Caitlin Long on Bitcoin, Repo Fiasco, Blockchain And Rehypothecation (#GotBitcoin)

Leaders Series: Caitlin Long at the Wyoming Blockchain Coalition. Caitlin Long on Bitcoin, Repo Fiasco, Blockchain And Rehypothecation (#GotBitcoin)

She spent over 2 decades working for big banks, and was one of the leading voices advocating for the use of blockchain technology in the financial services community.

Caitlin Long is the Co-Founder of the Wyoming Blockchain Coalition

While president of Symbiont she jointly led its index data project with Vanguard.

Related:

Caitlin Long Reveals The ‘Real Reason’ People Are Selling Crypto

Ultimate Resource On Stablecoins

Flight To Money Funds Is Adding To The Strains On Banks

California Legalizes Public Banking!!!!

Caitlin is a Wyoming native, and recently launched the Wyoming Blockchain Coalition which helped pass five bills into law. These bills are laying the foundation to make Wyoming the epicenter for cryptocurrency firms and blockchain technology companies.

How Did You Get Into The Crypto / Blockchain Industry?

In 2012 I came across bitcoin in Austrian School economics circles. But I didn’t act on it right away, just as most people don’t when they first hear about bitcoin. It’s bewildering at first, and it takes time and repetition to sink in. Then, in February 2013, I was flat on my back for days recovering from surgery when an article by Jeffrey Tucker hit my inbox. It contained some “how to” advice about bitcoin, and I remember thinking “it’s finally time to figure this thing out.” That day I set up my first wallet.

What Did You Do Before You Got Sucked Down The Blockchain Rabbit Hole?

Before jumping to blockchain full-time in 2016, I’d spent 22 years on Wall Street in various senior roles (most recently as head of Morgan Stanley’s pension business). Initially I felt pressure to keep my bitcoin interest quiet, as a manager inside an investment bank — but gradually felt more comfortable and started participating in an internal bitcoin forum. Morgan Stanley’s CTO saw that, and out of the blue in 2014 he called to ask me to join his blockchain working group. From there it wasn’t long before I had one foot out the door to pursue blockchain full-time — it was a gradual process, but by 2016 I was all-in.

What Was Your Motivation In Starting The Wyoming Blockchain Coalition, And Why Do You Feel Passionate About This?

My passion is honest ledgers. That must sound odd and tremendously boring to your readers. But most folks don’t realize that the financial system’s ledgers are not honest. When I figured this out, it was like a betrayal — a punch to the gut — that made me question my chosen profession. But it’s true. We do not have a fair and honest financial system. One reason is that Wall Street’s accounting systems are rarely in sync with each other and smart actors have figured out how to exploit these inconsistencies to their advantage. Some of this is nefarious, but much of it is just systemic sloppiness. We will only have a fair financial system when we restore property rights back to the owners of assets in the financial system, and account for them using honest ledgers.

I witnessed some of these issues first-hand, but publicly can point to the Dole Food case as one of many examples. In February 2017 a Delaware court case detailed how 49.2 million valid claims were filed for Dole Food shares in a class-action lawsuit, but there was a problem: only 36.7 million Dole Food shares existed! All 49.2 million claims were backed up by valid brokerage statements proving that the shareholders owned the shares, but there were only 36.7 million shares outstanding. When the financial system can create 12.5 million real claims to phantom shares that don’t exist, it’s the same as if your county clerk issued someone else a valid deed to your house. It’s dishonest and shocking.

Here’s another example. The vote tally in the 2017 Procter & Gamble proxy fight was laughably inaccurate, three times, and no one really knows who won because the parties simply agreed to stop fighting and settle. The first count found P&G won by 6.2 million votes. The second count found the challenger, Nelson Peltz, won by 42,780 votes. The third and final count found P&G won by 498,312 votes. Do these wildly different vote counts give you confidence that Wall Street keeps accurate track of the securities in your brokerage account? The Wall Street Journal’s headline captured the exasperation,: “P&G Concedes Proxy Fight, Adds Nelson Peltz to Its Board,” even though P&G actually won that latest count!

All of this inaccuracy is unacceptable to me, as it should be to anyone who believes in free and fair markets. Wall Street’s ledgers are not honest. Blockchain can make them so!

What’s Been The Most Inspiring Experience You’ve Had In Blockchain-Land Thus Far?

By far the most meaningful project on which I’ve worked was the Wyoming Blockchain Coalition’s passage of five blockchain bills in 2018 that make Wyoming a crypto haven. This was a purely volunteer project and was a labor of love for me, as I was born and raised in Wyoming and care deeply for my native state. Had someone been paying us for the time we spent on the ground in Cheyenne making it happen, they would have paid a fortune! But for me it was a service project, both for my native state and the blockchain community. The opportunity came at the right time for Wyoming, and fit the state’s needs like a glove. It was the most intense and gratifying project I’ve worked on in years — and I hope everyone in the community can find and make a similar contribution during their careers!

Caitlin Long (Left) And Tyler Lindholm (Right), The Legislator Who Shepherded The Blockchain Bills Through The Wyoming Legislature.

What Are Some Ideas You’re Excited About In The Blockchain Ecosystem?

I’m most excited by the idea of making securities markets a lot fairer to regular folks by issuing and trading securities on a blockchain. This idea was originally that of Symbiont, my former company — and it’s a great one. The insight is that if a company registers its shares on a blockchain at its genesis moment — which is when it registers with the Secretary of State in its state of incorporation — then its stock ledger will be accurate, honest and tamper-proof. No more phantom shares of Dole Food or inaccuracies in the P&G proxy vote! Blockchains can clean this up.

We Always Overestimate What Will Happen In Five Years And Underestimate What Will Happen In Twenty. Where Do You See This All Going?

I believe we will all be using bitcoin for payments in 20 years. I’m a bitcoin maximalist, but believe it will take 20 years for bitcoin to become pervasive.

Unfortunately, I believe the financial system will crack hard when the West hits the proverbial debt ceiling and our lenders stop lending to us — no one knows exactly when that will happen — and that’s when the rubber will hit the road for cryptocurrencies. Bitcoin used to be countercyclical (e.g., it rose during the financial crisis in Cyprus), but recently its trading pattern has been procyclical (i.e., it rises when stock markets rise) as institutional money flows into it. But I believe it will eventually prove to be powerfully countercyclical again.

I used to worry about the instability of the traditional financial system — but bitcoin makes me optimistic about the future because it provides a viable alternative!

Thanks to Caitlin for participating! Connect with her on LinkedIn or Twitter.

What Is Unique About The City Of London’s Laws Regarding Rehypothecation?

Good question – except there aren’t any. There aren’t any laws about rehypothication in the City of London. The City of London is an

‘offshore’ jurisdiction with regard to regulation (the so-called “Euromarkets”)

As you know rehypothication (simplified) is the ability to re-use and re-use assets as collateral ad infinitum… Many Wall St. banks have established subsidiaries there, to shift assets off their books.

The reports below indicate that this was the main reason behind the demise of MF Global, Lehman, AIG, etc..

IMF: The Nonbank-Bank Nexus and the Shadow Banking System

Reuters: http://newsandinsight.thomsonreu…

Zerohedge: Why The UK Trail Of The MF Global Collapse May Have “Apocalyptic” Consequences For The Eurozone, Canadian Banks, Jefferies And Everyone Elseand Shadow Rehypothecation, Infinite Leverage, And Why Breaking The Tyranny Of Ignorance Is The Only Solution and Has The Imploding European Shadow Banking System Forced The Bundesbank To Prepare For Plan B?

Naked Capitalism Blog: Revisiting Rehypothecation: JP Morgan Markets Its Latest Doomsday Machine (or Why Repo May Blow Up the Financial System Again)

Dole Food Had Too Many Shares

It’s enough to make you wish for a blockchain.

In 2013, tropical-fruit tycoon David Murdock, who was the chairman, chief executive officer and biggest shareholder of Dole Food Co., took it private for $13.50 a share. A lot of shareholders felt that that price was way too low, and that Murdock had sandbagged the shareholders by driving down the value of the company so he could buy it cheaply for himself.

So they sued, and they won. In 2015, the Delaware Chancery Court ordered Murdock to pay shareholders another $2.74 a share, plus interest. There was a class action on behalf of shareholders, covering 36,793,758 shares, and after the court ruled in their favor, the class lawyers informed the shareholders and asked them to submit a form to claim their $2.74 a share.

They got back claims from 4,662 shareholders for a total of 49,164,415 shares. “That figure substantially exceeded the 36,793,758 shares in the class,” Delaware Vice Chancellor Travis Laster drily noted in an opinion Wednesday. Oops! Somehow shareholders owned 33 percent more Dole Food shares than there were Dole Food shares.

Huh. So. The simple explanation would be “a quarter of those people were lying,” but nope. Almost all the claims were valid, 2 or at least, “facially eligible.” So the lawyers sheepishly went back to Vice Chancellor Laster to explain what happened and ask what to do about it.

What Happened? Two Things. The First One Is Just A Pure Pointless Mess. Essentially The Way Everyone Owns Stock Is:

- Cede & Co., a nominee of the Depository Trust Co., owns all the stock in all the companies.

- DTC keeps a list of its “participants” — banks and brokers — who “really” own that stock, and how much each of them own.

- The participants, in turn, keep lists of “beneficial owners” — people and funds — who really really own the stock, and how much each of them own.

So if you own stock, what you really have is an entry in your broker’s database, and your broker in turn has an entry in DTC’s database, and DTC (well, Cede) has an entry in the company’s database of shareholders of record.

If you sell the stock, your broker takes it out of your account (at your broker), and DTC takes it out of your broker’s account (at DTC), and DTC adds it to the buyer’s broker’s account (at DTC), and the buyer’s broker adds it to the buyer’s account (at the buyer’s broker). As far as the company is concerned, Cede owned the stock the whole time.

If this all makes your head hurt, you are not alone. Sometimes it makes DTC’s head hurt too, and it needs to lie down for a while in a dark room and listen to soothing music. DTC calls this a “chill.” I am not kidding. 3

So when there’s a merger that’s about to close, it’s too crazy for DTC to both keep track of trades and deal with getting the merger payment to shareholders. So DTC will place a chill on the stock, and just not record trades for the three days leading up to the closing. From Wednesday’s opinion 4 :

DTC placed “chills” on its records for its participants’ positions in Dole common stock as of the close of business on November 1. A “chill” restricts a participant’s ability to deposit or withdraw the security. Once DTC initiated the chills, the participants’ positions in Dole common stock were locked in and could not change.

Nov. 1, 2013, Was The Closing Date, 5 But The Chill Effectively Covered The Three Previous Days:

DTC’s centralized ledger did not reflect all of the trades in Dole common stock on the day of the merger or during the two days preceding it. Under the current standard of T+3 for clearing trades, DTC did not receive information about all of the transactions that took place on October 30, October 31, or November 1.

This doesn’t actually mean that you couldn’t trade Dole stock in the three days leading up to the merger closing. You could, and lots of people did. About 32 million shares traded in those last three days. 6 It just means that DTC doesn’t want to hear about it. DTC was chilling. Instead:

The DTC participants who facilitated transactions that had not yet cleared when the merger closed were responsible for properly allocating the merger consideration among the parties to the transactions.

As far as DTC was concerned, whoever owned shares as of the close on Oct. 29 owned the shares at the time the merger closed. If you sold your shares after that time, your broker and the buyer’s broker — the DTC participants — had to sort that out themselves.

You can see why this would be a problem for the current Dole lawsuit. If you owned a share of Dole stock as of Oct. 30, DTC thinks you owned it at closing. If you sold the share to me on Oct. 31, my broker (and your broker) thinks that I owned it at closing. It’s just one share, but it has turned into two shares as far as “facially eligible” claims go. 7

This is a weird problem: If you owned the stock on Oct. 30, and then sold it before the closing, you’re kind of a jerk for submitting a claim pretending that you owned the stock at closing. 8 But this all happened a pretty long time ago and maybe you forgot.

Fortunately this problem is solvable. The solution is simultaneously trivial and extremely difficult. The key thing to realize is that those trades in the last three days happened, and somehow the original merger consideration — the $13.50 a share paid on Nov. 4, 2013 — found its way to the people who really owned the stock at the end of Nov. 1.

DTC might not have had a complete and up-to-date list of them, but DTC’s participants had mechanisms to get the money to the right place. (Intuitively: If Broker A sold shares to Broker B on Oct. 31, DTC would send the merger money to Broker A on Nov. 4, and Broker A would pass it along to Broker B, etc.)

Whatever voodoo they did back then, they could probably do again. The problem of distributing the $2.74 can be reduced to a previously solved problem, the problem of distributing the $13.50. So it is trivial.

It’s also kind of hard, in that the brokers have to go back and figure out who actually owned the shares at the time, but that’s their problem.

The Delaware vice chancellor concludes that for him to figure out who actually owned the shares, or for the lawyers to figure it out, “would be lengthy, arduous, cumbersome, expensive, and fundamentally uncertain,” and “functionally impossible” to do “in a practical or cost-effective manner.” That sounds hard! So the lawyers suggested, and the judge approved, letting the brokers figure it out instead:

Under this method, it will be up to the DTC participants and their client institutions to resolve in the first instance any issues over who should receive the settlement consideration. Shifting the burden to them is efficient because they already had to address these issues for purposes of allocating the merger consideration.

If new issues arise, the DTC participants and their client institutions have access to their own records, and they have visibility into the terms of their contractual relationships, such as the terms on which shares are borrowed.

Any ensuing disputes are between the beneficial owners and their custodial banks and brokers. Those disputes should be resolved pursuant to the contractual mechanisms in the governing agreements or, if necessary, through a judicial proceeding limited to the parties.

There might be lots of issues, but they won’t be the court’s problem. Good solution.But there is another problem that created extra Dole shares. This is also a mess, but not a pointless one. It’s a real economic issue, and also one that people seem to get emotional about. It is: short-selling.

Some Quick Background. The Way Short-Selling Works Is:

- Mr. A owns a share of stock.

- Mr. B borrows Mr. A’s share of stock.

- Mr. B sells the share to Mr. C.

But now Mr. A and Mr. C each own one share of stock. Where there was only one share, now there are two. A “phantom share” has been created. Well, not really. The trick to balancing the books is to remember that Mr. B owes Mr. A a share of stock. So Mr. B now owns negative one share of stock. There’s a total of one share: one for A, and one for C, and negative one for B. One plus one minus one is one. It’s no problem. 9

“But what if …,” you start to ask, and I reply: Shh, shh. It just works. What if the company pays a dividend? Well, Mr C. physically possesses the share — don’t think too hard about that metaphor — so the company pays the dividend to Mr. C. But Mr. A also owns the share, and he wants the dividend too.

But it’s OK, because Mr. B owns negative one share, so he has to pay a dividend. So he pays the dividend to Mr. A. 10 In practice, this is all intermediated through brokers, and Mr. A is unlikely to ever find out that his share was borrowed or that he got his dividend from Mr. B. For Mr. A, the whole thing just works quietly and seamlessly. It’s magic.What if the company is acquired in a management buyout for $13.50 in cash? Same thing.

The company sends $13.50 to Mr. C. Mr. B sends the $13.50 to Mr. A. The two owners of the one share of stock each get the full $13.50 merger price for that one share of stock. Mr. B, who is short one share of stock, pays one merger price. Everything works. 11 It just works. It’s still magic.

What if the company is acquired in a management buyout for $13.50 in cash and then, three years later, a court adds another $2.74 in cash to the merger price? Same … wait. I have no idea. The magic might break down here. As the court points out:

The shorting resulted in additional beneficial owners who received the merger consideration, who fell within the technical language of the class definition, and who could claim the settlement consideration.

Meanwhile, the lenders of the shares, not knowing that the shares were lent, also could claim the settlement consideration.

This is another means by which two different claimants could submit facially valid claims for the same underlying shares.

That’s basically true of the original merger consideration, too. There, brokers would owe merger consideration to people who owned more shares than actually existed, and they’d go get that extra consideration from the short sellers. Everything balanced out. Maybe that will happen here too. But it’s harder. If you were short Dole Food stock on Nov. 1, 2013, you were doing it in an account with a broker. You posted collateral in that account.

When it came time to collect the $13.50 from you, the broker had no problem collecting it. But that was three years ago. If the broker comes back to you now for the extra $2.74, you might feel entirely within your rights to reply “new phone who dis?” You might not have an account with that broker any more.

You might not even exist any more. (People die; hedge funds close.) You certainly haven’t been posting collateral against your Dole Food short position for the last three years. That position was closed out ages ago.

Anyway This Could Account For Millions Of The Phantom Shares:

As of October 31, 2013, traders had shorted approximately 2.9 million shares of Dole common stock. Because the price of Dole common stock traded above the merger price through closing, it is likely that traders shorted additional shares on November 1, resulting in even more shares in short positions as of closing.

So that’s a fun one! I don’t know how the brokers will deal with this problem, but I will just quote the court and say: “Any ensuing disputes are between the beneficial owners and their custodial banks and brokers.” Let us wash our hands of them.

Isn’t this such a delightful muck? As Vice Chancellor Laster writes:

This problem is an unintended consequence of the top-down federal solution to the paperwork crisis that threatened Wall Street in the 1970s. Through the policy of share immobilization, Congress and the Securities and Exchange Commission addressed the crisis using the 1970s-era technologies of depository institutions, jumbo paper certificates, and a centralized ledger.

It’s enough to drive even a sensible vice chancellor to talk about blockchains 12 :

Distributed ledger technology offers a potential technological solution by maintaining multiple, current copies of a single and comprehensive stock ownership ledger. The State of Delaware has announced its support for distributed ledger initiatives.

I want to push back on that a little. There are two problems in this case. One is mechanical: figuring out who actually owned Dole stock as of the closing date three years ago. A blockchain would presumably solve that problem, without requiring the court and the lawyers to embark on a “lengthy, arduous, cumbersome, expensive, and fundamentally uncertain” dive through the records to figure out who owns what. But the current system also solves the problem, without requiring the court and the lawyers to do anything arduous or expensive. They just send the problem off to the current ledgering system — DTC and the custodian brokers and so forth — and that system deals with it. It’s like a blockchain, only it’s made up of hundreds of humans and computer systems at dozens of banks, glued together in a way that somehow more or less works. It’s not even expensive. “DTC advised class counsel that this process is feasible and requires payment of a base fee to DTC of $2,250, with the potential for additional consultation fees if difficulties arise.” 13 That’s like 0.002 percent of the amount being distributed. It does seem like a half-competent blockchain would be faster and cheaper and more transparent. But the idea that the current system can’t solve this problem is wrong. The current system can solve it fine. Just not in a way that any individual human can see or understand. The solution is, let’s say, distributed.

The other problem is economic: People owned more Dole shares than actually existed, because they bought them from short sellers, and now if you want to pay off all the owners, you have to track down the short sellers to make them pay up. That problem is hard, and it seems like the current system might have real problems with it: If the short sellers died, or went out of business, or closed their accounts, or just really don’t want to pay some extra merger consideration three years after the fact and yell a lot when their brokers ask them to, then the brokers will have a hard time finding all the money. Would a blockchain fix this? I don’t know. A blockchain would make it easy to identify the short sellers, three years later. (That’s what blockchain immutability is good for.) But then what? They could still have died, or closed their accounts, or yell.

But, sure, Delaware, and Vice Chancellor Laster, are not wrong that a distributed ledger system to keep track of who owns what shares in real time would make all of this a lot easier. 14 And I can see why Delaware is thinking about it. This is not the first time we have talked about the antique goofiness of the current system, and how it messes with mergers. Dell Inc. also did a management buyout, and a Delaware court also found that its shareholders should have gotten paid more. But some of those shareholders who should have gotten paid more didn’t, because of two separate failures to grapple with the convoluted registry system. (Some of them failed to own their shares the right way. Others failed to vote them the right way. Neither was entirely the investors’ fault.) That system has worked pretty well for 40 years. But it is starting to show its age. There are little cracks that give us brief glimpses of the abyss below. Why not cover them up with a fresh, cool coat of blockchain?

- I’m eliding some details here. The 2015 decision combined class action and appraisal claims for a class including all of the Dole shareholders other than Murdock and his affiliates. That was a total of about 54.1 million shares. “This decision likely renders the appraisal proceeding moot,” the vice-chancellor found then. But the subsequent class-action settlement excluded the appraisal claimants, who had their own lawyers and took care of themselves separately. They had about 17.3 million shares. The other 36.8 million shares, covered by the class action, are what we’re talking about here. Their payout comes to about $115.8 million, including interest (but before deducting attorneys’ fees).

- They did kick out 48,758 shares after double-checking.

- I mean, I am about the lying down in a dark room with soothing music. But not about the “chill.”

- Citation omitted.

- It was a Friday; the merger consideration was paid out on Monday, Nov. 4.

- Most of them in the last two days. By comparison, the average daily volume over the previous year was about 1.3 million shares.

- From the opinion:For purpose of the settlement, multiple owners could submit claims for shares involved in trades that had not cleared. A DTC participant who continued to hold the shares as reflected on DTC’s records could submit a claim, but so could the beneficial owner who was a client of the DTC participant that acquired the shares and therefore owned them as of closing. Both claims could appear facially valid even though they involved the same underlying shares.

- Though I mean I see your point. Murdock paid $13.50 in cash in the merger; the court ultimately found that he should have paid $16.24. If I owned the stock at the closing, I got $13.50, and am now entitled to get the extra $2.74. But if I bought it from you the day before the closing, I paid you about $13.55 (the closing price on Oct. 31). The extra $2.74 (or $2.69) is kind of a windfall to me. You, on the other hand, might have been a long-term shareholder who thought Dole was destined for great things, who voted against the underpriced merger, and who finally sold in disgust the day before it closed. In a real sense Murdock’s underpayment harmed you, not me. But, whatever, the deal is that the people who owned stock at closing are the ones who get the extra payment. And to be fair that was priced in: The stock closed at $13.55 the day before the merger closed, and a whopping $13.65 the Friday of the closing. And then the next Monday all those buyers got cashed out for $13.50, as they knew they would be. Presumably they only paid over the merger price because they thought they might get a second chance in court.

- People sometimes complain about “naked short selling” creating “phantom shares,” which they demonstrate by pointing to the fact that people own more shares of Company XYZ than there are shares outstanding. But this is no problem at all, is true of every company, and has nothing to do with naked short selling. “Naked” short selling means selling stock short without borrowing it. That is mostly illegal. It would indeed create “phantom shares.” But so does regular, clothed short selling. Either way, the trick is that the person doing the short selling — naked or otherwise — now owns a negative number of shares, which precisely balances out the “phantom shares” that the short selling creates.

- This is covered by Section 8 of the Master Securities Loan Agreement. But for our purposes let’s just pretend it happens by the operation of magic.

- This also seems to be covered by Section 8 of the MSLA, though … less clearly? Everyone seems to think it works, though.Again this all happens through DTC, brokers, etc. Like realistically what happens is:

- There are like 1000 shares outstanding.

- The company pays $13,500 to Cede & Co.

- DTC looks at its books and sees that Broker X owns 100 shares.

- Cede pays $1,350 to Broker X.

- Broker X looks at its books and sees that it has customers who own 150 shares, and other customers who are short 50 shares.

- Broker X bills those short customers for $675.

- Broker X takes that $675 from the shorts, and the $1,350 from Cede, and gives it to the long customers.

- Everything checks out.

- Albeit in a footnote.

- The lawyers “have budgeted $10,000 for additional consultations.”A de- centralized ledger to keep track of who owns what shares in real time would solve these issues. (The move to T+2 settlement will also help) The key thing is updating the share registry in real time on the blockchain.

Updated: 9-30-2019

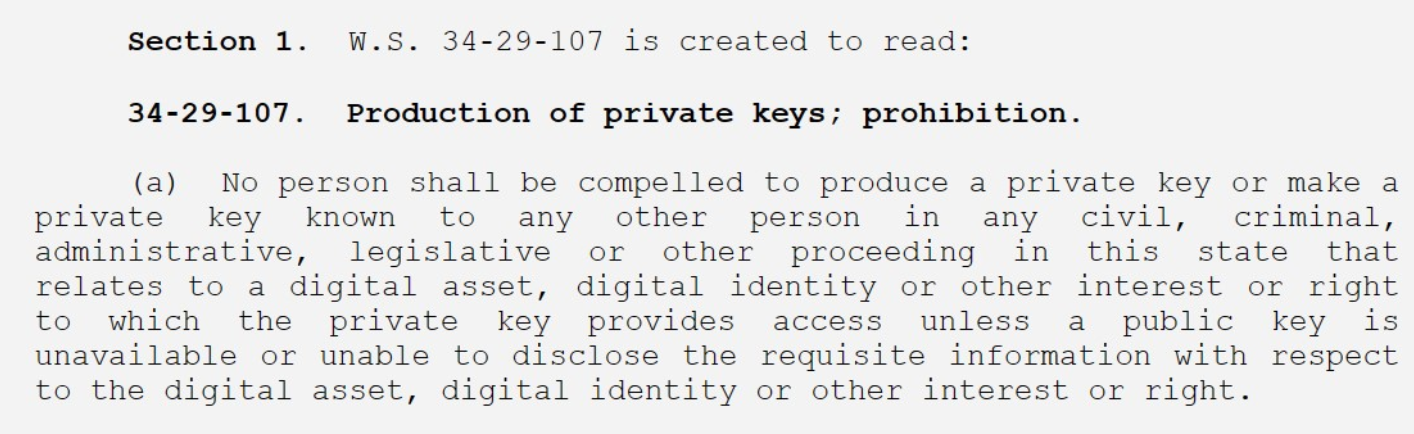

Caitlin Long: New Wyoming Law Will Protect Privacy of Wallet Keys

Wyoming Blockchain Coalition president Caitlin Long hinted at two new prospective state laws she believes will be highly popular among cryptocurrency developers and owners.

In an interview during Peter McCormack’s podcast on Sept. 27, the 22-year Wall Street veteran and cryptocurrency activist reflected on the pioneering crypto legislation already passed — and reportedly planned — in her home turf, the United States state of Wyoming.

New laws would protect blockchain developers as well as privacy of wallet keys

According to Long, the first of the two new laws to reportedly be proposed will state that:

“Anyone in the state of Wyoming cannot be compelled in a criminal or civil or administrative or legislative hearing or anything, any other proceeding to disclose [their] private keys.”

The second, she continued, would bolster protections for open-source developers and ensure that they cannot be prosecuted solely on the basis of misuse of the code they have written.

She underscored that if the law passes, developers will not be “criminally prosecuted solely for having written code” nor be held liable for others’ use of their code, malicious or otherwise.

A Potted History Of Wyoming’s Crypto Legislation

As previously reported, America’s least populous state has approved a steady stream of proactive blockchain and cryptocurrency-related legislations.

At the end of January, Wyoming Senate passed a bill — later passed by the House on Feb. 14 — that allows for cryptocurrencies to be recognized as money. The bill places crypto assets into three categories:

Digital Consumer Assets, Digital Securities And Virtual Currencies.

Also in January, Wyoming passed a bill defining certain open blockchain tokens as intangible personal property, as well as a bill pertaining to the creation of a fintech regulatory sandbox.

This February, Wyoming passed two further blockchain-related bills on tokenization and issues with compliance.

In early 2018 both the Wyoming Senate and House of Representatives passed a bill that relaxed securities regulations and money transmission laws for certain tokens offered via an initial coin offering (ICO) in the state.

A separate house bill regarding the exemption of virtual currencies from the Wyoming Money Transmitter Act was passed by the Wyoming state legislature in March 2018, as well as a house bill exempting virtual currencies from state property taxation in February. Yet, further pro-crypto and blockchain senate and house bills had already been passed into Wyoming law.

Earlier this month, Long responded to the recent unrest in the money markets with an analysis of the systemic fragility of the traditional financial sector as compared with Bitcoin (BTC).

Updated: 10-24-2019

PODCAST: Caitlin Long On Bitcoin As Insurance Against Financial Collapse

“To me, it’s an insurance against instability in the mainstream financial industry,” said Caitlin Long, one of the most experienced Wall Street professionals to defect to the crypto space.

“I think about, ‘What’s the probability that the mainstream financial industry goes poof?’” she continued, adding:

“That’s how I think about the asset allocation to bitcoin in my own portfolio. Specifically, what I mean by that is it’s the settlement system risk that’s the issue. I’m not talking about price risk. Obviously, bitcoin’s more volatile than most traditional financial assets, but bitcoin is less volatile from a systemic perspective than I think the traditional financial industry is.”

Long spoke with CoinDesk for one of the inaugural episodes of Bitcoin Macro, a pop-up podcast featuring the speakers and themes of CoinDesk’s upcoming Invest: NYC conference on Tuesday, Nov. 12.

Listen to the podcast here or read the whole transcript below.

The last six months have seen a growing dialogue between the bitcoin industry and the larger global macro community. No longer written off as some ignorable niche, increasingly people are asking: Is bitcoin a macro asset? Is it a safe-haven asset? How will it perform in the next recession?

After 20 years in corporate finance, Long began going to bitcoin meetups, eventually falling all the way down the rabbit hole and coming to provide a vital bridge for colleagues in both spaces. In particular, her leadership in Wyoming blazing a trail for pro-crypto, pro-innovation regulations serves as an example around the country and beyond.

In This Episode Of Bitcoin Macro, Nolan Bauerle Sat Down With Long To Discuss:

Why she believes her early interest in bitcoin could have gotten her fired from Morgan Stanley.

Why bitcoin is a macro asset, but only for a very small niche (and why it isn’t ready for mainstream institutions just yet).

Why bitcoin isn’t likely to represent a safe haven asset in short-term blips – but could be powerful in the context of a major shock.

Why more traditional financial institutions are dipping their toes in, but only through VC and other risk structures (not through self-custody).

Why Wyoming is poised to do for the crypto industry what South Dakota did for the credit card industry.

Emerging issues with bitcoin lending.

Why the most interesting chart to Long is the bitcoin hashrate and the spread between household net worth and non-financial sector debt in the United States.

Nolan Bauerle: Welcome to Bitcoin Macro, a pop-up podcast produced as part of CoinDesk’s Invest New York Conference in November. I’m your host, Nolan Bauerle. Both the podcast and the event explore the intersection of bitcoin and the global macroeconomy with perspectives from some of the leading thinkers in finance, crypto and beyond.

For this podcast, we’re trying to do things a little bit differently, where we’re going to create a series of questions for each of our speakers to really capture one of our themes and to highlight some of the subjects that will be on stage in November. This year’s theme really is around bitcoin, how bitcoin is behaving in the world today given all of these circumstances that we’re seeing in the global economy. Today, I’m joined by Caitlin Long, one of the most famous Wall Street defectors, refugees, I’m not sure what to call it.

Caitlin Long: Yep.

Nolan Bauerle: But certainly one of the most famous names to first enter the industry. So Caitlin Long is now in Wyoming doing important work over there to create, I think, a jurisdictional arbitrage I suppose we could call it for everyone in America to know that there is at least going to be one state that has exercised its rights to welcome this new form of finance into its borders. So, Caitlin, welcome. Thank you.

Caitlin Long: Thank you. It’s great to be here.

Nolan Bauerle: Well, we’re really excited. I mean, I have this idea that you can kind of get a sense of the history of Bitcoin by the human capital that started to be attracted to this industry. So, of course, it was the cypherpunks to start because this had been their project for a long time. And then there was a political slant. A lot of, let’s say, libertarians or anarchocapitalists came along, and they were sort of generation two. The third generation, as far as I can tell that really jumped in two feet first, was Wall Street. It really was the first sort of non-sentimental group that joined. There wasn’t really a large end game other than this trades, this is interesting, this is a finite digital resource, we can do stuff with this. I’ve never quite understood where you fit in that. So when and how was it that you turned towards this?

Caitlin Long: I think it was that second group. I found it through Austrian school economics circles even though I was working on Wall Street at the time. I kept my head down for fear of being fired at Bitcoin meetups and the like that I went to on my own time and dime after hours and on weekends. I learned a lot, but also just kept it very quiet that I was running a business at Morgan Stanley. I just didn’t want that to break into the press at the time. That probably would’ve gotten me fired.

Nolan Bauerle: And a significant business at Morgan Stanley?

Caitlin Long: Well, yeah, it’s a pension solutions group. I dealt with a lot of company plan sponsors of big pension funds, helped a lot of them settle, did big transactions for GM, and Verizon, and Bristol Myers Squibb, Motorola, et cetera. Through that, I got to really understand where the problems are in the mainstream financial system. I encountered them myself directly and figured out, not immediately… It took a little while for me to realize that this technology called blockchain was actually going to be the solution to a lot of those problems.

Eventually, I popped my head up and the chief technology officer of Morgan Stanley called me because he saw me on a Bitcoin forum. That was about 2014, so almost five years ago or so, and started working together to vet all of the startups that we’re calling Morgan Stanley at the time. What was fascinating about it is he’s a huge skeptic, and it was really helpful to me to work with somebody like that because it pushed me to become a better person in my own arguments. So far, we’ve both been right. Bitcoin hasn’t died. It has become something. Institutions are coming into it, but he’s also been right that this was all a lot slower than I think many of us anticipated in the early days.

Nolan Bauerle: Well, it sounds like the anti-fragility aspects of this technology that we love were added to your own understanding of it. So nothing wrong with being challenged and understanding how to solve other people’s problems when they become your own when you understand more of them, when people bring them up. So to jump in now to the questions, we’re really focused on how Bitcoin is behaving in today’s global economy. So the first question is, is Bitcoin a macro asset?

Caitlin Long: Yes. But for a very small niche. It’s uncorrelated. It has obviously very high volatility. It’s not ready for prime time for big institutions just yet.

Nolan Bauerle: So the way I’ve been trying to frame this is we’ve got sort of the main stage of global finance, or global economics, and all the changes that we’re seeing around us. So we’ve got this main stage. We’ve got people waiting in the wings to come onto the main stage and maybe some chorus singers in the background from the main part of the stage. Where would you put Bitcoin right now? Is it in the wings waiting to enter the main stage in global finance? Or is it a core singer who’s already on stage, but we don’t know what they’re going to do yet?

Caitlin Long: Oh, it’s definitely waiting in the wings. There’s some very basic issues that I spotted as a former ERISA fiduciary. ERISA, as you may know, is the highest standard of care for institutional asset managers. ERISA fiduciaries have personal liability. I was personally sued as a fiduciary of Morgan Stanley’s pension fund, named personally in a lawsuit. When that’s your standard, you have to be very, very careful. Some of the basic things about Bitcoin need to be ironed out before it’s ready for a ERISA prime time. For example, what’s the exact legal status of the asset? Do I know I actually have clear legal title when I buy a Bitcoin? Obviously, if I have private keys, I know I possess it, but is a judge can recognize that?

And then obviously all of the custody issues surrounding it as well. It’s not a security so there are a lot of folks, like Fidelity for example when it got into the custody business, did not pay homage to the phrase qualified custodian because only securities need to be held by a qualified custodian. But the reality is that the vast majority of investment managers are using custodians for everything. They’re not set up to self-custody assets, so custody is a huge part of what needs to get solved before we start getting ERISA-level investors into this asset class, which I think is coming but we’ve got a few steps to get there first.

Nolan Bauerle: When you were talking about the ERISA aspect of it, I was unaware there was much skin in the game for a lot of people managing money on Wall Street. But apparently, this is an example of it.

Caitlin Long: Oh yeah. ERISA’s a process statute. You have to ask the questions. It doesn’t hold you, the fiduciaries, liable for the outcome. What it does is hold them liable for having examined all of the options. It’s a process statute.

Nolan Bauerle: Got it. Got it. Got it. Within the context of some of the more volatile countries that we see in the world today, so we’re even seeing that volatility come back to the renminbi with the recent devaluation. Is Bitcoin a safe-haven asset?

Caitlin Long: I think so. Obviously, Cyprus is the example of that where you see a so-called left-tail event, you see a real run on the financial system. That’s the place where Bitcoin can really shine. I think that’s coming in multiple iterations, but we’re not there yet. We’ve just experienced the repo market meltdown related to the end of the third quarter for the big financial companies that have trouble funding themselves over the September 30th date. You know, Bitcoin actually traded down in the face of that. So it’s not exhibiting in the short-term for what is probably a minor blip that’s not going to be the big one, so to speak. Bitcoin isn’t trading as a safe-haven asset, but if we hit a big one, that’s when I think its day will really come.

Nolan Bauerle: When more of this modern monetary theory sort of takes hold and even more mistakes are made, perhaps that’s the opportunity?

Caitlin Long: Yeah, absolutely. To me, it’s an insurance against instability in the mainstream financial industry. I think about, “What’s the probability that the mainstream financial industry goes poof?” That’s how I think about the asset allocation to Bitcoin in my own portfolio. Specifically, what I mean by that is it’s the settlement system risk that’s the issue. I’m not talking about price risk. Obviously, Bitcoin’s more volatile than most traditional financial assets, but Bitcoin is less volatile from a systemic perspective than I think the traditional financial industry is.

When we buy treasury bonds in our brokerage account, we don’t own the treasury bonds. We own an IOU from our broker-dealer. So it’s really the settlement risk that’s the issue, and that’s where I see there’s tremendous instability. The left-tail risk is higher than we all think it is in the traditional financial sector. The severity, if it goes bust, is also extraordinarily high. So when I compare that to Bitcoin where I can own my asset outright taking 20% price volatility as an insurance policy to me doesn’t feel like a bad trade-off at all.

Nolan Bauerle: Especially when you look at the, let’s say there’s much more of this coming. We’ve seen Argentina recently, so there we’ve already seen Bitcoin behave as a safe-haven asset simply because the options were so limited. In the United States, we saw this sort of liquidity crunch already before the 2008 meltdown. When these same signs were coming forward in 2006, there was these similar liquidity crunches. People were not able to get the kind of liquidity they required and very similar things were going on.

Of course, Satoshi Nakamoto, I’ve always believed that the Japanese pseudonym was really to have the kind of experience or authority to say to America that, “What happened in Japan is now on your shores.” So where do you see some of those? What I mean by that, what happened to Japan in the last decade, they really are now addicted to quantitative easing. They’re never going to get out of it. It doesn’t look like they’ve got their demographic crunch going on, and Abenomics are just going to be the thing there. So I’ve always had it in my mind that what we were really hearing from, through the pseudonym, Satoshi Nakamoto, was kind of a finger wag to say to America that, “You actually broke your monetary policy leavers. Their broken. You can’t use them anymore.” Do you see that continuing, and do you see Bitcoin being able to really thread the needle on this?

Caitlin Long: Oh, yes. The system broke in 2008, and we’ve been band-aiding it ever since then. In fact, actually this repo episode we were just talking about is the fourth such episodes since 2008. Now, the vast majority of people didn’t even understand that because they’re not watching the plumbing of the financial system. But it’s very obvious that the plumbing in the financial system has been fundamentally broken since 2008, and the only reason that the system hasn’t hit a wall yet is because it’s been drugged with continued injections of liquidity, which is essentially just the central banks socializing losses, which is a problem because profits are privatized and losses are socialized in the traditional financial system. A lot of people have the right intuitive feel that that’s unfair, and it is.

But I think that the challenge is that we don’t know when this is going to come to a head. I look at one really important data point, which is, “What’s the household net worth in the United States relative to the total amount of non-financial sector debt?” Right now, there’s a spread between the two of several trillion dollars. That tells me that basically there’s still balance sheet left in the United States for debt to still be piled onto the United States economy. That’s why we haven’t seen the financial system hit the wall yet. That’s why interest rates are still higher in the U.S. and they are in other countries. When you see negative interest rates, it means there’s no balance sheet left in that country. The only reason they haven’t totally hit the wall yet is because the financial system is global and so interconnected, and the U.S. is carrying the rest of the world. But that U.S. balance sheet is going to get used up at some point, and that’s likely when we see a regime change.

Nolan Bauerle: When I think of Bitcoin’s behavior over the past few days, of course, this breaks the narrative a little bit. It’s always been expected that Bitcoin, given these circumstances, would just perform. We’ve got a lot of rumors of or whispers of a recession. The same idea, there’s a certain conviction that Bitcoin will behave well in a recession. In your opinion, what happens to Bitcoin in a recession given what we’ve seen in the past few days?

Caitlin Long: I think it totally depends on the severity of the recession. If it’s just a blip… Like, we just talked about this is the fourth such repo episode, we didn’t see Bitcoin correlate to strong performance in the previous ones because frankly, only financial market participants who were paying attention and the issues in the money markets didn’t spill over into the mainstream economy. They are spilling into the mainstream economy now. But yet, as we start to see that this is the most severe such repo market episodes since 2008, will it come close to 2008? We don’t know yet. It’s not over at least in the short-term.

We’re taping this on the Friday before quarter-end, before September 30th. It doesn’t look like you’re going to see a bank hit a wall before September 30th but to be clear, this was a pretty important, pretty painful episode. There was clearly a bank, or two, or more out there that wasn’t going to be able to fund themselves past the end of the third quarter without an emergency bailout from the Fed, which is exactly what happened. Banks are supposed to be well-capitalized, right? The Fed, just in June, came out and talked about the resilience of the financial system and let all the big U.S. banks buy back stock and pay dividends. Now, three months later, the Fed’s having to come to the rescue to inject cash into the system. It’s obvious to me that the banks are under-capitalized still. I’ve known that for years, but we’re just seeing yet another example playing that out.

Nolan Bauerle: It is a funny image, the idea of these large banks basically asking for overdraft protections from their bank. You can imagine the scene, it looks pretty ridiculous.

Caitlin Long: Yeah. Obviously, the Fed knows who it is. There are a lot of rumors in the marketplace, but at this point, the bank lived to fight another day and it doesn’t necessarily mean that it’s going to hit a wall at some point. But you can look at the stock prices, particularly of the big European banks, where interest rates are negative and have been for quite some time. It’s pretty obvious who some of the logical candidates are for funding problems. At some point, the balance sheet of the United States is not going to be able to carry the entire world on its shoulders.

Nolan Bauerle: Mm-hmm (affirmative). Mm-hmm (affirmative). Yeah. That’s an original take. I haven’t heard that yet, but I see it the moment you mentioned it. Moving on to the next question, you’re somewhat removed I would say from Wall Street these days given that you’re committed to that wonderful project out in Wyoming. But I’m still curious if you’ve been able to pick up if the narrative around Bitcoin has changed within the main mainstream financial world over the last six months?

Caitlin Long: Sure. I still talk to a lot of folks on Wall Street, very much in touch with friends over the years. The answer is yes, but it’s still folks who are dipping toes and getting off zero, as Pomp likes to say, are doing it in their venture portfolio allocation. This is high-risk stuff. This is not even any sort of significant allocation in portfolios. It’s just a small allocation within the venture allocation, which is typically not that big anyway. So we’re seeing toes dip into the water so far because of the timing of when some of those small pension funds got in that the returns have been amazing. But it’s still not a mainstream thing, and it’s all being done through VC structures. I’m not aware of any of the big pension funds that are directly buying in self-custody in Bitcoin. So far, that’s only been hedge funds, and it’s still not even that mainstream among hedge funds.

Nolan Bauerle: That, to me, sounds a lot like the, let’s say, behavior of Bitcoin in mainstream financial world. Has there been any change in the way they might think about it? So that’s not even about the commitment of any capital allocation. But if they said, “Oh yeah, look, we saw this trade war between America and China erupt. Oh look, there was a lot of flow out of China in the OTC desks towards Bitcoin. Oh, I get it. That makes sense. There’s this a way to hedge the devaluation over there in capital controls.” Is there stuff like that that people have said, “Oh, it clicked”?

Caitlin Long: No. But I’ll tell you what, they’re doing for the personal portfolio. Again, when you’re in a fiduciary asset management status, the asset managers don’t have personal liability like an ERISA fiduciary does but they’re fiduciary for their customer’s assets. It’s just not ready for prime time yet. I can’t underscore enough how those basic issues that I mentioned earlier, being able to know definitively that you got clear legal title to the asset. That sounds so basic, but to be honest, the vast majority of law all around the world doesn’t recognize digital assets and it doesn’t fit into the traditional categories of commercial law. Commercial law is what I refer to as the base layer of the legal system. It tells you what the rights and obligations of parties to a commercial transaction are, and it gives a judge a roadmap for handling disputes.

Until you have that clarity, the vast majority of institutional investors just can’t touch it from a fiduciary perspective. This is why Wyoming has done something really important because we’ve clarified those things, and we’ve also set up a digital asset custody regime that respects how Bitcoin works rather than trying to force it into the status quo of custody, which is… I’ve had all kinds of problems with it in my pension business. We can talk about if you’re interested in hearing, but the gist is Wyoming’s actually solving these basic issues and it’s the only place within the United States.

My personal bet, part of the reason I moved back here from the New York area this summer, is we’re going to end up in Wyoming what South Dakota is to the credit card industry. South Dakota grabbed the entire credit card industry away from New York State in the early 1980s because New York had a very low cap on its usury rates under New York law that it was not willing to change. South Dakota, when interest rates and short-term rates went to 21% in under the Volcker Fed, South Dakota said, “We’ll take our usury law cap off. Come out and head to South Dakota. You’re welcome here.” Forty years later, we’ve got in South Dakota, 16,000 jobs. That’s the same is going to be true in Wyoming if this plays out the way I hope and actually think it will. This is going to be the home of digital-asset custody.

Nolan Bauerle: Yeah. When you mentioned that point about the law, what I find so strange is that the purpose of common law really is that people are free to contract. I’m free to say this thing has value, and you’re free to come up with a price. That’s all are just basic rights. It does become strange that this isn’t easily recognized. Even stranger still, when I was looking at some of the way the Chinese… I mean, I would never recommend anything about how the Chinese regime has dealt with Bitcoin. However, when it came to the OTC trades, they said something interesting. They said, “Look, this is property and a person is free to destroy their own property and do what they wish with their property.” They said, “Therefore, we cannot stop any OTC trading of a thing that we recognize as property.” It’s funny that of all places, China came up with probably the most common law interpretation of Bitcoin. I find that remarkable for the strangest reasons.

Caitlin Long: Yeah, that’s interesting. I didn’t realize that, but Wyoming did something similar. It’s logical. This is property. But, how do you fit it into existing categories of property? Is it money? Is it a security? Is it something else? Is it a commodity? So the point is until you actually have mapped these assets, specifically Bitcoin, to exist in commercial law categories, you don’t know definitively in a dispute how it’s going to be treated. I’ll tell you, one of the biggest compliments that I got for the work we’re doing in Wyoming was from a big institutional investor who reached out and said, “We aren’t touching Bitcoin until we know definitively that we’re not going to end up in a lien mess.”

The issue is that when people are lending Bitcoin, which, of course, is happening right and left now… We’ve got a number of coin-lending companies that are basically paying interest for people to deposit their Bitcoin. How are they doing that? Because, obviously, there’s no interest. But in the Bitcoin system, it’s because they’re lending it out for a spread on the other side. Right? So the issue is that there is a lien being created on that asset, and how do you know when you buy it that you’re buying it free and clear of any other liens because you can’t track the liens on the Bitcoin blockchain?

In fact, in the OTC markets, the Coinbase coins that comes directly from the miners trade at a premium. I think there are two reasons for that. One is that they’re clear from an anti-money laundering and OFAC-type perspective and you know that they’ve never got to [inaudible 00:23:31] or a sanctioned country like North Korea for example. But I think the other one is this point that we’re talking about. No one likes to talk about it because it’s boring and it makes your head explode, but it’s a really important point.

It gets back to this issue of, “How do I know I have clean title? How do I know that somebody’s not going to come back to me and say, ‘The coin lending company sold you that Bitcoin that was subject to a lien? It’s mine.’” A judge is going to look at that and they’re going to say, “Yeah, that lien was valid and you have to give it up.” This is why an institution cannot afford to take risks like this. Until they know they have a jurisdiction where it’s clear that they are able to take clean title… Believe it or not, there’s litigation in Wyoming already. There have been a couple of court cases. We’re starting to get some of the legal clarity, not just with the statute, but also the litigation in Wyoming that’s going to give institutional investors comfort to come in here.

Nolan Bauerle: Yeah, I really never had considered the full depth of an obstacle that liens would have with all the lending. That is true.

Caitlin Long: Oh, yeah.

Nolan Bauerle: There’s large volumes, over a billion in 2018, the last time I saw a full-year resume of what had gone and I’m sure it’s more this year. So that’s an important part of the industry already. Interesting.

Caitlin Long: The person who reached out to me was from a significant hedge fund, and this was five years ago. So they had identified this five years ago as an issue and stayed out of it for that reason.

Nolan Bauerle: Wow. Wow. Interesting stuff.

Caitlin Long: Yeah.

Nolan Bauerle: Well, you brought us to our last question, a chart, or a data point, or a trend that illustrates your current belief in Bitcoin’s behavior in this market?

Caitlin Long: Well, the highest correlation of Bitcoin price is to its hash rate, and we continue to see the hash power coming into the network. As long as that’s up and to the right, the general price trend for Bitcoin is going to continue to be up and to the right. Obviously, there are daily fluctuations, but that’s the chart that I pay the most attention to. At a macro level, if I could throw in one other, it’s the chart I referred to earlier which is the spread between household net worth and non-financial sector debt in the United States. As long as that stays positive, then interest rates are likely to continue to be above zero in the U.S. and we still have balance sheet to carry the rest of the world. But we’re adding another $2.5-3 trillion a year on financial sector debt in U.S. dollars, and we’re eating into that spread pretty rapidly.

Nolan Bauerle: That is a large amount. Yeah, you bring up the hash rate and it certainly did a signal this week’s price dip. That really crashed on Monday. I noticed that and hadn’t really tied the two together in my mind yet. But thanks for doing that.

Caitlin Long: It is fascinating though because that was not a withdrawal of hash rate. The way that that’s calculated is it’s probability-based in the sense that when you have a very long time to propagate a block, the hash rate looks like it’s crashing even though the hash power in the network hasn’t been withdrawn. That incident was entirely within the probability of Bitcoin. I haven’t seen an analysis of how many standard deviations around the 10-minutes average block appending time. But it was an unusual situation, but it was not a flaw in the Bitcoin network. It’s just one of those low probability but entirely foreseeable events.

Nolan Bauerle: Like, what you’re saying is basically the hash rate was wrestling with the difficulty rate more than it had been over the last little while?

Caitlin Long: Yeah. And I’m not the right person to–

Nolan Bauerle: Therefore, propagating time’s a little higher.

Caitlin Long: If propagation time was higher, yeah. I’m not the right person to explain it. Luckily, I was around some core developers who were talking about it. This wasn’t a cause for alarm, no question, but yet the press reported it as if it were. This was something that was entirely foreseeable. Bitcoin, as you know, is a probability-based system so when you get something that’s a several standard deviation event, you can’t say that that wasn’t foreseeable and you can’t say that that there are fundamental problems in the system. It’s going to happen periodically, and it has happened before. It just hasn’t happened with as many people looking at it as happened this week.

Nolan Bauerle: Interesting stuff, Caitlin. Thanks a ton for your time. For all those listeners out there, you’re going to hear a lot more of this quality content coming from Caitlin and our other fine speakers in November in New York City at Invest. Thank you for your time.

Caitlin Long: Thanks, Nolan.

Nolan Bauerle: Thank you, Caitlin.

Updated: 10-25-2019

Colorado Could Be Next In the Race To Bank Crypto (And Cannabis)

The Takeaway:

Colorado’s Office of Economic Development & International Trade has begun the process of creating special-purpose banking legislation to cater to crypto companies.

The aim is to get a bill in front of Colorado lawmakers by December.

Additionally, Colorado is exploring the option of extending crypto-specific banking laws (similar to those passed in Wyoming) in order to cater to the underbanked cannabis industry.

Colorado is proposing a joint initiative with Wyoming, New Mexico, Arizona and others to bring blockchain legislation to the attention of federal lawmakers.

Colorado could be the next Wyoming.

Following the Cowboy State’s passage of 13 blockchain-friendly laws earlier this year, its neighbor to the south is now looking to help crypto companies get bank accounts.

Earlier this month, Colorado’s Office of Economic Development & International Trade (OEDIT) hosted the first meeting of a working group focused on legislation to authorize the creation of special-purpose banking institutions in the state.

To some degree, the proposed bill will likely emulate the Special Purpose Depository Institutions (SPDI) law passed in Wyoming. Indeed, thanks to Wyoming’s work on blockchain legislation, Colorado (and other U.S. states) can save time and effort by perusing 200 pages of legislation, chock-full of banking complexity.

Colorado’s new special banking working group, convened by the OEDIT, continues the work done over the last 12 months by the Colorado Blockchain Council. In March, Colorado signed its Digital Token Act, also similar to Wyoming’s token law.

To be sure, Colorado’s proposed crypto-banking bill has some lawmaker support. Backing the initiative, State Sen. Jack Tate told CoinDesk in an email:

“My sense is that we will continue to support blockchain industry growth in the Colorado economy while at the same time look within our own government sector for practical blockchain applications that warrant funding.”

Off To The Races

The enactment of multiple state laws around crypto is good for everyone, but clearly there’s a bit of competition between states.

One attendee at Colorado’s first SPDI group meeting said his impression was it might “steal Wyoming’s thunder.”

The Colorado banking group’s roadmap was set out with military precision, according to Joseph Pitluck, CEO of FreeRange, which helps banks and trust companies manage digital assets. He told CoinDesk:

“I think Wyoming is going to be surprised. Colorado has a pretty impressive timeline for the SPDI to try and get everything lined up by December. It was less an informal discussion and more like invasion plans being drawn up, like a D-Day landing or something. They are very organized and pretty serious contenders.”

New Mexico is also looking at ways to get SPDI legislation to pass as quickly as possible, said Pitluck. New Mexico’s Legislative Council is busy drafting a version of the Wyoming bill with a view to having a hearing in mid-November, according to New Mexico House Commerce Committee chair Antonio Maestas.

In the case of Colorado, Eric Kintner, a partner at law firm Snell & Wilmer and the co-chair of Colorado’s SPDI working group said they had to “boil it down to a bi-weekly schedule to get a marker down by December.”

In terms of timelines, Kintner told CoinDesk:

“The legislature then meets for five months and this may have to go through a couple of committees because it involves banking. So we would be looking at about the end of next year.”

Not So Fast

However, former Wall Street executive Caitlin Long, the gubernatorial appointee to the Wyoming Blockchain Task Force, pointed out that it took Colorado two, 120-day legislative sessions to pass its utility token law.

The SPDI is a much heavier lift, she said, particularly when factoring in the incumbent banking system. Long told CoinDesk:

“I wish Colorado luck but I am very skeptical that they will be able to pull it off. A big reason is the incumbent banking system, which was a big obstacle to us in Wyoming and is much stronger in Colorado than it was in Wyoming.”

Kintner said he was “cautiously optimistic” when it comes to the state’s bankers. The Colorado Bankers Association has been attending Blockchain Council meetings, Kintner said.

“They have concerns that will have to be addressed,” he said, “but I don’t have a sense that they are completely opposed to it.”

Stepping back, there are various cultural and economic factors at play here. In contrast to Colorado, Wyoming is a small state with less in the way of taxes to collect. Wyoming also has a history of blazing a trail with commercially focused and innovative laws, such as the Limited Liability Company Act back in the late 1970s. Some in Wyoming feel the state lost out to other states like Delaware on LLC innovation and are keen to retain a lead with blockchain.

“Maybe they [Wyoming] need to find ways to raise revenue and they view crypto as maybe a cottage industry that might set up shop there,” said Kintner. “Maybe that works and maybe that doesn’t; I don’t know. But I don’t view this process as necessarily having to be competitive one where only one state will benefit.”

Looking ahead, Kintner even suggested a joint initiative among the likes of Wyoming, New Mexico and Arizona, to pull together with a view to being heard at the federal level.

Said Kintner:

“One of the areas that we are focused on is trying to convene kind of regional conferences where like a front range conference, so Congress will realize Wyoming and New Mexico and Arizona and Colorado all have this so why don’t we look at it at more federal level.”

Cannabis economy

Colorado has experience when it comes to creating a concerted push for federal law changes with its flourishing cannabis industry. And at the state level, the SPDI group is exploring whether it can service both the unbankable crypto realm as well as its chronically underbanked cannabis industry.

OEDIT Program Director Jana Persky Told CoinDesk:

“We are specifically asking for industries like cannabis to get involved in this working group. Right now it’s hard to say what the actual solution will be, but we are actively working to bring members of the cannabis industry into the conversation to try and find a solution that benefits as many people as possible.”

Similar to crypto, cannabis companies inhabit a regulatory lacuna and struggle to get banking services. Colorado’s cannabis industry has been hamstrung between state and federal law for some years now, and has evolved to the point that over 30 banks and credit unions quietly provide services to the multibillion-dollar industry, according to the Colorado Bankers Association.

Meanwhile, the Secure And Fair Enforcement (SAFE) Banking Act, designed to legally bank cannabis companies at the level of federal regulation, has been passed by the U.S. House and lobbyists expect there is a good chance it will go through the Senate and be signed by the end of this year.

On the subject of cannabis and blockchain potentially overlapping, Tate, the state senator, told CoinDesk:

“It’s not necessarily overlap – it’s just that those two industries face similar circumstances. … I think there is a general intellectual curiosity as to how the marijuana industry is challenged as compared to blockchain businesses, but ultimately our group is focused on blockchain technology.”

The cannabis industry is not only more mature than crypto, but the financial stakes are also higher, said Kintner.

“On the face of it,” Kintner said, an SPDI bill like the one created in Wyoming for crypto might work for cannabis too. But another consideration on the table for Colorado is lending, which would be a very different animal from the Wyoming SPDI: the latter is non-lending and not FDIC insured, requiring crypto businesses to hold reserves of cash equal to 100 percent of their deposits.

“We are not sure whether it should be something like Wyoming has done or something totally different,” said Kintner. “It’s an open question right now whether this [cannabis] fits within what we are trying to do or whether it should be separate or whether the current landscape is such that we don’t need to do anything further.”

The official position held by Colorado banks is that there needs to be a change to Federal law. Amanda Averch, a spokeswoman for the Colorado Bankers Association told CoinDesk:

“From day one, we have said the solution to the conflict of state and federal law regarding cannabis in this state is an act of Congress. I can’t really speak to blockchain and crypto which seem to be a whole set of different challenges.”

Wyoming’s Long agreed that marijuana was probably a logical motivation for Colorado to proceed with an SPBI initiative, but added:

“I don’t think the impetus for Colorado to try and copy Wyoming is marijuana. I think it’s that many people in the industry know what’s about to happen, which is about $20 billion of assets are about to come into Wyoming.”

Updated: 11-12-2019

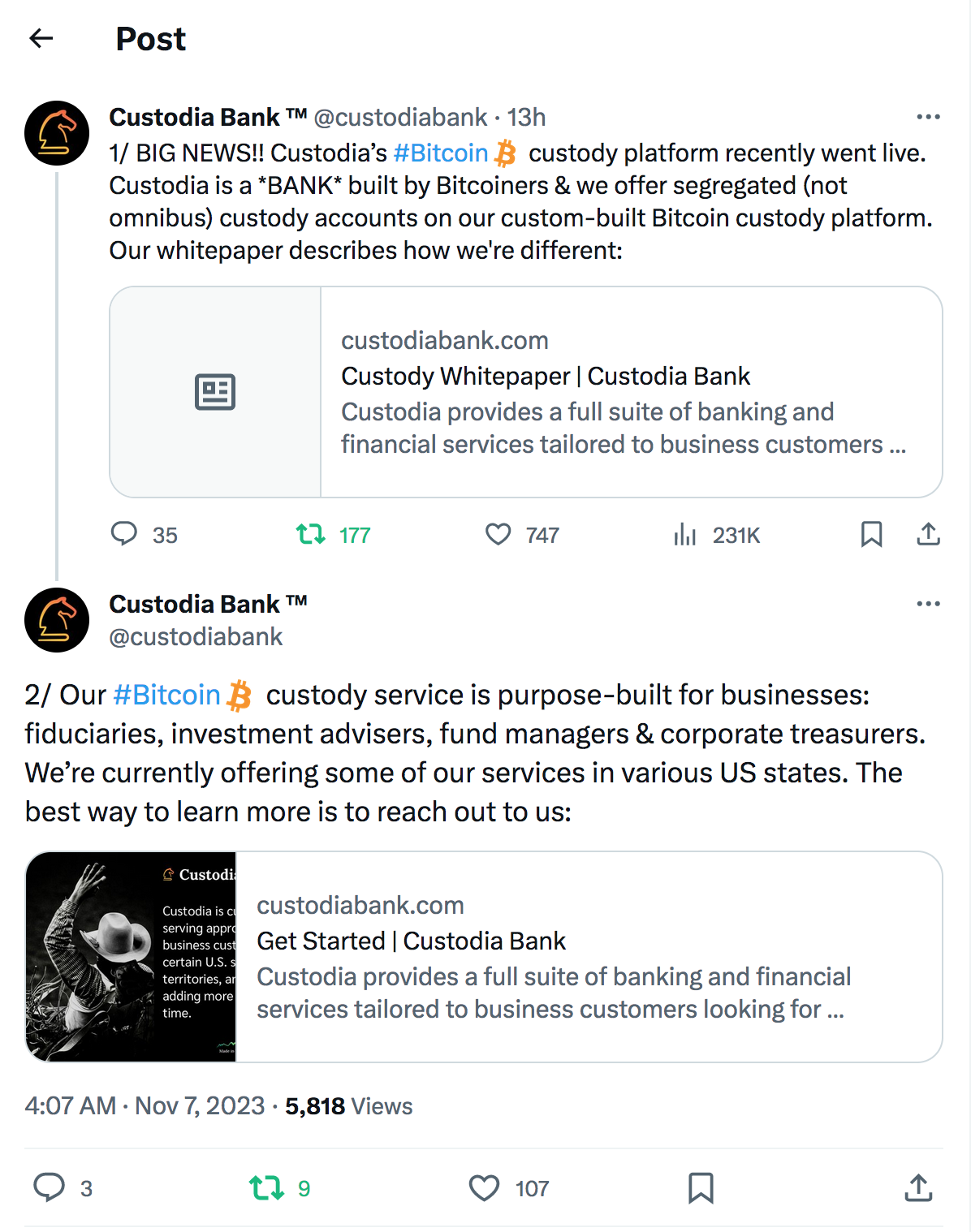

Wyoming Unveils First-Ever Crypto Custody Rules for ‘Blockchain Banks’

The United States’ state of Wyoming has unveiled a series of opt-in custody rules for its so-dubbed “blockchain banks,” covering areas such as forks, airdrops and staking.

The rules were announced during the Fordham Law Blockchain Regulatory Symposium in New York on Nov. 11, according to a thread of tweets published by Wyoming Blockchain Task Force president Caitlin Long.

“First-ever” regulatory provisions for crypto custodians in many areas

Wyoming’s “blockchain banks” — legally known as “special purpose depository institutions” (SPDIs) — were approved by the Wyoming state legislature in February of this year and were introduced to serve those businesses unable to secure FDIC-insured banking services due to their dealings with cryptocurrency.

In her tweets, Long — a 22-year Wall Street veteran and cryptocurrency activist — indicated that the newly-released custody rules include what she claims are the first-ever regulatory provisions for digital asset custodians in many areas — including forks, airdrops, staking, customer notice requirements and so forth.

As regards airdrops, the rules state that all proceeds defined as ancillary/subsidiary — i.e. those earned via forks, airdrops, staking gains — automatically accrue to the customer, not the custodian, unless otherwise agreed in writing.

The rules also proscribe SPDIs from authorizing or facilitating the rehypothecation of crypto assets under its custody.

According to Long, the document was reviewed by four crypto sector Chief Technical Officers, alongside multiple Chief Operating Officers and dozens of attorneys.

Wyoming’s impressive crypto-legislative activity

As Cointelegraph has extensively reported, America’s least populous state has approved a steady stream of blockchain and cryptocurrency-related legislations.

In January, Wyoming’s Senate passed a bill — later passed by the House on Feb. 14 — allowing for cryptocurrencies to be recognized as money.

That same month, Wyoming passed a bill defining certain open blockchain tokens as intangible personal property, as well as a bill to establish a fintech regulatory sandbox.

This February, Wyoming passed two further bills on tokenization and industry compliance — the latter establishing SPDIs.

In 2018, the Wyoming Senate and House of Representatives passed a bill relaxing securities regulations and money transmission laws for certain tokens offered via an initial coin offering in the state.

A separate house bill exempting cryptocurrencies from the Wyoming Money Transmitter Act was passed by the state legislature in March 2018, as well as a house bill exempting them from state property taxation in February.

Yet, further pro-crypto and blockchain senate and house bills had already been passed into Wyoming law.

Updated: 11-15-2019

Wyoming’s New Crypto Banking Law Could Defang New York’s BitLicense

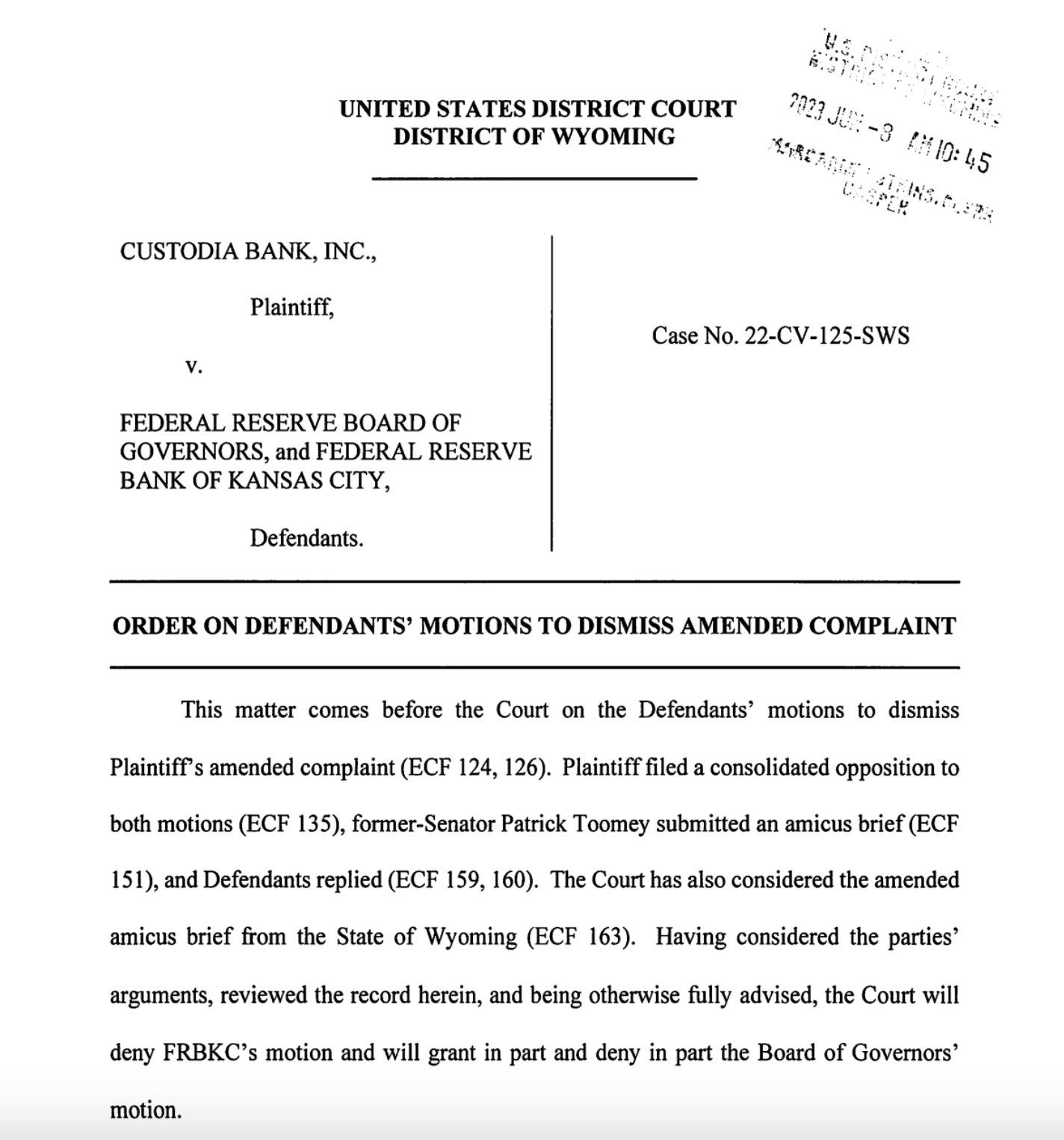

There’s a way cryptocurrency businesses can get around New York’s notoriously hard-to-get BitLicense, and it runs through Wyoming.

At least, so say members of the team that drafted the 13 crypto-friendly laws enacted by the Western state this year. One of those laws allows Wyoming to charter Special Purpose Depository Institutions (SPDIs), a new type of fully-reserved fiat bank that can also custody crypto assets.

With an SPDI, crypto exchanges and other startups could operate in New York without going through the state’s licensing rigmarole, under the same legal principles that exempt banks from needing state money transmitter licenses, Wyoming advocates said.

“We are fairly confident that the Wyoming SPDI will be able to operate in New York without a BitLicense,” Chris Land, general counsel of the Wyoming Division of Banking, said Tuesday at CoinDesk’s Invest: NYC event in New York.

The New York Department of Financial Services (NYDFS), which created the BitLicense in 2014, did not answer requests for comment by press time.

The BitLicense was one of the earliest regulations specially crafted for the blockchain industry. But many firms have complained that it is onerous and has driven entrepreneurs and innovators away from New York, the U.S. financial capital.

Only 18 BitLicenses have been granted in the rule’s five years of existence. Getting hold of one is known to be a slow and expensive process, and that’s if you are in full compliance with all the requirements, which amount to a heavy-duty version of a money transmitter license. Some companies that fell short of NYDFS’ expectations have publicly bemoaned the process.

Banking balm

In addition to addressing the BitLicense problem, an SPDI could ease a longstanding pain point for crypto businesses: the difficulty of obtaining banking services.

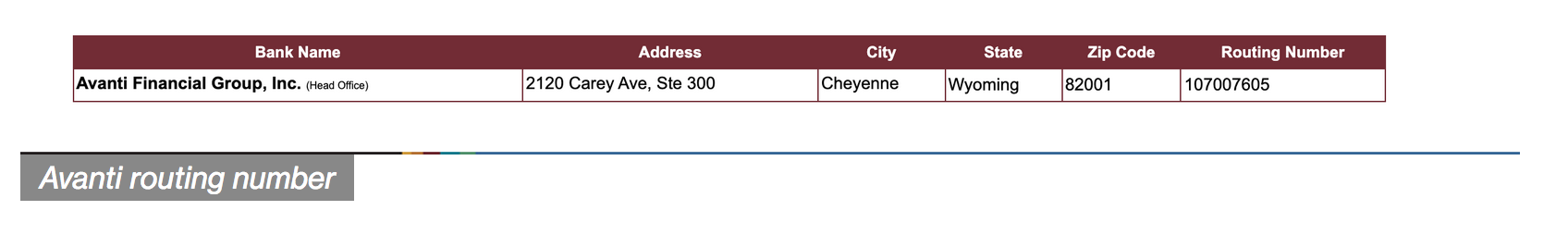

Once approved for the charter (the statutory minimum capital requirement to apply is $5 million), firms would have master accounts with the Federal Reserve and the own ability to clear their own wires.

In other words, they could literally be their own banks, to use a familiar motif from crypto-land.

“Some companies might choose to partner with unaffiliated SPDIs and others might choose to create their own affiliated SPDI,” Caitlin Long, the gubernatorial appointee to the Wyoming Blockchain Task Force, told CoinDesk.

“The significance is that crypto companies won’t need to rely anymore on the few traditional banks that have been willing to bank the industry,” she said.

The handful of crypto-friendly banks in the U.S. includes Silvergate in California and Signature and Metropolitan Commercial in New York. Long said one of the best-known of these banks (she wouldn’t say which one) employs 65 compliance officers, making the whole business very expensive.

History repeats

If the Wyoming SPDI works out as suggested, it could be seen as an interesting parallel to the way Citi found a clever way to sidestep New York’s tough usury laws. The bank made a landmark decision in 1981 to move its credit card operation to South Dakota, where legislators were won over by Citicorp’s promise of jobs if that state lifted its usury ceiling.

And as part of the “far-reaching impact” of the SPDI, Long said she is optimistic the NYDFS will view the bank charter as trumping the BitLicense since banks have higher capital and regulatory requirements than money transmitters do.

“The Wyoming SPDI would need to apply to NYDFS to open a branch in New York and NYDFS would need to approve the application, but there’s a lot of favorable case law precedent,” said Long, a former Morgan Stanley executive. “So if NYDFS denies the application, I think it would go to litigation and the Wyoming bank would likely prevail.”

Long also sounded optimistic about lawyering up if need be. After she spoke alongside Land on Tuesday’s panel, she said, “multiple New York attorneys came up to volunteer pro bono to help the Wyoming Banking Division litigate if it ever comes to that.”

Updated: 12-12-2019

Kraken Job Ad Hints At Plan To Build Special-Purpose Wyoming Bank

Kraken appears to be preparing to open a limited-purpose bank in Wyoming that would let it store customers’ fiat deposits – and possibly operate in New York without a BitLicense.

The cryptocurrency exchange has opened up a position for an operations director to oversee a Wyoming special-purpose depository institution (SPDI). The job includes building out an operations team, developing systems and operational processes to be an SPDI and integrating that entity into the exchange’s platforms.

The director would also ensure the functionality of the different capabilities that come with being an SPDI bank, including access to Fedwire, Fed Master Accounts, the Automated Clearing House and correspondent banking.

It’s unclear whether Kraken has applied yet for an SPDI from Wyoming. While it and other firms have expressed interest in pursuing the charter, none have announced doing so. Kraken did not respond to request for comment by press time.