JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini (#GotBitcoin?)

Coinbase and Gemini reportedly had their accounts approved with JPMorgan Chase in April. JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini (#GotBitcoin?)

JPMorgan Chase, the United States’ largest bank, has reportedly taken on U.S. cryptocurrency exchanges Coinbase and Gemini as customers.

Related:

JPMorgan Chase With It’s JPM ShitCoin Wants To Take On Bitcoin

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End of 2019: Report

JPMorgan Chase Settles Crypto Credit Card Lawsuit For $2.5M

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years

JPMorgan’s New App Service For Young People Fails

JPMorgan Scams Investors With Phantom Yields In EMBI Indexes

Citigroup, JPMorgan Chase And Others Fined $1.2 Billion Over FX Trading

A report from the Wall Street Journal on May 12 cited unnamed sources apparently familiar with the matter, who highlighted that the move is the first time the banking giant has served clients from the crypto industry.

The move is the latest in a string of positive developments for bitcoin and another sign that Wall Street is becoming more comfortable with the business of cryptocurrencies.

Coinbase, founded in 2012, is the largest U.S.-based bitcoin exchange, with more than 30 million accounts. Gemini, founded in 2014 by Tyler and Cameron Winklevoss, is a smaller exchange, but it has been in the vanguard of the industry’s movement to attract mainstream clients and embrace regulation.

The accounts were approved in April, and transactions are just starting to be processed, the people said.

What is notable is that JPMorgan was willing to extend services to businesses built around bitcoin. Such businesses have for years been blocked by banks from opening up accounts. Bankers were concerned with exposing themselves to bitcoin’s shadier uses, like money laundering, and the added glare from regulators.

Coinbase and Gemini had to go through a long vetting process to get JPMorgan’s approval, the people said. What separates the exchanges from others in the space is the degree to which they have become regulated entities. The fact that both are regulated by multiple parties played a big part in the approval process.

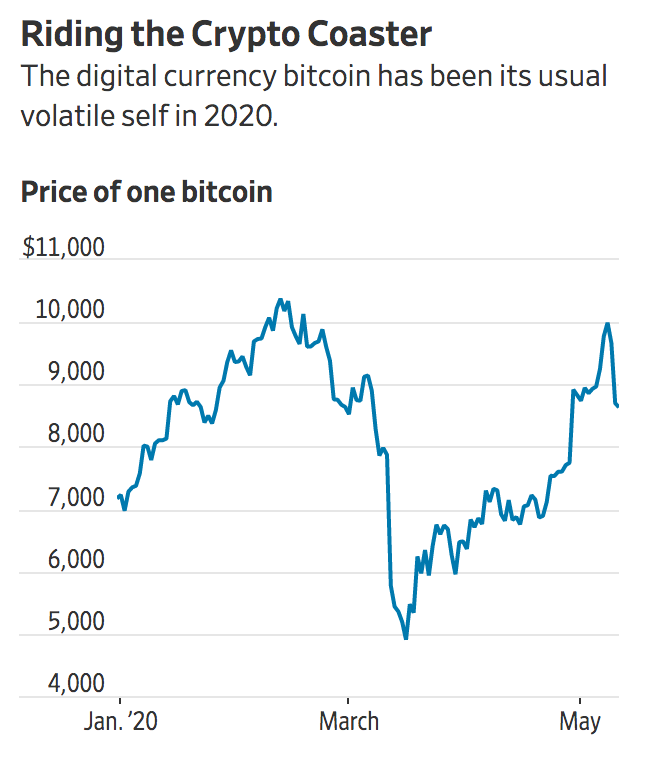

Bitcoin has had a run of good news lately. The price has more than doubled from its March lows, recently touching $10,000, though it is still more than two years removed from its all-time high of $19,800. Trading volumes hit record highs in April and March as investors became interested in the digital currency as a hedge against volatility in traditional markets.

Meanwhile, more Wall Street traders are in the market as well. Average daily trading volume this year of CME’s bitcoin futures contract has risen 43% from the same time frame a year ago, the exchange said. Nearly 850 new accounts have been opened this year, more than twice as many as a year ago. Popular vehicles for institutional investors, including the Grayscale Bitcoin Trust, an over-the-counter ETF, have seen increased activity as well.

Gemini obtained a trust charter from the New York State Department of Financial Services in 2015. Coinbase is registered as a money services business with Financial Crimes Enforcement Network, or FinCEN, and also has a specialized license for crypto businesses, called the BitLicense, from the DFS. Both are licensed as money transmitters in multiple states.

The bank is primarily providing cash-management services to the firms and handling dollar-based transactions for the exchanges’ U.S.-based customers, according to the people. It will process wire transfers, and deposits and withdrawals through the Automated Clearing House network, an electronic funds-transfer system.

Although Coinbase and Gemini are built around trading cryptocurrencies, many of their customers link traditional bank accounts to their accounts on the exchanges. Handling transfers in and out of those bank accounts requires a payments processor.

JPMorgan’s services don’t extend to any bitcoin or cryptocurrency-based transactions. The firms handle those themselves.

Both exchange accounts were reportedly accepted in April, with transactions now starting to be processed, sources told the WSJ.

JPMorgan Chase is not processing Bitcoin (BTC) or other cryptocurrency transactions on behalf of the exchanges but is providing cash-management services and handling dollar transactions for their U.S.-based clients. The bank will reportedly process all wire transfers and dollar deposits and withdrawals via the Automated Clearing House network.

Coinbase And Gemini Are Notably Regulated

The sources have claimed that both exchanges were asked to undergo a rigorous vetting process, pointing to major banks’ long-standing reluctance to forge relationships with crypto-related businesses.

Coinbase and Gemini have both established themselves as thoroughly-regulated entities; the latter, owned by the Winklevoss twins, has previously drawn criticisms from diehard libertarian cryptocurrency advocates for its controversial 2019 “crypto needs rules” ad campaign.

This April, Gemini obtained a new security qualification, a Service Organization Control (SOC) 1 Type 1 certification, after passing a review by Big Four accounting firm Deloitte.

Coinbase Custody had, for its part, previously sealed both an SOC 1 Type 2 and a SOC 2 Type 2 evaluation by major accounting firm Grant Thornton.

Coinbase is registered as a money services business with the Financial Crimes Enforcement Network and Gemini obtained a trust charter from New York’s Department of Financial Services back in 2015.

Both exchanges have also satisfied the requirements to operate under NYDFS’ exacting BitLicense framework and are licensed money transmitters in multiple states.

JPMorgan’s Jamie Dimon Has Been A Vocal Bitcoin Critic

For those who have followed JPMorgan chairman and CEO Jamie Dimon’s stance toward the crypto space in recent years, news of the bank’s pathbreaking support for both exchanges may be somewhat surprising.

Among his spicier statements, Dimon has said that Bitcoin is “worse than tulip bulbs,” predicting that speculation on the coin “won’t end well.”

The bank has been positive about blockchain’s potential, however, and announced plans to issue its own settlement-focused digital currency, JPM Coin, in mid-February 2019.

Recently, the bank has reportedly been considering a merger of its in-house blockchain unit Quorum — which underlies its Interbank Information Network — with the well-known Ethereum-focused firm ConsenSys.

Updated: 5-20-2020

Keeping Enemies Close: JPMorgan Servicing Crypto Firms Opens A New Frontier

Despite JPM’s boss being tough on crypto, the bank takes on two regulated exchanges as clients in what some are calling a “game-changer.”

As the largest among the United States’ “Big Four” banks, JPMorgan Chase comes across as an unlikely ally to digital asset service providers seeking to break through the glass ceiling still separating traditional and crypto finance. When the news broke on May 12 that the bank has been serving U.S.-based crypto exchanges Coinbase and Gemini since April, some digital finance experts saw it as a sign that the relationship may finally be thawing.

Despite JPM’s CEO Jamie Dimon consistently disparaging cryptocurrencies’ aptitude as a financial instrument, the institution has not been dismissive of blockchain technology, most notably developing proprietary DLT-based tools for international settlements. Now that the major U.S. bank seems to be extending its acceptance to crypto-related businesses as well, are the traditional players having a qualitative shift in perception of the digital finance space?

The Importance Of Being Compliant

Coinbase and Gemini are well-suited to be in the vanguard of the crypto industry’s integration with the traditional financial system. The two companies have been particular about securing the most exacting regulatory credentials on both federal and state levels.

Both are registered with the U.S. Treasury’s Financial Crimes Enforcement Network, and their custodian services have earned security qualifications in accordance with rigorous certification standards. They have also obtained notoriously scarce licenses from New York State Department of Financial Services: Gemini holds a Trust License, while Coinbase operates under a specialized BitLicense.

Experts surveyed by Cointelegraph noted that crypto firms willing to walk the extra mile to ensure full regulatory compliance will be the first to capitalize from mainstream financial institutions’ growing interest in digital assets. Michael Sonnenshein, the Managing Director at digital asset management firm Grayscale Investments, commented to Cointelegraph that JPMorgan’s announcement — alongside the news of Paul Tudor Jones’ allocation to Bitcoin — shows promise for greater cooperation between financial firms and compliant digital currency firms, adding:

“There is increased awareness in the banking sector that digital currencies represent a growing market with strong upside potential. Those that are leading the way in terms of regulatory approvals will be able to reap serious benefits through these relationships.”

Pursuing Mutual Interests

While legacy banks could benefit from the digital assets’ potential and rapidly expanding user base, crypto firms require banking services because most of their day-to-day operations are still fiat-based. Some traditional financial organizations have already tapped into this market, so JPM’s move is hardly unprecedented. Amrit Kumar, president and chief scientific officer of the blockchain company Zilliqa, told Cointelegraph:

“State Street — the second oldest non-retail bank in the U.S. — has been offering custody services to stablecoin issuers such as Gemini. Silvergate is also another bank that has been serving crypto players by offering fiat banking services. Having said that, JPMorgan’s entrance in this area gestures toward the growing trend where traditional institutions are now offering banking, custody, and other services to blockchain companies.”

Marc Fleury, CEO and co-founder of the fintech firm Two Prime, weighed in with a similar point: “For all the hype around ‘replacing traditional finance,’ crypto companies still need to maintain bridges to the fiat system, for not everyone accepts crypto for payments.”

According to Adam Traidman, CEO of crypto finance firm BRD, there is a difference between routine banking services that every digital currency company has to request at some point and strategic partnerships that can reveal more fundamental shifts in market structures. He added:

“It’s more than just a banking customer for corporate treasury management. It’s strategic, and could be a channel for customer acquisition, a technology play for the creation of a digital currency or perhaps even more likely, the beginning of an aggressively developing M&A market for crypto companies, where traditional financial institutions are the buyers.”

What Do Big Banks Want?

What could these strategic partnerships entail in the case of JPMorgan Chase and regulated crypto exchanges? One of the answers could lie in the bank’s business model that emphasizes wealth management and catering to high-net-worth clients. Meltem Demirors, chief strategy officer of investment firm CoinShares, noted to Cointelegraph:

“It appears that the initial focus will be custody clients, who are by nature high net worth individuals and institutions. […] It is likely that closer collaboration with two regulated, highly respected crypto firms will be beneficial for JP Morgan to bring digital assets to their wealth management clients in a controlled, low-risk manner.”

Demirors mentioned that JPMorgan Wealth Management has been courting crypto wealth for some time, and many digital finance executives are likely personal clients of the bank already. Another reason why establishing ties with major crypto platforms could prove a solid business move is the rising demand for exposure to digital assets and banks’ corresponding drive to meet this demand. Demirors said that banks would rather offer low-risk exposure to crypto “versus seeing AUM [Assets Under Management] leave their platforms to flow into crypto.” She went on to add:

“I imagine most banks will look to partner first, before investing in building their own infrastructure, but as evidenced by Fidelity, some may also choose to bring these capabilities in-house as the opportunity grows.”

Another lens through which the emerging partnership could be viewed is investment logic, as Fleury noted to Cointelegraph:

“There is some justified speculation that JPMorgan, an investment bank, is angling for the future underwriting business for the rumored IPOs of the two stalwart exchanges. Even if that were the case, the establishment of these traditional banking relationships marks a new era of legitimacy for crypto at large.”

Aside from these direct benefits, there are some far-flung considerations that might have contributed to JPM executives’ decision to get involved with cryptocurrency players. For one, Traidman thinks that the bank could be looking to gain a foothold in the digital finance space ahead of the U.S. government’s anticipated move toward digitizing the dollar at some point in the not-so-distant future:

“This may be the first step in the private sector’s foray to attempt and win contracts from the U.S. government to implement contactless payments via the ‘Digital USD’ referred to in the first draft of the original stimulus bill. Keep your friends close; keep your enemies closer. […] Their strategy may be to onboard crypto companies and then leverage the relationships to prove out a commercial version of such digital currency technologies prior to the U.S. government awarding a contract to the private sector.”

What Comes Next

Manuel Rensink, Strategy Director for the fintech firm Securrency, considers JPM’s move to bank Gemini and Coinbase a “game-changer,” adding that it “provides a roadmap for the deeper integration of digital assets into mainstream modern finance.” Rensink anticipates that many more traditional banks will follow the example and get involved with the regulated crypto sector due to digital assets’ natural edge from the advantages provided by their underlying tech:

“The programmability of digital assets on blockchain rails allows for better security, smarter compliance, and faster distribution to those in society in need of funds. While borrowing the unit of account convenience from the USD, a digital asset can be a more efficient medium of exchange that can immediately move between your phone and existing payment infrastructure.”

Additionally, Kumar is convinced that “blockchain-backed assets are no longer an asset class that traditional financial institutions can afford to avoid.” Tapping into the niche is an opportunity for traditional financial institutions to offer products and services appealing to both crypto-native and non-native users.

Updated: 5-20-2020

‘The Tables Have Turned’ Binance Exec Says of JPMorgan’s Support for Crypto Firms

Catherine Coley, CEO of Binance.US, says that traditional finance now recognizes that crypto involves “real assets and real customers with real business models.”

“We’re finally recognizing that crypto is just another opportunity in our financial future, rather than seeing it as a kind of misfit or unacceptable type of industry,” says Catherine Coley, CEO of Binance.US.

In an interview with Cointelegraph, Coley responded to news that JPMorgan Chase — the United States’ largest bank — had taken on cryptocurrency exchanges Coinbase and Gemini as customers.

“I take it as a very positive signal. We’ve seen specialist banks before being established to specifically support crypto, because traditional banks were not taking crypto businesses seriously,” Coley said.

This, she noted, led to the growth of specific banks that supported crypto or crypto marketplaces as “specialized businesses.” Some of these gained significant traction, as with the crypto-focused California-based commercial bank, Silvergate, which saw strong Q1 growth this year and went public last fall. Coley said:

“I think that was a strong, prior signaling that crypto businesses actually do have traditional revenue models, are consistent businesses involving real assets and real customers with real business models.”

JPMorgan now looks at the likes of Coinbase “as if it’s just another business,” Coley said, something she regards as an “extremely positive” development.

Spotlight On Jamie Dimon

Prior to the bank’s announcement, JPMorgan chairman and CEO Jamie Dimon had established himself as one of cryptocurrencies’ staunchest critics. The contended that Bitcoin is little more than a speculative bubble — “worse than tulip bulbs” — and predicted that its story “won’t end well.”

“It’s unfortunate for Dimon that it was so public,” Coley said, but “that’s how everyone’s journey with Bitcoin began. You know, disbelief, confusion, education, understanding, acceptance… obsession.”

While there’s no clear sign yet that Dimon’s truce with the coin has tipped over into obsession, Coley emphasized that the evolution of the bank’s position should not be overlooked. The number of stakeholders that a bulge bracket bank like JPMorgan has to factor into their decision making is “enormous,” she noted:

“Look how the tables have turned! It’s interesting to have seen the evolution of his stance in real time. This acceptance phase that we’re in now will lead to broader adoption, to more mainstream opportunities; prior skepticism has switched to seeing us as trusted businesses.”

Updated: 6-15-2020

JPMorgan Analysts: Bitcoin Is Likely To Survive (As A Speculative Asset)

Bitcoin proved itself a resilient asset, if not a stable or useful currency, during March’s global financial meltdown, according to analysts at one of the world’s largest investment banks.

In a note to investor clients circulated June 11 and obtained by CoinDesk, JPMorgan Chase & Co. analysts described how bitcoin has shifted from a fairly uncorrelated asset to one whose price more closely tracks traditional stocks.

“Though correlations were modest and mostly mean-reverting around zero for much of the past couple of years, in recent months they have moved sharply higher in some cases (equities) and lower in others (U.S. dollar, gold),” wrote the team of strategists led by Joshua Younger.

The analysts, who normally cover bonds, noted bitcoin’s success in outperforming traditional assets in March on a volatility-adjusted basis. The report also found that liquidity on major bitcoin exchanges was, surprisingly, more resilient than for traditional assets such as equities, gold, U.S. Treasury bonds and foreign exchange.

The results of their analysis “suggest that bitcoin saw among the most severe drops in liquidity around the peak of the crisis in March, but that disruption was cured much faster than other asset classes,” the researchers wrote. “At this point, bitcoin market depth is above its 1-year trailing average, while liquidity in more traditional asset classes has yet to recover.”

Stablecoins, whose values are generally pegged to government currencies, got a brief mention and were described as relatively “unscathed” by the March turbulence.

From March 2-23, the S&P 500 plunged 29% as investors looked to cash out amid increasing concerns about the coronavirus.

The JPMorgan analysts reckoned that cryptocurrencies successfully passed their first stress test during this period despite volatile price action. During the March panic, crypto valuations did not diverge all that much from their intrinsic values, showing little flight to liquidity within the asset class, the analysts wrote.

While the market structure for crypto during this period was more resilient than its traditional counterparts, according to the report, bitcoin did not quite live up to its reputation in some corners as a port in a storm.

“There is little evidence that bitcoin and others served as a safe haven (i.e., ‘digital gold’) — rather, its value appears to have been highly correlated with risky assets like equities,” the report concluded. “This all likely points to the continued survival of the asset class, but likely still more as a vehicle for speculation than as a medium of exchange or store of value.”

While that may sound like faint praise, the analysts’ assessment differs sharply from past comments by JPMorgan’s chairman and CEO, Jamie Dimon, who dismissed bitcoin as a “fraud” around the height of the 2017 bull market. During the subsequent “crypto winter,” financial services giants such as Fidelity and ICE began laying the groundwork for potential institutional investment in the asset class.

JPMorgan Chase has been experimenting with blockchain technology since 2016, and it recently began banking two of the largest U.S. crypto exchanges, the megabank’s first clients in the sector.

Updated: 2-10-2021

Don’t Expect Large Firms To Follow Tesla’s Bitcoin Move, JPMorgan Says

While the crypto community expects more large firms to emulate Tesla’s Bitcoin purchase, JPMorgan’s strategists don’t think it will happen.

Strategists at JPMorgan Chase, one of the largest investment banks in the United States, believe that Tesla’s $1.5 billion Bitcoin (BTC) purchase will not necessarily trigger a ton of similar investments.

A group of JPMorgan strategists led by Nikolaos Panigirtzoglou reportedly argued that Bitcoin’s highly volatile nature could keep mainstream corporate treasurers away from Bitcoin.

“The main issue with the idea that mainstream corporate treasurers will follow the example of Tesla is the volatility of Bitcoin,” the strategists wrote in a note to investors, Bloomberg reported Tuesday.

According to JPMorgan, even a small portion of Bitcoin in corporate treasures’ portfolios would be associated with a high level of risk as such companies usually maintain their portfolio volatility at around 1%.

Even if Bitcoin makes up 1% of total allocations, it “would cause a big increase in the volatility of the overall portfolio,” potentially driving the portfolio’s volatility up to 8% due to Bitcoin’s 80% annualized volatility, the strategists said.

Elon Musk’s Tesla Motors made the headlines on Feb. 8 by announcing a $1.5 billion Bitcoin purchase in a filing with the United States Securities and Exchange Commission. The news fueled a parabolic spike in an already rallying crypto market, with Bitcoin subsequently hitting a new all-time high of above $48,000.

Following the huge move, a number of major crypto figures including Galaxy Digital founder Michael Novogratz expressed confidence that “every company in America” will follow Tesla’s decision to allocate a part of their balance sheets to Bitcoin.

Grayscale Investments CEO Michael Sonnenshein also predicted that the world will soon see a lot of “other visionary leaders and disruptive companies actually realizing it has really moved from why to why not.”

Some crypto players also speculated that U.S. tech giant Apple could be the next institutional player to adopt the crypto asset.

Don’t count on other large companies to emulate Tesla Inc.’s decision to add Bitcoin to its balance sheet, according to JPMorgan Chase & Co.

“The main issue with the idea that mainstream corporate treasurers will follow the example of Tesla is the volatility of Bitcoin,” strategists at the bank led by Nikolaos Panigirtzoglou wrote in a note. Still, they argue, its move puts a spotlight on the trend.

Tesla disclosed Monday it invested $1.5 billion in Bitcoin and intends to begin accepting the cryptocurrency as a form of payment. Its announcement sent the digital coin to record highs, pushing its price above $48,000 at one point on Tuesday. Experts are now debating whether the high-profile move will have ripple effects within the industry and whether other public-company CFOs will make similar investments.

Corporate treasury portfolios are typically stuffed with bank deposits, money market funds and short-dated bonds, meaning that annualized volatility — or the range of swings during the course of a year — hovers around 1%. Adding a 1% Bitcoin allocation “would cause a big increase in the volatility of the overall portfolio,” wrote the strategists. Such an allocation could mean the portfolio’s volatility rises to 8% due to Bitcoin’s 80% annualized volatility, they said.

But fans were heartened by Tesla’s foray into the cryptosphere, arguing that it pushes digital assets further into the mainstream. Following the announcement, longtime crypto investor Mike Novogratz suggested soon “every company in America” would accept Bitcoin as payment.

“Irrespective of how many corporates eventually follow Tesla’s example, there is no doubt that this week’s announcement changed abruptly the near-term trajectory for Bitcoin by bolstering inflows and by helping Bitcoin to break out above $40k,” wrote JPMorgan’s strategists. How sustained the rally becomes might depend on whether “less speculative” institutional flows materialize — such as those into the popular Grayscale Bitcoin Trust.

Updated: 2-12-2021

JPMorgan Will Get Into Bitcoin ‘At Some Point’, Says Co-President

JPMorgan co-president Daniel Pinto said that the current demand “isn’t there yet” for the firm to get into Bitcoin, but he is sure that “it will be at some point.”

Major U.S. investment bank JPMorgan Chase will eventually have to get involved in Bitcoin (BTC), co-president Daniel Pinto believes.

The executive told CNBC Friday that JPMorgan’s decision to introduce Bitcoin services would depend on the client demand to trade Bitcoin. Although the current demand is not strong enough, Pinto is confident that it could grow further:

“If over time an asset class develops that is going to be used by different asset managers and investors, we will have to be involved […] The demand isn’t there yet, but I’m sure it will be at some point.”

Pinto’s latest remarks follow some bullish signals that have been circulating around JPMorgan for a while. During an internal Zoom call in January, JPMorgan’s global markets head Troy Rohrbaugh reportedly acknowledged that the bank’s own employees were increasingly asking about the bank’s Bitcoin plans. Pinto was already saying that he was open-minded about Bitcoin, people familiar with the matter reported.

JPMorgan’s potential move into Bitcoin appears somewhat ironic, considering that the company’s CEO Jamie Dimon is known for his negative stance toward Bitcoin. In September 2017, Dimon called Bitcoin a “fraud,” comparing the world’s largest cryptocurrency to “tulip mania” and predicting a massive collapse.

At the time, Bitcoin was trading around $3,500. Three months later, the digital coin hit $20,000 — though it did enter a multi-year bear market shortly thereafter.

Bitcoin overtook JPMorgan in terms of market capitalization at $352 billion in November 2020. The milestone came shortly after Dimon compared Bitcoin to proprietary blockchain networks with regulatory controls, stating, “Bitcoin is kind of different and it’s not my cup of tea.”

JPMorgan strategists have provided mixed signals about Bitcoin in the past. In October 2020, JPMorgan reportedly suggested that Bitcoin’s price would double or triple in the long term. A few months later, JPMorgan strategists John Normand and Federico Manicardi argued that Bitcoin was the least reliable hedge during periods of acute market stress.

Updated: 2-25-2021

Crypto Boom Has Been Good To Coinbase Ahead Of Planned Listing

Coinbase Global Inc. is the latest company that’s taking an unconventional route to becoming a public company. A look at the largest cryptocurrency exchange’s latest financial statements shows something else that sets it apart: It’s making money.

About 85% of the 130 companies that went public in the U.S. last year were unprofitable, according to data compiled by Bloomberg that excludes special purchase acquisition companies and real-estate investment trusts.

Coinbase, which plans a direct listing rather than a traditional initial public offering, swung from a loss to a profit of $322 million last year on net revenue that more than doubled to $1.14 billion.

The gains highlight an underlying tension between the exchange’s business model and the buy-and-hold ethos of many Bitcoin proponents. Some 96% of Coinbase’s revenue last year came from fees on transactions on its exchange, according to its filing with the Securities & Exchange Commission. So the less that crypto traders hold — or “hodl,” as it’s know — the better Coinbase does.

And that appears to have been the case in 2020. Verified users of the exchange rose 34% to 43 million last year, while monthly transacting users jumped 180% to 2.8 million, according to the filing. A majority of its net revenue was derived from trades in Bitcoin and Ethereum.

The company’s shares have changed hands in recent private transactions at levels that would value Coinbase at close to $100 billion, a person familiar with the matter said. That could make it one of the biggest companies to go public since Facebook Inc.

Break-Through Moment

The emergence of Coinbase as a publicly traded company is anticipated to be a break-through moment for the industry, marking a milestone on the road to maturity for crypto as a mainstream asset class. It also should provide some transparency into the more opaque corners of the market.

In its filing, Coinbase detailed an investigation by the Commodity Futures Trading Commission since 2017, and disclosed that it has received subpoenas from the Treasury Department’s Office of Foreign Assets Control and attorneys general of California and Massachusetts.

Coinbase Reveals U.S., State Probes as It Seeks to Go Public

Coinbase said it plans to disclose material information over Twitter, potentially including Chief Executive Officer Brian Armstrong’s account, as well as via LinkedIn and YouTube.

The exchange’s plans to go public come as Bitcoin trades at around $50,000 after hitting an all-time high of $57,355 on Feb. 21, meaning its value has increased by more than 400% over the last year.

Cryptocurrencies have been buoyed by monetary and fiscal stimulus aimed at fighting the impact of the pandemic, as well as its embrace as a store of value by corporations such as Tesla Inc., MicroStrategy Inc. and Square Inc.

Investors such as Cathie Wood, founder of Ark Investment Management, are also bullish. Wood told a Bloomberg panel on Thursday that Bitcoin has the potential to reach trillions of dollars in market capitalization.

Among potential risk factors that could affect its plans, Coinbase listed the volatile nature of crypto as the main concern. Another risk is competition from so-called decentralized exchanges, which effectively let people trade coins without an intermediary.

Such exchanges are part of so-called decentralized finance movement, or DeFi, in which apps let people trade, lend and borrow coins from each other directly. In the same prospectus, Coinbase noted that it has invested in DeFi protocols — possibly in potential competitors.

One other noteworthy risk factor: “the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed Bitcoin, or the transfer of Satoshi’s Bitcoins.”

In an echo of Robinhood Markets’s mission to democratize access to financial markets, Coinbase’s Armstrong said that the company’s goal is to solve problems in the current financial system and “create more economic freedom.”

“If the world economy ran on a common set of standards, that could not be manipulated by any company or country, the world would be a more fair and free place, and human progress would accelerate,” Armstrong wrote in a letter addressing potential investors.

Nasdaq Debut

The offering could be the first major direct listing to take place on the Nasdaq. All previous ones, including Spotify Technology SA, Slack Technologies Inc., Asana Inc. and Palantir Technologies Inc., were listed on the New York Stock Exchange. Online video game company Roblox Corp. has also announced that it’s planning a direct listing, after earlier delaying its IPO and raising capital privately.

Coinbase won’t raise any proceeds in the transaction, the filing shows. The company didn’t list an address for its headquarters, saying that instead it became a “remote-first” company in May.

Started in 2012, Coinbase has raised more than $500 million from backers that include Y Combinator and Greylock Partners, according to its website. The company was valued at more than $8 billion in 2018 after a $300 million funding round led by Tiger Global Management.

Andreessen Horowitz, Tiger Global, Ribbit Capital, Union Square Ventures and co-founder Frederick Ernest Ehrsam III are listed among its biggest shareholders, the filing shows.

Owners of Coinbase’s Class A common stock will be allowed to sell in the listing and will not be subject to lock-up agreements. Class A stock carries one vote per share, while Class B has 20, according to the filing.

Coinbase will be listed under the symbol COIN. Goldman Sachs Group Inc., JPMorgan Chase & Co., Allen & Co. and Citigroup Inc. are advising on the transaction.

Updated: 3-7-2021

JPMorgan Sends Its Private Clients A Primer On Crypto

The report, which was produced in February 2021 and obtained by CoinDesk Friday, has been distributed to clients of JPMorgan Private Bank, which requires a minimum balance of $10 million to open an account.

JPMorgan has sent a report to its private banking clients to educate them on the risks and opportunities of investing in crypto.

The report, which was produced in February 2021 and obtained by CoinDesk Friday, has been distributed to clients of JPMorgan Private Bank, which requires a minimum balance of $10 million to open an account.

The comes after CNBC reported in February that JPMorgan co-president Daniel Pinto claimed “demand isn’t there yet” from clients for crypto services, but it “will be there at some point.”

The report breaks down how bitcoin could be valued, applying three different metrics: the number of users, the value of gold and the global money supply.

1. If applying a version of Metcalfe’s law – that bitcoin’s value is proportional to the square of the number of users – it would be worth $21,667.

2. If applying the current value of gold to the max supply of 21 million bitcoin, it would be valued at $540,814.

3. Whereas applying the global value of money to bitcoin’s max supply would place the crypto’s valuation at $1.9 million.

The report plays down bitcoin’s common comparison to gold. Despite having diversifying properties, bitcoin’s “volatility characteristics and correlation profile refute the comparison to the traditional safe haven asset.”

Updated: 3-9-2021

JPMorgan Launching ‘Crypto Exposure Basket’ Featuring Microstrategy And Square

The financial services giant has filed paperwork with the SEC to launch a debt instrument linked to 11 crypto-focused firms.

JPMorgan Chase has designed a new debt instrument that provides investors direct exposure to a basket of crypto-focused companies, according to a new filing with the United States Securities and Exchange Commission, or SEC.

JPMorgan’s Cryptocurrency Exposure Basket (Mar 2021) is described as an “unequally weighted basket consisting of 11 Reference Stocks of U.S.-listed companies” that operate businesses directly and indirectly related to cryptocurrencies.

The instrument allocates 20% to MicroStrategy, the data analytics firm with 91,064 BTC on its balance sheet. It also provides direct exposure to Square (18%) and Riot Blockchain (15%), two companies with significant exposure to Bitcoin. Nvidia Corporation and PayPal Holdings each account for 15% of the basket.

Advanced Micro Devices, Taiwan Semiconductor Company, Intercontinental Exchange, CME Group, Overstock.com and Silvergate Capital are also included in the basket.

The Prospectus States:

“The weights of the Reference Stocks were determined based in part on exposure to Bitcoin, correlation to Bitcoin and liquidity.”

JPMorgan says payouts are based on how the basket of companies performs. The minimum investment is $1,000 with a maturation date of May 2022.

The new product represents one of many ways institutional investors can gain access to the high-flying cryptocurrency market. Wall Street is already flocking to digital currencies, which largely explains the strong price support underlying Bitcoin. The flagship digital currency traded as high as $54,888 on Tuesday, according to TradingView.

If the recently launched Purpose Bitcoin exchange-traded fund is anything to go by, traditional investors have a strong appetite for digital assets. The Canadian ETF saw nearly $100 million in volume during its debut earlier this month, putting it on track to exceed $1 billion in assets after the first week.

Updated: 4-26-2021

JPMorgan To Let Clients Invest In Bitcoin Fund For First Time

The JPMorgan bitcoin fund could roll out as soon as this summer, sources tell CoinDesk. NYDIG will be the fund’s custody provider.

JPMorgan Chase is preparing to offer an actively managed bitcoin (BTC, +8.47%) fund to certain clients, becoming the latest, largest and – if its CEO’s well-documented distaste for bitcoin is any indication – unlikeliest U.S. mega-bank to embrace crypto as an asset class.

The JPMorgan bitcoin fund could roll out as soon as this summer, two sources familiar with the matter told CoinDesk. Institutional bitcoin shop NYDIG will serve as JPMorgan’s custody provider, a third source said.

JPMorgan’s bitcoin fund will be actively managed, multiple sources told CoinDesk. That’s a notable break from the passive fare offered by crypto industry stalwarts like Pantera Capital and Galaxy Digital, which let well-heeled clients buy and hold bitcoin through funds without ever touching it themselves. Galaxy and NYDIG are now offering bitcoin funds to Morgan Stanley clients.

The JPMorgan fund will be for private wealth clients, a source familiar with the situation told CoinDesk.

The move by JPMorgan marks a sharp turn for the $3 trillion bank.

JPMorgan CEO Jamie Dimon called bitcoin a dangerous fraud in 2017, threatening then to “fire in a second” any trader who touched the stuff. “If you’re stupid enough to buy it, you’ll pay the price for it one day,” he said at the time.

While he quickly walked back the “fraud” label and has more recently toned down his rhetoric, Dimon, who has repeatedly argued that government regulation of cryptocurrencies is inevitable, maintained late last year that bitcoin is “not my cup of tea.”

Despite its CEO’s personal disdain for the crypto, top deputies within its Corporate and Investment Banking division acknowledged in February that client demand might force the institution to change.

JPMorgan’s hulking investment, commercial banking and wealth management divisions have gradually evolved in their treatment of crypto and blockchain, even if the client-facing bitcoin fund is new. The bank’s research analysts regularly issue market insight on bitcoin’s price and prospects in reports available to clients.

The firm’s Onyx division seeks to speed up interbank payments via blockchain technology and JPM coin, for example. After five years of quiet development, Onyx is mounting a global hiring campaign for blockchain engineers.

On the Investment Banking side, JPMorgan issued its first crypto-adjacent investment product in March, a structured note tied to the performance of bitcoin proxy stocks such as MicroStrategy and Riot Blockchain.

JPMorgan’s new fund product, however, will be its first directly dependent on bitcoin’s performance.

Bank representatives did not respond to CoinDesk’s questions by press time.

Updated: 6-25-2021

Institutions Have No Appetite For Bitcoin At This Price Level: JPMorgan

JPMorgan does not expect a bull run for Bitcoin over the medium term based on the BTC-to-gold volatility ratio.

As Bitcoin’s (BTC) price failed to hold its breath above $35,000 on Thursday, JPMorgan expects an overall bearish movement below the critical price level based on the BTC-to-gold volatility ratio.

In a note sent to investors on Wednesday, JPMorgan detailed its reasoning to see the fair value of Bitcoin between $23,000 and $35,000 over the medium term. The banking giant previously pictured a $140,000 roadmap if the biggest cryptocurrency matches gold’s allocation and volatility profile.

But that’s off the table for the foreseeable future, according to JPMorgan’s note, which predicts that “full convergence or equalization of volatilities or allocations [between gold and Bitcoin] is unlikely in the foreseeable future.“

JPMorgan also said that China’s crackdown on mining operations would have a positive impact on Bitcoin over the medium term, “as it accelerates a shift away from China’s high share in bitcoin’s hash rate, reducing concentration.”

Not many institutions are joining MicroStrategy’s hunt to buy the dip. “More than a month after the May 19 crypto crash, bitcoin funds continue to bleed, even as inflows into physical gold ETFs stopped,” JPMorgan said, adding:

“This suggests that institutional investors, who tend to invest via regulated vehicles such as publicly listed bitcoin funds or CME bitcoin futures, still exhibit little appetite to buy the bitcoin dip.”

According to JPMorgan, another major factor preventing a possible bull run is the end of a six-month lock-up period for the Grayscale Bitcoin Trust fund, which saw a nearly $4-billion inflow in December and January. As Cointelegraph reported, July 19 will see the most significant single unlocking day, with 16,000 BTC worth around $627 million released.

Following the April all-time high, Bitcoin has been hovering between $30,000 and $40,000 for the last couple of weeks. After diving below $29,000 on Tuesday, BTC’s price is moving around $34,000, according to Cointelegraph Markets Pro and TradingView data.

8-8-2021

JPMorgan Now Offers Clients Access To Six Crypto Funds … But Only If They Ask

JPMorgan now offers access to six different crypto funds from GrayScale, Osprey Funds and NYDIG.

JPMorgan Chase quietly opened up access to six crypto funds over the past three weeks as it looks to offer crypto exposure to a variety of clients.

In the latest move, the bank’s private clients will now have access to a new Bitcoin fund created by crypto investment firm New York Digital Investment Group (NYDIG).

NYDIG is owned by Stone Ridge Asset Management and the “Stone Ridge Bitcoin Strategy Fund” offers exposure to Bitcoin via futures markets.

The NYDIG fund is in addition to five crypto funds that the bank opened access to last month: Grayscale Investments’ Grayscale Bitcoin Trust, Bitcoin Cash Trust, Ethereum Trust and Ethereum Classic Trust, as well as the Osprey Bitcoin Trust.

While the traditional financial institution has taken a big leap by offering crypto exposure via six different funds, it is reportedly taking a cautious approach to how it offers its new digital-asset services.

According to unnamed sources quoted by Business Insider, JPMorgan advisors are not allowed to overtly promote the crypto funds, and can only conduct the transactions upon the client’s request.

The Grayscale and Osprey Funds are open to all users of its various wealth management platforms including its self-directed Chase trading app, while the NYDIG fund is only open to private banking clients.

The investment banking giant has a complicated history with cryptocurrency, after CEO Jamie Dimon described Bitcoin as fraud back in 2017.

Analysts at Goldman Sachs appear to be working through some of the same issues, despite the firm actively working to offer exposure to the sector.

In June, Jeff Currie, the global head of commodities research at Goldman Sachs described Bitcoin as a “risk-on” asset similar to copper. In the same month, analysts from the bank released a crypto report which concluded that Bitcoin is not “a long-term store of value or an investable asset class”.

Goldman Sachs currently provides crypto services through a derivatives trading desk and a Bitcoin futures trading platform that was rolled out last month. The firm has also filed for a sort-of DeFi-based ETF in late July.

Updated: 8-8-2021

JPMorgan Says Digital Currencies Must Balance Inclusion, Banks

The creation of central bank digital currencies to address economic inequality with new retail loan and payments channels must be designed so they don’t “cannibalize” a country’s commercial financial system, according to JPMorgan Chase & Co.

If set up hastily, retail CBDCs could risk “disintermediating commercial banks” and lead to the exodus of 20% to 30% of their funding base — “potentially rapidly under stress,” JPMorgan strategist Josh Younger wrote in a note Thursday.

It’s possible to have more “financial inclusion” without significantly affecting the structure of the monetary system, he said. That’s because most lower-income households have less than $1,000 in their checking accounts, and those balances represent a small share of overall bank funding, according to Younger.

“If every last one of those depositors were to hold only retail CBDC, it would not have a material impact on bank funding,” Younger said.

“Financial inclusion” is frequently mentioned as a potential benefit of retail CBDCs. Federal Reserve Governor Lael Brainard, in May remarks, cited it as a major impetus for the U.S. central bank to consider its own CBDC. She also said the Atlanta and Cleveland Feds are conducting separate research projects on digital currency and financial inclusion.

“Hard caps of $2,500 would likely meet the needs of the vast majority of lower income households while not having any discernable effect on the funding mix of large commercial banks,” Younger said in the report. “Relatively heavy handed caps on holdings would be needed to reduce the utility of a retail CBDC as a store of value.”

Updated: 8-19-2021

JPMorgan Chase Reportedly Shuts Down Bank Accounts Of Bitcoin Mining Firm

Delaware-based Compass Mining offers U.S. citizens exposure to Bitcoin mining via its private infrastructure.

American banking giant JPMorgan Chase has reportedly blocked all account activities of Compass Mining, a Bitcoin (BTC) mining company based out of Delaware. The information came to light when Compass Mining CEO Whit Gibbs announced:

“Shoutout to Chase for shutting down Compass Mining accounts for doing our part to replace the old guard with self-sovereign, future-focused supporters of hard money. Get behind #Bitcoin or get out of our way.”

Compass Mining has been involved in offering mining rigs and hardware hosting services for Bitcoin mining. Under the pretext of supporting the Bitcoin hash rate and network, the company allows individual users to undertake mining operations via its private infrastructure.

Cointelegraph has reached out to both parties for further comments and will update this article should they respond.

JPMorgan has previously shown support to the crypto ecosystem — all the way from seeking blockchain talent to allowing wealthy investors access to crypto funds.

On Aug. 6, in an effort to offer crypto exposure to clients, JPMorgan allowed access to six crypto funds in a span of three weeks. This move has now exposed traditional investors to a Stone Ridge Bitcoin Strategy Fund that intended to strategize around Bitcoin futures contracts and pooled direct and indirect Bitcoin investment.

Last month, Mary Callahan Erdoes, director of asset and wealth management at JPMorgan, highlighted the importance of meeting the demand for crypto investments. “A lot of our clients say, ‘That’s an asset class, and I want to invest,’ and our job is to help them put their money where they want to invest,” she said.

JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,JPMorgan Provides Banking Services,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin Advocates Cry Foul As US Fed Buying ETFs For The First Time

Final Block Mined Before Halving Contained Reminder of BTC’s Origins (#GotBitcoin?)

Meet Brian Klein, Crypto’s Own ‘High-Stakes’ Trial Attorney (#GotBitcoin?)

3 Reasons For The Bitcoin Price ‘Halving Dump’ From $10K To $8.1K

Bitcoin Outlives And Outlasts Naysayers And First Website That Declared It Dead Back In 2010

Hedge Fund Pioneer Turns Bullish On Bitcoin Amid ‘Unprecedented’ Monetary Inflation

Antonopoulos: Chainalysis Is Helping World’s Worst Dictators & Regimes (#GotBitcoin?)

Survey Shows Many BTC Holders Use Hardware Wallet, Have Backup Keys (#GotBitcoin?)

Iran Ditches The Rial Amid Hyperinflation As Localbitcoins Seem To Trade Near $35K

Buffett ‘Killed His Reputation’ by Being Stupid About BTC, Says Max Keiser (#GotBitcoin?)

Blockfolio Quietly Patches Years-Old Security Hole That Exposed Source Code (#GotBitcoin?)

Bitcoin Won As Store of Value In Coronavirus Crisis — Hedge Fund CEO

Decentralized VPN Gaining Steam At 100,000 Users Worldwide (#GotBitcoin?)

Crypto Exchange Offers Credit Lines so Institutions Can Trade Now, Pay Later (#GotBitcoin?)

Zoom Develops A Cryptocurrency Paywall To Reward Creators Video Conferencing Sessions (#GotBitcoin?)

Bitcoin Startup Purse.io And Major Bitcoin Cash Partner To Shut Down After 6-Year Run

Open Interest In CME Bitcoin Futures Rises 70% As Institutions Return To Market

Square’s Users Can Route Stimulus Payments To BTC-Friendly Cash App

$1.1 Billion BTC Transaction For Only $0.68 Demonstrates Bitcoin’s Advantage Over Banks

Bitcoin Could Become Like ‘Prison Cigarettes’ Amid Deepening Financial Crisis

Bitcoin Holds Value As US Debt Reaches An Unfathomable $24 Trillion

How To Get Money (Crypto-currency) To People In An Emergency, Fast

Bitcoin Miner Manufacturers Mark Down Prices Ahead of Halving

Privacy-Oriented Browsers Gain Traction (#GotBitcoin?)

‘Breakthrough’ As Lightning Uses Web’s Forgotten Payment Code (#GotBitcoin?)

Bitcoin Starts Quarter With Price Down Just 10% YTD vs U.S. Stock’s Worst Quarter Since 2008

Bitcoin Enthusiasts, Liberal Lawmakers Cheer A Fed-Backed Digital Dollar

Crypto-Friendly Bank Revolut Launches In The US (#GotBitcoin?)

The CFTC Just Defined What ‘Actual Delivery’ of Crypto Should Look Like (#GotBitcoin?)

Crypto CEO Compares US Dollar To Onecoin Scam As Fed Keeps Printing (#GotBitcoin?)

Stuck In Quarantine? Become A Blockchain Expert With These Online Courses (#GotBitcoin?)

Bitcoin, Not Governments Will Save the World After Crisis, Tim Draper Says

Crypto Analyst Accused of Photoshopping Trade Screenshots (#GotBitcoin?)

QE4 Begins: Fed Cuts Rates, Buys $700B In Bonds; Bitcoin Rallies 7.7%

Mike Novogratz And Andreas Antonopoulos On The Bitcoin Crash

Amid Market Downturn, Number of People Owning 1 BTC Hits New Record (#GotBitcoin?)

Fatburger And Others Feed $30 Million Into Ethereum For New Bond Offering (#GotBitcoin?)

Pornhub Will Integrate PumaPay Recurring Subscription Crypto Payments (#GotBitcoin?)

Intel SGX Vulnerability Discovered, Cryptocurrency Keys Threatened

Bitcoin’s Plunge Due To Manipulation, Traditional Markets Falling or PlusToken Dumping?

Countries That First Outlawed Crypto But Then Embraced It (#GotBitcoin?)

Bitcoin Maintains Gains As Global Equities Slide, US Yield Hits Record Lows

HTC’s New 5G Router Can Host A Full Bitcoin Node

India Supreme Court Lifts RBI Ban On Banks Servicing Crypto Firms (#GotBitcoin?)

Analyst Claims 98% of Mining Rigs Fail to Verify Transactions (#GotBitcoin?)

Blockchain Storage Offers Security, Data Transparency And immutability. Get Over it!

Black Americans & Crypto (#GotBitcoin?)

Coinbase Wallet Now Allows To Send Crypto Through Usernames (#GotBitcoin)

New ‘Simpsons’ Episode Features Jim Parsons Giving A Crypto Explainer For The Masses (#GotBitcoin?)

Crypto-currency Founder Met With Warren Buffett For Charity Lunch (#GotBitcoin?)

Bitcoin’s Potential To Benefit The African And African-American Community

Coinbase Becomes Direct Visa Card Issuer With Principal Membership

Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

Jill Carlson, Meltem Demirors Back $3.3M Round For Non-Custodial Settlement Protocol Arwen

Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Bitcoin’s Lightning Comes To Apple Smartwatches With New App (#GotBitcoin?)

E-Trade To Offer Crypto Trading (#GotBitcoin)

Bitfinex Used Tether Reserves To Mask Missing $850 Million, Probe Finds (#GotBitcoin?)

21-Year-Old Jailed For 10 Years After Stealing $7.5M In Crypto By Hacking Cell Phones (#GotBitcoin?)

You Can Now Shop With Bitcoin On Amazon Using Lightning (#GotBitcoin?)

Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin, Bright Future Ahead (#GotBitcoin?)

Crypto Faithful Say Blockchain Can Remake Securities Market Machinery (#GotBitcoin?)

Disney In Talks To Acquire The Owner Of Crypto Exchanges Bitstamp And Korbit (#GotBitcoin?)

Crypto Exchange Gemini Rolls Out Native Wallet Support For SegWit Bitcoin Addresses (#GotBitcoin?)

Binance Delists Bitcoin SV, CEO Calls Craig Wright A ‘Fraud’ (#GotBitcoin?)

Bitcoin Outperforms Nasdaq 100, S&P 500, Grows Whopping 37% In 2019 (#GotBitcoin?)

Bitcoin Passes A Milestone 400 Million Transactions (#GotBitcoin?)

Future Returns: Why Investors May Want To Consider Bitcoin Now (#GotBitcoin?)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin?)

Major Crypto-Currency Exchanges Use Lloyd’s Of London, A Registered Insurance Broker (#GotBitcoin?)

How Bitcoin Can Prevent Fraud And Chargebacks (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.