Ultimate Resource For Sports And Athletes Getting Rich From Bitcoin vs Crypto

Chiefs Tight End Sean Culkin to Convert Entire NFL Salary Into Bitcoin. Ultimate Resource For Sports And Athletes Getting Rich From Bitcoin vs Crypto

The fifth-year player will use Zap’s Strike to take his entire base salary of $920,000 in what Culkin said was “the hardest form of currency.”

Kansas City Chiefs player Sean Culkin will take the entirety of his 2021 base salary – $920,000 – in bitcoin.

Related:

NBA Player’s Contract Tokenization Plan Can Move Forward: Reports (#GotBitcoin)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin)

The fifth-year tight end is the first National Football League player to be paid entirely in bitcoin. Offensive tackle Russell Okung, who famously followed through on his declaration to “pay me in bitcoin,” still takes half of his $13 million salary in fiat.

Culkin will start stacking biweekly sats via Zap’s Strike, the same fiat-to-bitcoin salary conversion service Okung uses. The Chiefs are aware of Culkin’s arrangement but his reserve contract is still denominated in dollars, he said.

“This is generational for me,” Culkin told CoinDesk.

Taking 100% of one’s income in BTC might not be a wise financial decision for everyone, Culkin admitted. But he said his financial expenses, risk parameters and long-term conviction in bitcoin made it the right move for him.

Culkin said he became aware of bitcoin in summer 2016 but it wasn’t until March 2020 that he began seriously considering it as an investment. One year later, Culkin is slated to swap his fiat income flow for bitcoin alone.

He said he’s unfazed by the very real possibility of market dips. Strike will automatically convert his cash paychecks to bitcoin no matter the price.

“I don’t want to have to feel pressured to be like, ‘I don’t know if I’m gonna buy this week,’” Culkin said. The system will allow him to remain “detached” from market movements so he can focus on football.

“Professional athletes today operate as independent businesses and are more sophisticated investors than they’ve ever been before,” Zap CEO Jack Mallers said in a statement. “We’re excited to help facilitate the growing intersection between sports and finance by converting his entire NFL salary to Bitcoin.”

Culkin wasn’t the first footballer to make crypto news on Monday. Trevor Lawrence, the presumptive top pick in this week’s NFL draft, signed an endorsement deal with the FTX-owned investing app Blockfolio and was paid in an undisclosed cryptocurrency, the New York Times reported.

“For me, it makes sense to get paid in the hardest form of currency, and it’s something that is resistant to inflationary pressures that I think is very relevant in this current economic environment,” Culkin added.

How Do They Get Rich From Bitcoin

Bitcoin has revolutionized the world economy, and more importantly, it has changed the lives of lots of people, especially those who quickly believed in its abilities and promises. From ordinary people to big-time celebrities and even athletes, bitcoin is a success story that has affected every work of life. The following is a list of some of the sports athletes that have benefited from Bitcoin.

Cameron Winklevoss and Tyler Winklevoss, better known as the Winklevoss twins, have been in the bitcoin business since 2013. Many consider them to be the very first athletes to become Bitcoin Billionaires. They bought around $11 million worth of Bitcoin some years back, and when Bitcoin attained a value of $20,000, they became Billionaires.

Both started out as Olympic athletes and participated at the Beijing Olympics in 2008. Considered to be two of the wealthiest investors in the cryptocurrency world, the twins continue to grow their investment portfolios every day. The Twins are owners of the leading US cryptocurrency exchange Gemini. The company is one of the few in the US that has obtained the BitLicense from Local Authorities in New York.

Want to Join the Bitcoin success story? try one of our best Bitcoin Profitable Trading Autobots that will help your profits skyrocket. The Profit Revolution is one of them.

Richard Sherman

A household name in the NFL community, the popular cornerback, is one of the first athletes to invest in cryptocurrency. Richard Sherman has said several times that he was warned from investing in crypto, thankfully he didn’t listen to the naysayers. He has been a big supporter of blockchain technology and has increased his investment portfolio to include Bitcoin, Ethereum, and Litecoin.

Sherman invested in bitcoin early enough, and one of the first sports athletes to encourage people to carry out transactions using Bitcoin. Sherman’s online store has been accepting payments in bitcoin since 2013. On his first Bitcoin investment, he was able to turn a $1,000 investment into a $20,000 profit. He is currently an investor in Cobinhood, a crypto exchange that allows trading without any charges.

Mike Tyson

One of the most recognized names in the world of sports is Mike Tyson. He was known for his incredible punches and footwork that he was revered in the boxing community. He even knocked out an opponent in 30 seconds in a fight.

The boxing legend marked the first celebrity sponsored crypto product with the unveiling of his Mike Tyson bitcoin ATMs in 2015. He also collaborated with Bitcoin Direct to come up with a bitcoin wallet.

He was an early adopter of Bitcoin, and he has grown into a prominent time investor and benefactor of the leading cryptocurrency.

Chad Johnson

First got into bitcoin back in 2014. He adopted it as a means of making payments and encouraged his fans to use it as a payment method on his website. He said, “There is no upper limit to bitcoin. The entire Bitcoin story is interesting and I want to see how it unravels. I am lucky enough to have gotten into it quite early, and I am quite happy that it has lead to the birth of so many other things.” He added, “just seeing the progress bitcoin has made over the last few years gives me great joy.

Lionel Messi

Arguably the best footballer (soccer player) in the world, the Argentine and Barcelona player, is also part of the cryptocurrency/blockchain movement. He has collaborated with Sirin Labs in producing the first cryptocurrency smartphone. The phone, tagged “Finney phone” will have lots of features explicitly aimed for crypto users.

Final Words

Cryptocurrency, and by extension, by extension bitcoin is for everyone. The fact that athletes are making profits, and building wealth with it, means you too can be a part of the success story. Join the bitcoin bandwagon now, and change your life forever.

Updated: 10-20-2015

MMA Fighter Becomes First Ever To Be Paid In Bitcoin

Jon Fitch on Saturday became the first MMA fighter to ever receive his purse in bitcoin.

To be an MMA fighter, you need to be tough, smart and relentless – built to stand the tests of time. So naturally, it was only a matter of time before a relentless fighter in The Octagon partners with the currency of over 75 lives, bitcoin. Jon Fitch on Saturday became the first MMA fighter to ever receive his purse in bitcoin.

Fitch Wins Bitcoin Bout By Unanimous Decision

The fight was held at the Foxwoods Resort Casino in Mashantucket, Conn, as the main event versus Yushin “Thunder” Okami for the World Series of Fighting (WSOF) promotion. Fitch was a former welterweight championship contender in the UFC, having won 16 matches in a row at 170 lbs.

Now, he was able to secure a win against a normally much bigger opponent, who walks around at 210 lbs, and had to cut weight to get to 170. The scores were 29-28, 30-27 and 30-27.

The reasons for him to start getting paid in bitcoin are varied, but it is for practical matters as much as anything else as it appears Fitch has ethical issues with the current economic state of affairs. Fitch told Inverse:

“After the 2008 financial collapse, I was left under $180,000 on my condo in San Jose. I didn’t want to keep supporting people who kind of make those things happen. So I started playing around with cryptocurrency. Now I see all the possible things it can be used for. Especially the blockchain and the technology behind that.”

A lot of people don’t know how much, or how little, MMA fighters get paid. Now that Fitch is outside the UFC, working in the main event on a secondary circuit pays just over US$1,000, which he’ll receive in the digital currency. He does not have a sponsor, but his win on Saturday may help with that going forward.

“The appeal for me with bitcoin and MMA is it’s an international sport,” he explained. “A lot of guys have problems with getting paid and the payment processing that goes on. You fight in Brazil or somewhere else, and it takes a few weeks before you get your check. It’s not always easy for a lot of fighters. They’ve got people to pay, trainers, expenses, and things like that.”

The win on Saturday night took his record to 27-7-1 and leaves him as the primary contender for the currently vacant WSOF Welterweight Title.

Updated: 3-1-2021

How Crypto Is Going To Shake Up The World Of Mixed Martial Arts

A crypto-focused platform is vowing to shake up the world of mixed martial arts — bringing much-needed digitization to the sport, and helping fighters earn a living.

A team of mixed martial arts and marketing experts have created a fan-centric platform that’s designed to bring the sport into the digital age.

MMAON says mixed martial arts is considered to be the world’s fastest-growing sport, with the likes of Conor McGregor propelling the discipline to an international stage.

The online platform is designed to connect stakeholders of this thrilling sport — including organizers, athletes, sponsors and fans. With COVID-19 affecting MMA events globally, causing fights to be postponed and fans to stay at home, digitization has never been more important.

Tomaž Ambrožič, a renowned sports marketing expert, described the creation of the MMA Digital Hub as “a very innovative approach.” The platform is set to adopt a similar approach to that of IMDb, which has now become an undisputed authority in the world of film.

He explained: “Each fighter will have their profile set up in one place, with the platform giving fans the opportunity to interact with the fighters, including in the form of a dedicated social media channel and even with the option to reward the fighters directly through the fans.”

A compelling twist lies in how fans will be able to vote on which fighters they would like to see face each other in the ring. Enthusiasts will also have the chance to follow each fighter as they train for upcoming events and share their predictions.

Fighting For The Fighters

MMAON says that it also wants to help fighters make a comfortable living. Despite the fact that MMA is one of the most demanding and difficult sports in the world, many stars currently have low earning potential — and only a handful earn a substantial amount.

Through this crypto-focused platform, fighters will be able to receive tips from loyal fans — and athletes will be able to offer branded merchandise and sports equipment to generate revenue.

A broader range of sponsorship opportunities will also be offered, something that contracts with professional sporting bodies often prohibit.

Frank Mir, a former UFC heavyweight world champion who serves as a consultant on the project, has said he wished that platforms such as MMAON existed during the early stages of his career — describing it as a “phenomenal concept” that will allow young fighters to be seen by everyone.

He added: “Sometimes you get a little envious when you think about what it would be like to have all these things when I was fighting in my younger years… How much more could I earn? How could I become more popular? It must be easier for every generation.”

One of MMAON’s top priorities will involve encouraging as many world-famous fighters as possible to become part of the revolution.

A Knockout Startup

Executives say the MMAON token will have a plethora of use cases — enabling fighters to supplement their income even when they are not in the cage.

Fans will be able to pay fighters to create customized training programs for them, and launch crowdfunding in order to bring the fights they want to see to life.

The cryptocurrency is also set to be used as a means of payment for pay-per-view fights and ticketing. In time, staking these tokens will also enable users to receive discounts on merchandise and special events.

MMAON has also been endorsed by Mohammed “The Hawk” Shahid, the president of the BRAVE Combat Federation, who is serving as an advisor to the platform — providing insight and feedback to help the company continue its growth.

He added: “MMAON contributes to the sport by not only being a one-stop shop solution for the mixed martial arts industry but it focuses on fighters benefiting every step of the way from the growth of the sport. This is going to be a revolution in the sport of MMA.”

Updated: 5-3-2021

Soccer Player Ifunanyachi Achara The Latest Sports Pro To Take Salary In Bitcoin

The Nigeria-born Toronto FC forward sends some of his bitcoin home to help his family avoid surging inflation rates in Africa’s largest economy.

A fifth-year forward for Toronto FC is the latest professional athlete to convert a portion of his salary to bitcoin (BTC, +1.17%).

Ifunanyachi Achara, 23, said he takes around half of his Major League Soccer (MLS) salary in bitcoin by linking with a third-party exchange service. He switched to Bitwage in February after months of self-executing Binance buys.

Achara is among the first pro athletes to go public with their bitcoin salaries. Like National Football League players Sean Culkin and Russell Okung, Achara said he believes bitcoin is a hedge against fiat inflation – particularly in his home country. The Nigerian naira’s annual inflation hit a four-year high at above 18% in March.

“The rate of inflation is killing us,” Achara said in an interview. “The more the U.S. prints money during COVID to help people, the more it devalues our currency. So my family, when I send them money home, I send them bitcoin.”

Bitcoin remittances have appealed for years to pockets of foreigners moving money back home. BTC’s decentralized nature allows users to sidestep high wire-transfer fees. In the case of Nigeria, whose government shuts down private citizens’ bank accounts, according to Achara, it allowed him to skirt a monetary blockade.

“If I wanted to send money to my parents to move away from a state that I felt like was really violent, I couldn’t,” Achara said. “I couldn’t send them money to the bank. It was just through Bitcoin that I was able to send my family money more easily and efficiently and as fast as possible.”

Many Nigerians are storing their wealth in foreign bills, according to Bloomberg. Achara’s family is just doing it in bitcoin. They occasionally trade their bitcoin for the local currency, he said. Meanwhile, Nigeria’s central bank is allegedly closing crypto traders’ bank accounts.

For Bitwage, Achara is the company’s first pro athlete, though CEO Jonathan Chester said the company is “in conversations with other athletes, musicians and famous influencers.”

“We’ve been helping people get paid in bitcoin for seven years,” Chester said via email, “but this is the first year that we are really starting to see bitcoin payroll pick up with mainstream markets.”

Updated: 5-9-2021

NFL Quarterback Tom Brady Hints At Owning Bitcoin

The GOAT’s Twitter profile picture now shows him with laser eyes.

Tampa Bay Buccaneers quarterback Tom Brady, arguably one of the most talented American football players of all time, has hinted that he’s a Bitcoiner.

On Monday, Brady changed his Twitter profile picture to one with laser eyes, potentially implying to his 1.9 million followers that he is invested in Bitcoin (BTC). The football star made the change less than a day after Blockworks co-founder Jason Yanowitz challenged him to do so and provided the updated picture.

The crypto asset’s price was seemingly unaffected by the NFL player’s pseudo-announcement. At the time of publication, BTC’s price is $57,500, having risen 8% in the last seven days. However, players in the crypto space including MicroStrategy CEO Michael Saylor and Anthony Pompliano both acknowledged Brady’s presumed entry as a Bitcoiner.

The seven-time Super Bowl champion announced in April that he would be backing a new nonfungible token, or NFT, platform called Autograph. The marketplace aims to provide a tool for digital collectibles and will feature big names in sports and entertainment.

At the time of publication, Brady’s representatives have not provided any comments regarding his Bitcoin holdings.

Updated: 6-18-2021

Pro Basketball League In Canada Will Offer Players Bitcoin Salaries

“The ability to have part of my salary go directly into an investment that I believe will appreciate greatly over the next 10-30 years is a no-brainer,” said Guelph Nighthawks guard Kimbal Mackenzie.

The Canadian Elite Basketball League will be allowing players from its seven teams to accept a portion of their salaries in Bitcoin starting next week.

According to a Thursday announcement, the Canadian Elite Basketball League, or CEBL, has partnered with Toronto-based cryptocurrency exchange Bitbuy to convert part of basketball players’ existing salaries from Canadian dollars to Bitcoin (BTC) on request. The league said it will arrange for the funds to be delivered to the players’ personal crypto wallets.

More than 70 players on the active roster from the Edmonton Stingers, Fraser Valley Bandits, Guelph Nighthawks, Hamilton Honey Badgers, Ottawa Blackjacks, Niagara River Lions, and Saskatchewan Rattlers will be seemingly eligible for the crypto payments. Bitbuy will also be joining the CEBL as an official sponsor.

The Nighthawks’ Kimbal Mackenzie said he would be one of the first players to accept the CEBL’s offer. The 24-year-old guard recently re-signed with the team for the 2021 CEBL season beginning June 24.

“The opportunity to be paid in Bitcoin is something I’m incredibly excited about,” said Mackenzie. “I believe cryptocurrency is the future. The ability to have part of my salary go directly into an investment that I believe will appreciate greatly over the next 10-30 years is a no-brainer.”

Though many sports franchises and organizations have partnered with crypto and blockchain firms, many people have expressed concern about Bitcoin as a medium of exchange given the crypto asset’s price fluctuations. Mackenzie added in a separate interview that he would accept half of his salary in Bitcoin and was seemingly unconcerned about any potential volatility:

“[If Bitcoin falls], so be it. It was a decision I was prepared to make. On the other hand, if it increases, maybe I will retire in two years.”

Since reaching an all-time high price of $64,899 in April, Bitcoin has dropped significantly following Tesla CEO Elon Musk saying the company would stop accepting the crypto asset as payment for vehicles due to environmental concerns. At the time of publication, the BTC price is $36,788, having fallen more than 5% in the last 24 hours.

Updated: 7-2-2021

NBA’s Portland Trail Blazers To Wear Crypto Logo For Next Five Years

The Trail Blazers will reportedly feature the StormX logo on team jerseys for the next five years, beginning with the 2021-22 season.

The Portland Trail Blazers, an American professional basketball team competing in the National Basketball Association (NBA), is moving into the cryptocurrency industry with a new partnership.

The NBA announced Thursday that the Trail Blazers has landed the league’s first jersey patch sponsorship program with StormX, a blockchain company allowing users to earn crypto rewards by completing micro-tasks or shopping at global partner stores online.

Fresh, groundbreaking, revolutionary.

We’re excited to announce we are joining forces with @stormxio, the first cryptocurrency jersey patch partner in the NBA! https://t.co/hAHDdMABDA pic.twitter.com/ZWpmp9k2wr

— Portland Trail Blazers (@trailblazers) July 1, 2021

As part of the sponsorship deal, the Trail Blazers will reportedly feature the StormX logo on team jerseys for the next five years, beginning with the 2021-22 season.

The parties did not disclose the size of the deal but said that they signed an “eight-figure contract” including in-arena branding. According to sponsorship experts, jersey patch deals average around $10 million per year.

In addition to the jersey patch, StormX and the Trail Blazers will also partner to launch their first nonfungible tokens, or NFTs, based on the Gameday Poster Series, a series featuring unique designs from local artists for Trail Blazers’ team.

Issued in the form of digital collectibles representing the team’s posters, the Trail Blazers’ NFTs will be rolled out later in July, according to the announcement.

Trail Blazers president and CEO Chris McGowan said that StormX will help “educate and motivate Rip City around cryptocurrency and earning crypto cashback.”

StormX was founded in Seattle by Calvin Hsieh and Portland-grown Trail Blazers fan Simon Yu with a mission to boost financial independence. The firm’s platform allows earning crypto cashback from more than 800 stores across over 170 countries via an internet browser extension.

“We’re honored to be the first crypto company to form a jersey sponsorship with not only a team of such high caliber, but also with a league of the same stature,” Yu said.

The NBA has been expanding its move into the crypto and blockchain industry recently. In mid-June, NBA’s Philadelphia 76ers entered a marketing partnership with major blockchain fan token providers, Chiliz and Socios.

Dutch Football Team AZ Alkmaar To Hold Bitcoin

AZ Alkmaar announced crypto broker Bitcoin Meester as its exclusive and official cryptocurrency partner.

In a statement posted on the club website on Thursday, the Eredivisie side, which finished third in the 2020/2021 Dutch football season, announced crypto broker Bitcoin Meester as its exclusive and official cryptocurrency partner until mid-2024.

According to the announcement, the sponsorship deal with be finalized fully in Bitcoin, with the Dutch club stating its intentions to keep the BTC sum on its balance sheet.

For AZ’s commercial director Michael Koster, the appeal of Bitcoin and crypto is undeniable hence the club’s decision to adopt BTC. “The cryptocurrency market is booming, with an exponential growth of users in recent years,” Koster added.

Koster added that non-crypto entities like football teams require the guidance of established market participants like Bitcoin Meester. Indeed, the crypto broker is one of the few licensed cryptocurrency businesses by the Dutch central bank.

Crypto regulations seem to be a major topic of discussion among the authorities in the Netherlands, with one government official recently calling for a complete Bitcoin ban.

Crypto companies are increasingly entering into sponsorship deals with sports teams to boost brand recognition and grow their business. As previously reported by Cointelegraph, Crypto.com recently announced a global partnership with Formula 1.

From Major League Baseball to the National Basket Ball Association, several American sports franchises and star athletes are also embracing Bitcoin and crypto. Back in June, seven-time Super Bowl champion Tom Brady inked a celebrity crypto-endorsement deal with crypto exchange giant FTX.

Updated: 7-16-2021

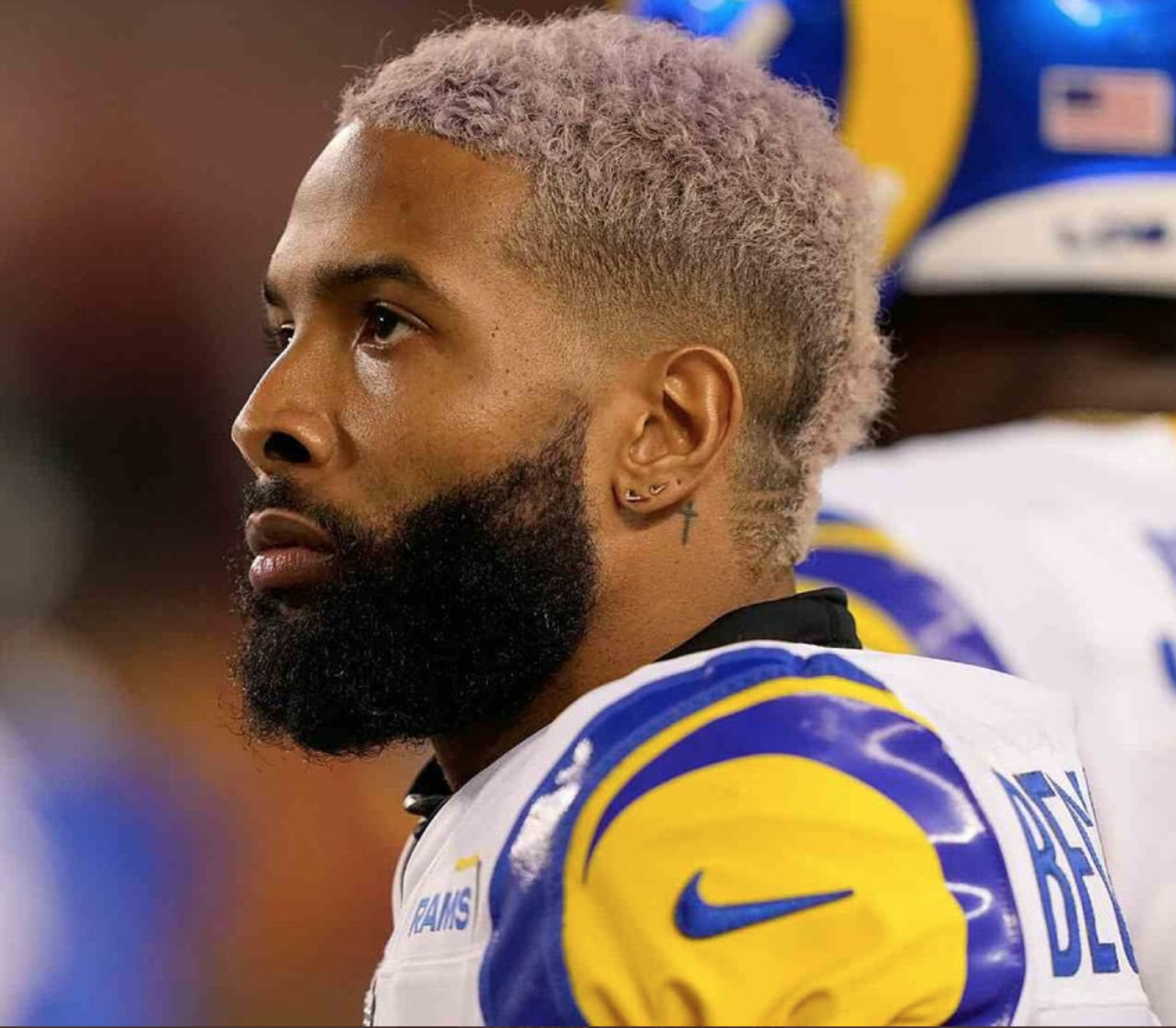

NFL’s Saquon Barkley Converting Endorsements To BTC To Create ‘Generational Wealth’

Saquon Barkley will use Strike to convert all of his endorsements into Bitcoin and noted that he became interested in BTC after researching inflation.

NFL star Saquon Barkley has revealed that he will be converting all of his endorsement money into Bitcoin (BTC).

Barkley was the 2018 NFL offensive rookie of the year and plays as a running back for the New York Giants — a team that is also sponsored by Grayscale.

The 24-year-old explained the rationale for the move earlier today during an appearance on “The Best Business Show,” hosted by Bitcoin proponent and Morgan Creek Digital co-founder Anthony Pompliano. He noted that his research on inflation is what drove his interest in Bitcoin:

“We’re seeing inflation and we’re learning you can’t save wealth. That’s why I am going to be taking my marketing money in Bitcoin.”

Barkley was joined on the show by Jack Mallers, the CEO of Strike, a payments company based on the Lightning Network. The NFL star cites the CEO as a key person who helped educate him on the benefits of investing in Bitcoin. Mallers was also highly influential in El Salvador’s embrace of Bitcoin.

As part of the move to convert his reported eight-figure yearly marketing endorsement money, Barkley will take direct deposits into his Strike account and instantly convert the money into BTC.

Barkley stated that he sees his opportunity in the NFL as a chance to emulate cult sports figures such as Lebron James of the LA Lakers, Kevin Durant of the Brooklyn Nets and Tom Brady of the Tampa Bay Buccaneers, by creating generational wealth for his family.

He emphasized that he can’t generate that amount of wealth from his NFL salary alone, as a career in the NFL is short-lived and he runs a risk of a career-ending injury at any moment.

“When you see the KD’s, the Lebrons and Bradys of the world and you want to create generational wealth, you can’t do that with the sport that I play and the position that I play and coming off of injuries. When you sit out of football for a whole year, you realize that this game could be taken away from you.”

During the show, Mallers offered advice to new investors by asserting that the question shouldn’t necessarily be focused on “Should I buy Bitcoin?” but more toward, “Should you store your money?” to counter inflation.

BREAKING: Saquon Barkley has announced on The Best Business Show that he is taking 100% of his endorsement money in Bitcoin going forward.

That’s more than $10 million annually.

What a legend. pic.twitter.com/6gpQBewgMv

— Joe Pompliano (@JoePompliano) July 14, 2021

Barkley isn’t the first NFL star to convert payments into Bitcoin, and Cointelegraph reported on Dec. 30 2020 that NFL free agent and BTC proponent Russell Okung was using Strike to convert a portion of his NFL salary into BTC.

The NFL’s great Tom Brady has also become involved in the crypto sector this year after he announced the launch of his NFT marketplace, dubbed “Autograph,” in April, and also hinted that he owned BTC the following month.

On June 29, Cointelegraph reported that Brady was set to take an equity stake in the FTX crypto exchange as part of an endorsement deal.

Updated: 8-19-2021

PSV Eindhoven Soccer Club To Accept New Sponsorship Deal In Bitcoin

Anycoin Direct will now be an official partner of PSV for the next two seasons, helping grow crypto awareness across Europe.

The football ecosystem has stepped up its adoption game as more clubs continue to involve crypto in mainstream operations.

Netherland-based top-tier football club PSV Eindhoven has partnered with local crypto trading platform Anycoin Direct, which will pay the club an undisclosed amount of Bitcoin (BTC) in a new sponsorship deal.

According to the official statement, Anycoin Direct will remain an official partner of PSV Eindhoven for the next two seasons with the goal of growing awareness of crypto across Europe.

By using the crypto platform’s services, PSV Eindhoven will be able to receive the total sponsorship amount in Bitcoin, making it the first major football club in the European Union to get paid sponsorship in cryptocurrency.

PSV Eindhoven commercial director Frans Janssen reportedly created the Bitcoin wallets for accepting the sponsorships after the deal was signed off. Supporting the move, he said, “As a club in the heart of the Brainport region, we are always innovating, cryptocurrency fits well into this picture.”

Earlier this year in April, PSV experimented with nonfungible tokens (NFT) by auctioning a digital version of the 1988 European Cup Final, which it had won against Benfica.

To signify the importance of the win for the club, the NFT was also accompanied by an official certificate signed by Hans van Breukelen, the goalkeeper who played on the championship team.

Out of all the use cases that crypto offers, football clubs are placing bets on fan tokens. Some of the recent federations to take part in this experiment are Arsenal and Manchester City, both in partnership with a fan engagement platform Socios.

Arsenal’s intent behind launching the AFC fan token is to allow its global fanbase to participate in club decisions via online polls and improve fan engagement. Similarly, Manchester City’s CITY fan token will allow fans access to rewards, promotions and club decisions via polls. Both the fan tokens will be powered by Socios’ Chiliz blockchain and its in-house CHZ token.

Cade Cunningham Will Receive Signing Bonus In Bitcoin

Joe Pompliano of Huddle Up reported on Thursday that the Detroit Pistons rookie has agreed to an exclusive, multi-year endorsement deal with crypto company BlockFi. As part of his deal, Cunningham will receive 100 percent of his signing bonus in Bitcoin.

The 19-year-old Cunningham was the No. 1 overall pick in this year’s draft. He will make $45.6 million over the next four years as part of his rookie contract with the Pistons, which is separate from his signing bonus.

Cryptocurrency continues to gain in popularity among professional athletes. We already saw another young star in a different sport make a similar move.

Updated: 9-6-2021

NFL Reportedly Bans Teams From Crypto Advertisements And NFT Sales

The NFL has reportedly restricted cryptocurrency and NFTs until the league establishes a strategy “for sports digital trading cards and art.”

The United States National Football League (NFL) has reportedly barred all teams and members from crypto-related sponsorships and advertisements, as well as nonfungible token (NFT) sales.

According to a report by The Athletic, the NFL has restricted the sale of sponsorships to cryptocurrency trading firms and NFTs until the league establishes a strategy “for sports digital trading cards and art.” The new guidelines were shared by an anonymous NFL member familiar with the matter:

“Clubs are prohibited from selling, or otherwise allowing within club controlled media, advertisements for specific cryptocurrencies, initial coin offerings, other cryptocurrency sales or any other media category as it relates to blockchain, digital asset or as blockchain company, except as outlined in this policy.”

Going against the NFT and token sales trends from mainstream soccer teams such as PSV Eindhoven, Manchester City and Arsenal, as well as the National Basketball Association, the NFL has ruled out creating or selling team NFTs, at least for now.

The NFL official reportedly said that teams would only be allowed to discuss sponsorship deals with crypto-related “investment advisory and or fund management services” if their advertising sponsorship rights are limited to promoting the company’s corporate brands.

The NFL did not immediately respond to Cointelegraph’s request for comment.

Legendary footballer Lionel Messi, tennis star Naomi Osaka and others sports stars have previously shown interest in crypto investments. On July 15, NFL star Saquon Barkley shared his intent to convert his endorsement payments into Bitcoin (BTC).

Barkley cited inflation as one of the main reasons why one cannot save wealth. “That’s why I am going to be taking my marketing money in Bitcoin,” he said.

Updated: 9-7-2021

NBA Star Steph Curry Asks Twitter For Crypto Advice

The NBA star tweeted a public call-out to the crypto twitter community to help further his education in the space.

Following a lucrative $206,000 purchase of a popular Bored Ape Yacht Club nonfungible token, or NFT, last week, NBA all-star Steph Curry has reached out to his 15.5 million Twitter fanbase for advice on progressing in the crypto game on Tuesday.

The Golden State Warriors guard tweeted: “Just getting started in the crypto game…y’all got any advice??”

According to the basketball athlete’s Open Sea profile, he currently owns 16 NFTs in total, including the blue-furred Bored Ape showcased in his Twitter profile.

Legendary NFL quarterback Tom Brady, currently sporting the Tampa Bay Buccaneers jersey, humorously offered his perspective:

Whatever you do…don’t laser eyes! https://t.co/VVqUx6E6Oe

— Tom Brady (@TomBrady) September 7, 2021

Brady’s picture depicted the infamous Laser eyes, a popular meme adopted by the crypto community, politicians, sportspersons and other notable industry figures earlier this year to declare their support for leading crypto asset Bitcoin (BTC).

Serial entrepreneur and early investor in Nasdaq-listed crypto exchange Coinbase, Gary Vaynerchuk also offered his thoughts with a hustle philosophy one would come to expect from the maverick entrepreneur, simply replying: “50 hours of homework”.

In response to Vaynerchuk, Twitter user @Wealth_Theory replied rather accurately: “There is not one person on earth who did 50 hours of homework before ramming money into altcoins. Lol”

According to live data from DappRadar, the NBA’s slam dunk NFT project Top Shot sits in the fourth position as the most popular NFT marketplace across the last 30 days with $28.11M in sales volume between 112,360 traders.

Data from CryptoSlam also reveals that Top Shot is the fourth largest NFT collection of all-time by sales volume, with Axie Infinity, CryptoPunks and ArtBlocks claiming the podium spots.

Crypto And Sports: A Marriage Made In … Well, We’ll See

Digital currencies look to football, basketball, and wrestling fans to expand their investor base.

Sports teams, buffeted by the pandemic, need money. And, after a blockbuster year, cryptocurrency investors have a lot of it.

For digital currencies to continue that upward trajectory, however, they need to “expand the investor base”—a euphemism for finding new and, almost by definition, less sophisticated investors willing to pump up the price of Bitcoin, Ethereum, Dogecoin, and any other cryptocurrency that is the flavor of the day.

Which helps explain why crypto companies are pouring hundreds of millions of dollars into sponsorship and commercial deals with professional sports. It’s an effort to lure their massive fanbases into crypto.

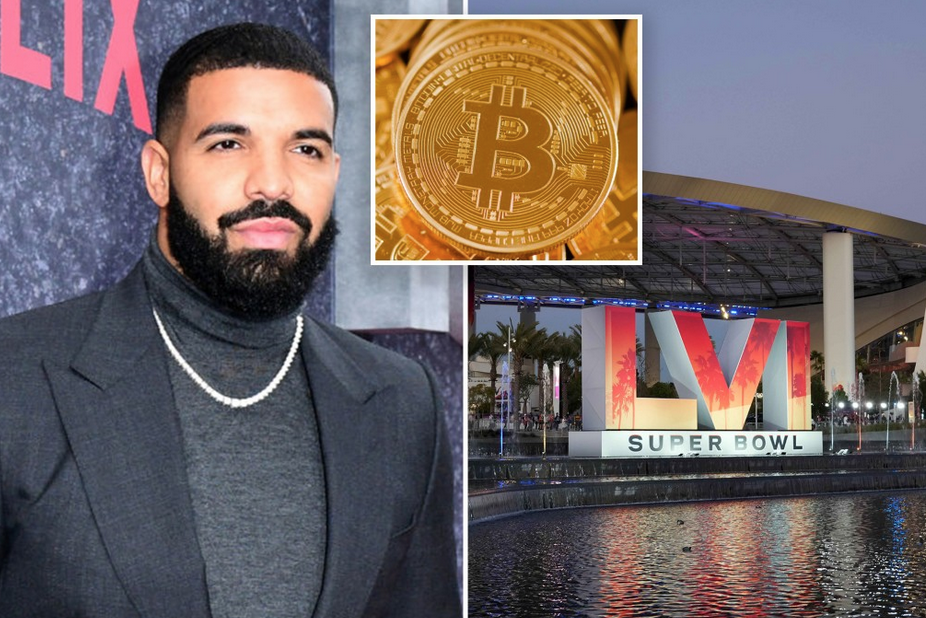

Crypto.com has paid to become the official cryptocurrency exchange and technology sponsor of Italy’s Serie A soccer league. Rival exchange FTX alone has announced deals since June totaling more than $360 million in basketball, baseball, and esports. The NBA’s Miami Heat now play home games at the FTX Arena.

Sports fans have long been easy prey for companies pushing risky or addictive behavior, something the teams do little to discourage. The trend is worrying. Some 40% of the jersey sponsors in English soccer’s Premier League are gambling companies, up from just 10% in 2008.

As marketing spending increased, so did gambling revenue: In the decade before the pandemic, British spending on betting almost doubled, to £4.7 billion ($6.4 billion) a year.

There’s a strong correlation between appetite for gambling and investment in cryptocurrencies, too. A survey by the gambling treatment charity GamCare found that 50% of regular gamblers have participated in crypto trading, compared with only 3% of the general population.

What is new is the way teams are providing incentives for their fans to join the craze, a practice best illustrated by the rise of so-called fan tokens. These cryptocurrencies are pitched by their creators as a way for clubs to increase digital engagement with fans.

In practice, that means token holders get access to exclusive content, such as voting on which song to play in the stadium while the players warm up, or which motivational quote to plaster on the changing room wall. Hardly mind-blowing stuff.

The market leader is Socios.com, which sells tokens for more than 50 different teams and sports, from soccer’s FC Barcelona to basketball’s Chicago Bulls and the Ultimate Fighting Championship.

The value of those tokens fluctuates with demand, and each token confers one vote in the frequent polls.

Alexandre Dreyfus, the chief executive officer of Malta-based Socios, is adamant that the model is better than classic fan membership programs that charge a recurring flat fee.

With a token, “I have access to a service that doesn’t cost me money every year,” Dreyfus says. “You can own something that provides you with a service, but can resell it—and if you don’t want it, you don’t have to buy it.”

The targets are supporters outside domestic markets who follow multiple sports and clubs—for instance, a Japanese or Brazilian fan who supports Arsenal in the Premier League, Paris Saint-Germain in Ligue 1, basketball’s Chicago Bulls, and motorsport’s Aston Martin Cognizant F-1 team.

Dreyfus envisions Socios as a platform for global fans to get exclusive(ish) access to teams, which can themselves extract additional revenue from supporters with whom they otherwise have little interaction. In a marketing stunt, part of Lionel Messi’s PSG signing bonus announced on Aug. 12 was in the form of the Socios fan tokens.

The marketing appeal is obvious, but these tradable tokens pose a more insidious hazard. “If it’s voting on fun things like music or the color of the team bus, that’s only going to be appealing to younger fans, and if that’s the case you’re pushing young people towards cryptocurrency investment,” says Adam Willerton, secretary of the Leeds United Supporters Trust, a fan group for the Premier League team that is part-owned by the NFL’s San Francisco 49ers. Socios sells Leeds tokens. “Football fans are just being used to bump the price up.”

Dreyfus argues that the price needs to respond to demand in order to give teams an incentive to provide good content. Better content should, in theory, foster demand for the token, boosting the price.

The team can then sell more tokens to raise additional capital. So far, however, they’ve proven little more than a means of speculation similar to meme stocks, fueled by frenzied forum discussions. And none of this is regulated.

There’s an added layer of complication. In order to buy the tokens at all, you first have to buy Chiliz, a cryptocurrency developed by Socios and its parent company. And the Chiliz price swings. So the price of your fan token might increase when denominated in Chiliz, but the price of Chiliz itself might decline. Fans are exposed to two layers of risk.

It’s like a casino where the value of the chips changes. Sure, you might double your stack at the blackjack table, but the $100 chip you bought on the way in might be worth only worth $50 by the time you leave. Of course, the inverse is true: The price of Chiliz can increase.

And that may be where the greatest opportunity lies for Socios and its backers, which include the French telecoms billionaire Xavier Niel. With the launch of each new token, more fans will in theory then buy Chiliz coins, whose total circulation is capped. The price of Chiliz has accordingly risen 17-fold this year. That in turn increases the barriers to entry for new fans.

There is some desperation at play here on the part of the teams. The European soccer market (total revenue in the top five leagues) contracted by 13% in the 2019-20 season because of the pandemic, according to Deloitte.

The combined £150 million pounds that the Daily Telegraph reported that teams in the region have made this year from Socios offsets some of that. It’s a nice fillip to the coffers, but there may be a longer-term cost.

Crypto And Sports: A Marriage Made in … Well, We’ll See

Digital currencies look to football, basketball, and wrestling fans to expand their investor base.

Sports teams, buffeted by the pandemic, need money. And, after a blockbuster year, cryptocurrency investors have a lot of it.

For digital currencies to continue that upward trajectory, however, they need to “expand the investor base”—a euphemism for finding new and, almost by definition, less sophisticated investors willing to pump up the price of Bitcoin, Ethereum, Dogecoin, and any other cryptocurrency that is the flavor of the day.

Which helps explain why crypto companies are pouring hundreds of millions of dollars into sponsorship and commercial deals with professional sports. It’s an effort to lure their massive fanbases into crypto.

Crypto.com has paid to become the official cryptocurrency exchange and technology sponsor of Italy’s Serie A soccer league. Rival exchange FTX alone has announced deals since June totaling more than $360 million in basketball, baseball, and esports. The NBA’s Miami Heat now play home games at the FTX Arena.

Sports fans have long been easy prey for companies pushing risky or addictive behavior, something the teams do little to discourage. The trend is worrying. Some 40% of the jersey sponsors in English soccer’s Premier League are gambling companies, up from just 10% in 2008.

As marketing spending increased, so did gambling revenue: In the decade before the pandemic, British spending on betting almost doubled, to £4.7 billion ($6.4 billion) a year.

There’s a strong correlation between appetite for gambling and investment in cryptocurrencies, too. A survey by the gambling treatment charity GamCare found that 50% of regular gamblers have participated in crypto trading, compared with only 3% of the general population.

What is new is the way teams are providing incentives for their fans to join the craze, a practice best illustrated by the rise of so-called fan tokens. These cryptocurrencies are pitched by their creators as a way for clubs to increase digital engagement with fans.

In practice, that means token holders get access to exclusive content, such as voting on which song to play in the stadium while the players warm up, or which motivational quote to plaster on the changing room wall. Hardly mind-blowing stuff.

The market leader is Socios.com, which sells tokens for more than 50 different teams and sports, from soccer’s FC Barcelona to basketball’s Chicago Bulls and the Ultimate Fighting Championship.

The value of those tokens fluctuates with demand, and each token confers one vote in the frequent polls. Alexandre Dreyfus, the chief executive officer of Malta-based Socios, is adamant that the model is better than classic fan membership programs that charge a recurring flat fee.

With a token, “I have access to a service that doesn’t cost me money every year,” Dreyfus says. “You can own something that provides you with a service, but can resell it—and if you don’t want it, you don’t have to buy it.”

The targets are supporters outside domestic markets who follow multiple sports and clubs—for instance, a Japanese or Brazilian fan who supports Arsenal in the Premier League, Paris Saint-Germain in Ligue 1, basketball’s Chicago Bulls, and motorsport’s Aston Martin Cognizant F-1 team.

Dreyfus envisions Socios as a platform for global fans to get exclusive(ish) access to teams, which can themselves extract additional revenue from supporters with whom they otherwise have little interaction.

In a marketing stunt, part of Lionel Messi’s PSG signing bonus announced on Aug. 12 was in the form of the Socios fan tokens.

The marketing appeal is obvious, but these tradable tokens pose a more insidious hazard. “If it’s voting on fun things like music or the color of the team bus, that’s only going to be appealing to younger fans, and if that’s the case you’re pushing young people towards cryptocurrency investment,” says Adam Willerton, secretary of the Leeds United Supporters Trust, a fan group for the Premier League team that is part-owned by the NFL’s San Francisco 49ers. Socios sells Leeds tokens. “Football fans are just being used to bump the price up.”

Dreyfus argues that the price needs to respond to demand in order to give teams an incentive to provide good content. Better content should, in theory, foster demand for the token, boosting the price.

The team can then sell more tokens to raise additional capital. So far, however, they’ve proven little more than a means of speculation similar to meme stocks, fueled by frenzied forum discussions. And none of this is regulated.

There’s an added layer of complication. In order to buy the tokens at all, you first have to buy Chiliz, a cryptocurrency developed by Socios and its parent company.

And the Chiliz price swings. So the price of your fan token might increase when denominated in Chiliz, but the price of Chiliz itself might decline. Fans are exposed to two layers of risk.

It’s like a casino where the value of the chips changes. Sure, you might double your stack at the blackjack table, but the $100 chip you bought on the way in might be worth only worth $50 by the time you leave. Of course, the inverse is true: The price of Chiliz can increase.

And that may be where the greatest opportunity lies for Socios and its backers, which include the French telecoms billionaire Xavier Niel. With the launch of each new token, more fans will in theory then buy Chiliz coins, whose total circulation is capped. The price of Chiliz has accordingly risen 17-fold this year. That in turn increases the barriers to entry for new fans.

There is some desperation at play here on the part of the teams. The European soccer market (total revenue in the top five leagues) contracted by 13% in the 2019-20 season because of the pandemic, according to Deloitte.

The combined £150 million pounds that the Daily Telegraph reported that teams in the region have made this year from Socios offsets some of that. It’s a nice fillip to the coffers, but there may be a longer-term cost.

Updated: 9-8-2021

Rob Gronkowski Follows Tom Brady Into Crypto In Ambassador’s Role With Voyager Digital

“Gronk” will launch a series of campaigns aimed at making crypto investment more accessible and engaging for a mass-market audience.

Four-time Super Bowl-winning tight end Rob Gronkowski has followed teammate and best friend Tom Brady into the crypto world, taking an ambassadorial role with brokerage platform Voyager Digital.

“Gronk” will launch a series of campaigns aimed at making crypto investment more accessible and engaging for a mass-market audience, Voyager announced Wednesday.

The premier campaign is entitled “New Best Friend” and features Gronk playing at home with a Shiba Inu – the breed of dog associated with dogecoin and shiba inu coin.

Gronk posted a preview on Twitter of him doing push-ups with the dog on his back.

The campaigns will continue in the coming months and include a livestream event and a non-fungible token (NFT) drop to benefit Gronk Nation Youth Foundation.

Gronk has ventured into crypto previously, launching a series of non-fungible tokens (NFT) commemorating some of his most famous plays from his four Super Bowl wins.

In his new ambassadorial role with Voyager, Gronk is following the suit of teammate Tom Brady, who became a part owner and ambassador of crypto derivatives exchange FTX in June. A month earlier, Brady revealed that he had “definitely” invested in crypto in an interview with FTX founder Sam Bankman-Fried as part of CoinDesk event Consensus 2021.

Having retired from the game in 2019, Gronk returned to football a year later, following Brady from the New England Patriots to the Tampa Bay Buccaneers, for whom they combined to help win Super Bowl LV in February this year.

Updated: 9-11-2021

NBA’s Steph Curry Sees Crypto Providing Access To Opportunity

NBA superstar Steph Curry, who recently entered into a partnership with the fast-growing digital-asset exchange FTX, said he wants to use cryptocurrencies as a socially conscious platform.

The two-time most valuable player spoke with Bloomberg’s Emily Chang at a charity event for his Eat. Learn. Play. foundation. Football great Tom Brady and model Gisele Bündchen also signed their own deal with FTX earlier this year.

FTX, which was valued at $18 billion in its most recent round of fundraising, has announced a number of sports-related deals and partnerships in recent months.

The Cal Golden Bears signed a 10-year, $17.5 million naming rights deal with the company just last month. In addition, the NBA’s Miami Heat play in FTX Arena and the company is also the official crypto exchange of Major League Baseball.

A condensed version of the interview with the Golden State Warriors basketball guard follows.

You caused a bit of a stir this week taking to Twitter saying you’re getting into crypto and you wanted some help.

And some people think that crypto could actually open up economic opportunity for underserved communities. I’m curious what excites you about crypto?

I think we’re obviously at the beginning. I know it’s been around for a while, but from a mass awareness perspective, understanding how this is going to be a part of the next generation and how they think about financial opportunity and access to that.

And right now, it’s just about education. I think in terms of what it actually is, how it can be leveraged in the proper ways. I’m curious about it. I’m involved in it. And understand there is a big community right now that is excited about what this will mean for democratizing financial institutions and how we do things. So it’s about educating the next generation.

This is going to be around. This is going to be something that you can participate in. And hopefully we can create that access to opportunity through it and do it in a fun way too because it is kind of overwhelming when you think about a lot of the questions that people have about what is it actually doing.

Tom Brady told you not to laser eye. You changed your avatar to a Bored Ape, nod to NFTs -– what’s up with that?

You’ve got to have fun with it. When we both signed up with FTX and there was a little dip in here and there, and four hours after he had a launch, it’s very similar to what I did. But it’s a volatile kind of market right now. But the long-term prospects are very positive.

And the biggest thing about what Tom is doing you know, what I’m trying to do, with that partnership specifically is to create a socially conscious platform within crypto.

The founder of FTX, he’s very committed to that, setting a standard for what it means to be socially responsible within the success of the crypto, and I can get behind that as well.

Updated: 9-22-2021

76ers Become Second NBA Team To Ink Crypto Ad Patch Deal

The Philadelphia team will sport the Crypto.com logo on its jerseys starting this season.

When the National Basketball Association’s season starts next month, not one but two teams will be wearing crypto-related ad patches.

The Philadelphia 76ers announced Wednesday that Crypto.com’s logo will be emblazoned on all team uniforms. The Sixers join the Portland Trail Blazers, which inked a deal with crypto e-commerce site StormX earlier this year.

It’s just the latest major crypto brand activation in the world of sports, with Crypto.com, crypto exchange FTX (whose logo is, among other places, on uniforms of Major League Baseball umpires) and others making a land grab for sports fans everywhere.

The Sixers partnership with Crypto.com is for six years, an exchange representative told CoinDesk. The deal’s cost was not disclosed though a source with knowledge tells CoinDesk it is valued at eight figures annually.

Crypto.com has made a number of high-profile sports partnerships of late but this is its first with the NBA. Major partnerships for the crypto exchange include soccer club Paris Saint-Germain, car racing league Formula 1, and the National Hockey League’s Montreal Canadiens.

The Sixers deal also includes a non-fungible token (NFT) angle. The team is launching its first batch of digital collectibles through Crypto.com’s NFT platform.

“Crypto.com will be woven into the fabric of our identity, and together, we will change the landscape for how crypto is integrated in sports,” 76ers President of Business Operations Chris Heck said in a statement.

Crypto.com Tops $400 Million In 2021 Sports Deals On 76ers Pact

The trend of partnerships between cryptocurrency firms and sports teams continues, with Crypto.com and the Philadelphia 76ers basketball team entering into a deal.

The pact will include plans for the launch of a non-fungible token (NFT) series by the 76ers, while Crypto.com becomes the National Basketball Association team’s official jersey patch partner, according to a statement. The crypto platform will also present a school to educate fans on cryptocurrency.

This is Crypto.com’s first partnership in the NBA, after the platform has sealed deals with the likes of Formula 1, Paris Saint-Germain and the National Hockey League’s Montreal Canadiens. Its partnerships with sports brands total over $400 million, a person familiar with the matter said.

“Crypto.com will be woven into the fabric of our identity, and together, we will change the landscape for how crypto is integrated in sports,” said Chris Heck, 76ers president of business operations, in the statement.

The tie-up comes as digital-asset operations more generally begin to see sports as a way to reach a wider base of potential customers. The Tezos blockchain teamed up with McLaren Racing in June for a multiyear partnership across Formula 1, IndyCar and e-sports.

And crypto-derivatives exchange FTX’s Chief Executive Officer, Sam Bankman-Fried, said in an interview earlier this month that there are indications its sponsorships with the likes of the Miami Heat and Major League Baseball have been a “non-trivial piece” of how people became aware of FTX.

“The Philadelphia 76ers are a perfect fit for our world-class roster of sports partners,” said Kris Marszalek, co-founder and CEO of Crypto.com, in an email. “Not only will we see great brand exposure, but I’m especially excited about the unique experiences for fans we’ll create together.”

Updated: 10-13-2021

Crypto Scoring Big With European Football

Introducing crypto and blockchain into football isn’t easier than scoring a back-post tap-in: “We had to educate a lot, explain how it worked and why it was interesting for them.”

The Beautiful Game. Soccer, or football, as those living in the “old world” tend to call it. It’s a sport that has many names, a sport that commands a support base of some 4 billion people.

The power of football is undeniable. Its best players, the Ronaldos and the Messis, are some of the most recognizable people on the planet. Its biggest teams have millions of fans scattered across the world and broadcasters reach more than half of the people on the planet.

The European football industry alone turned over 25 billion euros in revenue in 2020, according to Deloitte, an indicator of the value in the biggest theater for the sport.

The popularity of football is due in large part to its simplicity as a game, and this has inevitably led to the biggest leagues and competitions attracting massive audiences and generating plenty of revenue for all involved.

Whether it’s through team sponsorships or marketing on broadcasts and advertising space, the sheer size of its viewership makes football a prime way for brands and businesses of all kinds to reach a lot of consumers.

While the cryptocurrency and blockchain space is still in its infancy, it’s a burgeoning industry that is quickly redefining finance and remittance, individual sovereignty of wealth, and a host of other use cases.

A number of different firms and organizations have taken the world of crypto into the football arena in different ways, but they’ve quickly made moves to be associated with some of the biggest players, teams and competitions as a result.

Here’s exactly how cryptocurrencies have been introduced to global football audiences and blockchain technology applied to some of the industry’s most popular applications.

Tapping Into A Huge Audience

Football is the most-watched sport in the world, captivating the minds of billions throughout its history. This audience is made up of fans of all types, from fanatics to casual viewers and impartials.

The love of the game has fostered an environment that goes far beyond what is happening on the television screens, from the physical world of merchandise and memorabilia to the digital world of predictions games, fantasy sports and betting.

Both areas are prime candidates that can be improved by the different use cases blockchain technology and cryptocurrencies offer.

One such company that hopes to disrupt the game is Skrill, a global payments firm that has had a long relationship with European football.

As Rupinder Singh, senior vice president of consumer and digital wallets divisions at Skrill, tells Magazine, the company’s history of football sponsorship goes as far back as 2013 in the United Kingdom’s Football Conference league, while its parent company Paysafe’s other digital wallet, Neteller, became a sponsor of Premier League outfit Crystal Palace at the same time.

Part of Skrill’s payments bouquet is a cryptocurrency wallet that allows users to store and manage a selection of tokens. The company’s footprint in European football has grown significantly since its humble beginnings sponsoring third-tier football eight years ago.

Who would have bet few years ago that there would tokens, digital assets on the front of jerseys? This is an investment we made to make a strong statement about digital assets globally. pic.twitter.com/WJ05PY2mIb

— Alexandre Dreyfus (@alex_dreyfus) September 26, 2021

In March 2021, Skrill signed as an official partner of U.K. Premier League team Leeds United, its latest big-name sponsorship deal in recent years. It had already partnered with Italian Serie A giants A.C. Milan last year.

It also has a foothold in the United States as a front-of-jersey sponsor of Los Angeles-based club LA 10 FC, which plays in the growing United Premier Soccer League.

From the outside looking in, one might wonder how cryptocurrency and blockchain firms can synergize with the football industry. History provides an answer, as marketing through advertising channels in the football industry has been tried and tested by various brands for decades.

Singh believes that “the football audience is one of the most digitally adept audiences in the way they consume content, interact with their clubs or each other within online communities and entertain themselves through sports gambling or fantasy sports.”

According to him, the jump to cryptocurrencies is a natural extension for such a group of potential customers. Singh also thinks many more firms from the crypto space could benefit from becoming involved in the football ecosystem:

“Football will likely always be of interest to crypto companies as long as they continue to see the behaviors of their customers mirror those of football fans, plus the obvious reach and impact that the sport has in every market across the world.”

Crypto.com is another cryptocurrency firm that is popping up on advertising boards in arenas and stadiums across the world. A partnership with the Italian Serie A has seen Crypto.com’s branding feature on pitchside advertising.

As Crypto.com chief marketing officer Steven Kalifowitz tells Cointelegraph, a decision to begin advertising in the football space was made at the end of 2020, and there’s been no delay in making this happen.

French football giant Paris Saint-Germain F.C. also welcomed the company as its “Official Cryptocurrency Platform Partner” in 2021. Part of the deal would see PSG release exclusive nonfungible tokens and pay a “significant” portion of the sponsorship fee in its native Crypto.com Coin.

Borussia Dortmund, one of Germany’s premier football clubs, has also partnered with a cryptocurrency firm. Growing crypto derivatives exchange Bybit secured a sponsorship deal that was unveiled late in 2020, which was touted to help grow Dortmund’s brand in Asia.

Cryptocurrency exchange BitMEX has its logo emblazoned on the left sleeve of A.C. Milan’s men’s, women’s and esports team jerseys after it signed a deal to become the Italian club’s official cryptocurrency trading partner.

Bringing Digital Scarcity To Big Brands

No other space has taken to the NFT craze like sports have. You need not look further than the NBA Top Shot ecosystem to see the perfect synergy among blockchain-based NFTs, tokens and sports fans.

Memorabilia, collectibles, prized signatures, and player and team cards have been popular for decades, with fanatics taking great joy out of showcasing their prized, rare possessions.

The advent of blockchain technology and cryptocurrencies has facilitated the digital evolution of nonfungibility, where sports stars, teams and brands can create one-of-a-kind digital collectibles that are verifiable. They’ve proved to be massively popular — and this has spilled into the football space in a big way.

Dapper Labs Signs Multiyear Partnership With NBA Star Kevin Durant’s Boardroom

The deal includes a role for Durant to help create original NBA Top Shot Moments.

Boardroom, a sports media company created by NBA star Kevin Durant and his investment firm Thirty Five Ventures, has agreed to a two-year partnership with Dapper Labs, the companies announced Wednesday. Terms of the deal weren’t disclosed.

* Dapper Labs, the creator of the popular basketball collectible platform NBA Top Shot, said the deal includes a creative development role for Durant to curate and create NBA Top Shot Moments and video content.

* Boardroom said the partnership will lead to giveaways, spotlights around key Moments, fan-to-fan trading and behind-the-scenes video content.

* Durant was one of many stars from the National Basketball Association, including Michael Jordan, who invested in a large funding round for Dapper in March.

* “From the moment we met with Kevin and [Thirty Five Ventures co-founder Rich Kleinman], it was clear that we shared a passion to bring fans closer than ever and in the most epic ways to their favorite athletes,” Dapper Labs CEO Roham Gharegozlou said. “As KD continues to put his stamp on game-changing moments, we’re able to offer fans access to him in entirely new ways and cement NBA Top Shot’s place at the center of the fan experience.”

Updated: 10-19-2021

Coinbase Announces Multiyear Partnership With NBA And WNBA

The deal comes as the NBA prepares to start its 2021–2022 season, marking the association’s 75th anniversary.

Major cryptocurrency exchange Coinbase has inked a deal with the National Basketball Association, giving the platform the opportunity to educate basketball fans on crypto.

In a Tuesday announcement, Coinbase said it would become the exclusive cryptocurrency platform partner of the National Basketball Association, or NBA, Women’s National Basketball Association, NBA G League, NBA 2K League and USA Basketball as part of a multiyear sponsorship deal.

According to the NBA, Coinbase will create “unique content, innovations, activations and experiences” for basketball fans to learn about the crypto space, as well as be a partner of the WNBA Commissioner’s Cup, the USA Basketball men’s and women’s national team exhibition tours and the NBA G League Ignite.

Coinbase chief marketing officer Kate Rouch said the partnership would involve “interactive experiences to engage with the NBA and WNBA’s incredible community and athletes around the world.” The announcement comes as the NBA prepares to start its 2021–2022 season, marking the association’s 75th anniversary.

According to data from Statista, an average of 1.6 million people watched NBA regular-season games across major networks during the 2019–2020 season. Coinbase said it would be featured during nationally televised NBA games.

Many crypto companies and platforms have formed partnerships with sports organizations across the globe as the space expands and seemingly becomes more profitable as a sponsor. Crypto derivatives exchange FTX announced it had become the official sponsor of Major League Baseball in June and previously struck a deal to name the Miami Heat’s home stadium the FTX Arena until 2040.

Updated: 10-26-2021

NFL Quarterback Tom Brady Gives Fan 1 BTC For His Historic 600Th-Touchdown-Pass Ball

The GOAT rewarded a Tampa Bay Buccaneers fan after wide receiver Mike Evans mistakenly handed him the ball following the historic touchdown.

Tampa Bay Buccaneers quarterback Tom Brady nearly lost ownership of the ball behind his 600th touchdown pass, but now he’s paying for it… in Bitcoin (BTC).

In Sunday’s game between the Buccaneers and Chicago Bears, Brady threw his 600th career touchdown pass to fellow teammate Mike Evans — he is the only player in NFL history to have ever achieved so many touchdown passes in his career.

The wide receiver, apparently not realizing the significance of the ball, handed it off to Byron Kennedy, a fan wearing a jersey with Evans’ namesake.

According to Ken Goldin, the founder of sports memorabilia auction company Goldin Auctions, the ball could be worth anywhere from $500,000 to $900,000. Kennedy at first seemed to give up the ball in exchange for a vague promise of a meet and greet with the quarterback. However, Brady later revealed on Monday Night Football that he had offered the fan 1 Bitcoin (BTC) — roughly $62,081 at the time of publication — as thanks for handing it over quickly.

“There were a lot of negotiations in order to get the ball back,” said Brady. “Byron realized he lost all of his leverage once he gave the ball away […] I’m also giving him a Bitcoin. That is pretty cool, too. At the end of the day, I think he is still making out pretty.”

Hey @FTX_Official, let’s make a trade…Let’s get this guy a Bitcoin https://t.co/emBFE1Lyr7

— Tom Brady (@TomBrady) October 25, 2021

According to Tampa Bay Times reporter Rick Stroud, the Buccaneers have also agreed to give Kennedy two signed team jerseys, a helmet with Brady’s autograph, Mike Evans game cleats, a jersey signed by the wide receiver, season tickets for the rest of the year and through 2022, as well as a $1,000 credit towards purchases at the team’s store. Even with some experts predicting the BTC price is likely to rise, many online pointed out the value of Kennedy’s compensation did not come close to that of the historic football.

“I would have gone for season tickets for life,” said investigative reporter David Amelotti.

Brady is one of many crypto-friendly professional athletes. He launched his own nonfungible token platform called Autograph — where he plans to auction the 600th touchdown ball as an NFT — and has received tokens as part of an endorsement deal with crypto exchange FTX.

Updated: 10-30-2021

Dallas Mavericks Fan Wins $100K In Bitcoin At NBA Shootout Event

Isaiah Stone won $100,000 worth of Bitcoin in a Voyager Digital-sponsored NBA shootout event.

A Dallas Mavericks fan won $100,000 in Bitcoin (BTC) after making a series of shots in a National Basketball Association (NBA) shootout event sponsored by crypto brokerage firm Voyager Digital.

Isaiah Stone, the winner of the basketball shootout, completed all stages of the challenge that included a free throw, a three-pointer and a half-court field goal. According to the Dallas Mavericks, the Voyager-sponsored prize money was the largest on-court promotion for the team.

On Wednesday, Voyager Digital entered into a five-year partnership deal with Mark Cuban’s Dallas Mavericks to increase crypto exposure among NBA fans through various fan engagement promotions.

As Cointelegraph reported, the crypto trading platform will also have naming rights over the franchise’s Mavs Gaming Hub in Dallas, a venue for the Mavs NBA 2K League team. According to Cuban:

“Our partnership with Voyager will allow Mavs and NBA fans to learn more about Voyager and how they can earn more from Voyagers’ platform than from traditional financial applications.”

In addition, the NBA franchise’s rewards program allows fans to buy merchandise and win rewards in cryptocurrencies including Bitcoin, Ether (ETH) and Dogecoin (DOGE).

On Oct. 19, prominent crypto exchange Coinbase signed a multi-year partnership with five NBA leagues — the NBA, Women’s National Basketball Association (WNBA), NBA G League, NBA 2K League and USA Basketball — as an official partner to improve fan interaction.

Coinbase chief marketing officer Kate Rouch said that “as part of the partnership, we will create interactive experiences to engage with the NBA and WNBA’s incredible community and athletes around the world.”

Updated: 11-2-2021

NFL Quarterback Aaron Rodgers Will Accept Part Of $22M Salary In Bitcoin

The Green Bay Packers player’s total salary would be worth roughly 368.8 BTC at a price of $60,636.

Aaron Rodgers, quarterback for the Green Bay Packers football team, has said he will be taking part of his National Football League salary in Bitcoin.

In a video posted to his Twitter account on Nov. 1, Rodgers — dressed as fictional character John Wick, likely for Halloween — said he would be partnering with Cash App to take a portion of his salary in Bitcoin (BTC). The NFL reported in July that Rodgers would be earning a $1.1-million base salary on top of a $14.5-million signing bonus and a $6.8 million roster bonus from March, totaling roughly $22.3 million.

I believe in Bitcoin & the future is bright. That’s why I’m teaming up with Cash App to take a portion of my salary in bitcoin today.

To make Bitcoin more accessible to my fans I’m giving out a total of $1M in btc now too. Drop your $cashtag w/ #PaidInBitcoin & follow @CashApp pic.twitter.com/mstV7eal04

— Aaron Rodgers (@AaronRodgers12) November 1, 2021

According to data from Cointelegraph Markets Pro, Rodgers’ total salary would be worth roughly 368.84 BTC at a price of $60,636 at the time of publication. Though the crypto asset reached an all-time high price near $67,000 on Oct. 20, it dipped under $60,000 more than once last week and has been mainly moving between $60,000 and $63,000.

Rodgers joins other professional sports players embracing crypto as the space seemingly becomes more mainstream. Last week, Tampa Bay Buccaneers quarterback Tom Brady said he would be compensating the fan who held his 600th-career-touchdown football with 1 BTC along with some signed sports memorabilia.

Updated: 11-4-2021

Kevin Durant’s New SPAC Firm To Focus On Crypto And Blockchain

Brooklyn Nets star Kevin Durant has been inducted into the “blank check” hall of fame.

Kevin Durant, a two-time NBA champion, has launched a special purpose acquisition company (SPAC) to look at collaborating with technology-driven businesses, including cryptocurrency enterprises. The firm was established in conjunction with Durant’s business associate Rich Kleiman.

Durant, who was an early Coinbase backer, isn’t done exploring the sector yet. His new SPAC company is planning to invest in crypto and blockchain-related businesses.

The new SPAC, Infinite Acquisition Corp, which was formed on Wednesday, according to its United States Securities and Exchange Commission filing, seeks to raise $200 million in its initial public offering (IPO).

A SPAC is a company that was formed to combine with or acquire another private firm and eventually go public. Because its only aim is to combine with a private firm and thereby skirt the requirements of an IPO, such firms are commonly known as “blank check” businesses.

The SEC filing provides a brief rundown of the crypto market, with names such as Coinbase, Kraken, lending and interest savings solutions such as BlockFi, hardware wallet maker Ledger, and successful nonfungible token-related projects, including Ethereum-based game Axie Infinity and Dapper Labs (the creators of NBA Top Shot).

Apart from crypto and blockchain, Infinite Acquisition will look at a wide range of prospective targets, such as businesses in the sports, health and wellness, e-commerce, and food technology and supply industries, according to the filing.

Infinite Acquisition is planning to go public on the New York Stock Exchange with the ticker NFNT.U and sell 20 million shares at $10 each. The offering will be underwritten by Credit Suisse and Infinite intends to purchase back all shares with cash should the SPAC fail to complete a merger or acquisition in less than 18 months.

Updated: 11-16-2021

Goodbye, Staples Center. Hello, Crypto.com Arena

Staples Center is getting a new name for Christmas: Crypto.com Arena.

The downtown Los Angeles venue — home of the Lakers, Clippers, Kings and Sparks — will wear the new name for 20 years under a deal between the Singapore cryptocurrency exchange and AEG, the owner and operator of the arena, both parties announced Tuesday. Crypto.com paid more than $700 million for the naming rights, according to sources familiar with the terms, making it one of the biggest naming deals in sports history.

The arena’s new logo will debut Dec. 25, when the Lakers host the Brooklyn Nets, and all of Staples Center signage will be replaced with the new name by June 2022.

Crypto.com’s chief executive, Kris Marszalek, hopes that the new name will come to be seen as a sign of the times.

“In the next few years, people will look back at this moment as the moment when crypto crossed the chasm into the mainstream,” Marszalek said when reached at his home in Hong Kong.

“This is just such a brilliant move from the guys at AEG, because the next decade belongs to crypto,” he said. “And this positions L.A. and this particular venue right at the center of it.”

AEG owns a number of sports teams, including the Kings and Galaxy, and venues, including L.A. Live, the Oakland Coliseum and London’s O2 Arena. It is one of the nation’s largest event promoters, producing Coachella, among others.

Chief Executive Dan Beckerman said that a blockchain finance company was just the thing for downtown L.A.

“It’s a bit of a match made in heaven, when we think about the type of brands that we like to partner with,” Beckerman said. “Crypto.com is looking for the most unique branding platform to make a statement and drive adoption, and we’re looking for an innovative, forward-thinking company to help us chart a course for the future of sports and entertainment events.”

AEG and Crypto.com are still working out exactly how far the partnership will go beyond the name, but integrating cryptocurrency payments into the arena and online purchases may be on the horizon.

Visitors will see one clear change at the entrance to the arena from L.A. Live, adjacent to the statue of Magic Johnson, where 3,300 square feet will become a dedicated Crypto.com “activation space” featuring crypto-centric interactive experiences for sports or music fans. Crypto.com has also signed with the Lakers and Kings as their official crypto partner.

The storied venue got its original name in December 1997, when then-booming Staples Inc. paid $100 million for the rights for 10 years. Beckerman, who was chief financial officer of AEG when the arena complex was first being developed, said that the value of the name was less of a sure thing back then.

“When we were selling the arena, nobody knew what it was, nobody knew what it could be. Downtown was very different than downtown is today,” he said.

But after Staples Center became the home of the Lakers squads that Kobe Bryant and Shaquille O’Neal led to three consecutive championships in the early 2000s, after the downtown district around the center developed into a revived tourist and residential district, and after the venue became frequent host to major events such as the Grammys, its place in the city’s cultural landscape solidified.

Staples signed a deal in 2009 for naming rights in perpetuity — but AEG bought the naming rights back for an undisclosed sum in 2019. The pandemic put the search for a new name sponsor on hold, but the Crypto.com deal came together quickly after conversations began at the end of summer.

Staples’ fortunes have declined since the late ‘90s, but the office supply company still has more than 1,000 stores across the country and has been on the Fortune 500 list for the last 21 years.

Crypto.com is 5 years old, and its business relies on a form of money that has been officially banned in China — though the company says it complies with all relevant regulation in the countries where it does operate. Marszalek has never attended a game at Staples Center; the Christmas game will be his first visit.

But AEG’s Beckerman said he was impressed by the company’s commitment to the arena. “The long-term piece of this is actually most important to us, and they shared this vision,” Beckerman said. He described AEG as “bullish” on cryptocurrency more broadly.

With 10 million users and 3,000 employees, Crypto.com is a major player in the crypto world. Its core business is running an exchange that allows users to trade cryptocurrencies, store them in an online account and access them with a Visa rewards debit card, but it also has an NFT wing, cryptocurrency payment software, its own token and a number of other products in the works.

Marszalek declined to share specific figures but said that the company reached profitability in early 2021 and has seen revenue grow 2000% in the last year.

Renaming Staples Center is the latest phase of a marketing blitz for the crypto company. A new ad unveiled by the company in October features Matt Damon intoning the “four simple words that have been whispered by the intrepid since the time of the Romans … fortune favors the brave.”