Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

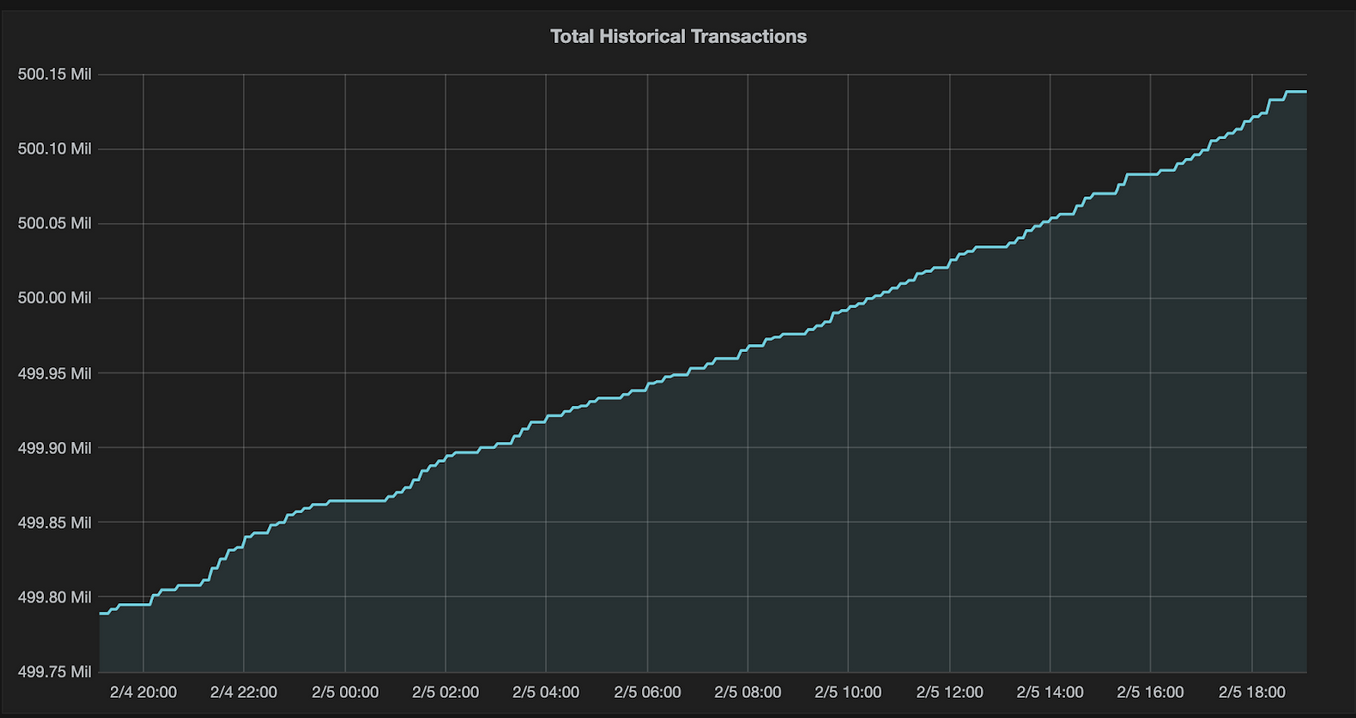

The Bitcoin network has surpassed 500 million transactions since going live over 11 years ago. Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

According to blockchain analytics site Statoshi, there have been half a billion transactions on the Bitcoin blockchain as of press time.

Crypto firm Casa CTO Jameson Lopp, co-founder & CTO site Statoshi celebrated the milestone on Twitter, saying:

“Today, as of block 00000000000000000001145bf2e7cb7f04df55feaf3b55d9f6511522bbbf333f at height 616064, Bitcoin surpassed 500 million transactions confirmed on the blockchain.”

From the First Bitcoin Transaction to Today’s Milestone

The first-ever Bitcoin transaction took place on Jan. 12, 2009. Nakamoto and the late Hal Finney were the early contributors to the project. Nakamoto sent Finney 10 BTC as a test, after which the computer scientist began mining blocks himself.

Ten months later, on Oct. 5, 2009, the New Liberty Standard set an initial Bitcoin exchange rate against the dollar. At the time, $1 was worth 2300.03 BTC.

The first-ever transaction of Bitcoin for physical goods took place on May 22, 2010. The famous Bitcoin Pizza saw two pizzas bought for 10,000 BTC by Laszlo Hanyecz. The programmer had offered users on a Bitcointalk forum the BTC in exchange for two pizzas. A teenager named Jeremy Sturdivant, nicknamed Jercos, accepted the Bitcoin and sent Hanyecz two pizzas from Papa John’s. This marks the first commercial transaction for Bitcoin.

After 11 years, Bitcoin is now hitting another major milestone of passing half a billion transactions. As Twitter user Hodlonaut tweeted:

“Bitcoin isn’t talking about this. Or about how revolutionary and unprecedented its traits of censorship resistance and immutability are. Bitcoin just is. And does. Once block at a time.”

Updated: 2-6-2020

Bitcoin Price Targets $10K As BitMex Open Interest Soars To $1.5B

The bullish sentiment continues to build in the crypto market as numerous altcoins post double-digit gains on a daily basis. Bitcoin’s spot price (BTC) on crypto exchanges also continues to push higher with the passing of each day and earlier today the price broke above $9,800, extending to $9,862 before pulling back to trade around $9,650.

Recently published data from Skew Markets shows Bitcoin futures with a May 2020 and June 2020 expiry date rising to $10,000 and above at a handful of exchanges. This further reinforces the general belief that Bitcoin’s bullish trend will continue for the foreseeable future.

Bitcoin futures Open Interest (OI) at BitMEX has also risen to a new high at $1.5 billion. Open Interest simply highlights the size of contracts that buyers and sellers have open on the exchange. The recent narrative amongst traders suggests that when OI reaches $1 billion the market dumps and Bitcoin price contracts.

Generally, most crypto traders track the fluctuations in OI to determine the strength of bullish and bearish trends in Bitcoin’s price action. When Bitcoin price and OI increase in tandem analysts infer that the trend is strong, whereas the opposite conclusion is reached when the price, volume, and OI move against each other.

Interestingly, the $1 billion threshold on OI has been breached, yet Bitcoin price continues to rally higher each day.

OI has risen across a number of exchanges over the past few weeks and today Bakkt followed the trend as the number of open futures positions reached a record high at $13 million on Feb. 5.

The same phenomenon occurred at the Chicago Mercantile Exchange, where Bitcoin futures reached a new 5-month high at $249 million.

The overall cryptocurrency market cap now stands at $276.2 billion and Bitcoin’s dominance rate is 64.3%. As the dominance rate fluctuates and Bitcoin struggles to gain above $9,800, altcoins have continued to press higher, producing double-digit gains.

Tron (TRX) rallied 11.08%, Binance Coin (BNB) gained 6.75%, and Ether (ETH) notched a 4.49% gain which brought the price to $212.96.

Updated: 2-6-2020

Open Positions In Bakkt’s Bitcoin Futures Jump To Record Highs

While bitcoin hit fresh three-month highs on Wednesday, open interest in monthly bitcoin futures on the Intercontinental Exchange’s (ICE) Bakkt platform jumped to record highs.

Open interest, or the number of open futures contracts, rose to $13 million, surpassing the previous record high of $12 million reached on Feb. 3, according to data analytics firm Skew.

Open interest has risen sharply, by 13.6 percent from $5.5 million to $13 million over the past two weeks. Open positions on the Chicago Mercantile Exchange’s bitcoin futures also jumped to a five-month high of $249 million on Wednesday – up 34.5 percent from $185 million seen two weeks ago.

Bitcoin’s price has risen by 19 percent since Jan. 24. The cryptocurrency printed a high of $9,775 on Wednesday, a level last seen on Oct. 28.

Analysts keep track of changes in open interest to gauge the strength of price moves.

An uptick in price along with a rise in open interest indicates there is strength behind the move higher. A trend is said to be lacking substance when the two metrics move in opposite directions.

Bakkt Volumes Decline

Meanwhile, trading volumes in Bakkt futures have been in a declining trend since hitting a record high of over $44 million, or 6,601 BTC, on Dec. 18.

As of Feb. 5, trading volume was $27 million, of which $16 million came from the physically settled futures.

Volumes on CME, however, have held strong, with seven sessions in the last two weeks registering more than $500 million volume, as noted by Skew.

Updated: 2-7-2020

CME Bitcoin Futures Hit $10K As BTC Price Finally Nears Five Figures

Bitcoin (BTC) crossed the $10,000 mark for swathes of institutional investors this week as markets looked increasingly likely to surge higher still.

CME Reaches $10K Per Bitcoin

Data from CME Group’s Bitcoin futures shows the implied price of Bitcoin reaching the symbolic five figures on Feb. 6.

Since then, a slight correction has sent BTC/USD a shade lower — it currently trades at $9,800, while CME’s futures are hovering around $9,900.

Considerable enthusiasm has accompanied sustained price momentum for Bitcoin throughout the past week’s trading.

After challenging $9,000 support on Feb. 4, an abrupt upward surge saw the largest cryptocurrency reach new local highs of $9,840 — its best position since mid-September.

As Cointelegraph reported, Bitcoin’s year-to-date performance currently stands at more than 35%, second only to Tesla stock in terms of gains since Jan 1.

Analyst Eyes $10K Futures Close

For Cointelegraph Markets analyst filbfilb, press-time levels represented an important watershed for BTC/USD, with a major move in either direction a strong possibility.

“Overall picture is good going into the close… Would be glorious if CME takes us across 10k into the close,” he summarized to subscribers of his Telegram trading channel on Friday.

Filbfilb added that he eyed potential support at $9,550 should a sell-off ensue.

Futures markets meanwhile continue to reach new achievements, with fellow operator BitMEX seeing new record open interest for its own futures product — $1.5 billion.

Updated: 11-29-2021

Bitcoin Transaction Fees Are Down By Over 50% This Year

Transaction fees have dropped this year, after a spike earlier this summer.

According to YCharts data, the average transaction fee of Bitcoin (BTC) has dropped from $4.40 to $1.80 this year, a decrease of 57.97%. This rise may be attributed to a variety of factors.

One explanation is that the fast expansion of the Bitcoin Lightning Network, in which transactions are off the blockchain, may have been a catalyst.

For perspective, the Bitcoin network charges a fee for each transaction. This payment is then divided between miners. When the network is congested and demand for transaction processing far surpasses the supply of miners, users frequently pay more.

On April 21, the average transaction fee on the Bitcoin network reached an all-time high of $62.8 per transaction as miner outages in China slowed block production at a time when demand for Bitcoin was robust.

The drop in costs may be attributed to Bitcoin miners becoming less skeptical and not losing interest in processing transactions. When this happens, the mining difficulty, which measures how difficult it is to validate a Bitcoin transaction, falls.

Another possible reason for the declining transaction cost is the decongestion of the mempool, which is the collection of all pending transactions before being confirmed.

When a transaction is sent to the Bitcoin network, it remains in the mempool until it receives confirmation. Because each BTC block has a certain size of 1MB, a large mempool may encourage miners to favor more lucrative transactions.

During these instances, customers begin paying more in order for their transactions to not get stuck in the mempool. This raises the overall transaction cost on the Bitcoin network.

The size of the Bitcoin mempool has been well below its maximum capacity as shown by the chart below.

The average transaction count has also dropped significantly in recent months. On an average per day, there were more than 350,000 transactions at the start of 2021, but that number has now fallen to between 250,000 and 213,000 transactions per day.

Another possible explanation for the decline in transaction costs is that traders and holders of Bitcoin tend to use less BTC. A drop in demand causes the cost per token to fall, which decreases transaction fees.

Meanwhile, Ethereum fees have also plummeted with the rest of the cryptocurrency market. The average transaction fee of the Ethereum network was $4.90 as of publishing time, having peaked at $69.92 on May 12, 2021.

As a new week gets underway, Bitcoin (BTC) is back at $57,000, ending a tumultuous few weeks that saw the price plummet.

Updated: 11-30-2021

Bitcoin Network Settling An Average Of $95K For Every $1 In Fees

Bitcoin’s settlement efficiency has been improving, which means more value can be sent for lower transaction fees.

The Bitcoin network’s value settlement efficiency has been improving steadily recently, with more being settled for lower fees.

Over the past week, the Bitcoin network has transferred or settled an average of $95,142 of value for every $1 worth of fees.

The on-chain settlement efficiency has been gradually increasing since May as more has been moved around the network during the bull cycle.

On-chain analyst Dylan LeClair made the observation using data from analytics provider Glassnode. The value is derived by dividing the mean transaction volume by the fees.

The final settlement costs amounted to just 0.00105% of the total value transferred of $451.3 billion.

According to CryptoFees, Bitcoin is seventh in the list of networks ordered by daily transaction fees. Its seven-day average is around $678,000, which puts it behind Ethereum, Uniswap, Binance Smart Chain, SushiSwap, Aave and Compound.

The fee tracking platform reports that Ethereum is currently processing $53 million in daily fees, 98.7% more than the Bitcoin network. Bitcoin and Ethereum should not be compared in terms of value settlement and fees as they are two different entities — the former is a store of value asset and the latter a smart contract and decentralized application network.

Ethereum’s mean transaction volume divided by the fees comes out at just $139 in value transacted per dollar in fees.

The settlement efficiency of the Ethereum network has declined as more value has accrued to the network and a much greater demand has been put on it, especially with the rise of DeFi and nonfungible tokens (NFTs) over the past 18 months.

According to Bitinforcharts, the average transaction fee on the Bitcoin network is around $2.13 at the moment. Comparatively, the Ethereum network’s average fee is a whopping $42.58. As reported by Cointelegraph on Monday, Bitcoin transaction fees are down by more than 50% this year.

The divergence in average transaction fees between the two networks can be seen widening from the end of July.

Updated: 12-1-2021

Bitcoin Has Surpassed PayPal In Transaction Volume And Could Leave Behind Mastercard ‘In Time’ Too, Says Intelligence Firm

Apex cryptocurrency Bitcoin (CRYPTO: BTC), which has already exceeded PayPal Holdings Inc. (NASDAQ: PYPL) in terms of transaction volume, could surpass Mastercard Inc. (NYSE: MA) “in time,” according to blockchain intelligence firm Blockdata.

What Happened: Bitcoin could attain the transaction volumes attained by Mastercard in five years, as per Blockdata.

However, the bitcoin volume growth will be based on three factors – the increase in the number of transactions, bitcoin’s price rise, and the increase in the average amount of bitcoin sent per transaction.

The Bitcoin network processed an estimated $489 billion per quarter in 2021 on average, Blockdata said.

For comparison, PayPal processed an average of $302 billion per quarter, while the Mastercard network processed $1.8 trillion per quarter and the Visa Inc. (NYSE: V) network processed an average of $3.2 trillion per quarter.

Bitcoin’s processed volume could equal that of Mastercard as soon as 2026, if the cryptocurrency’s 2021 price growth is taken as a metric, as per the report. If the average yearly bitcoin price is used as a growth metric, it could attain the level only by around 2060.

Why It Matters: Launched in 2009, Bitcoin has gained increasing mainstream adoption over the past few years. It is the world’s largest cryptocurrency with a market capitalization that surpassed the $1 trillion mark this year.

The rise in Bitcoin’s acceptance as a major store of value and payment option has also been influenced by major corporations adding the cryptocurrency to their balance sheet.

Bitcoin’s year-to-date gains are 94.3%. The cryptocurrency is down 17.0% from its all-time high of $68,789.63 reached in November.

Updated: 1-27-2022

Bitcoin Annual Settlement Volume Exceeded That Of Visa Last Year At $13.1T

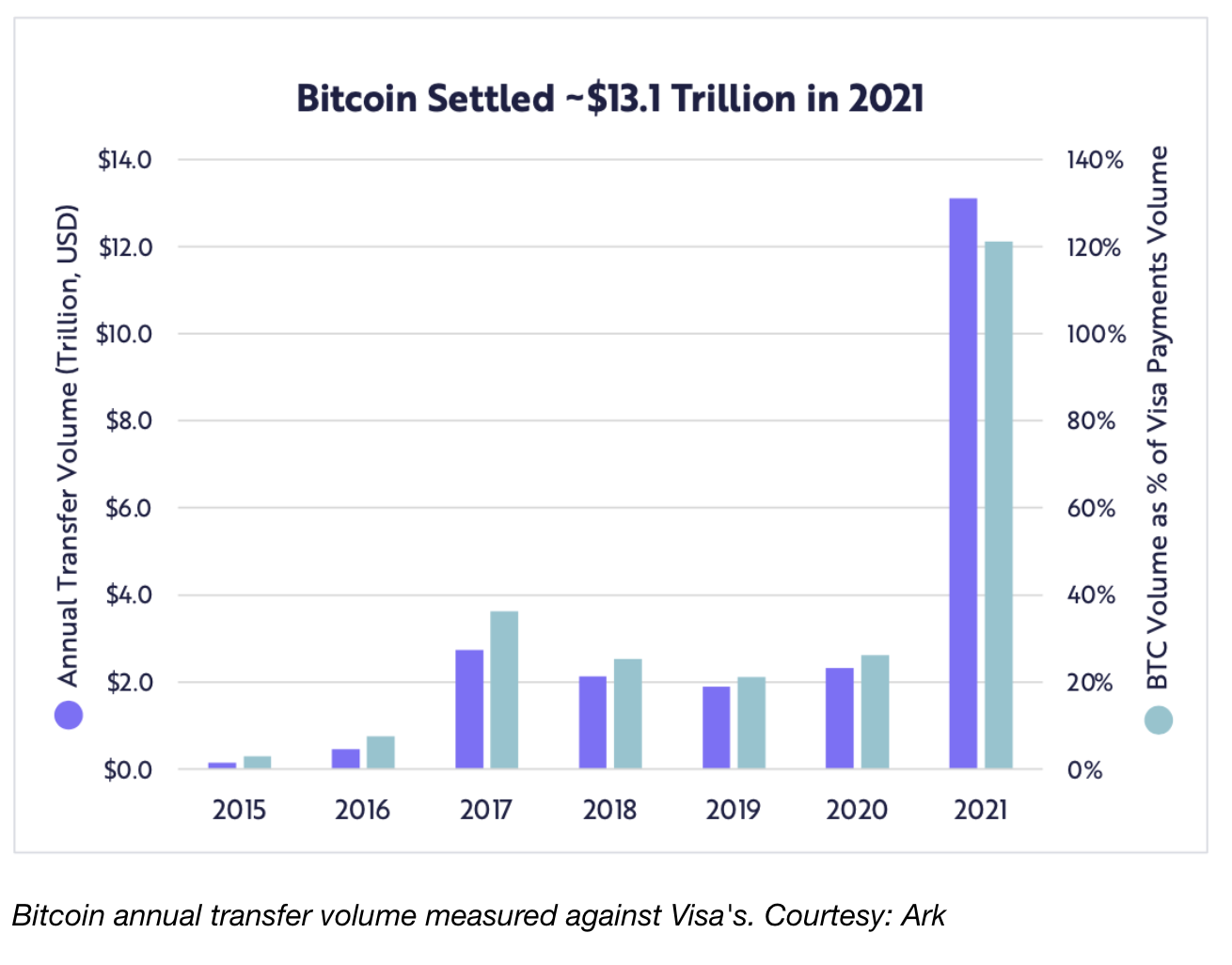

Bitcoin’s BTC annual settlement volume officially exceeded the payments volume of Visa Inc. last year, Cathie Wood-led Ark Investment Management said in a research report.

What Happened: Bitcoin’s cumulative annual transfer volume in 2021 surged 463% from the prior year to $13.1 trillion, just ahead of Visa’s number, ARK analyst Yassine Elmandjra wrote in the report titled “Big Ideas 2022,” citing data from Glassnode, Visa and FRB services.

Bitcoin’s average daily transfer volume surged more than five-fold year-over-year to $35.9 billion in 2021, while the cryptocurrency’s average transaction value grew six times to $136,555.

Elmandjra also announced the news on Twitter.

Bitcoin’s annual settlement volume has officially surpassed Visa’s. More than $13.1 trillion of value was settled on-chain in 2021. pic.twitter.com/qwIsNqtu8y

— Yassine Elmandjra (@yassineARK) January 25, 2022

Why It Matters: Launched in 2009, Bitcoin has gained increasing mainstream adoption over the past few years. It is the world’s largest cryptocurrency by market capitalization.

The cryptocurrency is down 47.5% from its all-time high of $68,789.63 reached in November.

Ethereum’s blockchain handles about five times the daily volume of Bitcoin, thanks to its robust ecosystem of decentralized finance (DeFI) protocols, play-to-earn blockchain games and non fungible tokens (NFTs), it was reported in September.

Nevertheless, blockchain intelligence firm Blockdata had noted in December that Bitcoin, which already exceeded PayPal Holdings Inc. in terms of transaction volume, could surpass Mastercard Inc.“in time.”

Updated: 2-1-2022

Bitcoin Network Transaction Volume Surpasses American Express

A recent NYDIG report found that Bitcoin had settled more transaction volume in Q1 2021 than “all credit card networks combined for the entire year” when including intra-network transactions.

New research has found that the annual transaction volume on the Bitcoin network surpassed that of some well-known card networks, such as American Express (AmEx) and Discover, during 2021.

The Saturday “NYDIG Research Weekly” report stated that Bitcoin processed $3 trillion worth of payments during 2021, placing it above popular credit card networks American Express ($1.3 trillion) and Discover ($0.5 trillion).

The report authors, NYDIG global head of research Greg Cipolaro and research analyst Ethan Kochav, also found that the Bitcoin network had settled more transaction volume in Q1 2021 than “all credit card networks combined for the entire year.”

“This is astonishing growth, in our opinion, for a payment network that just had its 13th birthday,” they wrote. American Express issued its first card in 1958, and Discover in 1985.

However, the Bitcoin network still has a way to go before catching up to Visa and Mastercard, which processed $13.5 trillion and $7.7 trillion in transactions, respectively.

It also should be noted that the study only looked at the United States dollar value of transaction volume rather than the actual number of transactions. Therefore, it’s likely that most of the Bitcoin (BTC) transactions were simply users purchasing, swapping and selling their BTC rather than using it to pay for anything.

While Bitcoin’s growth in transaction volume has not always been linear year-to-year, Cipolaro and Kochav said that it has “kept up at a torrid pace when looking at 5-year compound annual growth rates.”

“At the end of 2021, transaction volumes have been growing by nearly 100% annually over the past 5 years.”

In November 2021, a Blockdata report estimated that the Bitcoin network could potentially match the dollar value transferred on Mastercard’s network by as early as 2026. It also found that the Bitcoin network already processes more volume by dollar value than PayPal.

According to the report, the Bitcoin network processed about $489 billion per quarter in 2021, which is greater than PayPal’s $302 billion.

The measure of Bitcoin transaction volumes doesn’t report the raw volume of on-chain transactions but rather “relies on statistical analysis by data providers (such as Glassnode) to remove transactions without economic substance.”

The report includes “intra-entity transactions,” which are transactions between addresses within the same wallet or owned by the same organization. For example, this might apply to a crypto exchange that is frequently moving Bitcoin around between different addresses. So, in other words, the $3-trillion figure should perhaps be taken with a pinch of salt.

Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,Bitcoin Achieves Major Milestone,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Jill Carlson, Meltem Demirors Back $3.3M Round For Non-Custodial Settlement Protocol Arwen

Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.