Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin)

Cryptocurrency exchange Deribit recently published an analysis explaining that cryptocurrency companies are racing to adopt financial services known from legacy finance. Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin)

The post points out that all crypto companies, exchanges included, will soon offer users interest accounts, cost-effective ways to perform transactions, and tax services. Throughout his post, he explains why these features, along with others, will become a standard offering for exchanges in the next 2 years.

Adoption Is Well Underway

The crypto community is already seeing a number of companies adopt features that traditional financial institutions offer. The only difference is that many of these companies are making these features more appealing to their customers, in ways that banks cannot or will not..

The crypto lending platform Celsius, for example, recently began to offer users outside of the US and Japan up to 8.1% APR on bitcoin deposits at its highest loyalty level. While the majority of traditional banks have savings accounts and loyalty programs that allow investors to earn interest, most offer much lower rates than what Celsius will provide.

According to Celsius CEO Alex Mashinsky, it has become difficult to earn yield on crypto today due to the rise of crypto-lending platforms. As a result, he is attempting to increase investor returns with higher interest rates that are paid out in Celsius’s CEL token. Mashinsky told Cointelegraph:

“To boost the yield we wanted to do something other than paying bitcoin on bitcoin, so we’ve decided to pay in our CEL token. We also have a loyalty program with different tiers to show how much interest users will receive. Basically, we are convincing people to join Celsius by paying them more.”

And much like traditional banks, Celsius will also offer compounding interest on crypto deposits, joining the likes of Nexo and DeFiprime.

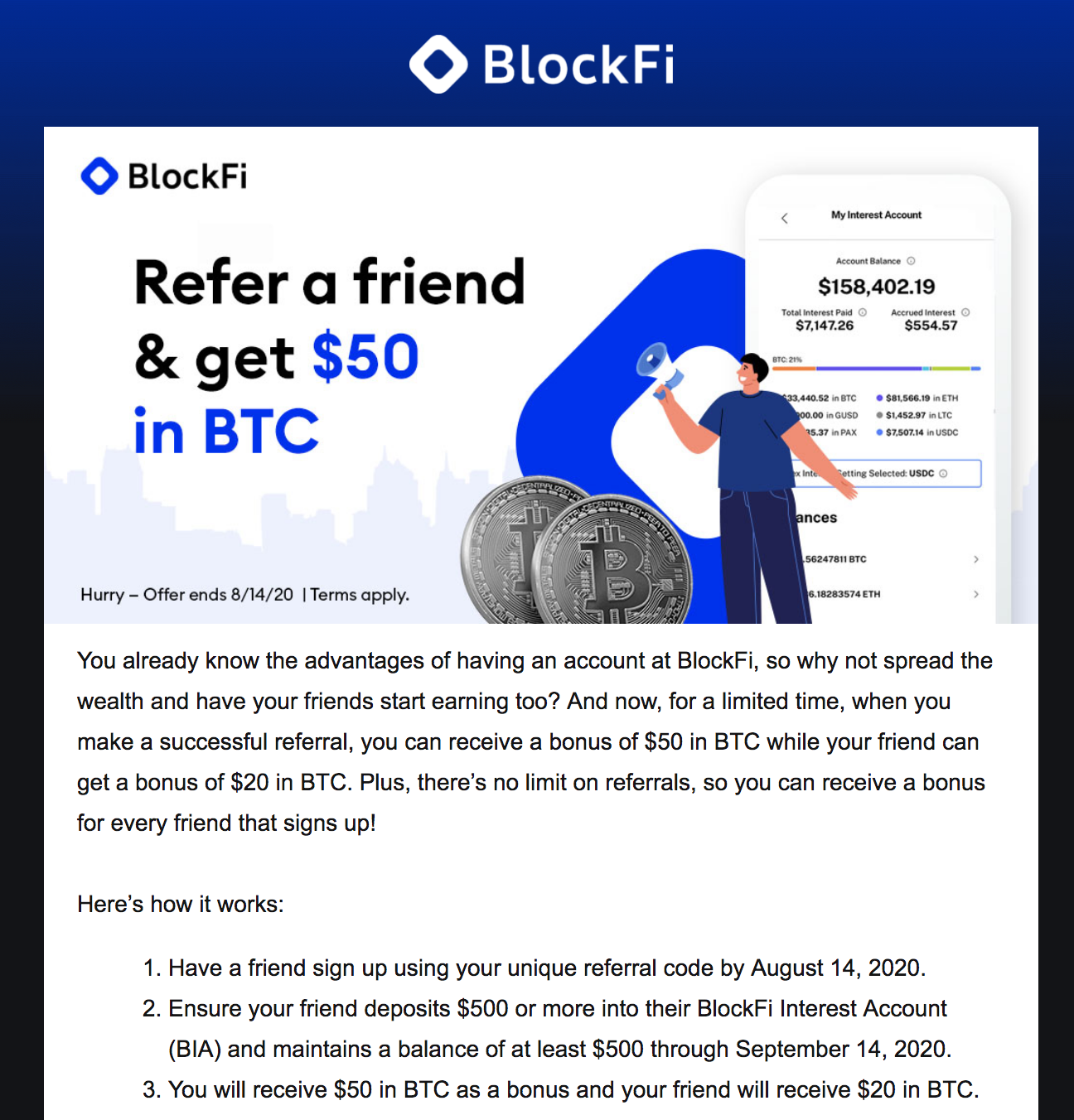

Crypto-lending startup BlockFi also recently announced that users can earn compounding interest on and trade loans backed by assets. BlockFi’s initial annual percentage yield on the assets will be 8.6% for Coinbase’s USDC stablecoin and 3.78% for litecoin.

Founder of TechCrunch and hedge fund Arrington XRP Capital, Michael Arrington, noted that higher interest rates are already driving adoption. He told Cointelegraph:

“I know of first-time crypto users who are buying stablecoins to get higher interest rates than they normally would be able to with fiat.”

Arrington sees great potential for crypto-lending companies, as the entire crypto loaning industry is estimated to be worth $4.7 billion. Arrington said:

“Keep a close eye on crypto-lending companies that are experiencing rapid growth with compelling interest earning rates and low cost loans for crypto and digital dollars, aka stablecoins. We’re seeing growth trajectories in the sector that mirror some of the most successful fintech companies’ like PayPal’s early days.”

Although these rates are much higher than what traditional banks offer, crypto-lending platforms typically only offer collateral backed loans. According to Credit Karma, collateral backed loans in general are risky due to shorter repayment periods and the possibility of losing the collateral if the loan is not paid back as agreed.

Arrington Explained That The Sector Is Growing Rapidly Nevertheless, Saying:

“Leveraging blockchain payment rails instead of the traditional banking system creates an opportunity for firms to distribute a banking app at the same speed and scale as Uber. Traditionally this wasn’t possible because local partnerships were needed for every market that financial companies operated in – crypto fundamentally changes the game.”

Crypto Companies Are Getting Rid Of Fees

Another major innovation being made by crypto companies is the removal of exchange fees, which have been roundly criticized as too high. Traditional banks are also famous for hitting users with costly fees. According to a recent MyBankTracker study, the average checking account fee per month at leading US banks is $9.60.

On Jan. 28 digital money platform Uphold introduced zero-commission trading on 30 cryptocurrencies, but only on through iOS and Android mobile apps.

According to Uphold CEO J.P. Thieriot, removing fees will ensure affordable access to cryptocurrency for millions of retail investors. He told Cointelegraph:

“Cryptocurrencies were one of the more expensive asset classes for retail investors to trade, with fees north of 200 basis points on some mainstream platforms. The goal here is to create something useful for people around the world and in everyday context, while differentiating us from our competitors. Ultimately, the internet of money is likely to evolve in ways that banks haven’t been able to do a good job with.”

Bloomberg also recently reported that zero-fee trading is coming to crypto, just as it has come to traditional exchange-traded funds and to online stock transactions. Global financial technology co-head at ConsenSys Lex Sokolin told Bloomberg:

“Free trading has become a feature of all fintech direct trading offerings, from Robinhood to SoFi and even JPMorgan. So it’s not surprising that in a digital race to acquire the most users, execution prices are starting to collapse.”

Yet without exchange fees, crypto companies will likely be earning smaller amounts of revenue. Thieriot is confident this model will be beneficial overall, though, saying:

“In moving to lower fees, Uphold expects the typical tradeoff between higher volume and lower margin. The good news is that unlike incumbent banks and brokerages, our cost structure is a fraction of theirs. We are crypto-native and technology-led, which imbues important structural advantages.”

Crypto companies aim to drive user adoption, but will this help?

While high interest rates and zero-fee trading, along with other features, are aimed to drive user adoption of cryptocurrencies, skepticism remains.

According to a new report entitled “Cryptocurrencies and the Future of Money” published by IE University’s Center for the Governance of Change (CGC), existing cryptocurrencies have failed to achieve the objectives envisioned by their pioneers, and are in general not considered as money.

Research Director at the IE Center for the Governance of Change, Mike Seiferling, said:

“Although innovations are making digital currencies more realistic candidates to replace traditional money and create benefits for users across large volumes of transactions, our research suggest that cryptocurrencies still have a long way to go before they can compete, let alone or overtake, traditional forms of money backed by central and commercial banks.”

Updated: 8-20-2020

Pomp’s Morgan Creek Leads $50M Investment In Crypto Lender BlockFi

BlockFi’s Bitcoin reward card is inching forward.

BlockFi, a major American cryptocurrency lending startup, has completed another funding round featuring major industry investors.

The company has raised $50 million in a Series C round led by Anthony Pompliano’s crypto asset management firm Morgan Creek Digital, BlockFi announced on Aug. 20.

Also known as Pomp, Morgan Creek’s co-founder Pompliano is joining BlockFi’s board of directors following the investment.

The appointment comes after Morgan Creek participated in all three of BlockFi’s funding rounds over the past 12 months, including the $18 million Series A round in August 2019 and the $30 million Series B round in February 2020.

The funding round also featured some established BlockFi investors like Winklevoss Capital, venture capital fund Valar Ventures and CMT Digital. Other participating investors included Castle Island Ventures, SCB 10X, Avon Ventures, Purple Arch Ventures, Kenetic Capital, HashKey, and NBA player Matthew Dellavedova.

As announced, the new funding comes amid BlockFi seeing a 10-fold revenue increase over the past year. The company now has $100 million in revenues over the past year, while managed assets account for more than $1.5 billion to date, BlockFi’s representatives said.

Similarly to previous funding round announcements, BlockFi outlined that the newly raised funds will be used to further grow the company as well as the upcoming release of a Bitcoin (BTC) rewards credit card.

BlockFi revealed plans for the card in early 2020, positioning it as the “world’s first ever crypto-rewards credit card.” Similarly to existing crypto reward apps like Lolli, BlockFi wants to provide global customers with cashback in cryptos like Bitcoin. The card is expected to be released in Q3 or Q4 2020, with CEO Zac Prince claiming that the crypto rewards would amount to somewhere between 1.5% and 3% from purchases in fiat.

Arrington begs to differ. “Fewer people are making this argument. Features like zero-fee trading and high interest rates are already driving adoption.”

Updated: 10-27-2020

BlockFi Takes 5% Stake In Grayscale’s $4.8B Bitcoin Trust

Crypto lender BlockFi has become one of Grayscale Bitcoin Trust’s (GBTC) biggest whales.

* BlockFi holds 5.07% of Grayscale’s $4.8 billion bitcoin trust, or 24,235,578 GBTC shares, according to Tuesday Securities and Exchange Commission (SEC) filings. Grayscale is owned by CoinDesk’s parent firm Digital Currency Group.

* CEO Zac Prince said in a press statement BlockFi’s “significant” GBTC position will “add value” to the “marketplace for liquid and illiquid” shares. “There are lending markets related to GBTC,” he told CoinDesk in an email.

* Crypto fund manager Three Arrows Capital is the only other entity with comparable GBTC holdings, having amassed over 21 million shares by June. That represented a 6.26% stake in GBTC at the time.

* Entities are required to publicly disclose ownership positions over the 5% threshold. GBTC became an SEC reporting company in January.

Updated: 12-19-2022

Important Update – BlockFi Wallet Accounts

Dear Customer,

Today, we took an important step toward our goal of returning assets to clients through our chapter 11 cases. It is our belief that clients unambiguously own the digital assets in their BlockFi Wallet Accounts. As such, we filed a motion requesting authority from the U.S. Bankruptcy Court to allow clients to withdraw digital assets that are held in their BlockFi Wallet Accounts.

We will be seeking similar relief from the Supreme Court of Bermuda with respect to BlockFi Wallet Accounts held at BlockFi International Ltd. This motion does not impact withdrawals or transfers from BlockFi Interest Accounts, which remain paused at this time.

In order to facilitate withdrawals from BlockFi Wallet Accounts, we also requested permission to update the User Interface to properly reflect transactions as of the platform pause on November 10, 2022 at 8:15 p.m. (prevailing Eastern Time).

This is a necessary step towards ensuring all clients are treated fairly and that the User Interface properly reflects the digital assets in Wallet Accounts as of the pause so BlockFi can honor all withdrawal requests from Wallet Accounts properly if authorized by the U.S. Bankruptcy Court and, with respect to BlockFi International Ltd., the Supreme Court of Bermuda.

While filing this motion is an initial step, we will continue to work towards solutions that maximize value for all clients and other stakeholders and will share updates as quickly as practicable.

We are looking forward to discussing this motion with the U.S. Bankruptcy Court and key parties in our cases, and expeditiously moving towards a path that returns Wallet Accounts assets to clients. We expect that our request will be heard by the U.S. Bankruptcy Court at our hearing currently scheduled for January 9, 2023, at 10:00am ET.

We expect that our request for similar relief with respect to BlockFi International Ltd. will be first heard before the Supreme Court of Bermuda at our hearing currently scheduled for January 13, 2023 at 10:30am AST and then scheduled for a full hearing after that on a date to be fixed.

Additional information regarding our chapter 11 cases, including court documents and claim information, can be found by visiting BlockFi’s claims agent Kroll at https://restructuring.ra.kroll.com/blockfi.Clients with questions about the process may call Kroll at (888) 773-0375 (Toll Free) or (646) 440-4371 (International), or email1 blockfiinfo@ra.kroll.com.

BlockFi

Updated: 12-20-2022

BlockFi Files Motion To Return Frozen Crypto To Wallet Users

Crypto lender BlockFi has asked a U.S. bankruptcy court for the authority to return the crypto held in BlockFi wallets to users.

Bankrupt crypto lending platform BlockFi has filed a motion requesting authority from a United States bankruptcy court to allow its users to withdraw digital assets currently locked up in BlockFi wallets.

In a motion filed on Dec. 19 with the U.S. Bankruptcy Court in the District of New Jersey, the lender asked the court for authority to honor client withdrawals from wallet accounts that have been frozen on the platform since Nov. 10.

The court documents also request permission to update the user interface to properly reflect transactions as of the platform’s pause.

In a widely shared email sent to affected users, BlockFi called the motion an “important step toward our goal of returning assets to clients through our chapter 11 cases,” adding:

“It is our belief that clients unambiguously own the digital assets in their BlockFi Wallet Accounts.”

According to BlockFi, this motion will not impact withdrawals or transfers from BlockFi Interest Accounts, which remain paused at this time.

The lending platform has also signaled intentions to seek “similar relief from the Supreme Court of Bermuda with respect to BlockFi Wallet Accounts held at BlockFi International Ltd.”

BlockFi International is a subsidiary of the company based in Bermuda, which runs its non-U.S. operations.

Crypto blogger Tiffany Fong shared the communication sent to her by BlockFi on Dec. 19, commenting that the embattled firm appears to be moving much faster than Celsius, which filed for bankruptcy over five months ago, compared to BlockFi’s bankruptcy filing in November.

According to the court documents, a hearing to decide if the motion will be granted is scheduled for Jan. 9.

A separate hearing regarding wallet accounts held at BlockFi International Ltd is scheduled to go before the Supreme Court of Bermuda on Jan. 13.

BlockFi halted client withdrawals and requested clients not to deposit to BlockFi wallets or Interest Accounts on Nov. 11, citing a lack of clarity around FTX.

By Nov. 28, BlockFi filed for Chapter 11 bankruptcy, for the company and its eight subsidiaries. BlockFi International filed for bankruptcy with the Supreme Court of Bermuda on that same day.

Updated: 12-21-2022

FTX Paid For Blockfolio Deal Mostly In FTT Token It Invented

FTX, the bankrupt cryptocurrency exchange, used a token it invented to fund its takeover of trading platform Blockfolio, according to financial statements obtained by Bloomberg News.

FTX paid roughly $84 million in 2020 to take a majority stake in Blockfolio, in what was then among the largest crypto acquisitions. About 94% was paid in FTT tokens, a cryptocurrency that FTX created, according to documents reviewed by Bloomberg.

Details of the Blockfolio acquisition, which haven’t been previously reported, offer a glimpse of former FTX CEO Sam Bankman-Fried’s appetite for whimsical financial engineering, and an early hunger to amass customers through large-scale deals.

Bankman-Fried doubled down on that ethos this year, going on a buyout binge for firms including Voyager and BlockFi, although those deals were thwarted when FTX imploded in November.

At the time the Blockfolio deal was announced, news outlets reported FTX financed it with a mix of cash, crypto and equity, without further details. The arrangement heralded big things for FTX, which Bankman-Fried founded only a year before.

The agreement gave it a 52% equity stake in Blockfolio and valued the company at almost $160 million — with the option to buy the rest within two years, the financial statements show.

A spokesperson for Bankman-Fried declined to comment.

The disgraced crypto entrepreneur faces criminal charges including fraud. Regulators allege that he misused FTX customer money for luxury real estate and political donations, and to bankroll sister trading firm Alameda Research.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.