Buying Bitcoin Has Been Profitable 98.2% of The Days Since Creation (#GotBitcoin?)

Bitcoin (BTC) has been profitable as an investment 98.2% of the days since its creation, data from holdcalc.com as of July 1 indicates. Buying Bitcoin Has Been Profitable 98.2% of The Days Since Creation (#GotBitcoin?)

Counting 3830 days back — to January 4, 2009, one day after the coin’s Genesis Block was hashed — holdcalc’s data suggests that on 3671 of these, it was profitable to buy bitcoin (BTC) as an investor.

That leaves 69 unprofitable days — which include virtually all days during December 2017, at the apex of bitcoin’s historic bull run to $20,000 — as well as almost all of January 2018.

The most recent cluster of unprofitable days recorded in hodlcalc’s data are during the end of last month — between 25 and 29 June 2019 — when the coin was trading between the $11,170 and $12,907 price points.

Parallel to holdcalc’s rolling statistics, a cryptocurrency market analysis published by twitter handle CL on June 24 suggests that bitcoin has entered the so-called “stealth phase” of its renewed bull run.

The study opens by noting that the top coin has now crossed both its 50-week and 50-day moving averages, and goes on to analyze bitcoin’s realized value — a metric reportedly first proposed by a Coin Metrics researcher. Realized value, the study outlines, is the weighted UTXO market cap for BTC — i.e. a measure of the value of all coins in circulation at the price they were last transacted.

In addition to bullish technicals, on-chain data such as bitcoin’s hash rate, active wallet addresses and transactions per day are all surpassing all time highs or otherwise close to doing so, the study claims — all of which are metrics that numerous cited studies have purportedly been shown to have a positive correlation with price performance.

To argue the case that the coin is now in its stealth phase, the analysts provide a chart showing the logarithmic growth of bitcoin’s price and public interest — comparing BTC:USD data with Google Trends results for “bitcoin.”

The study argues that the public has, by and large, failed to take stock of the current price ascent, given that there are as many “google searches for “Bitcoin” today at over $10,000 as in 2013 when Bitcoin was only at $1,000.”

As reported earlier, crypto twitter investor and strategist CryptoKea has today argued — against the bull run narrative — that bitcoin’s most likely retracement range is $6,600-$8,000, while others have proposed more moderate estimates of circa $9,500.

To press time, bitcoin is circling the $11,000 mark, down just over 6% on the day, according to Cointelegraph’s bitcoin price index.

New Analysis: Every Bitcoin Holder Makes a Profit After 1,335 Days

According to new analysis, presented Sept. 8, the amount of time it is necessary to have held Bitcoin to make a profit is 1,335 days or roughly 3 years and 8 months. This roughly correlates to the four-year cycle length based on reward halving periods.

Profiting From Bitcoin Is Largely A Waiting Game

While a 100% sure profit would have taken a maximum of 1,335 days, this relates to the bull-run in late 2013, when Bitcoin price surged to $1150. If you had bought in right at the top, then it took 1,335 days before Bitcoin finally broke that level in early 2017.

Assuming you missed buying the peak of that rally, your wait for profit would have been considerably less. Holding Bitcoin for 317 days would have given you a 75% chance of profit. There was a 60% chance of profit of you held Bitcoin for 35 days, and the likelihood that you were up over any single day was 50%.

If That Seems Like A Long Time, Check The S&P 500

For comparison, to achieve a sure profit on the S&P 500, you would have to have held it for 23 years.

Also, bear in mind that this analysis purely looks at the chance of profit and not the scale of that profit. When Bitcoin is on a bull-run, profits dwarf those achievable on stock market indices.

For example, the Grayscale Bitcoin Investment Trust outperformed everything so far in 2019 with an almost 300% appreciation YTD, as reported by Cointelegraph in July.

Updated: 5-11-2020

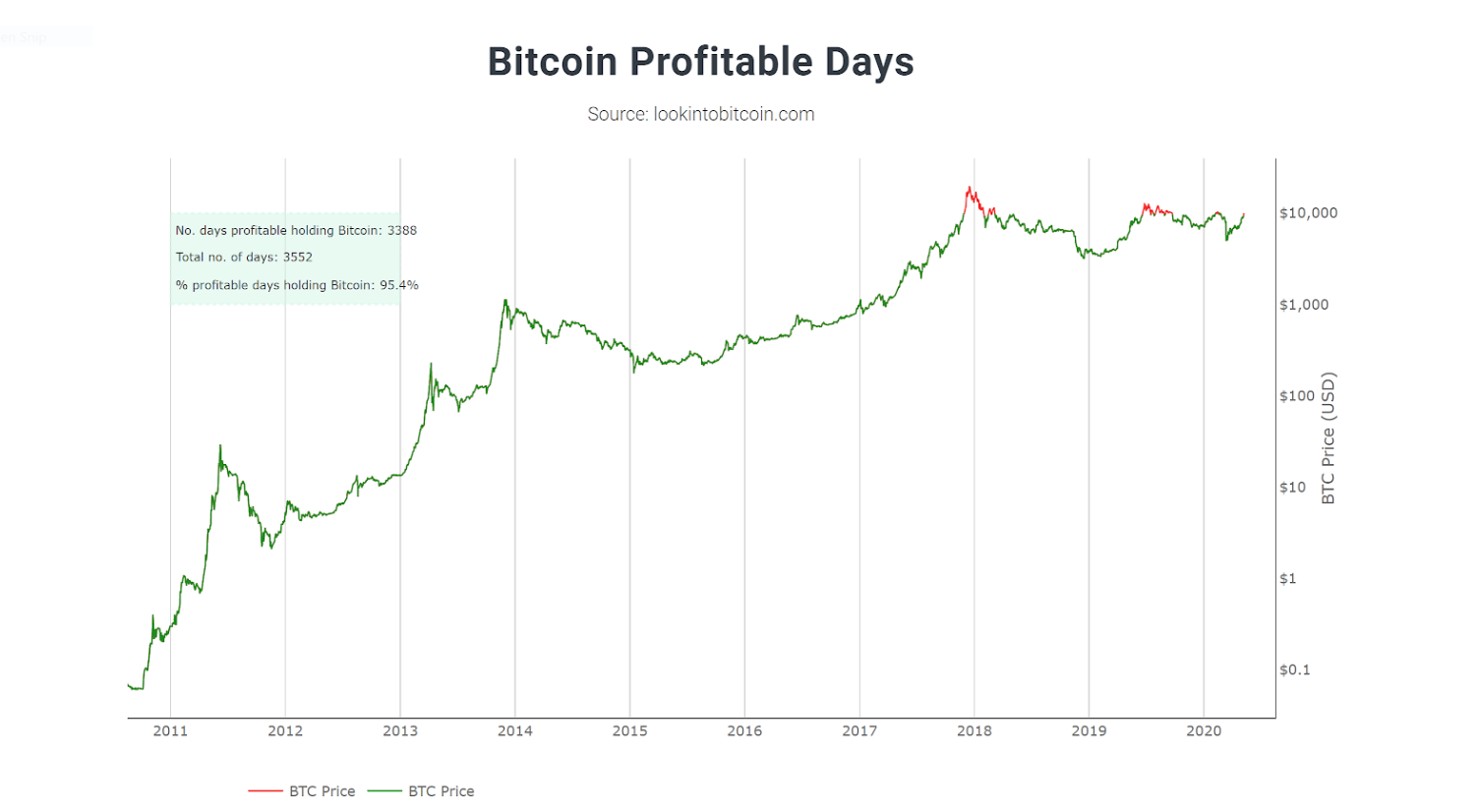

Hodling Pays Off As Buying Bitcoin Has Been Profitable 95.4% of Days

As crypto traders brace for today’s Bitcoin halving, data shows buy and hold remains the most profitable strategy.

With the Bitcoin (BTC) halving happening in less than 4 hours there is strong evidence that investors are continuing to accumulate Bitcoin.

Readers will recall that on March 12, a day now referred to as Black Thursday, the price of the top-ranked crypto asset on CoinMarketCap crashed more than 50%, registering its second biggest daily drop in history.

While this was an incredibly painful 48-hours for over leveraged traders, the resulting bargain bin prices on and other cryptocurrencies presented a potential once-in-a-lifetime opportunity for long term investors.

Bitcoin’s impressive rise from $3,750 to $9,450 aside, just how much of an opportunity these past few weeks have been is also clear to see in a number of on-chain and market cycle sources.

On-chain data provides unique insight into the behaviour of market participants by analyzing transactions that take place on the blockchain.

From the size of transactions and wallets, to more complex tools, blockchains offer a wealth of data.

The information drawn from blockchains can help investors and researchers understand what has happened to price in the past and it can also offer guidance on what to expect in the future.

Bitcoin Price Briefly Dropped Below Its Cost Basis

The MVRV Z-score is an on-chain indicator that uses blockchain analysis to identify periods where Bitcoin is extremely over or undervalued relative to its ‘fair value’. The MV part of the name stands for Market Value which is essentially the market cap of Bitcoin, or the number of coins in circulation multiplied by price.

The RV part stands for Realized Value, which uses the price of coins when they were last sent from one wallet to another, rather than the current price. So we can think of Realized Value as the average cost basis investors paid for their Bitcoin.

In the week following Black Thursday, Market Value (blue line on the chart below) was lower than Realized Value (orange line).

This moment is highlighted by the arrow on the chart. This is a rare occurrence in Bitcoin’s history due to the digital currency’s aggressive price growth over time, and whenever this occurs it signals an incredible buying opportunity for long term investors.

In addition to this, the indicator also uses a standard deviation line called the z-score (red line on the chart) which pulls apart differences in the MVRV data. The z-score can call market bottoms (green zone) and tops (red zone) very effectively.

It has called the previous market cycle tops to within 2 weeks! After a brief dip into the green ‘buy’ zone, the z-score has now excited and has been rising rapidly since, resulting in the recent price spike up beyond $10,000.

Whales Buy The Dip Following A Simple Indicator

The 200-week moving average has been a consistently resolute support for Bitcoin over time. As shown below, when the price retraces back to this moving average it has historically been a great ‘buy-the-dip’ opportunity.

Whales are known to seize on the opportunity and start buying whenever price hits this key level. CryptoCobain a Bitcoin OG and whale was not shy about his buying at these levels during the recent market crash. The Bitcoin whale humorously tweeted:

“I Call Upon The Old Gods. I Call Upon The New Gods. I Summon You. In The Words Of The Elders, Pump It”

In addition to just using the standard 200 (WMA) line, it is possible to create a heatmap from its movement over time, given its role as a key support for Bitcoin price.

The 200-WMA heatmap chart shows that while Bitcoin price has bounced hard from this important moving average over the past few weeks, there is still a long way to go before the market becomes overheated.

The orange and red dots on the Bitcoin price line represent high monthly changes of between +12 and +16% to the 200WMA.

Historically these colours have highlighted the months where Bitcoin price is becoming over extended and where the market begins to top out.

Currently, the price remains firmly in the dark blue so one could interpret this as meaning that price has plenty of room to increase based on Bitcoin’s previous market structures.

Long Term Investors Continue To HODL

On-chain data continues to show that sentiment among mid to long-term investors remains positive and that they are not prepared to sell their holdings any time soon.

Despite the major volatility in Bitcoin price in recent months, the percentage of Bitcoin that has not moved on-chain for over a year has remained around 60%. This indicates there are strong hands among Bitcoin investors.

The chart also shows the cyclical nature of HODL’ing. There is typically a sustained drop in the number of coins held for over a year as the market approaches the late stages of a Bitcoin bull market.

This is shown by the green down arrows on the chart below. Currently there is no sustained drop in +1yr HODL’ing which again suggests the market is just starting to enter a new bull market with investors accumulating more Bitcoin.

As the wider market becomes more aware of these levels of HODL’ing, this will put further demand side pressure on an already scarce asset.

Recent Weeks Show Rapid Changes In Investor Sentiment

After briefly dipping into the capitulation level six weeks ago, the market spent the past few weeks in the hope and fear area. The most recent pump shows investor sentiment entering the optimism and denial stage.

The Relative Unrealized Profit/Loss metric is able to monitor market sentiment through actual market activity, rather than just claimed behaviour. It is able to achieve this by looking at the ratio between the Bitcoin market cap and when investors are taking profit.

In doing so it has consistently highlighted the key market stages throughout Bitcoin’s history, including market tops and bottoms.

In fact, looking back at previous cycles we can see that it is likely to be some time before investor sentiment reaches the greed level which has historically proven to be an excellent time to take profit for the smart investors.

BTC Days In Profit Continues To Rise

While Bitcoin volatility over recent months has had some traders feeling queasy, zooming out to view the long term shows long-term HODL’ers continue to benefit from the asset’s remarkable ascent over time.

Reviewing the percentage of days in Bitcoin’s history where buying Bitcoin would have put investors in profit at today’s prices, we see it stands at a staggering 95.4%. For those who can stomach the short term price swings, patience clearly pays.

As the halving draws ever closer and central banks across the globe continue to print without pause, any of the significant downside risks associated with Bitcoin are beginning to look increasingly limited.

Thus, the only thing left for investors to wonder about is how soon will it be before the percentage of profitable days for holding Bitcoin reaches 100% as the price breaks out into new all-time highs?

Updated: 8-19-2020

98% of All Bitcoin Is Now Worth More Than When You Bought It

At around $12,000, buying Bitcoin has been a profitable activity on 97.6% of all days since April 2013, data confirms.

Bitcoin (BTC) has delivered gains to its holders on almost 98% of all days since 2013, new data confirms.

According to a dedicated social media-based monitoring resource which tracks profitability, buying Bitcoin has made its holder richer on 97.6% of days.

BTC Profitability “Characteristic Of Bull Runs”

Put another way, as on-chain analytics service Glassnode noted in its The Week On-Chain weekly report on Monday, 97.6% of Bitcoin unspent transaction outputs (UTXOs) are in profit.

This means that only 2.4% of UTXOs were created — as part of a transaction between wallets — when the BTC price was higher than current levels at around $12,000.

“Extended periods at this level and above are characteristic of bull runs as BTC moves toward new all-time highs (at which point the metric reaches 100%),” Glassnode commented.

Despite a slight pullback overnight on Tuesday, Bitcoin continues to delight hodlers, with monthly gains still at almost 30%.

A retracement for gold and stocks appeared to fuel selling pressure, but under the hood, Bitcoin’s fundamentals remain stronger than ever.

As Cointelegraph reported, hash rate has hit its highest ever average rate, while difficulty is set to follow suit at the next readjustment in four days’ time.

Bullish Evidence Mounts

Continuing, Glassnode added that each time UTXO profitability passes 95%, it sparks a brief but intense bull run for BTC lasting up to three months.

Other metrics, meanwhile, suggest that Bitcoin is rather at the start of a longer bull run than at the end of a sudden uptick. Specifically, Glassnode’s Compass, which employs a basket of factors to chart Bitcoin’s strength, continues to flash firmly bullish.

“The compass’ continued position in the upper right quadrant provides an optimistic signal of continued bullish sentiment and on-chain activity,” the report added.

“This trend supports the widely circulating speculation that BTC is indeed in the early phases of entering a bull market.”

Previously, Cointelegraph noted that Bitcoin’s relative strength index, or RSI, was mimicking its performance after the 2016 block subsidy halving, which saw all-time highs of $20,000 a year later.

Buying Bitcoin Has Been, Buying Bitcoin Has Been, Buying Bitcoin Has Been,, Buying Bitcoin Has Been,Buying Bitcoin Has Been, Buying Bitcoin Has Been, Buying Bitcoin Has Been,, Buying Bitcoin Has Been,Buying Bitcoin Has Been, Buying Bitcoin Has Been, Buying Bitcoin Has Been,, Buying Bitcoin Has Been,Buying Bitcoin Has Been, Buying Bitcoin Has Been, Buying Bitcoin Has Been,, Buying Bitcoin Has Been

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.