High-Frequency Trading Is Newest Battleground In Crypto Exchange Race (#GotBitcoin)

High-frequency trading (HFT), a longtime and controversial practice in traditional markets, is becoming commonplace in crypto, too. High-Frequency Trading Is Newest Battleground in Crypto Exchange Race (#GotBitcoin)

Placing trading servers physically close to exchanges’ matching engines can win an edge on speed. This helps HFT firms make large profits in the legacy markets.

Related:

Ultimate Resource On Bitcoin Price Manipulation By Wall Street

Caitlin Long on Bitcoin, Repo Fiasco, Blockchain And Rehypothecation

Famous Former Bitcoin Critics Who Conceded In 2020-22

Ultimate Resource For Money Laundering, Spoofing, Market-Rigging, Etc. In Banking Industry

An Anatomy of Bitcoin Price Manipulation

Ultimate Resource On Insider Trading

The Takeaway

Crypto exchanges such as ErisX, Huobi and Gemini are trying to attract large algorithmic traders with colocation offers.

Demand for the service is high, but its benefits are a matter of debate, due to the structure of the crypto market.

A handful of cryptocurrency exchanges are rolling out the red carpet for high-frequency traders.

Huobi, based in Singapore, and ErisX, in Chicago, have separately begun offering colocation, in which a client’s server is placed in the same facility or cloud as the exchange’s, officials at each exchange told CoinDesk. This allows those investors to execute trades up to a hundred times faster, giving them an edge over the rest of the market.

These exchanges join Gemini, which was one of the first crypto firms to offer colocation at a popular data center in the New York area, and is about to expand the option to include a second site in Chicago.

Notably, none of these exchanges charges for the service, seeing it as a way to differentiate themselves. “It’s our competitive advantage,” said Andrey Grachev, head of Huobi Russia, the exchange’s Moscow client office.

To be sure, such accommodations remain rare in crypto, which historically was dominated by individual traders and only recently began to draw interest from institutional investors such as hedge funds and family offices.

But the exchanges’ moves are a sign that high-frequency trading (HFT), a longtime and controversial practice in traditional financial markets, is slowly entering the crypto sphere. And though “bots” have been present in crypto since the days of Mt. Gox, colocation takes algorithmic trading to a different level.

Eric Wall, former crypto and blockchain lead at Cinnober, a financial technology company acquired by Nasdaq, told CoinDesk:

“It’s big business, everyone I’ve been speaking to that runs an exchange mentioned being approached by Wall Street types with these kinds of requests.”

Most crypto exchanges are not ready to satisfy this demand, Wall said. These are “very new concepts to many retail-focused exchanges with no experience of the traditional world, it seems.”

800K Trades A Day

In the six months since Huobi opened its Russia office, around 50 clients have taken advantage of its colocation service by locating their servers in the same cloud and using the same domain name service (DNS) as the exchange, according to Grachev.

The option allows these clients to make trades 70 to 100 times faster than other users, he said. “One of our clients makes about 800,000 trades a day, and there are more and more such clients.”

Unlike many crypto exchanges that use cloud-based servers, ErisX has a hardware matching engine, located in the Equinix data center in Secaucus, New Jersey, said Matthew Trudeau, the exchange’s chief strategy officer.

The same facility houses the matching engines of a range of major traditional exchanges, brokers and trading firms, Trudeau told CoinDesk, so traders that colocated servers in the data center can connect to ErisX’s matching engine there. (The firm launched spot trading in several cryptocurrencies in April and recently obtained regulatory approval for futures.)

Gemini, founded in 2014 by Cameron and Tyler Winklevoss, also houses its primary trading platform at Equinix and offers colocation there. The exchange plans to offer another colocation option soon in Equinix’s Chicago data center, where multiple stock exchanges — and their HFT customers — keep their hardware, according to Gemini’s website.

In a statement, Gemini’s managing director of operations Jeanine Hightower-Sellitto said the exchange “offers a variety of connectivity options to suit our customers’ needs. Each option is available to all of our customers free of charge.”

Coinbase, the leading U.S. crypto exchange, almost entered the fray, but this year closed down its Chicago division that had been working on services for high-frequency traders, including colocation. At the time, the exchange cited its prioritization of other institutional services.

The company declined to comment for this article. (Gemini, which just opened a Chicago office, hired some of Coinbase’s former employees there.)

Controversial Practice

All of this invites the question of whether HFT, given its history on Wall Street, could exacerbate problems in the opaque and volatile crypto markets.

As depicted in Michael Lewis’s book Flash Boys, algorithmic stock traders placed their servers in the physical vicinity of exchanges’ to execute trades faster than other investors and make profits on arbitrage between markets in fractions of a second.

The issue with HFT, as explained by Lewis, is that in a market where some players can perform trades hundreds of times faster than ordinary users, they get an unfair advantage and leave ordinary, non-algorithmic traders with inferior price options.

Another problem with HFT, according to a 2011 report by the International Organization of Securities Commissions (IOSCO), is that it can dramatically increase volatility in markets.

In particular, it contributed to the so-called Flash Crash on May 6, 2010, when the prices of many U.S. securities fell and recovered dramatically in minutes, exposing ordinary traders to a higher risk which they couldn’t manage as quickly as HFTs.

High-speed trading has led to other technical glitches that cost companies hundreds of millions of dollars, the Federal Reserve Bank of Chicago wrote in 2012, noting that “some high-speed trading firms have equity ownership stakes in certain exchanges.”

Maturing Market

However, ErisX’s Trudeau (who, it should be noted, was one of the early employees of stock exchange IEX, the heroes of Flash Boys) argued that high-frequency arbitrage and automated trading, in general, can benefit markets.

They are helping to narrow the price spread between different exchanges over time and make markets more efficient – including the crypto market, Trudeau said, explaining:

“This phenomenon has occurred in other asset classes as trading has become more electronic and more automated. Market makers and arbitrageurs are able to trade more efficiently, which improves price formation, price discovery and liquidity. Arbitrage opportunities may become fewer and more fleeting, which is a sign of a more efficient and maturing market.”

It’s important, however, to check if the exchanges and high-frequency traders strike deals with preferential terms which are not disclosed to the market, he noted.

As for ErisX, it “offers transparent, standardized pricing and connectivity options for our customers. All customs are offered the same terms of access and fees,” Trudeau said.

For its part, Huobi tries to make sure all users “compete on a level playing field,” said the exchange’s head of global sales and institutional business, Lester Li.

Li Told CoinDesk:

“Our users know that we monitor for any abusive trading activity. We also continually remind users that there will always be risks when you trade, that is why we strongly recommend users to trade within their means and be mindful of the risks involved.”

Protecting Retail

Still, other exchanges contacted by CoinDesk made a point of saying they don’t do anything special for algo traders.

A smaller exchange tailored for institutional clients, LGO Markets, which launched earlier this year, took the opposite approach, deliberately slowing the trading process for everyone, according to CEO Hugo Renaudin.

Before getting matched, the orders are gathered into batches and the hash of every batch gets recorded in the bitcoin blockchain — each batch takes around 500 milliseconds to form, so this serves as a “speed bump” for trades, Renaudin said. As a result, “every trader has the same feedback on the activity of the platform.”

Taking a similar stance, Kraken’s vice president of engineering, Steve Hunt, told CoinDesk the exchange doesn’t do anything differently for HFT customers.

“We want all customers regardless of size or scale to have equal access to our marketplace,” Hunt said.

Binance, the world’s largest crypto exchange, is not considering offering colocation, account manager Anatoly Kondyakov told attendees of a recent “elite investor” meetup in Moscow. He gave two reasons.

First, “we’re trying to protect retail customers,” Kondyakov said, answering a question from the audience. Second, colocation means an official presence in a particular jurisdiction, he said, which Binance is not willing to do at the moment. (Binance is known for its deft regulatory arbitrage.)

Too Soon?

Still, others said the crypto market hasn’t caught up with the traditional financial world to the point where offering colocation services to HFT firms would make much sense.

“Currently, the crypto market structure is still developing. HFT, in the context of equity and FX markets, does not really exist,” said Wilfred Daye, head of financial markets at San Francisco-based exchange OKCoin.

Traders coming into crypto from the traditional markets do ask for colocation, he said, but “the ask is one-off, not a popular ask in crypto,” so OKCoin doesn’t offer this service.

David Weisberger, сo-founder and CEO of market data platform Coinroutes, has another reason to be skeptical about HFT in crypto: this market is so much more dispersed and volatile that what works with stocks just won’t with bitcoin.

The concept of HFT front-running is irrelevant in crypto, Weisberger said, where the prices vary between different exchanges much more than in traditional markets:

“In futures or equities, with relatively large minimum quote variations, the bid offer spread is often stable with a lot of bids and offers at the same price. In that circumstance the fastest gets to be at the front of the queue whenever the price changes. Those orders at the front of the queue are profitable, while the ones at the back are not. In crypto, the tick size (price variation) is so small, it is easy to be ‘first’ by paying a slightly higher amount, so no need for incredible speed.”

Plus, crypto exchanges are so scattered around the world that there is no point in “being colocated to one exchange and still having to wait seconds for Binance to update,” Weisberger added.

The reason there is demand for colocation at crypto exchanges, he concluded, is simply human nature:

“People always fight the last war. People do what they are used to.”

Updated: 1-27-2020

Ultrafast Trading Costs Stock Investors Nearly $5 Billion A Year, Study Says

U.K. regulator’s study says ‘latency arbitrage’ imposes a small but significant tax on investors.

High-frequency traders earn nearly $5 billion on global stock markets a year by trading shares at slightly out-of-date prices, imposing a small but significant tax on investors, a new study says.

The study—released Monday by the U.K.’s financial regulator, the Financial Conduct Authority—sheds light on a controversial practice called “latency arbitrage,” in which ultrafast traders seek to react to fresh, market-moving information more quickly than others can.

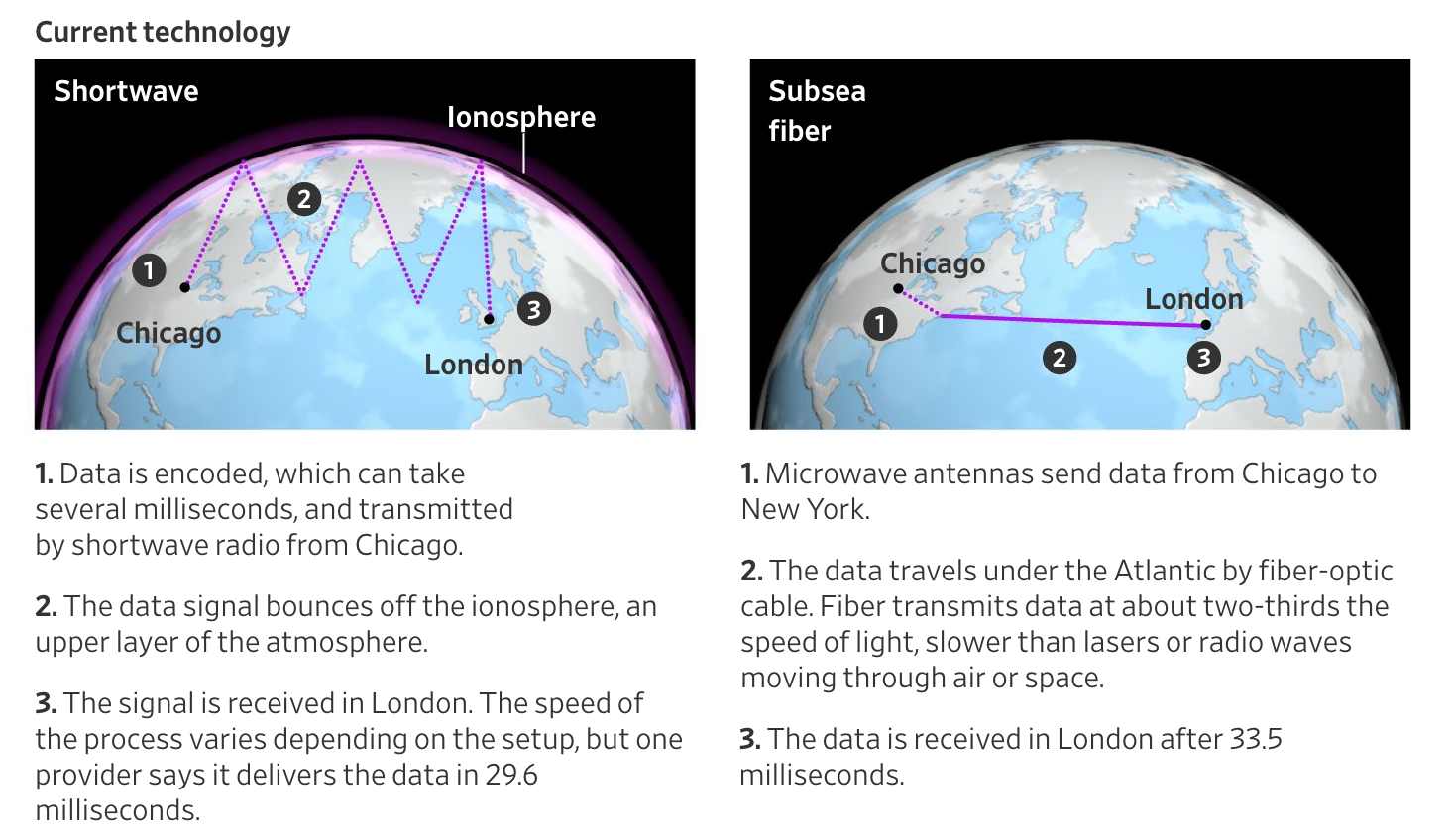

Such information could range from corporate news to economic data to price fluctuations in other stocks or markets. Electronic trading firms invest in sophisticated technology, such as networks of microwave antennas linking exchanges thousands of miles apart, to process such information and execute trades in millionths of a second.

The FCA’s study comes as politicians in both Europe and the U.S., including Sen. Bernie Sanders (I., Vt.) and Sen. Elizabeth Warren (D., Mass.), have pushed for a financial-transaction tax, a policy aimed in part at curbing high-speed trading. The study could also fuel efforts by exchanges to restructure their markets to limit latency arbitrage—for instance, by introducing split-second delays before trades, known as speed bumps.

Many experts say latency arbitrage raises costs for investors by making everyone in the markets less likely to post competitive price quotes for stocks, knowing that those quotes could get picked off by speedy traders. That, in turn, means investors get slightly worse prices whenever they buy or sell shares, traders say.

Advocates of high-frequency trading say concerns about latency arbitrage are overblown, and they have disputed past studies that suggested the practice reaps billions of dollars a year in profits. Precise data on latency-arbitrage profits is unavailable because of the opaque nature of most high-frequency trading firms.

The FCA’s study called latency arbitrage a “tax” amounting to 0.0042% of daily stock-trading volume. The study’s authors derived that figure by examining about two months of activity at the London Stock Exchange in 2015, using a type of raw trading data that hasn’t been previously studied by researchers.

Although that’s a tiny number—less than one-half of one-hundredth of 1%—the study’s authors say it adds up. If latency arbitragers made a similar rate of profits elsewhere, they would have earned $4.8 billion on stock exchanges around the world in 2018, including $2.8 billion at U.S. exchanges, the FCA study found.

Moreover, the impact of latency arbitrage is unevenly distributed, with big investors facing the greatest costs, according to the study’s authors, who include two FCA researchers and a professor at the University of Chicago’s Booth School of Business.

“The latency arbitrage tax does seem small enough that ordinary households need not worry about it in the context of their retirement and savings decisions,” they wrote. “Yet at the same time, flawed market design significantly increases the trading costs of large investors, and generates billions of dollars a year in profits for a small number of HFT firms and other parties in the speed race,” they added.

The study found that about one-fifth of trading activity at the LSE was concentrated in brief “races” between firms seeking to engage in latency arbitrage. In such races, two or more firms attempt to trade the same stock at the same time, but only the first can profit by being the quickest to execute its trade.

During the period examined in the study—43 trading days from August to October 2015—about 22% of trading volume in FTSE 100 stocks took place in such races, which on average lasted 81 millionths of a second, the study found. The FTSE 100 is the U.K.’s large-cap index, with such companies as BP PLC and Vodafone Group PLC.

The FCA’s study relied on more than 2 billion electronic messages that trading firms sent to the LSE, or that the exchange sent to traders, during that period.

Such data—which hasn’t been used in past studies of latency arbitrage—showed failed attempts to trade as well as actual trades. That allowed the authors to reconstruct the tiny bursts of activity in which multiple firms raced to seize the same brief profit opportunity.

The data also showed only a few firms can profit from latency arbitrage, a finding that likely reflects the cost of building and maintaining the technology needed for ultrafast trading.

More than 80% of races in FTSE 100 stocks were won by the same half-dozen firms, the study found. It didn’t identify the firms in question.

Updated: 12-15-2020

High-Frequency Traders Push Closer To Light Speed With Cutting-Edge Cables

Firms aim to gain nanoseconds of advantage over rivals by using hollow-core fiber to convey data.

High-frequency traders are using an experimental type of cable to speed up their systems by billionths of a second, the latest move in a technological arms race to execute stock trades as quickly as possible.

The cable, called hollow-core fiber, is a next-generation version of the fiber-optic cable used to deliver broadband internet to homes and businesses. Made of glass, such cables carry data encoded as beams of light. But instead of being solid, hollow-core fiber is empty inside, with dozens of parallel, air-filled channels narrower than a human hair.

Because light travels nearly 50% faster through air than glass, it takes about one-third less time to send data through hollow-core fiber than through the same length of standard fiber.

The difference is often just a minuscule fraction of a second. But in high-frequency trading, that can make the difference between profits and losses. HFT firms use sophisticated algorithms and ultrafast data networks to execute rapid-fire trades in stocks, options and futures. Many are secretive about their trading strategies and technology.

Hollow-core fiber is the latest in a series of advances that fast traders have used to try to outrace their competition. A decade ago, a company called Spread Networks spent about $300 million to lay fiber-optic cable in a straight line from Chicago to New York, so traders could send data back and forth along the route in just 13 milliseconds, or thousandths of a second.

Within a few years the link was superseded by microwave networks that reduced transmission times along the route to less than nine milliseconds.

HFT firms have also used lasers to zip data between the data centers of the New York Stock Exchange and Nasdaq Inc., and they have embedded their algorithms in superfast computer chips. Now, faced with the limits of physics and technology, traders are left fighting over nanoseconds.

“The time increments of these improvements have gotten markedly smaller,” said Michael Persico, chief executive of Anova Financial Networks, a technology provider that runs communications networks used by HFT firms.

High-frequency trading is controversial, with critics saying that some ultrafast strategies amount to an invisible tax on investors. Industry representatives say such criticism is unfounded.

Chicago-based DRW Holdings LLC and Jump Trading LLC are among the trading firms that have used hollow-core fiber, people familiar with the matter said. Jump’s venture-capital arm has invested in Lumenisity Ltd., a U.K. startup that makes such fiber, one of the people said.

High-frequency traders use hollow-core fiber for short distances of several hundred yards at most, according to industry engineers and executives. One common use, they say, is to connect the data center housing an exchange’s systems to a nearby communications tower. From there, HFT firms transmit data onward through cross-country networks of microwave antennas.

Replacing standard fiber with hollow-core fiber over that brief stretch might speed up a firm’s network by a few hundred nanoseconds. A nanosecond is a billionth of a second.

Anova started using hollow-core fiber about two years ago after a few trading firms deployed it, Mr. Persico said. Two other firms that provide communications services for high-speed traders, McKay Brothers LLC and BSO Network Solutions Ltd., also said they use hollow-core fiber in their networks.

Hollow-core fiber was pioneered in the 1990s but never gained widespread use because of a key problem: Signals sent through such fiber fade faster than over standard fiber, making it impractical to use hollow-core fiber for long distances. It is also costly to manufacture because of its intricate structure.

In recent years, though, the cost has come down and some manufacturers have succeeded in creating hollow-core fiber that can transmit data over longer distances. That has spurred interest from traders.

One manufacturer, OFS, has received more than a dozen inquiries about hollow-core fiber from HFT firms or providers of high-speed trading networks during the past year, said Daryl Inniss, director of new business development at OFS. Hollow-core fiber made by OFS—a U.S.-based unit of Japan’s Furukawa Electric Co. Ltd.—is already being used by several firms active in HFT or trading technology, he added.

Lumenisity, the startup backed by Jump, is betting that hollow-core fiber will find uses beyond trading, for instance in telecommunications and 5G networks. “We see HFT as an early adopter for the use of hollow-core,” Lumenisity Executive Chairman David Parker said in an interview. He declined to comment on his firm’s relationship with Jump.

The jury is out on whether hollow-core fiber will make deeper inroads into HFT. Industry skeptics say that even if manufacturers create fiber that can send data for tens or hundreds of miles, it is unlikely to replace wireless networks that transmit over straight lines through the air since underground cables inevitably have bends that slow transmission.

Supporters say hollow-core fiber could be used for high-bandwidth links in places like northern New Jersey where the NYSE and Nasdaq have their data centers, or even under the Atlantic, connecting London and New York, if the technology gets good enough.

“When you’re sending light into a solid fiber, it’s like you’re sending it through a window 50 miles thick,” said Dave Gustafson, a former head of wireless engineering at Jump. “With hollow-core, you’re sending it through 50 miles of air.”

Updated: 4-2-2021

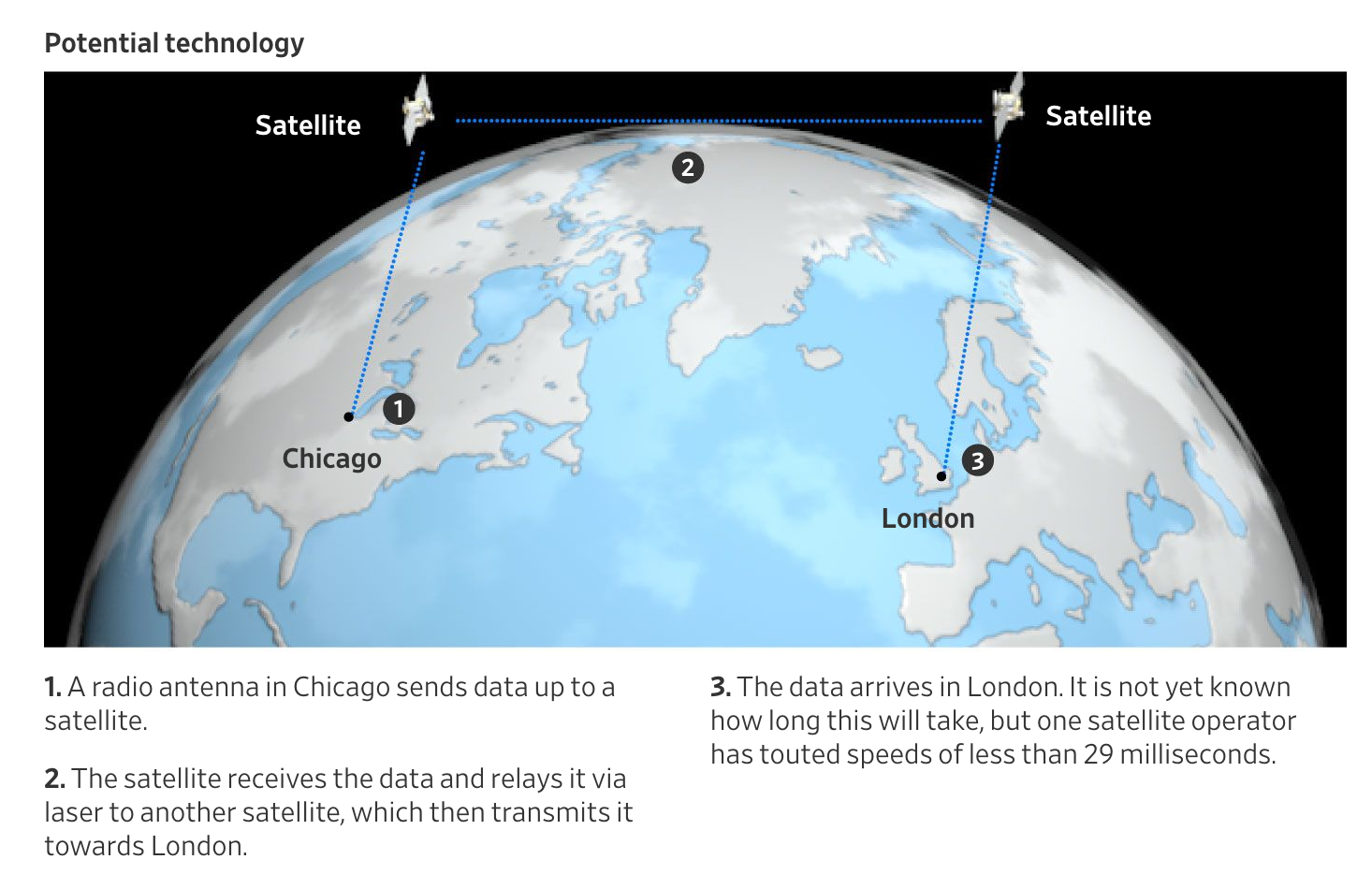

High-Frequency Traders Eye Satellites For Ultimate Speed Boost

Satellite networks could represent the next technological leap forward for a business where every millisecond counts.

n the relentless quest to speed up stock trades, space may be the final frontier.

Today, high-frequency traders use microwaves, lasers and advanced kinds of fiber-optic cable to shave fractions of a second off the time it takes to execute trades. It’s a business that depends heavily on the ability to transmit data as quickly as possible between financial centers.

Price moves in key markets drive fluctuations in other markets, and HFT firms must race from one exchange to another to adjust their trading activity in light of the latest data. Otherwise, they risk losing money to faster HFT firms with fresher information.

Satellite networks orbiting a few hundred miles above the Earth’s surface could represent the next technological leap forward.

Starlink, deployed by Elon Musk’s Space Exploration Technologies Corp., has already launched more than 1,000 satellites.

Amazon.com Inc., OneWeb Global Ltd. and Telesat Canada are building rival networks set to go live in the coming years. And a U.K. space entrepreneur is planning a network that would cater to the high-frequency trading crowd.

The satellites in such constellations would orbit the Earth far closer than older generations of telecommunications satellites.

They are also smaller and cheaper to launch. This makes it possible to deploy networks of hundreds or thousands of satellites, in which at least one satellite is always nearby, no matter where on the planet you are, even as the satellites whiz by at thousands of miles an hour.

The more advanced projects plan to use laser links between satellites to create speedy data networks covering the globe. With such a network, a Chicago trader could beam U.S. futures prices to a satellite overhead, which would relay them over a chain of several satellites, then down to London. Such space-based connections could be faster than existing networks on Earth.

That has the potential to change the way that high-frequency traders send data between exchanges in North America, Europe and Asia.

Masters Of The Universe

Satellite networks could speed up data transmission for high-frequency trading firms.

Updated: 5-10-2021

Wall Street Uses Old Tricks (High-Frequency, Price Arbitrage, Futures Trading, Options Writing, ) In $2.4 Trillion Crypto Jungle

Wall Street traders like Trey Griggs are finding a new lease on life in the $2.4 trillion crypto Wild West.

After two decades in energy trading, the 51-year-old was lured by a former Goldman Sachs Group Inc. colleague this February into a new world of market-making in digital currencies.

Now he’s in fighting spirits — unleashing old-school finance tricks to exploit the industry’s rampant inefficiencies, volatility and downright weirdness.

“All the fun that used to be had 30 years ago in the commodity markets and is no longer fun — that fun is now in crypto,” says the U.S. chief executive officer at GSR Markets in Houston.

Griggs is among crypto newcomers deploying systematic strategies that are tried-and-tested in conventional asset classes — price arbitrage, futures trading, options writing — in a booming new corner of finance. As more mainstream investors get behind Bitcoin, boutique firms are joining the likes of Mike Novogratz in an ever-broadening crypto rally that keeps breaking records.

For those who can stomach the price swings, the threat of exchange hacks and the byzantine market structure, complex fast-money trades are offering an alternative way to ride the digital mania.

At GSR, the firm’s bread and butter is market-making, where traders pocket the spread between buy and sell orders.

In stocks, that’s a nearly oligarchic business where the likes of Citadel Securities and Virtu Financial operate at lightning speed.

In virtual currencies, where hundreds of exchanges offer free access at a slower pace, GSR can capitalize on the big volumes without splurging millions on high-frequency infrastructure.

“Part of the tech we have is just to tell us did we actually trade or not, is this trade good or bad,” says GSR co-founder and former Goldman trader Richard Rosenblum. “We don’t want to be slower than our competitors, but it’s just not quite as much of the driver.”

For every strategy in stocks, bonds or currencies rendered boring by low rates, regulation or market crowding, there’s a lucrative trade in a token lying across the hundreds of exchanges out there. Or so the thinking goes.

While crypto die-hards have made merry like this for years, the relentless rallies across the tokensphere this year are drawing more Wall Street converts seeking riches and new thrills.

Take Mark Treinkman. After a career mostly at proprietary stock-trading shops like Chimera Securities, digital money is renewing his passion for quant trading.

“I’ve been going through some of my old strategies and things that wouldn’t have worked in equities in decades have an edge in crypto still,” he says.

A market-neutral strategy run by his $60 million firm BKCoin Capital gained 71% last year using investing styles that often include arbitraging different prices across exchanges and the gap between the spot and futures market.

For a few minutes during trading on Wednesday, for example, the price of Ethereum Classic jumped well above $100 on the Coinbase exchange. The digital token was trading at less than $80 at other venues, offering an obvious opportunity for investors to make money simply by buying in one place and selling in another.

It’s one of the best-known — albeit diminishing — discrepancies exploited by the likes of Alameda Research, a crypto trading firm filled with former traders from high-frequency shops. A famous example is the kimchi premium, the tendency for Bitcoin to trade higher in South Korea thanks to strong demand and the difficulty of moving money around to profit from the gap.

With no one-stop prime broker to centralize trading books and offer clients leverage across venues, traders like Treinkman face plenty of challenges in their bid to arbitrage price gaps, but say the rewards are commensurate.

And the opportunities pop up everywhere. For instance, when longer-dated futures in pretty much any asset class trade higher than the spot price — known as contango — the former almost always converges to the latter as the contracts mature.

That’s popularized the crypto basis trade, where an investor goes long the spot rate and shorts the futures.

When Bitcoin last peaked in mid-April, the December contracts were nearly 4% higher than August which were in turn about 2% higher than the spot reference rate, as speculators unleashed bets on rising prices. By contrast, the December oil contracts were trading beneath August’s on the same day, according to the data compiled by Bloomberg.

“The crypto market is still dominated by retail investors who use excessive leverage and bid the premiums for futures,” said Nikita Fadeev, a fund manager at $60 million crypto unit at quant firm Fasanara Capital.

Trades common in the industry also include short-term momentum and a form of statistical arbitrage, which bets on gaps between various tokens eventually closing like when Ethereum is surging but Bitcoin isn’t, Fadeev says.

As assets grew, the fund recently appointed Laurent Marquis, the former co-head of derivatives at Citadel Securities, as chief risk officer, and Steve Mobbs, co-founder of quant fund Oxford Asset Management, as senior adviser.

Over in Zug, Switzerland, St. Gotthard Fund Management has transformed from an old-school family office writing options on Swiss shares to a digital evangelist in its income strategy aiming to yield 8% a year. Just like in stocks, the investing style sells derivatives to take advantage of big demand to hedge price swings — which causes the volatility priced into options to be higher than what’s likely to come to pass.

For option writers like St. Gotthard, that means the premiums are much juicier, though they also come with a higher risk of having to actually pay out, like an insurer during an earthquake.

“The major difference at the end of the day is how much premium retail investors are willing to pay,” says chief investment officer Daniel Egger. “On the other hand of course we’ve written calls we wished we hadn’t in those moves up.”

In fact, going long crypto over the past year has proved the easiest and most profitable way to tap into the boom. And for those choosing the systematic route, competition is rising.

For example, in order to get an edge in its market-making strategy, BKCoin has recently installed servers at Asian crypto exchanges, a move known as co-location in the high-frequency world of stocks. It’s a sign the industry is growing up fast.

“In any emerging market we’ve seen these inefficiencies decrease over time,” said George Zarya, founder of Bequant, a crypto prime brokerage that caters to systematic traders. “There are more professional players that come in.”

Updated: 9-10-2022

How Does High-Frequency Trading Work On Decentralized Exchanges?

High-frequency trading allows cryptocurrency traders to take advantage of market opportunities that are usually unavailable to regular traders.

Following the decentralized finance (DeFi) boom of 2020, decentralized exchanges (DEXs) solidified their place in the ecosystems of both cryptocurrency and finance. Since DEXs are not as heavily regulated as centralized exchanges, users can list any token they want.

With DEXs, high-frequency traders can make trades on coins before they hit major exchanges. Plus, decentralized exchanges are noncustodial, which implies that creators cannot pull an exit fraud — in theory.

As such, high-frequency trading firms that used to broker unique trading transactions with cryptocurrency exchange operators have turned to decentralized exchanges to conduct business.

What Is High-Frequency Trading In Crypto?

High-frequency trading (HFT) is a trading method that uses complex algorithms to analyze large amounts of data and make quick trades. As such, HFT can analyze multiple markets and execute a large volume of orders in a matter of seconds. In the realm of trading, fast execution is often the key to making a profit.

HFT eliminates small bid-ask spreads by making large volumes of trades rapidly. It also allows market participants to take advantage of price changes before they are fully reflected in the order book. As a result, HFT can generate profits even in volatile or illiquid markets.

HFT first emerged in traditional financial markets but has since made its way into the cryptocurrency space owing to infrastructural improvements in crypto exchanges.

In the world of cryptocurrency, HFT can be used to trade on DEXs. It is already being used by several high-frequency trading houses such as Jump Trading, DRW, DV Trading and Hehmeyer, the Financial Times reported.

Decentralized exchanges are becoming increasingly popular. They offer many advantages over traditional centralized exchanges (CEXs), such as improved security and privacy. As such, the emergence of HFT strategies in crypto is a natural development.

HFTs’ popularity has also resulted in some crypto trading-focused hedge funds employing algorithmic trading to produce large returns, prompting critics to condemn HFTs for giving larger organizations an edge in crypto trading.

In any case, HFT appears to be here to stay in the world of cryptocurrency trading. With the right infrastructure in place, HFT can be used to generate profits by taking advantage of favorable market conditions in a volatile market.

How Does High-Frequency Trading Work On Decentralized Exchanges?

The basic principle behind HFT is simple: buy low, sell high. To do this, HFT algorithms analyze large amounts of data to identify patterns and trends that can be exploited for profit.

For example, an algorithm might identify a particular price trend and then execute a large number of buy or sell orders in quick succession to take advantage of it.

The United States Securities And Exchange Commission Does Not Use A Specific Definition Of High-Frequency Trading.

However, It Lists Five Main Aspects Of HFT:

* Using High-Speed And Complex Programs To Generate And Execute Orders

* Reducing Potential Delays And Latencies In The Data Flow By Using Colocation Services Offered By Exchanges And Other Services

* Using Short Time Frames To Open And Close Positions

* Submitting Multiple Orders And Then Canceling Them Shortly After Submission

* Reducing Exposure To Overnight Risk By Holding Positions For Very Short Periods

In a nutshell, HFT uses sophisticated algorithms to continually analyze all cryptocurrencies across multiple exchanges at very high speeds. The speed at which HFT algorithms operate gives them a significant advantage over human traders.

They can also trade on multiple exchanges simultaneously and across different asset classes, making them very versatile.

HFT algorithms are built to detect trading triggers and trends not easily observable to the naked eye, especially at speeds required to open a large number of positions simultaneously.

Ultimately, the goal with HFT is to be the first in line when new trends are identified by the algorithm.

After a large investor opens a long or short position on a cryptocurrency, for instance, the price usually moves. HFT algorithms exploit these subsequent price movements by trading in the opposite direction, quickly booking a profit.

That said, large cryptocurrency sales are typically harmful to the market because they usually drag prices down. However, when the cryptocurrency rebounds to normal, the algorithms “buy the dip” and exit the positions, allowing the HFT firm or trader to profit from the price movement.

HFT in cryptocurrency is made possible because most digital assets are traded on decentralized exchanges. These exchanges do not have the same centralized infrastructure as traditional exchanges, and as a result, they can offer much faster trading speeds.

This is ideal for HFT, as it requires split-second decision-making and execution. In general, high-frequency traders execute numerous trades each second to accumulate modest profits over time and generate a large profit.

What Are The Top HFT Strategies?

Although there are too many types of HFT strategies to list, some of them have been around for a while and aren’t new to experienced investors.

The idea of HFT is frequently connected to conventional trading techniques that take advantage of cutting-edge IT capabilities. However, the term HFT can also refer to more fundamental ways of taking advantage of opportunities in the market.

Briefly put, HFT may be considered a strategy in itself. As a result, instead of focusing on HFT as a whole, it’s important to analyze particular trading techniques that employ HFT technologies.

Crypto Arbitrage

Crypto arbitrage is the process of making a profit by taking advantage of price differences for the same cryptocurrency on different exchanges.

For example, if one Bitcoin (BTC) costs $30,050 on Exchange A and $30,100 on Exchange B, one could buy it on the first exchange and then immediately sell it on the second exchange for a quick profit.

Crypto traders who profit from these market inconsistencies are called arbitrageurs. Using efficient HFT algorithms, they can take advantage of discrepancies before anyone else. In doing so, they help stabilize markets by balancing prices.

HFT is highly beneficial to arbitrageurs because the window of opportunity for conducting arbitrage strategies is usually very small (less than a second).

To rapidly seize short-term market opportunities, HFTs rely on robust computer systems that can scan the markets quickly. In addition, HFT platforms not only discover arbitrage opportunities but can also make trades up to hundreds of times faster than a human trader.

Market Making

Another common HFT strategy is market making. This involves placing buy and sell orders for a security at the same time and profiting from the bid-ask spread—the difference between the price you’re willing to pay for an asset (ask price) and the price at which you’re willing to sell it (bid price).

Large companies called market makers provide liquidity and good order in a market and are well-known in conventional trading. Market makers can also be linked to a cryptocurrency exchange to guarantee market quality.

On the other hand, market makers that do not have any agreements with exchange platforms also exist—their aim is to use their algorithms and profit from the spread.

Market makers are constantly buying and selling cryptocurrencies and setting their bid-ask spreads so that they make a small profit on each trade.

They may, for example, buy Bitcoin at $37,100 (the ask price) from someone wanting to sell their Bitcoin holdings and offer to sell it at $37,102 (the bid price).

The $2.00 difference between the bid and ask prices is called the spread, and it’s mainly how market makers earn money. And, while the difference between the ask and bid price might seem insignificant, day trading in volumes can result in a significant chunk of profit.

The spread ensures that the market maker is compensated for the inherited risk that accompanies such trades. Market makers provide liquidity to the market and make it easier for buyers and sellers to trade at fair prices.

Short-Term Opportunities

High-frequency trading is not intended for swing traders and buy-and-holders. Instead, it’s employed by speculators wanting to wager on short-term price fluctuations. As such, high-frequency traders move so quickly that the price might not have time to adjust before they act again.

For instance, when a whale dumps cryptocurrency, its price will typically drop for a short time before the market adjusts to meet the supply-demand balance.

Most manual traders will lose out on this dip because it may only last for minutes (or even seconds), but high-frequency traders can capitalize on it. They have the time to let their algorithms work, knowing the market will eventually stabilize.

Volume Trading

Another common HFT strategy is volume trading. This involves tracking the number of shares traded in a given period and then making trades accordingly. The logic behind this is that as the number of shares traded increases, so does the market’s liquidity, making it easier to buy or sell a large number of shares without moving the market too much.

To put it simply, volume trading is all about taking advantage of the market’s liquidity.

High-frequency trading allows traders to execute a large number of transactions quickly and profit from even the smallest market fluctuations.

Updated: 9-15-2022

Ex-Citadel Execs Raise $50M For High-Frequency Crypto Trading Platform

Portofino’s backers believe that access to high-frequency trading, or HFT, could bring more hedge funds and institutional investors into crypto.

Cryptocurrency startup Portofino Technologies has officially launched its high-frequency trading platform for digital assets, securing major funding from venture capital firms in the process.

In launching its platform, Portofino disclosed that it had raised $50 million in equity funding from Valar Ventures, Global Founders Capital and Coatue.

Although Portofino didn’t disclose how the funding will be used, the company has been active on the hiring front, having recruited over 35 employees across 5 global locations.

Portofino was founded in 2021 by former Citadel Securities employees Alex Casimo and Leonard Lancia. The company is building crypto-focused high-frequency trading technology, which is mainly used by hedge funds.

While the company is only now coming out of stealth mode, it claims to have traded billions of dollars across centralized and decentralized crypto exchanges.

High-frequency trading, or HFT, refers to automated trading platforms that are typically used by large financial institutions to execute large batches of orders at extremely high speeds.

These platforms rely on complex algorithms to analyze market trends and trading opportunities that can be executed in seconds.

On the crypto front, HFT strategies can now be executed on decentralized exchanges, or DEXs. Unlike centralized exchanges, DEXs offer much faster trading speeds and new arbitrage opportunities.

Portofino’s HFT technology is looking to build on these capabilities by increasing access to liquidity.

Hedge funds and other institutional investors have shown a keen interest in cryptocurrencies, but overall adoption has been slow due to several factors, including regulations and a lack of infrastructure.

As the head of crypto investment manager Apollo Capital told Cointelegraph:

“No one wants to be the first into something like this. Because if you’re the first one and things go wrong, then there’s a career risk. That will flip at some point to the opposite.”

High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,High-Frequency Trading Is Newest,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Government-Backed Bitcoin Hash Wars Will Be The New Space Race

Lars Wood On Enhanced SAT Solvers Based Hashing Method For Bitcoin Mining

Morgan Stanley Adds Bitcoin Exposure To 12 Investment Funds

One BTC Will Be Worth A Lambo By 2022, And A Bugatti By 2023: Kraken CEO

Rocketing Bitcoin Price Provides Refuge For The Brave

Bitcoin Is 3rd Largest World Currency

Does BlockFi’s Risk Justify The Reward?

Crypto Media Runs With The Bulls As New Entrants Compete Against Established Brands

Bitcoin’s Never-Ending Bubble And Other Mysteries

The Last Dip Is The Deepest As Wife Leaves Husband For Buying More Bitcoin

Blockchain.com Raises $300 Million As Investors Find Other Ways Into Bitcoin

What Is BitClout? The Social Media Experiment Sparking Controversy On Twitter

Bitcoin Searches In Turkey Spike 566% After Turkish Lira Drops 14%

Crypto Is Banned In Morocco, But Bitcoin Purchases Are Soaring

Bitcoin Can Be Sent With A Tweet As Bottlepay Twitter App Goes Live

Rise of Crypto Market’s Quiet Giants Has Big Market Implications

Canadian Property Firm Buys Bitcoin In Hopes Of Eventually Scrapping Condo Fees

Bitcoin Price Gets Fed Boost But Bond Yields Could Play Spoilsport: Analysts

Bank of America Claims It Costs Just $93 Million To Move Bitcoin’s Price By 1%

Would A US Wealth Tax Push Millionaires To Bitcoin Adoption?

NYDIG Head Says Major Firms Will Announce Bitcoin ‘Milestones’ Next Week

Signal Encrypted Messenger Now Accepts Donations In Bitcoin

Bitcoin Is Now Worth More Than Visa And Mastercard Combined

Retail Bitcoin Customers Rival Wall Street Buyers As Mania Builds

Crypto’s Rising. So Are The Stakes For Governments Everywhere

Bitcoin Falls After Weekend Rally Pushes Token To Fresh Record

Oakland A’s Major League Baseball Team Now Accepts Bitcoin For Suites

Students In Georgia Set To Be Taught About Crypto At High School

What You Need To Know About Bitcoin Now

Bitcoin Winning Streak Now At 7 Days As Fresh Stimulus Keeps Inflation Bet Alive

Bitcoin Intraday Trading Pattern Emerges As Institutions Pile In

If 60/40 Recipe Sours, Maybe Stir In Some Bitcoin

Explaining Bitcoin’s Speculative Attack On The Dollar

VIX-Like Gauge For Bitcoin Sees Its First-Ever Options Trade

A Utopian Vision Gets A Blockchain Twist In Nevada

Crypto Influencers Scramble To Recover Twitter Accounts After Suspensions

Bitcoin Breaks Through $57,000 As Risk Appetite Revives

Analyzing Bitcoin’s Network Effect

US Government To Sell 0.7501 Bitcoin Worth $38,000 At Current Prices

Pro Traders Avoid Bitcoin Longs While Cautiously Watching DXY Strengthen

Bitcoin Hits Highest Level In Two Weeks As Big-Money Bets Flow

OG Status In Crypto Is A Liability

Bridging The Bitcoin Gender Gap: Crypto Lets Everyone Access Wealth

HODLing Early Leads To Relationship Troubles? Redditors Share Their Stories

Want To Be Rich? Bitcoin’s Limited Supply Cap Means You Only Need 0.01 BTC

You Can Earn 6%, 8%, Even 12% On A Bitcoin ‘Savings Account’—Yeah, Right

Egyptians Are Buying Bitcoin Despite Prohibitive New Banking Laws

Is March Historically A Bad Month For Bitcoin?

Bitcoin Falls 4% As Fed’s Powell Sees ‘Concern’ Over Rising Bond Yields

US Retailers See Millions In Lost Sales Due To Port Congestion, Shortage Of Containers

Pandemic-Relief Aid Boosts Household Income Which Causes Artificial Economic Stimulus

YouTube Suspends CoinDesk’s Channel Over Unspecified Violations

It’s Gates Versus Musk As World’s Richest Spar Over Bitcoin

Charlie Munger Is Sure Bitcoin Will Fail To Become A Global Medium Of Exchange

Bitcoin Is Minting Thousands Of Crypto ‘Diamond Hands’ Millionaires Complete W/Laser Eyes

Dubai’s IBC Group Pledges 100,000 Bitcoin ($4.8 Billion) 20% Of All Bitcoin, Largest So Far

Bitcoin’s Value Is All In The Eye Of The ‘Bithodler’

Bitcoin Is Hitting Record Highs. Why It’s Not Too Late To Dig For Digital Gold

$56.3K Bitcoin Price And $1Trillion Market Cap Signal BTC Is Here To Stay

Christie’s Auction House Will Now Accept Cryptocurrency

Why A Chinese New Year Bitcoin Sell-Off Did Not Happen This Year

The US Federal Reserve Will Adopt Bitcoin As A Reserve Asset

Motley Fool Adding $5M In Bitcoin To Its ‘10X Portfolio’ — Has A $500K Price Target

German Cannabis Company Hedges With Bitcoin In Case Euro Crashes

Bitcoin: What To Know Before Investing

China’s Cryptocurrency Stocks Left Behind In Bitcoin Frenzy

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Bitcoin Jumps To $50,000 As Record-Breaking Rally Accelerates

Bitcoin’s Volatility Should Burn Investors. It Hasn’t

Bitcoin’s Latest Record Run Is Less Volatile Than The 2017 Boom

Blockchain As A Replacement To The MERS (Mortgage Electronic Registration System)

The Ultimate Resource On “PriFi” Or Private Finance

Deutsche Bank To Offer Bitcoin Custody Services

BeanCoin Currency Casts Lifeline To Closed New Orleans Bars

Bitcoin Could Enter ‘Supercycle’ As Fed Balance Sheet Hits New Record High

Crypto Mogul Bets On ‘Meme Investing’ With Millions In GameStop

Iran’s Central Banks Acquires Bitcoin Even Though Lagarde Says Central Banks Will Not Hold Bitcoin

Bitcoin To Come To America’s Oldest Bank, BNY Mellon

Tesla’s Bitcoin-Equals-Cash View Isn’t Shared By All Crypto Owners

How A Lawsuit Against The IRS Is Trying To Expand Privacy For Crypto Users

Apple Should Launch Own Crypto Exchange, RBC Analyst Says

Bitcoin Hits $43K All-Time High As Tesla Invests $1.5 Billion In BTC

Bitcoin Bounces Off Top of Recent Price Range

Top Fiat Currencies By Market Capitalization VS Bitcoin

Bitcoin Eyes $50K Less Than A Month After BTC Price Broke Its 2017 All-Time High

Investors Piling Into Overvalued Crypto Funds Risk A Painful Exit

Parents Should Be Aware Of Their Children’s Crypto Tax Liabilities

Miami Mayor Says City Employees Should Be Able To Take Their Salaries In Bitcoin

Bitcoiners Get Last Laugh As IBM’s “Blockchain Not Bitcoin” Effort Goes Belly-up

Bitcoin Accounts Offer 3-12% Rates In A Low-Interest World

Analyst Says Bitcoin Price Sell-Off May Occur As Chinese New Year Approaches

Why The Crypto World Needs To Build An Amazon Of Its Own

Tor Project’s Crypto Donations Increased 23% In 2020

Social Trading Platform eToro Ended 2020 With $600M In Revenue

Bitcoin Billionaire Set To Run For California Governor

GameStop Investing Craze ‘Proof of Concept’ For Bitcoin Success

Bitcoin Entrepreneurs Install Mining Rigs In Cars. Will Trucks And Tractor Trailers Be Next?

Harvard, Yale, Brown Endowments Have Been Buying Bitcoin For At Least A Year

Bitcoin Return To $40,000 In Doubt As Flows To Key Fund Slow

Ultimate Resource For Leading Non-Profits Focused On Policy Issues Facing Cryptocurrencies

Regulate Cryptocurrencies? Not Yet

Check Out These Cryptocurrency Clubs And Bitcoin Groups!

Blockchain Brings Unicorns To Millennials

Crypto-Industry Prepares For Onslaught Of Public Listings

Bitcoin Core Lead Maintainer Steps Back, Encourages Decentralization

Here Are Very Bitcoiny Ways To Get Bitcoin Exposure

To Understand Bitcoin, Just Think of It As A Faith-Based Asset

Cryptos Won’t Work As Actual Currencies, UBS Economist Says

Older Investors Are Getting Into Crypto, New Survey Finds

Access Denied: Banks Seem Prone To Cryptophobia Despite Growing Adoption

Pro Traders Buy The Dip As Bulls Address A Trifecta Of FUD News Announcements

Andreas Antonopoulos And Others Debunk Bitcoin Double-Spend FUD

New Bitcoin Investors Explain Why They’re Buying At Record Prices

When Crypto And Traditional Investors Forget Fundamentals, The Market Is Broken

First Hyperledger-based Cryptocurrency Explodes 486% Overnight On Bittrex BTC Listing

Bitcoin Steady As Analysts Say Getting Back To $40,000 Is Key

Coinbase, MEVP Invest In Crypto-Asset Startup Rain

Synthetic Dreams: Wrapped Crypto Assets Gain Traction Amid Surging Market

Secure Bitcoin Self-Custody: Balancing Safety And Ease Of Use

UBS (A Totally Corrupt And Criminal Bank) Warns Clients Crypto Prices Can Actually Go To Zero

Bitcoin Swings Undermine CFO Case For Converting Cash To Crypto

CoinLab Cuts Deal With Mt. Gox Trustee Over Bitcoin Claims

Bitcoin Slides Under $35K Despite Biden Unveiling $1.9 Trillion Stimulus

Bitcoin Refuses To ‘Die’ As BTC Price Hits $40K Just Three Days After Crash

Ex-Ripple CTO Can’t Remember Password To Access $240M In Bitcoin

Financial Advisers Are Betting On Bitcoin As A Hedge

ECB President Christine Lagarde (French Convict) Says, Bitcoin Enables “Funny Business.”

German Police Shut Down Darknet Marketplace That Traded Bitcoin

Bitcoin Miner That’s Risen 1,400% Says More Regulation Is Needed

Bitcoin Rebounds While Leaving Everyone In Dark On True Worth

UK Treasury Calls For Feedback On Approach To Cryptocurrency And Stablecoin Regulation

What Crypto Users Need Know About Changes At The SEC

Where Does This 28% Bitcoin Price Drop Rank In History? Not Even In The Top 5

Seven Times That US Regulators Stepped Into Crypto In 2020

Retail Has Arrived As Paypal Clears $242M In Crypto Sales Nearly Double The Previous Record

Bitcoin’s Slide Dents Price Momentum That Dwarfed Everything

Does Bitcoin Boom Mean ‘Better Gold’ Or Bigger Bubble?

Bitcoin Whales Are Profiting As ‘Weak Hands’ Sell BTC After Price Correction

Crypto User Recovers Long-Lost Private Keys To Access $4M In Bitcoin

The Case For And Against Investing In Bitcoin

Bitcoin’s Wild Weekends Turn Efficient Market Theory Inside Out

Bitcoin Price Briefly Surpasses Market Cap Of Tencent

Broker Touts Exotic Bitcoin Bet To Squeeze Income From Crypto

Broker Touts Exotic Bitcoin Bet To Squeeze Income From Crypto

Tesla’s Crypto-Friendly CEO Is Now The Richest Man In The World

Crypto Market Cap Breaks $1 Trillion Following Jaw-Dropping Rally

Gamblers Could Use Bitcoin At Slot Machines With New Patent

Crypto Users Donate $400K To Julian Assange Defense As Mexico Proposes Asylum

Grayscale Ethereum Trust Fell 22% Despite Rally In Holdings

Bitcoin’s Bulls Should Fear Its Other Scarcity Problem

Ether Follows Bitcoin To Record High Amid Dizzying Crypto Rally

Retail Investors Are Largely Uninvolved As Bitcoin Price Chases $40K

Bitcoin Breaches $34,000 As Rally Extends Into New Year

Social Media Interest In Bitcoin Hits All-Time High

Bitcoin Price Quickly Climbs To $31K, Liquidating $100M Of Shorts

How Massive Bitcoin Buyer Activity On Coinbase Propelled BTC Price Past $32K

FinCEN Wants US Citizens To Disclose Offshore Crypto Holdings of $10K+

Governments Will Start To Hodl Bitcoin In 2021

Crypto-Linked Stocks Extend Rally That Produced 400% Gains

‘Bitcoin Liquidity Crisis’ — BTC Is Becoming Harder To Buy On Exchanges, Data Shows

Bitcoin Looks To Gain Traction In Payments

BTC Market Cap Now Over Half A Trillion Dollars. Major Weekly Candle Closed!!

Elon Musk And Satoshi Nakamoto Making Millionaires At Record Pace

Binance Enables SegWit Support For Bitcoin Deposits As Adoption Grows

Santoshi Nakamoto Delivers $24.5K Christmas Gift With Another New All-Time High

Bitcoin’s Rally Has Already Outlasted 2017’s Epic Run

Gifting Crypto To Loved Ones This Holiday? Educate Them First

Scaramucci’s SkyBridge Files With SEC To Launch Bitcoin Fund

Samsung Integrates Bitcoin Wallets And Exchange Into Galaxy Phones

HTC Smartphone Will Run A Full Bitcoin Node (#GotBitcoin?)

HTC’s New 5G Router Can Host A Full Bitcoin Node

Bitcoin Miners Are Heating Homes Free of Charge

Bitcoin Miners Will Someday Be Incorporated Into Household Appliances

Musk Inquires About Moving ‘Large Transactions’ To Bitcoin

How To Invest In Bitcoin: It Can Be Easy, But Watch Out For Fees

Megan Thee Stallion Gives Away $1 Million In Bitcoin

CoinFLEX Sets Up Short-Term Lending Facility For Crypto Traders

Wall Street Quants Pounce On Crytpo Industry And Some Are Not Sure What To Make Of It

Bitcoin Shortage As Wall Street FOMO Turns BTC Whales Into ‘Plankton’

Bitcoin Tops $22,000 And Strategists Say Rally Has Further To Go

Why Bitcoin Is Overpriced by More Than 50%

Kraken Exchange Will Integrate Bitcoin’s Lightning Network In 2021

New To Bitcoin? Stay Safe And Avoid These Common Scams

Andreas M. Antonopoulos And Simon Dixon Say Don’t Buy Bitcoin!

Famous Former Bitcoin Critics Who Conceded In 2020

Jim Cramer Bought Bitcoin While ‘Off Nicely From The Top’ In $17,000S

The Wealthy Are Jumping Into Bitcoin As Stigma Around Crypto Fades

WordPress Adds Official Ethereum Ad Plugin

France Moves To Ban Anonymous Crypto Accounts To Prevent Money Laundering

10 Predictions For 2021: China, Bitcoin, Taxes, Stablecoins And More

Movie Based On Darknet Market Silk Road Premiering In February

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

US Gov Is Bitcoin’s Last Remaining Adversary, Says Messari Founder

$1,200 US Stimulus Check Is Now Worth Almost $4,000 If Invested In Bitcoin

German Bank Launches Crypto Fund Covering Portfolio Of Digital Assets

World Governments Agree On Importance Of Crypto Regulation At G-7 Meeting

Why Some Investors Get Bitcoin So Wrong, And What That Says About Its Strengths

It’s Not About Data Ownership, It’s About Data Control, EFF Director Says

‘It Will Send BTC’ — On-Chain Analyst Says Bitcoin Hodlers Are Only Getting Stronger

Bitcoin Arrives On Wall Street: S&P Dow Jones Launching Crypto Indexes In 2021

Audio Streaming Giant Spotify Is Looking Into Crypto Payments

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Bitcoin Moves $500K Around The Globe Every Second, Says Samson Mow

Pomp Talks Shark Tank’s Kevin O’leary Into Buying ‘A Little More’ Bitcoin

Bitcoin Is The Tulipmania That Refuses To Die

Ultimate Resource On Ethereum 2.0

Biden Should Integrate Bitcoin Into Us Financial System, Says Niall Ferguson

Bitcoin Is Winning The Monetary Revolution

Cash Is Trash, Dump Gold, Buy Bitcoin!

Bitcoin Price Sets New Record High Above $19,783

You Call That A Record? Bitcoin’s November Gains Are 3x Stock Market’s

Bitcoin Fights Back With Power, Speed and Millions of Users

Exchanges Outdo Auctions For Governments Cashing In Criminal Crypto, Says Exec

Coinbase CEO: Trump Administration May ‘Rush Out’ Burdensome Crypto Wallet Rules

Bitcoin Plunges Along With Other Coins Providing For A Major Black Friday Sale Opportunity

The Most Bullish Bitcoin Arguments For Your Thanksgiving Table

‘Bitcoin Tuesday’ To Become One Of The Largest-Ever Crypto Donation Events

World’s First 24/7 Crypto Call-In Station!!!

Bitcoin Trades Again Near Record, Driven By New Group Of Buyers

Friendliest Of Them All? These Could Be The Best Countries For Crypto

Bitcoin Price Doubles Since The Halving, With Just 3.4M Bitcoin Left For Buyers

First Company-Sponsored Bitcoin Retirement Plans Launched In US

Poker Players Are Enhancing Winnings By Cashing Out In Bitcoin

Crypto-Friendly Brooks Gets Nod To Serve 5-Year Term Leading Bank Regulator

The Bitcoin Comeback: Is Crypto Finally Going Mainstream?

The Dark Future Where Payments Are Politicized And Bitcoin Wins

Mexico’s 3rd Richest Man Reveals BTC Holdings As Bitcoin Breaches $18,000

Ultimate Resource On Mike Novogratz And Galaxy Digital’s Bitcoin News

Bitcoin’s Gunning For A Record And No One’s Talking About It

Simple Steps To Keep Your Crypto Safe

US Company Now Lets Travelers Pay For Passports With Bitcoin

Billionaire Hedge Fund Investor Stanley Druckenmiller Says He Owns Bitcoin In CNBC Interview

China’s UnionPay And Korea’s Danal To Launch Crypto-Supporting Digital Card #GotBitcoin

Bitcoin Is Back Trading Near Three-Year Highs

Bitcoin Transaction Fees Rise To 28-Month High As Hashrate Drops Amid Price Rally

Market Is Proving Bitcoin Is ‘Ultimate Safe Haven’ — Anthony Pompliano

3 Reasons Why Bitcoin Price Suddenly Dropping Below $13,000 Isn’t Bearish

Bitcoin Resurgence Leaves Institutional Acceptance Unanswered

WordPress Content Can Now Be Timestamped On Ethereum

PayPal To Offer Crypto Payments Starting In 2021 (A-Z) (#GotBitcoin?)

As Bitcoin Approaches $13,000 It Breaks Correlation With Equities

Crypto M&A Surges Past 2019 Total As Rest of World Eclipses U.S. (#GotBitcoin?)

How HBCUs Are Prepping Black Students For Blockchain Careers

Why Every US Congressman Just Got Sent Some ‘American’ Bitcoin

CME Sounding Out Crypto Traders To Gauge Market Demand For Ether Futures, Options

Caitlin Long On Bitcoin, Blockchain And Rehypothecation (#GotBitcoin?)

Bitcoin Drops To $10,446.83 As CFTC Charges BitMex With Illegally Operating Derivatives Exchange

BitcoinACKs Lets You Track Bitcoin Development And Pay Coders For Their Work

One Of Hal Finney’s Lost Contributions To Bitcoin Core To Be ‘Resurrected’ (#GotBitcoin?)

Cross-chain Money Markets, Latest Attempt To Bring Liquidity To DeFi

Memes Mean Mad Money. Those Silly Defi Memes, They’re Really Important (#GotBitcoin?)

Bennie Overton’s Story About Our Corrupt U.S. Judicial, Global Financial Monetary System And Bitcoin

Stop Fucking Around With Public Token Airdrops In The United States (#GotBitcoin?)

Mad Money’s Jim Cramer Will Invest 1% Of Net Worth In Bitcoin Says, “Gold Is Dangerous”

State-by-state Licensing For Crypto And Payments Firms In The Us Just Got Much Easier (#GotBitcoin?)

Bitcoin (BTC) Ranks As World 6Th Largest Currency

Pomp Claims He Convinced Jim Cramer To Buy Bitcoin

Traditional Investors View Bitcoin As If It Were A Technology Stock

Mastercard Releases Platform Enabling Central Banks To Test Digital Currencies (#GotBitcoin?)

Being Black On Wall Street. Top Black Executives Speak Out About Racism (#GotBitcoin?)

Tesla And Bitcoin Are The Most Popular Assets On TradingView (#GotBitcoin?)

From COVID Generation To Crypto Generation (#GotBitcoin?)

Right-Winger Tucker Carlson Causes Grayscale Investments To Pull Bitcoin Ads

Bitcoin Has Lost Its Way: Here’s How To Return To Crypto’s Subversive Roots

Cross Chain Is Here: NEO, ONT, Cosmos And NEAR Launch Interoperability Protocols (#GotBitcoin?)

Crypto Trading Products Enter The Mainstream With A Number Of Inherent Advantages (#GotBitcoin?)

Crypto Goes Mainstream With TV, Newspaper Ads (#GotBitcoin?)

A Guarded Generation: How Millennials View Money And Investing (#GotBitcoin?)

Blockchain-Backed Social Media Brings More Choice For Users

California Moves Forward With Digital Asset Bill (#GotBitcoin?)

Walmart Adds Crypto Cashback Through Shopping Loyalty Platform StormX (#GotBitcoin?)

Congressman Tom Emmer To Lead First-Ever Crypto Town Hall (#GotBitcoin?)

Why It’s Time To Pay Attention To Mexico’s Booming Crypto Market (#GotBitcoin?)

The Assets That Matter Most In Crypto (#GotBitcoin?)

Ultimate Resource On Non-Fungible Tokens

Bitcoin Community Highlights Double-Standard Applied Deutsche Bank Epstein Scandal

Blockchain Makes Strides In Diversity. However, Traditional Tech Industry Not-S0-Much (#GotBitcoin?)

An Israeli Blockchain Startup Claims It’s Invented An ‘Undo’ Button For BTC Transactions

After Years of Resistance, BitPay Adopts SegWit For Cheaper Bitcoin Transactions

US Appeals Court Allows Warrantless Search of Blockchain, Exchange Data

Central Bank Rate Cuts Mean ‘World Has Gone Zimbabwe’

This Researcher Says Bitcoin’s Elliptic Curve Could Have A Secret Backdoor

China Discovers 4% Of Its Reserves Or 83 Tons Of It’s Gold Bars Are Fake (#GotBitcoin?)

Former Legg Mason Star Bill Miller And Bloomberg Are Optimistic About Bitcoin’s Future

Yield Chasers Are Yield Farming In Crypto-Currencies (#GotBitcoin?)

Australia Post Office Now Lets Customers Buy Bitcoin At Over 3,500 Outlets

Anomaly On Bitcoin Sidechain Results In Brief Security Lapse

SEC And DOJ Charges Lobbying Kingpin Jack Abramoff And Associate For Money Laundering

Veteran Commodities Trader Chris Hehmeyer Goes All In On Crypto (#GotBitcoin?)

Activists Document Police Misconduct Using Decentralized Protocol (#GotBitcoin?)

Supposedly, PayPal, Venmo To Roll Out Crypto Buying And Selling (#GotBitcoin?)

Industry Leaders Launch PayID, The Universal ID For Payments (#GotBitcoin?)

Crypto Quant Fund Debuts With $23M In Assets, $2.3B In Trades (#GotBitcoin?)

The Queens Politician Who Wants To Give New Yorkers Their Own Crypto

Why Does The SEC Want To Run Bitcoin And Ethereum Nodes?

US Drug Agency Failed To Properly Supervise Agent Who Stole $700,000 In Bitcoin In 2015

Layer 2 Will Make Bitcoin As Easy To Use As The Dollar, Says Kraken CEO

Bootstrapping Mobile Mesh Networks With Bitcoin Lightning

Nevermind Coinbase — Big Brother Is Already Watching Your Coins (#GotBitcoin?)

BitPay’s Prepaid Mastercard Launches In US to Make Crypto Accessible (#GotBitcoin?)

Germany’s Deutsche Borse Exchange To List New Bitcoin Exchange-Traded Product

‘Bitcoin Billionaires’ Movie To Tell Winklevoss Bros’ Crypto Story

US Pentagon Created A War Game To Fight The Establishment With BTC (#GotBitcoin?)

JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini (#GotBitcoin?)

Bitcoin Advocates Cry Foul As US Fed Buying ETFs For The First Time

Final Block Mined Before Halving Contained Reminder of BTC’s Origins (#GotBitcoin?)

Meet Brian Klein, Crypto’s Own ‘High-Stakes’ Trial Attorney (#GotBitcoin?)

3 Reasons For The Bitcoin Price ‘Halving Dump’ From $10K To $8.1K

Bitcoin Outlives And Outlasts Naysayers And First Website That Declared It Dead Back In 2010

Hedge Fund Pioneer Turns Bullish On Bitcoin Amid ‘Unprecedented’ Monetary Inflation

Antonopoulos: Chainalysis Is Helping World’s Worst Dictators & Regimes (#GotBitcoin?)

Survey Shows Many BTC Holders Use Hardware Wallet, Have Backup Keys (#GotBitcoin?)

Iran Ditches The Rial Amid Hyperinflation As Localbitcoins Seem To Trade Near $35K

Buffett ‘Killed His Reputation’ by Being Stupid About BTC, Says Max Keiser (#GotBitcoin?)

Blockfolio Quietly Patches Years-Old Security Hole That Exposed Source Code (#GotBitcoin?)

Bitcoin Won As Store of Value In Coronavirus Crisis — Hedge Fund CEO

Decentralized VPN Gaining Steam At 100,000 Users Worldwide (#GotBitcoin?)

Crypto Exchange Offers Credit Lines so Institutions Can Trade Now, Pay Later (#GotBitcoin?)

Zoom Develops A Cryptocurrency Paywall To Reward Creators Video Conferencing Sessions (#GotBitcoin?)

Bitcoin Startup Purse.io And Major Bitcoin Cash Partner To Shut Down After 6-Year Run

Open Interest In CME Bitcoin Futures Rises 70% As Institutions Return To Market

Square’s Users Can Route Stimulus Payments To BTC-Friendly Cash App

$1.1 Billion BTC Transaction For Only $0.68 Demonstrates Bitcoin’s Advantage Over Banks

Bitcoin Could Become Like ‘Prison Cigarettes’ Amid Deepening Financial Crisis

Bitcoin Holds Value As US Debt Reaches An Unfathomable $24 Trillion

How To Get Money (Crypto-currency) To People In An Emergency, Fast

Bitcoin Miner Manufacturers Mark Down Prices Ahead of Halving

Privacy-Oriented Browsers Gain Traction (#GotBitcoin?)

‘Breakthrough’ As Lightning Uses Web’s Forgotten Payment Code (#GotBitcoin?)

Bitcoin Starts Quarter With Price Down Just 10% YTD vs U.S. Stock’s Worst Quarter Since 2008

Bitcoin Enthusiasts, Liberal Lawmakers Cheer A Fed-Backed Digital Dollar

Crypto-Friendly Bank Revolut Launches In The US (#GotBitcoin?)

The CFTC Just Defined What ‘Actual Delivery’ of Crypto Should Look Like (#GotBitcoin?)

Crypto CEO Compares US Dollar To Onecoin Scam As Fed Keeps Printing (#GotBitcoin?)

Stuck In Quarantine? Become A Blockchain Expert With These Online Courses (#GotBitcoin?)

Bitcoin, Not Governments Will Save the World After Crisis, Tim Draper Says

Crypto Analyst Accused of Photoshopping Trade Screenshots (#GotBitcoin?)

QE4 Begins: Fed Cuts Rates, Buys $700B In Bonds; Bitcoin Rallies 7.7%

Mike Novogratz And Andreas Antonopoulos On The Bitcoin Crash

Amid Market Downturn, Number of People Owning 1 BTC Hits New Record (#GotBitcoin?)

Fatburger And Others Feed $30 Million Into Ethereum For New Bond Offering (#GotBitcoin?)

Pornhub Will Integrate PumaPay Recurring Subscription Crypto Payments (#GotBitcoin?)

Intel SGX Vulnerability Discovered, Cryptocurrency Keys Threatened

Bitcoin’s Plunge Due To Manipulation, Traditional Markets Falling or PlusToken Dumping?

Countries That First Outlawed Crypto But Then Embraced It (#GotBitcoin?)

Bitcoin Maintains Gains As Global Equities Slide, US Yield Hits Record Lows

HTC’s New 5G Router Can Host A Full Bitcoin Node

India Supreme Court Lifts RBI Ban On Banks Servicing Crypto Firms (#GotBitcoin?)

Analyst Claims 98% of Mining Rigs Fail to Verify Transactions (#GotBitcoin?)

Blockchain Storage Offers Security, Data Transparency And immutability. Get Over it!

Black Americans & Crypto (#GotBitcoin?)

Coinbase Wallet Now Allows To Send Crypto Through Usernames (#GotBitcoin)

New ‘Simpsons’ Episode Features Jim Parsons Giving A Crypto Explainer For The Masses (#GotBitcoin?)

Crypto-currency Founder Met With Warren Buffett For Charity Lunch (#GotBitcoin?)

Bitcoin’s Potential To Benefit The African And African-American Community

Coinbase Becomes Direct Visa Card Issuer With Principal Membership

Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

Jill Carlson, Meltem Demirors Back $3.3M Round For Non-Custodial Settlement Protocol Arwen

Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)