Jeffrey Epstein Accusers Sue Jamie Dimon’s JPMorgan Chase For Enabling And Profiting From Sex Trafficking

Ex-JPMorgan Exec Staley Had ‘Profound’ Friendship With Epstein, US Virgin Islands Claims. Jeffrey Epstein Accusers Sue Jamie Dimon’s JPMorgan Chase For Enabling And Profiting From Sex Trafficking

* USVI Filed Amended Complaint In Manhattan On Tuesday

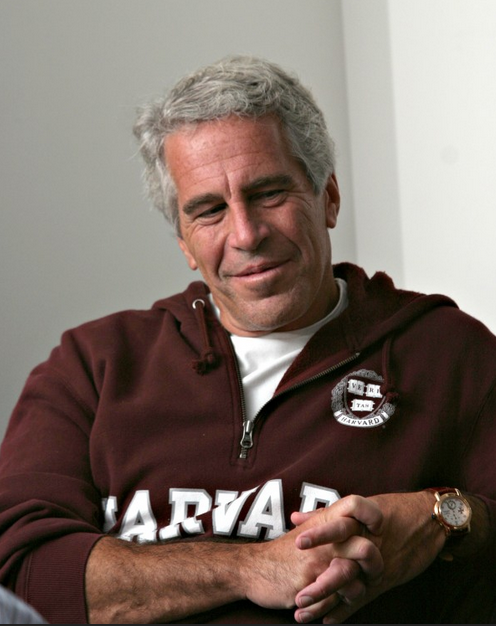

The US Virgin Islands has expanded allegations that JPMorgan Chase & Co. and its former private wealth chief Jes Staley facilitated sex trafficking for Jeffrey Epstein.

Related:

Boy Scouts Weighs Bankruptcy Due To Sex-Abuse Allegations

Boy Scouts of America Considers Bankruptcy Filing Amid Sex-Abuse Lawsuits

The Faithful Are Considering Abandoning The Church

Catholic Church Used Bankruptcy For Sexual-Assault Cases

The Virgin Islands, which sued the bank last month, filed an amended complaint in Manhattan federal court on Tuesday claiming that Staley had a “profound” friendship with Epstein and may have been involved in his sex-trafficking ring.

Related:

JPMorgan Chase With It’s JPM ShitCoin Wants To Take On Bitcoin

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End of 2019: Report

JPMorgan Chase Settles Crypto Credit Card Lawsuit For $2.5M

JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years

JPMorgan’s New App Service For Young People Fails

JPMorgan Scams Investors With Phantom Yields In EMBI Indexes

Citigroup, JPMorgan Chase And Others Fined $1.2 Billion Over FX Trading

A lawyer for Staley, who isn’t named as a defendant in the suit, responded Wednesday to deny the allegations that the banker helped facilitate sex trafficking.

Staley was forced to step down as chief executive officer of Barclays Plc in 2021 amid a UK regulatory probe into how he characterized his past ties to Epstein, who was found dead in his US jail cell in 2019.

Charitable Fund

Epstein and Staley exchanged about 1,200 emails over the course of 10 years, according to the amended complaint. It offers details about the business relationship between the two, including a plan discussed in 2011 between Staley and Epstein to establish a “very HIGH profile” charitable fund.

Epstein, the amended complaint says, pitched the idea as an “exclusive club” with a minimum $100 million donation and that JPMorgan would act as the fiduciary.

JPMorgan “allowed Staley to remain a decision maker on Epstein’s accounts,” according to the amended complaint.

A spokesperson for New York-based JPMorgan declined to comment.

During his tenure as a JPMorgan customer between 1998 and 2013, the bank serviced about 55 accounts for Epstein containing “hundreds of millions of dollars,” the amended complaint states.

The accounts were used to pay Epstein’s victims — in one instance, $600,000 — and the recruiters who helped find them, the USVI alleges.

Red Flags

The transactions, including offshore transfers and foreign currency conversions, should have raised red flags, the USVI claims. The suit is seeking unspecified damages for what it says were violations of sex-trafficking, bank-secrecy and consumer laws.

The USVI suit makes similar claims to those contained in proposed class actions filed in November by Epstein victims against JPMorgan and Deutsche Bank AG.

The office of USVI Attorney General Denise George, who was removed from her post at the end of 2022 just days after the suit was filed, conducted an investigation into Epstein’s activities and presented the findings to JPMorgan in September.

According to the complaint, the USVI probe found that the bank “pulled the levers through which recruiters and victims were paid” and was indispensable to the operation of Epstein’s trafficking enterprise.

Epstein for decades cultivated the ultra-wealthy including lingerie titan Les Wexner and Apollo Global Management Inc. co-founder Leon Black, who paid him in excess of $150 million for providing financial advice.

Wexner has said he cut ties with Epstein in 2007 and later accused him of deception and misappropriating “vast sums of money from me and my family.”

Black made clear he had no knowledge of Epstein’s abuse of underage girls and a report by law firm Dechert commissioned by Apollo’s board, said he wasn’t involved in Epstein’s criminal activities.

Black, who’s worth $10.5 billion, according to the Bloomberg Billionaires Index, was forced to step down as chairman of Apollo.

Epstein was arrested and charged with sex-trafficking by Manhattan federal prosecutors in 2019 and his former girlfriend, Ghislaine Maxwell, was convicted of similar charges in December 2021.

During her trial, a JPMorgan banker testified that Epstein wired her $31 million, money prosecutors characterized as Maxwell’s payment for procuring young girls for the financier.

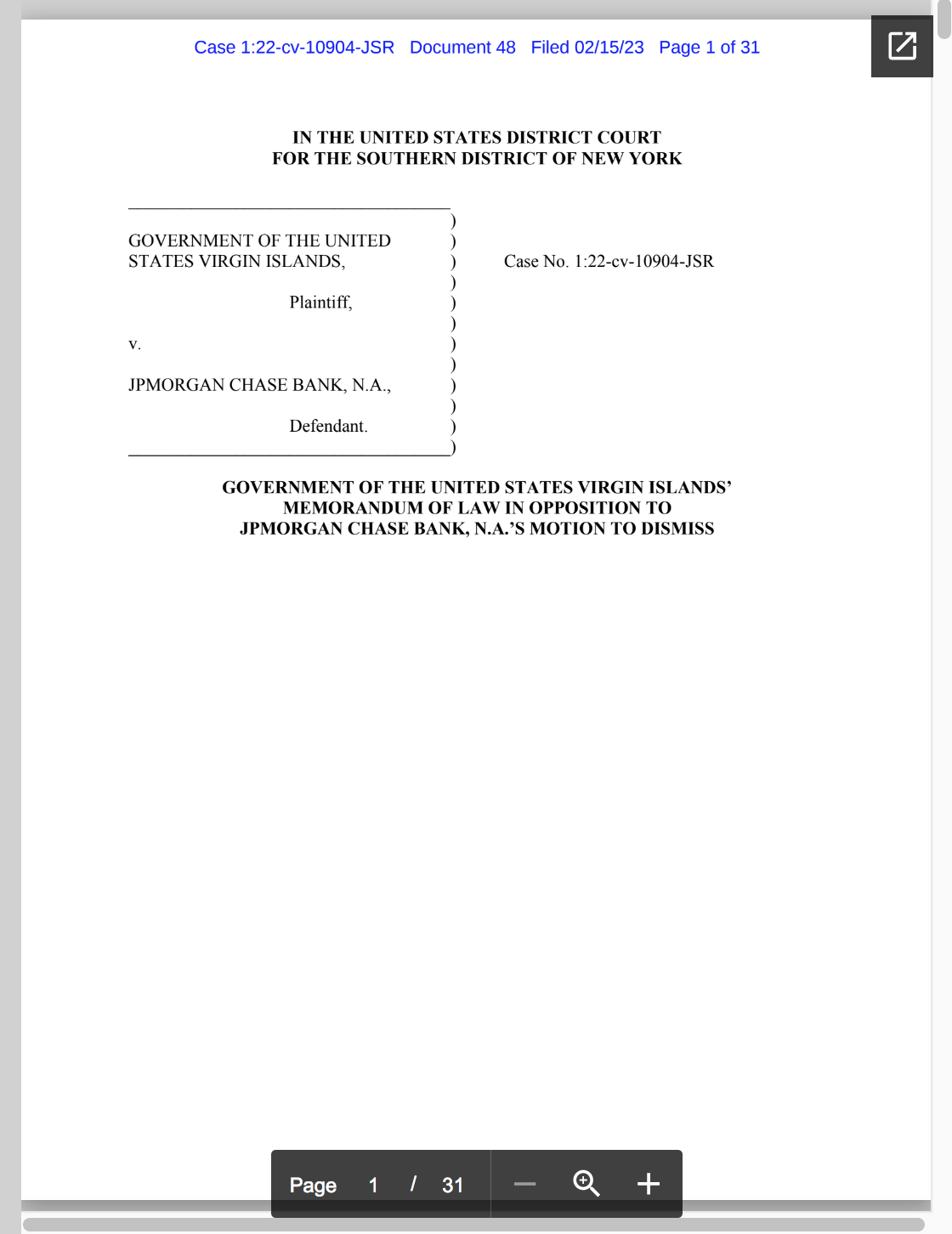

The case is USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

Updated: 1-17-2023

Jes Staley ‘Personally Observed’ Epstein’s Abuse, Woman Suing JPMorgan Claims

* Victim Made Allegations In Amended Lawsuit Against JPMorgan

* Staley Led Epstein Relationship For JPMorgan Private Wealth

A woman suing JPMorgan Chase & Co. for facilitating her sexual abuse by Jeffrey Epstein is claiming Jes Staley “personally observed” that abuse when he was the bank’s head of private wealth.

The woman, who is suing as Jane Doe 1 in a proposed class action against the largest US bank, made new allegations about Staley’s knowledge of Epstein’s abuse in an amended complaint filed late Friday in Manhattan federal court.

According to the complaint, Staley frequently visited Epstein’s properties, including his New York townhouse massage room, a “stash house” apartment on Manhattan’s Upper East Side and his US Virgin Islands estate.

The then-JPMorgan executive allegedly met many of Epstein’s trafficking victims and “personally observed the sexual abuse of young women, including Jane Doe 1.”

JPMorgan on Tuesday declined to comment on the amended complaint.

Staley, who is not named as a defendant in the suit, has consistently denied knowledge of Epstein’s abuse. A lawyer for Staley declined to comment on Tuesday.

The new allegations seek to bolster the argument that JPMorgan was aware of Epstein’s conduct but nonetheless turned a blind eye. The bank has moved to dismiss the suit in part by arguing that it fails to show the bank knew about Epstein’s abuse.

“As a result of Staley’s direct and actual knowledge of Epstein’s sex-trafficking venture, JP Morgan had direct and actual knowledge of Epstein’s sex-trafficking venture,” the amended complaint alleges.

Staley left JPMorgan in 2013 and joined Barclays Plc as chief executive officer a few years later. He stepped down from that role in 2021 following a UK regulatory probe into his relationship with Epstein.

The amended complaint more specifically alleges that JPMorgan was aware that Epstein used his accounts at the bank to settle sexual abuse lawsuits and for expenses related to “apparent criminal activity.”

“To put it plainly, Epstein needed a bank that knew he was engaging in illegal activity and did not care, which Epstein had in JP Morgan,” the complaint states.

Staley bragged within JPMorgan about Epstein’s value to the bank, according to the complaint, and benefited from the relationship with “massages, private jet flights with victims and co-conspirators.”

Adult Survivors Act

The amended complaint also alleges top-level executives at JPMorgan, including Chief Executive Officer Jamie Dimon, were aware of Epstein’s 2006 Florida arrest and “made the decision to monitor” news about him.

Some executives allegedly lobbied to have the bank cut ties with Epstein after allegations about his sex trafficking surfaced publicly but were overruled until 2013, when the bank finally ended its relationship with the financier.

Lawsuits against both JPMorgan and Deutsche Bank, which became Epstein’s main bank after 2013, were filed separately in November by Jane Doe 1, who is represented by David Boies.

The suits claim the banks knowingly benefited and received things of value for assisting and supporting Epstein’s sex-trafficking scheme.

Like JPMorgan, Deutsche Bank has also sought dismissal of the claims, denying knowledge of Epstein’s conduct. JPMorgan further argues the claims against it, which relate to events between 1998 and 2013, are barred by the statute of limitations.

The plaintiffs are suing under New York’s Adult Survivors Act, which temporarily lifts the time limit for sexual assault claims, but both banks say the law does not apply to them.

Epstein was found dead in his US jail cell in 2019, after being charged with sex-trafficking. His connections to US and British elites led to career downfalls for a number of prominent Wall Street names.

The case is Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019, US District Court, Southern District of New York (Manhattan).

Updated: 2-1-2023

JPMorgan Calls Suit Over Epstein ‘Masterclass In Deflection’

* Bank Asks Manhattan Judge To Dismiss US Virgin Islands Lawsuit

* USVI Claims Bank Turned A Blind Eye To Epstein Sex-Trafficking

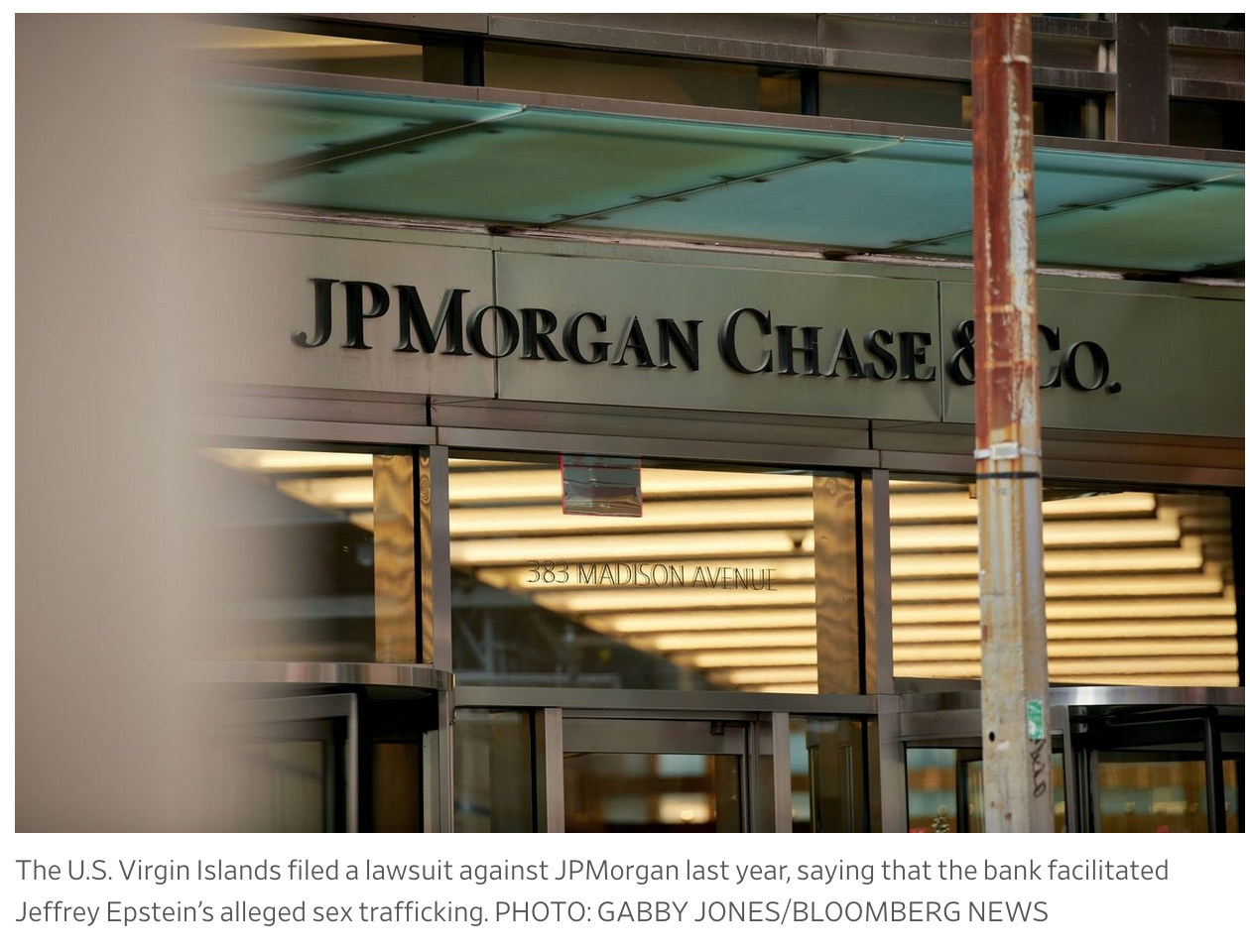

JPMorgan Chase & Co. asked a judge to throw out a US Virgin Islands lawsuit that claims the bank turned a blind eye to Jeffrey Epstein’s sex-trafficking, calling the allegation a “masterclass in deflection.”

“Having sought and obtained more than $100 million from Jeffrey Epstein’s estate and businesses for damages caused by his sex-trafficking crimes, the United States Virgin Islands (USVI) now casts farther afield for deeper pockets,” the bank said in a court filing Wednesday.

USVI Attorney General Denise George in December sued the bank in Manhattan federal court saying it was part of an “ongoing effort” to hold accountable those who facilitated Epstein’s activities. Epstein brought many of his victims to his villa on Little St. James, the private island he owned.

According to the attorney general’s suit, JPMorgan concealed “wire and cash transactions that raised suspicion of a criminal enterprise whose currency was the sexual servitude” of women and girls in the Virgin Islands.

George also claims JPMorgan’s willingness to do business with Epstein unfairly enriched it at the expense of other banks.

In its request to have the lawsuit dismissed, JPMorgan said it ended its banking relationship with Epstein 10 years ago and the suit involves neither Epstein’s estate, nor his businesses, nor his victims.

USVI is trying to hold JPMorgan accountable for not “sleuthing” out Epstein’s crimes a decade ago, the bank said.

“Yet USVI had access at the time to the same information, allegations, and rumors about Epstein on which it alleges” JPMorgan should have acted, the bank said.

“USVI did nothing to stop Epstein during this period, notwithstanding the fact that he registered with the USVI as a Tier 1 sex offender,” the bank said. “To the contrary, during the same period, USVI granted Epstein and his businesses lucrative privileges and massive tax incentives.”

Epstein was found dead in his jail cell in 2019, after being arrested and charged with sex-trafficking by Manhattan federal prosecutors. His former girlfriend, Ghislaine Maxwell, was convicted of similar charges in 2021.

The case is USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

Updated: 2-7-2023

JPMorgan Says Claims That Staley Observed Epstein Abuse Are Unsupported

* Banks Ask Court To Dismiss Amended Suits By Epstein Victims

* Suit Says Staley Knew Of Abuse, Meaning JPMorgan Did As Well

JPMorgan & Chase Co. pushed back on allegations that its former executive Jes Staley “personally observed” Jeffrey Epstein’s abuse, calling them “unsupported” and “conclusory.”

The bank on Tuesday night asked a federal judge to dismiss an amended lawsuit filed last month by Epstein victims who claim JPMorgan facilitated his sex-trafficking ring.

The revised suit added claims that Staley had direct knowledge of Epstein’s activities, contending that meant the bank knew as well.

JPMorgan said the unsupported allegation that Staley observed the lead plaintiff’s sexual battery by Epstein couldn’t be used to impute knowledge to the bank.

“Actual knowledge of Plaintiff’s battery cannot be established by the unsupported assertion that, at an unspecified time, Staley ‘observed [Plaintiff] in circumstances indicating sexual abuse and trafficking,’” the bank said in its filing.

Staley, who is not named as a defendant in the suit, has consistently denied knowledge of Epstein’s abuse. He left JPMorgan in 2013 and was later appointed chief executive officer at Barclays Plc. He stepped down in 2021 following a UK Financial Conduct Authority probe into his ties to Epstein.

The amended complaint alleges that Staley, who was JPMorgan’s head of private banking at the time, frequently visited Epstein’s properties, including his New York townhouse massage room, a “stash house” apartment on Manhattan’s Upper East Side and a US Virgin Islands estate.

He met many of Epstein’s trafficking victims and witnessed the financier “sexually grabbing” some of them, the suit claims.

But JPMorgan said that, while “odious,” such grabbing didn’t establish the plaintiff was a sex-trafficking victim, much less that Staley knew that she was. The bank noted that the crime of sex-trafficking only applies to children or adults subject to force or coercion.

“Without that crucial detail, Plaintiff alleges nothing more than that a JPMC employee developed a bond with a wrongdoer customer,” the bank’s lawyers wrote.

‘Meritless’

Even with the new allegations about Staley, the suit’s “sparse allegations and meritless legal theories” mean it should be dismissed, JPMorgan said.

Proposed class actions against both JPMorgan and Deutsche Bank, which became Epstein’s main bank after 2013, were first filed separately in November by a plaintiff identified as Jane Doe 1.

The suits claim the banks knowingly benefited and received things of value for assisting and supporting Epstein’s sex-trafficking scheme.

Like JPMorgan, Deutsche Bank has also sought dismissal of the claims, denying knowledge of Epstein’s conduct.

In a filing late Tuesday, Deutsche Bank argued that Doe added “few new factual allegations” in the 60-plus pages she added to her original complaint and instead offered “conclusory” and “unsupported” claims that are legally inadequate for the case to proceed.

The Frankfurt-based bank also said it recently learned from Doe’s lawyer that she entered into a settlement with Epstein’s estate which included a “broad release” of claims against any entity that was ever engaged by or worked for the financier.

This means that Doe has waived her claims against Deutsche Bank, the company’s lawyers said in the filing.

The plaintiffs, represented by David Boies, are suing under New York’s Adult Survivors Act, which temporarily lifts the time limit for sexual assault claims, but both banks say the law does not apply to them.

Epstein was found dead in his US jail cell in 2019, after being charged with sex-trafficking. His connections to US and British elites led to career downfalls for a number of prominent Wall Street names.

The case is Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019, US District Court, Southern District of New York (Manhattan).

Updated: 2-15-2023

Ex-JPMorgan Executive’s Jeffrey Epstein Emails Revealed In Lawsuit Against Bank

* Emails Cited In Usvi Suit Claiming JPMorgan Facilitated Abuse

* JPMorgan Has Said Any Knowledge By Staley Doesn’t Apply To It

Former JPMorgan Chase & Co executive Jes Staley engaged in a discussion of Disney princesses with Jeffrey Epstein in July 2010, according to several emails cited in a lawsuit filed against the bank by the US Virgin Islands.

“That was fun,” Staley allegedly wrote. “Say hi to Snow White.”

“[W]hat character would you like next?” Epstein allegedly responded.

“Beauty and the Beast.”

According to the USVI, the exchange was referring to young women and girls Epstein was procuring. The territory unsealed the language Wednesday as part of a court filing aimed at bolstering its argument that JPMorgan, as Staley’s employer at the time, is liable for facilitating Epstein’s sexual abuse.

The new allegations follow an amended complaint in a separate lawsuit against JPMorgan by Epstein victims claiming Staley “personally observed” his former client’s misconduct.

A lawyer for Staley declined to comment on Thursday. Staley, who is not a defendant in either lawsuit, has consistently denied knowledge of Epstein’s sexual abuse.

JPMorgan declined to comment on the USVI filing on Wednesday. The bank has moved to dismiss both suits, claiming that the allegations concerning Staley are unsupported and that any knowledge on his part can’t be imputed to the bank.

JPMorgan has also argued that it’s not clear that the allegations about Staley concern minors or women under coercion.

Staley, who left JPMorgan in 2013 and became chief executive officer of Barclays Plc two years later, was known to have exchanged upwards of 1,200 emails with Epstein over the years, but their contents have not been previously disclosed.

Staley stepped down as Barclays CEO in 2021 following a UK Financial Conduct Authority probe into his ties with Epstein.

According to the USVI, Epstein also occasionally emailed Staley photos of young women.

‘I Realize the Danger’

In another email cited in the suit, Staley appeared to write Epstein from the latter’s villa on Little St. James in November 2009.

At the time, Epstein was under home confinement in Palm Beach, Florida, following his release on charges of soliciting a minor for prostitution but was allowed to travel to New York to meet with his lawyers.

“Presently, I’m in the hot tub with a glass of white wine,” he wrote. “This is an amazing place. Next time, we’re here together. I owe you much. And I deeply appreciate our friendship. I have few so profound.”

According to a December 2009 email, Staley got his desired reunion.

“I realize the danger in sending this email,” Staley allegedly wrote. “But it was great to be able, today, to give you, in New York City, a long, heartfelt, hug.”

Epstein was a customer of the bank between 1998 and 2013 and held about 55 accounts, containing hundreds of millions of dollars, USVI says.

At least 20 individuals paid through JPMorgan accounts were “victims of trafficking and sexual assault in Little St James,” according to the lawsuit.

The case is USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

Updated: 2-17-2023

JPMorgan Staffer Expected Bank To Drop Epstein In ‘08, Suit Says

* USVI Cites Email Expecting Epstein Exit ‘Pending Dimon Review’

* Bank Says It Has ‘Not Seen Any Evidence Of Such A Review’

It was August 2008, the brink of a global financial crisis, and inside JPMorgan Chase & Co. an employee was expressing confidence the bank was about to kick out a wealthy client whose name was becoming infamous: Jeffrey Epstein.

“I would count Epstein’s assets as a probable outflow for ’08,” the staffer wrote in an internal email about Epstein’s roughly $120 million portfolio, several weeks after the customer pleaded guilty to soliciting a minor for prostitution. “I can’t imagine it will stay (pending Dimon review).”

Epstein remained a JPMorgan client for five more years.

The missive, referring to Chief Executive Officer Jamie Dimon, is the latest twist in ongoing lawsuits to hold the largest US bank liable for handling Epstein’s money for years before and after his initial indictment in 2006, and in doing so, allegedly facilitating his sex trafficking of young women.

Unclear from the court documents is why the employee, who isn’t identified, thought the bank’s CEO and chairman would get involved in deciding whether to keep on handling Epstein’s money. Trish Wexler, a JPMorgan spokesperson, said the firm has “not seen any evidence of such a review.”

The plaintiff – the US Virgin Islands – wrote in a filing unsealed Wednesday that the email shows the firm’s relationship with Epstein “was reviewed and approved at the highest levels.”

The bank is fighting the USVI lawsuit, which it called a “masterclass in deflection,” and another filed by Epstein’s victims, asking judges to dismiss both cases.

The email’s emergence this week underscores anew how JPMorgan’s dealings with Epstein, who died by apparent suicide in 2019, continue to haunt the New York-based bank roughly a decade after it ultimately severed ties.

Epstein entered into a controversial plea deal in mid-2008, under which he was still able to work from a Florida office during the day while serving a 13-month sentence. JPMorgan kept him on as a customer after that conviction.

Epstein’s relationship with former JPMorgan executive Jes Staley is central to the lawsuits. Staley led JPMorgan’s private bank and then its asset management operations, during which time he is alleged to have continued to personally handle the bank’s relationship with Epstein. Staley left the bank in January 2013. Six months later, JPMorgan dropped Epstein as a client.

Following Epstein’s arrest in 2019 on sex trafficking charges, the firm has been facing questions about why it kept providing financial services after his initial guilty plea and what information the company and its executives were privy to over the years.

Staley became CEO of Barclays Plc in 2015. He stepped down from that post in 2021 following a UK Financial Conduct Authority probe into his ties with Epstein. Staley is still contesting the FCA’s findings.

JPMorgan has said allegations involving Staley are unsupported and that any knowledge on his part can’t be imputed to the bank. The banker isn’t a defendant in either lawsuit and has consistently denied knowledge of Epstein’s sexual abuse.

A lawyer for Staley declined to comment.

The case is USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

Updated: 2-22-2023

Staley’s Ties To Epstein Spark Mea Culpa From Bowdoin President

Bowdoin College President Clayton Rose told students, faculty and staff that he was “clearly wrong” to call Jes Staley someone who “represents all that is great about Bowdoin and the culture and values here” during an interview in 2019.

Staley, JPMorgan Chase & Co.’s former private wealth chief and a member of Bowdoin’s class of 1979, was recently accused in a lawsuit against the bank of having “personally observed” sexual abuse by Jeffrey Epstein, with whom he allegedly had a “profound” friendship.

Epstein, a financier who was convicted in 2008 of soliciting a minor for prostitution, was charged with sex trafficking in 2019 and died in jail of an apparent suicide.

“Epstein’s conduct was monstrous, and the revelation about the extent of Jes’s relationship with him is deeply disturbing,” Rose wrote in a letter released Wednesday.

JPMorgan said in a court filing Wednesday that emails between Staley and Epstein “provide no basis to infer that Staley detected Epstein’s sex-trafficking.”

Staley, who is not named as a defendant in the litigation against JPMorgan, has consistently denied knowledge of Epstein’s actions. His lawyer didn’t immediately respond to an email seeking comment.

Staley left JPMorgan in 2013 and became chief executive officer of Barclays Plc two years later. He was named to the Bowdoin board in 2007, and resigned on Nov. 1, 2021, the same day he stepped down from Barclays after a regulatory investigation was opened into his relationship with Epstein. Barclays declined to comment.

“Whatever we learn about the truth of the specific and deeply troubling allegations made in the court filing, from what we now understand about the depth of his relationship with Epstein, I was clearly wrong,” he said about his comment in 2019.

A call and email to Rose’s office and a Bowdoin spokesperson weren’t immediately returned.

Updated: 2-23-2023

Dimon Records Sought In Suits Over JPMorgan’s Epstein Ties

* USVI Says Dimon Documents Through 2019 Relevant To Its Claims

* Epstein Victim In Separate Suit Seeks Ceo’s Pre-2006 Documents

Plaintiffs in two lawsuits accusing JPMorgan Chase & Co. of facilitating Jeffrey Epstein’s sex trafficking are asking for court orders requiring Chief Executive Officer Jamie Dimon to turn over additional documents.

In separate filings Thursday in Manhattan federal court, the US Virgin Islands and an Epstein victim said JPMorgan was refusing to turn over Dimon documents from certain time periods. Both suits claim the CEO was involved in the bank’s decision to keep Epstein after his sex abuse came to light.

A JPMorgan spokeswoman declined to comment on the filings.

The USVI said the bank was objecting to turning over documents from after 2014. The territory wants Dimon’s documents until August 2019. Though not referenced in the filing, Epstein was found dead in his jail cell that month while awaiting trial on sex-trafficking charges.

Epstein was a client of the bank between 1998 and 2013, but the USVI said some of JPMorgan’s allegedly unlawful conduct continued past the end of its relationship with Epstein. The part of USVI’s Thursday filing describing the alleged post-2013 conduct was redacted.

The victim, who has filed a proposed class action as Jane Doe 1, said JPMorgan had refused to turn over Dimon documents from before 2006. According to her filing, the bank argues that doing so would be unduly burdensome. JPMorgan is allegedly taking the same stance with former general counsel Stephen Cutler and another person named Vanessa Budhu.

“JPMC cannot seriously contend that only documents after 2006 are relevant to Doe’s claims when the genesis of its relationship with Epstein began at least eight years prior,” lawyers for Doe said in their Thursday filing. “Indeed, as the complaint makes clear, between (at least) 2000 and 2005, Epstein provided clients to JP Morgan and, in exchange, JP Morgan allowed Epstein to do as he pleased with his JP Morgan accounts.”

The cases are both before US District Judge Jed Rakoff, and JPMorgan has asked him to dismiss both of them on the grounds that there is no evidence that the bank knew Epstein was involved in sex-trafficking.

Both suits focus on the relationship between Epstein and former JPMorgan private banking head Jes Staley, alleging the latter was aware of his client’s illegal activities. The bank has contended that allegations that Staley “personally observed” sexual abuse or exchanged emails with Epstein don’t show that he had knowledge of crimes that can be imputed to JPMorgan.

Epstein victims who sued JPMorgan claim the bank chose to profit from Epstein’s sex-trafficking venture rather than follow the law, collecting millions of dollars from handling his accounts.

The cases are USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan) and Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019, US District Court, Southern District of New York (Manhattan)

Updated: 3-9-2023

JPMorgan Sues Former Executive Jes Staley Over Jeffrey Epstein Ties

Bank reveals Staley is accused of sexual assault in unnamed woman’s lawsuit.

JPMorgan Chase & Co. sued former executive Jes Staley over his ties to Jeffrey Epstein, identifying Mr. Staley as the “powerful financial executive” accused of sexual assault in a lawsuit against the bank.

Late last year, an unnamed woman alleged that JPMorgan aided Epstein’s sex trafficking by allowing him to remain a client and helping him send money to the late financier’s victims.

The woman, in her lawsuit against the bank, said an Epstein friend sexually assaulted her using aggressive force but said she was afraid to identify him publicly. JPMorgan Wednesday said that friend was Mr. Staley.

JPMorgan’s lawsuit against Mr. Staley adds him to the woman’s lawsuit and another Epstein-related case filed by the U.S. Virgin Islands. The legal maneuver allows the bank to argue Mr. Staley should have to pay damages if the bank is held responsible.

A lawyer for Mr. Staley declined to comment.

Mr. Staley has maintained he was friendly with Epstein but never knew about his alleged crimes.

“I thought I knew him well and I didn’t,” Mr. Staley said in early 2020. “For sure, with hindsight, with what we all know now, I deeply regret having had any relationship with Jeffrey Epstein.”

JPMorgan’s move to try to shift the focus to Mr. Staley represents a break with a former executive who had risen to the top of the bank and was once considered a possible successor to Chief Executive Jamie Dimon.

Mr. Staley developed a relationship with Epstein when he was running JPMorgan’s asset-management unit, which includes its business that caters to rich clients.

After leaving JPMorgan in 2013, Mr. Staley became chief executive of British banking giant Barclays PLC. He resigned in November 2021 amid a U.K. regulatory investigation into whether the bank had been truthful about his relationship with Epstein, who was charged with sex trafficking before his apparent suicide in 2019.

The lawsuits have detailed Mr. Staley’s communications with Epstein as evidence that JPMorgan should have known about their relationship. Emails between the two men showed a close bond, according to court papers, and included what the U.S. Virgin Islands have said were photos of young women in seductive poses.

Mr. Staley had “affirmatively misrepresented the true facts of his and Epstein’s personal interactions,” the bank said in court papers, and “repeatedly provided misleading information” about Epstein’s character and conduct.

“The plaintiffs have made troubling allegations concerning the conduct of our former employee Jes Staley, and if true he should be held responsible for his actions,” a JPMorgan spokeswoman said Wednesday. “If these allegations against Staley are true, he violated this duty by putting his own personal interests ahead of the company’s.”

Brad Edwards, one of the lawyers representing the woman in the civil suit against JPMorgan, said the filing “is a damning admission of wrongdoing by JPMorgan.”

Mr. Dimon should be forced to answer questions about how he supervised Mr. Staley, Mr. Edwards said. JPMorgan has resisted a request for Mr. Dimon to be deposed in the case.

A judge Thursday ruled the bank must turn over documents from Mr. Dimon through 2019, a wider time frame than the bank had wanted to deliver. There hasn’t been a ruling about whether he will be deposed.

The bank has sought to have the lawsuits dismissed, saying it didn’t know about Epstein’s alleged crimes and can’t be held liable.

The U.S. Virgin Islands suit alleges that Mr. Staley vouched for Epstein as a JPMorgan client when internal compliance officers raised questions.

The bank’s compliance team repeatedly asked for reassurances after Epstein was first indicted on sex-crime charges in 2006, when he pleaded guilty to those charges in 2008, and in later years when news reports about similar behavior continued to surface, according to the court documents.

JPMorgan has said it cut off Epstein’s accounts in 2013, shortly after Mr. Staley left the bank. Epstein died in jail in 2019 while awaiting trial on federal sex-trafficking charges.

Updated: 3-13-2023

JPMorgan’s Jes Staley Suit Seen Ss Prelude to Settlement Over Epstein Claims

* Bank Faces Famed Lawyer David Boies In Suit Over Epstein Ties

* JPMorgan’s Motions To Dismiss Arguments Scheduled For Monday

David Boies rose to fame by taking on Microsoft Corp. in a massive 1990s antitrust case. The case eventually settled, but not before the lawyer eviscerated Bill Gates in deposition testimony that was later shown at trial.

Jamie Dimon would no doubt like to avoid a similar fate.

JPMorgan Chase & Co.’s recent lawsuit against former executive Jes Staley sets up a likely settlement by the bank of claims that it facilitated Jeffrey Epstein’s sex-trafficking, several legal experts said.

The bank filed its March 8 complaint after weeks of unsavory revelations about Staley’s relationship with Epstein put forth in two suits against JPMorgan, one of which was filed by Boies on behalf of Epstein victims.

The bank denies the accusations in both cases and maintains that its claims against Staley don’t affect its position that the suits are without merit. JPMorgan is set to argue its motion to dismiss the cases before US District Judge Jed Rakoff on Monday.

Hours before the hearing, Rakoff authorized the deposition on Wednesday of Mary Erdoes, JPMorgan’s private banking chief. The bank’s lawyers have been fighting efforts to have Dimon face similar questioning, arguing the CEO was not involved in discussions about Epstein’s accounts.

JPMorgan declined to comment for this story. A lawyer for Staley, who previously held Erdoes’s position at the bank, also declined to comment. Staley has previously denied involvement in Epstein’s sex-trafficking.

Carliss Chatman, a former litigator who is now a law professor at Washington and Lee University, said a settlement would be an opportunity for the bank to acknowledge Epstein victims’ pain but then shift the blame to Staley.

“What they would be saying is ‘Yes, we acknowledge this guy harmed you and agree he is a bad actor we negligently hired,’” she said.

‘Crisis Litigation 101’

Chatman and several other legal experts said JPMorgan’s move against Staley is as much about public relations as bolstering its legal position. The bank’s arguments are actually fairly strong, they said, but JPMorgan will not want to withstand the steady drumbeat of headlines that going to trial would guarantee.

“Big companies always tend to settle for PR reasons,” said Chatman. “This just looks bad, it really does. The PR move — ‘I blame someone else and settle’ — it is kind of crisis litigation 101.”

Tanya Pierce, a professor at Texas A&M University law school, agreed. “I don’t think this will go to trial with JPMorgan as a defendant,” she said. “I think the PR damage is too great.”

As such, it’s “good strategy” for the bank to go after Staley ahead of trying to negotiate a settlement, Pierce said.

“Settlement strategy revolves in large part around the threat of what could happen in litigation, if a case were to actually be tried in front of a jury,” said Pierce. “So bringing Staley into the lawsuit focuses attention on him and on his actions and away from JPM and its actions.”

If JPMorgan does settle, it wouldn’t be the first deal obtained by Boies and law partner Sigrid McCawley for Epstein victims. Prince Andrew last year settled for undisclosed terms a lawsuit filed by the lawyer on behalf of Virginia Giuffre, who claimed the British royal was one of several powerful men to whom Epstein “lent” her for abuse.

The settlement came a month after Andrew lost his motion to dismiss the case in Manhattan federal court, which resulted in Buckingham Palace stripping King Charles’s younger brother of his honorific titles and royal patronages.

Giuffre made similar allegations against Harvard Law School Professor Alan Dershowitz, who represented Epstein during a Florida investigation into abuse allegations and helped negotiate a lenient non-prosecution agreement.

But Dershowitz hit back with a countersuit alleging extortion. The parties last year reached a deal in which no money changed hands and Giuffre said she “may have made a mistake” in identifying Dershowitz.

In a recent interview, Dershowitz declined to discuss the settlement but made clear he still harbored hard feelings toward Boies.

“He goes after people — I am the exception — who can’t fight back,” Dershowitz said, “and that’s how you get settlements.”

Boies, who declined to be interviewed, has also been criticized for using hardball tactics against accusers of his former client Harvey Weinstein and a journalist investigating Theranos Inc., where he was a board member. The lawyer’s aggressive style has both fans and detractors.

No Legal Slam Dunk

“He likes taking on big fights and to be in the middle of the action,” Daniel Rubinfeld, a New York University law professor who has worked on the Microsoft case with Boies, said. “To me he is what’s good about the plaintiff’s bar.”

JPMorgan is Boies’s biggest target yet in his yearslong crusade on behalf of Epstein victims. Boies and McCawley have represented Epstein’s victims pro bono in previous cases. A spokesperson for Boies didn’t respond to a request for comment on whether the suit against JPMorgan was also being handled pro bono.

From a legal standpoint, the claims against JPMorgan are by no means a slam dunk.

“Obviously now everyone knows a lot about Epstein and what he has been up to,” said former federal prosecutor Nadia Shihata, who prosecuted one of the cases against R Kelly. “But the question will be ‘What did JPMorgan know at the time and does that rise to the level of knowledge or should-have-known?’”

If US District Judge Jed Rakoff dismisses the suits after Monday’s arguments, it may be because he wasn’t convinced plaintiffs showed that what Staley knew, JPMorgan knew as well.

The bank has said that allegations that Staley “personally observed” Epstein’s sex-trafficking and that the two exchanged “inappropriate” emails in which they appear to refer to young women using the names of Disney princesses reflect activity that were outside the scope of Staley’s employment.

JPMorgan clearly aimed to put more distance between it and Staley in its suit last week, describing him as an employee whose “acts of disloyalty occurred repeatedly, lasted for years, and persisted despite numerous opportunities to correct them.”

Not everyone thinks JPMorgan’s gambit to separate itself from a longtime employee will work though. Lawyer Kim Adams, who has litigated many human-trafficking cases, said she thought the suit against Staley could ultimately backfire on the bank.

“From a survivor perspective, it’s a shirk of responsibility for their own actions,” said Adams. “They are trying to diversify the guilt here and the responsibility. The survivors may well look at this as a way of them acknowledging what happened and adding credibility to plaintiff’s case.”

Chatman said JPMorgan may succeed in having some parts of the suits dismissed but that the judge was likely to leave for a jury the question of whether or not JPMorgan was responsible for Staley’s actions.

Bad Atmospherics

Judges are “loathe to dismiss” claims about employer responsibility, she said.

She said JPMorgan has a strong defense, though, that it doesn’t have any responsibility to non-customers harmed by a person using his own money that just happened to be deposited at the bank.

“I get why they are naming the banks, but I think it’s hard case,” Chatman said. The plaintiffs argue Epstein used his accounts to fund his sex trafficking venture, including to pay victims hush money and finance the private jet that transported them.

Whatever the merits of its arguments though, JPMorgan almost certainly wants to avoid making them to a jury also faced with “grievously hurt” young women, said Adam Zimmerman, a Loyola Law School professor.

“Assuming it goes to a jury, it has all the atmospherics of a bad corporate behavior case combined with Jeffrey Epstein,” Zimmerman said. “It’s not something you can imagine a typical Fortune 500 company wanting to have to deal with.”

Updated: 3-28-2023

Jamie Dimon To Face Questioning In Lawsuit Over JPMorgan’s Epstein Ties

Bank has resisted U.S. Virgin Islands’ efforts concerning a deposition.

Jamie Dimon will be questioned in a civil lawsuit over JPMorgan Chase & Co.’s relationship with Jeffrey Epstein, people familiar with the matter said.

The U.S. Virgin Islands sued JPMorgan late last year, saying the bank facilitated Esptein’s alleged sex trafficking and abuse by allowing him to remain a client and helping him send money to the late financier’s victims.

Lawyers for the U.S. Virgin Islands had asked a judge to order Mr. Dimon, the bank’s chief executive, to answer questions under oath. JPMorgan resisted, saying he played no role in the bank’s dealings with Epstein.

The two sides struck a deal for Mr. Dimon to be deposed, the people said.

The planned deposition was reported earlier by the Financial Times.

Epstein banked with JPMorgan for a number of years until it cut ties with the convicted sex offender in 2013. Epstein died in jail in 2019 while awaiting trial on federal sex-trafficking charges.

A judge earlier this month ordered the bank to turn over documents from Mr. Dimon through 2019, a wider time frame than the bank wanted to deliver.

The plaintiffs have deposed several JPMorgan employees so far in the case and another filed by an unnamed woman who accused Epstein of sexual abuse. The cases are running together in Manhattan federal court.

JPMorgan has denied that the bank aided Epstein and has sought to blame any relationship on former executive Jes Staley.

Mr. Staley has maintained he was friendly with Epstein but never knew about his alleged crimes.

Updated: 3-31-2023

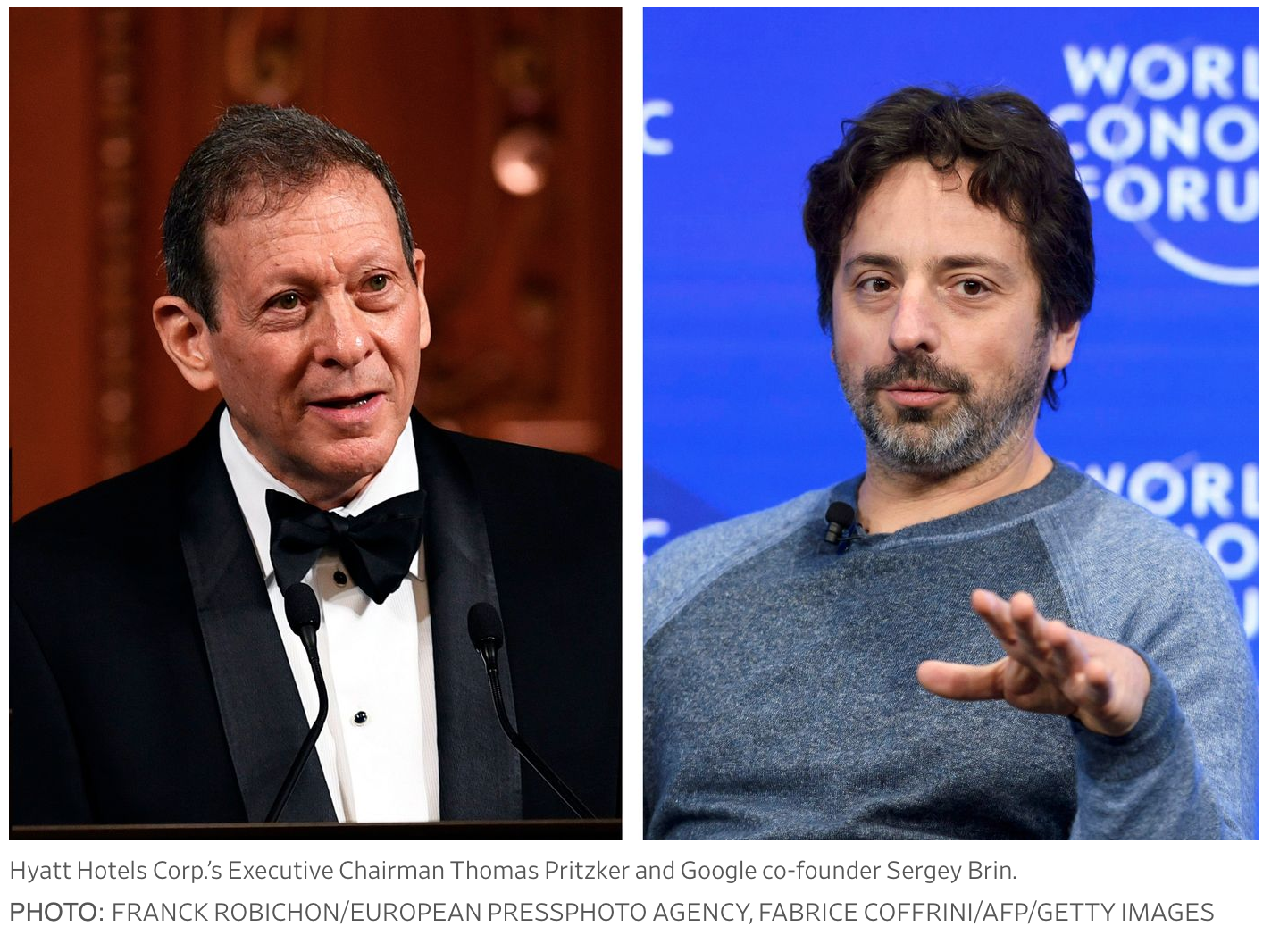

Google Co-Founder, Other Billionaires Are Issued Subpoenas In Lawsuit Over JPMorgan’s Ties To Jeffrey Epstein

Sergey Brin, Thomas Pritzker, Mortimer Zuckerman and Michael Ovitz are asked for information in U.S. Virgin Islands’ civil suit against bank.

The U.S. Virgin Islands issued subpoenas this week to Sergey Brin, Thomas Pritzker, Mortimer Zuckerman and Michael Ovitz to gather information for its civil lawsuit against JPMorgan Chase & Co. over the bank’s relationship with Jeffrey Epstein, according to people familiar with the matter.

The subpoenas from the U.S. territory’s attorney general seek any communications and documents related to the bank and Epstein, the people said.

The four men are some of the wealthiest people in the U.S., and it couldn’t be determined why they were being asked for the communications and documents. In civil cases, lawyers can use subpoenas during the discovery process to get information from people who aren’t a party to a lawsuit but could provide evidence related to the case.

The U.S. Virgin Islands sued JPMorgan late last year in a Manhattan federal court, saying the bank facilitated Epstein’s alleged sex trafficking and abuse by allowing the late financier to remain a client and helping him send money to his victims.

The civil lawsuit alleges that JPMorgan received referrals of high-value business opportunities from Epstein and turned a blind eye to his activities. The bank has said it didn’t know about Epstein’s alleged crimes and can’t be held liable.

Mr. Brin is a co-founder of Google and a board member of parent Alphabet Inc. Mr. Pritzker is executive chairman of Hyatt Hotels Corp. Mr. Zuckerman is a real-estate billionaire and owner of U.S. News & World Report. Mr. Ovitz is a venture capitalist and former talent agent for Hollywood stars.

The four men couldn’t immediately be reached for comment. A spokeswoman for U.S. News & World Report declined to comment. Spokespeople for Google and Hyatt didn’t respond to requests for comment.

Jamie Dimon, JPMorgan’s chairman and chief executive, is expected to be questioned as part of the case after the two sides reached an agreement for him to be deposed, the Journal reported earlier this week.

Epstein, who had a residence in the U.S. Virgin Islands, banked with JPMorgan for a number of years until it cut ties with the convicted sex offender in 2013. Epstein died in jail in 2019 while awaiting trial on federal sex-trafficking charges.

Lawyers have questioned several JPMorgan employees so far in this case and another filed by an unnamed woman who accused Epstein of sexual abuse. The cases are running together in Manhattan federal court.

JPMorgan has sought to have the lawsuits dismissed. The bank has denied that it aided Epstein and has sought to blame any relationship on former executive Jes Staley, whom the bank has sued. Mr. Staley has maintained he was friendly with Epstein but never knew about his alleged crimes.

Updated: 4-3-2023

JPMorgan Bankers Joked About Epstein’s Reputation, USVI Says

* Executive Mary Erdoes Deposition Redacted In New Court Filing

* USVI Accuses JPMorgan Of Delaying Charges Against Epstein

JPMorgan Chase & Co. executives joked about Jeffrey Epstein’s “interest in young girls,” the US Virgin Islands said in a court filing in its lawsuit accusing the bank of aiding his sex-trafficking.

The US territory made the claim on Monday while asking a federal judge for permission to amend the lawsuit.

USVI claims that the bank allowed Epstein to avoid scrutiny and obstructed law enforcement from uncovering his crimes earlier while he was a client from 1998 to 2013.

In the filing, USVI referenced a recent deposition from JPMorgan’s Asset and Wealth Management chief executive Mary Erdoes but it was heavily redacted.

Lawyers for the territory claim “Epstein’s behavior was so widely known at JPMorgan that senior executives joked about Epstein’s interest in young girls.”

USVI then cites a 2008 email Erdoes received as an example, however the content of the email is blacked out. The territory also pointed to internal emails at JPMorgan about Epstein being under investigation or sued for sexual abuse and communication from a senior compliance official in 2010.

Young women and an alleged recruiter for Epstein’s trafficking venture were also paid from the late sex offender’s JPMorgan accounts, according to the court filing.

Epstein made cash withdrawals to further his sex trafficking while the bank allegedly failed to follow anti-money laundering requirements.

“JPMorgan knowingly did not follow these requirements because it knew that doing so would have prevented Epstein’s secret cash transactions that were necessary to his sex-trafficking operation from escaping knowledge of federal investigative and prosecuting agencies,” lawyers for USVI wrote.

Federal prosecutors charged Epstein with sex trafficking in 2019. He was found dead in his prison cell in Manhattan. Authorities ruled it a suicide.

US District Judge Jed Rakoff last month dismissed a majority of USVI’s claims against JPMorgan but allowed one claim to remain — that the bank knowingly benefited from Epstein’s behavior.

The US territory, which filed the suit against the bank late last year, is asking for permission to file an additional claim under the Trafficking Victims Protection Act.

A victim of Epstein, Jane Doe, was the first to file a lawsuit against JPMorgan in November, claiming it facilitated Eptein’s trafficking operation.

JPMorgan contends that it merely provided routine banking services to Epstein, while Doe argued that he was afforded special treatment because he brought in wealthy clients.

The banks have long claimed that they didn’t know about Epstein’s crimes. Former JPMorgan executive Jes Staley has emerged as a central figure in the lawsuits, with Doe claiming that he “personally observed” sex-trafficking victims. Both USVI and Doe allege in their suits that any knowledge Staley had should be imputed to JPMorgan as his employer.

The cases are Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019; Jane Doe 1 v. Deutsche Bank, 22-cv-10018, and USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

Updated: 4-6-2023

JPMorgan Subpoenas Staley’s Former Hedge Fund in Epstein Dispute

* Bank Seeks Communications From When Staley Was At Bluemountain

* Staley Joined Fund In 2013 But Left To Become CEO At Barclays

JPMorgan Chase & Co. subpoenaed information from the hedge fund where Jes Staley was once managing partner as part of its lawsuit over his ties to Jeffrey Epstein, according to people familiar with the matter.

Lawyers for the bank recently sent a subpoena to Assured Investment Management, the people said. Assured is the successor to BlueMountain Capital, which Staley, 66, joined in 2013 after more than 30 years at JPMorgan, where he rose to become head of private banking.

According to one of the people, the subpoena requests any communications Staley had with Epstein during his time at BlueMountain. A spokeswoman for JPMorgan declined to comment. A spokeswoman for Assured didn’t respond to requests for comment. Staley’s lawyer also didn’t respond to requests for comment.

JPMorgan is facing two lawsuits claiming it benefited from Epstein’s sex-trafficking. The bank, which has denied knowing about Epstein’s conduct, in turn sued Staley in March.

It claims his contacts with Epstein, who was a bank client between 1997 and 2013. violated JPMorgan’s policies and argues that he should be responsible for any damages stemming from the two suits.

The bank is also attempting to claw back tens of millions of dollars in compensation it paid to Staley.

His time at BlueMountain, which was co-founded by Andrew Feldstein and Stephen Siderow, has not previously received much attention amid the revelations about his relationship with Epstein.

Staley was only at the fund a short time before he became chief executive officer at Barclays Plc in 2015. BlueMountain was acquired and rebranded by Assured Guaranty Ltd in 2019.

Staley stepped down as Barclays CEO in late 2021, after a Financial Conduct Authority inquiry raised questions about exactly how transparent Staley had been with the UK bank about his ties to Epstein.

Staley has long claimed his relationship with Epstein tapered off after he left JPMorgan and completely ceased when he joined Barclays.

In April 2015, while he was still at BlueMountain, Staley and his wife briefly visited Epstein’s private island, Little St James, in the US Virgin Islands, Bloomberg has previously reported.

The two suits against JPMorgan, one by an Epstein victim and the other by the USVI, both claim Staley knew about his client’s sex-trafficking and argue that his knowledge should be imputed to his then-employer.

A considerable amount of material about Staley’s relationship with Epstein has been disclosed in the litigation, including the contents of some of the 1,200 emails the two men exchanged over the years.

Federal prosecutors charged Epstein with sex trafficking in July 2019, but he was found dead in his jail cell a month later.

The cases are USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan) and Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019, US District Court, Southern District of New York (Manhattan)

Updated: 4-12-2023

JPMorgan Internally Flagged Epstein’s Large Withdrawals Years Before His 2008 Conviction, Lawsuit Alleges

In 2006, court papers say, bank staffers noted financier was withdrawing $750,000 a year in cash.

JPMorgan Chase & Co. employees internally flagged Jeffrey Epstein’s large cash withdrawals two years before he was convicted of soliciting a minor for prostitution, according to new court papers filed Wednesday.

A JPMorgan risk-management team in 2006 noted that Epstein “routinely” made cash withdrawals of $40,000 to $80,000 several times a month, the U.S. Virgin Islands said in an amended lawsuit against the bank.

At the time, Epstein was pulling more than $750,000 a year in cash from the bank, according to the lawsuit.

Epstein was first charged with a sex crime in 2006. He pleaded guilty to solicitation of prostitution with a minor in 2008 and spent about 13 months in prison.

JPMorgan continued providing services to Epstein until 2013, when it says it closed his accounts. Epstein died in jail of an apparent suicide in 2019 while awaiting trial on federal sex-trafficking charges.

The U.S. Virgin Islands sued JPMorgan late last year in a Manhattan federal court, saying the bank facilitated Epstein’s alleged sex trafficking.

The suit alleges the financier used the bank to pay his victims with cash and wire transfers, transactions that should have been concerning to the bank.

Another lawsuit filed by an unnamed woman who accused Epstein of sexual abuse also accuses the bank of failing to monitor his transactions. The cases are running together in Manhattan federal court.

Banks are required to file suspicious-activity reports on sizable cash withdrawals and transactions that could indicate crimes such as money laundering. JPMorgan, the U.S. Virgin Islands says, had information that could have flagged Epstein’s alleged crimes to law enforcement sooner.

Lawyers have questioned several JPMorgan employees so far in this case, including Mary Erdoes, its head of asset and wealth management. Her deposition hasn’t been released publicly, but Wednesday’s court filing sheds light on its contents.

Ms. Erdoes said in a deposition that JPMorgan executives knew as far back as 2006 that Epstein was accused of paying cash to have underage girls and young women brought to his home, according to the filing.

The filing alleges that Epstein’s behavior was so widely known at the bank that his interest in girls was the subject of jokes. In 2008, the filing says, Ms. Erdoes received an email asking whether Epstein was at an event with pop star Miley Cyrus, a minor at the time.

Ms. Erdoes and a JPMorgan spokeswoman declined to comment. The bank previously has said Ms. Erdoes wouldn’t overrule the bank’s compliance officials to protect a customer and “has only one recollection of formally meeting with [Epstein], which was the day she fired him as a client.”

The bank has denied that it aided Epstein and has sought to shift the focus to former executive Jes Staley. In a lawsuit against Mr. Staley last month, JPMorgan said the former executive “affirmatively misrepresented the true facts of his and Epstein’s personal interactions.”

Mr. Staley has said he never knew about Epstein’s alleged crimes. His lawyer has declined to comment about the allegations in the JPMorgan lawsuit.

In 2010, JPMorgan compliance officials decided that Epstein “should go,” according to the Wednesday filing, and raised questions about Epstein’s behavior.

A senior compliance official in 2011 voiced concerns about extending Epstein a loan in relation to a modeling agency that had been accused of bringing underage girls into the U.S.

According to court papers, the official noted that Epstein was no longer managing retail billionaire Leslie Wexner’s money and questioned whether he had any clients at all.

“I would like to know if in fact he is managing anyone’s money at this point or is it all his money,” the official wrote.

The compliance officer also said that Epstein had sponsored accounts and credit cards for two 18-year-olds in 2004, one of whom was named regularly in media reports about Epstein’s “escapades,” according to the filing. That woman had received $450,000 from Epstein, the complaint said.

Epstein deposited hundreds of thousands of dollars into the accounts of one known victim and another unnamed “recruiter” after he pleaded guilty in 2008, the U.S. Virgin Islands claimed in its amended lawsuit.

The compliance department flagged other payments Epstein made to women, the suit says. One official referred to Epstein as a “Sugar Daddy!”

The bank, according to court papers, was told the cash was being used for fuel and landing fees for Epstein’s private planes. Yet withdrawals continued while Epstein was in prison, the filing said.

Updated: 4-21-2023

JPMorgan’s Ties To Jeffrey Epstein Were Deeper Than the Bank Has Acknowledged

The bank has said it shut the convicted sex offender’s accounts in 2013, but its bankers were still meeting with him years later, people familiar with the matter said.

JPMorgan Chase & Co. had ties to Jeffrey Epstein that ran deeper than the bank has acknowledged and extended years beyond when it decided to close the convicted sex offender’s accounts, according to people familiar with the matter.

Mary Erdoes, a top lieutenant to Chief Executive Jamie Dimon, made two trips to Epstein’s townhouse on Manhattan’s Upper East Side, in 2011 and 2013, when Epstein still was a client of the bank, said the people familiar with the matter.

She exchanged dozens of emails with him and discussed sharing with him fees related to a charitable fund the bank was considering launching, the people said.

John Duffy, who ran JPMorgan’s U.S. private bank for the ultrarich, went to Epstein’s townhouse for a meeting in April 2013, the people said.

One month later, the private bank renewed an authorization allowing Epstein to borrow money against his accounts despite repeated warnings from compliance staffers about his unusual banking practices.

Justin Nelson, one of Epstein’s bankers at JPMorgan, had about a half-dozen meetings at Epstein’s townhouse between 2014 and 2017, the people said. He also traveled to Epstein’s ranch in New Mexico in 2016, the people said.

JPMorgan has said it closed Epstein’s accounts in 2013. Ms. Erdoes has previously said through a JPMorgan spokesman that the only time she remembered meeting Epstein was the day she fired him as a client of JPMorgan’s private bank. Ms. Erdoes declined to comment for this article.

Epstein was convicted of soliciting a minor for prostitution in 2008 and forced to register as a sex offender. He was arrested in 2019, accused of orchestrating a scheme to traffic and sexually abuse girls.

The bank has denied knowing about Epstein’s crimes and has sued one of its former executives, Jes Staley, accusing him of misleading the bank about Epstein’s character and conduct. Mr. Staley’s lawyers have said the allegations against him are baseless.

The new details show that JPMorgan was treating Epstein like a star client after his first conviction and despite repeated warnings from its own employees. And after JPMorgan closed Epstein’s accounts, bankers kept meeting with him for years.

A JPMorgan spokesman said the level of interaction with Epstein wasn’t atypical for a client of a private bank. Any meeting held with Epstein after 2013, the spokesman said, was regarding other JPMorgan bank clients whom Epstein represented.

Mr. Nelson declined to comment, the spokesman said. Mr. Duffy, who no longer works at the bank, didn’t respond to requests for comment.

A pair of lawsuits filed against JPMorgan late last year in federal court in Manhattan have drawn fresh attention to the bank’s ties to Epstein, who died in 2019 in New York jail of what the city’s medical examiner said was a suicide.

At the time, he was awaiting trial on sex-trafficking charges. The lawsuits, brought by a woman who has accused Epstein of sexual abuse and by the U.S. Virgin Islands—home to Epstein’s private island getaway—alleged that the bank moved the money that was used to pay off his purported victims.

JPMorgan said it isn’t liable for Epstein’s crimes. Through a spokeswoman, lawyers for the Virgin Islands and the Epstein accuser said the public filings in the lawsuits speak for themselves.

In response to the two lawsuits, JPMorgan has handed over documents detailing interactions between Epstein and more than 20 employees and executives, past and present.

Many of them have given sworn testimony in depositions, and Mr. Dimon, the CEO, is expected to do the same next month.

Epstein became a JPMorgan client in about 1998, according to documents filed in connection with the lawsuits. Over the years, the bank would come to manage some 55 Epstein-related accounts containing hundreds of millions of dollars, the documents show.

Epstein formed a close bond with Mr. Staley, who ran the private bank that caters to the firm’s wealthiest clients. Epstein connected JPMorgan to Glenn Dubin, co-founder of Highbridge Capital Management, one of the fastest-growing hedge-fund firms of the 2000s.

JPMorgan bought a controlling stake in Highbridge in 2004 for more than $1 billion. Epstein earned a finder’s fee of about $15 million, The Wall Street Journal has reported.

The next year, the Palm Beach, Fla., police department launched an investigation after several teenage girls said Epstein paid them for massages and sexually assaulted them. He was indicted in 2006 for sex crimes.

That year, JPMorgan executives and compliance staffers began writing emails and memos sharing press reports about Epstein and discussing what to do with his accounts, classifying them as “high risk,” according to the Virgin Islands lawsuit.

JPMorgan executives were aware that Epstein had been accused of using cash to pay for girls to come to his house, Ms. Erdoes said in a previously reported deposition for the lawsuits.

A compliance team pointed out that Epstein routinely made large cash withdrawals, up to $80,000 at a time and more than $750,000 a year, according to the lawsuit.

Epstein pleaded guilty in 2008 in Florida state court to procuring and soliciting a minor for prostitution. He was sentenced to 18 months and required to register as a sex offender. He ultimately served about 13 months in a work-release program.

Epstein advised JPMorgan’s Mr. Staley in 2008 as he negotiated his compensation at the bank, according to the lawsuit. In 2009, Mr. Staley visited Epstein’s Palm Beach mansion and Little St. James, his private island, the Virgin Islands lawsuit said.

The Virgin Islands lawsuit said communication between the two men “suggest that Staley may have been involved in Epstein’s sex-trafficking operation.”

The suit alleges Epstein wired money to a woman around the time that Mr. Staley stayed at Epstein’s Palm Beach, Fla., mansion and then again to the same woman when Mr. Staley told Epstein he would be in London.

Mr. Staley has said he was in the dark about Epstein’s alleged crimes and regrets their long-running friendship.

In September 2009, Mr. Staley was promoted to a new job running JPMorgan’s sprawling corporate and investment bank. Ms. Erdoes took over running its asset and wealth-management unit.

Mr. Staley visited Little St. James that November. “Presently, I’m in the hot tub with a glass of white wine,” Mr. Staley emailed Epstein, according to the lawsuit.

“This is an amazing place. Truly amazing. Next time, we’re here together. I owe you much. And I deeply appreciate our friendship. I have few so profound.”

JPMorgan’s compliance department was pressuring the bank to drop Epstein. “See below new allegations of an investigation related to child trafficking—are you still comfortable with this client who is now a registered sex offender,” one compliance officer wrote in a 2010 email, according to a recent filing in the Virgin Islands suit.

JPMorgan stuck with Epstein and granted him the ability that year to borrow against his $50 million account.

In January 2011, the bank’s anti-money-laundering compliance director contacted general counsel Stephen Cutler to get him to re-approve the relationship, according to the recent filing. Mr. Cutler didn’t respond to a request for comment.

A review of the relationship fell to Mr. Staley. Epstein told him “there was no truth to the allegations, no evidence,” compliance officials reported in 2011, the Virgin Islands lawsuit said.

“We will continue to monitor the accounts and cash usage closely going forward.”

Mr. Staley traveled to Little St. James again in January 2011, the people said.

In March of that year, Mr. Cutler asked a member of his team to seek information about Epstein from prosecutors, but the U.S. attorney in Miami didn’t disclose whether it was conducting a criminal investigation, according to the people familiar with the matter.

The bank’s anti-money-laundering division recommended closing Epstein’s accounts, the Virgin Islands lawsuit said.

Top bank executives continued meeting with Epstein. Epstein had pitched to JPMorgan a multibillion-dollar donor-advised philanthropy fund, where he would help bring in wealthy clients that could put in a minimum $100 million, according to the people familiar with the matter.

For months, Ms. Erdoes, Mr. Staley and Epstein discussed working together on the fund. Epstein’s potential compensation was a sticking point, according to emails reviewed by the Journal.

“Everyone is marching together to create something very powerful and we will solve the comp issues,” Ms. Erdoes wrote to Epstein in October 2011.

The fund never got off the ground.

Ms. Erdoes visited Epstein’s Manhattan townhouse in 2011 and 2013, said the people familiar with the matter. The 2011 meeting was about settling a lawsuit Epstein had filed against Bear Stearns, which JPMorgan had acquired, over losses from the investment bank’s collapse, the JPMorgan spokesman said.

Ms. Erdoes played a role in negotiating that settlement with Epstein for JPMorgan, according to the emails reviewed by the Journal. The bank offered Epstein $9.2 million to resolve the lawsuit, the emails show.

Mr. Nelson, who is currently a managing director at JPMorgan working with hedge-fund founders and big investors, visited Epstein at his New York townhouse several times, accompanied by other JPMorgan executives and bankers, the people said.

None of those visits have previously been reported.

Mr. Staley left the bank in early 2013, and JPMorgan decided to close Epstein’s accounts a few months later. Mr. Staley later became the CEO of Barclays PLC, but left the British bank in late 2021 after U.K. regulators said he provided an incomplete accounting of his relationship with Epstein.

JPMorgan employees continued meeting with Epstein after his accounts were closed about other clients and to discuss introductions he could make to potential clients, according to people familiar with the meetings.

Epstein had ties to ultrarich JPMorgan clients such as Leon Black, the co-founder of private-equity firm Apollo Global Management. Over the years, Mr. Black paid Epstein a total of $148 million for trust- and estate-tax advice, an independent review found.

Mr. Nelson went to Epstein’s townhouse seven times between 2014 to 2017, and visited Epstein’s ranch south of Santa Fe in January 2016, according to the people familiar with the matter.

Managing director Paul Barrett scheduled at least five meetings with Epstein from 2014 to 2017 before he left JPMorgan, according to documents reviewed by the Journal.

Epstein’s 2019 death ended the criminal trial against him.

The lawsuits against JPMorgan are scheduled to go to trial in October.

Updated: 4-30-2023

Epstein’s Private Calendar Reveals Prominent Names, Including CIA Chief, Goldman’s Top Lawyer

Schedules and emails detail meetings in the years after he was a convicted sex offender; visitors cite his wealth and connections.

The nation’s spy chief, a longtime college president and top women in finance. The circle of people who associated with Jeffrey Epstein years after he was a convicted sex offender is wider than previously reported, according to a trove of documents that include his schedules.

William Burns, director of the Central Intelligence Agency since 2021, had three meetings scheduled with Epstein in 2014, when he was deputy secretary of state, the documents show. They first met in Washington and then Mr. Burns visited Epstein’s townhouse in Manhattan.

Kathryn Ruemmler, a White House counsel under President Barack Obama, had dozens of meetings with Epstein in the years after her White House service and before she became a top lawyer at Goldman Sachs Group Inc. in 2020.

He also planned for her to join a 2015 trip to Paris and a 2017 visit to Epstein’s private island in the Caribbean.

Leon Botstein, the president of Bard College, invited Epstein, who brought a group of young female guests, to the campus.

Noam Chomsky, a professor, author and political activist, was scheduled to fly with Epstein to have dinner at Epstein’s Manhattan townhouse in 2015.

None of their names appear in Epstein’s now-public “black book” of contacts or in the public flight logs of passengers who traveled on his private jet.

The documents show that Epstein arranged multiple meetings with each of them after he had served jail time in 2008 for a sex crime involving a teenage girl and was registered as a sex offender.

The documents, which include thousands of pages of emails and schedules from 2013 to 2017, haven’t been previously reported.

The documents don’t reveal the purpose of most of the meetings. The Wall Street Journal couldn’t verify whether every scheduled meeting took place.

Most of those people told the Journal they visited Epstein for reasons related to his wealth and connections. Several said they thought he had served his time and had rehabilitated himself.

Mr. Botstein said he was trying to get Epstein to donate to his school. Mr. Chomsky said he and Epstein discussed political and academic topics.

Mr. Burns met with Epstein about a decade ago as he was preparing to leave government service, said CIA spokeswoman Tammy Kupperman Thorp.

“The director did not know anything about him, other than that he was introduced as an expert in the financial services sector and offered general advice on transition to the private sector,” she said. “They had no relationship.”

Ms. Ruemmler had a professional relationship with Epstein in connection with her role at law firm Latham & Watkins LLP and didn’t travel with him, a Goldman Sachs spokesman said.

Epstein introduced her to potential legal clients, such as Microsoft Corp. co-founder Bill Gates, the spokesman said. “I regret ever knowing Jeffrey Epstein,” Ms. Ruemmler said.

A spokeswoman for Latham & Watkins said Epstein wasn’t a client of the firm.

In 2006, Epstein was publicly accused of sexually abusing girls in Florida who were as young as 14 years old.

The Federal Bureau of Investigation and police investigated, and Epstein reached a deal with prosecutors in 2008. He avoided federal charges and pleaded guilty to soliciting and procuring a minor for prostitution.

He registered as a sex offender and served about 13 months in a work-release program.

Epstein’s case generated waves of media coverage at the time, with publications in the U.S. and abroad reporting on accusations from underage girls and young women.

In 2006, several politicians returned donations from Epstein. Some associates moved to distance themselves from him.

His biggest known client, retail billionaire Leslie Wexner, later said he cut ties in 2007. His bank, JPMorgan Chase & Co., later said it closed his accounts in 2013, though some bankers continued to meet with him for years after.

In 2015, Virginia Giuffre publicly accused Epstein of sexually abusing and trafficking her when she was a teen and forcing her to have sex with influential people, including Prince Andrew. Prince Andrew has denied the allegations and last year settled a sex-abuse lawsuit by Ms. Giuffre.

Despite the negative press, Epstein’s days were filled from morning to night with meetings with prominent people, the documents show.

There were dinners at New York restaurants, meetings at luxury hotels and gatherings in the offices of prominent law firms. Many appointments were held at Epstein’s townhouse in Manhattan.

Prosecutors alleged in 2019 that the townhouse is where Epstein sexually abused female victims for years, many underage, and that he paid some of them to recruit their friends to engage in sexual activity.

After the Miami Herald reported that dozens of women said they were abused, prosecutors charged Epstein in 2019 with a sex trafficking conspiracy. He died that year in a New York jail while awaiting trial in what the city’s medical examiner said was a suicide.

Mr. Burns, 67 years old, a career diplomat and former ambassador to Russia, had meetings with Epstein in 2014 when Mr. Burns was deputy secretary of state.

A lunch was planned that August at the office of law firm Steptoe & Johnson in Washington. Epstein scheduled two evening appointments that September with Mr. Burns at his townhouse, the documents show.

After one of the scheduled meetings, Epstein planned for his driver to take Mr. Burns to the airport.

Mr. Burns recalls being introduced in Washington by a mutual friend, and meeting Epstein once briefly in New York, said Ms. Thorp. “The director does not recall any further contact, including receiving a ride to the airport,” she said.

The following month, October 2014, Mr. Burns stepped down from his role at the State Department to serve as president of the Carnegie Endowment for International Peace, a think tank.

He ran the Carnegie Endowment until he was nominated in early 2021 by President Biden to serve as CIA director.

The documents show that Epstein appeared to know some of his guests well. He asked for avocado sushi rolls to be on hand when meeting with Ms. Ruemmler, according to the documents.

He visited apartments she was considering buying. In October 2014, Epstein knew her travel plans and told an assistant to look into her flight. “See if there is a first class seat,” he wrote, “if so upgrade her.”

In 2014, Epstein called Ms. Ruemmler within weeks of her leaving the Obama White House. Epstein planned a lunch in August 2014 at his townhouse, followed by a series of meetings to introduce her to a wider circle of his acquaintances.

Ms. Ruemmler first met Epstein after he called her to ask if she would be interested in representing Mr. Gates and the Bill & Melinda Gates Foundation, the Goldman Sachs spokesman said.

A spokeswoman for Mr. Gates said Epstein never worked for Mr. Gates, misrepresented their relationship, and that Mr. Gates regrets ever meeting with him.

Epstein and his staff discussed whether Ms. Ruemmler, now 52, would be uncomfortable with the presence of young women who worked as assistants and staffers at the townhouse, the documents show.

Women emailed Epstein on two occasions to ask if they should avoid the home while Ms. Ruemmler was there. Epstein told one of the women he didn’t want her around, and another that it wasn’t a problem, the documents show.

Ms. Ruemmler didn’t see anything that would lead her to be concerned at the townhouse and didn’t express any concern, the Goldman spokesman said.

Several people who visited Epstein during this time period said they noticed young women at his townhouse. One of the visitors, Helen Fisher, an anthropologist who studies romantic love and attachment, had lunch with Epstein in January 2016 to discuss her work.

Dr. Fisher said that after the lunch, Epstein invited her to speak with his staff. “And then, in filed, I would say, six young women,” she said. “All of them good looking. All of them young.”

Dr. Fisher said Epstein never funded her work, they weren’t friends and they didn’t stay in touch. “I didn’t have anything to do with Jeffrey Epstein,” she said. “But I remembered it because of his spectacular house and because of the six young women.”

Over the next few years, Ms. Ruemmler, then a partner specializing in white-collar defense at Latham & Watkins, had more than three dozen appointments with Epstein, including for lunches and dinners.

“In the normal course, Epstein also invited her to meetings and social gatherings, introduced her to other business contacts and made referrals,” the Goldman spokesman said. “It was the same kinds of contacts and engagements she had with other contacts and clients.”

In 2015, she was scheduled to fly with Epstein to Paris and in 2017 he planned to stop in St. Lucia to take her to his island home in the U.S. Virgin Islands for the day, according to the documents.

Ms. Ruemmler never visited his island and “never accepted an invitation or an opportunity to fly with Jeffrey Epstein anywhere,” the Goldman spokesman said.

In addition to her current role as general counsel at Goldman Sachs, Ms. Ruemmler is co-chair of its reputational risk committee, which monitors business and client decisions for potential damage to the bank’s image.

Epstein also connected Ms. Ruemmler with Ariane de Rothschild, who is now chief executive of the Swiss private bank Edmond de Rothschild Group.

The bank hired Ms. Ruemmler’s law firm, Latham & Watkins, after the introduction to help with U.S. regulatory matters, according to the bank and the Goldman spokesman.

Mrs. de Rothschild, who married into the famous banking family, had more than a dozen meetings with Epstein. He sought her help with staffing and furnishings as well as discussed business deals with her, according to the documents.

In September 2013, Epstein asked Mrs. de Rothschild in an email for help finding a new assistant, “female…multilingual, organized.”

“I’ll ask around,” Mrs. de Rothschild emailed back.

She bought nearly $1 million worth of auction items on Epstein’s behalf in 2014 and 2015, the documents show.

Mrs. de Rothschild was named chairwoman of the bank in January 2015. That October, she and Epstein negotiated a $25 million contract for Epstein’s Southern Trust Co. to provide “risk analysis and the application and use of certain algorithms” for the bank, according to a proposal reviewed by the Journal.

In 2019, after Epstein was arrested, the bank said that Mrs. de Rothschild never met with Epstein and it had no business links with him.

The bank acknowledged to the Journal that its earlier statement wasn’t accurate. It said Mrs. de Rothschild met with Epstein as part of her normal duties at the bank between 2013 and 2019, and Epstein introduced the bank to U.S. finance leaders, recommended law firms and provided tax and risk consulting.

“In parallel to that, Epstein solicited her personally on a couple occasions for advice and services on estate management,” the bank said.

Mrs. de Rothschild had no knowledge of any legal proceedings against Epstein and “was similarly unaware of any questions regarding his personal conduct,” the bank said.