BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Larry Fink believes Bitcoin may evolve into a global market. BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

https://www.youtube.com/watch?v=HrMFXKTYxck&list=PLU1KxUVqGmaPHHgR2YqTskZjiMH8obWfF

“Bitcoin has caught the attention and the imagination of many people. Still untested, pretty small relative to other markets.”

He Then Added:

“Can it evolve into a global market? Possibly.”

Fink isn’t the only BlackRock executive touting Bitcoin’s potential value. Last month, the company’s chief investment officer, Rick Rieder, told CNBC that not only is Bitcoin “here to stay” but that it will “take the place of gold to a large extent.”

Related:

Federal Reserve Taps BlackRock To Purchase Bonds For The Government (#GotBitcoin)

BlackRock Exposes Confidential Data on Thousands of Advisers on iShares Site (#GotBitcoin?)

BlackRock Offices Raided in German Tax Probe (#GotBitcoin?)

Previously, comments like these would have been considered highly irregular coming from institutional brass, not to mention the world’s largest asset manager with assets under management north of $7.4 trillion as of 2019.

But the public’s perception of Bitcoin has changed dramatically over the past year. Record inflows into Grayscale products, the growth of Bitcoin corporate treasuries, and Guggenheim’s Securities and Exchange Commission amendment to gain exposure to BTC represent a seismic shift in institutional adoption.

Beyond these moves, investment legends Paul Tudor Jones and Stanley Druckenmiller are also backing Bitcoin.

Institutional demand for Bitcoin has created an alarming shortage in the market, with the likes of PayPal and Cash App scooping up most, if not all, newly mined BTC. PayPal alone is buying up almost 70% of the new supply, according to Pantera Capital.

Currently, only 900 BTC is mined each day. With demand increasing following the deflationary May halving, prices are likely to continue higher. Even Citibank has predicted a comparatively astronomical Bitcoin price by the end of 2021.

Although BlackRock doesn’t outright own Bitcoin, it has indirect exposure to the asset through MicroStrategy, a business intelligence firm that converted its balance sheet to BTC. BlackRock is the largest MicroStrategy investor with a 15.2% stake in the company.

Updated: 7-22-2019

CEO of World’s Largest Asset Manager Makes The Case For Crypto

The CEO of asset management giant BlackRock says there’s a huge need for emerging technologies like cryptocurrency.

In a new interview with CNBC, Larry Fink says the concept of Libra and cryptocurrency fills a gap that’s sorely needed for people who move money across borders.

“I was in Europe this past week. I had to buy a new briefcase because mine broke. And when I was going to sign the receipt, it asked me if I wanted to pay in euro or dollar. And I chose dollar. Then I looked at it – I’m still being charged 3%.

When you think about all the people who may work in one country and send money back home, they generally do that through organizations that charge 5% to 10%. There is a need, whether it’s a Libra or something else, to democratize the exchange of foreign currencies. Today with computers and the electronic market, it should be ten basis points, five basis points…

I don’t believe we need an international currency, but there is a huge need to bring down the fees.”

Back in April, Forbes reported BlackRock hired former Ripple product marketer Robbie Mitchnick and announced a “massive management overhaul” to focus on alternative investments.

The company is exploring the potential of Bitcoin and cryptocurrency, but has not confirmed whether it plans to offer crypto assets to its customers.

Updated: 12-28-2020

BlackRock Seeks VP Blockchain Lead To ‘Drive Demand’ For Firm’s Crypto Offerings

The world’s largest asset manager, BlackRock, is seeking to hire a vice president to help build and execute strategies and “drive demand” for the company’s crypto and crypto-related offerings.

* BlackRock, which has $6.84 trillion assets under management, has posted a job vacancy for a New York-based VP of blockchain to help with the valuation of crypto assets.

* According to the post, the applicant must have at least a year’s experience in the technological foundations of blockchain technology including cryptographic hash functions, distributed network consensus mechanisms, and public-private key cryptography.

* Candidates should be able to “devise and articulate fundamental valuation methodologies for crypto-assets; evaluate game theory and decentralizing governance models associated with blockchain technology,” said the listing.

* BlackRock CEO Larry Fink recently made some bullish comments on bitcoin, stating it has “caught the attention” of many people and that the nascent cryptocurrency asset class can possibly “evolve” into a global market asset.

Updated: 1-20-2021

BlackRock Files To Add Bitcoin Futures To Two Of Its Funds

BlackRock Inc. is adding cash-settled Bitcoin futures as an eligible investment to two funds, according to regulatory filings.

The world’s largest asset manager filed updated prospectuses for two funds on Wednesday with the U.S. Securities and Exchange Commission that included cash-settled Bitcoin futures among the assets they can buy.

The funds where the exposure could be added are BlackRock Strategic Income Opportunities and BlackRock Global Allocation Fund Inc.

A BlackRock spokesperson declined to comment beyond the filing.

Updated: 1-27-2021

Blackrock CEO Calls Bitcoin An Untested Asset In A ‘Very Small Market’

Larry Fink said he was fascinated with the media hype surrounding Bitcoin but expressed concerns about the crypto asset’s volatility and market size.

Just one week after asset manager Blackrock appeared to be preparing to invest in Bitcoin futures, CEO Larry Fink has some mixed messages on crypto.

In an interview with Bloomberg on Wednesday, Fink referred to Bitcoin (BTC) as a volatile asset within “a very small market.” The CEO’s remarks continued, with fascination over the media coverage of Bitcoin, given that the “asset category is so small compared to other asset categories.”

“[Bitcoin] could be another store of wealth, but right now it’s still untested,” said Fink. “It has huge volatility, moving in 5-6% increments with small dollar investments moving it.”

He Added:

“It has not been proven yet on the long-term viability of it. Some form of a digitized currency is going to play a bigger role in the future, and it may be Bitcoin. It may be something else that has developed.”

Other executives at the investment manager have made seemingly more bullish remarks. In November 2020, Blackrock chief investment officer Rick Rieder said “Bitcoin is here to stay” and the crypto asset would likely “take the place of gold to a large extent.”

BlackRock has indirect exposure to Bitcoin through its ownership stake in business intelligence firm MicroStrategy. The company made an initial $425 million investment in the crypto asset in summer 2020 and has since added thousands more BTC to its holdings.

However, Blackrock may be exploring the possibility of getting more directly involved in the crypto space. Last Wednesday, a pair of prospectus filings for two of Blackrock’s funds appeared on the website for the United States Securities and Exchange Commission. Both mentioned potentially using Bitcoin derivatives and other assets as part of its investment scheme, but neither was definitive about the investment firm’s entry into the Bitcoin futures market.

At the time of publication, the price of Bitcoin is $30,734, having fallen 4% in the last 24 hours.

BlackRock’s Entry Reflects A Change In Institutional Outlook On Crypto

The entry of the world’s largest asset manager into the realm of crypto finance could potentially signal the entry of other big-name players.

On Jan. 20, BlackRock, the world’s largest asset manager with over $8.7 trillion assets under management, appeared to have given the green light to two of its associated funds, BlackRock Global Allocation Fund Inc. and BlackRock Funds, to invest in Bitcoin futures.

In this regard, the prospectus documents filed with the United States Securities and Exchange Commission suggest that BlackRock is looking to dabble in Bitcoin (BTC), especially as the first ever cryptocurrency has been added to the company’s lists of derivative products cleared for use.

Furthermore, over the last few months, the company’s executive brass had spoken positively about Bitcoin, alluding to the fact that in the near future, a number of institutions may look toward digital assets to expand their list of financial offerings.

For example, in an interview last November, Rick Rieder, chief investment officer of BlackRock, said that Bitcoin has the potential to “take the place of gold to a large extent.” A somewhat similar sentiment was echoed by the company’s CEO, Larry Fink, who told the media that Bitcoin has caught the attention of the masses and has the potential to possibly evolve into a global market of its own.

Lastly, it’s also worth remembering that exactly one month ago, BlackRock posted a job advert seeking a qualified individual for the role of vice president, blockchain lead for its New York office. According to the post, the role required applicants to be able to devise and set in motion various strategies that can help “drive demand for the firm’s investments and technology offerings.”

What Does Blackrock’s Entry Mean For The Market?

BlackRock investing in Bitcoin futures is a significant step forward for the global crypto ecosystem, as it brings tremendous credibility to Bitcoin as a new asset class. Jason Lau, chief operating officer of cryptocurrency exchange OKCoin, told Cointelegraph that this move will set the stage for other asset managers to follow since most traditional asset managers are typically “consensus followers,” adding:

“With BlackRock’s announcement, other asset managers are going to be able to point to BlackRock’s work in convincing their investment committees and the client investment boards about the potential and maturity of BTC and the crypto ecosystem.”

Currently, CME futures and investments trust shares issued by Grayscale and Bitwise are two of the primary vehicles for institutions to get involved with crypto. However, due to this severe limitation, there have been large premiums from trusts versus the underlying price of BTC. For example, Lau stated that during the recent BTC price appreciation in December, Grayscale had a 40% premium on Bitcoin’s underlying value.

Kyle Samani, a managing partner at Multicoin Capital — a thesis-driven investment firm — told Cointelegraph that BlackRock’s entry is a big step forward for the entire industry. He believes that by enabling some of its funds to go long on BTC, it will allow more investors to join the space.

Is Blackrock Late To The Party?

While some are rejoicing at the news of BlackRock making its way into the crypto market, Maksim Balashevich, founder and CEO of Santiment — a market intelligence platform for cryptocurrencies — told Cointelegraph that from a purely “behavior analyses” standpoint, it’s not just the big headlines that should be considered.

Instead, the reaction of the masses, which, more often than not, is the single most crucial factor that determines market price action, could be more decisive. He added: “BlackRock’s entry is no special event but just yet another ‘latecomer’ from ‘big money’ funds. The move won’t have any implications except further professionalizing, increasing the liquidity of the market.”

When asked about the impact BlackRock’s entry may have on Bitcoin’s potential value stabilization, Balashevich pointed out that despite these “big moves,” crypto volatility is here to stay and that many more ups and downs will happen in the coming months. “Players like BlackRock are sharks playing against each other,” he said.

Lastly, on the subject of whether the point of saturation in terms of institutional entry into this space is getting closer, he believes that the industry is indeed “getting very close to the top” and that “there aren’t too many big players left to enter the market.”

Could An SEC-Approved Bitcoin ETF Be On The Horizon?

Historically, the SEC has rejected a number of ETF proposals — such as those submitted by Phoenix Wilshire, Gemini, etc. — sighting price manipulation, lack of liquidity and price indexing sources as key concerns. However, with BlackRock making inroads into this space, it seems as though the stage may finally be set for an ETF being approved sometime in 2021, as Lau pointed out:

“An increasing number of large reputable financial firms a la BlackRock, Guggenheim, SkyBridge, etc. are entering the crypto space and lending their sign of approval. This may give the regulatory body more confidence in the maturation of the crypto market and the need for an ETF to give further access to crypto.”

He pointed out that it will be extremely interesting to see if BlackRock’s ETF business, iShares, decides to become the first major mover to recognize this fast-opening window of opportunity and file for an ETF itself. Recently, investment management firm VanEck has once again submitted an application with the SEC to create a new Bitcoin ETF. This move was followed by another similar application submitted by Valkyrie Investments. So the ETF race is back on following a brief period of calm.

Also, with Bitcoin recently scaling past the $42,000 threshold, it appears as though a number of Wall Street institutions are quickly warming up to the crypto industry, as is highlighted by the fact that MassMutual recently became the latest big-name player from the realm of traditional finance to acquire $100+ million worth of BTC.

Not only that, a number of high-profile investors such as Paul Tudor Jones and Stanley Druckenmiller have cozied up to this relatively new asset class in recent times and from the corporate domain, companies such as Square and PayPal have purchased Bitcoin.

Updated: 2-17-2021

BlackRock Has Started To ‘Dabble’ In Crypto, Says CIO

“Holding some portion of what you hold in cash in things like crypto seems to make some sense to me,” said Rick Rieder.

Rick Rieder, chief investment officer at BlackRock Financial Management, hinted that the firm ha already invested a percentage of its portfolio into crypto.

In an interview with CNBC’s Squawk Box on Wednesday, Rieder said BlackRock — with more than $8.6 trillion in assets under management — has “started to dabble a bit” into crypto investments.

The chief investment officer described the volatility of cryptocurrencies like Bitcoin (BTC) as “extraordinary” but acknowledged that many investors were looking for “places that appreciate under the assumption that inflation moves higher as debts are building.”

“Holding some portion of what you hold in cash in things like crypto seems to make some sense to me, but I wouldn’t espouse a certain allocation or target holding,” said Reider. “My sense is the technology has evolved and the regulations have evolved to the point where a number of people find it should be part of the portfolio.”

Rieder did not specify what percentage of BlackRock’s assets under management may be in crypto, but his comments come following the multitrillion-dollar asset manager mentioning Bitcoin in two prospectus filings with the United States Securities and Exchange Commission. The filings suggest the possibility of BlackRock using Bitcoin derivatives and other assets as part of its investment scheme.

Executives at the asset management firm have spoken positively about crypto in recent months. Rieder previously said that Bitcoin has the potential to “take the place of gold to a large extent,” while in December 2020, CEO Larry Fink said Bitcoin caught his attention and could possibly evolve into a global market.

The chief investment officer’s recent remarks follow Tesla making a $1.5-billion Bitcoin purchase earlier this month, prompting many firms to face questions about if they’ll consider investing in the crypto asset.

Microsoft and General Motors have both said they have no immediate plans to put Bitcoin on their balance sheets, while Amsterdam-based payment processor Adyen did not rule out the possibility.

Updated: 5-16-2021

Bitcoin Is Durable, Says BlackRock’s Rick Rieder

The chief investment officer seemed to be unmoved by Elon Musk’s announcement on Wednesday but still highlighted some challenges Bitcoin will likely face.

Rick Rieder, chief investment officer at BlackRock Financial Management, is pushing back against Telsa CEO Elon Musk’s decision to drop Bitcoin as a form of payment.

In an interview with CNBC’s Squawk Box on Thursday, Rieder said Bitcoin (BTC) had “not reached maturity yet” and still had some hurdles to overcome, like the public perception of its energy consumption and price volatility. Though he didn’t specifically mention Musk’s claims that the crypto asset comes “at a great cost to the environment,” he said BTC wasn’t “a normal, stable asset” just yet.

“I think it’s durable,” said Rieder, referring to Bitcoin. “I think it will be part of the investment arena for years to come, but some of these challenges and the volatility around it — regulatory dynamics, fiat currency concerns relative to crypto […] — are real. They will be overcome over time.”

“Bitcoin is an interesting asset. It is one that has not reached maturity yet,” BlackRock’s @RickRieder #btc #bitcoin. “I think it’s durable. I think it will be part of the investment arena for years to come … but these challenges are real. They will be overcome over time.” pic.twitter.com/EentcYawQN

— Squawk Box (@SquawkCNBC) May 13, 2021

Rieder said in February that Blackrock had “started to dabble a bit” in crypto, acknowledging that investors may sometimes want to hold digital assets instead of fiat. His comments came following the multitrillion-dollar asset manager mentioning Bitcoin in two prospectus filings with the United States Securities and Exchange Commission. The filings suggest the possibility of BlackRock using Bitcoin derivatives and other assets as part of its investment scheme.

Following Musk’s remarks on the environmental impact of Bitcoin, the price of the crypto asset fell to under $50,000 for the first time in weeks. At the time of publication, BTC’s price is $50,590, having dropped 11% in the last 24 hours.

The head of fixed income at the world’s largest asset manager says he is distributing his wagers broadly in the face of unprecedented times. He doesn’t expect the pandemic recovery and fiscal stimulus to spur a wave of inflation that ends the long bull market in bonds, but he is also hedging those wagers after learning early in his career that being right isn’t the same thing as making money.

Recently, that has meant trimming assets sensitive to inflation and interest-rate swings, building up cash in his portfolios and buying more corporate loans for their higher returns. To the clients calling to ask whether the economy is overheating, he says price increases are likely temporary, but that the Federal Reserve will have to gradually reduce support for the economy—a prospect he doesn’t find daunting.

“We don’t think inflation is going to be that high for a persistent period of time,” says Mr. Rieder, 59 years old. “But if the markets believe in inflation, well that’s more important than whether six months from now people say, ‘Gosh, you were right.’”

His stance is a key marker on Wall Street, and it stands out at a time when broad inflation worries have racked markets. BlackRock handles $9 trillion in assets on behalf of investors around the globe. Mr. Rieder oversees roughly 20% of that. That alone would give his decisions reach far beyond the company. He is also known as a wizard at divining market forces from the swings of currencies or sovereign bonds.

Many on the Street disagree with his sanguinity. Investors including Bridgewater Associates founder Ray Dalio and billionaire trader Stanley Druckenmiller are among those worried that the government’s post-pandemic largess risks fueling inflation, hurting the dollar and inflating asset bubbles. A measure of inflation surged in April as the U.S. recovery gained steam, with consumer prices jumping to the highest 12-month level since 2008.

Mr. Rieder’s position is supported by benchmark bond yields, which continue to suggest a rapid return to slow, steady growth. The yield on the 10-year Treasury note, which tends to rise when investors expect a surge in growth and inflation, settled at its highest level in more than a month after data Wednesday showed a bigger-than-expected climb in consumer prices. It remains below its yearly high of 1.749% hit at the end of March.

Wall Street colleagues and competitors describe Mr. Rieder as the opposite of a swashbuckling trader: affable, modest, measured—a 10-handicap golfer whose favorite course is Augusta National. In an era of slow growth, heavy borrowing and perpetually low interest rates, his focus on the crosscurrents of markets and economics commands attention from many.

“There isn’t an investor out there who doesn’t want to know what he’s thinking,” says Marc Badrichani, global head of sales and research at JPMorgan Chase & Co. “With an expansive view of global markets, he has a unique ability to spot emerging trends and incorporate them into long-term investment strategies.”

Raised in Westchester County in New York and educated at Emory University and the University of Pennsylvania’s Wharton School, Mr. Rieder says he enjoyed picking penny stocks when he was younger, such as shares of AMF Bowling Worldwide Inc., and thought he might become a financial analyst.

After business school, he joined E.F. Hutton & Co. in 1987 without knowing much about bonds. Brokers shouted and flashed hand signals. The trading floor was jammed with bulky computers, but he says he relied on blotters, pen and paper.

“I’ll never forget the first month, sitting there and thinking maybe this is the wrong job,” Mr. Rieder says. “I couldn’t figure out what they were talking about. It was all lingo. I’d go home, and then a week later I’d realized I heard that word again.”

An early trade provided a lifelong lesson. Mr. Rieder bought a chunk of Canadian bonds issued by a utility company, Hydro-Québec. He still remembers the coupon and maturity—details on a bond that affect its value.

He would stay after work to write down the price of every asset that could move his investment. Certain in his analysis, he bought even more. But word of his position got out to traders at other banks. The price moved against him, and he eventually sold at a significant loss. Ever since, he has avoided putting too many eggs in one basket, a strategy he calls “make a little bit of money a lot of times.”

“It changed my thinking and really influenced how I thought about fixed income,” Mr. Rieder says. “I learned that you may be right, but if enough people believe you’re wrong the markets can really hurt you.”

It is a strategy that served him well during his climb at BlackRock. He joined the firm in 2009 to run alternative investments for fixed income and became known for his deep dives into data and a habit of cramming multiple, tiny charts into presentation slides. His performance—three of the funds he manages have been awarded gold medals by rating company Morningstar—eventually earned him a promotion to chief investment officer of fixed income in 2010.

In April 2019 he took over BlackRock’s Global Allocation Fund, which includes investments in stocks. Institutional-class shares have since posted a cumulative return of 35% through March 31, outperforming benchmarks and other comparable funds. More than 85% of BlackRock’s actively managed taxable fixed-income assets beat peers or benchmarks over the one- and five-year periods ended March 31.

Morningstar analyst Claire Butz says the ratings company upgraded the Global Allocation Fund in May because of Mr. Rieder’s leadership and ability to combine big-picture views with extensive research. She says his takeover was “a welcome change from the previous manager’s more siloed approach.”

BlackRock has also ascended. Quarterly profit rose 49% in April. The firm posted record inflows, with $61 billion pouring in to fixed-income investments in the first quarter of 2021. Across all strategies, BlackRock took in $171.6 billion in net new money, up from roughly $35 billion in the year-earlier quarter.

That size makes BlackRock a prized client for bond desks across Wall Street, with dedicated top-ranked salespeople squabbling over the revenue generated from its trades. It also poses a challenge for Mr. Rieder’s strategy—making it hard to invest in smaller markets without moving prices.

The inflows also indicate that investors remain willing to buy bonds and other fixed-income investments, despite the worries about inflation or a sudden reversal from the Fed.

Mr. Rieder expects growth to surge and the dollar to remain stronger than many analysts and investors currently predict. Inflation could be “shocked higher over the next few months,” Mr. Rieder says, but he expects it to remain contained in the long term by trends that include an aging population.

“We are living in a very different time than the 1970s and 1980s because of the demographics,” he says. “As the baby-boomer population ages, individuals have to buy fixed income for pensions, retirement investments—and soak up this huge amount of debt that’s coming, meaning it’s not as scary today.”

Still, he has adjusted his holdings for potential inflation risks. He has pared positions in junk bonds, citing their extremely low yields. He is also holding a lot of cash in portfolios, increasing his investments in loans and buying long-dated corporate bonds with derivatives that offer protection from interest-rate swings. He is holding some euros, too.

The possible end of easy monetary policy doesn’t worry Mr. Rieder, who has lived through previous Fed tapering that didn’t deal a lasting blow to stocks and other assets.

“Letting rates normalize, knowing what that plan is—markets can deal with that, they just don’t like uncertainty,” he says. “It’s really hard setting your portfolio up when you’re not certain how that plan will evolve.”

Updated: 7-15-2021

BlackRock CEO Larry Fink Seeing ‘Very Little’ Demand For Crypto Lately

Fink said he has been asked about crypto and bitcoin in the past, but not in the last two weeks.

BlackRock CEO Larry Fink said in a CNBC interview on Wednesday that he is not seeing much demand for digital assets.

* Talking on CNBC’s “Squawk Box” before a call to discuss BlackRock’s second-quarter earnings, Fink said he has been asked about crypto and bitcoin (BTC, -1.47%) in the past, but not in the last two weeks.

* “We see very little demand for those [crypto] types of things,” Fink said.

* He had previously said that bitcoin has “caught the attention” of many people and that the cryptocurrency market was still relatively small compared with others.

* “If we could improve financial literacy. If we could help more people focus on not just speculating of markets and the ups and downs but translating that into investing in the long run,” Fink said in December, commenting on meme stocks.

* BlackRock said Wednesday it has about $10 trillion of assets under management.

BlackRock Closes In On The Once Unthinkable, $10 Trillion In Assets

Chief Executive Larry Fink says inflation is here to stay.

BlackRock Inc.’s second-quarter profit rose 14% on new money coming into the giant asset manager, a sign that investors are becoming more confident about an economic recovery.

The company posted a quarterly profit of $1.378 billion or $8.92 a share, up from $1.214 billion or $7.85 a share a year earlier. Its revenue grew 32% to $4.82 billion.

Its assets under management rose 30% to $9.5 trillion, from $7.3 trillion a year earlier, cementing its dominance as the world’s largest money manager. Known for its funds that track markets and trade rapidly on exchanges, BlackRock’s returns reflect the market’s tremendous rally since the depth of the pandemic and Chief Executive Larry Fink’s push to build a company that serves nearly all types of investors.

While the firm’s returns were lifted by a slate of assets rising to record highs, its fortunes remain tied to markets and shifts in investor sentiment. Mr. Fink will now have to navigate an environment where the pandemic and the central banks’ intervention in markets are changing the economy in radical ways. Prices for things from used cars to oil have risen as the U.S. economy opens up.

And, as the largest shareholder of many of the country’s largest companies for investors, Mr. Fink thinks inflation is likely here to stay.

“I don’t think it’s temporary,” he said.

He said government policies that focused on protecting domestic jobs and America’s supply chain will have inflationary effects. He added that most of the businesses he is talking to are behind on their hiring plans for 2021. This is going to lead to wages rising.

“We’re making structural changes that are going to change the framework of inflation,” he added.

He projects that inflation will exceed 2% annually over the next five years or so.

BlackRock said it was raising base salaries by 8% for active employees up to and including director levels.

Shareholders weren’t thrilled by the prospect of higher wages eating into future profits. BlackRock stock fell by more than 3% in morning trading.

Although BlackRock adjusted profits beat analysts’ estimates, the amount of new money it took in was less than what Wall Street had projected.

BlackRock added roughly $81 billion of new investor money, down from the $100.2 billion haul in a year earlier. Part of the fall came from one big pension fund withdrawing indexed assets in the first half of the year.

Money moving through the company’s sprawling lineup of exchange-traded funds, index products and other funds is a barometer of Wall Street sentiment and where major investors are making bets.

Amid the surge in stocks, bond funds have lost some of their luster this year. Investors added $41.29 billion in money to BlackRock’s bond funds in the second quarter, down from $60 billion in the year-ago quarter.

Some investors are demanding higher yields to be compensated for the risks of inflation.

“Inflation is more damaging to fixed income because the cash flows don’t mean as much as it used to for investors,” said Kyle Sanders, an analyst with Edward Jones.

Some $23 billion of new flows in the quarter went into money funds and cash management products.

With interest rates so low, BlackRock has had to cough up money to prevent yields of money-market funds from dipping below zero in recent months. In the second quarter it gave up some $160 million to prevent yields from turning negative. That is about twice what it gave up in the first quarter.

The firm continues to drive the cost of many funds ever lower, squeezing competitors across the industry. This strategy has cemented the dominance of its exchange-traded funds that trade like stocks on exchanges. That business took in $75 billion in new flows in the quarter.

BlackRock’s business of funds run by bondpickers and other portfolio managers that make active bets continues to gain new investor flows. Despite being a smaller chunk of the firm’s assets, this business generated $1.8 billion in base fees and securities lending revenue in the quarter, on par with the $1.8 billion from index-tracking strategies and ETFs.

Mr. Fink said that active flows helped buoy growth. “Our quarter really yells at that,” he said. “That is indicative of the importance of the active side of BlackRock.”

BlackRock sells software, including a suite of tools called Aladdin, to banks and other institutions to measure risk. Technology-services revenue—which includes fees from Aladdin—rose by about 14%.

BlackRock has also been trying to become a bigger purveyor of funds that can profit from governments’ new focus on climate risks. It generated $35 billion in net flows from sustainable-branded funds in the quarter.

As the firm grows bigger, it faces more scrutiny on how it is wielding shareholder votes on behalf of millions of investors. Mr. Fink said Wednesday that BlackRock is studying ways to let more people whose money the firm is investing for exercise their own voting power.

Updated: 1-6-2022

Larry Fink Wants To Save The World (And Make Money Doing It)

CEO of giant asset manager BlackRock uses his position to push firms to address climate change.

Few private citizens wield more power in America today than Larry Fink, the chief executive of BlackRock Inc. in pushing companies to embrace climate-friendly policies, that has made him a lightning rod.

The firm he runs manages some $10 trillion for pension funds, endowments, governments, companies and individuals, equal to more than 10% of the world’s gross domestic product in 2020. Its funds are among the three largest shareholders in more than 80% of the companies in the S&P 500.

As steward for millions of investors, BlackRock wields vast shareholder voting power, which it uses either to back managements or to prod them in new directions.

Today, Mr. Fink is telling CEOs that companies must prepare for a scaleback of fossil fuels, and that the private sector should work with governments to do so.

He warns of the disruption climate change could cause both the economy and financial markets, but sees historic investment opportunity in the energy shift. It’s a point he has made to conferences in Davos, Venice, Riyadh and Glasgow over the past year.

“This is the beginning of a long but rapidly accelerating transition—one that will unfold over many years and reshape asset prices of every type,” he said in a letter to CEOs last year.

Mr. Fink’s power, combined with his advocacy on a hot-button issue, has made him a flashpoint for activists, politicians and unions, both those who think BlackRock isn’t doing enough and others who say it’s doing too much.

Five Democratic senators wrote to Mr. Fink in 2020 saying BlackRock needed to support more shareholder resolutions to match his promises. In France that year, activists stormed BlackRock offices, flung papers and paint and scrawled “GREENWASHING” above a desk.

Tariq Fancy, a former BlackRock executive who runs an educational nonprofit, said Mr. Fink’s message is distracting people from more-dramatic measures Mr. Fancy argues are necessary, such as carbon taxes.

“It’s like giving wheatgrass to a cancer patient,” he said. “The false promise of this wheatgrass serves to delay the onset of the more painful, yet necessary, solutions.”

Hanging over the discussion is the argument that Mr. Fink is taking on a role better left to elected representatives.

In mid-2021, two Republican senators wrote to a large 401(k)-type plan expressing concern BlackRock was putting its CEO’s views ahead of investors’ needs and infusing left-leaning priorities in its voting guidelines.

Real-estate investor Sam Zell said to CNBC a few years ago: “I didn’t know Larry Fink had been made God.”

Mr. Fink says BlackRock acts as a voice for its investors. Mr. Fink, who describes himself as a conservative Democrat, says he isn’t being political when he says investors and businesses should work alongside the government to address broad problems. When companies play a role, he says, they reduce the need for governments to engage in deficit spending to tackle the issues.

“I believe in the power of American capitalism,” Mr. Fink said. “Progressives don’t believe deficits matter. I do.”

Mr. Fink says companies that embrace their responsibilities in crises can fulfill a role in society while delivering returns to shareholders. In an interview at his horse farm in Westchester County, north of New York City, he brought up an example from the previous century.

“See what Johnson & Johnson did in World War I and II,” he said. “You can call them opportunists by providing Band-Aids and gauzes and all that stuff to the military, but they were there during the crisis and stood there.”

As for BlackRock, he says, it can help investors by offering funds focused on environmental, social, and governance-minded investing, plus software to gauge climate-related risks such as drought and floods.

In 2020, he told CEOs BlackRock would be increasingly disposed to vote against boards and companies that don’t report their climate risks in formats BlackRock endorses.

Mr. Fink also presses companies to disclose more on the social effects of their business, such as the welfare of their workers or their local communities. To him, this is just good business; he says companies attentive to societal needs wind up protecting shareholder returns.

Many of BlackRock’s investors want the firm simply to track the markets through index funds, which it does in channeling money into economies from China to Argentina to Saudi Arabia.

Mr. Fink’s prominence partly reflects changes in finance, including a move away from active stockpickers and toward passive index funds. That in turn has shifted the dynamic in corporate boardrooms to give power to large asset managers such as BlackRock.

U.S. government officials have called on Mr. Fink to help them cope with crises—the pandemic-rattled financial markets in March 2020, and, a dozen years earlier, market dangers posed by the failing bank Bear Stearns.

“Treasury Secretaries and finance ministers come and go,” said David Rubenstein, the co-founder of the private-equity firm Carlyle Group Inc. “They work for someone else who can fire them tomorrow and have to build what others want them to. When you are the CEO of the biggest asset manager, you don’t have to do that.”

Laurence Fink got his start on Wall Street at First Boston, where he ran a desk that pooled together mortgages and other loans and sold off pieces of the bundles. While investors snapped up safer tranches of this financial innovation, the riskiest parts stayed on the bank’s balance sheet.

When interest rates fell in 1986, his desk lost $100 million in the second quarter. Mr. Fink was forced to leave.

He founded BlackRock two years later with the desk’s head trader, Rob Kapito, and six others. A scrappy bond manager in its early days, BlackRock lured investors with the pitch that it had the same risk technology as big banks but without the conflicts they had when they used their own money to make bets on companies.

In March 2008, BlackRock was drawn into Fed efforts to cope with the deflating housing bubble. On a Sunday, New York Fed President Tim Geithner and Treasury Secretary Hank Paulson asked Mr. Fink for help as they scrambled to forestall a messy collapse of Bear Stearns, desperate to find a solution before Asian markets opened in a few hours.

Mr. Fink raced from his farm to the Federal Reserve Bank of New York after getting Mr. Geithner’s call that day.

The officials wanted Bear to be absorbed by JPMorgan Chase & Co. but that bank worried about Bear’s stash of rapidly souring mortgage assets. No one was sure what these were worth. Messrs. Geithner and Paulson asked Mr. Fink: If the Fed provided financing for a newly formed company that would absorb Bear’s bad assets, was there a reasonable chance the collateral could cover the loan?

Mr. Fink told them U.S. taxpayers wouldn’t lose money over the long run. U.S. officials moved the radioactive assets into a limited-liability company financed by the Fed so JPMorgan could be comfortable taking over Bear, which it did. BlackRock helped select which assets went into the LLC portfolio and oversaw it for the government. That program ultimately delivered gains for taxpayers.

“Larry was perfect for this job,” Mr. Paulson recalled. “No one understood the market better, and BlackRock was not teetering on the brink.”

Roughly a year later, Mr. Fink got a chance for BlackRock to acquire Barclays PLC’s money-management business. BlackRock had considered buying the business in the past. Now he pressed for a deal.

In June 2009, he celebrated the birth of his first grandchild. He held the baby, then headed to the office for an all-nighter to raise the final $3 billion needed to acquire Barclays Global Investors.

The deal lifted BlackRock’s assets under management to roughly $3 trillion and gave it an arsenal of index-mirroring funds with much lower fees than actively managed funds.

It also gave Mr. Fink a megaphone. When it was time to proof an annual letter on how BlackRock approached its duties as a shareholder, Mr. Fink initially refused to sign it. He thought the letter didn’t reflect his voice, and wanted one that did.

Now that BlackRock reached across the entire market, Mr. Fink decided the firm needed to be a counterweight to activist investors who target companies looking to make a quick buck. “There needed to be a louder voice for long-term investors,” he said.

BlackRock in 2012 released the first of Mr. Fink’s annual letters to CEOs, which have become required reading for many chief executives. He uses the letters to prod, scold and push companies to disclose more about how they provide for workers, the environment and the community at large.

The letters emerge from a monthslong writing process that involves debates by executives and occasional help from former Fed and Treasury speechwriters.

“Climate risk is investment risk,” Mr. Fink has told readers. Also, “Profits and purpose are inextricably linked.”

Starting in 2019, his letters drew the attention of a Federal Trade Commission official, Bilal Sayyed, who showed some to colleagues at the antitrust agency and asked them to think about whether BlackRock was affecting competition in industries.

The FTC later proposed a rule that a money manager must alert regulators when, across all of its funds, it oversees a certain size stake in a particular company. The proposal’s fate is in limbo in the Biden administration.

For much of his career, Mr. Fink was known for arriving at the office by 6 a.m., while traveling two weeks a month. He now starts his workday about 7:30 following a session with a trainer. His back feels the toll from years of desk work, said Mr. Fink, who is 69.

BlackRock’s board and executives, as part of discussions on succession planning, recently asked Mr. Fink to continue as CEO. He said he is planning to retire in no more than five years.

As a CEO, he can be impatient, colleagues say, and hates to be beaten. When Fidelity Investments in 2018 shook the money-management business by offering zero-fee index funds, Mr. Fink called a meeting and told his teams to pick up the phone and put BlackRock’s name in front of clients.

“Stop tripping over your d—ks,” he demanded, according to several people at the meeting. BlackRock fired back at Fidelity by cutting costs on several funds.

On March 18, 2020, with the coronavirus spreading, stocks tumbling and bond trading seizing up, Mr. Fink got another summons to Washington.

Treasury Secretary Steven Mnuchin organized an Oval office meeting, hoping the conversation would make clear to then-President Donald Trump that a government response to the pandemic needed to be big.

The president and officials debated what needed to be done and how. They discussed how much the government should spend to keep the economy afloat. “Trillions,” Mr. Fink said.

In the next week, the government unveiled a roughly $2 trillion package, some of it to fund an emergency effort to prop up financial markets.

A formal role for BlackRock wasn’t discussed at the meeting, but soon the Fed hired a BlackRock unit to help it pump money into corporate bonds—a first for the central bank—and other markets. The markets stabilized, and bond ETFs gained the stamp of approval as a central bank tool.

Part of BlackRock’s assignment was helping the Fed buy bond exchange-traded funds, including BlackRock’s own. In the rush to head off a deep recession, the Fed didn’t bid out the job. it simply hired BlackRock.

In April that year, three Democratic lawmakers urged the government to provide safeguards to avoid cementing BlackRock’s importance to the economy through the firm’s crisis work.

Mr. Fink said he understands why BlackRock’s role was controversial. The firm estimates it lost money on the work, given the resources and time consumed, said people familiar with the matter. It didn’t charge fees on any ETFs in the portfolio it ran for the Fed and rebated fees from its own ETFs back to the Fed.

Mr. Fink has cut back his travel during the pandemic but invites one or two CEOs each week to his Manhattan townhouse for dinner. He says they order take-out food and do the dishes afterward. He spends Thursday evenings to Sunday afternoons at his farm, where he has installed a desk in a barn filled with American folk art.

There, he has planted some 400 American chestnut trees as well as apple trees, elms and maples through the years. Mr. Fink gets excited as he identifies each species.

Through the day, the duck ringtone on his cellphone goes off. When company executives phone to cajole, persuade or threaten BlackRock on how it should handle proxy votes on executive pay or climate proposals, Mr. Fink hands them off to a BlackRock group that interacts with companies.

Though he is in discussions on rules guiding the firm’s votes, he removes himself from decisions on any one vote.

“I tell them factually that is not my job,” he said.

Among thousands of recent shareholder votes, BlackRock wielded ballots in ways that helped to shake up Toshiba Corp.’s board, elect three board members at Exxon Mobil Corp. in a referendum that revealed discontent with the oil company’s climate strategy, and oppose an executive-pay package at AT&T Inc.

In 2017, Mr. Fink was part of a group of CEOs serving as a sounding board for former President Trump on business policies. After the racially motivated and violent clash in Charlottesville, Va., that year, Mr. Fink huddled with another member, PepsiCo Inc.’s then-CEO Indra Nooyi, over what both considered Mr. Trump’s insufficient condemnation of those behind the violence, and the two decided to step down from the group. Some other CEOs arrived at the same position, leading the president to dissolve it.

Three former BlackRock employees have key positions in the Biden administration, including the firm’s former head of sustainable investing. Mr. Fink says he has never raised money for any presidential candidate and has donated to both Republicans and Democrats over the years.

BlackRock published a study in 2019 on how it said climate change and events related to it affect the municipal-bond market and how extreme weather threatens infrastructure. The firm forecast that 58% of U.S. metro areas would suffer gross domestic product losses of at least 1% over the next decades if they didn’t prepare for climate risks.

With its index funds, BlackRock is locked into investing in all kinds of companies, from coal miners to wind farms. In portfolios run by active managers, the firm has scaled back thermal coal exposure, as it pledged to, and said last year it would flag companies that posed significant climate risk for potential selling.

Addressing a meeting in Venice of leaders from the Group of 20 nations last July, Mr. Fink urged ministers to create more private-public partnerships for renewable-technology investments.

One idea he pushed was authorizing the World Bank and International Monetary Fund to shoulder the first losses on sustainable-energy projects, so other investors would feel safe putting in money. It was an echo of how the U.S. in 2008 fenced off the worst Bear Stearns holdings to encourage JPMorgan to take over the firm.

In the lead-up to the Glasgow climate summit, Mr. Fink asked other finance CEOs to press government leaders to create incentives for investors to fund alternative-energy sources. He urged other executives to drop calls for carbon taxes, saying their cost would trigger a backlash, according to people familiar with the matter.

He also helped steer debates among finance executives on steps needed for the steel, aviation and oil-and-gas sectors to reduce carbon emissions, and on how society should account for the growing pile of assets that would be deemed worthless along the way.

“Society is trying in certain instances to pressure companies to do more, including at times what ought to be the role of government,” said Evan Greenberg, the CEO of insurance company Chubb Ltd. , who has gone fly-fishing with Mr. Fink.

He added: “I believe Larry chose consciously to approach it as an opportunity, rather than something he is expected to do.”

Updated: 2-9-2022

BlackRock Planning To Offer Crypto Trading, Sources Say. Could This Make Spot Bitcoin Approval ETF Inevitable?

Clients would be able to trade crypto through the firm’s Aladdin investment platform, said one of the sources.

BlackRock, the world’s largest asset manager, is preparing to offer a cryptocurrency trading service to its investor clients, according to three people with knowledge of the plans.

The New York-based company, which manages over $10 trillion in assets for institutions, plans to enter the cryptocurrency space with “client support trading and then with their own credit facility,” one of the people said. In other words, clients would be able to borrow from BlackRock by pledging crypto assets as collateral.

One of the people said BlackRock will allow its clients – which include public pension schemes, endowments and sovereign wealth funds – to trade cryptocurrency through Aladdin (short for “Asset, Liability, Debt and Derivative Investment Network”), the asset manager’s integrated investment management platform. The timetable for unveiling the service is unclear.

The asset manager may have been telegraphing its intentions as early as June when it began hiring for an Aladdin blockchain strategy lead. These days it’s taken as known that Wall Street banks and large financial institutions are edging into crypto, with the likes of Goldman Sachs, Morgan Stanley and Citi carefully choosing strategies.

BlackRock has already sent some positive signals to the market regarding crypto, including trading CME bitcoin futures, as per a filing with the U.S. Securities and Exchange Commission. The company also has plans to launch the iShares Blockchain and Tech ETF, an exchange-traded fund tracking an index composed of companies involved in crypto technologies in the U.S. and abroad.

BlackRock also owns 16.3% of MicroStrategy, whose CEO, Michael Saylor, regularly trumpets news about his firm’s bitcoin holdings.

A second person with knowledge of the plans said BlackRock was “looking to get hands-on with outright crypto” and was “looking at providers in the space.”

A third person referred to a working group of “approximately 20 or so” inside BlackRock that is evaluating crypto, adding, “They see all the flow that everyone else is getting and want to start making some money from this.”

Updated: 4-12-2022

Blackrock And Others Infuse $400 Million Into Stablecoin Issuer Circle

BlackRock joined three other firms to invest $400 million in Circle, the issuer of the second largest stablecoin (USDC). The world’s largest a*set manager will also act as the primary manager of USDC reserves to help explore the stablecoin’s use in capital markets.

“It’s tremendous to have Blackrock in particular put their confidence behind a critical part of the infrastructure that we think has the opportunity to be a huge part of the way the future financial and economic system works in the United States,” Jeremy Allaire, Circle’s founder and CEO, told Yahoo Finance.

Along with BlackRock, Circle’s private capital raise of $400 million comes from Fidelity Management and Research, the London-based hedge fund Marshall Wace, and fintech asset manager, Fin Capital. BlackRock was not the lead investor in this funding round.

The news comes a month after BlackRock Chairman and CEO Larry Fink wrote in a letter to shareholders that the firm was “studying digital currencies, stablecoins, and the underlying technologies.”

Unlike other crypto a*sets, the value of stablecoins aren’t supposed to fluctuate if properly managed. Instead, these tokens are pegged to another a*set, most often the U.S. dollar.

Currently, the total circulating supply of USDC amounts to $51 billion, down by $2 billion as of the stablecoin’s February 28 attestation. According to Allaire, USDC’s reserves are composed of cash and short-duration U.S. Treasury bonds that are held in custody by BNY Mellon.

As part of this announcement, Blackrock will take a principal role in managing USDC’s reserves, which should enhance USDC’s legitimacy in the eyes of crypto-native and traditional investors alike.

While the broader partnership between the two firms could prospect a wide range of applications for USDC in traditional capital markets, Circle’s Allaire said the stablecoin could bring more efficiency to capital markets by improving transaction settlement time and finality while lowering counterparty risk.

“This is an opportunity to invest for what I really think is going to be the future plumbing of the financial system and given the role [BlackRock] plays with $11 trillion in a*sets under management, I think they care a lot about how the financial system is going to work in the future,” Allaire added.

As for Circle, its plans for a SPAC aren’t over, according to Allaire. While the company announced in July of last year that it would enter public markets through a special purpose acquisition company with plans to list in the fourth quarter of the year, it renegotiated the terms of the deal in mid-February, allowing it to raise private capital up to a 15% discount at a $9 billion valuation.

This “re-SPAC” as Allaire called it, is a less conventional route for companies going public through the investment vehicle. According to Allaire, Circle hopes to “de-SPAC” and list publicly in the third quarter of this year.

Updated: 5-10-2022

BlackRock’s $100 Million London Trader Turns Bearish Amid Record Losses

* Alister Hibbert Shifts Strategy With Stock Markets Tumbling

* The Strategic Equity Hedge Fund Is Down 13% This Year

BlackRock Inc. star money manager Alister Hibbert has turned bearish as his hedge fund endures its worst-ever losses amid a sharp decline in stocks.

The BlackRock Strategic Equity Hedge Fund tumbled 13% this year through April, a person with knowledge of the matter said. That exceeds its worst annual decline of 11%.

The money manager, who has profited from the historic surge in stocks since starting the fund in 2011, turned net short for the first time ever this month, said the person. His portfolio was net long about 35% at the end of last year.

The reversal marks a seismic shift underway in global markets as soaring inflation forces central banks to end quantitative easing and raise interest rates. That has led to a selloff in markets with growth stocks, led by the technology sector, falling further in a setback for equity-focused hedge funds.

Hibbert has run his fund with a tilt toward growth stocks and owned shares such as Microsoft Corp. and Mastercard Inc. He flagged his cautious outlook earlier this year, telling clients that the strongest phase of economic recovery, characterized by soaring earnings and cyclical performance, was now over. The fund had about $9 billion of assets on Dec. 31.

“It is clear that the normalization of the economy post-pandemic is not going to be an entirely orderly process,” he wrote in a letter to investors in March.

A BlackRock spokesman declined to comment.

BlackRock shares have tumbled about 34% this year. In a March letter to investors, Chief Executive Officer Larry Fink expressed disappointment in the stock’s performance and cited challenging markets for the decline.

London-based Hibbert has long been one of the best-paid risk-takers at the world’s biggest asset manager and key to BlackRock’s expansion into active management and driven-performance fees. He earned a nine-figure sum, more than triple the size of Fink’s $30 million payout in 2020.

Hibbert started the hedge fund more than a decade ago with just $13 million and turned it into one of the largest long/short money pools, generating annualized returns of almost 17% until last year. The fund has had only two annual declines. Hibbert also runs a concentrated long only fund — BlackRock Global Unconstrained Equity Fund — which is down about 20% this year, according to Bloomberg data.

Equity hedge funds have been the worst performing broad strategy so far this year, losing 6.4% through April, according to data compiled by Bloomberg.

Updated: 9-29-2022

Amundi, Blackrock Stumble In China As Wealth Products Disappoint

* The Money Managers Launched Wealth Offerings In Past 2 Years

* Products Struggling Amid Turbulent Markets, High Expectations

China may be a lucrative wealth management market, but it’s also a difficult one to crack.

Two of the world’s biggest investors, Amundi SA and BlackRock Inc., have stumbled since starting selling wealth products through joint ventures in the country over the past two years.

Chinese retail investors have criticized Amundi for falling short of performance targets, while local press have highlighted how some BlackRock’s offerings are making losses.

The slow start comes at a turbulent time for markets, as onshore bond yields slide and an index of the nation’s shares falls more than 20% this year.

China’s unique wealth management culture — until recently, banks and others had promised guaranteed high returns — is adding to the global money managers’ woes, as irate local investors demand better performance.

“They entered the market at a difficult time,” said Harry Handley, a senior associate at Shanghai-based consultancy Z-Ben Advisors Ltd. “For fixed income-focused Amundi, it faces an environment where onshore yields are falling,” he said. For BlackRock, which focuses more on stocks, “equity volatility has been high and the CSI 300” — a gauge of Chinese equities — “has been weak.”

Amundi, Europe’s largest money manager with $1.9 trillion in assets under management, launched a joint venture with Bank of China Ltd.’s wealth management unit in 2020, the first after China allowed global firms to participate in the sector.

BlackRock, which oversees $8.5 trillion, started the second with a subsidiary of China Construction Bank Corp. in 2021.

Amundi BOC Wealth Management Co. began selling so-called wealth management products in China in 2020, placing at least 80% of the underlying assets for most offerings in debt.

Like peers, it sets what’s called a performance benchmark for each of them, which can take various forms from an exact percentage like 3% to a range or a premium on top of a market rate.

These benchmarks came into use after the country started to overhaul the asset management industry, including the 29 trillion yuan ($4.1 trillion) wealth products sector, in 2018, which included banning promises of guaranteed returns.

The benchmarks are headaches for global money managers. If a company sets the rate too low, it won’t attract customers. If it sets it too high and falls short, investors may take their business elsewhere.

To make matters worse, Chinese banks and others have traditionally reached their targets by investing in what’s called non-standard assets, such as risky, opaque and less-liquid debt that isn’t listed on public markets.

It’s a Catch-22 for global asset managers that may not be willing to do the same.

“Amundi made it clear from the outset of this joint venture that it will stay away from the shadow-banking exposure that is a yield-enhancing staple of products from local banks,” Z-Ben’s Handley said. “It is essentially a trade-off between instilling global risk management standards and meeting onshore performance expectations.”

Almost 90% of wealth management products met or exceeded their benchmarks in the first half of the year, according to research firm PY Standard.

All but five of the 30 Amundi BOC offerings that had matured as of Sept. 8 fell short of theirs, registration data show.

Retail investors have criticized the Amundi BOC products on social media sites such as Zhihu, the Chinese equivalent of the question-and-answer website Quora, for giving much lower gains than their benchmarks.

Amundi BOC said in an emailed response that wealth management products witnessed fluctuations in the first half of the year due to swings in bond and equity markets.

The company’s first batch to mature, which were all one-year, fixed-income products, still delivered positive returns even as markets fell for half the time, it said.

To be sure, non-standard debt, which was widely used to prop up returns before 2018, accounted for just 7% of wealth management products’ assets as of June 30, down almost 6 percentage points from a year earlier, according to official data.

“Some underperforming fixed income-plus products” — which invest in debt and, for example, equities — “may not have done well in timing the market this year,” said Zhang Wenchao, president of Shanghai Yunhan Asset Management Co. “Trading capabilities are key for the ‘plus’ part.”

BlackRock CCB Wealth Management Co. initially took a different approach, starting with two equity products. Equity offerings accounted for less than 0.3% of all wealth management products in China as of June 30, according to official data. Fixed income-focused ones make up 94%.

Two of the joint venture’s four products as of late July were sitting on losses, the highest share of loss-making products among wealth management firms, local media 21st Century Business Herald reported last month.

BlackRock CCB now has five products, two of which focus mostly on fixed income while one is a more balanced hybrid of equities and debt. The two equities offerings are still loss-making.

Still, as of the end of last month, the equity products were beating their benchmarks, according to Bloomberg calculations.

BlackRock is replacing the head of the China wealth management unit, it said in an emailed statement Thursday.

A spokesperson for BlackRock said it’s committed to offering a range of products to Chinese investors.

Amundi BOC had $11.6 billion in assets under management as of June 30. BlackRock CCB raised more than 7 billion yuan with its five products. The figures are a tiny fraction of the money overseen by Amundi and BlackRock globally.

The stakes are about to get higher. Wealth management products were included as investment options in the government’s framework for establishing an individual pension system earlier this year.

The plan is to allow people to open pension accounts that will have tax benefits. Asset managers may raise close to $700 billion under the program in 10 years, brokerage China International Capital Corp. estimates.

Wealth management products are generally a profitable business. Nineteen firms focused on selling them reported a combined $2.3 billion in profit in the first half of 2022, up 68% from a year earlier, according to data compiled by local trade media China Fund News.

Amundi, which won customers partly by setting hard-to-reach performance benchmarks, must decide whether to lower them for future offerings. In a sense, both it and BlackRock are learning the difficulties of China’s unique market.

People’s expectations about wealth management products were shaped over many years, said Zhou Yiqin, president of GuanShao Information Consulting Center, which specializes in financial regulations. “It may take five to 10 years to gradually change them.”

Updated: 10-13-2022

BlackRock Profit Falls 16%

Firm’s assets under management decreased to $8 trillion, from $8.5 trillion in the second quarter.

A souring market weighed on investing giant BlackRock Inc. in the third quarter, pushing profit down 16%.

The world’s largest asset manager reported net income of $1.41 billion, down from $1.68 billion in the same period a year earlier.

Earnings amounted to $9.25 a share. That exceeded the $7.06 expected by analysts polled by FactSet.

Revenue dipped 15% to $4.31 billion, above analysts’ estimates of $4.2 billion.

Central banks including the Federal Reserve are raising interest rates to try to cool red-hot inflation, adding stress to a market that is increasingly jittery over a possible recession.

Stocks started the third quarter relatively strong, but soon headed lower as the Fed made increasingly clear that its rate increases are here to stay.

BlackRock is a top provider of exchange-traded funds and other low-cost alternatives that track market indexes, and demand for passive investing has helped fuel the firm’s growth.

BlackRock is also a large provider of actively managed investments, which include businesses like stock-and bond-picking funds.

Investors’ faith in the market declined, evidenced by slowing inflows of $17 billion, down from $75 billion a year ago.

The firm’s assets under management were about $8 trillion, down from $8.5 trillion in the second quarter. That marks the third quarter-over-quarter decline in a row.

BlackRock ended last year with $10.01 trillion in assets, the first time any money manager surpassed that milestone.

BlackRock’s base management fees—fees not tied to performance that the firm receives for administering fund holdings—dipped 10% from a year ago to $3.53 billion.

Performance fees from the firm’s actively managed funds fell 76% to $82 million. BlackRock said that partly reflected lower fees from a single hedge fund.

Its technology remains the asset manager’s bright spot. Revenue from Aladdin, its proprietary software that helps investors manage their portfolios and assess risk, rose 6% to $338 million.

Updated: 6-15-2023

BlackRock ($10 Trillion AUM) Files For Spot Bitcoin ETF

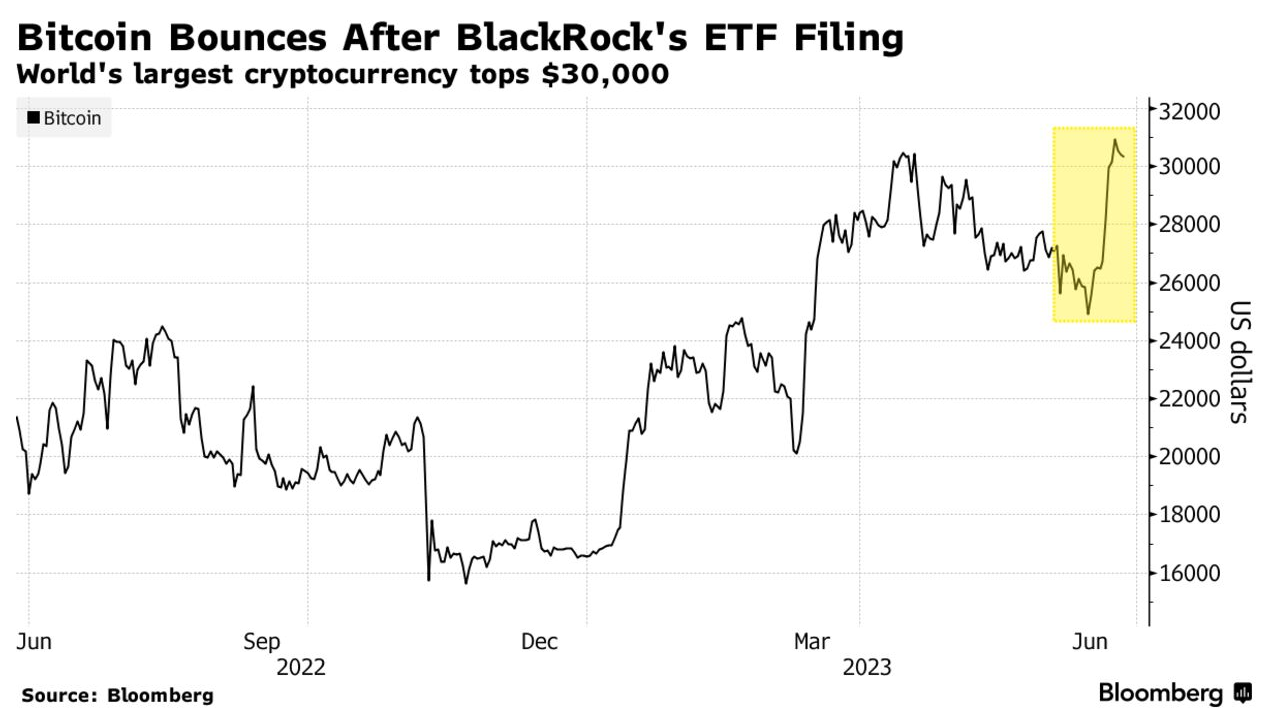

BlackRock may not be easy for the SEC to turn away. It’s the world’s largest asset manager with more than $10 trillion in assets under management (AUM) and the company and its CEO Larry Fink has political power to possibly match that of the SEC and its leader Gary Gensler.

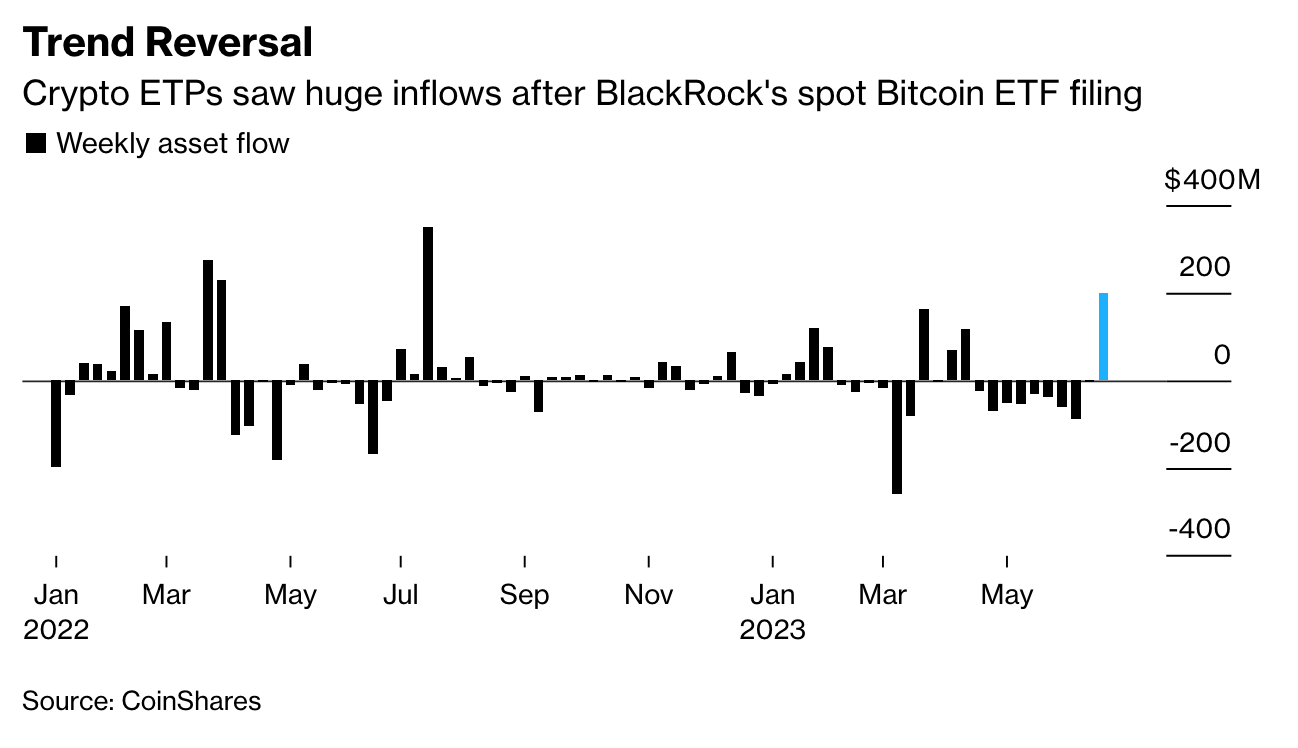

The world’s largest asset manager moving forward with a bitcoin ETF is viewed by some in the industry as an endorsement of the cryptocurrency at a time when the SEC is taking action against some of its biggest players, including Coinbase.

“As the overall ETF industry leader, a BlackRock spot bitcoin ETF could gather significant assets quickly, even if just a small percentage of cryptocurrency assets went into it,” said Todd Rosenbluth, head of research at VettaFi.

“BlackRock’s increasing engagement shows Bitcoin continues to be an asset of interest for some of the world’s largest financial institutions,” said Sui Chung, CEO of CF Benchmarks, a subsidiary of crypto exchange Kraken.

The move is especially impactful for the U.S. crypto industry now, participants said.

If an asset manager as big as BlackRock is making such a move at a time when crypto regulation is being tightened, “they probably have done sufficient due diligence to know there is a decent chance for the ETF to get approved by the regulators,” according to Matt Zhang, founder and managing partner at Hivemind.

A representative at BlackRock didn’t return requests seeking comment.

In the current regulatory environment, BlackRock’s filing for a bitcoin ETF “says a lot about institutional confidence in at least bitcoin,” according to David Tawil, president and co-founder at ProChain Capital.

It also may bode well for the whole crypto industry, Tawil said. “You’d only apply for a crypto ETF if you believe in the longevity of the asset class,” Tawil said in a phone interview.

While the SEC named several cryptocurrencies, such as BNB, Solana Cardano and Polygon as securities in the lawsuits against Binance and Coinbase, Chairman Gary Gensler has repeatedly said that bitcoin was the only cryptocurrency he was prepared to publicly label a commodity, rather than a security.

The SEC’s recent actions are “actually not bad for bitcoin,” said Peter Eberle, chief investment officer at Castle Funds. “Perhaps BlackRock saw that and has decided that they want to make a move in that direction,” noted Eberle in a call.

“We have filed a registration statement with the SEC, and due to regulatory filing restrictions, we are not able to provide further comment,” a BlackRock spokeswoman said in an emailed statement.

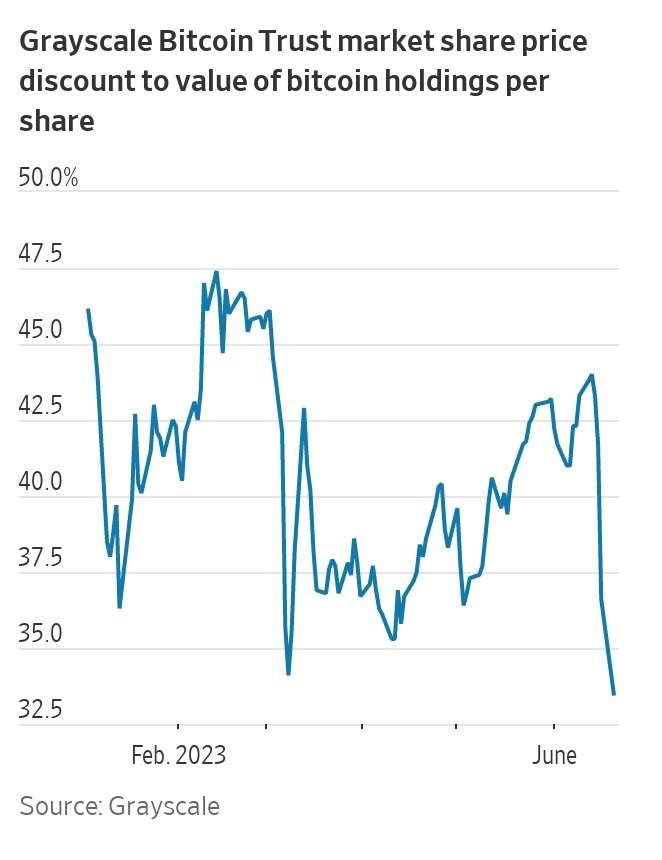

BlackRock’s attempt at a spot Bitcoin ETF lands amid digital asset-manager Grayscale Investments LLC’s high-profile legal battle with the SEC. Grayscale sued the regulator after it denied a bid to convert the Grayscale Bitcoin Trust into a physically backed ETF, citing fraud and manipulation concerns related to the underlying market.

“Perhaps BlackRock is in agreement with us in Bloomberg Intelligence that Grayscale is going to win their lawsuit with the SEC and they want to make sure their hat is in the ring in the event of an approval,” Seyffart said.

BlackRock has prior dealings with the crypto space. The company had partnered with Coinbase on making it easier for institutional investors to manage and trade Bitcoin.

BlackRock filed paperwork with the Securities and Exchange Commission Thursday for a spot bitcoin ETF, which would hold the cryptocurrency as the underlying asset and track its price.

At least a dozen asset managers have previously filed for spot bitcoin ETFs and been rejected by the Securities and Exchange Commision. The regulator has argued that such products are vulnerable to fraud and market manipulation.

Coinbase Global would be the custodian for the fund’s bitcoin holdings, according to the filing.

BlackRock declined to comment.

The iShares Bitcoin Trust aims to be the first ETF with the cryptocurrency itself as the underlying asset, rather than futures contracts. Futures let traders bet on whether an underlying market such as oil, gold or, in this case, bitcoin, will rise or fall.

Futures trade separately from the underlying asset they are derived from; those values can deviate, sometimes widely.

Grayscale Bitcoin Trust, the crypto asset manager which operates the largest bitcoin futures ETF, is currently suing the SEC, arguing that it should be able to convert its ETF into a spot bitcoin offering. Grayscale has said it expects a verdict in the fall, though a ruling could come sooner.

The BlackRock filing could be to facilitate a fast launch in case a court rules against the SEC’s previous decisions, said Rosenbluth.

The investment firm joins a long line of applicants; ARK is among those still waiting to hear from the SEC, and Grayscale has appealed its rejection.

BlackRock has filed an application for a Bitcoin spot exchange traded fund (ETF). The investment company is the world’s largest and it would be the first crypto spot ETF in the United States, if it receives approval.

According to a filling by the Nasdaq stock exchange with the U.S. Securities and Exchange Commission, Coinbase Custody Trust Company would be the custodian of the fund’s Bitcoin holdings and Bank of New York Mellon would custody its fiat.

BlackRock’s iShares Bitcoin Trust would be traded as Commodity-Based Trust Shares.

According to the application filed on June 15:

“The Shares have been designed to remove the obstacles represented by the complexities and operational burdens involved in a direct investment in bitcoin.”

The Bitcoin price will be updated “at least” every 15 seconds during regular market trading using the CF Benchmarks Index.

The Blackrock ETF filing is live, and it’s * SPOT *

“The assets of the Trust consist primarily of bitcoin held by a custodian on behalf of the Trust.”

— Swan (@Swan) June 15, 2023

The document notes that previously approved spot exchange traded products in the commodities and currency markets “are generally unregulated and […] the Commission relied on the underlying futures market” as “the basis for approving” trust shares in the past. Thus:

“As such, the regulated market of significant size test does not require that the spot bitcoin market be regulated in order for the Commission to approve this proposal.”

The SEC has not approved a spot Bitcoin ETF so far, despite numerous applicants. Grayscale took the SEC to appeals court to argue for the soundness of the Bitcoin futures after the SEC rejected its application to create a spot Bitcoin ETF.

Cathie Wood’s ARK Invest and European investment firm 21Shares have also been pressing for spot Bitcoin ETF approval, filing their third applications in April.

The world’s first spot traded Bitcoin ETF was Canada’s Purpose Bitcoin ETF, set up in early 2021.

The iShares unit of fund management giant BlackRock (BLK) filed paperwork Thursday afternoon with the U.S. Securities and Exchange Commission (SEC) for the formation of a spot bitcoin (BTC) ETF.

To be named the iShares Bitcoin Trust, the fund’s assets are to “consist primarily of bitcoin held by a custodian on behalf of the Trust,” according to the filing. That custodian will by crypto exchange Coinbase (COIN), said the filing.

CoinDesk earlier on Thursday reported on BlackRock’s intention to soon file for a bitcoin ETF.

Though approving a number of futures-based bitcoin ETFs, the SEC has notably rejected other fund management company attempts at opening a spot bitcoin ETF, including those from Grayscale, VanEck, and WisdomTree.

“The proposed ETF is benchmarked against the CME CF Bitcoin Reference Rate,” said Sui Chung, CEO of CF Benchmarks, a subsidiary of crypto exchange Kraken, commenting on the filing.

“CF Benchmarks takes price data exclusively from cryptocurrency exchanges that adhere to the highest possible standards of market integrity and transparency. This protects investors as products benchmarked against it can then consistently and reliably track the spot price of the underlying asset,” Chung added.

The move comes at a time when crypto industry is reeling from U.S. regulatory crackdown, which recently saw the SEC suing crypto exchange Coinbase and Binance.

The market sentiment, following the filing of the ETF application by a TradFi giant, seem to have gotten a slight boost as the price of bitcoin has gained a bit on the news, rising to just shy of $25,600.

Updated: 6-16-2023

BlackRock’s Bitcoin ETF ‘Is The Best Thing To Happen’ To BTC, Or Is It?

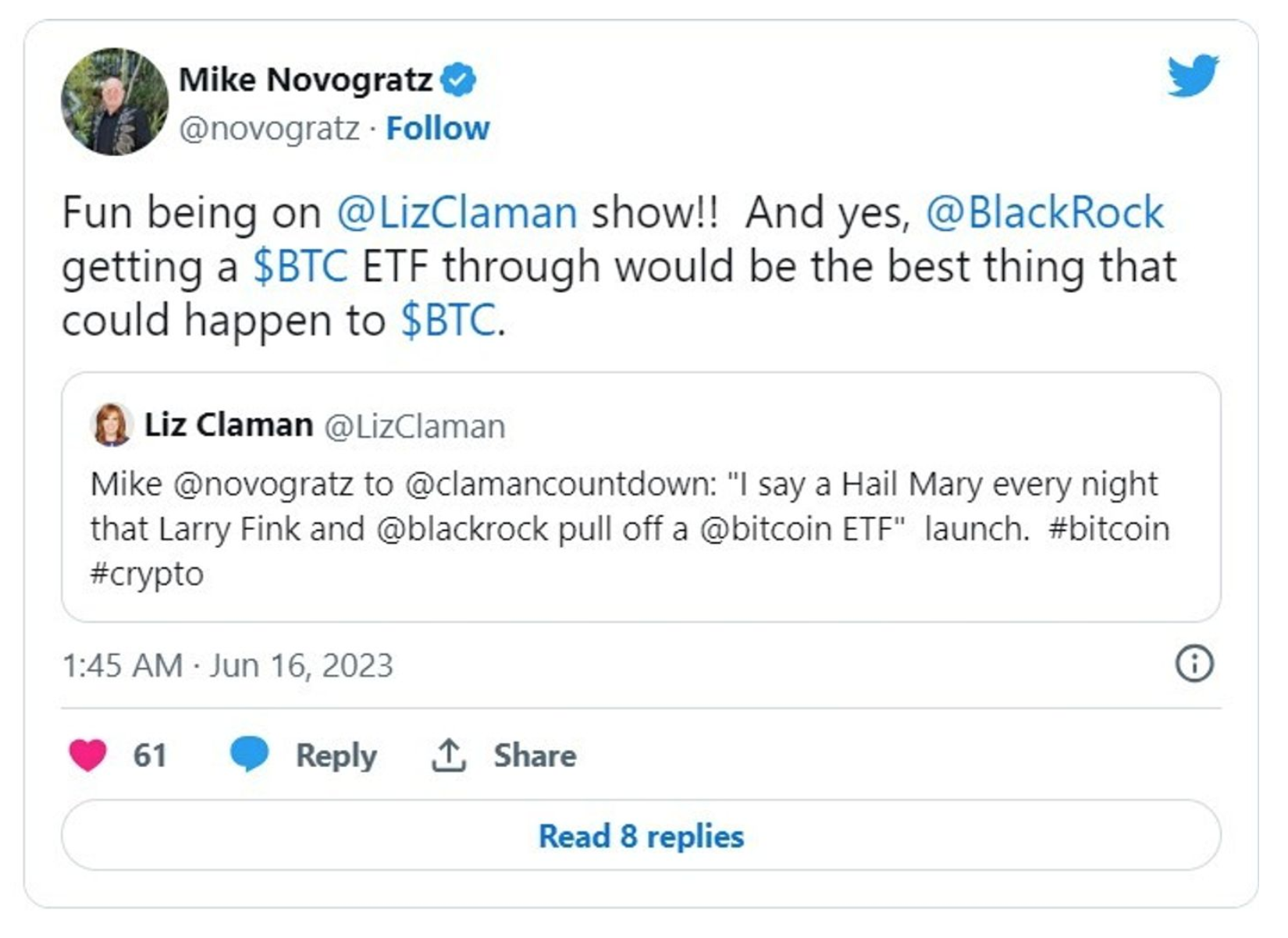

Galaxy Digital CEO Mike Novogratz was among those over the moon with the news, others warn it could be the start of a major institutional takeover.

BlackRock’s latest filing for a spot Bitcoin (BTC) trust will drive investors’ confidence in Bitcoin and may even be “the best thing that could happen” to BTC, according to some crypto industry observers — but others warn of a hidden cost.

During an interview on June 16, Galaxy Digital CEO Mike Novogratz said the approval of BlackRock’s ETF application would be “the best thing that could happen to $BTC.”

“I say a Hail Mary every night that Larry Fink and @blackrock pull off a @bitcoin ETF,” Novogratz said on the Fox News segment, according to a tweet by host Liz Claman.

Fun being on @LizClaman show!! And yes, @BlackRock getting a $BTC ETF through would be the best thing that could happen to $BTC. https://t.co/2fFBeB9eyo

— Mike Novogratz (@novogratz) June 16, 2023

Meanwhile, cryptocurrency analyst James Edwards of Finder.com — a financial product comparison website — told Cointelegraph that the timing of BlackRock’s filing should provide “confidence” in both Bitcoin as an asset and also Coinbase in its upcoming legal battle fight with the SEC:

“BlackRock’s willingness to press on with a Bitcoin ETF at a time when the SEC is on a warpath against crypto is very telling. It shows confidence in Bitcoin’s status as a commodity — rather than a security,” he said, adding:

“It’s unlikely that BlackRock would push forward with an ETF of this nature without serious consultation with regulators and confidence in Bitcoin’s future legal status.”

BlackRock’s intention to use Coinbase Custody to control funds should also be seen as a massive confidence booster for Coinbase as it prepares its legal defense, Edwards explained.

He added that BlackRock — the world’s largest asset manager — likely wouldn’t partner with Coinbase had they not been “confident” in Coinbase’s legal position.

The Downside

Others argue that the traditional investment giant’s latest moves undermine the “ethos” of decentralized cryptocurrencies, or, that the company may find a way to profit from retail investors.

Investor Scott Melker explained in a June 16 interview that such an approval would be a disservice to crypto-native innovators who built the industry:

“As good as this may be for institutional adoption of the space, it kind of violates the ethos, it is a bit of a dishonest push away from the people who built the industry in the United States.”

Cinneamhain Ventures partner and Ethereum bull Adam Cochran believes that BlackRock will swoop in on the “discounted coins” of retail investors, a theory also shared by Melker.

Blackrock ETF… https://t.co/3g77QNdAun

— The Wolf Of All Streets (@scottmelker) June 15, 2023

Steven Lubka, a managing director at Swan Bitcoin, shared a similar view, predicting that BTC will reach $1 million, but few retail investors would reap the rewards because the bulk of BTC will be owned by BlackRock, Goldman Sachs and other ETF issuers.

Melker added that Wall Street firms will continue to move into the space and that U.S. regulators will likely “choose them” over incumbent platforms.