Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

With Blockchain technology becoming more prevalent worldwide, particularly as it relates to cryptocurrencies and StableCoins, regulators continue their struggle to develop appropriate legislation that embodies an ideal balance between regulation and innovation. Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

In an effort to help shape these new regulations and encourage legislation that is favorable to the crypto industry, many crypto leaders have increased their presence in Washington, primarily through lobbying efforts. (Lydia Beyoud, Bloomberg Law). In fact, lobbying efforts increased significantly during 2018 with larger crypto groups spending six-figures per quarter on lobbying alone, and crypto-specific companies filing twice as many lobbying reports in 2018 as 2017. (Id.).

While Congress and other federal lawmakers are still primarily in the information gathering phase, the crypto industries attempt to accelerate the regulatory process through increased lobbying efforts appears to be paying off. (Alex Lielacher, Brave New Coin). The Token Taxonomy Act, for example, was recently introduced to Congress in December 2018. If passed, this Act would provide favorable capital gains treatment for crypto trading and establish that crypto assets and digital tokens are not securities. (Joseph Young, Cointelegraph).

In addition to increasing their lobbying efforts, multiple crypto companies and virtual currency startups have begun banding together to form trade groups and alliances. Such alliances seek to present policymakers with a united voice and primarily focus on encouraging the development of appropriate regulations and investor-friendly tax treatment for cryptocurrencies. (Brian Fung, Washington Post).

For example, the Blockchain Association, which is based in Washington D.C., acquired over nineteen members in six months, including several top digital-currency exchanges and crypto-investment firms. The Blockchain Association aims to educate lawmakers and establish itself as the go-to lobbying organization for the crypto industry. It also seeks to develop legislation and regulations capable of protecting consumers and encouraging innovation. (Jeff Engel, Xconomy).

Lawmakers worldwide are faced with the question of how to regulate cryptocurrencies. At the same time, various companies and crypto leaders are banding together in an attempt to influence their country’s legislation and regulations. For example, CryptoUK has actively lobbied the U.K. government and the Russian Association of Cryptocurrency and Blockchain to assist the Russian government in researching, developing, and enacting appropriate cryptocurrency legislation. (Maria Lobanova, Bitcoin Magazine).

Blockchain companies in China, India, and Australia have also begun teaming up with financial institutions and banks in an effort to influence the evolving regulations surrounding cryptocurrencies and blockchain technology. (Jimmy Aki, CCN). In the end, while the crypto industry has been increasing its lobbying efforts both in Washington and abroad, with the approach and impact varying between countries, introducing and obtaining approval for favorable cryptocurrency legislation primarily continues to be an uphill battle.

Proof of Stake AllianceStaking The Future: The Proof of Stake Alliance serves as a unified voice to support, grow and protect proof of stake-based technologies and innovations that will power the next generation of the internet.

Black Women Blockchain Council: Our mission is to create a safe space that inspires, trains and activates a talent and economic pipeline of black women pursuing professional and entrepreneurial careers in blockchain and fintech; including inspiring and educating the next generation (K-12 and College/University) of diverse and inclusive blockchain leaders.

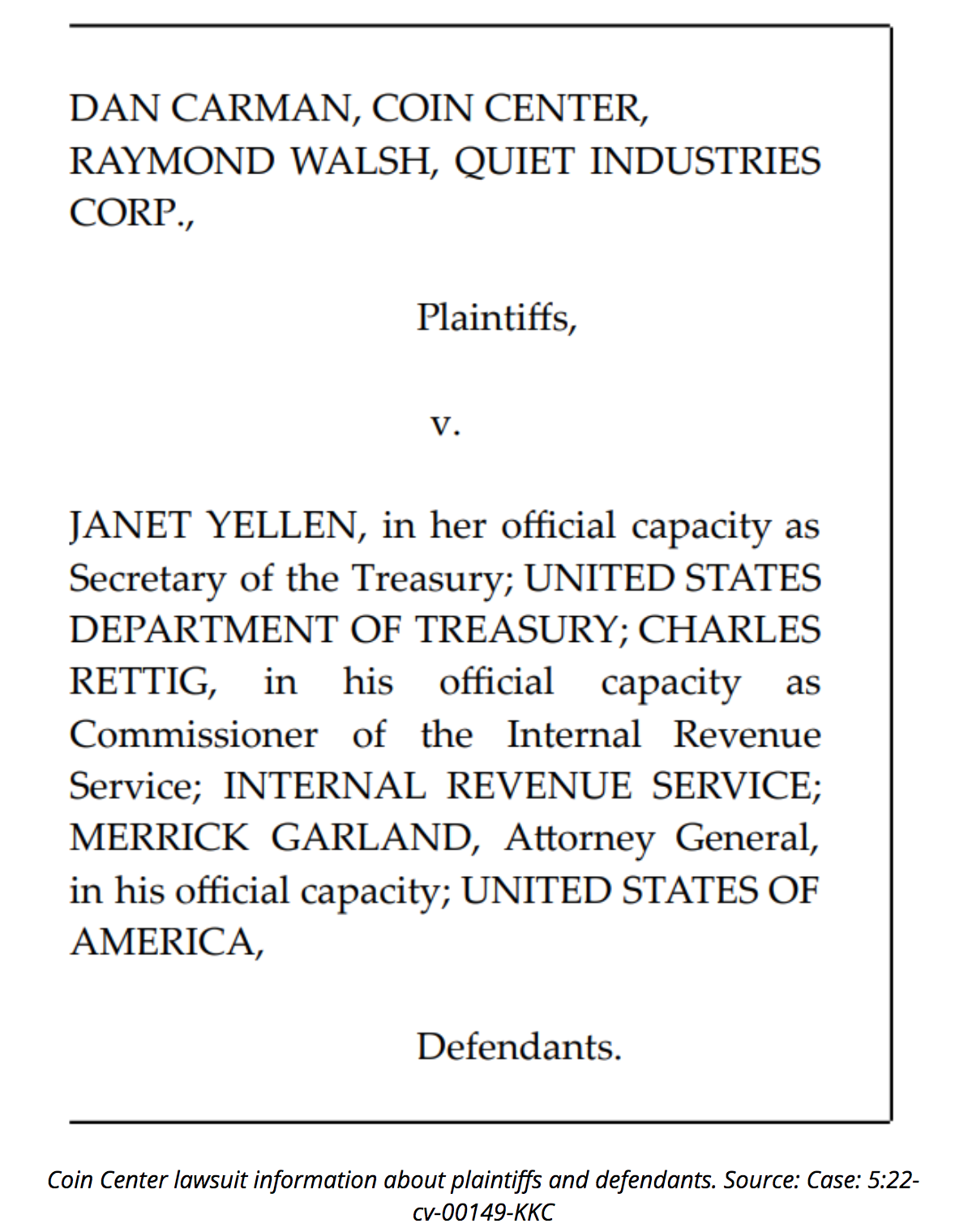

Coin Center Is The Leading Non-Profit Focused On The Policy Issues Facing Cryptocurrencies. We engage in research, educate policymakers, and advocate for sensible regulatory approaches to this technology.

Based in Washington, D.C., Coin Center is the leading non-profit research and advocacy center focused on the public policy issues facing cryptocurrency and decentralized computing technologies like Bitcoin and Ethereum.

Our mission is to build a better understanding of these technologies and to promote a regulatory climate that preserves the freedom to innovate using permissionless blockchain technologies.

We do this by producing and publishing policy research from respected academics and experts, educating policymakers and the media about blockchain technology, and by engaging in advocacy for sound public policy.

The Chamber Of Digital Commerce Is The World’s Leading Trade Association Representing The Digital Asset And Blockchain Industry

Grayscale Donates $1M To Coin Center, Pledges Up To $1M More In Matched Contributions

Grayscale hopes to build off the success of Kraken’s donate-and-match program from 2018.

Grayscale Investments, the world’s largest digital-asset manager, has pledged $1 million to Coin Center, Washington, D.C.’s most influential cryptocurrency advocacy group — a move it believes will help broaden “foundational knowledge” of the industry.

The million-dollar donation was announced Monday in a press release, which also revealed Grayscale’s plan to match contributions to Coin Center through the end of February. Over that period, Grayscale plans to match donations dollar-for-dollar up to an additional $1 million.

Grayscale got the inspiration for the donate-and-match program from Kraken, the San Francisco-based exchange that managed to raise over $3 million for Coin Center in 2018. That included $2 million in direct support from Kraken.

“Coin Center has played a key role in advocating for issues that affect our ecosystem,” Grayscale told Cointelegraph.

The asset manager added that in the past two months, “Coin Center filed two strong comment letters that played a key part in correcting issues in proposed rulemaking by the Financial Crimes Enforcement Network, or FinCEN, that would have had serious negative consequences for self-hosted wallet users and the overall digital currency industry.”

Coin Center is a leading think tank focused on advancing public policy issues in the realm of digital assets and blockchain. In 2017, the advocacy group took to Congress to demonstrate to lawmakers how Bitcoin works. Last year, the organization reached out to the cryptocurrency community to help ensure that COVID-19-era lockdown measures don’t encroach on civil liberties and privacy.

When asked about the most pressing advocacy work needed for the crypto industry today, Grayscale said:

“It all comes down to education. Regulators need to have foundational knowledge of a topic to be able to make informed decisions about the bills that cross their desk. Education is both the biggest challenge and opportunity for our industry when it comes to policymakers.”

Neeraj Agrawal, Coin Center’s director of communications, told Cointelegraph he was “blown away by the community and industry’s continued support” of the advocacy group. “We are going to use these funds to continue representing Bitcoin, Ethereum, and cryptocurrency in general in D.C.,” he said.

In the coming year, Coin Center plans to remain focused on advancing financial privacy and “more sensible tax policy,” Agrawal said.

Ripple Ran Crypto’s Most Expensive Lobbying Program In 2020

Per the latest in lobbying disclosures, Ripple Labs shelled out for its lobbying on legislation looking to change the treatment of crypto under securities laws.

Ripple Labs spent $690,000 on lobbying in the United States in 2020, which still didn’t save the firm from the Securities and Exchange Commission.

Per legally mandated disclosures for 2020, Ripple’s lobbying program dwarfed those of other firms in the crypto industry. Coinbase, which looks to become the first American crypto exchange to issue public shares, spent $230,000 over the same year, while other exchanges like Binance.US, Gemini and Kraken did not report any spending on lobbying.

Ripple’s spending on lobbying is, however, relatively paltry compared with the giants of Big Tech. Facebook, for example, spent well over $5 million in just the fourth quarter of 2020.

The Diem Association, formerly known as the Libra Association, reported no lobbying activity over 2020, despite the prospective stablecoin issuer’s major struggles with regulators. In the past, it had contracted with the Washington, D.C. offices of law firm Skadden.

While the Diem Association has consistently downplayed its relationship with Facebook, Facebook maintained a $200,000 contract with lobbyists at FS Vector over 2020 to focus on blockchain issues.

Ripple was, incidentally, also an FS Vector client. The first half of 2020 also saw Ripple terminate its in-house lobbying team. It now relies solely on contracts with professional firms.

Lobbying activities that Ripple funded were aimed primarily at legislation before Congress like the Token Taxonomy Act and the Digital Commodity Exchange Act. These pieces of legislation set new rules for which digital assets are or are not securities.

Questions of securities law and crypto are obviously critical to Ripple’s business model. The firm had long faced questions as to whether XRP was in fact a security. These questions culminated in the SEC, the securities regulator in the U.S., filing a suit against Ripple Labs near the end of December 2020.

In its complaint, the SEC alleges that “the overwhelming majority of Ripple’s revenue came from its sales of XRP, and Ripple relied on those sales to fund its operations.”

Neither Ripple nor FS Vector responded to Cointelegraph’s request for comment. Representatives for Diem declined to comment.

Updated: 1-28-2021

Crypto Industry Jumps Into Lobbying In Response To FinCEN

The Blockchain Association’s ranks swell as firms look to aid its work in keeping crypto transactions peer-to-peer.

The crypto lobby is growing as more firms join the effort to fight rules that attack financial privacy.

The Blockchain Association today announced the addition of five new members, with membership now totaling 30 firms. The new members are Uniswap, Blockfi, Fireblocks, CMT Digital and Blockchain Capital.

In its tweet announcing the news, the Blockchain Association attributed the rise in membership to its work in presenting an industry response to rules from the United States Treasury Department’s Financial Crimes Enforcement Network, or FinCEN, at the tail end of the Donald Trump administration. The association wrote, “Battling back the FinCEN process was an important step, demonstrating what is possible when we speak with one voice.”

FinCEN’s proposal involved extending $10,000 thresholds on reporting all crypto transactions and $3,000 limits on transactions with self-hosted wallets that lack identifying features. The rules, derived from the Bank Secrecy Act, would be a major interference in peer-to-peer transactions. They are, as of this week, in motion again.

The Blockchain Association, as a trade association, unites members of a single industry under a shared umbrella and lobbies Congress on behalf of mutual interests. Many firms in crypto operate their own in-house lobbying operations or individual contracts with established firms.

Other members of the crypto industry lobby have benefitted from the attention that FinCEN has drawn to policymaking. Nonprofit Coin Center recently saw a $1 million donation from Grayscale. A Coin Center representative commented on its coming priorities: “Most of our work in 2021 will likely be continuing to hold to the line for financial privacy and hopefully advancing some more sensible tax policy.”

Coin Center and the Blockchain Association were, indeed, highly visible allies in the fight against FinCEN’s proposal.

The Blockchain Association had not responded to Cointelegraph’s request for comment as of publication.

Updated: 2-9-2021

Amid Hiring Spree, Blockchain Association Adds Token Taxonomy Act Guru To Team

The former aide to Representative Davidson will join crypto’s leading trade association.

The Blockchain Association, a leading trade association and lobbying group, has hired Ron Hammond as its new director of government relations.

The Blockchain Association has been one of Washington, D.C.’s biggest advocates for the crypto industry since its launch in 2018. Executive director Kristin Smith recently appeared on Cointelegraph’s Top 100 list.

Hammond, meanwhile, cut his teeth working on crypto policy for Representative Warren Davidson, most notably the Token Taxonomy Act, which is also the origin of the relationship with the Blockchain Association.

It was at Davidson’s roundtable for crypto industry stakeholders back in September 2018 that the Blockchain Association made its inaugural public appearance, Hammond told Cointelegraph.

Subsequently, Hammond worked as a lobbyist for Ripple before going independent earlier this year.

Hammond is the Blockchain Association’s fourth new full-time hire since the new year, “More than doubling the number of permanent, non-intern employees on the team,” said Graham Newhall, the association’s communications advisor.

The Blockchain Association’s rapid growth has tracked with mass interest in lobbying from the crypto industry, especially in the wake of the Financial Crimes Enforcement Network’s proposals to restrict trading with self-hosted wallets. “We’re bursting at the seams with things we’d like to be doing,” Newhall said of the surge. “It’s been a nice confluence of new members and new team members.”

Beyond responses to FinCEN, Hammond noted that the change in presidential administration makes this a critical time to get involved with new decision makers. He said that he aims to focus on “The big issues that are being picked up from the previous administration,” namely “securities law and custody, as well as tax.”

Laws and regulations governing blockchain and cryptocurrencies have been soaring in the public consciousness, enabling those involved to get more ambitious. According to Hammond, the new goal within financial regulation is “Making sure that the Blockchain Association has not just a seat of the table, but is actually, in some cases, leading the conversation.”

At the end of January, the Blockchain Association announced the addition of 5 new members, bringing total backing up to 30 firms.

Updated: 2-10-2021

Jack Dorsey Commits $1M To Coin Center On Top Of Grayscale’s $2M Donation

The D.C.-based advocacy group just raised millions for its ongoing research and lobbying efforts. Here’s how the numbers broke down.

2021 is shaping up to be a generous year for cryptocurrency donations. On Wednesday, Coin Center, the leading cryptocurrency nonprofit in Washington, D.C., announced that it had raised millions in additional funding from high-profile names in the crypto industry.

Jerry Brito, Coin Center’s executive director, tweeted that his organization had received enough donations to claim the $1 million in matched contributions from Grayscale Investments, the world’s largest crypto fund manager.

Less than three weeks ago, Grayscale announced that it had donated $1 million to the advocacy group and pledged an additional $1 million in matched contributions. A few days later, digital currency exchange Kraken announced that it was pledging $100,000 to Coin Center.

Perhaps the most noteworthy news item came in a follow-up tweet when Brito confirmed that Twitter CEO Jack Dorsey donated $1 million to the advocacy group. “We were almost to our goal for the matching campaign when he put us over the top and then some,” he said.

Coin Center has received and incredibly generous gift of $1 million from @jack — we’re speechless.

We were almost to our goal for the matching campaign when he put us over the top and then some.

Your confidence in our work is incredibly humbling.

— Jerry Brito (@jerrybrito) February 10, 2021

Dorsey is also behind Square, whose mobile payments app lets users buy and sell Bitcoin. Square is also one of the largest corporate holders of BTC, with 4,709 units of the virtual currency on its books. That’s equivalent to nearly $210 million in today’s value.

Coin Center’s advocacy work is increasingly focused on advancing financial privacy and “sensible tax policy,” according to Neeraj Agrawal, the organization’s director of communications.

The crypto community is known for its generousity, especially in the wake of the 2017-18 bull market where millions of people around the world made a fortune investing in digital assets. Companies like The Giving Block are making it easier for organizations to accept digital currency donations.

The Giving Block recently published three job postings on its website, which reflects the growth of the crypto donations industry.

Bitcoin Core Non-Profit Gets Approved For Tax Exemption, Perks For Donors

501(3)(c) status boosts the project’s legitimacy as well as its efficiency in using donations.

A new non-profit aiming to fund Bitcoin development education and research has been approved for special tax status, conferring benefits on donors.

Brink, which launched in the fall, has been approved as a 503(c)(3) organization according to a Feb. 10 blog post. The status both exempts Brink from federal taxes and provides some interesting benefits to donors, especially considering their use of Bitcoin.

Donations to 503(c)(3) organizations in the U.S. have always been an important tax write-off, but considering the long-term confusion over the IRS seemingly asking for Bitcoin users to pay capital gains taxes on any use of Bitcoin as a payment. In its announcement, Brink says that it offers an alternative:

“Donations of long-term appreciated assets like Bitcoin generally don’t incur capital gains tax and can be claimed as an income tax deduction for the full fair-market value.”

Headed by Bitcoin core developer John Newberry, Brink runs fellowship and educational programs for new devs. Newberry told Cointelegraph that Brink had looked for the designation since its beginning: “We always planned to be a 501c3, and our corporation bylaws are completely consistent with that designation.”

The legal status as a 503(3)(c) non-profit will also open Brink up to new disclosure requirements, which Bitcoin’s innate transparency may make simpler.

However, the BTC address that Brink advertises on its Twitter feed appears to be unused. Newberry told Cointelegraph that the wallet was for a one-time donation, saying that those interested can now donate in Bitcoin and fiat here.

The firm’s Bitcoin donation window actually leads to an Open Node API. Open Node offers instant conversion from crypto to fiat, which raises the question: Does Brink not actually hold BTC donations in BTC?

Newberry did not respond to Cointelegraph’s request to specify a wallet address.

The confusion over having to pay capital gains taxes on any payment in Bitcoin had led many to call for a de minimis on the value of those payments before the IRS can come for them.

Updated: 2-12-2021

Wall Street Embrace Of Crypto Grows Closer As Employees Argue On Its Behalf

On a Zoom call with traders in January, co-President Daniel Pinto suggested he was open-minded about bitcoin.

Wall Street giants are facing increased pressure from their employees about accepting bitcoin as a legitimate asset class, CNBC reported Friday.

* Joining a Zoom call with thousands of JPMorgan Chase traders in January, co-President Daniel Pinto suggested he was open-minded about the cryptocurrency, CNBC said, citing people with knowledge of the call.

* Pinto was responding to global markets head Troy Rohrbaugh acknowledging that the bank’s own employees are increasingly asking when it will get involved in cryptocurrency.

* When subsequently clarifying his comments, Pinto iterated that the decision would be based on demand from clients.

* “The demand isn’t there yet, but I’m sure it will be at some point,” he said to CNBC.

* This news emerges hot on the heels of Goldman Sachs hosting a private forum with Mike Novogratz on Feb. 2, in which the founder of institutional crypto investment firm Galaxy Digital discussed bitcoin, ethereum and more, CNBC said.

* JPMorgan is often seen by crypto enthusiasts as the epitome of mainstream finance skepticism of cryptocurrency, CNBC said, thanks largely to comments made by CEO Jamie Dimon in 2017 when he labelled bitcoin a “fraud,” saying he would fire any traders known to be trading it.

Updated: 3-5-2021

Blockchain Association Meeting With Key Biden Staff About Regulations

The crypto advocacy group is going on a charm offensive and meeting with top representatives of the Biden administration.

U.S.-based crypto advocacy group, the Blockchain Association, is lobbying key figures in the Biden administration to advocate for more favorable regulations.

The Association’s executive director, Kristin Smith, told Fox Business the group has already met with or is in the process of scheduling meetings with high-ranking Whitehouse officials including Treasury Secretary Janet Yellen, Deputy Secretary nominee and former BlackRock executive Wally Adeyemo, along with representatives of the Treasury Department.

Citing reported comments from Yellen about how the primary utility of cryptocurrency is “illicit financing,” Smith said the association’s key aim was to assist the Treasury chief to “understand the value of crypto networks:”

Our number one priority is helping Yellen understand crypto goes beyond the financing of criminal enterprises.”

Yellen has been criticized by the crypto sector for describing Bitcoin as “an extremely inefficient way of conduction transactions,” and speculating that BTC is not “widely used as a transaction mechanism.”

Despite her apparent hostility toward Bitcoin, Yellen has expressed openness to centralized DLT, with the secretary stating a digital dollar could offer “faster, safe, and cheaper payments” than existing fiat currency last month.

Adam Traidman, CEO of crypto wallet BRD, indicated representatives of the crypto sector are “trying to work as high up the Treasury food chain as we can,” adding:

“We’re not opposed to regulation and compliance, but we need time to spur innovation and grease the skids for adoption of crypto first.”

Traidman emphasized concerns regarding regulations for wallets and crypto-to-crypto transactions, stating: “One of our main goals is to carve out crypto to crypto transactions from most regulations. If crypto transfers have to meet wire transfer rules, that will harm the industry.”

Some in the crypto community have also expressed concern regarding Joe Biden’s nominee for chairman of the Securities and Exchange Commission, Gary Gensler — who has previously described Ethereum’s 2014 ICO as an unregistered securities offering.

Earlier this week, Gensler told the Senate Banking Committee the SEC will work to ensure the crypto markets “are free of fraud and manipulation,” accusing off-shore exchanges of having been “rife with fraud.”

The Blockchain Association’s members include crypto heavyweights Circle, Binance.US, Grayscale, and Kraken.

Updated: 3-15-2021

Proposed FinCEN Rule Is A ‘Grave Threat To Personal Privacy,’ Says Coin Center

In its latest comment, the advocacy group goes after the proposed requirement to create currency transaction reports for crypto transactions.

After the U.S. Treasury Department extended the comment period for anyone to express their thoughts on a proposed crypto rule, non-profit crypto policy advocate group Coin Center has made another — and possibly final — argument to regulators.

Coin Center directed its comment to the Financial Crimes Enforcement Network, or FinCEN, over proposed rules that would require registered crypto exchanges in the U.S. to verify the identity of people using “an unhosted or otherwise covered wallet” for a transaction of more than $3,000 and report on all crypto transactions of more than $10,000.

The advocacy group referred to the proposal as “a grave threat to personal privacy, Fourth Amendment rights against warrantless search, as well as a substantial threat to continued responsible innovation.”

Specifically, Coin Center said crypto transactions should not be subject to the same requirements as those facing bank customers moving $10,000 or more in cash. The group claims that requiring institutions to create a currency transaction report, or CTR, for crypto transactions is “automated mass surveillance of innocent transactions.”

“Any transaction over $2,000 that is merely ‘relevant to a possible violation of law or regulation’ will trigger a suspicious activity report (SAR) requirement, which already applies to crypto transactions today,” said Coin Center. “Any CTR report filed without an accompanying SAR is, by definition, a report about an American resident’s entirely innocent and otherwise private financial activities.”

The Group Added:

“If FinCEN insists on further extending the gambit of warrantless mass surveillance, then it should by no account do so in a way that prejudices new technologies and the companies and individuals that use them.”

FinCEN first proposed the crypto wallet rule in December and said its website was open to comments until Jan. 4. The regulatory body later extended this deadline on Jan. 15 for an additional 14 days until its most recent — and possibly final — extension to March 29.

Since the proposed rules were filed last year, Coin Center has urged people in the crypto space to file comments to regulators, and decried the original short window of opportunity to do so.

Feedback from groups like Coin Center and the Blockchain Association could have been responsible for one or more of the extensions, which pushed the proposed wallet rule out of the former administration’s purview to that of recently confirmed Treasury Secretary Janet Yellen.

Updated: 4-6-2021

Coinbase And Square Lead New Crypto Lobbying Effort

The Crypto Council for Innovation is looking to lead the charge for sensible cryptocurrency regulations around the world.

Major stakeholders in the cryptocurrency scene, like Coinbase and Square, have formed an alliance to better relate with policymakers and regulators on the subject of crypto regulations. They are joined by other major players in the cryptocurrency scene, such as Fidelity Digital Assets and crypto-focused investment firm Paradigm.

Dubbed the Crypto Council for Innovation, the CCI aims to facilitate constructive dialogue with governments and regulatory agencies about the benefits of cryptocurrencies, according to the details published on the group’s website.

An Excerpt From The CCI’s Website Reads:

“CCI supports governments and institutions worldwide in efforts to shape and encourage the responsible regulation of crypto in a way that unlocks potential and improves lives.”

According to the CCI, effective communication with regulatory stakeholders will help to separate “fact from perception” as far as cryptocurrencies are concerned.

Indeed, anti-crypto rhetorics espoused by regulators around the world often echo misrepresentations about the crypto industry. Back in February, U.S. Treasury Secretary Janet Yellen declared that cryptos were being increasingly used for criminal activities.

Yellen is not alone in such assertions despite existing research showing that the criminal share of global cryptocurrency commerce is less than 1%.

The CCI is the latest crypto-focused lobbying effort to emerge with groups like the Blockchain Association and Coin Center also working towards sensible cryptocurrency regulations.

As previously reported by Cointelegraph, Ripple spent the most money in lobbying efforts in the United States in 2020. The company is currently fighting a securities violation lawsuit brought against the firm by the U.S. Securities and Exchange Commission.

Crypto lobbying groups have recorded some successes in fighting harsh cryptocurrency laws. In India, a coalition of industry proponents under the aegis of the Internet and Mobile Association of India, or IAMAI led the charge against the central bank ban of 2018 leading to a reversal of the diktat by the Supreme Court in March 2020.

Members of the IAMAI are currently trying to convince government officials to adopt a more nuanced approach to crypto regulations in India.

Crypto Lobby Groups Are Gaining Traction In Washington As The Threat Of Regulatory Bottleneck Looms

The blockchain industry is looking to shed the negative association between digital assets and crime as the threat of additional regulatory oversight looms.

Crypto-focused lobbying groups in Washington, DC are playing an increasingly vital role in reorienting policymakers away from the view that digital currencies are used primarily for illegal transactions. Now, they are preparing for, potentially, their biggest battle yet.

The Blockchain Association, an industry trade group representing crypto firms, has added 10 members to its brass since December 2020, bringing its total to 34. Kristin Smith, the group’s executive director, told Bloomberg that the association’s members are extremely concerned about federal regulators clamping down on the industry over misplaced fears.

“We in the industry think it’s hugely problematic,” she said, adding that “It misses the entire point of this innovation.”

Smith was commenting on recent proposals by the Financial Action Task Force and Treasury Department to increase surveillance of the cryptocurrency market over concerns about money laundering and other illicit activities. The proposals, which could be finalized later this year, would place more burdens on investors and blockchain networks.

Coin Center, a leading DC-based advocacy group, is raising money in preparation for a lengthy lobbying battle or lawsuit over the proposed regulations. Jeremey Brito, the group’s executive director, told Bloomberg:

“Our job is to say absolutely there is a real risk here and that we all need to work together, but don’t throw away the baby with the bathwater.”

Grayscale, the world’s largest digital asset manager, donated $2 million to Con Center earlier this year. Twitter CEO Jack Dorsey also contributed $1 million to the advocacy group.

Despite concerns about sweeping government regulations, the threat of an outright ban on digital assets is long gone, according to billionaire investor Tyler Winklevoss. In a recent What Bitcoin Did podcast episode with Peter McCormack, Winklevoss said:

“I think that the U.S. will never outlaw Bitcoin. There’s too much precedent that’s been set in the courts. The Coinflip order, which was a CFTC [Commodity Futures Trading Commission] enforcement action which was upheld in the courts, considered Bitcoin a commodity like gold.”

Digital assets have reentered public discourse over the past six months as Bitcoin (BTC) charted new all-time highs and major institutions like Morgan Stanley and MassMutual got involved. On the corporate side, Tesla and MicroStrategy have added billions of dollars worth of BTC to their balance sheets — moves that many believe will normalize digital-asset exposure moving forward.

JPMorgan Chase, Citigroup, Goldman Sachs and BlackRock have all recognized Bitcoin’s emergence as a new asset class and, in some cases, one that could challenge gold for store-of-value supremacy.

Cryptocurrencies have reached several major milestones this year. The collective market capitalization of all digital assets topped $1 trillion in January before doubling less than three months later.

Updated: 4-7-2021

The Accidental Crypto Lobbyist

Our reporter contacts state lawmakers for clarification and ends up inadvertently reshaping a bill.

I think I just saved stablecoin issuers in West Virginia.

I know, that’s a bold statement. And especially by a journalist whose job is to report on events, not influence them. For the record: I was NOT trying to influence the legislative process here.

But I think I did. And the episode speaks to the surprising malleability of legislators when, after a year of crafting massive legislation, you catch them off guard. Allow me to explain.

West Virginia’s Legislature is considering a sweeping overhaul to the state’s criminal code – its biggest in decades – with a package delegates have been sharpening for nearly a year. Their 400-page behemoth would strengthen drug sentencing, expand homicide provisions, modernize anti-hacking statutes and establish a tiered system for misdemeanors and felonies.

Pretty normal fare for a criminal code overhaul. But I noticed something strange last week in House Bill 2017. It seemed to ban people from issuing or transacting in cryptocurrencies not sanctioned by the 38th most populous state in the U.S.

“If any person shall, without authority of law, issue any note, cryptocurrency, or other security purporting that money or other thing of value is payable by or on behalf of such person, with intent thereby to create a circulating medium, he or she shall be guilty of a misdemeanor,” read the section 61-4-7 of the bill. (Cryptocurrency, bolded here, was new to the “unauthorized currency” provision).

Huh? Was this a crypto ban? I wasn’t sure. The following section, 61-4-8, only made me more confused:

“If any person … shall knowingly pass or receive in payment any such note, cryptocurrency, or security, he or she shall be guilty of a Class 3 misdemeanor.”

Sure looked like a crypto ban to me. But I’m no lawyer. Hell, I haven’t even ordered those LSAT study books yet. (Sorry, Mom!) So I emailed a few real attorneys to hear their take.

‘Very Curious’

Drew Hinkes of Carlton Fields responded first. “This bill would benefit from further clarification,” he began. Not a very promising start.

HB 2017’s “very curious definition” of cryptocurrency was unlikely to spell a sweeping ban on digital assets or any crypto with supposed intrinsic value (bitcoin (BTC, -1.18%)), Hinkes explained. Rather, it seemed tailored to “cryptocurrencies that promise payment to the holder,” or perhaps asset-backed stablecoins with redeemable reserves.

(My favorite example of an asset-backed, redeemable crypto is sardine coin. Holders can exchange their tokens for a vintage tin of salty fish. That European initial coin offering is, alas, not available to U.S. residents. More relevant are dollar-pegged stablecoins like USDT (+0.02%), USDC (+0.06%) and DAI (-0.04%), which are backed by fiat currency in a brick-and-mortar bank and/or other assets and boast a combined market capitalization of $56 billion, or 77% of West Virginia’s annual GDP.)

Carol Van Cleef of Bradley was my next stop. She deemed the proposal “disturbing” and said it would render authorized stablecoins “as a nonfactor in payments.”

“When I see something like this – my first question is where did it come from, who is behind and why,” she said.

I agreed. So I found the emails of the bill’s 11 co-sponsors and contacted them en masse.

I did not realize it then, but Wednesday was set to be a banner day for HB 2017. After nearly a year of drafting and committee work, it was headed for final vote on third reading. The cryptocurrency rider had been in there from the start and it was just hours away from passing.

‘Your contribution is appreciated’

I woke up to a cordial email from Delegate Bryan Ward. “Good morning, sir,” wrote the first-term member. “This bill was voluminous and technical amendments are forthcoming in an effort to perfect the language.”

“An amendment, specifically addressing your concern relating to cryptocurrency will be offered by Delegate Daniel Linville. I’m fortunate to have colleagues here in the house of delegates with broad ranging expertises. Your contribution to the process of crafting the best bill is appreciated.”

What? My contribution to the crafting of a better bill? I am not a constituent of West Virginia nor am I a registered lobbyist. I know how to report, not how to influence. I was not sure what was going on.

Linville, who chairs the Technology and Infrastructure Committee, emailed me the amendment he would propose on the floor of the house of delegates later that day. It would strike all mentions of cryptocurrency from section 61-4-7.

“This should be taken up within the next few hours,” he said.

So I tuned into the livestream on YouTube. Indeed, a few hours later, Linville asked his fellow delegates to adopt his amendment. He said he had met with the bill’s co-sponsor that morning and decided to excise cryptocurrency from the law. Better to remove a few words than pass a bill suggesting crypto was counterfeit money, he said. Would his fellow delegates sign on?

“Aye,” agreed the chamber by voice vote, adopting the amendment. Nobody stood in his way.

HB 2017 then passed the House by a vote of 76 to 22.

Something Is Amiss

Shortly after the bill’s passage I began reviewing my notes. It sure seemed that I had acted like a last-minute lobbyist for the cryptocurrency industry – though I hadn’t meant to do it. I had found a bill confusing, interviewed lawyers who also found the bill confusing, and then dug up the email addresses of 11 politicians who, when prompted, found their bill confusing, too.

“This bill was voluminous and technical amendments are forthcoming in an effort to perfect the language,” Ward had said to me.“Your contribution to the process of crafting the best bill is appreciated.”

(I have emailed Linville and Ward to ask if the amendment was being planned even before I reached out, but have not heard back.)

All this happened in the final moments before the bill’s passage in the house. On the third reading.

But it’s a good thing for the crypto industry I am not a lobbyist because, despite torpedoing the stablecoin provision without even trying, I still wouldn’t be a very effective one. Remember, there were two sections of this bill in question, the first (61-4-7) to make unauthorized stablecoin issuance illegal and a second (61-4-8) to bar the transfer of such cryptos between parties.

Also remember: An amendment “specifically addressing my concern” had been offered and approved. I had only mentioned 61-4-7 in my email. Likewise, the amendment only did away with the ban in cryptocurrency issuance. Which means that if the bill is enacted into law, it would still … ban crypto transfers?

I’m really not sure. And neither was Hinkes, the lawyer who thought the bill’s previous rendition warranted a rewrite.

“Without ‘cryptocurrency’ in [section 7], [section 8] makes less sense,” he told me, pointing out the statute’s “any such” clause references a cryptocurrency that’s no longer there. Perhaps the courts could enforce the ghost clause through complicated judicial jiu-jitsu, but probably not.

“Again, this bill as amended would benefit from further clarity,” he said.

The bill is now up for consideration in the West Virginia Senate.

CORRECTION (4/7/21 18:46 UTC): This article has been updated to reflect that Carol Van Cleef’s comments were directed at “authorized” cryptocurrencies.

Updated: 4-11-2021

Crypto Lobby Plans To Shake Reputation As Criminals’ Currency

Even as cryptocurrencies steadily gain support on Wall Street, they’re still regarded by regulators as a tool for criminals to conceal shady transactions — posing a challenge to the nascent industry as it seeks to win wider respect.

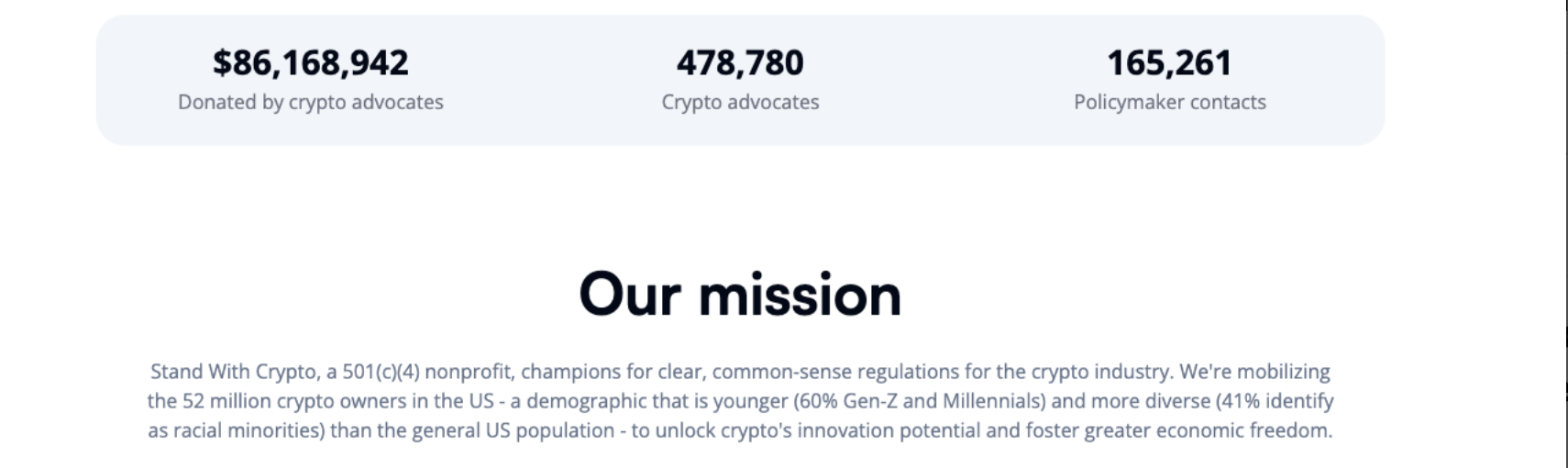

That’s creating a potentially lucrative opportunity for new groups in Washington advocating for digital currencies. Some prominent crypto lobbying organizations say they’ve increased their membership and raised millions of dollars to help improve the industry’s image.

While banks including Goldman Sachs Group Inc. are exploring digital assets for certain clients, recent actions by regulators show an uncertain road ahead. Late last month, an international anti-fraud watchdog proposed regulations that crypto advocates say would squash a large part of their industry.

The recommendations, from the 39-member Financial Action Task Force, would increase surveillance of many cryptocurrency transactions. They come on the heels of a similar anti-money-laundering proposal from the U.S. Treasury Department that could be finalized later this year. Many crypto proponents are opposed to increased surveillance.

The Treasury and FATF proposals come as Bitcoin has rocketed into the financial mainstream. On Monday, the virtual currency traded at about $59,000, more than twice its level at the end of 2020 and more than eight times its level last April. Other cryptocurrencies such as ether have seen similar gains.

The soaring prices have given ammunition to Bitcoin lobbying groups emerging in Washington. In the past three months, they’ve used the new regulatory pushes to raise millions of dollars in funding and convince cryptocurrency firms to establish a Washington presence.

Even as the finance world has embraced cryptocurrencies and pumped up their prices, they’ve struggled to shake their reputation as a tool allowing thieves and drug dealers to hide illegal transactions. Some crypto advocates say disabusing regulators of that perception is the biggest challenge virtual assets face.

“We in the industry think it’s hugely problematic,” said Blockchain Association executive director Kristin Smith of the proposed rules. She said they would put heavy surveillance burdens on investors and operators of cryptocurrency networks and make it difficult for some services to remain decentralized.

“It misses the entire point of this innovation,” Smith said.

Since December, the Blockchain Association, a trade group for crypto firms, has added 10 members, bringing its total to 34, Smith said. The association, which is less than three years old, has more than doubled its employees to seven. She said the association’s members, which include crypto-exchange Binance.US and Ripple Labs, have discussed making large contributions to the association to ramp up hiring and buy advertising to polish Bitcoin’s image.

Coin Center, a Washington-based think tank and cryptocurrency advocacy group, since December has garnered more than $300,000 through a fundraising drive with mostly individual donors contributing small amounts of cryptocurrency.

It also received $2 million from crypto-investment firm Grayscale Investments LLC and $1 million from Twitter-founder Jack Dorsey, whose other firm, Square Inc., recently made a $30 million investment in Bitcoin.

Coin Center executive director Jerry Brito said that, for now, his group is saving the money as a war chest in case it needs to fight a larger lobbying battle or file a lawsuit over the new regulations.

“Our job is to say absolutely there is a real risk here and that we all need to work together, but don’t throw away the baby with the bathwater,” Brito said.

One of Bitcoin’s earliest uses was as the only accepted currency on a website for drugs and other illicit goods known as the “Silk Road,” which the Federal Bureau of Investigation shut down in 2013. More recently, Bitcoin has been the preferred payment method of hackers locking up computer data in so-called ransomware attacks.

Even January’s riots at the U.S. Capitol had a Bitcoin connection. A month before the attacks, a now-deceased computer programmer in France sent more than $500,000-worth of the cryptocurrency to far-right groups that helped stage the assault.

Bitcoin’s defenders say illicit activity has become less of an issue. Bitcoin wallets are only identified by a string of characters, but the “blockchain” ledger that records Bitcoin transactions is public, allowing authorities to follow the money trail when wallet owners attempt to convert Bitcoin into dollars. They can see that a wallet is hosted by Coinbase, for example, and subpoena Coinbase for the owner’s name.

Chainalysis, a Bitcoin forensics firm that works with law enforcement agencies, says illicit activity makes up a decreasing proportion of Bitcoin transactions, though there are still problem areas like the ransomware attacks.

“Law enforcement investigators are becoming increasingly savvy” in tracking criminal activity on Bitcoin’s network, said Jesse Spiro, Chainalysis’ chief government affairs officer.

Still, world governments have remained wary. A government official in India earlier this year said the country would move to ban cryptocurrencies. Nigeria and China have also cracked down on purchases.

In the U.S., Representative Brad Sherman, a California Democrat, wants to bar Bitcoin’s use by Americans. Though Sherman’s idea hasn’t taken root, in March billionaire investor Ray Dalio of Bridgewater Associates LP said he viewed it as a high probability that the U.S. would at some point ban its use.

The regulatory threats aren’t stopping some banks from tiptoeing into the market. Goldman Sachs in March said it was close to offering investment vehicles for digital assets to clients of its private wealth management unit. Morgan Stanley is planning to offer its clients access to cryptocurrency funds. So far, the largest U.S. banks still don’t let their clients hold Bitcoin directly.

At the heart of the Treasury and FATF proposals are recommendations to expand how much governments monitor cryptocurrency transactions. Both proposals would require financial firms to make more frequent reports on large transactions and to identify the counterparties of their customers on certain activities.

Opponents of the FATF proposal say it would make impossible several recent cryptocurrency innovations. For example, the past year has seen explosive growth of “smart contracts” built on the Ethereum network, an open-source crypto platform, that allow for the automatic enforcement of transactions without a financial firm ever taking custody of the cryptocurrency.

The FATF proposal would require the operators of those networks to keep track of the activity of their users, something many of the networks don’t have the resources to carry out.

The Treasury proposal, for which the official comment period ended on March 29, drew thousands of comments from both small Bitcoin investors and major financial firms. Some lobbyists had said they were optimistic Treasury officials would scale back at least some of the rules.

Now, the FATF proposal is giving them new reason to worry. FATF’s recommendations aren’t binding on members, which include the U.S., the European Union and other major economies, but are considered a blueprint for anti-fraud regulators. In some cases, not following the recommendations can lead to sanctions or trade limits.

The FATF rule would require participants in a cryptocurrency network, even if they didn’t have custody of any currency, to register with regulators and report their activities — and those of their users — to authorities.

Such participants could include people like software developers who have created decentralized cryptocurrency exchanges or who operate certain kinds of nodes that process transfers over the Bitcoin network, according to Coin Center.

Coin Center wrote that the recommendations amounted to “mass warrantless surveillance.”

FATF is taking comments on its new proposal through Apr. 20 and could finalize it later this year.

Smith said that FATF, which is based in Paris, doesn’t have an open process for its recommendations, which made the proposal more of a surprise to the industry and harder to affect through lobbying. FATF is accepting comments on the proposal, and Smith said the Blockchain Association and some of its members plan to submit comments.

Smith said her group also plans to reach out to officials at some of FATF’s member countries, including the U.S. and Japan, which co-chair a virtual-asset working group at FATF, as well as to Singapore, which has been especially proactive in trying to grow its cryptocurrency industry.

Updated: 4-18-2021

Crypto Council For Innovation Report: Criminals Will Move Away From Bitcoin

A recent report co-authored by an ex-CIA director has found that criminals will increasingly move away from using Bitcoin.

A recent report published by the pro-cryptocurrency lobbying group Crypto Council For Innovation and co-authored by former CIA deputy director Michael Morell analyzed the degree of illicit activity associated with Bitcoin and concluded that criminals will decreasingly leverage bitcoin to launder money.

The report, titled “An Analysis Of Bitcoin’s Use In Illicit Finance,” noted the fact that Bitcoin is pseudonymous (as opposed to completely anonymous) as a reason that other cryptocurrencies that better protect user privacy represent a “far larger” percent of total transaction volume for illicit activities than bitcoin.

Furthermore, it highlighted the fact that fiat currencies are often better tools for obscuring criminal activity than bitcoin is.

“A currently serving official at the [Commodity Futures Trading Commission] added that it ‘is easier for law enforcement to trace illicit activity using Bitcoin than it is to trace cross-border illegal activity using traditional banking transactions, and far easier than cash transactions,’” according to the report.

And, Despite the fact that some regulators and news outlets have highlighted the potential for cryptocurrencies like bitcoin to be used as media for financing terrorism, this report found the contrary.

“On the key issue of terrorist financing, [a] former CIA terrorism expert was quoted as saying that ‘the hype is much greater than the reality and that cryptocurrency is not yet an important platform for terrorist organizations,’” per the report.

Finally, the authors of the report asked themselves the question: “In light of the conclusions we have reached, why do we see such alarmist statements and articles about the threat posed by Bitcoin?”

Firstly, the authors attributed these statements to a lack of understanding of the technology behind Bitcoin, the propensity for “bad” news to drive perception and the fact that “Bitcoin and its decentralized nature seem to pose a disruptive threat to traditional financial institutions.”

Updated: 4-19-2021

Blockchain Association Executive Debunks Rumored Crypto Crackdown By Treasury

A United States blockchain lobbying group executive says there is no danger of a crypto crackdown in the country.

Kristin Smith, executive director of the Blockchain Association has dismissed fears that the United States Department of the Treasury was close to cracking down on Bitcoin (BTC) and cryptocurrencies.

Indeed, rumors of the Treasury bringing money laundering charges against some financial institutions using cryptocurrencies began circulating on social media over the weekend.

The report emerged during a period of massive selloffs in the crypto space, with the market capitalization dropping over $240 million as Bitcoin slid to $52,000.

In an interview with CNBC, Smith debunked the reports, stating that it was the Department of Justice’s remit to charge companies with money laundering.

Janet Yellen, the secretary of the U.S. Treasury, is a noted crypto critic, who in February characterized the apparent misuse of cryptocurrencies for illegal activities as a growing concern.

Meanwhile, several studies show the criminal usage of cryptocurrencies accounts for a minute proportion of global crypto commerce. Indeed, Michael Morell, a former acting director of the Central Intelligence Agency, recently published a paper showing that the broad generalization of digital currencies as conduits for criminal financing was exaggerated.

Morell’s paper also concluded that blockchain forensic tools are sufficiently robust to detect illicit crypto transactions.

Commenting on the efforts by crypto stakeholders to remedy the disinformation in Washington regarding the industry, Smith remarked that several market actors are contributing more resources in positive lobbying efforts on the Hill.

Earlier in April, prominent organizations in the cryptocurrency space like Coinbase and Square announced a new lobbying initiative dubbed the Crypto Council for Innovation. Apart from the Blockchain Association, other groups like Coin Center are also pushing for sensible digital currency regulations in America.

For Smith, events such as the Coinbase listing on Nasdaq offer proof of the growing market validation for the crypto industry, a phenomenon that authorities in Washington can hardly overlook.

Updated: 5-30-2021

Bitcoin Likely Won’t Entirely Replace Current Financial System, Coin Center Director Says

Bitcoin may not cause the current monetary and financial system to go extinct, though its usage will likely vary depending on one’s location.

Bitcoin may not mean an end to traditional currency and banking, according to research director of Coin Center Peter Van Valkenburgh

“I think there are folks in the Bitcoin community who probably make too many noises about how Bitcoin is going to dominate all economic systems and nobody will be using dollars anymore, and nobody will be using banks anymore, and I think that’s actually a little foolhardy,” Van Valkenburgh said in a Friday interview with the Washington Journal on C-Span.

“The fact of the matter is that there’s going to be times when a Bitcoin transaction is what you want. Definitely if you are in an oppressive state like Nigeria or Belarus, you might find it more useful to use Bitcoin. In the U.S., we have a pretty stable banking system. We have the rule of law, we have a pretty well-functioning government.”

The way in which Bitcoin is used can depend on users’ geographic location. In some countries, Bitcoin (BTC) is seen as more of a speculative asset, used for trading and investing.

In other regions, Bitcoin can serve as a vehicle of greater freedom, providing users more flexibility and faster payments, as well as an avenue out of inflationary troubles when compared to traditional finance and currency.

“Generally speaking, here in the U.S., you’ll probably still use credit cards and Venmo and things like that, but maybe you’ll want to buy some Bitcoin because it can be a way to balance your investment portfolio against the threat of inflation,” Van Valkenburgh said, subsequently referring to similarity to gold in terms of limited supply.

“So maybe, you know, as part of a balanced portfolio that includes other safer investments, you might have a little bit of Bitcoin to hedge against inflation,” he noted.

Updated: 6-3-2021

Regulators Starting To Take Crypto Seriously, CoinShares Exec Says

Regulators don’t want to stifle the growth of crypto industry, CoinShares’ Meltem Demirors said.

The $2.6 trillion market cap peak compelled regulators worldwide to take a serious look at cryptocurrencies, but they also don’t want to stifle a growing industry, CoinShares chief strategy officer Meltem Demirors said.

Stating that “uncertainty is the name of the game for the industry,” Meltem Demirors noted that it took over the macro environment for the last few weeks. “Gary Gensler, the chair of the SEC, has indicated he wants to get more serious about regulating crypto exchanges,” she added, “Across the world, we are seeing regulators starting to take note.”

Cryptocurrencies started this year with under $1 trillion total market cap, peaking at $2.6 trillion a few weeks ago. Demirors said regulators are starting to take the asset class seriously. “We will continue to see uncertainty why the industry, investors, and speculators alike wait to see how regulation shapes up,” she added.

Speaking on regulators’ perception of the market, Demirors said that regulators want to ensure Know Your Customer and Anti-Money Laundering compliance and ensure market oversight without stifling the growing crypto industry.

Demirors stressed the central bankers’ warnings on crypto have an impact on sentiment. “Sentiment informs demand, and demand informs what takes place in the market,” she explained.

The exec described what we’ve seen over the last weeks as the biggest deleveraging event. Following the May 19 sell-off, which saw the largest daily wick in Bitcoin (BTC) history, nearly 60% of total leverages have been unwound from the crypto derivatives market, she noted.

“We see a lot of investors and traders taking a risk-off approach where they are trying to minimize their directional exposure until we see how these regulations are going to shape up.”

Commenting on the price actions of crypto, Demirors doesn’t believe the crypto prices will stay flat for too long, stating, “There’s over $3 trillion of dry powder on the sidelines in the US institutions alone. It is going to get deployed, and I can’t help but believe some of that will find its way into this market.”

Updated: 6-21-2021

Iran Government Reportedly Bans Local Blockchain Association

A crypto warning list is the main cause of the ban, according to the head of the Iran Blockchain Community.

The Ministry of Interior of the Islamic Republic of Iran has blocked the activities of the Iran Blockchain Community (IBC), but the association claims they still haven’t received direct notice.

The Social Affairs Organization of the Ministry required reports on IBC’s financial performance and dealings with cryptocurrency exchanges via a notice posted in local newspaper Hamshahri Online last week, according to local sources.

Over the weekend, the ministry blocked the association’s activities, but IBC spokesperson Sepehr Mohammadi, who is also the CEO of one of two crypto exchanges listed as sponsors of the association’s website, said no verbal or written warning was given to the board members.

In an open letter to the Social Affairs Organization, the IBC chairman noted that monitoring the performance of blockchain ecosystem participants is the right of the association. He added that issuing and publishing warning lists for new users to avoid traps is also a mission for the IBC.

High-risk Iranian companies involved in crypto were on the IBC warning list, so Mohammadi believes this is the leading cause of the ban. “Vested interests will do anything to stop IBC’s efforts. They managed to publicize the notice before IBA was informed,” he added.

According to the local media, a member of the parliament accused crypto-related domestic nongovernmental organizations of transferring foreign currency overseas. As one of the NGOs in the crypto and blockchain space, IBC denied the claim and said the association is focused on promoting blockchain technology in the country.

Following a “summer ban” for crypto mining, Iran is seeking healthy regulation for cryptocurrencies. Iranian President Hassan Rouhani said the country needs to legalize cryptocurrency activities to preserve and protect national interests. He called for a joint study between different parties to establish a legal framework for cryptocurrencies.

Updated: 6-24-2021

Major Players Will Speak At A New Bitcoin Event Aimed At Institutional Investors

Featured speakers include Twitter CEO Jack Dorsey, Blockstream founder Adam Back and Ark Invest’s Cathie Wood.

The Crypto Council for Innovation is hosting a virtual event on July 21 aimed to “destigmatize mainstream narratives about Bitcoin.”

According to a Thursday announcement, Square, Ark Invest and Paradigm are backing “The ₿ Word,” an event on “how institutions can embrace Bitcoin.”

The project, scheduled for launch next month, will offer featured speakers including Twitter CEO Jack Dorsey; Blockstream founder Adam Back; Ark Invest’s Cathie Wood; Michael Morell, former acting and deputy director of the United States Central Intelligence Agency; and John Newbery, director of Brink — a nonprofit focused on supporting Bitcoin (BTC) development.

“The ₿ Word is a Bitcoin focused initiative that aims to demystify and destigmatize mainstream narratives about Bitcoin, explain how institutions can and should embrace it, and raise awareness around areas of the network that need support,” said the project.

Formed in April, the Crypto Council for Innovation, or CCI, is an alliance of crypto-friendly firms including Coinbase, Square, Fidelity Digital Assets and Paradigm. The group was created to give companies a better means to lobby lawmakers on crypto and blockchain regulation.

“Bitcoin is a positive force in the world because it increases financial access and opportunity, but the complexity that makes its network so powerful also makes it difficult to understand at first,” said Paradigm co-founder Matt Huang. “We hope this initiative helps the investment community and policymakers better understand how transformative a moment we’re in right now.”

At the time of publication, the event lists five sessions that will be available on July 21, with an additional live panel with Dorsey, Wood and others on “Bitcoin As A Tool For Economic Empowerment.” Coin Metrics co-founder Nic Carter and MIT Digital Currency Initiative director Neha Narula will also be speaking in the online sessions.

Many experts posited that institutional investors would help drive mainstream interest in Bitcoin and other cryptocurrencies, in addition to potentially helping its price. Data from banking giant JPMorgan Chase in May, however, suggests that retail investors may be purchasing more BTC than institutions, using platforms like PayPal and Square.

Updated: 7-27-2021

Blockchain Australia Association Calls The State For Crypto Safe Harbor

The Australian crypto industry “cannot afford to wait years for regulatory clarity,” and consumers require confidence to access crypto services, the Australian blockchain association argued.

Blockchain Australia, a major association representing the local cryptocurrency industry, has officially introduced its crypto regulation recommendations to the federal government.

The association filed a submission to the Senate Select Committee on Australia as a Technology and Financial Centre last Friday, calling the government to provide a safe harbor for local crypto service providers.

Pointing out a set of regulatory recommendations, Blockchain Australia stressed the need for a coordinated and graduated approach to adopt a “fit-for-purpose regulatory framework,” ensuring innovation and competition in the country while enhancing consumer outcomes.

The crypto advocates emphasized that local industry “cannot afford to wait years for regulatory clarity,” and local consumers require confidence to access regulated crypto services in the country, stating:

“The government and relevant regulators should provide crypto asset providers a safe harbor until such a time that they introduce guidance or legislation. Any legislation should contain an appropriate transition period and not apply retrospectively.”

As part of the recommendations, Blockchain Australia recommended establishing a regulatory working group that works across industries to facilitate greater communication between the crypto industry and financial authorities. “The first exercise to be undertaken by the group should be a token mapping exercise, examining the work done in overseas jurisdictions,” the association noted.

The organization pointed to cooperation with many Australian authorities, including the Australian Securities and Investments Commission (ASIC), the Australian Prudential Regulation Authority, the Reserve Bank of Australia, the Australian Competition and Consumer Commission and the Australian Taxation Office.

Blockchain Australia specifically asked ASIC to update the local custodial service regulation, known as RG133, to explicitly state that licensed custody providers can provide crypto asset custodial services.

The news comes after local financial players expressed more concerns over the cryptocurrency industry in Australia. In mid-July, the Australia Securities Exchange filed a submission to the Senate Select Committee on Financial Regulatory Technology, warning about security risks of crypto custody on centralized crypto exchanges.

Updated: 8-9-2021

Blockchain Australia Says Gov’t Still Dismissing Industry As A ‘Wild West’

The industry body has accused the government of leaning into narratives about malicious actors and scams rather than engaging with the blockchain space to establish fit-for-purpose regulation.

Blockchain Australia, an association representing the local crypto industry, has warned that the country has fallen behind on the regulatory front due to the undue persistence of a dismissive “wild west” narrative.

The association has been proactive in its engagement with the state in recent months as the government continues to review the future of blockchain and fintech and regulation in the country.

Appearing before the Senate Select Committee on Australia as a Technology and Financial Centre last week, Blockchain Australia CEO Steve Vallas said that the association strongly resists the notion that the crypto space remains “a bit of a wild west” and has been “very deliberately asking for the regulators to engage with us.” Tracing the narrative’s emergence to the 2017–2018 initial coin offering (ICO) boom, Vallas accused the government of responding to the phenomenon with an overly passive “wait and see” approach:

“The landscape […] today is entirely different. We don’t see an appetite within Australia for ICOs, we don’t see the regulators comfortable allowing that to happen again, so we have a new chapter, but the narrative has persisted. […] When people don’t understand the space, the tendency is to lean in on the wild west, to lean in on nefarious and bad actors.”

Vallas’ argument was broadly echoed by Michael Bacina, a partner at the Australian law firm Piper Alderman, who specializes in digital law with a focus on fintech, regtech and the blockchain and digital assets industry. Unlike Vallas, however, Bacina drew a close parallel between Australia’s regulatory lag and the situation in some other jurisdictions, particularly the United States. In the latter, in cases such as crypto exchange-related crimes, he claimed that people are “effectively reading the tea leaves of what prosecutions have occurred to try and understand.”

Following Vallas and Bacina, Chloe White, managing director at Genesis Block, told the committee that the Australian government has focused its energies on the industry only intermittently and largely at times of hype. Instead of continuing to engage with the space during quiet periods, local policymakers have failed to develop “a real understanding of the space and its trajectory” and have remained “in a very reactive position where policy advice and analysis has been concerned,” she said.

Earlier this year, Australian Senator Andrew Bragg argued that Australia must introduce better regulations for crypto assets if the country aspires to “stay ahead of the game” and foster tech and financial innovation.

Updated: 11-9-2021

Climate Chain Coalition Advocates For The Creation Of A Green Economy At COP26

A number of representative and delegates supporting the Climate Chain Coalition group spoke at a dedicated panel on Tuesday at COP26.

Delegate representatives from the Climate Chain Coalition spoke at the United Nations Climate Change Conference, also known as COP26, in Glasgow, Scotland on Tuesday.

The Climate Chain Coalition, or CCC, is a global environmental initiative consisting of 250 member organizations and individuals aligned to utilize blockchain, distributed ledger, or DLT, and other promising digital technology solutions to foster the growth of a climate-focused economy.

Hosted by CCC strategic director Miroslav Polzer, the panel of expert representatives, including Denby McDonnell, Tia Kansara and Cointelegraph editor-in-chief, Kristina Cornèr, among others, spoke unequivocally about the importance of subjects ranging from carbon nonfungible tokens (NFTs) to accountability in corporate practices.

Programme manager at the Blockchain For Climate Foundation Denby McDonnell spoke on the panel about her organization’s endeavor to place the Paris Climate Agreement on the blockchain, specifically mentioning article 6.2, as well as discussing the recent launch of a new crypto-carbon platform, BITMO.

“The BITMO platform enables issuance and exchange of blockchain internationally transferred mitigation outcomes as ERC-115 nonfungible tokens [NFT’s] on the Ethereum blockchain.”

Amid the rising adoption of carbon-credit certifications by tech firms to accurately verify and report their carbon emission data, thought leaders and experts from the field are calling for greater advocation of carbon-negativity, rather than what some have considered “greenwashing” strategies.

Mcdonnell Revealed The Potential Implications Of The BITMO Platform For Facilitating Transparent And Openly Accountable Carbon Data Reporting, Stating:

“BITMO is a secure record of issuance, transfer and retirement for each country’s internationally transferred mitigation outcomes that can be reconciled with national carbon registries and meet future UN requirements.”

Tia Kansara, Chief Executive Officer of Replenish Earth, and special advisor to the United Nations Framework Convention on Climate Change (UNFCCC), as well as a newly-appointed member of the coalition, spoke eloquently on the importance of embracing an array of technologies such as DLT to realize a net-positive economic model.

Our challenge going forward is two-fold. The first is going transboundary. At some point, we need to go beyond our own egotistical perspectives, our own nationalistic borders, to the means through which we can govern for the global commons.

Citing Former United States President John F. Kennedy’s Vision For A Lunar Landing Mission Back In 1962, As Well As George Land’s Infamous 1968 Study On Child Geniuses Which Determined That “Non-Creative Behavior Is Learned”, Kansara Stated:

The second is a step in consciousness. We cannot transform our lives by thinking and extending linear incremental models of the past, and the way that we do that is by looking at frontier tech.

Also represented at the COP26 conference on Tuesday was the independent advisory group, Germanwatch, which published and presented its analytical findings in the Climate Change Performance Index 2022.

The composite index investigated the environmental performance of 60 countries worldwide, collating the data into four distinctive parameters aligned with consensus objectives in the Paris Climate Agreement, and then reporting those findings in a corresponding ranking list.

The group determined that greenhouse gas emissions (GGE) should account for 40% of the ranking system, while energy use, renewable energy and climate policy should be equally distributed a 20% share of the total.

Germany improves 6 places in #CCPI2022. #ClimateProtectionAct & lower #emissions in 2019 lead to 13th place. The new coalition must further expand performance in #EnergyUse, #Renewables & #ClimatePolicy through good mix of instruments.

More info: https://t.co/0gxhh3ITi9 pic.twitter.com/E1u6GMFaha— Germanwatch (@Germanwatch) November 9, 2021

Assessing growth over the prior few years, as well as defined targets that governments have publicly expressed, the index outlined the United States, Canada, Russia, Algeria and Australia as just some of the more geographically prominent nations worthy of red scoring, the latter of which being the world’s largest supplier of coal.

A stark admission was within the ‘Very High’ scoring category which lay empty, despite Denmark, Sweden and Norway securing the top three spots.

Of the major industrialized nations, China moved up to 37th as a result of commended advancements in the renewable energy space, while the United States placed further down the rankings in 55th, one position above the Russian Federation.

Co-Author Of The Index Jan Burck Shared His Opinion Of How Readers And Interpreters Of The Report Should Assess The Findings:

“As in the year before, we don’t see any country with a perfect record. Even the countries in the front are not doing good enough for being on track for well below 2 degrees.”

Updated: 1-28-2022

Crypto Industry Heavyweights Form Political Action Committee For US Midterms: Report

Backers of the PAC include top executives at FTX and SkyBridge Capital.

A group of executives from major firms in the crypto industry have formed a political action committee (PAC) to support candidates running in November’s midterm elections.

-

Backers of the PAC include top executives at crypto exchange FTX and SkyBridge Capital, the hedge fund led by Anthony Scaramucci, who was briefly a White House communications director under President Donald Trump.

-

The “GMI PAC” has attracted $5.3 million in contributions so far, according to a report by Politico. It aims to raise more than $20 million to support “candidates who work to give U.S.-based innovators the opportunity to build next-generation technologies and services here in America rather than doing that valuable work overseas,” according to its website.

-

CMS Holdings co-founder Dan Mastuszewski, a member of the group’s board, said that such a body is “long overdue.”

-

“GMI PAC is the crypto community’s campaign arm and we are here to stay,” Mastuszewski said in a statement Friday.

-

A number of U.S. politicians have been vocal in their advocacy of cryptocurrency and opposition to legislation which they believe unnecessarily stymies its growth and adoption.

Updated: 1-31-2022

Coinbase-Backed Crypto Lobby Group Gears Up For Regulation With New Leader

* Former WEF Exec Becomes CEO Of Crypto Council For Innovation

* Founding Members Include Fidelity, Coinbase, Paradigm, Block

When companies including Fidelity Investments’ digital asset arm, Coinbase and Block (then known as Square Inc.) first formed their trade group last April, the largest crypto token was hovering around $60,000.

Sheila Warren, previously an executive at the World Economic Forum, will be joining the group known as the Crypto Council for Innovation with prices across the asset class trending markedly lower and significant regulatory headwinds on the horizon.

Warren and her new team at the Crypto Council for Innovation (CCI) intend to shape the narrative around digital assets as the U.S. and other countries move forward on regulations.

“We’re in a critical moment for the crypto ecosystem,” Warren, who starts her new role on Feb. 2, told Bloomberg in an interview. She expects that the next two years will be especially important for the industry as digital assets become more widely adopted and governments seek to take a more active oversight role.

The Crypto Council for Innovation’s members include Paradigm, which recently raised a record-breaking fund, as well as venture capital firms Ribbit Capital and Andreessen Horowitz. Prior to joining CCI, Warren held several posts at the World Economic Forum, including head of data, blockchain, and digital assets and member of the executive committee.

She is taking up the CEO post as many crypto firms and advocacy groups are beefing up their presence in Washington, D.C.–motivated in large part by last year’s infrastructure bill, which added new tax-reporting requirements for crypto brokers that many in the industry have called overly broad. “The infrastructure bill was a massive wake up call to a lot of people,” Warren said.

In the short-term, CCI plans to focus on U.S. policy given the level of activity that’s occurring domestically–the White House is working on an executive order to create a government-wide strategy for digital assets. At the same time, the Federal Reserve is mulling a potential U.S. digital dollar and policy makers are examining how best to regulate stablecoins.

The White House directive, in particular, will be key and hopefully provide crypto firms more clarity on how they should be regulated and by which government agencies, Warren said. U.S. Securities and Exchange Commission Chair Gary Gensler has indicated he intends to more closely scrutinize cryptocurrency exchanges and wants them to register with his agency.

But Warren said CCI also wants to focus on global policy and she plans to continue engaging with other countries she developed connections with during her time at WEF.

“Crypto is a global phenomenon and so being mindful and aware of what’s happening all around the world is going to be a very important part of what CCI does,” she said.

WEF’s Blockchain Head Will Lead The Crypto Council For Innovation

CCI board member Fred Ehrsam cited the WEF executive’s “in-depth knowledge of crypto” in addition to her experience working with governments across the globe.

Sheila Warren, the head of blockchain and distributed ledger technology at the World Economic Forum, will be assuming the position of CEO of the Crypto Council for Innovation, or CCI, starting in February.

In a Monday announcement, the CCI said that beginning on Wednesday, Warren would lead the alliance of crypto-friendly firms aimed at supporting lawmakers on crypto and blockchain regulation. CCI board member and Coinbase co-founder Fred Ehrsam cited the WEF executive’s “in-depth knowledge of crypto” in addition to her experience working with governments across the globe.

“The crypto ecosystem is poised to deliver large-scale economic growth, empower communities and improve lives all over the world,” said Warren. “I am excited to drive CCI’s mission of realizing the transformative potential of crypto through education and advocacy for a responsible, forward-thinking global policy environment that will ensure that crypto’s benefits are accessible to all people, regardless of their current economic privilege.”

We’re honored to announce @sheila_warren as the new CEO of CCI. Sheila will lead us in demonstrating and communicating the transformational promise of crypto to policymakers, regulators, and people around the globe. #FutureofInnovationhttps://t.co/ETGcYGp8SK

— Crypto Council for Innovation (@crypto_council) January 31, 2022