Rich Chinese Splashing Out On Luxury In Singapore

Chinese snap up cars and condos. When ultra-wealthy Chinese entrepreneurs started moving to Singapore en masse in 2019, investment firms were salivating at the chance to manage billions in new money. So far, it hasn’t quite happened. Rich Chinese Splashing Out On Luxury In Singapore

Hedge funds, banks and private equity firms say few of their recent meetings with Chinese tycoons in the city-state have brought in business beyond basic custodian deals, even as the new arrivals spend lavishly on mansions, luxury cars and golf club memberships.

A senior executive at one of Singapore’s largest hedge funds described it as one “big zero.” Another money manager — among the more than 10 interviewed — said none of the handful of inquiries has resulted in fresh funds to manage. They declined to be identified discussing private matters.

Investors “are not coming with a bunch of cash in suitcases,” said Emmanuel Pitsilis, co-head of Asia-Pacific at Partners Capital Investment Group, adding that the new arrivals already have global investments in place so any cash flowing into the country isn’t automatically being deployed to local capital markets.

The relative pittance of new business from super wealthy Chinese emigres is becoming a hot-button topic and possible prelude to social discord as lawmakers seek answers from the government.

When tax exemption programs were changed to attract family offices, part of the pitch was that the new money would boost investments and spark a wave of employment. Instead, Singapore is mostly seeing higher prices for everything from condos to cars.

To be sure, plenty of cash is coming in and family office assets at the city’s banks are on the rise. But money managers say very little of that cash is being invested in funds or private equity firms that would generate the hefty fees needed to create a flood of jobs.

Finance executives cite two main reasons for the reluctance, even as outflows from China reach at least $150 billion annually, according to Natixis SA. The capital markets in Singapore and Southeast Asia are tiny by Chinese or Hong Kong standards, and it takes time for these tycoons to feel comfortable with advisers they barely know.

Pitsilis said the newcomers have global allocations in place and the region represents a new, unfamiliar market full of potential pitfalls. Asian clients in general take longer to trust money managers compared with counterparts in the US, where a whole ecosystem of advisers and data providers make the decision easier, he said.

“Just because they’re changing location,” doesn’t mean they’re suddenly going to alter everything else and their investments, said Pitsilis, whose firm manages $48 billion for family offices, endowments and other investors.

Low Liquidity

The local bourses meanwhile lack the liquidity and high-profile names on the scale of New York and Hong Kong. Hong Kong’s total stock market value is more than 10 times higher than Singapore, according to data compiled by Bloomberg, while daily trading dwarfs its rival hub.

That leaves private equity and venture capital across the greater Southeast Asian region, which remain relatively small compared with China and Silicon Valley.

“All of Vietnam had a couple of billion dollars in PE investment in 2021,” Pitsilis said, citing a report from Bain & Co. “That’s the same size as some of these family offices.”

The limited investment is surprising given there’s plenty of evidence the Chinese tycoons are setting up bases and spending loads of money on other things.

The Monetary Authority of Singapore last year estimated there were about 700 family offices at the end of 2021. Industry experts say the current estimate is more like 1,400, with mainland Chinese the biggest drivers of growth, according to service providers.

The backlog alone of single family offices applying for tax incentives and pending approvals is around 200, according to Senior Minister Tharman Shanmugaratnam.

Signs of Chinese wealth are easy to spot in Singapore. Many of the city’s historic black and white bungalows – newly converted to private bars for wine and whisky connoisseurs – are popular among Chinese billionaires.

The price of golf memberships for expats at the exclusive Sentosa Golf Club surged last year to S$840,000 ($630,000) as more Chinese join, according to brokerage Singolf Services Pte.

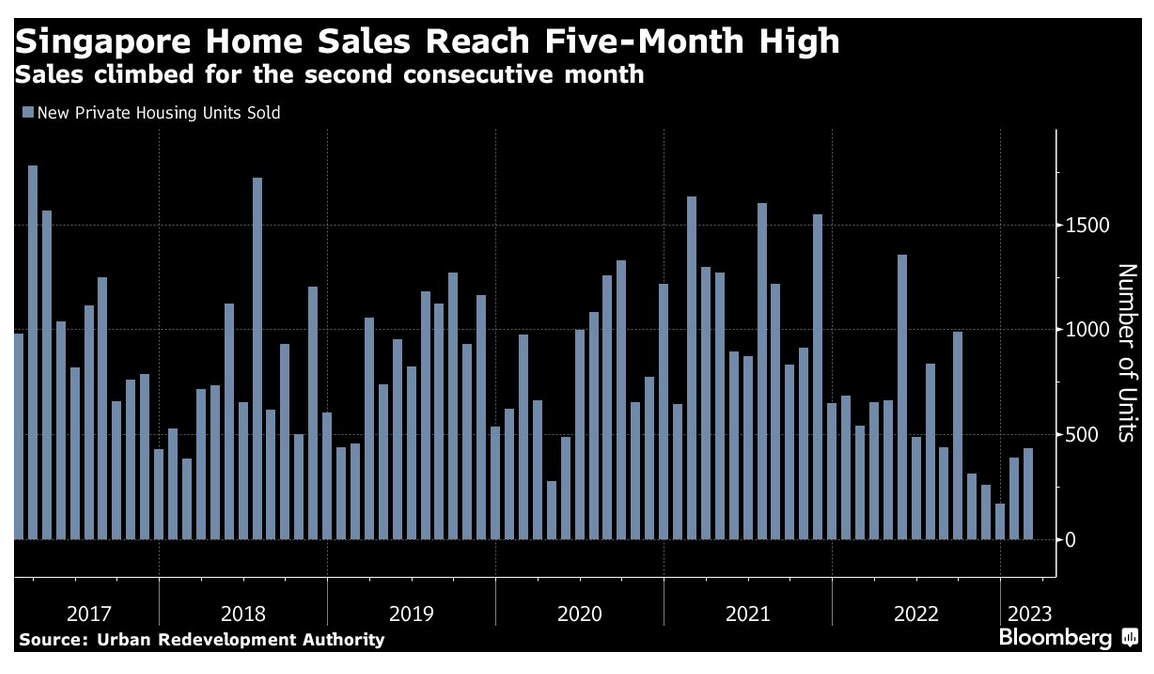

The nation’s real estate market has defied a global slump as newcomers snap up luxury condos, driving prices higher for 12 straight quarters.

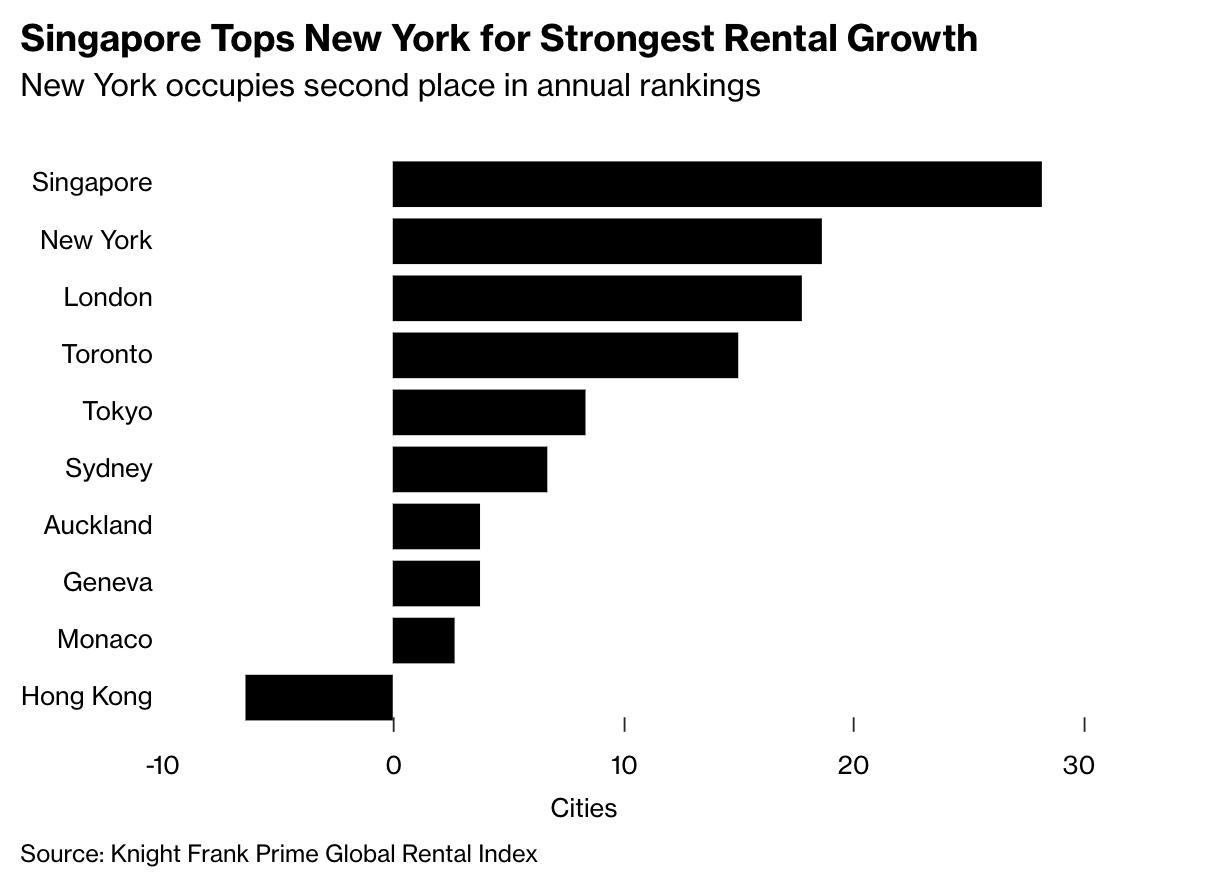

High-end residential rents in the fourth quarter of 2022 were up 28% compared with a year earlier, helping the city push New York off the top spot for gains. Retail sales surged almost 13% in February, while license fees for cars are hitting fresh records of almost $90,000.

Even the city’s palate is changing, according to Sing Tien Foo, NUS Business School professor of real estate. A rising number of restaurants offer more hotpot items from Sichuan province and spicy lamb skewers favored in Beijing to cater to the arrivals. Visitors to Chef China Hua Chu restaurant are welcomed by a black-visored astronaut sporting a Chinese flag.

Sing co-authored a paper in 2020 that showed Chinese foreign buyers with high spending power tend toward ‘conspicuous consumption’ and properties with visible features of luxury such as penthouse apartments.

His research showed they also like to create their own enclaves and social networks in places like Sentosa, where foreigners are often granted exceptions to rules preventing non-citizens from buying mansions.

“We can’t stop this trend – more and more foreigners will find Singapore a very livable country so they’d like to move over here and the government is trying to attract the talent,” he said. “They have to manage the sentiment properly – I think it’s a very sensitive social issue.”

Yet this flood of Chinese money hasn’t done as much for the financial services sector — and some lawmakers are wondering why not.

Over the past seven months, politicians from the opposition parties and even the ruling People’s Action Party have asked the government for more details on whether the surge in wealth will effect the income gap, what rich immigrants have been investing in locally, and what impact Chinese non-residents have had on property prices and rents.

The government has taken notice. Alvin Tan, minister of state for trade and a former banker at Goldman Sachs Group Inc., told Parliament in October its agencies had set up “Deal Fridays” sessions to encourage more investment and interactions.

Singapore increased luxury taxes amid a surge in prices for high-end property and cars to reap more from the rich without driving them offshore.

The Economic Development Board said that 24,699 jobs were created in a range of roles including software engineers, researchers and public relations between 2011 and 2022. Family offices also generate jobs indirectly through external finance, tax and legal professionals, according to a spokesperson for the development agency.

Singapore also changed the conditions for family offices seeking tax exemptions a year ago, introducing higher minimum asset management standards and local investment requirements. Just last month it ramped up employment and investment thresholds for applicants to its Global Investor Programme.

That’s a pathway to citizenship for people so rich that the application itself – with no guarantee of success – requires that S$10,000 be wired to a government account at Deutsche Bank AG. Around 200 applicants have been granted permanent residency through the program in the three years through 2022.

But capitalism is wily. One family office executive said their firm aims to meet the higher local spending requirements by booking their fund purchases with the locally-licensed arm of a Swiss bank rather than the overseas unit. Such a shift may boost assets – the industry reached S$5.4 trillion in 2021 — but not create more jobs.

Even local banks attracting deposits from rich Chinese may not reap the higher profits that come from trading and margin loans. Oversea-Chinese Banking Corp., United Overseas Bank Ltd. and DBS Group Holdings Ltd. all posted lower fees from managing rich clients’ funds for the fourth quarter.

That’s even after the DBS chief executive officer said the bank had opened almost half of all new family offices in Singapore over the past few quarters.

While philanthropy would be another way of alleviating resentment among Singaporeans, some local charities say they’ve had limited support from the wave of rich Chinese migrants.

As CEO at the National Volunteer and Philanthropy Centre until late 2022, Melissa Kwee helped encourage the city’s rich and powerful to give back, boosted by her own experience as a member of one of Singapore’s wealthiest clans.

She says the city’s well-heeled immigrants should do more for charities and small businesses.

“One of our national issues is really social cohesion, which is the flip side of social inequality,” said Kwee, whose family manages hotels and commercial properties across the region. “The suspicion of and resentment of foreigners coming here to just use Singapore leaves a bitter taste in people’s mouths because of conspicuous consumption.”

For Kwee, encouraging the recently-migrated Chinese to do more philanthropy and volunteering is key to making them feel connected to their new home. Outside of investing in money managers, they could partner with local businesses trying to go abroad, she added.

The Asian Philanthropy Circle – an invitation-only platform for wealthy givers – is launching a sub-group designed to engage Chinese donors while the Asian Venture Philanthropy Network frequently holds events.

Over time, the effort of starting family offices, moving relatives to Singapore and living in the country will spark more local investments, said Crossinvest (Asia) Pte Chief Operating Officer Lucy W. Gao-Azak, whose firm also helps single family clients establish their own operations. But she warns it won’t be the tsunami some had hoped for.

“It’ll never be the home market for Chinese investors and they’ll always invest in what they’re familiar with,” she said. “Investors will rarely sacrifice and compromise performance of returns for any regional bias.”

Updated: 4-13-2023

While Americans Cut Back, China Goes Full Bling

Beijing’s economic revival is fueling a fashion renaissance like no other, and mega-luxury vendor LVMH is a big beneficiary.

China’s Ludicrously Capacious Money Bag

Okay, you tell me: Is this a coincidence? Just days after President Emmanuel Macron “kowtowed” — as Andreas Kluth put it — to President Xi Jinping of China, a flood of French protesters stormed the Paris headquarters of LVMH, the world’s largest luxury vendor … which happens to be heavily reliant on Chinese business. Symbolism, baby! It’s a beautiful thing.

LVMH reported blowout earnings today, most of which Andrea Felsted says were driven by Asia. As Chinese consumers escaped from the grasp of Covid Zero, they flocked to brands like Dior, Burberry and Loewe 1 . China’s economic revival is fueling a fashion renaissance like no other:

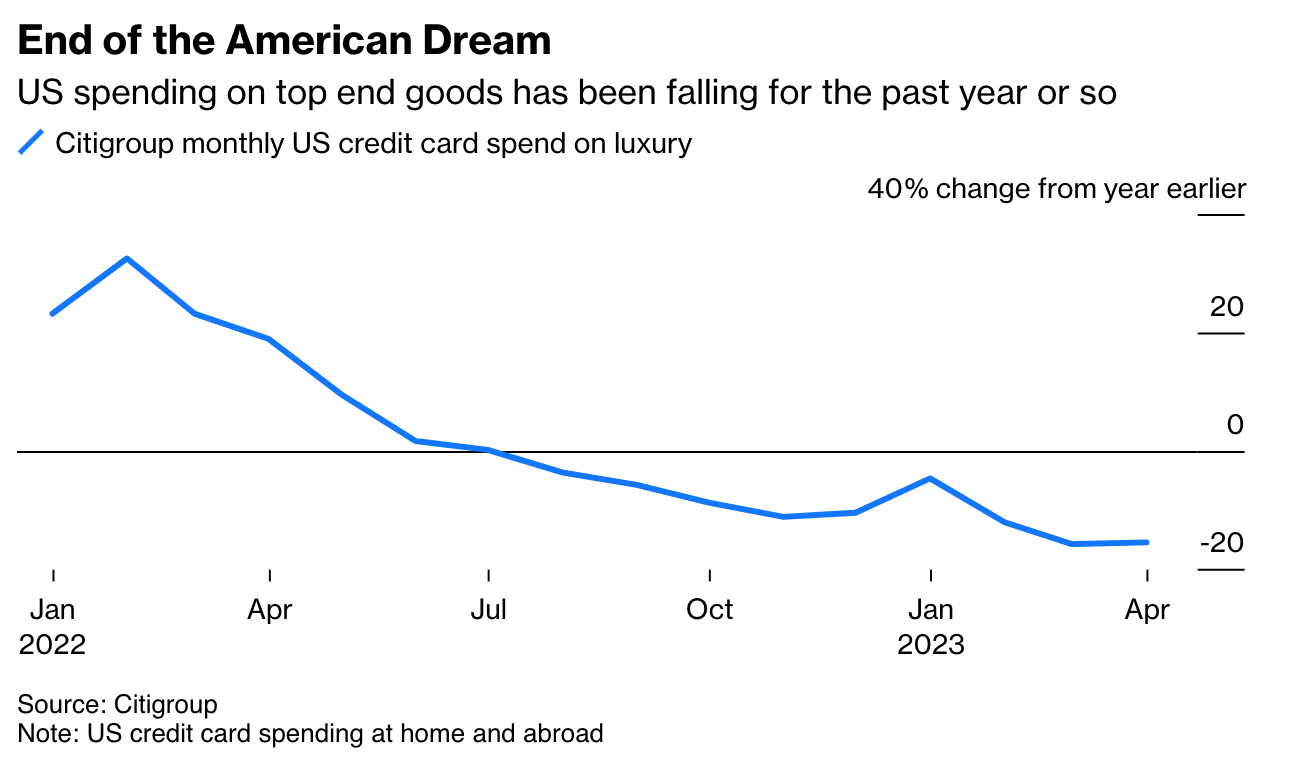

This stands in stark contrast to what’s happening in the US. Although American millennials and Gen Z-ers love to romanticize “old money” on TikTok, their urge to splurge on “ludicrously capacious” bags is fading fast.

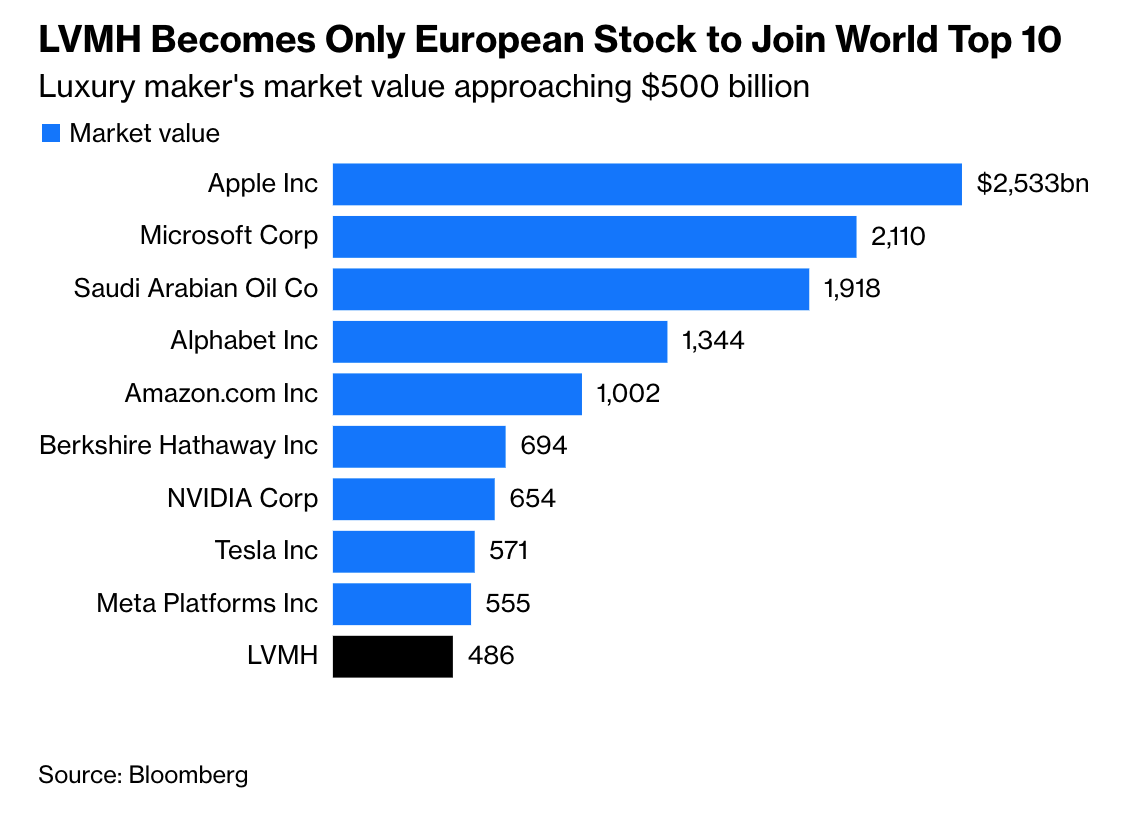

But even a protest and a dimming American appetite aren’t about to dim LVMH’s Tiffany-made sparkle. Today’s rally catapulted its market cap to $486 billion, where it briefly landed a spot as the world’s 10th-largest company:

France is far from the only place that’s been rocked by protests recently. China, too, has faced the wrath of angry homeowners boycotting their mortgages. Despite that, Shuli Ren says sentiment is improving slightly, with 17.5% of households planning to buy a home in the spring. I guess if you can buy a lifetime of Louis Vuitton, you can probably afford to be your own landlord, too.

Hermes Sales Jump As China, US Shoppers Snap Up Kelly Bags

* Trends In Early April In US, China Similar To First Quarter

* CFO Says Second Quarter Will Benefit From Easy Comparables

Hermes International’s quarterly sales jumped as Chinese shoppers snapped up its pricey scarves and Kelly handbags, fueling optimism the global luxury industry’s top performers will carry on growing despite economic headwinds.

Revenue climbed 23% in the first three months of the year at constant exchange rates, Paris-based Hermes said Friday, exceeding analysts’ estimates. The shares rose as much as 2% in early trading, and have gained more than a third in 2023.

“After a very good fourth quarter, we had robust traffic, even slightly higher in early 2023” in China, Chief Financial Officer Eric du Halgouet told reporters Friday. Sales during the Chinese New Year were “very good,” the company said.

The results come a day after LVMH, the world’s largest luxury conglomerate, posted a double-digit sales increase, buoyed by the return of Chinese customers following the end of Covid restrictions. The persistent strength of LVMH and Hermes have made them darlings of investors at a time when even big technology companies have seen growth slow.

That’s made LVMH Europe’s most valuable company and its Chairman Bernard Arnault the world’s richest person, according to the Bloomberg Billionaires Index. Last week, Hermes’ valuation crossed the symbolic threshold of €200 billion ($221 billion) for the first time.

Whether weaker luxury players such as Gucci-owner Kering SA will benefit as strongly as Hermes and LVMH from a resurgent Chinese shopper remains to be seen, analysts said.

‘Nice Dynamic’

Hermes’ sales for Asia Pacific excluding Japan were up 22.5% for the first three months of the year. The luxury label known for its silk carre scarves also saw 19% growth in the Americas, a strong performance amid concern over a potential US slowdown.

Du Halgouet said trends so far this month for both China and the US look similar to the first-quarter performance, adding that Hermes is seeing a “nice dynamic” in China while the brand hasn’t seen a slowdown in the US so far.

“Growth for all regions and categories came in materially ahead of consensus,” Stifel analyst Rogerio Fujimori wrote in a note Friday, adding that Hermes offers “best-in-class sector fundamentals.”

While LVMH Moet Hennessy Louis Vuitton SE posted stellar quarterly growth in Asia excluding Japan, it warned it was seeing slower US growth.

Du Halgouet said Hermes doesn’t expect to see Chinese tourists return in droves before the fourth quarter. In the first quarter, Hermes saw the return of travel flows inside Asia with “very nice” performances in Hong Kong and Macau.

He added that the company should benefit from easy comparables in the second quarter as China was heavily hit by lockdowns last year.

Hermes’ ready-to-wear division saw the strongest growth, up more than a third. Its watch unit isn’t experiencing a trend reversal after growing 25% in the quarter, du Halgouet added. Some top Swiss watch executives have warned of early signs of a slowdown.

Hermes may be in a category of its own as far as pricing power is concerned. Demand for its handbags typically surpasses its production capacity, and many bags also have higher resale values.

The company aims to open one new leather manufacturing facility per year in its home country in order to maintain growth of around 7% for leather goods, Executive Chairman Axel Dumas said last week when Hermes opened a new facility in Louviers, Normandy.

This opening brings the total of its leather plants in France to 21. The facility will boost the output of small Kelly bags which cost €7,700 in France.

Updated: 4-14-2023

U.S. Billionaires Have Grown Nearly One-Third Richer During The Pandemic While A ‘Permanent Underclass’ Struggles

Wealth inequality in the United States is “more extreme and dangerous than income inequality” and could be alleviated by a federal wealth tax, a new report says.

The nation’s billionaires are almost a third richer than they were at the beginning of the COVID-19 pandemic in 2020, according to new calculations by the global charity Oxfam, which published the report this week.

The number of U.S. billionaires is almost 60% higher than it was a decade ago, reaching more than 700, Oxfam said.

“The huge rise in pandemic wealth followed trillions of dollars being injected into financial markets to avert their collapse,” the report said. “This fresh cash, while vital to keeping economies afloat, ended up with the ultra-wealthy who were able to ride a stock market surge, without the guardrails of fairer taxation to share that wealth more equitably.”

Meanwhile, Oxfam pointed to a “permanent underclass” in the nation, saying that almost a third of the U.S. labor force earns less than $15 an hour, with half of all working women of color earning less than that.

In addition, the racial wealth gap has grown wider since the 1980s and is close to what it was in the 1950s, the report said.

Ahead Of Tax Day Next Week, Oxfam Presented Five Main Arguments For A Wealth Tax:

* It would be a source of new revenue that could be invested in policies that help working families and women: Oxfam said a proposal by Sen. Elizabeth Warren, a Massachusetts Democrat, to tax billionaires alone would raise $114 billion annually — enough to reinstate the expanded child tax credit that gave qualifying families up to $3,600 per child in 2021 under the American Rescue Plan. That credit was shown to have reduced child poverty rates amid job losses, inflation and other economic concerns.

* It would help narrow the racial wealth gap: Eighty-six percent of total wealth in the U.S. is owned by white families, while Black, non-Hispanic families own just 3%, according to figures by the Institute on Taxation and Economic Policy (ITEP) cited by Oxfam.

The report also cited research by various scholars who say that taxing the wealthy would help reduce racial wealth inequality, because white families are five times more likely than Black families to receive huge gifts and inheritances.

“In the absence of progressive taxation, this creates a dynastic form of wealth, especially for the ultra-wealthy,” Oxfam said in its report. In addition, 92% of families worth over $30 million are white, non-Hispanic families, though they account for 59% of the U.S. population.

* It would help with the climate crisis: Oxfam cited two main arguments for this. First, the wealthiest people make the climate crisis worse through their investments and emissions, with “the investments of a sample of 125 of the richest billionaires [resulting] in a million times more emissions than the average person,” Oxfam said.

Second, revenue from a wealth tax could help fund replacement of energy systems in the U.S., and could also be used to help victims of climate-induced harms like cyclones, famines and droughts around the world, the organization said.

* It would reduce the federal debt: Tax cuts since 2001 have added $10 trillion to the debt, according to figures by the Center for American Progress cited in the report.

More than 80% of the tax cuts passed from 2000 to 2018 “went to the richest 40%, and most of it went to the richest 5%,” Oxfam said, citing an ITEP analysis. Oxfam added that proposed social-spending cuts to resolve standoffs over U.S. government debt usually disproportionately affect people living in poverty, namely women, girls and people of color.

* It would help protect democracy from oligarchy: “The ultra-wealthy and corporations now play a vastly outsized role in determining public policy in this country,” Oxfam said. For example, corporate lobbying last year rose to $3.5 billion, and accounted for 87% of all lobbying.

Among the consequences of this, according to the report, are the preservation of tax cuts for the ultra-wealthy, still no movement on the federal minimum wage, and no reins on corporate stock buybacks.

Democratic lawmakers have long argued that the wealthiest Americans don’t pay their fair share in taxes, particularly after a 2021 ProPublica investigation of billionaires’ tax returns.

A number of Democratic tax proposals in recent years have taken aim at unrealized capital gains of the ultra-wealthy, though some tax-law experts have raised concerns about the constitutionality of that approach.

President Joe Biden last year called for a “billionaire minimum income tax” that would require households worth more than $100 million to pay at least a 20% tax rate on their full incomes, including on unrealized gains.

His budget proposal this year called for a 25% minimum tax on households worth more than $100 million.

A separate 2021 proposal from Sen. Ron Wyden of Oregon called for taxing billionaires’ unrealized capital gains to pay for Biden’s later-shelved Build Back Better agenda.

Proposals to hike taxes on the wealthy have drawn Republican ire. Sen. Chuck Grassley of Iowa, for example, criticized Biden’s latest budget for what he called “its reckless taxes and out-of-control spending,” denouncing it as “a roadmap to fiscal ruin.”

Some U.S. billionaires, like Microsoft Corp. co-founder Bill Gates, Tesla Inc. Chief Executive Elon Musk and billionaire hedge-fund manager Leon Cooperman, have also pushed back against wealth-tax proposals, saying that they already pay their share of taxes; that they’re being vilified; and that such taxes could be illegal.

Other billionaires, however, have voiced support for such proposals: George Soros, Abigail Disney and more than a dozen other ultra-wealthy individuals wrote in a 2019 blog post that a wealth tax would be good for America, citing some of the same reasons Oxfam laid out in its report.

In total, Oxfam said, an annual net wealth tax could raise $582.6 billion each year by taxing more than just billionaires and using marginally higher rates: “2% for wealth above $5 million, 3% above $50 million, and 5% above $1 billion.”

Updated: 5-22-2023

China’s Big-Spending, Picky Youth Are Global Luxury’s Lifeline

* Selective Gen Z Shoppers Will Drive Long-Term Industry Growth

* Wealthiest Chinese Clients Expected To Weather Economic Woes

About two dozen Chinese taste-makers gathered on a recent spring evening in Shanghai for an exclusive showcase hosted by online luxury retailer Mytheresa.com GmbH.

In a red-brick colonial building near the historic Bund district, they wined and dined with stylists and executives as four up-and-coming Chinese designers spoke about the inspiration behind the hand-embroidered dresses and crisply tailored blazers on show.

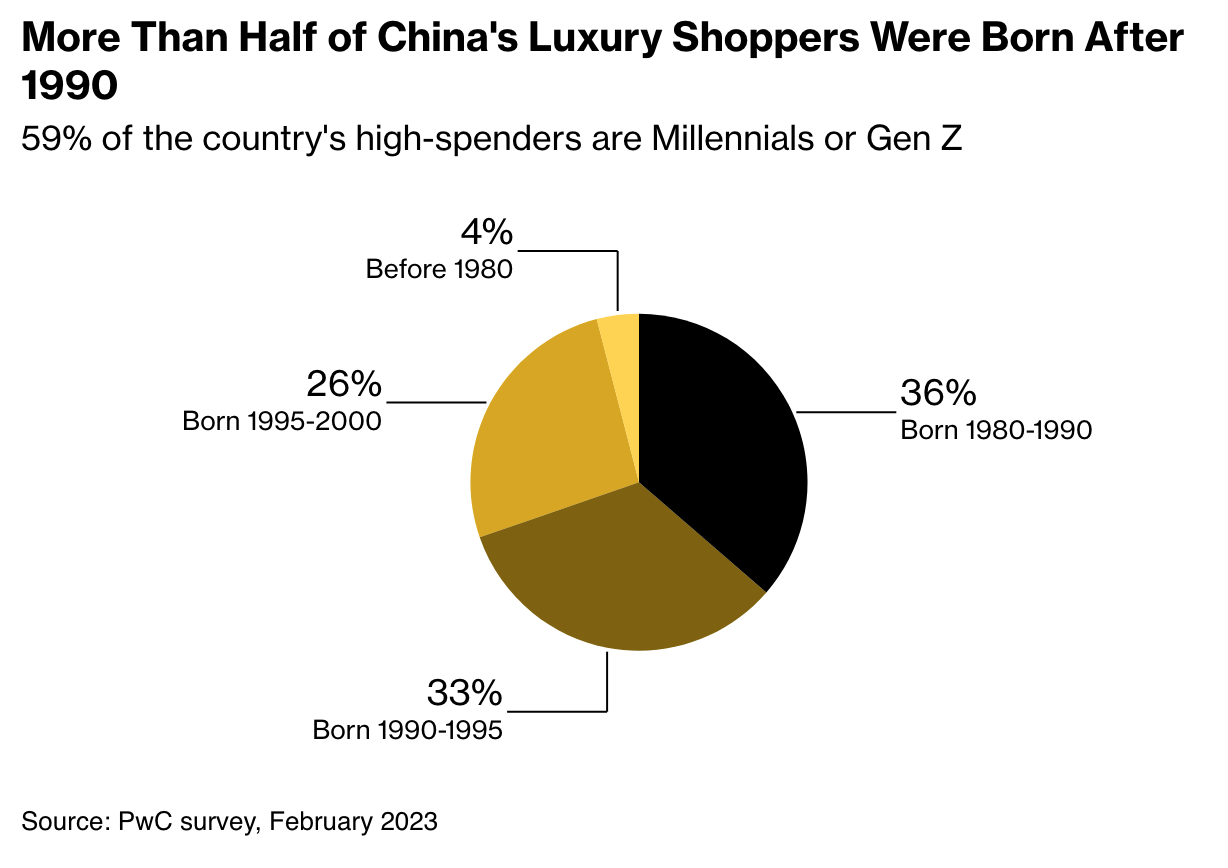

While special events for top-tier clients are common in fashion hubs across the world, what set this one apart was the attendees’ youth, with almost all of them born from 1990 onward.

The country’s shoppers are already some of the world’s most influential, accounting for about a fifth of the $325.4 billion global luxury market, PwC estimates.

The average client in China is 29 years old, five years younger than peers elsewhere and yet spends $800 per week, or 30% more than the rest of the world, according to luxury online retail platform Farfetch Ltd.

Big-spending Gen Zs will propel China to the position of world’s top buyer by 2025 — usurping both the US and Europe, according to PwC.

While that’s got foreign brands racing to secure a share of the lucrative market, they face elevated risks from the young shoppers they depend upon for growth.

Youth unemployment is surging, the economic recovery shows signs of losing momentum and young consumers are demanding custom experiences over the mass-market offerings that excite their parents.

“The biggest change after the pandemic I can say is Chinese customers start to value service and the personalized experience more than ever,” said Judy Liu, Greater China president at Farfetch.

“Chinese customers are younger, they have higher spending capabilities and they are also a group of very sophisticated customers.”

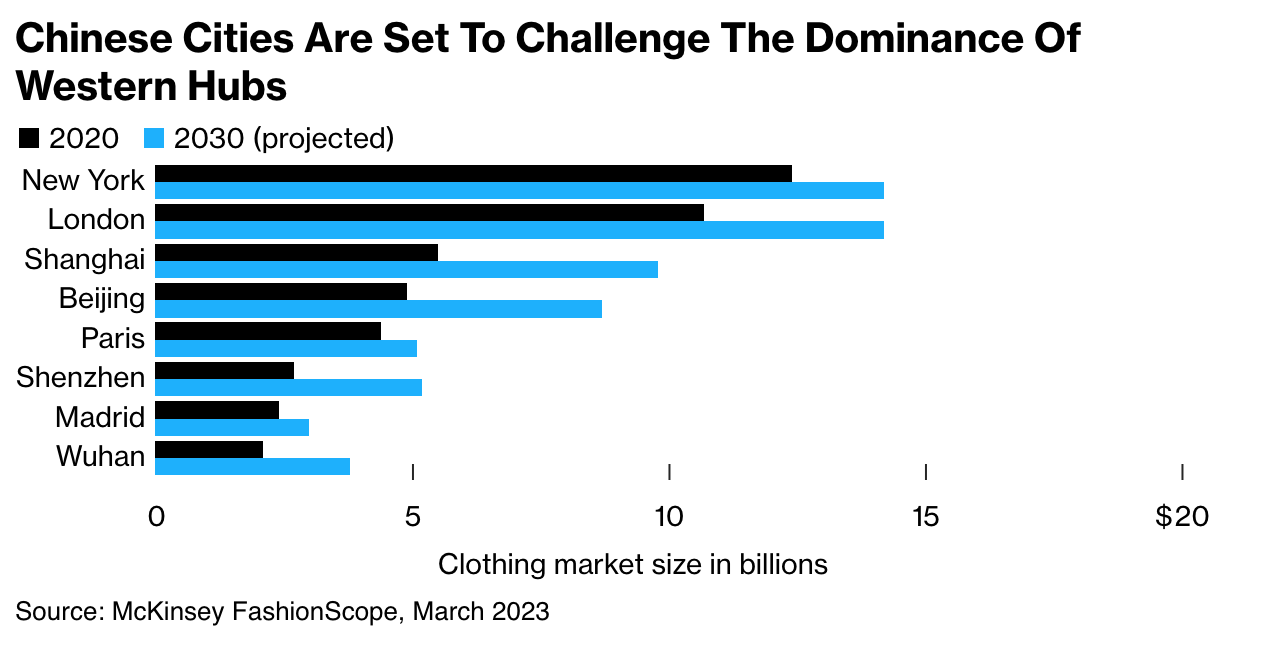

Top brands are expanding their domestic footprint to court these shoppers. Luxury behemoth LVMH Moet Hennessy Louis Vuitton SE is shifting resources out of Hong Kong to focus on mainland China, while Hermes International has been opening new stores or revamping existing shopfronts in recent years.

Mytheresa set up its first Asian office in Shanghai last summer to provide on-the-ground personal shopping services since top local clients couldn’t visit overseas luxury hubs given Chinese pandemic curbs.

Foreign luxury brands are also ramping up other efforts to tap into Chinese youth who live their lives largely online. Shoppers who bought specific Prada SpA products during Lunar New Year in January were granted access to exclusive digital art pieces, while LVMH’s livestream of a fashion show in northern China last year drew 270 million views online.

“Luxury brands won’t just launch products but offer more extensive services to help consumers” who prefer pleasure and a healthy lifestyle over buying huge quantities of items, said Joann Cheng, chief executive officer of Lanvin Group Holdings Ltd.

Some companies have diversified into home products, like aromatherapy oil, and are even investing in hotels, she said.

Sun Aoyu, a 21-year-old Chinese undergraduate studying in Sweden, says he steers clear of hot-selling items and since the onset of the pandemic has shifted a big portion of his unlimited budget — financed by his parents — away from clothes and shoes toward designer home decor and high-end sports equipment.

“In the past, I might be intrigued to pay for something that looks nice, but after Covid, I focus more on my own feelings and experiences,” he said. “I only pay for brands that can help me express myself, instead of buying something to show off.”

Gen Z — the 270-million-strong cohort born since 1995 — is estimated to see total spending rise fourfold from 2019 to 16 trillion yuan ($2.3 trillion) by 2035, China Renaissance estimates.

Still, even super-rich youth aren’t completely insulated from the national economic environment, which features skyrocketing unemployment and an uncertain jobs outlook.

Ji Zhengyang, a 22-year-old finance student in Chongqing, said he used to spend more than 100,000 yuan a year — typically on his father’s credit card — on luxury goods.

While his parents are still offering financial support, he’s drastically cut his spending in the past year and now prefers to buy watches, which he bets are a better investment than clothes.

“I’ll still spend on luxury when I really find something that fits me, but I’m just no longer such an active shopper when I constantly get information on how bad the job market is,” he said.

“Consumption just naturally becomes more conservative when we have lower expectations for the future.”

Nevertheless, the industry is optimistic that big-spending Chinese shoppers will weather any economic storms. Some of Mytheresa’s clientele will head to Europe in coming months to visit luxury brands’ factories and dine with top designers, while Farfetch is planning to expand its customer base to lower-tier cities and expects the sector to return to growth this year.

“The top customers have been growing faster in the previous quarters and the gap between them and the regular customers is widening” amid the global economic softness that hurts the ultra-rich far less than the middle classes, said Michael Kliger, chief executive officer of Mytheresa. “The top clients have a much bigger appetite for spending.”

Updated: 5-23-2023

Luxury Stocks Lose $30 Billion In One Day On Demand Fears

* Deutsche Bank Says Investors Could Become More Selective

* Analysts Flag Slowdown In The Us As A Growing Concern

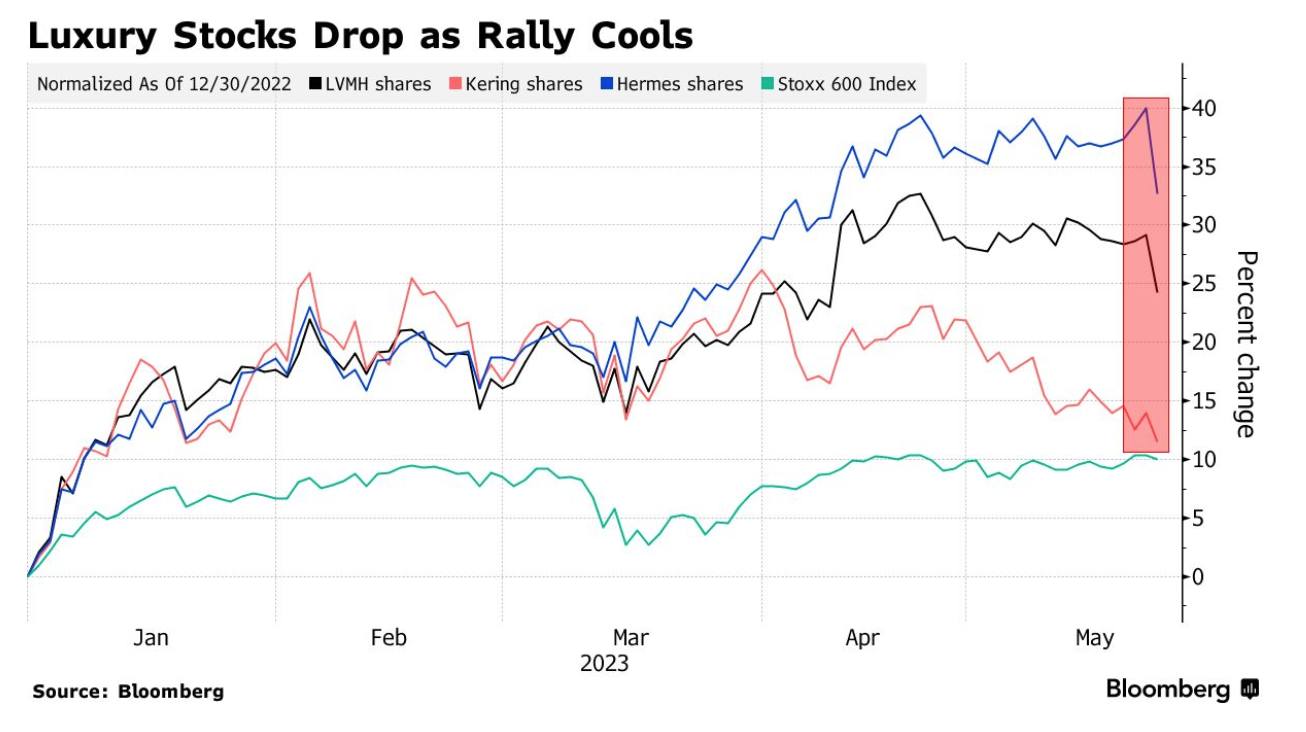

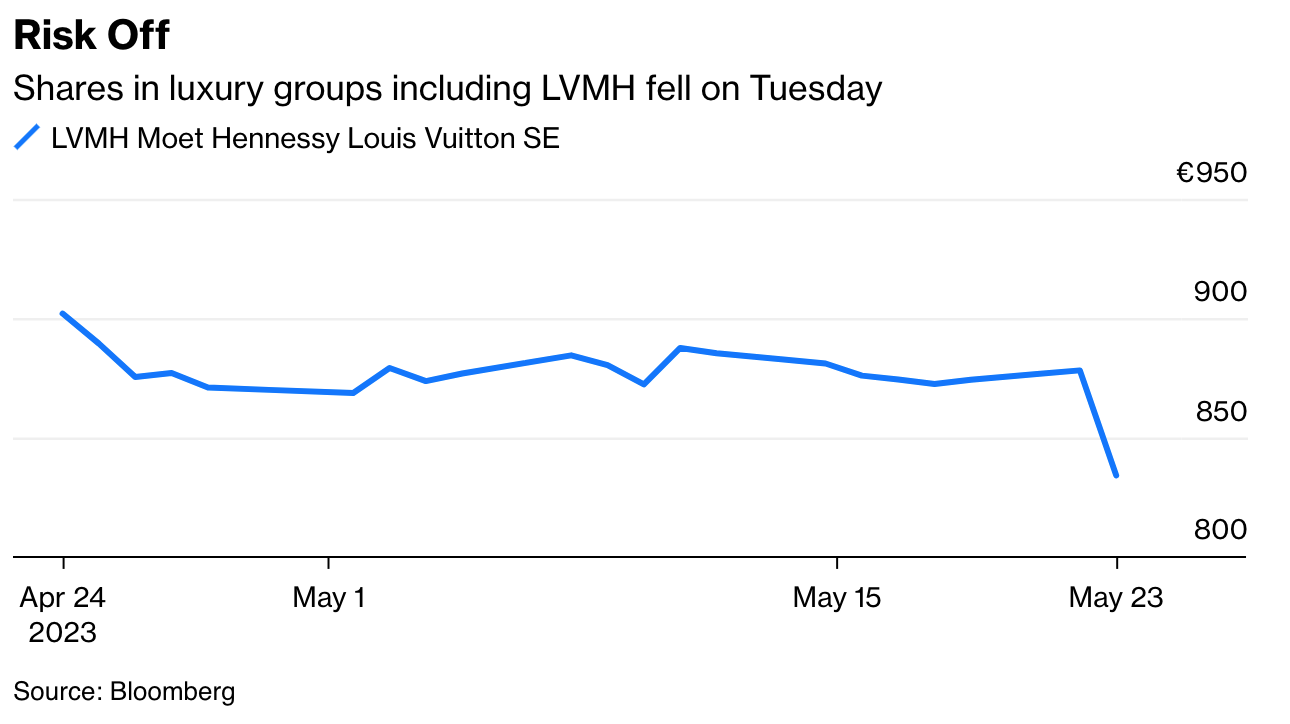

A blistering rally in luxury goods stocks this year powered by international demand particularly from China has taken a hit, wiping out more than $30 billion from the sector on Tuesday.

Shares in Hermes International slumped as much as 5.5%, while LVMH Moet Hennessy Louis Vuitton SE dropped around 4% and Gucci owner Kering SA saw its stock decline more than 2%.

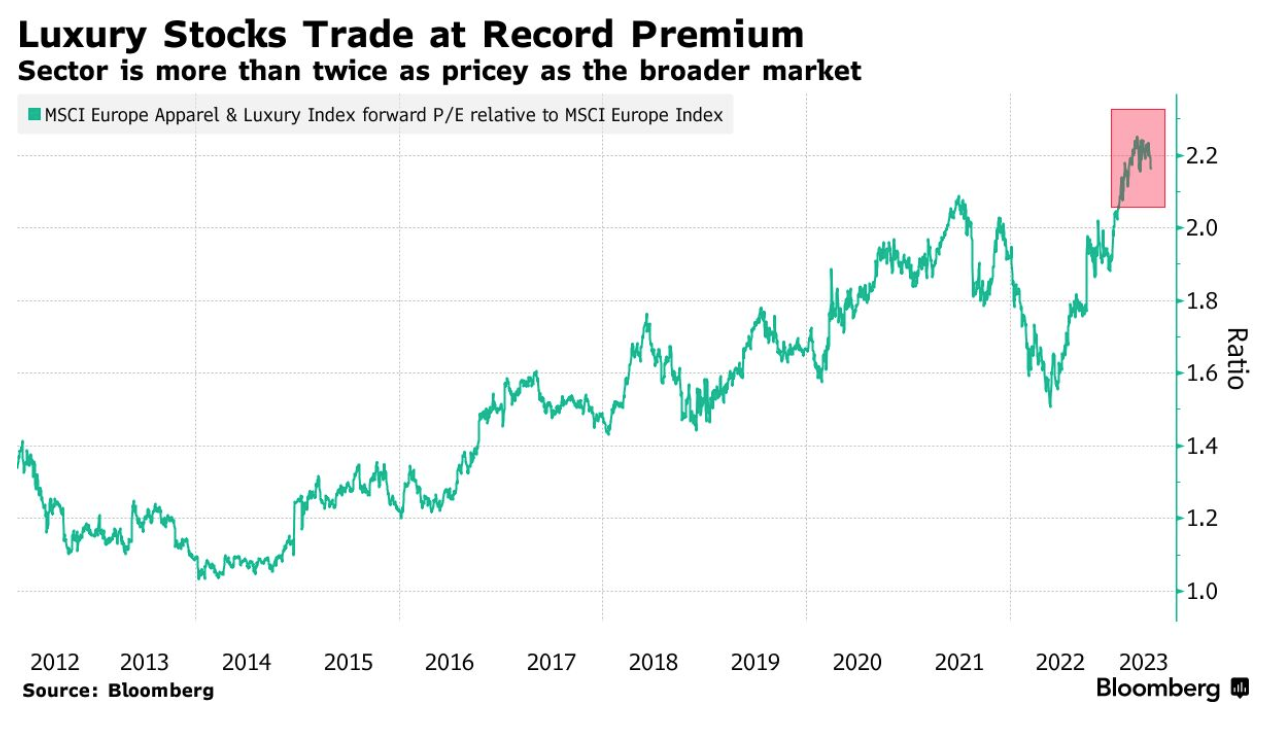

In the past year, the high-flying sector has become to the European stock market what Big Tech is to the US: a collection of dominant businesses whose growth has held up even as the economy waxes and wanes.

Confidence in that view has now been dented, however, with attendees at a luxury conference in Paris organized by Morgan Stanley flagging a “relatively more subdued” performance in the US, according to Edouard Aubin, an analyst at the investment bank.

That reflects “weakness in the aspirational consumer in particular.”

That was counterbalanced by more buoyant demand elsewhere, according to Morgan Stanley. “Overall, we found corporate commentary resilient, pointing to an ongoing soft landing in the US largely offset by strength in other markets.”

Both Asia and the US are important markets for European luxury companies. Asia excluding Japan accounted for 30% of LVMH’s sales in 2022, while the US made up 27%, according to the company’s annual report.

Deutsche Bank AG analysts have also said that a slowdown in the US is now a growing concern. While the rebound in Chinese demand has been among the key drivers of strong sales, investors are likely to be picky from here on, they added.

Still, luxury stocks have been outperforming by a large margin this year: LVMH is up 25% and Hermes has added 34%, both outperforming a 10% rise in the broader Stoxx Europe 600 Index. Neither LVMH nor Hermes were immediately available to comment on the conference in Paris.

“The luxury sector remains a crowded long for many investors, with the sector’s premium to the market at historically high levels,” Deutsche Bank analyst Matt Garland said in a note.

The rally has seen LVMH balloon in size, with its market value breaching the $500 billion level last month, becoming the first European company to hit that milestone.

Those gains have flown in the face of a broader economic slowdown, as investors have bet that Chinese shoppers will be keen to spend after emerging from one of the world’s strictest lockdowns.

Last month, LVMH’s shares hit a record after reporting a surge in sales, while Hermes also saw quarterly sales jump as Chinese consumers snapped up its pricey scarves and Kelly handbags.

However, early warning signs have emerged, with LVMH noting that it is seeing a slowdown in US growth, while British fashion brand Burberry Group Plc said that it is seeing demand for sneakers and entry-level products softening among younger Americans.

The Luxury Party In The US Is Over

LVMH, Hermes and Richemont got used to American consumers spending lavishly on their goods. Now the curtain is coming down.

On Monday, Sidney Toledano, who runs LVMH Moet Hennessy Louis Vuitton SE’s portfolio of smaller fashion brands, told the Financial Times Business of Luxury Summit that when it came to top-end goods, the world didn’t revolve only around the US and China.

The slump in share prices on Tuesday of luxury groups including LVMH, Hermes International and Cie Financiere Richemont SA shows that investors don’t share this view.

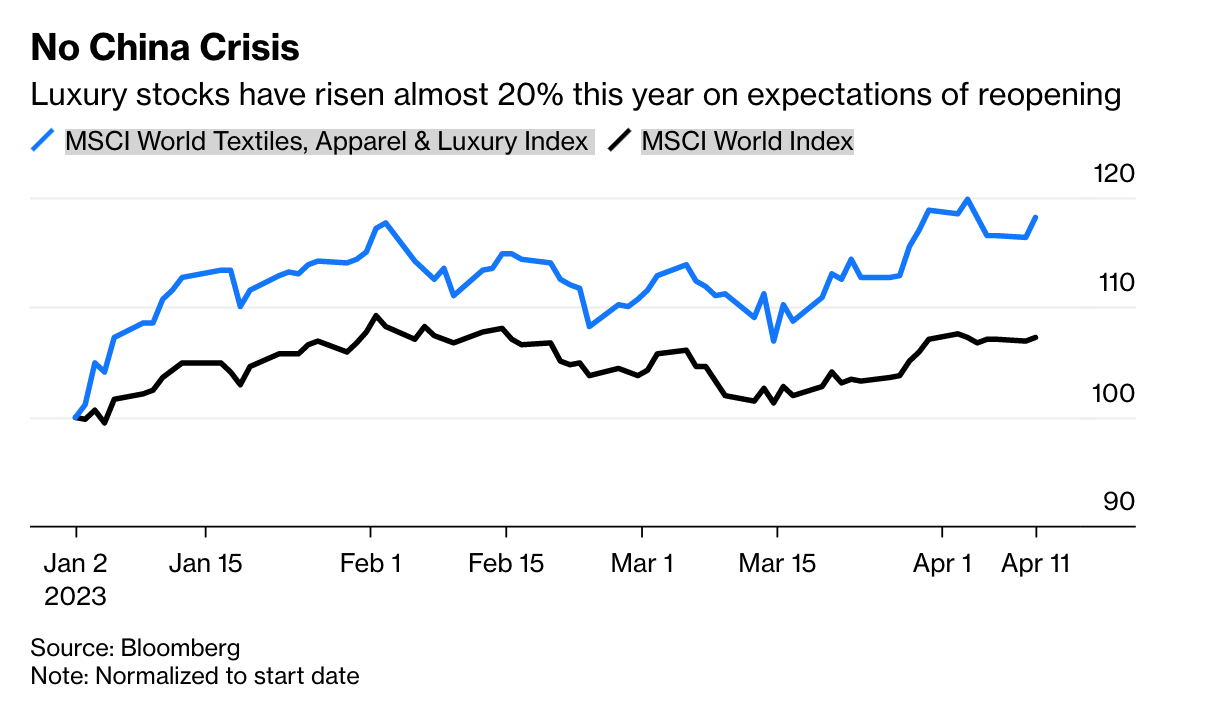

At Monday’s close, the MSCI World Textiles Apparel & Luxury Goods Index had risen close to 20% since the beginning of this year, with industry leaders accelerating by much more. Valuations have largely depended on two things: China’s post-Covid recovery continuing apace and a soft landing in the US luxury market. At least one of those is in doubt.

US credit-card spending, tracked by analysts at Citigroup Inc., has been weakening for the past year or so. It showed no improvement in April, Citigroup said.

This has been followed by two more unhelpful staging posts. First, Johann Rupert, chairman of Cartier-owner Richemont, earlier this month confirmed that the US market had been slowing since November.

Then, last week, Burberry Group Plc reported a 7% decline in Americas sales in its most recent quarter, weaker than rivals. While the super-rich continue to spend, Burberry Chief Executive Officer Jonathan Akeroyd said younger, more aspirational US consumers were cutting back on purchases of sneakers, hats and belts.

Although not a luxury brand, Foot Locker Inc.’s profit warning on Friday is also of note. While there could be an element of new CEO Mary Dillon trying to get bad news out upfront, there may be some crossover between its customer base and those who aspire to swap their Nike Dunk sneakers for Dior.

On Tuesday analysts at Deutsche Bank AG said the US deceleration was a “building concern.” They’re right.

The US, alongside South Korea, has been the driver of luxury fortunes for the past three years. As Chinese regions yo-yoed between lockdowns and reopening, Americans, particularly young consumers who had discovered European luxury, kept spending. It helped that they were flush with stimulus payments as well as stock market and cryptocurrency gains.

This encouraged luxury brands to open new stores in the US, particularly away from the main shopping hubs of New York and Los Angeles and in locations such as Austin, Texas.

While the slowdown in US luxury buying isn’t severe enough to imperil those stores, it’ll be worth watching whether brands soon become saddled with underperforming outlets from the expansion.

Investors would be wise to remember the wave of store closures in China seven to eight years ago, after brands opened stores in smaller cities only to see spending in the country contract.

Against this backdrop, LVMH looks exposed, as it generated 23% of its sales from the US in its first quarter. That said, it has some of the world’s most muscular brands, led by Louis Vuitton and Dior, and also generated 36% of its sales from Asia, excluding Japan, in the first quarter.

More at risk are names that are trying to revive their fortunes, such as Gucci-owner Kering SA. Burberry is also in turnaround mode, and is more exposed to downturns among premium rather than ultra-wealthy customers.

But it has also historically generated about 40% of its sales from Chinese shoppers (it is around 30% currently) and has a new, star, designer in Daniel Lee.

With the US market moderating, there is even more need for Chinese consumers to pick up the bling baton. So far, spending has been concentrated in domestic locations, such as Hainan, or in trips to nearby destinations, such as Macau and Hong Kong.

Largescale group tours to Europe have not yet begun, which is needed to keep Chinese consumption going in the right direction. And, of course, any faltering of the Chinese recovery story — Richemont’s Rupert also said shoppers there remained cautious — would be a further setback.

For luxury stocks to hold on to their gains this year, a scenario as perfect as unboxing the latest It Bag must unfold: The US decelerates, but China picks up speed, continuing the robust performance that top-end sellers have enjoyed over the past couple of years.

That’s the best-case scenario. It’ll be thwarted by Chinese consumers losing their love of luxury goods, or a hard landing in the US.

Updated: 6-30-2023

The Hamptons Are Experiencing A Record-Setting Retail Boom: Where To Shop

Commercial real estate rates out east are surpassing those in New York, Hong Kong, Milan, London, Paris and Tokyo. Here’s why, and 16 boutiques to shop at on your next trip.

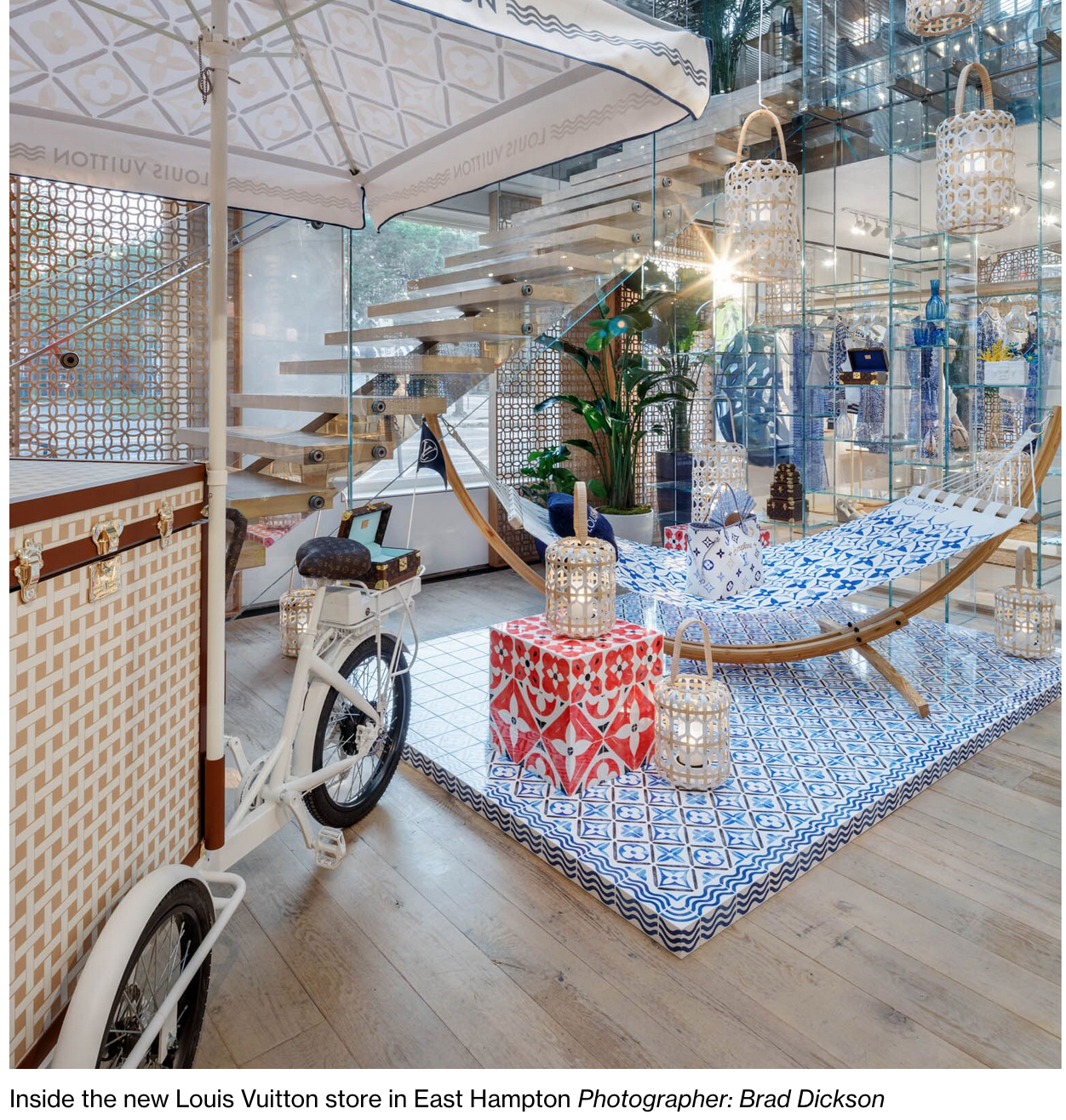

In April, Bernard Arnault, chairman and chief executive officer of LVMH Moet Hennessy Louis Vuitton SE, purchased an East Hampton boutique for $22 million—a new record price for commercial real estate in the tony beachside community.

At $4,400 per square foot, it wasn’t just a big deal locally: That number also exceeds the average rates for retail space in prime areas of Hong Kong, Milan, London, Paris, Tokyo and even Manhattan’s Upper Fifth Avenue (49th to 60th streets), where, according to a report by Cushman & Wakefield, an annual average rent of $2,000 per square foot made it the world’s most expensive shopping street in 2022.

While record-topping residential real estate sales are commonplace in the Hamptons, commercial properties here have not historically seen the same demand.

That’s changing as East Hampton finds itself in the midst of an unprecedented retail boom, driven by the spending power of a population that’s become less and less seasonal. Local agents estimate that overall commercial lease prices have increased by about 25% in the past 12 to 24 months, thanks to a spike in demand.

“There are many brands that are in the Hamptons for the first time this year—many,” says Hal Zwick, director of commercial real estate for Compass in the Hamptons, adding that the full-time local population has swelled by 10% to 15% since the pandemic.

Arnault’s space, at 1 Main Street, now houses an outpost of Louis Vuitton, its first Hamptons boutique. For its opening event over Memorial Day weekend, the store greeted guests with live music, Champagne and caviar-topped blinis; on the second floor, an artist painted flowers on a monogrammed suitcase to show off the brand’s on-site personalization services.

Louis Vuitton is just one of many boutiques to have opened in East Hampton Village in recent weeks; others include Chanel, Valentino and Prada. Even the Munich-based luxury e-commerce titan Mytheresa.com GmbH has set up its first brick-and-mortar location, with a five-week pop-up starting June 29.

“We’re seeing more international tenants,” says Zwick. “They want to be in the Hamptons because they know that’s where their clients are.” Mytheresa, for instance, has data showing that its Hamptons-based shoppers typically spend 30% more than customers anywhere else in the US.

Bidding wars for prime locations and scarcity of retail space have some brands thinking outside the box, and sometimes outside of East Hampton. Some have set up shop at hotels this year (Givenchy at Topping Rose House; Milly at the Surf Lodge).

Retailers such as Nordstrom have set up mobile storefronts for return drop-offs and alterations and Mytheresa retrofitted an auto body shop for its venture.

Across the board, though, the new shops offer curated edits and exclusive products that reflect the Hamptons lifestyle. They also host special events to draw in big spenders, such as runway shows, cocktail fundraisers and floral arranging classes.

It’s as much a reason to plan a trip as the area’s luxurious hotels and excellent new restaurants and bars.

Here are 16 boutiques to prioritize, from the latest openings to shops with exciting new capsule collections that celebrate the season.

Chanel

The theme for this bi-level, classic shingle-style boutique is “Parisian summer fantasy,” with manicured gardens and Chanel’s timelessly elegant design codes: contrasting black and white, interlocking C motifs and polished accents that echo Mademoiselle Chanel’s apartment on rue Cambon. Besides the iconic tweeds and handbags, the location carries enough evening wear for a season full of galas. Also look for the coveted Coco Beach collection, with its ’90s-inspired swimsuits, two-tone terrycloth sets, mini-dresses and the most stylish surfboards around. 26 Newton Lane, East Hampton

Mytheresa

The company’s pop-up is a partnership with of-the-moment Flamingo Estate, whose candles and soaps you’ve probably seen in fancy restaurant bathrooms. There are sections for women, men and children—plus a wide array of daily experiences, such as floral arranging classes, style makeovers and appearances by designers. Fashion aficionados will want to browse a series of exclusive capsule collections created specifically for Mytheresa; they’ll include brands such as Dolce & Gabbana, Versace, Toteme, Dodo Bar Or and Camilla. 9 Railroad Avenue, East Hampton

Curio

Co-founder Danielle Licata noticed that the clients of her multibrand retail shop in Miami’s Faena District were often Hamptons residents, so she came to them with Curio’s first summer residency, running through Sept. 30. She says her goal is to promote “underexposed” designers like Guiseppi di Morabito, who makes maximalist party dresses, and Lebanon’s Maison Rabih Kayrouz. The selection is huge, with more than 100 men’s and women’s brands including better-known labels such as Isabel Marant and Silvia Tcherassi. On its calendar of events are celebrity book signings, fitness classes, runway shows and charitable cocktail evenings. 2183 Montauk Highway, Bridgehampton

Prada

Across the street from Louis Vuitton, this TikTok-worthy boutique is decked out in blue-and-white stripes, reminiscent of a beach towel. It feels like stepping into summer. So do the beachy items on display, like bucket hats, pool slides, and crochet tote bags—all prime examples of quiet luxury, with neutral, color-blocked tones and timeless silhouettes. 2 Newtown Lane, East Hampton

Marina St Barth

Just in time for kaftan season is this haven of elevated resort wear, peddling straw hats, sandals, beach cover-ups, swimwear and breezy dresses for leisurely days in the sun. It carries its own line, along with a selection from resort designers such as Melissa Odabash and Carmen Sol. 32 Park Pl., East Hampton

Louis Vuitton

A summery white Moke serves as shuttle from anywhere in East Hampton to Louis Vuitton’s sprawling new boutique, featuring a gallery-worthy lantern installation and decor inspired by an idealized version of its seaside surrounds: beach chairs, surfboard, hammocks, and some banana palms thrown in for good measure. It carries the LV by the Pool collection, with luxurious beach attire and monogrammed mules, but the most coveted item may be a limited-edition Neverfull bag that says “Hamptons” on it. And if handbags aren’t your thing, you can order a custom-made pingpong table, complete with gold-colored accents to enliven your summer entertaining. 1 Main St., East Hampton

Valentino

This two-floor boutique prominently features the Escape collection, whose bold archival prints, like a rainbow loop or retro crepe de chine, and easy-to-wear summer staples. For men, there are T-shirts, Bermuda shorts, shirts and sweaters; for women, expect a wide selection of dresses, kaftans, swimwear and stylish sets designed for head-to-toe coordination. The 1970s-style headscarves and the mini bucket bags make especially covetable purchases. 53 Main St., East Hampton

Givenchy Plage

At this July pop-up, you’ll want to make a bee line for two items in particular: raffia tote bags that can withstand the sand, and right-on-trend marshmallow wedges, which are perfect for events where you don’t want your heels sinking into the grass. Topping Rose House, 1 Bridgehampton-Sag Harbor Turnpike

Zimmermann

Visit any high-end resort town around the world—Saint-Tropez, Capri, Honolulu, Palm Beach—and you’re bound to spot a Zimmermann boutique or a stylish woman wearing its refined resort wear. The Australian brand now has two locations out east: one on Newton Lane in East Hampton and one in Southampton, both carrying its signature romantic florals and showstopping dresses for formal summer events. It also has some of the most elegant swimwear around, with embellishments and flattering cuts. 27 Newton Lane, East Hampton

Reformation

If you’re in the market for a coordinating linen set or a breezy dress that will translate from day to night, this is the spot. Bonus: Most pieces retail for less than $300, and the shop offers an extended range of sizes. 85 Main Street, East Hampton

Simkhai

Designer Jonathan Simkhai will be spending time in this boutique throughout the season to offer hands-on styling assistance to customers—providing that extra dose of confidence when shopping the brand’s sought-after, crystal-embellished mules and flattering evening dresses. 64 Main St., Southampton

Derek Lam 10 Crosby

The rapidly-expanding Derek Lam 10 Crosby label has just planted its first Hamptons flag, where the self-described “intergenerational” edit includes a specialty denim bar that features a large range of shades and silhouettes, from skirts to shorts to wide-leg jeans. Here you can find something to wear back to the city—be it a crisp white shirt or a tailored midi dress. 20 Newton Lane, East Hampton

Zegna

Just down the street from the new Sant Ambroeus restaurant is this Italian menswear powerhouse, which is launching an exclusive capsule collection in collaboration with Mr. Porter. Shoppers can expect a modern take on the heritage brand’s signature design codes, with sharp tailoring and timeless, versatile pieces. 50 Newton Lane, East Hampton

Urban Zen

Donna Karan’s Sag Harbor boutique is tucked in the back of one of the area’s buzziest restaurants, Tutto Il Giorno. It spotlights the work of African artisans as part of the designer’s efforts to provide a platform for emerging talent. Pick up a unique safari-inspired jacket in a soft summer suede or a floaty, hand-dyed Indian silk slip dress—the whole space feels more like a private lounge than a shop. 16 Main St., Sag Harbor

Diptyque

Bound to be the go-to spot for foolproof gifts for your host, it’ll sell the full range of scented candles and diffusers you know and love—plus a limited-edition Summer Essentials collection. Our favorites? The classic Baies and Gardenia scents. 11 Newton Lane, East Hampton

Aerin

“All of our Aerin stores from the Hamptons to Palm Beach to Miami, each have a special edit inspired by their location,” says beauty and entertaining mogul, Aerin Lauder, of her eponymous boutiques in East Hampton and Southampton. In the East End locations, that involves sun hats by Sarah Bray, sandals, kaftans, fragrances and elevated entertaining essentials, from refined glassware to board games, such as backgammon and chess. 7 Newton Lane, East Hampton

Updated: 7-7-2023

Ultra-Wealthy Continue To Prop Up Dubai’s Luxury Property Market

Dubai’s luxury residential market continued its hot streak, with 176 homes worth at least $10 million changing hands in the first half of this year, according to property consultancy Knight Frank.

“Dubai’s luxury homes market continues to attract the attention of the world’s wealthy, with global high-net-worth-individuals remaining laser focused on acquiring second homes in the emirate,” said Faisal Durrani, Knight Frank’s head of Middle East research.

The city emerged as the world’s busiest market for properties worth over $10 million during the first quarter, surpassing Hong Kong and New York. Demand has stayed resilient in the segment, with transactions worth $3.1 billion recorded in the first half.

With average prices hovering around 6,900 dirhams ($1879) per square foot, the emirate’s luxury offering is still “relatively affordable,” Knight Frank said.

Dubai’s luxury property boom has been in part due to the emirate’s deft handling of the Covid pandemic, followed by a raft of government measures to attract more long-term expatriates, and the war in Ukraine that led to an influx of Russians.

In addition, international buyers from China are also “quickly re-emerging as key players in the city’s residential landscape,” Knight Frank said.

Roughly a third of all luxury homes sold are located on Palm Jumeirah, the artificial and palm-shaped area on reclaimed land off Dubai’s coast. Other, more inland areas away from the coast could soon gain prime status, according to Knight Frank.

“Improving inland infrastructure could be one way to spur development away from the coast, particularly given the rising importance of green space or parks to internationalhigh-net-worth-individuals eyeing up residential purchases in Dubai,” Durrani said.

Updated: 7-25-2023

LVMH’s US Weakness Weighs On Sales And Shares As China Rebounds

* All Regions Grew At Double Digits In 2Q Except For US

* Luxury Demand Is Normalizing After 2021, 2022 Boom: CFO

LVMH shares slumped as a sluggish economy deterred some US shoppers from buying its high-end clothes and handbags in the second quarter, offsetting a rebound in China.

Revenue fell 1% in the US on an organic basis, the company said Tuesday, the only region that showed a drop. Sales at the luxury group’s biggest unit, which includes labels such as Louis Vuitton and Celine, jumped 21%, meeting analysts’ estimates.

LVMH shares fell as much as 4.1% in early Paris trading Wednesday. They’re still up 21% for the year to date.

The slowdown in the US particularly affected aspirational customers who splurged less on entry-level luxury products, Chief Financial Officer Jean-Jacques Guiony told reporters. The trend was pronounced online and in smaller cities, he said.

“The global mood isn’t for the revenge buying that we experienced in 2021 and 2022, so we’re talking more about normalization” of demand for luxury goods overall, Guiony said.

Led by billionaire Bernard Arnault, LVMH follows Cartier owner Richemont and Burberry Group Plc in reporting weaker demand in the US during the period.

EssilorLuxottica SA, the French-Italian owner of the Ray-Ban and Oakley sunglasses, also on Tuesday posted North American revenue that fell short of estimates.

LVMH has weathered the US slowdown better than its peers. The group benefits from a bigger global footprint and a wide array of brands spanning Moet & Chandon to Tiffany & Co.

The results hint “at a first step to normalization,” Luca Solca, analyst at Sanford C. Bernstein wrote in a note. “The transition is likely going to produce some turbulence,” but “in the absence of a hard landing recession, the sector should soon find an even keel.”

The group also also been charging more, with Christian Dior earlier this month increasing prices by 4% on average globally, following a similar move by Louis Vuitton last month, Guiony said.

Marketing Costs

Still, first-half profit from recurring operations slightly missed expectations, coming in at €11.6 billion ($12.8 billion) compared with analysts’ average estimate of €11.8 billion.

LVMH incurred significant marketing costs in the first half, Guiony added, due to high-profile fashion shows, notably at Christian Dior and Louis Vuitton, with Pharrell Williams’ menswear debut last month in Paris.

The spending was higher than usual and Guiony said he expects it to be lower in the second half.

Sales at all divisions grew by double digits in the second quarter, except for the wines and spirits unit, which was hurt by weaker demand for its Hennessy Cognac in the US.

Guiony told analysts the worst is probably over with US demand for that spirit likely to have bottomed out.

When it comes to Chinese shoppers, Guiony said they’re buying increasingly outside of their country, but in regional tourist destinations rather than further afield. Organic sales in Asia excluding Japan soared 34% in the second quarter.

Europe is seeing the return of wealthy Chinese tourists who are traveling independently rather than in groups, as was common before Covid, he added, explaining that it’s impossible to predict when larger numbers of Chinese tourists will return to Paris or Milan.

The results were a mixed set, according to Jie Zhang, analyst at AlphaValue, adding that visibility for the rest of the year remains low, notably due to uncertain macro-economic environment in China.

Updated: 7-26-2023

Hamptons Luxury Bidding Wars Hit Record High Even As Prices Sag

While limited inventory keeps a lid on transactions in the Long Island beach towns, buyers are hungry for desirable listings.

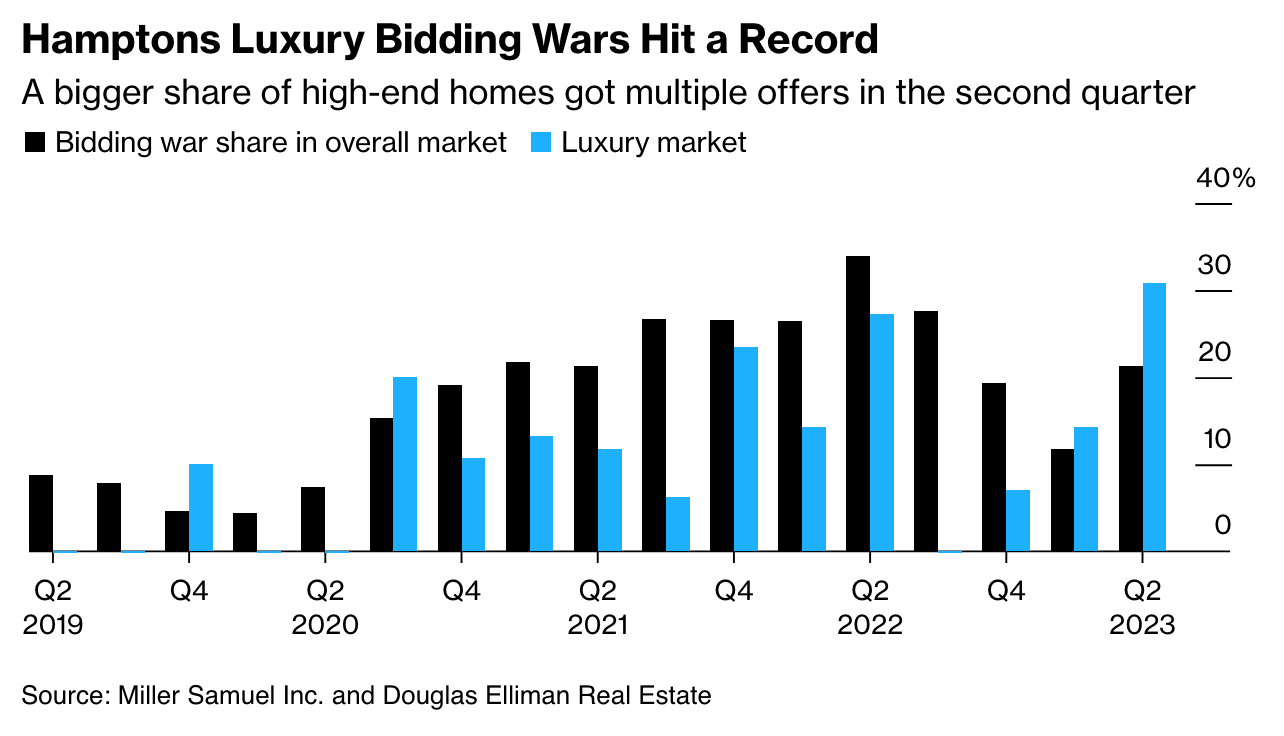

Bidding wars for luxury homes in the Hamptons hit a record high in the second quarter, even as sales and prices declined in the broader market across the Long Island beach towns.

Nearly 31% of luxury deals that closed in the period came after multiple offers, topping the previous high of 27% set a year ago, according to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate.

The category represents the most expensive 10% of transactions, which in the quarter meant any home that sold for $4.4 million or more.

“The majority of it is the lack of inventory,” said Justin Agnello, an East Hampton-based agent at Douglas Elliman who has represented buyers and sellers in several recent bidding wars.

“But it’s also that if you do bring something to the market that’s really appealing, buyers are even more hungry for it.”

Across all price ranges, about 21% of purchases were for more than the asking price. One property in that category was 37 Dune Road #C in East Quogue, a five-bedroom oceanfront home built in 2003.

It was listed for $3.25 million and Douglas Elliman agent Enzo Morabito anticipated a $3 million sale. The deal ended up closing at $3.526 million after a four-way bidding war.

Even with tough competition, prices and transaction volume in the Hamptons have been sliding since last year, as rising interest rates and employers’ requirements for in-person work in New York City made the East End less attractive for buyers.

As in markets throughout the country, the lack of listings has been constraining purchases.

The median sale price of all Hamptons single-family homes and condos was $1.45 million, a 9.4% decline from the second quarter of 2022. Closings totaled 259, down 41%, Miller Samuel and Douglas Elliman said.

Inventory has been a challenge in the Hamptons since the pandemic buying frenzy severely depleted what was on the market. But the number of listings available at the end of the second quarter was up 6.6% from a year earlier to 955, meaning buyers got a bit more to choose from.

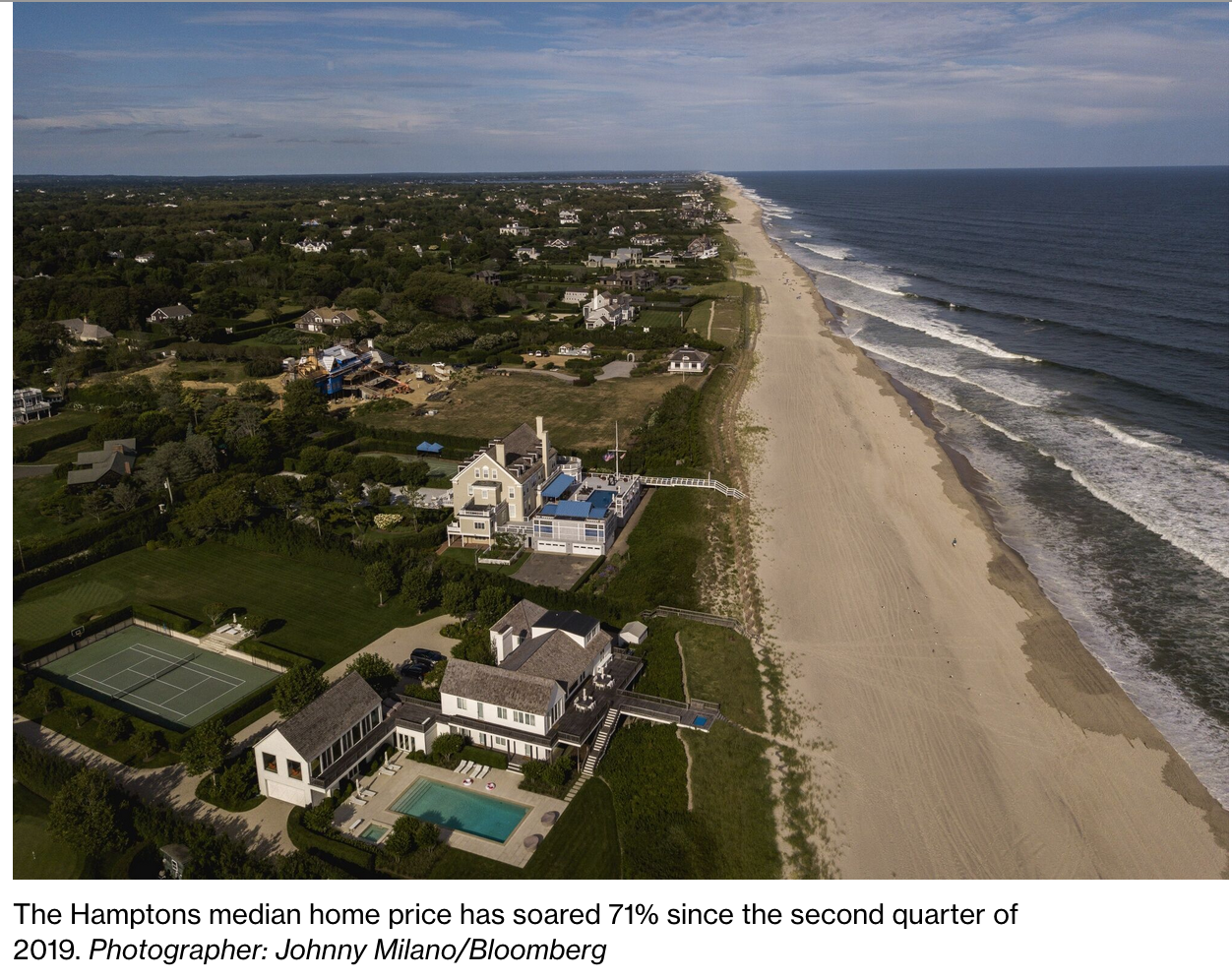

Hamptons prices are still sharply higher they were before the pandemic. The median has soared 71% since the second quarter of 2019, according to Jonathan Miller, president of Miller Samuel.

“That’s an extreme comparison,” he said. “While most housing markets have seen substantial increases because of lack of supply, that’s a big number.”

In the luxury tier, the median sale price in the quarter was just shy of $6.4 million, down 25% from a year earlier but still 6.6% higher than before the pandemic. There were 26 luxury sales, a drop from the 45 notched in last year’s second quarter.

On Long Island’s North Fork, prices have been on an upswing as buyers look for a less expensive alternative to the Hamptons. The median in the quarter was $980,000, up 8.3% from a year earlier and the third-highest on record.

Updated: 9-3-2023

Luxury Retailers Are Following The Money To India’s New Affluent

Hermes, Christian Louboutin are among those willing to pay skyrocketing rent for space in historic real estate.

A few blocks from the Reserve Bank of India’s headquarters in Mumbai lies the true marker of the country’s rising wealth — a new store from Indian fashion designer Sabyasachi Mukherjee in a restored building dating from the early 1900s.

The opening of the four-story flagship makes Sabyasachi the latest luxury retailer to follow the money to southern Mumbai, which has been the home of India’s financial services industry since the precursor to the Bombay Stock Exchange began there under a banyan tree in 1875.

In more recent years, Hermes International, Christian Louboutin and others have set up shop, willing to pay the neighborhood’s skyrocketing rents for space in historic real estate and access to a rising upper class.

“The coming of age of the Indian high net worth individual market is really attracting luxury players,” said Anurag Mathur, a partner at Bain & Company in New Delhi.

The pandemic fueled a desire for personal luxury while limiting travel, making Indians buy these goods in their home country, he said. For luxury brands, “there’s clearly a desire to look for a new frontier and India very much, with its change, offers that.”

Around 1.66 million people in India are forecast to have more than a million dollars’ net worth by 2027. The bracket of those with $30 million to their name is forecast to grow by almost 60% in the five years from 2022, according to Knight Frank’s Wealth Report.

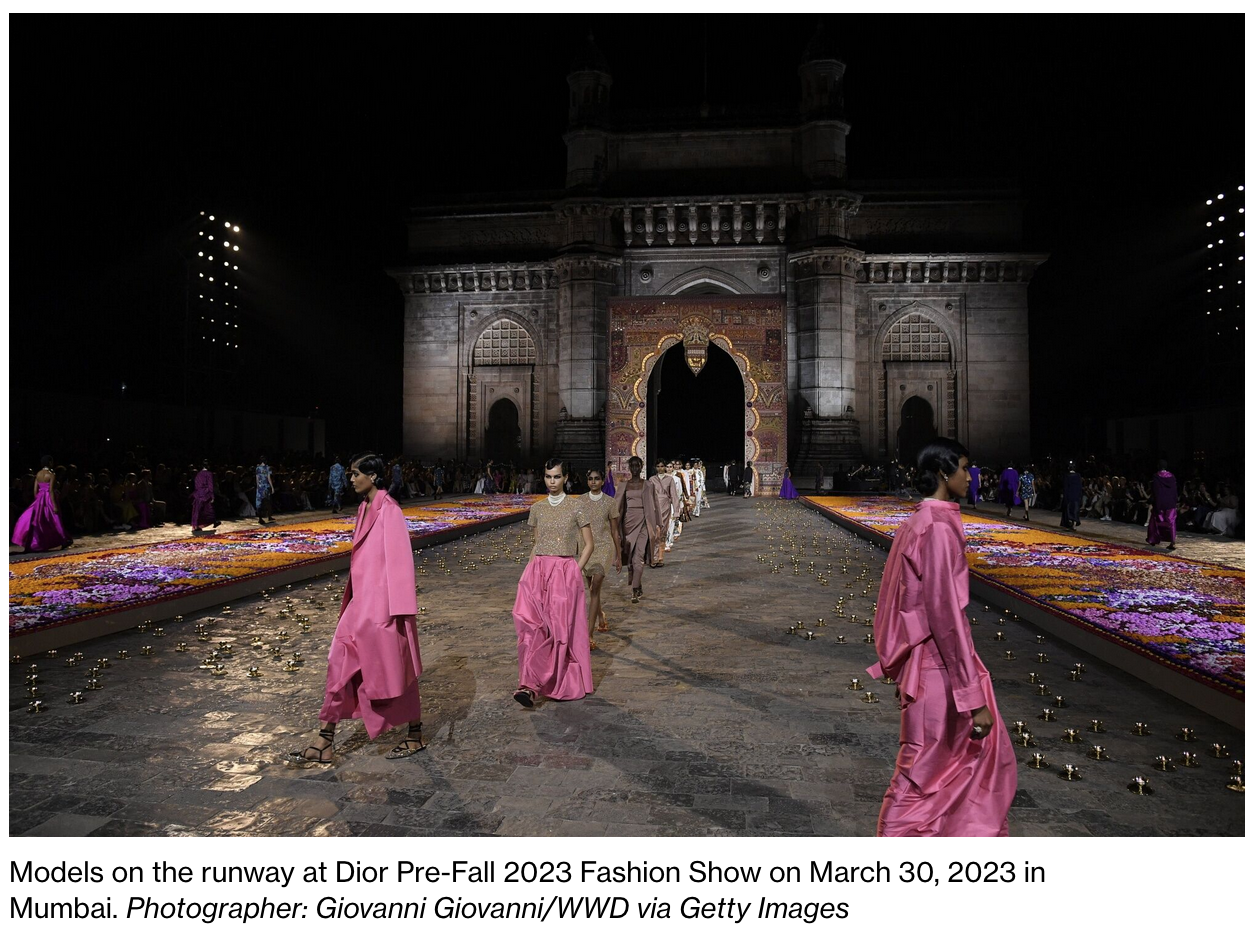

Signs that international brands are paying attention were on full display earlier this year when Dior chose Mumbai’s iconic Gateway of India as the backdrop for its first runway show in India.

The collection boasted sequined dresses, bright pops of pink and traditional Indian needlework on jackets, skirts and bags in an appeal to local consumers, and their wallets.

The neighborhood around the Gateway — including the boutique-filled The Taj Mahal Palace hotel — has always been home to affluent, old school business families.

But while commercial real estate has gotten too pricey for some financial services firms, several international brands see the value.

“The increased demand for luxury brands, the limited supply of properties available and severe market competition have forced rentals higher,” said Karl Nagarwalla of Nagarwalla Estates, a group that’s helped companies like Hermes and Louboutin get their showrooms in the city.

Monthly rent for retail spaces in the area can stretch beyond $6,044 to $7,250 for a 1,000-square-foot space, he said.

As a result, many banks, mutual fund managers and traders have moved to new financial districts, including the Bandra Kurla Complex anchored by Bank of America and Citibank, as well as suburban areas to the north.

“If you look at Mumbai, the streets have remained the same, but the people have always changed,” said Abha Narain Lambah, principal architect at Abha Narain Lambah Associates, which has worked on restoring buildings in the area.

The previous occupants of the colonial-era buildings in southern Mumbai — stockbrokers, for example — weren’t looking at the architecture or the design value of it, she said.

“Gentrification, new entrepreneurship, change of use is a feature that we have to embrace as long as those buildings can be recycled and adaptively reused.”

Many of the city’s heritage buildings have served multiple purposes throughout their history, and the new Sabyasachi store is no exception.

The property, a Grade IIA heritage status building in neoclassical design, was restored and acquired from HSBC Bank by Indian City Properties in early 2021.

It was designed by the architectural firm Chambers & Fritchley in 1913, and was originally built for the British Bank of the Middle East, one of 37 banks in the area that eventually became known as the bank district, according to Indian City Properties.

“This strategic acquisition was not only aimed at preserving the cultural heritage of the Fort area but also at retaining its distinctive architectural character,” said Avinash Gupta, chief business officer at Indian City Properties, referring to the area that until the mid-1800s was a fortress town surrounded by bastions and guns.

Sabyasachi , known for its elaborate wedding dresses and jewelry, has been able to expand with backing from Aditya Birla Fashion and Retail Ltd., which took a 51% stake in the brand with an all-cash deal in 2021.

The investment helped Aditya Birla in its most recent quarter — the company reported a loss in the three months ended June, but said Sabysaschi’s revenue rose rose and sales have had “good traction” at the Mumbai store, according to filings to the Bombay Stock Exchange.

Aditya Birla isn’t alone in adding premium and luxury brands to its portfolio. Asia’s richest man, Mukesh Ambani, also has set his sights on bringing luxury experiences to India.

His Reliance Brands Ltd. has invested in MM Styles Ltd., which owns the eponymous fashion house run by Bollywood stylist Manish Malhotra.

The conglomerate has also taken a 52% stake in the label of Ritu Kumar, another Indian designer. Reliance’s latest financial results highlight the growth in non-food business, with its retail unit that includes fashion and lifestyle brands delivering 15% growth in revenue year-on-year.

“The competitiveness is good — the market as a collective is growing. There’s enough and more opportunity for all the brands to have over the next decade or so,” Bain’s Mathur said. “The pandemic made people question what are they storing their money for.”

Updated: 10-10-2023

Sales Slow At Louis Vuitton’s Owner As China Sputters

Luxury-goods retailer struggled to lure Chinese consumers back to its stores.

LVMH Moët Hennessy Louis Vuitton reported a sharp slowdown in sales growth as the world’s biggest luxury-goods company struggled to lure big-spending Chinese consumers back to its boutiques after the end of China’s pandemic restrictions.

The owner of Louis Vuitton and Dior said sales in its Asia market—which is dominated by China and excludes Japan—rose 11% over a three-month period ending on Sept. 30, stripping out the effects of currency fluctuations. That is down from a 23% rise in the first half of the year.

China’s economic woes spell trouble for LVMH and other luxury groups that built their business around the assumption that the country would continue to power the industry’s growth.

Economists say worsening structural problems make it unlikely that China can extend the period of breakneck growth that made it the world’s biggest luxury market. Investor concern over Chinese spending has weighed on LVMH shares, which are down almost 20% since mid-July.

Luxury-goods companies are also counting on China to offset slumps in other parts of the world, where inflation and higher interest rates are squeezing consumer spending.

LVMH said sales rose a meager 2% in the U.S.—a market that was once its fastest-growing and a key driver of its postpandemic boom.

Sales rose only 7% in Europe, a slowdown that Chief Financial Officer Jean-Jacques Guiony ascribed to a “notable change” in clientele spending compared with the first half of the year.

“This seems a sign of continuing moderation, as consumers sober up after the post-pandemic euphoria,” Bernstein analyst Luca Solca wrote in a note.

China was the world’s largest luxury market before Covid-19 hit. Consulting firm Bain & Co. estimated that Chinese consumers accounted for between 17% and 19% of global luxury spending last year.

By contrast, they accounted for one-third of global spending on luxury goods in 2019, the consulting firm said.

In January, Beijing relaxed border restrictions, sending European luxury shares soaring. The news came just as spending by wealthy Western consumers was leveling off after a frenzy of post-Covid buying.

Initially, China’s decision set off a flurry of spending as people dined out and splurged on travel around the country and in Asia.

Luxury executives expressed optimism that a Chinese rebound would make it a strong year for sales of high-price handbags, luxury jewelry and other expensive items.

But as the sugar high of the reopening wore off, underlying problems in China’s economy that had been building for years began reasserting themselves.

The property boom and government overinvestment that fueled growth for more than a decade have ended.

Big debts are crippling households and local governments. Joblessness among young people ages 16 to 24 hit record highs this year before Beijing stopped disclosing the data this summer.

Guiony, LVMH’s CFO, said the slowdown in sales growth was in part due to tougher year-on-year comparisons. The third quarter of last year—before a wave of Covid-19 infections swept across China—was LVMH’s strongest in the country.

He said sales to Chinese consumers from the company’s key fashion and leather-goods division were up 40% in the third quarter from the same period two years ago, in line with its performance in the first half.

Predicting what will happen next in “the Chinese market is an almost impossible task,” he said.

Most recently, Chinese consumers spent and traveled less during October’s Golden Week holiday period—typically a tourism and spending bonanza—than the government had projected, figures showed.

In recent months, Chinese nationals have begun traveling again. For now, Chinese nationals traveling to Europe tend to be business people and more affluent.

Middle-class Chinese citizens who found the pandemic tougher are taking longer to regain the confidence to spend. High airfare prices mean that international travel remains out of reach for many.

For most brands that make up LVMH’s fashion and leather-goods division, Chinese nationals made about 30% of their purchases outside mainland China this year, twice the percentage of last year, Guiony said.

Still, those figures remain a long way from pre-Covid numbers when two-thirds of Chinese spending took place outside the country.

“That entails some difference in behavior,” Mr. Guiony said. “If you’re buying in your home country, average [receipts] will tend to be lower than if you do once in your lifetime in a foreign country where you want to buy something.”

Overall, LVMH posted third-quarter sales of €19.96 billion, the equivalent of $21.16 billion, a 9% rise on an organic basis compared with the year-ago period.

Fashion and leather goods, the company’s largest division, booked a 9% rise in quarterly sales to €9.75 billion, well below the 20% growth it posted for the first six months of the year.

Its wine and spirits division was pressured by a decline in sales of cognac in the U.S., with revenue dropping 14%. Revenue growth among the group’s watches and jewelry labels also slowed to 3% for the period, LVMH said. Perfumes and cosmetics grew 9% from a year earlier.

Traffic in Sephora stores in North America, Europe and the Middle East helped push up sales at the selective retail division, which clocked 26% sales growth in the quarter.

The luxury group’s DFS travel retail business also benefited from the recovery of international travel and, in particular, from the gradual return of travelers to Hong Kong and Macao, the company said.

The figures from LVMH are the first indication of how Europe’s big luxury houses have fared in the third quarter, with the French handbags maker Hermès and Gucci-owner Kering set to update investors later this month.

LVMH Sales Growth Slows As Global Luxury Demand Cools

* Stock Posts Biggest Intraday Decline Since November 2021

* Wine & Spirits Unit Sales Tumbled 14% From Year Before

LVMH shares tumbled after the world’s largest luxury group reported softer sales growth in the third quarter — more evidence the post-pandemic boom in high-end goods is losing steam.

Organic revenue at the crucial fashion and leather goods unit, which includes Louis Vuitton and Christian Dior, rose 9%, the company said Tuesday, below analysts’ expectations and half the pace of the first six months.

Sales at the wines and spirits unit tumbled 14%, much worse than estimates.

“After three roaring years and outstanding years, growth is converging toward numbers that are more in line with the historical average,” LVMH Chief Financial Officer Jean-Jacques Guiony said during the quarterly presentation.

LVMH Moet Hennessy Louis Vuitton SE fell as much as 8.5% in Paris trading, the biggest intraday decline in almost two years. The stock, a favorite of investors in recent years, had already lost some luster as China’s recovery underwhelmed and demand from US consumers cooled.

The luxury group’s market value has plunged by about €110 billion ($117 billion) from a record in April. LVMH ceded its rank as Europe’s most valuable company to Danish drugmaker Novo Nordisk A/S last month.

LVMH is considered a bellwether for luxury and shares of rivals including Hermes International and Gucci owner Kering SA, which report later this month, also tumbled on Wednesday.

LVMH’s sales in Asia, excluding Japan, grew 11% — well short of estimates in the third quarter and a sign that China may be weaker than expected.

The only unit that recorded sales ahead of analysts’ expectations was selective retailing, which includes cosmetics chain Sephora.

Asked about the long-term growth outlook of Dior, the group’s second biggest fashion label, Guiony said it had tripled in size in less than seven years.

“At some point, growth rates have to normalize,” he said. “Don’t expect the brand to continue to grow 30% per annum for ever. It will not happen,” he said, adding that Dior will continue to deliver value.

Guiony said its jewelry brand Bulgari fared a bit better in the third quarter due to its bigger exposure to Asia compared to Tiffany, which has a bigger footprint in the US. Organic revenue growth in the US was only 2% in the period.

Consumers ‘Sober Up’

Overall, LVMH posted 9% organic revenue growth, below estimates.

“This seems a sign of continuing moderation, as consumers sober up after the post-pandemic euphoria,” Bernstein analyst Luca Solca said in a note.

Updated: 10-12-2023

Chinese Opt For Trendy Mcdonald’s Over Hermes In Blow to Hong Kong Tourism

* New Kind Of Chinese Tourist Opting For Cheaper Activities

* Chinese Traveled And Spent Less Than Before During Golden Week

Mainland Chinese visitors to Hong Kong used to flaunt Hermes handbags in shopping malls for social media photos.

These days, the most popular kind of post is a tourist holding a McDonald’s takeout bag on a quiet street in the city’s Mid-Levels district named MacDonnell Road.

Hong Kong is welcoming a new kind of post-pandemic Chinese tourist, who instead of splurging on luxury items now opts for more low-key activities.

Getting their cues from influencers on Xiaohongshu, an Instagram-like app, many take selfies on streets with quirky names or dense residential complexes, while others pose outside a police station that has been prominently featured in classic Hong Kong movies.

The changes in travel habits, brought on by a younger generation of social-media users, comes as the Chinese economy weaken, with younger people in particular adjusting their consumption patterns as youth unemployment remains high.

Consumers across the country traveled and spent less than expected during the recent Golden Week holiday.

“Most of my time in Hong Kong now is for taking photos by following the footsteps of influencers on Xiaohongshu,” said Mike Guo, a tourist from Beijing, after taking pictures beside a road sign in the Kennedy Town neighborhood.

The area has attracted many Chinese tourists for its proximity to the sea and trendy coffee shops.

That’s hurting Hong Kong’s hopes that it can turn to mainland Chinese tourists to prop up its sluggish economy. Before Covid, the tourism industry contributed around 3.6% of Hong Kong’s gross domestic product and employed about 232,700 people, accounting for about 6% of employment, according to the government.

During Golden Week, retail sales in the city were similar to that of a regular weekend in Hong Kong even though shops saw an increase of 20% to 30% in foot traffic, said Oliver Tong, head of retail in Hong Kong at JLL.

The pessimism is even extending to the next Lunar New Year holiday, he added.

The sale value of luxury goods including jewelery and watches was HK$5.2 billion ($665 million) in August, according to the Census And Statistics Department, a 31% fall from the same period in 2018 before large-scale political protests and Covid-19 hit the city.

The retail and services industries further suffered as Hong Kong residents leaving the city outnumbered tourists coming from the mainland.

There were a total of 1.5 million departures, while the number of travelers from the mainland stood at about 970,000, according to data from the Immigration Department.

Another major factor taking the sheen off Hong Kong is the strength of the dollar-pegged local currency, with the offshore Chinese yuan weakening almost 5% against the Hong Kong dollar since the beginning of the year. The two currencies now are close to parity.

“Very few people come to Hong Kong for shopping because it is not very cheap under the current exchange rate,” said Guo, who used to fly to Hong Kong once a month for shopping and buying insurance, but now thinks there’s no big price difference between the two places for luxury goods.

And while Hong Kong used to be the undisputed shopping destination of China, the city is now facing fierce competition from Hainan province. The tax-free tropical island in the country’s south is emerging as the hottest destination for luxury shopping, with global brands increasing their presence there.

Last week, LVMH’s duty-free unit DFS Group announced that it would build a mega mall there, the company’s first in mainland China.

“Nowadays, I only buy luxury products in Sanya, Hainan, because I can get a better deal there,” said Jiaxing Shi, who was visiting Hong Kong for the first time from Guangzhou, a city just one hour away by high-speed train.

Shi spent the afternoon taking pictures with her friends near a harbor-front coffee shop in Kennedy Town.

The changing behavior of Hong Kong’s biggest group of visitors is a wake-up call to its tourism industry, which has been criticized in recent years over its complacency to slowness to evolve beyond promoting consumption-led attractions.

For example, the government recently launched a campaign to promote Hong Kong’s nightlife by setting up night markets selling local snacks and souvenirs, which attracted more locals than tourists.

Paul Chan, co-founder of Walk in Hong Kong, a company offering walking tours, believes that the tourism industry should take the opportunity to change.

Beyond shopping malls and restaurants, the city has distinctive cultural offerings like its old neighborhoods and more rural areas, he said.

“We urgently need to diversify our image to let rest of the world know that we have much more to offer,” said Chan.

Updated: 10-13-2023

These Stocks Are Booming, and That’s Bad News for China’s Growth

Shares of retailers that offer value-for-money products have climbed along with their sales

HONG KONG—Chinese shoppers are increasingly looking for bargains, lifting shares of companies that cater to budget-conscious shoppers even as the nation’s broader market stumbles.

Chinese sales have been soaring at online retailer Pinduoduo, budget household-goods chain Miniso

and Japanese fashion brand Uniqlo. The companies have become a magnet for cost-conscious Chinese consumers, and are faring better than their more upmarket rivals.

The country’s postpandemic economic recovery has been uneven so far. Its citizens have resumed shopping, traveling and dining out but more are scrutinizing everything they spend money on.

Chinese social-media platforms are rife with discussions about “consumption downgrades,” where people share their experiences of finding cheaper versions of everyday items such as face wash and work apparel. Overall retail sales in China rose in single-digit percentage terms in the past few months from a year ago, according to official data.

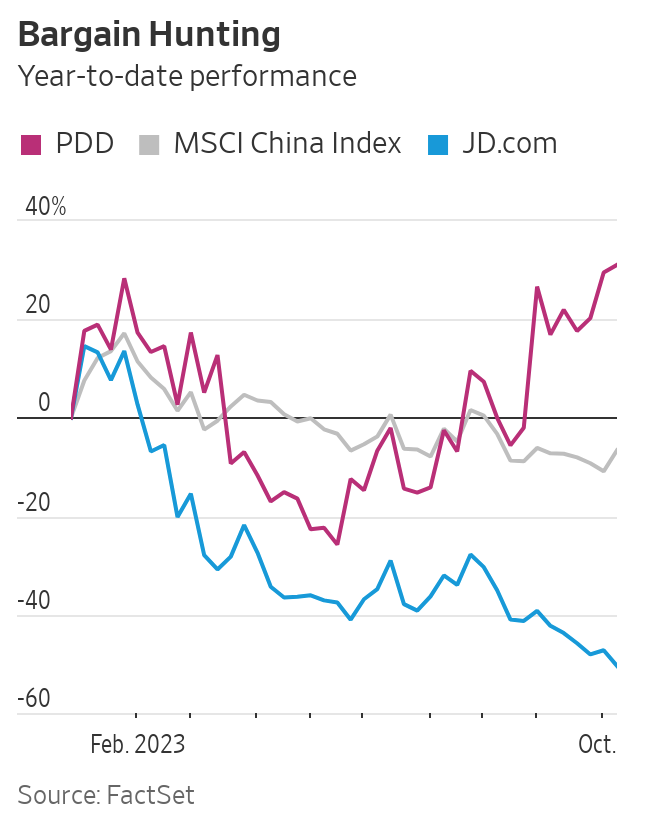

Investors are making wagers on the new spending habits of Chinese consumers. American depositary receipts of Nasdaq-listed PDD, which owns Pinduoduo, are up 31% this year and its market capitalization of about $142 billion is now roughly three times that of e-commerce rival JD.com

JD.com’s ADRs are down 50% in the year to date, while the broad MSCI China index has fallen back into a bear market.

PDD’s revenue jumped 66% to $7.2 billion in the second quarter, according to its most recent results. Founded in 2015, Pinduoduo sells groceries, apparel, electronics and other items online at prices lower than many other retailers.

Its platform, which has been popular with people from less developed parts of the country, is also drawing more middle-class consumers in major cities. PDD executives said the company has stepped up its efforts to provide more savings to value-seeking shoppers.

It also sells branded goods: A recent promotion saw Pinduoduo offering a discount of up to 500 yuan, equivalent to almost $69, on Apple’s new iPhone 15 Pro Max, whose regular retail price starts at 9,999 yuan.

Revenue at JD.com rose 7.6% to $39.7 billion during the second quarter. The e-commerce giant has also pivoted more toward selling inexpensive and discounted goods.

Earlier in the year, international investors were more optimistic about China’s post-Covid recovery and the spending power of its growing middle and upper-class population.

They drove up the shares of luxury goods makers which derive a chunk of their sales from Chinese consumers, such as LVMH Moët Hennessy Louis Vuitton and Richemont, the owner of watch and jewelry brand Cartier. These stocks have slumped in recent months as economic data weakens.

Many Chinese households are grappling with increased uncertainties around their employment and incomes, while the country’s housing downturn is eroding the value of the properties they own. That is making people spend more selectively, and hunt for bargains.

“Consumers are hoping to maintain their quality of life at the lowest possible cost,” said Chris Gao, an analyst with CLSA Securities. People’s income expectations need to recover in order for consumption to pick up, Gao added.

Chinese consumers have been spending less on clothing lately, according to a recent CLSA survey. It also found that many local shoppers think the apparel brand Uniqlo offers the best value for money—more so than Western brands such as H&M, Zara, and Gap—and was the most purchased brand among all age groups surveyed.

On Chinese social media, people have shared anecdotes about how they switched to Uniqlo for work attire and unexpectedly encountered others wearing the same outfits.

The Tokyo-listed shares of Fast Retailing, which owns Uniqlo, have risen more than 30% this year. The company said its same-store sales in mainland China—its biggest international market—expanded 40% in the three months to May from a year ago.

Uniqlo’s China sales hit a record for the company’s fiscal year that ended on Aug. 31, Fast Retailing said on Thursday. It noted that the post-Covid recovery was stronger than its expectations.