Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

Stagflation ETF Coming To Ride Soaring Prices, Slow Growth. Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

* Proposed Merk Fund Would Track TIPS, Real Estate, Oil, Gold

* A Place To Hide If Inflation Surge Proves More Than Transient

Investors may soon have an ETF to weather one of the worst possible outcomes for the U.S. economy: surging inflation coupled with stagnant economic growth.

Related:

Black Americans & Crypto (#GotBitcoin?)

Black Americans Are Embracing Bitcoin To Make Up For Stolen Time

‘Bitcoin And Black America’ Author: Protest By Buying BTC

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

The Merk Stagflation ETF would be passively managed and track an index of so-called “stagflation-sensitive” asset classes, according to a Securities and Exchange Commission filing Wednesday. If approved by regulators, the fund would hold 55%-85% U.S. Treasury Inflation-Protected Securities and between 5%-15% real estate, gold and oil.

Fears about stagflation — a toxic mix of rising costs, falling employment and slow growth — have stalked markets for months as consumer prices rise at the fastest pace in four decades and the Federal Reserve moves closer to raising interest rates to cool the pace of growth.

Few expect that to be the likely outcome, especially with Fed Chair Jerome Powell saying he’ll take a nimble approach to monetary policy and some price pressures expected to ease as supply chains roiled by the pandemic are repaired.

But elevated producer prices are a sign that concerns about stagflation could flare up again, according to Miller Tabak + Co.’s Matt Maley.

“There’s no question that stagflation concerns have eased in recent months, but I worry that they’ll rise again in the coming months. Therefore, a stagflation ETF could gain a lot of interest,” said Maley, the firm’s chief market strategist, who isn’t involved with the ETF. “Higher inflation and lower profit margins will likely raise concerns about stagflation before long.”

The ticker and management fees for the ETF are not yet listed.

Updated: 2-18-2022

Beware The Invisible Losses Inflation Foists On Investors

It’s more important than ever to understand the difference between nominal and real returns. Unfortunately, too many don’t.

When it comes to investment returns, most people, including those who work in financial markets, only consider nominal numbers. For example, they look at the price of the S&P 500 Index now, where it was a year ago and work out what the total return was including dividends in that period.

They do the same calculation for bonds, substituting interest payments for dividends. By those measures, the S&P 500 returned about 14% and 10-year U.S. Treasury notes lost about 5%. 1

But what investors should be looking at are real numbers, which take into account the effect of inflation. This is not an abstruse, academic distinction.

Good investments are ones that should, at the very least, maintain your ability to buy the things you want and need to buy in the future. In periods of low inflation, there isn’t much difference between nominal and real returns in the short term.

When inflation is high and rising, good nominal returns become more modest ones, modest returns turn into bad ones and bad returns turn into woeful ones. In the examples above, the real returns have been roughly 7.7% for the S&P 500 and minus 12.5% for 10-year Treasuries given that the consumer price index surged 7.5% in the period.

The Russell 2000 Index of small cap stocks lost 16% in real terms and, measured in dollars, emerging markets some 20%.

And with central banks set to rein in inflation, albeit very reluctantly, more obvious nominal losses will be added to less visible real losses. That is what happens when the risk premiums demanded by investors in almost every asset class are miniscule – as is still the case even after the recent turbulence in markets.

Government bonds are a decent proxy for extremely slim risk premiums. The overwhelming consensus in markets is that inflation will rapidly drop, capping the rise in short-term interest rates and bond yields and thus supporting all types of riskier assets.

The rise in bond yields over the last six months has helped drive real yields — the yield offered by inflation-linked bonds before inflation is added in — higher. The yield on five-year Treasury Inflation-Protected Securities, for example, has jumped by a percentage point since mid-November. It is that rise in real yields that has unsettled other markets.

But the real yield on five-year TIPS is still below zero at minus 1%, and it is not clear what that number means. Indeed, the concept of future real yields is so fuzzy as to be almost meaningless. For very short-term rates, the real yield calculation is fairly straightforward: It is the official interest rate minus the inflation rate.

The federal funds rate, for example, is about zero, so the real rate given the latest consumer price index reading is minus 7.5%. Future real rates, though, are a residual.

They are merely the result of subtracting the expected inflation rate over the next five years from current nominal bond yields. But what markets expect and what they get are not the same thing. Inflation that is higher than markets expect means that actual real yields end up lower than forecast and vice versa.

If you’re confused about this, you’re not alone. I’m probably being generous in saying so are 95% of people who work in financial markets. For clarity, understand that two things, both guesses, dominate the current calculation of future real yields.

The first is that the market thinks the U.S. rate of inflation as measured by the CPI will fall to less than 3.5% over the next couple of years. The second is the main driver, which is that markets expect energy prices to fall. The spot price for West Texas Intermediate crude is roughly $92 a barrel.

It’s price for the first quarter of next year in the futures market is about $80. But both the forward energy market and the forward inflation market have been consistently and spectacularly wrong for almost two years.

If they continue to be wrong — and the chances are high because, among other reasons, fossil-fuel investment has plummeted in recent years but demand continues to grow — then inflation and inflation expectations will ratchet up further. And, all things equal, bond yields will have to rise a lot further to keep real yields from dropping.

The problem is that despite the rise in nominal bond yields in the past year, they remain so low that they reward investors even less than the expected rate of inflation over the life of the bond. Yet those expectations forecast a huge drop in the inflation rate.

But if inflation slows more modestly, or stays where it is, the only way for investors not to lose money in real terms is to demand much higher nominal yields on bonds. That means even more losses for investors on top of those they have already suffered on their fixed-income assets.

Efforts by central banks to contain inflation will just mean that investors lose money more obviously. That’s not just in government bonds, but increasingly in credit and equities as well. It’s a sort of lightbulb moment, but not in a good way.

Updated: 4-12-2022

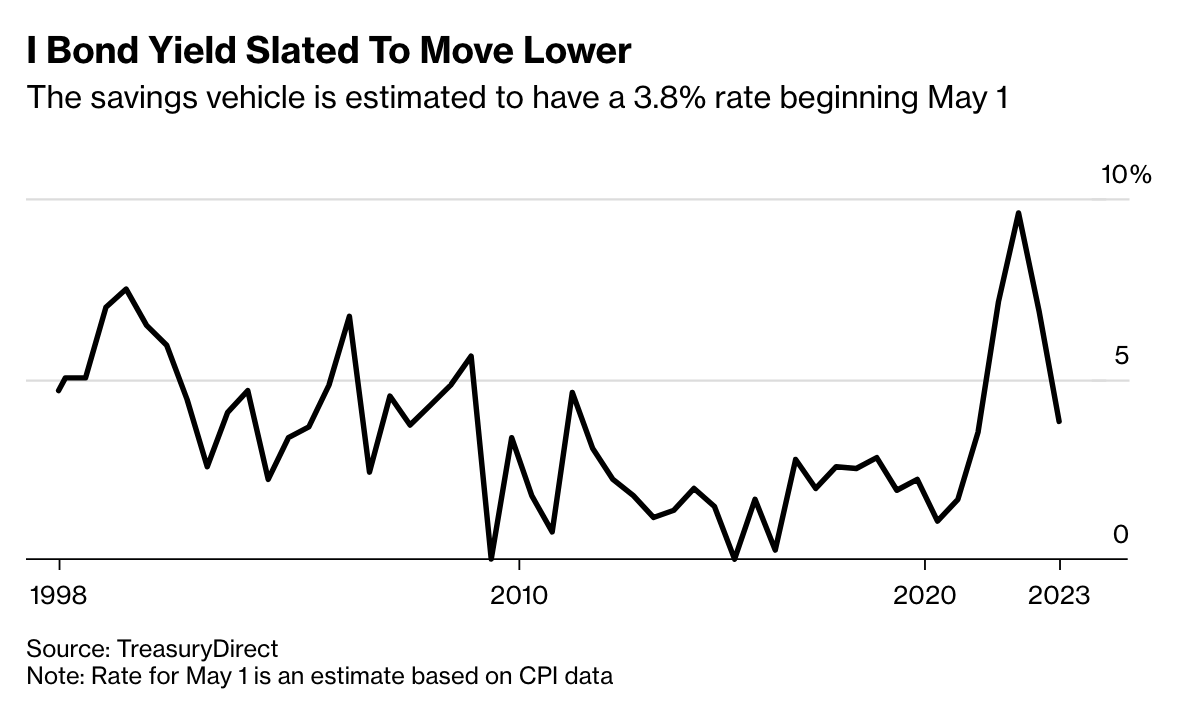

The Safe Investment That Will Soon Yield Almost 10%

The March surge in the consumer-price index is the latest boon to buyers of U.S. savings bonds that are adjusted for inflation, known as I Bonds.

There’s no such thing as a free lunch in finance. Except maybe this: The interest rate on inflation-adjusted U.S. savings bonds will approach 10% beginning in May.

U.S. Treasury Series I Bonds, or I Bonds, will offer annual interest payments of 9.6%, based on the bond’s latest inflation rate calculation, which is tied to March’s consumer-price index.

Prices rose by 8.5% year over year in March, the fastest pace since December 1981, according to the Bureau of Labor Statistics.

The interest is compounded every six months and reassessed in May and November each year. The bonds haven’t always been hot sellers, but that has changed with the surge in U.S. inflation gauges.

Over the past six months, nearly $11 billion in I Bonds have been issued, compared with around $1.2 billion during the same period in 2020 and 2021, according to Treasury Department records.

“That’s been a hot topic,” said Kathy Jones, chief fixed-income strategist at Charles Schwab. “The I Bond has been very popular because of the yield. For six months at least, you’ve got a pretty fat yield there.”

I Bonds are guaranteed by the federal government. The bonds pay a fixed rate that is set by the Treasury, plus an inflation-adjusted rate that is determined by the change in CPI over the past six months.

Thanks to the upward trajectory of CPI, I Bonds have become a top yielding U.S. asset, even though they carry virtually no risk of principal loss.

For investors seeking a safe and high-yielding investment, there is “nothing nearly as good as the I Bond,” said Joshua Rauh, a senior fellow at Stanford’s Hoover Institution.

The bonds could pay more if Treasury Secretary Janet Yellen chooses to raise the fixed interest rate, which has held at 0% since May 2020.

Even without a bump from Ms. Yellen, the rate will be more than 150 times the annual interest paid by the average U.S. bank on a savings account and more than triple the current yield on a 30-year U.S. Treasury bond. It’s also almost triple the 3.54% the I Bonds paid just one year ago.

There are a few strings attached. I Bonds can’t be traded like Treasurys and they are only available through the U.S. Treasury Department’s website, TreasuryDirect.gov.

They can’t be redeemed for at least one year and I Bonds redeemed after less than five years will be penalized the last three months of earned interest. There are special provisions for those affected by a disaster.

Since they aren’t purchased through banks or brokerages and don’t pay commissions or expenses, the assets have drawn limited attention from financial advisers. As of March 31, there was a total of $57.2 billion of I Bonds outstanding, which amounts to less than 0.25% of all U.S. debt held by the public, according to the Treasury Department.

Mr. Rauh is trying to change that. He wrote an opinion article in The Wall Street Journal in February with Stanford visiting economics fellow and former Federal Reserve Board member Kevin Warsh urging the administration to raise the annual cap on I Bonds from $10,000 to $100,000 per person.

(The current cap rises to $15,000 for individuals who choose to put $5,000 of their tax return in paper bonds.) Rep. Alex X. Mooney (R., W.Va.) said last month that he was introducing a bill that would ask Treasury to assess the feasibility and impact of raising the I Bond cap.

I Bonds were introduced in 1998 by former Vice President Al Gore and Treasury Secretary Robert Rubin as a way to help Americans save for investments like college and retirement and to “ensure that those savings will never be undercut by future inflation,” Mr. Gore said at the time.

Treasury is working on an overhaul of TreasuryDirect.gov to make it more user friendly, according to a senior spokesman, noting that the department is “currently in the process of developing an updated, modern replacement for the current TreasuryDirect system.”

Updated: 5-6-2022

Which Investments Do Best When Real Interest Rates Are Negative?

History suggests the assets to buy—and the ones to avoid—according to this professor.

With inflation topping 8% by some estimates, real interest rates have hit a low not seen in the U.S. since the aftermath of World War II. In fact, they have turned negative.

Real interest rates measure the interest one is receiving net of the inflation rate (that is, the interest rate minus inflation). Current estimates have real interest rates somewhere between negative 6% and negative 7%.

Often investors get spooked when negative real interest rates appear, since it means they are losing money (in a real sense) by holding on to safe assets like Treasury bills or T-Bonds. And many speculate that it is this loss of wealth that forces investors into riskier positions.

We decided to examine this phenomenon and see how different asset classes perform when real interest rates turn negative and stay negative for a while.

The upshot: Historical data shows that when real interest rates go negative, the riskiest asset classes (emerging-markets stocks, small-caps, etc.) have done extremely well in the first half of such a cycle—outperforming safer assets by over 1.5 percentage points a month.

Yet this reverses in the second half of the cycle: On average, the riskiest assets have underperformed by over a percentage point in the second half of a negative-rate cycle.

The Research

To investigate this issue, research assistants Jaehee Lee and Natalia Palacios helped me gather interest-rate data (based on T-bills), inflation data and mutual-fund-return data for various asset classes over the past 50 years.

We then examined periods during the past half-century when real interest rates went negative and stayed negative for more than a month.

We found seven such periods, the average length of which was 2.5 years. Next we divided each such cycle into a first and a second half to examine how the performance of the different asset classes compared during the two halves.

Two findings are worth noting. First, during the first half of a negative-rate cycle, the riskiest mutual funds performed best. Emerging-markets funds, U.S. small-cap funds and international-stock funds averaged 1.96%, 1.13% and 1.03% returns a month, respectively.

This is far superior to all other equities, and far better than the average bond fund, which had average returns of 0.35% a month during this period.

The Flip Side

Yet everything flipped as the cycles matured. In the second halves, the riskiest funds underperformed. For instance, emerging-markets funds lost an average of 1.13% a month. So while investors were seeking risk in the first half, it appears they quickly ran away from it the longer the U.S. remained in a negative real interest-rate environment.

As for the present situation, the current negative-rate cycle began in the second quarter of 2020. That means, if our pattern holds true, lots of investors likely have shifted over to riskier assets already.

But, since we are still in the cycle, approaching the beginning of the third year, it’s impossible to know yet where the first half ends and the second begins. Thus, even if we haven’t fully hit the point where investors move out of riskier positions, judging by historical data, it can’t be far off.

Investors Bet Big On Recovery Bonds

* This Year, Issuers Have Sold The Most Recovery Bonds Ever

* The Product Offers Spread Pick Up, Duration And High Ratings

Money managers scouring the credit markets for yield are being seduced by a relatively rare type of security — so-called recovery bonds — for their attractive spreads, duration and safety.

The bonds are typically issued by state utilities trying to recapture losses from natural disasters, such as wildfires or storms, through special fees levied on customers’ electric bills. The charges are then bundled up and sold as notes which get classed as asset-backed securities.

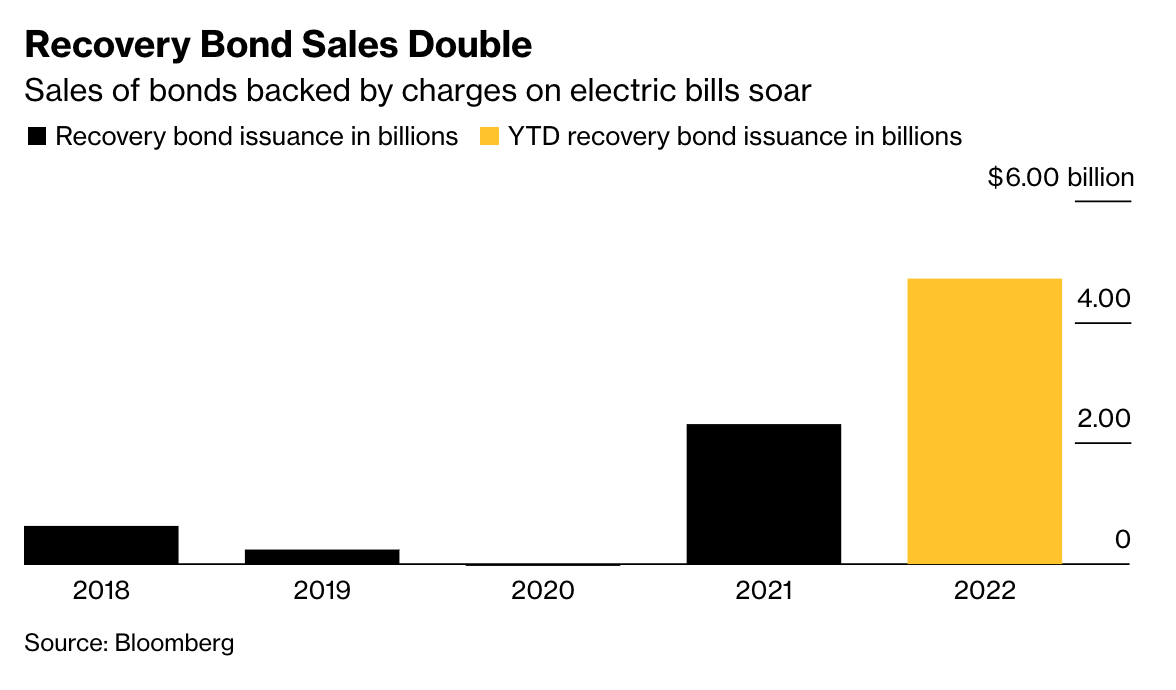

Issuances of recovery bonds soared in 2021, with roughly $2.3 billion of notes sold. This year, that figure has already doubled to roughly $4.7 billion so far, according to Bloomberg data. Those numbers are only likely to increase over the next couple of years, said JPMorgan strategists in an April 29 research note.

While these securitizations are still scarce compared to those backed by other asset classes, investors are eating them up. Utility giant PG&E Corp. recently issued $3.6 billion of recovery bonds — aimed at recouping costs caused by the wildfires that ravaged California in 2017 — in a deal that has both structured and corporate investors jostling for orders.

This is because recovery bonds unlock opportunities for ABS money managers that they cannot seem to find anywhere else. These include longer-dated tenors — ranging from 10 to 30 years — compared to most ABS deals which barely scrape the five-year mark.

For corporate investors, who usually do not play in structured products, the appeal is even greater given the high-quality AAA ratings of the notes which is not often seen in the corporate world.

“Corporate investors throw in big orders, splashing the pot,” said David Goodson, head of securitized credit at Voya Investment Management, in an interview. “That duration and spread at the AAA level makes these bonds look attractive relative value-wise.”

The assets offer a substantial spread pick up relative to other types of consumer ABS, such as bonds backed by auto loans and credit card debt, according to the JPMorgan strategists.

The difference in spreads between credit card and stranded asset ABS stands at almost 40 basis points, up from the low single digits in 2019, they wrote in their note.

The bonds are also backed by state legislation that allows utilities to impose recovery charges, making them a safe haven compared to other types of bonds backed by consumer credit, according to market watchers. Delinquencies are also less frequent than in other types of consumer credit-backed bonds.

“Electricity is a necessity so it’s unlikely that the consumer will stop paying,” said Deborah Newman, an ABS analyst at S&P Global Ratings, in an interview.

Another comfort for investors is that the bonds have a credit enhancement feature called a true-up mechanism. This adjusts customer charges to ensure that payments are balanced out and stabilized even if there are variations in collections, which can be too low or too high some months due to population changes or other factors.

There are, however, certain risks. Storms or other natural disasters that make it difficult for the utility to provide power is one of them, as the customer’s obligation to pay the charges is tied to receiving that electricity, said Newman.

But the downsides are relatively few. Even if a utility files for bankruptcy, the harm to ABS investors might still be minimal, as the utility will likely continue to operate even through bankruptcy, said Newman.

Apart from the PG&E offering, there is another recovery bond deal that could hit the market soon, led by a subdivision of the state of Louisiana.

Updated: 6-27-2022

Yield-Hungry Investors Are Flocking To High-Dividend ETFs

With bonds slumping, a record amount of money is pouring into exchange-trade funds focused on big dividend payouts.

With markets in tumult and inflation surging, the allure of high-dividend stocks is growing fast.

Exchange-traded funds that track the highest-yielding stocks have taken in about $25 billion in assets so far this year, a new record for the value-oriented category, and inflows could reach $50 billion by year-end, according to Bloomberg Intelligence senior ETF analyst Eric Balchunas.

Companies that pay big dividends to their holders have long been wallflowers compared to sexier tech stocks, but that’s changing as the Federal Reserve rapidly hikes interest rates, raising fears of a recession, sending growth stocks spiraling and causing bond prices to slump.

“Investors have a need for yield, yet people are skittish to get that yield in the bond market because they know the Federal Reserve is hell-bent on raising rates,” Balchunas said on Bloomberg’s “Trillions” podcast. “With these ETFs, you’ve got this perfect one-two punch where they have two things people want right now — exposure to energy and high dividends.”

Energy companies often have high dividend yields, and the sector is the only portion of the S&P 500 Index that’s in the green this year as the war in Ukraine has crimped supplies, with the sector rising 29% as of Friday’s close versus a decline of 18% for the broader benchmark.

Meanwhile, dividend-paying stocks have outperformed every other factor except value year-to-date, according to data compiled by Bloomberg.

Some of the high-dividend ETFs have energy stakes approaching 20%, helping boost their performance. Exxon Mobil Corp., which yields just over 4% and whose stock is up 42% this year, is a top holding in many funds.

These include the WisdomTree US High Dividend Fund and the iShares Core High Dividend ETF, both of which have total returns of about 2% so far this year.

Many funds have dividend yields between 3% and 4%, about double the S&P 500’s trailing 12-month yield of 1.6%. While the 10-year Treasury note yields over 3% as well, “until the Fed cools off, the bond market is going to be a tough place,” said Balchunas.

“We’ve seen it in mutual fund flows with older investors bailing. That will be a constant drain on the prices of bonds for the foreseeable future.”

The yields offered by high-dividend ETFs may be similar across funds, but they vary greatly in how they find that yield. The Vanguard High Dividend Yield ETF holds about 440 stocks and tracks the FTSE High Dividend Yield Index, which is made up of US companies (excluding real estate investment trusts) that have paid above-average dividends for the previous 12 months.

The SPDR Portfolio S&P 500 High Dividend ETF, meanwhile, homes in on 80 of the S&P 500’s highest-yielding companies.

The ETFs also weight their portfolio companies differently, which can dilute or amp up concentration. Some weight by market cap, some weight every stock equally, and some weight based on dividends.

In WisdomTree’s ETF, for example, which focuses on the highest dividend yields, Exxon Mobil has a 7.3% weight, while it is a much more tame 2.8% in Vanguard’s market cap-weighted fund.

“If a fund weights by dividends you clearly are going to have some stocks that dominate, and that can be a little scary, because yes, this thing yields a lot but now it’s really controlling your fund,” said Balchunas. “Some investors would likely opt for the equal-weighted version on these funds.”

Consumer-Staples Stocks Are Bright Spot In Bleak Market

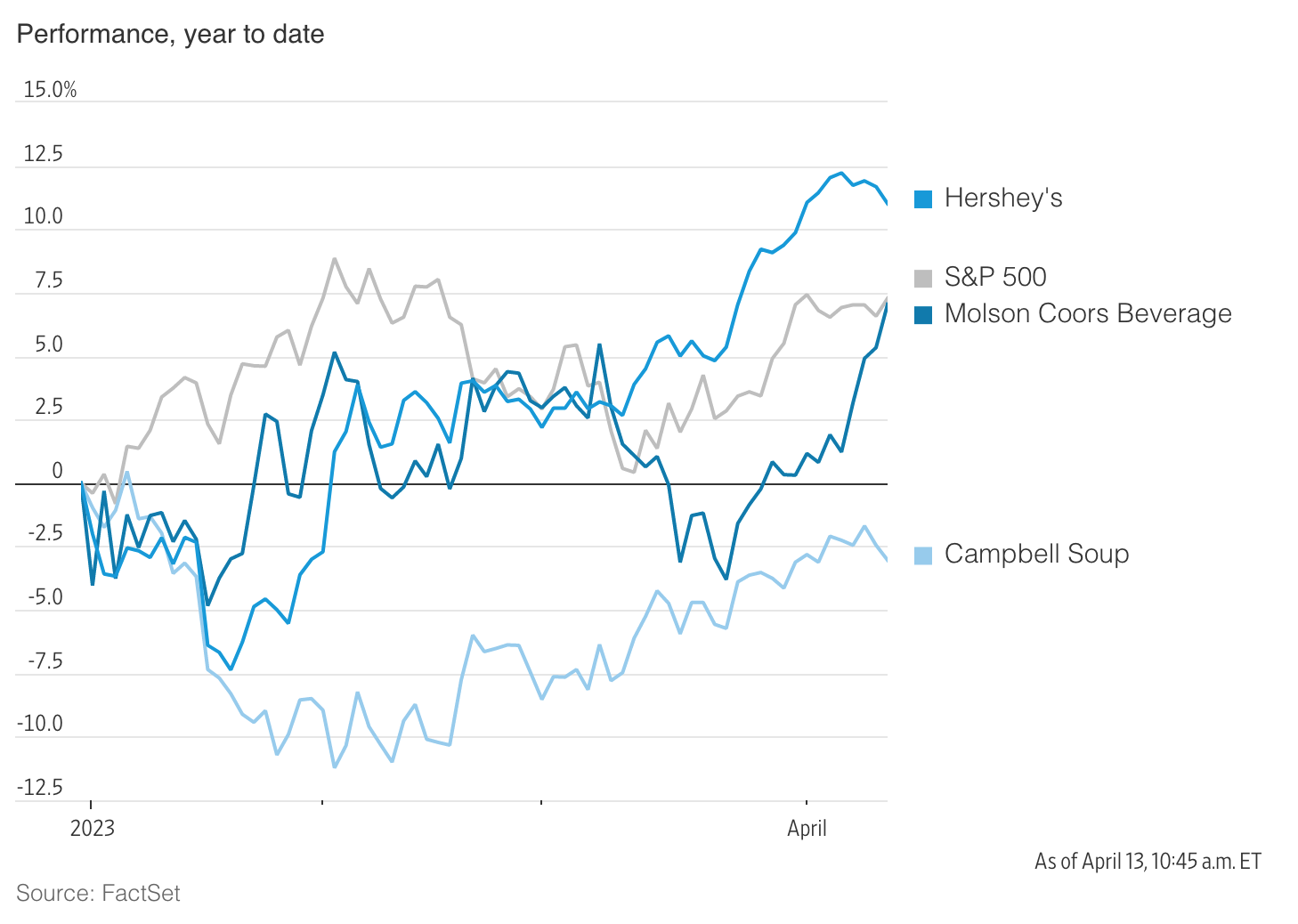

Molson Coors, Hershey and Campbell Soup are among the S&P 500’s best performers of late.

Almost everything has fallen in the stock market this year. Consumer-staples stocks are bucking the trend.

Shares of companies selling staples such as beer, chocolate and canned soup have raced past the broader market in 2022. Molson Coors Beverage Co. is up 19% for the year, while Hershey Co. has risen 14% and Campbell Soup Co. has gained 11%. That is compared with the S&P 500, which has fallen 18%.

One reason why? Consumer-staples companies are commonly regarded as a haven during volatile markets and recessionary periods. Investors often buy shares of companies that sell these day-to-day household goods for their strong dividend yields and steady business.

Shares of staples companies trailed well behind those of technology companies the past several years, but investors wary of decades-high inflation, tightening monetary policy and a potential recession are now taking another look at the group.

“The shift over the next quarter should be to be more defensive,” said Justin Burgin, director of equity research at Ameriprise Financial. “In bear markets, it’s the portfolio that loses the least is the winner.”

Mr. Burgin said the firm is still overweight shares of technology, financial and healthcare companies, but is considering adding exposure to more defensive sectors, like staples.

He noted that staples companies have had nearly unchanged—albeit lower—profit margins for the past decade, making them relatively stable investments.

“It’s steady. It doesn’t change… it’s a good place to kind of hide out,” he said about the sector.

Some analysts believe consumer sector companies, especially big-box retailers, may be able to hold up better than other industries in the short term as costs for things from labor to fuel rise.

“In the near term, having the staples part of the market is an important part of the portfolio,” said Mona Mahajan, a senior investment strategist at Edward Jones. “There’s a focus on the lower-end consumer and where they’re gravitating as inflation starts to bite a little bit.”

Analysts have warned that higher prices could push consumers to adjust spending habits, which could lead to a recession. A consumer survey conducted by Morgan Stanley Research released last week listed inflation as the No. 1 concern for two-thirds of respondents.

To be sure, not all investors are convinced staples stocks can keep rising.

The S&P 500’s consumer-staples sector hit an all-time high in April, but has fallen since then as investors have grappled with higher-than-expected inflation readings and downbeat earnings reports from major retailers.

Walmart Inc. missed first-quarter earnings expectations due to pressures such as high fuel prices, labor costs and inventory levels.

Jack Janasiewicz, portfolio manager at Natixis Investment Managers Solutions, says the staples sector faces two key risks: continuing economic slowdown and potential margin compression. He says he is shying away from the stocks because the companies don’t have room to absorb more price increases without passing them down to consumers.

“Now’s not the time, just kind of looking to batten down the hatches in the staples sector,” Mr. Janasiewicz said.

The S&P 500’s consumer-staples sector is also more expensive than the broader index, trading at 20.13 times its expected earnings over the next 12 months versus 16.46 times earnings for the benchmark as a whole, as of Thursday.

Mr. Janasiewicz said his firm is staying away from investments in materials, industrials and commodities, instead acting more keenly on healthcare and bellwether tech stocks.

The U.S. is experiencing some of the highest rates of inflation the nation has seen since the early 1980s as Americans are noticing price hikes at the grocery store, gas station and coffee shop.

The price of goods and services climbed 6.8 percent in November, according to the most recent U.S. Labor Department data. The inflation rate rose by that same tally in October. All told, inflation has risen by at least 5 percent since June.

The statistics basically mean “for every dollar you have, you can’t buy the same amount of goods and services,” said Vicki Bogan, a finance professor at Cornell University in upstate New York.

“At the core of this, prices are going up, so the money that you have, you can’t buy as much,” said Bogan, who is also an expert on household finances.

Black households are being hit the hardest by inflation. They are paying more for goods and services across the board due to the spike in prices. African-Americans spent 7.1 percent of their post-tax income on energy, compared to 5.4 percent spent by whites, Forbes reported.

Black households spent 12.5 percent of their income on food, versus 11.1 percent for whites. According to a Bank of America researchers, the spending power shock from these higher inflation categories was 4 percent for African-Americans, compared to 2.9 percent for whites.

There’s no true consensus from economists on when inflation may slow down, with some predicting later this year and others forecasting further out to 2023 and 2024. But even if prices continue to rise this year, there are steps Black households can take now to fend off rising inflation, Bogan told Finurah.

1. Learn New Skill To Gain Better Employment

Now might be a good time for the family’s income earners to update their professional skills or learn entirely new ones, Bogan said.

That’s because one solid way to combat inflation is to find a higher paying job or start working in a field that stays in high demand no matter how poorly the economy performs, Bogan said.

2. Up Your Investing Game In The Stock Market

Some Black families have investment portfolios that are mostly in bonds, but because inflation is so high right now, “the value of any bond assets are eroding over time,” Bogan said. Instead, it might be time to get more aggressive and invest in individual stocks, mutual funds or exchange-traded funds, she said.

The thinking behind this strategy, Bogan said, is for a family to grow its invested money at a higher percentage than the rate of inflation. It’s important for Black households to invest more right now in particular because “otherwise you’re kind of losing money,” Bogan said.

3. Time To Move? Weigh Your Option On Renting Or Buying

Bogan said, depending on where a family lives, the household should do research and see if it’s cheaper for everyone to move into a rental unit or purchase a home. Each family will come to a different conclusion, she said, but the goal here is to lower one’s monthly housing cost.

The average apartment rent price in the U.S. rose to $1,680 for a one-bedroom and $1,958 for a two-bedroom, according to December data from Apartmentguide. The average monthly mortgage payment is roughly $1,600, according to U.S. Census data from September.

4. Hold Off On Big Purchases For Now

Bogan said the price of nearly everything expensive has gone up, so it wouldn’t be wise for families to overpay on something if the purchase isn’t absolutely necessary. Perhaps that means delaying the purchase of a new car or holding off a vacation trip out of town, she said.

The goal with this strategy is to keep as much money in the household as possible until inflation falls.

“Maybe some of those prices may go down in the future,” Bogan said.

Updated: 2-10-2022

Higher Inflation Is Probably Costing You $276 A Month

Who is feeling the price squeeze the most? Millennials, Latinos and the middle class are at the top of the list.

The average U.S. household is spending an additional $276 a month because of inflation that is rising at its fastest rate in 40 years, a new economic analysis showed.

The squeeze stems from higher prices across a range of products and services, including cars, gasoline, furniture and groceries.

Inflation accelerated to a 7.5% annual rate in January, the Labor Department said Thursday, reaching a new four-decade high as consumer demand and supply constraints continued to push prices higher. Inflation has been above 5% for the past eight months.

“A lot of people are hurting because of high inflation. $276 a month—that’s a big burden,” said Ryan Sweet, a senior economist at Moody’s Analytics who conducted the analysis. “It really hammers home the point of ‘what is the cost of inflation?’”

Mr. Sweet came up with the figure by comparing what the average household spent under 7.5% inflation versus the amount it would have spent when inflation was 2.1%, the average in 2018 and 2019.

Prices for certain goods and services jumped more than prices for others—which means people who paid for those things probably have suffered a bigger inflation burden than those who didn’t.

Any consumers unlucky enough to have needed a new washing machine might have taken a bigger hit compared with others from inflation, because laundry-equipment prices leapt 12.1% last year.

Research shows that inflation is also squeezing some groups, on average, more than others. The consumer-price index reflects the change in prices for the average basket of spending.

But people’s spending baskets vary based on who they are, which influences to some degree their daily needs, where they live, how they get around and what they do for fun.

With prices for different goods and services rising at different rates, those variations influence how big a chunk inflation is eating out of their budgets.

A study by Wells Fargo & Co. economists broke out the impact in fine demographic detail based on December 2021 inflation rates. It uses the spending basket for 2019 and 2020—more recent than that used for CPI—and found that inflation hit 6.5% in December, down from the 7% reported by the Labor Department using the spending basket for the previous two years.

The calculations don’t necessarily capture the whole picture of each demographic group’s financial realities. The economists noted that the way the government measures housing costs means they likely overstated the cost burden for homeowners and understated it for renters.

Lower-earning households devote the biggest share of their budgets to rent, which means they probably are experiencing much higher inflation.

Here Are Some Of The Study’s Findings:

• Middle-class households were squeezed harder than other groups, with prices up 6.7% in December. That is 0.5 percentage points higher than for the lowest and highest income brackets. Transportation costs proved decisive here: Middle-class households spend a bigger share of their budgets than others on gasoline—its price was up nearly 50% in December—and used vehicles. Higher earners tend to buy new cars, prices for which climbed at a slower rate. Just 72% of households in the bottommost earning group owned or leased vehicles in 2020, compared with 90% overall, according to Labor Department data.

• Higher-earning households spent relatively more on dining out and recreation, which rose much less than overall inflation. This group also devotes more spending toward education, in part because, on average, it has more children under 18 years old than other income groups, Labor Department data show.

• Hispanic or Latino households faced inflation of 7.1%, thanks again to a disproportionately large share of spending on used autos and gasoline. That compared with 5.6% for Asian families, who tend to earn more than the average American household.

Those ages 35-44 saw their costs rise 6.9% in 2021, higher than any other age group, though the rate for younger age groups was just slightly less. Those ages 65 and up experienced 5.8% inflation, in large part because of the share of their spending that went toward healthcare—16%, versus 4% for those under 25. Healthcare services rose just 2.5% in 2021. Younger consumers spent a bigger share of their budgets on cars and gasoline.

Inflation’s ripple effects might affect groups differently, too. An analysis of auto lending by New York Fed economists found that surging auto prices offset the drop in interest rates, translating to an 8% jump in the monthly payment for the typical new auto-loan borrower to $418 in 2021 compared with 2020.

That so far hasn’t resulted in trouble making payments—except among the under-30 crowd. Delinquency rates among this group rose in the fourth quarter, suggesting that “there may be challenges brewing for some younger borrowers,” the economists said.

Updated: 4-15-2022

Dividend Aristocrat Stocks Can Help You Keep Ahead Of Inflation. These 15 Take Top Prizes For Raising Payouts

Companies that have raised dividends the most over the past 10 years have tended to outperform the broader market — by a lot.

Some investors are interested in stocks that pay high dividend yields for a source of income. Others believe it is better to focus on total returns over long periods. The Dividend Aristocrats are a group of stocks that appeal to both camps.

Below is a list of Dividend Aristocrats that have increased their payouts the most over the past 10 years. The group’s performance has been, in a word, incredible.

Connection Between Dividends And Inflation

MarketWatch’s Mark Hulbert advises investors to pay attention to dividends when inflation is high. He points to data showing that companies in the benchmark S&P 500 Index SPX, -0.88% tend to increase dividends at a higher rate than inflation.

Turning to the S&P 500 Dividend Aristocrats — a group within the benchmark that has increased annual regular dividends for at least 25 years — Hulbert makes the case that this group can be expected to pay dividends matching the yield on 10-year U.S. Treasury notes TMUBMUSD10Y, 3.121% over the next decade.

And that’s on top of the potential for stock market gains when holding a group of blue-chip companies.

The Dividend Aristocrats don’t necessarily provide high income — many have low current dividend yields. The idea is that a commitment by management to increase payouts to owners over time might correlate with better long-term performance.

Best Dividend Compounders

We decided to highlight Dividend Aristocrats that have raised payouts the most over the past decade. To do this, we expanded our pool beyond those in the S&P 500.

S&P Global maintains a large number of Dividend Aristocrat indexes. You can see the full list here, and a shorter list of Aristocrat indexes tracked by exchange traded funds here.

We Focused On The Three Broad Groups Of Dividend Aristocrats Listed On U.S. Exchanges:

* The S&P 500 Dividend Aristocrats Index SP50DIV, -0.08% is made up of the 65 stocks in the S&P 500 that have raised regular dividends on common shares for at least 25 years. It is tracked by the ProShares S&P 500 Dividend Aristocrats ETF NOBL, -0.68%.

The S&P 400 Dividend Aristocrats Index has 48 stocks of companies that have raised dividends for at least 15 consecutive years, drawn from the full S&P Mid Cap 400 Index MID, -2.06%. It is tracked by the ProShares S&P MidCap 400 Dividend Aristocrats ETF REGL, -1.27%.

* The S&P High Yield Dividend Aristocrats Index SPHYDA, -0.92% is made up of the 119 stocks in the S&P Composite 1500 Index SP1500, -1.35% SP1500, +1.65% that have increased dividends for at least 20 straight years.

It is tracked by the SPDR S&P Dividend ETF SDY, -0.61%. The S&P Composite 1500 itself is made up of the S&P 500, the S&P Mid Cap 400 and the S&P 600 Small Cap Index SML, -1.73%.

So the S&P High Yield Dividend Aristocrats Index includes all the stocks in the S&P 500 Dividend Aristocrats Index. But it excludes some that are in the S&P 400 Dividend Aristocrats Index.

The name of the High Yield Dividend Aristocrats Index is confusing, because the yields aren’t necessarily high — they range from 0.19% to 5.08%.

Combining the three Dividend Aristocrat Indexes and removing duplicates gives us a pool of 136 companies.

From that group, here are the 15 companies that have shown the highest compound annual growth rates (CAGR) for regular dividend payouts over the past 10 years. It makes no difference what the current dividend yield may be or what it was 10 years ago:

Notes About The Dividend Aristocrats That Have Grown Payouts The Most Over The Past 10 Years:

* The Dividend Aristocrat with the highest 10-year dividend growth CAGR was Cintas Corp. CTAS, -1.49%, which also had the best total return for 10 years through April 19, 2022, with dividends reinvested.

That return of 1,119% compares to a total return of 295% for the S&P 500. In fact, among this group of 15 best dividend compounders among the Aristocrats, 13 have beaten the S&P 500’s 10-year return.

* The current yields for the group may be low — 10 are below 2% and five are below 1%. Many also had low yields 10 years ago. But if you look at the second column from the right, you can see how high the yields would have grown on shares held for 10 years.

Based on current payouts and prices paid 10 years ago, three of the 15 now yield 10% or more, with nine yielding more than 7% and 12 yielding more than 5%.

All in all, this group of 15 Dividend Aristocrats that have grown their dividends the most over the past 10 years has performed remarkably well. It made no difference how high or low the dividend was. A focus on generous increases of the payouts was correlated with high total returns eventually high income.

Updated: 4-22-2022

How To Stop Your Fund Manager From Feeding On Your Cash

Investors don’t have to settle for scraps anymore now that interest rates are rising.

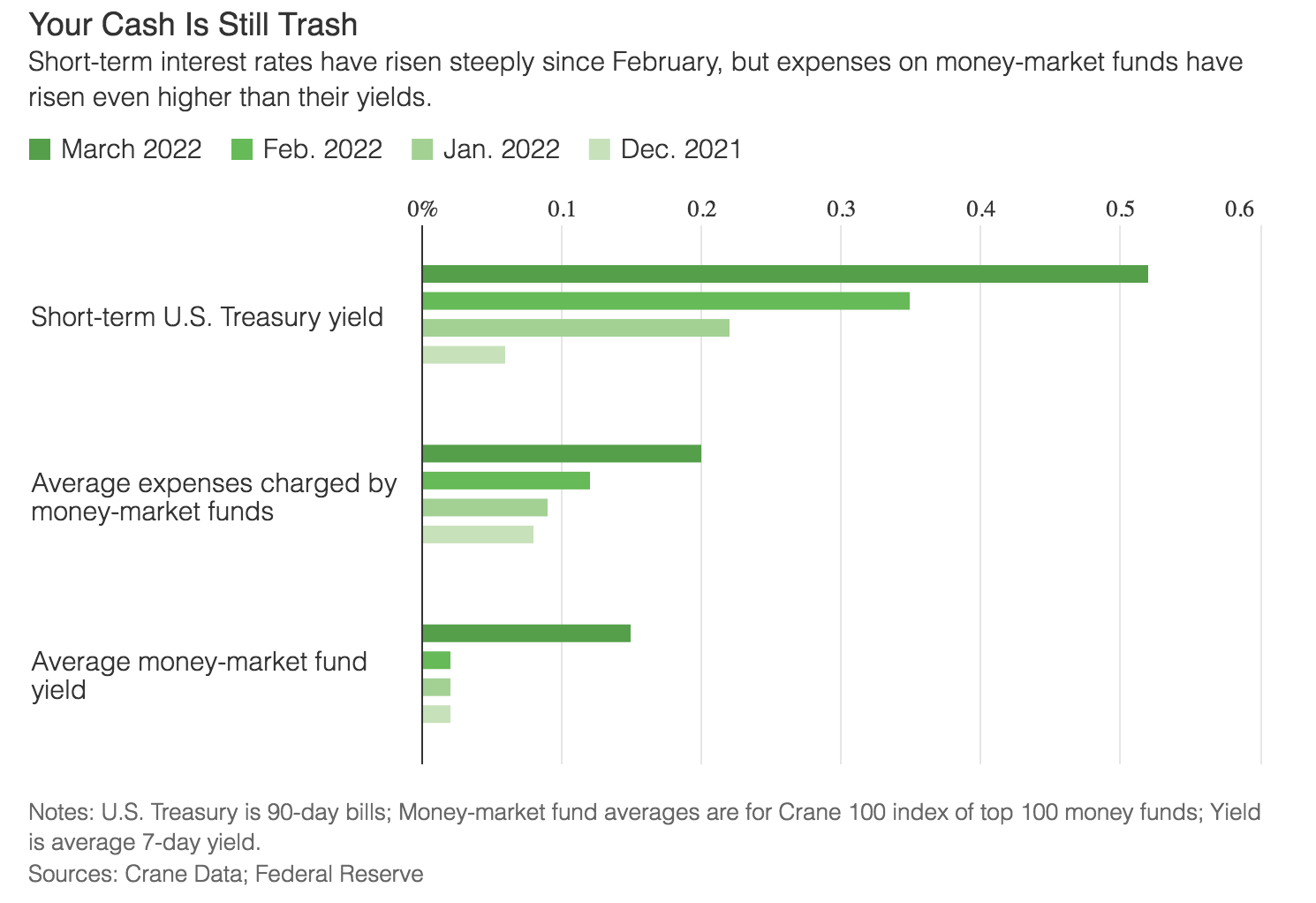

As interest rates rise, the benefits are accruing to the people who manage cash, not to the investors who hold it.

In the first quarter, the yield on three-month Treasury bills rose 0.46 percentage point. The yield on retail money-market mutual funds rose a measly 0.03 point—while their expenses shot up 0.22 point.

Don Roth, a 63-year-old aviation engineer in the Cincinnati area, says he might have to buy a new house soon, so he is keeping a higher-than-usual 5% of his portfolio in cash. “It’s frustrating,” he says. “It just sucks to see all that money sitting there earning absolutely nothing.”

With fund managers capturing nearly all the extra income from the Federal Reserve’s 0.25-percentage-point interest-rate increase last month, you’ll have to take matters into your own hands to maximize the return on your cash.

Money-market funds own investment-grade short-term debt; they seek to maintain a stable price per share, typically as close as possible to $1.00, and pay dividends that should rise and fall to track short-term interest rates.

Why, then, has almost all the recent rise in rates gone to asset managers, rather than investors?

Fund companies charge roughly 0.25% to 0.5% annually to manage retail money-market funds. With the Fed keeping interest rates within spitting distance of zero for most of the past decade, many money-market funds could barely cover what it cost to run them.

That left managers little choice but to skip charging some or most of their fees. Otherwise some of the funds would have produced less income than they incurred in costs, resulting in negative yields for investors.

So asset-management companies have been subsidizing these funds with fee waivers for years. Look, for example, at Dreyfus Government Cash Management, with $115 billion in assets.

According to a recent disclosure, this fund’s manager, a unit of Bank of New York Mellon Corp. , waived or reimbursed fees totaling $91 million between 2019 and 2021.

So, to some extent, it’s only fair that the recent rise in yield has gone into asset managers’ pockets (assuming expenses weren’t too high in the first place). Fund companies are performing a service and expect to be paid for it after years of forgoing normal fees.

To put it bluntly, “the big dog’s gotta eat first,” says Peter Crane, president of Crane Data, a firm that monitors cash and other short-term investments.

Here’s how heavy those subsidies have been: As of March, with rates heading up, Mr. Crane reckons money managers were pulling in total fees at a clip of about $10.3 billion a year. At the end of 2021, with rates so low that managers had to waive fees, their take was running at only about $4 billion a year.

Some companies that run money funds might even try clawing back past fees they couldn’t collect when rates were low. A disclosure document from Columbia Management Investment Advisers, a unit of Ameriprise Financial Inc., suggests that firm may think it can.

A spokeswoman for Columbia declined to comment, although Mr. Crane doubts that any company would dare try such a clawback.

In any event, money funds are already in the money for them, but not yet for you. The average yield on the Crane 100 index of the 100 largest funds stood this week at 0.20%.

That’s up a hair from 0.15% on March 31 and an improvement from its pathetic 0.02% at the end of February—but still far below the yield this week on one-month and three-month U.S. Treasury bills, at 0.33% and 0.83%, respectively.

Updated: 4-25-2022

Wall Street Finds New Value In Cash As Global Fears Weigh On Markets

As bond yields rise and stock prices wobble, cash is no longer trash on Wall Street.

Worries about the war in Ukraine, China’s Covid-19 outbreak, a U.S. or European recession and surging global inflation are making a long-spurned asset increasingly popular with Wall Street’s top money managers these days: cash.

As stock and bond prices have retreated from records in the tumult of headlines, more asset managers said they are looking to move funds into low-risk, cash-like assets.

That marks a shift from recent years, when steadily climbing equity indexes trained investors to buy every dip and not miss out on gains by holding cash.

Rick Rieder, managing director at BlackRock Inc., said the world’s largest asset manager is increasing cash holdings by more than 50% in many portfolios to a weighting that is “much, much higher” than it had been in years past.

With central banks battling inflation by raising interest rates across the world, he expects stock prices to remain volatile for the next two to six months.

“For now, one of the most attractive things you can do is have patience, and if you can get paid to have patience that’s a pretty good place to be,” Mr. Rieder said.

Prime money-market funds’ holdings in the Americas rose from just under $146 billion in February to $193 billion in March, their highest levels of the year, according to data from the Investment Company Institute.

Many expect such holdings to keep rising as rates on money markets, short-term bonds and other cash-like investments climb with interest-rates set by the Federal Reserve.

Additionally, yields on 10-year U.S. Treasury notes rose last week above the rate of projected average annual inflation over the next decade for the first time since March 2020. That means investors can once again earn a return on risk-free U.S. government bonds and it is meaningfully more expensive for companies to borrow money.

These developments are testing the long-held market view that there is no alternative to U.S. stocks, which is often referred to using the acronym “TINA.” The lack of alternatives was “one of the biggest bull mantras for the equity market,” said Ohsung Kwon, U.S. equity strategist at Bank of America.

“If the cash yield really hits 3%, I think that the TINA argument really diminishes,” Mr. Kwon said. “That is obviously not the best environment for risky assets.”

In recent years, the S&P 500’s dividend yield, which measures the annualized payouts by companies in the index as a proportion of their share price, has exceeded the yield on bonds maturing in 10 years or more.

Moreover, stocks have delivered almost triple their historic return since 2009, meaning they offered both the income of bonds and the potential for greater gains—a compelling argument for portfolios to be overweight on U.S. equities.

Bank of America is expecting the Federal Reserve to raise U.S. interest rates to 3% by early next year from their current level of 0.25% to 0.50%.

That would produce a similar rate for cash-like assets such as money-market funds, which track short-dated Treasurys, high-quality investment-grade bonds and commercial paper. That rate would be more than double the current 1.4% dividend yield of the S&P 500.

Even though rates are well below that today, fund managers said they are ready to move into cash.

Bank of America’s April survey of global asset managers showed cash holdings are near the highest level since April 2020, which was the aftermath of the Covid-driven market selloff, and cash is one of the survey’s most popular trades.

Gaurav Mallik, chief investment strategist and global head of client solutions at State Street Global Advisors, said portfolios at his firm are holding at least 50% more cash than they did at the beginning of the year, with increased focus on “keeping dry powder” by holding cash and money-market funds.

“Cash is king right now in terms of the return you’re getting,” Mr. Mallik said.

The TINA narrative is drawing other challenges. Floating-rate debt, which pays increasingly higher interest as short-term borrowing costs rise, has garnered more attention recently, as have Treasury inflation-protected securities.

While bond prices have fallen, hurting investors who held them already, those lower prices mean higher payouts that are attractive to new investors.

In addition, fund managers and advisers said they are getting more questions from clients about vehicles such as savings bonds.

Rich Steinberg, chief market strategist at the Colony Group, said that as inflation started rising last year he began fielding inquiries about Series I savings bonds, which track the consumer-price index and will offer a yield of 9.62% in May. He purchased the maximum $10,000 investment each for himself and his wife.

Mr. Steinberg has increased holdings of cash and is looking to put more money in short-dated U.S. Treasury bonds if the Fed continues its expected path of raising interest rates to at least 2% by year-end.

“If the Fed follows the game plan that they’ve started to communicate, I think the TINA days are numbered,” he said.

Updated: 4-27-2022

21Shares Launches Hybrid Bitcoin And Gold ETP To Enable Inflation Hedge

Launched in cooperation with ByteTree, the new BOLD ETP by 21Shares comprises 18.5% of BTC and 81.5% of gold at launch.

21Shares, a major issuer of cryptocurrency exchange-traded products (ETP), is launching a new ETP tracking a mix of Bitcoin (BTC) and gold.

The Switzerland-based firm on Wednesday announced the launch of the 21Shares ByteTree BOLD ETP (BOLD), a new product aimed at providing inflation protection by tracking an index providing risk-adjusted exposure to both BTC and gold.

Listed on the SIX Swiss Exchange, the new hybrid ETP is subject to monthly rebalances, according to the inverse historic volatility of each asset. At launch, BOLD comprises 18.5% of BTC and 81.5% of gold.

The new ETP was developed in collaboration with the United Kingdom-based alternative investment provider, ByteTree Asset Management. The product is positioned as the world’s first combined BTC and gold ETP.

“Gold has historically delivered portfolio protection in inflationary environments while Bitcoin is the digital equivalent of gold,” ByteTree CEO Charlie Erith said, adding:

“In a time of rising structural inflation and heightened geopolitical risk, we believe this can act as an important risk and return diversifier in a balanced portfolio.”

21Shares co-founder and CEO Hany Rashwan pointed out that many people in the crypto community view BTC as a digital alternative to gold, stating:

“This hybrid product combines the traditional value of gold with the promising return rates of Bitcoin, which is considered by many as the new gold.”

With the new ETP, 21Shares has reached a major milestone as BOLD is the 30th digital asset ETP launched by the firm. Formerly known as Amun, 21Shares is one of the world’s largest crypto ETP providers, the world’s first multi-crypto ETP on the SIX Swiss Exchange in November 2018.

Earlier in April, 21Shares launched The Sandbox (SAND) ETP to offer crypto investors exposure to the metaverse. The new metaverse-focused ETP tracks the performance of SAND, the native token of community-driven gaming platform The Sandbox.

21Shares is also among the companies that are expected to launch Australia’s first Bitcoin and Ether (ETH) exchange-traded funds (ETF) soon. According to a recent update from CBOE Australia, the ETFs will not commence trading on Thursday as previously scheduled due to additional checks.

World’s First Combined Bitcoin, Gold Exchange-Traded Product Listed In Switzerland

The product was developed by ETP issuer 21Shares and crypto data provider ByteTree Asset Management.

The world’s first exchange-traded product (ETP) that combined exposure to bitcoin (BTC) and gold has been listed on the Swiss SIX stock exchange.

* The product was developed by ETP issuer 21Shares and crypto data provider ByteTree Asset Management.

* The ByteTree Asset Management BOLD ETP will track a customized benchmark index comprising bitcoin and gold, which rebalances on a monthly basis according to the comparative volatility of the two assets. Whichever has been less volatile over the past 360 days will be given the higher weighting.

* At launch the weighting will be 18.5% bitcoin and 81.5% gold.

* “Bond-to-equity ratio of 60:40 has lost its luster: BOLD is the new 60:40. Gold’s volatility is now lower than Nasdaq, but the yellow metal has offered better returns than tech stocks, tech stocks are falling because of peak internet. So, bitcoin is likely to outperform Nasdaq in both bull and bear markets,” said Charlie Morris, ByteTree’s founder and chief investment officer.

* While crypto ETPs have become widespread in Europe with more than 70 now listed, BOLD appears to the be the first that combines bitcoin and gold exposure.

* Bitcoin has often been compared to gold becuase its perceived benefits in portfolios as a hedge against inflation. Investment products that combine the benefits of the two while offsetting some of their risks could therefore prove popular as inflation in the eurozone area hit 7.5% last month.

Mom And Pop Investors Took A Billion-Dollar Bath Trading Options During The Pandemic

* A Way To Play Lottery, Just With Financial Market: Researchers

* Losses Happened During Post-Covid-Crash Bull Run In S&P 500

Of all the risky things amateur investors did while locked at home in the pandemic, dabbling in stock options was one that veteran investors were convinced would end badly.

They weren’t wrong.

Turns out, taking leveraged flyers on meme stocks mentioned on Reddit’s WallStreetBets trading forum is harder than it looks. New research from economists at the London Business School found that mom-and-pop day traders managed to lose more than $1 billion during the bull market.

The bill climbs to $5 billion when the cost of doing business with market-makers is factored in.

The study, “Retail Trading in Options and the Rise of the Big Three Wholesalers,” shines considerable light on the fate of individual investors who became obsessed with side bets on the stock market in the era of zero-commission trading.

Spurred by Reddit posts and urged on by Twitter and TikTok influencers, daily volume in bullish contracts set record after record as stuck-at-home tinkerers flocked to the contracts in an effort to juice up returns.

Researchers Svetlana Bryzgalova, Anna Pavlova and Taisiya Sikorskaya estimated that retail investors lost $1.14 billion trading options from November 2019 to June 2021, assuming a 10-day holding period. Trading costs ate up an additional $4.13 billion.

To measure the performance of nonprofessional traders, the authors tracked options orders coded as originating with retail brokerages and sent to high-volume market makers known as wholesalers.

A few factors were at play, said the authors, among them hapless market timing by the retail group. Super-wide bid-ask spreads in their options of choice ate up a large portion of the cohort’s potential gains.

Retail traders were a principal pandemic-era Wall Street story. At home with little to do during the early days of the Covid outbreak, many turned to wagering on the stock market. They placed bets on everything from sturdy tech companies to reopening plays and bankrupt firms.

It all reached a peak at the start of 2021, when an army of day-traders bid up the prices of so-called meme stocks like GameStop Corp., whose shares skyrocketed more than 50% in a single session on multiple occasions.

The study is one of the first big unpackings of that sensational chapter in modern market history. A sign that era is receding came Tuesday when Robinhood Markets Inc. said it is dismissing 9% of its full-time staff, after the online brokerage’s “hyper growth” has cooled.

But at the peak of the frenzy in 2021, small-time traders were buying more than 23 million call options a week, according to Options Clearing Council data compiled by Jason Goepfert at Sundial Capital Research.

That’s way above any other period going back to 2000. Sundial defines small-time as a trader who buy or sells 10 or fewer contracts at a time.

The derring-do of newcomers was frequently called out by Wall Street. One tactic in particular — buying out-of-the-money calls days or hours before they were likely to expire — was pilloried as a newbie gambler’s mistake.

In one celebrated instance, more than 50,000 contracts effectively betting that GameStop would surge sevenfold changed hands on Feb. 25, 2021. The option expired the next day.

Trading costs cited by the researchers may not have been easy to discern by many at-home traders. Platforms like Robinhood revolutionized so-called zero-commission trading — they route trading orders to market-makers like Citadel Securities or Susquehanna, who then pay the brokerages for the orders and, in return, provide cheaper trades for the Robinhood clients.

The no-fee trades lured a lot of new clients onto Robinhood and others. But the average bid-ask spread in options with less than a week to expiration is a “whopping” 12.3%, the LBS researchers found.

The average quoted spread of retail trades across all maturities is more than 13%, compared with 11% for the overall market. Therefore, they might have underestimated the indirect trading costs in the options market, the researchers wrote.

“The more they trade, the more they lose because of these bid-ask spreads — every time, they have to pay the round-trip trading costs,” said Pavlova in an interview.

Bryzgalova, an assistant professor at LBS, says among the types of contracts and stocks retail traders prefer, “these are all transactions that have lottery-like features.”

“They like skewness in payoffs, they like companies that recently have been traded a lot so they’re quite popular. They like, obviously, cheap contracts because many of them are cash constrained,” she said of patterns she observed among the retail crowd.

Retail traders tend to favor short-term options in particular, she added. “If you buy a call option, you pay some money for it today — and then it either doesn’t work out, so you get zero, or there’s a small chance that you get something positive,” she said.

“That’s why it looks like buying a lottery ticket to us,” she said, adding that there are other strategies investors can use that have different profiles in terms of gains or losses.

To be sure, the researchers say they had to work in certain premises since they did not have access to account-level data from a brokerage like Robinhood, meaning a rundown of when a trader moved into and out of certain positions. Therefore, they had to make assumptions about the holding period, as well as prices.

They found that stocks mentioned on WallStreetBets tended to be highly favored by retail investors. That, however, didn’t mean their bets paid off — the list of top losers for retail trades include GameStop and AMC, though both of those stocks are in the top-five-winners basket for the market as a whole.

“So it is about market timing,” said Pavlova. “They were buying these names, but at the wrong time,” and are sometimes choosing the wrong contracts.

Perhaps most striking is that the market during this period racked up impressive gains, even accounting for a 35% Covid-induced decline during the first quarter of 2020. The S&P 500 rose more than 40% between November 2019 and mid-2021. And just about everything caught a bid during that stretch — three of the index’s sectors each added more than 50%.

“Buying options is an easy way to lose money because of the highly-skewed payoff,” Pavlova said. “The options that they like, they lose money most of the time, and sometimes they get these really big wins — but those are rare.”

Updated: 4-28-2022

War Brings An Uncomfortable Windfall For Commodity Traders

* Volatility, Arbitrage Create Dynamics Where Traders Thrive

* Glencore, Bunge See Strong 2022 After Booming Start To Year

It’s an awkward but unavoidable truth: War in Ukraine is proving quite good for business for the world’s top commodities traders.

Glencore Plc expects its full-year trading profits will again exceed its targeted range following a bumper first-quarter performance, while crop giant Bunge Ltd. boosted its earnings estimates for the year by more than 20% after reporting its own stellar results.

Since Russia’s February invasion of Ukraine, commodity markets have been thrown into disarray. That has boosted prices and cut off supply, creating a harrowing environment for consumers of raw materials but the perfect conditions for trading houses.

Commodities traders, who transport the world’s resources, have been able to profit from the volatility, arbitraging cargoes through the web of sanctions and supply disruptions to keep material flowing.

“What we’ve always found is that in times of high volatility, high prices and high volume is when we have the opportunity to make the most money,” Bunge chief financial officer John Neppl said on a conference call following the release of the company’s booming first-quarter results.

To be sure, that activity doesn’t come without risks. The surge in volatility has put the balance sheets of commodity traders under huge strain, with massive daily price moves triggering billions of dollars in margin calls across the industry.

The bumper profits also come with increased scrutiny from policy makers and central banks, concerned by the industry’s liquidity and a perceived lack of market oversight.

“Yes traders are nimble, they are finding solutions and absorbing risk that the whole world doesn’t want to take,” said Jean-Francois Lambert, an industry consultant with Lambert Commodities. “So when the market is very volatile they make huge margins, that’s a fact of life.”

If the companies weren’t doing their job of hauling commodities from one place to another, nation’s would find it much harder to find the necessary resources, from diesel to food, he said.

Grains Shortage

Together, Russia and Ukraine are some of world’s top exporters of wheat, corn and sunflower oil. Disruptions of plantings in Ukraine and the challenges of paying for Russian grains have helped boost prices to multi-year highs.

Before the war, Ukrainian ports along the Black Sea were gateways for much of the region’s grains to be loaded onto ships bound for Asia, North Africa and the Middle East. Now they’ve become part of the war, blockaded and shelled.

As importing countries like Egypt, Algeria and China scramble for food products, those traders with positions outside the Black Sea such as Viterra and the so-called ABCD group of major crop merchants — Archer-Daniels-Midland Co., Bunge, Cargill Inc. and Louis Dreyfus — have been able to offer buyers grains from alternate sources like France, the U.S. and Brazil.

As prices for crude oil have remained elevated, that’s taken cooking products such as palm oil and soybean oil higher, benefiting crush margins for the traders.

ADM has not yet raised its earnings estimate for the year, although some analysts already have. It did say this week it anticipates 2022 results will exceed those of last year, without going into specifics.

Combined with a shortage of crops in South America, disruptions in the war-torn region will “drive continued tightness in global grain markets for the next few years,” ADM CEO Juan Luciano said in a conference call on Tuesday.

Whipsaw Energy

In the world of energy, independent traders such as Vitol Holding BV, Trafigura Group, Gunvor Group Ltd. and Mercuria Energy Group Ltd. are all closely held and do not release quarterly results.

Still, signs point to strong performance. For instance, shortages of diesel that have recently sent prices around the world surging were well flagged by some of the group.

Some of the biggest trading units are nestled within the wider business of energy majors, meaning more disclosure of performance. TotalEnergies SE saw first-quarter profits rise threefold as prices for oil and refining margins surged, while rival Shell Plc has flagged that results for its gas-trading segment “are expected to be higher” than in the fourth quarter.

“The rebound in energy prices seen since the second half of 2021 amplified after Russia’s military aggression against Ukraine,” TotalEnergies’ CEO Patrick Pouyanne said in a statement on Thursday, adding on a later earnings call that margins could further improve.

Metals Dislocation

Meanwhile, Glencore, the world’s biggest commodities trader, said Thursday that its marketing division will record profits “comfortably” above the top end of its $2.2 billion to $3.2 billion guidance range this year.

The company is active in energy and also agricultural products through its stake in Viterra. But it’s metals trading where it really dominates, holding positions anchored by an array of mining and smelting assets.

Jefferies analyst Christopher LaFemina reiterated in a note on Thursday his buy rating for Glencore, calling it a “top pick” for U.K. mining companies. “Commodity market dislocations and supply shocks have created extraordinary arbitrage opportunities for Glencore’s marketing business,” he said.

Updated: 4-29-2022

Einhorn’s Greenlight Defies April’s Rout With 10.6% Gain

* Veteran Fund Manager Has Been Voicing Concerns About Economy

* Month’s Performance Brings This Year’s Total Return To 15.4%

David Einhorn’s Greenlight Capital chalked a 10.6% gain in April, according to a person with knowledge of the firm’s performance, weathering the worst month for U.S. stocks in years.

That brought his total return this year to 15.4%, the person said, asking not to be identified discussing the confidential results. A spokesperson for Greenlight declined to comment.

Einhorn, who founded the New York-based firm in 1996, has been signaling a bearish posture in recent weeks. In a letter to investors this month, the 53-year-old laid out concerns about the pace of Federal Reserve efforts to fight inflation and the potential for Russia’s invasion of Ukraine to hurt the U.S. economy.

“The market is beginning to price in its doubts about the Fed’s resolve and likely failure to return inflation to its 2% target.

Even as the Fed resets the market’s expectation to a faster tightening cycle, inflation expectations are increasing and long-term bond prices are falling,” Einhorn wrote in the letter.

There was a lot of potential for some pessimistic bets to pay off.

The S&P 500’s monthly drop of 8.8% marked the index’s worst April performance since 1970. The Nasdaq 100 fell 13.4% for its biggest slump since 2008. And fixed income wasn’t spared either, with a benchmark tracking bonds worldwide dropping more than 5% for the worst month since at least 1990.

Einhorn’s performance over the past four months is better than what he achieved for all of last year. Greenlight ended 2021 up 11.9%, as technology shares and other growth companies faltered toward year-end and value stocks started climbing. In that case, Einhorn said in his fourth-quarter letter that almost all of the gains came from stocks he was long.

Einhorn is still clawing his way back from a 20% loss in 2015 and an additional 34% loss in 2018. He still needs a gain of 11.8% to get back to even.

Updated: 5-2-2022

The Ideal Portfolio to Survive a Bear Market

Given how much the economy has changed in such a short period, what worked in the past may not work now.

The U.S. stock market is very likely in a bear market that anticipates a recession will start later this year. This means the time is now to shift portfolios from risk-on mode to risk-off before the losses get even worse. But what worked in the past when hedging against a bear market may not work now, given the ever-changing economic dynamics. It’s also important not to fall for some old myths.

In many ways, the economy is in uncharted waters. The pandemic spawned disruptions in global supply chains as frictions in the reopening of economies stoked inflation. The war in Ukraine has sired additional price pressures that have left the Federal Reserve well behind the curve in fighting inflation and with its credibility severely strained.

So the central bank is playing catch-up, and is considering multiple increases in its federal funds policy rate of 50 or even 75 basis points. That and the recent bond markets yield-curve inversion, falling real wages as well as declining consumer confidence and real household spending, rising mortgage rates and excessive inventories almost guarantee a recession.

Then there’s the dramatic shift in Fed policy, from quantitative easing to quantitative tightening.

The central bank went from pumping $140 billion into the financial system every month, to winding down those purchases to nothing, to soon letting its balance sheet assets shrink – a big shock to equity holders who were accustomed to more-than-ample liquidity. So as the bear market deepens, here are some thoughts:

—Long the U.S. dollar against other major currencies. As the recession spreads globally and equity markets swoon, the greenback’s haven status will become more even desirable. British sterling, the euro and the Japanese yen have been especially weak and will probably continue to be so.

—Treasury bonds. The recent dramatic leap in yields may have fully discounted the Fed’s credit-tightening campaign. Also, as in the past, once the central bank realizes it has done the recessionary deed, it will reverse gears and ease credit. It’s normal for the Fed to cut the fed funds rate even before the onset of recession, and Treasury bonds rally at that point.

—Stocks are a long way from the bottom if the recession and bear market unfold as I predict. The S&P 500 is down 13.3% this year but has the potential to drop a further 32% given current valuations. Speculative stocks are especially vulnerable.

The long bull market since 2008 (with the exception of the early days if the pandemic in March 2020) and virtually free money has fueled highly-leveraged positions that will only be revealed when those securities crumble. Robinhood Market Inc.’s collapse may be the harbinger of more to come.

—Growth stocks can be disasters when their prospects fail to meet investor expectations, as was recently the case with Netflix Inc. The stock fell 35% on April 11, dragging down other streaming stocks. Users flocked to Netflix in the early months of the pandemic while at home but easing lockdowns and competition from other streaming services in the past year have been brutal.

Netflix and other so-called FANG stocks depend on big earnings growth in future years, so they are extremely sensitive to interest rates that discount those earnings to determine present stock prices.

Ten dollars in earnings 10 years hence is discounted to $9.05 today at 1% interest rates, but to $5.58 at 6%. The NYSE FANG+ Index is down 34% from its November 2021 peak, and as the Fed raises rates and they fail to meet rosy projections, downward pressure will likely persist.

The Barron’s Big Money poll found 59% believe equities are the most attractive asset class, only 6% like cash and bonds weren’t even listed as an option. Stocks reach their bottom when the last bulls capitulate.

—Homebuilder stocks have dropped, but probably still have further to fall. Weakness in single-family housing demand is coming as mortgage rates rise, the pandemic-era bailout funds are spent and the pandemic-driven flight to homes in the suburbs and rural areas is completed.

New home sales in March fell 8.6% from February and 12% from a year earlier. At the same time, homebuilders have finally regained their confidence after the subprime mortgage collapse, and inventories of new homes are climbing.

—Covid variants persist. They aren’t as lethal as earlier, but they are very disruptive to global economic activity. China is facing renewed lockdowns in major cities, especially Shanghai, and the International Monetary Fund slashed its growth forecast for China this year to 4.4%, well below Beijing’s 5.5% target. Gone are the days of double-digit growth in China, the world’s second-largest economy.

—Cash. As the bear market unfolds, cash will continue to go from trash to king. Cash and short-term securities such as 3-month Treasury bills don’t return much and have negative inflation-adjusted returns but will provide much better returns than plunging stocks.

Many believe that spending on essentials such as utilities, consumer staples and health care is relatively immune from weakness in recessions. Therefore, their corporate earnings and stock prices should hold up. History says no.

This chart lists the price changes in the S&P 500 and its components in the last four recessions. The only non-negative was the 24.2% rise in consumer staples in the 2000-2002 bear market. As shown in the last column, the averages of all 10 fell by double digits.

As the bear market unfolds, defensive stocks will again be on the defensive. Consumer staples producer Proctor & Gamble Co. recently warned that shoppers may balk at the ever-rising prices that have fueled the company’s recent growth. Consumers, especially lower-income households, are already buying staples in small quantities, switching to cheaper store brands and more-rigorously hunting for deals.

After households bought new appliances during the pandemic lockdown, they’re satiated and are now cutting back. Whirlpool Corp. is reducing its sales forecast for dishwashers, refrigerators and other products after company sales fell 8.2% in the first quarter. Whirlpool said industry-wide volume in North America fell 4% in the quarter from a year earlier while inflation is hyping costs.

And worried Americans aren’t sleeping better at night. Mattress-makers are delaying product launches and cutting costs as demand for big-ticket items falls. That’s the reverse of earlier in the pandemic when home-improvement spending drove sales.

Carvana Co., a pandemic star that buys and sells used cars, is suffering. It sold 105,185 cars in the first quarter, 7,800 fewer than in the prior quarter. Rising interest rates, falling used-car prices and inflation-wary consumers are all weighing on sales. In the previous two years, Carvana doubled its sales volume.

Don’t expect the bear to hibernate until the depths of the recession can be fathomed and the Fed pivots from credit-tightening to ease. That may not be until 2023.

Updated: 5-3-2022

How To Invest When Both The Stock Market And Bonds Are Falling

The best protection from this volatility is to have a long-term financial plan and stick with it, advisers say.

Chances are your portfolio is taking a beating right now as stock and bond prices fall together for the first time in decades. Yet the best strategy in moments of volatility like this one, financial advisers say, is also one of the least satisfying: Do nothing.

Doing nothing right now is easier said than done, with anxiety rising along with inflation and interest rates, and the global economic uncertainties caused by the war in Ukraine and the third year of the pandemic only growing.

When losses mount, it is human nature to want to do something, behavioral economics has shown. Like King Lear, we tend to assume that “nothing will come of nothing,” even if decades of long-term market returns may show otherwise.

But when does it pay to act? When should traditional portfolios be scrapped? Advisers say that whether you should do nothing or something may depend primarily on if you are closer in age to the aging Lear or his daughter Cordelia.

For younger investors, the advice is simple: “Don’t sweat it,” said William Bernstein, an independent financial adviser based in Eastford, Conn. “If stocks tank, that’s good for you since you will be able to buy them more cheaply,” he said. ”If you are young you want the market to tank.”

“Doing nothing is pretty good advice if your time horizon is 10 years or more,” said Elliot Pepper, a financial planner in Baltimore. “Since markets can and will be volatile, always make sure the money you might need in the next six to 12 months isn’t in the stock market—it should be in cash such as a high-yield savings account or in U.S. Treasury bonds, he said.

The best protection from this volatility is to have a long-term financial plan and stick with it, advisers say. Yet even those with a plan may find they can’t tolerate as much volatility as they initially thought. Others may realize they hold a more aggressive portfolio, with a higher allocation to stocks, than they intended, simply because stock prices have risen significantly in recent years.

Paul Auslander, an adviser in Clearwater, Fla., says he has met with prospective clients “who come in thinking they have a 60/40 portfolio only to discover it has drifted to 80% in stocks.”

For older investors, things can be more complicated, and in times like now, “some modifications may be needed,” said Mr. Auslander.

Mr. Bernstein recommends assessing how much stock-market risk you can afford to take.

For example, a 65-year-old with a 25-year life expectancy who spends 2% of his or her $1 million portfolio annually, or $20,000, can afford to invest, and lose, significantly more in stocks than someone who needs a 5% withdrawal, or $50,000 a year.

Anyone needing those larger withdrawals should hold no more than 50% in stocks, advises Mr. Bernstein.

As bonds fall in tandem with stocks, some advisers say the traditional 60/40 stock-and-bond portfolio may need a rethink.

“It sort of dispels the idea that you can effectively hedge with your standard stock-and-bond mix of a portfolio,” said Kevin Gordon, a senior investment research manager at Charles Schwab. “If inflation keeps rising and if economic growth keeps slowing, that means we’re in a countercyclical type of environment for growth and inflation.”

Mr. Gordon suggests rebalancing your retirement portfolio more than just once a year.

“If you’re more of the passive type and you’re not taking a day-to-day approach to investing, the advice there is to not take as much as a calendar-based approach to rebalancing but take more of a volatility-based approach,” he says.

Elliot Dole, an adviser in St. Louis, is shifting some of his clients’ money into alternative investments such as lending funds to “diversify away from reliance upon only stocks and bonds.”