Bitcoin Miners Are Making Utilities Power Grids More Safe, Reliable And Secure #GotBitcoin #BitcoinFixesThis

Bolstering power networks against extreme events can require billions of dollars but some utilities are taking smaller measures. Bitcoin Miners Are Making Utilities Power Grids More Safe, Reliable And Secure #GotBitcoin #BitcoinFixesThis

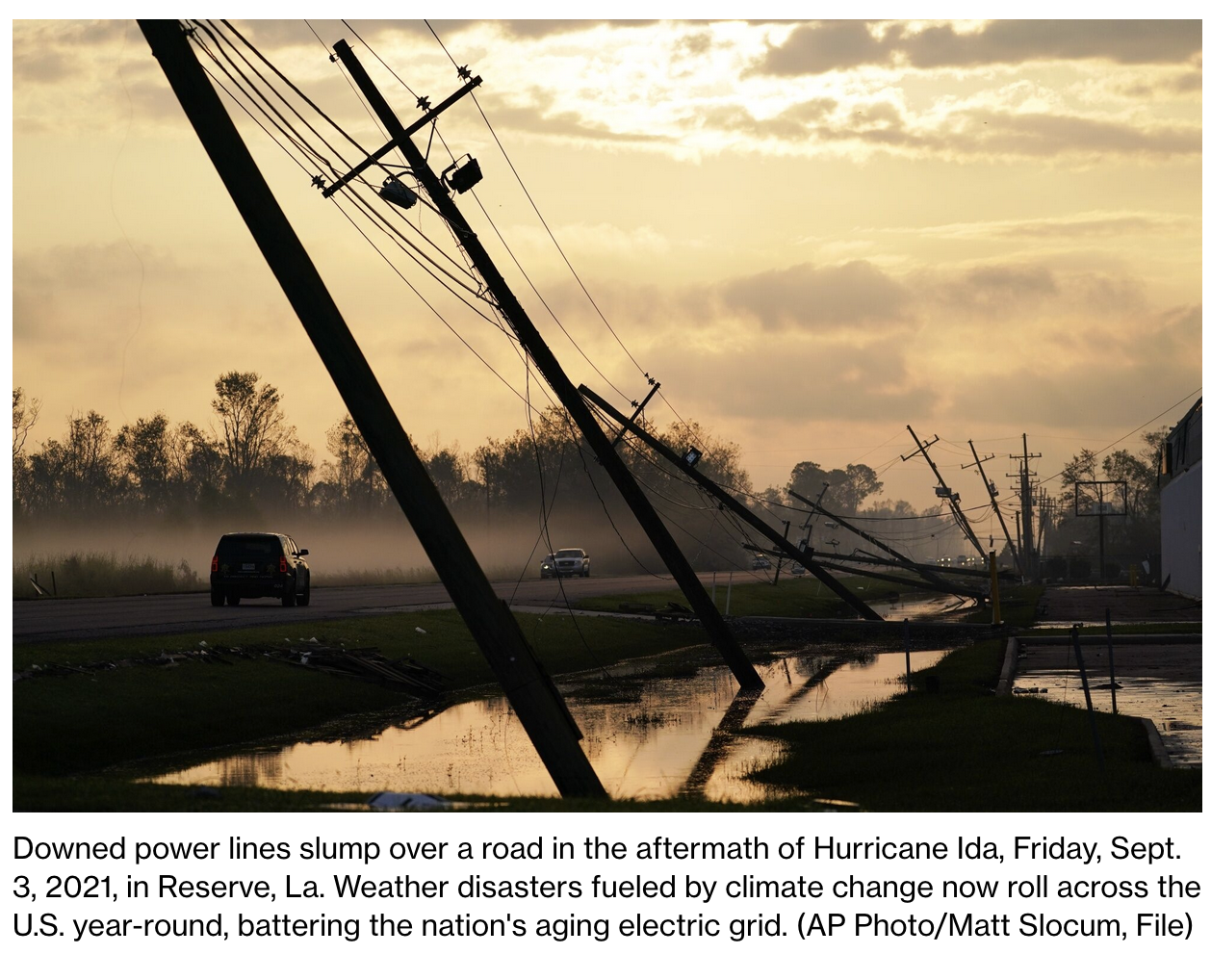

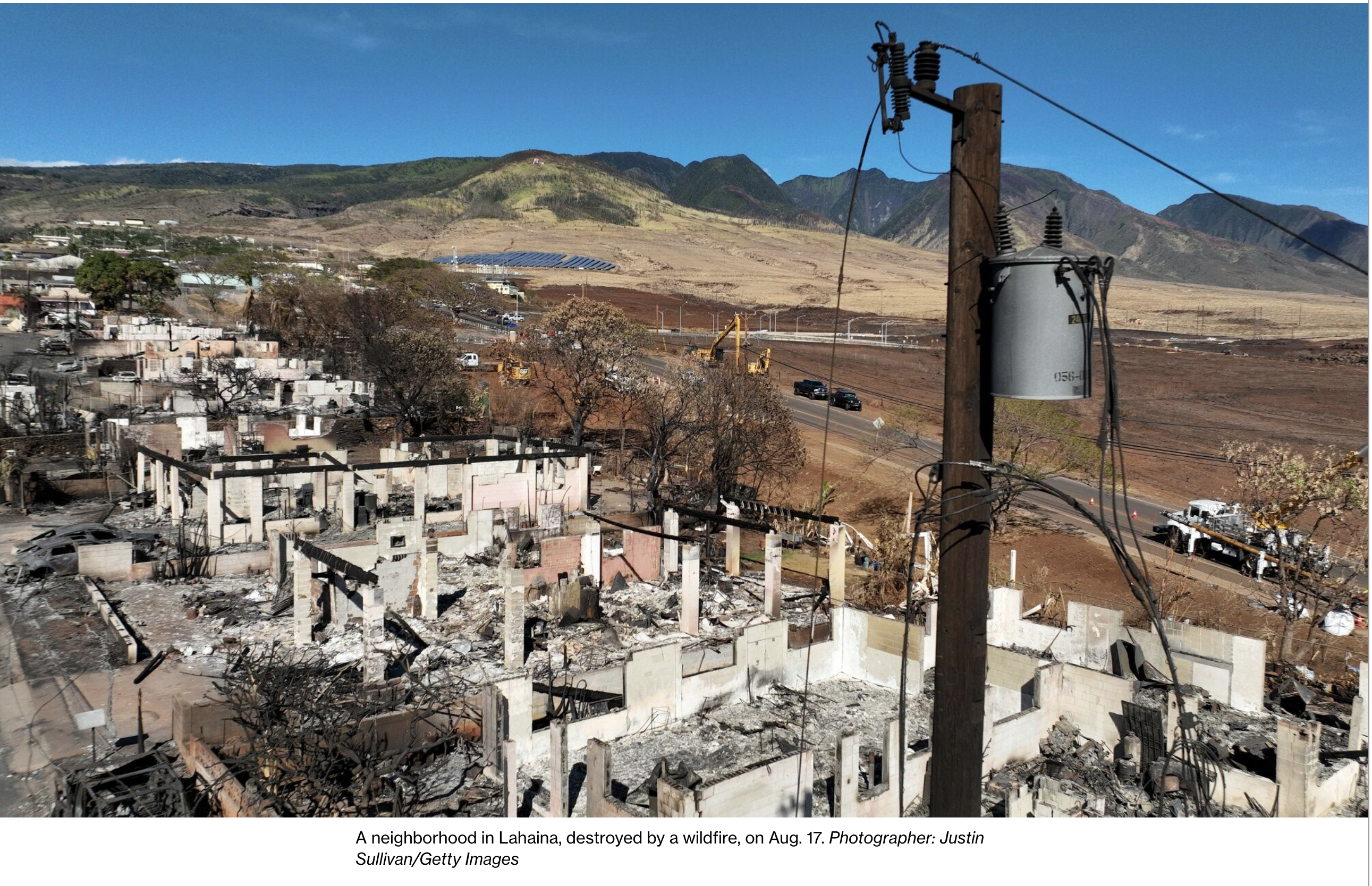

From wind-driven wildfires to massive hurricanes, extreme weather poses challenges for utilities, often causing power networks to fail—sometimes with deadly consequences.

California’s largest utility, PG&E Corp. , says it is planning to file for bankruptcy by month’s end, citing an estimated $30 billion in liabilities it faces from more than 750 lawsuits related to its alleged role in sparking wildfires in recent years.

Related:

Layer1 Stabilizes Texas Grids With ‘Bitcoin Batteries’

Giant Batteries Supercharge Wind And Solar Plans

Regulator Weighs Disclosing Names of Utilities That Violate Grid Security Rules

America’s Electric Grid Has A Vulnerable Back Door—And Russia Walked Through It

Governments Turn Against Deep-Sea Mining In The Face Of Increase In Demand For Metals

Ultimate Resource On Small And Mega-Battery Innovations And Facilities

Homes And Farms Where Families Go Off the Grid

Dropping Off The Grid: A Growing Movement In America Part I

California Wants Its Salton Sea Located In The Imperial Valley To Be ‘Lithium Valley’

Ultimate Resource On Hydrogen And Green Hydrogen As Alternative Energy

“Mining Bitcoin could eventually help the world transition to green energy”. Calling Bitcoin mining “a great stabilizer” for the power grid, the Foundry Digital CEO said the technology could become a “bridge between the current energy production and a world where 100% of our energy is produced from renewables.”

“Bitcoin mining provides a steady base load and yet it’s still intermittent to allow grids stability,” said Colyer. “This creates a really powerful economic dynamic for renewable energy products.”

“Nation-states, they can’t sleep on this, and they’re going to find ways to take advantage of their natural resources to be involved in Bitcoin mining […] At some point Bitcoin mining will look like a utility, and it’s going to be a part of critical infrastructure for countries.” Mike Colyer, CEO of Foundry Digital, a crypto mining subsidiary of Digital Currency Group

————-

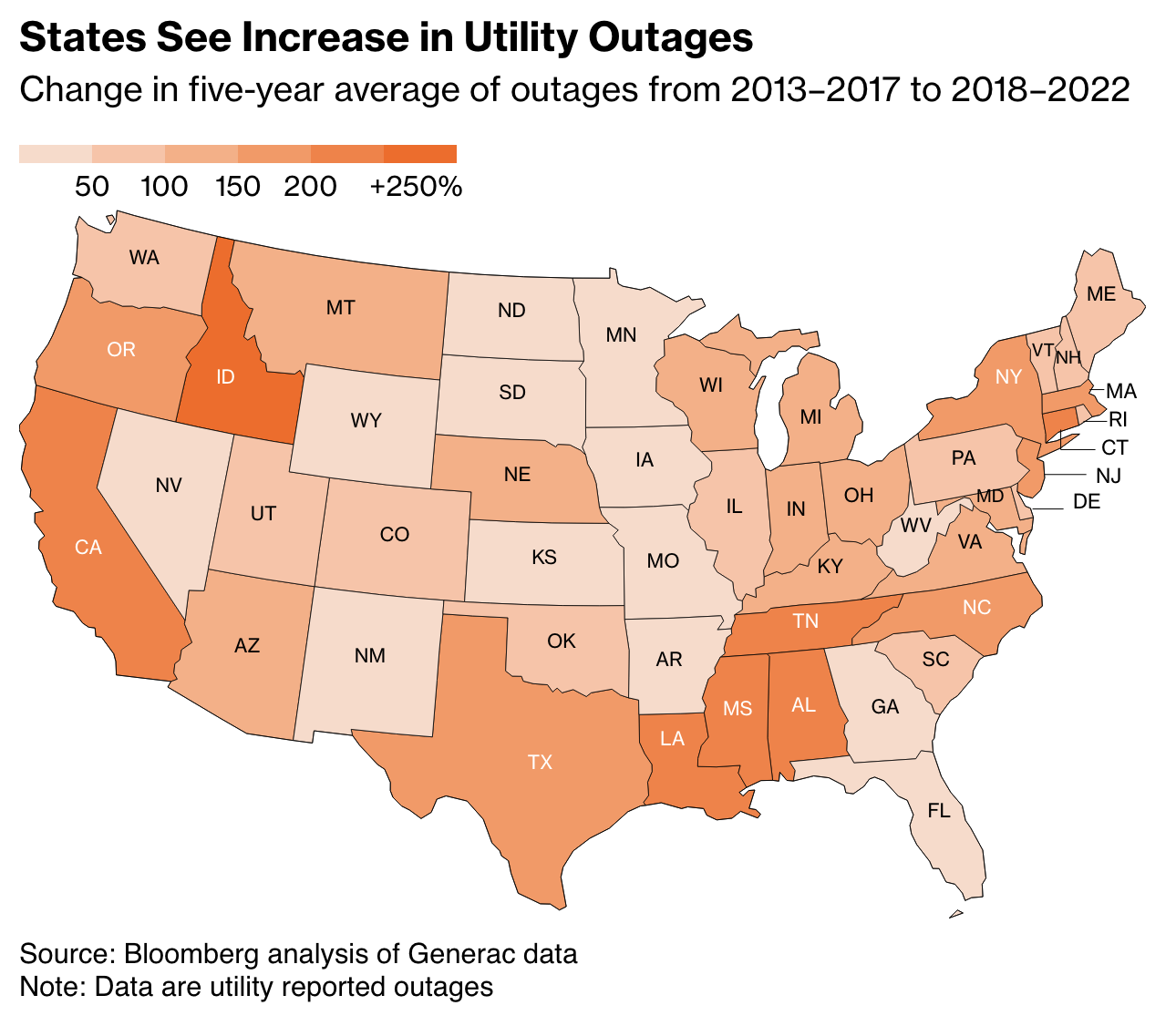

Hardening power networks against storms can cost billions of dollars and take years. But there are measures utilities can take to make their systems safer. Here are some of them.

Stronger Utility Poles

Among the most immediate improvements a utility can make is replacing flammable wooden utility poles with ones made out of concrete, steel or fiberglass, which are less fire-prone and stronger.

Florida Power & Light credits an extensive pole replacement program, begun after the devastating 2004 and 2005 hurricane seasons, with limiting the damage it saw during 2017’s Hurricane Irma. The new poles, many of them concrete, can withstand winds up to 145 miles an hour.

Insulated Power Lines

Traditional power lines aren’t insulated except by air, leaving the copper and wire conductors susceptible to damage from tree limbs, wildlife, even stray balloons.

To fix that problem, utilities have begun deploying power lines covered by three layers of insulation.

“These covered conductors are very effective to protect against a potential short circuit or arcing conditions,” said Bill Chiu, managing director of grid modernization and resiliency at Southern California Edison.

Buried Lines

Utilities can protect power lines from dangers like falling trees by burying them underground, but it is expensive and can be difficult in some terrains. Southern California Edison and Pacific Gas & Electric estimate that it costs about $3 million a mile.

Duke Energy , which serves six states, including the Carolinas, has gotten around the cost problem by putting only the most troublesome sections of its lines underground. One drawback: When a problem occurs on an underground line, it can be tough to repair.

Sensors/Reclosers

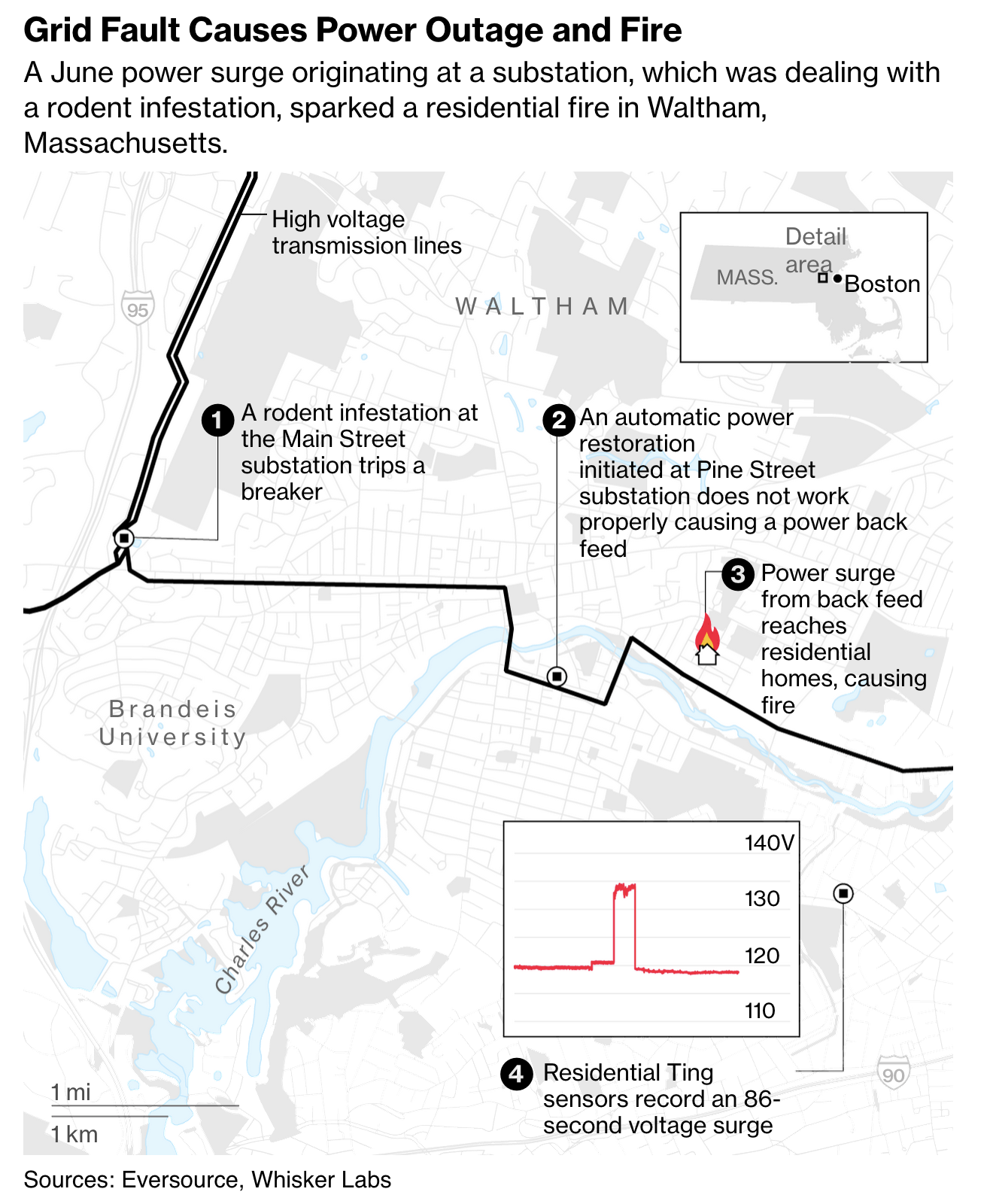

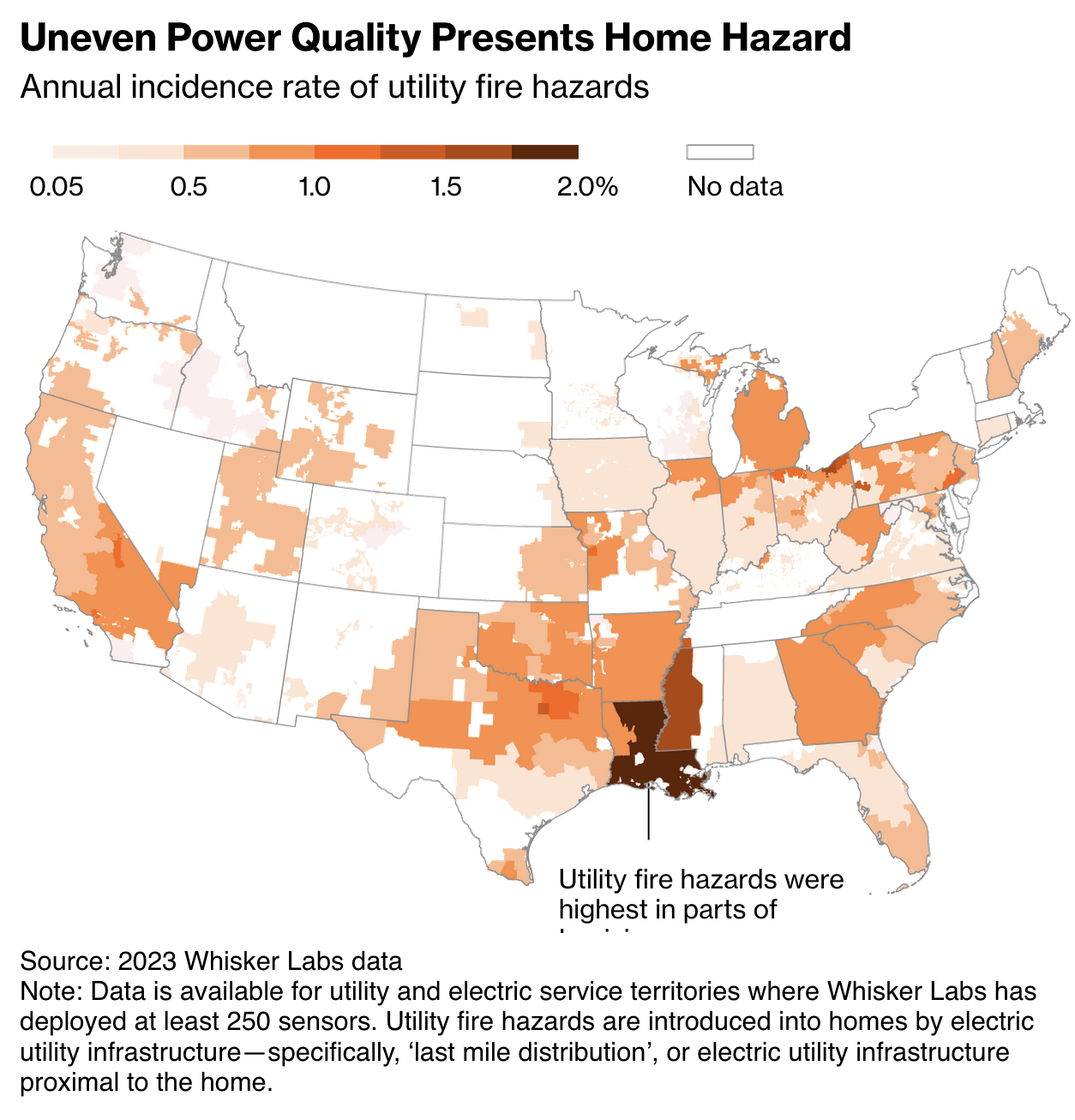

Utilities use sensors and switching technologies to catch and isolate problems on power lines. The sensors can alert a utility when power flow is disrupted or experiences a surge.

A switching technology called a recloser will then temporarily de-energize a line as it remotely tries to detect any anomaly, often automatically. Meanwhile, other switches kick in to reroute power around the trouble spot.

Duke Energy estimates this helped it avoid more than 80,000 extended outages during Hurricane Florence in September.

Weather Monitoring

Knowing how weather conditions are playing out locally is critical to knowing how likely it is that a fire might ignite, as well as where and how quickly it might spread.

California utilities have been installing weather monitoring devices on power poles to supplement those used by public weather and fire agencies. The devices, typically installed at a height of 20 feet, measure wind speed, direction and gusts, as well as humidity and temperature.

Since 2010, San Diego Gas & Electric has installed 177 weather stations across an area the size of Connecticut, and has plans to deploy more.

Wildfire Cameras

Utilities in the West have built camera networks that help them monitor the remote parts of their service territories. The cameras are often installed on telecommunications towers atop high peaks, and when they spot a fire, they can triangulate to give utilities and firefighting agencies a precise location.

Knowing whether there is a lot of vegetation in the area to fuel a fire, or nearby cities and towns, gives utilities and firefighters a jump start on figuring out how to battle a blaze and repair damage.

“You know what you’re dealing with immediately,” said Brian D’Agostino, director of fire science and climate adaptation for San Diego Gas & Electric.

MicroGrids Threatening The Utility Industry’s 100yr Old Monopoly On Power Generation And Distribution

Distributed Generation Microgrids Will Reach Nearly $13 Billion in Annual Market Value by 2018

You know that experience, when you buy a new car, and suddenly you see the model everywhere? Since Superstorm Sandy I’ve had the equivalent experience with the term ‘micro-grid.’

Policymakers and thought leaders in the US Northeast started talking micro-grid in earnest shortly after the October 2012 storm leveled swaths of their region. Lately, the term seems to arise in almost every interview I do about transmission and reliability – whether about the US, Japan, Sweden, India or other areas of the world.

These small, electricity islands have been around for a long time, but mostly confined to colleges and military bases. Are we about to see more widespread development?

Micro-grids are smaller versions of the larger grid, but the power plants are closer to the customer. Hence, they have fewer miles of wire that is vulnerable to falling trees. They are typically connected to the larger grid. But when the grid goes down, the micro-grid can disengage and keep operating. So micro-grids are used as a way to maintain electric reliability in carved-out areas.

I recently asked three respected smart grid experts for their views on a potential micro-grid boom, and they gave me three different slants.

“Truthfully, I think micrograms are a very good concept – it has certain applications – but not in general,” said GE’s John McDonald, director of technical strategy and policy development for GE Energy Management’s Digital Energy.

He sees micro-grids as successful in rural areas on military bases and at universities. “But you wouldn’t want to have, in the Continental US, the grid be composed of thousands of little micro-grids. It would be very difficult to manage that,” McDonald said.

Bradley Williams, vice president for industry strategy at Oracle Utilities, has a different view. Information technology can solve problems that inhibit more widespread use of microgrids, he says.

“The military bases and campuses are piloting this, but that is just the beginning,” Williams said.

He envisions communities driving future micro-grid development, particularly those with building codes that require solar, wind or other forms of self-generation.

“I do think it is coming: it will not be driven by the utilities,” he said, adding that utilities will get on board once they know micro-grids pose no danger to line workers – an information management issue that Oracle is working on.

Meanwhile, Michael Gordon, CEO of Joule Assets, describes the coming micro-grid as a bundling of distributed generation and virtual power plants, which can serve utility resource needs.

micro-grids will help alleviate a kind of inefficiency beginning to emerge on the grid as more and more consumers and businesses buy their own generators following each big storm, he said.

“People are installing things that are not cost-effective because they don’t want a one week outage,” said Gordon, whose New York company helps create energy reduction assets.

What’s coming are micro-grids made up of consumer-producers who will sell into the various electricity markets, Gordon said. The consumer will finance and build the asset and then sell energy, efficiency or demand reduction. The utility may act as buyer.

It is not only Superstorm Sandy that is spurring talk of micro-grid. Discussion heightened about the concept, as well, after the 2011 earthquake and tsunami in Japan. The Sendai micro-grid at Tohoku Fukushi University continued to provide power while the rest of the grid failed, points out a PWC report, “The Future of micro-grids: Their Promise and Challenges.”

micro-grids are also gaining steam because of the Obama administration’s push for more combined heat and power, which is often included within a micro-grid. Obama wants the US to build 40 GW of CHP by 2020.

Here Are A Couple Of Micro-Grid Developments To Watch In The US.

The Connecticut Department of Energy and Environmental Protection in February announced that it is evaluating 27 micro-grid projects for possible funding. The projects were among 36 that sought $15 million in available state grants. Some of the projects are sizable – as large as 10 MW. Governor Dannel Malloy has recommended an additional $30 million for the program over the next two years.

In nearby New York, Governor Andrew Cuomo has created an energy highway blueprint to modernize the state’s electric system, which has resulted in several proposals, some of them micro-grid.

Micro-Grids

With the launch of dozens of successful pilot programs globally, the adoption rate of micro-grids is expected to accelerate over the next several years. Micro-grids offer greater resilience, a high potential for integrating distributed renewable generation resources, and the ability to isolate themselves, when necessary, from the wider power grid–a capability known as islanding. According to a recent report from Navigant Research, North America is currently the leading micro-grid market and will remain the leader through 2020. Total micro-grid capacity in North America will reach 5.9 gigawatts in 2020, representing 64 percent of worldwide capacity, the study concludes.

“The U.S. has pockets of poor power quality scattered across the country, as well as a structure of behind-the-meter markets for distributed energy resources that favors micro-grids,” says Peter Asmus, principal research analyst with Navigant Research. “The latter has stimulated creative aggregation possibilities at the retail level of power service. Instead of being driven by grid operators or municipal utilities, which is the case in Europe, the micro-grid market in the United States is customer-driven.”

The first U.S. state moving forward with a policy program to promote micro-grids is Connecticut, which is responding to a pair of extreme weather events, according to the report: Tropical Storm Irene in August 2011 and a rare blizzard that hit the East Coast in October 2011. Both events led to massive power outages. This effort — which has authorized construction of up to 27 micro-grid sites as of early 2013 — is supported by an initial grant and loan program of $15 million.

North America Will Lead the Worldwide micro-grid Market With Nearly 6 Gigawatts of Total Capacity by 2020

Whether tied to the larger utility grid or islanded from it, micro-grids are becoming an increasingly common way for campuses, communities, and other large power users to harness the benefits of distributed power generation. Many of these systems are deployed by end-use customers who are not getting the quality of energy services they desire from their host distribution utilities. According to a recent report from Pike Research, a part of Navigant’s Energy Practice, annual revenues from distributed generation micro-grids will reach $12.7 billion in 2018.

“micro-grids represent a fundamental building block of the ultimate smart grid, designed to serve the needs of energy producers, consumers, and distribution utilities,” says senior research analyst Peter Asmus. “Perhaps most importantly, micro-grids are an important accelerator for various kinds of distributed power generation, particularly from renewable sources.”

Some of the technologies that will enable the growth of micro-grids in coming years, such as system controllers, are still immature, while others, such as solar photovoltaics, are already global markets in their own right. The foundation of any micro-grid is distributed generation (such as solar PV or small wind power), but nearly as critical are smart, bi-directional islanding inverters that enable micro-grids to operate in standalone mode, disconnected from the wider grid. Over the course of the next several years, the islanding function of inverters for renewable distributed energy generation, combined heat and power (CHP), fuel cells, and energy storage will become much more prevalent, according to the report.

Standard Solar To Install One of The Nation’s First Commercial Solar Micro-Grids

Standard Solar, a leader in the full-service development, construction, integration, financing and installation of solar electric systems, in partnership with Solar Grid Storage, today announced the installation of a grid-interactive energy storage system co-located with a new photovoltaic (PV) array, creating one of the nation’s first commercial scale micro-grids.

Located at Konterra’s corporate headquarters in Laurel, MD, this innovative, islandable micro-grid system is powered by a 402kW solar PV array. In the event of a grid power outage, the Solar Grid Storage advanced lithium-ion energy storage system allows critical circuits at Konterra to remain energized. The project is financed by the Kingdon Gould Jr. family and supported through a Maryland Energy Administration (MEA) “Game Changer” Grant.

“Widespread implementation of grid-connected energy storage systems is key to solar PV becoming a mainstream energy supplier,” said Tony Clifford, CEO of Standard Solar. “As one of the nation’s first commercial micro-grids, this project can truly be a game changer for PV. Not only does it provide backup power to Konterra, it also supports grid integrity and allows for participation in ancillary markets for electricity. The commercial potential of grid-based solar storage is enormous and we are honored to be leading the way in partnership with Solar Grid Storage, MEA and Konterra.”

The system has the potential to reduce PV project costs and offers new benefits to hosts including backup power, demand reduction and peak shaving. Moreover, the system can enhance grid reliability by helping balance the grid through frequency regulation, volt-ampere reactive (VARs) compensation, and demand response services. The system is scheduled to be operational by the fall of 2013.

MEA’s Game Changer Competitive Grant Program was created to provide cost-sharing grants for innovative clean energy generation technologies and market strategies in Maryland. The winning grantees embrace either a new technology or a new methodology that extends beyond existing renewable energy generation; the Game Changers seek to advance the market into uncharted territory. Winners were evaluated on the merits of their energy production, cost-effectiveness, market potential, project viability, cost share, project performance measurement and verification methodology, and project visibility. The projects are funded based on their ability to help the State meet its renewable energy portfolio standard of 20 percent by 2022, and the grant recipients’ progress towards that goal will be evaluated for two years following their award.

“Advancing our energy storage infrastructure builds greater confidence in Maryland’s grid resiliency,” said Abigail Ross Hopper, MEA Director. “Grid storage technology also improves the delivery service of our first responders, armed services, telecommunications, waste water treatment plants, and emergency shelters.”

Earlier this month, Standard Solar made its second Commitment to Action as part of the Clinton Global Initiative America (CGI America) meeting. CGI is an initiative of the Clinton Foundation that convenes global leaders to create and implement innovative solutions to the world’s most pressing challenges. During CGI America, held this month in Chicago, Standard Solar pledged a two-pronged commitment to address the industry challenge of fully integrating photovoltaics (PV) with the grid. The Konterra system is Standard Solar’s first project under this commitment.

About Standard Solar

Standard Solar, Inc. is a leader in the full-service development, construction, integration, financing and installation of solar electric systems. Dedicated to making solar solutions more accessible to businesses, institutions and governments, the company is leading the way to energy independence. Committed to offering responsible and energy cost-saving solar solutions that conform to the highest standards, Standard Solar is one of the most trusted and respected solar companies. Since 2004, Standard Solar has been the partner of choice to make solar energy financially accessible, helping customers through financing options, including Power Purchase Agreements (PPAs) and navigating expanded federal and state and local tax credits. The company’s Standard Energy Solutions (SES) division provides home energy solutions including home solar, energy efficiency and energy management services. Named one of the Fastest Growing Private Companies in America for three consecutive years by Inc. Magazine, Standard Solar is headquartered in Rockville, MD. For more information, please visit www.standardsolar.com.

About Solar Grid Storage

Solar Grid Storage is a company of experienced solar veterans who have developed a ground breaking business model to allow batteries to be added to commercial solar photovoltaic (PV) installations while lowering costs and adding new benefits. The Solar Grid Storage solution provides all standard PV functions while unlocking innovative new uses of solar energy. Its PowerFactor(TM) systems are deployed at virtually no cost to the host, enable PV systems to operate and provide emergency power during outages, can reduce peak demand charges, and help grid operators balance power on the grid. Solar Grid Storage’s technical expertise, industry insight, and proprietary storage-as-a-service model integrating storage into solar installations while reducing costs is ushering in the grid of the future.

CONTACT: PR Contact for Standard Solar:

Wilkinson Shein

Keira Shein, 410-363-9494

Military Installations Already Using Micro-Grids Successfully

America’s Defense Department is the largest single global consumer of petroleum, and its military operations comprise the largest demand for all forms of energy. In addition, bases located within the United States and abroad depend on aging transmission systems susceptible to cyber-terrorism and unreliability.

This report analyzes the uses and development of the military micro-grids. The report begins with an overview micro-grids and smart grids. It provides case studies of military installations already using micro smart grids successfully.

A micro-grid is a smaller version of the Smart Grid that is localized to a particular area, so its potential use for military functions is vast. Similar to the function of the smart grid, a military micro-grid is also expected to improve the energy efficiency and accelerate the integration of various renewable energy resources.

The DoD moves about 50 million gallons of fuel monthly in Afghanistan, much of which is for power generation. The fuel powers more than 15,000 generators in Afghanistan alone. What if, through use of micro-grid technologies, the military could cut that fuel transportation and use in half?

The Department of Defense is already working on establishing a network of independent micro-grids that integrate distributed renewable generation, electric vehicles, and demand response at its bases. The growth potential for military micro-grid market is anticipated to result in upwards of 54.8 megawatts total capacity by 2018.

According to the Secretary of Defense, 40+ DoD military bases either have operating micro-grids, planned micro-grids, or have conducted studies of micro-grid technologies. The DoD also has 600 forward operating bases (FOBs) and is investigating the deployment of mobile micro-grids in Afghanistan.

This report provides service and technology providers, government contractors, and military installations with a guide to understanding military micro-grids. It acts as a solid start to planning a military micro-grid design and installation, providing case studies of existing military micro-grid systems.

This report profiles major smart grids technology and service providers to the military. Companies profiled in this report include: Honeywell International, Lockheed Martin Corporation, Eaton Corp Plc, General Electric, Skybuilt Power, Sturman Industries, Sandia National Laboratories, and ZBB Energy Corporation.

Many other examples exist of the growing use of micro-grids. Readers, please feel free to use the comment section here to let us know about them.

Is The Utility Industry Doomed?

Utilities seem indispensable. Yet suddenly there is talk on Wall Street of a looming “death spiral” for the business, with solar power being the culprit.

Hyperbole? Yes, but only up to a point. Back in May, the Dow Jones Utility Average came within a whisker of its pre-crisis all-time high set early in 2008. High dividends sell well with investors when interest rates are so low, especially when such payments are backed by something as solid as the electricity grid.

But danger can come out of a clear blue sky or even a cloudy one. Take a look at Germany. Generous subsidies there caused solar panels to sprout all over what is hardly a tropical paradise. As traditional utilities E.ON and RWE have struggled to adapt, their combined market value has slumped 56% over the past four years in a rising German stock market.

The death-spiral thesis runs thusly. Subsidies and falling technology costs are making distributed solar power—panels on roofs, essentially—cost-competitive with retail electricity prices in places like the southwestern U.S. As more people switch to solar, utilities sell less electricity to those customers, especially as they often have the right to sell surplus power from their panels back to the utility.

The result: Utilities must spread their high fixed costs for things like repairing the grid over fewer kilowatt-hours, making solar power even more competitive and pushing more people to adopt it in a vicious circle.

But distributed solar power is still in its infancy. In sunny California, costs shifted onto customers without panels from those with them amounted to just 0.73% of that state’s utilities’ revenue last year, according to Moody’s. So why worry?

The utilities sector divides into two broad camps. Regulated utilities operate integrated networks of power plants, transmission and distribution grids. They agree to spending plans and an allowed rate of return with state regulators, determining customers’ monthly bills. Meanwhile, merchant generators operate power plants selling electricity to the highest bidder.

Despite the perceived threat to regulated utilities, it is actually the merchant generators who look more exposed to distributed solar power for now.

As a rival power source, solar takes market share from traditional generators. And once panels are installed, the sun’s energy is free, so it will displace more expensive sources such as gas-fired plants. This serves to reduce prices overall, so solar power cuts both volume and price for traditional generators. Not the sort of outlook that garners a high earnings multiple.

David Crane, chief executive of merchant generator NRG Energy, calls the spread of distributed energy the biggest change to hit the industry since the grid was built many decades ago. To adapt, NRG is investing in solar and other distributed sources, essentially taking cash generated today by its traditional business and redeploying it into growth opportunities.

For regulated utilities, the idea that solar panels will enable everyone to leave the grid, making such networks redundant, is overstated. Solar power is intermittent. Batteries can help, but ISI Group estimates their price needs to drop by a factor of 10 to be competitive with grid power.

Moreover, distributed energy’s small penetration means the existing grid is needed for a while to come. So regulators have to balance encouraging renewable power with the continuing need to prevent blackouts. Last month, regulators curbed Arizona Public Service’s planned charge to solar-panel owners to mitigate the costs of grid maintenance being pushed onto non-owners—but didn’t reject the idea of that fee altogether.

Even if panels don’t deal regulated utilities a fatal blow, investors still have cause for concern. Solar panels aren’t the only technology out there. For most of the U.S., natural gas from shale is a bigger energy opportunity. Gas isn’t free like sunlight. But it is still cheap—and available day or night. And besides power stations, it can fuel generation equipment that fits in a basement. Stirling engines, for instance, burn gas to make power and also capture useful heat.

Such machines potentially can be used alongside solar panels, allowing owners to switch between different sources. At that point, connection to the grid really can become optional.

Mass adoption is likely years away, but it is no longer over the horizon. NRG is piloting Stirling-engine products now. And while solar and wind power represent just 4.2% of the U.S. generation mix, they were only 1.3% five years ago, and the pace of adoption is accelerating. What looks too expensive or esoteric today can quickly make gains; think mobile versus fixed-line phones.

Distributed power will keep eating away at the traditional utilities’ share of an electricity market that is barely expanding anyway. U.S. electricity consumption this year is forecast by the Energy Department to be 2% below the peak in 2007. Efficiency efforts keep eroding electricity requirements.

“Essentially, we do not see the recent slowdown in electric load growth as cyclical anymore; it is a new and permanent feature of modern life,” says Julien Dumoulin-Smith of UBS.

That structural element is why, even if the sound of bells tolling is faint, the impact on utility stocks will be felt much sooner. Greg Gordon and Jon Cohen of ISI Group point out that absent expected growth in demand, regulators may be reluctant to approve regulated utilities’ investment plans. Why saddle bill payers with the cost of an asset built to last 40 years if it might only be needed for 15 or 20? And in this business, less investment means less allowed return—and, therefore, earnings.

For utility stocks, that squeezes the “terminal value”: the number put on forecast cash flows stretching into infinity that underpins a large chunk of most companies’ valuation. Messrs. Gordon and Cohen calculate a theoretical price/earnings multiple of more than 15 times for a utility with assets expanding at 3% a year, and with a terminal value. Cut growth to zero and take away the terminal value, and that earnings multiple drops by a quarter.

And in contrast to the past decade, U.S. interest rates look set to rise. So utilities will also find their dividends a less effective draw for investors, even as the competitive threat gathers steam.

The gyres may look exceedingly wide, but that spiral is taking shape.

Solar Energy Has Blown Past Grid Parity

For decades, grid parity has been the holy grail of the solar industry. It’s the mythical transition point when solar suddenly becomes cheaper than the grid, opening up a world of new demand and leading to a solar revolution.

As recently as two years ago, the solar industry was fighting the fact that solar power cost significantly more than the grid, requiring subsidies to keep the industry afloat. Today, rapidly falling costs have transformed the industry, and in many locations grid parity is already in the rear view mirror.

US And European Projects Are Already Below Grid Prices

US solar projects aren’t yet being sold to the grid on the spot market, but they are below retail prices and approaching parity with prices on the wholesale market. SunPower signed an agreement to sell power from its 100 MW Henrietta Plant in California for 10.5 cents per kW-hr, well below the state’s retail rate of about 16 cents per kW-hr.

First Solar is also selling power from a Macho Springs project in New Mexico for 5.79 cents per kW-hr. Even when you add in state incentives amounting to about 2.7 cents per kW-hr for the next ten years, the cost of about 8.5 cents per kW-hr is well below the 10.1 cent per kW-hr average cost of electricity in New Mexico during July.

Europe’s feed-in tariffs for solar power are now below 15 Euro cents per kW-hr, well below the 26.5 Euro cents the average retail customer pays.

Residential Solar Is The Game Changer

What has really upset the traditional energy industry is the expansion of homeowners generating their own power. SolarCity (NASDAQ: SCTY) is the industry’s leader, offering $0-down solar leases to customers who then sell excess power back to the grid. Solar leases still benefit from the 30% federal investment tax credit, but there’s no guaranteed rate from the utilities. In that respect, it’s the best judge of grid parity.

What SolarCity (and, to a smaller extent, SunPower) can do is lease panels for a lower cost than the price of retail power. In California, for example, that means leasing a solar system for $0.18 while utilities charge in excess of $0.20 per kW-hr. For SolarCity, payback comes over 20 years — and the payoff is projected to be between $1.50 and $2.70 per watt this quarter, versus a typical installation cost of about $3-$4 per watt.

Residential solar already costs less than the grid, and, considering the high margins SolarCity and SunPower are generating, there’s still opportunity to mover lower.

Solar Power Is Here To Stay

The cost of solar power is moving lower, while the cost of generating electricity from traditional sources typically rises 1%-3% each year. With solar already past grid parity in Chile, on California roofs, and on most utility scale projects, the sky is the limit for the industry.

Grid parity marks the point where solar demand should explode worldwide, and it’s blowing through that point faster than most people think.

To See The Future of Electric Power, Just Travel To Africa

Utilities may soon be obsolete in Hawaii and California. But let’s not forget that some parts of the developing world may simply leap-frog into the future, eschewing centralized grids for solar + storage solutions.

The government of Equatorial Guinea has selected MAECI Solar, a division of Management and Economic Consulting, Inc., in collaboration with GE Power Water and Princeton Power Systems, Inc., to install a 5-megawatt (MW) solar micro-grid system on Annobon Province, an island off Equatorial Guinea in west central Africa. The solar micro-grid will feature 5-MW solar modules and system integration by MAECI, an energy management system and controls from Princeton Power Systems and energy storage from GE. The island-wide micro-grid will provide reliable, predictable power, supply enough electricity to handle 100 percent of the island’s current energy demand and be the largest self-sufficient solar project on the continent of Africa.

“MAECI is fortunate to have witnessed firsthand the development of Equatorial Guinea over the past few years,” said Chris Massaro, senior vice president, MAECI. “We are extremely excited to bring this solar micro-grid solution to Annobon Island as well as support President Obiang Nguema’s vision to raise the quality of life for the people and bring economic diversification to Equatorial Guinea. This project brings both. The Annobon Electrification Project will be the platform for economic growth on the island by bringing a much needed power supply that will enable the development of multiple industries, add 700 to 1,000 direct and indirect jobs to Annobon Island and significantly raise the standard of living.”

Annobon Province has a population of approximately 5,000 residents. Today, the residents have reliable electricity for up to five hours per day and spend an average of 15-20 percent of their income on supplemental power. The solar micro-grid in development will eliminate this expense entirely and provide reliable electricity 24 hours a day, seven days a week. The project is a part of Equatorial Guinea’s National Economic Development Plan Horizon 2020, which aims to make Equatorial Guinea an “emerging economy” and accelerate its development and democratization by 2020.

“We’re excited to be a part of this historic project for Annobon Province and Equatorial Guinea,” said Jeff Wyatt, general manager of GE’s solar and energy storage business. “GE’s energy storage technology will help enable reliable, predictable power for the residents of Annobon through balancing the real-time supply and demand of solar and withstanding extreme heat environments without the need for air conditioning. This is an ideal technology for micro-grids like Annobon Island.”

The Annobon micro-grid is enabled by the Princeton Power Systems’ BIGI-250 energy management platform, the world’s first three-port industrial-scale solar energy management system, with UL listing and thousands of operating hours in commercial applications since 2012. Princeton Power Systems has extensive prior experience working with GE’s energy storage team. GE’s batteries, in addition to providing superior high temperature performance and improved safety, offer environmental responsibility with non-toxic and recyclable materials and worldwide support.

“Today, over 1 billion people are without power. We are taking our experience in micro-grids from Alcatraz Island, the U.S. Department of Defense and private sector customers to now apply it to improving quality of life for people in rural areas where grid power does not exist or is not reliable,” said Ken McCauley, president and CEO, Princeton Power Systems. “We look forward to future global projects across the world to provide power to these areas to have hospitals, lighting and other basic human needs.”

Projects

Nkoilale, Kenya:

PowerGen’s third Kiva funded micro-grid is also in the Maasai Mara. Nkoilale is a commercial center with various businesses catering to both locals and visitors passing through. The 1.4 kW micro-grid installed in May 2014 allows the business owners to better serve their customers while reducing their energy expenses.

Ololailumtia Village, Kenya:

This village on the edge of the Maasai Mara has two PowerGen micro-grids providing electricity to different portions of the town thanks to Kiva and its lenders. The micro-grids bring power for lighting, TV, refrigeration, a medical clinic and other uses of power to over 100 beneficiaries. The first was installed in March and the second in April of 2014. The March grid was the first ever micro-grid loan for PowerGen and Kiva and we are excited to build on the partnership to bring more renewable energy solutions to villages like Ololailumtia across Kenya.

Takawiri Island, Kenya:

This micro-grid in eastern Lake Victoria served 15 customers with a 705W AC grid when it was initially installed in December 2013. Since then, we have expanded the grid to reach 31 customers with a total of 1410W. We installed this grid with our partner, access:energy.

Mageta Island, Kenya:

The micro-grid on Mageta Island is the smallest of our three Lake Victoria grids with our partner, access:energy. Installed in December 2013, it is 360W and connects to seven customers.

Sinda Village, Zambia:

The Zambian micro-grid was installed in July 2013 and is currently bringing power to approximately 35 individuals in the Eastern Province town of Sinda. This project was completed with PowerGen’s partner in Zambia, Zamsolar. The micro-grid features metering technology from an American partner, Lumeter.

Remba Island, Kenya:

Along with our partner, access:energy, a micro-grid was installed in September 2013 on Remba Island in Lake Victoria. The island, known as “Slum Island,” is only a few hundred meters long, yet houses thousands of individuals who rely on generators, batteries, and kerosene as their only sources of power. The micro-grid has over 2 kW of solar and 1 kW of wind power that will provide electricity to hundreds on the island.

Updated: 2-16-2021

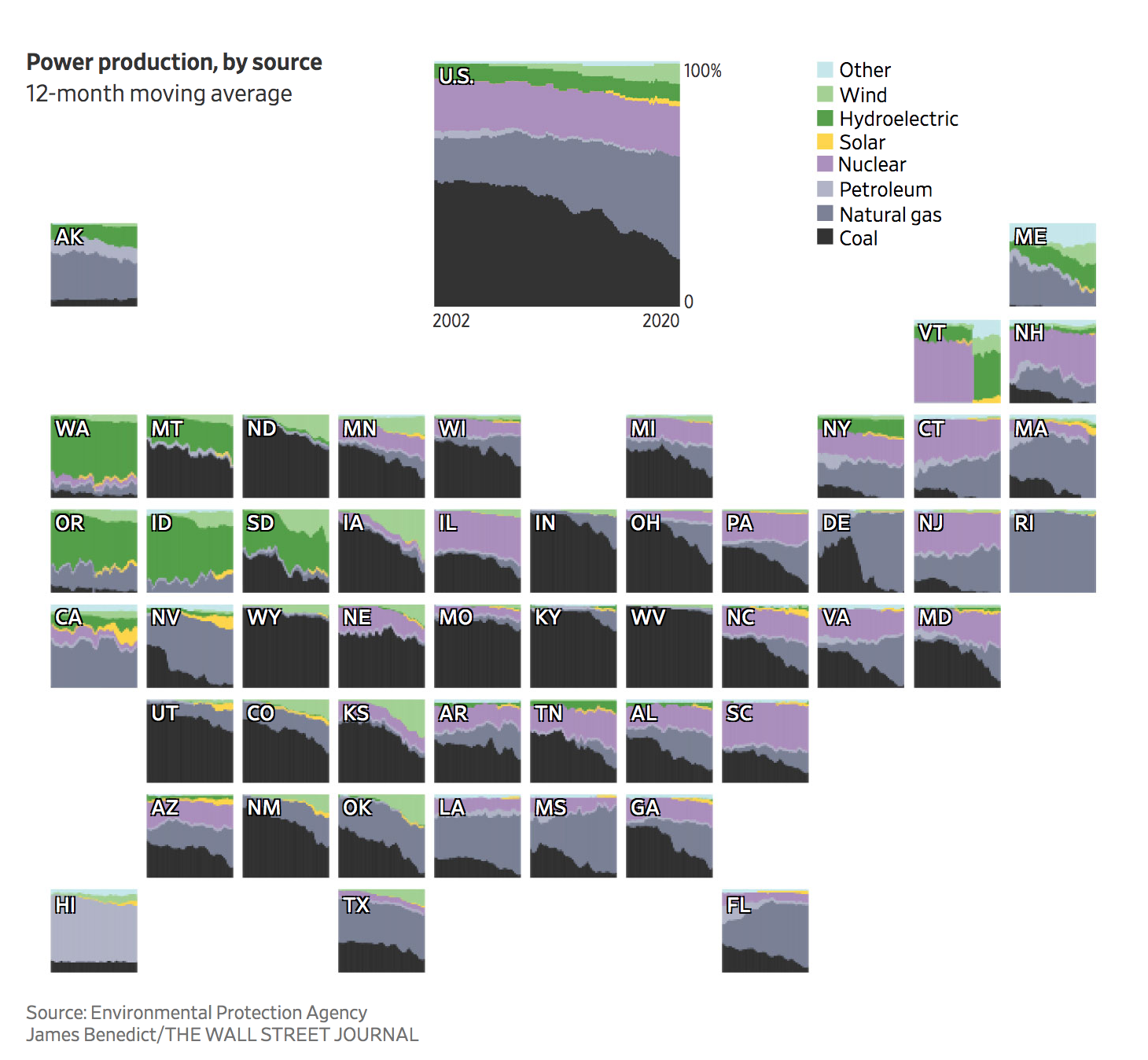

We’re Gonna Need A Better Power Grid

Once-in-a-lifetime events like the Texas polar vortex are becoming more routine, and our electrical systems can’t handle them.

Expect More Texas Vortexes

In northern New Jersey, where this newsletter is lovingly hand-carved from a single block of wood each day, there has been roughly a foot of snow on the ground for the past two weeks, with temperatures dipping repeatedly into the teens, with no noticeable effect on background levels of New Jersey-ness. Meanwhile, Texas gets some cold weather and a little snow on the ground, and the state is laid out like Conor McGregor.

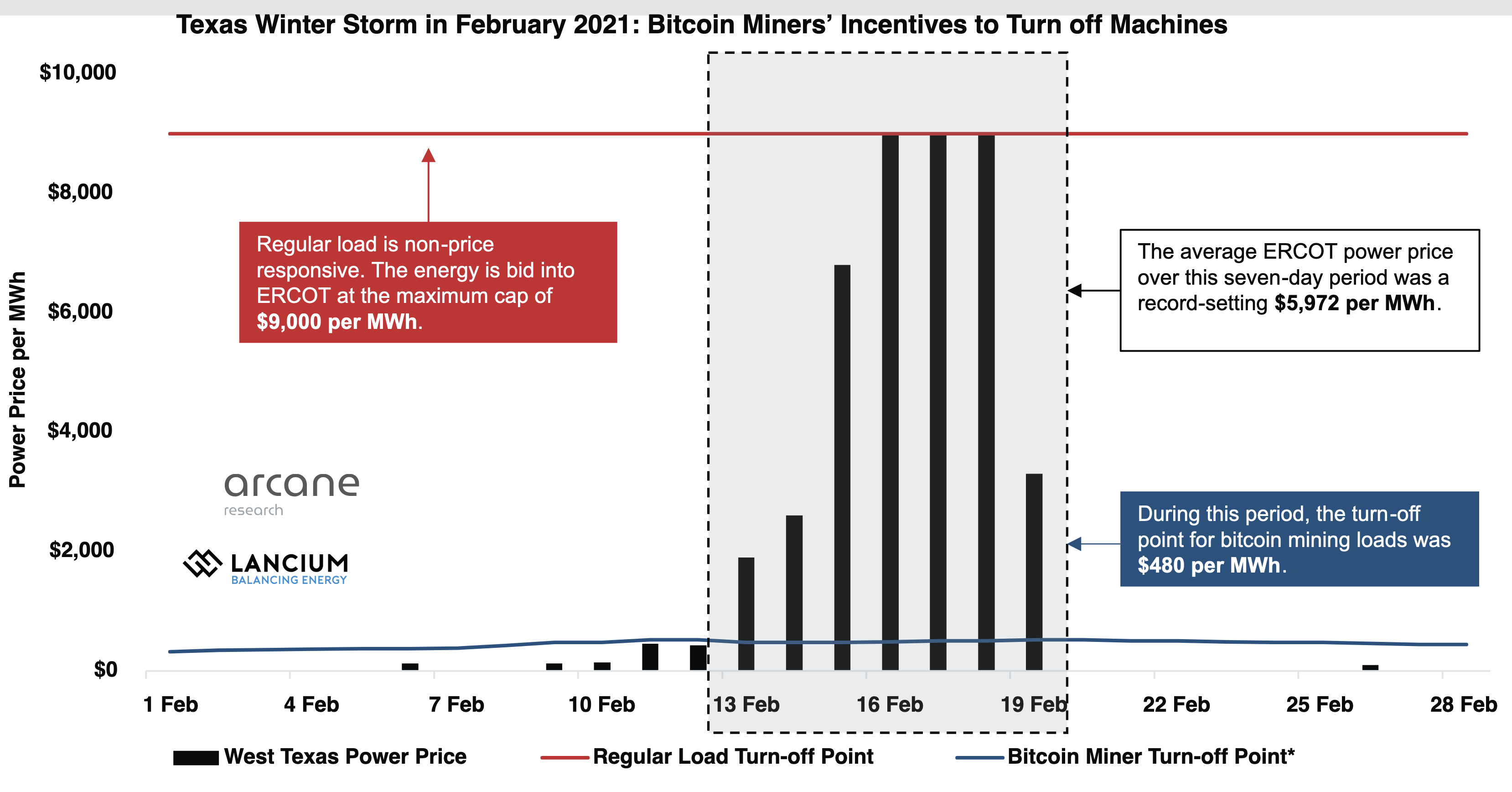

Millions of Texans lack electricity after an overwhelmed system buckled beneath the weight of too many people turning up the heat just as icy weather froze all the stuff that makes the heat come on. The difference between New Jersey and Texas, at least on the limited issue of resilience to winter storms, is one of frequency: They just don’t happen that often in Texas.

Many Texans blamed frozen wind turbines, suggesting things would be better if we went back to powering everything with coal and gas. But fossil fuels froze up, too, and not that much wind capacity has shut down this week, Liam Denning notes. And cold weather hobbled Texas power back when wind was much less important. The real issue is an electrical system that’s not up to the task of handling extreme weather events, Liam writes. This is true not only of Texas but also New Jersey, wildfire-wracked California and every state in between.

Such once-per-generation weather crises are becoming annual events. The Jersey Shore faces rising sea levels and devastating hurricanes. California’s wildfire season now runs from January to December. And the polar vortex gripping Texas could become a regular feature as global warming weakens the jet stream. It may cost us, but we need a power system that can handle the punishment without making the underlying problems worse. Read the whole thing.

Updated: 6-13-2021

Is El Salvador Bitcoin’s Green Savior?

El Salvador’s move to make bitcoin legal tender offers an opportunity to prove that cryptocurrency can power renewable energy development, says CoinDesk’s chief content officer.

Well, the giant Bitcoin Miami love fest conference turned out to be more than just late-night beach parties. It actually delivered some news – a bombshell announcement big enough to quell concerns about the event being a COVID-19 superspreader event.

All week, the crypto world has been alight with the news that the Central American country of El Salvador will become the first nation to treat bitcoin as legal tender.

The implications of that announcement dominate this week’s newsletter. In particular, the main column focuses on the prospect of also spurring renewable energy development across the country via a system of bitcoin-funded community microgrids.

Bitcoin And Green Energy: El Salvador’s Leapfrog Chance

Possibly the only thing this week that got bitcoiners more excited than El Salvador President Nayib Bukele’s move to make bitcoin legal tender was his followup that bitcoin miners will get access to geothermal power from volcanoes.

The bitcoin community is not only celebrating a new Central American haven but pointing to El Salvador as a proving ground for “green” bitcoin. Because geothermal plants draw their energy from an existing, naturally occurring heat, their carbon footprint is minimal.

But I think El Salvador (population 6.4 million), one of the poorest countries in the Western Hemisphere, has an opportunity to make a far more groundbreaking energy play than the buzz generated by linking a volcano to a bitcoin mine.

A Humble Proposal: The government should work with miners, local community leaders and foreign investors to strategically fund the expansion of the country’s electricity coverage, specifically via a decentralized network of cheap, clean, cyber-secure, and community-empowering solar or wind-power microgrids.

The best way to overturn the flawed narrative – most recently furthered by U.S. Sen. Elizabeth Warren – that bitcoin will destroy the planet if we don’t curtail it is to demonstrate the opposite: that miners prefer low-cost green sources of power and that they can be a force multiplier for green energy infrastructure at large.

If executed properly, El Salvador’s bitcoin project could achieve a host of the United Nations’ Sustainable Development Goals (SDGs) in one shot. That’s a story I’d love to tell.

Underwriting Green Economic Development

While Warren, Elon Musk and others have been beating the drum about Bitcoin’s energy usage exceeding Sweden’s, bitcoin mines are being deployed in multiple locations across the world, not only to tap existing renewable or stranded energy sources such as wasted natural gas destined for flaring, but to underwrite the development of green electricity infrastructure to serve wider communities.

In a recent episode of our “Money Reimagined” podcast, Harry Sudock, vice president of strategy at mining infrastructure provider GRIID, told us his company is seeing relentless demand from wind, hydro and solar developers for bitcoin mining; co-locating facilities offers revenue guarantees that allow communities to expand renewables to serve local people.

Without those guarantees, these enterprises tend to stall because they depend on bureaucratically administered and sparsely distributed government subsidies to fund their rollout.

In other words, bitcoin mining can serve as that missing piece of risk capital needed to kick-start infrastructure projects, not only to shift the world toward renewable energy but also to foster economic development. There are deep-pocketed companies ready to do this – payments provider Square, for example, which is investing $5 million into a new bitcoin-driven solar facility run by Blockstream.

To maximize the social impact of this effort, we need to look beyond large-scale, state-run, centralized energy projects such as El Salvador’s geothermal plants and seek ways to fund community-based green power projects run as regional microgrids.

A decentralized network of such grids would provide what power experts call “redundancy,” creating multiple backups to offset the vulnerability of the centralized national grid to outages caused by weather or other disruptions. (For a sense of why centralized systems are more vulnerable, think of the tens of millions of people along the U.S. Eastern Seaboard who were impacted by a single ransomware attack on the Colonial Pipeline. A decentralized structure gives hackers a smaller payoff in terms of disruption.)

Most importantly, if bitcoin miners source their power from local, community-based grids, their payments for it – transferred in newly legal tender bitcoin – will go to those communities, providing a steady long-term source of income. (Ideally, microgrids would be governed as cooperatives, or even as distributed autonomous organizations, or DAOs, to ensure wide distribution of proceeds and that there is accountable reinvestment in sustainable development.)

With those funds in hand and new, more widely distributed, reliable, low-cost sources of electricity available, local entrepreneurs could, for example, build out a network of charging stations, creating the foundation for local businessmen to spin up electric vehicle transport services. There’d be power to pump water into farmers’ irrigation systems.

They could expand cell phone services, which are vital for bitcoin payment apps such as Lightning-based Zap, whose CEO, Jack Mallers, was instrumental in President Bukele’s bitcoin awakening.

The geothermal mining proposal is not antithetical to this idea. Bitcoin payments to the national geothermal energy company, LaGeo, would go to upgrading and maintaining the national system into which the microgrids are integrated to provide greater security and reliability. Or, in a direct application of the so-called “money battery” concept, energy tariff payments to the government by bitcoin miners could fund the development and maintenance of the microgrids in other places.

Flip The Debate

For those who believe bitcoin’s offer of a censorship-resistant, programmable, universally accessible source of digital currency is a positive force for the world, projects like this provide an opportunity to sway public opinion and get people to recognize that it can drive sustainable growth opportunities if managed properly.

We need to table the dysfunctional debate about bitcoin’s environmental impact. Critics focus on bitcoin’s energy consumption, but it’s the wrong lens. El Salvador and so many other poor countries need to consume more, not less, energy if they are to prosper. And excessive consumption is only a problem if the resource is finite, which is not the case with solar, wind or geothermal energy.

The problem is bitcoin’s mining’s source of energy. And the reality, one that too many crypto advocates ignore, is that bitcoin does access a massive amount of fossil fuel energy.

Its carbon footprint is by no means small and will grow bigger as usage expands unless deliberate actions are taken to reduce it.

We need policy actions that can put both sides of this debate into a more reasonable context. El Salvador can lead the way – especially given the interest among other Latin American leaders to follow its example.

Still, to ensure the spoils of development are spread among host communities and to keep miners and grid operators in a symbiotic contractual relationship that serves the interests of both, regulation is needed. Rules can be set for minimizing mining activity during peak hours to manage the “duck curve” problem caused by unused solar capacity and for ensuring there is constant reinvestment in capacity for the community at large.

The question is, will Bukele’s government, which has been accused of authoritarianism and has resisted efforts by U.S. President Joseph Biden to expand regional anti-corruption efforts, seize the initiative to spread the wealth? Or will corrupt officials and wasteful state companies monopolize the bitcoin windfall?

Well, here’s an opportunity for the Biden Administration to strike a deal.

Deeply poor El Salvador is one of the biggest sources of undocumented immigrants crossing through Mexico into the United States. If the U.S. sees the big picture here, it should take a more positive stance towards El Salvador’s Bitcoin policy than we’re currently hearing from Washington – the U.S.-dominated International Monetary Fund expressed concerns Thursday about it.

It can help the country leverage the opportunity to develop prosperity among the very communities that are sending their people on those treacherous journeys to the U.S.

This is a unique opportunity for everyone. Let’s not squander it.

Updated: 6-29-2021

Smart Charging Tries To Chill The Summer Power Grid

With a $9 million round, ev.energy seeks to shuffle electric vehicles off of power peaks and onto solar surges.

With summer heat frizzling already frazzled power grids, the California Independent System Operator, which handles the state’s grid and wholesale energy market, took a drastic step June 16: it asked electric vehicle owners to charge before 5 p.m. or after 10 p.m.

Battery-driven cars and trucks, tools to fight climate change, are ironically exacerbating heat-wave power outages. Thankfully, however, there’s a better option than just pulling their plugs.

A London-based startup called ev.energy is selling a software platform that directs a vehicle to chug electrons only at the most propitious times. Plug your Tesla in at 5:30 p.m. on a hot summer day and the system might not start tanking it up until 2 in the morning. The trick, beyond building a slick app where drivers punch in how long the vehicle will be plugged in, is getting an accurate snapshot of the grid.

Ev.energy’s system connects to utilities, electricity distributors and grid operators to forecast demand and nudge its network of 20,000 or so vehicles off the peaks and, when possible, into the troughs. In a best-case scenario, the arrangement cuts carbon emissions associated with a charging session by 20%.

“I know it’s a cliche, but I genuinely talk to my team about scenarios where it is actually a win for the customer, a win for the utility and a win for us,” said co-founder and Chief Executive Officer Nick Woolley. “And don’t forget the big goal, which is we get a faster decarbonization of transportation plus the electricity system as well.”

The system, which prioritizes charging when wind and solar generation is buzzing, will tweak its schedule to consider solar panels on a user’s home. One of its neatest tricks is to knock down the so-called renewable energy duck curve, getting thousands of cars to charge at the end of a particularly sunny or windy day when the grid is surging with green electricity.

To date, an electric vehicle’s charging has been pretty much only as smart as its owner. The greenest drivers try to avoid plugging in on a hot day, lest they siphon from a coal-burning plant that wouldn’t otherwise be running; but generally everyone is kind of fudging it — making a best guess based on weather and, occasionally, alarming warnings from state grid chaperones.

In three years, ev.energy, has signed on 16 energy companies in Australia, Europe and the U.S., while licensing its software to companies that make cars and vehicle-charging hardware. This morning, its staff of about 30 is celebrating $8.8 million in a new round of investment led by Energy Impact Partners, a New York-based firm focused on sustainable energy startups.

The company declined to disclose its valuation in the round or annual revenue. According to Woolley, it is one of the only smart charging startups bridging the gap between the grid and the driver.

The challenge will be signing on utilities. Many of those organizations find it easier to model and serve power demand when consumption is fairly static. And if anyone is going to flex large blocks of power, they like to be the ones doing it. To a power distributor, flipping the “off” switch on a giant factory that has agreed to idle at peak hours is a lot tidier than thousands of Chevrolet Bolts suddenly cutting the power cord.

Still, they’re coming around. In England, ev.energy bids on contracts in which it promises to make flexible a certain share of demand. In a best-case scenario, it also convinces utilities to give electric vehicle owners reduced rates to charge at certain times. “I think that is the window on the future for all utilities,” Woolley said.

The other hurdle, of course, is electric vehicle adoption. A place like Texas, for example, has major grid problems, but not enough electric vehicles, as of yet, to prioritize them as a potential circuit breaker.

To be sure, though, the business case improves by the day, every time an EV rolls out of a factory or a massive automaker pulls the cover off a new electron-driven vehicle. And when the battery-powered pickups finally arrive, a steady stream of them will be heading to Texas.

Updated: 7-21-2021

The World’s No. 1 In Geothermal Electricity, Kenya Aims To Export Its Know-How

By 2030 the country aims to almost double geothermal capacity, to 1.6GW.

When Kenya opened the Olkaria power plant four decades ago, it was considered more research project than commercial venture. Located in Hell’s Gate National Park, a barren zone of volcanic rock permeated by sulfurous gases and populated mostly by warthogs and zebras, the facility generated electricity using steam rising from deep in the ground.

The untested and costly geothermal technology was at best experimental, with the first unit expected to supply power for perhaps 10,000 homes. Today, Olkaria generates more than 50 times that, and the technology is on track to become the backbone of the country’s electricity grid. “Our strategy going forward is geothermal,” says Rebecca Miano, chief executive officer of the state-owned Kenya Electricity Generating Co., or KenGen.

For decades, Kenya and surrounding countries focused on hydroelectric power and oil-fueled thermal stations, but lately they’ve awakened to the potential of their vast underground energy resources. The region sits astride the Great Rift Valley, an area where tectonic plates meet, bringing the magma at the Earth’s core closer to the surface.

It’s one of the world’s most active volcanic zones—Mount Kilimanjaro lies at its heart—with dozens of hot springs hinting at the intense heat lying just below. Kenya gets nearly half of its electricity from geothermal plants, more than any other country, according to researcher Fitch Solutions, and it’s on track to increase that to almost three-fifths by 2030.

Olkaria, the continent’s first geothermal power station, is fed by pipes drilled almost 2 miles into the Earth’s crust. These deliver high-pressure steam as hot as 350C (662F), which is used to propel giant turbines.

Over the next five years, KenGen plans to invest $2 billion in four new plants and other upgrades at Olkaria that will almost double Kenya’s geothermal capacity to more than 1.6 gigawatts—enough to power a city of 1 million. Longer term, KenGen predicts, the country has the potential to generate at least six times that.

The biggest obstacle, in Kenya and across the region, has long been the initial investment. The turbines and other equipment above ground add up to about $3 million per megawatt, but the real expense lies below the surface. A single well can cost as much as $6 million, and each unit typically requires multiple drilling attempts to find sufficient steam to keep the turbines spinning; for the first station at Olkaria, KenGen drilled 33 wells.

Early on, geothermal “was thought of as too risky, and high upfront cost was a hindrance,” says Peter Omenda, a consultant who’s worked on numerous projects in the area. While technological advancements have brought down the price and made it easier to get more steam from each well, the expense of drilling remains a significant hurdle.

To help offset costs, Kenya in 2008 created the state-controlled Geothermal Development Co., which is intended to shoulder the investment risks associated with the technology. Similar to oil wildcatters, the GDC drills wells, and when it discovers a field that has potential, it sells the steam to KenGen or others that build the above-ground infrastructure.

The GDC has raised $746 million, mainly from international lenders such as the World Bank, to develop the Menengai Crater, a site about 60 miles north of Olkaria where three independent power producers expect to open geothermal plants in 2023, after years of delays.

Competition from other renewables, which can be faster to build and promise a more rapid return on investment, is another concern. Kenya gets about 12% of its electricity from wind and solar, up from less than 1% five years ago. Unlike those technologies, though, geothermal doesn’t require a stiff breeze or sunny skies to provide a steady flow of energy.

And when compared to hydropower—which Kenya is also counting on as it seeks to get to 100% renewable sources by 2030—geothermal plants aren’t threatened by droughts or belligerent neighbors that might cut off the water supply. “Geothermal provides clean, non-intermittent baseload electricity that other sources of renewables cannot,” says Derrick Botha, an analyst with Fitch Solutions.

For KenGen, geothermal is becoming a significant generator of revenue from outside the country. In February it won a $6.6 million contract to drill wells in Djibouti, and in 2019 it joined with two Chinese companies on a contract to provide geothermal drilling services in Ethiopia. KenGen says it’s in talks with Rwanda and the Democratic Republic of Congo as governments across Africa embrace geothermal.

“It’s going to be exciting to see that capacity transferred to other countries and a chance to replicate the business,” says Marit Brommer, executive director of the International Geothermal Association, a group that promotes the technology. “Geothermal power will enable access to electricity for many communities at an affordable price.”

Updated: 4-4-2017

Nigerian Scientist Invents Device That Can Supply The Entire African Continent Uninterrupted Power Supply

Nigerian engineer, Obayagbona Emmanuel Imafidon, has stated that he has invented a power-generating device that can solve the power shortage in the country. In an interview with Guardian, the graduate of Electrical Engineering from the Institute of Management and Technology in Enugu said he could generate power from thunder lightning and that he has been working on it since 2006.

He said: “I have been researching on generating constant power from thunder lightning. That is using a strike of thunder lightning to generate power that can serve Nigeria and Africa for five years and 30 days. That means that whenever thunder strike for once, we are sure of uninterrupted power for five years and thirty days.

“One may think it is not possible and if it is possible why the western world has not converted lightning to electricity, but what I have developed so far is a prototype. There are five chambers including the trapping zone which is made of lightning arrestor. There is the storage zone and the conversion zone, which convert static energy into current electricity and transmit the energy into transmission zone.

The transmission zones will first of all step down the power from as high as five mega volts and there are five storage zones that have the capacity of storing over 25 mega volts of power. “When it stores the 25 MV of power, the conversion zone takes one mega vote at a time, send signals to other sensory zones which shut down other sensory zones from discharging at the same time.

Now the transmission zone of the power generating plant will step down the megavolt to whatever Nigerians need. “For instance, Nigeria is generating 330,000 megavolts, but my device generate 5 million volts and then give Nigerians their 330 KV and still have about 4670, 000 megavolts left as reserve.

Nigerian engineer invents power-generating device to end blackout “Taking a look at the prototype, the first time I worked on it was March 10, 2006. I built this prototype with five zones- the power trapping zone, the annexing zone and in between the annexing zone, there is the sensory zone, conversion zone and transmission zone. In Nigeria, we are generating 330,000 volts. Now when thunder strikes, the trapping zone (which is made of trapping arrestor) will trap a maximum of 5 mega volts from 330mgv that comes from lightning.

“Lightning comes with 330 mega volts and the trapping arrestor here is capable of trapping five million megavolts, thereby allowing 330 megavolts to be wasted in the atmosphere for other lightning arrestors to trap and neutralise the energy to the ground through a process called earthling.

If you look at most masts around, you will see something like a Y-metallic shape placed on top of a building, this is called lightning arrestor. “The lightning arrestor is used to trap the power discharged from lightning and this comes with a lightning power of about 20 billion watts, while in Nigeria we are generating 2,600 megawatts of power. The voltage lightning comes along with 330 megavolts, while we are generating 330,000 megavolts.

So you can see that there is a far cry between lightning energy and hydro electricity which the country relies on. “The trapping zone will be built by the Russians, Germany or USA in order to capture a maximum of 5 mega volts and allow 330,000 megavolts to be wasted in the atmosphere for the trapping arrestor.

Now, the five megavolts trapped by lightning will send the signal or energy to the annexing zone. You can see that we have so many trapping zones here and that is because you don’t know the direction lightning may come from. So, we cannot use one lightning director to achieve the purpose and that is why we have several lightning arrestors here.

“We have various strategic places where these lightning arrestors will be mounted because we have some places that are prone to lightning and these include some parts of Enugu State like IMT area and Zik Avenue. When this lightning arrestor traps the lightning, it transmits energy down the annexing zone. Enugu State is going to be one of our trapping zones of lightning energy. We are going to have one in Edo, Cross River, Rivers and Delta states. “These riverine areas are prone to lightning.

After that, the transmission zone captures each storage zone which accommodates five megavolts each. The five storage zones will give 25 megavolts. With this you can move this quantity through the sensory zones, so that when one is discharging energy, signals will be sent to other sensory zones to trap down other capacitors so that they will not discharge at the same time. The reason is that if they discharge at the same time, before we wait for lightning to come again, it may take a longer time and people will say the invention is not complete. “That is why we have to create a control measure to shut down other storage zones when one is working.

For the one that is working the device is built in such a way that only one sensory zone works from the five megavolts stored in the first storage zone. “That one megavolt is being transmitted to the conversion zone and this is transmitting electricity into current electricity.

When lightning comes with static electricity for instance when there is power outage, especially when it is raining. All of a sudden, there is lightning haze and when it is so, you find out that when lightning strikes, the earth wire will absorb the lightening energy and that energy that is being discharged to the ground carries the energy to the house socket through earth wire.

And if the electricity is plugged to the wall socket, the neutral wire will transmit that energy through the wire that is inserted to the plug. When it gets to the electronics, it powers it automatically and that is the moment when it is going off, you will see smoke coming from the socket.

“I have not been able to trap lightning due to insufficient fund to buy the materials. To trap lightning you will need high level energy industrial storage capacitors and this will be built either by Germany, China or USA. It will be built in such a way that when lightning strikes, it will charge the capacitor and the capacitor will retain static energy and this energy that is being retained will be converted through a unit called conversion zone and the conversion zone is an industrialised material that will be built by synergic work of various engineers. It is a project for which the Nigeria Society of Engineers (NSE) needs to support me in order to come up with the work.

The materials to be imported for it are not within the country. “I have done investigations in Lagos, Onitsha and Aba and these things are not within the Nigeria market. We need to build a capacitor and the conversion zone. “Your car for instance, converts static energy to mechanical energy through the ignition system. That is what enables the car to move.

The generator converts static energy from the spark plug through the electrical energy and that is how you have light. The motorcycle converts static energy and that is why you can ride it. So it is possible to convert static energy, stored in the capacitor into electrical energy to give light. “On the other hand, we will consult other research bodies in Enugu like PRODA which is into building of prototype.

The conversion zone is another area where we can source for engineers to build. Currently, what I am doing is incomplete. The prototype cannot generate power, but theoretically it is possible and feasible because it has been proven over and over by professors at the University of Nigeria, Nsukka (UNN.) “There was a time I was interviewed by three professors from the UNN. They called me at a time to come and explain how the strike of lightning could generate electricity in Nigeria and Africa for five years and thirty days. Why I said Africa is because lightning does not only occur in Nigeria alone, it occurs across Africa. So wherever lightning occurs, this power generating plant will be built there.

“The NSE is there to further the experiment, research, inventions to bring them into limelight. I found out that government set aside funds for research but how the funds are being used is a different kettle of fish. I am emphasising on NSE because in the USA, when a young person invents anything, all their engineers gather to give their support. But in Nigeria, they will want you to carry out the research alone so that when you fail, they will say you don’t know what you are talking about.

“One major advantages of generating power from lightning is that it will save Nigeria from constant blackout. Every time you hear that water level has dropped and as such we are not able to generate enough electricity. There is no year that thunder does not strike in Nigeria and one strike of lightning can give power for five years and thirty days, then we will have enough power for our home and industrial needs.”

Updated: 11-6-2021

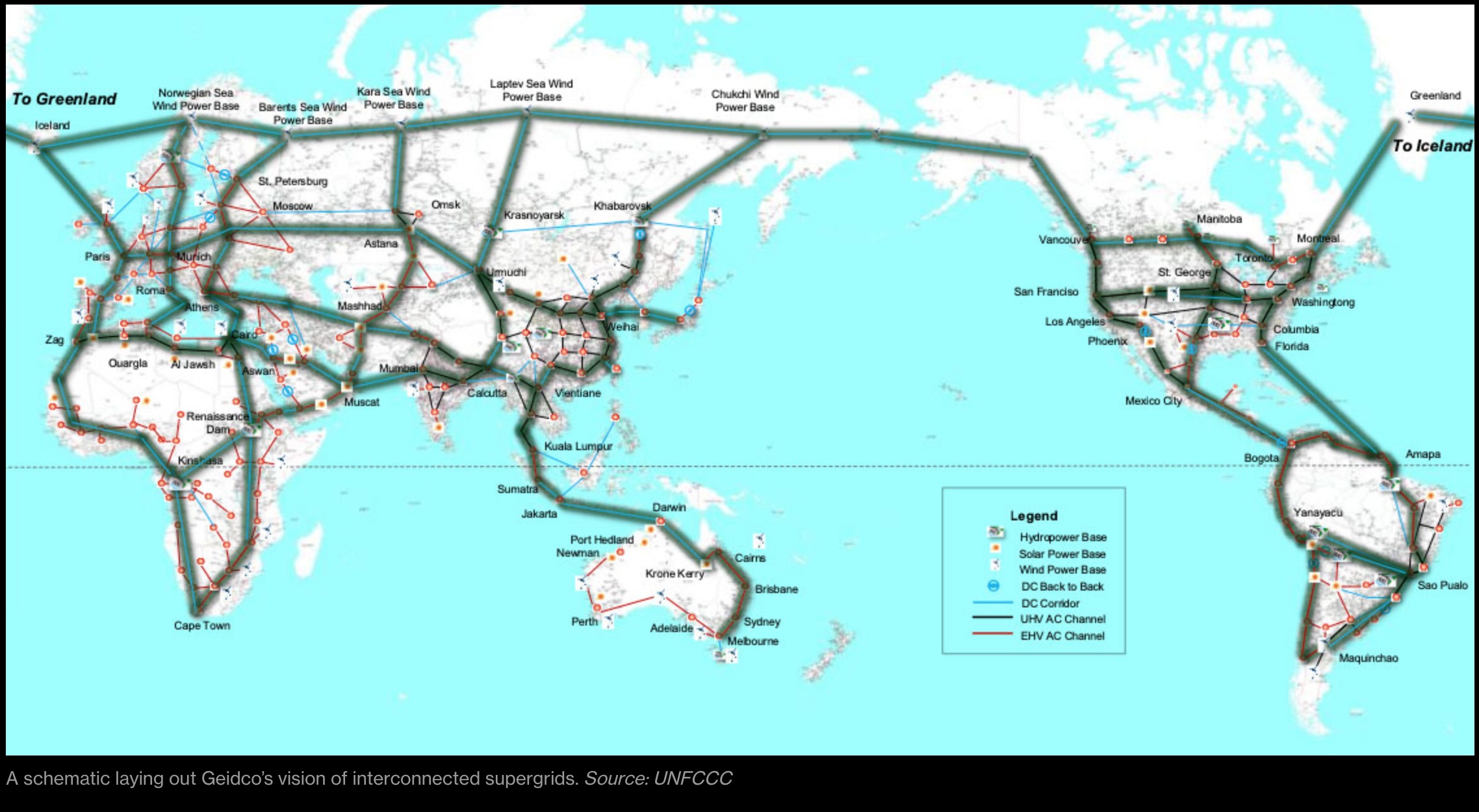

The Future of Power Is Transcontinental, Submarine Supergrids

China wants to lead the way in creating a global energy internet.

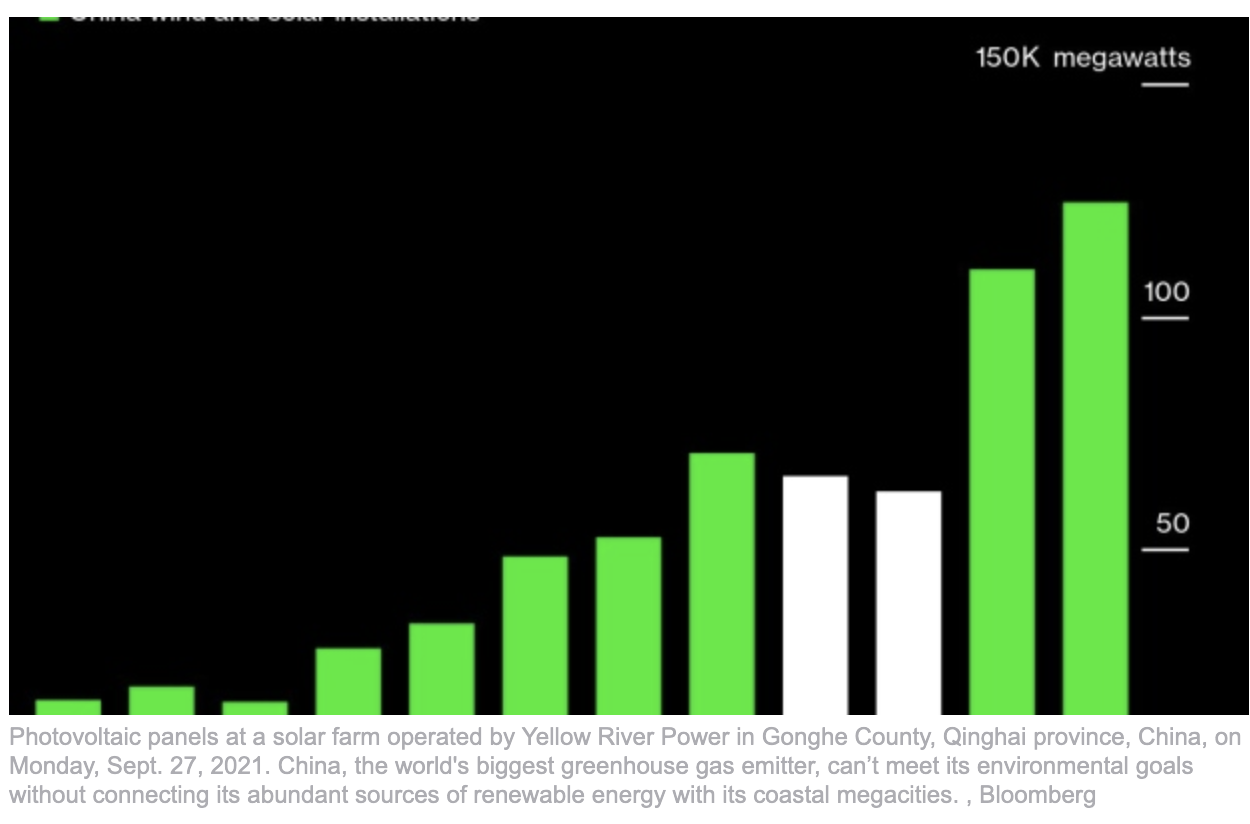

Ever since President Xi Jinping pitched the idea of a “global energy internet” to the United Nations six years ago, China’s been trying to persuade the world to build the high voltage highways that would form its backbone.

That plan to wrap the planet in a web of intercontinental, made-in-Beijing power lines has gone pretty much nowhere. Yet the fortunes of so-called supergrids appear to be turning, if not on quite the spectacular, Bond-villain scale Xi first envisaged.

China has both a manufacturing and technological edge in ultra-high-voltage direct current (UHVDC) transmission lines, and has taken a lead in proposing global technical standards and governance for them.

If Xi’s plans are ever realized, those are advantages that some believe could have profound geopolitical implications, granting China power and influence similar to what the U.S. gained by shaping the global financial system after World War II.

Yet it isn’t China that’s driving renewed interest in cables that can power consumers in one country with electricity generated hundreds, even thousands, of miles away in another. That’s because carbon-neutrality commitments, technological advances, and improved cost incentives are accelerating a broad expansion of renewable power generation.

Coal, gas and even nuclear plants can be built close to the markets they serve, but the utility-scale solar and wind farms many believe essential to meet climate targets often can’t. They need to be put wherever the wind and sun are strongest, which can be hundreds or thousands of miles from urban centers.

Long cables can also connect peak afternoon solar power in one time zone to peak evening demand in another, reducing the price volatility caused by mismatches in supply and demand as well as the need for fossil-fueled back up capacity when the sun or wind fade.

As countries phase out carbon to meet climate goals, they’ll have to spend at least $14 trillion to strengthen grids by 2050, according to Bloomberg New Energy Finance. That’s only a little shy of projected spending on new renewable generation capacity and it’s increasingly clear that high- and ultra-high-voltage direct current lines will play a part in the transition. The question is how international will they be?

In April, the European Union set up a working group to help supersize its grid, already the world’s most developed international system for trading electricity, with goals including development of a multi-nation offshore network for wind farms.

Denmark in February announced plans to construct one piece, a $34 billion artificial Energy Island that will sit at the heart of a hub-and-spoke transmission system. With an eventual targeted capacity of 10 gigawatts, the project would add two-thirds to Denmark’s total existing generation capacity, too much to serve only its home market.

Even in the U.S., which has lagged on grid integration—as the deadly, multiday blackout in Texas revealed in February—interest is stirring. A March report from Breakthrough Energy, a group funded by Microsoft Corp. founder Bill Gates, offered scenarios for transcontinental HVDC lines to unite the U.S.’s three, still-separate grids.

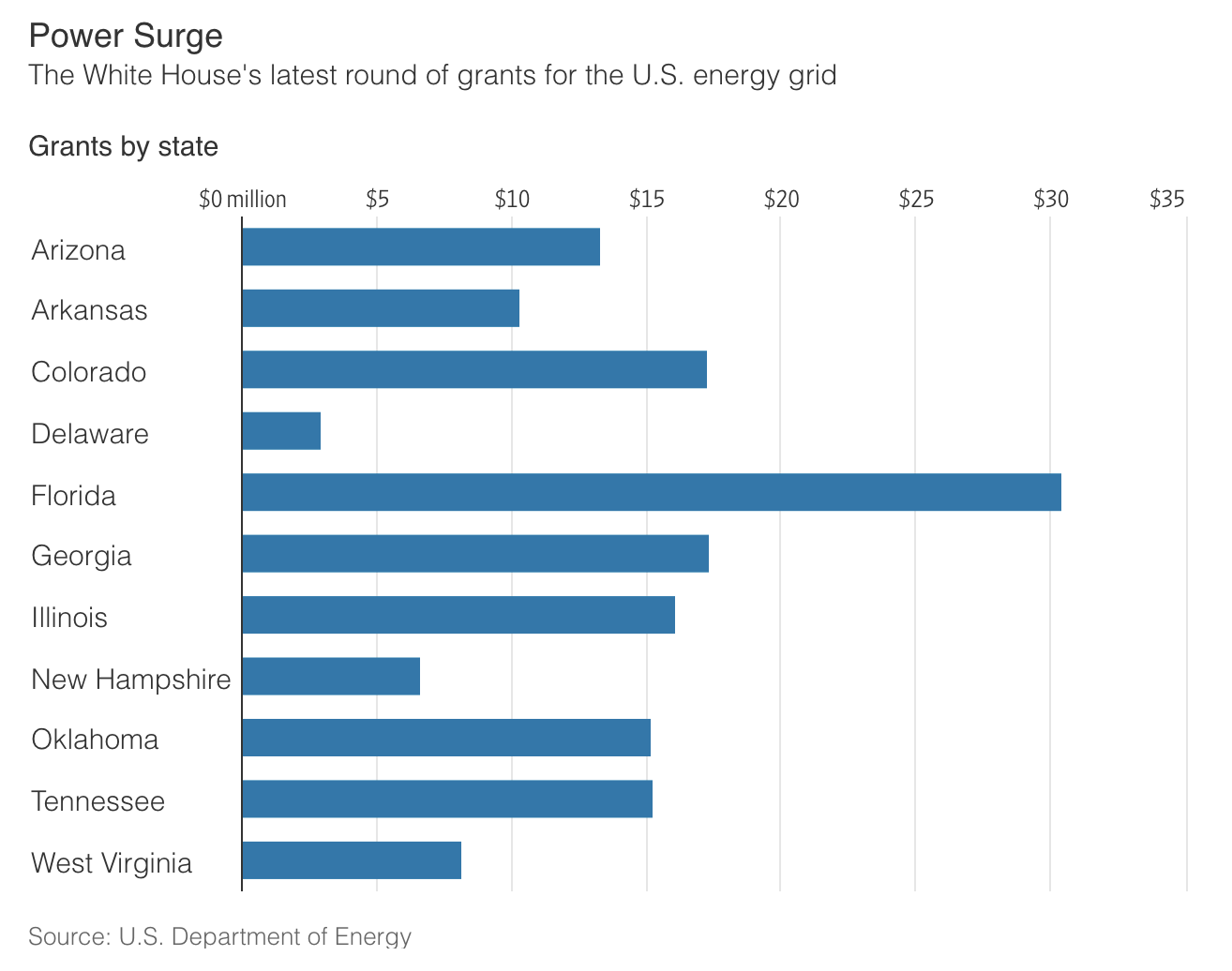

President Joe Biden’s infrastructure proposal includes $100 billion for power grids and would establish a new Grid Deployment Authority “to spur additional high priority, high-voltage transmission lines” along federal highways, although it isn’t sure how much of that will make it through Congress. And a study commissioned by agencies in Canada, Mexico, and the U.S on the potential to connect their grids is due to be published this year.

For people who’ve been promoting the idea of supergrids for years, it feels as though the winds have turned in their favor. “I think our time has come,” says Mika Ohbayashi, director of the Renewable Energy Institute, a Tokyo-based organization set up in the wake of the 2011 Fukushima nuclear disaster by Softbank Group Corp. founder Masayoshi Son.

Its mission is to promote a Northeast Asia supergrid that would connect China, Japan, Mongolia, Russia, and South Korea. Says Ohbayashi: “I cannot imagine a Japan in 2050 which is still isolated from everywhere else.”

Europe has been building HVDC connectors to allow the controlled supply of power from one nation’s AC grid to another for decades: In 2018, European countries traded just over 9% of their electricity across borders, compared to less than 2% in the Americas and 0.6% in Asia, according to the International Energy Agency.

The trade tends to reduce prices by increasing competition. It also boosts resilience, ensuring that should one nation’s grid suffer a catastrophic outage, it could simply draw from others to keep the lights on.

But it’s the need for long-distance transmission that is driving a lot of the interest in supergrids right now, as the dash to replace fossil fuels with renewable energy gathers pace. That’s especially true for offshore windfarms, seen as a key growth area for renewables.

Although converting from AC to DC and back again at each end of a cable is expensive, lower loss rates mean that HVDC power lines become economical over distances higher than about 500 miles (800km) above ground, and 31 miles (50km) for buried and submarine cables.

Hornsea 1, currently the world’s largest offshore windfarm is 120 kilometers (75 miles) off the U.K. coast. Dogger Bank, an even bigger British project once complete, will be 5 miles further. And with the development of turbines on floating platforms, there are few limits on how far windfarms can be pushed out to sea.

This month Hitachi ABB Power Grids Ltd., a major provider of HVDC technology launched a new line of transformers developed specifically for floating turbines.

HVDC cables can also make viable the construction of remote, power plant-size renewable installations on land. Mongolia’s Gobi desert is at the heart of the Northeast Asia supergrid project promoted both by China and Ohbayashi’s institute.

In theory, the Gobi has potential to deliver 2.6 terawatts of wind and solar power—more than double the U.S.’s entire installed power generation capacity—to a group of Asian powerhouse economies that together produce well over a third of global carbon emissions.

The Gobi’s potential remains largely unrealized, in part because there is currently little means to deliver the power produced there beyond Mongolia’s tiny market.

The same goes for the U.S., where with the right infrastructure, New York could tap into sun- and wind-rich resources from the South and Midwest. An even more ambitious vision would access power from as far afield as Canada or Chile’s Atacama Desert, which has the world’s highest known levels of solar power potential per square meter.

Jeremy Rifkin, a U.S. economist who has become the go-to figure for countries looking to remake their infrastructure for the digital and renewable future, sees potential for a single, 1.1 billion-person electricity market in the Americas that would be almost as big as China’s.

Rifkin has advised Germany and the EU, as well as China; Xi’s vision of a global energy network is straight out of his 2011 book, The Third Industrial Revolution.

Persuading countries to rely on each other to keep the lights on is tough, but the universal, yet intermittent nature of solar and wind energy also makes it inevitable, according to Rifkin. “This isn’t the geopolitics of fossil fuels,” owned by some and bought by others, he says. “It is biosphere politics, based on geography. Wind and sun force sharing.”

If transcontinental, submarine electricity superhighways indeed lie in our shared future, China is showing the way. In December, it completed a $3.45 billion, 970-mile-long, 800-kilovolt UHVDC line to carry solar- and wind-generated power from the high Tibetan plains to China’s center.

That followed construction of a 1.1 million-volt cable that can transmit up to 12,000 megawatts of power—a little more than the entire installed generation capacity of Ireland—from the deserts and mountains of Xinjiang province to the doorstep of Shanghai, almost 2,000 miles east. (High voltage cables are classed as 500 kilovolts and above, while ultra-high voltage—a Chinese specialty—operate at 800 kilovolts or above.)

The global supergrid effort has been spearheaded by Liu Zhenya, a former head of the State Grid Corp. of China (SGCC), who chairs the Global Energy Interconnection Development and Cooperation Organization, a UN-backed body based in Beijing.

Geidco’s phased plan starts by strengthening national grids and moves on to building regional networks, before finally—around 2070—completing construction of a full 18-channel Earth-spanning grid.

SGCC, which is the world’s largest utility, has been on a buying spree that’s enabling it to do some of that first-stage strengthening. Since 2008, it has acquired stakes as high as 85% in electricity distribution companies in the Philippines, Portugal, Australia, Hong Kong, Brazil, Greece, Italy, and last year, Oman. Other Chinese companies have also been buying shares in foreign grids.

“From a U.S. perspective, this is something to be worried about,” says Phillip Cornell, an energy specialist at Washington’s Atlantic Council. “It isn’t that ‘I will cut off your power,’ like Russia cut off gas supplies to Europe in 2006, or like OPEC in the ‘70s.

But the equation with the global financial system is a good one. You are laying down the backbone of countries’ power systems, and there is a lot of hardware and software involved. All of a sudden, you are in a Chinese ecosystem.”

Such ecosystem concerns led the U.S. to pressure allies to bar China’s Huawei Technology Co. Ltd from participating in the building of 5G networks. In the age of the Internet of Things, electricity grids and communications networks will increasingly provide access to each other, an assumption that lies at the heart of Xi’s global energy plan.

“Is there potential for backdoor access by the Chinese state?’’ asks Cornell. “There is certainly a lot of access to consumer information—and you can imagine that, in future, would create a lot of leverage.”

If the U.S. hasn’t voiced the kinds of security concerns over Xi’s global grid push that it has over Huawei, that’s probably because China has struggled to get its ambitions off the ground. Of the 125,000 km of high-voltage grids Geidco mapped in a 2019 report, very little has been built. The first stage of a Pakistan-China link, due to go live later this year, marks an exception.

The Northeast Asia supergrid, for now, remains a desktop project. The Asian Development Bank’s seven-nation Greater Mekong Subregion Power Trading and Interconnection initiative has made slow progress since its launch in 1992.

After some heavy-handed selling of supergrids in speeches and conferences—Liu Zhenya has likened them to intercontinental ballistic missiles and boasted that China would set global technical standards—officials in Beijing have begun to soft-pedal some of the more controversial proposals.

One example: to create a centralized international body that would direct and oversee the operation of a global grid. A spokeswoman for Geidco declined to discuss the supergrid plans.