Numerous Times That US (And Other) Regulators Stepped Into Crypto

From capping off the era of ICOs to tightening regulations on private wallets, U.S. financial watchdogs waded deeper into the crypto land than ever in 2020. Numerous Times That US (And Other) Regulators Stepped Into Crypto

As digital assets made strides toward mainstream status in 2020, the guardians of the incumbent financial system have been working hard to minimize disruption caused by their integration.

In the U.S., regulatory and law enforcement interventions throughout the year have left some projects out of business, empowered traditional players to take a closer look at crypto, and sent some unequivocal messages to cryptocurrency service providers globally.

Naturally, the steady legitimization and expansion of the crypto space led regulators to get more involved than ever before. Below are the biggest cases of U.S. watchdog and law enforcement agencies’ involvement that have arguably been the most consequential in shaping the relationship between the crypto industry and state power in 2020.

Related:

SEC vs. Telegram

While the Securities and Exchange Commission first squared off with Telegram over its token sale in October 2019, it wasn’t until the summer of 2020 that the landmark case was settled. The Telegram Open Network was initially set to draw hundreds of millions of Telegram’s messenger users into a global blockhain-based financial ecosystem.

Throughout 2018, TON raised some $1.7 billion by selling contracts associated with Gram, the system’s native token, to qualified investors. Mindful of the potential collision with the U.S securities regulator, Telegram bosses followed a framework known as the Simple Agreement for Future Tokens (SAFT). The first stage of the process entailed the sale of contractual rights to buy tokens if and when the network goes live.

While those legal rights are sold as securities — in this case, under exemption Reg. D — the resultant tokens are, theoretically, not.

In the case of Telegram, the SEC disagreed. The commission’s response was to initiate an emergency action against Telegram and the Telegram Open Network in federal court. The watchdog argued that the two-stage token distribution plan still constituted the sale of unregistered securities, a position that the court ultimately upheld.

The resulting settlement included an $18.5-million penalty, as well as an obligation to return more than $1.2 billion to investors. TON never ended up going live, while its struggle with the SEC went down is history as maybe the final act of the ICO era.

OCC Crypto Custody Authorization

The Office of the Comptroller of the Currency is an independent bureau within the United States Department of the Treasury. The OCC’s job is to charter and supervise national banks and savings associations. U.S. financial institutions that seek to operate nationwide must undergo an extensive review process with the OCC.

On Jul. 22, 2020, the OCC published an interpretive letter authorizing federally chartered banks to provide cryptocurrency custody services. The agency has never prohibited organizations operating within its purview to hold digital assets on behalf of their clients, but the sheer lack of guidance and legal clarity held back the expansion of many credit organizations’ services into the digital asset space.

To clients interested in their banks providing custody services, those banks could say ‘it’s just too risky right now.’

The letter equated encryption key escrow service with physical safekeeping of assets.

The regulator’s forward-thinking approach to digital currencies could be related to the fact that Brian P. Brooks, Acting Comptroller of the Currency, spent two years as the chief legal officer of Coinbase prior to the present appointment.

DoJ’s Billion-Dollar BTC Seizure

Armed with a new set of guidelines coming from the office of the Attorney General, the U.S. Department of Justice spent much of the fall ramping up enforcement action against crypto-related players. The process culminated in a complaint of forfeiture against a billion dollars worth of Bitcoin and BTC forks in early November.

he funds were believed to have been in possession of an unnamed hacker who had previously stolen them from now-defunct online black market Silk Road. In tracking the record-breaking pot of digital wealth, government investigators relied heavily on blockchain analytics firm Chainalysis’ assistance.

As the price of Bitcoin is soaring, in 2021 law enforcement will likely be motivated to invest even more energy and resources in pursuing crypto stolen in previous high-profile heists. Blockchain intelligence firms will surely be there to help.

DoJ & CFTC vs. BitMEX

The fate of crypto derivatives platform BitMEX illustrates what can happen to those who wear out the patience of several U.S. regulators. Incorporated in the Seychelles, BitMEX has long been under suspicion of serving U.S.-based customers, rendering the exchange subject to U.S. anti-money laundering and derivatives trading regulations.

The two-pronged payoff came in early October 2020, when the DoJ brought criminal charges against the platform’s founders for “willfully failing to establish, implement, and maintain an adequate anti-money laundering (“AML”) program,” while the Commodity Futures Trading Commission filed a civil case, charging the firm with facilitating unregistered trading for United States residents. BitMEX was forced to implement emergency changes to its c-suite and bring in a chief compliance officer.

Perhaps the key takeaway from this story was aptly articulated by the SEC Commissioner Hester Pierce, who called the BitMEX case a clear message to the global crypto industry. She said “when there are U.S. users of a product or a service, there’s going to be enforcement of U.S. laws.”

FinCEN v. Self-Hosted Wallets

A week before Christmas, the Treasury’s Financial Crimes Enforcement Network (FinCEN) released a proposal for a long-dreaded regulation designed to increase the transparency of transactions in which digital funds travel from centralized exchanges to private wallets.

If adopted unaltered, the rule will require exchanges to collect personal information about the wallet’s owner from the sender, if the amount transferred exceeds $10,000 in one day, or $3000 in a single transaction.

In addition to promising a lot of extra work for crypto exchanges, the proposed rule can deal yet another blow to the very concept of private, peer-to-peer cryptocurrency transactions. However, some observers argued that it would be enough for those wishing to get back to the territory of pseudonymous transactions to simply transfer the holdings from the wallet on record with FinCEN to a new one.

SEC vs. XRP

Unlike the Telegram Open Network, which the Securities and Exchange Commission shot down before it could ever take off, Ripple’s XRP token has been traded for almost 7 years and on the day the SEC knocked on the door, was ranked #3 cryptocurrency by market capitalization.

While the constant #1 and #2 of the market cap ranking, Bitcoin and Ether, were consistently absolved in the Commission representatives’ statements on the grounds of these assets’ decentralized nature, there has always been some suspense around the question of whether XRP is a currency or security. A considerable portion of the XRP supply is consolidated at the hands of a single firm, Ripple Labs.

In late December 2020, the SEC struck with a lawsuit claiming that XRP is a security and that the token’s distribution amounts to offering investment contracts. The news sent XRP price into a tailspin and prompted a chain of delistings from major exchanges. Although it will take months before the case even reaches trial, it is clear that the SEC’s move will profoundly shift the balance of power in the crypto space.

Treasury vs. BitGo

In the final days of 2020, another arm of the Treasury — the Office of Foreign Asset Controls — reminded crypto businesses with ties to the U.S. about one more source of regulatory scrutiny: compliance with various sanctions programs. The crypto custodian and the watchdog reached a $98,000 settlement over BitGo’s 183 apparent violations of the Treasury’s sanctions between 2015 and 2019.

The firm’s transgression entailed failing to block users residing in sanctioned jurisdictions such as Crimea, Cuba, Iran, Sudan and Syria from using BitGo online wallets.

Updated: 3-22-2021

Jamie Dimon May Soon Turn Away Deposits In Order To Comply With Simple Leverage Regulation, And He’s Not Happy

It’s A Strange Problem: JPMorgan Chase and other big banks are getting more assets than they even want.

You don’t need to feel too sorry for Jamie Dimon, the chief executive officer of JPMorgan Chase & Co., the largest bank in the U.S. by assets and the largest in the world by trading and fee revenue. But it’s easy to see why he might be miffed at the Federal Reserve at the moment.

On March 19, the Fed announced that a temporary regulatory break for banks will expire as scheduled on March 31. Dimon had told investment analysts in January that if the break went away, his bank would have a financial incentive to turn away deposits, as it has done in the past (for large institutional deposits, that is; the bank still likes retail deposits, which tend to be sticky and produce other banking business).

Here’s A Snippet From The Jan. 15 Earnings Call As I Transcribed It From Bloomberg’s Recording:

Dimon:

Remember, we were able to reduce deposits $200 billion within like months last time.

Jennifer Piepszak, Chief Financial Officer:

Yeah.

Dimon:

But we don’t want to do it. It’s very customer unfriendly to say, “Please take your deposits elsewhere … .”

It’s common for Jamie Dimon to complain about “gold-plated” banking regulation, but in this case he seems to have a point. A Fed regulation that makes it unprofitable for banks to take in deposits—when taking in deposits has always been a key function of banks—is a bit hard to justify.

How we got to this point is complicated but interesting. The old style of bank regulation was to limit the leverage of banks. It was analogous to how banks themselves require homebuyers to have some skin in the game. Homebuyers have to put in some of their own money so the mortgage loan they get is smaller than the value of the house they’re purchasing.

That way, if the homeowner stops making payments, the bank can seize the house, sell it, and get back what it lent. Similarly, under simple leverage regulation, banks had to show that the value of their assets (such as the loans they make and cash in the vault) was substantially greater than their liabilities (such as the deposits they take in, which is money they owe to the depositors). Roughly speaking, the excess of assets over liabilities was called capital.

But that simple system failed. Banks can make more money by going big on risky assets like high-interest loans than by investing in safe, low-yielding stuff like Treasury securities.

And as long as regulators treated all assets alike, it made sense to load up on risky ones.

But risky assets are more likely to go bust, so regulators wisely started taking the safety of different assets into account.

It was a big improvement, but not perfect: Some banks understated the riskiness of their assets, which became a problem in the global financial crisis of 2008-09. For instance, some loaded up on the debt of their national governments because it was given a zero risk-weighting, when in fact it was highly risky.

The new system is belt and suspenders. The belt is risk-weighted capital regulation, under which riskier assets require a bank to have more capital against them, while very safe assets require little or none. There’s also a backup system—the suspenders—where all assets are treated alike, just as in the old days.

This is called the supplementary leverage ratio. It was agreed to by a wide range of nations under the auspices of the Bank for International Settlements and took effect in 2018. The SLR is meant to deal with situations where a bank has loads of assets that aren’t as safe as they’re said to be.

The suspenders are supposed to hang loose most of the time while the belt does the real work of holding up the pants, so to speak. In last year’s Covid-19 recession, though, banks suddenly got flooded with more assets than they could handle.

The Fed bought Treasuries to drive down interest rates and paid for them by creating reserves, which show up as assets on banks’ balance sheets. Businesses drew down lines of credit and deposited the proceeds in banks. Consumers’ bank accounts were swollen by government relief checks.

Demand for consumer and business loans was weak, so banks stashed most of the incoming money in Treasury securities or left it in cash. (Funds from customers are both an asset to the bank, because they can invest the money, and a liability, because they have to return it someday.)

Suddenly the suspenders weren’t so loose anymore. Without even trying, banks had acquired a lot more assets on their balance sheets. Most were supersafe, but the SLR applied equally to every dollar of them, regardless of their safety.

Realizing there was a problem, the Federal Reserve and other federal bank regulators in May 2020 exempted Treasuries and reserves at the Fed from the calculation of the supplementary leverage ratio.

Not permanently, but through March 31, 2021. It said the exemption “will provide flexibility to certain depository institutions to expand their balance sheets in order to provide credit to households and businesses in light of the challenges arising from the coronavirus response.”

This year banks lobbied vigorously for the exemption to be extended or even made permanent, but, as mentioned above, on March 19 the Fed said without explanation that the exemption would end at the end of the month.

What happens now? Nothing right away. Banks have more capital than they need, so they won’t have to shed assets starting April 1. Zoltan Pozsar, an analyst at Credit Suisse Group AG, wrote in a note to clients on March 16, ahead of the Fed announcement, that “Neither the Fed nor the market should fear mayhem if the exemption expires.”

One key reason, he said, is that the major banks won’t be affected by the expiring exemption because they never opted into it in the first place for their operating subsidiaries. And, he wrote, 90% of the currently exempt Treasuries and Fed reserves are being held at the operating subsidiary level.

In the longer run, though, there could be problems. Pozsar wasn’t quite as blithe when he discussed the SLR on the Odd Lots podcast aired by Bloomberg on March 3.

If banks such as JPMorgan Chase push away institutional deposits by charging fees or putting on negative interest rates, the money will spill into money-market funds, he predicted. But these funds won’t have any good place to put the money either, he said.

If they pour into Treasury bills, they could push the bill yields negative. But money-market funds can’t afford to earn negative returns because they promise to pay back investors 100 cents on the dollar.

Pozsar said the Fed system could assist by allowing money-market funds to stash more money with it through overnight reverse repurchase agreements. The Federal Reserve Bank of New York did just that two weeks later, announcing on March 17 that it would allow each of its counterparties to do overnight reverse repos of $80 billion a day, up from $30 billion previously.

Pozsar, who used to work for the New York Fed, called that “foaming the runway” for the March 31 expiration of the SLR exemption.

In 2014, when the supplementary leverage ratio was under discussion, Fed staff predicted [PDF] that the impact of the enhanced version of the ratio on the biggest banks would be modest because, after all, the Fed was about to start shrinking its balance sheet. In reality, the balance sheet is bigger than ever now and still growing.

As the Fed continues to buy Treasuries and mortgage bonds and pays for them with reserves, banks’ assets will continue to swell, and eventually the supplementary leverage ratio could become the “binding constraint” on the banks’ behavior; the suspenders will become tight. That would be a return to the bad old days.

Some of the resistance to keeping the leverage exemption in place past March 31 is based on concerns that banks need bigger safety buffers. That’s a legitimate concern. But the question of how much capital banks need is separate from the question of how those capital levels should be determined.

There area actually four ways of setting capital: risk-weighted capital, supplementary leverage ratio, post-stress estimate of risk-weighted capital, and post-stress estimate of supplementary leverage ratio. That ends up causing confusion and treating banks differently when they’re engaged in the same activities.

It’s “not clear you can fix the gaming of one rule by adding more rules,” says a 2017 presentation [PDF] by Robin Greenwood, Sam Hanson, Jeremy Stein, and Adi Sunderam of Harvard University and the National Bureau of Economic Research for a Brookings Papers on Economic Activity conference.

Their preference: a single standard that takes into account stressful scenarios and is “generally more sensitive to the kinds of data that you wouldn’t want to bake into a hard rule.”

The Fed may end up having more to say about this.

Updated: 3-26-2021

Former US Office Of The Comptroller Of The Currency Official Says Crypto Has Backing But Dollar Doesn’t

Former OCC acting comptroller Brian Brooks claimed that cryptocurrencies like Bitcoin “actually are backed by something.”

Brian Brooks, former acting comptroller of the currency of the United States Office of the Comptroller of the Currency, has claimed that cryptocurrencies like Bitcoin (BTC) have some backing, while the U.S. dollar may not have any.

Brooks gave his remarks in a CNBC Squawk Box interview with Joseph Kernen to unpack recent Bitcoin-related remarks by the U.S. Federal Reserve chair Jerome Powell. Earlier this week, Powell argued that cryptos like Bitcoin are “essentially a substitute for gold” but at the same time they are “not backed by anything.”

CNBC host Kernen pointed out that gold has historically been seen as a store of value, expressing confusion over Powell’s comments, stating. “He just said it’s like gold but not a store of value. Does he not think that gold is a store of value?”

In response, Brooks said that there are many reasons why people have flocked to Bitcoin over the past year, including the Fed dramatically increasing the dollar supply. “So when you do that, it means that the dollar is at least a 40% less good store of value than it was a year ago. And that is one of the reasons people opt to Bitcoin,” he stated.

In reference to the United States abandoning the gold standard under President Richard Nixon in 1971, Brooks said:

“The point I really wanna make is the dollar may not actually be backed by anything […] But cryptocurrencies actually are backed by something. They’re backed by underlying networks, and what you’re buying when you buy a crypto token — whatever it is Bitcoin or anything else — you’re buying a piece of a financial network built to transact all kinds of stuff.”

Brooks stated that the increasing number of network applications over the past few years is the main reason that the crypto industry is worth almost a $2 trillion today. “I believe in the wisdom of crowds. I think that crowds are telling you that these networks are where finances are going in the future. I wanna be part of that,” he concluded.

U.S. authorities have been actively investigating the concept of a digital dollar. On Monday, Powell said that the Fed would not proceed with the digital dollar without support from Congress.

Updated: 4-22-2021

House Passes Digital Asset Innovation Act To Clarify Crypto Regulations

U.S. financial regulators will now work together to create modalities for clear-cut crypto regulations in America.

The United States House of Representatives on Tuesday passed H.R. 1602 — the Eliminate Barriers to Innovation Act — introduced by Rep. Patrick McHenry (R-NC).

H.R. 1602 was among six bipartisan financial services-related bills passed by the House on Tuesday, with the McHenry-sponsored legislation focusing on regulatory clarity for cryptocurrencies.

Introduced back in March, the bill seeks to clarify the roles of agencies like the Securities and Exchange Commission and the Commodity Futures Trading Commission in the policing of cryptocurrencies in the United States.

The bill also seeks to answer the ongoing debate of whether crypto tokens are securities or commodities.

Addressing the floor of the House during the passage of the bill, McHenry remarked:

“[This bill] requires the Securities and Exchange Commission and the Commodity Futures Trading Commission to establish a working group focused on digital assets. This is the first step in opening up the dialogue between our regulators and market participants and move to needed clarity.”

#BREAKING: The House just passed 6 bipartisan Financial Services bills, including Ranking Member @PatrickMcHenry’s Eliminate Barriers to Innovation Act.

Learn more: https://t.co/jYrqQbSxXf

Watch the Ranking Member’s remarks pic.twitter.com/BAAyEf91qy

— Financial Services GOP (@FinancialCmte) April 20, 2021

Under the terms of the bill, Congress would have 90 days to establish the working group among participants from the SEC, CFTC and the private sector.

The private-sector participants would draw from fintech and financial services companies as well as small- and medium-scale enterprises and academia.

Once constituted, the working group would have a year to issue a report analyzing the current crypto regulatory climate. The panel’s work would also focus on matters like crypto custody, cybersecurity, private key management and investor protection concerns.

The patchwork nature of crypto regulations in the U.S. continues to be a source of some frustration among industry stakeholders in the country. Some industry insiders have argued that the U.S. is at risk of losing ground in the emerging digital economy due to the lack of regulatory clarity for digital assets.

Earlier in April, Goldman Sachs CEO David Solomon predicted a big evolution for crypto regulations in the United States.

Updated: 4-29-2021

Congress Takes One Step Closer To Regulatory Clarity With H.R. 1602

A bipartisan bill addressing cryptocurrencies made it through the House of Representatives. Next up: the Senate.

The House passed a bill geared toward ultimately clarifying digital asset regulation in the U.S. If it becomes law, the industry might finally have the regulatory clarity it has been seeking.

The U.S. House of Representatives passed H.R. 1602, the “Eliminate Barriers to Innovation Act of 2021,” last week, sending it to the Senate, which referred it to the Senate Banking Committee. If passed and signed into law, the bipartisan bill would commission a working group to evaluate how the U.S. currently treats digital assets.

Why it matters

This might be the first major crypto bill to get anywhere in Congress. What’s more, it’s one that, if passed, would have a direct impact on how the U.S. treats digital assets. This could finally provide companies in this industry with some much-requested regulatory clarity.

The fact the bill has support from both parties is another mark in its favor. Of course, if regulatory agencies don’t act until this bill is implemented, it’ll be quite some time before any actual clarity is adopted.

Breaking It Down

The entire House of Representatives passed the “Eliminate Barriers to Innovation Act,” introduced by Reps. Patrick McHenry (R-N.C.) and Stephen Lynch (D-Mass.) in March, making it the first major crypto-specific legislation to get through one of the bodies of Congress.

A number of other bills have also been introduced to define how cryptocurrencies can or should be treated under U.S. law, but few have made any progress.

“It’s the first bill to address regulatory clarity for digital assets and digital asset marketplaces to pass the house, and in a bipartisan fashion no less,” said Amy Davine Kim, chief policy officer at the Chamber of Digital Commerce.

Representatives for McHenry and Lynch did not respond to requests for comment.

According to the terms of the bill, a working group would be established with representatives from the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), financial technology firms, financial firms regulated by the SEC or CFTC, academic institutions or advocates looking at digital assets, small businesses using financial technology, investor protection groups and entities supporting historically underserved businesses.

The group would have one year to evaluate the current legal and regulatory landscape for digital assets, how this landscape impacts crypto markets and how other countries approach the industry.

More important, the group would be asked to draft recommendations for improving the regulatory landscape (and, in turn, improving the markets), as well as best practices to minimize fraud and ensure investors are protected.

The bill asks that the recommendations be limited to the powers the SEC and CFTC already hold.

“It brings a number of stakeholders to the table, so it’s not just the SEC, it’s not just the CFTC, it’s also businesses and thought leaders who actually have expertise in the digital asset space,” Kim said.

Creating a working group with this many stakeholders also brings sunlight to the process of drafting or updating the regulatory framework around digital assets, she noted.

The next step is bringing the bill before the Senate. Right now the Senate Committee on Banking, Housing and Urban Affairs, helmed by Senators Sherrod Brown (D-Ohio) and Pat Toomey (R-Penn.), is looking at the bill.

Kim said the Digital Chamber has already been in touch with some Senators to move the bill forward.

No sponsors have been named yet, according to a search of public records.

A number of other actions last week might further give heft to the idea of regulatory clarity coming to the U.S.

The House of Representatives Committee on Financial Services also renewed the Fintech Task Force last week, under the leadership of Reps. Lynch and Tom Emmer (R-Minn.), both of whom are returning to their roles.

“I’m hopeful that the work of this task force will continue to lay the foundation for a better understanding of these financial technologies, and today’s release of the fintech report is yet another step towards fostering financial innovation and keeping America competitive on the global stage,” Emmer said in a statement.

Updated: 6-8-2021

Global Banking Regulator Plans To Hold Consultation On Crypto Exposure

The group has previously warned of “financial stability concerns” and risks faced by banks when it comes to cryptocurrencies.

The Basel Committee on Banking Supervision has said it will be publishing a consultation paper aimed at banks reducing their risk of exposure to crypto.

According to the Switzerland-based Bank of International Settlements, or BIS, the Basel Committee will publish the paper on crypto exposure this week following its decision to hold a public consultation on the matter. The announcement came during a Friday meeting, during which the committee also discussed the impact of the current pandemic on the banking system as well as any proposed policy initiatives:

“While banks’ exposures to cryptoassets are currently limited, the continued growth and innovation in cryptoassets and related services, coupled with the heightened interest of some banks, could increase global financial stability concerns and risks to the banking system in the absence of a specified prudential treatment.”

The BIS added that though many authorities seek the approval of the Basel Committee, the regulator relies on its members to enforce proposed actions. In other words, the committee’s decisions do not carry the force of law. Banking regulators from countries including Japan, the United States and many nations in Europe are members of the group.

Calling for a “prudential treatment” of crypto has been a common theme for the committee. In 2019, the regulator said that cryptocurrencies were “unsafe to rely on” as a medium of exchange or store of value.

Updated: 6-11-2021

Regulator Interest Is Good For The Crypto Ecosystem, Says BlockFi CEO

Regulatory clarity enables crypto companies to continue to innovate, Zac Prince says.

BlockFi CEO Zac Prince agrees with United States Senator Elizabeth Warren that there is a lot of noise in the crypto industry. Still, he expects that the clarity that comes with regulations will positively impact the ecosystem.

Describing regulators’ interest in crypto as a natural evolution of the technology, Prince said that discussions like Wednesday’s Senate Banking Committee hearings are very positive trends overall for the crypto sector.

It’s easy to miss the forest for al the trees, he said, highlighting that crypto is an asset class that has generated substantial wealth for millions of people. “It’s been the best performing asset class in seven out of the last ten years,” he said.

The crypto industry is creating lots of new jobs across the board, Prince noted, stating, “This is something that we want to continue to happen in America.”

Asked about his opinion on the impending regulations on cryptocurrencies, he said that he expects the rules to be favorable for the business:

“Regulatory clarity enables companies like BlockFi to continue innovating. It enables consumers and investors to participate in this sector with the utmost confidence.”

This week, the Senate Banking Committee discussed a U.S. government-backed central bank digital currency in a session where Senator Warren took a generally critical stance against crypto.

Calling crypto a “fourth-rate alternative to real currency” and a “lousy investment,” she then went on to call Dogecoin (DOGE) a “bogus” currency. Warren said that the volatility of cryptocurrencies makes them unsuitable as a medium of exchange.

Republican Senator Asks FinCEN To Reconsider Controversial Crypto Rule

The FinCEN rule, proposed under former President Donald Trump, needs to be revisited, Sen. Pat Toomey said Thursday.

Proposed U.S. regulation around cryptocurrencies might be counterproductive, the top-ranking Republican on the Senate Banking Committee said Thursday.

A proposed Financial Crimes Enforcement Network (FinCEN) counterparty rule would impose a heavy burden on cryptocurrency firms but may not actually combat illicit activity, Sen. Pat Toomey (R-Pa.) wrote in a letter to Treasury Secretary Janet Yellen.

He also described draft Financial Action Task Force (FATF) guidance as “concerning.”

“Cryptocurrencies stand to dramatically improve consumers’ privacy, access to financial services, and power to make decisions for themselves,” the letter said. “Some have argued that cryptocurrency is a technology that could be as revolutionary as the internet.”

The statement comes a day after Sen. Elizabeth Warren (D-Mass.) railed against bitcoin as a potential tool for criminals that also carries environmental and consumer-protection issues.

The controversial FinCEN rule was proposed by Yellen’s predecessor, former Treasury Secretary Steven Mnuchin, in the waning days of the Donald Trump presidency. Under its provisions, any crypto exchanges or financial institutions would be required to keep name and physical address information for transactions above $3,000, and file reports for transactions above $10,000.

Opponents to the rule say this could impact decentralized finance (DeFi) products, as many smart contracts that store funds do not require names or addresses. DeFi aside, simply maintaining excess records beyond typical know-your-customer (KYC) requirements may prove a burden to smaller exchanges.

A public comment period was extended immediately before Trump left office, and again after current President Joe Biden took over, but the actual proposal is still pending.

“While I recognize that FinCEN and FATF’s proposals are seeking to address the misuse of cryptocurrencies for illicit activity, if adopted, they would have a detrimental impact on financial technology (‘fintech’), the fundamental privacy of Americans, and efforts to combat illicit activity,” Toomey wrote. “I urge you to make significant revisions to them.”

Malicious actors may find it easier to act outside the regulated financial sector should these rules be implemented, Toomey argued.

FATF’s proposed guidance, which would also impose reporting requirements on DeFi, could likewise harm the sector by imposing “onerous recordkeeping requirements” that don’t apply to the U.S. dollar, the senator wrote.

FinCEN Rules

Beyond the burdens on the crypto sector, Toomey suggested FinCEN look at modernizing currency reporting requirements placed around the dollar. The reporting requirements around U.S. dollar transactions are 40 years old and based on thresholds from the time they were implemented.

Law enforcement officials can more effectively track funds and analyze suspicious activity today, the lawmaker said.

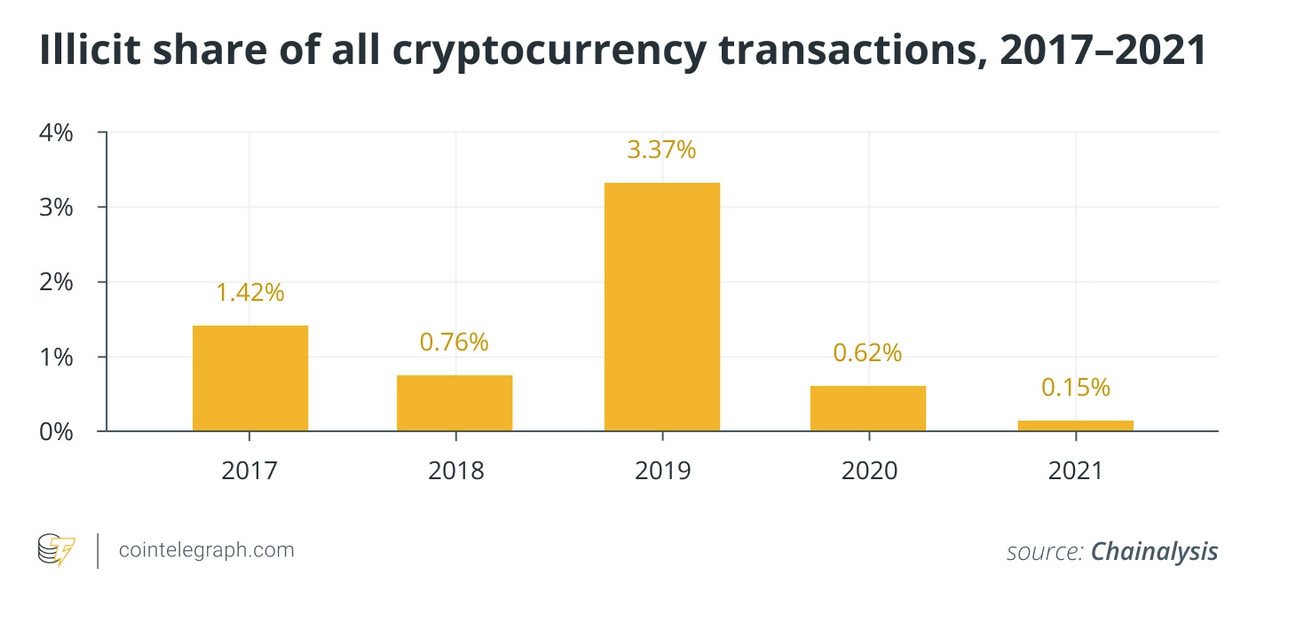

Crypto is included in this bucket: Toomey pointed out that the FBI was recently able to recover much of the crypto paid by Colonial Pipeline in a ransomware attack.

“Instead of seeking to impose onerous regulatory requirements on cryptocurrencies, FinCEN should collaborate with stakeholders and analytics firms to understand what existing and emerging capabilities exist for identifying illicit cryptocurrency activity,” he wrote.

A FinCEN spokesperson did not immediately return a request for comment.

Bitcoin, Other Crypto Assets Targeted For Stiff Banking Regulation

Proposal would require banks dealing in some crypto assets to hold substantial buffers in case of losses.

The top global standard setter for banking regulation proposed a strict new rule that would require banks to essentially set aside a dollar in capital for every dollar of bitcoin they own.

The Basel Committee for Banking Supervision, a group of global central bankers and regulators, announced the plan Thursday in a public consultation about how it intends to treat cryptocurrency assets, which it said had prompted concerns about consumer protection, money laundering and terrorist financing.

“Certain cryptoassets have exhibited a high degree of volatility, and could present risks for banks as exposures increase,” the Basel, Switzerland-based committee said in a statement.

Interest in cryptocurrencies from mainstream financial firms and corporations has surged this year. Mastercard Inc. has said it plans to support some cryptocurrencies on its network and Bank of New York Mellon Corp. has invested in a cryptocurrency startup. Bitcoin rose 3.8% to $37,776.15 from its Wednesday 5 p.m. ET level.

The committee, which includes the Federal Reserve, European Central Bank and other major central banks, doesn’t enforce rules itself but sets minimum standards that regulators around the world agree upon and implement locally. The secretariat for the committee is based at the Bank for International Settlements, known as the central bank for central banks.

The committee said that banks should apply a 1,250% risk weight to bitcoin, which is “similar in effect to the deduction of the asset from capital.” If a bank holds $100 of bitcoin exposure, it would give rise to risk-weighted assets of $1,250, which when multiplied by the minimum capital requirement of 8% results in setting aside at least $100, the committee said in its statement.

The committee cited the lack of record of these assets and the very high volatility in proposing the rules. The capital requirements would put bitcoin and other coins on par with the riskiest assets that banks hold, such as ones for which the bank doesn’t have full information or has very large investments in companies.

As a comparison, according to Basel guidelines banks should apply a 400% risk weighting “for speculative unlisted equity.” Basel guidelines on residential mortgages, for instance, which are relatively safe and are backed by collateral, are as low as 20%.

Physical gold held by a bank has a 0% risk weight, meaning banks don’t need to hold capital against it.

The committee proposed less-stringent capital requirements for crypto assets that meet certain conditions, such as tokenized traditional assets and stablecoins. These type of crypto assets are often pegged to the value of a mainstream currency such as the U.S. dollar, and so are theoretically less volatile.

These are eligible for treatment under the existing Basel rules, while bitcoin would be subject to the “new conservative prudential treatment.”

Banks have until Sept. 10 to respond to the committee’s proposals. Central-bank digital currencies aren’t included in the consultation.

Bank Regulators Plot Toughest Capital Rule For Bitcoin

Banks must set aside enough capital to cover losses on any bitcoin holdings in full, global regulators proposed on Thursday, in a “conservative” step that could prevent widescale use of the cryptocurrency by big lenders.

The Basel Committee on Banking Supervision, made up of regulators from the world’s leading financial centres, proposed a twin approach to capital requirements for cryptoassets held by banks in its first bespoke rule for the nascent sector.

El Salvador has become the world’s first country to adopt bitcoin as legal tender even though central banks globally have repeatedly warned that investors in the cryptocurrency must be ready to lose all their money.

Major economies including China and the United States have signaled in recent weeks a tougher approach, while developing plans to develop their own central bank digital currencies.

The Swiss-based Basel committee said in a consultation paper that while bank exposures to cryptoassets are limited, their continued growth could increase risks to global financial stability from fraud, cyber attacks, money laundering and terrorist finance if capital requirements are not introduced.

Bitcoin and other cryptocurrencies are currently worth around $1.6 trillion globally, which is still tiny compared with bank holdings of loans, derivatives and other major assets.

Basel’s rules require banks to assign “risk weightings” to different types of assets on their books, with these totted up to determine overall capital requirements.

For cryptoassets, Basel is proposing two broad groups.

The first includes certain tokenized traditional assets and stablecoins which would come under existing rules and treated in the same way as bonds, loans, deposits, equities or commodities.

This means the weighting could range between 0% for a tokenized sovereign bond to 1,250% or full value of asset covered by capital.

The value of stablecoins and other group 1 crypto-assets are tied to a traditional asset, such as the dollar in the case of Facebook’s proposed Diem stablecoin.

Nevertheless, given cryptoassets are based on new and rapidly evolving technology like blockchain, this poses a potentially increased likelihood of operational risks which need an “add-on” capital charge for all types, Basel said.

‘Unique Risks’

The second group includes cryptocurrencies like bitcoin that would be subject to a new “conservative prudential treatment” with a risk-weighting of 1,250% because of their “unique risks”.

Bitcoin and other cryptocurrencies are not linked to any underlying asset.

Under Basel rules, a 1,250% risk weight translates into banks having to hold capital at least equal in value to their exposures to bitcoin or other group 2 cryptoassets.

“The capital will be sufficient to absorb a full write-off of the cryptoasset exposures without exposing depositors and other senior creditors of the banks to a loss,” it added.

Joseph Edwards, head of research at crypto brokerage Enigma Securities, said a global regulatory framework for cryptoassets is a positive given that banks in Europe are divided over involvement in the sector.

“If something is to be treated as a universal asset, it effectively needs to meet quorum with regards to how many parties will handle it. This should move the needle somewhat on that,” Edwards said.

Bitcoin gained after Basel’s announcement, trading up 1.5% at $37,962 at 1053 GMT.

Few other assets have such conservative treatment under Basel’s existing rules, and include investments in funds or securitizations where banks do not have sufficient information about their underlying exposures.

The value of bitcoin has swung wildly, hitting a record high of around $64,895 in mid-April, before slumping to around $36,834 on Thursday.

Banks’ appetite for cryptocurrencies varies, with HSBC saying it has no plans for a cryptocurrency trading desk because the digital coins are too volatile. Goldman Sachs restarted its crypto trading desk in March.

Basel said that given the rapidly evolving nature of cryptoassets, a further public consultation on capital requirements is likely before final rules are published.

Central bank digital currencies are not included in its proposals.

Bitcoin Plan Roils Crypto World Seeking Regulatory Clarity

International banking regulators’ proposal to classify Bitcoin as the riskiest of assets dragged cryptocurrencies further into the mainstream financial world.

It would also make it extremely costly for banks to hold digital tokens on their balance sheets, potentially delaying crypto’s wider adoption.

The Basel Committee on Banking Supervision proposed that a 1,250% risk weight be applied to a bank’s exposure to Bitcoin and certain other cryptocurrencies. Bitcoin jumped on the announcement, then erased the gains. It was trading around $36,200 as of 10:30 a.m. in Hong Kong on Friday.

“The only consistency has been the volatility — it’s been big spikes, tons of enthusiasm, followed by big selloffs,” Ross Mayfield, investment strategy analyst at Robert W. Baird & Co., said of Bitcoin’s moves. “If you believe in it you’re probably to stomach the volatility, but if you’re just in it because it seems like the hot way to get a quick buck, that volatility is going to be hard to deal with.”

The Ruling Sparked A Bevy Of Reactions Across Wall Street And Other Financial Centers Worldwide. Here’s A Sampling:

Luke Sully, CEO At Treasury Technology Specialist Ledgermatic:

“It’s a piece of news that both advocates and critics of Bitcoin will declare as a win. It demonstrates that Bitcoin is now a recognized asset class with risk management parameters for the banks, but these same parameters could be a potential deterrent given the onerous capital requirements that may make it an unpalatable business,” he said. “There are a few underlying assumptions in this risk weighting, the most obvious being that the price may go to zero and investors could lose their full allocation. The capital requirements don’t protect the banks clients from transaction, settlement and FX volatility either.”

David Tawil, President Of Prochain Capital, A Crypto Hedge Fund:

To me, this whole thing, along with the IMF, is just a way for those entities to get involved in the conversation. In terms of putting these requirements it’s going to go ahead, and at least for now, take traditional banks that are traditional regulated by these regulatory entities essentially out of this game and that will allow for more and more alternative players, who are not regulated, to go ahead and to pull further ahead,” he said.

“A regulator has very little upside and enormous downside — it’s like being a policeman. You want to protect people. So the furthest you can go in terms of lodging measures that stop activity, the better. And so, I think that they are for the first time inserting themselves. This certainly does not mean the end of cryptocurrency, the end of Bitcoin.”

Marc Chandler, Chief Market Strategist At Bannockburn Global Forex:

“I don’t think these things are good or bad themselves — it depends on what the objective is,” he said. “It’s not decentralized, it’s highly concentrated. Crypto was born in an age in which we had very extreme disparities of wealth and income — how can it not reflect that? The bulk of Bitcoin that’s owned by wallets have more than 100 Bitcoins, that’s more than $300,000 — how many Americans have $300,000 to put into crypto as opposed to retirement money?”

Matt Maley, Chief Market Strategist For Miller Tabak + Co.:

“Obviously tougher capital requirements cause banks to have more capital on hand — that can have an impact on their earnings. The committee is saying because of risks involved — cryptocurrencies are very volatile — you have to have more capital on hand to protect against declines,” he said. “If it’s going to cost banks more to hold these cryptocurrencies on their books, they’re theoretically going to be less likely to hold the same kind of size as they otherwise would.”

Wells Fargo Analyst Mike Mayo Said In A Bloomberg TV Interview With Matt Miller:

“It is getting hammered, but you know what? It’s getting treated like any other higher-risk asset like subprime loans, or CDOs, or derivatives, or structured products. And it is a new product. It’s untested through economic cycles. It’s untested through liquidity.”

Updated: 6-12-2021

Crypto’s Image Takes Beating In Washington, Dimming Fans’ Hopes

Just a few months ago, crypto enthusiasts were hopeful that Washington was warming to digital assets. But cyberattacks demanding Bitcoin ransoms, wild trading and rebukes from regulators have eroded their optimism.

The timing couldn’t be worse. Policy makers are poised to make a number of critical rulings on virtual tokens in the coming months — decisions that may reveal how deep of a hole the industry has to climb out of. Potentially under consideration are whether to approve a Bitcoin exchange-traded fund, allow crypto mutual funds and grant banking licenses to financial firms.

For advocates, the setbacks are fueling anxiety that some of their top priorities will be blocked by federal agencies, and that lawmakers will take take a tougher tack on oversight.

Evidence is growing that Capitol Hill is moving in that direction. Senator Mark Warner, a Virginia Democrat, said last month that cryptocurrencies are “crying out for some level of regulation.” Senator Elizabeth Warren reiterated that view Wednesday.

“Our regulators, and frankly our Congress, are an hour late and a dollar short,” the Massachusetts Democrat said in a Bloomberg TV interview. “We need to catch up with where these cryptocurrencies are going.”

The rough patch started in May when Securities and Exchange Commission Chairman Gary Gensler urged lawmakers to pass a law regulating crypto exchanges, arguing that the lack of oversight posed a serious threat to U.S. investors. The comments shocked Bitcoin proponents who predicted Gensler would be an ally because, unlike most government officials, he’s well versed in virtual coins.

Fuel Shortages

Then came the Colonial Pipeline Co. hack, which triggered fuel shortages across the Eastern U.S. As in previous breaches, the culprits demanded ransom payments in Bitcoin — shining a spotlight on cryptocurrencies’ national security implications.

Long gas lines predictably attracted the attention of lawmakers and the scrutiny could make some on Wall Street nervous about further embracing assets that are routinely linked to illicit transactions.

The Justice Department recovered most of the tokens that Colonial paid out by tracking transactions on the public ledger for Bitcoin, showing how the technology can aid law enforcement agencies.

Still, Warren said a key feature of cryptocurrencies is that they allow people to secretly move money, making the coins a “haven for criminals.” A reminder of her point came Wednesday when JBS USA disclosed that it had paid $11 million to hackers who forced the world’s largest meat producer to shut down all its U.S. beef plants.

Another issue: Bitcoin has lost more than a third of its value since early May. A series of negative tweets from Elon Musk has contributed to the plunge, underscoring to crypto critics that token prices are too volatile and easily influenced by social media to be safe for unsophisticated investors. The frenzy tied to nonfungible tokens and dogecoin — a cryptocurrency created as a joke — has amplified those concerns.

“We can’t deny the potential impact that a negative media narrative might have on the regulatory and legislative conversations in D.C. in the short term,” said Kristin Smith, executive director of the Blockchain Association trade group.

Much of high finance’s focus is on Gensler, who previously taught courses on digital currencies at the Massachusetts Institute of Technology, because the SEC will determine whether a Bitcoin ETF can trade on U.S. exchanges.

Game-Changer

The product is seen as a game-changer because it would let investors trade in-and-out of the world’s most popular cryptocurrency throughout the day without exposing them to the risks of having to store their tokens. Adding another layer of safety, consumers could buy ETFs from tightly policed brokers instead of purchasing Bitcoin from unregulated exchanges. And mutual funds and other institutional investors could pump a lot more money into crypto-related assets through ETFs.

An SEC spokeswoman declined to comment.

Under Gensler’s predecessor Jay Clayton, the SEC blocked multiple ETF applications, arguing that Bitcoin is too volatile and susceptible to manipulation. Gensler’s comments that crypto exchanges lack investor protections signals he may share some of those concerns, said Stephen Myrow, a former Treasury Department official during George W. Bush’s administration.

“It’s a big shift from four months ago when everyone said, ‘Gensler taught a crypto class at MIT so we’re going to get all our applications approved,”’ said Myrow, managing partner of Beacon Policy Advisors, a Washington-based firm that tracks regulatory and legislative proposals.

The SEC faces a June 17 deadline on one proposal to list an ETF from VanEck Associates Corp., one of several applications it’s considering. The agency has previously delayed making a decision on VanEck’s plan, and amid Washington’s heightened attention on crypto, it may choose to kick the can down the road again. The regulator may also put off decisions on the five other applications, but the agency needs to respond to each of them by July 16.

SEC Warning

The SEC has also expressed worries about mutual funds investing in Bitcoin futures, something that is allowed under existing rules. The agency warned in a May 11 statement that it would be scrutinizing funds’ crypto holdings.

Updated: 6-22-2021

Biden Nominee For Treasury Dept Will Prioritize Crypto Regulation

Brian Nelson said he would push for implementation of the Anti-Money Laundering Act of 2020, “including new regulations around cryptocurrency.”

Brian Nelson, President Joe Biden’s nominee for under secretary of the Treasury Department’s division on terrorism and financial crimes, said he would prioritize implementing new regulations around cryptocurrency.

In a Tuesday hearing of the Senate Committee on Banking, Housing, and Urban Affairs, Nelson said he would be focusing on Anti-Money laundering (AML) regulations if he were to be confirmed for the position in the Treasury Department’s terrorism and financial intelligence arm, adding that cryptocurrency would be a particular priority.

Responding to a question from Nevada Sen. Catherine Cortez Masto regarding “the damage done by crypto heists,” Nelson said the Anti-Money Laundering Act of 2020 reflected expanded regulators’ ability to prevent cryptocurrencies from undermining existing laws. However, he implied that the creation of crypto was also part of “responsible innovation” in the United States.

“If I am confirmed, I will prioritize implementing the pieces of that legislation, including new regulations around cryptocurrency,” said Nelson. “I think that legislation provided new authorities — or clarified the law — that cryptocurrencies or currency in whatever form, be it virtual or fiat, is covered by the Bank Secrecy Act.”

The Financial Crimes Enforcement Network, or FinCEN — which operates within the Treasury Department — has previously used the Bank Secrecy Act to apply to cryptocurrencies in certain cases, though the legislation was passed back in 1970. Nelson said the BSA was a “powerful tool to allow FinCEN to ensure that no matter the form of the currency that they have the tools to regulate.”

“It reflected a balancing of regulating to prevent virtual currency and other types of new technology from undermining our anti-money laundering system while also being respectful of the fact we need to support responsible innovation and preserve that here in the United States.”

At the same Senate hearing, Elizabeth Rosenberg, Biden’s nominee for assistant secretary for terrorist financing at the Treasury Department, said she would look at making the current AML regulatory requirements for crypto “appropriate and consistent.” Janet Yellen, the current Treasury secretary, previously called cryptocurrency a “particular concern” for AML, adding that she believed it was “mainly for illicit financing.”

FinCEN proposed regulations earlier this year that would consider convertible digital currency or digital asset transactions subject to similar Anti-Money Laundering and Combating the Financing of Terrorism requirements. Last month, the Treasury Department also called for exchanges and custodians to report crypto transactions greater than $10,000 to the Internal Revenue Service.

Updated: 6-23-2021

Will Regulation Adapt To Crypto, Or Crypto To Regulation?

1. Introduction

Blockchain technology promises to provide humanity and freedom with the rise of Web 3.0, a truly decentralized internet. Some even argue that the significant rise of the decentralized finance (DeFi) sector has become an important symptom of the conceptual shift from centralized services to decentralized ones, with Web 3.0 being its cornerstone.

Moreover, some even compare the invention of blockchain technology to the revolution brought by the advent of the internet itself. Symbolically, the original source code for the World Wide Web, developed by British computer scientist Tim Berners-Lee, is set to be auctioned off at Sotheby’s on June 23 as a nonfungible token, or NFT.

All three of them — NFTs, DeFi and Web 3.0 — are intertwined. But with that internet-blockchain comparison comes a crucial notion: Without proper regulation in the crypto and blockchain space, there will not be the same success in technological innovation as what we saw over the past 25 years, which changed the world as we know it.

It is now becoming obvious that a lack of regulation would harm crypto innovations. As the decentralized technology sector has grown significantly, the space has started to attract increasing attention from regulators globally, which are targeting stablecoins, DeFi, NFTs, crypto assets, smart contracts, unhosted wallets, central bank digital currencies and so on.

Meanwhile, some experts such as Caitlin Long, the founder and CEO of Avanti Financial, for example, see the started “crypto regulatory crackdown” as a positive trend, which will only benefit innovators. And others propose “a right way to regulate crypto.”

On the other hand, the current regulation is not suitable for crypto, and adjusting newly emerged decentralized technologies to it might ruin the core values of decentralization, bringing us back to where we started: with the centralized parties in control over the space. Is that the price we are willing to pay in order to become a regulated industry?

In order to find the right balance, the crypto space requires a much deeper and closer working relationship that would include both regulators and innovators.

Only in a dialogue between crypto businesses and regulators, authorities and industry representatives, will it be possible to find the right way to regulate the emerging tech industry — through smart regulation — and the space that is promising to change our lives — a promise that was fulfilled by proper regulations for the internet at the turn of the last century.

To find out what crypto and blockchain industry representatives think about this regulatory dilemma, Cointelegraph reached out to a number of them to ask for their opinions on the following question: Will crypto lose its core values on the way to being regulated, or will the regulation adapt to decentralized tech and its benefits for society?

2. Agata Ferreira, Law Professor And Expert At The EU Blockchain Observatory And Forum:

“Regulators are on a learning curve when it comes to blockchain in general. Legal and regulatory frameworks are developed incrementally and have been built to govern centralized and intermediated societal design within well-defined jurisdictional boundaries. Decentralized, disintermediated and borderless blockchain networks challenge regulators who have also been taken by surprise by some blockchain innovations — for example, stablecoins.

Regulatory awareness and approaches to blockchain innovation have evolved. Recently, there has been increasing regulatory activity and scrutiny, and we can expect that this trend will continue. Regulators still largely seek to apply existing regulatory principles to crypto, which is not always in sync with decentralized tech.

The hope is that with time, regulators realize the value and acknowledge the benefits of decentralization and adapt their regulatory approaches accordingly. As the technology matures, so will the regulatory approaches to it. Hopefully not through trial and error, but through carefully considered and informed regulatory steps.”

3. Alex Wilson, Co-Founder Of The Giving Block:

“Crypto isn’t going anywhere, and I’m confident it will overcome any regulatory hurdles along the way. I’m sure there will be ups and downs and huge variations among different countries. The countries that embrace crypto now will have a huge leg up on countries that try to stifle crypto because they will miss out on an entire generation of entrepreneurs building crypto companies.

Some countries that have done a relatively good job attracting crypto entrepreneurs include Singapore, Switzerland and Portugal, in part fueled by low or no taxes on crypto. I’m surprised that more countries haven’t tried harder to attract this next generation of entrepreneurs.”

4. Cristina Dolan, Founder And CEO of InsideChains, Vice-Chair Of MIT Enterprise Forum:

“The on-ramps and off-ramps for crypto are regulated by default because the exchanges that offer crypto-to-fiat conversions require Know Your Customer and Anti-Money Laundering processes. There is more visibility across crypto blockchain networks than there is across traditional siloed financial systems that prevent visibility throughout the entire transaction process.

Regulatory acceptance of crypto will enable faster adoption of these valuable and transparent technologies for next-generation financial systems. The level of creativity shown by fintech entrepreneurs is growing exponentially; the recent success of DeFi is just the beginning.

The central bank digital currencies (CDBCs) will offer programmable money. These CDBCs will enable visibility by governments and the ability to program fees and taxes into transactions. The launch of CDBCs will not eliminate nor compete with the entrepreneurial creativity that is fueling the growth of new crypto or DeFi products.

While interest rates remain artificially low, the attraction to crypto-enabled investments will continue to grow especially as regulations become less ambiguous.”

5. Denelle Dixon, CEO And Executive Director Of Stellar Development Foundation:

“Clearly, there is debate on what crypto’s core values really are. Early uses of cryptocurrency attracted people who wanted access to the financial system to be redistributed, out of the hands of institutions and into the hands of people. While being inspired by those initial principles, we see a path to working with existing financial systems.

In fact, linking to the world’s infrastructure is critical to have blockchain actually empower individuals with access. I see regulation as a necessary and iterative process. At Stellar, we have a crystal-clear vision of how our technology helps drive financial inclusion and positive economic growth in the developing world.

Plus, adapting to regulations in different countries and jurisdictions will continue to be necessary for any business that wants to operate globally. We see blockchain/crypto as an opportunity for more collaborative regulation — keeping its core values on the way to delivering a highly positive impact for society.”

6. Diana Barrero Zalles, Director Of ESG And Impact At Emergents @ Weild & Co.:

“Civilizations throughout history have been built on standards that everyone agreed to follow based on an underlying notion of morality and conscience, and justified by a universal recognition of the inherent dignity of each person. Promises should be kept and commitments should be met. Breaking promises is considered unjust while breaching contracts can cause harm to the other party.

Decentralization at the core of crypto presents a new and exciting form of governance that will back a new generation of community-driven innovations and business models. This does not mean decoupling crypto, just because it’s new, from the core principles of justice behind human civilization. Just like centralized decision-makers, communities can come to a consensus to arrive at the right outcome, often more accurately than individuals.

The ‘wisdom of the crowds’ concept suggests that collective intelligence can surpass that of individual experts when solving problems, making decisions, predicting answers and innovating. For a population that is at least 51% likely to be right, a collective estimate will be much closer to being right than any single person’s estimate (e.g., guessing the weight of a cow at a country fair).

Most communities would disapprove of the use of decentralized structures for harm, as shown by the response to The DAO hack, where the Ethereum hard fork was placed to return stolen funds to their rightful owners.

Regulation, which has traditionally upheld society’s basic principles, is now met with a wave of decentralized governance. Regulators around the world are adapting accordingly to enable these structures to develop within existing core principles. We can take a step back from the decentralization vs. centralization debate to evaluate how both can be balanced for the ultimate benefit of the community.”

7. Emin Gün Sirer, CEO Of Avalabs, Professor At Cornell University, Co-Director Of IC3:

“Crypto will always have a base that says traditional regulators have no say in operations on these networks. This ethic is absolutely vital for continuing to build and offer technologies that keep individuals around the world connected to a financial system. As we’ve seen in some authoritarian regimes, access to the legacy financial system can hinge on abandoning your beliefs and conforming to state-approved messaging.

That said, service providers engaging with fiat will always have to answer regulators’ calls. The likeliest outcome is that there is a split in crypto between regulator-approved services and those that make business trade-offs in a commitment to the ideals of permissionless systems.”

8. Marc Powers, Law Professor And Former SEC Attorney:

“Blockchain has the promise to provide the entire world with a technology that advances several worthy core values: financial independence and freedom, financial and political security for many sovereign populations, financial inclusion for billions of people, and allowing cost-effective and speedy peer-to-peer activities without intermediaries.

Whether sovereigns will allow crypto to survive with reasonable regulation which promotes those values is a good question. As a former U.S. Securities and Exchange Commission staffer, I am doubtful but hopeful.

First and foremost, blockchain is the antithesis of a central government or authority, and by implementation, the technology marginalizes our traditional financial intermediaries. Second, groupthink unwilling to consider and develop a more efficient financial system that adapts the technology must change.

I believe there is a chance for our customary laws on finance, banking and capital raising to do so. United States SEC Commissioner Hester Peirce and former acting comptroller of the currency of the U.S. Office of the Comptroller of the Currency Brian Brooks are on the right track here.

However, that is not what happened after the advancement of the last great technology, the internet and the dot-com bust through the passage of SOX, which required thousands of new regulations in the name of consumer and investor protection.

However, calls for regulation this time will be primarily for the benefit of the sovereigns and banks, not truly for consumers or investors. As a result, I see a continuation of a dual system, one crypto-owned, used and managed by the people, the other — the traditional financial system, which will eventually offer central bank digital currencies to its population.”

9. Mati Greenspan, Founder of Quantum Economics:

“Many crypto assets are exceptionally resistant to regulation by design. One of Bitcoin’s main reasons for being invented was to have a currency that is independent of governments and banks, so it makes sense that regulators are having such a tough time overseeing this particular market.

There’s no doubt that over time, they’ll manage to gentrify mainstream usage, but there will always be loopholes and workarounds available, especially for the more technically savvy.”

10. Thibault Verbiest, Chairman Of The IOUR Foundation, Expert At The World Bank and the EU Blockchain Observatory And Forum:

“As long as our societies live in a state system, with rule of law, regulators will always look for legally responsible entities in case of illegal or reprehensible acts, even if it means prosecuting the wrong person. We have seen this attitude since the beginning of the internet when access and hosting providers were prosecuted while they were not the actual perpetrators.

The United States, and then Europe, had to legislate some 20 years ago to protect these intermediaries. Today, this ‘neutrality’ of intermediaries is being challenged in the name of the fight against terrorism or the protection of intellectual property.

A similar phenomenon is at work in the blockchain ecosystem, with the first lawsuits against miners (and certainly tomorrow against block producers in the case of proof-of-stake protocols). DeFi is a real challenge for regulators.

In the current context, regulators naturally target stablecoins backed by national currencies (U.S. dollar, euro, etc.) because the link with a fiat currency necessarily subjects them to existing regulations (AML, KYC, etc.).

But if we talk about perfectly decentralized finance, in which there are no intermediaries, no stablecoins backed by a national currency, and where only non-professionals intervene anonymously, then this world is indeed a wild west for the regulator.

In the end, regulation will probably focus on digital identity, and the real democratic battle will be at this level. The temptation for regulators will be to impose a centralized identity, granted either by the state or by private entities that the state can requisition if necessary (this is already the case with Facebook, in particular). The challenge is, therefore, to promote decentralized identities, managed by users directly from their wallet.”

11. Tim Draper, Founder Of Draper Associates And Draper Fisher Jurvetson:

“Good question. I believe that Bitcoin, as a flag-waver for trust and freedom, will continue to be global. I think that the best governments in their current form are trying to adapt to this new technology, knowing that it will be good long-term for their citizens.

The bad governments that are trying to control their people with their own currencies will make this new, global, trusted and free world difficult and their people will suffer. Of course, the people can vote with their feet.”’

12. Wes Levitt, Head Of Strategy At Theta Labs Inc.:

“Crypto and regulations seem to be meeting in the middle, which is the best outcome to hope for if you believe in crypto values. There was never a plausible scenario where Bitcoin replaces global finance without any input or pushback from government regulators.

Censorship resistance will remain intact because it would be nearly impossible for governments to prevent peer-to-peer crypto transactions. What they can do is enforce surveillance and restrictions on the fiat-to-crypto gateways, which could shut some crypto users out of access to traditional finance.

With respect to CBDCs, they are largely contradictory to crypto’s original values. They are not decentralized, not censorship-resistant (quite the opposite, it will probably be trivial for a central bank to deny you usage of them) and they will be inflationary. I don’t see CBDCs replacing Bitcoin, Ether, etc., but they will coexist. But it is important to recognize that aside from both being digital currencies, CBDCs and Bitcoin have little in common and serve very different purposes.”

13. Yoni Assia, Founder And CEO of eToro:

“Breaking down barriers and increasing access to information, products and services will remain a core value for the crypto industry — this was the purpose it was developed for — and will enhance processes at every level across multiple sectors.

With CBDCs being a big topic for both the industry and policymakers, regulation of crypto in the financial sector is likely to set the scene for regulation of decentralized tech and blockchain more generally. EToro fully supports regulatory measures designed to protect and educate investors and end-users.

We hope that any guidelines put in place will balance the need to protect investors with a desire to support their participation in the crypto markets, and that increased regulation will help to facilitate greater use of a technology that can not only deliver real benefits to the financial services sector, but also facilitate greater financial inclusion globally.”

Updated: 6-24-2021

What Crypto Firms Can Expect From Friday’s FATF Plenary Meeting

Regulatory insiders say the sheer volume of crypto feedback means updated guidance from the FATF could be delayed.

There’s a lot at stake this week as crypto comes further within the creep of global regulations.

The Financial Action Task Force (FATF), an intergovernmental anti-money laundering (AML) body, wraps its second annual review of progress made by member countries to implement a cryptocurrency compliance framework.

It’s been over two years since the FATF recommended bringing cryptocurrency firms (virtual asset service providers, or VASPs, in FATF parlance) within its regulatory framework. This has created challenges for the industry and regulators alike, particularly around areas like the Travel Rule, where third-party VASPs must exchange personally identifiable information (PII) about customers along with transactions.

To further complicate matters, the FATF’s proposed regulations have been forced to expand in step with crypto innovation to accommodate rapidly evolving areas like decentralized finance (DeFi) and stablecoins.

Since the last plenary meeting in March 2021, when FATF issued draft guidance, there has been an overwhelming response from the industry. In short, many in the space are worried regulators will take too broad an approach, particularly when it comes to things like DeFi.

Indeed there has been such an enthusiastic response from the industry, that some are predicting the FATF will likely kick the can down the road to its next plenary meeting in four months’ time, regulatory insiders told CoinDesk.

Bipartisan Crypto Bills Pass US House of Representatives – Again

The Blockchain Innovation Act and parts of the Digital Taxonomy Act were included in the broader Consumer Safety Technology Act.

The U.S. House of Representatives passed two crypto bills on Tuesday evening.

The Consumer Safety Technology Act, sponsored by Rep. Jerry McNerny (D-Calif.), directs the Consumer Product Safety Commission to establish a pilot program to explore use cases for artificial intelligence in commerce.

The two blockchain bills – the Blockchain Innovation Act and parts of the Digital Taxonomy Act – direct the Secretary of Commerce and the Federal Trade Commission (FTC) to study and report on the use of blockchain technology and digital tokens.

The Consumer Safety Technology Act was approved in a previous session of Congress, passing the House in September 2020, but was never approved by the Senate and died at the close of the session.

By reintroducing the bill and passing it onto the Senate again, McNerny and his co-sponsors, including longtime blockchain advocate Rep. Darren Soto (D-Fla.), are giving the bill a second chance.

The blockchain bills are one of many in a series of attempts to provide regulatory clarity on digital asset ownership and management. Many in the crypto market are increasingly demanding regulation, claiming that the lack of a legal framework stifles innovation.

Previous attempts to provide regulatory clarity, including Rep. Warren Davidson’s (R-Ohio) Token Taxonomy Act, which was first introduced in 2018, have failed to gain any meaningful traction.

Supporters of blockchain regulation fear that a lack of governmental guidance puts the United States at risk of falling behind other nations, including China.

“Emerging technologies like artificial intelligence, blockchain technology and cryptocurrency are playing a growing importance in our daily lives and are going to be an economic driver for the 21st-century economy,” Soto said in a speech on Tuesday, adding:

“It’s essential that the United States continue to be a global leader in these emerging technologies to ensure that our democratic values remain at the forefront of this technological development.”

Soto said the Consumer Safety Technology Act is the first step toward the Congressional Blockchain Caucus’ long-term goal of creating a Blockchain Center of Excellence in the Department of Commerce.

Updated: 6-29-2021

Expect Even More Oversight Of Crypto From Regulators, Says eToro

Yoni Assia believes that unprecedented retail investor interest will push regulators to be more proactive about crypto regulation.

Crypto-friendly trading platform eToro is expecting regulators to ratchet up their oversight of the crypto industry, given the increasingly high levels of participation by retail traders and smaller investors. In comments for the Financial Times, eToro CEO Yoni Assia said:

“We are seeing a significant increase in the interest of retail investors and traders in the crypto market. As a part of that growth we should expect also regulators to carefully look at this growing business of retail investors in the crypto markets.”

At the start of this year, eToro had itself struggled to keep up with “unprecedented” demand from crypto traders, with over 380,000 new users opening accounts over the span of 11 days.

Assia’s comments to the United Kingdom’s leading financial newspaper also follow hot on the heels of an intervention by the country’s Financial Conduct Authority, which this week ordered leading crypto exchange Binance to cease all regulated activities in the United Kingdom.

While more regulation is a foregone conclusion, in Assia’s view, he also argued that “the most important thing for regulators is to understand crypto, and understand that it is here to stay.” The eToro CEO has a perspective that spans several different jurisdictions.

Based in Israel, almost 70% of eToro’s users are in Europe, and the company now has its sights on the United States, where it hopes to go public following a merger with a special purpose acquisition company.

Crypto literacy is not only key for regulators, Assia said, but traders themselves need to be sober about the risks they are courting in a fast-paced industry. He stated, “An asset that went up 100 per cent can very easily go down 50 per cent. There’s no doubt that if something went up 1,000 per cent it’s very volatile, and you should understand that as part of your portfolio allocation.”

Founded in 2007, eToro has supported Bitcoin (BTC) trading since 2013. Crypto assets reportedly accounted for 16% of its revenue in 2020, and the platform’s number of users was 20.6 million as of the first quarter of this year.

In that same quarter, the company saw new registrations hitting the 3-million mark — a major uptick, as during the course of 2020, eToro had onboarded roughly 5 million new users in total.

Assia has previously characterized 2020 as a “big year for stocks” but noted that 2021 has been “dominated by crypto headlines.” Already in late January, he noted that crypto trading volumes on eToro were up more than 25 times compared with the same period last year.

While Assia has attributed likely regulation to increased consumer demand, other industry experts have a different view. Speaking to Cointelegraph earlier this month, Marc Powers, a law professor and former attorney at the Securities and Exchange Commission, said: