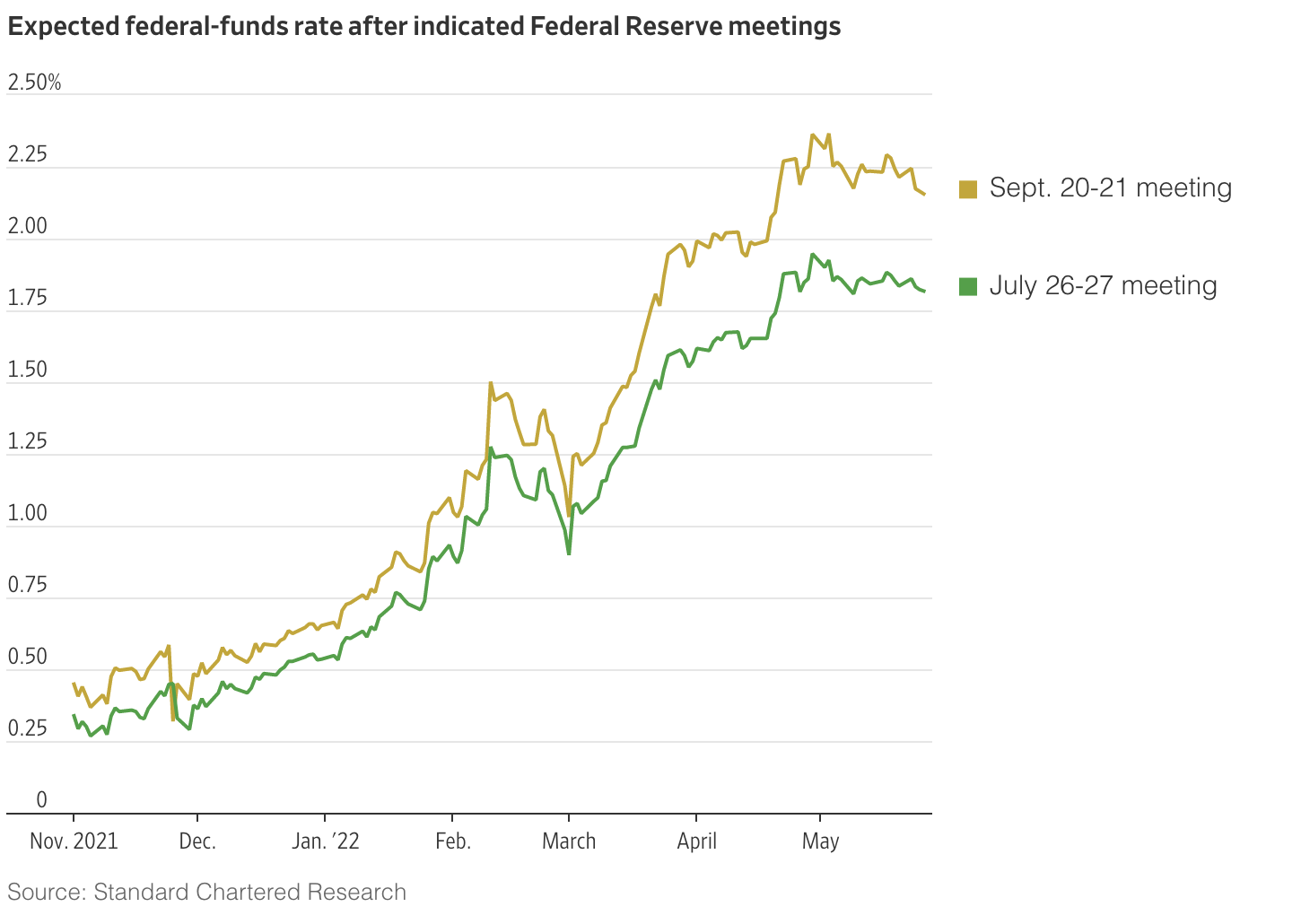

Both increase pressure on the Federal Reserve to bring forward interest-rate hikes, in turn raising the relative attractiveness of the dollar.

The currency market rule of thumb with a stronger greenback is that it hurts economies — particularly in fragile emerging markets — that are reliant on commodity imports priced in dollars. The flipside of this is that commodity and hydrocarbon-exporting economies receive a foreign exchange boost.

But big exporting powerhouses such as the European Union and Japan also benefit when their currencies are relatively cheaper to the dollar. The European Central Bank is certainly not protesting the slow, steady weakness of the euro as it tries to recover from the pandemic.

It’s a little more complex for the U.S. economy: Despite a huge embedded trade deficit, the economic impact is somewhat offset by the dollar being the world’s reserve currency. The Fed avoids giving any views on the value of the dollar when setting interest rate policy.

But its unwavering dovishness on keeping policy rates near zero and still buying tens of billions of bonds each month looks to be increasingly tough to justify. Further strong labor market reports could tip the balance.

Nothing in life is simple. So the Fed has to steer the narrow course between not leaving low rates too late and then having to overdo hikes to quash the inflation beast — or indeed withdrawing stimulus too sharply and causing a repeat of the 2013 or 2018 taper tantrums.

Former New York Fed president Bill Dudley believes the Fed has left it too late and is between a rock and a hard place but the 10-year U.S. Treasury yield at 1.6% shows the bond market is still a believer in the central bank’s skillsets.

The recent consumer price index increase of 6.2% is a clear-and-present danger: If this miles-above-target inflation persists, it will only hasten the Federal Open Market Committee’s timing in bringing its QE taper to a swifter conclusion.

A stronger-than-expected October non-farm payroll release just lends weight to the premise that the economy is recovering faster from the pandemic, fueled by yet more multi-trillion dollar fiscal stimulus programs and a Fed balance sheet fast approaching $9 trillion.

It’s not hard to conclude this may well bring forward the first rate hike.

Higher yields will make the dollar more attractive. Increased global uncertainty just speeds it up. U.S. growth doesn’t have to be the best in the world, just among the best. Its size alone will carry the dollar along nicely.

This does not mean the dollar is cheap. It can be frustrating watching expensive things just get richer. But improving economic conditions and yet more fiscal stimulus in the U.S. mean there are further reasons to eschew the paltry yields available in Europe and Japan for the bright lights stateside.

No examination of the dollar is complete without reference to China. The yuan has strengthened steadily versus the dollar over the past 18 months. Chinese exports have risen impressively but the overall economic picture is of weakening growth.

So be under no illusion that yuan strength is anything other than a carefully controlled affair. Beijing is focused on the dual task of boosting domestic consumer demand while limiting the damage from a credit explosion in its out-of-control real estate market.

A strong yuan also has the benefit of lessening the impact of higher commodity prices onto its producers as well as reducing the cost of stockpiling basic resources.

To mitigate some of the impact of outrunning the stronger dollar, China has been steadily reducing the greenback’s share in the weighted currency basket that it uses to set the yuan’s daily reference rate.

Furthermore it has been allowing substantially more foreign capital to invest in its domestic equity and bond markets. Overseas investors hold 2.3 trillion yuan ($360 billion) of Chinese government bonds attracted by substantially higher yields.

For stock market funds, it is a chance to gain wider exposure to the second-largest economy. But, at some point, the Chinese authorities will decide that propping up its currency has served its purpose and allow the yuan to naturally weaken — adding another medium-term reason to own the dollar. A currency with capital controls is strictly for the brave.

There still really isn’t much to beat the dollar’s current appeal with the S&P 500 powering to yet more record highs. A boom economy, the FOMO-driven stock market and the prospect of rate hikes not so far away makes the U.S. currency a pretty comfortable place to sit it out the many troubles around the world.

It helps also that the Fed is no longer supporting the global economy by flooding the world with dollars as it did at the height of the pandemic. For now it’s the no-brainer trade, at least until the next U.S.-led downturn or some Fed mistake.

Updated: 11-16-2021

Bitcoin Price Briefly Drops Below $60,000 As Strong Dollar Weighs On Crypto

After last week’s rally, some cryptocurrencies fall more than 10% from recent highs.

Cryptocurrencies slid in overnight trading, with some of the most popular digital tokens losing more than 10% from recent highs. Some investors pointed to the stronger dollar as a catalyst for the fall.

Bitcoin briefly fell below $59,000 on Tuesday, tumbling to its lowest price this month, before edging up to trade around $60,550.

The selloff began Monday and extended into a second day, with the digital asset down more than 5% since Monday at 5 p.m. ET. Ether slid for a fifth consecutive day, also declining another 7% to around $4,260. It is down more than 10% from its latest record.

“A lot of people view crypto as a risk-on investment,” said Martha Reyes, head of research at Bequant, a digital-asset brokerage and exchange. In times of stress, “people will be looking to raise cash and they will raise cash where they’ve maybe had the most profits.”

The slide comes after a rally that powered bitcoin last week to a record of $68,990.90. Cryptocurrencies received a boost from the debut of the first exchange-traded fund to hold bitcoin futures contracts, which spurred buying.

They were also caught up in a flurry of risk taking in markets, which included some of the most speculative growth stocks.

Some signs of nervousness are beginning to show in broader markets as concerns about runaway inflation rise after the biggest uptick in consumer prices in the U.S. in more than three decades.

Covid-19 cases are also beginning to pick up in the Northern Hemisphere as winter approaches, with some European countries tightening restrictions.

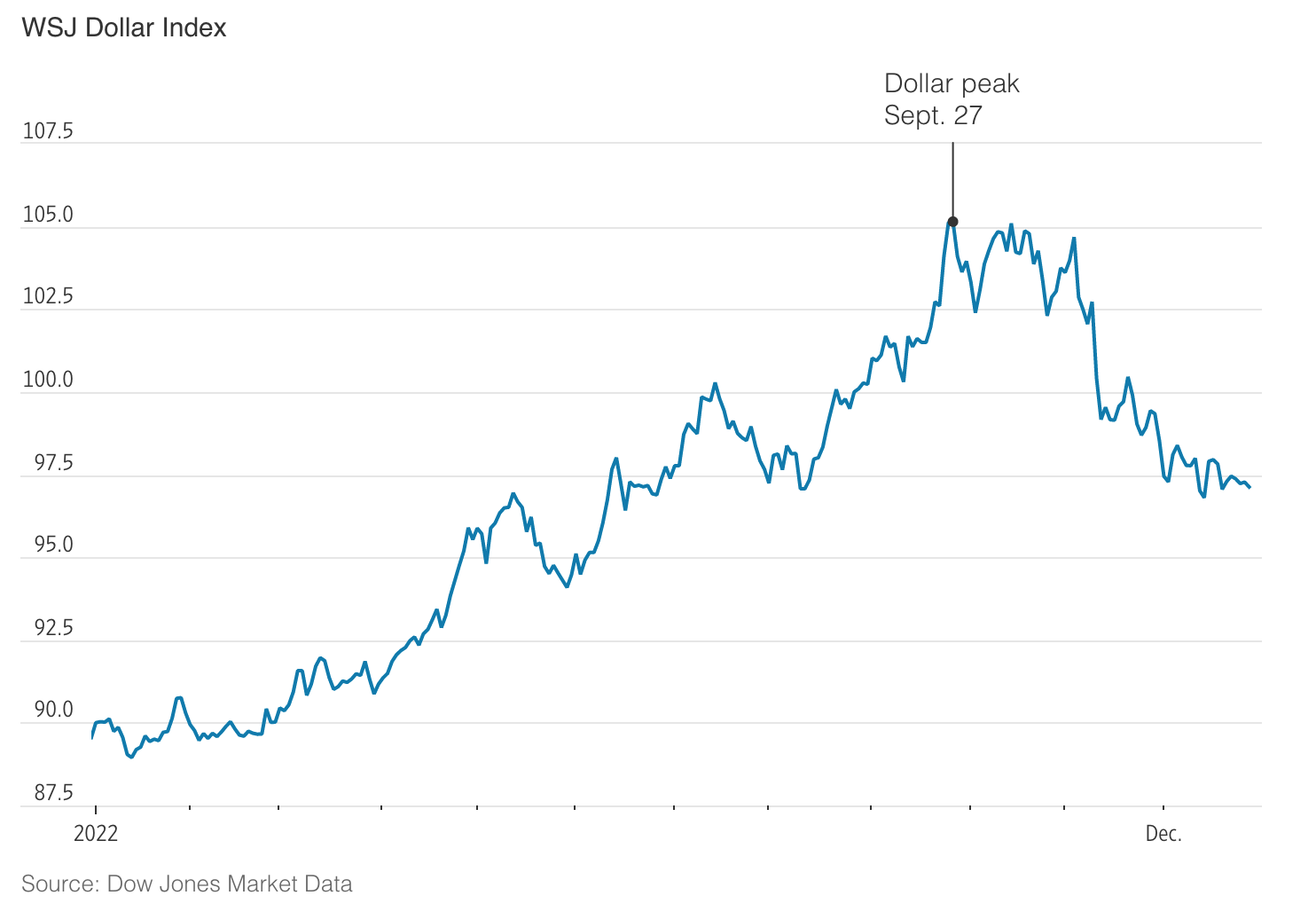

Traditional safe-haven assets such as the dollar and gold have rallied. The WSJ Dollar Index, which measures the greenback against a basket of currencies, reached its highest level since July 2020 Tuesday.

The dollar’s strength also indicates investors continue to bet that the Federal Reserve may have to raise interest rates to deal with inflation, according to researchers at Capital Economics.

Higher rates would attract yield-seeking capital flows to the U.S. The researchers expect the dollar to keep appreciating through next year.

This matters for cryptocurrencies because tighter Fed policy would weigh on the broader market and likely hit the riskiest assets hardest, said Joel Kruger, a currency strategist at LMAX Group. This is having a short-term negative impact on cryptocurrencies, he said.

Recent advances in regulation of cryptocurrencies in the two biggest economies in the world may also be weighing on the market, analysts said.

President Biden signed a $1 trillion infrastructure bill Monday. The bill includes a section on digital assets, adding similar tax-reporting rules as those for traditional securities such as stocks and bonds.

“We’ve been surprised by the pace of development in the U.S.,” said Ms. Reyes. “It would be unfortunate if it stifled innovation too much.”

China’s economic planning agency on Tuesday reiterated opposition to cryptocurrency mining and laid plans for a further crackdown.

It said it had told local authorities last week to “completely clean out mining activities” in their regions.

Computer labs at state-owned enterprises would be inspected and punished if they were engaged in mining, Meng Wei, a spokeswoman for the National Reform and Development Commission, told a news conference.

The next step would be to target cryptocurrency-mining activities being conducted on an industrial scale and state-owned companies involved in the industry, Ms. Meng said. Punitive charges would be levied on groups that mine crypto using power bought at residential electricity prices, she said.

Updated: 11-24-2021

Dollar Rises To Highest Level Since July 2020 After U.S. Data

* Bloomberg Dollar Index Has Gained More Than 2% This Month

* Biden’s Fed Picks Have Given U.S. Rates, Greenback A Boost

The dollar surged to its strongest level in more than a year, driven by a climb in Treasury yields this week following U.S. President Joe Biden’s decision to renominate Jerome Powell as head of the Federal Reserve.

The Bloomberg Dollar Spot Index was up as much as 0.5% after a swath of U.S. economic data was released Wednesday, including figures that showed jobless claims at the lowest level in decades. The move pushed the greenback index to a level last seen in July 2020.

The gauge has added more than 2% this month as concerns about rising inflation have spurred bets on tighter Fed policy. The dollar has strengthened against all but two of 16 major currencies tracked by Bloomberg, as threats ranging from Covid to soaring inflation loom around the world.

“We have a nice perfect storm for the USD higher,” said Brad Bechtel, global head of foreign exchange at Jefferies. “You have an element of U.S. outperforming the rest of the world, which will drive U.S. rates higher, as well as an element of safe-haven demand for dollars as emerging markets continue to see their currencies melt down and Covid rates spark new concerns on growth in the Eurozone.”

Traders are watching progress in the labor market for clues on the Fed’s policy path, as Powell has emphasized such progress is a key condition for tightening monetary conditions in the world’s largest economy.

JPMorgan Chase & Co. strategists led by Paul Meggyesi forecast a stronger greenback next year as Fed rate hikes approach, they wrote in a report Tuesday.

The greenback gained about 1.1% against the New Zealand dollar, the day’s biggest loser among Group-of-10 currencies, after the New Zealand central bank raised its benchmark rate by a quarter point as forecast, but disappointed some hawks by saying it would take a cautious approach to further tightening.

Updated: 12-10-2021

Investors Are Most Bullish On Dollar Since 2015, BofA Says

Investors’ dollar positioning and views are the most bullish since 2015, buttressed by expectation the Federal Reserve’s hawkish pivot will translate into higher rates, according to a Bank of America Corp. survey.

A majority of respondents now expect the Fed to end its asset-purchase program in the first quarter of 2022, pulling forward expectations from the second quarter in the previous tally.

“Investors pivot on the Fed, however, continues to come with low terminal rate expectations, which is one of the reasons why the curve has flattened so meaningfully in this latest move,” strategists Ralf Preusser and Myria Kyriacou wrote.

Respondents cited central bank tightening as the biggest risk to the market in 2022, followed by inflation and peaking liquidity.

The dollar’s rally in 2021 comes ahead of any rate hikes from the central bank, with the Bloomberg Dollar Index on track for its strongest year since 2015. Conversely, most-emerging market currencies have floundered: Only three of the 24 tracked by Bloomberg have gained against the dollar.

In addition to shifting dollar bets, emerging-market currency exposure has turned negative for the first time since 2018, they wrote. The strategists said that the December Fed meeting still has room to drive both positions further, while noting that positions have already shifted and that investors have reduced some portfolio risk.

Updated: 1-3-2022

Bitcoin Dips Below $47K As US Dollar Surge Dampens BTC Price Performance

It’s not looking great for Bitcoin on short timeframes, and Ethereum is becoming an increasingly popular bet instead.

Bitcoin (BTC) crisscrossed $47,000 on Jan. 3 as the first Wall Street trading days of 2022 got off to a modest start.

Ethereum Steals The Limelight

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting in a narrow range as the week began, with traders split over short-term outcomes.

“It’s just a matter of time before BTC breaks out, and the longer it takes, the harder it will pump,” popular Twitter account Galaxy summarized.

“Q1 is up only. You heard it here first.”

Such optimism was far from universal, however. For Cointelegraph contributor Michaël van de Poppe, the time had come to look closer at altcoins than BTC.

“Good bounce from Ethereum and I think this one is bottomed,” he said about the state of ETH/USD Monday.

“Still need additional confirmation, but shows more strength than Bitcoin at this point. Ultimate confirmation above $4,100.”

ETH/USD was up over 2% in 24 hours at the time of writing, with BTC/USD conversely showing no inclination to tackle even daily highs.

On macro markets, the S&P 500 was up a touch at the Wall Street open, amid predictions that the first half of the year would be a further boon for equities across the board thanks to the prospect of key interest rate hikes.

The U.S. dollar, meanwhile, saw a sudden boost on Jan. 3, with the U.S. dollar currency index (DXY) rapidly gaining — as is customary, to Bitcoin’s detriment.

Never Mind The Bearish Divergence

Among Bitcoin-focused analysts, meanwhile, TechDev led calls to quash bearishness, arguing that on-chain indicators do not support a bearish thesis.

Concerns about both the relative strength index (RSI) and moving average convergence/divergence (MACD) pale in comparison to more fundamental indicators still yet to print a bearish outlook, he said at the weekend.

4/

The 2 points are valid to point out, but I don’t focus on them as they’ve not been historically accurate at identifying macro cycle trend changes.

2 that have? Macro LLs and 2W RSI floor breaks. Neither of which have happened.

If they do, my macro outlook will change. pic.twitter.com/qUedP5juZ8

— TechDev (@TechDev_52) January 3, 2022

With conviction remaining high and selling declining, TechDev was in good company.

“In case no-one noticed, we have come a long way from nerdy retail HODL’ers being the buyers of last resort,” entrepreneur Alistair Milne added.

“We now have billionaires, multinationals and countries waiting to buy the dips. Whoever is taking the other side of the trade needs their head examined IMO.”

A fresh influx of institutional interest is considered by some to be ready to begin this month.

Updated: 3-3-2022

Dethroning King Dollar Won’t Be An Easy Feat

There is no alternative to the world’s reserve currency despite any concern or wishful thinking to the contrary.

If the last dozen years or so has taught us anything about markets and the economy, it’s that anything can happen, no matter how unlikely. The U.S. housing market was considered as solid an investment as there ever was because prices never fell nationally — until the subprime crisis came along.

The idea that the European Union would ever come close to breaking apart and taking the euro with it was unthinkable — until Greece defaulted. And everyone knew that inflation like that of the late 1970s was never coming back — until the pandemic snarled supply chains worldwide.

So it’s natural that a sort of cottage industry has sprung up in the last decade or so trying to anticipate the next so-called black swan event that could upend the global economy and markets.

As my Bloomberg News colleagues Joe Weisenthal and Tracy Alloway do a good job of explaining, there is a growing concern that perhaps Russia’s invasion of Ukraine could mark the beginning of a turning point for the U.S. dollar — and not for the good.

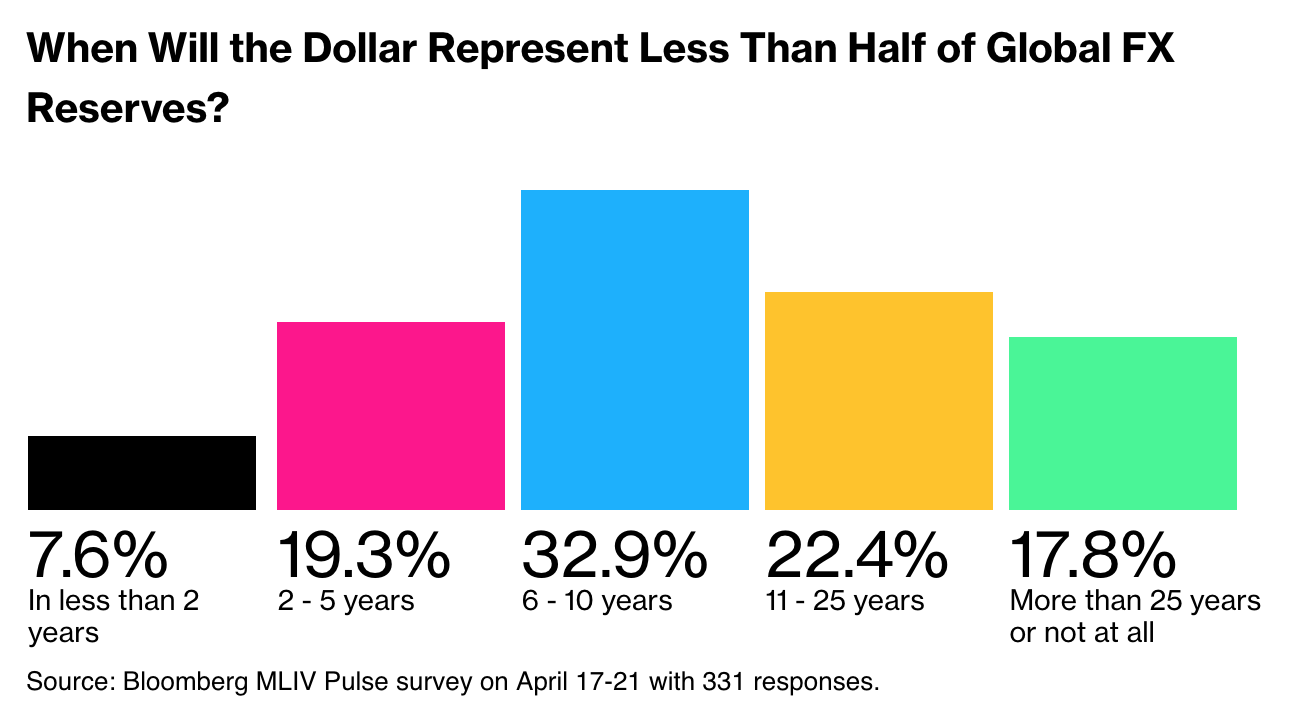

The thinking is that the U.S. has “weaponized” the dollar through heavy financial sanctions imposed on Russia, including preventing that country’s central bank from accessing its foreign currency reserves. “As such, it may make less and less sense for global reserve managers to hold dollars for safety, given that they could be taken away right when they’re most needed,” they write.

Make no mistake, any such move away from the dollar would have earth-shattering consequences. The dollar has been the world’s reserve currency since the U.S. and its allies agreed at the 1944 Bretton Woods conference to peg it to a rate of $35 per ounce of gold. According to the International Monetary Fund, the dollar’s share of global reserves stands at 59%, far above the euro at 20.5%.

After the euro, there’s a steep drop to the No. 3 slot, which is occupied by Japan’s yen at 5.83%. As the world’s primary reserve currency, the U.S. enjoys the “exorbitant privilege” that goes along with that, such as interest rates that are lower than they might otherwise be and the government being able to fund budget deficits in perpetuity.

Dominant Position

The dollar makes up a majority of global currency reserves, easily topping the euro, which is second.

To consider how difficult it is to come up with a viable alternative to the dollar, consider China’s yuan. (The euro doesn’t count, given how close the European Union came to breaking up over its debt crisis a decade ago. Plus, it’s more of a monetary union than a fiscal one.)

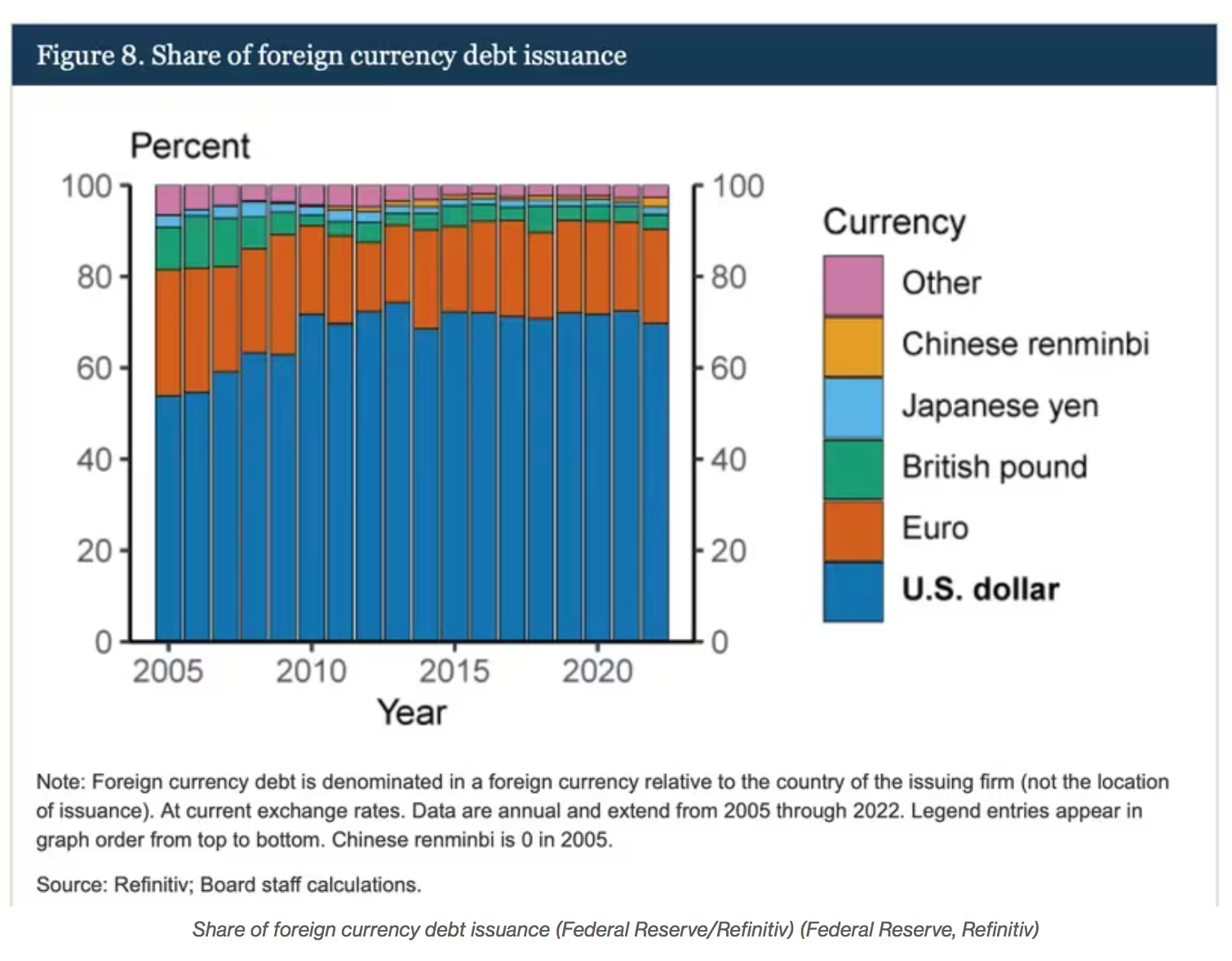

The Asian nation, which has the world’s second-largest economy after the U.S., has spent a lot of time and effort over the past decade trying to make the yuan a viable alternative to the dollar. And, yet, less than 3% of the world’s foreign-exchange reserves are denominated in yuan.

On top of that, only about 3% of global transactions are conducted in yuan, compared with 40% for the dollar, according to SWIFT, the messaging service that facilitates the vast majority of money transfers globally.

Not A Contender

The yuan accounts for a minuscule share of global payments even though China has the world’s second-largest economy.

The benefit to holding reserves in dollars is that U.S. markets are so much deeper and more liquid than any other. At $23 trillion, the U.S. Treasury market is more than double the size of Japan’s government bond market.

And even if you wanted to buy so-called JGBs, you probably couldn’t because the Bank of Japan owns a vast majority of them, so much so that no trading is done in the JGB market on some days.

As for Europe, the U.K., France, Italian and German bond markets are all less than $3 trillion in size. Foreign holdings of U.S. Treasuries have soared to $7.74 trillion from around $1 trillion at the start of the century, according to the U.S. Treasury Department.

And while America’s politics and brand of democracy can seem messy at times — especially lately — foreign investors do take comfort in the country’s strict adherence to the rule of law that draws capital from all around the world in good times and bad.

Although global foreign-direct investment flows surged 77% to an estimated $1.65 trillion in 2021, the U.S. experienced an even bigger jump of 114% to $323 billion, according to the United Nations Conference on Trade and Development.

The dollar’s share of global currency reserves has slowly eroded over the years, dropping from around 73% in 2001, but the current level is still up from the low of around 45% going back to the early 1960s.

And although the rise in cryptocurrencies offers bad actors another option to park their money out of the reach of regulators and other authorities, no country of consequence is going to attempt to park their reserves in Bitcoin. But that’s the point.

As FHN Financial economist Chris Low wrote in a research note to clients on Wednesday, as long as the world doesn’t suddenly see a string of bad actors “launch megalomaniacal attacks on their neighbors, they don’t really have to worry” about having their dollar assets frozen. “The sanctions on Russia are extraordinary because Russia’s misbehavior under (President Vladimir) Putin is extraordinary,” Low wrote.

Of course, nothing is forever, but it can sure seem like it in the foreign-exchange market. Before the dollar, the British pound was the world’s dominant currency, having held the crown throughout the 1800s until World War II. By that measure, the dollar has a long way to go before being toppled. The simple fact is, there is no alternative.

Updated: 3-4-2022

Bitcoin Drops For Third Straight Day As Dollar Hits 21-Month High, US Wages Eyed

A continued uptick in wages would imply more inflation and strengthen the case for rate hikes by the Fed.

Bitcoin (BTC) fell for the third straight day on Friday as lingering geopolitical tensions and rising oil prices pushed the U.S. dollar higher.

The leading cryptocurrency by market value was trading at $41,400 during the early European session, representing a 2.5% drop on the day. Sellers regained dominance after the cryptocurrency failed to establish a foothold above $45,000 earlier this week.

“Asian desks and high frequencies are cutting exposure on BTC while long only funds in European are selling. Brokers are also selling on behalf of clients more than usual as sentiment leaning slightly more bearish at the moment,” Laurent Kssis, a crypto exchange-traded fund (ETF) expert and director of CEC Capital, told CoinDesk in a Telegram chat.

The dollar index, which tracks the greenback’s value against majors, jumped to 98.08, the highest since June 2020, according to a chart provided by TradingView.

The haven bid for the greenback strengthened during Asian hours triggered by a flight to safety as Russian forces started shelling Europe’s largest nuclear power station in Ukraine. Asian stocks tanked to a 16-month low while oil remained in demand above $110 per barrel on both sides of the Atlantic.

Assets priced or traded in dollars typically drop when the dollar rises. According to Kevin Kelly, co-founder and global head of macro strategy at Delphi Digital, the greenback and bitcoin have a pretty inverse correlation.

“2017 was one of the worst years for the dollar, and that coincided with a huge run in bitcoin,” Kelly said in the latest weekly analyst call. “We saw bitcoin run-up in early 2021. That was on the back of the dollar weakness.”

The U.S. Labor Department’s closely watched employment report is scheduled for release at 13:30 UTC (8:30 a.m. ET). The report is expected to show that average average hourly earnings rose another 0.5% in February, pushing the year-over-year gain to 5.8%, according to Bloomberg.

The non-farm payrolls (NFP) figure is likely to show the economy added 415,000 jobs, pushing the unemployment rate down to 3.9% from 4%.

Focus On Wage Growth

While the NFP may grab headlines, the market is likely to move more on the wage growth represented by average hourly earnings.

An above-forecast wage growth may bolster inflation worries, validating the U.S. Federal Reserve’s hawkish stance. The dollar may find more buyers in that case, possibly bringing selling pressure to asset prices, including bitcoin.

According to macroeconomic theory, an uptick in wages can push up inflation. As wages rise, employers pass on the increase in labor cost to the final consumer, resulting in an uptick in the general price level in the economy. Workers demand higher wages in response, setting a vicious cycle of wage-push inflation in motion.

In recent months, the Fed has changed its stance to controlling price pressures from the dual mandate of price stability and maximum employment. U.S. inflation at the consumer level has risen to a four-decade with the ongoing Russia-Ukraine military conflict is likely to put further upward pressure on the general price levels.

On Thursday, Fed Chair Jerome Powell told lawmakers that the central bank is poised to raise rates by 25 basis points later this month and that they are prepared to do whatever it takes to control inflation, even at the expense of the economy, according to The New York Times. Markets expect the central bank to deliver five quarter percentage point rate hikes within the year.

Updated: 3-6-2022

Dollar Strength Builds As Ukraine War Deepens

The ICE U.S. Dollar index hits its highest level since May 2020 as investors dash to safer assets.

Escalating conflict between Russia and Ukraine has sent investors dashing to safer assets, propelling the dollar to its highest level since the coronavirus-induced volatility of two years ago.

The ICE U.S. Dollar index, which tracks the currency against a basket of others, surged as high as 98.92 this past week, its highest level since May 2020. It finished the week with a 2.1% jump, one of the largest in the past five years.

Investor anxiety swelled as Russia advanced across Ukraine, upending markets across the globe and sending traders scrambling for assets perceived as safer, such as gold, U.S. government bonds and the dollar. The U.S. currency in particular is often seen as the ultimate haven asset because of its status as the world’s reserve currency. In times of turmoil, traders tend to seek out dollar liquidity and dump riskier investments.

That scenario represents half of what is known as the so-called dollar smile, a market theory that posits that a strong dollar tends to emerge when the global economy sours and traders rush for safety. The other half of the smile, according to the framework, occurs when the U.S. economy is healthy compared with other countries, spurring investors to buy dollar-denominated investments.

The economic effects from the war in Ukraine, combined with the expectations that the U.S. will outperform global markets, has propelled the dollar to an unusual sweet spot, analysts say.

The recent move by the dollar builds on earlier strength that began last year amid expectations of higher interest rates in the U.S., which tend to bolster the currency as higher yields make it more attractive to investors.

But the crisis in Ukraine sent bets on the dollar into overdrive.

Concerns have mounted that the war and the sanctions inflicted by the West will ripple across the European continent, stunting growth while inflationary pressures rise. For now, investors believe the U.S. economy, in contrast, will be relatively insulated from the war, prompting bets by traders on U.S. stocks.

That divergence rippled across markets. The broader WSJ Dollar Index, which tracks the dollar against a basket of 16 currencies, closed at its highest level since July 2020, while the euro tumbled below $1.10 Friday for the first time in almost two years. The British pound lost 1.3% against the dollar for the week.

The moves came alongside broader risk-off sentiment around the globe, sending gold up 4.2% for the week and the S&P 500 down 1.3%. The pan-continental Stoxx Europe 600 index tumbled 7% to finish near its lowest level in nearly a year.

“There’s so much uncertainty that I struggle to see risk appetite improving in the near term, and that should play into the dollar’s hand,” said Craig Erlam, senior market analyst at Oanda.

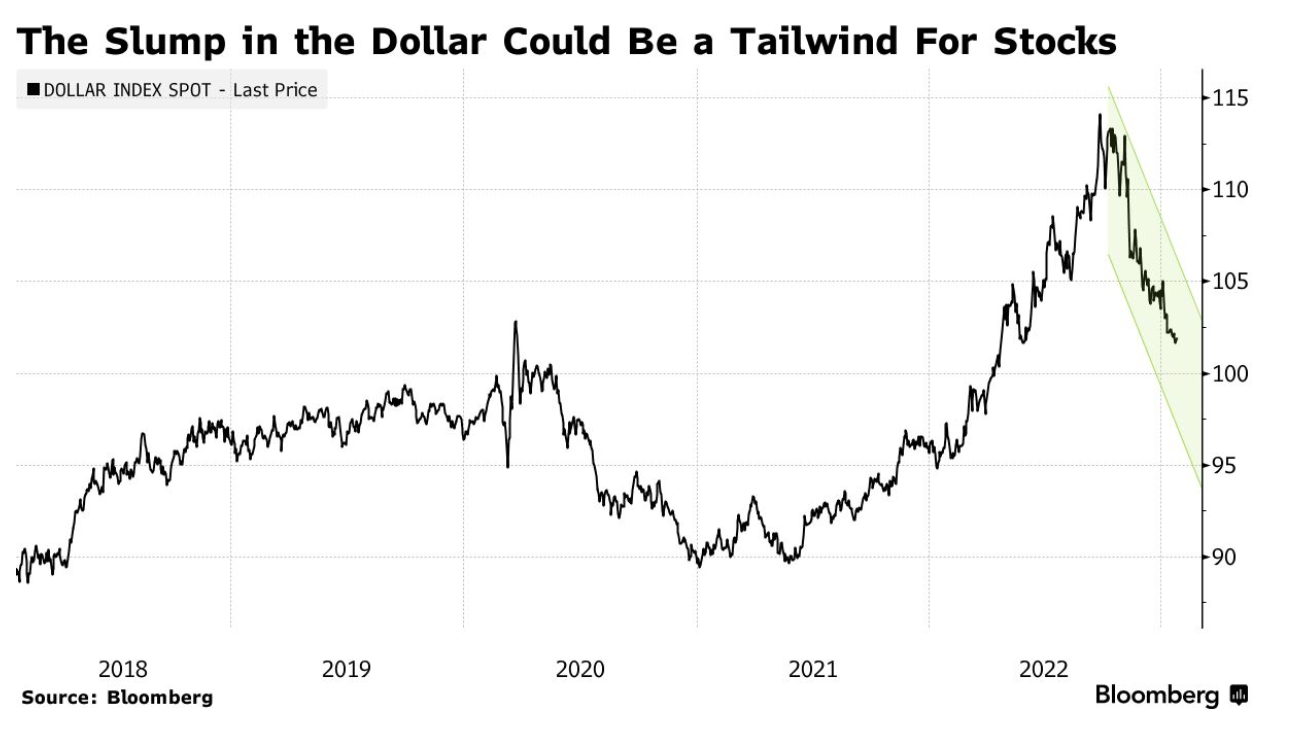

A strong dollar, though, can be a double-edged sword, potentially weighing on U.S. companies that generate revenue outside the U.S. When the dollar rises, revenues in other currencies lose value. Companies in the S&P 500 generate roughly 40% of their revenue from outside the U.S., FactSet data show.

Recent history has shown evidence of an inverse correlation between the S&P 500 and the dollar. Take, for example, 2015, when the ICE U.S. Dollar Index surged 9.3% for the year amid concerns about Chinese growth, a slide in emerging-market currencies and expectations of an interest-rate increase from the U.S. Federal Reserve.

Late that year, the central bank raised interest rates for the first time in nearly a decade. The S&P 500 closed down 0.7% that year.

This time, though, things could be different, said Huw Roberts, head of analytics at Quant Insight, a data analytics firm. With economic growth potentially slowing in Europe and elsewhere, more investors may begin pouring more money into the U.S.

“At the moment, our models show that a stronger dollar is a very small positive for the S&P 500,” he said. “I think earlier in the year, there was a sense that the world could start catching up on American [stock market] exceptionalism. I think what’s happened in the last week or so is that some investors have stopped thinking about this.”

Keith Lerner, co-chief investment officer for Truist Advisory Services, is betting that demand for U.S. equities will counterbalance any downside that major indexes see as a result of a stronger dollar. His equity portfolios are currently tilted 82% for U.S. equities, he said, versus the roughly 61% allocation from his benchmark MSCI ACWI index, MSCI’s flagship global equity index.

“The closer you are to Ukraine and Russia, the more challenges you are going to have,” said Mr. Lerner, who noted that his portfolios have had a longstanding overweight tilt toward U.S. stocks. “The strong dollar is going to result in…somewhat of a hit to profits of U.S. companies, but that will be offset by the greater demand for the higher quality companies that people will pay a premium for relative to international markets.”

Updated: 3-7-2022

Bitcoin Steadies As Gold Hits $2K, US Dollar Strongest Since May 2020

Surging commodities and a strong dollar add to stock traders’ woes, with Goldman Sachs’ former CEO wondering why crypto assets are not “having a moment.”

Bitcoin (BTC) stayed near one-week lows on March 7 as a flight to safety among investors did the crypto markets no favors.

Gold, Dollar Spell Sour Times For Stocks

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing at around $37,600 overnight before tracking around $1,000 higher.

The pair had faced pressure into the weekly close, resulting in its lowest levels this month amid reports that Western sanctions against Russia could expand to include an oil embargo.

An already panicky atmosphere thus fueled performance by safe-haven gold, which returned to $2,000 per ounce for the first time since August 2020 on March 7.

Coming in step was the U.S. dollar, which surged against its peers to see the U.S. dollar currency index (DXY) target 100 in a near two-year record.

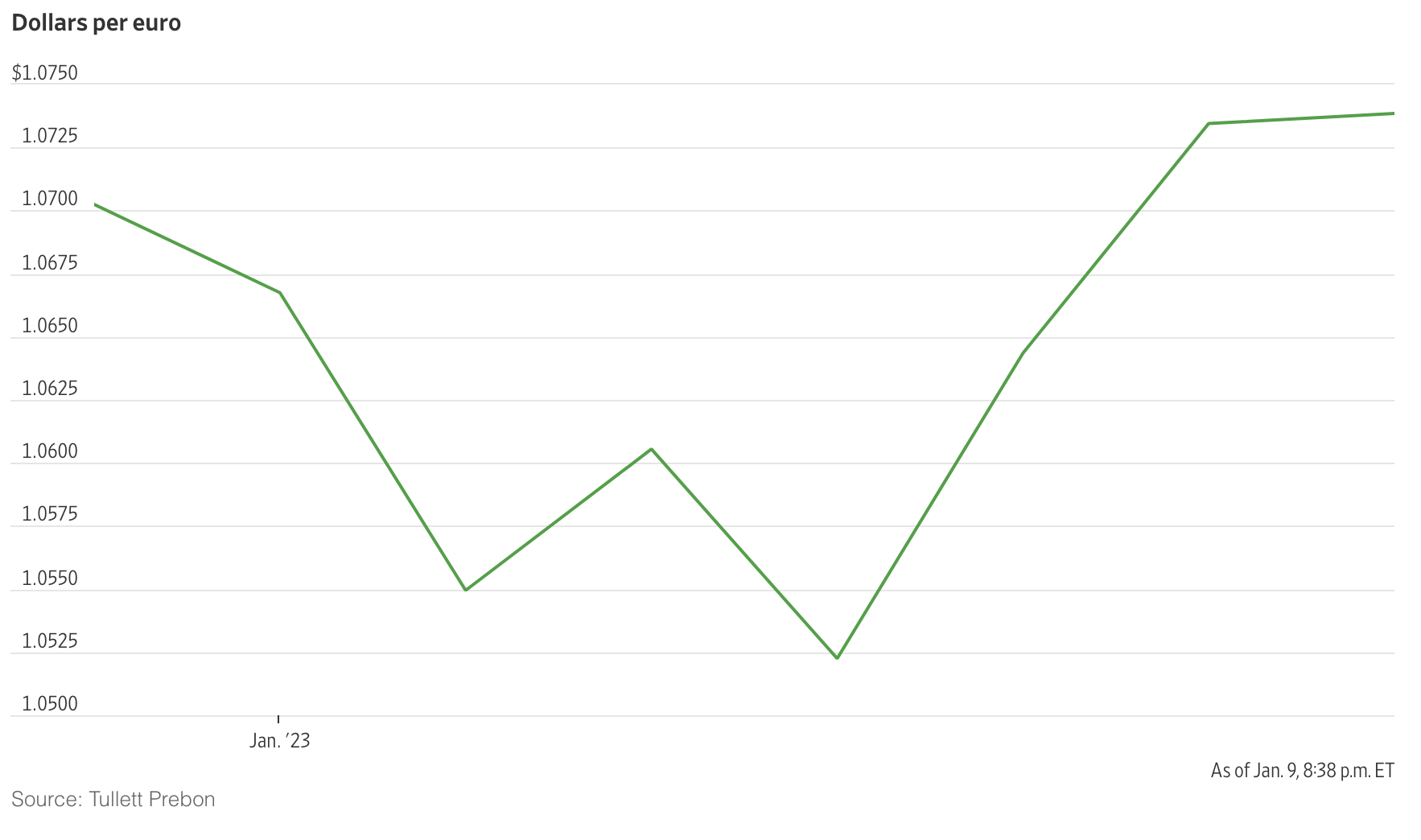

Other major world currencies, such as the euro, paid the price, with EUR/USD falling below $1.09 to hit lows similarly not seen since the aftermath of the March 2020 COVID-19 crash.

“If Bitcoin was uncorrelated from the Stock Market, it would be performing the way gold has performed since December,” analyst Matthew Hyland argued in a synopsis on March 6.

“Bitcoin is correlated to the Stock Market. It has not “decoupled.’ Perhaps one day it does decouple but until it happens, you can’t conclude it has or will.”

Such a “decoupling” was arguably more needed than at any time recently as the stocks, themselves, faced a potential mixture of skyrocketing commodity prices and inflation-taming measures from governments.

Prior to the Wall Street open, S&P 500 futures were knocking on 2% declines, while Germany’s DAX was already down nearly 4%.

Ex-Goldman CEO Blankfein: Crypto Should Be “Having A Moment”

The extent of Bitcoin’s lackluster performance meanwhile even caught the attention of the traditional finance world.

Lloyd Blankfein, former CEO of Goldman Sachs, queried why crypto more broadly was not seeing larger inflows against a background of government control over money.

“Keeping an open mind about crypto, but given the inflating US dollar and the stark reminder that governments can and will under certain circumstances freeze accounts and block payments, wouldn’t you think crypto would be having a moment now? Not seeing it in the price, so far,” he tweeted on March 7.

Responding, MicroStrategy CEO Michael Saylor blamed conflicting investment profiles active in Bitcoin specifically, but forecast that the status quo would ultimately be broken and would allow it to fulfill its function as a long-term investment.

“There is a tension between conventional traders that see Bitcoin as something to buy or sell depending upon their current risk assessment & interest rate expectations, and fundamental investors that simply want to buy it all and hold forever,” he wrote.

“Over time, the HODLers will win.”

Updated: 4-4-2022

Oil Falls As Dollar Surge Offsets Plan For New Russia Sanctions

* U.S, EU And Group Of Seven To Announce New Restrictions

* API Reports Rise In Crude Stocks At Cushing, Oklahoma, Hub

Oil ended a volatile session lower as a stronger U.S. dollar offset a potentially bullish impact from plans by the U.S., European Union and Group of Seven nations to install new round of sanctions on Russia.

West Texas Intermediate fell 1.3% to close below $102 a barrel. The dollar rose after remarks by the Federal Reserve Governor Lael Brainard that the nation’s central bank would continue to tighten policy methodically and shrink its balance sheet at a rapid pace as soon as May.

A stronger dollar, which makes commodities priced in the currency less attractive, outweighed the plan from the U.S. EU, and G-7 nations to increase sanctions on Russian financial institutions and state-owned enterprises. Restrictions would also apply to all new investments in Russia.

The “U.S. dollar strength likely contributed to late day sell-off,” in the oil market, said Ryan Fitzmaurice, a commodities strategist at Rabobank.

In post-close trading, U.S. oil futures extended losses to briefly fall below $100 a barrel.

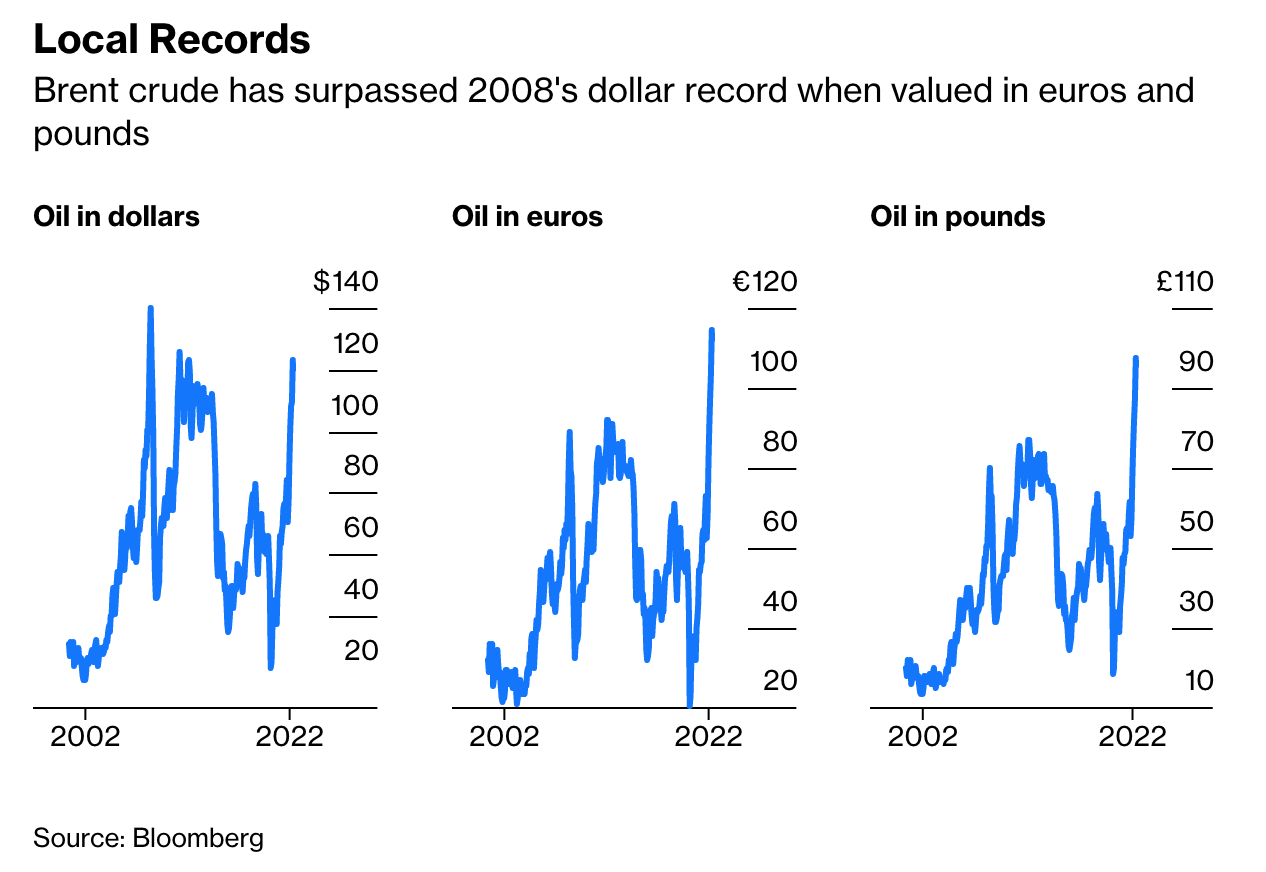

Oil rallied to the highest level since 2008 in the first quarter as Russia’s invasion disrupted supplies in an already tight market faced with roaring demand and dwindling stockpiles. The U.S. and U.K. already moved to ban Russian oil, and mounting civilian casualties in Ukraine are piling pressure on governments to take further steps against Russia.

Earlier, European Commission President Ursula Von Der Leyen said the trade bloc was working on further measures that will include sanctions on oil imports. Germany’s foreign affairs minister said the bloc will exit Russian fossil fuels, starting with coal.

“The threat of European sanctions on Russian oil remains an upside risk for crude prices despite the firm opposition in the short term from certain member states,” said Craig Erlam, senior market analyst at Oanda.

With the war in Ukraine in its second month, Russia faces allegations its troops massacred civilians in Bucha and other towns, an accusation Moscow denies.

The possibility of new curbs is offsetting the impact in the global crude market of a vast release from the U.S. Strategic Petroleum Reserves (SPR,) beginning in May, in a bid to tame prices. Other countries have said they’ll also make drawdowns.

That move has reshaped the oil futures curve, keeping a lid on nearby prices but lifting those further into the future.

“Many who were long oil got out in the last week or so on the basis that the SPR was just too much for the market to handle without some real evidence of dropping Russian crude exports,” said Scott Shelton, an energy specialist at TP ICAP Group Plc.

In one sign of tightness, Saudi Arabia raised selling prices for all regions. Saudi Aramco increased its Arab Light crude for next month’s shipments to Asia to $9.35 a barrel above the benchmark it uses, a record differential.

Many Western companies aren’t taking Russian crude, although discounted exports are going to buyers in Asia, including China and India. On Monday, commodity trader Trafigura Group offered to sell a cargo of Russia’s Urals grade at a record discount, but there were no bids.

Meanwhile, industry-funded American Petroleum Institute reported a 1.08 million barrel rise in U.S. crude stocks last week. For fuels, the group estimates gasoline inventories declined more than half a million barrels and distillates rose by almost 600,000 barrels.

Updated: 4-19-2022

Bitcoin climbs Above $41K On Wall Street Open As Gold Dives, Dollar Cements Highs

Bitcoin carves out its own trajectory as Wall Street trading gets underway in the first session after Easter.

Bitcoin (BTC) reclaimed $41,000 on April 14 as the first day of Western stock market trading after Easter painted a more bullish picture.

Analysis Calls For Caution On BTC

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking above $41,000 during April 19, reaching five-day highs on Bitstamp.

In a refreshing change to the gloomy atmosphere over the holiday period, the largest cryptocurrency began to copy what gold had achieved days prior, the latter since declining from $1,998 to $1,960 per ounce at the time of writing.

Equally energized, however, was the U.S. dollar, which continued cementing its strength in an ongoing potential headwind for BTC.

The U.S. dollar currency index (DXY) remained above the crucial 100 mark on the day, with analysts previously predicting that its next move would be a make-or-break moment for crypto.

As crypto sentiment exited “extreme fear,” monitoring resource Material Indicators nonetheless called for a level-headed appraisal of BTC price action.

Several moving averages, it said on April 19, needed to be reclaimed before the outlook could fundamentally change.

Before you get too excited about yesterday’s #Bitcoin PA, remind yourself that bulls need to reclaim these key moving averages to validate a trend reversal. To avoid potential bull trap, watch for volume and wait for confirmations. https://t.co/26BLOFwenL pic.twitter.com/r219S4YYCv

— Material Indicators (@MI_Algos) April 19, 2022

On April 18, however, the account acknowledged the “bullish” nature of the current chart setup.

Pundit Pins Hopes On RSI Bull Trigger

In a now rare bull flag from the stock market, meanwhile, the S&P 500 posted a bottom signal on April 19, which has historically spurred BTC price gains.

The move involves the stochastic relative strength index (RSI) on the three-week chart. Aurélien Ohayon, CEO of software firm XOR Strategy, concluded that a repeat performance was now due.

#BITCOIN ONE OF THE MOST ACCURATE BOTTOM DETECTORS I HAVE FOUND.

When the 3W-Stochastic RSI K-line of the S&P500 touched the 0 line, a #BTC bottom has been reached and a huge bull run has followed.

It just touched the the 0 line.#SPX $SPX $BTC #Crypto pic.twitter.com/DKRJv6FqIq

— TAnalyst (@AurelienOhayon) April 18, 2022

Bitcoin’s own RSI chart looked similarly primed for positive performance. On daily timeframes, RSI stood at 44.7, having just climbed above the 14-day moving average in what has been a bullish event throughout 2022.

Bitcoin Struggles As Dollar Breaks Multi-Year Bearish Trend Line

The latest moves in crypto markets in context for April 19, 2022.

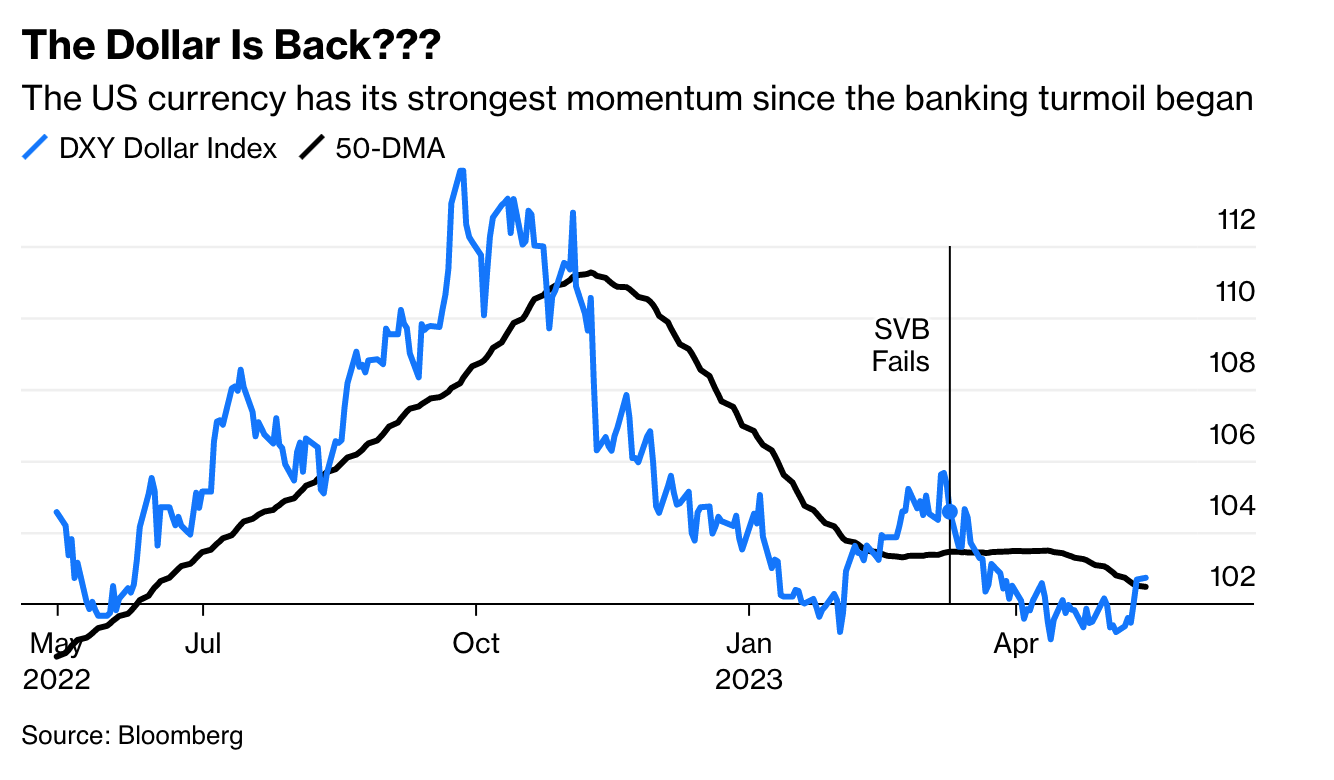

While bitcoin has held vital support, the cryptocurrency does not appear to be out of the woods yet, given the continued strength of the U.S. dollar.

The top cryptocurrency by market value traded near $40,700 at press time, having printed a high of $41,250 during the Asian trading hours. On Monday, buyers held the three-day chart 200-period moving average, staving off a major technical breakdown.

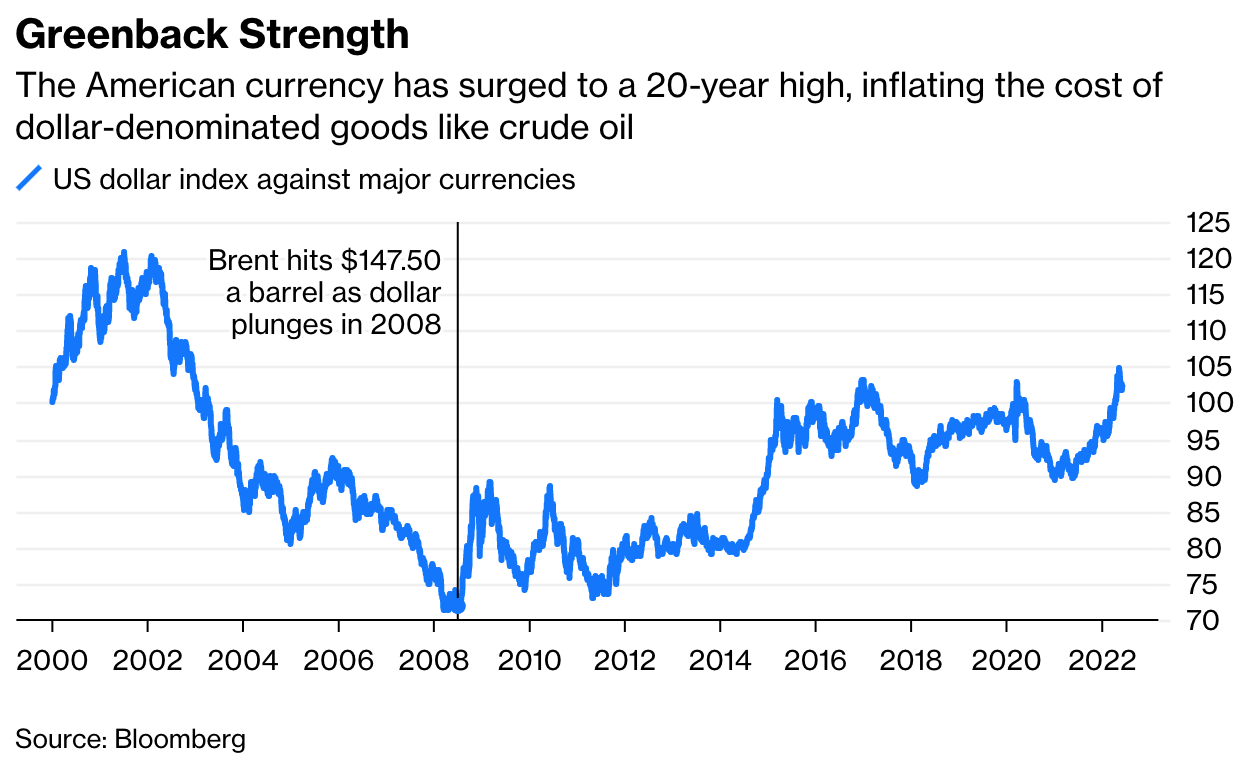

The dollar index (DXY), which tracks the greenback’s value against majors, rose to 101 early today, refreshing two-year highs and taking the month-to-date gain to 2.5%.

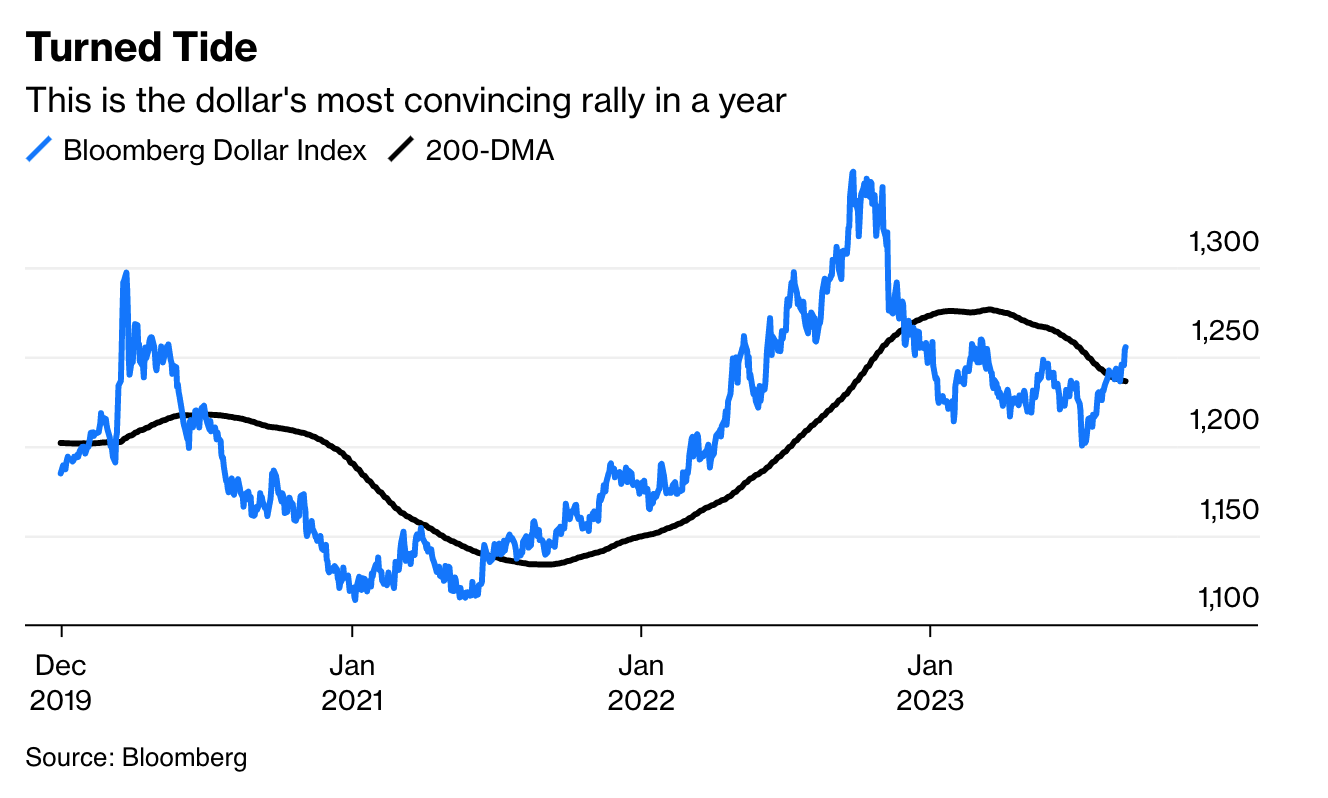

The global reserve currency has risen 12% since May 2021, marking its best stretch since its run-up in late 2014 through early 2015, per data provided by charting platform TradingView.

The DXY may see further gains, as the monthly chart shows the two-decade bearish trendline has been breached to the upside.

“We’ve been warning that USD strength is one of the biggest headwinds for markets, including BTC and crypto. As BTC struggles to keep its head above $40K, the U.S. dollar index (DXY) just broke 100 for the first time in almost two years,” analysts at Delphi Digital wrote in a note published Monday. “The greenback is now on the verge of a multi-decade breakout as two of its major currency pairs (EUR and JPY) are both vulnerable of technical breakdowns of their own. The EUR and JPY make up ~70% of the DXY index.”

“Looking back over the last 10 years, we can see how BTC’s price tends to trend in the opposite direction of DXY momentum. In other words, when the dollar is gaining momentum, BTC underperforms (and vice versa),” Delphi’s analysts added.

Ether, the second-largest cryptocurrency by market value, traded flat at around $3,050, having tested dip demand under the psychological support of $3,000 yesterday. The cryptocurrency has seen increased demand for December call options in recent weeks.

“Ethereum is caught between two powerful colliding forces: (declining on-chain activity + market correlation) vs. (institutional adoption + Web3),” Ilan Solot, partner at the Tagus Capital Multi-Strategy Fund, said in an email. “The latter will prove a secular shift, while the former is merely a cyclical dynamic. These cyclical forces are coiling ETH ever tighter into a spring.”

While top cryptocurrencies traded sideways, Terra’s LUNA and privacy-focused monero (XMR) chalked up double-digit gains.

Terra’s algorithmic stablecoin UST replaced Binance USD (BUSD) as the third-largest stablecoin by circulation during the later hours of Monday. Monero is set to implement a hard fork in July to improve network security and fee changes, developers confirmed in a GitHub post.

Updated: 4-28-2022

U.S. Dollar Surges Amid Investor Jitters, Rising Yields

WSJ Dollar Index within striking distance of highest level since 2002 after gaining 1% Thursday.

The U.S. dollar extended its rapid climb Thursday, reaching multiyear highs against the euro, the British pound and the yen.

The U.S. currency has been one of the few beneficiaries this year of a market battered by geopolitical fears and worries about the consequences of interest-rate increases from the Federal Reserve.

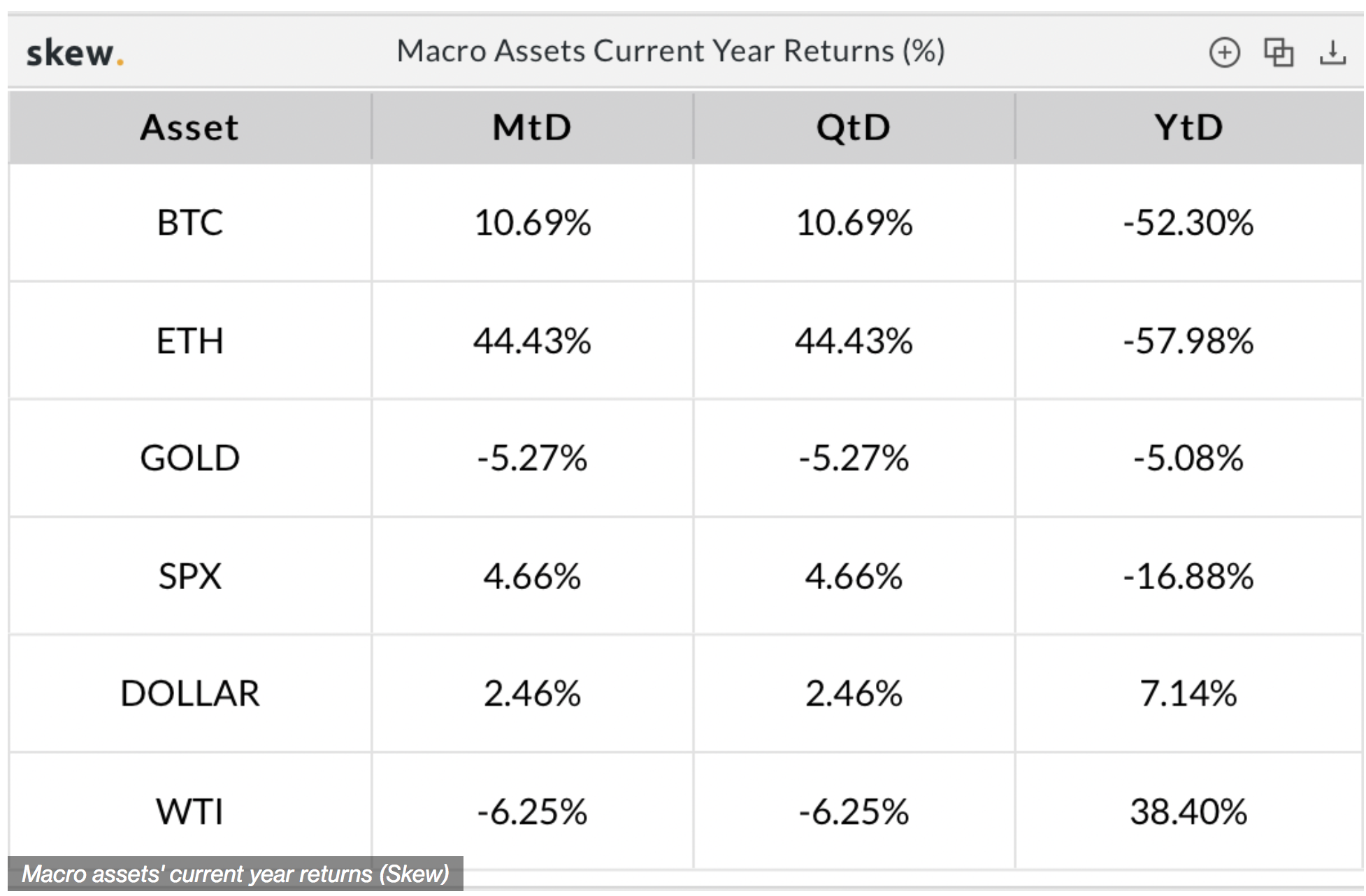

The WSJ Dollar Index, which measures the U.S. currency against a basket of 16 others, has risen 7.1% in 2022, outpacing everything from stocks to bonds to gold.

That has provided shelter to investors seeking reprieve from volatility elsewhere in markets, while stirring concerns about how a strong dollar might affect everything from multinational companies to emerging-market economies.

The dollar tends to perform well when investors ditch riskier investments and seek shelter in assets that they perceive as more secure. Its status as the world’s reserve currency makes the dollar a particularly attractive haven.

Analysts also attribute its strength to U.S. economic resilience and a central bank ramping up to battle inflation by raising interest rates. Investors now expect the Fed will begin a rapid series of rate increases, including a half-percentage point at its meeting next month.

The bulk of the dollar’s appreciation occurred just this month, said Stephen Gallo, European Head of FX strategy for BMO Capital Markets.

The WSJ Dollar Index rose 0.74% to 95.89 Thursday, even as the S&P 500 added 2.5%. That marked the index’s highest closing level since March 2020, when the coronavirus pandemic sent stocks plummeting and investors piling into the dollar.

The dollar has now climbed in all but two of the last 21 trading sessions, putting the currency within striking distance of a 20-year high. The dollar index rose as high as 97.33 in March 2020 on an intraday basis—around 1.4% above its recent levels. Any move past that would be the index’s highest level since 2002.

Higher interest rates typically support the dollar by making U.S. assets more attractive to yield-seeking investors. Investors expect that the Fed will increase short-term rates more aggressively this year than its central-bank peers.

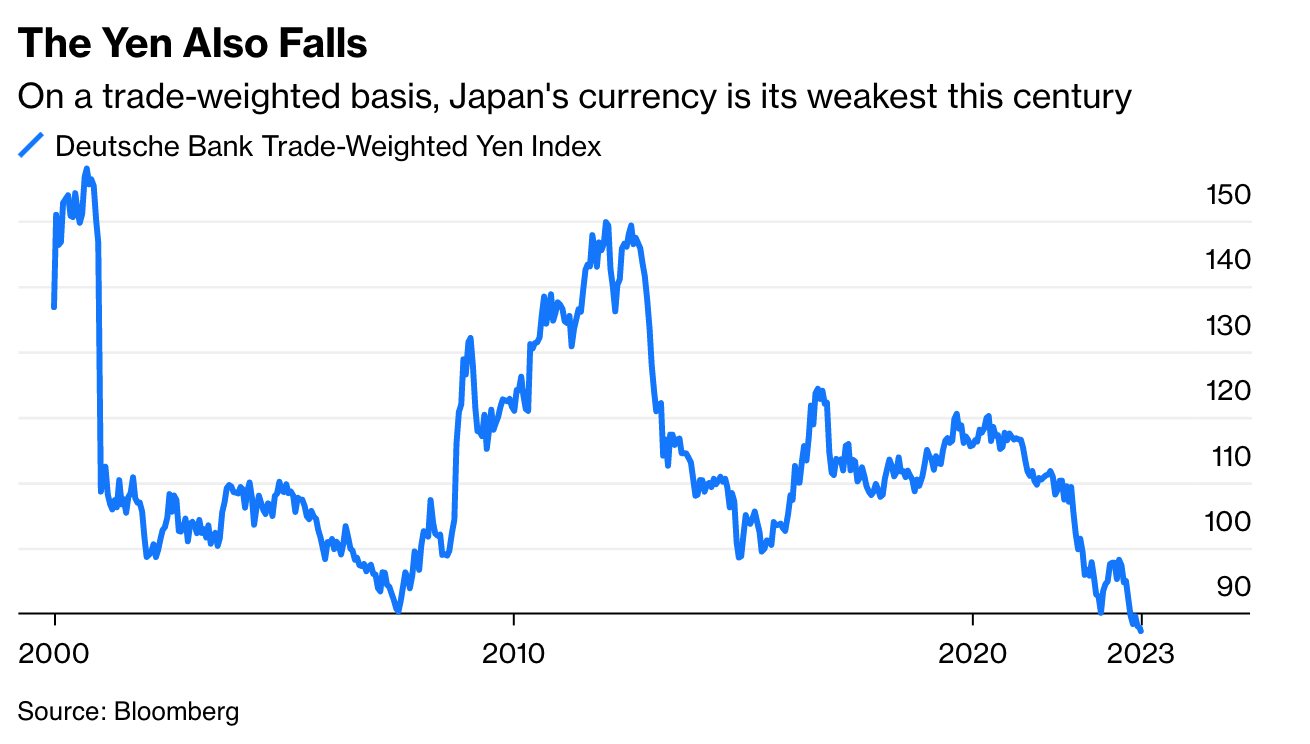

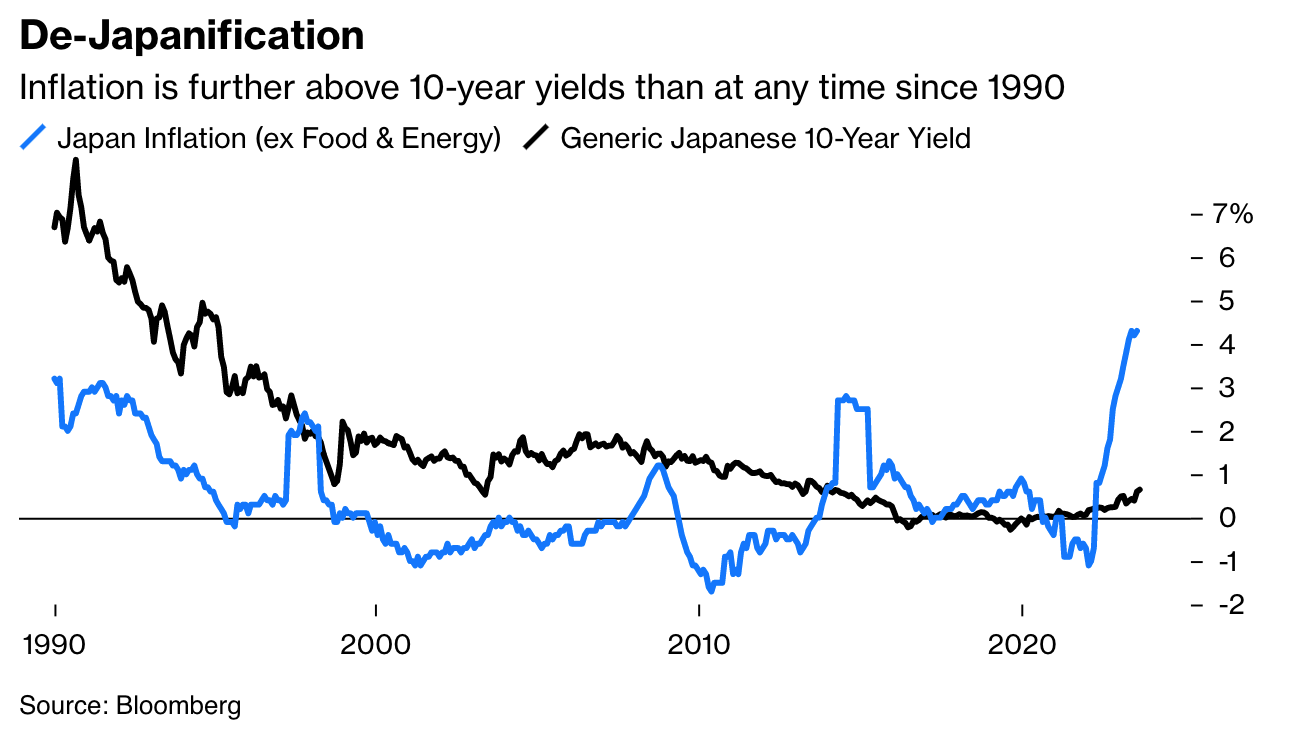

The Bank of Japan on Thursday reinforced its commitment to low interest rates despite rising inflation. The bank said it would purchase 10-year Japanese government bonds at a yield of 0.25% every business day to ensure that the yield doesn’t exceed that level. That sent the yen weakening to more than 130 to the dollar for the first time since April 2002.

The European Central Bank, meanwhile, would continue to lag behind the Fed in tightening monetary policy, ECB President Christine Lagarde said earlier this month, noting that the euro area’s economy is likely to absorb a greater blow from the war in Ukraine.

The dollar rose 0.57% against the euro Thursday, closing at $1.05—the euro’s lowest closing rate since 2017. Investors have attributed the euro’s fall this week to growing worries about rising energy prices and lower economic growth.

Elsewhere in currency markets, the greenback advanced 0.69% against the British pound to its highest level since mid-2020. The British pound has lost over 5% against the dollar since the beginning of the month.

“When two of the biggest central banks in the world are maintaining easy monetary policy on a relative basis versus the Fed, those rate differentials…are a huge part of the dollar’s strength,” said Charlie McElligott, a cross-asset macro strategist at Nomura Securities International.

Also boosting the dollar, analysts and investors said: the war in Ukraine and fears that mounting Covid-19 cases in China will spawn further pandemic lockdowns.

A strong dollar has implications for global economies and markets. Companies in the S&P 500 generate roughly 40% of their revenue from outside the U.S., FactSet data show, and a strong dollar makes it more expensive for companies to bring home foreign sales.

Already this earnings season, companies including Alphabet Inc. and Microsoft Corp. have mentioned the negative impact of a strong dollar on results.

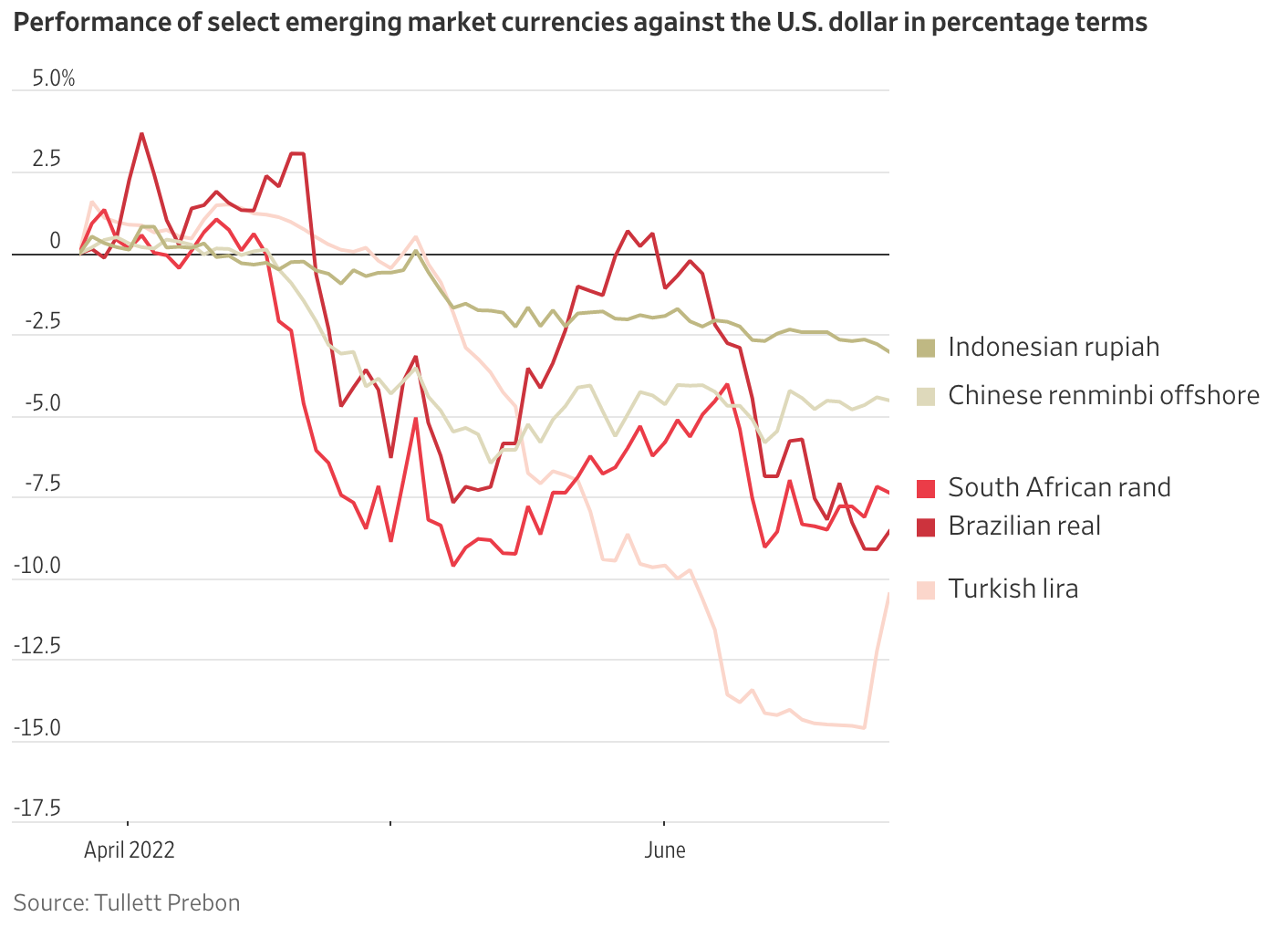

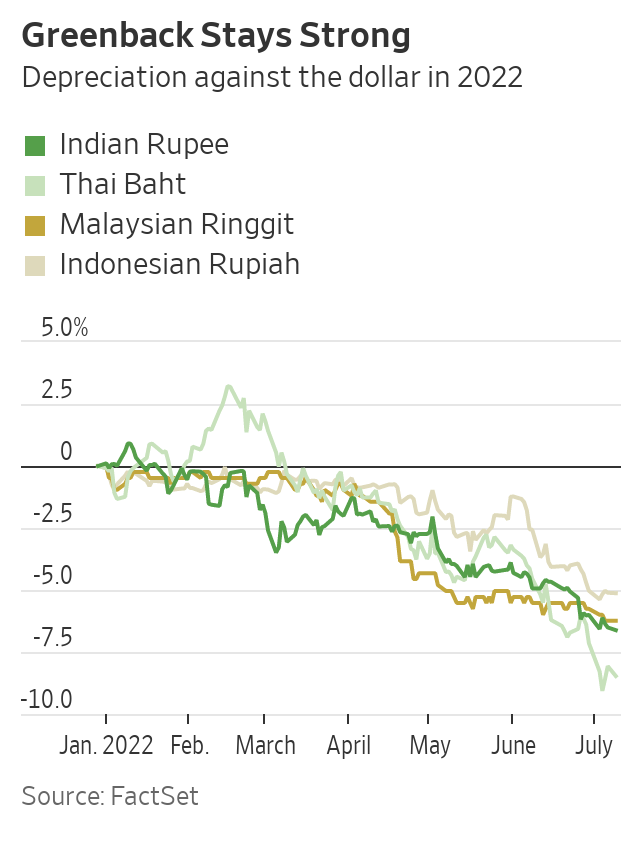

A strengthening dollar also tends to weigh heavily on emerging markets and often causes foreign traders to pull back from investing there. By pushing down the value of emerging-market currencies, a rising dollar makes dollar-denominated debt more expensive for them to repay.

On Thursday, the dollar jumped against emerging-market currencies, cutting further into the gains that some notched earlier this year. The greenback rose 1.3% against the Chilean peso and 0.9% against the South African rand. It pared initial gains against the Brazilian real.

The pace of the dollar’s rise this year has surprised some analysts and investors and has already begun to reset expectations for the rest of the year.

“I am this week doubting my view that the dollar would give back some of its gains, and I am beginning to fear that we will have a stronger dollar for longer this year,” said Jane Foley, head of foreign-exchange strategy at Rabobank.

“The global economic conditions that will lead to [a stronger dollar] are not pretty,” she said. “We’re talking about Europe’s [economy] under potential pressure and the greater possibility of a lack of energy supply to Germany. We’re talking about slower growth in China.”

Bitcoin Rejects $40K As US Dollar Strength Hits 20-Year High

The U.S. dollar currency index breaks through resistance to hit its highest level since 2002 — to the detriment of practically everything.

Bitcoin (BTC) made a fresh bid to crack $40,000 on April 28 as Wall Street trading opened to twenty-year highs for U.S. dollar strength.

DXY Now In “Parabolic Rally”

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting a high of $39,883 on Bitstamp before momentum waned, sending the pair $800 lower hours later.

Traders had predicted what they saw as a relief bounce, with the implication that the subsequent rejection would spark continuation of the downtrend.

On the day, caution was advised.

“BTC currently consolidating in this falling wedge. In case of a breakout, I’d be targetting $42 thousand. It’s good to wait for confirmation first if you decide to take the trade, IMO,” popular Twitter account Daan Crypto Trades argued.

“Only a strong break and reclaim of $40.6 thousand would make me look at higher targets,” fellow trader Crypto Ed added.

“Charts: mostly pointing lower. Liquidity: a squeeze to the upside to hunt the shorts.”

However, with limited movement on Bitcoin, itself, attention was fully focused on the dollar, which continued to outdo itself as the U.S. dollar currency index (DXY) hit its highest levels since 2002.

“The parabolic rally by DXY does not bode well for risk-on assets like stocks and Bitcoin. Until the rally cools off, playing defense is the way to go,” commentator Benjamin Cowen warned.

Others agreed that DXY was now “parabolic,” while trading guru Blockchain Backer saw similarities between the dollar’s current setup versus other currencies and the period immediately after the March 2020 COVID-19 cross-asset crash.

U.S. Dollar Currency Index (DXY) is rising and parabolic.

Started peeking at other currencies, and was looking at the Euro vs USD (EURUSD). And realized… I’ve seen this before. This was how the bottom looked in the crypto market before the big reversal happened after C-19. pic.twitter.com/M8uxBYZXX0

— Blockchain Backer (@BCBacker) April 28, 2022

A reversal of trajectory for USD should give Bitcoin some relief, the theory goes, with Cointelegraph contributor Michaël van de Poppe forecasting it to do “really well” in such circumstances.

Analyst: USD will crumble in upcoming “major currency crisis”

The rampant USD was, meanwhile, sparking concerns about knock-on effects for other economies.

Should instability enter the picture, volatility may return to haunt risk assets already at the mercy of central bank anti-inflation policy. Ironically, the spark might be Japan, where the central bank continues to print money.

“Whichever way Yen goes from here, chaos follows,” Brent Johnson, CEO of Santiago Capital predicted on April 27.

“If capital flows back into Japan & it retraces to the support line, it’s a rug pull on funds allocated to rest of the globe. If continues to dive it pressures the PBOC to let the Yuan also fall. Neither of these options is good…”

The Japanese yen also traded at twenty-year lows on the day.

“What do Keynesian investors do in a crisis? They rush into the $ thinking it is safety,” Alasdair Macleod, head of research for precious metals trading firm Goldmoney, added.

“Nearly all investors and money managers have been brainwashed into thinking this way since the Nixon shock. This morning JPY slide accelerates.”

Macleod saw what he called a “major currency crisis” coming, engulfing the dollar’s strength “next” as it followed the fate of the yen, euro and pound sterling.

Updated: 5-1-2022

Crypto And The Dollar Are Partners, Not Rivals

The disruptions of Covid and Russia’s invasion of Ukraine have shown the strength of the Western system and the weakness of China’s.

“My hope is that it creates world peace or helps create world peace.” That’s what Jack Dorsey, the former Twitter Inc. chief executive and now head of the digital payments company Block Inc., said about Bitcoin at a webinar in July 2021.

It is more likely that war creates a bigger global appetite for Bitcoin. Times of tumult are often associated with monetary transformations.

A classic example is the way, in the time of the Black Death and the Hundred Years’ War, the English monetary system was fundamentally altered.

There was a post-plague spike in commodity prices — especially for salt, the price of which rose sevenfold from 1347 to 1352. At the same time, the survivors of the Black Death were able to exploit a tight labor market to exchange feudal bondage for cash wages. The English economy became increasingly monetized.

European merchants, meanwhile, developed a new form of peer-to-peer credit instrument, the bill of exchange, which facilitated trade between England, the Low Countries and northern Italy.

More recent examples abound. The Spanish conquests in the New World transformed the global economy by increasing the supply of silver and gold, much of it used to pay for the Habsburgs’ European wars. The expansion of the British Empire exported the gold standard, creating a new and more stable international monetary system in which sterling was the dominant currency.

The world wars left Britain weighed down by debt and ushered in the first era of dollar dominance, with the U.S. currency pegged to gold and all the other major currencies less rigidly pegged to the dollar.

It was conflict, once again, that ended that Bretton Woods system in 1971. As the Vietnam War dragged on, President Richard Nixon’s breaking of the dollar’s peg to gold ushered in a new era of floating fiat currencies, characterized at first by high inflation and exchange rate volatility, then by a series of international agreements (the Plaza Accord in 1985, the Louvre Accord two years later), latterly by more ad hoc and less transparent arrangements in an environment of falling inflation and rapidly growing capital flows.

The events of the past two years — first the Covid-19 pandemic and now the Russian invasion of Ukraine — have been sufficiently disruptive to make another shift in the global monetary order seem likely. But what form will it take? Two hypotheses have come to the fore, by no means mutually exclusive.

The first is that cryptocurrency’s hour has arrived. In the words of Michelle Ritter, chief executive of the tech company Steel Perlot Management LLC, “Social media’s hinge moment came in 2011, when videos, tweets and other posts from Libya, Egypt, Yemen, Syria and Bahrain sparked the Arab spring … [Now] we find ourselves at a similar turning point” with cryptocurrency.

The hedge fund Bridgewater Associates LP noted that “Russia’s invasion of Ukraine is the first major event where cryptocurrencies are part of the equation.”

Hypothesis two is that we are witnessing the twilight of the dollar. According to Zoltan Pozsar of Credit Suisse Group AG, the decision by the U.S. and its European allies to freeze much of the Russian central bank’s foreign-exchange reserves was a watershed moment.

It will, he has argued, “encourage central banks to diversify away from the dollar, or try to re-anchor their currencies to assets that are less susceptible to influence from U.S. or European governments.”

According to Pozsar’s March 7 note, “Bretton Woods III,” we are leaving behind the post-1971 Bretton Woods II, a system in which “inside money” (U.S. Treasuries) replaced “outside money” (gold). Bretton Woods III will take us back to outside money (gold and other commodities) as the world reduces its reliance on dollars and dollar-denominated bonds.

BitMEX founder Arthur Hayes made a similar point in his March 16 essay, “Energy Cancelled.” “Why should any central bank ‘save’ in any Western fiat currency, when their savings can be expropriated arbitrarily and unilaterally by the operators of the digital fiat monetary networks?” In “The Doom Loop,” he predicts “$1 million Bitcoin and $10,000–$20,000 gold by the end of the decade.”

These gentlemen are by no means the first to predict the demise of the dollar. But whenever I hear such arguments I am reminded of an old Larry Summers line. Speaking at Harvard’s Kennedy School of Government in November 2019, the former Treasury secretary observed: “You cannot replace something with nothing.”

What other currency was preferable to the dollar as a reserve and trade currency, he asked, “when Europe’s a museum, Japan’s a nursing home, China’s a jail, and Bitcoin’s an experiment”?

First, take a look at what happened when crypto went to war. At the beginning of the Russian invasion there was a great deal of discussion about how the Kremlin would somehow use cryptocurrency to evade Western sanctions. Certainly, there was an initial surge of ruble purchases of Bitcoin.

But American and European regulators put the major crypto exchanges on notice. Coinbase Global Inc. blocked over 25,000 Russia-linked addresses that it believed were linked to illicit activity.

In any case, as Tigran Gambaryan of Binance Holdings Ltd. pointed out, “Crypto is not a very efficient way for a government and for a nation-state to elude sanctions.”

Crypto played a bigger part in facilitating private donations to the Ukrainian government. According to Gillian Tett of the Financial Times, writing on March 10, “about $106 million of crypto donations have flooded in.” Vitalik Buterin, the founder of Ethereum, tweeted: “Reminder: Ethereum is neutral, but I am not.”

His co-founder, Gavin Wood said he would “personally contribute $5 million” if Polkadot, his new token, was accepted. Sergey Vasylchuk, chief executive of blockchain company Everstake, launched a decentralized autonomous organization based on the Solana blockchain to raise donations for the Ukrainian army.

Slava Ukraini! But please note that $106 million is a rounding error compared with the amounts of dollar-denominated military aid Ukraine is receiving from the U.S. government, which could total $19.67 billion if the Biden administration’s latest proposal is approved by Congress.

Let’s keep this simple. Cryptocurrencies such as Bitcoin and Ethereum are attractive assets to hold in unstable places and at unstable times. Certain kinds of stablecoins (pegged to the U.S. dollar) may be even more attractive.

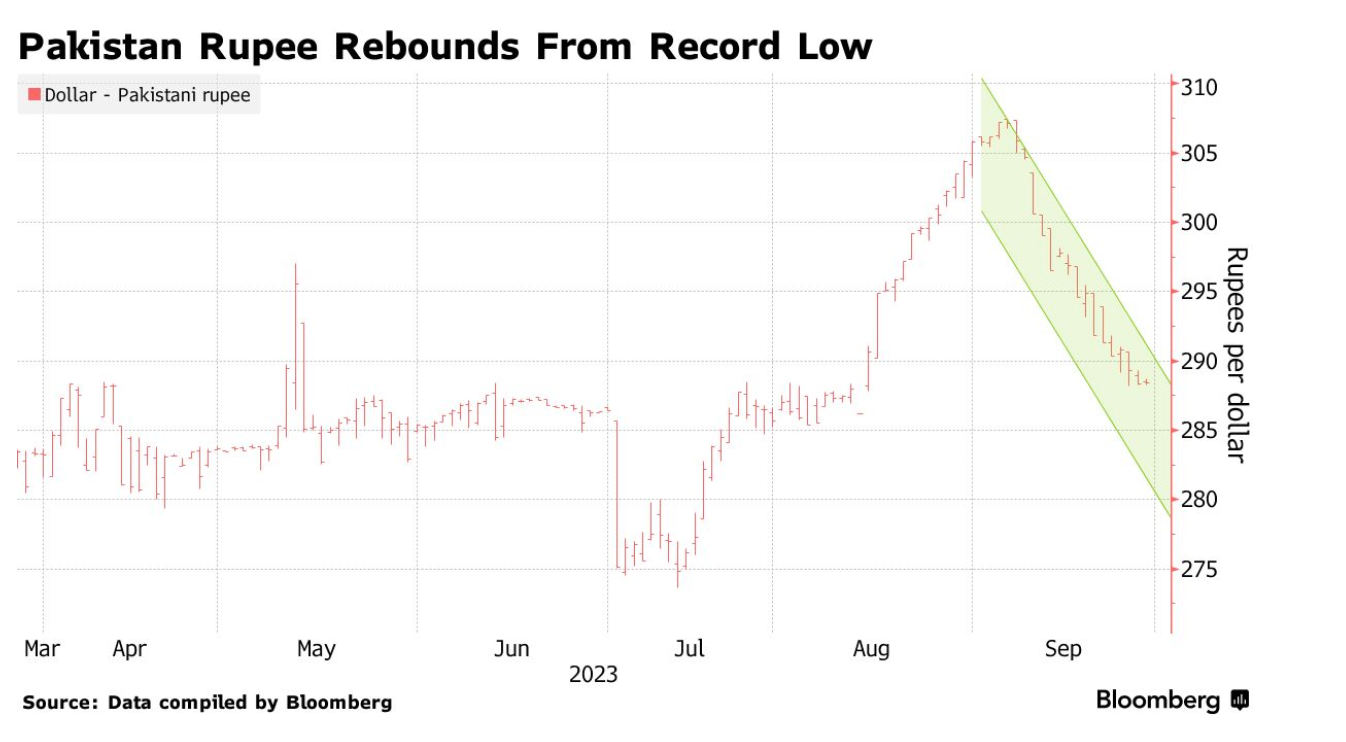

As Sirio Aramonte, Wenqian Huang and Andreas Schrimpf point out in a recent Bank for International Settlements note, that’s why there was so much Turkish trading in stablecoins in 2020 and 2021, as the pandemic combined with the Turkish government’s reckless monetary policy to tank the lira.

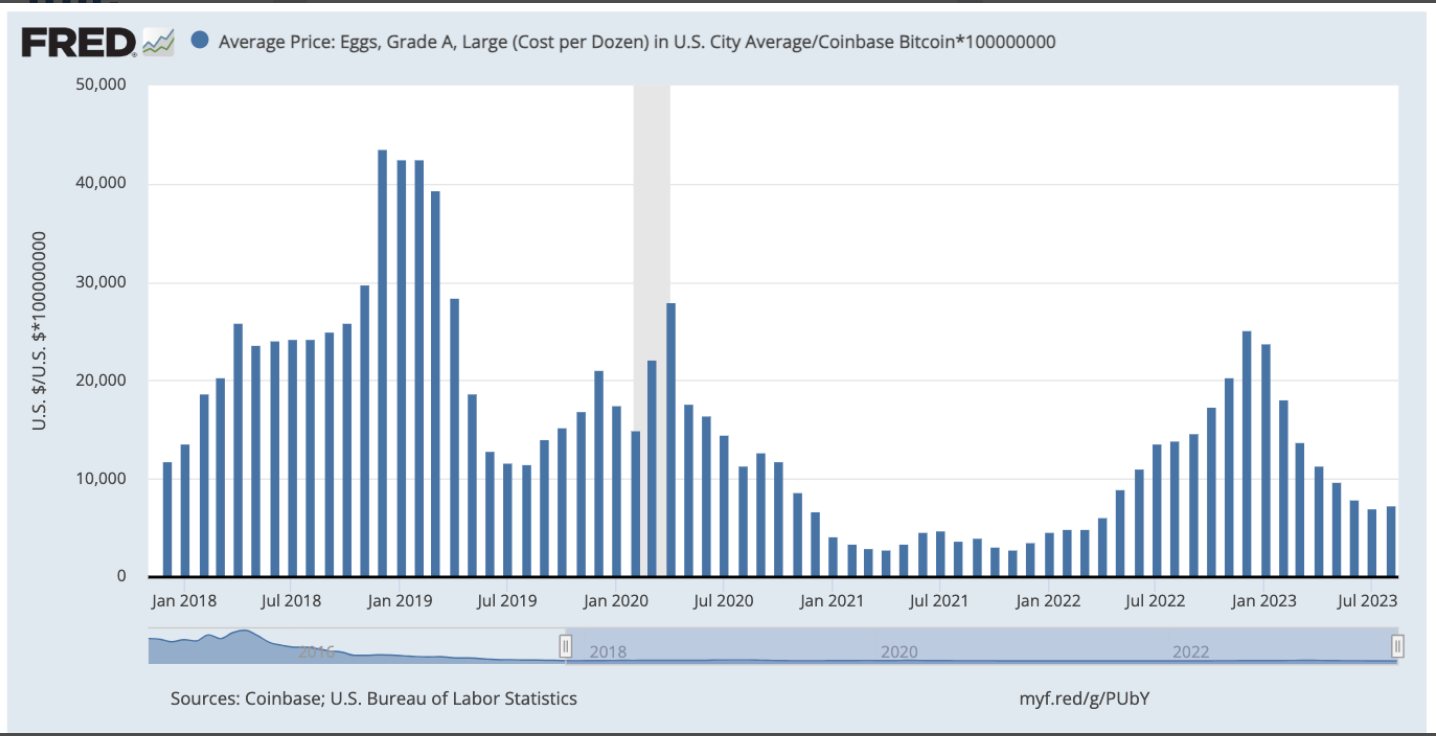

When the pandemic began, you really were well advised to put some money into Bitcoin and Ethereum. Relative to January 2020, your investments are up by factors of, respectively, 21.7 and 5.4.

Your gold position is up just 25%. Even in time of war, crypto has beaten out gold. Since the eve of the Russian invasion, Bitcoin is up 3.8%, Ethereum 9.1% and gold is down 1%.

But in war one needs more than assets that retain or gain value. It is much more important to be able to make payments to domestic and foreign vendors in return for the stuff you need from them.

As is well known, the Ethereum blockchain can process only about 15 transactions a second, whereas Visa can handle thousands of credit-card transactions a second.

For Russia over the past two months, it was more important that Western credit-card companies could not disable Russian payments than that Russians could buy Bitcoin.

And that is because since 2014 (when their first, more limited invasion of Ukraine happened) the Russians have built their own National Card Payment System (NSPK) for processing transactions and a domestic card system known as Mir which runs on the NSPK rails — as do cards issued by China’s UnionPay Co.

In the great scheme of the global economy, digital payments are a bigger deal than crypto. That is because payments systems exploiting artificial intelligence — such as Ant Financial Services Co.’s Alipay and Tencent Holding Ltd.’s WeChat Pay — can process vastly more transactions much faster than any blockchain-based system and can then spit out credit ratings based on the data they aggregate and analyze.

Several years ago, I grew very concerned that these Chinese payment systems were going to eat the world — or at least were going to become dominant in emerging markets.

Fortunately for the Western world, the Chinese Communist Party decided that Alibaba founder Jack Ma was getting too big for his boots and pulled the plug on his and Eric Jing’s plans for world domination.

The Chinese challenge in payments is not over, however. Bytedance Inc.’s immensely popular TikTok platform is implementing payments features.

Kenyan fintech giant M-Pesa, Ethiopian state-owned Ethio Telecom and Pakistani telecom provider Jazz are among the companies in 19 countries using Huawei Technology Co.’s Mobile Money platform. Chinese-owned African mobile payments platform OPay is now the second-largest fintech startup in Africa in terms of size and value.

But the new thrust of Chinese policy is to persuade other countries’ central banks to develop digital currencies that are interoperable with China’s central bank digital currency, e-CNY, via “bridges” between central banks.

Thailand, Hong Kong and the United Arab Emirates are working with China on such bridges. China’s alternative to SWIFT — a renminbi-denominated Cross-border Interbank Payments System — now has 1,200 member institutions across 100 countries.

Another Chinese agency is the state-backed Blockchain-based Service Network (BSN), which aims to create a digital architecture connecting public and private blockchains.

In 2021, BSN launched the Universal Digital Payment Network, which seeks to build a “standardized digital currency transfer method and payment procedure.”

According to Chinese reports last August, at least three foreign banks are planning to access e-CNY through a private clearing platform built by Shanghai’s City Bank. As the February 2022 Beijing Olympics showcased, foreigners in China can already create their own e-CNY wallets without a Chinese banking account.

Yet if China plans to build an alternative payments architecture to the one dominated by American and European institutions, it has a very, very long way to go.

In January, shortly before the Russian invasion of Ukraine, China held just over $1 trillion of its roughly $3 trillion worth of foreign reserves in U.S. Treasury bonds, according to the Treasury Department. More than half of China’s reserves are denominated in dollars, according to the most recent data published by the State Administration of Foreign Exchange.

Beijing has clearly been flabbergasted by the U.S. decision to freeze Russia’s central bank reserves. “Chinese economists … find it shocking that the U.S. would carry out such measures against Russia,” wrote the Chinese economist Yu Yongding of the Chinese Academy of Social Sciences last month.

“The international financial system is based on the trust that all participants will play by the rules, and honoring debt obligations is one of the most important rules there is.

Whatever the justification, freezing a country’s foreign-exchange reserves is a blatant breach of that trust … Now that the U.S. has proved its willingness to stop playing by the rules, what can China do to safeguard its foreign assets? I don’t know.”

I don’t know either. The problem for China is that prophecies of the dollar’s demise, which people have been making since the late 1960s, keep turning out to be wrong.

True, as the University of California, Berkeley’s Barry Eichengreen has pointed out, the dollar’s share of allocated international reserves has declined somewhat since the beginning of the century, from 71% to 59%. But it’s not as if central banks have been swapping dollars for renminbi.

The currencies that have grown more popular with reserve managers are those of Canada, Australia, Sweden, South Korea and Singapore. This is not an erosion of dollar dominance that greatly diminishes the ability of the U.S. to impose financial sanctions. As the Russians have discovered, even the Swiss were willing to participate in the Russian reserve freeze.

Nor is that the only measure of dollar dominance. In 2021, the U.S. currency was used in 40% of all international payments by total transaction value. In second place was the euro. The Chinese currency came a miserable fourth — just 2.7% — behind even sterling.

In The Words Of Sebastian Mallaby Of The Council On Foreign Relations:

Dollar defeatism is vastly overblown. Around the world, almost three-fifths of private foreign-currency bank deposits are held in dollars. A similar share of foreign-currency corporate borrowing is done in dollars. …

The Federal Reserve estimates that foreigners hoard about half the outstanding stock of dollar bank notes. … [Foreign central banks] hold dollars knowing that others will gladly accept them, just as many learn English because others speak it. … A standing credit line in renminbi is the financial equivalent of fluency in Esperanto.

As the prolific economic historian Adam Tooze points out, the other central banks that issue reserve currencies are all on the other end of swap lines from the Federal Reserve, key sources of liquidity in times of financial crisis such as late 2008 and early 2020.

Meyrick Chapman argues persuasively that, for the global economy, “America remains the ‘consumer of last resort.’ Until that changes, the dollar will retain its ascendency.”

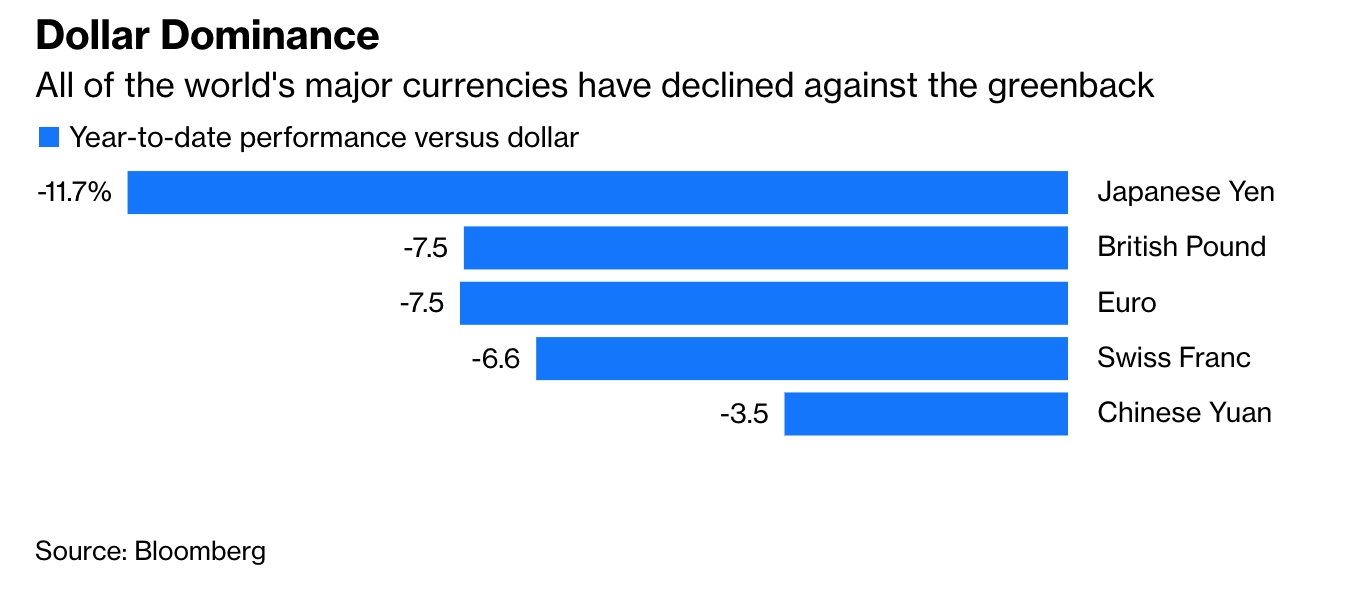

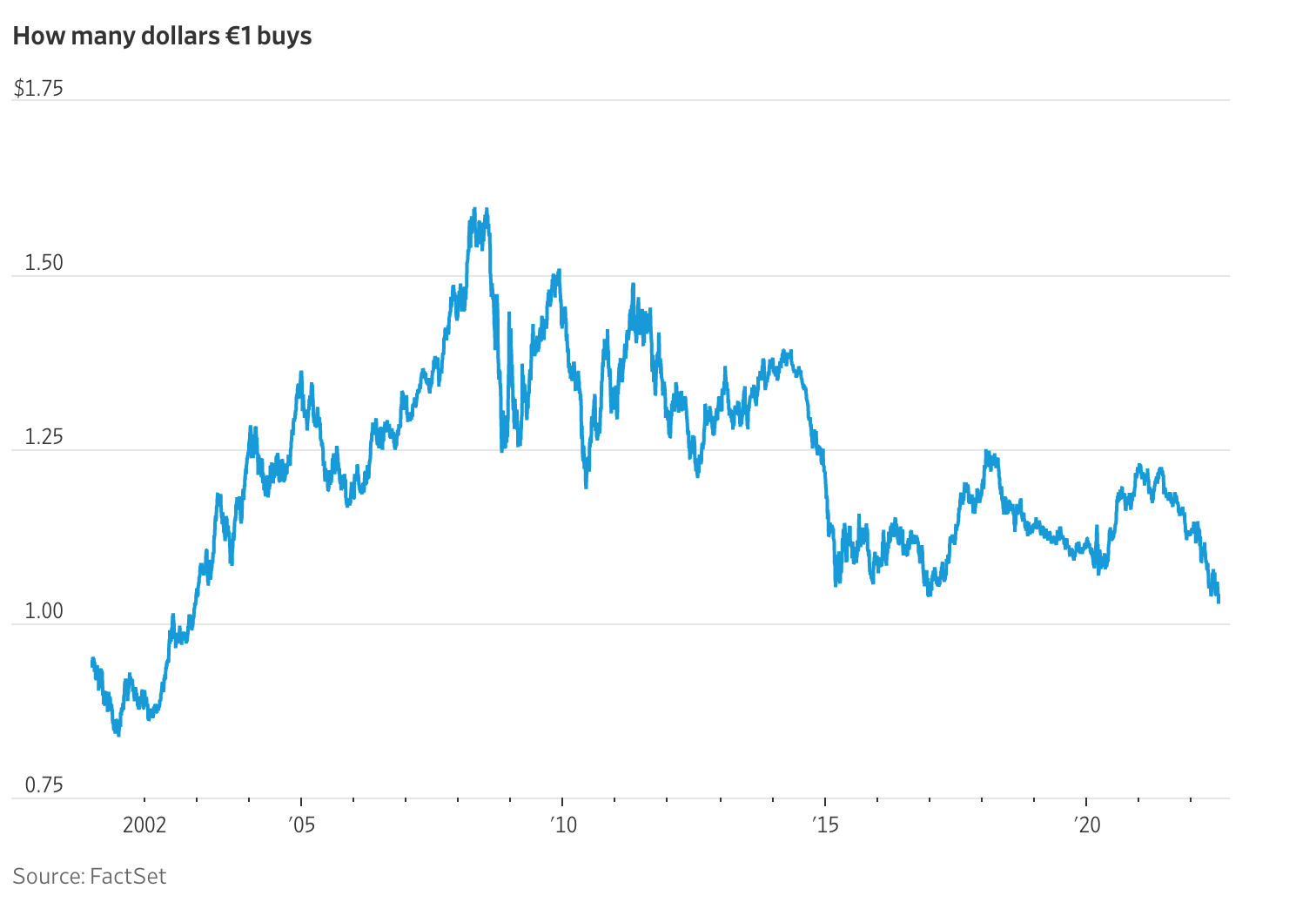

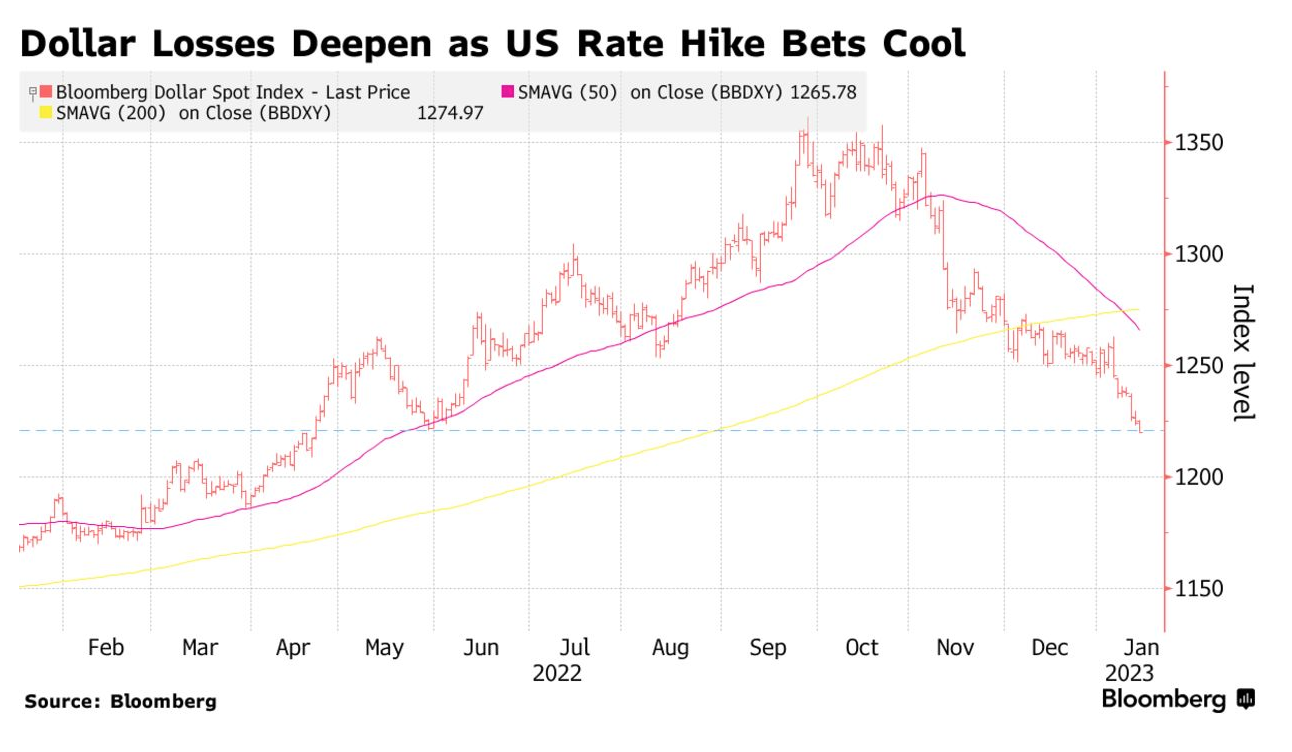

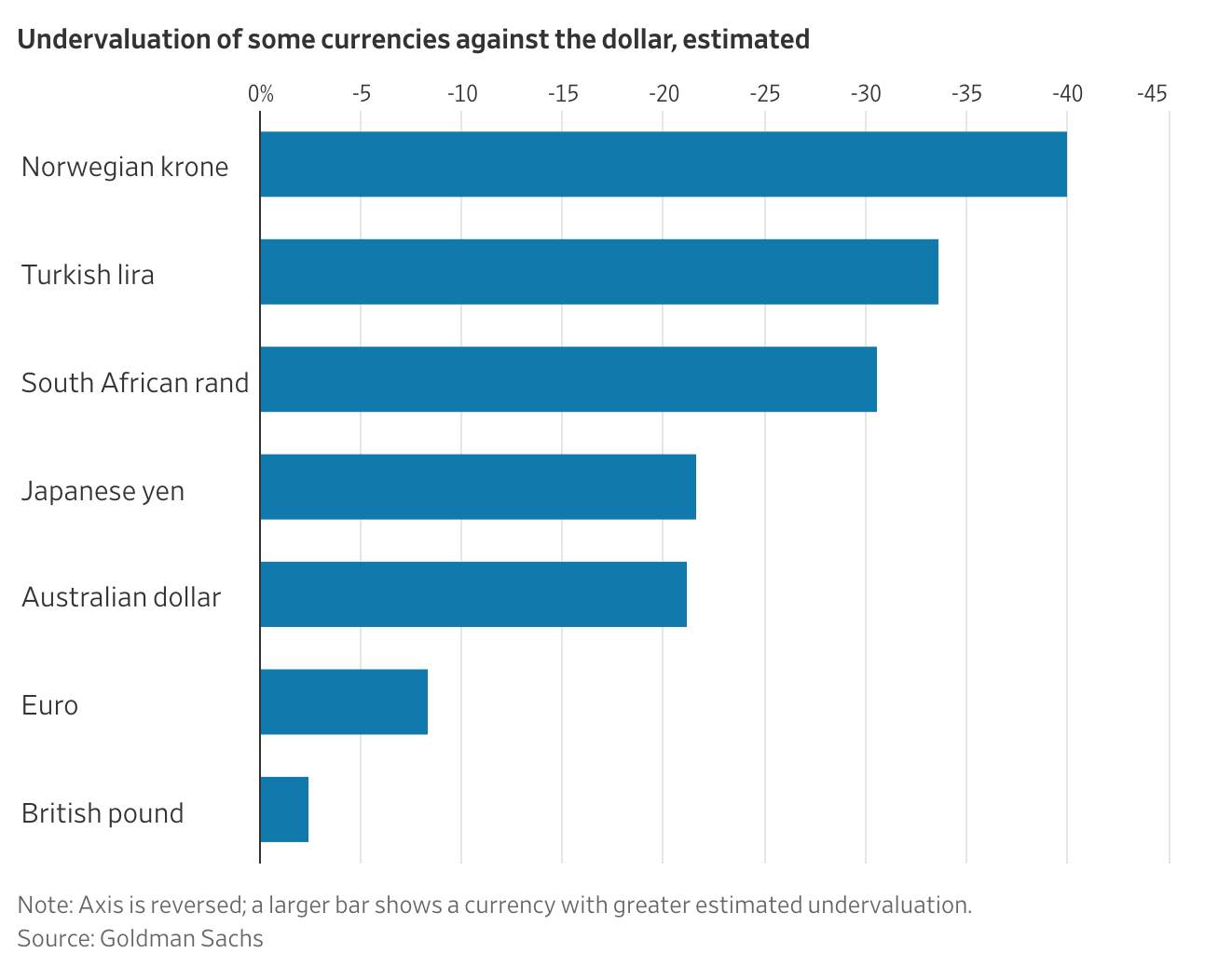

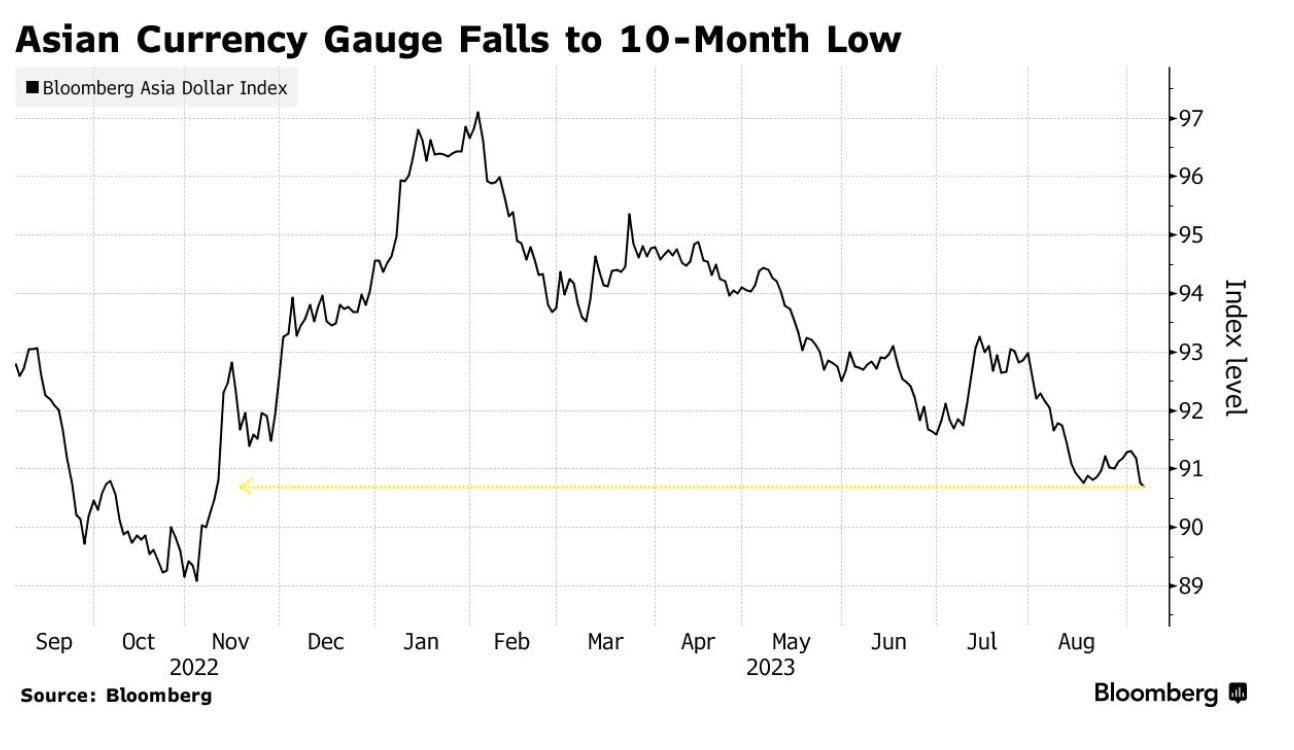

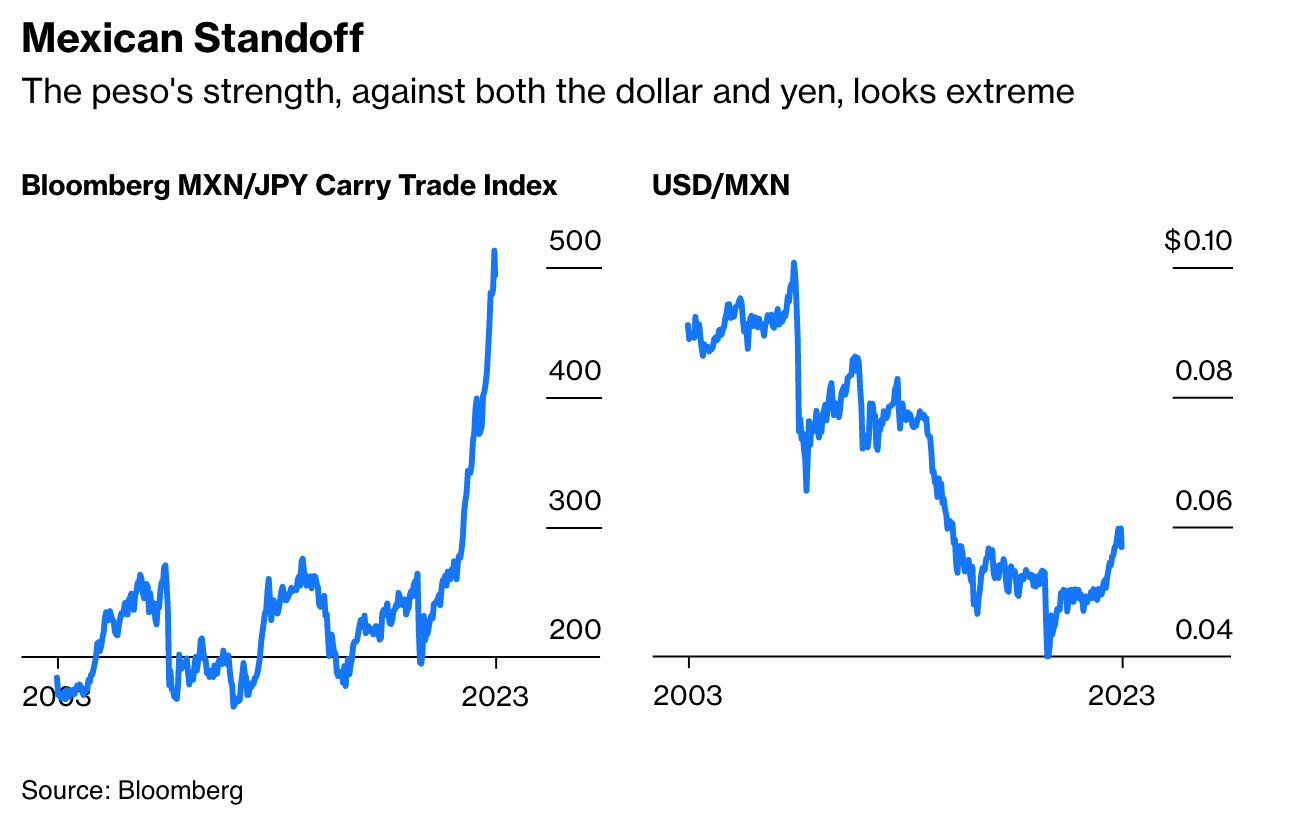

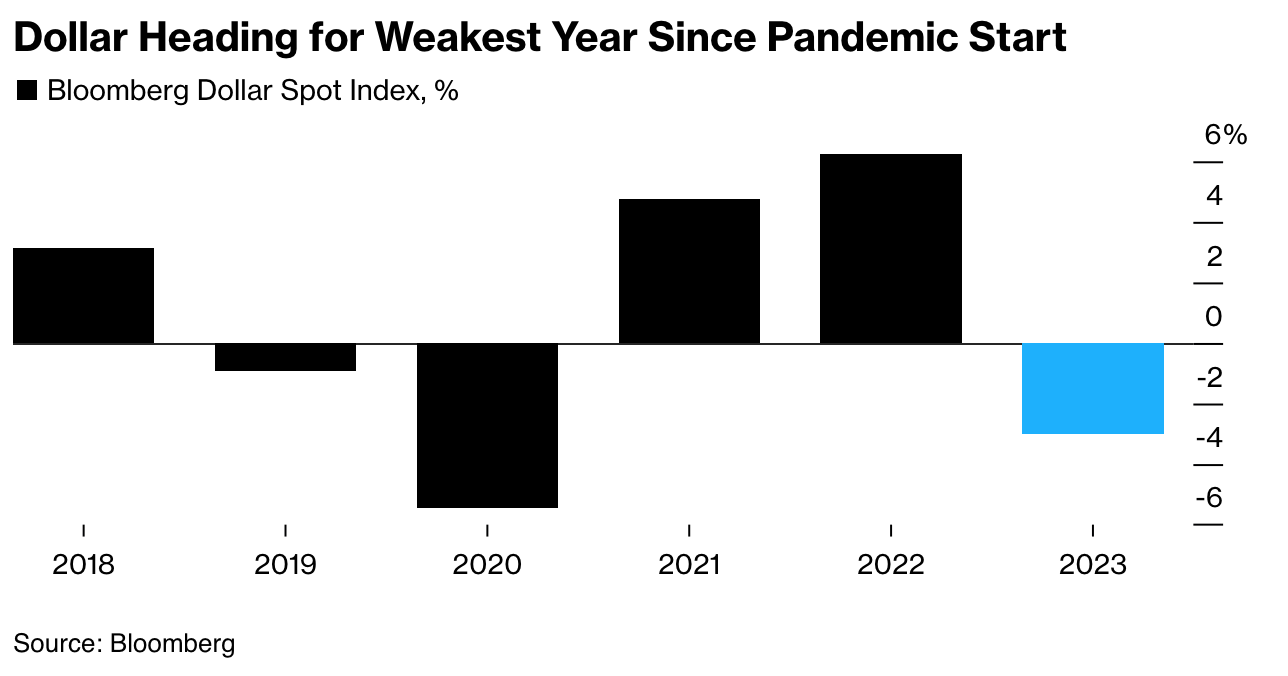

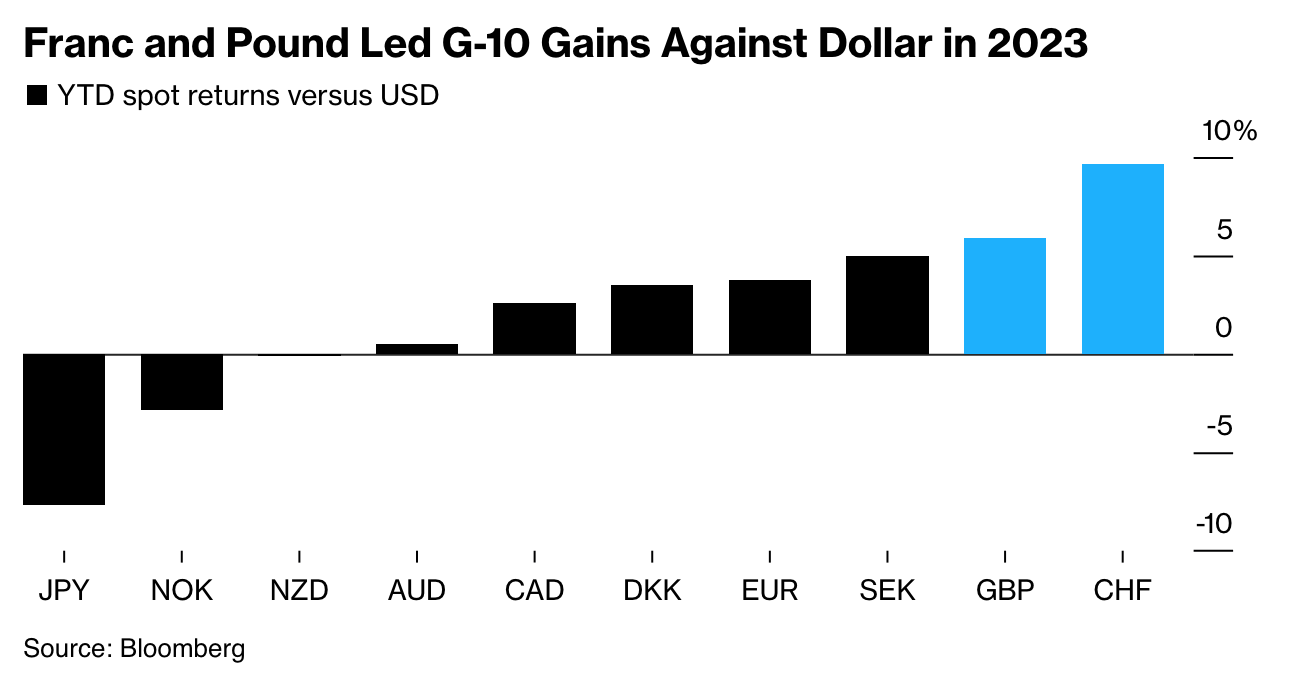

All of this helps explain the extraordinary dollar rally we have seen this year, which has seen it strengthen significantly against most other major currencies, particularly the Japanese yen, which has depreciated by nearly 27% since the beginning of 2021. The euro is down by 16%, the pound by 10%.

Can we therefore, like Larry Summers, dismiss cryptocurrency as a mere experiment? Some might go even further, condemning it as no better than a host of Ponzi schemes.

There are now between 10,000 and 20,000 different cryptocurrencies in existence, according to CoinMarketCap. That would be excessive even if they were all impeccably designed and managed.

There is a great deal of loose talk among the crypto bros. What is one to think when (for example) Mike Novogratz of Galaxy Digital LP says of his favorite stablecoin, Terraform Labs’ UST, that it’s “all good as long as there’s not a run on the bank.”

What, like Lehman Brothers?

Or how about this from Sam Bankman-Fried, founder of crypto exchange FTX, who was asked to explain the practice of yield-farming on Bloomberg’s “Odd Lots” podcast.

Yield farming, to put it simply, is borrowing someone else’s crypto tokens in exchange for your own “governance tokens,” and then exchanging the borrowed tokens for higher-yielding DeFi (decentralized finance) instruments. This was how Bankman-Fried put it:

Like this is a valuable box as demonstrated by all the money that people have apparently decided should be in the box. And who are we to say that they’re wrong about that? … And so then, you know, [the governance] token price goes way up.

And now it’s a $130 million market cap token because of, you know, the bullishness of people’s usage of the box. And now all of a sudden, of course, the smart money [goes and pours] another $300 million in the box and … it goes to infinity. And then everyone makes money.

Never mind the Wild West; this is the Wacko West. According to a report from the blockchain analytics firm Elliptic, around $10 billion in DeFi projects was lost to various hacks and scams in 2021.

In one case, members of the Bored Ape Yacht Club — who collect non-fungible token cartoons of, yes, bored apes — were duped into giving up the passwords to their crypto wallets.

When you read such stories, you begin to understand the strong impulse of so many central bankers and financial regulators around the world to shut down the whole crypto circus.

Some countries have already banned the use of crypto for payments as well as bitcoin mining: not only China, but also Algeria, Bangladesh, Bolivia, Egypt, Morocco and Nepal.

There are European and American officials who itch to regulate crypto more tightly, if not to ban it, such as Fabio Panetta of the European Central Bank, Gary Gensler of the Securities Exchange Commission and acting U.S. Comptroller of the Currency Michael Hsu, who recently compared the current state of crypto to the “fool’s gold rush” before the 2008-9 financial crisis.

We know already which way Brussels will go. Grinding its way through the European bureaucracy is the European Commission’s Markets in Crypto-Assets Regulation, which will require crypto exchanges to make full disclosure of everyone buying and selling digital assets.

The British government, by contrast, clearly hopes to attract more crypto business to London — hence Chancellor of the Exchequer Rishi Sunak’s suggestion that the venerable Royal Mint should develop an NFT, a flight of fancy that went down badly with Patrick Jenkins of the Financial Times (“the crypto cult exudes an oligarch-like arrogance”).

But what will the U.S. opt to do? Last year it seemed as if the Genslerites were in the ascendant and European-style regulation was only a matter of time.

All that changed with the fight that broke out inside the Beltway over last year’s infrastructure bill, which alerted a significant number of Democratic legislators to the fact that the U.S. crypto community now has both votes and dollars.

According to a recent Morning Consult survey, 20% of American adults and 36% of millennials own cryptocurrency. As Kevin Roose pointed out in a voluminous primer for the New York Times, crypto is suddenly ubiquitous, with Matt Damon and Larry David doing ads, the mayors of Miami and New York City touting their pro-bitcoin credentials, Colorado and Florida vying to be the No. 1 crypto state, two NBA arenas named after crypto companies, and both Pepsi and Applebee’s offering their own NFTs.

Most important of all, “crypto entrepreneurs are donating millions of dollars to candidates and causes, and lobbying firms have fanned out across the country to win support for pro-crypto legislation.”

The first fruit of all this lobbying was the White House executive order issued on March 8, 2022, on the “Responsible Development of Digital Assets.”

Gone was the hostile language of last year. “The rise in digital assets creates an opportunity to reinforce American leadership in the global financial system and at the technological frontier,” states the EO.

“The United States must maintain technological leadership in this rapidly growing space, supporting innovation while mitigating the risks for consumers, businesses, the broader financial system and the climate.”

This is crypto’s glad confident morning in Washington. “We are in a similar moment with cryptocurrencies,” declared Democratic Senator Ron Wyden recently, “to the one we were in 30 years ago in the early days of the Internet.” I hear this a lot in Silicon Valley, too. But what exactly does it mean?

It is generally agreed that the U.S. dominance of the first two eras of the Internet — Web 1.0 (nerds with email and web pages) and Web 2.0 (nerds making money by building platforms) — owed much to the relatively permissive legislation passed by Congress in the 1990s, notably the 1996 Communications Decency Act, and specifically its Section 230.

In essence, Section 230 created a special regulatory space for the rapid development of Internet platforms by exempting them from the legal liabilities associated with publishing companies, while also entitling them to moderate content as they saw fit.

The really interesting question for today’s legislators is: What would a Section 230 for DeFi/Web 3.0 look like? In a provocative new blog post, Manny Rincon Cruz proposes three elements:

No Virtual Asset Service Provider (VASP) status for developers of decentralized protocols. Code is already protected as free speech, and decentralized protocols have no intermediaries providing exchange, custody, or transfer services because DeFi users transact directly with each other.

Exclude DeFi “exploits” from the Computer Fraud and Abuse Act (CFAA). Exploits occur when a user interacts with a protocol, as its code is written, and profits by taking advantage of arbitrage opportunities or design weaknesses. As long as users do not break other criminal laws, exploits help DeFi by exposing buggy code.

No banking charter requirements for stablecoin issuers such as Circle and Tether. Unlike bank deposits, users can sell their USDC or USDT without redeeming them. Since these stablecoins cannot produce “bank runs,” they should not be subject to banking-specific regulations.

No doubt this is just the beginning of a debate about what light-touch regulation might look like for Web 3.0. But it is surely a better debate to have than one about how to out-regulate the Europeans.

The point is that U.S. dollar dominance and flourishing crypto are not alternatives to one another, but complementary.

Just as Bitcoin was never meant to be — and never will be — a substitute for the dollar, so DeFi is additional to rather than a substitute for the existing financial system, which we shall no doubt continue to use for decades to come in order to pay our taxes and also, I would guess, our employees and our utility bills.

Bitcoin is not about to bring about world peace, despite the hopes of some early enthusiasts. Nor will crypto emancipate us from the protective if sometimes stifling embrace of the nation-state, as some radical libertarians once imagined.

But if decentralized finance becomes as big an American success story as e-commerce has been, then it will provide yet another reason for foreigners to invest in America — and therefore to own and transact in dear old dollars.

Updated: 5-2-2022

The Hideous Strength Of The U.S. Dollar

The U.S. currency’s rapid rise will make it harder for other countries to curb inflation.

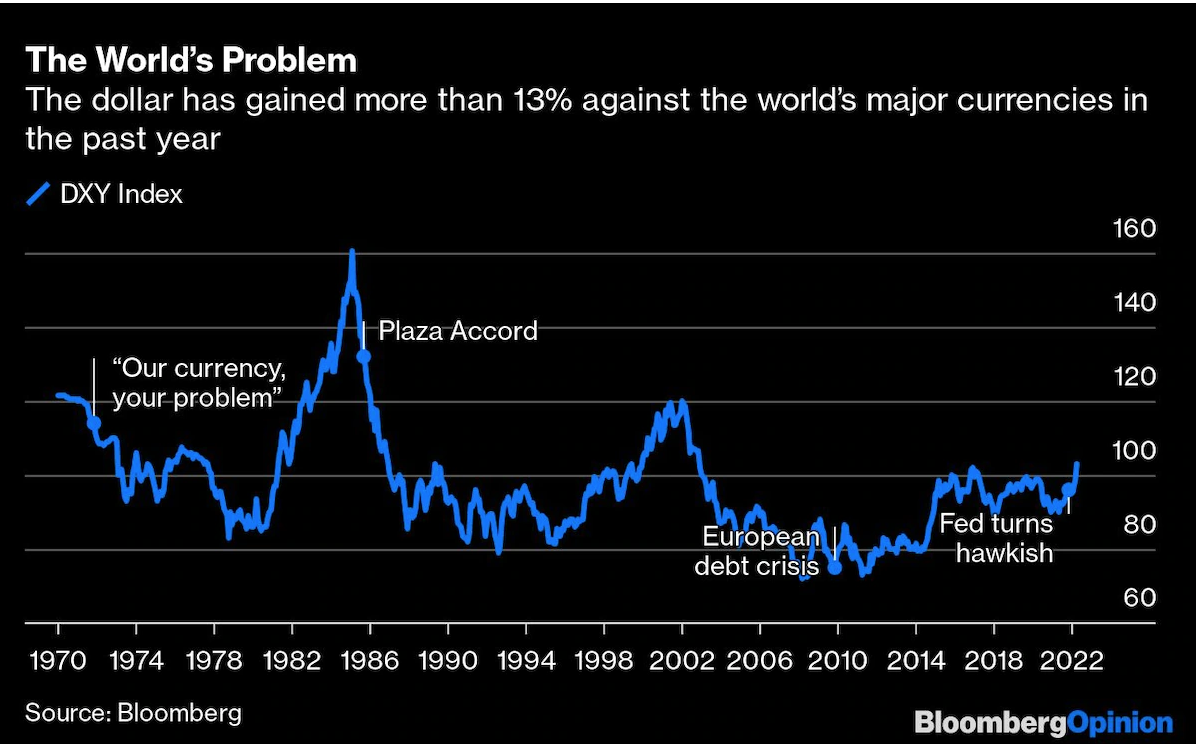

“It’s our currency, but it’s your problem,” was the 1971 message from John Connally, Richard Nixon’s treasury secretary, to U.S. trading partners dismayed by the dollar’s then weakness.

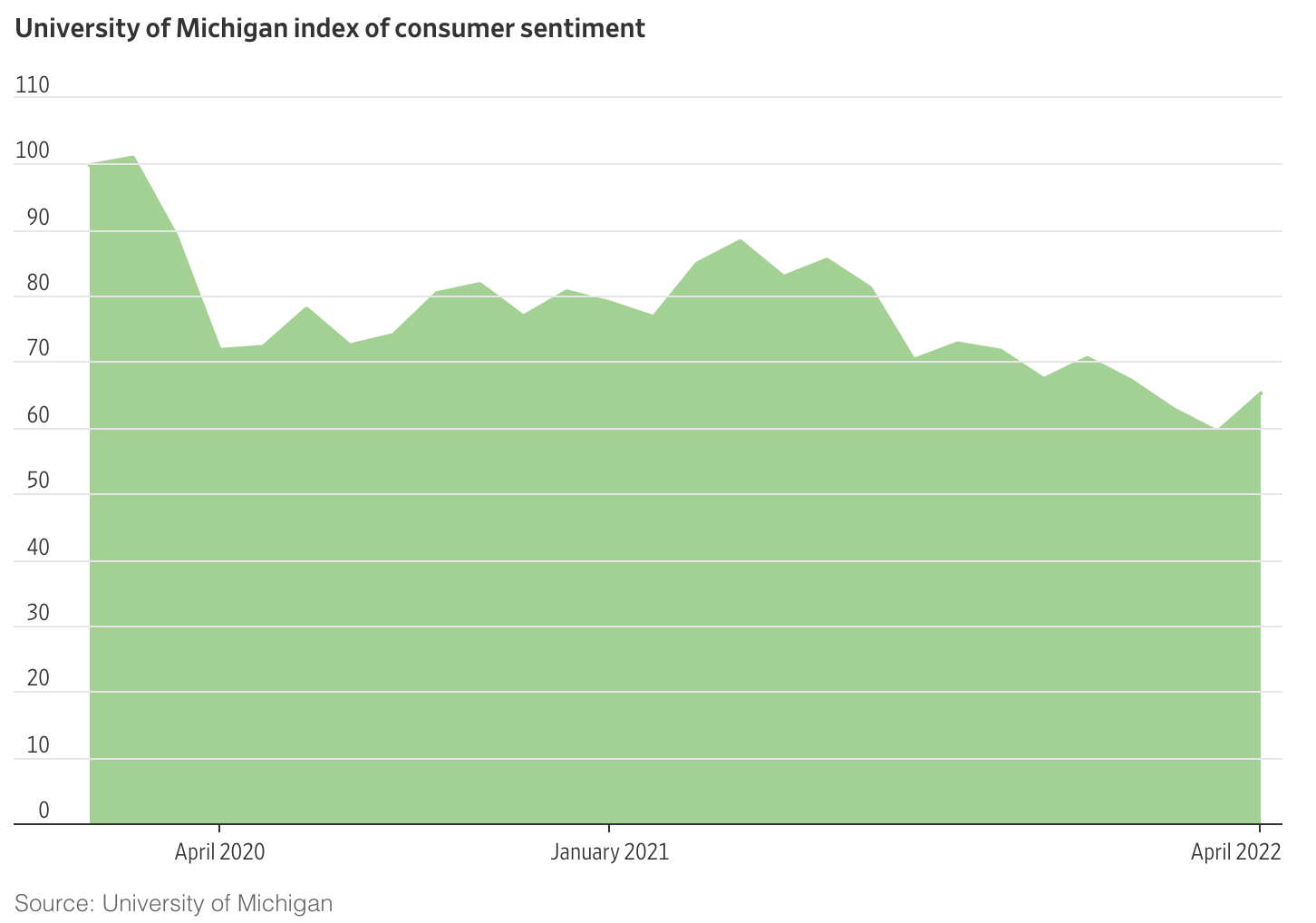

What was true then remains true today, albeit in the opposite direction with the greenback having risen 6% in April and 13% in the past year to its strongest level for two decades against a basket of major currencies.

The Federal Reserve needs to be mindful of the threat to global growth posed by the U.S. currency’s rapid ascent.

The greenback is the logical haven for investors seeking financial refuge from a confluence of global shocks that started with the pandemic and has been intensified by Russia’s invasion of Ukraine, culminating in an energy and food price surge.

King dollar rules supreme as the Fed maintains a policy of benign neglect in the currency market, having provided almost limitless access to dollar liquidity for central banks around the world in the past two years.

Bar a handful of outliers, including the Brazilian real and the Peruvian sol, the dollar is omnipotent versus pretty much every currency in both the developed and developing world.

That’s putting the squeeze on policy makers everywhere to defend their currencies or risk importing yet more inflation into their already beleaguered economies.

The Fed’s monetary policy is dictated by the needs of the domestic economy. With inflation, the most important element of its mandate, surging by 8.5% in March, the U.S. central bank is expected to follow March’s quarter-point interest-rate rise with accelerated half-point increases starting this week.

The futures market anticipates a Fed funds rate of at least 2.5% by year end, up from 0.5% currently; the dollar’s ascent reflects expectations for a shift in interest-rate differential with other countries.

The stronger dollar is also doing the Fed’s work in combating inflation by tightening financial conditions on a trade-weighted basis.

Although the U.S is the world’s largest economy and a huge importer of goods, it is relatively insulated from the global energy and food price shock by its domestic production of fuel and foodstuffs.

It also benefits because all major commodities are priced in dollars. It’s everyone else’s problem if raw materials suddenly become more expensive in their respective currencies.

The world has suffered bouts of an overly strong or weak dollar several times during the past half-century. The explosion in oil prices in the 1970s culminated in a global recession, exacerbated by the aggressive rate hikes implemented by Paul Volcker’s Fed. His inflation-beating policies in turn resuscitated the dollar into the mid-1980s:

The perceived advantage that delivered to the exporting nations of Japan and Europe versus American industry led to the 1985 Plaza Accord, which dramatically reversed the dollar’s strength and boosted the U.S. economy at the expense of other nations, particularly Japan.

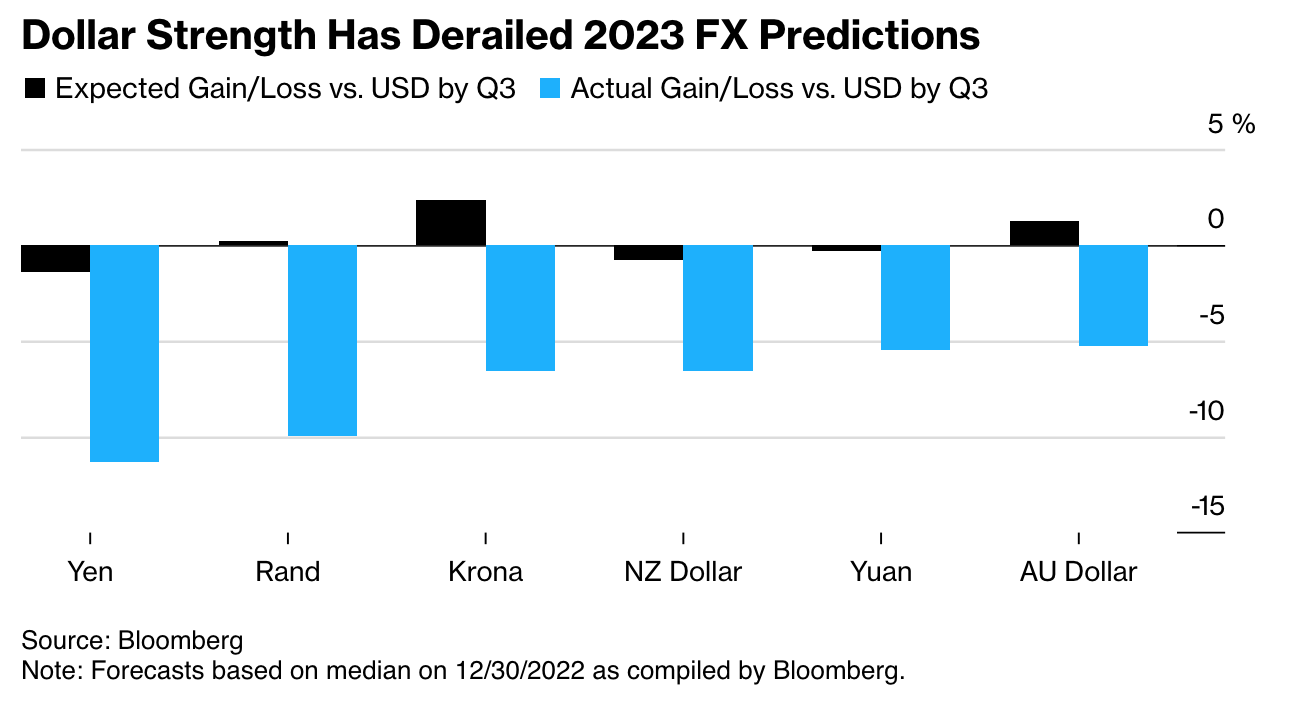

The current weakness in the currencies of Japan and Europe would typically be welcomed for juicing their exports. But the recent slippage in the Chinese yuan, the world’s second-most important trade-weighted currency, puts matters into a different league.

All three regions are facing an unusual and potentially intractable problem of imported inflation. There’s a clear and present danger of rising prices slowing global economic growth to the extent that a recession is possible, and stagflation a real risk.

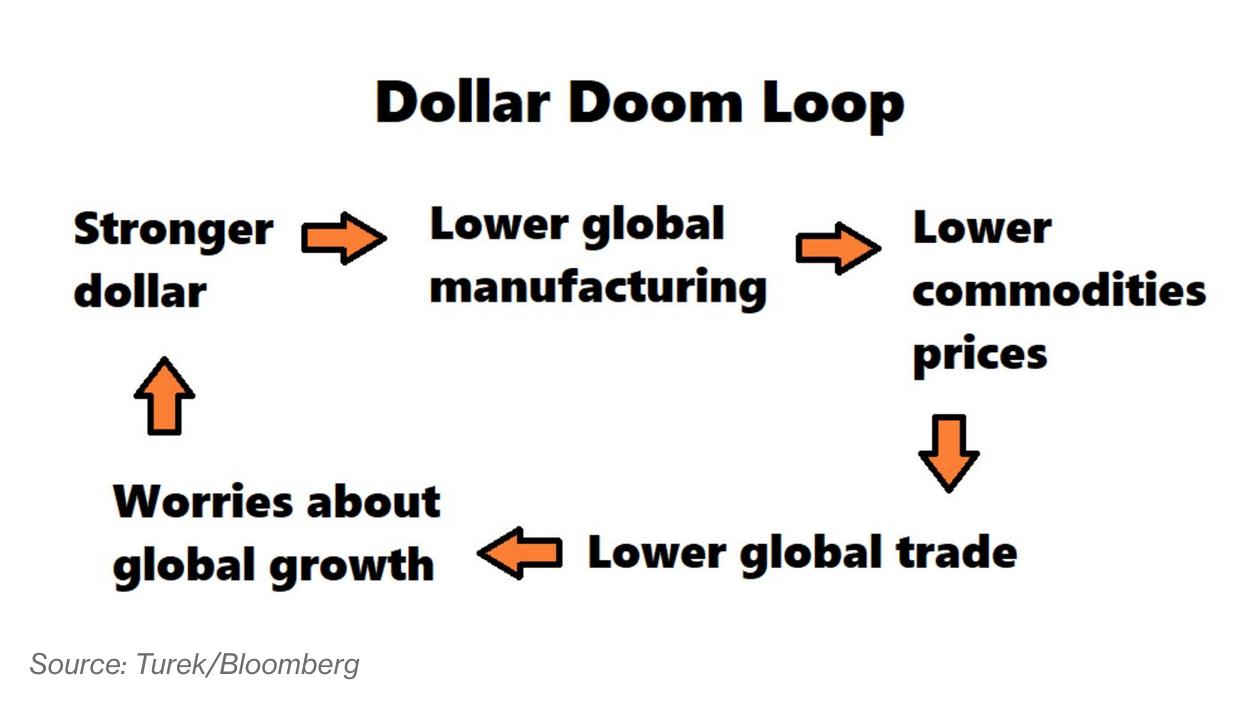

“The dollar’s rally is like an uphill avalanche,” according to Kit Juckes, a currency strategist at Societe Generale SA. “Just as an avalanche picks up snow, rocks, trees and anything else in its path as it slides down a mountain, the dollar’s rally has the knock-on impact of causing more currencies to weaken. A broad-based move, though, tightens global monetary conditions, and so downside economic risks grow.”