Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Central Banks Provide Guidance On Banks’ Crypto Exposure: Bank For International Settlements. Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

“Cryptoassets and stablecoins will be subject to a conservative prudential treatment. The standard will provide a robust and prudent global regulatory framework for internationally active banks’ exposures to crypto-assets that promotes responsible innovation while preserving financial stability.” Pablo Hernández de Cos, chair of the Basel Committee and Governor of the Bank of Spain

Related:

Ultimate Resource On Central Bank Digital Currencies (#GotBitcoin)

IMF: Network Effects Could Spark Blaze of Bitcoin Adoption

The report, dubbed “Prudential treatment of cryptoasset exposures,” introduces the final standard structure for banks regarding exposure to digital assets, including tokenized traditional assets, stablecoins and unbacked cryptocurrencies, as well as feedback from stakeholders collected in a consultation launched in June. The Basel Committee on Banking Supervision noted the report will soon be incorporated as a new chapter into the consolidated Basel Framework.

Pablo Hernández de Cos, chair of the Basel Committee and Governor of the Bank of Spain, noted about the standard:

“The Committee’s standard on cryptoasset is a further example of our commitment, willingness and ability to act in a globally coordinated way to mitigate emerging financial stability risks. The Committee’s work programme for 2023–24 endorsed by GHOS today seeks to further strengthen the regulation, supervision and practices of banks worldwide. In particular, it focuses on emerging risks, digitalisation, climate-related financial risks and monitoring and implementing Basel III.”

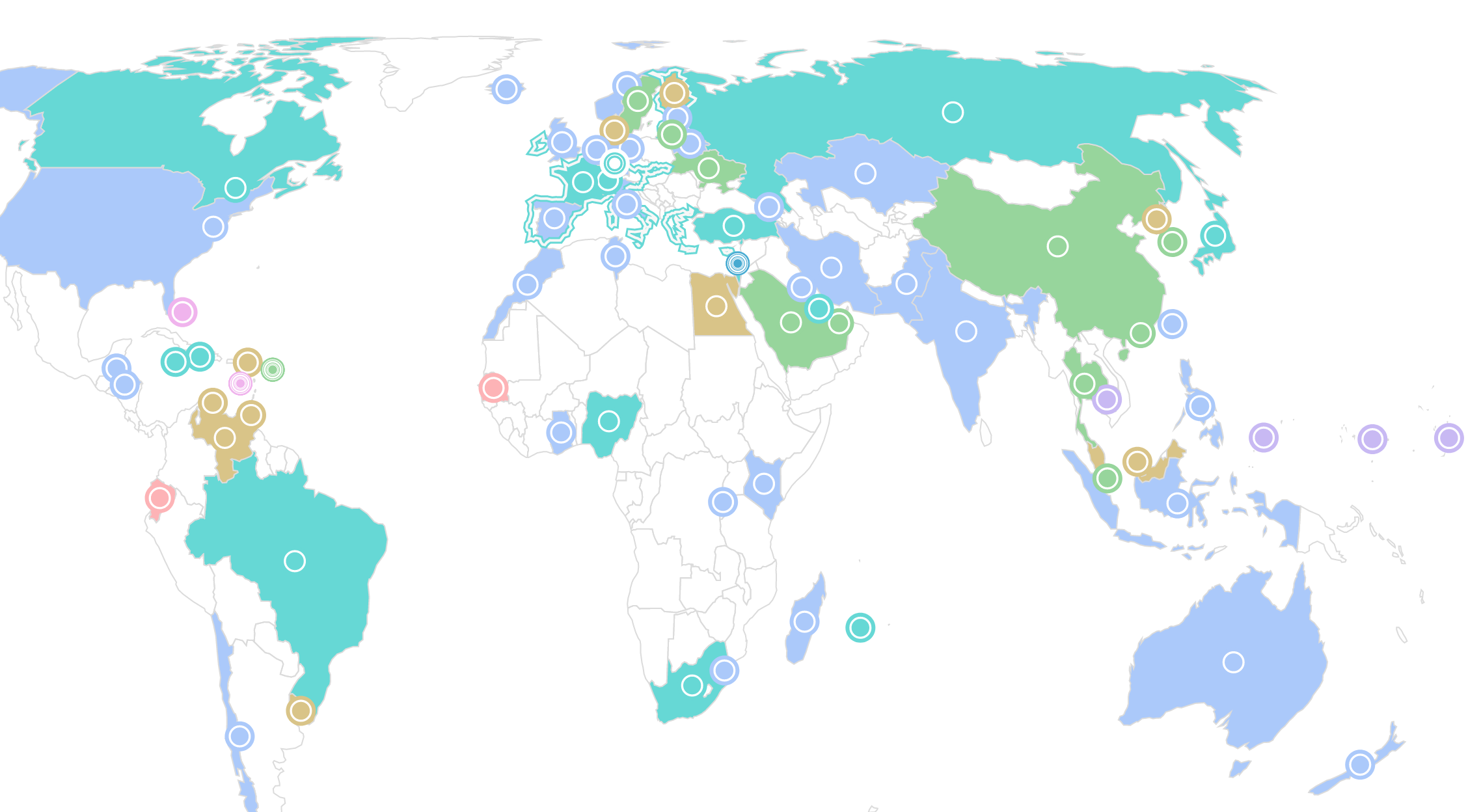

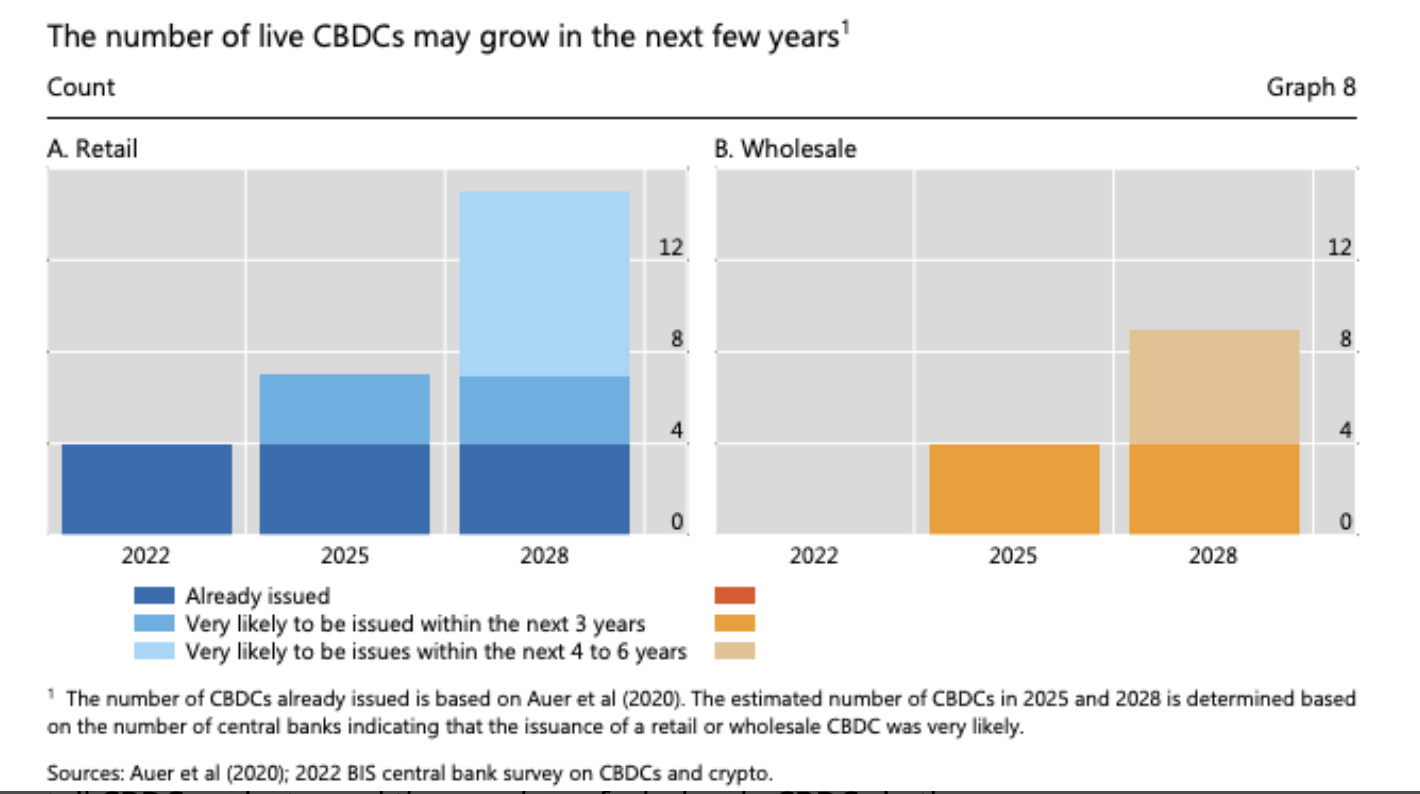

The BIS disclosed in September the results of its multi-jurisdictional central bank digital currency (CBDC) pilot, following a month-long testing phase that enabled cross-border transactions worth $22 million. The pilot program involved the central banks of Hong Kong, Thailand, China and the United Arab Emirates, as well as 20 commercial banks from those regions. According to a report by the BIS published in June, around 90% of central banks are considering the adoption of CBDCs.

The new standard limits crypto reserves among banks to 2% by 2025, and goes into effect on January 1, 2025.

Updated: 2-1-2022

India To Introduce 30% Crypto Tax, Digital Rupee CBDC By 2022–23

Finance minister Nirmala Sitharaman believes the introduction of a CBDC will provide a “big boost” to India’s digital economy.

In a speech discussing the budget for 2022, Indian finance minister Nirmala Sitharaman announced the launch of a central bank digital currency (CBDC) by 2022–23 as a means to boost the country’s economic growth.

Sitharaman highlighted the need for digital inclusion across numerous business verticals while announcing the fund allocation set in the Union Budget.

Speaking about the launch of a digital rupee, she added that the introduction of a CBDC will provide a “big boost” to the digital economy. She also highlighted the possibility of a more efficient and cheaper currency management system made possible by digital currencies.

“It is therefore proposed to introduce digital rupee using blockchain and other technologies to be issued by the Reserve Bank of India, starting 2022-23.”

Complementing the launch of a digital version of the Indian rupee, Sitharaman also proposed the introduction of a 30% crypto tax that targets all transfers of virtual digital assets. She suggested:

“Any income from transfer of any virtual digital asset shall be taxed at the rate of 30%. No deductions in respect of any expenditure or allowance shall be allowed while computing such income, except the cost of acquisition.”

Any income from transfer of Virtual Digital Asset shall be taxed at 30% : FM @nsitharaman#Budget2022 – 2023#AatmaNirbharBharatKaBudget pic.twitter.com/J88YTIGPz5

— All India Radio News (@airnewsalerts) February 1, 2022

The finance minister also highlighted that any losses that occurred while transacting digital assets cannot be used as compensation against any other income source. In other words, investors will not be able to show losses or hacks of cryptocurrencies to offset taxation on profits.

To keep track of crypto investments in the country, Sitharaman further proposed to implement a tax deduction at source (TDS) of 1% above a yet-to-be-determined threshold.

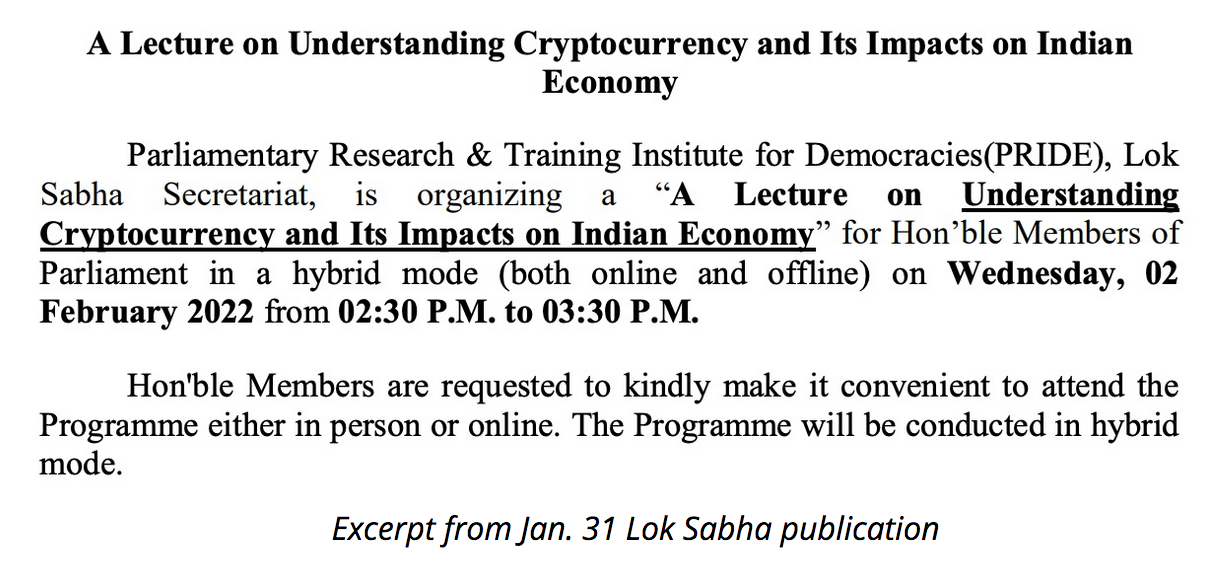

Local Indian media publication Lok Sabha highlighted that a parliamentary research group has organized a crypto-focused training for Wednesday, Feb. 2.

As Cointelegraph pointed out, the legislative business calendar for the lower house of parliament no longer includes a bill that could potentially ban crypto in the country.

Previously, published texts of the bill propose banning “private cryptocurrencies” in India while retaining use of “the underlying technology of cryptocurrency.”

Updated: 10-31-2022

India’s Central Bank To Start Wholesale CBDC Pilot Nov. 1

A pilot for a retail version will start within a month.

India’s central bank will introduce a pilot wholesale central bank digital currency (CBDC) Nov. 1, and a retail version will start within a month. In a statement, the Reserve Bank of India (RBI) said the use case for the wholesale digital rupee is the “settlement of secondary market transactions in government securities” because it would reduce transaction costs.

Nine prominent banks have been identified for participation in the pilot. These are State Bank of India (SBIN), Bank of Baroda (BANKBARODA), Union Bank of India (UNIONBANK), HDFC Bank (HDFCBANK), ICICI Bank (ICICIBANK), Kotak Mahindra Bank (KOTAKBANK), Yes Bank (YESBANK), IDFC First Bank (IDFCFIRSTB) and HSBC (HSBA).

The RBI said a pilot of the retail version is planned for launch within a month in select locations in closed user groups comprising customers and merchants. The bank published a 50-page concept note for the introduction of a central bank digital currency earlier this month.

Since early 2021 it’s been known that 80% of central banks around the world are exploring CBDCs. Recently, Australia’s Central Bank started a CBDC research project and announced plans to complete the pilot by mid-2023. The central banks of Israel, Norway and Sweden have teamed up to explore retail CBDC.

The Bank of International Settlements has also conducted a project with the central banks of Hong Kong, China, the United Arab Emirates and Thailand to study CBDCs and their possible role in cross-border payments and multi-CBDC transactions. The six-week pilot project successfully had 20 different commercial banks conduct over 160 payments worth around a total of $22 million.

India will have a prominent role in framing global crypto regulation when it takes over the G-20 group presidency for one year, starting from Dec. 1, 2022, until Nov. 30, 2023. The nation’s finance minister, Nirmala Sitharaman, has said crypto will be part of the agenda.

Sitharaman has said that she seeks to arrive at a framework or a standard operating procedure after discussions with G-20 members and institutions based on their studies and research around the topic.

“We would definitely want to collate all this and do a bit of study and then bring it on to the table of the G-20 so that members can discuss it and hopefully arrive at a framework or SOP (standard operating procedure) so that globally, countries can have a technology-driven regulatory framework,” she said.

In January 2022, Indian Prime Minister Narendra Modi sought global cooperation to tackle the challenges posed by cryptocurrencies. Later in July, the Finance Minister said no legislation is possible without significant international collaboration while re-stating the RBI’s known stance to parliament – ban cryptocurrencies to avoid a destabilising effect on monetary and fiscal stability.

Monetary Authority of Singapore Completes Phase 1 of CBDC Project, With More Trials To Come

The first part of the project found there was no urgent need for a retail CDBC, although the bank said it wanted to be prepared in case that changes.

The Monetary Authority of Singapore (MAS) has completed the first phase of its central bank digital currency (CBDC) project, according to a report on Monday.

This stage of Project Orchid explored the potential use cases for a digital Singapore dollar as well as the infrastructure required to implement one. It looked at the concept of purpose-bound digital Singapore dollars, which allows senders to specify how and where the money will be used.

They found there is currently no urgent need for a retail CBDC but said they want to be prepared in case that changes.

“MAS’ vision is to build an innovative and responsible digital asset ecosystem in Singapore,” the report said. The country has been collaborating with the crypto industry and issuing licenses to big players such as Coinbase and Blockchain.com, and has continued to explore a retail CBDC despite feeling like there is no need for one. Project Orchid was announced in November last year and even then-Managing Director Ravi Menon said that the benefits of a retail CBDC were “not compelling.”

Countries around the world have been looking into retail CBDC’s. A BIS survey in May revealed that 90% of the 81 responding central banks have started work on a CBDC. The U.S., U.K. and European Union are reviewing whether or not they should issue a CBDC while China is further along than most countries in its CBDC trials.

“Although MAS does not see an urgent case for retail CBDC, it is envisioned that the study of potential use cases for a programmable digital SGD (Singapore dollar) and the infrastructure required, would enable MAS and the financial services ecosystem in Singapore to develop capabilities to support a retail CBDC should the need arise,” the report said.

MAS believes that a CBDC would be a small part of the money supply in the same way that physical cash is. Banknotes and coins issued by MAS only account for around 8% of the entire money supply, while privately issued money makes up 92%, the report said.

“Second, the retail CBDC system will form part of Singapore’s national foundational digital infrastructure, which brings together payments, digital identity and data exchange and authorization and consent mechanisms to protect the privacy and welfare of individuals more holistically,” the report said. It will be fully interoperable with other payment systems.

Some of the use cases of a CBDC will be tested through trials with the public and private sector in 2022 and 2023. The trials will include looking at government and commercial vouchers that can be used to purchase goods at the upcoming Singapore FinTech Festival.

Government payouts will also be tested that do not require participants to have a bank account plus the CBDC will be used to automatically release grants.

The next phase of Project Orchid will look at what the best ledger technology is for the CBDC and how this can be integrated with the existing infrastructure.

Privacy Protection A Top Issue For Digital Yuan: China’s Central Bank Governor

“We must strike a delicate balance between protecting privacy and combating illicit activities,” said Yi Gang.

Privacy protection is one of the top issues among the many still remaining when it comes to the use of China’s central bank digital currency (CBDC), the digital yuan, according to China’s Central Bank Governor Yi Gang.

“It is also important to keep in mind that anonymity and full disclosure are not as simple as black and white. There are many subtleties in between,” Gang said during a virtual speech at Hong Kong FinTech Week. “Therefore, we must strike a delicate balance between protecting privacy and combating illicit activities.”

The central banks and governments of several major economies around the world have signaled their intent to explore the development of a CBDC with an eye on China’s lead on CBDCs.

The stress on privacy comes in a month when China’s digital yuan, also known as the e-CNY, reached the milestone of 100 billion yuan (US$13.9 billion) in transaction volume.

But that figure was a meager 14% increase from the end of last year, compared with its growth of 154% in the last six months of 2021. The e-CNY is being rolled out on a trial basis across the country in 23 cities.

While Gang emphasized the e-CNY is “mainly positioned as cash to meet the needs of domestic retail payment” to enhance inclusive finance and improve payment system efficiency, he stressed that the e-CNY has been designed to “ensure privacy protection and financial security through by-and-large anonymity and managed anonymity.”

He explained that is accomplished via the fact that “transaction-related data is encrypted for storage,” “entities and individuals are prohibited from arbitrary inquiry or information usage without rigorous legal authorization” and that China’s central bank keeps “small-amount soft wallets and hard wallets to meet the need for small-value anonymous transactions, both online and offline.”

However, the credibility of China’s privacy promises comes under the shadow of its infamous propaganda efforts and governmental heavy-handedness, particularly during the 2021 crypto crackdown when it declared all cryptocurrency transactions and mining illegal.

Singapore’s MAS Says No Urgent Case For Retail CBDC, But Launches 4 Fast Trials Of It

The Monetary Authority of Singapore will trial a retail central bank digital currency in various contexts at a fintech event, despite the electronic payment options already available.

The Monetary Authority of Singapore (MAS) has wrapped up the first stage of its Project Orchid examination of a retail central bank digital currency (CBDC). According to the white paper released on Oct. 31, there is no “urgent case” for a retail CBDC in Singapore, but the study envisioned the infrastructure required in case a need arose.

It also conceptualized a new model for digital currency — purpose-bound money — and pulled large Singaporean banks and government agencies into the research with a series of trials.

Singaporean consumers do not need a retail digital dollar at present because of the high quality of services already available, the authors wrote. They indicated, however, that the most foreseeable use case may be for the benefit of the MAS rather than users:

“Electronic payments in Singapore are pervasive, and households and firms in Singapore are already able to transact digitally in a fast, secure and seamless manner today. […] The case for a retail CBDC in Singapore could strengthen over time, especially if innovative uses emerge or there are signs that digital currencies not denominated in SGD are gaining traction as a medium of exchange locally.”

The MAS uses the concepts of programmable payment (“the automatic execution of payments once a pre-defined set of conditions are met”) and programmable money (“embedding rules within the medium of exchange itself that defines or constraints its usage”) to devise its purpose-bound money (PBM), which “specifies the conditions upon which an underlying digital currency can be used.”

This highly constrained, nonintermediated form of CBDC would serve well for vouchers, the authors of the white paper said. Four trials will be conducted at the Singapore FinTech Festival from Nov. 2 to 4.

The Monetary Authority of Singapore (@MAS_sg) has marked the successful completion of Phase 1 of Project Orchid w/ a report detailing potential uses of a purpose-bound digital Singapore dollar and the supporting infrastructure required #CBDC #digitalmoney https://t.co/3QwH5cPFoz

— Central Bank Payments News (@cbpaymentsnews) October 31, 2022

DBS Bank said it would issue digital Singapore dollars with smart contract capabilities enabled by the Open Government Products office in a pilot program that would make instant settlement possible, saving merchants one or two days of processing time.

One thousand consumers and six merchants are participating in that trial. The bank, which is Singapore’s largest, said that PBM would be applicable in the Community Development Council scheme that provides households with vouchers to counteract inflation and the high cost of living.

Other financial institutions will issue commercial vouchers that can be used at the festival, disburse government funds to people without bank accounts and disburse grant money to financial training providers.

Singapore has been researching a wholesale CBDC since 2016, but this white paper was the first step in the MAS’ expansion into a retail CBDC, which began last year.

Reserve Bank of India To Reportedly Launch Digital Rupee Pilot In November

Now debuting a wholesale CBDC, the RBI plans to launch the digital rupee for the retail segment within a month in select locations.

The Reserve Bank of India (RBI) is on track to debut a central bank digital currency (CBDC) after announcing its digital rupee project in February.

The central bank of India will launch the digital rupee pilot for the wholesale segment on Nov. 1, the RBI announced on Oct. 31.

The pilot will involve nine locally operating banks, including the biggest Indian bank, the State Bank of India. According to a report by Reuters, other banks in the pilot will also include Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC.

The main use case of India’s CBDC pilot will be to settle secondary market transactions in government securities. The digital rupee is expected to add more efficiency to the interbank market by reducing transaction costs of settlements, the RBI said.

Wholesale CBDCs are a type of CBDC primarily used by financial institutions like banks, involving interbank transactions such as securities settlement and cross-currency payments.

Unlike wholesale CBDCs, retail CBDCs are utilized by households and businesses, allowing them to make payments directly and store value via the digital version of a specific fiat currency, like the Indian rupee. According to the new report, the RBI plans to launch the digital rupee for the retail segment within a month in select locations.

India has been somewhat quick in launching a CBDC. Indian Finance Minister Nirmala Sitharaman announced the initial plans in February 2022, declaring that a digital rupee would be a “big boost” for India’s economy. The RBI then proposed a three-step graded approach for its rollout, aiming for little or no disruption to the traditional financial system.

While rushing the CBDC’s development, the Indian government has been taking measures to make crypto less attractive for local investors, including adopting a 30% tax on digital asset holdings and transfers in April.

As previously reported by Cointelegraph, the new crypto taxes had a negative impact on the country’s crypto ecosystem, forcing industry entrepreneurs to move to friendlier jurisdictions.

Updated: 11-1-2022

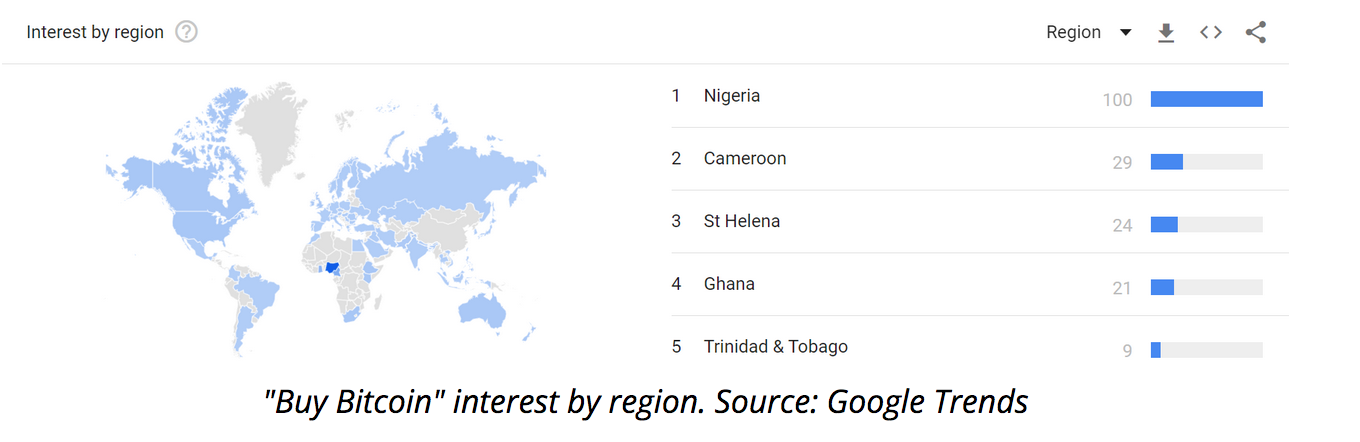

Skeptical Nigerians Aren’t Sold On Africa’s First Digital Currency

A look at adoption and acceptance of the eNaira one year after it was introduced.

About a year ago, Nigeria introduced a digital version of its official currency, the Naira.

The introduction of the so-called eNaira was partly a response to concerns that the rising popularity of crypto in the country was threatening the banking system.

There are a few countries experimenting with their own versions of digital money, including the Central African Republic, China, Jamaica, The Bahamas, and various islands in the Eastern Caribbean. Other countries, including the United States, are in the “studying” and “thinking deep thoughts about feasibility” phase of things.

So how’s it going for Nigeria and the eNaira? Bloomberg reporter Ruth Olurounbi and Bloomberg Nigeria Bureau Chief Anthony Osae-Brown weigh in.

Chinese Central Bank Exec Says Digital Yuan Will Offer ‘Controllable Anonymity’

China’s digital yuan is one of the earliest CBDCs whose pilot phase has expanded to include millions of users and billions in transaction volume.

Chinese central bank governor Yi Gang, in a recent speech at Hong Kong Fintech Week, talked about the progress of their national digital currency called the digital yuan. He outlined the progress and the adoption of the national digital currency.

During his speech, Yi noted that the digital yuan is being positioned as an alternative to cash in China, a country with a robust digital payment infrastructure. He added that “privacy protection is one of the top of the issue on our agenda.”

He went on to describe the two-layer payment system that would offer controllable anonymity to the users. At tier one, the central bank supplies digital yuan to the authorized operators and processes inter-institutional transaction information only.

At tier two, the authorized operators only collect the personal information necessary for their exchange and circulation services to the public.

Yi promised that data will be encrypted and stored and, personal sensitive information would be anonymized and not shared with third parties. Users can also make anonymous transactions up to a certain amount, and there will be specialized e-wallets to facilitate those transactions.

The central bank governor noted that anonymity is a two-faced sword and thus must be dealt with carefully, especially in the financial ream and explained:

“We recognize that anonymity and transparency are not black and white, and there are many nuances that need to be carefully weighed. In particular, we need to strike a precise balance between protecting individual privacy and combating illegal activities.”

Yi’s comments are in line with the central bank digital currency (CBDC) program head Mu Changchun, who in July reiterated a similar stance saying CBDC doesn’t have to be as anonymous as cash. Mu had said that a completely anonymous CBDC would interfere with the prevention of crimes like money laundering, terrorism financing, tax evasion and others.

China started its CBDC program as early as 2014 and, after years of development, launched the pilot in 2019. Since then, the program has expanded to millions of retail customers across the country. In 2022, the CBDC testing has expanded to some of the most populous provinces.

The extent of the CBDC trail can be estimated from the fact that the total digital yuan transaction volume crossed $14 billion by the third quarter of 2022.

Updated: 11-2-2022

Bank For International Settlements Will Test DeFi Implementation In Forex CBDC Markets

The centralized financial institution says the automated market making technology in DeFi can serve as a “basis for a new generation of financial infrastructure.”

According to a new announcement on Nov. 2, the Bank for International Settlements, or BIS — along with the central banks of France, Singapore and Switzerland — will embark on a new initiative dubbed “Project Mariana” in its exploration of blockchain technology. Project Mariana intends to use decentralized finance, or DeFi, protocols to automate foreign exchange markets and settlement.

Project Mariana explores using automated market makers for the cross-border exchange of hypothetical CHF, EUR and S$ wholesale CBDCs. It’s a #BISInnovationHub joint venture with the French, Swiss & Singapore #CentralBanks@banquedefrance @MAS_sg @SNB_BNS https://t.co/GsNLpXZlsD pic.twitter.com/2tMitZcNF2

— Bank for International Settlements (@BIS_org) November 2, 2022

This includes using DeFi protocols to stimulate the hypothetical exchange of cross-border transactions between the Swiss franc, euro and Singapore dollar wholesale central bank digital currencies, or CBDCs. The technologies involved in building Project Mariana include smart contracts and automated market maker protocols, or AMMs.

Researchers seek to combine pooled liquidity in AMMs with innovative algorithms to determine the prices of tokenized assets, potentially developing into a basis of exchanges for CBDCs.

As an organization created by central banks to regulate the international financial framework, BIS wrote that “AMM protocols could form the basis for a new generation of financial infrastructures facilitating the cross-border exchange of CBDCs.” Cecilia Skingsley, head of the innovation hub at BIS, added:

“This pioneering project pushes our CBDC research into innovative frontiers, incorporating some of the promising ideas of the DeFi ecosystem. Mariana also marks the first collaboration across Innovation Hub Centres; expect to see more in the future.”

BIS and the collaborating central banks have set a tentative date of mid-2023 for delivering a proof-of-concept. The financial institution was previously skeptical of digital assets due to their inherent price variance and lack of a unified regulatory framework.

Nevertheless, BIS has praised elements of distributed ledger networks, such as their technological prowess relative to fiat money. According to a recent report authored by BIS, 90% of central banks worldwide are currently researching the utility of CBDCs.

Updated: 11-6-2022

Buying Bitcoin ‘Will Quickly Vanish’ When CBDCs Launch — Arthur Hayes

Looking to buy BTC to avoid the CBDC “horror story?” The best time was “yesterday,” the former BitMEX CEO said.

Bitcoin holders looking to avoid Central Bank Digital Currencies (CBDCs) may have gained a surprise ally — banks.

In his latest blog post titled “Pure Evil,” Arthur Hayes, ex-CEO of crypto derivatives platform BitMEX, argued that banks may limit the impact of the CBDC “horror story.”

Hayes: Bitcoiners and banks stand against CBDC ’dystopia’

CBDCs are currently in various stages of development worldwide.

Fans of financial sovereignty naturally fear and even despise them, as they imply total government control over everyone’s money and purchasing power — “a full-frontal assault on our ability to have sovereignty over honest transactions between ourselves,” said Hayes.

Among opponents of CBDCs are not only Bitcoiners, however. Sharing the cause will likely be the commercial banks they have sought to oust from power with BTC.

“I believe that the apathy of the majority will allow governments to easily take away our physical cash and replace it with CBDCs, ushering in a utopia (or dystopia) of financial surveillance,” the blog post explained. Hayes continued:

“But, we have an unlikely ally that I believe will impede the government’s ability to implement the most effective CBDC architecture for controlling the general populace — and that ally is the domestic commercial banks.”

In implementing a CBDC, a government could either make the central bank the only “node” in the digital network, or use commercial banks as nodes in a less radical overhaul of the financial system. These systems Hayes calls the “Direct Model” and “Wholesale Model,” respectively.

“Given that every country that has at least reached the ‘choosing a CBDC model’ stage has opted for the Wholesale Model, it’s clear that no central bank wants to bankrupt their domestic commercial banks,” he reasoned.

As such, to “placate” banks to a certain extent but still achieve benefits such as eradicating cash, governments may ultimately be kept in check by the kind of entities known for limiting crypto exchange transactions and banning hodlers’ accounts.

“For politicians who care more for power than profits, this is their chance to completely destroy the influence of Too Big to Fail banks — and yet, they seem to remain politically unable to do so,” Hayes added.

‘Capital Controls Are Coming’

The topic of CBDCs received extensive attention even beyond the crypto industry, as they represent a major shift in both money and politics.

In an interview with Cointelegraph last week, Richard Werner — development economist and professor at De Montfort University — described them as a “declaration of war.”

“In other words, the bank regulator is suddenly saying we’re going to compete against the banks now because the banks have no chance. You can’t compete against the regulator,” he said.

Hayes, meanwhile, flagged Bitcoin as a safe haven still available for those already opposed to any form of zero-cash economy — but not for long.

Buying BTC will become increasingly difficult, or perhaps outright impossible, once CBDCs are implemented.

“This window won’t last forever. Capital controls are coming, and when all money is digital and certain transactions are not allowed, the ability to purchase Bitcoin will quickly vanish,” he warned, adding:

“If any of this doom porn resonates with you and you don’t own at least a very small % of your liquid net worth in Bitcoin, the best day to have bought Bitcoin was yesterday.”

Updated: 11-7-2022

Bank of Korea Tested NFT Trading, Remittances With CBDC: Report

The central bank recently completed a 10-month-long experiment of a digital South Korean won.

The Bank of Korea (BoK) has developed and tested a program that facilitates cross-border remittances by linking different central bank digital currencies (CBDC) from other countries, local media outlet Yonhap News reported on Monday.

The central bank had recently completed a 10-month experiment into a digital South Korean won, Governor Chang Yong Rhee revealed in a September speech.

During the project, the bank also tested the use of its CBDC to purchase non-fungible tokens (NFT), according to the report.

Major economies such as the U.S., U.K. and European Union have been exploring the issuance of CBDCs, while China has already carried out several trials. South Korea began its CBDC trial last year and completed the first of two phases by January.

In his speech, Rhee said that some decisions about a digital won required “trade-offs.”

“We have realized that there is no such thing as perfect technology or CBDC designs that can satisfy all the various goals and expectations at the same time,” Rhee said.

For instance, the bank made a decision to “improve compliance at the sacrifice of privacy,” Rhee said.

BoK established a virtual money laundering and terrorism financing monitoring system and will facilitate data submission, Yonhap News reported.

The experiment found that a CBDC could process up to 2,000 transactions per second, Yonhap News reported. However, it also found that distributed ledger technology, which underlies crypto, does not yet have the scalability needed for a retail CBDC, Rhee said in his speech. So it may be better to use the standard centralized ledger database, he added.

In July, BoK announced it was working on “real world” tests of a CBDC with ten commercial banks.

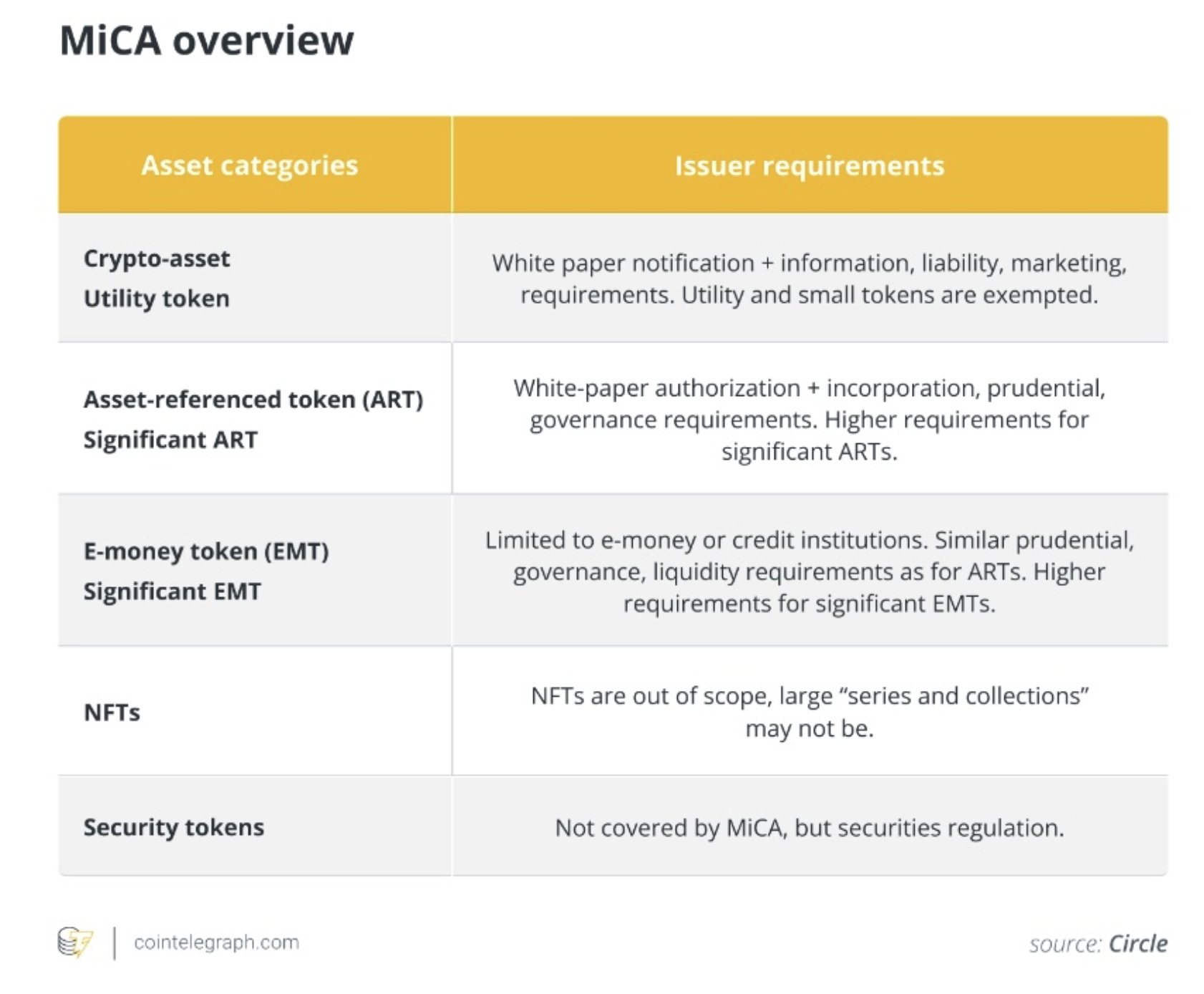

CBDCs May Need Global Regulation, EU Commissioner Says

Paolo Gentiloni says a series of international agreements may be needed to stop state-backed digital currencies from infringing on countries’ sovereignty.

Central bank digital currencies (CBDCs) may require a network of international deals to stop state-backed money from infringing on other countries’ sovereignty, European Union Commissioner Paolo Gentiloni said on Monday.

The bloc of 27 nations is considering a digital version of the euro, but needs to resolve issues such as how a digital euro will work for cross-border payments.

“How do you avoid the risk of infringing the sovereignty of other jurisdictions through a digital currency … while developing a digital currency with global ambition, as the digital euro will be?” said Gentiloni, who is responsible for economic policy at the European Commission, the EU’s executive arm. Gentiloni was speaking at a conference on the digital euro organized by the Commission and the European Central Bank.

“This, of course, brings the possibility of specific agreements with other jurisdictions regulating this kind of dimension,” he added.

In October 2021, the Group of Seven major industrialized nations warned that countries that are developing digital versions of their fiat currency need to be wary about treading on other jurisdictions.

EU policymakers have also raised the risk that easy access to a digital euro from overseas could undermine the currency, much like the dollarization of states that adopt U.S. currency without the Federal Reserve’s permission.

The International Monetary Fund has also raised the possibility of an international CBDC platform that could ease cross-border payments but that is now beset by delays and costs.

Gentiloni’s remarks at a conference in Brussels drew an immediate response – including from the Bahamas, one of the few countries that has already rolled out its own CBDC, the sand dollar.

“It is critical that any cross-border initiative, taken in regards to the work on CBDCs, reflects an inclusive approach to the needs that will be expressed by the Bahamas and small countries in this arena,” John Rolle, governor of the Bahamas’ central bank, told the conference.

Updated: 11-9-2022

Some Central Banks Have Dropped Out Of The Digital Currency Race

There are at least four countries that have either scrapped or halted CBDC plans so far, and each central bank has its own reasoning for not launching one.

As countries around the world race to launch a central bank digital currency (CBDC), some jurisdictions have slowed down or dropped out of the race altogether.

While many observers were pushing a narrative of urgency around CBDCs, some countries have decided that launching a CBDC isn’t currently necessary, while others have tested CBDCs only to dismiss them.

Each country had its own reasons, with global central banks providing very different insights on why their CBDC-related project didn’t go well or didn’t need to launch in the first place.

Cointelegraph has picked up four countries that have either stopped or paused their CBDC or CBDC-like initiatives based on publicly available data.

Denmark

Denmark is one of the top European countries in terms of digital payments, as its population relies on cash far less than other European nations.

The Nordic country was also one of the earliest countries to explore the possibility of issuing a CBDC, with the Danish central bank expressing interest in issuing a digital currency in 2016. The Danmarks Nationalbank then started working on digitizing the local fiat currency and the possible introduction of a Danish digital krone.

After only a year of research, the Danish central bank dismissed the idea of launching a CBDC, ruling that it would do little to improve the country’s financial infrastructure. The regulator argued that Denmark already had a “secure and effective” payments infrastructure in place, which provided instant payment options.

“It is not clear how retail CBDCs will create significant added value relative to the existing solutions in Denmark,” the Danmarks Nationalbank stated in a CBDC-related report in June 2022.

The central bank referred to associated costs and possible risks, also pointing out potential difficulties for the private sector. The bank still continues to monitor global CBDC development has not completely ruled out a CBDC in the future.

Japan

Japan is the third wealthiest economy after the United States and China, and also is the third largest pension market in the world.

The Japanese central bank — the Bank of Japan (BOJ) — released its initial report on CBDC development in October 2020 and subsequently started testing its digital currency proof-of-concept in early 2021, planning to finish the first pilot phase by March 2022.

However, in January, former BOJ official Hiromi Yamaoka advised against using the digital yen as part of the country’s monetary policy, citing risks to financial stability.

In July 2022, the bank issued a report in which it claimed it had no plan to issue a CBDC, the “strong preference for cash and high ratio of bank account holding in Japan.”

The regulator also emphasized that a CBDC, as a public good, “must complement and coexist” with private payment services in order for Japan to achieve secure and efficient payment and settlement systems.

“Nevertheless, the fact that CBDC is being seriously considered as a realistic future option in many countries must be taken seriously,” the report noted.

Ecuador

Ecuador’s central bank, Banco Central del Ecuador (BCE), officially announced its own electronic currency known as dinero electrónico (DE) back in 2014. Key drivers of the DE program were increasing financial inclusion and reducing the need for the central bank to hold and distribute large amounts of fiat currency.

As of February 2015, Ecuador managed to adopt DE as a functional means of payment, allowing qualified users to transfer money via a mobile app. The application specifically allowed citizens to open an account using a national identity number and then deposit or withdraw money via designated transaction centers.

While Ecuador’s DE is widely referred to as a CBDC, some industry observers have questioned whether it was really a CBDC because it was based on the United States dollar instead of a sovereign national fiat currency.

The Ecuadorian government cited the support of its dollar-based monetary system as one of the goals behind its DE platform after it started to accept U.S. dollars as legal tender in September 2000.

According to online reports, Ecuador’s DE operated from 2014 to 2018, amassing a total of 500,000 users at its peak out of a population of roughly 17 million people.

The project was eventually deactivated in March 2018, with the BCE reportedly citing legislation abolishing the central bank’s electronic money system. Passed in December 2021, the law stated that e-payment systems should be outsourced to private banks.

Years after dropping its central bank digital money initiative, Ecuador has apparently remained skeptical about the whole CBDC phenomenon. In August 2022, Andrés Arauz, the former general director at Ecuador’s central bank, warned eurozone policymakers that a digital euro could potentially disrupt not only privacy but also democracy.

Finland

For those who think that the Bahamas and China were the first countries in the world to roll out a CBDC, the Bank of Finland has some news.

In 2020, the central bank of Finland issued a report titled “Lessons learned from the world’s first CBDC,” providing a description of its Avant smart card system, which it created back in the 1990s. The Bank of Finland argued that Avant is not only the project that “can be considered the world’s first CBDC” but also was the “only one” that went into production at the time.

Following years of research, the Bank of Finland launched its Avant project in 1993. The project involved smart cards similar to that used in debit and credit cards today. According to various sources, Avant cards preceded the attempts to create current CBDCs.

“A key difference between Avant and the CBDC systems being designed today is that for modern CBDC systems cards would probably be an additional feature. In Avant, cards were the main component,” the Bank of Finland noted in the report.

The bank also suggested that the project essentially represented a “token-based retail CBDC,” based on the current CBDC terminology.

Avant became obsolete and was eventually discontinued in 2006 because it became more expensive than simple debit cards, according to the Bank of Finland. The Avant card was initially cost-free for consumers, but fees were later added, which naturally affected the demand for the card in a negative way, the bank noted.

In the meantime, debit cards were progressing, adding smart card technology and becoming less expensive for consumers.

Despite higher fees, the Avant card had some non-obvious benefits compared to debit cards. According to the Bank of Finland, Avant allowed consumers to pay anonymously as it offered a possibility to avoid creating or using a bank account at all.

After dropping its own CBDC-related project years ago, Finland appears to support a pan-European digital currency. In August 2022, Bank of Finland governor Olli Rehn promoted the adoption of a digital euro functioning in tandem with private fintech solutions to conduct cross-border payments in Europe.

The whole world is now keeping an eye on CBDCs and no country is ignoring the new financial phenomena — even those who have already set aside their own CBDC plans.

While it’s still to be seen how various CBDCs will actually play out, it’s also important to draw lessons from past experiences, with many central banks stressing the importance of coexistence between CBDCs and the private financial sector.

Updated: 11-10-2022

David Chaum Rolls Out Privacy-Protecting CBDC Technology

The “godfather of cryptocurrency” suggested a CBDC design for a pilot with the Swiss National Bank.

Will central bank digital currencies (CBDC) replace cash and bank transfers in the future? And will they be an ultimate tool for financial surveillance and control? Or is another, more benign, future possible?

David Chaum, creator of the Bitcoin predecessor eCash and, more recently, the elixxir cryptocurrency, believes the democratic world can have a version of CBDCs that protects privacy. He is working with the Swiss National Bank (SNB) on Project Tourbillon, designed for privacy-focused central bank money.

The project will be developed under the auspices of the Bank of International Settlements’ (BIS) Innovation Hub, the organization announced on Thursday. The project will add to the range of CBDC pilots already in the works by the BIS Innovation Hub, like the projects Helvetia and Mariana – both involving the SNB, too.

The technology underlying the Project Tourbillon will combine privacy preserving functions and quantum-resistant cryptography developed by Chaum, the BIS announcement says. The system will also be scalable as it will be “using an architecture that is compatible with, but not based on, distributed ledger technology,” the press release reads.

The concept, based on Chaum’s blind signature technique, has been outlined in a joint research paper by Chaum and Thomas Moser, alternate member of the SNB governing board.

According to Morten Bech, head of the BIS Innovation Hub Swiss Centre, the project allows to avoid trade-offs between cyber resilience, scalability and user privacy.

“Project Tourbillon will build and test a prototype that reconciles these trade-offs and pushes central banks’ technological frontier,” Bech said in the BIS announcement.

The prototype is slated to be completed by mid-2023.

Not Like China

According to Chaum, the SNB first approached him last year about his eCash technology and he took it as a chance to prove that a CBDC can be designed in a privacy-protecting fashion. Speaking with CoinDesk in an exclusive interview, he pointed out China as an example of omnipresent digital surveillance by the government.

China’s central bank has one of the world’s most advanced CBDC projects, with 100 billion yuan (US$13.9 billion) in transactions already completed.

The U.S. and Europe can do better, Chaum believes. He acknowledges that “CBDCs are a big deal” in the world at the moment and is well aware of the fact that many believe CBDCs will be “the end of privacy in money.”

“It’s incredibly ironic for me that something I’ve been working on 40 years ago has become the actual pivotal distinction between the East and West – privacy in payments,” Chaum said.

“It really becomes a choice: Are we going to have a kind of protection we are entitled to and that distinguishes us as a human rights-based democracy, or we basically are going to have the same thing as in China,” he added.

Chaum says the eCash 2.0 technology he created and described in the paper with SNB’s Moser, is a “superior payment system” with both privacy and anti-counterfeiting protection built into it.

He believes it’s important to show that a CBDC can actually preserve privacy so that no government can say it’s impossible and use it as an excuse to build something similar to the Chinese model.

In another scenario, a government might be willing to maintain privacy in developing its CBDC, but at some point that government can discover that criminals are using those privacy features to conceal illegal activities. That in turn can become a reason to abandon the idea of privacy altogether.

Chaum believes the technology he invented can prevent both scenarios: preventing anyone from tracing how people use their money and, at the same time, allowing the law enforcement to track criminal funds.

How this works in practice is not easy to unpack.

Revocable Anonymity

The eCash 2.0 model has two tiers when it comes to issuing central bank digital money: a central bank does it via commercial banks, which onboard users.

To get some CBDC on their digital wallets, users need to request it from banks with which they already have accounts. Banks perform know your customer diligence and send a specific authentication code to the central bank so that money can be issued.

Cryptographic mechanics of eCash 2.0 allow central banks to issue those coins to a user without knowing which user exactly owns specific coins, says Mario Yaksetig, the project’s cryptographer. Neither knows the commercial bank that onboarded the user, although both the central and commercial banks know how much money in CBDC a known user received from the system.

A central bank holds a blockchain-based ledger of all the valid coin identifiers, Yaksetig said, so no one can forge new coins, but transactions between wallets are not recorded on a blockchain. “There is no record of transactions whatsoever,” Yaksetig told CoinDesk.

However, users can voluntarily give up the privacy of their coins if they want law enforcement to trace stolen funds. For this, a user would need to reveal his unique cryptographic key to, say, the police, and then the police can see when these stolen coins are being spent at a restaurant, a store or other kind of merchant, because merchants, unlike individual users, would be known to the system.

So the police would be able to find where that merchant is, go there and arrest the thieves, Chaum said.

Alternatively, instead of going to the police, a robbed or scammed user might request reissuance of his money using his unique key, Chaum said, so he can spend those coins before the criminals do.

Asked if a government building a CBDC can use what he created to make a system that can be surveilled and censored, making crypto’s worst fears about CBDCs come true, Chaum believes his technology is ill-suited for that.

“There is no way to use it for evil because all it does is protect privacy,” he said. You can opt to use decentralized cryptocurrencies if you wish, but “if you choose to use government-issued money, the government should not be able to see how you spend it,” he added.

The Clearing House Stands Up For Bank Rights, Opposes CBDC In Comments For US Treasury

The payments operator responded to a Treasury inquiry related to the presidential executive order with an appeal to keep bank interests in sight when designing digital assets.

United States payment systems operator The Clearing House has released its response to a Treasury Department request for comment on “digital-asset-related illicit finance and national security risks as well as the publicly released action plan to mitigate the risks.”

The Clearing House found significant security serious risks associated with digital assets but was concerned that banks should have the same opportunities to participate in the market as nonbanks.

The Treasury Department issued its request for comments on Sept. 20 as part of its ongoing response to President Joe Biden’s Executive Order 14067 from March 9, 2022, “Ensuring Responsible Development of Digital Assets.”

In its 22-page response letter, The Clearing House addresses some of the questions posed by the Treasury, and it highlights five main points that it sees as ways to mitigate national security and illicit finance risks posed by privately issued non-bank digital assets (many cryptocurrencies and stablecoins) and U.S. government tokens (central bank digital currencies, or CBDCs). The letter, dated Nov. 3, was made public on Nov. 10.

Leaders from #fintech and traditional financial services agree: a government token (central bank digital currency #CBDC) is a “perilous societal prospect” https://t.co/AO1Jo2Gm8L

— The Clearing House (@TCHtweets) October 28, 2022

The Clearing House called for a federal prudential framework with standards for digital assets service providers that are equivalent to those for depository financial institutions engaged in functionally similar activities. Furthermore, banks “should be no less able to engage in digital-asset-related activities than nonbanks.”

The Company Minces No Words On CBDC, Stating:

“The risks associated with the possible issuance of a CBDC in the U.S. outweigh its potential benefits and, therefore, it should be determined that a CBDC is not in the national interest.”

In the event the United States decides to adopt a CBDC, “the foundational requirements in place to prevent criminal and illicit use of commercial bank money must be applied to a U.S. CBDC in such a way that criminal actors are not incentivized to use CBDC,” the company writes.

The Clearing House Sees Limited Appeal For A U.S. CBDC, In Any Case:

“Intermediaries must have a clear business case for assuming the customer identification/identity verification, AML/CFT screening, and sanctions compliance obligations, particularly as the risks associated with such assumption may, without fees, be unsupported by the low margins typically associated with the provision of custodial services.”

The Clearing House is owned by 23 banks and payment companies. It was founded in 1853.

Updated: 11-11-2022

New York Fed Collaborates With Singapore MAS To Explore CBDCs

A joint effort is aimed at assessing the possible use of wholesale central bank digital currencies in cross-border transactions.

The New York Innovation Center (NYIC) of the Federal Reserve Bank of New York and the Monetary Authority of Singapore (MAS) will launch a joint experiment with wholesale central bank digital currencies (wCBDCs). Regulators are keen to test the wCBDCs potential for cross-border wholesale payments.

On Nov. 11, the MAS announced the launch of Project Cedar Phase II x Ubin+. In its framework, NYIC and MAS will leverage wCBDCs as a settlement asset in cross-border cross-currency transactions. The aim is to assess the possible ability of wCBDC to reduce settlement risk.

Leong Sing Chiong, deputy managing director at MAS, highlighted the concept of “interoperability,” which lies at the core of the experiment:

“The project takes a practical approach and designs for any future wholesale CBDC to be interoperable across networks, while maintaining each network’s autonomy.”

As the statement goes, Project Cedar Phase II x Ubin+ will not advance any specific policy outcome, nor does it signals any imminent decisions on issuing a central bank digital currency (CBDC) by the Federal Reserve. A report with the project’s findings should be released in 2023.

On Nov. 4, NYIC released a report on the first phase of Project Cedar. During the first phase, spot transactions were carried out between different currencies on different ledgers through a permissioned blockchain network with an unspent transaction data output model.

Project Cedar complements the Boston Fed’s work on a retail CBDC in Project Hamilton, being conducted in conjunction with the Massachusetts Institute of Technology’s Digital Currency Initiative. Ubin+ is MAS’ international initiative to improve efficiency and reduce the risks of cross-border foreign exchange settlement by advancing cross-border connectivity and interoperability of wholesale digital currencies.

The Fed still has no plans to issue a CBDC, NY Fed Executive Vice President and Head of Markets Michelle Neal said at a presentation in Singapore, but it has investigated foreign exchange spot settlement “from the perspective of the Federal Reserve.”

Updated: 11-15-2022

Big Banks, NY Fed Start To Test Digital Tokens For ‘Wholesale’ Transactions

Citigroup, HSBC, BNY Mellon, Wells Fargo and Mastercard, are among the financial giants taking part.

A group of major banks and the Federal Reserve Bank of New York have started to test the use of digital tokens representing digital dollars to improve how central bank money is settled between institutions.

Citigroup (C), HSBC (HSBC), BNY Mellon (BK) and Wells Fargo (WFC) are among the banks taking part, along with payments giant Mastercard (MA), the New York Fed announced Tuesday.

The 12-week proof-of-concept pilot program will explore the use of a platform known as the regulated liability network, or RLN, whereby banks issue tokens that represent customers’ deposits that are settled on a central bank reserve on a shared distributed ledger.

The project will be conducted in a test environment using only simulated data.

While many central banks are developing or considering developing retail central bank digital currencies, which are forms of digital money for use by the public, many are also testing wholesale CBDCs, which are fiat money in token form for exchange among financial institutions to improve existing clearing and settlement processes.

NY Fed Launches 12-Week CBDC Pilot Program With Major Banks

Banking giants including BNY Mellon, Citi, U.S. Bank and Wells Fargo will be issuing tokens and settling transactions through simulated central bank reserves as part of the pilot.

The Federal Reserve Bank of New York’s Innovation Center, or NYIC, announced that it would be launching a 12-week proof-of-concept pilot for a central bank digital currency, or CBDC.

In a Nov. 15 announcement, the New York Fed said the program would explore the feasibility of an “interoperable network of central bank wholesale digital money and commercial bank digital money operating on a shared multi-entity distributed ledger” on a regulated liability network.

Banking giants including BNY Mellon, Citi, HSBC, Mastercard, PNC Bank, TD Bank, Truist, U.S. Bank and Wells Fargo will be participating in the pilot by issuing tokens and settling transactions through simulated central bank reserves.

“The NYIC looks forward to collaborating with members of the banking community to advance research on asset tokenization and the future of financial market infrastructures in the U.S. as money and banking evolve,” said NYIC Director Per von Zelowitz.

The proof-of-concept project will test the “technical feasibility, legal viability, and business applicability” of distributed ledger technology, as well as simulate tokens and explore regulatory frameworks. The NY Fed said the project could “potentially be extended to multi-currency operations and regulated stablecoins.”

The launch of the NYIC pilot project followed the center releasing research on its wholesale central bank digital currency program on Nov. 4. The first phase of the CBDC trial, dubbed Project Cedar, tested foreign exchange spot trades to determine whether a blockchain solution could improve “speed, cost, and access to cross-border wholesale payments.”

Federal regulators in the United States have not reached any consensus on whether to launch a digital dollar in the country, but agencies and those in the private sector have been exploring the possibility.

Following U.S. President Joe Biden issuing an executive order aimed at establishing a framework on digital assets, some lawmakers questioned what Congress’ role might be in passing legislation in support of a CBDC and how a digital dollar might curtail similar innovations from the private sector.

Updated: 11-17-2022

Fed Paper Looks At Theoretical Role Of Remuneration, Convenience In CBDC Design

The discussion paper reviews the literature on the impact of CBDCs in large, developed economies and draws some conclusions and specific design elements.

The importance of remuneration in the design of a central bank digital currency (CBDC) was emphasized in a paper released by the United States Federal Reserve Board on Nov. 17. The paper, part of the Fed’s Finance and Economics Discussion Series, reviews the theoretical literature on CBDCs in large, developed economies, with a particular view to the United States.

It looks at the risks and benefits to the banking system of introducing a CBDC, with a particular focus on the role of CBDC design in the implementation of monetary policy and remuneration — that is, payment of interest — as a critical design feature.

A CBDC could help control bank disintermediation resulting from its introduction, the authors find, and it can help in the management of the Fed’s balance sheet by making the holding of CBDCs more or less attractive relative to bonds.

The authors conclude that “Remuneration is arguably the key design feature that any central bank would want to contemplate.” They go on to say:

“A CBDC that pays no interest is consigned to the role of a medium of exchange; its value would be determined almost entirely by the convenience it would render. […] A remunerated CBDC, on the other hand, would be more attractive as a store of value, and its rate of remuneration could serve as an additional policy tool.”

Interest can be proportional, expressed as a percentage or tiered, with the rate rising or falling nonlinearly as a policy tool, such as relative to the size of the holding.

The paper also considered convenience as a quality of a CBDC that can be manipulated for policy purposes:

“If a CBDC pays no interest, its use as a store of value is circumscribed. […] In such circumstances, CBDC is much like cash, and its usage would be determined by how much convenience it provides, relative to its money-like rivals.”

Updated: 11-22-2022

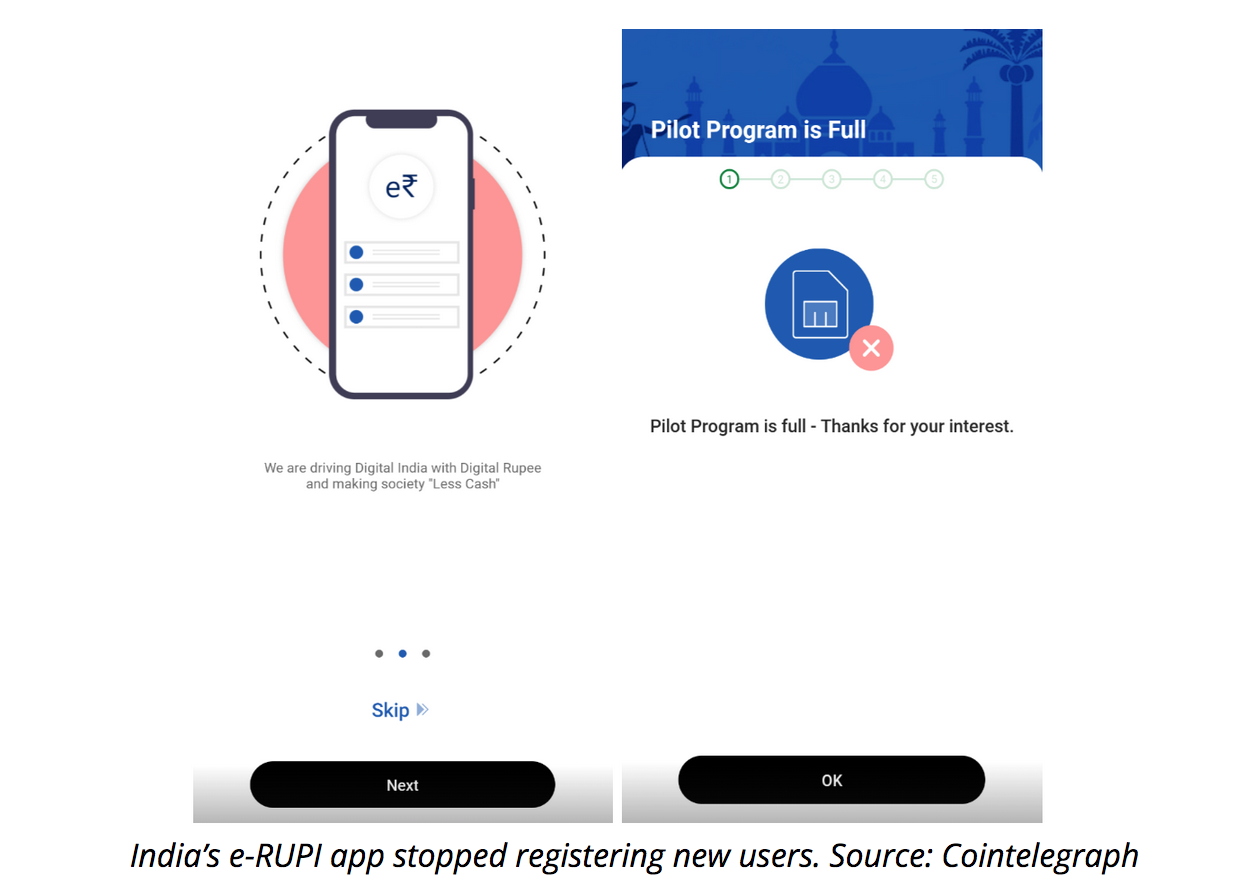

The Reserve Bank Of India To Launch A Retail CBDC Pilot In December

The digital rupee is intended as a supplement to the current payment system and not its replacement.

Having tested the wholesale usage of its central bank digital currency (CBDC), the Reserve Bank of India (RBI) is preparing to conduct the retail pilot of the “digital rupee.” The pilot should launch within a month.

According to the Economic Times of India, the RBI is in the final stage of preparing the rollout of the retail digital rupee pilot. Among the participants are the State Bank of India, Bank of Baroda, ICICI Bank, Union Bank of India, HDFC Bank, Kotak Mahindra Bank, Yes Bank and IDFC First Bank. Reportedly, at some point, the pilot is going to include all the commercial banks in the country.

Each bank participating in the trial will test the CBDC among 10,000 to 50,000 users. To integrate the new payment option, the banks will collaborate with PayNearby and Bankit platforms. The CBDC infrastructure will be held by the National Payments Corporation of India (NPCI). As the anonymous source specified to Indian journalists:

“The e-rupee will be stored in a wallet, the denominations will be available as per the customer’s request, just like you request cash from an ATM. Banks are launching this only in select cities.”

Both customers and merchants will have to download the special wallets for the CBDC, although later the RBI plans to fully integrate it with existing digital banking services. Reportedly, the digital rupee is intended as a supplement to the current payment system and not its replacement.

The wholesale segment pilot for the digital rupee was launched by RBI on Nov. 1. Its main use case has been the settlement of secondary market transactions in government securities. However, no information on the successful ending of the wholesale pilot is available at the time of writing.

Updated: 11-23-2022

Bank Of Japan To Trial Digital Yen With Three Megabanks

The Japanese central bank plans to make a decision on whether to issue a digital currency by 2026.

Despite Japan’s uncertainty on whether to issue a central bank digital currency (CBDC), the Bank of Japan (BoJ) continues experimenting with a potential digital yen.

The Japanese central bank has started a collaboration with three megabanks and regional banks to conduct a CBDC issuance pilot, the local news agency Nikkei reported on Nov. 23.

The pilot aims to provide demo experiments for the issuance of Japan’s national digital currency, the digital yen, starting in spring 2023.

As part of the trial, the BoJ is expected to cooperate with major private banks and other organizations to detect and solve any issues related to customer deposits and withdrawals on bank accounts.

According to the report, the pilot will involve testing the offline functionality of Japan’s possible CBDC, targeting payments without the internet.

Japan’s central bank plans to proceed with its CBDC experiment for about two years and make a decision on whether to issue a digital currency by 2026, the report notes.

The news comes amid countries around the globe increasingly launching CBDC research and development initiatives, with countries like China leading the global CBDC race.

As Cointelegraph reported on Nov. 22, the Reserve Bank of India is preparing to start a retail pilot of the digital rupee in collaboration with major local banks including the State Bank of India in December.

In mid-November, the Federal Reserve Bank of New York’s Innovation Center announced the launch of a 12-week proof-of-concept CBDC pilot in partnership with banking giants like BNY Mellon, Citi, HSBC and others.

While the majority of the world has been rushing to launch a CBDC, some countries like Denmark have dropped out of the digital currency race.

Among reasons for dropping their CBDC or CBDC-related projects, the central banks listed potential difficulties for the private sector, questionable value and benefits and other issues. Still, no central bank has ruled out the possibility of launching a CBDC completely.

Updated: 11-24-2022

CBDCs Could Reduce FX Transaction Speeds To 10 Seconds, NY Fed Says

The New York Fed simulated foreign exchange transactions using a distributed ledger to test for improvements over the current system.

Foreign exchange transactions could drop from a two-day process to less than 10 seconds if central bank digital currencies (CBDC) were involved, according to an experiment conducted by the Federal Reserve Bank of New York.

Project Cedar, a research effort launched by the N.Y. Fed’s New York Innovation Center (NYIC), tested the speed of FX transactions using distributed ledgers, finding that in a simulated example, they could lower the speeds of transactions with multiple participants and observers. The project intended to research the benefits of wholesale CBDCs, according to a brief report published Friday.

Each participant operated its own version of the ledger, rather than having the participants act as nodes in a single distributed ledger, the report said. Nevertheless, the participants were able to settle both sides of transactions simultaneously, finding a massive speed boost compared to the current system.

While the report detailed some of the technical aspects of the test – it used an undisclosed permissioned blockchain network and was written in the Rust programming language – it did not provide many details about how the simulation was conducted or how they confirmed transaction settlements.

This first phase saw each participant run “homogenous” ledgers, but future tests will see participants running different networks to test for cross-chain compatibility.

The Federal Reserve has been grappling with the question of whether it can or should issue a CBDC for years. While the Biden administration has indicated that the Fed should do so if it’s in the “national interest,” and various Fed branches – including Boston’s – have been conducting research, Fed officials have indicated they’ll wait for Congress to authorize a digital dollar before moving forward. This week’s report said it’s not meant to push for a particular outcome.

In a speech discussing the latest research, Michelle Neal, the head of the markets group at the N.Y. Fed, said the central bank branch wanted to test the technology from its own perspective to see if it could address concerns about risk and scalability.

“This indicates that a modular ecosystem of ledgers has the potential for continued scalability, and that distributed ledger technology could enable settlement times well below the current industry standard of two days, with the added guarantee of atomic settlement,” she said.

Updated: 11-24-2022

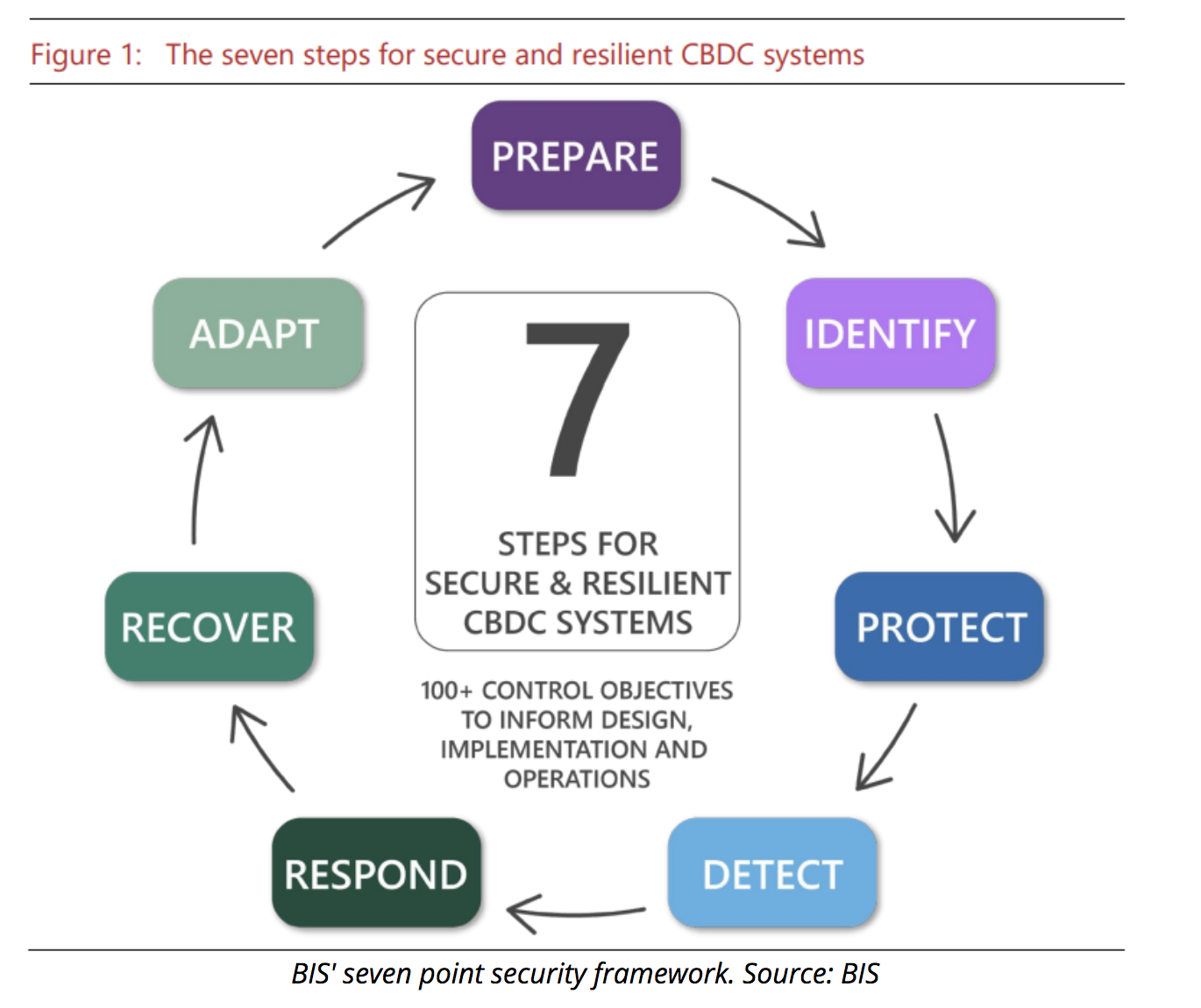

BIS Report Finds Uneven Progress, Differing Motivations In African CBDC Adoption

A survey of the continent’s central banks shows optimism about greater efficiency and inclusion, but several drawbacks remain; Nigeria already has an operational retail CBDC.

Mobile money has been a strong competitor to central bank digital currency (CBDC) in Africa, but many of the continent’s central bankers have greater faith in CBDC, according to a Bank for International Settlements (BIS) report published Nov. 24.

African central bankers also saw greater utility in CBDC for implementing monetary policy than bankers in other parts of the world, according to the BIS.

Nineteen African central banks responded to the survey that served as a basis for the report, and all of them stated that they were actively interested in CBDC.

Only Nigeria has issued a retail CBDC, the eNaira, meant for public use, while Ghana has a retail CBDC project in the pilot stage, and South Africa is currently running a project for a wholesale CBDC, meant for institutional use.

A new survey with 19 African central banks shows that the main concern regarding #CBDCs is cybersecurity, even more than elsewhere. High operational burden for the central bank is also a bigger concern than in other regions https://t.co/FzkCq5POOD pic.twitter.com/XqYHjRwyRv

— Bank for International Settlements (@BIS_org) November 24, 2022

The provision of cash was listed by African central bankers as a major motivation for the introduction of a CBDC for 48% of respondents. A CBDC would save money on the printing, transportation and storage of banknotes and coins, they said.

Financial inclusion was mentioned by all respondents. Less than half the adult African population was banked in 2021.

Sub-Saharan Africa accounts for two-thirds of the world’s money transfers by volume and more than half of all users. The entry of CBDC into this field could improve competition and lower costs, the report notes.

A CBDC would “support new digital technologies and their integration with the broader economy.”

Issuing And Operating A CBDC Is A Daunting Task:

“Here African central banks highlight aspects very similar to other EMEs [emerging market economies …]: network resilience, the cost, availability and combinability of technologies, and their scalability and functionalities. The operational cost of such a complex system is high.”

That was combined with cybersecurity concerns and the risk of low adoption in the minds of several of the central bankers.

Bank disintermediation also ranked among the concerns, although bankers expected CBDCs to help implement monetary policy. The cost of remittances was a big concern for design.

Updated: 11-29-2022

France, Luxembourg Test CBDC For 100M Euro Bond Issue

The Venus Initiative is the latest attempt to use digital representations of money for financial-market settlements.

France and Luxembourg have used an experimental central bank digital currency (CBDC) to settle a bond worth 100 million euros (US$104 million), the latest in a series of trials in tokenized financial markets.

The Venus Initiative “shows how digital assets can be issued, distributed and settled within the eurozone, in a single day” and “confirms that a well-designed CBDC can play a critical role in the development of a safe tokenised financial asset space in Europe,” Nathalie Aufauvre, general director of financial stability and operations at Banc de France, the French central bank, said in a statement.

The initiative also involved Goldman Sachs, Santander and Societe Generale as well as the publicly funded European Investment Bank.

The trial is the latest in a series of CBDC tests by the French central bank to manage liquidity in decentralized finance and settle cross-border transactions. The European Union has recently legislated to test out blockchain-based securities trading.

National Bank of Ukraine Releases Draft Concept For Digital Hryvnia

One of the design options for the Ukrainian CBDC describes the e-hryvnia available for usage in crypto exchange operations.

The National Bank of Ukraine (NBU) has introduced a draft concept for its central bank digital currency (CBDC) candidate digital hryvnia, or e-hryvnia.

Ukraine’s central bank on Nov. 28 released a statement on the concept of e-hryvnia, which aims to perform all the functions of money by supplementing cash and non-cash forms of the hryvnia as its key purpose.

The NBU said it has presented the e-hryvnia concept and continues developing the CBDC project with participants of the virtual assets market, payment firms and state bodies.

According to the announcement, the central bank is currently considering and developing three possible CBDC options, depending on design and main characteristics.

The first option describes the e-hryvnia for retail non-cash payments with the possible functionality of “programmed” money through smart contracts. A retail e-hryvnia would enable the implementation of targeted social payments and the reduction of government expenditures on administration, the NBU said.

The second CBDC option envisions the e-hryvnia available for usage in operations related to cryptocurrency exchange, issuance and other virtual asset operations.

“The e-hryvnia can become one of the key elements of quality infrastructure development for the virtual assets market in Ukraine,” the announcement notes.

The third option includes the e-hryvnia to enable cross-border payments in order to provide faster, cheaper and more transparent global transactions.

“The development and implementation of the e-hryvnia can be the next step in the evolution of the payment infrastructure of Ukraine,” Oleksii Shaban, director of NBU payment systems and innovative development department, said in the statement.

He added that a Ukrainian CBDC could have a positive impact on ensuring economic security and strengthening the monetary sovereignty of the state, as well as e sustainable economic growth.

According to the announcement, the Ukrainian Intellectual Property Institute registered the trademark “e-hryvnia” for the NBU in October 2022.

As previously reported, the NBU has been actively studying the possibility of issuing a CBDC in recent years, hiring blockchain developers and cooperating with major industry projects like the Stellar Development Foundation.

According to the regulator, the NBU launched a pilot project to issue the e-hryvnia for blockchain-based retail payments back in 2018.

India To Test Retail Version of Digital Rupee In Thursday Launch

* e-Rupee Will Come In The Same Denomination As Notes And Coins

* Four Banks To Participate Initially; Four More To Join Later

India’s central bank will launch the retail version of its digital currency on a test basis starting Thursday, a month after allowing some banks to use it for settling secondary-market transactions in government securities.

Four banks will initially run the digital currency pilot, with another four joining at a later stage, the Reserve Bank of India said in a Tuesday statement.

A select group of customers and merchants will take part in the pilot and use the e-rupee as a replacement for hard cash. Digital currency would be issued “in the same denominations that paper currency and coins are currently issued,” the RBI said.

India is joining countries including China in pushing forward with digital versions of their currencies, as it seeks to eliminate private cryptocurrencies that pose risks to financial stability.

The e-rupee would offer “features of physical cash like trust, safety and settlement finality,” the central bank said, adding that it will not earn any interest and can be converted to other forms of money, including deposits with banks.

Banks will distribute the e-rupee through digital wallets on mobile phones. Both person-to-person transactions and payments to merchants are possible. The latter will involve scanning a QR code, the central bank said.

Banks participating in the pilot are the State Bank of India, ICICI Bank, Yes Bank and IDFC First Bank in four cities. “The scope of pilot may be expanded gradually to include more banks, users and locations as needed,” the RBI said.

Updated: 11-30-2022

Digital Dollar Could Streamline Settlements, DTCC Says

The Depository Trust & Clearing Corp. is testing the use of a digital dollar in wholesale transactions, alongside major banks.

A digital dollar could streamline settlements to make financial markets more efficient, according to a report published Wednesday by the Depository Trust & Clearing Corp., the financial-infrastructure giant that has a hand in virtually every trade on the more than $40 trillion U.S. stock market.

DTCC said its report is the first-ever private-sector probe of what a central bank digital currency (CBDC) would mean for post-trade financial markets – the infrastructure that processes securities deals after a price has been agreed upon.

“This new initiative represents the essence of innovation … we should expect digital transformation to reshape markets and market structure in the coming years,” DTCC Managing Director Jennifer Peve said in a statement, referring to a program carried out with the nonprofit Digital Dollar Project and major banks such as Citigroup (C), Bank of America (BAC) and State Street (STT) to test the use of a digital dollar in financial markets.

“A U.S. CBDC should be carefully explored in consultation with key stakeholders across the public and private sectors,” Peve said.

A CBDC could help speed up settlement, in part by automating reports the DTCC must send to the Federal Reserve, the DTCC said. It cited evidence that distributed-ledger technology could save billions of dollars per year by simplifying how trades are confirmed and reconciled.

In August, DTCC announced it was processing as many as 160,000 trades per day on a blockchain via Project Ion. The Bank for International Settlements has said as many as nine in 10 of the world’s central banks are looking at a CBDC, although Federal Reserve Chairman Jerome Powell has suggested he is in no rush to issue a digital dollar.

Updated: 12-5-2022

Central Bank Plans To Make CBDC ‘Only Legal Digital Tender’ In Indonesia, Says Gov

“Collaboration and synergy on national and international level is critical to the development of Digital Rupiah,” said Perry Warjiyo.

Bank of Indonesia Governor Perry Warjiyo has announced developments in its plans to launch a central bank digital currency, or CBDC, for “various digital economic and financial transactions.”

In a Dec. 5 speech at the central bank’s annual meeting, Warjiyo said the bank planned to release details on the conceptual design of a digital rupiah — a currency the equivalent of the country’s fiat — and open the matter to public comment.

According to the governor, the Bank of Indonesia intended for the digital rupiah to be “integrated, interconnected, and interoperable” with other countries’ CBDCs following discussions with central bank officials.

The CBDC initiative, called Project Garuda, will start with the launch of a wholesale digital rupiah for “use cases of issuance, redemption, and interbank fund transfer” followed by “monetary operations and financial market development.” The project’s white paper states that the third phase will deal with end-to-end transactions between wholesale and retail digital rupiah users.

“Collaboration and synergy on national and international level is critical to the development of Digital Rupiah,” said Warjiyo.

Indonesia imposed a blanket ban on crypto payments starting in 2017, while trading in digital assets has largely remained legal in the country as regulated under the Commodity Futures Trading Regulatory Agency.

Warjiyo first announced plans for Indonesia to introduce a CBDC in May 2021 but did not provide a specific timeline for the digital currency’s release.

Updated: 12-6-2022

The Impact of CBDCs On Stablecoins With Bitget’s Gracy Chen

While CBDCs will cater to local demands, cooperation between countries could facilitate and support the widespread adoption of readily-available stablecoins.

For over 14 years, central banks worldwide have seen blockchain technology deliver highly secure, immutable, verifiable and transparent financial ecosystems, starting with the Bitcoin network.

Central bank digital currencies (CBDCs) stood out as one of the ways for fiat currency to harness a part of what cryptocurrencies achieve today.

To not only keep up with rising inflation and cut down on operational costs but also to counter money laundering and related concerns, 98 of 195 countries — representing over 95% of global GDP — have either launched or are researching and developing their own versions of CBDC.

With CBDCs joining the race to dominate the future of finance, the relevance of the stablecoin ecosystem — cryptocurrencies backed 1:1 with fiat, such as the United States dollar — comes into question.

As the managing director of crypto exchange Bitget, Gracy Chen got a front-row seat to the global disruption of cryptocurrencies. In an interview with Cointelegraph, Chen shared her thoughts on the future of stablecoins as CBDCs make their entry into the mainstream.