Smart Money Is Buying Bitcoin Dip. Stocks, Not So Much

Bitcoin whales bag spare BTC as exchange balances fall. Smart Money Is Buying Bitcoin Dip. Stocks, Not So Much

Old whales may have offloaded last year, but demand for BTC shows no sign of disappearing, the latest data reveals.

Bitcoin (BTC) is being aggressively bought up at prices near $30,000 as bidders begin to soak up liquidity from short-term sellers.

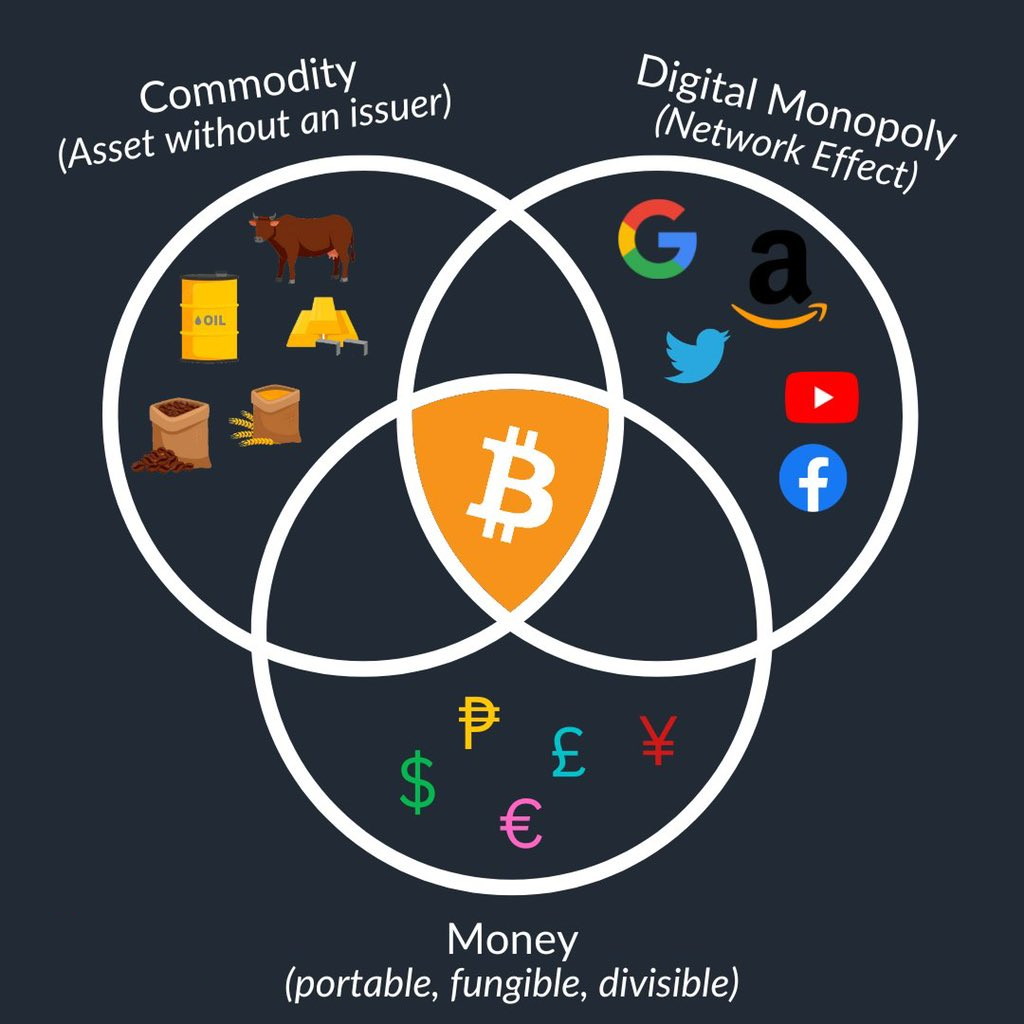

#Bitcoin is a 1-of-1 technology pic.twitter.com/UoZKrYTskf

— Blockware Solutions (@BlockwareTeam) January 21, 2023

Data from on-chain monitoring resource CryptoQuant shows that as of late December, Bitcoin exchanges have begun to shed their BTC reserves once more.

Related:

Want To Be Rich? Bitcoin’s Limited Supply Cap Means You Only Need 0.01 BTC

Ultimate Resource On Large And Small Bitcoin Hodlers

Annual January 3rd “Proof of Keys” Celebration of The Genesis Block! (#GotBitcoin)

BTC Conspicuously Attractive At Current Levels

After a period of traders sending BTC to exchanges, possibly to sell or to have on the side to divest away from further losses, exchanges are now seeing larger overall outflows than inflows.

Between Dec. 7 and Dec. 28, 2021, BTC reserves of the 21 major platforms monitored by CryptoQuant increased from 2.396 million to 2.428 million BTC.

Thereafter, the longer-term downtrend resumed, and as of Monday, exchanges’ tally stood at 2.366 million BTC — despite spot price action sitting at six-month lows.

Older whales, meanwhile, despite showing some impatience in recent years, are still apt to spark price trend reversals, CryptoQuant CEO Ki Young Ju believes.

“It seems they have been sold $BTC to new players at the tops or bottoms,” he said in a series of tweets about the topic, noting that institutions have likely been the main buyers since 2020.

Bitcoin Whales Go For (Another) Dip

While common knowledge, the exchange balance trend now coincides with palpable on-chain demand from major investors.

As noted by Twitter account CC15Capital this week, the run to $33,000 was accompanied by multi-million-dollar BTC buy-ins from one wallet in particular.

Since August, the account has amassed over $1 billion worth of BTC from a starting balance of zero.

The phenomenon further comes amid firm resolve from long-term holders not to sell. As Cointelegraph reported, coins that have not moved in a year or more now make up 60% of the overall BTC supply.

Whale accumulation, meanwhile, has been apparent elsewhere in the period following the comedown from $69,000 all-time highs.

The stock market is down—a lot. The good news is that there is a pile of money waiting in the wings to buy the dip. The question is whether stocks will compare favorably to Bitcoin’s remarkable returns.

The S&P 500 is down about 10% from its all-time high hit in January, putting the index officially in correction territory. The Nasdaq-100, an index of the largest market-capitalization companies in the tech-focused Nasdaq Composite, is down almost 15% from the record high it hit in late November.

Green Shoots? Institutional Crypto Funds See First Inflows In 5 Weeks

Nearly $14 million has been returned to BTC institutional funds over the past week, but Ethereum-based products are still seeing major outflows.

After five weeks of constant outflows, institutional investment is finally trickling back into crypto funds with Bitcoin (BTC) the asset of choice and Ether (ETH) falling out of favor.

In its weekly Digital Asset Fund Flows report, published on Monday, crypto investment firm CoinShares observed inflows for some institutional products.

It is the first time in five weeks that there has been a net positive inflow as $14.4 million re-entered the space with investors buying the dip.

The researchers reported that these inflows came during a period of significant price weakness, adding that this suggests investors “are seeing this as a buying opportunity” at current price levels.

Capital continued to flow out from CoinShares own BTC fund, but 21Shares and ProShares registered minor gains. Most of the inflows were for Bitcoin, which had $13.8 million for the week. Ethereum was the biggest loser over the period with an outflow of $15.6 million, but the multi-asset products made up the balance resulting in a net overall inflow.

CoinShares observed that the current seven-week run of ETH outflows now total $245 million “highlighting much of the recent bearishness amongst investors has been focused on Ethereum rather than Bitcoin.”

Analyst Willy Woo Also Suggested It Was Early Signs That Institutional Funds Are Starting To Return:

Early signs that institutional money is starting to come back in. pic.twitter.com/4P7d3Fmq4I

— Willy Woo (@woonomic) January 24, 2022

However, the total assets under management for the funds included in the report were $51 billion, its lowest level since early August 2021. The AUM has been depressed due to the falling value of the underlying assets over the past couple of months.

There was no change in the world’s largest fund, Grayscale, which has $30.6 billion in AUM, according to its latest update on Tuesday, however, the fund was trading at a record discount of around 30%.

Analysts and traders were looking for entry points following Bitcoin’s bounce and reclamation of $36,000, as reported by Cointelegraph.

The asset plunged to a six-month low of $33,000 during late Monday trading, according to Tradingview. But it has since recovered solidly with a 10% return to $36,276 at the time of writing. Should spot market momentum continue in this direction, weekly institutional inflows are likely to follow.

Updated: 1-6-2022

Bitcoin Could Outperform Stocks In 2022 Amid Fed Tightening — Bloomberg Analyst

The FOMC minutes on Wednesday revealed that policymakers intend to step up their fight against inflation in 2022.

The Federal Reserve’s signaling for tighter monetary policy in 2022 could provide short-term headwinds for risk assets such as stocks and cryptocurrency, but there’s a good chance that Bitcoin (BTC) still comes out on top as investors recognize its value as a digital reserve asset, according to Bloomberg commodity strategist Mike McGlone.

The January edition of Bloomberg’s Crypto Outlook described the Federal Reserve’s plan to raise interest rates in 2022 as a possible “win-win scenario for Bitcoin [versus] the stock market.”

The reasons stem from the fact that the S&P 500 Index is currently the most overextended above its 60-month moving average in over two decades and that Bitcoin is seeing growing mainstream appeal as an inflation hedge.

“Stretched markets have become common, but commodities and Bitcoin appear to be early reversion leaders,” McGlone said.

“It’s a question of bull-market duration, and we see the benchmark crypto coming out ahead.”

Minutes from the Federal Reserve’s December policy meeting revealed on Wednesday that central bankers are ready to aggressively curb their stimulus support more quickly than previously expected.

The plan, at least for now, includes three interest rate hikes in 2022 accompanied by a reduction in the Fed’s balance sheet, which currently stands at nearly $8.3 trillion in Treasurys and mortgage-backed securities.

Markets may be overreacting short-term but looking beyond hard to overestimate how hawkish the Fed minutes were.

QE reduction + 3 hikes OK, but 3 hikes + accelerated QT was not in anybody’s radar.

— Alex Krüger (@krugermacro) January 6, 2022

Although stimulus reduction is usually considered negative for risk assets, a broad category that includes equities and cryptocurrencies, McGlone believes Bitcoin is in a unique position to outperform in this environment:

“Cryptos are tops among the risky and speculative. If risk assets decline, it helps the Fed’s inflation fight. Becoming a global reserve asset, Bitcoin may be a primary beneficiary in that scenario.”

Within the broader cryptocurrency market, the Bloomberg analyst said he expects the “enduring trio” — namely Bitcoin, Ether (ETH) and dollar-pegged stablecoins — to maintain dominance throughout the year.

Data from Cointelegraph Markets Pro and TradingView showed a sharp decline in the value of Bitcoin on Wednesday following the release of the Federal Open Market Committee meeting minutes. The flagship cryptocurrency plunged below $43,000 for the first time since September and is currently down 8% over the past 24 hours.

Updated: 2-12-2022

Crypto’s Cold Start Is Bound To Thaw

The newbies who bought at the top of the market will no doubt retreat, but more sophisticated players may want to buy the dip.

First the economy overheats, then winter comes to Wall Street. January was especially horrible for the cutting-edge investor, and February might be even worse. At the end of last month, big tech stocks were down nearly 8%, according to the New York Stock Exchange’s FANG+ index — and that was before shares of Meta Platforms Inc. fell off a cliff last week.

The crypto winter has been even colder. Since the start of the year, Bitcoin has fallen by 12.5%; it is down 40% from its all-time high of $67,734 in November 2021. If you bought Ethereum at the top, you are down 38.5%. Only meme stocks such as GameStop Corp. and Robinhood Markets Inc. have been hit as hard. Oh, and let’s not forget Facebook — down 34% over six months.

By contrast, it’s been a rip-roaring start to the year for retro investors. Brent crude oil was up in January more than Bitcoin was down. Long coal was one of the trades of 2021: If you bought America’s biggest coal company, Peabody Energy Corp., a year ago, you’re up 252%. So much for COP26 and the Green New Deal. The winning trade of the post-pandemic era would seem to be long the past, short the future. But applying financial history to the future, I expect this crypto winter soon to pass.

It will be followed by a spring in which Bitcoin continues its steady advance toward being not just a volatile option on digital gold, but dependable digital gold itself; and DeFi defies the skeptics to unleash a financial revolution as transformative as the e-commerce revolution of Web 2.0

You can tell it’s a bear market for crypto because the usual suspects have been tweeting about it. (They’re always mum on the way up.) It doesn’t get better than Nouriel Roubini tweeting a Business Insider story with the headline: “Economist Paul Krugman says there are ‘uncomfortable parallels’ between the recent crypto slump and the subprime mortgage crisis.” Sorry, this doesn’t seem like the relevant historical analogy.

That’s not to say the crypto winter can’t deliver a bigger chill, if not the polar vortex or bomb cyclone of Roubini and Krugman’s imaginings. How much lower could Bitcoin go? It is worth recalling that, after the price of Bitcoin peaked during its first bubble — at $1,137 on Nov. 29, 2013 — it dropped by 84% to $183 just over a year later, on Jan. 14, 2015.

This pattern was repeated four years later, when the price peaked at $19,041 on Dec. 17, 2017, and bottomed out a year later at $3,204 — a cumulative drop of 83%. Were this historical pattern to repeat itself exactly, the price would fall to a low of $11,515 this November, 83% below its peak in November of last year.

However, such a plunge seems unlikely for two reasons. First, Bitcoin is a much larger asset than in the 2010s, with its market cap peaking at just shy of a trillion dollars last year. The process of adoption by individuals and institutions, which I forecast in the updated edition of “Ascent of Money” in 2018, continues apace. First came the hedge funds.

Then came the banks. Now the sovereign wealth funds, the pension funds and the big endowments are sniffing around. Sooner or later, a respectable central bank will admit that it has some Bitcoin in its reserves, and the financial journalists will pay less attention to El Salvador’s eccentric experiment to make Bitcoin legal tender, alongside the U.S. dollar.

Second, while Bitcoin remains a highly speculative investment, it is less speculative than it was a decade ago, based on measures of 30-day volatility and institutional adoption. Some institutional investors — such as the pension funds that have become limited partners in crypto hedge funds or venture funds — have long time-horizons, measured in years. The crypto newbies who bought at the top of the market will no doubt retreat to lick their wounds. But more sophisticated players will want to buy the dip.

What is going on here? Clearly this is more than just a crypto winter. Part of the metanarrative (sorry, couldn’t resist) would seem to be pandemic-related. After two years of Covid restrictions, people are eager for a return to the real world: real ballgames, real shopping, real travel, real gyms.

There was no way companies such as DoorDash Inc. (-45% over six months), Zoom (-64%) or Peloton Interactive Inc. (-80%) could expect demand for their services not to decline as stir-crazy Americans adjusted their behavior from pandemic to endemic conditions.

At the same time, the tight U.S. labor market has presumably driven up costs for tech companies more than for most. Good luck hiring a top engineer in Silicon Valley these days. Rumor has it that practically every graduating computer science major at Stanford already has an offer from Meta. Finally, there’s a chance that people just aren’t that into the metaverse as envisioned by Mark Zuckerberg — or feel they already have it (it’s called the internet).

At the time the Facebook founder unveiled it, many thought it was a genius move to extricate his business from the approaching army of antitrust hipsters and aggrieved politicians. But I don’t think his plan was to ward off antitrust actions by ceasing to be profitable. No rebranding alters the reality that Facebook is passe (ask any teenager), TikTok has eaten its lunch on viral video content, and the days of the Facebook-Google online ads duopoly are over.

Look a little closer, however, and you see that Wall Street’s winter has barely touched other big tech companies. Microsoft Corp. is up 6.8% compared with August last year, Alphabet Inc. 6.0%, Apple Inc. a mighty 17.3% — yes, it’s Springtime for Tim Cook in Cupertino. So this is a lot more complicated than a general rotation from “growth” to “value,” or from tech to the real world.

Clearly, the dominant force in financial markets today is the tightening of monetary conditions by central banks. In some cases, such as the U.K., interest rates have already gone up. In others, notably the U.S. and the euro area, rate hikes are a near certainty in the coming year.

The stated reason for these hikes is that (as previewed here last March) inflation has surged over the past year, as a result of massive fiscal and monetary expansion in response to the pandemic, combined with supply-chain and labor-market disruptions that caused shortages of goods and workers.

Jay Powell, chairman of the Federal Reserve, was not the only central banker to underestimate the inflation risk, but his are the words future historians will quote. “Frankly we welcome slightly higher … inflation,” he told the Financial Times a year ago.

“The kind of troubling inflation people like me grew up with seems unlikely in the domestic and global context we’ve been in for some time.”

We have gone from “What, me worry?” to “Five rate hikes priced in” in 12 short months. Not to mention a much more rapid taper of asset purchases than in the period after the global financial crisis, and the real possibility of quantitative tightening, i.e. a reduction in the size of the Fed balance sheet.

Powell’s metamorphosis from Alfred E. Neuman to Paul Volcker is the main reason for the decline in the price of Bitcoin. That is because Bitcoin was highly appealing when the Fed appeared set on a recklessly inflationary course: Remember, it soared from $4,904 on March 16, 2020 — when Wall Street belatedly woke up the scale of the disaster Covid would inflict — to a level nearly 14 times higher in November last year.

(That must also have been peak FOMO for the professional crypto-haters in economics departments across the country.) Now that the Fed has turned hawkish on inflation, the long-Bitcoin trade is less seductive.

Bitcoin today is seen primarily as “digital gold” (or, to be more accurate, an option on digital gold, as it could conceivably go to zero if the entire era of digital finance were brought to an end by rampant cyberwarfare or China winning “the quantum supremacy”).

As my Hoover Institution colleague Manny Rincon-Cruz argued in a brilliant essay last month, “Bitcoin’s core value proposition, and technological innovation, is digital scarcity via a public, decentralized ledger that tracks a fixed supply of 21 million bitcoins.” It’s that scarcity that investors like, compared with — as the pandemic made clear — the potentially unlimited supply of fiat currencies.

Rincon-Cruz suggests that Bitcoin in our time is playing the role gold played in the 1970s. In the inflationary 1970s, the price of gold surged nearly tenfold from its 1970 low ($256) to peak at $2,348 in February 1980.

However, following the appointment of Paul Volcker as Fed chairman in August 1979 and the rate hikes he imposed to fight inflation (the Fed funds target rate went from 10.5% when Volcker took over to 20% seven months later), gold plummeted. By January 1985, the price was back down below $800.

Of course, Jerome Powell is no Paul Volcker. The markets have already seen him blink once in the face of a stock market selloff, at the end of 2018. Nevertheless, the Fed seems far more constrained than it was back in January 2019, when Powell essentially abandoned the attempt to normalize monetary policy.

Inflation was nowhere to be seen at that time, whereas the last CPI print (7%) was the highest since 1982, the year Volcker’s “regime change” succeeded and inflation expectations subsided.

Yet that doesn’t mean rates are heading back to 20%. This is partly for the obvious reason that inflation seems unlikely to reach the eye-watering levels it reached in the second quarter of 1980, when it exceeded 14%.

But there is another, more profound reason. In his recent, pathbreaking work on the long-run history of interest rates, Yale economic historian Paul Schmelzing has argued for “suprasecular stagnation” — a multicentury tendency for interest rates to fall.

According to Schmelzing, recent arguments about “secular stagnation” as an explanation of falling nominal and real interest rates have focused too much on the recent past — to be precise, on the period since Volcker’s war on inflation. Schmelzing’s reconstruction of public and private interest rates since the 14th century shows a much longer-term trend for rates to decline.

“Global real interest rates,” Schmelzing writes, “have … followed a ‘gentle,’ persistent trend decline, at a level of 1-2 basis points per annum over [five] centuries.” Since the Renaissance, he argues, periods of negative real interest rates have been far from unusual. “Global real interest rates at the zero lower bound are fully consistent with deep historical trends — seen in the long context, interest rates over the past four decades have in fact [reverted] back to trend after reaching unusually elevated levels in the context of the oil shocks.”

A key point Schmelzing makes is that, over half a millennium, whichever government was seen as providing the safest asset — typically a bond paying a fixed annual amount — could pay relatively low nominal rates and quite often negative real rates.

I infer from Schmelzing’s research that Americans should not expect real rates to rise as high as they did in the early 1980s, when the 10-year rate, adjusted for inflation, went as high as 7%. Indeed, rates will likely remain negative through this year, even after five 25-basis-point Fed hikes.

It would take a much larger calamity than a mishandled pandemic to destroy the U.S. government’s reputation as the issuer of the safest financial asset, in a world awash with savings in search of a guaranteed return. (The accumulation and abundance of capital is the principal force driving down rates, in Schmelzing’s account, with destructive events such as major wars only temporarily pushing them upward.)

Of course, the crypto selloff is about more than just inflation expectations. An important point is that, as so often in the history of bubbles, the most speculative investors have been buying on margin, utilizing leverage in the hope of maximizing gains.

As of Feb. 2, the three largest margin-lending crypto protocols — Maker, Compound and Aave — had margin loans outstanding of $9.3 billion, $3.5 billion and $4.5 billion, respectively, for a total of $17.3 billion. This is down 24% from the $22.7 billion peak in early December 2021, but still up more than 370% from a year ago.

Margin buying works wonders on the way up. It can wreak havoc on the way down, which typically begins when interest rates rise and credit conditions tighten. The crypto market correction in January triggered margin calls and collateral liquidations, leading Maker’s founder and others to debate on Twitter how to notify a user called “7Siblings” that about $650 million worth of Ethereum was about to be liquidated if he, she or they didn’t post some new collateral fast.

Another user tracked down 7Siblings’ wallet on Aave and noted that it had $75 million in stablecoins available. 7Siblings finally woke up (or sobered up) and managed to salvage most of the situation.

This is a classic crypto bro story, you might think. However, it relates not to Bitcoin but to Ethereum. As Rincon-Cruz points out, the two should no longer be conflated under the anachronistic label “cryptocurrency.”

If Bitcoin is fundamentally an inflation-hedging asset, because of its guaranteed finite supply, Ethereum and its imitators (e.g., Solana) offer something different: the possibility of re-engineering the financial system on the basis of “smart contracts.” As Rincon-Cruz explains:

Ethereum was launched in 2015 as a “world computer” capable of executing code across a decentralized network of machines. Until 2019, however, smart contract protocols and their tokens had yet to bear fruit. All crypto assets had to offer was digital scarcity, and so their price mimicked Bitcoin’s.

And while non-fungible tokens (NFTs) and meme coins are technically built and launched on top of smart contracts, their value proposition remains digital scarcity as digital collectibles or more volatile versions of Bitcoin.

Much more important than NFTs are the various open protocols known as decentralized finance, or DeFi: not only margin lending (see above) but also on-chain markets and automated investment strategies.

Rincon-Cruz draws an analogy between “Web 3” (the fashionable new name for crypto) and “Web 2,” the commercialization phase of the internet. The dot-com bust of 2000 seemed to vindicate everyone who had been skeptical about e-commerce during the 1990s bubble, just as the latest crypto selloff has vindicated those who have dismissed the last few years as another tulip mania.

True, a lot of the early experiments in DeFi were little more than initial coin offerings (ICOs) backed up with shoddy white papers. A number were blatant scams or mere jokes.

However, just as the skeptics missed the beginnings of Big Tech in the wake of the dot-com bust, so today’s crypto haters are missing the beginnings of a major disruption of the financial system in the form of DeFi. The example Rincon-Cruz cites is Uniswap, the largest on-chain decentralized exchange protocol.

I am sympathetic to this argument for two reasons. First, the existing global and national financial systems really are ripe for disruption. Intermediaries such as banks, credit card companies and money-transfer companies collect sometimes extortionate fees from both consumers and merchants.

(I speak with the bitterness of one who has to send monthly sums to family members in East Africa, far too big a cut of which goes to Western Union. But I could give many more examples, such as the usurious interest rates on credit card debt or the overdraft charges slapped on by banks.)

Secondly, DeFi looks like a bona fide financial revolution, taking advantage of new technological possibilities to reduce transaction costs in exciting ways. Skeptics love to insist that Ethereum isn’t money in the textbook sense (a store of value, a unit of account, a means of payment). This is to miss the point entirely. Let’s turn again to financial history.

After the Black Death of the mid-14th century, severe labor shortages eroded the system of feudalism whereby peasants worked the land as serfs and paid rent “in kind,” with shares of what they grew.

In England and in northern Italy, there was a shift to a more monetized economy, in which an increasingly mobile workforce was able to insist on payment in cash. The problem that beset the medieval and early-modern economy of Europe was an insufficiency of good-quality coinage.

For merchants seeking to conduct trade over land or sea, the defective monetary system of the time was especially problematic.

They got around it by developing the revolutionary financial innovation known as the bill of exchange — a simple piece of paper which extended credit from one merchant to another, typically for a period of several months, corresponding to the time it took for an item to be transported from port A to port B: in effect, an IOU.

(An example from 1398 can be seen here.) Over time, bills of exchange came to be negotiable — that is they could be sold to third parties. Merchants’ signatures were the basis for this credit system.

Notice that bills of exchange were not money in the textbook sense. Yet they constituted a form of peer-to-peer credit that proved crucial to the development of European commerce from the late-medieval period down to the 19th century.

Notice, too, that there was no need for third-party institutions to verify or process transactions: Specialist banks known as discount houses evolved much later. In other words, the system of late-medieval trade finance was the nearest thing to decentralized finance that was possible in a time when cheap paper was the revolutionary information technology.

Updated: 5-9-2022

Bitcoin Funds Had Surprise Inflows As Markets Plunged

Some $45 million flowed into these funds in the week through May 6. Investors apparently bought the market dip.

There was a surprising amount of inflows to digital-asset funds, the first time money came into the funds in four weeks. This came despite a plunge in prices for bitcoin (BTC) and most other cryptocurrencies.

Bitcoin funds racked up $45 million in inflows, CoinShares reported Monday. Because of outflows from funds targeting other cryptocurrencies, there was a net $40.3 million in inflows overall across all digital-asset funds.

The week’s inflows marked a sharp turn after four consecutive weeks of outflows.

James Butterfill, head of research at CoinShares, said the positive balance was likely due to “investors taking advantage of the substantive price weakness.” He questioned how durable the trend reversal might prove.

“Interestingly, we have not seen the same spike in investment-product trading activity, as we typically see historically during extreme price weakness periods,” Butterfill said. “It is too early to tell if this marks the end of the four-week run of negative sentiment.”

The price of bitcoin, the largest cryptocurrency by market capitalization, slid to $35,000 by Friday after opening the week at around $38,000. The price briefly spiked to $40,000 after the U.S. Federal Reserve hiked rates by 0.5 percentage point last week.

Most crypto funds trade on weekdays, when stock markets are open.

Bitcoin short funds, which profit off the BTC price falling, recorded their second-strongest inflows of the year, $4 million, reaching $45 million assets under management.

Funds focused on ether (ETH) extended their losing streak, seeing $12.5 million in outflows, bringing year-to-date outflows to $217 million.

Multi-asset funds recorded inflows of $1.7 million, totaling $150 million.

Solana’s SOL was the only altcoin seeing substantial inflows into funds, at $1.9 million, bringing its year-to-date inflows to $107 million.

Fund flows were lopsided by geography, as North American investment products saw inflows of $66 million while European funds saw outflows totaling $26 million.

Funds managed by Purpose and ProShare recorded inflows of $58.8 million and $19.3 million, respectively, while CoinShares XBT funds took a $18.4 hit, totaling $305 million in outflows since the start of the year.

Whales Wallets Have Been Feasting

According to Twitter crypto analyst Akash, Bitcoin whales have been accumulating through the previous downturns and sideways price action.

Akash said,

“Wallets holding 10,000 to 100,000 BTC have been on a buying spree since April 30.”

While this data is encouraging on some levels it’s important to remember that there are no guarantees against another trend change or further downside and traders would be wise to assume nothing and take extra care to manage their risk moving forward.

The overall cryptocurrency market cap now stands at $1.411 trillion and Bitcoin’s dominance rate is 41.5%.

Updated: 5-14-2022

Cathie Wood Just Keeps Buying Coinbase And Getting More Inflows

* ARK Funds Added Shares Of Largest US Crypto Exchange Amid Rout

* Flagship ARKK Fund’s Third-Worst Drop Was Met With Inflows

After one of the most dramatic weeks yet for ARK Investment Management, Wall Street can no longer have any doubts: Cathie Wood is sticking with her strategy — and investors are sticking with her.

The chances of both have been questioned this year as a selloff in speculative tech stocks laid waste to her future-focused exchange-traded funds. Wednesday was a particular low point, with the flagship ARK Innovation ETF (ticker ARKK) slumping 10% in its third-worst drop on record.

One of the biggest drags that day was Coinbase Global Inc., the largest US cryptocurrency exchange, which tumbled 26% after disappointing results and amid a rout of digital assets. But while the rest of Wall Street was ditching the stock, Wood and her team stuck to their playbook and used the drop to increase holdings, adding about 860,000 shares in the week through Thursday.

In many eyes, it’s a system that risks loading up on losers. Hitched to a concentrated portfolio of often highly speculative bets, it leaves Wood and her firm with plenty of critics. But the clarity of the goal — chasing companies that can win big from major technological shifts — and ARK’s commitment to it has won some remarkably loyal fans.

“Cathie Wood has not wavered at all in her conviction in her strategy, and in fact has doubled down on her strategy,” said Nate Geraci, president of The ETF Store, an advisory firm. “That’s attractive to a certain segment of investors.”

As it plunged on Wednesday, ARKK actually posted inflows. It was a relatively small amount for the $7.8 billion ETF — about $45 million — but net inflows in 2022 are more than $1.5 billion. That’s for a vehicle that has plunged as much as 61% this year.

“Investors that are in this strategy have stayed loyal to this strategy, have a long-term time horizon and view selloffs as opportunities to deploy some additional capital,” said Todd Rosenbluth, head of research at ETF Trends.

Of course, there’s also no shortage of investors ready to bet against ARK. Short interest in the main fund is a relatively elevated 14.8% of shares outstanding, according to data from IHS Markit Ltd.

Meanwhile, by the close on Wednesday the price of the Tuttle Capital Short Innovation ETF, which aims to deliver the reverse performance of the innovation fund on a daily basis, was more than double that of the ARK ETF. In other words, betting against Wood’s flagship strategy for a day cost twice as much as buying the fund itself to hold.

But things were looking more positive for ARK by the end of the week as tech stocks managed a rebound. The innovation fund jumped 12% Friday after climbing 5.6% a day earlier. One of Wood’s high profile picks, Robinhood Markets Inc., was surging after cryptocurrency billionaire Sam Bankman-Fried revealed a major stake.

It’s a long way from undoing recent damage to Wood’s main ETF — the fund would have to jump about 260% from here to reclaim its all-time high. But at least it provides some respite for the faithful.

Ultimately, investors continue to lean on Ark ETFs as vehicles to get in and out of disruptive technology. In a turbulent week for the flagship fund, trading volume surged to a record 316 million shares.

As Ark sticks to its strategy, investors “know exactly what they’re going to get” and can rely on its funds to make pure-play trades on innovation, Geraci said. “The benefit of Cathie Wood not wavering from her strategy during this brutal downturn is that I think it will help the longer-term viability of Ark.”

Updated: 5-16-2022

Warren Buffett Spends Big As Stock Market Sells Off

Berkshire Hathaway loads up on energy stocks as inflation soars.

The stock market’s selloff has been bad news for most investors.

Not for Warren Buffett and his team.

Mr. Buffett’s Berkshire Hathaway Inc. has used the slump as an opportunity to increase spending on stocks, deploying tens of billions of dollars the past couple of months after ending 2021 with a near-record cash pile.

The Omaha-based company bought 901,768 shares of Occidental Petroleum Corp. last week, according to a regulatory filing. The move makes Occidental, in which Berkshire began buying shares in late February, one of its 10 biggest holdings.

In the past few months, Berkshire has also boosted its stake in Chevron Corp., placed a merger-arbitrage bet on Activision Blizzard Inc., bought shares of HP Inc., Citigroup Inc. and Ally Financial Inc., and continued adding to its position in Apple Inc., which remained its biggest stockholding.

Meanwhile, it exited its position in Wells Fargo & Co., formerly one of its top stockholdings and a part of the Berkshire portfolio since 1989.

Investors got a look at what Berkshire has been buying—as well as what it has been selling—when it filed what is known as Form 13F with the Securities and Exchange Commission on Monday.

The SEC requires all institutional investors that manage more than $100 million to file the form within 45 days of the end of each quarter. Because institutions must disclose their equity holdings on the form, as well as the size and market value of each position, investors often use 13Fs to gauge how large money managers are playing the stock market.

One takeaway from Berkshire’s filing was this: The market’s tumult has allowed the company to go on a spending spree.

Mr. Buffett, a longtime adherent of value investing, has long advised that investors “be greedy when others are fearful.” That philosophy was likely difficult to practice for much of the past two years, during which investors’ mood largely seemed anything but fearful. Now that the market is slumping, Berkshire is in a prime position to add to its mammoth stock portfolio, investors say.

“Cash is dry powder, and he has a lot of it,” said Rupal Bhansali, chief investment officer for global equities at Ariel Investments, of Mr. Buffett. Ms. Bhansali manages Ariel’s global mutual fund, which owns Berkshire shares.

Ms. Bhansali, among others, also believes that Berkshire’s investments in Chevron and Occidental might reflect a bet that commodities prices will stay elevated for some time.

Energy stocks have been by far the best-performing group in the S&P 500 this year, benefiting from a surge in commodities prices that began after Russia’s invasion of Ukraine raised concerns about disruptions to oil and gas supply lines.

Chevron shares are up 47% this year, while Occidental shares have gone up 134%. In comparison, the S&P 500 has fallen 16%.

“They’re clearly owning companies that are likely to be an inflation hedge,” Ms. Bhansali said.

Energy stocks also offer two characteristics that Mr. Buffett has traditionally gravitated toward: low valuations, as well as shareholder returns in the form of buybacks and dividends, said Jim Shanahan, senior equity research analyst at Edward Jones.

Dividend-paying stocks have outperformed the S&P 500 this year, in part as investors whipsawed by market volatility have sought out stocks that can offer steady cash returns.

“It fits the profile,” Mr. Shanahan said of Berkshire’s Chevron and Occidental share purchases.

Berkshire ramped up its purchases of bank stocks, which also tend to trade at relatively low valuations and offer dividends. The company bought 55 million shares of Citigroup in the first quarter, a stake valued at about $3 billion.

The move marks a reversal of sorts for Berkshire: it unloaded much of its bank stocks in 2020, selling Goldman Sachs Group Inc. , JPMorgan Chase & Co. and much of its Wells Fargo stake, only to miss out on the financial sector’s remarkable rally in the second half of the year and 2021.

“They faced a lot of criticism for not having done more in March and April 2020,” Mr. Shanahan said of Berkshire. “But they defended it by saying back then they didn’t know how bad it was going to get. It was a different environment.”

Mr. Shanahan said that while the pandemic marked a period of missed opportunities for Berkshire, he is pleased to see the company ramping up its investment activity again.

With stock volatility remaining elevated, many investors and analysts expect Mr. Buffett, as well as Berkshire portfolio managers Ted Weschler and Todd Combs, to keep putting cash to work in the market over the coming months.

Berkshire ended last year with a mountain of cash on its hands—not necessarily out of a desire to build up its war chest, but because it had been impossible to find companies that seemed worth investing in for the long term, Mr. Buffett said to shareholders in his annual letter sent out in February. It had $106.3 billion in cash as of March 31, down from $146.7 billion at the end of 2021.

This year has changed that. With tightening monetary policy, slowing economic growth and sustained supply-chain disruptions putting markets on edge, Mr. Buffett is in his element, said David Kass, a finance professor at the University of Maryland’s Robert H. Smith School of Business.

“This is what I’d consider to be Warren Buffett’s sweet spot,” Mr. Kass said. “The almost wholesale selling in the market has provided Berkshire an opportunity to buy securities at bargain prices.”

Updated: 5-16-2022

Crypto Funds Saw Year’s Highest Inflows As Terra Crisis Crashed Markets

Some $274 million flowed into digital asset funds as investors bought the dip, amid a broad crypto-market sell-off triggered by Terra’s turmoil.

Digital-asset funds last week netted their highest inflows since late 2021 as investors bought into market panic caused by Terra’s implosion.

Crypto funds racked up $274 million in inflows in the week through May 13, when the terraUSD stablecoin (UST) – a cryptocurrency that’s supposed to trade at a fixed price of $1 – dropped to a few cents, wiping out most of its $18 billion market capitalization and also making the blockchain’s native token LUNA, once a top-10 cryptocurrency, virtually worthless.

James Butterfill, head of research at CoinShares, said it was a “strong signal that investors saw the recent UST stablecoin depeg and its associated broad sell-off as a buying opportunity.”

Bitcoin-focused funds were the clear winners, netting $299 million in inflows, the highest weekly inflow since the last week of October 2021. The data suggests that “investors were flocking to the relative safety of the largest digital asset,” Butterfill said.

The flurry of investment came as bitcoin (BTC) dipped to as low as $25,892 on Thursday amid fears Luna Foundation Guard, the organization that was supposed to support UST in a crisis, might panic-sell its reserve of roughly 80,000 bitcoin. The price of bitcoin recovered most if its losses late last week to change hands around $30,000, a significant psychological level.

Investors were polarized geographically because funds listed in North American saw $312 million of inflows, while $32 million flowed out of European funds.

Bitcoin ETF

Purpose, the provider of the largest bitcoin exchange-traded fund listed in Canada, booked $284 million in inflows, dwarfing flows of competitors.

Non-bitcoin funds struggled in the market sell-off, as some $26.7 million flowed out of funds managing ether (ETH), while vehicles focused on solana (SOL) recorded $5 million of outflows.

Investors in blockchain-related stocks apparently panicked, with some $51 million leaving funds that manage blockchain and crypto-focused equities.

In contrast, multi-asset funds, which manage more than one cryptocurrency, recorded $8.6 million in inflows, suggesting that some investors preferred a diversified approach.

Updated: 2-20-2023

Bitcoin Bulls Ignore Recent Regulatory FUD By Showing Continued Decoupling From Stocks

Bitcoin’s upward momentum can continue, according to Asian stablecoin demand and the BTC futures premium.

It might seem like forever ago that Bitcoin was trading below $18,000, but in reality, it was 40 days ago. Cryptocurrency traders tend to have a short-term memory, and more importantly, they attribute less importance to negative news during bull runs. A great example of this behavior is BTC’s 15% gain since Feb. 13 despite a steady flow of bad news in the crypto market.

For instance, on Feb. 13, the New York State Department of Financial Services ordered Paxos to “cease minting” the Paxos-issued Binance USD dollar-pegged stablecoin.

Similarly, Reuters reported on Feb. 16 that a bank account controlled by Binance.US moved over $400 million to the trading firm Merit Peak — which is supposedly an independent entity also controlled by Binance CEO Changpeng Zhao.

The regulatory pressure wave continued on Feb. 17 as the United States Securities and Exchange Commission announced a $1.4-million settlement with former NBA player Paul Pierce for allegedly promoting “false and misleading statements” regarding EthereumMax (EMAX) tokens on social media.

None of those adverse events were able to break investors’ optimism after weak economic data signaled that the U.S. Federal Reserve has less room to keep raising interest rates.

The Philadelphia Fed’s Manufacturing Index displayed a 24% decrease on Feb. 16, and U.S. housing starts increased by 1.31 million versus the previous month, which is softer than the 1.36 million expectation.

Let’s take a look at Bitcoin derivatives metrics to better understand how professional traders are positioned in the current market conditions.

Asia-Based Stablecoin Demand Remains “Modest”

Traders should refer to the USD Coin premium to measure the demand for cryptocurrency in Asia. The index measures the difference between China-based peer-to-peer stablecoin trades and the U.S. dollar.

Excessive cryptocurrency buying demand can pressure the indicator above fair value at 104%. On the other hand, the stablecoin’s market offer is flooded during bearish markets, causing a 4% or higher discount.

Currently, the USDC premium stands at 2.7%, which is flat versus the previous week on Feb. 13 and indicates modest demand for stablecoin buying in Asia. However, the positive indicator shows that retail traders were not frightened by the recent newsflow or Bitcoin’s rejection at $25,000.

The Futures Premium Shows Bullish Momentum

Retail traders usually avoid quarterly futures due to their price difference from spot markets. Meanwhile, professional traders prefer these instruments because they prevent the fluctuation of funding rates in a perpetual futures contract.

The two-month futures annualized premium should trade between +4% and +8% in healthy markets to cover costs and associated risks. Thus, when the futures trade below this range, it shows a lack of confidence from leverage buyers. This is typically a bearish indicator.

The chart shows bullish momentum, as the Bitcoin futures premium broke above the 4% neutral threshold on Feb. 16. This movement represents a return to a neutral-to-bullish sentiment that prevailed until early February.

As a result, it’s clear that pro traders are becoming more comfortable with Bitcoin trading above $24,000.

The Limited Impact Of Regulatory Action Is A Positive Sign

While Bitcoin’s 15% price gain since Feb. 13 is encouraging, the regulatory newsflow has been primarily negative. Investors are excited by the U.S. Fed‘s decreased ability to curb the economy and contain inflation. Hence, one can understand how those bearish events could not break cryptocurrency traders’ spirit.

Ultimately, the correlation with the S&P 500 50-day futures remains high at 83%. Correlation stats above 70% indicate that asset classes are moving in tandem, meaning the macroeconomic scenario is likely determining the overall trend.

At the moment, both retail and pro traders are showing signs of confidence, according to the stablecoin premium and BTC futures metrics.

Consequently, the odds favor a continuation of the rally because the absence of a price correction typically marks bull markets despite the presence of bearish events, especially regulatory ones.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

McDonald’s Jumps On Bitcoin Memewagon, Crypto Twitter Responds

America COMPETES Act Would Be Disastrous For Bitcoin Cryptocurrency And More

Lyn Alden On Bitcoin, Inflation And The Potential Coming Energy Shock

Inflation And A Tale of Cantillionaires

El Salvador Plans Bill To Adopt Bitcoin As Legal Tender

Miami Mayor Says City Employees Should Be Able To Take Their Salaries In Bitcoin

Vast Troves of Classified Info Undermine National Security, Spy Chief Says

BREAKING: Arizona State Senator Introduces Bill To Make Bitcoin Legal Tender

San Francisco’s Historic Surveillance Law May Get Watered Down

How Bitcoin Contributions Funded A $1.4M Solar Installation In Zimbabwe

California Lawmaker Says National Privacy Law Is a Priority

The Pandemic Turbocharged Online Privacy Concerns

How To Protect Your Online Privacy While Working From Home

Researchers Use GPU Fingerprinting To Track Users Online

Japan’s $1 Trillion Crypto Market May Ease Onerous Listing Rules

Ultimate Resource On A Weak / Strong Dollar’s Impact On Bitcoin

Fed Money Printer Goes Into Reverse (Quantitative Tightening): What Does It Mean For Crypto?

Crypto Market Is Closer To A Bottom Than Stocks (#GotBitcoin)

When World’s Central Banks Get It Wrong, Guess Who Pays The Price😂😹🤣 (#GotBitcoin)

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin And Gold

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Does Your Baby’s Food Contain Toxic Metals? Here’s What Our Investigation Found

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

Ultimate Resource On BlockFi, Celsius And Nexo

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

100 Million Americans Can Legally Bet on the Super Bowl. A Spot Bitcoin ETF? Forget About it!

Green Finance Isn’t Going Where It’s Needed

Shedding Some Light On The Murky World Of ESG Metrics

SEC Targets Greenwashers To Bring Law And Order To ESG

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Canada’s Major Banks Go Offline In Mysterious (Bank Run?) Hours-Long Outage (#GotBitcoin)

On-Chain Data: A Framework To Evaluate Bitcoin

On Its 14th Birthday, Bitcoin’s 1,690,706,971% Gain Looks Kind of… Well Insane

The Most Important Health Metric Is Now At Your Fingertips

American Bargain Hunters Flock To A New Online Platform Forged In China

Why We Should Welcome Another Crypto Winter

Traders Prefer Gold, Fiat Safe Havens Over Bitcoin As Russia Goes To War

Music Distributor DistroKid Raises Money At $1.3 Billion Valuation

Nas Selling Rights To Two Songs Via Crypto Music Startup Royal

Ultimate Resource On Music Catalog Deals

Ultimate Resource On Music And NFTs And The Implications For The Entertainment Industry

Lead And Cadmium Could Be In Your Dark Chocolate

Catawba, Native-American Tribe Approves First Digital Economic Zone In The United States

The Miracle Of Blockchain’s Triple Entry Accounting

How And Why To Stimulate Your Vagus Nerve!

Housing Boom Brings A Shortage Of Land To Build New Homes

Biden Lays Out His Blueprint For Fair Housing

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Cracks In The Housing Market Are Starting To Show

Ever-Growing Needs Strain U.S. Food Bank Operations

Food Pantry Helps Columbia Students Struggling To Pay Bills

Food Insecurity Driven By Climate Change Has Central Americans Fleeing To The U.S.

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Families Face Massive Food Insecurity Levels

US Troops Going Hungry (Food Insecurity) Is A National Disgrace

Everything You Should Know About Community Fridges, From Volunteering To Starting Your Own

Russia’s Independent Journalists Including Those Who Revealed The Pandora Papers Need Your Help

10 Women Who Used Crypto To Make A Difference In 2021

Happy International Women’s Day! Leaders Share Their Experiences In Crypto

Dollar On Course For Worst Performance In Over A Decade (#GotBitcoin)

Juice The Stock Market And Destroy The Dollar!! (#GotBitcoin)

Unusual Side Hustles You May Not Have Thought Of

Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

The Fed Is Setting The Stage For Hyper-Inflation Of The Dollar (#GotBitcoin)

An Antidote To Inflation? ‘Buy Nothing’ Groups Gain Popularity

Why Is Bitcoin Dropping If It’s An ‘Inflation Hedge’?

Lyn Alden Talks Bitcoin, Inflation And The Potential Coming Energy Shock

Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

What The Fed’s Rate Hike Means For Inflation, Housing, Crypto And Stocks

Egyptians Buy Bitcoin Despite Prohibitive New Banking Laws

Archaeologists Uncover Five Tombs In Egypt’s Saqqara Necropolis

History of Alchemy From Ancient Egypt To Modern Times

Former World Bank Chief Didn’t Act On Warnings Of Sexual Harassment

Does Your Hospital or Doctor Have A Financial Relationship With Big Pharma?

Ultimate Resource Covering The Crisis Taking Place In The Nickel Market

Apple Along With Meta And Secret Service Agents Fooled By Law Enforcement Impersonators

Handy Tech That Can Support Your Fitness Goals

How To Naturally Increase Your White Blood Cell Count

Ultimate Source For Russians Oligarchs And The Impact Of Sanctions On Them

Ultimate Source For Bitcoin Price Manipulation By Wall Street

Russia, Sri Lanka And Lebanon’s Defaults Could Be The First Of Many (#GotBitcoin)

Will Community Group Buying Work In The US?

Building And Running Businesses In The ‘Spirit Of Bitcoin’

What Is The Mysterious Liver Disease Hurting (And Killing) Children?

Citigroup Trader Is Scapegoat For Flash Crash In European Stocks (#GotBitcoin)

Bird Flu Outbreak Approaches Worst Ever In U.S. With 37 Million Animals Dead

Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.