A Guarded Generation: How Millennials View Money And Investing (#GotBitcoin)

The 2007-09 recession and college costs have left young adults loaded with debt and cynical about the markets. A Guarded Generation: How Millennials View Money And Investing (#GotBitcoin)

Three months after Lehman Brothers shut its doors in September 2008, Kate McGaughey got a call from the company she worked at doing legal research on oil-and-gas leases. She was being laid off.

Related:

Millennials Are Still Catching Up From The Last Recession. Now They Face a New One.

How Coronavirus Is Sending Millennials Back To Their Childhood Bedrooms

‘Playing Catch-Up In the Game of Life.’ Millennials Approach Middle Age In Crisis (#GotBitcoin)

As More Millennials Rent, More Startups Want To Lend To Them (#GotBitcoin)

Word To Millennials: The Hidden Dangers Of Automatic-Payment Apps (#GotBitcoin)

Bitcoin Enthusiast And CEO Brian Armstrong Buys Los Angeles Home For $133 Million

Blockchain Brings Unicorns To Millennials

With no savings after only five months in her first job after college, she had to take on four part-time positions and sell her bicycle, laptop and musical instruments to keep a roof over her head. She used to joke that her liberal-arts education had gotten her a bachelor’s in unemployment.

“I was sad and angry—angry because it wasn’t just me,” says Ms. McGaughey, who lives in Los Alamos, N.M. “I had seen so many other friends move back in with their parents or selling Cutco knives or just doing work that was beneath [their] potential. I felt like the classes of 2008 and 2009 were an entire lost generation.”

Like many in her generation, Ms. McGaughey had started her working life as venerable financial institutions were failing and bringing the stock markets down with them.

She came of age as the U.S. was confronting the worst joblessness since the Great Depression, and millions of Americans were losing their homes to foreclosure. As a result, more than half of millennials think their generation’s American dream has been upended, according to a survey for The Wall Street Journal conducted by MarketCast in September 2019.

Burdened And Distrustful

The nationwide survey of 1,440 Americans across the millennial, Generation X and baby boomer generations offered surprising insights into how the millennials view money and investing, and how those views often differ markedly from previous generations.

For instance, those born between 1981 and 1996 feel more financially burdened and are more focused on the here and now than their parents and grandparents. They also are more distrustful of financial institutions and less financially literate than prior generations.

In part because of financial uncertainty, many are putting off big milestones like buying homes—even while being committed to putting social values before monetary rewards when choosing investments or jobs.

More specifically, more than half of millennials surveyed feel overwhelmed by financial obligations, compared with 39% of Gen Xers and 31% of boomers.

Building up an emergency fund is a focus for 60% of those between the ages of 23 and 38, compared with a little over half of both prior generations.

What’s more, half of millennials say they want to invest but have no idea where to begin, compared with 32% of Generation X and less than 20% of baby boomers. Mistrust of financial institutions runs through 37% of millennials surveyed, compared with 29% of Generation X and 22% of baby boomers.

“I know several people who lost their homes during 2008 and 2009 and others who went bankrupt,” says Timothy Hooker, a 29-year-old financial adviser from Detroit.

“My mother was laid off from a big bank, and that hit home for me. Financial security is never guaranteed. It’s a continuous and evolving process.”

Mr. Hooker, who serves many clients from his generation, says millennials view investment risk very differently than their parents, wary about putting too much of their money into stocks out of concern about the next crash.

And the continuing turmoil in the stock market, driven by coronavirus fears and an oil-price crash, could add to millennials’ hesitation in entrusting their money to the market and taking on risk.

The Dow Jones Industrial Average’s 11-year bull run came to an end this week and the Dow posted its biggest one-day drop since 1987. The S&P 500 and Nasdaq Composite joined the Dow in bear-market territory.

A volatile market like this can take toll on young people’s emotions, says Stoyan Panayotov, senior adviser and founder at Babylon Wealth Management. “Seeing your investments going down can be nerve-racking for both experienced and novice investors.”

Growing up during the recession years from 2007-09, when about one in six U.S. workers lost their jobs, reshaped the way many millennials think about money and investing—but in some contradictory ways. Some, like Ms. McGaughey, became very focused on building up their rainy-day funds, while others adopted a, “You only live once” attitude about spending while you can.

Pinching pennies is a common practice, with 70% of those born between 1981 and 1996 trying to find ways to save a little money every day, either for long-term savings or big expenses like travel, the survey found.

However, 27% of millennials at least somewhat agree that their motto is to live in the present rather than plan for the future, reflecting a conflict between a YOLO mentality and a fear of the future.

Emily Anderson, a 31-year-old from Memphis, Tenn., who defines herself as a “free spirit,” spent her 20s traveling, working multiple jobs and studying for a master’s in journalism in Europe.

Her temporary jobs as a freelancer or waitress never put her in a position to have savings, so she never thought about buying a house or saving for her retirement. She chose to put her money in a smaller bank, wary of the mistakes big banks made in the past.

“I don’t trust bigger institutions and things that surround capitalism,” says Ms. Anderson.

What’s Your Passion?

Causes that are important to millennials, compared with older generations.

Dashed Expectations

Raised with the expectation that they could do anything they wanted if they worked hard enough, millennials instead entered a job market that offered fewer raises and opportunities than their parents had.

Those who started their careers around the recession experienced less economic growth in their first decade of work than recent generations, according to research by Deloitte. They have lower real incomes and fewer assets than previous generations at comparable ages, as well as higher levels of debt, Deloitte found.

Between 2010 and 2016, Gen Xers, baby boomers and the older silent generation all recouped some of their recession losses, while the average family headed by someone born in the 1980s fell further behind the older groups, in relative terms, according to data by the St. Louis Fed, which concluded that millennials are at risk of becoming a “lost” generation financially.

In addition to being more financially squeezed, they are more anxious than previous generations in part because the rise of social media put their lives on public display.

“We had millennials who were going through financial trauma and processing that during the recession, but at the same time everybody else was putting their best foot forward on social media,” says Erika Rasure, assistant professor of business and financial services at Maryville University.

Ms. McGaughey, now 34, is in a better financial situation 12 years after losing her legal-research job in Santa Fe, but her financial decisions are still haunted by the hard times she lived through.

“I’ve become a little bit more liberal with my spending habits, but the recession has left me with a residual pinching where I tend to buy organic only when I can stack a coupon on top of the sale price,” she says.

Even if millennials have found some stability now, they are still haunted by how they started out. Despite having a stable job as a storm-water sampler for a company in Los Alamos, N.M., Ms. McGaughey says she continues to be concerned about her basic welfare and security, and is focused on paying down her student loans and building a fund to protect herself in case she loses her job again.

Ms. McGaughey and 45% of her generation expect there to be a recession in the next year, compared with 37% of baby boomers, according to a survey conducted by data-and-consulting company Kantar.

This fear, coupled with student debt estimated at $1.6 trillion, stagnant wages and rising housing costs is keeping younger investors like Gina Gauthier out of the markets.

“That whole picture of having this enormous amount of debt but also wanting to pursue the American dream of owning a home and having a family has been a difficult balance to try to find,” says Ms. Gauthier, a 33-year-old from Chicago.

Ms. Gauthier says she would love to buy stocks or funds, but for the past few years, she and her partner have focused on providing for their 1-year-old son, Charlie, while trying to repay their combined $200,000 in student debt, retire their mortgage and build an emergency fund for health-care expenses.

This leaves them with no extra cash.

“I would love to invest, but if I have $400 available to me, does it need to go toward getting rid of this student debt that is carrying 7% interest or is it going to go toward investing in something—even if it is something I really care about—but that has no guaranteed returns?” she asks.

Making A Difference

That sense of meaning is central to millennials. Ms. Gauthier works as chief of staff for a venture-capital fund that invests in early-stage science and technology companies. She says the culture and purpose of a company is really important to her and is a big part of why she works in this field.

Despite not being in a position to invest, she says choosing to back a company that does good is her way of supporting impact investing, which means investing in companies that intend to contribute to measurable positive social or environmental footprints.

On an individual level, almost 70% of millennials would choose to invest in companies with positive sustainability elements even if that meant a 5% lower return on investment, the WSJ survey found.

“I think the world is at a crossroads,” says 26-year-old Austin Ritzel from Charlotte, N.C. “I truly believe that our actions will determine the future, and I think if we don’t make choices that value the environment and if we don’t address social issues like sexism, racism or xenophobia, we’re going to live in a progressively unhappier place.”

Mr. Ritzel says most of his decisions are influenced by those environmental and social concerns. He tries to consume less and takes animal welfare into account when buying food.

He also scrutinizes his investment choices so the companies in his Vanguard and Robinhood portfolios are aligned with his values.

This value-driven mind-set permeates every money-related decision millennials make: from the food they eat and the clothes they wear to the experiences they choose and the companies they apply to work for.

Mr. Ritzel, who will be moving to London in September to study international political economy and wants to pursue a career in sustainable investing, says compensation for him is important but that he wouldn’t settle for an employer that “merely pays well.”

“I need a place that takes into account how its decisions and actions impact the world around it,” he says.

Millennials aren’t as willing to settle as their parents and are more focused on living a meaningful life by working fulfilling jobs, pursuing their passions, exploring the world and constantly learning to expand their minds.

The need for personal fulfillment is 3.4 times higher among them than their parents.

Life Decisions

At the same time, millennials are delaying traditional life milestones, including marriage, homeownership and having children.

Since the 1960s, the percentage of people aged 18-31 who are married and living in their own household has dropped by more than 50%, according to Goldman Sachs. The cohort has also helped drive the number of births in the U.S. to their lowest levels since the 1980s.

Ms. McGaughey says she doesn’t think she wants children and prefers renting over owning, as it gives her more flexibility to change cities and to experience different neighborhoods. But, like her peers, she feels a responsibility to think about the world she will leave behind to the next generations and doesn’t want to make selfish choices with her money.

“I care about my friends’ and my co-workers’ kids inheriting a world with clean water and clean air, and I am really focused on working for employers that care not just about shareholders but about their social responsibility,” says Ms. McGaughey, adding that she feels proud of being part of a company that is working toward getting the B Corp certification, which is issued by nonprofit B Lab to companies that meet certain sustainability criteria.

As she thinks about being able to invest some day, Ms. McGaughey says she would like to support companies that care about sustainability or that have a lot of women in leadership roles.

“I feel a moral obligation to put my money where my values are,” she says.

The Financial Gurus Millennials Listen To

The generation is more comfortable getting advice on social media than at established institutions. Meet the new influencers.

During a lunch break in Gloversville, N.Y., Ryan kirner made his first YouTube video. As he sat in his 1999 Honda CR-V with a busted air conditioner, he explained how an 18-year-old can build credit.

That was October 2016. Now the 24-year-old is one of the most popular YouTubers giving financial and investing advice. Mr. Scribner’s YouTube account has more than 550,000 subscribers and counting. His videos draw up to 500,000 views a week.

Mr. Scribner also has a website, InvestingSimple.com, where he reviews investment products like robo advisers and online investing services. Last year, he says he made around $500,000 from his YouTube channel and his website.

“I just captured all this pent-up demand,” he says.

Mr. Scribner’s meteoric rise underscores how many millennials are grappling with financial literacy and turning to social media for help. About 1-in-2 millennials, defined as born between 1981 and 1996, want to start investing but don’t know how to begin, according to a survey conducted in late 2019 by MarketCast.

These wannabe investors are more comfortable learning about finance online than at bricks-and-mortar banks. The WSJ survey found that 46% of millennials prefer to learn about finance on a website, while 18% prefer social media. That compares with the 25% who say they would opt to go to an in-person expert like a financial adviser.

In similar fashion, 38% of millennials say they follow financial influencers on social media to keep up to date, compared with 16% of Gen-Xers and 12% of baby boomers. And 22% of millennials say social media and blogs have shaped their outlook about money, compared with 12% of Gen-Xers and just 4% of Baby Boomers.

Still, some of the ways in which such influencers are compensated point to potentially thorny issues, including possible conflicts of interest. Compensation for some influencers, for example, can include sponsorships by the very companies whose products they recommend.

Mr. Scribner’s website includes a section titled “FTC Disclaimer” that mentions the presence of “affiliate links” on the site, which according to the site means “if you choose to make a purchase, we may receive a commission.” The disclaimer also says,

“We only recommend products/services that are helpful and useful to our readers.”

Mr. Scribner, whose father is a financial adviser, says he thinks many millennials view traditional wealth managers as old-fashioned and shun them because they think it requires more financial know-how or money than they possess to enlist an adviser’s services. They prefer to use investing apps, Mr. Scribner says.

Mr. Scribner’s website includes a section titled “FTC Disclaimer” that mentions the presence of “affiliate links” on the site, which according to the site means “if you choose to make a purchase, we may receive a commission.” The disclaimer also says,

“We only recommend products/services that are helpful and useful to our readers.”

Mr. Scribner, whose father is a financial adviser, says he thinks many millennials view traditional wealth managers as old-fashioned and shun them because they think it requires more financial know-how or money than they possess to enlist an adviser’s services. They prefer to use investing apps, Mr. Scribner says.

Social-media companies say millennials are talking more than ever about investing. On YouTube, monthly uploads of videos on investing increased nearly ninefold between 2013 and 2019, according to data provided by YouTube.

A spokesperson for Instagram, the Facebook -owned social-media platform popular with millennials and their younger Gen Z counterparts, says there were more than three million posts on investing in the 30 days ended Feb. 11.

One of the biggest finance-focused accounts on Instagram is @MrsDowJones, a creation of 28-year-old Haley Sacks, a self-taught investor who posts investing memes, including one that humorously compares actual earnings and adjusted earnings to a Khloe Kardashian before-and-after makeover.

In one of her videos, filmed in a converted bedroom in her New York City apartment, she uses the ill-fated marriage of Tom Cruise and Katie Holmes to explain an options contract.

Her account has grown to more than 120,000 followers since launching in late 2017. She self-publishes and has her own website, mrsdowjones.com. She is working on increasing her YouTube presence and creating online courses and e-books.

Ms. Sacks says she makes money through partnerships with brands, speaking engagements and her clothing line. Ms. Sacks declines to share how much money she makes from her brand.

A lot of her work is encouraging millennials to be more open about how they are saving and spending money. “Most people would rather talk about death or sex than about finance,” she says.

Another challenge, Ms. Sacks says, is helping millennials realize that finance isn’t untouchable and that they don’t necessarily need to pay someone to start investing.

“I think the best news is that it’s not that hard,” she says. “It sort of feels like we’ve all been duped into thinking that this is so difficult.”

There are Instagrammers who take a more conventional approach to teaching their followers about finance. Jessica Ghaney, a 25-year-old living in Nova Scotia, runs the Instagram page Forex Tips 101, where she posts graphics on topics like how to spot when to buy or sell currencies based on patterns in their trading results. She started the account in April 2019 and now has more than 80,000 followers.

Ms. Ghaney, a nursing-school graduate, is a self-taught trader who started her account to find like-minded investors. “Giving tips along the way just brought me closer to a whole bunch of people,” she says.

Ms. Ghaney says most of her revenue comes from her online courses on technical analysis. In less than a year, she says she has made around $97,000 from her brand. Including her personal trading and real-estate income, she says she makes around $230,000 a year.

As more millennials head to social media to learn about investing, banks are trying to cash in as well. Bank of America and Wells Fargo are among the top financial companies paying social-media influencers for endorsements, according to market-research firm SocialBakers.

The firm points to how Bank of America has worked with Instagrammer Sarah Herron to advertise its Advantage Savings account. One Instagram post features Ms. Herron clutching a dog with her boyfriend.

A caption says she opened a Bank of America Advantage Savings account when she was 19, allowing her to save for milestones like starting a family. At the top of the post is a note that says the message is a “paid partnership” with the bank.

Ms. Herron declines to comment.

Chris Smith, enterprise social media executive at Bank of America, says the bank has research that suggests millennials and Gen Zers rely on influencers just as much as they do family and friends for advice.

“We partner with influencers to help educate our audiences,” he says.

San Francisco-based Wells Fargo has contracted with influencers for various campaigns, including the launch of its Propel credit card, says Jamie Moldafsky, chief marketing officer at Wells Fargo.

“The influencer should also be a customer in order to share their real-life experiences with the product,” she says.

In November, Instagrammer Leena Snoubar posted about how the Wells Fargo credit-card can earn holders rewards points for ordering food from a restaurant and streaming music.

Ms. Snoubar didn’t respond to multiple emails requesting comment.

Neither Wells Fargo nor Bank of America would say how much they pay influencers for their sponsorships.

Ms. Sacks, for her part, says in an emailed response to a question about how banks are using social media, “The #1 goal of the partnership should be integrity!

If this is not a priority and millennials are swayed by influencers who don’t really know the financial product they are selling and they end up misrepresenting it or it ends up being bad—it will only further the distrust millennials have in financial institutions (stemming from the financial crisis in 2008 that shaped the job market we came into) which is exactly what we DON’T want.”

Ms. Sacks adds: “I say ‘no’ to so many products that I don’t believe in or that just aren’t up to my standard because the trust of my audience is more important than any paycheck.”

Millennials’ Passions Haven’t Affected How They Invest

Despite feeling strongly about the environment and other causes, most millennials have never heard of, or don’t fully understand, ESG investing.

Millennials may be more passionate about environmental and social-justice causes than previous generations, but those values have yet to make a significant impact on how they invest.

Part of the disconnect, according to a survey conducted in September 2019 for The Wall Street Journal by MarketCast, is that many millennials simply aren’t familiar with socially responsible investing or don’t want to commit to it until they become more financially literate.

Katie Irwin, a 33-year-old accountant who works for the state of Colorado, has been investing for three years. She says that while she cares about how her investments might impact the causes she supports, she needs to learn more about finance before she starts investing based on environmental, social or governance (ESG) criteria.

“I want to be able to understand where and why and what I am investing in,” says Ms. Irwin, who has a pension plan through her job and a target-date fund through Vanguard Group.

It is a familiar theme for many in her generation.

According to the survey, the top passion causes among millennials, defined as those born between 1981 and 1996, are climate change at 41%, followed by human rights, poverty reduction and safe work environment, each at 39%, and environment sustainability at 38%.

The same survey also found that nearly half of millennials want to start investing but don’t know where to begin, and an overwhelming 87% of millennials had never heard of ESG investing. After the concept was explained to them, 44% said they would be interested in socially responsible investments vs. roughly a quarter of Gen-Xers and baby boomers.

“With some continued confidence and education, we may see ESG funds grow among millennials as the interest is there, but the familiarity isn’t,” says Kelly Lanan, vice president for young investors at Fidelity Investments Inc. Among Fidelity’s millennial clients, none of the top 10 most popular passive mutual funds by invested assets focus on sustainability.

Drawn To Tech Stocks

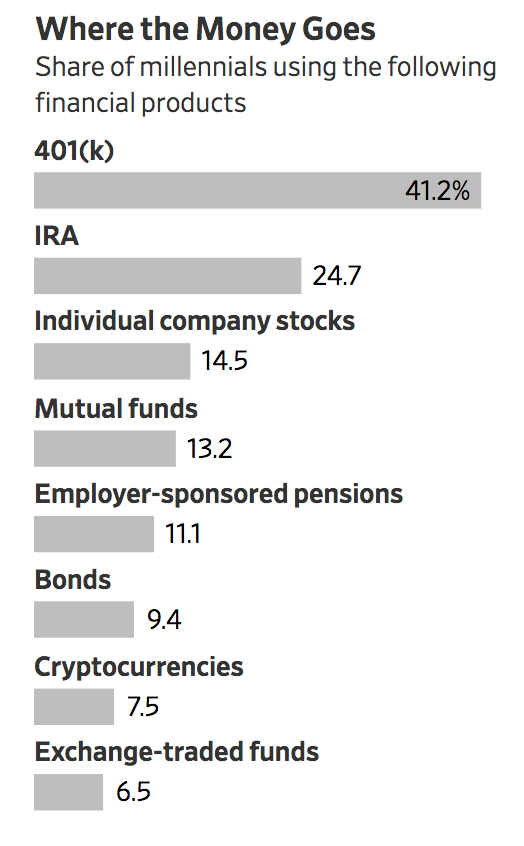

Among millennials who do invest, work-sponsored 401(k) plans are the most popular financial product at 41%, the survey found, followed by individual retirement accounts at 25%. About 19% say they invest in mutual funds and exchange-traded funds, while 15% invest in individual stocks.

Nina Gunderson, a 27-year-old financial adviser at UBS in New York, began investing through a work-sponsored retirement plan. She says buying stocks in environmentally and socially progressive companies doesn’t drive her portfolio.

“I’m trying to think about investments where they provide stability, where there’s opportunity for growth” she says.

ESG investments are rarely found in 401(k) plans and IRAs, according to the American Retirement Association’s Plan Sponsor Council of America. In 2018, only 2.9% of 401(k) plans had an ESG fund in their lineup, while the group estimates that just 0.1% of total IRA plan assets were in ESG funds.

For now, the choice for many millennials is target-date funds, which grow less risky as a target date approaches. Target-date funds are the default option in many company-sponsored retirement plans.

Fidelity, which manages about $3.2 trillion, says that 58% of millennial assets in its 401(k) plans were in target-date funds at the end of 2019. Among millennials who have all of their savings in 401(k)s, the share rose to 70%.

Among millennials whose investments are self-directed, holdings skew heavily toward trendy technology companies. The top stocks they held as of the end of December were Apple Inc., Amazon.com Inc., Tesla Inc., Facebook Inc. and Microsoft Corp., according to a survey by Apex Clearing of more than 730,000 U.S. investor accounts with an average age of 31 years and 3 months. The average account held about $2,300.

While many of these companies often appear in the holdings of ESG funds, there is nothing to suggest millennials are buying them for that reason.

“It’s easy to want to invest in something that’s been up the most,” Ms. Gunderson says.

Of the top 100 stocks held by millennial investors surveyed by Apex, 30% of holdings were in technology companies, 25% were services companies and 24% were consumer-goods firms. Bringing up the rear were utilities at 0.2%, basic materials at 1.5% and industrial goods at 3.3%. Oil giants Exxon Mobil Corp., Chevron Corp. and BP PLC also made the list.

Lucas Brito, 28, is one of these young investors who has a penchant for tech companies. He has traded Facebook stock in the past despite concerns about the company’s handling of user data, but has donated his earnings from Facebook to causes he cares about. “If they hold so much of my data and are making a profit off my data, I might as well get a cut of the pie,” Mr. Brito says.

He started trading stocks back in 2018 for fun, realizing it wasn’t so different than selling in-game credits on the popular online game “World of Warcraft.” “It’s like a virtual casino,” he says.

Mr. Brito, who works for a videogame company in Shanghai, China, says he and his fellow millennials are comfortable with tech companies because they grew up with them and understand their products. He also just thinks the sector has had exceptional growth compared with industries such as oil.

“How can you say it’s a bad investment to invest in them? All the big four grew so much in the last few years. When you compare [them] to oil, you’re sort of like, ‘Huh.’ ”

Inherited Wealth

Many millennials say they have too much student debt to even think about investing. Some 34% of the millennials in the Journal survey say they have so much student-loan debt that it’s a challenge to save for the future, while another 52% “feel overwhelmed by financial burdens.”

“If you have debt, it’s literally just going to be a wash if you’re putting that into the market,” says Lauren Simmons, who at age 22 became the youngest trader and the second black woman to work on the New York Stock Exchange floor.

Now 25, Ms. Simmons is working to launch a TV show to help young people with their finances.

“Having a conversation about millennials and investing is tricky because most of them are not in a position where they should be investing,” she says.

That situation might soon shift, however. It is estimated that millennials as a whole will inherit trillions of dollars from their parents, in what is expected to be the largest wealth transfer in history, says Danan Kirby, a 35-year-old client portfolio manager at Thornburg Investment Management in Santa Fe, N.M.

Mr. Kirby, who has been promoting investing based on ESG for more than 10 years, believes that once millennials have more assets and become more educated about finance, they will put money into socially responsible investments. “It will transfer into investing because it’s already in the millennial’s mind-set,” Mr. Kirby says.

Thornburg’s clients, who are mostly financial advisers, are increasingly seeking to recast their practices around sustainability as they prepare for a wave of millennial clients, Mr. Kirby says. Those advisers could be well-positioned to attract the quarter of millennials in the WSJ survey who say they prefer to go to a financial expert to learn about finance.

“The industry at large needs to do a much better job communicating with millennials as a whole about investments in general. Quite specifically, sustainability,” Mr. Kirby says.

Updated: 11-19-2020

‘Zillennials’ Are Going To Change Investing Forever, BofA Says

Eating meat is out, flight-shaming is in. Gen Z is transforming the world and investors need to be prepared.

As this new cohort — “Zillennials” — comes of age it’s going to eclipse the vaunted Millennials, boost emerging markets and help preferred sectors outperform as other more passe companies are likely to fall by the wayside, Bank of America Corp. wrote in a recent research report.

“The Gen Z revolution is starting, as the first generation born into an online world is now entering the workforce and compelling other generations to adapt to them, not vice versa,” strategists led by Haim Israel said.

Gen Z — the group born between about 1996 and 2016 — is on track to overtake Millennials in income by 2031, the BofA report says. And nine of 10 live in emerging markets, with India accounting for about 20% of the total.

Countries like Mexico, the Philippines and Thailand are also set to benefit from the changeover. Sectors that will benefit include e-commerce, payments, luxury, media and ESG, according to BofA, while areas like alcohol, meat, cars and travel may suffer.

Shifting Tastes

Gen Z Plan To Do Things Differently, Both With Their Lives And Money

BofA Conducted A Survey Of More Than 14,000 Gen Z Members In August, And Here Are Some Of The Conclusions:

* The majority have a meat restriction of some kind, and many don’t drink

* They welcome new technology to manage finances from phones to cryptocurrencies, implying banks and asset managers will need to reassess their services

* 40% of 16-18 year olds would rather interact virtually with friends versus 35% of Millennials and 30% of Gen X

* About 18% of 18-24 year olds surveyed watch traditional sports regularly each month, compared with 21% who watch eSports regularly each month

Investment Implications Could Include, According To BofA:

* Consumer-driven sustainable activism could lead to risks for “harmful” sectors like fast fashion

* Increasing focus on Asia-Pacific, which accounts for 37% of Gen Z income; that’s set to rise to 41% by 2040

* Voice technology could allow better access to e-commerce to individuals with limited literacy skills as voice assistants are launched in more languages

* The airline and travel industry could be affected by sustainability concerns as “flight shaming” becomes more prevalent

* Alcohol and tobacco companies will need to increasingly focus on products seen as healthier — such as beverages with lower sugar and alcohol contents, or heating rather than burning tobacco.

And in case this isn’t forward-thinking enough for you, BofA notes that the next to come along is Gen C: The Covid generation.

“It is the generation that will have only ever known problem solving through fiscal stimulus and free government money potentially paving the way for universal basic income and health-care access,” the strategists said. “Gen C will be unable to live without tech in every aspect of their lives” and “their avatars will protest virtually in the online Total Reality world with their friends on the latest cultural movement.”

Updated: 11-23-2020

Why Tomorrow’s Money Will Come In New Crypto Flavors

Five years ago, Bitcoin and its cousins in cryptocurrency seemed so unimportant that central banks could hardly be bothered to sneer at them.

Now central banks in small countries like the Bahamas and big ones like China are rolling out digital currencies of their own, with the European Central Bank and the U.S. Federal Reserve watching closely.

And these days, Bitcoin seems almost traditional compared with a raft of other new developments that might be pointing to a new path forward for money — or toward more of the ups and downs, scams and sudden fortunes that have marked much of the crypto era. Here’s a guide to some of the ideas that could transform the world of finance.

Central Bank Digital Currencies (CBDCs)

Central banks already deal with electronic versions of money, but a digital currency could extend some services that central banks provide to financial institutions to the public at large. A broadly used digital currency could mean payments clear more rapidly and make banking services available to the estimated 1.7 billion people around the world who lack them.

The People’s Bank of China, the most aggressive of the large central banks, has held trials involving e-wallets in a few cities.

Transactions with central bank currencies wouldn’t be anonymous — that would make it easier for governments to crack down on money laundering and tax evasion and, as privacy advocates note, give them a powerful new tool for surveillance.

The PBOC and other central banks sped up their efforts after Facebook Inc. and a slew of collaborators last year unveiled plans for a digital currency called Libra. For central bankers, currency isn’t merely an economic issue; it’s about sovereignty.

DeFi

What if computer code could take the place of bankers? That’s the goal of the decentralized finance, or DeFi, movement that’s grown out of a decade of experimentation with cryptocurrencies. A DeFi world could be one where money flows more efficiently and cheaply, its proponents say, and would create new ways for savers to earn money on their holdings.

Critics say DeFi is more likely reinventing the hype, wild speculation, and money-losing possibilities of crypto. DeFi revolves around applications known as dapps that perform financial functions on digital ledgers called blockchains.

Dapps let people lend or borrow funds from others, go long or short on a range of assets, trade coins or earn interest in a savings-like account. The transactions are governed by rules embedded in the software called smart contracts.

Like everything else in the realm of digital currencies, or software in general, DeFi accounts can be vulnerable to hackers. Even buggy code can destroy value. Users wiping themselves out by accident is dismayingly common, too.

Yield Farming

When you deposit money in a bank, you’re effectively making a loan that earns interest. Yield farming, or yield harvesting, typically involves lending cryptocurrency in return for interest and sometimes for fees, but more importantly for handouts of units of a new cryptocurrency. The real payoff comes if that coin appreciates rapidly.

The most basic approach is to lend digital coins, such as Dai or Tether, through a dapp such as Compound, which then lends the coins to borrowers who often use them for speculation.

Interest rates vary with demand, but for every day’s participation in the Compound service, you get new Comp coins, plus interest and other fees. If the Comp token appreciates — it almost doubled in value in June — your returns skyrocket as well, though a crash shortly thereafter showed the risk that accompanies the hoped-for reward.

Dex

A decentralized exchange, or dex, is a set of software protocols that buyers and sellers can use to find each other and carry out transactions through smart contracts, which are self-executing agreements.

Teams of developers set up dexes that then run on their own. Their use has ballooned this year, largely as a result of an explosion in the issuance of DeFi coins used in yield harvesting and other schemes promising huge returns.

Unlike many centralized exchanges, most dexes have welcomed new DeFi coins with open arms, letting them list with little scrutiny and for free. As these coins (including Comp, Dai and SNX) garnered followers, so did the decentralized exchanges willing to host them.

But along with the risks of hacking that all exchanges face, it remains to be seen whether regulators will let dexes — with their reluctance to check users’ identities — carry on with their wide-open operating style if they continue to grow.

Governance Tokens

In a decentralized enterprise, who gets to decide all the many things that get decided? In big disputes over the future course of Bitcoin, for example, whoever gets the most computing power on their side often wins, though the losers sometimes split off their transactions to create, in effect, a new currency, such as Bitcoin Cash or Bitcoin Gold.

To avoid that kind of messy battle without creating a central authority or entity, a slew of new crypto projects is instead relying on so-called governance tokens for decision-making. They’re often issued to regular token users, or with investments in Libra or other projects.

Holders can vote on the project’s strategy and any other issues that come up. The idea is to govern projects via a distributed network of stakeholders. There’s also the hope of making a newly minted variety of cryptocoin more attractive. If the arrangement seems reminiscent of the votes that come with shares of stock, that’s on purpose.

A big question is whether the U.S. Securities and Exchange Commission will deem governance tokens to be so much like equity shares that it will require startups to go through a formal public offering — a hurdle that all but ended an earlier craze of raising money through ICOs, or initial coin offerings.

Updated: 11-25-2020

The Stock Market Keeps Rising, But Millennials Aren’t Reaping The Benefits

Many young investors, wary of bear markets, have focused on paying off debt and saving instead.

Many millennials, having suffered through two nasty bear markets in the first years of their working lives, are missing out on some of the gains from the rally that brought the Dow Jones Industrial Average to 30,000.

The stock market’s surge in the midst of the pandemic has given investors confidence and helped businesses raise capital. It has also come with big swings, including one of the worst selloffs in history followed by one of the fastest recoveries, with triple-digit point moves in the Dow commonplace.

This has made many young investors wary of putting too much of their assets in stocks.

About half of millennials—generally defined as people born from about 1981 until 1996, sometimes called Generation Y—are invested in the stock market, roughly the same ratio as members of Generation X were at the same age, according to the Federal Reserve Bank of St. Louis.

The difference is that the value of their holdings is nearly a third lower than their counterparts at the same age, according to the St. Louis Fed.

A year of ups and downs in the market re-emphasized to Elizabeth Brozek the importance of a savings cushion, rather than of getting involved in trading. The 28-year-old graphic designer suffered a layoff earlier this year, a setback that pushed her to give priority to paying down high-interest debt and establishing an emergency fund.

“When the pandemic happened, I put my financial plan on hold,” she said. “I’m not looking to invest right now. I’m trying to stay in my lane.”

Ms. Brozek, of Phoenix, said that among her group of friends, investing in the stock market doesn’t represent potential opportunity. Instead, it feels less important than their other financial obligations.

“I don’t have the mental space to think about it,” she said. “Saving is the goal right now. Investing would be like the cherry on top.”

David Hill, 39, said he has been used to seeing dramatic changes in the market since he graduated from business school in 2008.

“The market is like a casino right now,” said Mr. Hill, a marketing professional in Oak Park, Ill. “But my financial security is not tied up in the stock market.”

For him, purchasing a home with his wife was the biggest financial move they have made in several years. The couple’s house is worth less than their retirement accounts, but it has kept their focus on housing rather than stocks. “I’m more worried about the economy than I am about the market,” he said.

The market turned sharply up this year while unemployment remained high and nervous consumers used what cash they had to pay off debt and save rather than invest in stocks.

“Those groups who weren’t invested in the first place are not trying to get into the stock market now,” said Kim Parker, director of social trends at the Pew Research Center. “They’re trying to keep their heads above water.”

Since 2008, Gallup found, stock ownership has decreased among Americans overall. Stock ownership was more common between 2001 and 2008, when 62% of U.S. adults said they owned stock, on average. As of June 2020, only 55% of Americans said the same.

Investors who owned stocks during the 11-year bull market that ended in March earned significant wealth, and likely were willing to weather a setback. The wealthy have always owned the most stocks, but the gap has widened.

The Federal Reserve’s data show that the top 1% of income earners and the bottom 60% each owned about 20% of total household wealth when the stock market bottomed out in the first quarter of 2009.

By the second quarter of 2020, the top 1% of income earners owned about 25% of household wealth, versus 15% for the bottom 60% of earners.

Put differently, the top 1% of households were worth $27.9 trillion in the second quarter, up from about $11 trillion at the time the market bottomed out in the first quarter of 2009. For the bottom 20%, household wealth rose from $2.3 trillion to $3.5 trillion.

The big gains went largely to wealthy, older investors who accumulated years of savings. “The overwhelming value of those stocks are held by white, college-educated, middle-aged and older families,” said Ray Boshara, senior adviser and director of the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis.

Adam Carrico, a 29-year-old nonprofit financial analyst living in Washington, D.C., said even though he has been “one of the lucky ones” able to save more in the coronavirus pandemic, he remains on the sidelines due to the stock market’s volatility.

“I thought about investing, but I’m definitely scared,” he said. “There’s a fear I didn’t have before: ‘You could be unemployed soon.’ And so I’ve seen the stocks go up and down, but I don’t know how much I trust the market, with the pandemic.”

Like most Americans, Mr. Carrico’s exposure to the markets is his retirement savings. He said he has just over $22,000 saved in a 401(k) but hasn’t made significant changes to his contributions since the pandemic.

Bureau of Labor Statistics data show that as of March 2020, 55% of all U.S. civilian workers participated in benefit pension plans or defined-contribution retirement plans, such as a 401(k). That means Social Security—which isn’t tied to the stock market’s ups and downs—remains the major source of retirement income for a large number of future retirees.

The Biden administration has announced plans to increase the program’s financing and expand benefits for beneficiaries under financial duress. But unresolved races will determine the future of the Senate, and concrete steps remain uncertain.

Mr. Carrico said he continues to make payroll contributions to his 401(k), but he remains “purposely blind” on his retirement plan’s performance, citing a deep fear of what the future could hold despite the Dow’s continued climb.

“I’m not paying attention to it,” he said. “Today, it could be great. Tomorrow, it could go down and I could get stressed looking at it. Life has enough stressors right now, and this is out of my control.”

Updated: 5-30-2021

Suddenly Wealthy From Markets, Some Millennials Are Stressed

After Nasdaq and bitcoin rallies, young investors weigh options for what to do with their money.

Soaring assets and stocks in the past year have in some cases handed midlevel workers huge windfalls.

Those who have benefited from the market surge typically fall into one of three categories, said Sahil Vakil, founder of personal-finance tech company MYRA: They were given company shares as compensation and those same shares recently boomed; they caught last year’s retail investing frenzy and rode the market to new highs; or they invested early on in cryptocurrency, to great success.

The Nasdaq Composite rose nearly 47% over the past 12 months, and even after a recent pullback, a crypto investor who put $10,000 in bitcoin at the end of 2019 could have netted more than $50,000 in gains after bitcoin’s 2020-21 surge.

In the past year, more than half of Mr. Vakil’s clients have experienced a market windfall. On the East Coast, Mr. Vakil says his clients typically work in the finance and consulting sectors; on the West Coast, most are working in the tech industry. The average household he works with holds $250,000 in assets and falls between the ages of 25 and 45.

Many of these workers may have struggled with stagnating wages and huge student loan debts earlier in their careers. Some worry they’ll mismanage this boon and forever ruin their chance at financial stability.

“These individuals completely feel and understand and recognize the pain of the last year, but now they’re being given an opportunity to come out of that,” Mr. Vakil said. “They’re saying, ‘This is my one chance.’ They’re taking it with both hands. They don’t want to mess it up.”

Here are some tips to manage a sudden windfall.

First, Put Long-Term Goals In Focus

Arun Gupta, a 36-year-old tech executive based in New York City, began investing in cryptocurrency, mostly bitcoin and recently ethereum, in late 2019. By the end of 2020, that original investment more than quintupled.

”I want to have enough money where if my family wants to splurge on a vacation, there isn’t anything holding us back,” he said.

“I don’t want [student debt] to be an issue for my kids or for anyone in my family.”

He chats about his crypto investments in a group message with other friends interested in bitcoin. To shore up his funds for those future goals, Mr. Gupta is planning to hold on to his bitcoin investments in hope they continue to grow.

”I just know having money sitting in a bank account—that’s not my nature,” he said. “I like to take risks with my money.”

Deal With The Feelings

A sudden market windfall in these times can lead to decision paralysis, said Meg Bartelt, certified financial planner and founder of Flow Financial Planning. She has seen clients wrestle with feelings of elation, fear, guilt and stress.

“From a mathematical perspective, they can now easily buy a home for $2 million, but psychologically, that’s unsettling,” she said. “They can’t wrap their heads around it.”

Ms. Bartelt’s first plan of action: Don’t buy the new vacation home or launch the new business, yet.

“Good financial decisions are rarely made in the middle of an emotional maelstrom,” she said.

“The piece of advice I find myself giving over and over again is actually a best practice in the world of what’s called ‘sudden money’: Don’t do anything that’s not necessary. I think it’s very worthwhile to not do anything big or irrevocable until your emotions have settled down around this huge wealth event.”

Set Aside Money For Taxes Immediately

Mr. Vakil said all his clients bring one big question: Will I be in trouble come tax time?

“The first concern all these people have, unanimously, is not ‘What do I do with this money?’” he said. “It’s ‘What do I do with my taxes?’”

For clients who have only recently begun trading, he said, coping with capital-gains taxes may be a new and confusing experience. For example, the profits on assets held a year or less are taxed at much higher rates than the profits on assets held longer than a year.

Those trading cryptocurrency must keep in mind that a sale or exchange from one cryptocurrency to another will count as a taxable event (this can also include events known as forks and airdrops in the crypto world). Keeping careful records of all transactions can help at tax time, as current law doesn’t yet mandate brokers to report crypto sales.

To help clients minimize their coming tax bills, Mr. Vakil often recommends tax-loss harvesting, which means selling losers strategically to reap losses that can offset the taxable profits from winners. For crypto investors, this may be difficult to untangle if they haven’t kept records on their own.

While brokerage firms must keep records about stock trades and send the information to the Internal Revenue Service, crypto exchanges don’t have to do this under current law.

Mr. Vakil also advises his clients who trade frequently that they may need to pay estimated taxes quarterly to Uncle Sam to avoid penalties at tax-filing time.

Sarah Behr, a financial planner and founder of Simplify Financial in San Francisco, often recommends moving money for taxes at the time of a sale into a separate account so it isn’t in danger of being spent or mismanaged. Large taxable gains are also an opportunity for investors who are charitably minded, says Ms. Behr.

Under current law, donors who make gifts of appreciated assets to charities often don’t owe capital-gains tax on the appreciation. Instead, they get a charitable deduction for the asset’s full market value.

“That allows you to get some of this stock off your plate that maybe allows you to have high gains,” said Ms. Behr. “And then you’re rewarding that charity with a larger gift than you would if you just gave cash.”

Next, Plan For Your Immediate Needs

For those unsure about what step to take next, Mr. Vakil recommends handling immediate concerns to buy yourself some more time.

That could be paying off your mortgage or car, or wiping out any other debts. With these monthly bills out of the way, the client has more brain space to consider what they want to do with this new, slightly smaller, pile of money.

One of the other initial steps on Ms. Behr’s list for clients: diversify their portfolios. Because many of these clients will have benefited from a company liquidity event, their portfolios may be heavily weighted toward one stock, which can be risky.

”Every time someone has a windfall, there should be a plan,” she said. “I’m trying to move them to action.”

Now vs. Later

Mr. Vakil and Ms. Behr say most of their clients don’t kick up their heels and sail off on a yacht.

”I don’t have clients who are like ‘I’m going to go off and buy a Lamborghini’ or ‘I’m going to Tahiti,’ although I’m sure those people are out there,” Ms. Behr said. “I get people asking ‘’How do I live now? Do I just live off my salary like I was before?’ And I say, ‘Look, the sky’s the limit.”

Planning how your sudden windfall could open a new chapter may feel intimidating to some, but to others, it is exciting.

Lalit Kalani, a 37-year-old trader now based in Mumbai, India, hasn’t made a million yet, but he says he’s closing in. He hopes the money he has made could become seed money for a new business or fund an early retirement.

“There were times last year I thought, ‘Why am I working? I should just be trading,’” Mr. Kalani said. “I have a runway now.”

Seek Advice In The Right Places

Seeking advice from family or friends on what to do immediately can also lead to complicated feelings of competition and decision fatigue, said Ms. Behr.

“A lot of them get overwhelmed,” she said. “Every one of these companies going public has some Slack channel talking personal finance, and it can get heated.”

Ms. Behr’s clients say the most common concerns in these Slack groups are tax-related (“Will I need to completely overhaul how I file?”) and future-obsessed (“Where should I put this money until I determine how I’ll manage it going forward?”).

Going from “I don’t feel financially stable” to “I finally have options” can feel shocking or even intimidating, Ms. Behr said.

Rather than relying on virtual water-cooler tips, she urges making a realistic financial plan and seeking the help of advisers they feel will understand their values.

Updated: 6-7-2021

Two-fifths Of Aussie Millennials Think Crypto Investments Beat Real Estate

Boomers down under are worried about volatility, but millennials are filling their crypto bags.

Research has revealed that one in five Australians believe that crypto is the key to homeownership as confidence in traditional savings dwindles.

The survey, conducted by cryptocurrency exchange Kraken, found that an increasing number of young Australians are becoming disheartened by traditional investment options. Almost one-quarter of those surveyed expressed concern that the value of money in traditional cash savings is decreasing.

The study found that 22% of the Australians surveyed believe investing in cryptocurrency is an easier way to save for a mortgage deposit than storing fiat in a bank account or other traditional savings methods.

Nearly 40% of Millennials — respondents born between the early 1980s and the mid-to-late-1990s — said that crypto assets are a sound alternative to buying an investment property. Further, 31% of Generation X participants — Australians born between the mid-1960s to early 1980s — also believe crypto assets are better investments than real estate, while only 24% of Generation Z respondents — those born between the late 1990s and 2010 — echoed this sentiment.

Almost half of the baby boomers surveyed — those born between the mid-1940s and mid-1960s — have not invested in crypto, citing volatility concerns.

One in five survey participants either currently own or have previously owned crypto assets, while 14% stated they currently hold an active crypto portfolio. Nearly 85% of respondents who already own crypto assets plan to buy more.

Kraken Australia managing director Jonathon Miller commented that while lagging behind the United States in terms of adoption, Australia is a rapidly growing market for crypto assets that is largely driven by demand from millennials:

“Australians still maintain some conservative attitudes toward investment. Property has been a cultural norm and high on the wish list for most investors, but as affordability continues to be an issue, we’re seeing more young people look for other options to grow wealth.”

He added that it is the younger Australians who are changing the dynamic and expects the broader market to come around to the idea of investing in digital assets.

“We’re confident that as more investors look to diversify their portfolios and seek investment opportunities outside of the traditional offerings, we’ll see cryptocurrency come into its own in APAC.”

Miller also emphasized the need for greater crypto education in Australia, and it looks like more is needed. Last month, Cointelegraph reported that more than half of Australian respondents from a different survey think Elon Musk invented Bitcoin.

Updated: 7-12-2021

Crypto Demand From Millennials Poses Big Test For Robo-Advisers

Superficially, it should be a perfect match. Interest in cryptocurrencies has surged among the young and tech literate, exactly the same demographic targeted by the big robo-advisers.

Yet even as the finance sector starts to embrace crypto, you won’t find Bitcoin or Ether in model advice portfolios. The dilemma for the industry is that registered investment adviser status is the foundation of its hard-won mainstream acceptance and conveys a legal duty to act in a client’s best interests.

As robo-advising becomes more popular – Schwab predicts assets managed by robo-advisers will grow to $460 billion next year — automated choices have come under far more scrutiny. While crypto’s big returns over the past year are tempting to any investor, extreme volatility and a relatively short track record point to substantial risk.

“When you plug cryptos into standard asset allocation models, you need to have a very high positive expected return in order to justify any holdings in the portfolio due to their risk,” said Jim Angel, a professor at Georgetown University. It’s “highly debatable” whether crypto belongs in an investor’s portfolio at all, he added.

Set on the other side is the opportunity. Survey after survey shows millennials — a generation just starting to gain investable assets yet often wary of the cost of traditional advice — are most likely to believe cryptocurrency is a legitimate asset class and indeed may already be buying Bitcoin.

The average U.S. crypto investor is a 38-year-old male with a household income of $110,000, according to a Gemini survey.

“The magnitude of how popular crypto has become is making people look at the space and wondering if this isn’t a way they can differentiate their platform,” said David Goldstone, manager of research and analytics at Backend Benchmarking. “They want to get them young and grow with them as the complexity of their financial picture grows,” he said, referring to clients.

So far none of the major players include crypto in model or automated portfolios, even if a couple like Canada’s Wealthsimple allow customers to trade crypto on the side. Still, pretty much everyone is looking at it.

California-based WealthFront, which has about $16 billion in discretionarily managed assets according to an estimate from Backend Benchmarking, is in the early stages of exploring a crypto offering that would likely include the ability to invest in Bitcoin and Ether, spokesperson Elly Stolnitz said. It’s too early to disclose specifics or timings, she said.

Right now, WealthFront customers are asked about risk-tolerance levels with portfolios built based on their responses. If someone changes their investment mix from the recommendation they’re shown the effects on their risk score and implications for financial goals.

“It’s in this context that we’ll show clients what their investment in crypto means within their portfolio as a whole,” Stolnitz said. “We know that many of our clients and target audience want to put some money into cryptocurrencies and we can help them think about it the right way.”

Rival New York-based Betterment with about $29 billion in assets under management is also weighing how to offer crypto — but not anytime soon.

“Crypto is something that we are very excited about as a company, but the plans for incorporating them into Betterment’s platform aren’t on the immediate road-map,” spokesperson Danielle Shechtman said. “Right now, we’re more so exploring how we might offer crypto in a responsible way, within a guided framework. In the event that Betterment does offer crypto as an investment strategy, we’d be focused on it as an asset class to hold as a small part of the overall portfolio.”

Startup Options

There are a couple of small startups that do offer robo-advice within a pure crypto basket, betting in the absence of a Bitcoin ETF there is customer demand for a managed solution.

One is Seattle-based Makara, co-founded by quantitative cryptocurrency hedge fund manager Jesse Proudman, which launched in June. It promises “crypto investing on autopilot” and claims to be the first such offering registered as an investment adviser with the SEC.

Clients can choose from six baskets, including decentralized finance and a “blue chip” weighted offering of coins with a market value of more than $10 billion. Fees are 1% of assets under management — notably higher than the 0.25% charged by conventional robo-advisers.

“There is significant pent-up demand for the asset class that isn’t satisfied by the existing exchange infrastructure,” Proudman said in an interview. “For the vast majority of market participants, this asset class is just too confusing.”

Makara doesn’t offer standard investments like stocks or bonds or require users to disclose what proportion of their total portfolio is in crypto, leaving overall rebalancing and risk judgment to the individual.

“We do remind people that this is an extremely volatile and speculative investment and should only be a part of their complete investment program,” Proudman said.

Updated: 12-9-2021

Big Jump In Investors Who Favor Crypto Over Stocks: Survey

The number of respondents who said they would be more likely to invest their money in crypto than traditional stocks increased by 140% in just five months.

New research by consumer data aggregator CivicScience has found that a growing number of investors are selling their shares to purchase more crypto.

The research questions were sent to people over 18 years old in the United States at varying times during 2021. The results were weighed by U.S. census data. Each question had between 1,000 and 40,600 respondents.

Out of 3,700 respondents surveyed, the number who said they would be more likely to invest their money in cryptocurrency than traditional stocks increased 140% in just five months.

Back in June, only 10% of respondents said they would be more likely to invest their money in cryptocurrency than traditional stocks, which rose to 24% in November.

Interesting those who said they follow the financial market and economy “very closely” or “somewhat closely” were more likely to swap their traditional assets for crypto.

Out of the 1,285 respondents who said they follow the market “very closely,” 40% said that they or someone they know has sold their traditional stocks to purchase crypto.

This percentage dropped to 30% for those who follow the market “somewhat closely,” and around 17% for those who said they followed the market “not closely at all.”

Around 44% of the 1,988 respondents who had sold stocks for crypto said they’d sold less than 10% of their portfolios.

But around one-fifth had sold over half of their stock assets to buy crypto, which Zack Butovich from CivicScience described as a “shockingly significant number.” That might be pushing it, but it’s certainly notable.

According to its website, CivicScience sources its data through digital and mobile content partnerships. Cointelegraph contacted CivicScience for more detail on its methodology and is awaiting a response.

CivicScience also found that those not interested in blockchain tech have continued to decline, from 80% in May of this year to 68% currently based on 40,571 responses from May 1 to Dec. 6.

Updated: 2-5-2022

Four Ordinary People Share How They Got Rich From Crypto

They once were average workers, with regular jobs and modest paychecks.

Now they’re loaded.

And all because they bet big on Bitcoin or other virtual money, snapping up online currencies early and often, sometimes sinking every spare dollar into the crypto market.

They were savvy enough to see the potential of an investment that some top financial advisors still don’t fully understand, where patience is a priority and one must navigate a world rife with its own language: chainlink, fiat, mining, DeFi.

Plenty of people have lost money speculating in this unregulated marketplace, where no banks or government agencies are involved.

But as of December, a staggering 83 percent of millennials have bought in.

And despite turbulence, crypto currency has shown an overall upward trajectory — and the ability to transform some people’s lives.

Just ask these four. They know even small investments can pay off big.

Rachel Siegel: Substitute Teacher Turned Millionaire

Back when she was a substitute public school teacher in New York City, Rachel Siegel lived in a dark apartment in the Lower East Side where every window faced a brick wall.

Now she sees sun and sea, thanks to a swanky condo she just bought in the Caribbean, where Siegel can take in sweeping views of the ocean from her private balcony.

Her journey began in late 2017 when a friend invited her to the after-party of a cryptocurrency conference.

“I remember walking into the room full of cryptocurrency enthusiasts, and I had never been in a room with so many passionate, driven people — and generally people who I didn’t think were about to lose all their money,” she told The Post.

That’s when Siegel, 29, decided to make her first investment in the currency, putting in whatever she had left over from her paycheck — usually just $25 a week.

“I didn’t have anything when I started in cryptocurrency, honestly,” she said. “I was just this substitute teacher with a really big idea.”

Her investments have yielded profits in the low seven-figure range, though Siegel declined to give an exact figure. It was more money than she’s ever had, though not enough to change her spending habits.

“I don’t buy big, flashy things. I’m not one of those people with fancy cars or new Rolexes,” she said.

“But I am now able to be a homeowner. Years ago I would look at the prices of homes and just think that’s completely unrealistic.”

She hasn’t yet moved into her new seaside retreat as the deal is closing now, but she did just splurge on a trip to Dubai, traveling first-class on Emirates.

“It was just the most lavish experience I’ve had in my life,” she said.

And she’s quit her teaching job. “It was scary at first to leave that income stream,” she said. “But there’s so much opportunity in this space.”

Now, Siegel works full-time as a cryptocurrency influencer, going by the pseudonym @CryptoFinally.

“The cool thing about cryptocurrency is that anybody can do it, and I’m one of those anybodies who did it,” she said.

“I was a substitute teacher with no serious technical knowledge that went to college for theater, and I made millions of dollars in this market via conviction, via education. I believe that anyone could follow that path, if they were dedicated to it.”

Kane Ellis: Teen Tech Worker Turned Maserati Owner

In 2011, Kane Ellis was an 18-year-old high school dropout working in IT when he learned how to mine cryptocurrency.

The Australian teen set up his computer to mine — essentially using computers to help verify and process transactions for the blockchain — thereby playing a small role in facilitating the growth of the crypto network.

All while he kept working at his day job.

He said that when he started, he earned only about four Bitcoins a day, then worth about $8.

“I got in it from the back-end side of things, not the investment side,” he said. “I just realized that my computer could make me an income.”

“When I was 18, obviously I thought this was cool for the profits, but then about six months into it, I realized this could be the future.”

He recalled foolishly once paying for a meal at McDonald’s with four Bitcoins. If he’d held onto those coins, they’d be worth $150,000 today.

Ellis, now 29, is the co-founder of CarSwap, an online market for auto buyers and sellers. And he holds most of his money in crypto.

“Cryptocurrencies have helped me live a better life being able to start my own business,” he said, “I’ve been able to live the life I’ve always dreamt of.”

He’s used his profits to purchase exotic cars, including his prized ride: a Maserati GranTurismo. The license plate jokingly reads BANKRUPT. “As a car guy, being able to buy my dream car like the Maserati MC Sportline at the age of 24 was a massive achievement,” Ellis said.

His Advice To Investors: “Hold your Bitcoins. Don’t go into it thinking it’s a short-term investment, because realistically it’s a long-term one. Two, five, ten years.”

Terrance Leonard: Navy Man With A Dream Home

Terrance Leonard first dabbled in cryptocurrency in 2013 while working as a software engineer. It didn’t go well.

“I’m a huge nerd, so it was something that was interesting to me,” the 32-year-old graduate of the Naval Academy told The Post. “But it was so difficult back then. It was like the Wild West. There wasn’t a lot of information, and I worried I would lose all my money.”

So Leonard pulled back from the industry until 2019, when a crypto-enthusiast coworker explained the ins and outs of the market over lunch. That’s when he decided to get back in with a $2,000 buy.

Since then, he has invested tens of thousands of dollars, primarily in Ethereum and some smaller coins like Unibright, and his stake has reached a cool million.

“It’s putting me on a path towards financial freedom,” Ellis said.

He recently cashed in some of his coins for a down payment on a four-bedroom home in Washington, D.C. His new digs feature a detached garage and extra yard space for his dog, Roman. Leonard, who lives on his own, plans to retire from full time work this year.

“Younger me would just be crazy excited — ecstatic even — to see where I am now,” he said.

“I was a geeky, nerdy kid who was into computers, and to be able to leverage those skills to build wealth has been amazing.”

Lea Thompson: Tech Worker Turned Crypto Influencer

Seattle-based Lea Thompson first heard about crypto in its early days when she visited a friend who mined the digital currency.

“I would go to his apartment and see all these computer rigs up and think, ‘What is this weird nerd thing you’re doing?’ “

It wasn’t until 2017 that she got hooked on the world of blockchain. Though she had a sales job in the tech industry, Thompson never felt like she earned enough money, so she worked a few “side hustles.”

One gig involved blogging for a platform that paid her in cryptocurrency.

“I started meeting more and more people that were working in the industry, and seeing their excitement for the potential this industry had just really inspired me.”

Thompson also began investing, putting $500 to $1,000 a month into Bitcoin and Ethereum buys, gradually building wealth and nearly 200,000 social media followers.

She declined to say how much her stake is worth today, but Bitcoin has quadrupled in value since the time she acquired most of her holdings.

Her profits were enough for Thompson to quit her tech job and become a full-time crypto content creator. Under the moniker Girl Gone Crypto, she now puts out “edu-tainment” videos about cryptocurrency and the blockchain.

“I felt a lot more confident leaving my secure day job to spend my energy in a way that feels really limitless right now,” she said.

“Crypto has totally changed my life. “It’s been really nice to settle into being able to afford luxury things, like even just a weekly massage.”

A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,A Guarded Generation: How,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin Enthusiast And CEO Brian Armstrong Buys Los Angeles Home For $133 Million

Nasdaq-Listed Blockchain Firm BTCS To Offer Dividend In Bitcoin; Shares Surge

Ultimate Resource On Kazakhstan As Second In Bitcoin Mining Hash Rate In The World After US

Ultimate Resource On Solana Outages And DDoS Attacks

How Jessica Simpson Almost Lost Her Name And Her Billion Dollar Empire

Sidney Poitier, Actor Who Made Oscars History, Dies At 94

Green Comet Will Be Visible As It Passes By Earth For First Time In 50,000 Years

FTX (SBF) Got Approval From F.D.I.C., State Regulators And Federal Reserve To Buy Tiny Bank!!!

Joe Rogan: I Have A Lot Of Hope For Bitcoin

Teen Cyber Prodigy Stumbled Onto Flaw Letting Him Hijack Teslas

Spyware Finally Got Scary Enough To Freak Lawmakers Out—After It Spied On Them

The First Nuclear-Powered Bitcoin Mine Is Here. Maybe It Can Clean Up Energy FUD

The World’s Best Crypto Policies: How They Do It In 37 Nations

Tonga To Copy El Salvador’s Bill Making Bitcoin Legal Tender, Says Former MP

Wordle Is The New “Lingo” Turning Fans Into Argumentative Strategy Nerds

Prospering In The Pandemic, Some Feel Financial Guilt And Gratitude

Is Art Therapy The Path To Mental Well-Being?

New York, California, New Jersey, And Alabama Move To Ban ‘Forever Chemicals’ In Firefighting Foam

The Mystery Of The Wasting House-Cats

What Pet Owners Should Know About Chronic Kidney Disease In Dogs And Cats

Pets Score Company Perks As The ‘New Dependents’

Why Is My Cat Rubbing His Face In Ants?

Natural Cure For Hyperthyroidism In Cats Including How To Switch Him/Her To A Raw Food Diet

Ultimate Resource For Cat Lovers

FDA Approves First-Ever Arthritis Pain Management Drug For Cats

Ultimate Resource On Duke of York’s Prince Andrew And His Sex Scandal

Walmart Filings Reveal Plans To Create Cryptocurrency, NFTs

Bitcoin’s Dominance of Crypto Payments Is Starting To Erode

T-Mobile Says Hackers Stole Data On About 37 Million Customers

Jack Dorsey Announces Bitcoin Legal Defense Fund

More Than 100 Millionaires Signed An Open Letter Asking To Be Taxed More Heavily

Federal Regulator Says Credit Unions Can Partner With Crypto Providers

What’s Behind The Fascination With Smash-And-Grab Shoplifting?

Train Robberies Are A Problem In Los Angeles, And No One Agrees On How To Stop Them

US Stocks Historically Deliver Strong Gains In Fed Hike Cycles (GotBitcoin)

Ian Alexander Jr., Only Child of Regina King, Dies At Age 26

Amazon Ends Its Charity Donation Program Amazonsmile After Other Cost-Cutting Efforts

Indexing Is Coming To Crypto Funds Via Decentralized Exchanges

Doctors Show Implicit Bias Towards Black Patients

Darkmail Pushes Privacy Into The Hands Of NSA-Weary Customers

3D Printing Make Anything From Candy Bars To Hand Guns

Stealing The Blood Of The Young May Make You More Youthful

Henrietta Lacks And Her Remarkable Cells Will Finally See Some Payback

AL_A Wins Approval For World’s First Magnetized Fusion Power Plant

Want To Be Rich? Bitcoin’s Limited Supply Cap Means You Only Need 0.01 BTC

Smart Money Is Buying Bitcoin Dip. Stocks, Not So Much

McDonald’s Jumps On Bitcoin Memewagon, Crypto Twitter Responds

America COMPETES Act Would Be Disastrous For Bitcoin Cryptocurrency And More

Lyn Alden On Bitcoin, Inflation And The Potential Coming Energy Shock

Inflation And A Tale of Cantillionaires

El Salvador Plans Bill To Adopt Bitcoin As Legal Tender

Miami Mayor Says City Employees Should Be Able To Take Their Salaries In Bitcoin

Vast Troves of Classified Info Undermine National Security, Spy Chief Says

BREAKING: Arizona State Senator Introduces Bill To Make Bitcoin Legal Tender

San Francisco’s Historic Surveillance Law May Get Watered Down

How Bitcoin Contributions Funded A $1.4M Solar Installation In Zimbabwe

California Lawmaker Says National Privacy Law Is a Priority

The Pandemic Turbocharged Online Privacy Concerns

How To Protect Your Online Privacy While Working From Home

Researchers Use GPU Fingerprinting To Track Users Online

Japan’s $1 Trillion Crypto Market May Ease Onerous Listing Rules

Ultimate Resource On A Weak / Strong Dollar’s Impact On Bitcoin

Fed Money Printer Goes Into Reverse (Quantitative Tightening): What Does It Mean For Crypto?

Crypto Market Is Closer To A Bottom Than Stocks (#GotBitcoin)

When World’s Central Banks Get It Wrong, Guess Who Pays The Price😂😹🤣 (#GotBitcoin)

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin And Gold

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Does Your Baby’s Food Contain Toxic Metals? Here’s What Our Investigation Found

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

Ultimate Resource On BlockFi, Celsius And Nexo

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

100 Million Americans Can Legally Bet on the Super Bowl. A Spot Bitcoin ETF? Forget About it!

Green Finance Isn’t Going Where It’s Needed