Let’s Retire ‘Acts of God.’ Disasters Are Human-Made And Insurers Are Fed Up (Single-Family, Condo Owners, Business Owners Beware)

Tornado Insurance Payouts On Track To Hit $5 Billion. Let’s Retire ‘Acts of God.’ Disasters Are Human-Made And Insurers Are Fed Up (Single-Family, Condo Owners, Business Owners Beware)

Related:

A California Start-up Wants To Fight Fire With An Impact Bond

Silver Lining of Coronavirus, Return of Animals, Clear Skies, Quiet Streets And Tranquil Shores

Insurance companies have set up claims centers in parking lots and agents are filing them on their mobile phones to speed payouts that could reach $5 billion from last week’s tornadoes.

That figure would make the storms that tore through six states last week one of the most costly tornado disasters in history. Damage is so widespread that some insurers are using aerial imagery to identify where claims will come from.

”Some parts of town are still standing, but for the most part it is just total devastation,” said Steve Jones, an agent for Shelter Mutual Insurance Co. in Mayfield, Ky., one of the hardest-hit locations.

His office is still intact but lacks electricity and internet connection, so a phone message directs policyholders to a “mobile catastrophe team” set up by the Missouri-based carrier in a fast-food restaurant parking lot.

Tornado damage is covered under most standard auto- and home-insurance policies, according to insurance regulators, executives, brokers and consumer activists. That compares to flooding which is typically excluded.

Some insurers in recent years have increased use of special deductibles for damage from windstorms, including tornadoes, to hold down their potential payouts, according to trade groups and regulators.

The deductible is the amount a policyholder pays to cover losses before the insurer pays on a claim.

Deductibles for homeowners’ policies are often $500-$1,000, but special deductibles can equal 1% or 2% of the coverage amount.

For a policy covering a $300,000 home, that could mean a $6,000 payout before the insurance kicks in. Consumer advocates say these special deductibles can be confusing and prohibitively expensive for homeowners.

Tornado deductibles in the six states affected generally are far smaller than those paid by coastal homeowners for hurricane coverage. Some carriers that cover homes in the affected area offer optional windstorm deductibles in exchange for lower annual premiums.

State Farm Mutual Automobile Insurance Co., a major insurer in the region, said it doesn’t use a separate windstorm deductible in the six states.

Estimates of damage from the storms have risen in recent days. Fitch Ratings said that collective insured losses could be several billion dollars, possibly rising to $5 billion. That is a fraction of the cost of two other major storms this year.

Winter Storm Uri in February had an insured cost of $15 billion and Hurricane Ida in August and September was about $40 billion, Fitch said.

Most U.S. tornadoes occur between April and June, according to the National Oceanic and Atmospheric Administration. They form from large thunderstorms as warm, humid air rises.

Tornadoes aren’t common in December, but the unusually warm weather last week produced the conditions necessary for the storms.

According to trade group Insurance Information Institute, based on Aon PLC data, the costliest U.S. catastrophe involving tornadoes occurred in April 2011, when a spate of twisters hit Tuscaloosa, Ala., and other areas, causing $8.5 billion in insured losses in 2020 dollars.

As of Thursday afternoon, State Farm had received more than 11,000 claims from the six states. Kentucky was the hardest hit with about 1,800 claims, and Tennessee is just behind, a spokesman said. The carrier had about 1,400 auto-insurance damage claims.

USAA said it had received nearly 2,000 claims by early Thursday. It is using aircraft to identify large losses and get settlements underway, a spokeswoman said.

Some agents said they are taking initiative to file claims for policyholders, to get a jump on the assignment of an adjuster and payment of temporary living expenses.

Kentucky Farm Bureau agency manager Mike Cartwright said he has filed claims from his own mobile phone while driving around Mayfield, and he has looked on Facebook at photos posted by clients.

“I knew I had them insured, so I turned in the claim to get the process started,” he said.

Robert Hunter, the Consumer Federation of America’s insurance director, said policyholders could find their coverage insufficient because of inflation.

The tornadoes hit as building materials, furniture and labor prices already have been surging, with inflation that has worsened in recent months.

Across the six states “there is enough damage to create ‘demand surge’ in the cost of rebuilding,” Mr. Hunter said. A home properly insured for a fire at $100,000 might cost well over that as entire tornado-hit communities seek to rebuild simultaneously.

Besides tornado damage to homes, U.S. property insurers also face many business claims. As well, comprehensive auto coverage covers tornado-related wind damage to a vehicle.

Updated: 9-22-2021

Ida Storm Damage Expected To Cost Insurers At Least $31 Billion

Auto, home, business insurers to reflect their share of costs in third-quarter earnings.

Ida is poised to join Katrina, Sandy, Harvey and Irma on the list of the top five costliest hurricanes as measured by insured losses.

Estimates of Ida’s damage have continued to climb as insurers disclose their costs. In one of the newest revisions, Risk Management Solutions Inc., a major catastrophe-risk modeling firm, last week estimated Ida’s U.S. insured losses at between $31 billion and $44 billion since its Aug. 29 landing in Louisiana.

At the low end of RMS’s range, Ida would nudge ahead of 1992’s Hurricane Andrew, the current sixth-place costliest storm with $29.7 billion in insured losses in 2020 dollars, according to data from the trade group Insurance Information Institute based on rankings by brokerage and consulting firm Aon

PLC.

Ida’s steep cost is tied partly to the Covid-19 pandemic. Risk modelers say disruptions to construction- and automotive-industry supply chains, as well as labor shortages, are driving up claims costs. In addition, protracted power outages have stretched out repair times.

Policyholders’ claims for Ida’s damage “will take a big chunk out of” coming third-quarter earnings, said David Motemaden, an analyst with Evercore ISI.

Publicly traded insurers with the biggest exposures include business and home insurers Chubb Ltd. and Travelers Cos., alongside personal-auto and home insurers Allstate Corp. and Progressive Corp., he said.

“Ida was definitely a significant storm,” Allstate Chief Executive Tom Wilson said at a Sept. 14 investor conference.

On Sept. 16, Allstate announced estimated gross losses from Ida of $1.4 billion, before accounting for reinsurance. Damage occurred in 19 states, the majority of it in Louisiana, the company said.

Reflecting anticipated reinsurance recoveries, Allstate put Ida’s net losses at $631 million, pretax, and $498 million, after-tax.

Progressive said last week in a news release that Ida’s losses through Sept. 15 totaled an estimated pretax $510 million, after reinsurance, in both the Gulf Coast and Northeast.

Some private-sector insurers’ business policies include flood coverage, and auto insurers are expected to be on the hook for many of the vehicles stranded, swept away or forsaken in floodwaters as Ida made its way up north with record-breaking rainfall.

“Comprehensive” auto coverage includes protection against flooding, and nearly 80% of insured drivers purchase this type policy, according to the Insurance Information Institute.

Hartford Financial Services Group Inc. Chief Financial Officer Beth Costello said at a Sept. 13 investor event that the business, home and car insurer is “continuing to work through the claim activity” from Ida and preliminarily sees costs “somewhere around $200 million pretax for us, plus or minus.”

Much of the cost will be borne by reinsurers, with which primary insurers contract to take on some of the financial responsibility for disaster-related claims, analysts said.

Maria, Irma and Harvey, which all occurred in 2017, tallied between $31 billion and $32 billion apiece in insured losses in 2020 dollars, while 2012’s Sandy clocked in at $33.93 billion, according to the Insurance Information Institute.

Katrina, in 2005, is well ahead in first place, at $86.57 billion.

Those tallies and RMS’s Ida estimates include coverage through the federal government’s National Flood Insurance Program.

RMS’s estimate encompasses damage to homes, businesses, automobiles, industrial facilities, infrastructure, marine cargo and watercraft, as well as business-interruption losses.

Standard homeowners policies typically exclude flooding damage, and many homeowners obtain separate policies through the National Flood Insurance Program, as do small businesses.

Including damage that was uninsured, analytics firm CoreLogic Inc. on Sept. 8 estimated Ida’s total losses at $43 billion to $64 billion.

Updated: 10-1-2021

National Flood Insurance Is Changing. Some Homeowners Face Huge Premium Increases

New pricing system that begins Friday considers distance from body of water, cost of rebuilding and other factors.

Chris Dailey and his wife are building a new home in coastal St. Petersburg, Fla., that will sit 7 feet above the flood level expected during a major storm.

So he was stunned to learn that under the federal flood insurance program’s revamped pricing, his annual premium is slated to soar to $4,986 from $441.

“It’s absolute insanity,” said Mr. Dailey, 52 years old. “This rate makes no sense.” He said he plans to go through with the project, which is about a block and a half from a canal that leads to Tampa Bay, but worries about the ability to sell it in the future.

The National Flood Insurance Program—the main provider of flood coverage in the U.S., with more than five million policies—is rolling out an overhauled pricing method starting Friday in an effort to reflect more accurately the flood risk that individual properties face.

The issue has gained importance with climate change, which scientists say is fueling sea-level rise and contributing to more-severe weather.

Under the new system, dubbed “Risk Rating 2.0,” some policyholders in especially vulnerable areas will face big premium increases while others in less-exposed spots will see smaller increases or even decreases.

Homes in high-risk flood zones with mortgages from government-backed lenders must have flood insurance, and private carriers also provide coverage in some areas.

The changes could present some homeowners in floodprone areas across the U.S.—especially along the Gulf Coast and Eastern Seaboard—with difficult decisions about whether they can afford to live there, insurance and real-estate specialists say.

Some buyers may find mortgages unattainable, making waterfront living increasingly the preserve of wealthy people. Developers may rethink where they build, and coastal real-estate markets could take a hit.

“There is no greater risk-communication tool than a pricing signal,” said Roy Wright, president of the Insurance Institute for Business and Home Safety, an industry research group, and former head of the federal flood insurance program. “For middle-income neighborhoods, this will become a real consideration,” he said.

Under the program’s decadeslong pricing system, the main variables considered were a property’s location on a flood map and its elevation. The new system considers a larger set of factors, including a property’s distance from a body of water, its first-floor height and the cost to rebuild it.

The previous method led to imbalances in pricing, with policyholders in lower-value homes often subsidizing those in higher-value homes, according to the Federal Emergency Management Agency, which runs the program.

“Risk Rating 2.0 fixes this injustice,” said David Maurstad, senior executive of the program.

Groups including the Association of State Floodplain Managers and Taxpayers for Common Sense support the changes, saying the updated pricing will encourage property owners to pursue mitigation measures, such as elevating homes or adding flood vents, to reduce flood risks.

Starting Friday, new policies will adjust to the full new rate. For existing policies, the changes kick in on April 1, 2022, with annual increases capped at 18% until they reach the full rate.

Based on a FEMA analysis, 23% of policyholders will see decreases in their premiums in the first year, 66% will have increases of up to $10 a month, 7% will see increases of $10 to $20, and 4% will have increases of more than $20.

Jake Holehouse, president of HH Insurance in St. Petersburg, said that analysis led him to believe homeowners could absorb the impact. But after getting access to the new system a month ago and deriving quotes, he found many examples of steep rate rises.

Exactly why is unclear because the new pricing algorithm isn’t public, but Mr. Holehouse thinks a key reason is the inclusion of the cost-of-replacement variable.

His client Tyler Payne, the mayor of nearby Treasure Island who lives on a canal, currently has a policy with the federal flood insurance program with a $2,710 annual premium. Come renewal time, that is poised to start climbing to a full rate of $5,415, Mr. Holehouse said.

“When you buy a home, you factor in all these costs,” said Mr. Payne, 31. “For one of them to potentially double over the next several years is a game-changer.”

Carl Schneider, an insurance agent in Mobile, Ala., said he doesn’t believe the new pricing method will prove overly disruptive. Among the clients for whom he has run the numbers, some are seeing jumps, but many are set for reductions.

“It’s a mixed bag,” he said. “You are going to see the majority of consumers very happy with the way the program more accurately rates their home.”

Some members of Congress, mainly from coastal states, are urging a delay in implementing the new rating system. Senators including Chuck Schumer (D., N.Y.) and John Kennedy (R., La.) wrote a letter last week to the FEMA administrator expressing concern about sharp premium increases that could become unaffordable for property owners.

The new system could affect the decisions of home buyers and builders. WinWay Homes, a custom-home builder in South Pasadena, near St. Petersburg, canceled a property purchase a few weeks ago because it is in a flood zone and could be harder to sell as a result of the flood-insurance changes, said owner Matt Carr.

He said property prices outside flood zones are increasing rapidly while those inside flood zones that aren’t on the water remain flat.

“Even if I pay more money outside a flood zone, I’m more comfortable that I can sell it to someone,” Mr. Carr said.

Flood Insurance Costs Set To Rise As FEMA’s New Rates Kick In

Climate risks threaten a program that is $20 billion in debt.

The federal government Friday rolls out a flood-insurance program revamped to reflect worsening climate change, a program that will raise rates for millions of homeowners in wealthy coastal areas and humble inland communities alike.

The Federal Emergency Management Agency in April announced the first significant update to the beleaguered National Flood Insurance Program, which covers about 5 million properties.

Premiums have risen steadily, but the program is more than $20 billion in debt, thanks in part to rising seas and stronger storms.

Now, a quarter of the participants will see lower costs, while the remainder will see premiums rise in increments as high as 18% annually. The maximum total increase will be $12,000, a level that will affect only the most expensive real estate.

“Climate change is going to make housing more expensive than it already is,” said Daryl Fairweather, chief economist at Redfin Corp. “This is just a first step.”

FEMA is facing an urgent but unpopular task. The program was created in 1968, when there were fewer major storms and fewer people living by the sea. But the U.S. coastal population grew by over 15.3 percent between 2000 and 2017, to over 94 million.

Moreover, many inland places that have seen huge surges in flooding lack accurate maps. A 2017 report from the Department of Homeland Security inspector general found that 58% of FEMA flood maps were wrong or outdated.

The insurance program was originally meant as a backstop for homes that private insurers found too risky. Now, however, it covers 95 percent of residential flood policies. In all, the program sweeps in about 5 million properties, including primary and vacation homes and businesses.

Deeply subsidized premiums, averaging under $800 annually, mean that the agency routinely pays out nearly four times what it takes in.

David Maurstad, the program’s senior executive and architect of the overhaul, said that nearly 90% of members would see premiums fall or rise only slightly, rather than the blanket increases of past years.

“The new rating methodology is correcting longstanding inequities,” he said Thursday. “We can no longer continue to ignore the fact that some of our policyholders had been unjustly subsidizing other policyholders. They should no longer bear the cost for the policyholders with higher-value homes, who’ve been paying less than they should.”

Until now, FEMA used a fairly simple methodology developed in the 1970s that based risk ratings on two factors: whether homes were inside a severe flood zone and their elevation within those zones.

FEMA says its new model, known as Risk Rating 2.0, is based on huge advances in technology.

The leaps include sophisticated catastrophe models that are standard for the private insurance industry, which will allow officials to evaluate individual properties and assess risk fairly.

Hiking premiums may encourage homeowners to think more deeply about the wisdom of living in endangered areas.

“People need to have very difficult conversations about adaptation, about relocating, “ said Laura Lightbody, project director of the Flood-Prepared Communities initiative of the Pew Charitable Trusts. “Price is one of the most clear ways to communicate risks.”

But even large premium increases may not nudge people away from the water. Residents of wealthy vacation spots like Miami Beach, Florida, and New York’s Hamptons can afford them.

Kevin McAllister, founder of Defend H20, a Hamptons nonprofit, said that $12,000 is “the cost of a Belgian block driveway or less for these homes.”

Gene Stilwell, executive sales manager at Town & Country Real Estate in East Hampton, said many residents will take the revamped program in stride.

“It’s worth it,” he said. “If something happens, they have the means to reconstruct and rebuild and fix whatever flood damage has occurred.”

Meanwhile, many other places with scant resources will be feeling painful increases for the first time. An $800 policy that increases 18 percent over 10 years would be $4,188, a significant increase for someone on a budget.

Last week, senators including Democrats Chuck Schumer of New York and Robert Menendez of New Jersey, and Republican Marco Rubio of Florida wrote FEMA to ask that the roll-out be delayed, arguing that too many people would see increases too abruptly. “This is a sharp departure,” they wrote.

Maurstad replied that the plan had been delayed once, and that the increases would proceed Friday.

On Monday, Menendez will introduce legislation that could cut maximum annual increases to 9%, institute means-testing and add vouchers for those who cannot afford the increases.

Updated: 6-24-2023

Insurers Harness Data To Help Clients Weather Storms, Floods

Another busy hurricane season is expected this year. The insurance industry is relying on flood analytics tools to help predict and even prevent damage.

Insurers are using rapidly evolving data tools to help predict, and potentially prevent, storm-related losses, an effort they hope will yield benefits during this year’s hurricane season.

The past six years had higher-than-average Atlantic hurricane activity, an unlucky streak for communities in the way. This year’s season—typically defined as June through November—is predicted to be another busy one.

Though scientists are split on how climate change might be influencing the number of hurricanes, warming is expected to intensify storm surges and rainfall, leading to more flooding.

Insurers and data providers to that sector have invested in data analysts and climate scientists to build and refine advanced models that can help map out potential damage well before any bad weather hits.

A street might flood while an adjacent building stays dry, so small inaccuracies in old databases can give a misleading impression on a given site’s vulnerability to flooding, said Dr. Kelly Hereid, a climate scientist who heads the catastrophe research and development unit at Boston-based Liberty Mutual Insurance Co.

One Liberty tool uses a combination of aerial imagery and machine learning to define buildings’ footprints and give a more accurate impression of risk, which then can be shared with clients to help shore up their defenses.

“What was available 10 years ago versus what’s available now has really dramatically changed,” Dr. Hereid said. “There is a massive ecosystem of improved flood analytics tools that are out there.”

Understanding the risk and taking proactive measures can make a big difference for companies. In the wake of 2017’s Hurricane Harvey, Dr. Hereid noted, the staff at Houston’s MD Anderson Cancer Center were able to walk and kayak through flooded streets to a working facility.

The cancer hospital, after earlier floods, had installed floodgates that allowed it to continue to operate even as the surrounding area was inundated with water.

Warming skies and oceans, a result of climate change, are widely believed to be making things worse. Munich-based insurer Allianz SE noted that hurricane rainfall, a major factor in Ida’s destructive and, in some cases, deadly impact, is believed to be 11% more intense than it was before the industrial age.

In last year’s season, Hurricane Ida tore through the Caribbean into Louisiana before dumping huge amounts of rain in scattered locales, causing an estimated $36 billion in insured losses, Allianz said in a recent report.

Better modeling has also helped the insurance industry stay solvent despite having to pay for heavy weather-related losses in recent years, said Mark Anquillare, president of Verisk Analytics Inc., a risk analytics company that provides advanced modeling to major insurers.

Verisk databases that store information on commercial property, for example, can distinguish between 14 types of restaurants—from a pub to a white-tablecloth establishment. Such granular data can provide insights on the risks an insurance company faces in a certain area, Mr. Anquillare said.

“All that data and all those analytics that are constantly improving, it’s made the industry better,” Mr. Anquillare said.

Cole Mayer, a senior structurer at the commercial insurance arm of Swiss Re, a Zurich-based provider of insurance and reinsurance, said more advanced modeling has helped with some of the company’s more complicated products.

Those include parametrics, an increasingly popular type of catastrophe insurance that operates as a kind of bet on future weather.

A parametric policy will quickly pay out, for example, when wind speed at a precise location exceeds an agreed-on speed, without the business needing to do a time-consuming proof of its losses.

“That data year-on-year gets better and better and more granular,” Mr. Mayer said.

Insurers said their client companies have made changes to be able to move quickly if their regions are struck by hurricanes or flooding.

One Allianz client, for example, provides temporary on-site housing for essential employees whose homes might be damaged by flooding, said Thomas Varney, Allianz’s North American head of risk consulting.

Another large client has placed generators in various locations to provide backups in case a storm disrupts electricity, Mr. Varney said.

In this warmer, wetter world, insurers have sought to collaborate more with clients on getting ahead of their climate risks, a practice that has the added bonus of reducing how much insurers might ultimately pay out, Liberty’s Dr. Hereid said.

Clients are thinking more about the big picture and how climate change can affect their bottom line, she said.

“We as a society have a lot of work to do to acknowledge that the climate of the past is not going to be the climate of the future,” Dr. Hereid said. “We have to do adaptation today.”

Updated: 7-2-2023

A $30 Billion Disaster Is Just The Tip Of A Deadly Climate Cycle

Pakistan’s record flooding last year displaced millions and left the country reeling. As a new monsoon season approaches, recovery efforts are floundering.

When night falls in the refugee camp outside Karachi, Shanawaz Khoso worries about snake bites. The 38-year-old and his seven children sleep in tents alongside 5,000 other displaced villagers, partially exposed to the elements and to creatures that include scorpions and venomous snakes.

When the sun rises, stifling heat and mountains of untreated sewage turn the camp into a breeding ground for disease. Fever and stomach pain are prevalent, but there are no doctors and there is no medicine.

“We are living here out of necessity,” Khoso says. “Nothing is coming here now. We’re terrified.”

With monsoon season fast approaching, Pakistan has already seen heavy rains and strong winds resulting in dozens of fatalities, hundreds of injuries and damage to roads, houses and farmland. This year, though, the rain is falling on a country still reeling. Just 10 months ago, severe flooding in Pakistan killed over 1,700, displaced 8 million and cost the economy more than $30 billion.

Now crop shortages linger, thousands remain homeless and the country is struggling with rebuilding, food supply, health care and debt. Relief aid has largely dried up. As new rains threaten the same areas hit by last year’s floods, Pakistan finds itself at the mercy of a pernicious pattern:

Climate change is driving more intense rainfall, which drives more intense flooding, which stymies recovery from past floods.

It’s a paradigm familiar to the other eight countries in what’s known as the Third Pole, which is facing the impacts of warmer air on both monsoons and melting mountain ice.

Glaciers in Asia’s Hindu Kush Himalayan region could lose 80% of their current volume by the end of this century, according to a recent study, threatening the livelihoods of as many as 2 billion people downstream — roughly a quarter of the world’s population.

Without effective mechanisms to finance their own recoveries, let alone prepare for future climate crises, developing nations are particularly unprepared.

“Pakistan is an avatar for what happens when climate-vulnerable countries that are not climate-resilient are in the firing line of changed weather conditions,” says David Miliband, president of International Rescue Committee, a humanitarian aid group. “They’re on the front lines of something that’s going to be faced by other countries.”

Khoso and his family moved to the refugee camp last August, after his hometown of Shikarpur was inundated. But within two months, relief aid to the camp started to run out — first food supply dwindled, then electricity was shut off, then the two health clinics closed.

Located roughly 65 kilometers (40 miles) from Karachi, the camp is too far for Khoso to find work on foot, but returning to Shikarpur isn’t an option: The rice paddies on which his family depended were lost in the flood.

“We use money from one crop to invest in the next one,” Khoso says. “That cycle has been broken.”

While Pakistan is no stranger to monsoons, 2022 was unprecedented. Flooding lasted more than four months, and at its height left a third of the country submerged.

The worst climate disaster in the country’s history, the floods were responsible for an economic hit of more than $30 billion, or roughly 10% of Pakistan’s 2021 economic output.

In many regions, little has improved since. Across Sindh province, where more than half of schools were damaged by the flood water, children continue to study in the open, Pakistan’s foreign minister, Bilawal Bhutto Zardari, said at a conference in May.

Stagnant water has fueled the worst malaria outbreak in the country since 1973, according to the World Health Organization. Few rural clinics remain standing to provide much-needed medical treatment.

Among all the challenges, though, the biggest might be food. The flood’s impact on livestock and farmland has limited Pakistan’s ability to feed its citizens: 10.5 million people, or about 5% of the population, are experiencing acute food insecurity.

The Pakistani rupee’s 30% decline against the dollar over the past year has also made imported food more expensive.

“Pakistan is facing a nutrition crisis,” the United Nations warned in a report last month. The country’s rate of severe acute malnutrition is twice the average for South Asia and four times higher than the global average, according to the UN.

“I’m very concerned that 33 million impacted [people] is not a number that any country has ever had to deal with as a single disaster,” Pakistan climate minister Sherry Rehman tells Bloomberg Green. “It is going to be very tough to rebuild even in three years.”

Many blame the lack of progress on a lack of funding. The World Bank estimates that Pakistan will need at least $16.3 billion for reconstruction and rehabilitation. Donors pledged $10 billion in relief at a UN conference in January, but it’s unclear how much of that money has been allocated.

Out of 20 million Pakistanis in need, only 7.7 million have received disaster relief of some sort, according to UN data.

“Developing countries are repeatedly hit by climate-led disasters and the quantum damage is barely understood by international communities,” Rehman says, adding that financial institutions’ preference for loans instead of grants is complicating recovery efforts.

Other troubled nations — war-torn Ukraine, earthquake-hit Turkey and drought-stricken Kenya — also compete with Pakistan for aid, which international donors say is shrinking amid wider economic uncertainty.

One of the most vulnerable countries to climate change, Pakistan is responsible for just 1% of global greenhouse gas emissions. That disconnect has put it at the forefront of conversations around “loss and damage,” shorthand for a program where developed nations compensate poorer nations for suffering linked to climate crises.

World Weather Attribution, which researches the link between extreme weather and greenhouse gas pollution, found that climate change made rainfall in Pakistan 75% more intense last August than it would have been otherwise.

While Pakistan played a key role in getting UN climate negotiators to establish a loss-and-damage fund at last year’s COP27 climate conference, almost all of the details still need to be ironed out. It’s unclear how much of that will happen at COP28 later this year.

Attendees at preparatory meeting in Germany last month came away concerned about unclear goals and inter-country bickering.

“It is still unknown when any funds might actually be made available to countries like Pakistan through [the loss-and-damage] mechanism,” says Lisa Dale, who researches climate-change adaptation at Columbia University.

A separate climate summit in Paris last month brought together more than 100 heads of government to address financial scarcity as the biggest impediment to climate action. A set of proposals known as the Bridgetown 2.0 agenda would create currency exchange guarantees, add disaster clauses to debt deals and foster more multilateral lending. But its political feasibility remains largely untested.

Pakistan’s slow recovery is creating a vicious cycle. Crop shortages caused by the flooding drove up food prices, then the government raised taxes and energy prices in an attempt to meet the terms of a loan deal with the International Monetary Fund. That pushed up inflation, which hit 38% in May compared to a year earlier.

Pakistanis started cutting back on spending, and job opportunities dried up. In June, the country secured initial IMF approval for a $3 billion loan program, lowering the risk of sovereign default but increasing pressure to maintain fiscal discipline.

In a village near Jamshoro city in Sindh province, it’s not uncommon to see roofs made of plastic bags or houses missing walls. Five villagers there tell Bloomberg Green they haven’t received any funding for reconstruction, and none can afford to make repairs.

“I am just desperate. What can I do?” asks Fateh Mohammad, 70, who supports a family of 18 by doing odd jobs. Five years ago, Mohammad earned a daily wage of 500 to 1,000 rupees ($1.76 to $3.52); now he makes less than 300 rupees a day, barely enough to buy 2 kilograms (4.4 pounds) of flour.

Not far from Mohammad’s shelter is one housing Gulsher Mallah, 22, who lost his goats to the flood and now works at a roadside restaurant. “There is hardly any business at the restaurant now,” he says. Over the course of a morning, he might sell a single bottle of water.

As a changing climate makes rainfall and other extreme weather more intense, experts say Pakistan’s experience will be replicated elsewhere. Any country’s recovery efforts depend on how quickly and effectively authorities can marshal resources, allocate funds and complete the work of rebuilding. That puts developing countries at a self-perpetuating disadvantage.

“They lack resources, both financial and technical, to help them buffer a shock like flooding,” Dale says. “These pre-existing conditions contribute to higher risk and longer recovery when a natural disaster does occur.”

Although Pakistan is highly vulnerable to climate change, experts say the country has yet to establish a robust disaster-response system. Rehman argues that the scale of destruction from last year’s floods is unprecedented, making rebuilding a Herculean task.

But even small adjustments could better prepare Pakistan for its next emergency, whether that means more coordination across aid organizations or rebuilding specifically with climate catastrophes in mind.

“The infrastructure has not become more climate-resilient,” says Adnan Khan, an Islamabad-based advisor at the nonprofit Red Cross Red Crescent Climate Centre. “Those communities have not been trained on how they can adapt to climate change.”

That’s where Yasmeen Lari comes in. In 1980, the 82-year-old architect co-founded the humanitarian organization Heritage Foundation Pakistan, which today has two training centers offering villagers free courses on building climate-resilient homes. Since 2010, Lari says Heritage has helped put up roughly 55,000 houses across Pakistan.

At the Heritage training center in Pono village in rural Sindh province, villagers learn to build octagon-shaped homes from bamboo, sand and straw. Each single-room structure takes about a week to put together, with construction costs roughly a tenth of those for a conventional concrete home.

The houses are slightly elevated and thus suited for heavy rain: When the flooding hit Pono village last year, all 70 of its octagon houses held up, even as many conventional homes collapsed.

Since then, the village has become a place of pilgrimage. About 500 people have received training there over the past 10 months, and each is asked to share what they learned with 10 more villages after returning home. “It’s the poor helping each other out,” says Naheem Shah, project manager for Heritage’s Pono village center.

Heritage is part of a small but growing grassroots movement to make climate adaptation more accessible to Pakistanis. Climate activist Rida Rashid, who lost five members of her extended family to the 2022 flooding, is building an online platform with features that include climate change literature translated from English to South Asian languages and on-the-ground footage of climate disasters.

Innovate Educate and Inspire Pakistan, a nonprofit based in Islamabad, has expanded its offering to include a climate education program for teachers.

But time is of the essence. Each monsoon season stands to exacerbate the aftermath of the last one. At the camp outside Karachi, Khoso says he dreads every raindrop that hits his family’s worn-out tents.

“We used to entertain guests,” he says of life before the flood. “Even if 10 people came, we didn’t have any problem serving them food. Our fortunes have completely changed.”

During April’s Eid holiday, an important Muslim festival for which wearing new clothes is custom, Khoso and his wife managed to dress up their children with donated outfits, but for the first time skipped their own.

Having accumulated 30,000 rupees in debt since arriving at the camp, Khoso says they didn’t have the financial means — or the inclination — to celebrate.

“We are just sitting here now at God’s mercy,” he says.

Updated: 7-11-2023

Insurers’ Failure On Climate Disasters Imperils Financial System

State-by-state regulation has resulted in dangerous data gaps. Only federal oversight can fix the problem.

Faced with year-over-year multibillion dollar losses, insurers are struggling with the increased frequency and destruction of climate change-induced weather events. Many companies have responded by raising premiums, exiting risky areas or reneging on their pledges to decarbonize by 2050.

This has serious implications for US households, businesses and financial companies that rely on insurers as a vital backstop against disasters.

While insurance companies are regulated at the state level, the fact that climate-related events often affect many states at once highlights the need for greater federal involvement in overseeing markets.

The state-by-state regulation model has fallen short. In particular, efforts to require the disclosure of information from insurers related to climate have been piecemeal, likely forcing state regulators to work off of incomplete information when supervising and regulating firms.

Fortunately, a federal agency that is charged with monitoring all aspects of the insurance industry can play an important role in helping fill climate-related data gaps: the Treasury Department’s Federal Insurance Office, created after the 2007-08 financial crisis.

Last year, the FIO took the important step of proposing data collection from property and casualty insurers regarding past and current underwriting to assess climate-related financial risk across the country.

Insurers are major players in the US economy, often serving as the main line of defense against losses when disaster strikes. But the risk from climate events extends well beyond insurance companies.

In a recent publication, Federal Reserve Board economist Benjamin Dennis described how risk flows from insurers to households to banks, using the example of Miami residential real-estate damage caused by hurricanes: “In the event of a hurricane in Miami, insurance companies take the first loss” but “when insurance coverage does not exist or is insufficient, losses spill over to homeowners.

If homeowners default for whatever reason, losses accrue to mortgage originators or purchasers depending on their exposure.”

Now, as insurance becomes increasingly unaffordable or unavailable, the pressure on consumers and other financial intermediaries grows. Given the interconnectedness of the sector, more holistic oversight by federal agencies is needed.

While states often coordinate on insurance regulation, these efforts are completely voluntary. The inadequacy of the voluntary approach is evident in the fact that only a third of states participate in the National Association of Insurance Commissioners’ Climate Risk Disclosure Survey, which was created over a decade ago.

Even with full participation, the survey data by itself would have limited usefulness without understanding its relationship to data on the broader financial system and economy.

Federal agencies have a role to play in closing these information gaps. The proposed data call from the FIO would be the first systematic, nationwide collection of climate-related insurance data, and could shed light on how an industry that operates on proprietary information and modeling is assessing climate-related risks.

As a member of the Financial Stability Oversight Council, the FIO can work alongside federal financial regulators to develop research and policy recommendations that better address the breadth of risks insurers assume and create within the financial system.

In addition, the data provided by the FIO could help the oversight council as it assesses whether and when to designate certain nonbank financial companies, including insurance companies, as systemically important financial institutions.

The FSOC recently proposed ways of improving its process for using this important designation, which subjects these firms to enhanced supervision and oversight by the Federal Reserve.

Following the 2007-2008 financial crisis, “systemically important” designations were critical in reigning in insurance giant AIG, whose risky activities exacerbated the crisis.

The Financial Stability Oversight Council needs timely and reliable data to determine major risks to the financial system, and nationwide data collected by the Federal Insurance Office could improve its ability to monitor and act before dangers flowing through the system lead to cascading defaults. Such a precautionary approach, based on increased federal oversight, is essential as climate events become increasingly frequent and severe.

Updated: 8-8-2023

Insurers Are Facing A Steep Rise In Reinsurance Rates

Despite big losses from Ian, hurricane season has so far been tame for bigger insurers.

Hurricane season is nearly over, though one more storm is potentially heading for Florida. For insurers, the worries won’t end on Nov. 30.

Insurers are in the middle of negotiations with reinsurers, which are trying to boost rates by 10% to 30%. Nearly two-thirds of U.S. property-catastrophe coverage renews each Jan. 1, including for many large diversified U.S. and European insurers.

It is too soon to know if the reinsurers will get what they want. Carriers might buy less reinsurance to limit the increase in cost, taking on more risk themselves and possibly limiting premium increases they would pass on to their customers.

Insurers have already been boosting premium rates on their business, homeowner and auto policies to deal with higher costs due largely to inflation.

Reinsurers are reacting to five years of outsize catastrophe losses and growing worries that climate change is intensifying the risks from storms and wildfires, among other concerns.

Hurricane Ian, which killed more than 130 people, is estimated to cost insurers from $40 billion to more than $70 billion, making it the nation’s second most-expensive natural disaster for the insurance industry. Hurricane Katrina cost more than $90 billion in today’s dollars.

Despite the big cost, large publicly traded property insurers came through Hurricane Ian on solid financial footing, based on their third-quarter reports. Their earnings were badly dented, but Moody’s Investors Service notes that they have considerable resources to draw on.

Dozens of mostly privately held, small- to midsize Florida-focused insurers will soon be filing detailed quarterly statements to regulators. Meanwhile, tropical storm Nicole might slam the state’s east coast later this week, possibly adding more disaster claims.

Many of the large national carriers, and all of the Florida-specific ones, rely on reinsurers—a globe-spanning community of giants like Munich Re, Swiss Re, Lloyd’s of London and Berkshire Hathaway Inc. and smaller players—to take on some of the risk of the policies they sell.

Reinsurance limited insurers’ losses from Hurricane Ian. Car and home insurer Allstate Corp. said its Ian-related estimated gross catastrophe losses totaled $671 million pretax, but reinsurance reduced what it will pay by $305 million, down to $366 million.

Allstate Chief Executive Thomas Wilson said the price increases being sought by reinsurers are due to their recent losses, worries about climate change and the dollar’s recent strengthening, which hurts some reinsurers because they sell coverage in U.S. dollars yet hold their capital in another currency.

“The combination of those three things will make for a really tight reinsurance market,” Mr. Wilson said. “It seems likely to me that the price will go up next year.” Allstate won’t face the hit all at once because its reinsurance program staggers renewals over three years, he said.

Rapidly rising interest rates are also hurting reinsurers. Higher rates reduce the value of the bonds they hold. If the companies face payouts, for example from a quick succession of major hurricanes, they might have to sell some of their bonds at a loss. The inflation being experienced by carriers is driving up reinsurance prices, too.

With so many issues stacked up, “this is really the most challenging renewal year probably since Katrina,” said David Flandro, head of analytics of Howden Group, a London-based broker. In the January 2022 renewal period, year-over-year property-catastrophe reinsurance price increases worldwide came in at 9%, according to Howden data.

Reinsurers haven’t been shy about the price increases they anticipate. Swiss Re’s Group Chief Financial Officer John Dacey said in an Oct. 28 earnings call that “prices will not show some sort of an evolutionary adjustment, but rather a fairly radical adjustment up.”

Across the U.S., “they’re definitely bracing for price increases,” Chris Dittman, executive managing director and Florida-segment leader at Aon Reinsurance Solutions, said of the firm’s insurance clients.

This summer, Florida-focused home insurers went through their renewal period with prices going up 25% to 30% in many instances, according to ratings firm Demotech Inc.

One uncertainty is what happens with the market for catastrophe bonds, which are an alternative to reinsurance. When interest rates were low, pension plans, endowments and other institutional investors bought catastrophe bonds for reasons including boosting returns. With rates higher now, investors could lose their enthusiasm for these securities.

If large numbers of investors abandon the cat-bond market, the trend would help drive reinsurance pricing higher, brokers and analysts said.

Before Hurricane Ian, 2022 had been a relatively mild year for U.S. insurers. Reinsurers, which face global risks, have had a tougher year. There were unusually fierce winter storms in Europe, unprecedented flooding in Australia and South Africa, and severe heat waves that sparked forest fires in southwest Europe, according to Swiss Re.

Updated: 8-14-2023

Wildfires And Thunderstorms Are Throwing Insurance Market Into Turbulence

Smaller but more frequent catastrophes are a primary driver of changing rates and coverage.

Hawaii’s deadly wildfires are a tragic illustration of a phenomenon roiling the insurance industry: increasing losses from what were historically considered “secondary” catastrophes.

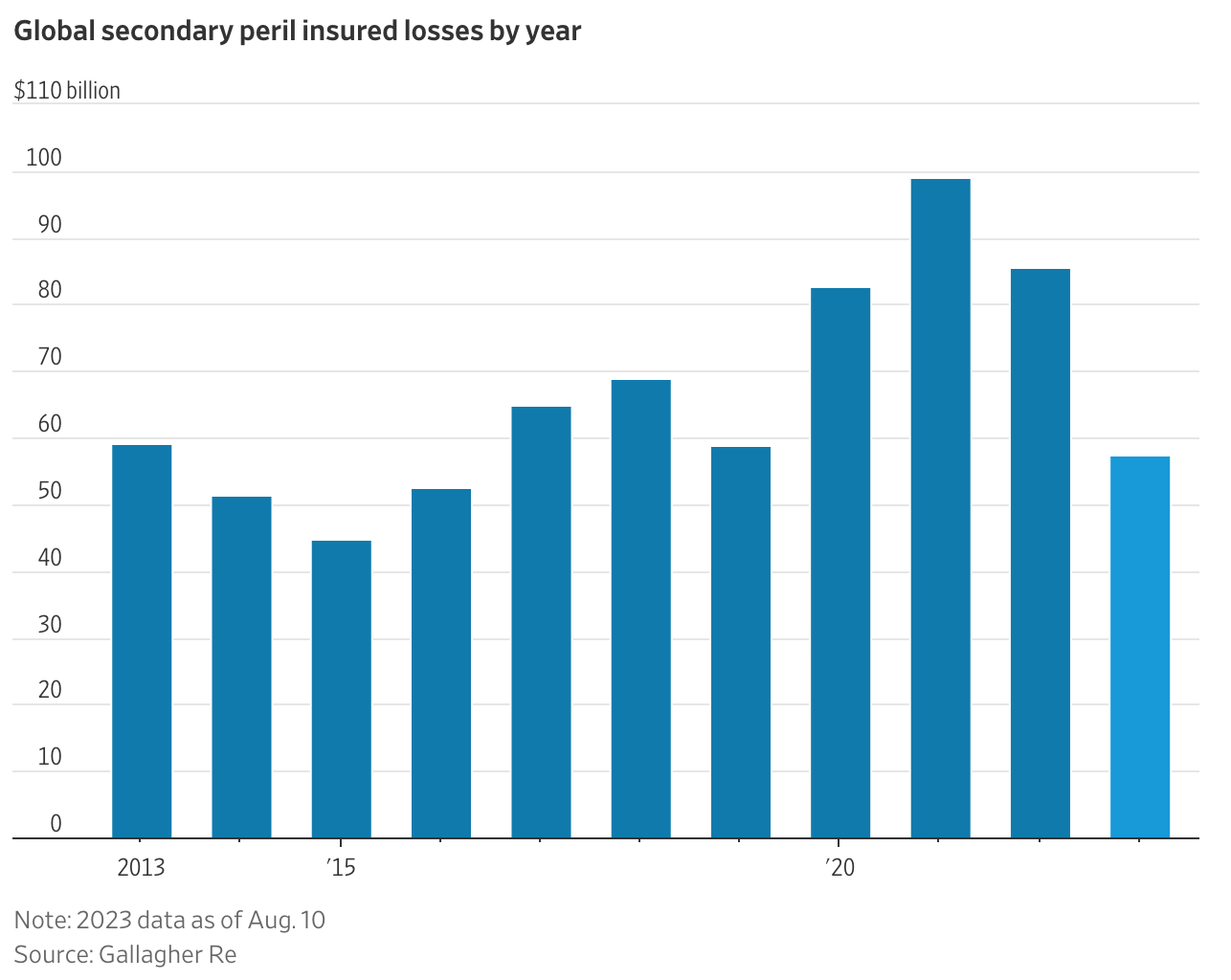

So-called secondary perils are more frequent than primary perils such as hurricanes or earthquakes, and generally less severe individually. But events such as wildfires, major thunderstorms, river floods and landslides have been collectively racking up increasingly sizable insurance losses in recent years.

A report by Swiss Re last week noted that widespread thunderstorms in the U.S.—or what are known as severe convective storms, marked by thunder and lightning, heavy rain and hail, strong winds and sharp temperature changes—have accounted for nearly 70% of global insured natural catastrophe losses in the first six months of this year.

Wildfires, too, have been significant insurance events in recent years. Since 2017, there have been two roughly $10 billion-insured-loss California wildfires, according to the Insurance Information Institute.

Climate change that increases the frequency or severity of events is only one part of the equation. There are also the effects of inflation, driving up property values and the cost of repair or replacement, as well as the “social inflation” of protracted litigation.

Erdem Karaca, head of catastrophe perils for the Americas at Swiss Re, says that losses from secondary perils have “been trending higher in recent years due to growing population and economic values” in regions exposed to them, citing Texas’s nearly 40% population growth in the past two decades as an example.

These secondary perils, as well as other often harder-to-model events such as Covid-19, have also played a key role in slowing the flow of capital into the reinsurance market that provides a backstop to insurers who write policies for homes and autos.

This, in turn, has helped drive a shift in pricing and coverage that has flowed through all the way to consumer prices.

During the era of superlow interest rates, investors chased yield in the form of things such as catastrophe bonds and other insurance-linked securities, or ILS, that make up what is known as alternative capital in the industry. That supply of money helped keep increases in the cost of insurance relatively muted, even as catastrophe losses started ramping up sharply in 2017.

But secondary perils may not be the kind of catastrophes investors thought they were underwriting when throwing money into this market. Such events have been “particularly challenging for ILS managers who have historically sold investors on being exposed to headline risk—the results have not borne that thesis out,” brokerage Arthur J. Gallagher & Co.’s Gallagher Re wrote in a January report.

Accordingly, there has been a reduction in capital from these alternative sources. Even through the first half of this year, with yields on ILS relatively higher than their benchmarks than in the past, “there were still no obvious signs of fresh reinsurance capital entering the market,” Gallagher Re wrote in July.

Less alternative capital in the market has allowed reinsurers to push through significant rate increases. That has been a boon to shares of large reinsurance providers, with U.S.-listed Everest Group, RenaissanceRe and Arch Capital Group all up by at least 34% over the last 12 months, versus a less than 1% gain for the S&P 500 financial sector overall.

On the flip side, primary insurers that buy reinsurance coverage to protect their capital have felt the effects of those higher costs.

State Farm cited rising reinsurance costs as a reason it stopped the sale of new home-insurance policies in California. Higher catastrophe losses have hit Progressive, Allstate ALL and others in the second quarter.

Not only have reinsurers in some cases raised the cost of coverage, but they have also moved up the starting point for when they will begin to absorb losses. Thus, the amount of losses that primary insurers have to take before reinsurance kicks in is in many cases getting larger.

Reinsurers are now typically seeking to start at the level of catastrophe losses that occur around once every 10 years, rather than the more typical starting point of one-in-three-year or -five-year events, Gallagher Re said in its January report.

Clearly, the insurance industry as a whole needs to keep adjusting to worse events, more often. That won’t happen without cost.

Updated: 8-31-2023

There’s A Better Way To Fight Wildfires, Indigenous Groups Say

First Nations people are sharing their knowledge on how prevent fires in Australia, promoting skills that are now crucial in the climate-change era.

More frequent fires. Smaller, cooler blazes. Nighttime and early morning burns.

Those are three important principles of what’s known as cultural burning, a firefighting practice honed by Indigenous people in Australia over the past 60,000 years.

The techniques stand in marked contrast to the “hazard-reduction” burns employed in the US, Canada and other places prone to wildfires, including most of Australia. Indigenous advocates say their own methods are more effective, safer and kinder to native flora and fauna.

In the wake of Black Summer three years ago, Australian politicians said they’d prioritize Indigenous techniques. It’s since funded a range of grants and says it is continuing to make investments.

But Indigenous organizations say far more is needed, especially now, with El Niño conditions bringing warmer temperatures that portend a more severe fire season.

Bloomberg Green spoke with two leaders of Australian organizations that promote and provide training in traditional burning methods, and a Canadian councilor who has welcomed Indigenous Australians to his province to help conduct cultural burns there. The conversation has been edited for length and clarity.

How Is The Indigenous Approach Different To A Typical Hazard-Reduction Burn?

Victor Steffensen, co-founder and lead fire practitioner, Firesticks, a nonprofit that promote Indigenous techniques: Our burning application is all year-around, when we include the harvesting techniques and the preparation of country (land). Sometimes we burn the same place two or three times in one year.

If there’s vegetation, like introduced grasses, that doesn’t belong in those systems, we’ve been walking through and burning them at different times than when we burn the native species. That allows us to protect the soils and the right types of vegetation.

Robbie Williams, the custodian of Fire Lore, which uses cultural burns: As it gets late in the afternoon, the winds will start to die right down. Then we’ll start coming in and doing all of our night burns so we can get more control of that fire and make it do exactly what we want.

If you come into one of our burns, what we call cold burns, you can literally walk along with the fire, touch the soil. Green grasses are still there.

You won’t get our fires going past your knees — that’s how little our fires are. When we burn, it gets rid of the fuel loads. It helps the trees become healthier. When they get into a nice healthy state, bushfires can’t come there anymore.

You say your techniques have been well received by farmers in Australia, who have embraced cultural burning as a way to protect their properties. How universal are your techniques?

VS: Everywhere will be different, but what I’m finding in Canada and in America is pretty much the same principles as in Australia. We are working with two Indigenous communities in Canada.

They had some knowledge, but basically we were starting from scratch and rebuilding that knowledge base, reading country, understanding soil types so that we’re able to apply a fire in a way that that only burns specific ecosystems.

In the first trips when I went over we only burned very small patches. Now three years later we’re burning 500 hectares because our confidence has grown immensely.

How Did Those Communities Fare During Canada’s Fire Season This Year?

VS: They didn’t get the brunt of the wildfires. But they are more or less protected this season if it does go their way as well. The communities are setting dates for next year and they want to continue the program.

We also have some members of the community coming to Australia for one of our fire workshops here. So we’re looking at getting more exchange happening and we’re set to continue the mentorship program next year.

Anthony Billyboy, the wildfires haven’t reached your community this summer. Do you feel like you community is protected because of the cultural burning you’ve done there?

Anthony Billyboy, councillor, Yunesit’in Government: In a way, yes. I feel it’s protected because we’ve done a lot of work in the past years [on cultural burning techniques].

A fire of a mass size, you can’t tell what it’s going to do — you just stay back. You get out of there. Having been a firefighter, it’s safety first. So we don’t want to be close, you just stay out of there.

I think it will help in some way. Maybe it will just come creep up to what we did already and it’ll stop because it’s so green.

Our community in Stone, Yunesit’in, we’ve done a lot of burning. Last year we received an award for it, for the huge work we did up and down the community where we started from the bottom of the mountain where it creeped up to the snow caps.

We had a good team, me and my wife and the brother-in-law, we just understand the land, so we put fire to the ground and we knew where it was going to make a difference and where it was going to stop.

What Are The Most Important Things You Have Learned About Cultural Burning?

AB: Probably the most important thing is we’re re-learning this. We’re re-introducing it to our people, where we work with youth and elders.

And another thing is it’s bringing back our traditional medicines and fruit berries and it’s bringing back our wildlife. It used to be if you drove a few kilometers out you’d be lucky to see deer. Now we have one just right in the backyard.

You Contend That Modern Hazard-Reduction Fires Can Actually Make Wildfires Worse. Can You Explain How?

RW: With hazard-reduction burns, they burn all the canopies of the trees, the leaf litter drops down and it builds up and gets worse every time they do it. It [creates] more fuel loads.

We do the burning the proper way by obeying fire lores — not burning the canopy, not cooking the soil and we allow everything to get away. That includes all the insects. It doesn’t build up fuel loads, it brings back the proper grasses. The trees don’t drop their leaf litter because we didn’t burn all the canopy.

Can You Burn Near Towns And In Rural Areas? And Is It Scaleable?

VS: We’re burning around townships now. We’re burning right in the middle of a town in the Hunter Valley. The residents all came out and saw a beautiful fire, and we had a workshop to show them why it was so important.

Burning the Indigenous way in built-up areas is far safer than hazard-reduction burns. There’ll be smaller fires, there’ll be more frequent fires — not one time a year where they burn massive amounts of landscape. They’re burning the wrong system at the wrong time and creating big great plumes of smoke.

RW: We’ve been doing projects in agriculture. Farmers are happy to work with us because we’re saving them a lot of money, getting rid of the weeds without using poisons. It also brings back the proper grasses for their country, which helps feed their cattle.

What Role Is Climate Change Playing?

VS: In Australia, climate change and global warming hasn’t affected our burning patterns — it might change our burning times. It’s the same with countries that are experiencing fires for the first time. It’s about being adaptable.

Updated: 9-24-2023

Let’s Retire ‘Acts of God.’ Disasters Are Human-Made And Insurers Are Fed Up

It’s important to add human agency. Our collective burning of fossil fuels is intensifying and increasing the frequency of storms and droughts, heat waves and wildfires. But that’s not all. Disasters happen when hazards collide with vulnerability.

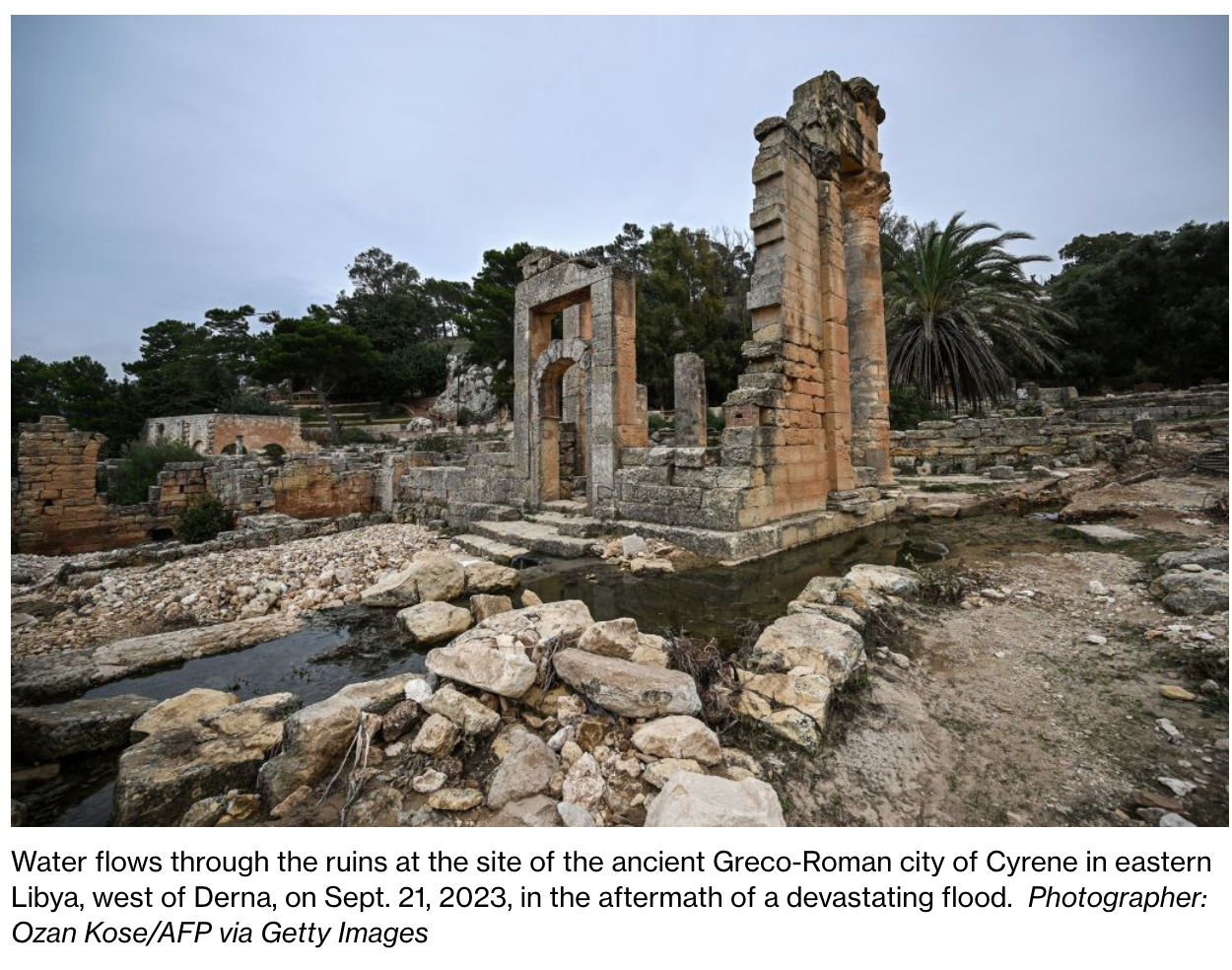

As Storm Daniel’s devastating ruins show, the cause is terrestrial.

At the start of September, torrential rain in the Mediterranean led to severe flooding, infrastructure damage and deaths in multiple countries. As climate change expedites more extreme weather events like this, we need to consider how they’re framed.

These so-called natural disasters are often construed as “Acts of God,” both actuarially and colloquially, but most of time the blame more fairly lies on human actions.

A low pressure system, named Storm Daniel by the Hellenic National Meteorological Service, dumped downpours over 10 days across several nations, including Spain, Greece, Bulgaria, Turkey and Libya. The rain in Spain fell over just a few hours, yet major flooding still led to five fatalities.

Greece, Bulgaria and Turkey had precipitation for four days, submerging Greece’s agricultural center, the Thessalian plain. The storm then strengthened into a “medicane,” a Mediterranean hurricane, dropping record-high amounts of water on Libya over 24 hours on Sept. 10-11.

Many areas were reported to have received between 150 millimeters and 240 millimeters of precipitation, with the town of Al-Bayda getting 414.1 mm. By comparison, in an average year, the coastal city of Derna — the epicenter of Libya’s resulting crisis — gets just 274 mm of rain.

Libya’s experience has been especially catastrophic. Rain is one thing, but the collapse of two huge dams is another. At around 3 a.m. on Sept. 11 the water broke through the barriers, unleashing a tsunami-size torrent on top of Derna. About 4,000 people are confirmed dead, with more than 8,000 still missing as of Sept. 21.

A rapid attribution study found that climate change played a role in the events. In Greece, Bulgaria and Turkey, global warming made the heavy precipitation up to 10 times more likely, with as much as 40% more rain. In Libya, scientists found that it was made up to 50 times more likely by fossil-fuel emissions, with as much as 50% more rain — though the weather event was still extremely unusual.

Friederike Otto, climatologist and co-founder of the World Weather Attribution initiative, told me the rainfall was far outside the realm of anything seen before.

After extreme events, weather attribution studies have become an important contributor to making human-caused global warming part of the conversation.

By comparing what exactly happened with models of a world not warmed by greenhouse gas emissions, researchers are able to calculate whether and how the climate crisis influenced a specific meteorological situation.

Libya is the perfect example. Reeling from years of civil war, corruption and neglect, the country was already fragile. Split between two governments, the critical maintenance on the destroyed dams simply didn’t happen despite repeated warnings from experts.

The structures, designed to protect against flash flooding, were damaged in a storm in 1986. More than a decade later, a study commissioned by the Libyan government revealed cracks and fissures in their structures. In 2021, a report said the dams hadn’t been maintained despite the allocation of more than $2 million in 2012 and 2013. There will now be an investigation to find out where the money went.

For years, discussion around how to adapt to a rapidly changing climate was hindered by many who argued that it would reduce pressure to cut emissions. That attitude has arguably lingered in news reporting of some events and risks letting governments get away with not doing enough to protect their citizens.

A prolonged food shortage in Madagascar, for example, was roundly portrayed in the media as the world’s first climate-driven famine, resulting from years of drought.

Those stories missed the core problem, though: bad governance and greed. Corporate land grabs have taken up much of the agricultural terrain while communities slip further into poverty. Indeed, an attribution study found that climate change wasn’t a significant driver of the food insecurity in Madagascar at all.

Elsewhere, land-management decisions have transformed absorbent wetlands into slick concrete — a factor behind the 2021 floods in Germany — and societal structures have made certain groups more exposed, such as in India where caste-based discrimination prevented some from entering evacuation shelters during cyclones.

Making these vulnerabilities part of the dialogue is the first step to taking effective action. Yet it doesn’t help that adaptation funding globally is still a fraction of the money that goes to emissions reduction. That’s becoming a more critical issue: Although deaths from natural disasters have been decreasing on the whole as disaster management has improved, climate change is making it much harder by spurring events well outside of previous experiences. Some measures may be expensive, but any costs involved will pale in comparison to doing nothing.

It’s hard to say whether proper maintenance would have completely prevented the dam bursts in Libya in the face of such an intense event. But it’s clear that human activity intensified both the threat and weaknesses, so much so that the people of Derna didn’t stand a chance.

So next time there’s a natural disaster, don’t forget: We’re making things so much worse for ourselves on the ground, too.

Updated: 9-25-2023

Why Insurers Are Pulling Out of High-Risk Areas

Is The Industry At A Crossroads?

This year has seen a spate of insurance companies announcing that they’re leaving markets like Florida and California, citing the increased risk of natural disasters, such as floods and wildfires. Elsewhere, premiums for certain types of insurance are skyrocketing — yet many insurance companies can’t seem to turn a profit in certain areas.

Melanie Gall is the co-director of the Center for Emergency Management and Homeland Security at Arizona State University, and she also manages the Spatial Hazard Events and Losses Database for the United States, known as SHELDUS.

In this episode, we talk to her about what’s driving insurers away from certain markets and what can still be done to protect businesses and homeowners from catastrophe.

Australia Warns of Multi-Billion Dollar Climate Disaster Costs

* Treasurer Says Disaster Funding Has Risen 433% In Three Years

* Australia Is Preparing For A Damaging Fire Season Over Summer

Australian Treasurer Jim Chalmers highlighted the soaring cost of disaster management in his nation ahead of a potentially disastrous wildfire season in the coming summer, fueled by El Nino.

Government funding for disaster recovery has blown out by 433% over the past three years, Chalmers said in excerpts of a speech to be delivered Tuesday in the northern city of Rockhampton. The costs stood at A$2.5 billion ($1.6 billion) in the year ended June 30.

“The pressure of a changing climate and more frequent natural disasters is constant, cascading, and cumulative,” Chalmers said.

Australia has experienced several years of devastating natural disasters, from the Black Summer bushfires during the 2019-20 summer to heavy rainfall and flooding across the country’s east in 2021 and 2022.

Authorities are warning of a growing risk of severe bushfires over the coming months due to an El Nino weather system over the Pacific Ocean causing high temperatures and low rainfall.

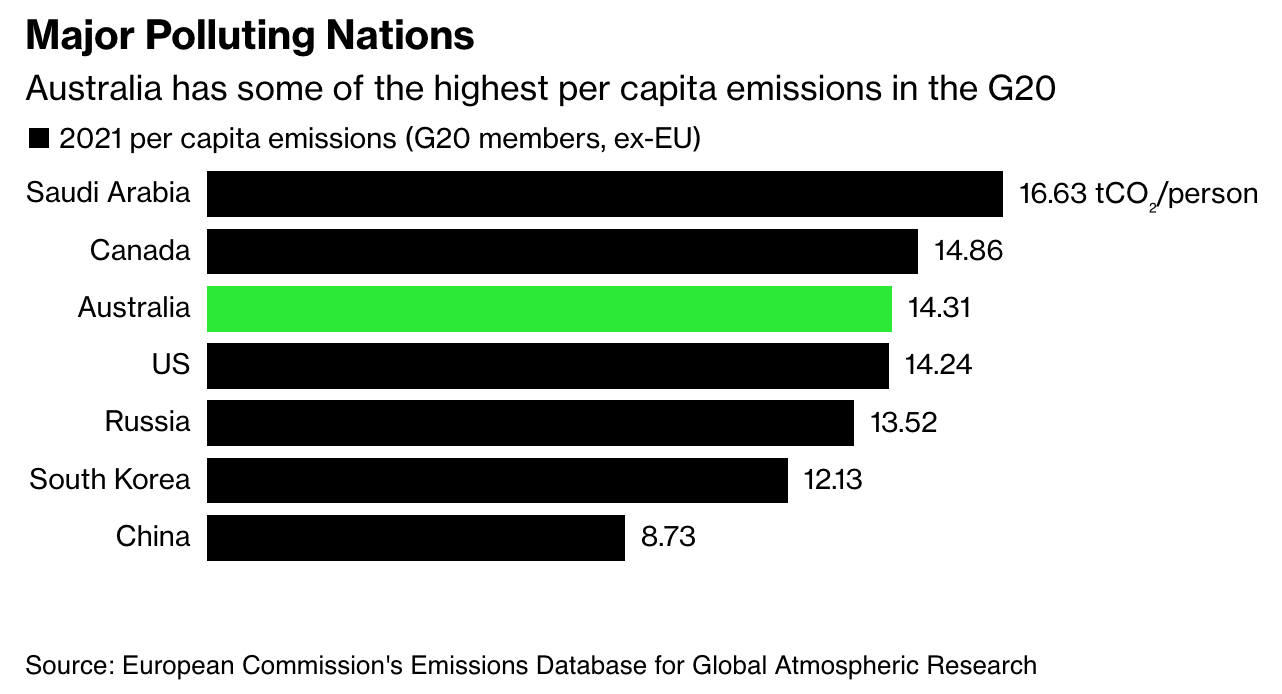

Australia is at the forefront of climate change impact, yet has faced criticism for lagging behind in addressing the risk, particularly under the previous center-right government that ruled from 2013 through to May last year. The nation is one of the biggest per capita carbon emitters and among the largest exporters of coal.

Emergency Management Minister Murray Watt said on Sunday that Australia was better prepared for the upcoming bushfire season than it was in 2019, saying government funding for aerial fire-fighting had doubled since then.

But Chalmers will say the economic damage from climate change is only just beginning to be understood, with the Black Summer bushfires and floods in October 2022 each costing the Australian economy about A$1.5 billion.

“If further action isn’t taken, Australian crop yields could be 4% lower by 2063, costing us about A$1.8 billion in GDP in today’s dollars,” he said.

Updated: 9-27-2023

Pacific Northwest Faces New Kind of Earthquake Risk, Tree Rings Reveal

A series of shallow earthquakes has the potential to strike the Pacific Northwest of the US with similar devastating force to the San Francisco quake of 1906, or the catastrophe that killed tens of thousands of people in Turkey and Syria in February, according to scientists.

Researchers from the University of Arizona examined the rings of ancient and submerged trees to determine that several quakes that struck the western Washington region about 1,000 years ago — known as the millennial cluster — occurred either simultaneously to produce an estimated 7.8 magnitude quake, or in rapid succession, such as the powerful back-to-back temblors that devastated parts of the Middle East.

Until now scientists had not been able to pinpoint the dates between the various fault ruptures, which they suspected could have been decades or even centuries apart.

But by comparing rings within living trees with those inside stumps submerged by lakes formed during the seismic events on the Seattle Fault and the Saddle Mountain Fault, they found that the quakes were likely linked, taking place late in the year 923 or early 924.

And that, researchers say, means the potential is there for a repeat event in an area which includes the cities of Seattle, Tacoma and Olympia, that is now home to some 4 million people.

“The evidence showed us that these trees from across the region died together, and this was in fact a linked event,” said the paper’s author Bryan Black, an associate professor of dendrochronology at the University of Arizona’s Laboratory for Tree-Ring Research.

“We’ve taken uncertainties around these two faults that used to span decades or centuries and narrowed it down to within one season,” Black said. “It’s a much different scenario if we have earthquakes on these two faults separated by 100 years versus 100 hours.

Demonstrating that these faults can rupture synchronously or in very rapid succession has really changed what we understand about the hazard in the region.”

Black cautioned that current quake models do not take into account the possibility that shallow fault activities in the area could be linked, either by underground connections or through the transfer of stress from one to another, which has implications for engineering design and policies.

For example, a second quake could provide the “knockout punch” that ends up destroying water mains and roads and triggering landslides and tsunamis.

Thankfully, he said, severe earthquakes are rare.

Updated: 10-16-2023

How A Little-Known Pollution Rule Keeps The Air Dirty For Millions Of Americans

Major investigation shows local governments are increasingly exploiting a loophole in the Clean Air Act, leaving more than 21 million Americans with air that’s dirtier than they realize

What You Need To Know About Loophole Hiding Extent Of US Wildfire Pollution

A legal loophole has allowed the US Environmental Protection Agency to strike pollution from clean air tallies in more than 70 counties, enabling local regulators to claim the air was cleaner than it really was for more than 21 million Americans.

Regulators have exploited a little-known provision in the Clean Air Act called the “exceptional events rule” to forgive pollution caused by “natural” or “uncontrollable” events – including wildfires – on records used by the EPA for regulatory decisions, a new investigation from the California Newsroom, MuckRock and the Guardian reveals.

In addition to obscuring the true health risks of pollution and swerving away from tighter control on local polluters, the rule threatens the potency of the Clean Air Act, experts argue, at a time when the climate crisis is posing an unprecedented challenge to the health of millions of Americans.

Where the EPA – the US agency monitoring air quality – has agreed to exclude bad air days from analysis, “we may have a sort of stable, relatively rosy picture when it comes to our regulatory world in terms of air-quality trends,” said Vijay Limaye, a climate and health epidemiologist at the Natural Resources Defense Council (NRDC), a non-profit advocacy group.

The truth is more complicated, and the air dirtier.

“The true conditions on the ground in terms of the air that people are breathing in, day after day, week after week, year after year, is increasingly an unhealthy situation,” Limaye said.

For the summer of 2023, more than 20 states so far, from Wyoming to Wisconsin to North Carolina, have flagged air-quality readings that were far higher than normal. Most of these days came in June, as skies in the midwest and eastern US were blanketed with Canadian wildfire smoke.

We pored over thousands of pages of regulatory documentation, correspondence and contracts, and analyzed hard-to-find public data to better understand how local regulators make use of the exceptional events rule, as global heating sparks extreme wildfires more often.

We Found That, Since 2016, When The EPA Last Revised The Guidance On Exceptional Events:

* Local regulators in 21 states filed requests with the agency to forgive pollution and, in 20 of those states, had them approved.

* In total, local regulators made note of almost 700 exceptional events. The EPA agreed to adjust the data on 139 of them.

* The adjustments came in more than 70 counties across 20 states. The affected areas stretched from the forested Oregon coast to the Ohio rust belt, from the craggy Rhode Island coastline down to the bayous of Louisiana.

* In more than half of the states where exceptional events were forgiven, industry lobbyists and business interests pressed to make that happen, sometimes as the only public voice in the regulatory process.

Also, to protect the status quo, some regulators spent millions of taxpayer dollars doing research for and making exceptional events requests, sometimes working hand in hand with industry stakeholders.

Meeting air-quality standards matters a lot to industry and politicians. Violations can add up to stricter, more costly and potentially unpopular pollution controls.

Critics say the growing use of the exceptional events rule for wildfires is of deep concern. “You need to level with the public about the number of days when the air quality was unhealthy,” said Eric Schaeffer, a former regulator who directs the Environmental Integrity Project.

“We have saved more lives in this country because we cleaned up the air than almost any other environmental policy,” said Michael Wara, the director of the climate and energy policy program at Stanford’s Woods Institute for the Environment. “And that’s what’s being undermined.

“The world has changed,” he said. “We are living in a different world when it comes to wildfire and all of its consequences, including air pollution.”

In response to written questions, the EPA said it takes all air pollution seriously.

“Wildland fire and smoke pose increasing challenges and human health impacts in communities all around the country,” Khanya Brann, an EPA spokesperson, wrote.

“EPA works closely with other federal agencies, state and local health departments, tribal nations, and other partners to provide information, tools, and resources to support communities in preparing for, responding to, and reducing health impacts from wildland fire and smoke.”

The EPA also pointed to “mitigation plans”, in which air districts that have experienced repeated exceptional events must create plans for educating and notifying the public about the pollution risk, as well as “steps to identify, study, and implement mitigating measures” like limiting the use of wood-burning stoves and wetting down unpaved roads before dust storms.

More ‘Toxic Soup’ And More Paperwork

In the US, clean-air policy long allowed local governments to write off some wildfire smoke on a case-by-case-basis as “unrealistic to control” or “impractical to fully control”.

But in 2005, the Republican senator Jim Inhofe of Oklahoma, who has long denied the climate crisis, won a years-long battle to amend the Clean Air Act.

The new rule gave local officials more opportunity to exclude pollution from regulatory consideration for an array of events, from fireworks displays and volcanic eruptions to wildfires and even unusual traffic events.

At first, the rule was used most successfully in a handful of south-western communities where high winds created a recurring problem of dust pollution.

Over time, local regulators have turned to exceptional events for wildfires more and more often to reach air-quality goals.

Our analysis of local and EPA records found that in 2016, air agencies flagged 19 wildfire events as potential exceptional events. In 2018 and 2021, 52 and 50 wildfire events were flagged. In 2020, 65 were.

“The uptick in exceptional events is absolutely consistent with what we see in the air pollution data,” said Marshall Burke, an associate professor of global environmental policy at the Stanford Doerr School of Sustainability.

Smoke is accounting for a higher proportion of overall air pollution, and it’s going up quickly, Burke said – not just in the western US, but nationwide.

No state is blamed more for smoke pollution than California, followed by Oregon and Canadian provinces, according to our analysis. Western states are more likely to point fingers at each other, while states in the midwest and north-east place the blame on Canadian provinces such as Alberta and Saskatchewan.

Wildfire smoke is a dirty and complicated polluter. Limaye, of the NRDC, called it a “toxic soup of air pollution”. It carries soot and ash, regulated as particulate pollution, as well as hydrocarbons and other gases that, cooked in sunlight, help form ground-level ozone.

It’s a growing concern for public health, both near the source and thousands of miles away. Smoke, especially from a long-burning fire, can travel long distances and linger at dangerous levels for weeks at a time.

We analyzed data recorded at air monitors nationwide. For every US county, on a day where the EPA excluded any data, we counted that day.