Buffett ‘Killed His Reputation’ by Being Stupid About BTC, Says Max Keiser (#GotBitcoin)

One of the most successful investors of all time, Warren Buffett might be killing his reputation by being so harsh on Bitcoin, Max Keiser believes. Buffett ‘Killed His Reputation’ by Being Stupid About BTC, Says Max Keiser (#GotBitcoin)

Warren Buffett, the fifth-richest person on the planet, has repeatedly expressed his unfriendly stance toward Bitcoin (BTC).

One of the most successful investors of all time, Buffett might be killing his reputation by being that harsh to BTC, according to one industry player.

Max Keiser, famous American broadcaster and known Bitcoin bull, is confident that Buffett’s highly critical stance on Bitcoin is no good for the legendary investor.

Keiser Argues That It’s Time To Leave Buffett In The Past

On May 2, Buffett’s Berkshire Hathaway reported a $50 billion Q1 loss, with Buffett admitting a major investor mistake.

Keiser subsequently argued that the legendary 89-year-old investor “killed his reputation by being stupid about BTC.”

He Tweeted On May 3:

“Now that Buffett is out of the game and stock buybacks are rightly being called out as fraudulent, investors will ask… If Buffett was dead wrong about so much, was he also wrong about #Bitcoin and Gold? ANSWER: YES. Buffett killed his reputation by being stupid about BTC.”

Keiser further tweeted that it is time to leave Buffett in the past, outlining that millennials and Gen Z should look to Bitcoin.

The Bitcoin bull also highlighted that Buffett “was already way overrated,” as he missed not only Bitcoin investment, but also gold, Apple and Amazon.

Pomp Says That Buffett Has Enough Cash To “Buy Every Bitcoin” In The Circulating Supply

By the end of March, Buffett’s Berkshire had a record $137 billion in cash and equivalent instruments. Anthony “Pomp” Pompliano, co-founder and partner at Morgan Creek Digital, tweeted on May 2 that Buffet is able to buy all circulating bitcoins with that amount. Pomp said:

“Warren Buffett has $137 billion in cash. That is almost enough to buy every Bitcoin in the circulating supply.”

Pomp’s tweet apparently was nothing but sarcasm though. In order to purchase all Bitcoin in circulation, Buffett would have to persuade every BTC hodler to sell him the cryptocurrency at current market price, Binance CEO Changpeng Zhao (CZ) pointed out.

Pomp subsequently supported CZ’s stance, outlining that having enough cash does not mean that one can get all the Bitcoin.

“I’m not selling mine and I figure you’re not either,” Pomp concluded.

After claiming that Bitcoin is “rat poison squared” in 2018, Buffett did not change his stance to the cryptocurrency even after Tron CEO Justin Sun gave him Bitcoin at a historic charity lunch in February 2020.

Although Buffett reportedly accepted Sun’s gift first, the legendary investor still claimed that cryptocurrencies have “zero” value and don’t produce anything.

Eventually, Buffett declared that he doesn’t own any crypto, reportedly having donated his crypto gift to charity.

Updated: 5-5-2020

Warren Buffett Expects Market Doom That Can Take Down Bitcoin With It

Warren Buffett has no intention of spending Berkshire’s $137 billion cash pile and, if stocks plummet, Bitcoin may see another significant correction.

Warren Buffett and Berkshire Hathaway remain reluctant in spending its $137 billion cash pile. Their cautious stance towards the abrupt recovery of the U.S. stock market may spoil the recent Bitcoin (BTC) rally.

The top-ranked cryptocurrency by market capitalization has long broken out of its short-term correlation with the U.S. stock market. But, a potential equities correction in the near-term raises the probability of a pullback in all high-risk and speculative assets.

Technically, Bitcoin Has More Reasons To Fall Than To Rise From $9,000

The Bitcoin price saw a vertical rally to $9,500 in a short period of time. It took less than two months for BTC to rise by nearly three-fold from $3,600.

Much of the positive sentiment around the upsurge of Bitcoin in April was attributed to the dominance of organic spot volume. It suggested that from $3,600 to mid-$7,000, retail investors accumulated BTC.

In previous rallies, spoof orders coming from the futures market created speculative short-term bubbles that burst as soon as a large whale triggered a cascading sell-off.

While high spot volume from exchanges like Coinbase can be considered an optimistic piece of data, it cannot solely justify the sustainability of such a large rally within a two-month span. The same way Buffett is struggling to find value in the stock market to lead major acquisition deals.

Speaking at the annual Berkshire Hathaway shareholders meeting, Buffett said that $137 billion is not a large cash pile if bad things start to pile up in the market. Berkshire has major stakes in leading conglomerates like Coca Cola and Kraft Heinz.

If the market begins to go in the opposite direction than analysts anticipate, the cash pile can be used to assist Berkshire’s portfolio companies.

Bitcoin is at a point where it faces strong overhead resistance in the $9,500 to $9,900 range and the U.S. equities market is still rattled by the economic consequences of the coronavirus pandemic.

Given the cyclical nature of Bitcoin, technical analysts weigh towards a correction for Bitcoin after its highly anticipated block reward halving on May 12.

Not All Bearish For BTC, Especially In The Long-Term

As Welt market analyst Holger Zschaepitz said, two previous Bitcoin halvings led to 10,000% and 2,500% gains for BTC.

Bitcoin is a deflationary currency because its supply of 21 million BTC is fixed and cannot be altered.

As such, any event that significantly impacts the supply of BTC will have a profound effect on the price of the cryptocurrency.

The halving decreases the rate in which new BTC is introduced to the market as Bitcoin moves towards capping its 21 million supply. As it gets closer to the figure, theoretically, the Bitcoin price is expected to increase and break out of its previous cycles.

The sentiment around stocks and high-risk assets remains cautious due to the uncertainty expressed by major investors like Buffett. But, over the long-term, data suggests Bitcoin is likely to persevere.

Long-time investors like Max Keiser are not impressed by Buffett’s recent investment decisions and his view of Bitcoin, however, adding that BTC outperformed most assets, including gold, in the past two months.

Updated: 5-5-2020

Buffett Described Bitcoin As Having “No Value,” Yet, Is Up 23% This Year While Berkshire Hathaway Is Down 21%

Billionaire investor Warren Buffett says he’s having a hard time finding attractive investments as the coronavirus ravages the global economy.

Maybe he should take advice from professional crypto investors like Pantera Capital’s Dan Morehead – and reconsider bitcoin.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

Bitcoin, the cryptocurrency the 89-year-old Buffett described in February as having “no value,” is up 23% this year to about $8,870.

The Standard & Poor’s 500 Index of large U.S. stocks, which Buffett routinely endorses for amateur investors, is down 12%. Shares of Berkshire Hathaway, Buffett’s insurance-to-utilities conglomerate and investment vehicle, are down 21% in 2020.

Morehead, a former Goldman Sachs mortgage-bond trader who later oversaw foreign-exchange options at Deutsche Bank in London and headed macro trading at the renowned hedge fund Tiger Management, started Pantera in 2013 as a bitcoin investment firm.

In a monthly letter last week, he echoed Buffett’s sentiment that there’s little visibility right now on the global outlook: “This is a really distressing, massively confusing time,” Morehead wrote.

What’s clear already, according to Morehead, is the pandemic’s devastating toll on the economy and the likelihood things won’t get much better anytime soon. That means big government deficits are coming, accompanied by unbounded money printing.

All that bodes well for bitcoin, according to Morehead – especially with the additional kicker coming next week from its underlying blockchain’s quadrennial “halving,” where the pace of new supply gets cut in half. Bitcoin is seen by many crypto investors as a bulwark against inflation.

“Like hydrostatic pressure, that flood of new money will float all boats,” Morehead wrote. “I strongly believe it’s close to inevitable that this will be very positive for cryptocurrency prices.”

The economic gloom is pretty stark. According to The Wall Street Journal, a report due Friday from the U.S. government could show the unemployment rate rose to 16% in April, which would represent a record high in data going back to 1948.

According to Politico, some estimates put the jobless rate rising to 22%, approaching the Great Depression high of 24.9%.

The U.S. Treasury Department said Monday it will borrow a record $3 trillion this quarter, a six-fold increase over first-quarter levels, to help fund coronavirus-related emergency spending.

Even Buffett warned, at his company’s annual shareholder meeting on Saturday, of the potential “extreme consequences” of the Federal Reserve’s moves to prop up corporate debt, according to CNBC.

“We’re doing things that we really don’t know the ultimate outcome to,” Buffett said.

According to The New York Times, Buffett is neither optimistic nor pessimistic, but “realistic.”

These days, though, it’s the crypto investors who seem more in touch with reality: “Record monetary and fiscal stimulus” are now driving the economy and markets, as Arca Funds, a cryptocurrency-focused investment firm, put it Monday in a newsletter. So far in 2020, the markets are on their side.

“If your entire investment thesis for owning stocks and bonds requires this much intervention just to survive, shouldn’t every debt and equity investor at least be willing to listen to alternative thought processes?” Arca wrote.

To be fair, Buffett says he’s looking to spend $30 billion to $50 billion on a special investment, so it might be hard to put that much into bitcoin without driving the price a lot higher; after all, the cryptocurrency’s entire outstanding market value currently stands at about $163 billion.

Buffett told CNBC interviewer Becky Quick in February that he didn’t own any cryptocurrency and “never will.”

He might be missing the boat: There’s a growing body of investors who see bitcoin as a promising investment for such depressing times. According to The Block, the Wall Street firm Jefferies recommended last week that investors buy bitcoin.

And a newsletter sent Monday by the London-based crypto investment firm ID Theory included a chart showing how dramatically money managers turned last week in their bets on bitcoin futures.

Pantera’s Morehead wrote in his letter last week that bitcoin prices could climb as high $115,000 by next year, a 13-fold increase over current levels. Buffett’s shareholders might drool over such returns.

“If you can find something that goes up in the biggest crisis in a century, you should have some of that in your portfolio,” Morehead wrote. “I think this is only the beginning.”

At the meeting on Saturday, Buffett “left investors with a sliver of hope,” according to The New York Times.

“The American miracle, the American magic has always prevailed and it will do so again,” he said.

Based on the prognostications of crypto investors who this year have proven more oracular than Buffett, that magic might come from entrepreneurs working to develop alternatives to the current financial and monetary system – and their inventions, including bitcoin.

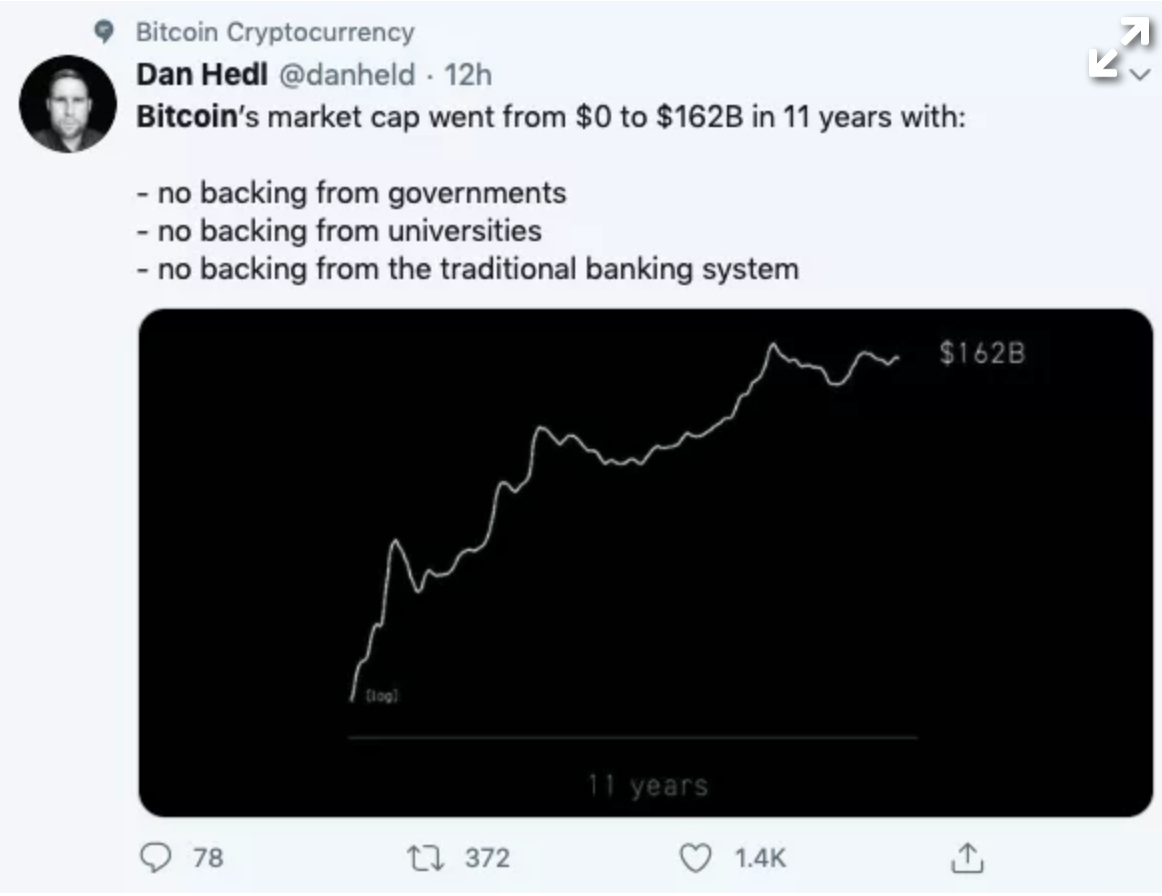

Tweet of the Day

Updated: 6-8-2020

Robinhood Users Steal From The Rich To Fill Their Bitcoin Bags: Max Keiser

Max Keiser called out Warren Buffett over his recent losses in the airline sector, claiming that Robinhood users had stolen his money and created wealth for Generation Z.

Broadcaster and renowned Bitcoin (BTC) bull Max Keiser has taken a knock on veteran investor Warren Buffett in a tweet posted on June 8.

Keiser claimed that users of the popular Robinhood stock and cryptocurrency trading app had stolen Buffett’s money by capitalizing on his recent losses in the airline sector. He further suggested that the profits made on Buffett’s mistimed stock sales were being invested into Bitcoin.

Stealing Buffett’s Bags

In early May, Buffett told shareholders of Berkshire Hathaway that he had sold all of the company’s airline stock at a huge loss, due to fears that the sector would not recover from the coronavirus pandemic.

However, users of the millennial-friendly zero-commission Robinhood trading app swooped in and bought the dip, snapping up shares in both Delta and American Airlines, according to Business Insider.

With airline stock since starting to rally, Keiser took a dig at his old foe, saying that the Robinhood users had “stolen” his money “creating wealth for poor Gen Z kids.” He went on to suggest that the users were:

“Picking over Warren Buffett’s career corpse; booking huge profits on his mistimed stock sales, and then rolling that money into Bitcoin”

A History Of Animosity

Keiser has a history of animosity towards Buffett, who has in the past famously described Bitcoin as “rat poison squared.” Last month he suggested that Buffett’s stance on Bitcoin had “killed his reputation.”

However, even United States President Donald Trump has called Buffett out for selling his airline stocks, saying that he had made a mistake.

Meanwhile the Robinhood app goes from strength to strength, raising $280 million to surpass its financing goals in a recent funding round.

Updated: 6-20-2020

Paul Tudor Jones To Be Biggest Bitcoin Holder In 2 Years — Max Keiser

Outspoken Bitcoin investor and host of the Keiser Report, Max Keiser, explains that his $400K BTC price prediction will coincide with the U.S. dollar’s collapse.

Cointelegraph Markets spoke with Wall Street veteran and host of the Keiser Report, Max Keiser, who explains the increasingly important role of Bitcoin in geopolitics amid potential “hash wars” and why he believes Paul Tudor Jones will become the biggest holder of BTC within two years.

Your 200K+ follower Twitter account @maxkeiser went silent for a few months. What happened?

Max Keiser: It was a software bug that froze the account for nine months. I believe it was a database contention problem. My friends at SwanBitcoin took on the challenge and sorted it out. I also sent two-dozen roses and a box of chocolates to Twitter HQ in SF, but I’m not sure that had any impact.

The United States’ national debt is now over 26 trillion. Is there a certain level at which the U.S. can default?

Max Keiser: The debt is big. But the interest on that debt is now bigger than America’s number-one budget item, the military’s 1.6 trillion spend. When the interest on the debt gets close to 100% of GDP then America will officially be a failed state. This looks like it will be the case within 5 years — as short interest rates snap back to historic levels of 5%, not the current 1/2%

Post-halving, Bitcoin’s inflation rate is now less than 2% akin to gold or the Fed’s inflation target. Is this do or die for Bitcoin now as a store-of-value?

Max Keiser: Let’s be clear, Bitcoin exhibits quantum mechanical characteristics pertaining to outcomes changing depending on observation. Per the Heisenberg Principle, the observer’s act of observing changes outcomes.

In Bitcoin’s case, it’s Bitcoin that’s observing us. As I’ve argued before, starting at around block 300,000, I started noticing that Bitcoin was becoming self-aware. This has grown exponentially to a state of meta-awareness and so instead of asking is it time for Bitcoin to prove itself we should be asking ourselves, what do we have to do as a species to prove we are worthy of Bitcoin.

This is why my Bitcoin VC fund is called Heisenberg Capital. As an aside, it’s outperformed every fund globally since inception in 2013 to today.

Will U.S.-China tensions and other geopolitical risks continue to put pressure on risk-on assets, and possibly affect Bitcoin?

Max Keiser: China, America, Russia and Iran will enter a Hash War to try and grab as much Bitcoin as possible. Iran is already mining Bitcoin. I believe they have 3% of the hash rate. This is another “Sputnik moment” where America has to decide if they want to win the Hash War or get relegated to the dustbin of history.

Do you agree that Paul Tudor Jones announcing his Bitcoin exposure is a major green-light for traditional investors? Is this a watershed moment? If not, what will it be?

Max Keiser: I think PTJ, who I followed closely when I was a stockbroker on Wall St. from 1983-1990, will be the biggest HODL’er of Bitcoin within 2 years. He is an absolute mercenary if he sees something he likes.

“The Bitcoin community has never seen the likes of PTJ and will be shocked by his take no prisoners audacity.”

You recently said that basic consumer protection is appropriate in the case of the Bitcoin Cash fraud. Can you elaborate on this?

Max Keiser: None of the hard forks and none of the altcoins will attract enough energy to survive. It’s a winner take all game and Bitcoin is not only starving alts of energy but also starving fiat money and their sponsoring nation-states of energy.

Bitcoin is an indestructible Godzilla with an insatiable appetite for energy that is transforming the world and everything that lives.

Regulators should warn people about failed projects like BCH, but the more likely scenario is that both BCH and the regulators go bankrupt due to a Bitcoin evisceration.

You have also been vocal about Ethereum criticizing Vitalik Buterin for failing to understand Bitcoin’s value proposition. What does he get wrong about Bitcoin?

When I was chatting with Vitalik in London, he was still working at Bitcoin Magazine at the time, and just planning ETH. He didn’t get how absolute scarcity drives the BTC market. He still doesn’t get it.

He’s repeatedly downplayed absolute scarcity. So, I never believed he really understood how BTC works. Funny, because the problems ETH has is that it’s a centralized, variable supply fiat-substitute that has all the problems of fiat money.

“Ironically, ETH is trying to be fiat money and failing.”

So I take it you’re not a fan of Ethereum 2.0 and its roadmap?

Max Keiser: It’s a Rube Goldberg machine to nowhere.

You’ve recently spoken with Bitcoin & Black America author Isaiah Jackson on your show. Why is this book so significant and timely right now with the current social unrest in the U.S.? How does Bitcoin help blacks in America?

Max Keiser: Bitcoin helps the biggest victims of fiat money the most. America’s Black community is the biggest victims of America’s fiat money so they potentially are the biggest winners as Bitcoin pushes out fiat and becomes the global reserve currency. I said on Keiser Report back when BTC was $1 that America’s Black community should buy up all the BTC they can and then they could buy the White community if they chose to.

Major banks are now changing their tune about Bitcoin, most notably JPM. Why do you think this is the case, and will this be a continuing trend?

Max Keiser: You don’t change Bitcoin, Bitcoin changes you — per the Heisenberg Principle effect — and the existence of a self-aware Bitcoin. With this in mind, I helped direct BTC’s attention to Jamie Dimon and JP Morgan by effectively “painting the target.” The protocol cracked that nut and now Jamie’s a BTC drone. The same thing is happening to Peter Schiff.

Do you see the stock market hitting new all-time highs this year? What does this mean for Bitcoin? Your Bitcoin price target by 2021?

Max Keiser: The U.S. stock market will probably hit new highs just like the markets hit new highs in Venezuela, Zimbabwe and Iran. Not because companies are doing well but because the currencies are collapsing.

“My target for BTC since 2011 has been $100,000 and I recently upped that to $400,000. The timing depends on when exactly the $USD collapses.”

It could happen any day. Better to be a few months early than a day late. When the dollar cracks, BTC price gaps higher by $10,000 at a clip. If you’re not already positioned, you’ll be eating dirt.

Updated: 6-23-2020

‘It Does Nothing’ — Buy Bitcoin, Don’t Protest, Says Max Keiser

Bitcoin is the best exit strategy from financial oppression after Covid-19, Keiser argues, as one economist says the Fed’s balance sheet will never shrink.

Bitcoin (BTC) is the only effective way for Americans to empower themselves and protests do not work, popular TV personality Max Keiser has said.

In the latest edition of his RT show the Keiser Report on June 23, Keiser delivered a frank appraisal of the current socio-economic situation in the United States.

Protests “Do Nothing” Compared To Buying Bitcoin

The Federal Reserve has exacerbated inequality thanks to its response to Covid-19, he and co-host Stacy Herbert argued, and the George Floyd protests are just as much due to economic oppression as police oppression.

Two familiar culprits — the Cantillion Effect and “interest rate apartheid” — are to blame for public anger.

The former refers to money printing putting wealth in the hands of those closest to the source, while the poor pay more to borrow it. By contrast, loans to banks and big business are either free or even subsidized, meaning that they are paid to borrow money.

“Black America will never be equal to white America; they will never have justice in white America,” Keiser said.

“The only thing they can hope for is individual sovereignty, and the only way to get there is through savings in Bitcoin — (it’s) the best way to get there.”

As money which is neither controlled by any central authority or able to be debased by a central bank, Bitcoin forms arguably the most comfortable way to exit the punitive fiat system.

For Keiser, those attending protests in Floyd’s memory are ignoring the reality of the situation — to effect personal change, they must take back their financial sovereignty.

“Tearing down a statue does nothing, marching in the street does nothing, electing people to office that you think are going to help you does nothing, none of that works,” he continued.

“I’m telling you as a white male Boomer Wall Street careerist that I would laugh at that, as my brethren would do — it does nothing.”

Economist: Fed balance sheet “will never shrink again”

The Keiser Report subsequently shed light on the future of the Fed’s economic policy. According to guest Stephen Roach, a Yale economist, Covid-19 has cursed the central bank’s position once and for all.

Roach believes that due to propping up the economy, from stock markets to buying up bonds, the Fed’s inconceivable $7.2 trillion balance sheet will never shrink.

In 2008, for example, the balance sheet stood at $800 billion and was all but doomed even before the pandemic.

“Now the Fed owns the treasury market, the muni market, the corporate bond market, the junk bond market, the CLO market and by proxy, the housing market and the stock market,” he said.

“They’re never going to drain that balance sheet — they own these markets and the moment they step away, they’re going to crash faster and harder than ever before.”

The Fed’s ownership of U.S. GDP now circles 30%, Keiser suggesting that further expansion would steer the country ever closer towards a medieval-style feudal setup, in which the elite owns everything and regular citizens live without power.

Updated: 8-31-2020

Bitcoin Will Hit New High ‘In Near Term’ As Buffett Exits USD — Keiser

The Sage of Omaha is getting out of the world’s reserve currency, Max Keiser claims, and that’s a prelude to Bitcoin hitting a new record.

The U.S. dollar is getting so weak that even Warren Buffett is getting out and Bitcoin (BTC) will see all-time highs, says Max Keiser.

In his latest forecast for macro, the RT host warned that safe havens would seriously outperform fiat. Buffett, he implied, knew what was coming.

Keiser: Buffett “Getting Out of USD”

“Buffett’s move into Japan, along with his GOLD investment, confirms he’s getting out of USD BIGLY,” Keiser wrote on Twitter Monday.

“USD is trending lower today, about to break key support. Bitcoin – Gold – Silver Will all make new ATH in the near term.”

He was referring to Buffett’s move into Japanese assets, taking a 5% stake in the country’s five biggest trading houses in a move which totals $6 billion, Reuters reports.

“The five major trading companies have many joint ventures throughout the world and are likely to have more. I hope that in the future there may be opportunities of mutual benefit,” the publication quoted him as saying.

The announcement came days after the Federal Reserve confirmed that it would let inflation rise above its 2% target as a temporary measure, something which weighed heavily on the dollar.

After volatility, the USD currency index (DXY) began plumbing new depths on Monday, bouncing off its lowest levels in two years. Late in July, when those levels first appeared, Bitcoin saw a price jump to $12,500.

As Cointelegraph reported, expectations remain that further dives in DXY will produce similar effects.

An Unlikely Bitcoin Bellwether

Buffett meanwhile is well known for his macro moves, even as he remains a steadfast Bitcoin skeptic.

Last week, the so-called “Buffett Indicator” warned about a stock market crash, even as large-cap equities continued their climbs higher.

Prior to that, Anthony Pompliano, co-founder of Morgan Creek Digital, publicly bet on Buffett eventually buying Bitcoin after he revealed moves into gold.

At the time, Keiser claimed that the gold entry alone would spark a run among investors, helping push BTC/USD to $50,000.

Perhaps Buffett’s most famous quip about Bitcoin is from 2018 when he referred to cryptocurrency as “rat poison squared.”

Updated: 12-31-2020

‘Rat Poison Squared’ Bitcoin Passes Warren Buffett’s Berkshire Hathaway By Market Cap

Bitcoin sees a fresh surge in trading activity as $30,000 nears and mainstream interest pours in.

Bitcoin (BTC) has posted its highest transaction volume since early 2018 as data points to more and more investors entering the market.

Figures from on-chain analytics resource Digital Assets Data highlights December 2020 as already sparking Bitcoin’s second-largest transaction volumes.

BTC Transaction Volume Eyes Record

At a total of $252.37 billion for the remaining 24 hours of December may yet take the tally further still as it rivals December 2017.

Other indicators, such as the size of unprocessed transactions in Bitcoin’s mempool and network transaction fees, also suggest heightened activity overall.

As Cointelegraph additionally reported, wallets containing both large and small balances also continue to increase to unprecedented levels.

Google Trends, meanwhile, has captured the highest levels of search interest in the term “Bitcoin” worldwide since February 2018.

The reason, one which is attracting attention from mainstream sources as well as seasoned crypto traders, lies in the price bull run that is continuing unabated this week. At press time, Bitcoin was challenging $29,300 amid a stubborn refusal to consolidate lower.

At $539 billion, the largest cryptocurrency surpassed the market cap yesterday of finance giant Berkshire Hathaway, the CEO of which, Warren Buffett, famously likened Bitcoin to “rat poison squared.”

Ether Continues To Outperform

Despite its 290% year-to-date returns, however, Bitcoin still pales in comparison to the performance of the largest altcoin Ether (ETH). As Digital Assets Data confirms, ETH/USD has sealed gains of almost 500% since Jan. 1. Versus the March lows, performance is even stronger.

In a series of tweets on Wednesday, Bobby Ong, creator of price data site Coingecko, gave his predictions for the crypto market in 2021. Among the major tokens, Ether would see a return to higher transaction fees but pass its existing all-time high from 2018.

“ETH will break past its $1,500 ATH mainly driven by DeFi. Gas fees will skyrocket again and highlight scalability issues,” he wrote.

“Most of the year will be spent coordinating on a Layer 2 scalability solution. My bet will be on ZK Rollup gaining traction towards the end of the year.”

For Bitcoin, Ong forecast a price trajectory towards $100,000, alongside the launch of a long-awaited exchange-traded fund and the first central bank adding Bitcoin to its balance sheet.

Updated: 1-18-2021

Here Are Buffett’s 16 Best (Most Stupid) Quotes About Bitcoin And Crypto:

1. “Cryptocurrencies basically have no value and they don’t produce anything. They don’t reproduce, they can’t mail you a check, they can’t do anything, and what you hope is that somebody else comes along and pays you more money for them later on, but then that person’s got the problem. In terms of value: zero.” – CNBC, February 2020

2. “It’s ingenious and blockchain is important but Bitcoin has no unique value at all, it doesn’t produce anything. You can stare at it all day and no little Bitcoins come our or anything like that. It’s a delusion basically.” – CNBC, February 2019

3. “If you and I buy various cryptocurrencies, they’re not going to multiply. There are not going to be a bunch of rabbits sitting there in front of us. They’re just gonna sit there. And I gotta hope next time you get more excited after I’ve bought if from you and then I’ll get more excited and buy it from you. We could sit in the house by ourselves and we could keep running up the price between us. But at the end of the time there’s one Bitcoin sitting there and now we’ve gotta find somebody else. They come to an end.” – CNBC, May 2018

4. “In terms of cryptocurrencies generally, I can say almost with certainty that they will come to a bad ending. If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it, but I would never short a dime’s worth.” – CNBC, January 2018

5. “Probably rat poison squared.” – Fox Business interview at 2018 meeting

6. “It’s a mirage basically. It’s a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money too. Are checks worth a whole lot of money just because they can transmit money? I hope Bitcoin becomes a better way of doing it but you can replicate it a bunch of different ways. The idea that it has some huge intrinsic value is just a joke in my view.” – CNBC, March 2014.

7. “It’s not a currency. It does not meet the test of a currency. I wouldn’t be surprised if it’s not around in 10 or 20 years. It is not a durable means of exchange, it’s not a store of value. It’s been a very speculative kind of Buck Rogers-type thing and people buy and sell them because they hope they go up or down just like they did with tulip bulbs a long time ago.” – CNBC, March 2014

8. “A rising price does create more buyers and people think ‘I’ve gotta get in on this’ and it’s better if they don’t understand it. If you don’t understand it you get much more excited than if you understand it.” – CNBC, May 2018

9. “It will feed on itself for a while and sometimes for a long while and sometimes to extraordinary numbers. But they come to bad endings and cryptocurrencies will come to bad endings.” – discussing speculative bubbles at Berkshire’s shareholder meeting in 2018.

10. “You’re going to be a lot better off owning productive assets over the next 50 years than you will be owning pieces of paper or Bitcoin.” – CNBC, March 2014

11. “I get in enough trouble with things I think I know something about. Why in the world should I take a long or short position in something I don’t know anything about? We don’t have to know what cocoa beans are gonna do, or cryptocurrencies, we just have to focus on eight or 10 stocks.”– CNBC, January 2018

12. “It draws in a lot of charlatans. It’s something where people who are of less than stellar character see an opportunity to clip people who are trying to get rich because their neighbor’s getting rich buying this stuff that neither one of them understands. It will come to a bad ending.” – 2018 shareholder meeting

13. “Bitcoin has been used to move around a fair amount of money illegally. The logical move from the introduction of bitcoin is to go short suitcases because the money that was taken in suitcases from one country to another – suitcases will probably fall off in demand. You can look at that as the economic contribution of bitcoin to the society.” – CNBC, February 2020

14. “We don’t own any, we’re not short any. We’ll never have a position in them.” – CNBC, January 2018

15. “I don’t have any Bitcoin. I don’t own any cryptocurrency, I never will. I may start a Warren currency, maybe I can create one and say there’s only going to be 21 million of them. You can have it after I die but you can’t do anything with it except sell it to somebody else.” – CNBC, February 2020

16. “I’m really sorry it happens because people get their hopes up that something like that is gonna change their lives.” – CNBC, February 2019

Updated: 8-8-2021

What Warren Buffett Misses About Valuing Digital Assets

Do digital assets have intrinsic value?

It has been argued that digital assets have no intrinsic value because they are not tied to cash flows, as in a conventional corporation. The argument is essentially that digital assets are a post-modern investment class where value is merely relative to what other people speculate the value is. That is, the only use for digital assets is speculation.

This seems true if you measure digital assets in relation to the standard of the conventional neo-classical finance, the Benjamin Graham/Warren Buffett thesis of valuation. Buffett famously missed out on investing in technology companies early because they lacked “fundamental value.”

The problem with discovering the intrinsic value of digital assets is that there is no accepted standard of intrinsic value for digital media in general. Only once we know that, can we know the intrinsic value of digital assets in particular. That is the problem this essay will attempt to solve.

Even the successful digital media companies that came after the dot-com boom show severe inefficiencies and coordination failures including: monopoly concentration, censorship, privacy concerns, the fragmentation and polarization of society, and the mental and physical health issues resulting from gamification and addiction.

These are economic inefficiencies and cultural problems that demand a solution and present an opportunity for economic and social gain. Even though large technology companies have became massively successful, the core problem of their fundamental value remains unresolved.

Let Us Consider The Benjamin Graham/Warren Buffett Model Of Fundamental Valuation. In Essence, It Says:

Low Price/High Cashflows = Good Fundamental Value Investment

It Can Basically Be Assumed That,

Low Price = Inefficient Aggregation Of Publicly Available Information

High Cashflows = High Customer Demand / Low Product Supply

Now, let us consider: Why doesn’t digital media fit into this fundamental valuation model?

The product that digital media produces is data, massive quantities of data. Data only becomes valuable when it is limited in supply. But the current fundamental valuation model does not distinguish valuable data from its opposite (neither does the efficient market hypothesis). Therefore, there is no economic consensus on what constitutes valuable data.

The implicit consensus is that valuable data is defined by the market price. But this does not make sense either, because price is only a small subset of all valuable data.

Valuable data must also include natural human communication that makes market activity possible. If price is only a small subset of valuable data, then saying it determines what is valuable is circular, if not absurd.

Valuable data is what allows for price coordination to happen in the first place. Because we haven’t come to a consensus about what that means, there is no way to understand how data is limited in supply, and therefore therefore no way the price mechanism can coordinate productive activity.

This may explain why our economy and culture have been so confounding since digital media became predominant; we are still trying to use price mechanisms to coordinate production of valuable data, even though valuable data is what causes price coordination.

Google, Facebook, Twitter all “produce” valuable data to sell. But the valuable data they sell is actually created by their users through extensive hours of uncompensated communication labor. People chat online while technology companies extract rents and earn free profits.

In this kind of economy, the actual content of the data does not matter, only price or its quantitative proxies; so price or its proxies will incentivize the production of non-valuable data.

Now, with digital assets, the distinction between the users, the platform and the end product (valuable data) is collapsed. The users are the owners and the marketers. In this kind of economy, the content or value of the communications data matters a lot.

Digital assets increase in value depending on the engineering, design and community decisions of the platforms they’re tied to. In other words, digital assets represent a type of platform-specific communication data.

In 1937’s “The Nature of the Firm,” Ronald Coase emphasizes the two forms of coordination admitted by economists, price coordination and internal coordination, within firms.

He asks, why isn’t everything organized by the price mechanism? Why do firms exist at all? He answers that there is a cost to using the price mechanism. In many cases, it is less expensive and more productive to coordinate internally.

When Coase was writing, internal coordination would have referred to businessmen in the firm. But in the context of distributed networks, internal coordination is any group of people who collaborate over digital media for a shared goal.

Internal coordination is a function of the norms, manners and virtues that precede economic transactions and makes them possible. The better the internal coordination, the more that a digital network grows, because it doesn’t have to rely on price coordination.

This distinction between price coordination and internal coordination shows that there is another layer in the Benjamin Graham/Warren Buffett thesis given above: Internal coordination is what allows price discovery to exist and what solves for inefficiencies, externalities and market failures. Internal and price coordination are in a reciprocal, equilibrium relationship.

Therefore, if the digital asset space is to compete with legacy digital media companies, it has to compete on internal coordination and objective values. It must be shown why digital assets are an objectively better economic system.

Updated: 10-31-2023

Warren Buffett’s ‘Crypto Stock’ Beats Apple And Amazon — But Not Bitcoin

Buffett’s bet on crypto-friendly Nubank has put Berkshire Hathaway $130 million in profit already this year.

Warren Buffett may still view cryptocurrencies and Bitcoin as “rat poison squared,” but he is generating big profits from his position in a crypto-friendly bank in 2023.

Warren Buffett’s “Crypto Bet” Up $130 Million In 2023

The “Oracle of Omaha” purchased 107 million shares of Nu Holdings, a Brazil-based fintech company and owner of the crypto-friendly Nubank, via his firm, Berkshire Hathaway, in two separate rounds in 2021.

Berkshire invested $500 million in Nu Holdings in June 2021 and raised its stake by another $250 million in December 2021. The firm has not sold a single share since, according to its second quarter 2023 earnings report.

Nu’s share price is currently up nearly 106% year-to-date (YTD), meaning Buffett’s $750 million position is now worth around $879.50 million, assuming Berkshire has still not sold any of its Nu shares. However, at its peak in February 2022, the position was worth over $1 billion.

Why is Nubank crypto-friendly?

Nubank has been dubbed crypto-friendly because some of its divisions offer crypto-related services to over 1.35 million users. Therefore, investing in Nubank can be seen as having indirect exposure to the cryptocurrency industry.

That includes Easynvest, a trading platform that offers a Bitcoin exchange-traded fund (ETF) product, and Nubank, a digital financial services platform that offers BTC and Ether trading. Nubank also launched a loyalty token on the Polygon blockchain.

Moreover, Nu Holdings allocated 1% of its cash holdings to Bitcoin in May 2022.

“This move reinforces the company’s conviction in Bitcoin’s current and future potential in disrupting financial services in the region,” Nubank stated at the time.

Nubank is the largest fintech bank in Latin America, with over 80 million customers in Brazil.

Nu Crushes Apple And Amazon Stocks

Underperforming Nu stocks are Buffett’s other top holdings, Amazon and Apple, which have gained 54.65% and 36%, respectively. Apple is by far the biggest holding of Berkshire Hathaway, comprising roughly 45% of its $354 billion investment portfolio as of September 2023.

Nu has also outperformed Berkshire Hathaway’s stock, which has risen 9.25% YTD.

Bitcoin Price Performance Catches Up With Nu Stock

Nevertheless, Bitcoin has finally caught up to the price performance of Nu stock this year. In fact, BTC price is now also up 106% YTD amid “Uptober” and recent Bitcoin ETF euphoria.

Interestingly, Bitcoin’s rapid rise to catch up with Nu over the past weeks has coincided with BTC decoupling from the stock market in October.

But while this is generally seen as a bullish sign, some commentators argue that Bitcoin ETF “hopium” is the driver of BTC price gains presently.

Indeed. Lots of historical data that shows bitcoin is tightly correlated to the stock market. The recent “decoupling” is driven imo by hopium over the ETF. But a significant downturn in stocks will bring BTC back to earth. pic.twitter.com/5hk523j3Gp

— Joe Carlasare (@JoeCarlasare) October 26, 2023

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Blockfolio Quietly Patches Years-Old Security Hole That Exposed Source Code (#GotBitcoin?)

Bitcoin Won As Store of Value In Coronavirus Crisis — Hedge Fund CEO

Decentralized VPN Gaining Steam At 100,000 Users Worldwide (#GotBitcoin?)

Crypto Exchange Offers Credit Lines so Institutions Can Trade Now, Pay Later (#GotBitcoin?)

Zoom Develops A Cryptocurrency Paywall To Reward Creators Video Conferencing Sessions (#GotBitcoin?)

Bitcoin Startup Purse.io And Major Bitcoin Cash Partner To Shut Down After 6-Year Run

Open Interest In CME Bitcoin Futures Rises 70% As Institutions Return To Market

Square’s Users Can Route Stimulus Payments To BTC-Friendly Cash App

$1.1 Billion BTC Transaction For Only $0.68 Demonstrates Bitcoin’s Advantage Over Banks

Bitcoin Could Become Like ‘Prison Cigarettes’ Amid Deepening Financial Crisis

Bitcoin Holds Value As US Debt Reaches An Unfathomable $24 Trillion

How To Get Money (Crypto-currency) To People In An Emergency, Fast

Bitcoin Miner Manufacturers Mark Down Prices Ahead of Halving

Privacy-Oriented Browsers Gain Traction (#GotBitcoin?)

‘Breakthrough’ As Lightning Uses Web’s Forgotten Payment Code (#GotBitcoin?)

Bitcoin Starts Quarter With Price Down Just 10% YTD vs U.S. Stock’s Worst Quarter Since 2008

Bitcoin Enthusiasts, Liberal Lawmakers Cheer A Fed-Backed Digital Dollar

Crypto-Friendly Bank Revolut Launches In The US (#GotBitcoin?)

The CFTC Just Defined What ‘Actual Delivery’ of Crypto Should Look Like (#GotBitcoin?)

Crypto CEO Compares US Dollar To Onecoin Scam As Fed Keeps Printing (#GotBitcoin?)

Stuck In Quarantine? Become A Blockchain Expert With These Online Courses (#GotBitcoin?)

Bitcoin, Not Governments Will Save the World After Crisis, Tim Draper Says

Crypto Analyst Accused of Photoshopping Trade Screenshots (#GotBitcoin?)

QE4 Begins: Fed Cuts Rates, Buys $700B In Bonds; Bitcoin Rallies 7.7%

Mike Novogratz And Andreas Antonopoulos On The Bitcoin Crash

Amid Market Downturn, Number of People Owning 1 BTC Hits New Record (#GotBitcoin?)

Fatburger And Others Feed $30 Million Into Ethereum For New Bond Offering (#GotBitcoin?)

Pornhub Will Integrate PumaPay Recurring Subscription Crypto Payments (#GotBitcoin?)

Intel SGX Vulnerability Discovered, Cryptocurrency Keys Threatened

Bitcoin’s Plunge Due To Manipulation, Traditional Markets Falling or PlusToken Dumping?

Countries That First Outlawed Crypto But Then Embraced It (#GotBitcoin?)

Bitcoin Maintains Gains As Global Equities Slide, US Yield Hits Record Lows

HTC’s New 5G Router Can Host A Full Bitcoin Node

India Supreme Court Lifts RBI Ban On Banks Servicing Crypto Firms (#GotBitcoin?)

Analyst Claims 98% of Mining Rigs Fail to Verify Transactions (#GotBitcoin?)

Blockchain Storage Offers Security, Data Transparency And immutability. Get Over it!

Black Americans & Crypto (#GotBitcoin?)

Coinbase Wallet Now Allows To Send Crypto Through Usernames (#GotBitcoin)

New ‘Simpsons’ Episode Features Jim Parsons Giving A Crypto Explainer For The Masses (#GotBitcoin?)

Crypto-currency Founder Met With Warren Buffett For Charity Lunch (#GotBitcoin?)

Bitcoin’s Potential To Benefit The African And African-American Community

Coinbase Becomes Direct Visa Card Issuer With Principal Membership

Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

Jill Carlson, Meltem Demirors Back $3.3M Round For Non-Custodial Settlement Protocol Arwen

Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Bitcoin’s Lightning Comes To Apple Smartwatches With New App (#GotBitcoin?)

E-Trade To Offer Crypto Trading (#GotBitcoin)

Bitfinex Used Tether Reserves To Mask Missing $850 Million, Probe Finds (#GotBitcoin?)

21-Year-Old Jailed For 10 Years After Stealing $7.5M In Crypto By Hacking Cell Phones (#GotBitcoin?)

You Can Now Shop With Bitcoin On Amazon Using Lightning (#GotBitcoin?)

Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin, Bright Future Ahead (#GotBitcoin?)

Crypto Faithful Say Blockchain Can Remake Securities Market Machinery (#GotBitcoin?)

Disney In Talks To Acquire The Owner Of Crypto Exchanges Bitstamp And Korbit (#GotBitcoin?)

Crypto Exchange Gemini Rolls Out Native Wallet Support For SegWit Bitcoin Addresses (#GotBitcoin?)

Binance Delists Bitcoin SV, CEO Calls Craig Wright A ‘Fraud’ (#GotBitcoin?)

Bitcoin Outperforms Nasdaq 100, S&P 500, Grows Whopping 37% In 2019 (#GotBitcoin?)

Bitcoin Passes A Milestone 400 Million Transactions (#GotBitcoin?)

Future Returns: Why Investors May Want To Consider Bitcoin Now (#GotBitcoin?)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin?)

Major Crypto-Currency Exchanges Use Lloyd’s Of London, A Registered Insurance Broker (#GotBitcoin?)

How Bitcoin Can Prevent Fraud And Chargebacks (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.