“Is Bitcoin Reacting To The Chaos Or Is Bitcoin Causing The Chaos?” Max Keiser

Updated: 3-13-2023: Banking Crisis Won’t Kill Crypto Banking Despite Short-Term Pain. “Is Bitcoin Reacting To The Chaos Or Is Bitcoin Causing The Chaos?” Max Keiser

From alternative banks to on-chain banking, crypto banking still has plenty of options, experts say.

Related:

The Weaponization of Bitcoin And Global Finance

Bitcoin Developer Amir Taaki, “We Can Crash National Economies”

US Pentagon Created A War Game To Fight The Establishment With BTC

Harvard University Stages ‘Digital Currency Wars’ Crisis Simulation

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

How Will Bitcoin Behave During A Recession

Fidelity: Fidelity Is Launching Commission-Free Crypto Trades For Retail Investors

The crypto ecosystem was built on the belief that no one entity, meaning a bank, should be in charge of one individual’s finances.

However, until that becomes a reality, traditional banking will likely have to serve as a bridge between centralized finance (CeFi) and decentralized finance (DeFi).

Thus, the shutdown of Silvergate Bank, Silicon Valley Bank (SVB) and Signature Bank will certainly cause headaches for the industry in the short term as many crypto companies search for new banking partners, uncertain if larger entities will even want to touch crypto companies anytime soon.

“For now it’s not clear what new financial institutions will partner with these crypto companies in the wake of Silvergate, SVB and now Signature,” said Ilya Volkov, CEO of and co-founder of YouHodler, a Swiss-based international fintech platform providing a variety of Web3 crypto and fiat service.

“The industry is currently running out of options and that needs to be addressed soon to prevent further problems,” Volkov added, noting that it will cause some fear-based reactions from the investors.

In the long run, however, this contagion shouldn’t hurt the crypto industry because there will likely be other smaller banks that could bridge the gap.

“Crypto liquidity is likely to take a hit in the short term but this is an opportunity for new innovative challenger banks to step up and take the place of SVB, Silvergate and Signature,” said Andrei Grachev, managing partner at digital asset market maker DWF Labs.

On-chain Banking And Other Adaptations

Another novel idea, to which only crypto can help provide a solution, is on-chain banking, according to Brent Xu, CEO and founder of cross-chain DeFi protocol Umee.

“Future banking should become on-chain. That means that banks are going to start to more resemble blockchains as opposed to purely centralized entities,” Xu said. Such technology will allow the banks to have “on-chain metrics related to their exposure to AFS (available for sale) securities like Treasurys and to allow better on-chain metrics for their cash management activities”, he added.

Regardless of the outcome, every bear cycle in crypto has experienced such conundrums and came out stronger, Xu said.

“Having been in this industry for as long as I have, this news doesn’t surprise me to the point where we have become numb to the effects. It is to be expected,” he said.

This won’t mean the end of crypto banking, he added. Rather, institutions that don’t adapt to new technology will be left behind.

“The crypto industry has gone through banking shifts like this every cycle. We won’t see a shortfall of banks. More so, we will see a shortfall of legacy banks that support this tech,” Xu added.

Updated: 3-14-2023

SVB Crisis: Here Are The Crypto Firms Denying Exposure To Troubled US Banks

Some of the biggest firms in crypto have denied exposure to any of the failed banks in the United States.

Amid the ongoing United States banking crisis, several major cryptocurrency firms have denied exposure to dissolved U.S. banks like Silicon Valley Bank (SVB).

As potential implications of the SVB crisis for the crypto market continue to unfold, Cointelegraph highlighted several major crypto firms that have declared to be unaffected by the issues so far.

Tether

Tether, the operator of the eponymous U.S. dollar-pegged stablecoin, Tether (USDT), was one of the first companies to deny exposure to SVB and other troubled U.S. banks as of mid-March.

On March 12, Tether chief technology officer Paolo Ardoino took to Twitter to announce that the stablecoin company has zero exposure to Signature Bank. The tweet came soon after Signature officially shut down operations the same day.

Ardoino previously said that Tether had no exposure to SVB on March 10. The chief technology officer posted a similar tweet about Silvergate on March 2, declaring that Tether did not have “any exposure” to the bank.

Tether’s USDT is the largest stablecoin by market capitalization, with a market value of $73 billion at the time of writing.

Its biggest rival, USD Coin, briefly lost its 1:1 peg with the U.S. dollar after its issuer, Circle, could not withdraw $3.3 billion in reserves from SVB.

Crypto.com, Gemini, BitMEX

Kris Marszalek, CEO of major cryptocurrency exchange Crypto.com, provided similar statements on the company being unaffected by the ongoing issues in U.S. banking.

In subsequent tweets on March 10 and March 12, Marszalek declared that Crypto.com had zero exposure to Signature, Silvergate and SVB.

https://t.co/pFc4Pz9nFR has $0 exposure to Signature Bank. https://t.co/TG2h7HyXE9

— Kris | Crypto.com (@kris) March 13, 2023

Other major exchanges, including Gemini and BitMEX, have also denied any exposure to the dissolved U.S. banks.

Despite having a partnership with Signature, Winklevoss brothers-founded Gemini exchange has zero customer funds and zero Gemini dollar (GUSD) funds held at the bank, the firm announced on March 13.

Gemini emphasized that all customer U.S. dollars and its GUSD reserves are held at banks like JPMorgan, Goldman Sachs and State Street Bank.

2/ All Gemini customer U.S. dollars are held at JPMorgan, Goldman Sachs, and State Street Bank.

— Gemini (@Gemini) March 13, 2023

BitMEX exchange also took to Twitter on March 13 to announce that the company had “no direct exposure” to Silvergate, SVB or Signature. “All user funds continue to be safe and accessible 24/7/365,” BitMEX added.

Exchanges like Binance and Kraken have partly denied exposure to the dissolved banks, with Binance CEO Changpeng Zhao stating that Binance does not have assets at Silvergate, and former Kraken CEO Jesse Powell also denying exposure to SVB.

Argo Blockchain

Bitcoin mining firm Argo Blockchain issued a statement on March 13, declaring that the company has no direct or indirect exposure to SVB and Silvergate Bank.

However, the company said that one of Argo’s subsidiaries holds a “portion of its operating funds in cash deposits” at Signature.

“These deposits are secure and are not at risk,” Argo noted, citing a decision by the U.S. Treasury and Federal Deposit Insurance Corporation to rescue customer deposits at the bank.

Animoca Brands

Animoca Brands, Hong Kong-based game software company and prominent investor in non-fungible token and gaming space, claimed that it had no assets at SVB and Silvergate as well.

On March 11, Animoca co-founder and chairman Yat Siu said that the company “does not bank with either Silicon Valley Bank or Silvergate.”

A spokesperson for Animoca also told Cointelegraph that the firm has “never had a banking relationship with Signature.”

A number of other firms, including Abra and Alchemy Pay, have partly denied exposure to the troubled U.S. banks, stating that they had no assets at SBV and Silvergate.

Some companies, like crypto custodian BitGo, declared it holds no assets at SVB while being “not impacted” by issues at Silvergate, USDC and Signature Bank.

SVB And Silvergate Are Out, But Major Banks Are Still Backing Crypto Firms

While two of the crypto industry’s biggest backers have fallen, crypto firms are not at a loss with a number of alternative and crypto-friendly support options available.

Over the last week, the collapse of three of the largest banks backing the crypto scene — Silicon Valley Bank (SVB), Silvergate Bank and Signature Bank — has many industry pundits wondering how United States-based crypto companies will fare after such losses.

While it has been said that there is “nobody left to bank crypto companies,” some in the crypto space have already highlighted the remaining options.

One Twitter user called out another after they said there is “basically no one left to bank crypto companies in the U.S.” by listing off some banks with crypto clients.

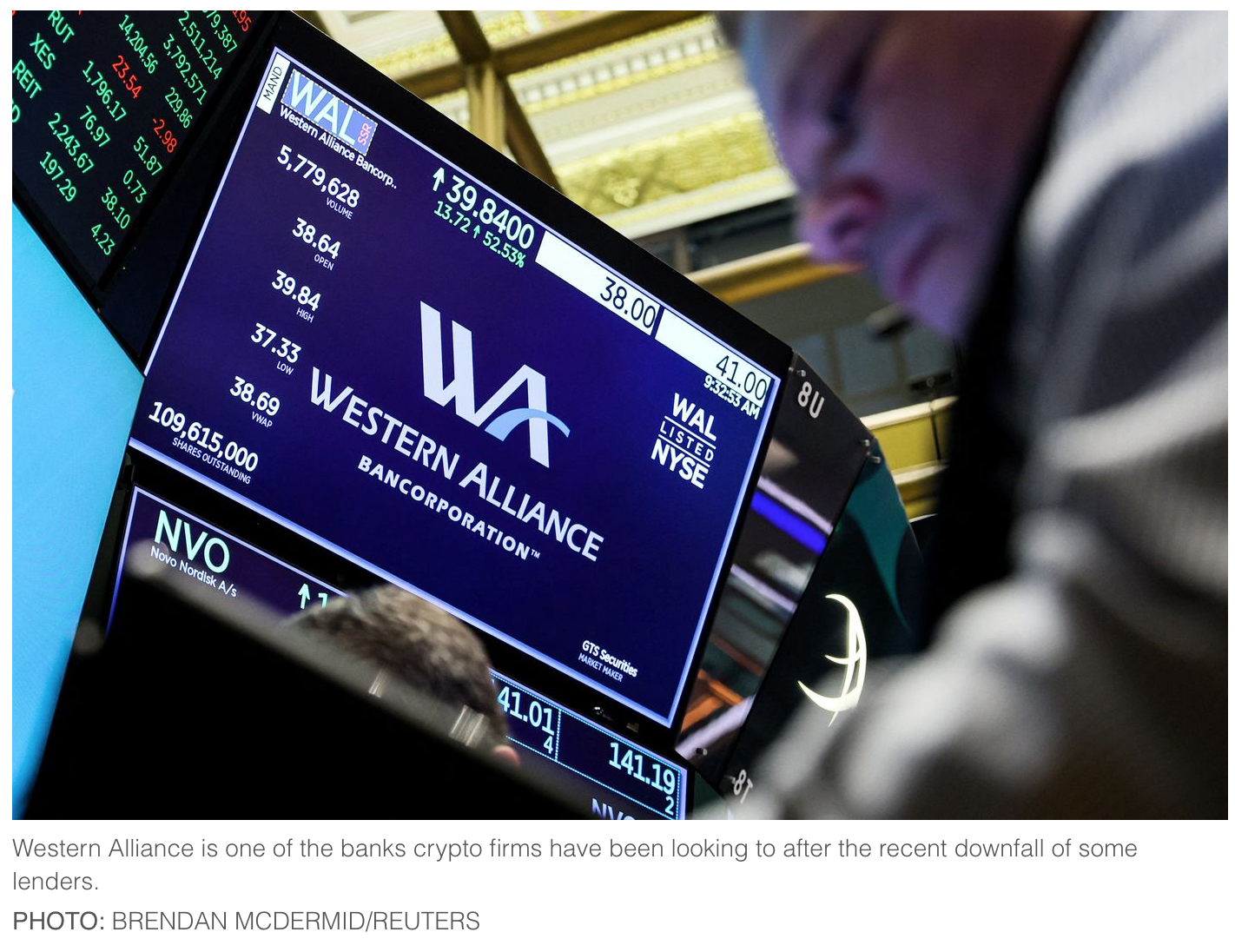

This is false. United Texas Bank, Western Alliance Bank, JP Morgan Chase, and Bank of New York Mellon all have crypto businesses as customers, and there are probably more. https://t.co/Q27bkzq2n8

— yuga.eth (@yugacohler) March 13, 2023

Along with that rebuttal, various users began to compile lists of banks that still could be long-term options for smaller crypto operations.

Although the situation surrounding banks, crypto and stablecoins is fragile, there remain mainstream options for those working in the space.

Bank of New York (BNY) Mellon

On Oct. 11, 2022, BNY Mellon announced the official launch of its digital custody platform for institutional clients to hold Bitcoin (BTC) and Ether BNY Mellon reports having $43 trillion in assets under custody, though it has not disclosed how much of that total includes BTC and ETH holdings. In March 2022, Circle chose BNY Mellon as one of its custodians for its USD Coin reserves.

On Feb. 9, during a cryptocurrency panel at Afore Consulting’s 7th Annual FinTech and Regulation Conference, the bank’s head of advanced solutions, Michael Demissie, said digital assets are “here to stay.”

In light of the recent events involving SVB, Circle also announced it was working on “expanded relationships” with existing partners, including BNY Mellon.

JPMorgan

JPMorgan launched its Onyx Digital Assets platform back in November 2020, which has since processed over $430 billion in transactions.

Recently, the firm began exploring “deposit tokens” as an alternative to privately issued stablecoins and central bank digital currencies on commercial bank blockchains.

Deposit tokens, in theory, can exist on both public and permissioned blockchain environments for uses, including peer-to-peer payments, support smart contract programmability or serve as cash collateral.

JPMorgan has also piloted blockchain usage, including collateral settlement, repurchase agreement trades and cross-border transactions.

Cross River

Cross River, a U.S.-based financial services firm, offers crypto solutions to fintech companies. It has served clients both inside and outside of the crypto space, including cryptocurrency exchange Coinbase and financial services giants Visa and Mastercard.

On March 13, days after the USDC depegging, Circle announced Cross River as its new commercial banking partner to produce and redeem USDC.

BCB Group

The British bank offers a custody solution for BTC and ETH wallets and has served the likes of Coinbase and Bitstamp since it was approved to provide digital services by the United Kingdom’s Financial Conduct Authority in late January 2020.

After the SVB fallout, Oliver von Landsberg-Sadie, CEO of BCB Group, tweeted that the group has no ties with SVB or Signature and no “material amount of its own” in USDC.

1/ .@BCBcrypto holds no material amount of its own funds in USDC, however BCB’s services relating to USDC include trading and custody through BCB Prime Services (Switzerland).

— Oliver von Landsberg-Sadie (@OliverBCB) March 11, 2023

Customers Bank

The bank offers instant payments for business-to-business transactions and instant settlement for cryptocurrency trading firms, exchanges, liquidity providers, over-the-counter desks, market makers and institutional investors on its “TassatPay” platform.

TasatPay has processed over $1 trillion worth of transactions since it launched in 2019, including $150 billion alone in January, according to recent reports.

Shortly after the fall of the former cryptocurrency exchange FTX, Customers Bank announced that it had no ties with FTX and that its “CBIT related deposit balances” are stable at $1.85 billion. It claimed to have over $20 billion in assets.

DBS

The Singaporean bank offers its own custody platform, DBS Digital Custody, to customers who can purchase BTC, ETH, XRP, Bitcoin Cash from the DBS Digital Custody exchange.

DBS also offers a separate financial tool, which it calls the DBS Digital Exchange and is backed by the bank. DBS DDEx operates “members-only exchanges,” through which users have access to digital assets, including security tokens and cryptocurrencies.

OCBC

Customers banking with OCBC cannot directly purchase crypto assets from the platform. However, OCBC bank accounts can be connected to a licensed trading platform that it is partnered with, such as eToro, to buy digital assets.

Mercury Bank

Mercury Bank boasts in its offering of banking services for Web3 startups, decentralized autonomous organizations and funds. However, it explicitly states it cannot work with “money service businesses” or exchanges.

While cryptocurrencies themselves cannot be held in a Mercury account, in its FAQs section, it says it does not “express restrictions” on buying crypto through a Mercury account.

The company has been active on Twitter since the string of U.S. banks went under, saying it is ready to onboard clients affected by the incident.

Our onboarding teams are working hard to make sure your applications are getting approved this weekend.

If you’re looking to submit an application, a priority signup link is below. https://t.co/NqOuuDgCt4

— Mercury (@mercury) March 11, 2023

Axos Bank

Another crypto-friendly bank, Axos began offering its commercial banking clients access to TassatPay back in May 2022. TassatPay is a digital payments alternative on a private and permissioned blockchain-based platform that allows for around-the-clock real-time payment capabilities, approved by a primary bank regulator. It has processed over $400 billion in transactions to date.

Axos also offers access to multiple crypto-related exchange-traded funds (ETFs), including Bitwise 10 Crypto Index Fund (BITW), Bitwise Crypto Industry Innovation ETF (BITQ), ProShares Bitcoin Strategy ETF (BITO) and the ProShares Short Bitcoin Strategy ETF (BITI), among others.

Swiss Banks

According to a recent Reuters report, banks in Switzerland are seeing an influx of interest from American crypto companies after the recent events.

Crypto-focused SEBA Bank said it has experienced a “pronounced uptick” in traffic on its website by visitors from the United States.

Arab Bank, based in Switzerland, reported an increase in U.S. firms, mostly in the crypto space, looking to open accounts after Silveragte doubts mounted. According to the report, 80% had been Silvergate customers.

The Swiss bank Sygnum is also a crypto-friendly bank with self-made claims of being “the world’s first digital asset bank.” Although, it has a policy not to take on clients from the U.S. due to unclear regulations.

More Banks Serving Crypto Firms

While this list of options available to crypto firms is not exhaustive, it highlights that there could still be a light at the end of the tunnel.

Other banks that could be of potential interest to the crypto industry include Jewel, Series, State Street Bank, Goldman, Capital Union, First Digital and others.

Jake Chervinsky, chief policy officer at the Blockchain Association, tweeted that with the fall of SVB, Silvergate and Signature, there is now a huge gap in the space for “crypto-friendly banking.”

The closures of Silvergate, SVB, and Signature create a huge gap in the market for crypto-friendly banking.

There are many banks that can seize this opportunity without taking on the same risks as these three.

The question is if banking regulators will try to stand in the way.

— Jake Chervinsky (@jchervinsky) March 12, 2023

He continued to say that, given that crypto firms will need new accounts, this is an “opportunity” for banks to seize but without the same risks as the three that failed.

Banking Crisis In U.S. Likely To Push Bitcoin Firms Offshore

Switzerland, Lichtenstein and island jurisdictions are among the potential benefactors of the trend.

U.S. crypto firms are looking for bank accounts offshore following the collapse of three digital assets-friendly financial institutions last week.

Sygnum in Switzerland and Bank Frick in Lichtenstein told CoinDesk they have seen an increase in requests to open accounts in the past few days from various jurisdictions – including the U.S.

Meanwhile, Swiss bank SEBA said it has already started onboarding crypto clients that have recently shown interest.

On the retail side, Gibraltar’s Xapo Bank has also seen increased demand for new accounts in the past few days and is adding GBP payment services with USDC options likely starting later this week.

Industry sources have also pointed to FV Bank in Puerto Rico, Jewel Bank in Bermuda, and Tether and FTX-tied Deltec in the Bahamas, as options for U.S. dollar-based banking.

A list sent out to some companies in the Digital Currency Group umbrella (which includes CoinDesk) also identified EQIBank in Dominica. These banks didn’t respond to CoinDesk’s request for comment.

Last week, three of crypto’s preferred banks in the U.S. became effectively defunct. Silvergate Bank (SI) was liquidated, whereas Silicon Valley Bank (SVB) and Signature Bank (SBNY) were shut down by regulators.

While an interim solution for Silicon Valley Bank has been set up in the form of a bridge bank to allow customers to use their accounts, in the long-term companies will have to move their funds to other banks.

The Federal Insurance Deposit Corporation (FDIC), which manages the process, typically organizes bridge banks for up to two years, said a spokesperson for the agency. That’s plenty of time for firms to go through the onboarding process of most banks.

Europe And Beyond

Europe’s relative regulatory clarity could prove an asset, particularly as the U.S. lacks a regulatory framework plus the trust of many crypto insiders in U.S. authorities has been shaken.

Reported claims that the closure of Signature Bank was part of a larger campaign against the crypto industry have raised concerns among industry participants.

“There is a very real risk that more crypto companies will move offshore, particularly with regulatory frameworks being proposed in the U.K. and the [European Union],” said Dave Weisberger, CEO and co-founder of algorithmic trading platform CoinRoutes.

Crypto firms will likely look beyond Europe for their banking needs because more jurisdictions are increasingly friendly toward digital assets. “Global crypto companies will definitely be looking at banking options in Europe, Hong Kong and the Middle East,” said Sanjay Raghavan, vice president of Web3 initiatives at real estate investment platform Roofstock onChain.

He pointed to the United Arab Emirates, which is “embracing crypto innovation and has announced plans to launch an economic free zone dedicated to crypto and digital asset companies.”

Some crypto firms were already looking to go overseas or offshore even before the closing of these three banks, said Josh Frank, co-founder and CEO of information platform The Tie.

“Many crypto companies already had multiple on and off-shore banking partners,” he said, noting that U.S. companies will likely prefer Caribbean and European banks first.

SEBA’s Managing Director Yves Longchamp said that interest in the bank’s services has increased in the past few weeks but especially the last few days, “across all segments in the space, from VCs [venture capital firms] to foundations to trading firms and treasuries.”

However, in his view, “it’s no longer reliable” to rely on one banking provider in one jurisdiction anymore, “particularly when recent messaging from the regulating bodies has been less than encouraging.”

The push for overseas banking is a “missed opportunity for the U.S. economy in my view, given it has the best chance of regulating the industry and helping it mature,” said Xapo Bank’s CEO Seamus Rocca.

Regulatory Pressure

Regardless of where U.S. crypto companies look for their banking partners, regulatory risk in their home jurisdiction will likely loom large.

The willingness of internationally established banks to do business with U.S. crypto entities at the moment also hangs on the question of what the U.S. regulators will let the companies do for their banking partnerships.

“Many European and Asian banks also have some U.S. presence, which could presumably put them in sight of regulators if they are banking U.S. customers via offshore entities,” Frank said.

Being approved by banks in European countries will likely take longer and be a heavier lift. Only crypto companies that are regulated and have proper compliance and governance will be able to access non-U.S. banks, said Henri Arslanian co-founder and managing partner of Dubai-based Nine Blocks Capital Management.

Longchamp said that “previously, the lack of a clear regulatory framework [for crypto firms] in the U.S. had been a large deterrent” to servicing clients. In the Asia-Pacific region for example, SEBA has always preferred not to “involve more U.S. aspects in a business unnecessarily.”

The bank, which is licensed in both Switzerland and Abu Dhabi, takes measures like “segregated accounts and risk management” to provide its clients “full autonomy over their assets,” Longchamp said.

Meanwhile, Bank Frick said that its reviewing every new onboarding case individually. “We apply and have always applied the same strict standards in the crypto area as in the classic banking business.

If all necessary local [know your customer/anti-money laundering] standards are fulfilled, it is also possible to onboard jurisdictions outside Europe,” Nicolas Marxer, Bank Frick’s head of blockchain banking, told CoinDesk.

Sygnum Bank, for its part, does not onboard U.S. clients, said Martin Burgherr, the bank’s chief clients officer, so the applicants for new bank accounts are likely knocking on the wrong door.

Santander, HSBC, Deutsche Bank, Others Still Willing To Serve Crypto Clients After Banking Failures, DCG Says

Major banks are still willing to work with crypto firms, though they may restrict services, according to messages from DCG viewed by CoinDesk.

Crypto conglomerate Digital Currency Group (DCG) is trying to find new banking partners for portfolio companies following the collapse of Silicon Valley Bank (SVB), Signature Bank (SBNY) and Silvergate Bank, according to a memo viewed by CoinDesk.

Santander (SAN), HSBC (HSBA), Deutsche Bank (DB), BankProv, Bridge Bank, Mercury, Multis and Series Financial are still willing to connect with crypto firms, according to the memo.

DCG’s efforts come after recent bank failures in the U.S., which left a lot of crypto firms and tech startups stranded and hunting for new banking partners.

DCG had also reached out to BlackRock (BK), JPMorgan (JPM) and Bank of America (BA), according to the list included in the memo. DCG is the parent company of CoinDesk.

The memo notes that banks may restrict some services for crypto firms such as brokerage and money market services and the ability to wire money to third parties.

Traditional banks may be willing to set up banking accounts for crypto firms but would place restrictions based on the level of crypto exposure, according to the messages.

Western Alliance and Bridge Bank are still opening accounts for crypto firms, despite the fall in their share prices. DCG had also reached out to international banks including Revolut in the U.K., United Overseas Bank (UOB) in Singapore and Bank Leumi in Israel.

A DCG representative will meet with Senate Banking Committee staff on Wednesday on the fallout from SVB, Signature and Silvergate, according to the memo.

CoinDesk has reached out to DCG, Santander, HSBC, Deutsche Bank, BankProv, Mercury, Multis, Series Financial, BlackRock, JPMorgan, Bank of America, Revolut, UOB and Bank Leumi for comment.

Updated: 3-20-2023

No Crypto Banking Port Has Really Opened Up In This U.S. Storm

As Silvergate, Signature and Silicon Valley banks imploded, crypto customers grabbed assets and ran, but those hoping to land at major U.S. banks have been mostly disappointed.

The biggest U.S. banks haven’t stepped forward to welcome homeless crypto businesses scrambling for banking services after fleeing the wreckage of Silvergate Bank, Signature Bank and Silicon Valley Bank.

CoinDesk asked the top 20 U.S. banks by assets if they were taking on crypto customers, especially those businesses that recently lost their banking homes in the recent carnage. Most of them remained silent on the question.

Some – including JPMorgan Chase (JPM), Citigroup (C), Bank of New York Mellon (BK) and Morgan Stanley (MS) – declined to comment.

Others were open about saying they aren’t comfortable taking on crypto clients.

KeyBank (KEY), a regional lender based in Ohio, is between Silicon Valley and Signature in scale, so around the size of the institutions that crypto clients have been accustomed to using. But a spokeswoman there said the bank is focusing on those that meet its “moderate risk profile.”

“Crypto-focused firms do not fall within this category at this time,” she said.

And Citizens Financial Group (CFG), which is among the larger regional banks, said it doesn’t have “direct credit exposure to crypto/digital asset businesses, and it’s not something we’re looking to get into at this time,” according to a spokesman.

The panic over the collapse of tech-oriented banks – marking two of history’s largest government bank takeovers with Signature and Silicon Valley, plus a more recent cash infusion to First Republic Bank (FRC) from its banking peers – flooded the industry with businesses looking for places to handle their banking.

The banks CoinDesk surveyed represent about $13 trillion in assets – or about 56% of the U.S. banking sector. Not even BNY Mellon – known to handle custody for crypto companies’ assets, such as much of the liquid cash in stablecoin issuer Circle Internet Financial’s reserves – chose to openly address the situation, even though it has expanded its Circle business amid the turmoil.

Careful Banks

The largest U.S. bank, JPMorgan, hasn’t slammed the door on crypto companies, but it’s being especially careful with any new customers, according to a person familiar with the situation.

It won’t take on any full-on crypto businesses, but it’s still willing to extend basic banking services to a handful of companies that touch the industry, the person said, such as firms investing in some crypto projects.

JPMorgan has a complicated history with big digital-assets firms. The Wall Street banking giant has been severing business ties with Gemini, as CoinDesk first reported earlier this month, but it still maintains its working relationship with crypto exchange Coinbase (COIN).

And while CEO Jamie Dimon is famously critical of digital assets, his bank has also experimented with high-level use of blockchain technology and its own internal token.

Citigroup is taking a similar approach as its rival at the moment. The doors are still open at Citi for new customers that can clear its due-diligence standards, but it’s not going near hard-core, crypto companies, such as token issuers, a person familiar with its approach said.

Industry insiders have been swapping hints about other banks – such as some foreign institutions that do business in the U.S. – they think might still be open to crypto companies.

A person at one major crypto company said that more than two dozen U.S. banks are still doing business with the industry, even if it’s not openly advertised.

When Circle lost some of its banking partnerships. For instance, it turned to a tiny institution in New Jersey, Cross River Bank, that was known to do business with tech investment firms.

“As long as a crypto company can demonstrate its ability to be a good bank customer, it should be able to be banked,” said Sheila Warren, CEO of the Crypto Council for Innovation.

Risky Clients

There’s also a risk that the very act of flagging friendly banks could open them up to questions about their own strengths.

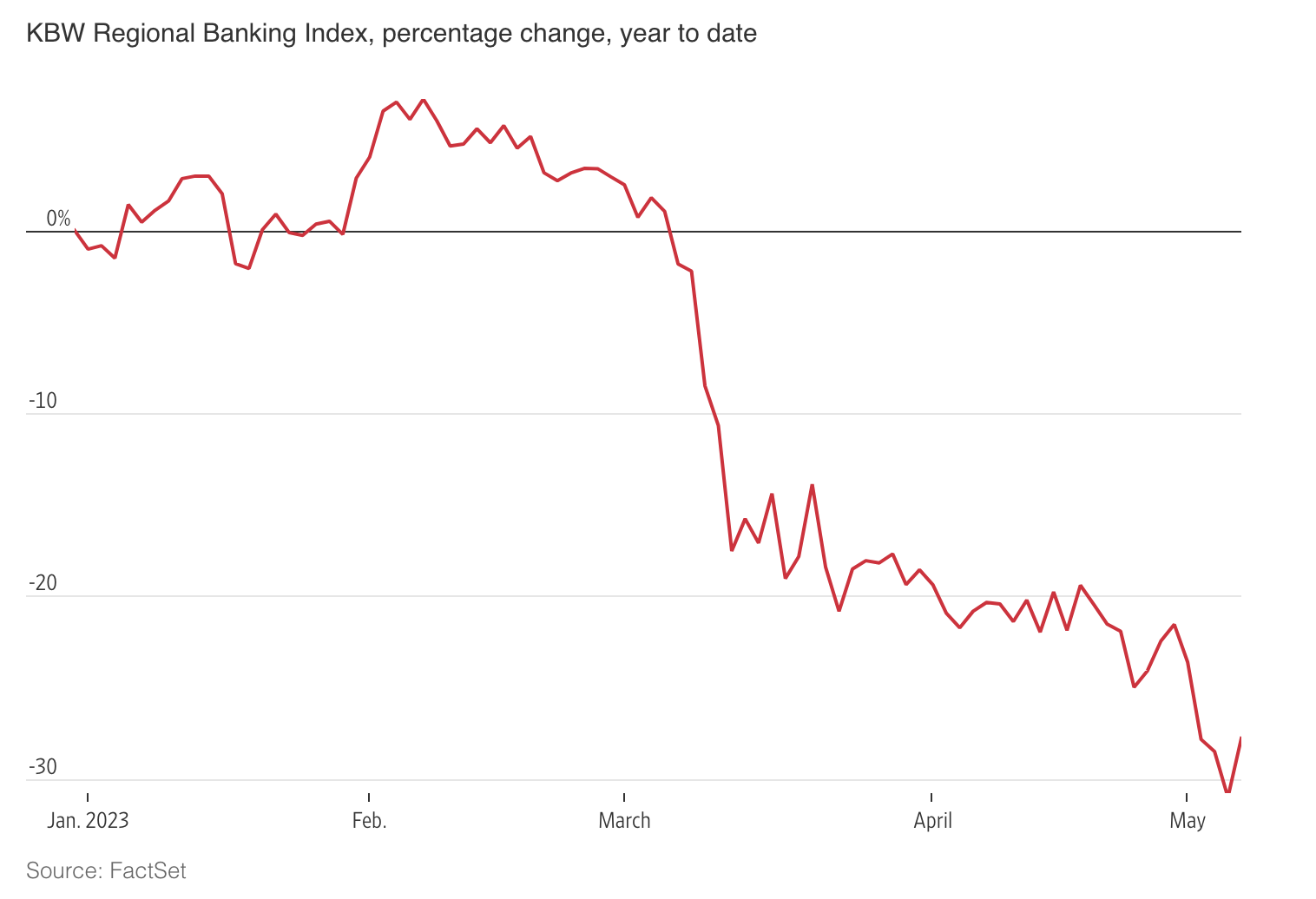

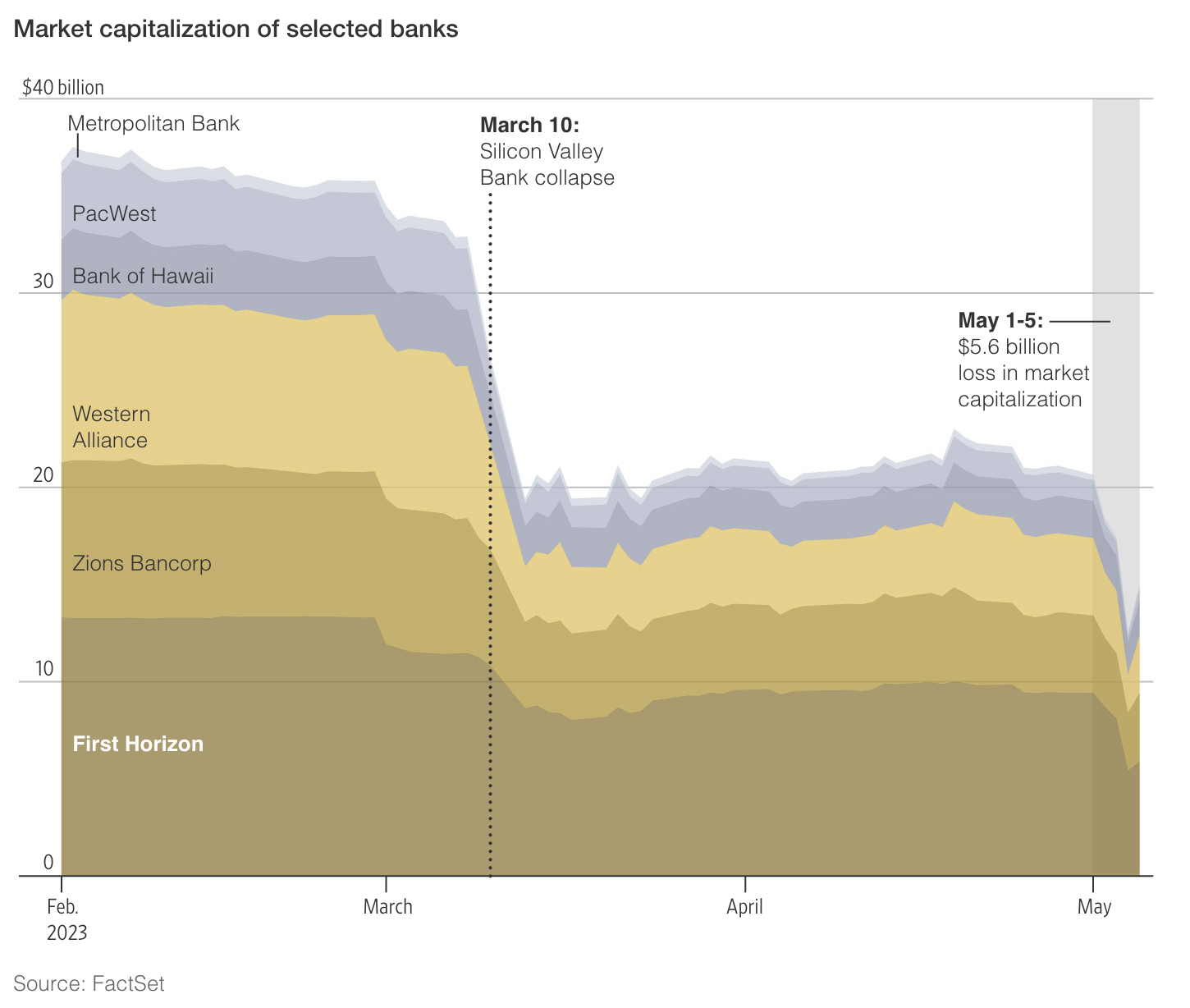

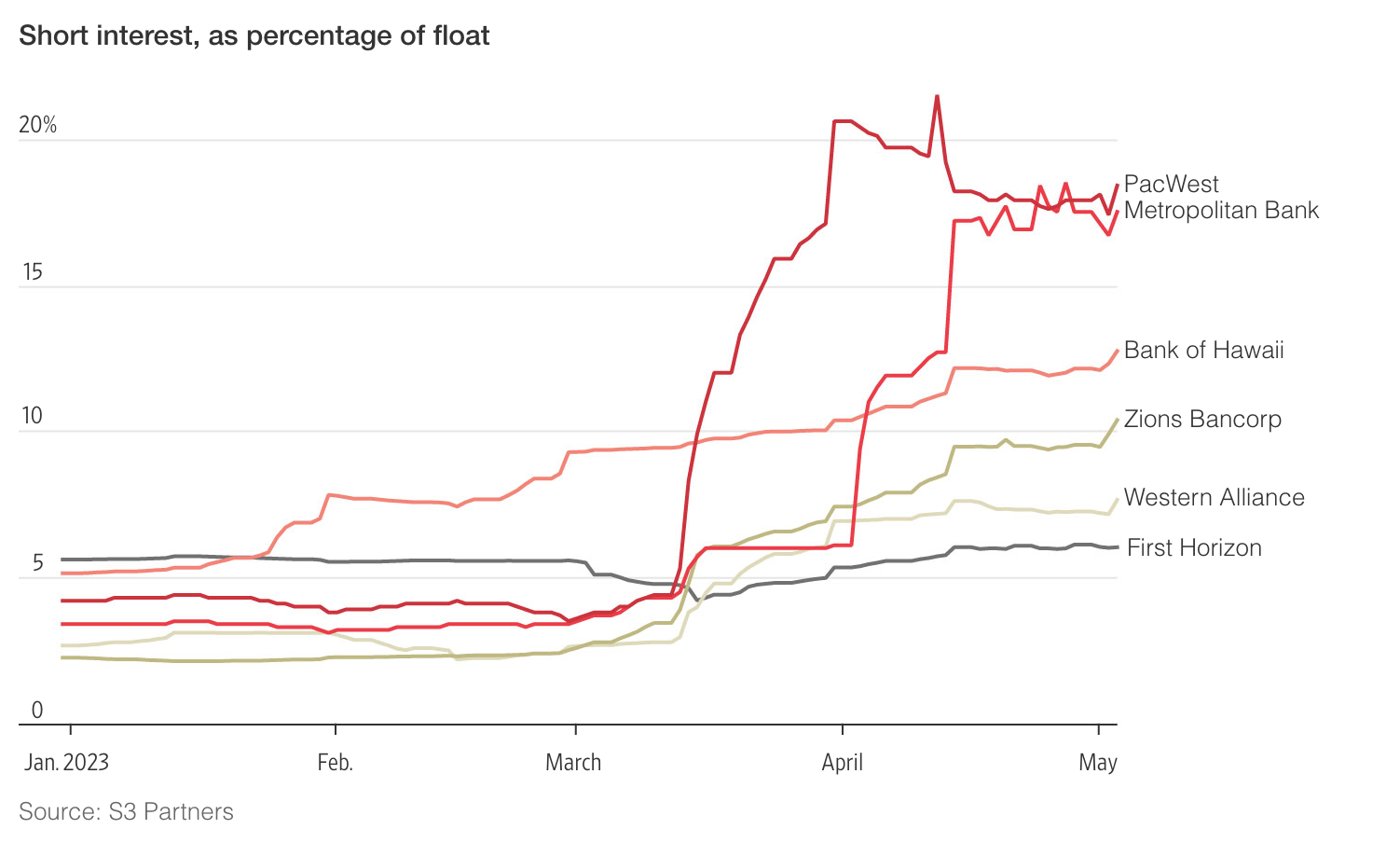

While banks struggle under a rush of customer applications, they are also dealing with their industry’s unsteadiness, with the KBW index’s measure of bank stocks sliding about 22% from the point at which Silvergate began faltering two weeks ago.

So crypto companies have been showing up at the doors of financial institutions that are themselves shaken by what’s been going on.

The banks are also unsure exactly which customers they can offer a hand to without it getting slapped by their regulators.

Whether the volatility or business practices of the crypto sector contributed to the failures of the industry’s favorite banks, the surviving institutions are under directives to be wary of digital assets.

Since the collapse of FTX, leaders of the Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency have expressed relief that they had resisted letting cryptocurrencies into the banking system.

In recent months, they have solidified that position by warning the lenders they oversee that those that focus on crypto clients aren’t likely to convince their government supervisors that they are running a safe-and-sound bank.

Most of the banks are taking these statements to heart, and some insiders – such as former House Financial Services Committee Chairman Barney Frank, who is a board member at Signature – have more pointedly accused regulators of gunning for crypto.

When asked if they could provide more clarity on what kind of crypto business exposure might be acceptable at the banks they oversee, spokespeople for the Federal Reserve and FDIC declined to go any further than the statements they have put out in recent months.

Officials from both agencies have been called to a March 29 hearing of Frank’s old House committee to explain what happened with Signature and Silicon Valley.

For customers of those banks, federal authorities blunted some of this month’s panic when the FDIC stepped in to take charge of them and open up its deposit insurance to cover all the normally uninsured customers – a cohort that the bulk of the crypto clients fit into.

Over the weekend, New York Community Bancorp (NYCB) stepped in to take over Signature’s non-crypto deposits, leaving an open question about the $4 billion in deposits still in limbo from its digital-assets business.

And federal officials have continued to try to calm the financial sector. Wally Adeyemo, deputy secretary of the U.S. Treasury Department, told CNBC last week that “deposit flows have stabilized in regional and small banks,” and in some cases they have “modestly reversed.” He credited that to the government’s aggressive move to protect uninsured depositors.

But banks are also seeing how charged up their critics are, such as Sen. Elizabeth Warren (D-Mass.), who hammered former Signature CEO Joseph J. DePaolo in a letter that cited “gross mismanagement that resulted in the bank’s failure.”

She argued that the bank “embraced crypto customers with insufficient safeguards.”

The senator ended her letter with the question, “Why did you fail to adhere to regulators’ warnings about the risks associated with the crypto industry?”

Updated: 3-27-2023

Banks Step Up To Serve Crypto Firms After Signature, Silvergate Blowups

Crypto executives say they have received a positive reception from regional and smaller upstart banks.

Some banks are rolling out the welcome mat for cryptocurrency firms that found themselves in need of banking services after the downfall of two big crypto-friendly lenders, Signature Bank and Silvergate Capital Corp.

As crypto companies have scrambled to establish new bank relationships, industry executives say they have received a positive reception from regional banks such as Customers, based in West Reading, Pa., and Fifth Third Bancorp, based in Cincinnati.

Other crypto firms are moving deposits to smaller upstart banks that tout themselves as digital pioneers, such as New Jersey-based Cross River Bank. Still others are considering taking their banking business offshore.

Meanwhile the biggest banks—such as JPMorgan Chase & Co. and Bank of New York Mellon Corp.—still do business with crypto clients, though they are selective about their client list and what banking services they provide.

A few weeks ago, crypto circles were abuzz with talk that Washington was plotting to kill crypto by cutting off its access to the banking system in what some commentators dubbed “Operation Choke Point 2.0.”

Those fears have now somewhat abated, as banks have stepped up to fill the vacuum created after Silvergate shut down and Signature was placed in receivership with the Federal Deposit Insurance Corp. earlier this month.

“There are dozens of other banks, both onshore and offshore, that are taking advantage of this opportunity,” said Rich Rosenblum, co-founder and president of crypto trading firm GSR.

Banks willing to service crypto firms have been inundated with applications during the past two weeks, crypto executives and bankers said.

After the collapse of Signature, one crypto banker said he enabled his phone’s “do not disturb” mode to get some sleep. He received so many texts in rapid succession that the phone overrode the setting.

Crypto trading firm B2C2 Ltd. is applying for 20 bank accounts across multiple currencies, according to its CEO, Nicola White.

A month ago, B2C2 had about half a dozen applications out, Ms. White said. “We clearly just want to diversify the options that we have,” she said.

The smaller banks that are open to crypto clients have been selective about whom they take on, dragging out the time it takes to establish accounts, bankers and crypto executives say.

One concern from the banks’ side is that they don’t want to have too much exposure to crypto for fear that it will make them a target for regulators.

“We believe that there is a set of U.S. banks that is likely to onboard some of the crypto firms, with a smaller concentration in each bank than previously,” said Michael Shaulov, chief executive of crypto-infrastructure startup Fireblocks Inc.

Fireblocks recently started banking with Fifth Third, people familiar with the matter said. The startup declined to comment on its own bank relationships.

A spokesman for Fifth Third said that, as a matter of corporate policy, the bank doesn’t engage in the business of banking companies that trade or directly handle crypto.

He added: “We recognize the need that all companies, including digital asset companies, have for traditional banking services including payroll, benefits, and accounts payable.”

Attracting deposits from crypto firms could help shore up banks’ balance sheets at a time when a string of failures has shaken confidence in the banking system. But it is a risky gambit.

Bank regulators have raised concerns about lenders’ involvement in crypto while the Securities and Exchange Commission’s aggressive pursuit of crypto firms has alarmed bankers who don’t want to do business with customers in the agency’s crosshairs.

Silvergate and Signature were attractive for crypto trading firms because they ran payment networks that let clients move dollars between each other on a 24/7 basis, making it possible to settle crypto-for-dollar trades outside normal banking hours.

The loss of Silvergate’s SEN network and the threat of losing Signature’s Signet network threw a wrench into the plumbing of crypto markets.

Now, crypto firms have been looking to move to regional banks that offer or are developing similar networks, such as Customers and Phoenix-based Western Alliance Bancorp., people familiar with the matter said.

“Losing SEN and Signet is operationally disruptive, but there are a number of regionals that are also building out these networks and services,” said Bob Rutherford, vice president of operations at FalconX, a digital-assets prime brokerage catering to institutions.

Among the larger banks, JPMorgan continues to provide banking services to crypto clients such as crypto exchange Coinbase Global Inc. BNY Mellon holds cash and Treasurys for stablecoin issuer Circle Internet Financial Ltd.

Other crypto firms have eyed offshore banks such as Puerto Rico’s FV Bank or Capital Union Bank in the Bahamas, industry executives said.

“The closure of Signature and Silvergate has prompted an increase in inquiries from prospective clients,” FV Bank CEO Miles Paschini said. “As a regulated bank and digital asset custodian we can offer firms who meet our strict compliance and risk requirements access to an integrated solution.”

Coinbase executives recently floated the idea of starting a crypto credit union that would help the industry access the financial system, people familiar with the matter said. A Coinbase spokeswoman said she would not comment on “rumor or speculation.”

Some executives cited Cross River as a growing force in crypto banking. After regulators shut Signature on March 12, Circle said it was partnering with the privately held New Jersey bank for automated settlement of its USDC stablecoin, replacing Signet and making Cross River an attractive option for firms using USDC.

A Cross River spokeswoman said the bank is considering accepting deposits only from companies with which it had existing relationships and “blue-chip customers who are integral to the fintech ecosystem.”

Other banks have welcomed new crypto clients, such as Surety Bank, a Florida lender with $220 million in assets that counts a number of cryptocurrency ATM companies as customers.

Crypto firms make up 5% of the company’s revenue. Surety CEO Ryan James said it is important for crypto firms to have access to banks.

“You want to be able to monitor it and have it in the American banking system,” he said. “You don’t want it to go underground.”

Updated: 3-27-2023

Bitcoin Has Benefited From U.S. Dollar Liquidity To Support Banks: Morgan Stanley

Traders on Binance now set the daily price for BTC with the crypto exchange’s share of trading volume reaching 80%, the bank said.

Expectations of increased U.S. dollar liquidity to support the banking sector following a string of forced closures has helped bitcoin (BTC) rally, but other factors are also at play, Morgan Stanley said in a research report Sunday.

Bitcoin, the world’s largest cryptocurrency by market cap, has gained 69% year-to-date.

“Bitcoin trading order book liquidity is at the lowest level in a year, meaning lower volumes can drive larger price moves than before,” analysts led by Sheena Shah wrote.

Traders on Binance, the world’s largest crypto exchange, now set the daily price for bitcoin with its share of trading volume reaching 80%, the report said.

Issuance of the largest stablecoin, tether (USDT), has risen 10% in the last month and 16% this year, but that hasn’t been enough to offset the reduction in other stablecoins such as binance USD (BUSD) and USD coin (USDC), the note said.

A stablecoin is a type of cryptocurrency whose value is pegged to another asset, usually the U.S. dollar. Stablecoins flows are indicative of money entering or leaving the crypto ecosystem.

Morgan Stanley noted that over half of total tether issuance – and 70% of recent issuance – is on the Tron blockchain.

Last week, the U.S. Securities and Exchange Commission sued Tron founder Justin Sun and his companies for fraud. Exchanges Kraken and Binance appear to be the main recipients of the new USDT, the note added.

US Crypto Firms Eye Overseas Move Amid Regulatory Uncertainty

Citing an ongoing regulatory crackdown, crypto companies are considering shifting to more favorable jurisdictions. Jeff Wilser reports.

I recently spoke with U.S. Senator Cynthia Lummis (R-Wyo.), aka “the Crypto Queen,” who wants to pass legislation that will bring regulatory clarity to the cryptocurrency space. She’s frustrated it hasn’t yet happened.

“The failure of the United States Congress to enact policy is pushing the industry to other countries,” she said.

“Europe is ahead of us in terms of its regulatory framework. Australia and the U.K. are getting ahead of us. Switzerland is far ahead of us.”

Other notables have said something similar. The CEO of Ripple, Brad Garlinghouse, told Bloomberg the crypto industry has “already started” moving outside of the U.S. Coinbase, the largest U.S.-based crypto exchange, is considering launching an overseas trading desk, driven by U.S. regulatory uncertainty.

Circle, issuer of the USDC stablecoin, is opening a new office in Paris because, as Circle’s chief strategy officer has said, “France is increasingly seen as a leader in crypto.”

So how serious is this threat? Are U.S. crypto companies really leaving? Or are these just the Web3 boys who cried wolf? (Garlinghouse, after all, threatened to move Ripple’s headquarters from the U.S. in 2020. Ripple is still here.)

“100%. It’s happening. It is absolutely true that people are leaving,” says Jason Gottlieb, a crypto-focused lawyer and partner at Morrison Cohen. Gottlieb says many of these founders are 20-something, without kids, and are able to work from anywhere. “Some of the brightest young entrepreneurs we have are saying, ‘Well, forget it. I’ll go to the Caymans. I’ll go to Portugal. I’ll go to Singapore.’”

I’ve seen some of this. In 2018 and 2019 I lived exclusively abroad, bouncing around digital nomad hubs including Lisbon, Budapest, Chiang Mai and Bali. Each spot had a bustling crypto scene. If you’re young and single and filled with wanderlust, why wouldn’t you want to live in a beachfront villa that costs $600 per month?

(As I wrote in 2018, crypto and digital nomads are a natural fit because “nomads, by definition, are decentralized.”) Then the COVID-19 pandemic accelerated this broader trend of Americans working overseas as the rest of the world discovered the concept of remote work.

And now? The last few weeks of regulatory and banking concerns have added “jet fuel” to crypto looking overseas, says David Nage, portfolio manager at Arca.

“The ability to operate is becoming less and less profitable for many startups in the United States,” he says, adding that many founders are considering Europe, Hong Kong and Latin America as possible alternatives. “No one has left yet,” says Nage. “They are exploring their options.”

So as of now the threat to leave is mostly talk, not action. But there’s a lot of talk. “This comes up constantly,” says Paul Kuveke, the chief operating officer of Mintbase, a non-fungible token (NFT) platform incorporated in the US. Kuveke says the decision of staying or leaving the U.S. is a frequent topic of conversation and is “something we constantly monitor.” One big reason is the legal ambiguity. “We live in a lot of gray areas.

We want answers,” says Kuveke. “Every conversation to do anything involves a consultation with lawyers. It’s expensive.” He adds that confusion about crypto tokens (are they a security?) has spooked founders.

“If you’re going to do a token sale of any kind, the consensus is to not launch in the United States. Go somewhere else,” says Kuveke.

The last month has seen a spate of government-mandated shutdowns of banking services for crypto companies, in what some are calling “Operation Choke Point 2.0” – a reference to an Obama-era program to deny financial services to legal but politically undesirable activities.

Meanwhile, the Securities and Exchange Commission has launched enforcement actions against major players including Coinbase, accusing the platforms of flouting securities laws.

Anxiety over tokens is one reason developers can have incentive to move overseas, says Kristin Smith, CEO of the Blockchain Association. “A lot of developers are compensated in tokens,” says Smith, such as those who contribute to a decentralized autonomous organization (DAO).

Smith cites a report from Electric Capital, a VC firm, titled “U.S. Share of Web3 Developers Is Shrinking.” It says that “global Web3 software development activity has grown more outside the U.S., threatening the U.S.’s preeminence in finance and technology.”

As my colleague Emily Parker has compellingly argued, crypto leaving the U.S. would impact more than just crypto. Think about the economic impact.

“If you have a gigantic office building stuffed with tech workers in New York City, all those people are going to eat lunch in sandwich shops across the street,” says Gottlieb. “Now they’re eating Ban Mian from the streets of Singapore.”

Nage estimates that $3 billion of crypto wages in the U.S. translates to over $750 million in taxes, and “there are definitely going to be countries that are welcome to that tax revenue.”

Smith even considers the growth of Web3 to be important to national security because “the next generation of the internet is going to be built on top of crypto networks,” and “we want to make sure the U.S. is leading that.”

“It’s happening. It is absolutely true that people are leaving.”

For Nexo, a crypto lending platform, leaving the U.S. was not just theoretical. “We had gotten to the point where retaining [U.S.] customers actually created difficulties and costs which didn’t match the expected revenue,” says Antoni Trenchev, Nexo’s co-founder and managing partner.

“On the engineering side, certain products couldn’t be offered in the same way [in the U.S.] so we had to rework the platform,” he says, which increased their engineering costs.

Ultimately the situation was “not viable,” so Nexo planned an orderly 18-month withdrawal. (It’s true that Nexo was issued cease-and-desist letters from several states; Trenchev says “that really caught us by surprise” because at that point they were already conducting a phased withdrawal.)

Trenchev has no regrets. Nexo has replaced the market share it lost in the U.S. with growth in the Middle East, North Africa and Southeast Asia, he says.

Nexo is setting up its new headquarters in Dubai, which Trenchev describes as having clear and friendly crypto regulations and a welcoming atmosphere.

“You have a lot of expats moving here,” says Trenchev, who adds that 800 crypto companies are “setting up shop” in the United Arab Emirates, which “creates an ecosystem of professionals and people you can hire.” Trenchev was particularly impressed by Dubai’s “Zero Problem policy” – a philosophy that businesses should face zero problems when they do business.

For him, the perks of “zero problems” have included clear regulations, top-tier internet, banks that welcome crypto clients and “food that only takes 15 minutes to get delivered.”

Others could soon be joining him. Smith says that she frequently hears joking comments from members of the Blockchain Association such as, “I guess we’re moving to Dubai!”

Some of that could be real, and some of that could be purely in jest. For many, this is similar to when Donald Trump won the presidency in 2016 and many Democrats talked about moving north to Canada.

Most stayed put, however. It’s easy to joke about moving to Montreal but harder to actually do it, which is something many crypto companies are discovering.

“The United States, overall, has the best infrastructure and support for small businesses in general,” says Kuveke, who has found it easier to do banking in the U.S. than Portugal, where he says the banks are “mind-bogglingly terrible.”

And moving to another country is “not a casual process,” says Kuveke, because it involves a gauntlet of paperwork and approvals and is “many months of work.” As of now his company, Mintbase, plans to remain in the United States.

Marshall Hayner, the CEO of Metallicus, a digital asset banking network, also decided to remain in the U.S. One reason is the simple fact that he enjoys living in the United States. “I love it here,” says Hayner.

But the motives are not just sentimental. “20% of the crypto market is based in the U.S.,” says Hayner, and he has little interest in abandoning that lucrative customer base.

He also thinks it’s important to be in the U.S. for a company to have legitimacy. “If you’re not part of the U.S. market, you just can’t be that big in the world of technology, right? You just can’t.”

“We’re at this critical moment. We really need to get the tone of government to change.”

Then there’s the possibility that in the future, if and when the U.S. passes clear regulation, the other international standards will eventually follow suit.

“When it comes to regulation and policy around financial services, the gold standard tends to be the U.S. and Europe. And then the other countries follow,” says Hayner.

So his logic is that if the U.S. ultimately issues guidelines that shape the global framework, why ditch the U.S. (and its wealthy customers) now just for a bit of corner cutting?

Kuveke has the same approach. “The U.S. will always take the lead on this stuff,” he says. “There’s not another country in my mind that will come out with regulation that everyone else will adopt.”

Kuveke clarifies that this is a long-term analysis – no one knows when the U.S. will take action – and that others in the space might not share his optimism because “most startups and small businesses don’t have the luxury of thinking on a 5-year or 10-year time horizon.”

This overall approach – swallow the bitter medicine of U.S. compliance, hope for better in the future – squares with what Preston Byrne, the tech and crypto-focused partner at Brown Rudnick, sees from his clients.

“Most of my American clients want to comply with American law,” says Byrne. He adds that they are taking a “harder approach towards compliance, even if it’s going to slow them down in the beginning.”

All that said, it’s possible that even if companies do not completely “leave” the U.S., in a more subtle manner the bumpy regulatory environment could leave the nation worse off.

“We see less growth of new products and services,” says the Blockchain Association’s Smith. She points to Coinbase as an example, saying the company has effectively said, “Maybe we need to focus on our derivatives offerings overseas.”

On a more macro level, Byrne says that because of the deep coffers of venture capital in Silicon Valley and New York, “the United States has sucked all of the oxygen out of the room, from a global point of view.”

But if the U.S. is about to get “kneecapped by their own regulators,” then that oxygen will flow to other parts of the world.

Smith doesn’t see an exodus as inevitable. “We’re at this critical moment. We really need to get the tone of government to change,” she says.

“We need to spread the fact that this is still a relatively nascent technology but there’s potential, and we want the United States to lead the innovation.” Ultimately, she thinks that “all is not lost. We can still turn this around.”

Crypto Industry Defies Strife As ETP Debuts Pick Up, Flows Rise

* Six Products Launched This Month, Most Since September 2022

* Crypto ETPs See About $182 Million In Inflows Last Week: BI

Exchange-traded products focused on digital tokens are launching at the fastest pace since before the collapse of FTX.

The new funds arrive as investors pour money into crypto products amid turmoil in the banking industry. But they also come as the crypto industry is being assailed by a number of regulatory enforcements and actions looking to clamp down on fraud and market manipulation.

On Monday, cryptocurrency exchange Binance Holdings Ltd. was sued by the US Commodity Futures Trading Commission for allegedly breaking derivatives rules.

“One of the most common reasons for crypto that advocates have always said is that it’s an alternative to the traditional financial system,” said David Donabedian, chief investment officer of CIBC Private Wealth US. “So in the midst of an environment in which it’s front-page news every day that there are issues in the US banking industry, I think it’s viewed as an opportunity to tout an alternative.”

Crypto fund provider CoinShares launched two physically backed exchange-traded products in Europe on Monday, while an investment product tied to Bitcoin from Bitwise started trading in the US last week.

That’s all on top of three new crypto ETPs that debuted in Europe from issuer Global X earlier this month.

That’s the greatest number of product debuts in one month since September, when there were seven launches, before the implosion of the once-vaunted FTX empire, which crypto investors have been attempting to move beyond.

The overall universe of funds is attracting investor money, too. All in all, cryptocurrency ETPs saw about $182 million in inflows for the week ending March 24, the best weekly showing since May 2022, according to data compiled by Bloomberg Intelligence.

The industry is likely betting that there’s still a lot of demand for crypto products even though prices were volatile last year, says Todd Sohn, ETF strategist at Strategas Securities.

“There’s still some demand out there for easy, transparent access” to alternatives like crypto, Sohn says.

Bitcoin and its brethren were staging somewhat of a comeback this year, as the financials sector sold off amid a banking crisis that buoyed the return of original narratives surrounding Bitcoin’s genesis, including that the digital asset’s independence from the traditional financial system could make it immune to its stresses.

But the rally was derailed Monday after the Binance lawsuit. Bitcoin fell as much as 4.5% on the news.

In the US, ETFs focused on digital assets remain the best performing for the year thanks to the rally in crypto prices, including a roughly 63% year-to-date run for Bitcoin.

The Valkyrie Bitcoin Miners ETF (ticker WGMI) is up more than 90% in 2023, while the Vaneck Digital Assets Mining ETF (DAM) and the VanEck Digital Transformation ETF (DAPP) round out the top three spots with returns of 75% and 59%, respectively.

To be sure, funds can take a long time to see the light of day between filing and launch, and timing anything perfectly is near impossible, says Bloomberg Intelligence’s Athanasios Psarofagis.

Plus, crypto firms, given the ethos of truly believing in the asset class, means they’re always “all in.”

“Also, as backwards as it may sound, it’s not a bad idea to launch after a bad run,” he says, adding that your performance looks great since inception if the market comes back because you launched at the bottom.

“So it’s like, ‘it can’t get any worse, let’s launch now,’” Psarofagis says.

Updated: 3-28-2023

Adoption And Nerves — Crypto Pumps Amid Banking Crisis

Despite four major banks imploding recently, Bitcoin remains resilient, but questions persist over the long-term sustainability of its ongoing rally.

On March 19, the United States Federal Reserve announced that it had entered a joint program with several major central banks — including the European Central Bank, the Bank of Canada, the Bank of England, the Bank of Japan and the Swiss National Bank — to support U.S. dollar cash flow and alleviate strains in global funding markets.

Moreover, Fed Chair Jerome Powell said swap lines — agreements between two or more central banks to maintain a crucial liquidity backstop and ease strains in global funding markets — will remain active until at least the end of April.

This could result in the Federal Reserve slowing its rate hikes, which have been cited as a contributing factor to the ongoing banking crisis.

Since the beginning of March 2023, several major financial entities, including Silvergate Bank, Silicon Valley Bank (SVB), Signature Bank and Credit Suisse, have collapsed.

Despite these developments, Bitcoin has rallied, reaching a high of $28,500 on March 24, its highest level since the crypto crash of June 2022. After a slump in March, where the flagship cryptocurrency dropped below $20,000, Bitcoin seems to have resumed its 2023 rally.

Since January, when Bitcoin traded at around $16,500, the digital asset has gained an impressive 72.73%. Of the roughly 4,600 days of Bitcoin as a tradable asset, investors have experienced 4,065 profitable days, challenging the instability-driven narrative surrounding the crypto ecosystem.

The Banking Crisis Explained

In recent weeks, the global banking industry has been rocked by a slew of events, sending shockwaves through financial markets. In Europe, Credit Suisse collapsed and had to be “rescued” by rival bank UBS.

This development did not surprise those following Credit Suisse’s monetary and legal troubles, which have been widely reported for months.

The Swiss National Bank and the Swiss Financial Market Supervisory Authority agreed to back up Credit Suisse with an emergency loan of 50 billion francs ($54.5 billion) if necessary.

UBS agreed to purchase Credit Suisse for $3.25 billion, which is less than half its market value just days before, but much higher than the initial offer of $1 billion, which Credit Suisse declined.

Meanwhile, the United States faces its own banking crisis across the Atlantic. Several banks, including SVB, Signature Bank and Silvergate Bank, have collapsed recently, prompting the Federal Reserve and the government to shore up depositors.

The banks mentioned above all faced large-scale bank runs.

These events typically occur when a bank loses the confidence of its customers, resulting in mass withdrawal requests.

In response to these developments, the Fed has used the Bank Term Funding Program (BTFP) to inject additional liquidity into the banking system and cover deposits, with politicians reassuring the public that the banking system is secure.

While these actions have attempted to restore confidence in the banking system and financial markets, some analysts warn they may only provide a short-term solution.

A recent study has shown that the U.S. banking system is highly vulnerable, with many banks potentially becoming technically insolvent during a bank run. Assuming the worst-case scenario of 100% uninsured deposits withdrawn, the study’s authors note that over 1,600 U.S. banks could collapse overnight.

What’s even more head-scratching is the researchers suggest that even if just 30% of uninsured deposits were to be withdrawn, 106 banks would collapse.

The Numbers Seem To Be In Favor Of Crypto

Bitcoin has been on a roll, gaining more than 13% over the past week and trading at $28,430 at the time of writing. The troubles facing the traditional banking system have raised concerns about trust in traditional assets, with more money seeming to flow into Bitcoin.

According to data from Coinglass, open interest in Bitcoin futures reached $12 billion over the weekend, a yearly high pointing to renewed interest in the flagship cryptocurrency.

Bitcoin open interest refers to the total number of outstanding positions in Bitcoin futures contracts that have not been closed or settled. It is a measure of market activity and interest in Bitcoin futures trading. When open interest is high, it suggests a lot of investor interest in BTC and vice versa.

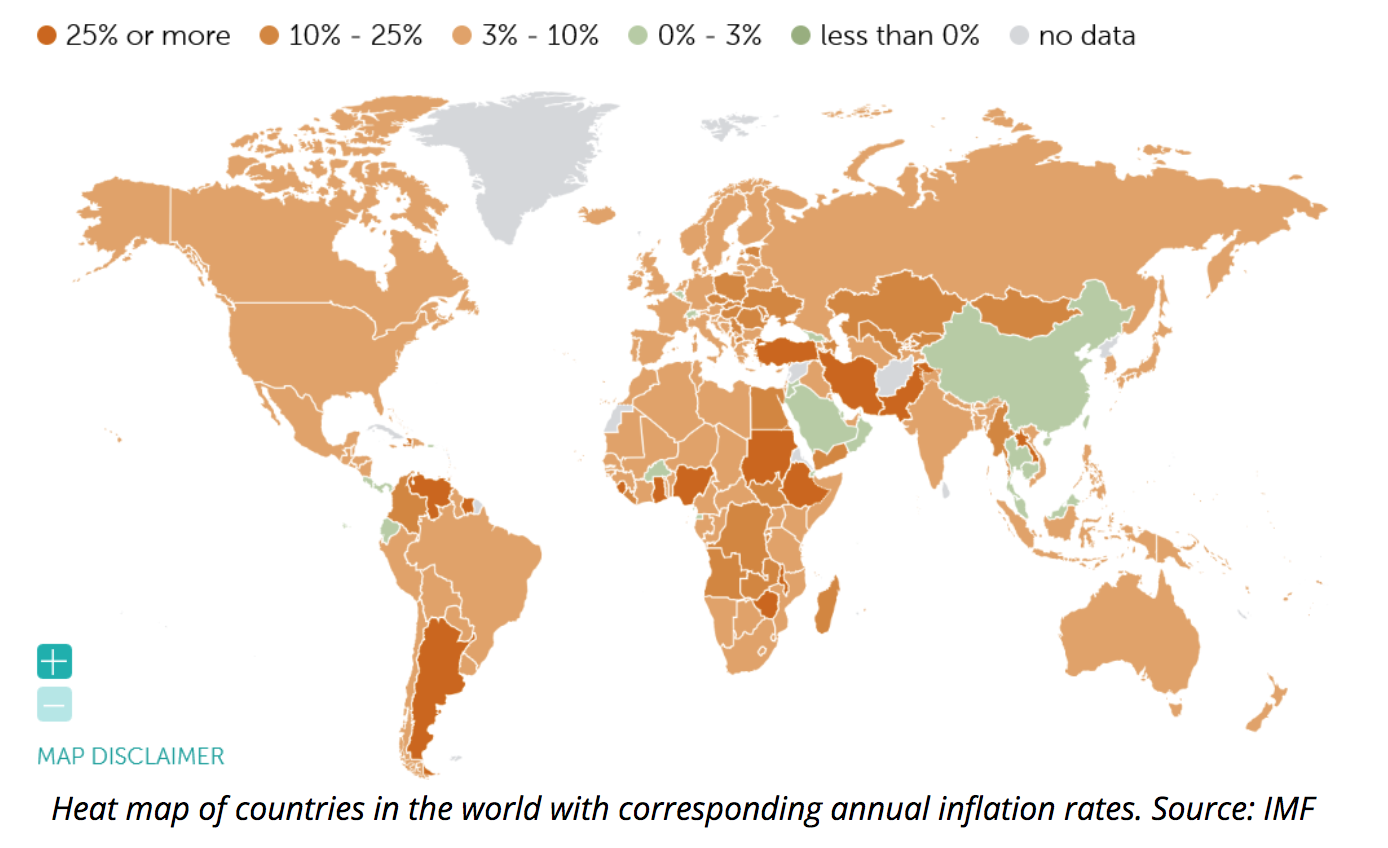

The renewed interest in crypto comes amid growing concerns over inflation, increasing global debt levels, and the unprecedented monetary and fiscal policies adopted by central banks and governments worldwide.

What Lies Ahead For Bitcoin?

With the ongoing fiscal momentum surrounding the crypto sector showing no signs of abating, $30,000 has continued to serve as a significant hurdle for Bitcoin.

However, if the digital asset approached or breached this level, many bulls could rake in short-term profits for themselves, potentially causing the cryptocurrency to dip again.

In an interview with Barron’s, Alex Thorn, head of research at digital asset group Galaxy, said we could be witnessing a seminal moment for Bitcoin.

He believes that as the fractionally reserved banking system teeters on the brink, “Bitcoin’s resilience, predictability, and relative safety stands in stark relief.”

Moreover, the Crypto Fear & Greed Index hit its highest index score this year, recording 66 on March 20. These levels have not been seen since Bitcoin posted its all-time high in November 2021. As of March 24, the index is sitting on a rating of 61, placing it firmly in the “Greed” territory.

The Crypto Fear and Greed Index aims to numerically present the current “emotions and sentiments” toward Bitcoin and the cryptocurrency market, with the highest score being 100.

The last time the index recorded a score above 66 was on Nov. 16, 2021, just days after Bitcoin’s all-time high of $69,000.

Chris Bradbury, CEO of decentralized finance platform Oasis.app and former lead product manager for MakerDAO, told Cointelegraph the latest rally is related to banking collapses and the broader fear in the U.S. and European banking sector, which saw vast amounts of value wiped out of bank stocks. He added:

“It’s unlikely we will see a sustained rally directly from this; however, we have started to see activity on-chain picking back up since the start of the year and a little bit more optimism more generally in the markets.”

Other observers of the crypto space think the recent pump is explained by factors that are less generous to the hypothesis of crypto as a safe haven and alternative to the traditional financial system.

Crypto researcher and software engineer Molly White recently noted that, among other things, Bitcoin is experiencing low liquidity and could also serve as an exit for traders nervous about stablecoins.

As USD Coin-to-dollar off-ramps were limited early in the banking crisis, many decided to move to different crypto assets like Bitcoin, White argued.

She further stated that influential people stand to benefit from an increased Bitcoin price. Ex-Coinbase chief technology officer Balaji Srinivasan made a $2 million bet that Bitcoin will hit $1 million in the next 90 days based on a belief that incoming liquidity from the Fed will “hyperinflate the dollar.”

As White posited, “If he owns a lot of Bitcoin already, or has OTM [out of the money] long positions, $3 million (counting the two bets plus the $1 million in tweet payments) would be a small price to pay if he can get BTC to tick up a few percentage points.”

As we head into a future plagued by growing financial uncertainty, it will be interesting to observe how the crypto market wades through the macroeconomic uncertainty permeating the global economy.

Updated: 3-30-2023

3 Strategies Crypto Firms Can Use To Land A New Banking Partner

After the recent collapse of three crypto-friendly banks, many firms are left hunting for new banking partnerships. Brett Philbin, Rachel Millard and Rosie Gillam of Edelman Smithfield offer advice.

If your crypto firm is on the hunt for a new bank, you are not alone.

The recent collapse of three crypto-friendly banks has added a fresh obstacle for digital asset firms that are still grappling with the impact of crypto winter and a regulatory crackdown.

But communications can play a key role in helping you define your public image and potential risks associated with your business – factors that potential banking partners are watching closely.

Brett Philbin is an executive vice president, Rachel Millard is a senior vice president and Rosie Gillam is a senior vice president in Edelman Smithfield’s Financial Services Practice.

Below Are Three Strategies That Can Aid In The Banking Courtship Process:

Clearly Articulate Your Focus On Risk And Compliance

There is high value in ensuring that the controlled elements of your business are front and center. Crypto is the least trusted of financial services subsectors, according to the 2023 Edelman Trust Barometer, which in November surveyed more than 32,000 respondents across 28 countries.

That’s a big reason why it’s critical that licenses, registrations and compliance standards are included in a prominent place on your website. Consider making them central to your “about the company” message. Highlight any compliance or financial health measures your company takes.

Ensure your risk management officer or chief financial officer is featured on the website along with their bios.

This step sends the message to prospective banking partners that you have someone in-house who can interact with them in the way they’re accustomed to working. These seemingly minor changes are valuable: They highlight the measures you have taken to reduce risk within the company.

Revisit Messaging On Your Corporate Website And Social Channels

Assume potential banking partners will do their homework by visiting your corporate website and your corporate social channels to deepen their understanding of your business, your leadership team and recent developments that could impact whether or not they choose to partner with you.

Make certain that critical information is accessible and understandable (spend time carefully crafting your “about” page). This is especially important if you operate in a niche category within the broader crypto ecosystem.

A decentralized exchange, for example, should be explicit in explaining how it differs from a centralized exchange, to help less-adept audiences understand the nuanced differences between the two.

Beyond the website, be sure to conduct a quick refresh of your social channels. Your online presence and demeanor can play a role in the evaluation process.

Use these channels to communicate updates about the company, including any recent developments that demonstrate long-term viability such as customer wins, partnerships and product launches.

On the other hand, while Crypto Twitter is awash with policy hot takes, consider whether your company is in the best position to contribute to this conversation.

Banks evaluating potential partners may weigh the liability associated with a firebrand company leadership willing to tweet at any regulator without regard for the impact it could have on their image.

Engage Trade Associations To Fight Some Battles

For many organizations, it’s better to skip the hot-take policy tweet and instead consider engaging with industry trade associations to carry forward those concerns and objectives.

Trade associations carry weight within Washington, D.C. They are able to take tough policy positions publicly and generate media interest in them in a way that individual companies cannot.

These organizations can also help broker productive and impactful backroom conversations with policymakers and facilitate introductions to potential partners and allies that can be helpful in driving longer-term growth strategies for your business.

Now more than ever, it’s clear the first stop on the road to mass crypto adoption is for firms to find a bank they can trust. The right communications strategy can help ensure you don’t end up having to settle for a tier-2 or tier-3 banking option. Employ these tactics to expedite your transition to a new banking partner today.

Updated: 3-28-2023

Turns Out The World’s Favorite Safe Asset Isn’t Risk-Free After-all #GotBitcoin

US Treasuries came back to haunt investors and bankers who ignored the basics of interest-rate risk—and there could be more surprises in store.

Look deeper into the latest US banking crisis, and the cause may come as a surprise to anyone still thinking in terms of the crash of 2008. It wasn’t dodgy loans to impecunious homebuyers that sank Silicon Valley Bank.

It was a stash of what are thought to be the safest securities on Earth: US Treasuries.

Those loans to the government were, of course, entirely safe in a very important sense. Uncle Sam is going to be good for the cash. (Set aside an unforeseen disaster with the debt ceiling—more on which in a moment.) But the final repayment date of SVB’s bonds was typically years away.

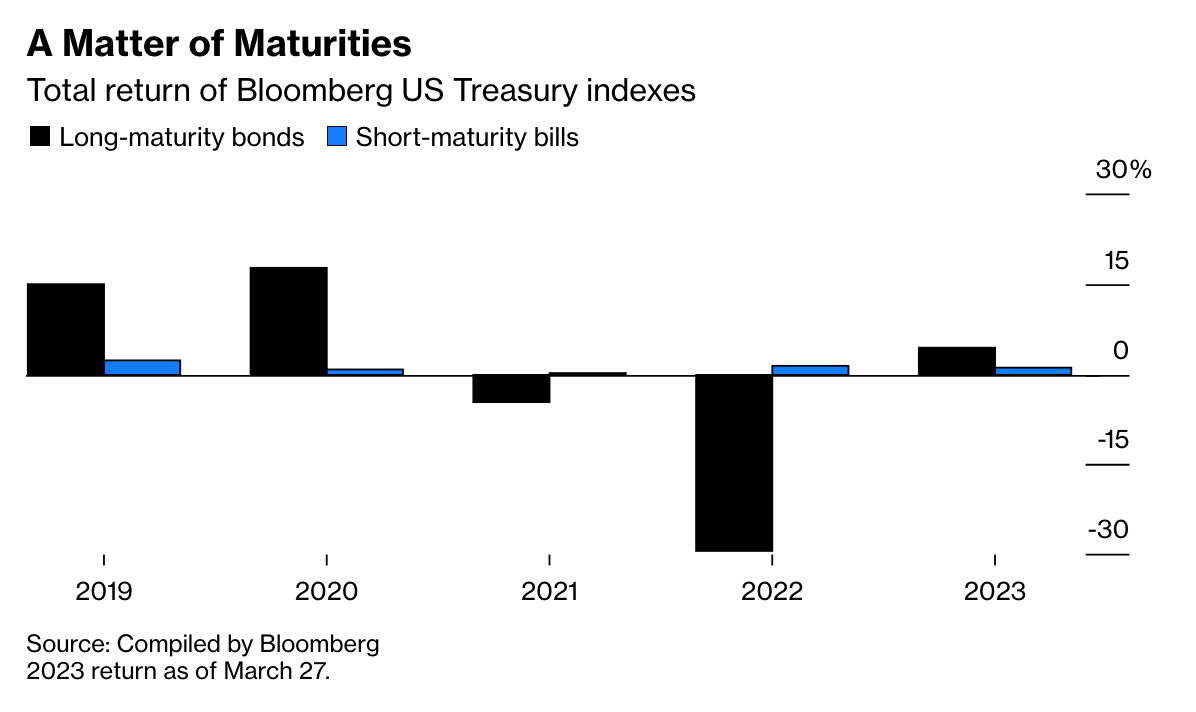

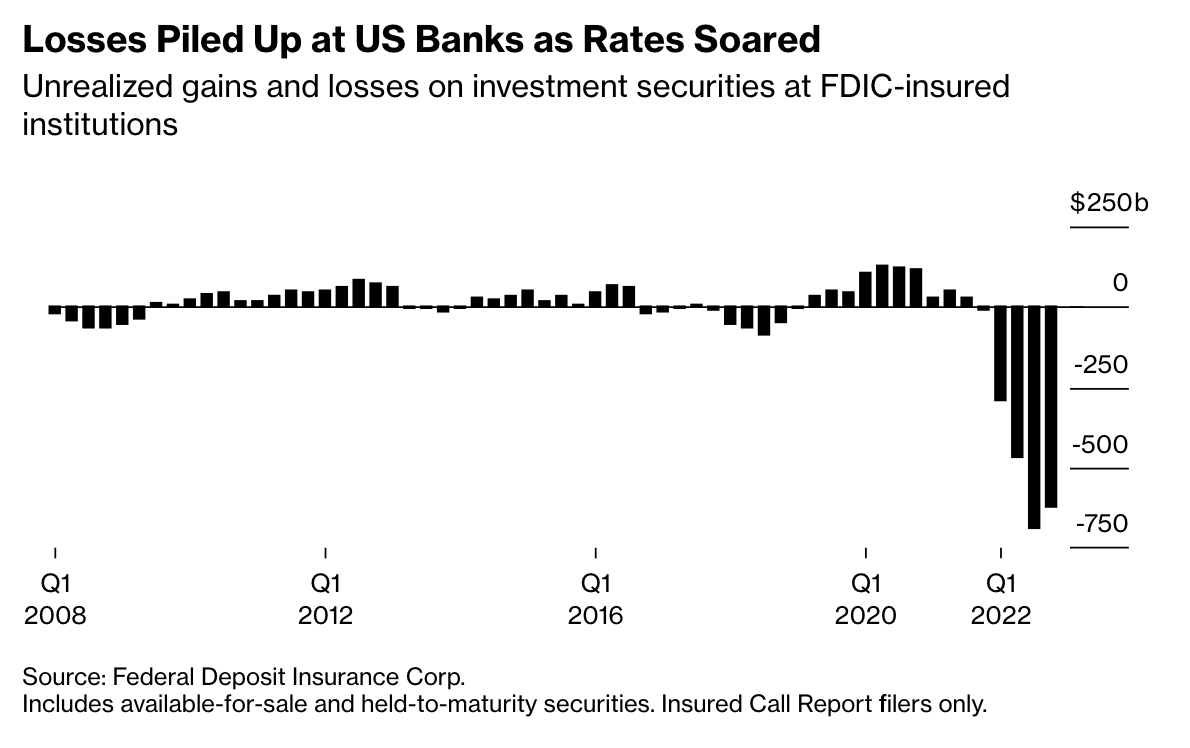

The problem is what happens to their price in the meantime. Purchased during a time of ultralow interest rates, those long-maturity Treasuries were always liable to lose their immediate resale value if rates took off. Which they’ve done in a big way over the past year.

The Federal Reserve raised rates at the fastest pace in decades to tame inflation, pushing its key policy rate from about zero to a range of 4.75% to 5%. Treasury prices spiraled downward, since bond prices move in the opposite direction of rates.

That’s only an immediate problem for someone who wants to sell a bond before it matures. Unfortunately for SVB, it fell into that category.

Its clients, many of whom had much more than $250,000—the cap on federal deposit insurance—at the bank, got nervous and started yanking out their money. SVB could only sell Treasury holdings, as well as mortgage bonds backed by government agencies, at steep losses. The bank collapsed within days.

“We always refer to Treasuries as the world’s safest asset,” says Paul McCulley, the former chief economist for Pacific Investment Management Co. “That’s from the standpoint of credit quality. That’s not from the standpoint of asset price stability. There’s a huge difference.”

Kim Forrest, chief investment officer of Pittsburgh-based Bokeh Capital Partners, says she can’t get over how SVB bankers failed to spot the duration risk they were taking. “It’s kind of head-spinning,” she says.

“They have to really know the parameters of what is going to happen to these bonds, given the forecasts for interest rates. What the heck happened? The supposedly bright people out in Silicon Valley couldn’t put that together and do a little calculus?”

Most banks don’t have as many uninsured deposits from jumpy tech startups as SVB did, but US lenders hold more than $4 trillion in government-backed securities. And Treasuries last year posted their worst losses since at least the early 1970s, with the longest-dated ones tumbling almost 30%.

That’s one reason fear of bank contagion won’t go away, even after the Department of the Treasury, the Fed and the Federal Deposit Insurance Corp. swooped in to offer emergency protection for all depositors at SVB and New York’s Signature Bank, which collapsed around the same time.

Policymakers haven’t said for sure whether other lenders will enjoy the same cover. Deposits have continued to flow out of banks—especially smaller, regional ones.

The Fed loaned billions to banks after SVB’s collapse to ensure their liquidity, including new emergency programs that offered generous terms for borrowing against Treasuries and other bonds that had lost value.

Essentially, the central bank—which already holds trillions of dollars’ worth of the low-yielding debt issued in the pandemic—was taking even more interest-rate risk out of the banking system.

But the Fed is also pushing ahead with monetary tightening. It raised rates another quarter of a percentage point on March 22. Bond prices have rallied anyway, because markets think Chair Jerome Powell and his colleagues will change course. If they don’t, that could spell more losses for Treasuries—and more trouble for banks that hold them.

Rising rates aren’t the only problem in the $24 trillion Treasury market. Another is a long-standing concern about the market’s liquidity—essentially, the ease with which trades can be carried out.

Many institutions and businesses count on the Treasury market to function smoothly. The past month’s fear and uncertainty has created near-unprecedented volatility, with the largest swings in some yields seen in 40 years.

Liquidity was “significantly compromised,” JPMorgan Chase & Co. strategists told clients in mid-March, as trading in Treasuries surged to a record $1.5 trillion on one day.

There are various explanations of the liquidity problem. Treasury debt has ballooned by more than $7 trillion since the end of 2019, and there’s a widespread belief that the size of the market has outstripped the capacity of bank dealers to keep it orderly.

Many say regulations imposed on banks after the 2008 financial crisis have also crimped dealers’ ability to keep enough bonds on hand to make sure buying and selling proceeds without hiccups

The Fed, Treasury and other regulators have been working for years on proposed fixes, but change has been slow in coming.

Then there’s the looming debt ceiling standoff—the possibility that politicians won’t reach a compromise on raising the nation’s self-imposed borrowing limit.

Failure to do so before the Treasury runs out of ways to keep funding government spending could potentially trigger an unprecedented default on US public debt and throw a wrench into the global financial system that relies on Treasuries.

The 2011 debt ceiling episode spurred S&P Global Ratings to downgrade US government bonds from the top AAA rating, days after a deal to lift the limit and avert default was reached.

The recurring fights in Washington over debt limits may be one reason investors around the world have been showing more interest in potential alternatives to US Treasuries as a safe place to store wealth.

Another is America’s aggressive use of financial sanctions, including the freezing of Russian central bank assets after the invasion of Ukraine, which has left some countries that hold lots of Treasuries wondering: Could that happen to us, too, someday?

Global alternatives that sometimes get touted include old favorites such as gold, new monetary units based on commodity baskets, or the currencies of other large economies, like China’s yuan—even though it’s hard to make a persuasive case that any of them are better than Treasuries.

For many American investors seeking a risk-free asset, cash seems like the best option. Below the $250,000 cap on FDIC insurance, a bank account is reliable.

But many individual and institutional savers alike have over the past months been seeking other options, like higher-yielding US money funds—which just attracted their biggest weekly influx since early in the pandemic.

Those funds invest heavily in Treasuries, though at very short maturities that largely protect them from interest-rate risk. As rates go up, the funds can keep rolling over their holdings and pay investors the new higher rates.

How much more volatility is in store for Treasuries—and how much more damage the financial system suffers as a result—mostly hinges on the Fed.

History suggests the US central bank has a poor track record when it comes to pulling off a major policy shift without something blowing up. SVB is already Exhibit A for this cycle.

McCulley recalls the wrecking of the US savings and loan industry in the 1980s—smallish mortgage lenders who went bust partly as a result of the same kind of duration risk that’s piled up on bank balance sheets today.

He points out that the Fed has been raising rates at the fastest pace since back then, when former Chair Paul Volcker oversaw the inflation fight. And he says his key question for the Fed is this: “For the last year you’ve been channeling Paul Volcker. How much Volcker is too much Volcker?”

Updated: 4-10-2023

Bitcoin Rallies Past $30,000 Mark For The First Time Since June

* World’s Largest Digital Asset Gains About 80% Year To Date

* Analysts Say Rebound Is Partially Due To Lower Liquidity

Bitcoin climbed above $30,000 for the first time since June, bolstered by bets on easier monetary policies that have made cryptocurrencies standout performers this year.

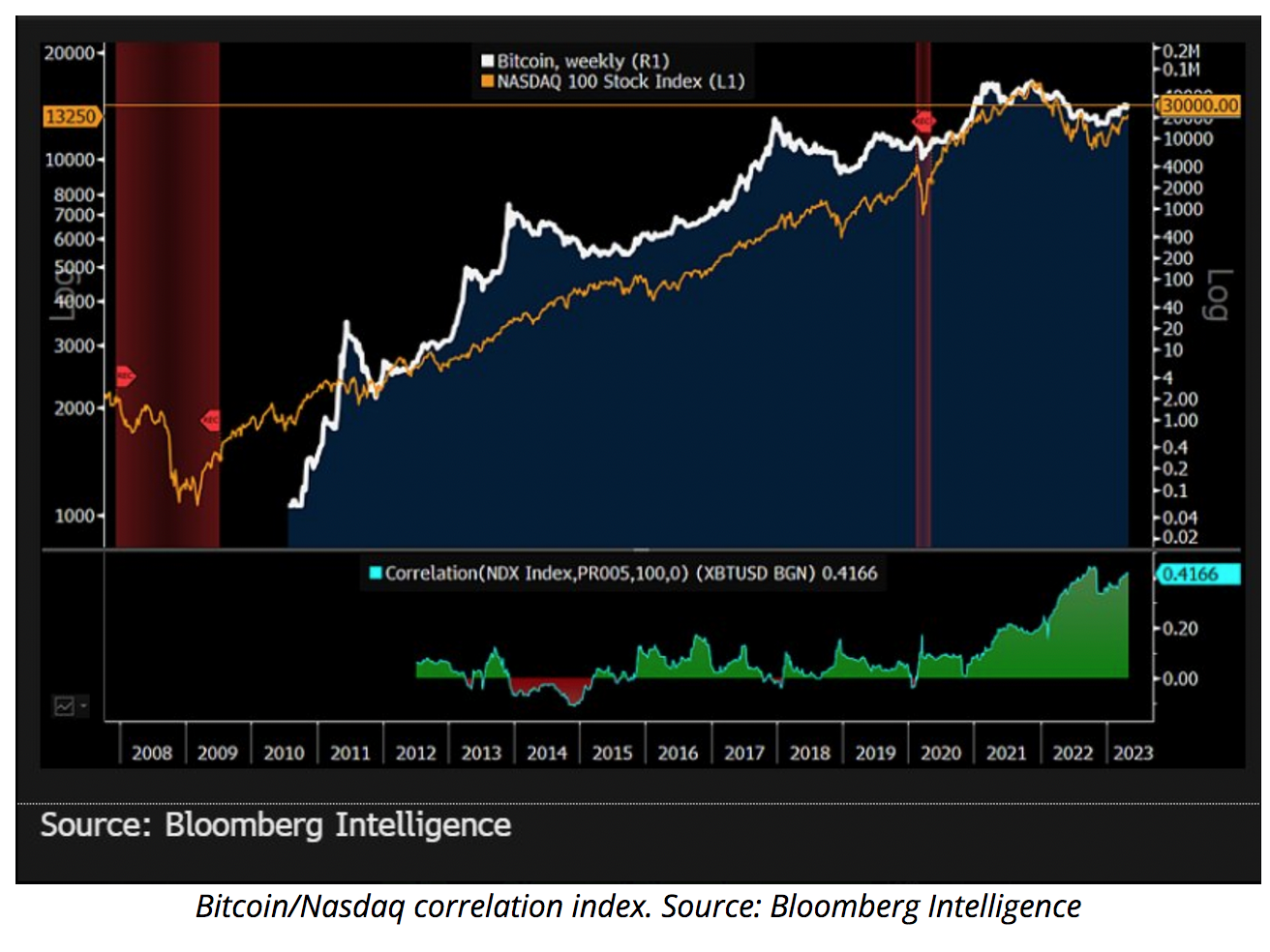

Bitcoin is now up 82% since Dec. 31, handily beating the tech-heavy Nasdaq 100’s 19% gain. Gold, another investor favorite this year, has climbed around 10%. Crypto’s rapid ascent has seen Bitcoin vault past where it stood when hedge fund Three Arrows Capital imploded last summer — yet it remains more than 50% below its all-time high in November 2021.

“30K is obviously a psychological magnet now,” said David Brickell, director of sales at Paradigm. “The bigger question is why is BTC not higher,” he said, adding that the coin looks to be ready to “take the next leg higher.”

Underpinning Bitcoin’s partial comeback are expectations that the banking crisis that erupted in the US in March will force the Federal Reserve to hit pause on rate increases.

That’s boosted the view among Bitcoin bulls that the token stands to gain from lower real interest rates, and that it offers shelter from turmoil in traditional finance.

“This rally may, in part, be driven by the expectation that rate hikes are almost done, but some groups of investors are drawn to crypto because it’s an asset outside of traditional banking and finance,” said Bradley Duke, co-chief executive officer of crypto exchange-traded product provider ETC Group.

Digital assets over the past two sessions broke out of weeks of range-bound trading, with analysts also citing technical factors as having given the token a nudge.

But hanging over the rally is persistently low liquidity, which bears say distorts pricing and could cause a rapid reversal should central banks stand firm on battling inflation.

“30K is very significant for both technical and fundamental reasons,” said Mati Greenspan, Quantum Economics chief executive officer. “The resistance has been building up for three weeks straight and has now finally broken.”

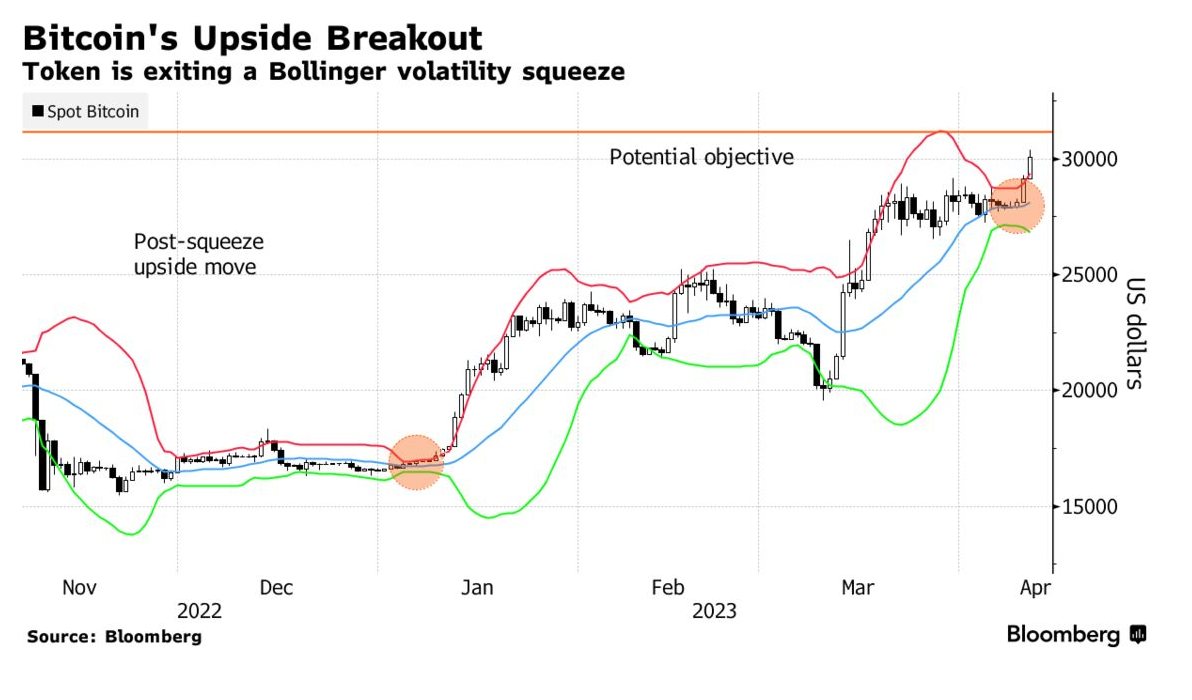

Bitcoin’s breakout above stiff resistance at $30,000 comes after a so-called squeeze of the Bollinger Band, which saw historical volatility fall to the lowest since January.

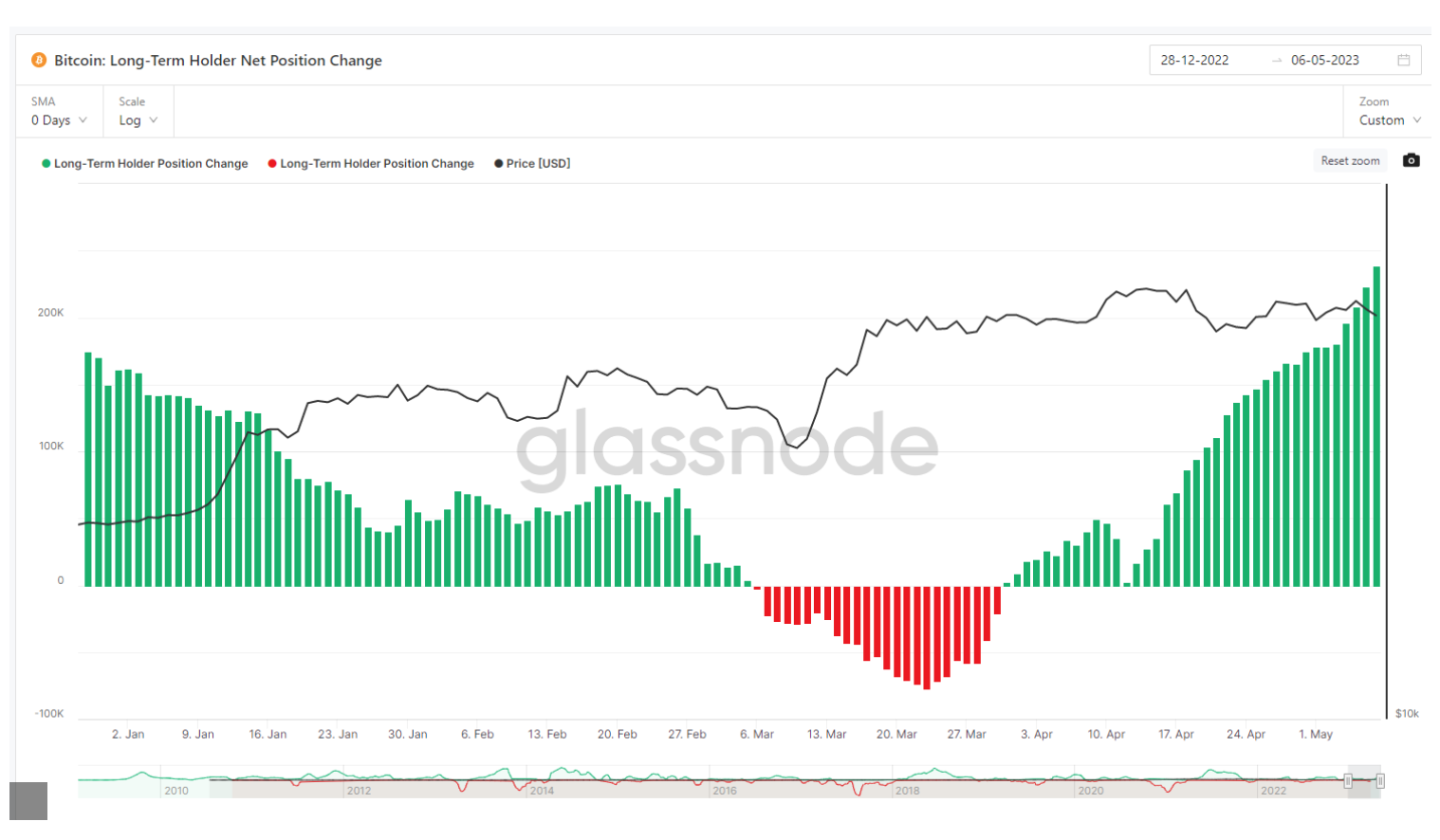

The compression back then resulted in a sharp move upward that looks similar to Tuesday’s upside breakout.