Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin While Also Liberating Afghan Girls From Taliban (#GotBitcoin)

Afghanistan and Tunisia are planning to issue sovereign bonds in bitcoin to fund infrastructural developments, reported Asia Times from IMF’s Springs Meetings summit. Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin While Also Liberating Afghan Girls From Taliban (#GotBitcoin)

Khalil Sediq, the governor of the Central Bank of Afghanistan, confirmed that they were looking to utilize cryptocurrency and blockchain technology to raise around $5.8 billion. Sediq said they would pair bitcoin with a form of metal futures, such as lithium.

The move would make it easier for Afghanistan to expose its $3 trillion lithium sector to investors across the world. The metal’s short supply against its booming demand in the electric-vehicle industry would pose profitable opportunities for Afghanistan.

Sediq went on to explain the situation that led them to opt for bitcoin over other fiat assets. The governor blamed the post-war conflict scenario that raised Afghanistan’s risk of debt. It prompted the IMF to expose the country to severe restrictions on non-concessional financing. In layman terms, developed economies were less likely to invest in Afghanistan owing to its risks limited to or beyond a geopolitical crisis, as well as to a perceived lack of fiscal and debt discipline.

I just uploaded “CI GCA interviews Aghanistan Central Bank Governor Khalil Sediq #IMFMeetings” to #Vimeo: https://t.co/L9MpKrWap0

— CapitolIntel (@CapitolIntel) April 15, 2019

Crypto solutions, explained Sediq, could allow Afghanistan economy to access global markets. He stated that they would use hyperledger’s blockchain technology financial services platform to issue their sovereign bitcoin bonds.

Bitcoin Liberates Afghan Girls From Taliban AND Oppressive Sharia Laws

Afghan women are rocking the boat for their social and financial freedoms, and their opponents wouldn’t even know it, thanks to an organisation that pays them to exercise those rights – in bitcoin.

Women’s Annex Foundation (WAF) encourages girls to think independently and discerningly through blog writing, software development, video production and social media. It gives them a platform to send their ideas into the world that both pays for them in bitcoin and provides free Web access in a safe place.

Related:

Charities Put A Purpose Behind Bitcoin

For co-founder Fereshteh Forough, it’s the hope for “digital literacy” – using a digital currency to support entrepreneurship:

“We want to teach the girls how they can use education combining the tools that they have – social media and technology – and create their own sustainable economy.”

The Plight of Afghan Women

The social and economic barriers that women in developing countries face everyday are disheartening. Even though women’s rights in Afghanistan have taken many positive steps forward since the end of Taliban rule in 2001, they remain at astounding odds with the standard found elsewhere in the world.

Afghanistan’s patriarchal society deplores the autonomy of women. Families commonly object to their girls’ employment, education or any pursuit that could make their control over themselves and their interests louder.

Although the statistics for female education have improved greatly over the last decade, families often make their girls leave school in their early or pre-teen years. And while it’s considered unacceptable for girls to be taught by men without the presence of women, there’s a lack of female teachers.

It’s at this juncture of social and economic inequality that WAF stands to make an impact.

Matthew Kenahan, who won the Blockchain Most Impactful Charity Award in Amsterdam last month and promised his winnings to WAF, said:

“If the WAF can provide a platform in which women can have their own income – a platform which pays out in bitcoin, a truly pseudonymous protocol which can truly conceal the identity, I think that we have the potential to really shake things up.”

Co-founders Forough and Roya Mahboob (or Roya Mahoob, Linkedin) hope that by earning a salary independently, the girls’ families might see their education as a source of income and become more supportive of it. It’s not always so straightforward, though. It’s common for families to confiscate money earned outside the home as an act of disapproval, for family use or other reasons out of the girls’ control.

“Having money is not the same as financial autonomy,” said Kenahan. “That requires actual control over that money, and how it’s spent, or not spent.”

Paying Out In Bitcoin

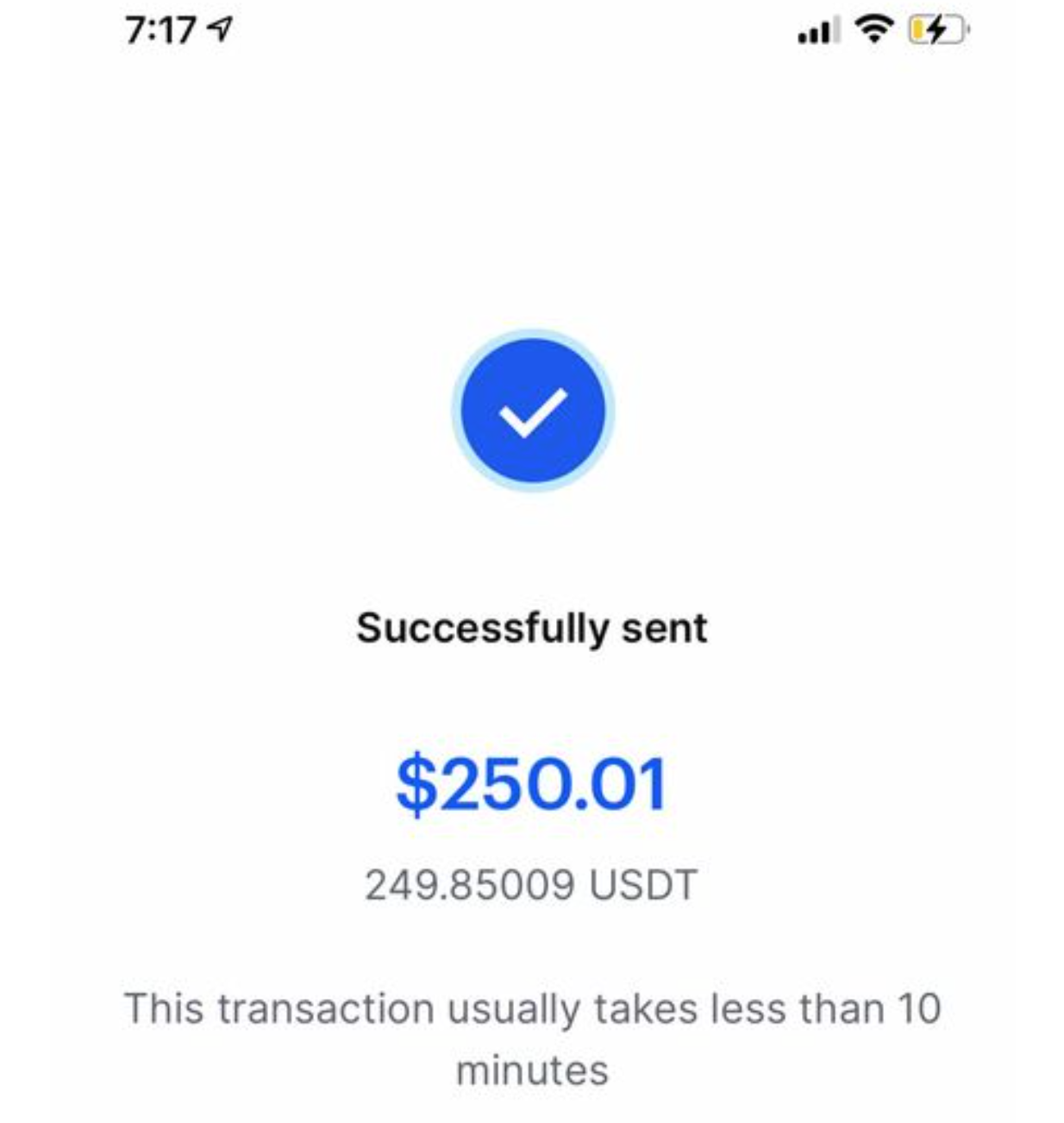

At least 2,000 WAF users in Afghanistan are paid in bitcoin. Their average income falls between $250 and $400 monthly.

The country’s average annual income is US$680, according to 2012 data.

Payouts to the girls in Afghanistan were problematic before bitcoin was integrated this February. It compensated users in US dollars via bank wires that required hefty fees or PayPal, which isn’t supported there. They would send the money to Mahboob in one lump sum, Forough recounted, who would then cash it and find a place to pay all her users in a given locaton.

“Imagine … it’s dangerous if a girl has a lot of cash in her pocket walking around the city,” she Forough. “And sometimes the family takes the money and there’s nothing for the girls.”

With bitcoin, no one other than the payee has to know that she has a bitcoin wallet. WAF can pay the girls in a timely manner with minuscule fees. This eliminates the need to open a bank account, which would require extensive documentation and the need for legal guardian approval if they are underage, which could result in more difficulties.

Bitcoin enthusiast Ross Mintzer, 27, spent three and a half months teaching girls English and music in Karachi, Pakistan from October 2011. Now in New York, where he was born and raised, he tries to send money to the schools when he can. He said:

“It’s impossible to send a small amount of money, a micropayment, and have it make sense because of the transaction fee. People have spoken to this many times, that bitcoin will change the remittance business, and I really believe it.”

Although, it seems other people could argue that for a long time.

“All I’m waiting for is for someone in Pakistan to open a shop where they can exchange the Pakistani rupee for the bitcoin, and I’m sending the bitcoin,” Mintzer said. “It’s easy, it’s powerful.”

Usability is something WAF is working on in Afghanistan, Forough said. Film Annex, the group’s parent company, provides a marketplace for content contributors to spend the bitcoins they earn, currently offering mobile and Skype credit. It offers Amazon gift cards to users in some regions, but since the concept of billing or shipping addresses doesn’t exist in Afghanistan – requiring any packages to be delivered to organisations or offices working with FedEx – users there can’t spend their digital currency earnings as easily.

Currently, WAF is scouting around for local shops in Afghanistan to collaborate with on bitcoin acceptance, particularly electronics stores, to give its girls easier access to their own smart phones and tablets – thereby encouraging further engagement with both social media and bitcoin.

Keeping Girls Connected

Developing countries lack the infrastructure needed to participate in and benefit from bitcoin. A 2011 Gallup study said that 3% of the Afghan population have home internet access.

For that reason, WAF has provided 11 computer labs in schools across Herat and Kabul free of charge. Forough said:

“We have to focus on infrastructure and girls in schools can be our target because they can be very easily influenced by the stream of content and everything. Once you find yourself in this stream you’ll find it fascinating and interesting and you’ll go with the stream and everyday you’ll elevate your level.”

It can cost around US$1 an hour to use an internet café in Afghanistan, she explained, a high price for many. Girls often have to find an all-women’s center, both to avoid verbal harassment from men and to steer clear of issues arising from disapproving family members.

The bitcoin technology is capable of improving the digital economy via e-commerce, personal finance, peer-to-peer philanthropy and crowd funding. But, Kenahan cautioned, the global community must act to ensure that all contenders in this economy are equipped to engage in it:

“Math-based currencies and cryptographic protocols are undoubtedly the main drivers of innovation within the fintech landscape … But without ensuring that the necessary tools and knowledge are both available and protected, I fear that women in socially oppressive environments will, yet again, be excluded from benefiting from the aforementioned fintech innovations. That’s a failure in my eyes.”

WAF also provides female teachers and a curriculum teaching them everything from the fundamentals of how to operate a computer to how to use sites like Twitter, Tumblr, LinkedIn, Facebook and the Women’s Annex platform. The schoolgirls that attend are between 13 and 19 years old.

Communication Without Borders

Community is as important to WAF’s goals as is individual empowerment. For Forough, bitcoin is a “social currency”, meaning that it’s one that assembles people by promoting social interaction, helps boost users’ social and digital presence; and revolutionary, especially in developing countries. She said:

“It’s the concept of digital citizenship, or communication without borders, and that’s how technology empowers people. I always wanted to have this for women in Afghanistan – to be powered using education and technology.”

At the same time, bitcoin also grants independence and self-responsibility to anyone that embraces it. In February PricewaterhouseCoopers reported that 96% of people surveyed that partake in bitcoin discussion are men. Given the reach of its different functions, it takes a certain curiosity and tenacity for one to educate him- or herself about it – about its role as a digital currency, as a store of value, as an undelrying technology; its regulatory grey area and its philanthropic application.

“If you have cash in your hand, you’re not gonna go and Google ‘what is the history of cash?’” Forough said. “Indirectly it [bitcoin] forces you to go through articles and interact with people that know; go to meetups. And this is the amazing part.”

And perhaps all that responsibility and self-reliance is the very thing keeping mainstream consumers from embracing it and consequently holding back more organisations from integrating bitcoin in other fields.

Kenahan called bitcoin “morally neutral, and infinitely useful”, and surmised that more philanthropic groups might emerge with greater understanding:

“It is certainly frustrating that programs like WAF may be overlooked due to the fact that bitcoin’s positive applications are constantly invalidated by past media hype surrounding Mt Gox, Silk Road, etc. If the full innovative potential provided by bitcoin and other math-based currencies were actually understood I feel, and hope, that tons of noble organisations like the WAF would sprout up.”

No Politics, Just Internet

WAF’s more active users generate more income. They receive a BuzzScore, an algorithm exclusive to the networks of Film Annex. It calculates users’ social media activity to rank their online influence, with factors including the frequency of content production and social sharing, subscriber numbers and growth rates, and the collective weight of both a user’s BuzzScore and those of her subscribers. As her BuzzScore increases, so do her earnings.

Good language, grammar and subject matter are also important elements of the process. Topical issues like education and women’s empowerment will likely merit a feature on Annex Press, the platform for professional writers, which can as much as double a user’s BuzzScore, thereby boosting her income further. Forough expalined:

“I monitor the girls’ activity and some girls in the schools have started writing much better, [they] are focused on very serious topics and sharing their stories. Some of them have two or three followers right now, some have 600 followers.”

The organisation has around 60,000 registered users worldwide – 6,000 of which are in Afghanistan. The platform supports content not averse to any religion or political view, with moderators serving users who speak the English, Dari and Pashta, Urdu, Arabic, Chinese and Italian languages, among others. This seems to suggest and exemplify WAF’s motto: “No politics, just Internet”.

About Women’s Annex

WAF is a nonprofit organisation that took off in 2012. Outside of Afghanistan, it operates in Pakistan, Egypt and Mexico. In addition to the computer labs that have been established in Herat and Kabul schools, it’s also built two independent computer labs in the respective areas.

The organisation is mostly driven by donations, but is also backed by Film Annex, who contributed greatly to the creation of the computer labs. The eleventh school is partially funded by Craig Newmark of Craigslist. WAF aims to raise $300,000 by the end of 2014.

Women’s Annex Foundation – Bitcoin Address: 1GetpNN3M8uBZznuQnucywSSKktAc5iecV

Updated: 7-28-2020

Donate Cryptocurrency To Rebuild Afghanistan 2.0 With Code To Inspire

Cryptocurrency Donations via The Giving Block

We’re happy to announce you can now support us on our mission to rebuild Afghanistan 2.0 by donating Bitcoin and cryptocurrency with The Giving Block!

At Code to Inspire, empowering students through technology is at the heart of what we do. We believe decentralized systems like the internet and Bitcoin are important tools to help level the playing field, to create more equal opportunity and a better future for young women in Afghanistan. We don’t immediately convert digital asset donations into fiat—we make an effort to hold the assets and to explore ways to use them to foster the development of new circular economies.

Cryptocurrency donations are classified as property transfers by the IRS, meaning it’s tax-deductible and not subject to capital gains tax. Check out this post from The Giving Block for more information and talk to your tax professional to confirm your eligibility.

We accept the following cryptocurrencies: Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Zcash (ZEC), Gemini Dollar (GUSD), Basic Attention Token (BAT), Chainlink (LINK).

Code to Inspire is a registered 501 (c) (3) tax-deductible organization in the US. EIN: 47-3076235 Donate Crypto here!

Bitcoin Bonds A Hot Topic

Blockchain and crypto payment solutions were a hot topic at World Bank and IMF 2019 Spring Meetings, held in Washington. The event saw delegates from developing countries posing cryptocurrencies like bitcoin as a potential solution to debt distress or high-risk debt levels. The discussions went on to question whether or not the current international financial architecture was able to prevent debt and economic crisis.

Sediq’s pro-bitcoin sentiments rippled through his Tunisian counterpart. Marouane El Abassi, Governor of Banque Centrale de Tunisie, told the meeting delegates that their country was looking to launching a sovereign bitcoin bond. The former World Bank official said the bitcoin and blockchain offered central banks an efficient tool to curb money laundering, terrorist financing, simplify remittance, and drain grey economies.

Javlon Vakhabov, Uzbekistan Ambassador to the United States, also revealed that they had dispatched a study group to the IMF World Bank to study bitcoin and blockchain. The delegate confirmed that they too were planning to issue sovereign bitcoin bonds in their cotton futures market.

Uzbekistan is the fifth-largest cotton producer in the world.

A Bright Future

The delegates’ positive take on bitcoin indicated the cryptocurrency’s vital prospects. A crypto-enabled bond escalates the industry into the world of mainstream finance. It further allows larger institutions to store value using bitcoin, thereby making it possible for others to use it as a payment method.

IMF director Christine Lagarde said the governments should initially issue bitcoin bonds using a closed and supervised approach.

3 Countries Tell IMF They Want To Issue Bitcoin Bonds

Afghanistan, Tunisia and Uzbekistan are currently mulling the possibility of a Bitcoin bond, all three interested in the instrument’s potential to help out critical sectors of the economy.

For Afghanistan, a bond could be tied to metals, specifically the country’s $3 trillion lithium industry. Despite being set for expansion due to a shortage of lithium, Afghanistan remains stifled when it comes to borrowing due to international restrictions.

The answer, Asia Times paraphrases Central Bank of Afghanistan governor Khalil Sediq as saying, lies in crypto solutions such as Hyperledger Fabric.

This, he claimed, “could offer a way to access international markets via a first-of-its-kind financial instrument made possible with hyperledger’s blockchain technology financial services platform.”

Similarly buoyant about the concept was newly-installed Tunisian central bank governor Marouane El Abassi. Abassi, known for his progressive stance on technology such as blockchain, said a dedicated working group was already studying the feasibility of a Bitcoin bond.

Bitcoin and Hyperledger’s Blockchain technology, he indicated,

offers central banks an efficient tool to combat money-laundering, manage remittances, fight cross-border terrorism and limit grey economies.

In line with many other nations, Tunisia is also getting to grips with the idea of issuing a digital version of its national fiat currency.

IMF Remains Cautious

For Uzbekistan meanwhile, a Bitcoin bond could end up tied to cotton futures, Uzbek Ambassador to the United States Javlon Vakhabov told the Spring Meetings.

The approaches may yet gain mixed reviews from the IMF, in particular. Earlier this month, managing director Christine Lagarde again called for caution regarding cryptoassets, saying supervised testing would be preferable as a first step.

“One approach, undertaken in Hong Kong SAR, Abu Dhabi, and elsewhere, is to establish regulatory ‘sandboxes’ where new financial technologies can be tested in a closely supervised environment,” she concluded in a blog post.

Above all, we must keep an open mind about crypto assets and financial technology more broadly, not only because of the risks they pose, but also because of their potential to improve our lives.

Lagarde likened the advent of early-stage cryptocurrency and associated financial technology to that of the telephone and its initial reception.

Bond, Bitcoin Bond: Japanese Firm Issues Debt Denominated In Bitcoins

Japan Takes The Lead

Japan has been at the forefront of regulating Bitcoin, with the government legalizing Bitcoins as a form of payment early this year. Regulators have also exempted Bitcoin from sales tax, increasing the volume of Bitcoin trades and at one point making Japan the largest Bitcoin market.

It comes as no surprise that a Japanese company, Fisco, has taken the lead in experimenting with Bitcoin bonds. As per a Bloomberg report, Fisco has issued a three year debt of 200 Bitcoins to another group firm.

The bond has a three percent interest rate. The company aims to arrange cryptocurrency debt for its clients if the Bitcoin market develops.

While Wall Street has taken an interest in cryptocurrencies, there haven’t been too many Bitcoin-denominated financial products so far. The efforts of the Winklevoss twins and others to start a Bitcoin ETF has remained stuck in regulatory red tape.

Borrowing In An Appreciating Currency – A Recipe For Disaster?

In the opinion of a substantial majority of people, the outlook for Bitcoin in the long term is positive. Bitcoin, although a risky asset, is expected to grow by leaps and bounds in the medium term.

In such a scenario, issuing bonds denominated in Bitcoin might be a recipe for disaster. One million dollars borrowed in mid-July could turn into debt of two million dollars in mid-August.

Ordinary businesses, whose core competency is not Bitcoin trading, cannot afford to take this substantial risk. Bitcoin-denominated loans could make sense to two types of companies. One, if the company is a Bitcoin trader who wants to take a short position in Bitcoin.

The other are companies whose earnings are denominated in Bitcoin (such as Bitcoin mining companies) who stand to benefit from Bitcoin price appreciation and can afford to pay back debt denominated in Bitcoin.

For ordinary companies, issuing Bitcoin-denominated debt is foolhardy.

What do you think about Afghanistan, Tunisia and Uzbekistan’s plans for Bitcoin bonds? Let us know in the comments below!

Updated: 8-14-2021

How The Taliban Overran The Afghan Army, (U.S. Wasted Over 2 Trillion Dollars) Built By The U.S. Over 20 Years

Afghanistan’s military was molded to match American operations and collapsed without U.S. air support and intelligence.

The Afghan government outpost in Imam Sahib, a district of northern Kunduz province, held out for two months after being surrounded by the Taliban. At first, elite commando units would come once a week on a resupply run. Then, these runs became more scarce, as did the supplies.

“In the last days, there was no food, no water and no weapons,” said trooper Taj Mohammad, 38. Fleeing in one armored personnel carrier and one Ford Ranger, the remaining men finally made a run to the relative safety of the provincial capital, which collapsed weeks later. They left behind another 11 APCs to the Taliban.

As district after district fell in this summer’s Taliban offensive, without much visible support from the Afghan national army and police forces, other soldiers simply made the calculation that it wasn’t worth fighting anymore—especially if the Taliban offered them safe passage home, as they usually did.

“Everyone just surrendered their guns and ran away,” said Rahimullah, a 25-year soldier who joined the army a year ago and served in the Shahr-e-Bozorg district of northeastern Badakhshan province. “We didn’t receive any help from the central government, and so the district fell without any fighting.”

Afghanistan’s national army and police forces, theoretically numbering 350,000 men and trained and equipped at huge cost by the U.S. and Western allies, were supposed to be a powerful deterrent to the Taliban. That is one reason why President Biden, when he announced in April his decision to withdraw all American forces from Afghanistan, expressed confidence in the Afghan military’s ability to hold ground.

“They’ll continue to fight valiantly, on behalf of Afghans, at great cost,” he said at the time.

The Afghan security forces have since then experienced a humiliating collapse, losing most of the country and the major cities of Kandahar and Herat in recent days. The Taliban, with fewer fighters and until recently no armor or heavy weapons, are now on the doorstep of Kabul.

This spectacular failure stemmed from built-in flaws of the Afghan military compounded by strategic blundering of the government of Afghan President Ashraf Ghani. The Taliban, meanwhile, took advantage of the U.S.-sponsored peace talks to deceive Kabul about their intentions as they prepared and executed a lighting offensive.

The Afghan army fighting alongside American troops was molded to match the way the Americans operate. The U.S. military, the world’s most advanced, relies heavily on combining ground operations with air power, using aircraft to resupply outposts, strike targets, ferry the wounded, and collect reconnaissance and intelligence.

In the wake of President Biden’s withdrawal decision, the U.S. pulled its air support, intelligence and contractors servicing Afghanistan’s planes and helicopters. That meant the Afghan military simply couldn’t operate anymore. The same happened with another failed American effort, the South Vietnamese army in the 1970s, said retired Lt. Gen. Daniel Bolger, who commanded the U.S.-led coalition’s mission to train Afghan forces in 2011-2013

“There is always a tendency to use the model you know, which is your own model,” said Gen. Bolger, who now teaches history at North Carolina State University. “When you build an army like that, and it’s meant to be a partner with a sophisticated force like the Americans, you can’t pull the Americans out all of a sudden, because then they lose the day-to-day assistance that they need,” he said.

Fears that the Afghan capital may succumb within days prompted Mr. Biden to send 3,000 American troops back to Afghanistan to secure the evacuation of U.S. and allied diplomatic missions.

When U.S. forces were still operating here, the Afghan government sought to maximize its presence through the country’s far-flung countryside, maintaining more than 200 bases and outposts that could be resupplied only by air. Extending government operations to the most of Afghanistan’s more than 400 districts has long been the main pillar of America’s counterinsurgency strategy.

Mr. Ghani had ample warning of the American departure after the Trump administration signed the February 2020 agreement with the Taliban that called on all U.S. forces and contractors to leave by May 2021. Yet, the Afghan government failed to adjust its military footprint to match the new reality. Many officials didn’t believe in their hearts that the Americans would actually leave.

“Politically it was suicide to leave certain regions, and to concentrate on certain others, and that made the Afghan army overstretched and critically dependent on close air support for logistics, medevac and combat operations,” Afghan Foreign Minister Haneef Atmar, who previously served as national-security adviser and interior minister, said in an interview.

“We did not have enough transition time to move from that arrangement to a new arrangement, to bring back forces from areas that are difficult to defend and to concentrate on the main population centers,” he added.

When the Taliban launched their offensive in May, they concentrated on overrunning those isolated outposts, massacring soldiers who were determined to resist but allowing safe conduct to those who surrendered, often via deals negotiated by local tribal elders. The Taliban gave pocket money to some of these troops, who had gone unpaid for months.

By the time the Taliban began their assault on major population centers this month, the Afghan military was so demoralized that it offered little resistance. Provincial leaders and senior commanders replicated surrender deals struck on the local level before. The elite commando units were one exception, but they were too few in number and lacked aircraft to move them around the country.

Mr. Ghani and his national-security adviser, Hamdullah Mohib, were opposed to last year’s Doha agreement and expected the Biden administration to reverse course instead of doubling down on the deal struck by Mr. Trump.

Mr. Mohib, a British-educated former ambassador with no military experience, took direct control of military operations, calling unit commanders and issuing orders that bypassed the normal chain of command, according to several senior government officials and diplomats. He couldn’t be reached for comment.

For much of the past year, the Afghan minister of defense, replaced in June by veteran anti-Taliban commander Gen. Bismillah Khan Mohammadi, was out of the country, receiving medical treatment in the United Arab Emirates. Mr. Ghani routinely sacked commanders. The latest chief of the army lasted less than two months.

The U.S.-sponsored peace talks in Doha allowed the Taliban to project themselves as a moderate, benevolent force just as Mr. Ghani’s political rivals in Kabul plotted to replace him with some sort of transitional administration that would facilitate a peace deal. Former President Hamid Karzai, in particular, tried to position himself as a neutral third force, frequently lashing out at Mr. Ghani and the U.S.

“The government ended up completely isolating many people,” said Hekmat Karzai, a former deputy foreign minister and a cousin of the former president. “It became a self-licking ice cream fantasy. It just talked to itself and had very senior positions led by very inexperienced people who hardly understood the reality,” he said.

“Do the troops have a reason to fight?” he asked. “I feel that the Taliban isn’t enormously strong. It’s that the government is in disarray.”

Andrew Watkins, senior analyst for Afghanistan at the International Crisis Group, a research and advocacy organization, said that there was no evidence the Taliban had increased their manpower to launch this summer’s offensive, apart from tapping some of the 5,000 insurgent detainees who had been released under the Doha agreement.

What changed between February 2020 and Mr. Biden’s withdrawal announcement was an end to American airstrikes that used to exact a heavy toll on insurgent fighters, he noted.

“The Doha agreement bought the Taliban a one year reprieve,” said Mr. Watkins. “They were able to regroup, plan, strengthen their supply lines, have freedom of movement, without fear of American bombardment.”

When the insurgents struck, after suggesting in public that they won’t attack big cities while peace talks continue, the blow was overwhelming.

“When the Kunduz province fell to the Taliban, so many soldiers were killed. We were surrounded,” said Abdul Qudus, a 29-year-old soldier who managed to make his way to Kabul this week. “There was no air support. In the last minutes, our commander told us that they cannot do anything for us and it’s just better to run away. Everyone left the war and escaped.”

Taliban Seize Afghanistan’s Mazar-e-Sharif As They Advance Toward Kabul

President Ghani seeks to negotiate a cease-fire but pledges defense of the capital.

The Taliban entered Afghanistan’s northern metropolis of Mazar-e-Sharif, eliminating one of the last significant sources of resistance to the insurgents, as President Ashraf Ghani sought to negotiate a cease-fire but pledged to defend Kabul.

Two anti-Taliban warlords leading the defenses of Mazar-e-Sharif, Atta Mohammad Noor and Abdul Rashid Dostum, just days earlier vowed to oust the militants from the country’s north. On Saturday, they abandoned the city and fled across the border to neighboring Uzbekistan, officials and local residents said.

“It is a domino effect. No one is interested in fighting,” said an Afghan security official. By nightfall, the insurgents opened the gates of the city’s prison and were seen near the historic Blue Mosque on Mazar-e-Sharif’s main square.

It was the latest in a series of stunning defeats that followed President Biden’s April decision to withdraw American forces, depriving the Afghan troops of the air support and contractors on whom they relied to operate.

Kabul—a bustling city of six million people—has increasingly turned into an island in a Taliban sea as the insurgents advance. The U.S. and British militaries are deploying thousands of troops to the capital to secure the evacuation of diplomats and other Western civilians ahead of an expected Taliban onslaught.

Mr. Biden said in a statement Saturday he would send approximately 5,000 U.S. troops to evacuate U.S. and allied personnel, a force slightly larger than the 3,000 personnel already in transit back to Afghanistan.

Gen. Mohammad Amin Darra-e-Sufi, a member of the provincial council, blamed Mazar-e-Sharif’s fall on the U.S. as he fled toward the Uzbekistan border. “They’ve sold out Mazar, God damn, may their house collapse,” he cursed when reached by phone Saturday night.

Videos circulating on social media showed a huge column of SUV’s, Humvees and Afghan police Ford Rangers in a traffic jam on the bridge over Amu Darya between Uzbekistan and Afghanistan. It wasn’t clear whether the Uzbek government would allow the soldiers and officials to enter.

In addition to Mazar-e-Sharif, the Taliban on Saturday conquered the capitals of the eastern provinces of Paktia, Paktika and Kunar, and pressed into several other cities. Outside Kabul, only one major Afghan city remains under Mr. Ghani’s control, the eastern hub of Jalalabad. It, too, has come under attack.

In his first public remarks since the Taliban raced through southern and western Afghanistan, capturing the major cities of Kandahar and Herat, Mr. Ghani said his priority is to remobilize the Afghan security forces that surrendered en masse.

“As a historic responsibility, I am trying to not let the war that has been imposed on the Afghan people cause the further killing of innocents, the loss of 20 years of achievement, the destruction of public institutions and longstanding instability,” Mr. Ghani said in a video message posted on social media, the country’s flag unfurled behind him.

Mr. Ghani appointed Brig.-Gen. Sami Sadat, a highly-regarded commander who held the Taliban at bay in the southern province of Helmand for weeks and in recent days assumed command of Afghanistan’s special-operations forces, to spearhead the defense of Kabul.

The Afghan leader has come under growing pressure from politicians to resign so that a transitional government headed by someone else could negotiate a cease-fire with the Taliban and prevent the storming of Kabul. While Mr. Ghani said in Saturday’s address that he is engaging in wide-ranging consultations, he stopped short of suggesting that a resignation was in the cards.

“Ghani’s recorded message created further confusion and failed to provide any reassurance to the people, especially Kabul residents who feel the city will inevitably be the next target as the Taliban are at the gate,” said Ali Adili, a senior researcher at the Afghan Analysts Network.

Afghan negotiators, the Taliban, the U.S. and other nations are engaged in discussions in Doha, Qatar, on how to find a political settlement to the war.

An Afghan security official said that Mr. Ghani wanted the Taliban to start cease-fire and power-sharing discussions now. After such an arrangement is in place, the president is willing to quit, he said. The Taliban have long insisted on Mr. Ghani resigning first.

A delegation of Afghan political leaders is due to travel Sunday to Islamabad, said aides to the politicians. Pakistan is considered the country with the most influence over the Taliban movement, as the Islamist group’s leadership has been largely based there since the 2001 U.S. invasion and long enjoyed the backing of Pakistani intelligence.

While Taliban negotiators in Doha proclaim that the movement doesn’t want a monopoly on power and seeks a negotiated solution, reality on the ground in Afghanistan suggested otherwise, with one city after another collapsing to the insurgent offensive.

For the U.S., the priority now is to convince the Taliban to hold off until the evacuation of Americans and other foreigners from Kabul is complete.

Mr. Biden said the U.S. has told Taliban representatives in Doha that any action on the ground in Afghanistan against U.S. personnel “will be met with a swift and strong U.S. military response.”

Kabul’s defenses are easily penetrated, and security officials estimate that hundreds of Taliban fighters already are in the city, ready to rise up and seize neighborhoods.

On the streets of Kabul’s Green Zone, where most embassies are located, local employees Saturday pushed wheelbarrows with crockery and electric items that the diplomatic missions were handing out to staff as they prepared to shut down.

Helicopters heading to the airport frequently flew overhead. The city’s passport office was mobbed by Afghans eager to secure travel documents needed for an escape. Few were available, with officials saying they had been ordered by the government to stop issuing passports so as not to encourage panic.

Taliban Seize Afghanistan’s Mazar-e-Sharif As They Advance Toward Kabul

President Ghani seeks to negotiate a cease-fire but pledges defense of the capital.

The Taliban entered Afghanistan’s northern metropolis of Mazar-e-Sharif, eliminating one of the last significant sources of resistance to the insurgents, as President Ashraf Ghani sought to negotiate a cease-fire but pledged to defend Kabul.

Two anti-Taliban warlords leading the defenses of Mazar-e-Sharif, Atta Mohammad Noor and Abdul Rashid Dostum, just days earlier vowed to oust the militants from the country’s north. On Saturday, they abandoned the city and fled across the border to neighboring Uzbekistan, officials and local residents said.

“It is a domino effect. No one is interested in fighting,” said an Afghan security official. By nightfall, the insurgents opened the gates of the city’s prison and were seen near the historic Blue Mosque on Mazar-e-Sharif’s main square.

It was the latest in a series of stunning defeats that followed President Biden’s April decision to withdraw American forces, depriving the Afghan troops of the air support and contractors on whom they relied to operate.

Kabul—a bustling city of six million people—has increasingly turned into an island in a Taliban sea as the insurgents advance. The U.S. and British militaries are deploying thousands of troops to the capital to secure the evacuation of diplomats and other Western civilians ahead of an expected Taliban onslaught.

Mr. Biden said in a statement Saturday he would send approximately 5,000 U.S. troops to evacuate U.S. and allied personnel, a force slightly larger than the 3,000 personnel already in transit back to Afghanistan.

Gen. Mohammad Amin Darra-e-Sufi, a member of the provincial council, blamed Mazar-e-Sharif’s fall on the U.S. as he fled toward the Uzbekistan border. “They’ve sold out Mazar, God damn, may their house collapse,” he cursed when reached by phone Saturday night.

Videos circulating on social media showed a huge column of SUV’s, Humvees and Afghan police Ford Rangers in a traffic jam on the bridge over Amu Darya between Uzbekistan and Afghanistan. It wasn’t clear whether the Uzbek government would allow the soldiers and officials to enter.

In addition to Mazar-e-Sharif, the Taliban on Saturday conquered the capitals of the eastern provinces of Paktia, Paktika and Kunar, and pressed into several other cities. Outside Kabul, only one major Afghan city remains under Mr. Ghani’s control, the eastern hub of Jalalabad. It, too, has come under attack.

In his first public remarks since the Taliban raced through southern and western Afghanistan, capturing the major cities of Kandahar and Herat, Mr. Ghani said his priority is to remobilize the Afghan security forces that surrendered en masse.

“As a historic responsibility, I am trying to not let the war that has been imposed on the Afghan people cause the further killing of innocents, the loss of 20 years of achievement, the destruction of public institutions and longstanding instability,” Mr. Ghani said in a video message posted on social media, the country’s flag unfurled behind him.

Mr. Ghani appointed Brig.-Gen. Sami Sadat, a highly-regarded commander who held the Taliban at bay in the southern province of Helmand for weeks and in recent days assumed command of Afghanistan’s special-operations forces, to spearhead the defense of Kabul.

The Afghan leader has come under growing pressure from politicians to resign so that a transitional government headed by someone else could negotiate a cease-fire with the Taliban and prevent the storming of Kabul. While Mr. Ghani said in Saturday’s address that he is engaging in wide-ranging consultations, he stopped short of suggesting that a resignation was in the cards.

“Ghani’s recorded message created further confusion and failed to provide any reassurance to the people, especially Kabul residents who feel the city will inevitably be the next target as the Taliban are at the gate,” said Ali Adili, a senior researcher at the Afghan Analysts Network.

Afghan negotiators, the Taliban, the U.S. and other nations are engaged in discussions in Doha, Qatar, on how to find a political settlement to the war.

An Afghan security official said that Mr. Ghani wanted the Taliban to start cease-fire and power-sharing discussions now. After such an arrangement is in place, the president is willing to quit, he said. The Taliban have long insisted on Mr. Ghani resigning first.

A delegation of Afghan political leaders is due to travel Sunday to Islamabad, said aides to the politicians. Pakistan is considered the country with the most influence over the Taliban movement, as the Islamist group’s leadership has been largely based there since the 2001 U.S. invasion and long enjoyed the backing of Pakistani intelligence.

While Taliban negotiators in Doha proclaim that the movement doesn’t want a monopoly on power and seeks a negotiated solution, reality on the ground in Afghanistan suggested otherwise, with one city after another collapsing to the insurgent offensive.

For the U.S., the priority now is to convince the Taliban to hold off until the evacuation of Americans and other foreigners from Kabul is complete.

Mr. Biden said the U.S. has told Taliban representatives in Doha that any action on the ground in Afghanistan against U.S. personnel “will be met with a swift and strong U.S. military response.”

Kabul’s defenses are easily penetrated, and security officials estimate that hundreds of Taliban fighters already are in the city, ready to rise up and seize neighborhoods.

On the streets of Kabul’s Green Zone, where most embassies are located, local employees Saturday pushed wheelbarrows with crockery and electric items that the diplomatic missions were handing out to staff as they prepared to shut down.

Helicopters heading to the airport frequently flew overhead. The city’s passport office was mobbed by Afghans eager to secure travel documents needed for an escape. Few were available, with officials saying they had been ordered by the government to stop issuing passports so as not to encourage panic.

Updated: 8-17-2021

Taliban Say Women Would Be Allowed To Work “Where They So Choose” In Government, The Private Sector, Trade And Elsewhere

In its five-year rule from 1996 until 2001, women were banned from working outside their homes and attending schools or colleges, required to have a male escort if they went out in public, and were expected to wear a burqa — a garment that covers the full face and body. Schools for girls were closed and women were rarely permitted to leave the house. The group also banned nearly all forms of entertainment, from music and television to sports and kite-flying.

Earlier Tuesday another Taliban official, who asked not to be identified due to the group’s rules for speaking to the media, said that now women would be allowed to work “where they so choose” in government, the private sector, trade and elsewhere, as long as they abide by Islamic regulations.

The Taliban vowed Tuesday to respect women’s rights, forgive those who fought them and ensure Afghanistan does not become a haven for terrorists as part of a publicity blitz aimed at reassuring world powers and a fearful population.

Following a lightning offensive across Afghanistan that saw many cities fall to the insurgents without a fight, the Taliban have sought to portray themselves as more moderate than when they imposed a strict form of Islamic rule in the late 1990s. But many Afghans remain skeptical — and thousands have raced to the airport, desperate to flee the country.

Older generations remember the Taliban’s previous rule, when they largely confined women to their homes, banned television and music, and held public executions. A U.S.-led invasion drove them from power months after the 9/11 attacks, which al-Qaida had orchestrated from Afghanistan while being sheltered by the Taliban.

Zabihullah Mujahid, the Taliban’s longtime spokesman, emerged from the shadows Tuesday in his first-ever public appearance to address those concerns at a news conference.

He promised the Taliban would honor women’s rights within the norms of Islamic law, without elaborating. The Taliban have encouraged women to return to work and have allowed girls to return to school, handing out Islamic headscarves at the door. A female news anchor interviewed a Taliban official Monday in a TV studio.

The treatment of women varies widely across the Muslim world and sometimes even within the same country, with rural areas tending to be far more conservative. Some Muslim countries, including neighboring Pakistan, have had female prime ministers, while ultraconservative Saudi Arabia only recently allowed women to drive.

Mujahid also said the Taliban would not allow Afghanistan to be used as a base for attacking other countries, as it was in the years before 9/11. That assurance was part of a 2020 peace deal reached between the Taliban and the Trump administration that paved the way for the American withdrawal.

The Pentagon said U.S. commanders are communicating with the Taliban as they work to evacuate thousands of people through Kabul’s international airport. It said the Taliban have taken no hostile actions there.

Mujahid reiterated that the Taliban have offered full amnesty to Afghans who worked for the U.S. and the Western-backed government, saying “nobody will go to their doors to ask why they helped.” He said private media should “remain independent” but that journalists “should not work against national values.”

Kabul, the capital, has remained calm as the Taliban patrol its streets. But many remain fearful after prisons and armories emptied out during the insurgents’ sweep across the country.

Kabul residents say groups of armed men have been going door-to-door seeking out individuals who worked with the ousted government and security forces, but it was unclear if the gunmen were Taliban or criminals posing as militants. Mujahid blamed the security breakdown on the former government, saying the Taliban only entered Kabul in order to restore law and order after the police melted away.

A broadcaster in Afghanistan said she was hiding at a relative’s house, too frightened to return home much less go to work. She said she and other women do not believe the Taliban have changed their ways. She spoke on condition of anonymity because she feared for her safety.

A group of women wearing Islamic headscarves demonstrated briefly in Kabul, holding signs demanding the Taliban not “eliminate women” from public life.

U.S. national security adviser Jake Sullivan said the U.S. and other governments will not simply take the Taliban at their word when it comes to women’s rights.

“Like I’ve said all along, this is not about trust. This is about verify,” Sullivan said at a White House briefing. “And we’ll see what the Taliban end up doing in the days and weeks ahead, and when I say we, I mean the entire international community.”

Whatever their true intentions, the Taliban have an interest in projecting moderation to prevent the international community from isolating their government, as it did in the 1990s.

The European Union said it was suspending development assistance to Afghanistan until the political situation is more clear but that it would consider boosting humanitarian aid.

EU foreign policy chief Josep Borrell said the Taliban must respect U.N. Security Council resolutions and human rights to earn access to some 1.2 billion euros ($1.4 billion) in development funds earmarked through 2024.

Foreign Secretary Dominic Raab said Britain might provide up to 10% more humanitarian aid, but the the Taliban would not get any money previously earmarked for security.

Evacuation flights resumed after being suspended on Monday, when thousands of people rushed the airport. In shocking scenes captured on video, some clung to a plane as it took off and then fell to their deaths. At least seven people died in the airport chaos, U.S. officials said.

On Tuesday, the Taliban entered the civilian half of the airport, firing into the air to drive out around 500 people there, said an Afghan official who spoke on condition of anonymity because he wasn’t authorized to brief journalists.

The Taliban appeared to be trying to control the crowd rather than prevent people from leaving. A video circulating online showed the Taliban supervising the orderly departure of dozens of foreigners.

The U.S. Embassy in Kabul, now operating from the military side of the airport, urged Americans to register online for evacuation but not to come to the airport before being contacted.

The German Foreign Ministry said a first German military transport plane landed in Kabul but took off with only seven people on board due to the chaos. Another left later with 125 people.

U.S. President Joe Biden has defended his decision to end America’s longest war, blaming the rapid Taliban takeover on Afghanistan’s Western-backed government and security forces. NATO Secretary-General Jens Stoltenberg echoed that assessment, while saying the alliance must investigate the flaws in its efforts to train the Afghan military.

Talks continued Tuesday between the Taliban and several Afghan politicians, including former President Hamid Karzai and Abdullah Abdullah, who once headed the country’s negotiating council. The Taliban have said they want to form an “inclusive, Islamic government.”

The talks focused on how a Taliban-dominated government would operate given the changes in Afghanistan over the last 20 years, rather than just dividing up ministries, officials with knowledge of the negotiations said on condition of anonymity to discuss the closed-door talks.

A top Taliban leader, Mullah Abdul Ghani Baradar, arrived in Kandahar on Tuesday night from Qatar, potentially signaling a deal is close at hand.

The vice president of the ousted government, meanwhile, tweeted that he was the country’s “legitimate” caretaker president. Amrullah Saleh said that under the constitution, he should be in charge because President Ashraf Ghani has fled the country.

Faiez reported from Istanbul, Gannon from Guelph, Canada, and Krauss from Jerusalem. Associated Press writers Tameem Akhgar in Istanbul, Jon Gambrell in Dubai, United Arab Emirates, Kirsten Grieshaber in Berlin, Jan M. Olsen in Copenhagen, Denmark, Pan Pylas in London, and Aya Batrawy in Dubai contributed to this report.

U.S. Halted Dollar Shipments To Afghanistan To Keep Cash Out Of Taliban’s Hands

U.S. officials are also blocking Taliban from Afghan government accounts managed by the Fed and U.S. banks.

The Biden administration last week canceled bulk shipments of dollars headed for Afghanistan as Taliban fighters were poised to take control of the capital city of Kabul, part of a continuing scramble to keep hundreds of millions of dollars out of the hands of the terrorist group, according to people familiar with the matter.

The U.S. is also blocking Taliban access to government accounts managed by the Federal Reserve and other U.S. banks and working to prevent the group’s access to nearly half-billion dollars-worth of reserves at the International Monetary Fund, according to those people.

The actions represent the last vestiges of diplomatic leverage Washington hopes will help prevent a deepening political and humanitarian crisis.

“Any central bank assets the Afghan government has in the United States will not be made available to the Taliban,” a Biden administration official said.

As the Taliban took over several provincial areas across the country and made its way toward Kabul last week, the U.S. Treasury Department made an emergency decision to work with the Federal Reserve Bank of New York to halt shipment of the sealed pallets of cash.

Although the U.S. and other allied governments haven’t recognized the Taliban as the legitimate government of Afghanistan, its control of the main organs of the state, including the central bank and other offices that house government coffers, make it the de facto power.

“As a matter of policy we do not acknowledge or discuss individual account holders,” a New York Fed official told the Journal. “We do, as a general practice, communicate with the appropriate U.S. government agencies to monitor events that may impact control of a foreign central bank,” the official said.

Ajmal Ahmady, Afghanistan’s central bank chief, who fled the country on Sunday, said in an interview that he learned on Friday that no more dollar shipments would be arriving, but he declined to comment further on the decision. He said the central bank has approximately $9 billion in reserves, nearly all of which are held outside the country.

With the U.S. move to block access to those reserves, “the amount accessible to the Taliban is almost 0.1%,” Mr. Ahmady said Tuesday.

Mr. Ahmady said that bank officials began reducing the amount of cash, including U.S. dollars, held at bank branches in provincial centers earlier this month amid concerns over the Taliban’s advance. By the time the first major provincial capital fell to the Taliban nearly two weeks ago, nearly all U.S. dollars had been repatriated, he said.

“During this entire period, no dollars fell into the hands of Taliban before Kabul fell,” Mr. Ahmady said. “All of it was secured.”

Still, the speed with which Taliban fighters took over the country surprised bank officials. Mr. Ahmady said he spent Friday working to secure local branch vaults and protect central bank staff, as well as take stock of the potential economic fallout and on Saturday met with private banks and market exchanges to try to quell panic over dwindling currency supply.

“We were still having a medium-term view at that time,” he said. “Even with the fall of these provinces, I don’t think anyone had the expectation that by Sunday, everything would fall.”

The IMF didn’t comment.

The Biden administration is also working to block other assets overseas.

Secretary of State Antony Blinken on Sunday warned that the U.S. would use its financial power in an effort to pressure the Taliban on several fronts, including through sanctions and financial aid that has been critical to keeping the Afghan economy afloat.

“Support from the international community, none of that will be forthcoming,” Mr. Blinken said. “Sanctions won’t be lifted, their ability to travel won’t happen, if they’re not sustaining the basic rights of the Afghan people and if they revert to supporting or harboring terrorists who might strike us,” he said.

Afghanistan’s reserve accounts at the world’s emergency lender will swell Monday by more than $450 million as part of a broader replenishment of bailout reserves at the IMF. As the de facto government, the Taliban could seek to tap that reserve, particularly as the nation faces a potential economic collapse.

But, the U.S., the IMF’s most powerful shareholder, is working to prevent that from happening, said the people familiar with the matter. Officially recognizing a country’s government as legitimate is a decision that the IMF’s collective membership would have to make. The lack of clarity on that matter, say former U.S. Treasury officials, will prevent the Taliban’s immediate access to the money.

Even if the Taliban gets access to the IMF account, it would require another country to exchange the IMF unit of lending into usable currency. China and Russia both have made political and economic overtures to the Taliban in recent years, including in actions favorable to the Taliban as members of the United Nations Security Council.

The U.S. government has sanctioned the Taliban as a terrorist organization, as have the U.N. and European Union. The Taliban’s seizure of the Afghan organs of state in Kabul effectively extends those sanctions to those institutions, some former Treasury officials and analysts said.

Because foreign banks and firms conducting transactions with the Afghan government now risk being penalized for doing business with the Taliban, cross-border trade and finance is expected to come to an abrupt halt, those people said.

Another powerful economic weapon that some former Treasury officials said is under consideration is declaring the entire country a sanctioned jurisdiction, as Washington has done with North Korea and Iran.

Afghanistan’s central bank has burned through nearly $700 million in foreign exchange reserves in the first few months of the year trying to prevent the country’s currency from collapsing, a circumstance that would spark hyperinflation, among other economic crises.

Updated: 8-20-2021

Bitcoin Lightning Network To The Rescue For Afghanistan

One of the countries that no longer has access to Western Union is Afghanistan. This is because the company decided to suspend all services to the embattled country until the current situation is better understood. Yes, you read that right. The money transmitter that is one of the two most popular services in the country has decided to shut down operations at the exact time that the average citizen needs help the most.

Afghanistan receives just under $800 million a year in remittances and it makes up approximately 4% of GDP. These aren’t massive numbers from a global perspective, but they are incredibly meaningful to the people on the ground that rely on Western Union for financial access.

Service Update as of August 18, 2021 pic.twitter.com/bwRMHLpYyi

— Western Union (@WesternUnion) August 18, 2021

It was infuriating to see this statement from the business. Rather than capitulate and shut down operations, they didn’t even attempt to increase agent capacity to deal with an increase in demand for their services. But it is useless to get mad. There is nothing that you or I can do about these types of situations.

Instead, the only solution is to build a better system. That is exactly what Jack Mallers and Strike are doing, which is interesting because Jack released a video today that shows how valuable his product has become.

With @Bitnob_official‘s Lightning Network integration, we now have free, instant, non-reversible remittances of any size to and from the United States, Nigeria, and Ghana.

— Jack Mallers (@jackmallers) August 19, 2021

$10 in my US bank account became spendable NGN for @bernard_parah in seconds.

Monetary history. pic.twitter.com/UXTf70qkpR

Western Union Suspends Money Transfers To Afghanistan, Cutting Off ‘Vital Channel’ Of Financial Support

Remittances make up nearly 4% of Afghanistan’s gross domestic product.

Western Union is suspending money transfers into Afghanistan as America withdraws troops from the troubled country now in the Taliban’s control.

“We recognize that our services provide a vital channel for our customers to support their loved ones, and we will continue to closely monitor this rapidly-developing situation and keep our customers and associates apprised of any developments,” the company said in a statement.

Western Union, which has the capacity to wire money from the U.S. to more than 200 countries and territories, said the perilous situation left it with no choice but to temporarily halt money transfers into Afghanistan, effective Aug. 16.

The widely-seen footage of Afghans clinging to a U.S. military plane as it took off from Kabul airport was a stark image marking the close of 20 years of American intervention in the country. But the Western Union announcement is a reminder of the less-visible assistance Afghan families have been receiving via informal financial channels from family and friends abroad.

Remittances — money beamed from abroad to people inside Afghanistan — constituted nearly 4% of the country’s gross domestic product last year, according to World Bank data. Last year, Afghanistan’s GDP was $19.8 billion, the World Bank said.

The countries where remittances made pup the largest share of GDP in 2020 were Somalia (35.2% of a $4.9 billion economy), the Kyrgyz Republic (28.4% of a $7.7 billion economy) and Tajikistan (26.6% of an $8.1 billion economy), World Bank data show.

People in Afghanistan received $788.9 million last year in remittances, the World Bank said.

Western Union and MoneyGram are the two big money transfer companies in most countries, according to Paul Vaaler, a professor at the University of Minnesota’s Carlson School of Management.

People living in urban areas like Kabul will be the ones feeling Western Union’s absence, said Vaaler, who has been studying the effects of remittances on the developing world, including Afghanistan.

MoneyGram did not respond to a request for comment on the status of its Afghanistan operations.

In rural areas, however, the informal hawala money transfer network found in Muslim-majority countries will continue on, Vaaler said.

Hawala, “transfer” in Arabic but with added references of “trust” in Hindi and Urdu, is a centuries-old, informal money transfer system to get money from one place to another, with a commission layered in. Because the network is based on trust and connections, the hawala dealers, or hawaladars, offering their services to move the currency, usually share ethnic ties with the customers they serve, Vaaler said.

Hawala is “used around the world to conduct legitimate remittances. Like any other remittance system, hawala can, and does, play a role in money laundering,” said the authors of a Treasury Department Financial Crimes Enforcement Network/INTERPOL report.

In the big picture, remittances accounting for approximately 4% GDP may not sound like a significant number, but anything helps in the war-torn country.

Afghanistan has a population of 37.4 million people and 54.5% live in poverty, according to the CIA’s World Factbook. (The poverty estimates are from 2016, the CIA notes.)

When it comes to the hawala networks, Vaaler said “that money is incredibly important. It’s literally the lifeblood of the rural economy.” For him, the big open question is what happens next for the hawala networks. However, he noted, “those groups, they know how to work with or avoid the Taliban.”

Taliban Takeover Renders Budget For Afghanistan Null And Void

U.S. forces are evacuating Americans and others after Afghan government’s collapse.

AFGHANISTAN’S FALL to the Taliban has rendered several provisions of House Democrats’ foreign-affairs budget inoperable less than a month after it passed the chamber and before it was formally taken up by the Senate. The foreign-affairs appropriations package, passed July 28, included money for Afghanistan programs such as clearing improvised explosive devices and analyzing whether women and girls are included in the now-defunct peace process, and giving priority to investments in Afghanistan’s handmade-crafts sector.

The House bill, which received no Republican support, called on the State Department to provide regular updates on the number of locally employed staff and contractors supporting the U.S. Embassy in Kabul’s operations as well as the “impacts to foreign assistance programs and the presence of diplomatic and development personnel in Afghanistan.” U.S. forces evacuated the embassy on Sunday and are currently spiriting out as many diplomats, Afghan allies and development personnel as possible following the Afghan government’s collapse.

Sen. Chris Coons, the chairman of the Senate Appropriations subcommittee on state and foreign Operations, is working with the Biden administration to revise the budget, a spokeswoman said. “As the situation in Afghanistan is fluid and unpredictable, it is necessary to see how it evolves before we are able to determine whether the United States can continue to stay engaged beyond providing humanitarian aid, which is urgently needed for the foreseeable future.”

Helping Afghanistan: Organizations Currently Accepting Crypto Donations

Basic needs for refugees, medical care on the ground and visa assistance — some crypto users are sending tokens to nonprofits and others to help the Afghan people.

With thousands of Afghans currently being accepted as refugees in different countries following the Taliban’s takeover of many highly populated areas, many nonprofit organizations are accepting donations in cryptocurrency.

Thousands, if not millions, of Afghans are attempting to or are in the process of fleeing their home in fear of what the Taliban may do now they are largely in control of the country. Organizations helping refugees and those on the ground have put the word out: They need funds to support Afghans arriving on foreign soil with often little more than the clothes on their backs.

Hearts & Homes for Refugees, a New-York based grassroots nonprofit, is currently calling for donations to assist the roughly 20,000 Afghans still in the country waiting for United State authorities to process special immigrant visas. The group hopes to raise enough funds to relocate Afghan families to Westchester County, and currently accepts Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), Litecoin (LTC), ZCash (ZEC), Gemini dollar (GUSD), BAL, Yearn.Finance (YFI), Polygon (MATIC), Synthetix (SNX) and Bancor (BNT) through its integration with the Giving Block.

Now more than ever we need help supporting new arrivals from Afghanistan w/ #crypto donations. Help nonprofits like Hearts & Homes where it matters & when it matters most!

— Hearts and Homes for Refugees (@HHRefugees) August 16, 2021

Please show your support for this campaign by donating at our @TheGivingBlock page: https://t.co/IdRGN9LiyV https://t.co/2Tn4SM1Kg6

CARE, an organization with offices across the world that advocates for women and girls, said 393,000 Afghans have been displaced during the Taliban takeover and are in need of emergency aid. Jack Butcher, the founder of consulting firm Visualize Value, launched a series of nonfungible token, or NFT, “care packages,” each of which is aimed to be sold to match the organization’s estimated cost covering a single family’s emergency needs for a month.

Each edition of this NFT covers one Afghan family’s emergency needs for a month.

— @jackbutcher (@jackbutcher) August 16, 2021

If you can’t help financially, please consider a RT.

↓ https://t.co/psxeBGBIhC pic.twitter.com/ocEI1RMwYW

Butcher said the 0.028 ETH proceeds of each NFT sale — totaling $124,576, as of Aug. 19 — have gone directly to CARE to help Afghans. At the time of publication, 195 of the individual NFTs are still available to purchase. Crypto users also have the option of purchasing 10 at a time for 0.28 ETH, or roughly $914, to help 10 families through late September.

Some organizations with operations on the ground in Afghanistan are also still in contact using social media and asking for help. Code to Inspire, a school aiming to educate Afghan girls on coding and robotics, is accepting crypto contributions via the Giving Block. Founder Fareshteh Forough reported today that students were “still coding at home.”

The situation in Afghanistan is still developing, but there have already been reports of assault, murder and human rights violations as the Taliban expand their foothold. However, it’s important for well-intentioned crypto users to be mindful about who they donate to; some fear that scammers may use the media attention to their advantage by stealing donations intended for Afghans.

Updated: 8-21-2021

Inside Afghanistan’s Cryptocurrency Underground As The Country Plunges Into Turmoil

Farhan Hotak isn’t your typical 22 year-old Afghan.

In the last week, he helped his family of ten flee the province of Zabul in southern Afghanistan and travel 97 miles to a city on the Pakistani border.

But unlike others choosing to leave the country, once his relatives were in safe hands, Hotak then turned around and came back so that he could protect his family home – and vlog to his thousands of Instagram followers about the evolving situation on the ground in Afghanistan.

He has also been keeping a very close eye on his crypto portfolio on Binance, as the local currency touches record lows and nationwide bank closures make it next to impossible to withdraw cash.

“In Afghanistan, we don’t have platforms like PayPal, Venmo, or Zelle, so I have to depend on other things,” said Hotak.

Afghanistan still mostly operates as a cash economy, so money in Hotak’s crypto wallet won’t help him put dinner on his table tonight, but it does give him peace of mind that some of his wealth is safeguarded against economic instability at home.

It also offers bigger promises down the road: Access to the global economy from inside Afghanistan, certain protections against spiraling inflation, and crucially, the opportunity to make a bet on himself and a future he didn’t think was possible before learning about bitcoin.

“I have very, very, very limited resources to do anything. I’m interested in the crypto world, because I have earned a lot, and I see a lot of potential in myself that I can go further,” he said.

Run On The Banks

For many Afghans, this week has laid bare the worst-case scenario for a country running on legacy financial rails: A nationwide cash shortage, closed borders, a plunging currency, and rapidly rising prices of basic goods.

Many banks were forced to shutter their doors after running out of cash this week. Photos featuring hundreds of Kabul residents crowding outside branches in a futile effort to draw money from their accounts went viral.

“There’s no bank I can go to right now, no ATM,” said Ali Latifi, a journalist born and based in Kabul. “I live above two banks and three ATM machines, but they’ve been off since Thursday,” said Latifi, referring to the Thursday before the palace ouster.

Without an authority helming the Central Bank, it appears that printing cash to cover the shortfall isn’t an option, at least in the short-term.

The Western Union has suspended all services and even the centuries-old “hawala” system – which facilitates cross-border transactions via a sophisticated network of money exchangers and personal contacts – for now, remains closed.

Sangar Paykhar, a Kabul native currently living in the Netherlands, has been in constant touch with relatives there in recent weeks. He said that many who live paycheck to paycheck were, at first, borrowing money from others to get by, but now, those able to lend out cash have started conserving their funds.

“They’ve realized the regime has collapsed” and that those they are lending to “might not have a job tomorrow,” said Paykhar.

A few days before the Taliban entered Kabul, Musa Ramin was among the people who queued outside a bank in a fruitless attempt to withdraw cash. But unlike other Afghans in line with him that day, months earlier, he had invested a portion of his net worth into crypto. Ramin had been burned before by a rapidly depreciating currency, and decentralized digital money had proven to be a trusted safeguard.

In 2020, on what was meant to be a brief layover on a trip from London to Kabul, Ramin got stuck in Turkey. A one-week, mandatory Covid quarantine ballooned into six months.

“I converted all my money to the lira,” he said. After the Turkish currency began to spiral, Ramin said his capital was cut in half, and he was forced to conserve it. “That is when I discovered bitcoin.”

With all flights cancelled and no other options for departure, Ramin realized he needed to find alternative ways to support himself while stranded in Turkey during the pandemic-related shutdown. That’s when he started trading crypto.

“At first, I lost a lot of money,” he said. But he’s since gotten the swing of managing his digital assets, thanks to Twitter and tutorials on YouTube.

Even after returning to Kabul, the 27 year-old says he put all his focus into trading crypto. 80% of his crypto capital is in spot exposure, primarily in major coins, like bitcoin, ethereum, and binance coin. The other 20% he uses to trade futures.

“I was making more money in crypto in a month than in construction in a year,” said Ramin, though he did acknowledge the risk that’s involved. “It’s easy making money in crypto but keeping that wealth is the difficult part.”

Despite that volatility, Ramin still sees crypto as the safest place to park his cash. “If a government isn’t formed quickly, we might see a Venezuela-type situation here,” Ramin told CNBC. He feels virtual tokens are his safest hedge against political uncertainty and plans to increase his exposure to digital currencies in the coming year to as much as 40% of his total net worth.

Ramin isn’t alone in his thinking. Google trends data shows that web searches in Afghanistan for “bitcoin” and “crypto” rose sharply in July just before the coup in Kabul. That said, because this tool is a measure of interest, the spike could be referring to 10 searches or it could be 100,000.

But in a country that has long relied on physical cash for virtually all transactions, not many people have the option to let their savings sit in a bank account, let alone a digital wallet.

Just take Hotak. He lives in a remote part of Afghanistan where there are no ATMs or bank branches nearby. That means he has to keep a lot of physical cash on hand, in order to cover daily expenses. “Afghanistan is an unexpected country, and you have to be ready for anything,” he said.

While Hotak thinks that crypto is his future, for now, the bulk of his income comes from day labor jobs, like shoveling, brick work, digging wells, and running a tailor shop that makes clothes.

“Zabul is not a very developed city. It’s a village, so that’s how I earn,” he said.

Signs Of A Growing Crypto Economy

It’s hard to get insight into crypto adoption in Afghanistan.

Beyond the fact that measuring cryptocurrency adoption at the grassroots level isn’t easy, people actively go out of their way to hide who they are.

Some Afghans, for example, will conceal their IP address by using a virtual private network, or VPN, in order to mask their geographic digital footprint.

And unlike many crypto boosters – who tend to be vocal and community-driven – digital currency supporters inside Afghanistan often don’t want others to know they exist.

“The crypto community in Afghanistan is very small,” said Hotak. “They actually don’t want to meet each other.” He thinks that could change if the political situation normalizes, but “for now, everyone just wants to stay hidden until things are nice.”

However, new research from blockchain data firm Chainalysis is offering fresh optics on the country’s apparently burgeoning peer-to-peer (P2P) crypto network, which is increasingly the most telling metric of adoption in Afghanistan. Hotak, as well as his friends, use Binance’s P2P exchange, which allows them to buy and sell their coins directly with other users on the platform.

Chainalysis’ 2021 Global Crypto Adoption Index gives Afghanistan a rank of 20 out of the 154 countries it evaluated in terms of overall crypto adoption. And when you isolate for its P2P exchange trade volume, Afghanistan jumps up to seventh place. That’s a big move in just 12 months: Last year, Chainalysis considered Afghanistan’s crypto presence to be so minimal as to entirely exclude it from its 2020 ranking.

“Afghanistan on top makes sense from a capital controls point of view, given it’s hard to move money in and out,” explained Boaz Sobrado, a London-based fintech data analyst.

And some experts tell CNBC that Chainalysis could actually be underestimating its overall adoption.

“Unlike many other countries, sanctioned nations don’t have good and clear data on P2P markets,” explained Sobrado. He says that is partly to do with the fact that it is harder to track those transactions.

There are other anecdotal signs of adoption across the country.

Nearly a decade ago, sisters and Afghan entrepreneurs Elaha and Roya – both of whom had a focus on computer science at Herat University – founded the Digital Citizen Fund, an NGO that helps women and girls in developing countries gain access to technology. The organization has 11 women-only IT centers in Herat and another two in Kabul, where they teach 16,000 females everything from essential computer skills to blockchain technology.

Before classes were suspended earlier this week, creating a crypto wallet was also part of the curriculum. Elaha Mahboob tells CNBC that some students have chosen to secure their money in crypto accounts and a few have specifically started investing in bitcoin and ethereum in order to achieve their long-term financial goals.

“This is especially important as they don’t have to worry about not having access to their money, because major banks in Afghanistan have closed,” Mahboob said.

A few Digital Citizen Fund participants have left the country and used the crypto accounts they made in class as a way to transfer their money out.

Afghanistan’s exposure to the cryptosphere was also taking place inside the presidential palace. Blockchain company Fantom told CNBC it had been working in tandem with the previous government.

One such project with the Ministry of Health involved piloting blockchain technology to track counterfeit pharmaceuticals. Fantom says the pilot “concluded successfully,” and they had been preparing for national rollout before the Taliban took over.

Then there’s Sweden-based Bitrefill, an online marketplace that helps customers live on cryptocurrency by exchanging digital coins like bitcoin or dogecoin for gift cards with partner merchants. In Afghanistan, the card offerings include multiple mobile phone service providers, games such as Fortnite and Minecraft, Hotels.com, and Flightgift, which can be redeemed for flights with 300 international airlines.

While the company wouldn’t share sales numbers on the record with CNBC, Bitrefill does have the endorsement of Janey Gak, who uses it to top up her phone. Her Twitter account has become a must-follow for those who want to understand the situation on the ground through her eyes, but she’s also evangelizing the power of bitcoin to transform the country.

“I’m just an ordinary person. I’m not anyone special,” she said. “I am just someone who discovered bitcoin a couple of years ago.”