Top 10 Books Recommended by Crypto (#Bitcoin) And Blockchain Thought Leaders

At the end of 2020, we collected an interesting and sometimes unexpected selection of books from people without whom the world of cryptocurrency and blockchain would be completely different. Top 10 Books Recommended by Crypto (#Bitcoin) And Blockchain Thought Leaders

These recommendations are for those who want to immerse themselves in the crypto industry.

They also aim to help readers understand the ideas that have influenced the worldview of these industry leaders.

Here Are The Top Books That The Best Crypto Minds Of Our Time Recommend Reading

Updated: 12-19-2021

Bitcoin Book For American Policymakers Gets 5X Funding On Kickstarter

With this book, Jimmy Song and a group of seven writers intend to reduce the policymaker’s reliance on traditional media’s narrative on Bitcoin and cryptocurrencies.

Big Cryptocurrency Craze

Hardcover – February 22, 2022 by Laura Shin (Author)

A group of eight Bitcoin (BTC) enthusiasts launched a Kickstarter campaign to publish an educational book for America’s federal policymakers, to reduce their reliance on the traditional media narrative on cryptocurrencies.

The campaign managed to attract $23,151 in funding, nearly five times the goal of $5,000.

The book was conceptualized soon after the United States House of Representatives passed the $1.2 trillion bipartisan infrastructure bill, which mandates stringent reporting requirements for the crypto community. According to the authors:

“We set out to write a book to help policymakers understand where Bitcoin users are from and what they care about. We want to dispel the notion that it’s a nerd money and show how it’s impacting so many people in America.”

The Kickstarter was launched by Jimmy Song, a Texas-based crypto entrepreneur and a seasoned author. Other authors include Annaliese Wiederspahn, Gary Leland, Pete Rizzo, Amanda Cavaleri, CJ Wilson, Charlene Fadirepo and Lamar Wilson.

As per the schedule, the manuscript for the Bitcoin book has been drafted and will be finalized by the end of 2021. By January, the authors intend to have the audiobook and paperback available for sale, which will be supported by a “book launch event in Washington DC to promote this book.”

While the Bitcoin book authors have already accounted for the initial funding of $5,000 for the book’s production, the additional funding will be invested in the book’s launch party:

“As authors of this book, we recognized that the impressions in Washington were far from the reality and sought to correct this perception.”

Supporting the Bitcoin book’s effort to demystify the ecosystem for the regulators, Federal Reserve chair Jerome Powell hinted at a lack of concern about crypto disrupting the nation’s financial stability.

As Cointelegraph reported, Powell also said that stablecoins have the potential to scale, “particularly if they were to be associated with one of the very large tech networks that exist.”

Bitcoin and Black America is a dynamic new book that explores the synergy between black economics, Bitcoin and blockchain technology. The global financial system is changing and the digital revolution will not be televised.

“The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution” by Gregory Zuckerman

“I was in hedge funds for more than a decade and read every single book I could find about them since it was a pretty secretive industry that protects it secrets to make money. So there is one outstanding track record in the space that everybody knows about fact wise but very little about actual secret sauce behind it. It was exactly the reason I liked the book ‘The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution.’ The story part is still strong and I would gladly advise it to anybody who follows markets, especially algo traders.”

— Gregory Klumov, Stasis founder and CEO

“The Origin of Species by Means of Natural Selection” by Charles Darwin

“Charles Darwin’s ‘Origin of Species by Means of Natural Selection.’ It is the most detailed work ever on the mechanics of competition, survival, adaptation to changing environments and growth — the fundamentals of the business world. Businesses are composed of organized collections of individual members of the human species.

Businesses therefore act in manners identical to the character of the human animal. They follow the same principles. Businesses begin, grow, flourish or disappear. They follow the laws of evolution exactly as species do. If you are in business and have not read ‘Origin’ from cover to cover multiple times, then you are a fool.”

— John McAfee, cryptocurrency entrepreneur and founder of computer security company McAfee

“Bitcoin Billionaires: A True Story of Genius, Betrayal, and Redemption” by Ben Mezrich

“Bitcoin Billionaires is clearly our favorite book of 2019! Ben Mezrich masterfully captures the Wild West days of Bitcoin and the personalities who were ‘crazy’ enough to believe in, invest in, and build the crypto revolution over the past decade. It’s fast-paced, colorful, and distills the complexity underpinning crypto in an accessible way that gives the reader a fundamental understanding of this new technology that’s reimagining the world.”

— Tyler and Cameron Winklevoss, Gemini co-founders

Read Cointelegraph’s Review of The Book Here

“The Cathedral and the Bazaar: Musings on Linux and Open Source by an Accidental Revolutionary” by Eric S. Raymond

Eric Raymond’s work on software development methods is based on an analysis of the Linux core development process and his personal experience managing the open-source Fetchmail project. This essay is often presented as a manifesto of the open-source movement.

The Cathedral and the Bazaar has expanded our vocabulary with new terminology. It also predicted the end of the cascading model of software development and the decline of the era of large software companies, thanks to the popular movement for free software. The central thesis of the essay is Raymond’s statement that “given enough eyes, all errors pop up.” He calls it the “Law of Linus.” — suggested by Paolo Ardoino, Bitfinex’s chief technology officer.

“Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies” by Reid Hoffman

Changpeng Zhao, known as CZ, became a leader in the crypto community of China when he founded cryptocurrency exchange Binance in 2017. Today, not one major crypto event can do without an energetic CZ. Recently, on his blog on Binance’s official site, he compiled a list of books that he recommended reading over the holidays. One of these is Blitzscaling by Reid Hoffman. CZ said that this book tells in detail how organizations of different sizes work, as well as some consequences when teams grow to different sizes.

According to CZ, this was very useful for Binance when the company planned its growth as an organization. Also, the book talks about recent topics including cryptocurrencies.

“The Advantage” by Patrick Lencioni

Here is another book recommended by Changpeng Zhao. The author, Patrick Lencioni, describes how organizational culture contributes to the long-term success of a business and explains how to change the stereotypes that have developed in this area. This process requires considerable efforts from the owners of the company, but as a result, those who monitor “corporate health” become leaders, because such a unique advantage cannot be copied.

The book is based on the many years of Lencioni’s personal experience, who is one of the leading thinkers in the field of business. He describes in detail the tools necessary for serious and interesting work.

Wall Street Journal commentators Paul Vigna and Michael Casey write about the fears and rumors surrounding Bitcoin as a means of calculation and encourage readers to prepare for a new economic reality that will come.

Mastering Blockchain: A Virtual Book Launch In A Physically Distant Yet Still-Connected World

There is a shared sense that the world has shifted.

“Mastering Blockchain: Unlocking the Power of Cryptocurrencies, Smart Contracts, and Decentralized Applications” by Daniel Cawrey and Lorne Lantz from O’Reilly Media is a masterful guide on the essentials of blockchain technology.

Often a daunting and elusive subject matter, Cawrey and Lantz demystify blockchain technology by presenting history, breaking down fundamentals, and providing real-life implementations covering the space with clarity and precision. Years of research led to their intimate understanding of the technology, but it was the conversations along the way that sharpened their ideas.

Daniel and Lorne, both longstanding members of Silicon Valley Bitcoin and Silicon Valley Ethereum meetup groups, would have had their book launch in person under normal circumstances. But 2020 is anything but normal.

Networking can be tough even in normal times, but today’s remote world adds a whole new set of challenges. The pandemic and its side effects changed the world. We no longer interact as much in person, and our information sources seem distorted. We’re all playing the classic game of “telephone” where one-to-one means that information gets lost in translation.

In the aim of educating and bridging communities, CoinDesk is hosting its first-ever VR event with Cawrey and Lantz to celebrate their book launch on Dec. 15, 2020, at 7 p.m. ET (4 p.m. PT and 8 a.m. Singapore time). Join us for the live event streaming on CoinDesk.com, YouTube and Twitter as we chat about the book, socialize in VR and discuss the future of IRL and virtual events.

The VR afterparty is limited. RSVP today for the open-to-the-public book launch and networking with the authors in AltspaceVR.

Mastering Blockchain: A Virtual Book Launch in a Physically Distant Yet Still-Connected World

7-7:10 p.m. ET – Opening Remarks with Tim O’Reilly, founder and CEO O’Reilly Media

7:10-7:25 p.m. – Why Crypto Meetups Matter hosted by Adam B. Levine

7:25-7:55 p.m. – Fireside Chat w/ Lorne and Daniel hosted by Michael Casey (with Q&A)

7:55-8 p.m. – Special Announcement

In their book, they tell the story of Bitcoin and analyze the role of cryptocurrencies in the modern world: How they came from and where they came from, what functions they perform, and what you need to know to be ready for a new world based on cyber economics.

By eliminating the need for an intermediary, cryptocurrency technology supports an infrastructure in which strangers can conduct business with each other. This is achieved by transferring the most important function of maintaining accounting registers from centralized financial institutions to a network of autonomous ones.

“Growth: From Microorganisms to Megacities” by Vaclav Smil

Recommendations from Cointelegraph

“The Age of Cryptocurrency” by Paul Vigna and Michael Casey

Bill Gates, a famous entrepreneur, public figure, philanthropist and former shareholder of Microsoft, traditionally shares a list of the best books to read each year in order to start the next year on the right foot.

Vaclav Smil is one of Gates’ favorite authors. In the book, the author explores growth in nature and society, and discusses how we can save the planet. Gates also warned that some sections of the book resemble an engineering manual.

In the book, growth is presented as the goal of sterilizing humans and all living organisms. The book discusses the problems of tracking the growth of empires and civilizations, explaining that we can outline the growth of organisms in the individual and evolutionary periods, but the progress of societies and economies, which is not so linear, includes both decline and renewal.

“The Art of War” by Sun Tzu

Despite the fact that the book is more than 2,500 years old, today it remains the reference book of many successful entrepreneurs. The laws and strategies described by prominent Chinese commander Sun Tzu are famously applicable in modern business conditions. The main thesis of the book is to know how to win before the start of the battle, counting all the moves, to know yourself and the enemy, choosing the right time, and using the whole range of tools and weapons available.

The main thing is to be able to comply with modern realities, know the main managerial positions, not be afraid of risk and apply effective strategic laws in practice. This is a good book on management strategy, reflecting the skills and thoughts of the Chinese commander.

“Super Pumped: The Battle for Uber” by Mike Isaac

One of the biggest business books of this year comes from Mike Isaac, a New York Times journalist who writes extensively on technology. This is a fascinating book that describes more than just recent events. The book describes almost the entire history of Uber, as well as the history of previous projects of Travis Kalanick, in which he earned a steady hostility to venture capitalists, which later expressed itself in relation to him in Uber. The book describes business details and the struggle with regulators.

Recently, it came to light that Showtime is planning to launch a TV series on the company’s success story, based on this book, and Mike Isaac will directly participate in its creation.

Updated: 6-28-2020

Book Review – Growing With Blockchain

Growing With Blockchain is a book for business decision makers who want to discover more about the possibilities of blockchain technology.

Growing With Blockchain: From Disruptive Potential to Operational Reality, as its title suggests, is about blockchain. Specifically, it is about turning the disruptive potential of blockchain into an operational reality, in order to help your business grow.

It is aimed squarely at decision makers, particularly those who may already be considering the possibilities of blockchain technology for their company.

It comprises 19 short essays (and a foreword), written by 18 of the leading blockchain performers. It should be noted that this book is written from a U.K. perspective, although a few chapters focus on subjects that are U.K. specific.

Each chapter looks at a particular aspect of blockchain technology and how it can be utilized by businesses.

Although the book is “blockchain, not Bitcoin,” it does look at payments as an application of blockchain. In his chapter, PayDock Founder Robert Lincolne suggests that the recent coronavirus lockdowns could have made blockchain more important for payments than ever.

Other topics include blockchain’s applications and their ramifications in fields as diverse as supply chain and intellectual property, the legal implications of working with blockchain, and how to get on board.

Authors have been drawn from across the industry, representing tech giants like IBM and Dell, along with smaller startups like Blockchain Rookies and Digital Catapult.

As a book… it grew on me.

At first, I wasn’t entirely convinced. Although the mix of authors covered different aspects of blockchain, there was understandably some overlap, leading to repetition.

There was also an occasional inconsistency of tone, where a chapter aimed at the layman might be followed by one which got quite technical. As I read the initial portion of the book, it didn’t feel like it was quite flowing from one topic to the next.

So I wondered if perhaps this wasn’t a book to be read cover to cover but one to cherry-pick your way through on your journey to blockchain enlightenment. And this book would work very well as something to dip into when necessary to learn about the varying aspects of blockchain implementation.

However, at this point, it seemed better to persevere straight onwards and am very glad I did. The later chapters flow so well from one topic to the next that I found myself thinking of ways to implement blockchain technology into my own (non-existent) business.

When I got to the last two chapters, which looks at how to tell whether a blockchain project is right for your business and how to go about initiating one, I was coming up with ridiculous ideas for businesses just so I could then implement blockchain technologies.

I felt that perhaps something like that might have been useful at the start of the book, as the barrage of information presented in the first few chapters could be quite overwhelming for some readers. However, it did round off the topic very nicely in a way that was easily accessible.

If you are the target audience for this book, then it comes heartily recommended. And if you just want to go deeper into the rabbit hole that is blockchain technology and its (current) possibilities, then this is a comprehensive read.

Cointelegraph readers can also get a 25% discount on the book, courtesy of PayDock. Simply use the discount code “25off-blockchain” to get £3.50 ($4.30) off the price at the following link.

Updated: 7-10-2020

Book Review: Digital Is The Cash

“Digital is the Cash” is a short, accessible read, looking at cryptocurrency from a vaguely African perspective, with a strong preference for Dash.

“Understanding the Past, Present & Future of Finance in One Read,” boasts the subtitle of Digital is the Cash by Nathaniel Luz. Whether the book achieves this lofty aim is likely to depend on the readers feelings towards Dash (DASH) being the future of finance.

You see, Luz is an ambassador for Dash Africa, and strongly believes that the cryptocurrency represents the future of money. His story is actually more interesting than that, as I discovered when I spoke to him, but potential readers should be warned that parts of this book read more like a press release.

It should be noted that Dash did not fund the writing of the book, although it has paid for a print run of hard copies which are being distributed to libraries and institutions around the globe.

Start At The Beginning

The first topic that the book tackles is money: what it is, how it has developed, and the various forms it has taken. From bartering to commodity money, through cash in metal and paper forms, and finally to digital currency in both credit/debit card form and cryptocurrency.

The writing style is accessible and enjoyable, with clear examples illustrating the concepts explained. The book would have benefited enormously from a decent editor, but once you get over the odd incongruous turn of phrase, the content is solid.

Luz then turns his sights on the history of the global financial sector. He explains the integration of national economies, the foundation of the U.S. Federal Reserve, the gold standard and its subsequent demise and the frequent failings of financial authorities across the globe.

Banking The Unbanked

The focus then shifts to banks and banking. Access to banking services is provided via a variety of methods, but traditional banking excludes a large proportion of the population in many parts of the world.

Luz explains how financial technology (FinTech) is enabling the unbanked to access financial services without needing a bank. Blockchain technology underpins these advances in the financial industry.

From Overview To Deep Dive…

At this point the book suffers from an abrupt change in style. Although the writing is still accessible, the content goes from an interesting overview to a quite technical examination of the next two topics.

First we get a look at blockchain technology and cryptocurrency, but the chapter goes into a level of detail which perhaps starts to hint at its target audience. We learn about different consensus algorithms, types of wallet and addresses, and then get a guide to buying, receiving and owning cryptocurrency.

It starts to feel a bit like a quick-start manual for those wanting to get into cryptocurrency for the first time. And in case there was any doubt as to which cryptocurrency the newbie reader should be getting into… we get to the chapter about Dash.

… To Sales Brochure

This chapter is an unashamed trumpeting of the magnificence of all things Dash. From its history and its functionality as a cryptocurrency, with sections on each headline feature, down to elements such as its treasury system, masternodes, governance and future development.

It is by far the longest chapter and in my opinion it feels a bit incongruous, which is an awful shame. On speaking to Luz after reading the book, I realized however, that this is not some corporate line, but down to his genuine belief in Dash’s potential to change the financial system in Africa.

He is an award-winning libertarian, and when travelling around the African continent, came face to face with the barriers of a lack of interconnectedness between national banking systems, each using different currencies.

Seeing the possibilities of cryptocurrencies to overcome this, he became an evangelist for the technology. When he discovered Dash, he felt that it ticked all of the right boxes and fell in love with its ease of use.

He Explained That The African Approach To Cryptocurrency Is To Preserve Wealth, Not To Speculate And Make Wealth:

“Cryptocurrency in Africa is a need. Cryptocurrency in the first world is a want. Cryptocurrencies should really focus on Africa, as Africa has the momentum to make it go mainstream.”

He is not paid to be an ambassador, but he can apply for funding from the treasury for certain promotional projects, such as the printing of hard copies of this book.

It’s Not Over Yet…

The final chapter of the book returns to its earlier style. We get an overview of areas in which blockchain technology is being harnessed, with examples of use-cases in a number of fields.

We also get a brief look at blockchain technology in Africa. Throughout the book, topics are discussed with a vaguely African perspective, but with Luz’s personal experience, I felt that this could have been explored more. This perhaps though, is missing the point, which is to turn people onto Dash.

To hammer this home, the book rounds off with “A Note to Regulators” and a rebuttal of some “Common misconceptions about Dash.”

On the whole, the book is informative and an enjoyable read. The Dash promotion is a bit blatant, although the content is still interesting, and might even sway you. To be fair, Dash’s remarketing from being privacy-focused to its ease of use for consumers and retail payments is pretty impressive.

If you are vehemently anti-Dash, then maybe this book isn’t for you. For everybody else, it’s an easy read at just 67 pages, and is now available as a free download, so why not?

Updated: 8-12-2020

Decoding Digital: What Is Cryptocurrency

Can learning an industry’s vocabulary help beginners gain a greater understanding of the industry itself?

According to author Cahill Camden, “Decoding Digital: What is Cryptocurrency” was inspired by a conversation with his parents at the height of the crypto bubble in early 2018, which was along the lines of “Ok, we don’t have that much money, but we’ve heard about Bitcoin. Is cryptocurrency something we should invest in?”

After searching for, and not finding, a book which would explain the things that they needed to know in order to make an informed decision, Camden decided to write one. This is a very common thread in the field of books’ origin stories, but is no less valid for its ubiquity.

We start with an explanation of Camden’s approach. Knowledge of a subject, he believes, depends upon an understanding of the words and concepts that define it.

“Words form concepts. Concepts form ideas. Ideas form theories. And theories inspire action.”

By understanding the words which are used to describe a topic therefore, we gain a greater understanding of the topic. The book is structured with this in mind. It is split into several chapters, each of which contains an entry for each related term or concept.

Each entry is further broken down with sections giving an essential overview of the term, followed by a deeper dive, some background details to impress your friends, an example sentence using the term, and the personal insights of the author.

As such, it can be used as much as a dip-in reference manual as a book, although the chapters are structured with a logical arc, so reading the book cover-to-cover (as I did) is also a good option.

As the book is primarily aimed at cryptocurrency novices, the first chapter-real gives us the obligatory introduction to fiat money, crypto and blockchain. As a nice addition however, we also get an insight into technology, perhaps not as many of us would think of it, but simply as a thing, system or invention which helps to solve a particular problem more efficiently.

The next chapter goes deeper into some of the technologies and ideas which back cryptocurrency, like decentralization, encryption, consensus and smart contracts. We move on to chapters on how to value cryptocurrencies, how to buy and sell them, and how to store them and the difference between public and private keys.

The format of this book is a real winner in my view. It is eminently accessible and easy to read, providing a good overview of the terms and the subject. In many ways I have to agree with Camden in his assertion that understanding a topic’s terms is (one) way to gain a deeper understanding of the subject.

It is a little simplistic in places, and it focuses purely on Bitcoin and Ethereum, with barely a mention of anything outside of that. At the time it was conceived then this was probably a very wise thing for those interested in investing in cryptocurrency for the first time, although in the current climate there are a great many altcoins which are also worthy of a first timer’s attention.

To be fair, the book doesn’t discount these, but it does, again very wisely, suggest that one needs to do one’s own research.

The only issue that I really had while reading this book was the section on smart contracts. There was no mention of the fact that the Bitcoin blockchain doesn’t support smart contracts, and in fact the chapter instead went into some of the consensus mechanisms for upgrading the Bitcoin network.

This was only a minor point, but I felt detracted from some of the groundwork done by the rest of the book in explaining things in a clear and concise manner.

In conclusion, this book does fulfil its purpose of advising novice investors as to how to get started in the cryptocurrency space, although it could perhaps already benefit from a slight update.

One might argue that such is the nature of cryptocurrency.

Updated: 8-18-2020

Book Review: The Little Book of Crypto

An introduction to crypto with none of the BS, but plenty of the S.

Author Cal Evans bills The Little Book of Crypto as “A No BS Introduction To Crypto.” Evans also claims to be “regarded as one of the best crypto lawyers” working for “the largest independent crypto-only law firm on the planet.” This will become relevant later.

The book claims to provide the reader with unique “in-industry” insights while serving as a great starting point for those who are beginning their cryptocurrency journey.

It also comes with a disclaimer of strong language, not recommended for readers under 18.

So Does It Achieve Its Aims?

The first thing you will notice about The Little Book of Crypto is that it isn’t all that little. Arguably, the 90-page Kindle version only takes up a tiny amount of electronic storage space, but the 237-page paperback is fairly regular-sized, albeit with a large font size.

The second thing you will notice is that it could have been a lot littler. Evans loves the sound of his own voice, and is not content to use five words when he could use hundreds. Each chapter is like a vague stream of consciousness, twisting off along numerous tangents until it arrives, slightly dazed and unsure what it has achieved, at the end.

Take the intro, which takes up almost 50 pages (that’s 20% of the book), to tell us what the author hopes to achieve with (the other 80% of) the book. Along the way, it takes in a cryptocurrency origin story, an admission to selling PCs with bootlegged copies of Windows 10 while at university, a five-page humblebrag anecdote, and a somewhat wonky take on how crypto can help the unbanked.

By this point you’ve probably also noticed something else. Evans doesn’t seem to be a native English speaker and didn’t think to use an editor who was one (or arguably even use an editor at all). I’m a huge supporter of self-publishing, but it does sometimes encourage people to cut corners, and without the checks and measures of a (native speaking) editor…

Satoshi Nakamoto is mentioned twice in the intro. Both spellings are different. Both are wrong. Anyone wanna buy some Etherium? D’oh! The flip side is that terms such as “fall fowl” and “no easy feet” may bring a wry smile to your face. And you get some absolute poetic gems like this [on trading]:

“No one cares about your style.. an idiot with a plan can make more money than a fool with money.”

Well, quite.

But despite not treating us to an editor, Evans clearly wants us to like him. He tells us that he will treat us like adults (in the slightly condescending way that you will get used to if you persevere), and uses cloying ‘bloke-in-a-pub’ language, complete with unnecessary swearing.

Take this example, giving the author’s advice on how to deal with experts: “assume that everything they say and everything they have done is absolute shit.”

Evans really doesn’t have much time for experts. As he himself attests, “the industry is nowhere near old enough for anyone to be an ‘expert.’” He also hates lawyers who work in crypto, as distinguished from himself, who is a “crypto lawyer.”

He is also, according to this book, the exception to the experts rule.

So should we listen to what Evans has to say? If we can get through the lack of editing, the verbosity and rambling nature, and the cloying tone, does Evans present us with some killer content?

In short, no. The rambling nature leads to a lot of repetition and requests to go back and check a completely different section, during which Evans regularly contradicts himself. On page ten he says:

“No one actually calls it ‘Cryptocurrency’ – It is just ‘Crypto’. Like many other technologies things get abbreviated and I want to talk to you like an adult; to do that, I’m not using its full industry term name like a child that’s in trouble with his mother.”

He then continues to use both, and later in the book even adds “crypto currency” into the mix.

But worse than the contradictions are the glaring howlers and inaccuracies. Talking about token sales (or crypto raises as he calls them) he says, “The law is so complex in this area that it is almost impossible to give a 110% accurate account of the whole landscape.”

I hope that isn’t the kind of logic he relies on in court.

He also seems to believe that Bitcoin difficulty is designed to increase over time, and that as “more complex equations are generated and more crypto enters the market, the need for miners also becomes greater.” Rather than… you know… more miners leading to an increase in difficulty.

He gets quite a lot of things almost right, but fudges it a little on the details, which is perhaps more dangerous than getting things completely wrong.

He seems to be one of those self-proclaimed “experts” that he gets so worked up about; a bit of a chancer who stumbled into the industry by luck, and hasn’t been rumbled as a fraud yet. My one piece of advice for anyone in that situation is, don’t write a book about it.

Quite who regards him as “one of the best crypto lawyers” is unclear. If he does have some deep legal knowledge of the cryptocurrency industry then he has struggled to get that across with the written word.

Early in the second chapter, entitled “The Law?”, Evans quips:

“After all, if I taught you everything I knew about crypto there is a possibility I would be out of a job!”

My suspicion is that with this book he just has and he soon will be. Evans, to his credit, has a different point of view, assuring us that he has plenty more crypto knowledge in reserve, by following up with the expected:

“(Although I am seriously doubtful that that amount of knowledge could be put into one book).”

And certainly not a “little” one like this, eh?

So, would I recommend this book? Well, perhaps bizarrely, I am genuinely glad that I’ve read it… in the same way that I’m glad that I’ve watched The Room. It made me smile lovingly at all the wrong places.

As a reference work on cryptocurrency, it’s a no… but…. Sorry, it’s just a no. In the immortal words of the author, it’s “as impacting as chewing gum on the sidewalk: annoying in every sense.”

Updated: 10-14-2020

‘Blockland’ Book Review: Part Gonzo, Part Bitcoin-Thriller, 100% Recommended

This mythologized take on the cryptocurrency industry is part holy scripture, part gonzo journalism and 100% recommended.

The first hint that Blockland – 21 Stories of Bitcoin, Blockchain and Cryptocurrency is perhaps not quite the same as the average book on the subject of crypto is splashed bold, right across its cover.

Eschewing the usual staid design cues, it instead features Trevor Jones’ artwork, “The Ecstasy (Bitcoin Angel).” The religious iconography of the image is striking, to say the least.

And it is carried through to the language of several of the chapters (or stories), conveying both the almost mythical nature of Bitcoin’s origin story and the devout faith of the many different flavours of crypto-believer.

So could Blockland be Bitcoin’s first sacred text?

A Life Less Ordinary

Before we get to that, I must confess that I could have easily taken an instant dislike to this book.

In the foreword, the author, Elias Ahonen, describes a whistle-stop crypto-fuelled globe-spanning trip of almost biblical excess, which brought back to mind the truly abominable The Little Book of Crypto by Cal Evans.

But while Evans’ similarly incredible travel anecdotes seemed designed purely to express how much cooler than the reader he considers himself, Ahonen has us feel like we’re drinking shots onstage at a huge Shanghai rap concert right alongside him.

It captures the intensity and the insanity that can manifest itself in what is essentially still a prepubescent industry being showered with more money than it knows what to do with.

So perhaps Blockland is actually cryptocurrency’s first rock’n’roll biography?

Once Upon A Time

The book tells 21 (often dramatized) stories of “Blockland” — the cryptocurrency space to you and me — starting with the creation of the first “Golden City of Bit” and the settlers who initially chose to inhabit it.

It tells of the pioneers who then decided to strike out and establish new communities, and the many ordinary folk who were drawn to the Blockland’s expanding world.

The chapter themes range from the quasi-spiritual (Satoshi’s Testament, The Sects of Satoshism), to the pioneer spirit (The Prospectors, Computing Frontiers), and even the spirit of excess (Mining Madness, Tulip Hangover)

While all of the underlying stories are true, the use of metaphor and allegory really does bring home what a magical and unlikely path cryptocurrency has taken to get here.

A Complete History Of …

The fact that these seemingly disparate chapters pull together to tell a coherent (and pretty much complete) story of cryptocurrency’s journey to date is very much to Ahonen’s credit.

The author gives an even and unbiased view of the space in a manner that is both easily accessible and utterly charming. There is no papering-over of the darker elements of cryptocurrency, but the benevolent nature of the community also receives substantial page-time.

Ahonen’s previous book was the infinitely more straight-laced Encyclopedia of Physical Bitcoins and Crypto-Currencies, published in 2016, which led to him being described as “one of the first Bitcoin historians.”

While both books are technically reference works, Blockland feels more like a fictional thriller in its pace and style.

A Right Riveting Read

So… part holy scripture, part gonzo journalism, and 100% roller-coaster ride, Blockland succeeds amazingly in both mythologizing and explaining the current state of the cryptocurrency industry.

This is the cryptocurrency book for people who are too cool to read cryptocurrency books. Buy it for yourself, then lend it to that friend you just know is a potential crypto-evangelist, if only they would take the time to learn about the subject.

Just make sure he or she returns it. It belongs on your bookshelf, after all.

The hardcover edition of Blockland: 21 Stories of Bitcoin, Blockchain and Cryptocurrency is available for pre-order from cryptonumist.com

Updated: 12-10-2020

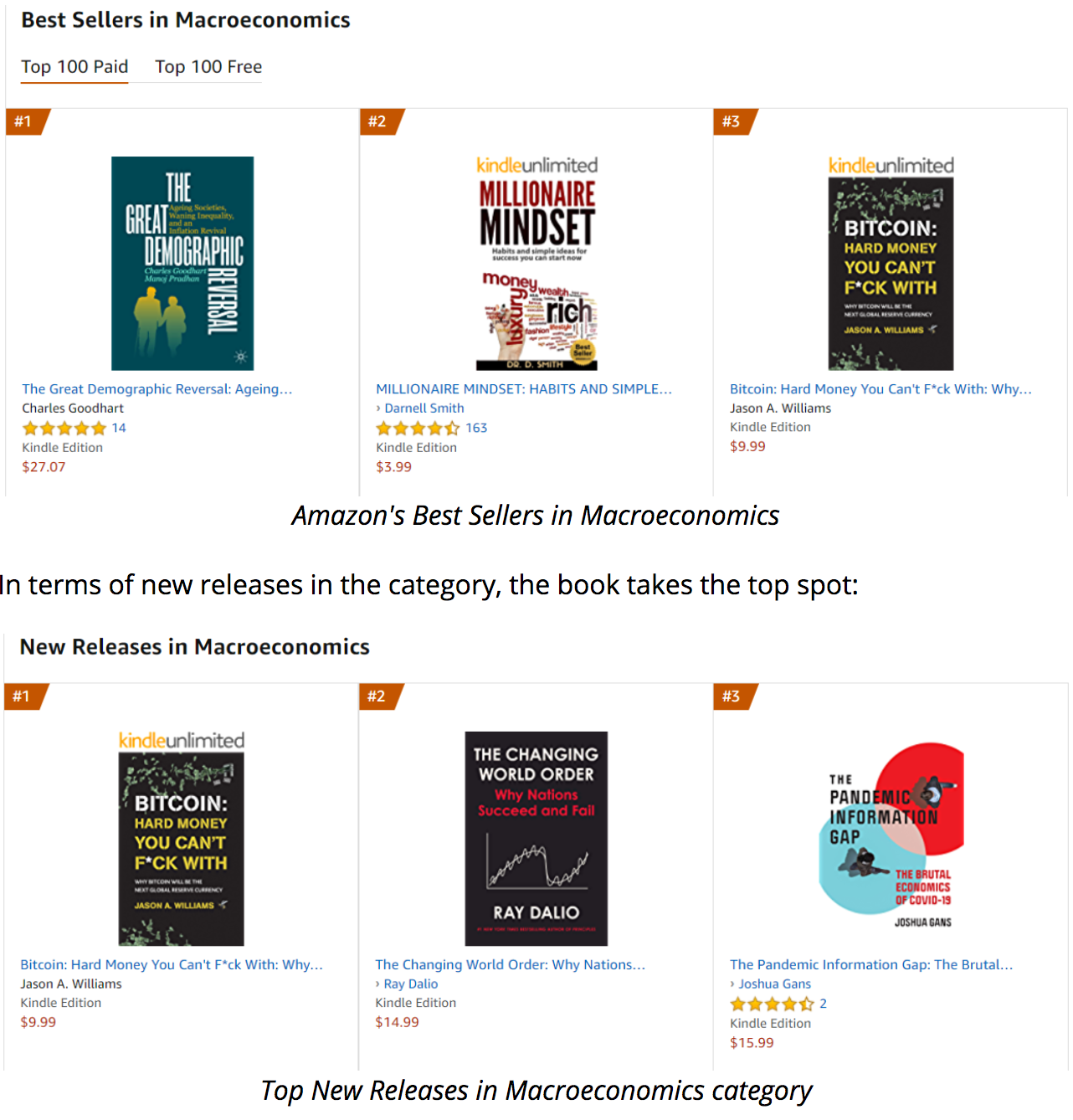

Bitcoin Book Breaks Into The Top 3 On Amazon’s Macroeconomics List

It appears that more people are reading about Bitcoin these days.

A new book on Bitcoin (BTC) has catapulted into the top three on Amazon’s macroeconomics bestseller list, offering more evidence that digital assets are piquing people’s interest. Released on Dec. 2, Bitcoin: Hard Money You Can’t F*ck With: Why bitcoin will be the next global reserve currency is currently the third-most-bought title in the Kindle macroeconomics category.

The book is authored by Bitcoin evangelist Jason Williams, entrepreneur and co-founder of Morgan Creek Digital Assets — the crypto-focused investment arm of Morgan Creek Capital. As Cointelegraph reported, Williams recently sold his 2007 Chevrolet Suburban for 0.4 BTC. If his Twitter feed is any indication, Williams has been scooping up a lot of Bitcoin for his personal stash this year.

Williams’ book offers a primer on Bitcoin for those who’ve had little exposure to the asset class. The Amazon sales page describes the book as follows:

“Hard Money You Can’t F*ck With explains bitcoin in simple, readable terms and maps out how this ‘magic internet money’ will grow into the best form of money we’ve ever had.”

The book is broken down into three main sections that include why Bitcoin matters now, a brief history of money, and how BTC can become the next global reserve currency.

It appears that retail interest in Bitcoin is ramping up again, likely as a result of BTC’s massive upsurge in recent months. Google searches for the term “Bitcoin” spiked in late September, then again in November.

Retail FOMO, or fear of missing out, was the main catalyst of the 2017 bull market, but it has been largely absent from this year’s rally. Google search trends and the performance of Williams’ book could be viewed as a proxy for layperson interest in the digital asset.

Here Are The Top 10 Books Blockchain Thought Leaders Recommend In 2020

With the continuous lockdowns and travel advisories brought on by the COVID-19 pandemic, 2020 seems to be a perfect year for discovering and reading new books.

As such, Cointelegraph collected a list of non-crypto-related book recommendations from 10 of the biggest thought leaders in the blockchain space. Sheila Warren, Caitlin Long, Alex Mashinsky, Tim Draper and others all chimed in to share their favorite or most interesting reads, demonstrating how their worldviews and perspectives have been shaped through literature.

Here Are The Top 10 Books These Influential Individuals Recommend Reading:

“The Secrets Of Spies” By Heather Vescent, Adrian Gilbert And Rob Colson

Recommended By Brian Behlendorf, Executive Director Of Hyperledger

Brian Behlendorf, executive director of Hyperledger, told Cointelegraph that a recent book he read and enjoyed was The Secret of Spies. This novel recounts tales of spies from all the way back in ancient times to today, focusing on major historical events. Behlendorf commented:

“People need to think more like a hacker thinks when designing things to make them resilient against failure, and so it’s fun to read about how spies and spycraft represented some of the first hostile-environment thinking that hackers later adopted and blockchain design really benefits from.”

“Pedagogy Of The Oppressed” By Paolo Freire

Recommended By Sheila Warren, Head Of Blockchain And Dlt For The World Economic Forum

Sheila Warren, head of blockchain and distributed ledger technology for the World Economic Forum, told Cointelegraph that a book that has shaped her thinking is Pedagogy of the Oppressed by Brazillian educator Paolo Freire. Warren shared that she came across this novel in law school while working on a project with the now-defunct Institute on the Arts and Civic Dialogue:

“This novel completely changed the way I think about power. Among other gems, the book outlines a framework for thinking about promoting dialogue, anchored in cooperation, unity, organization, and cultural synthesis. I’ve found myself revisiting this book over and over again, and it was the first thing I thought of when I first read the Satoshi whitepaper. My other suggestion is Strunk & White, The Elements of Style, because being a better writer never hurt anyone!”

“Ready Player Two” By Ernest Cline

Recommended By Tim Draper, Venture Capitalist And Bitcoin Investor

Tim Draper, venture capitalist and Bitcoin investor, told Cointelegraph that he enjoys reading science fiction, noting that Ernest Cline’s Ready Player Two is one of his favorite books. The New York Times bestseller was released this year and is the sequel to the worldwide bestselling book Ready Player One.

Unlike the first book, Ready Player Two has a different storyline yet involves all the previous characters. The novel focuses on a new technology called “ONI” that allows users to record their experiences in real life. While revolutionary, this book demonstrates the dangers of an addictive technology, alluding to what an artificial-intelligence-driven future could look like.

“When Money Dies” By Adam Fergusson

Recommended By Caitlin Long, Founder And CEO Of Avanti Financial

Caitlin Long, founder and CEO of Avanti Financial, told Cointelegraph that her favorite book is When Money Dies by British historian Adam Fergusson. Written in 1975, this book is a historian’s take on the 1923 hyperinflation in Weimar Germany. Long shared that she will always remember this book because it taught her to spot patterns applicable to any currency collapse:

“Economists tend to look at currency collapses on log charts, but log charts obfuscate the ‘rip your face off’ and ‘it’s finally over’ rallies along a currency’s path to collapse — it never happens on a straight line, and log charts smooth over huge underlying volatility. In Weimar Germany, the amplitude of market movements toward the end became staggering. At first the currency moved 2% intraday, then 5%, then 10%, then 20% and eventually 50% — intraday moves — relative to the value of stocks, and relative to more stable currencies, peppered with many head-fake rallies along the way. The ‘tipping point’ for a currency seems to be when society realizes en masse why prices are really going up — namely, that the denominator of a price (the currency) is going down in value. All prices are just ratios, expressed as the value of the good (numerator) in terms of the currency (denominator).”

Long mentioned that after reading this book, she questions whether stock market rallies are evidence that businesses are creating economic value or simply the result of a real decline in the purchasing power of money.

“Truman” By David Mccullough

Recommended By Alex Tapscott, Co-Founder Of The Blockchain Research Institute

Alex Tapscott, co-founder of the Blockchain Research Institute and author of Financial Services Revolution, told Cointelegraph that Truman by David McCullough is his favorite book of 2020, even though it was released years earlier in 1992. As the title suggests, Truman is a Pulitzer Prize-winning biography of former United States President Harry S. Truman.

According to Tapscott, Truman is prescient because today we find ourselves in a period of epochal change. However, Tapscott noted that unlike during Truman’s time, this change is being wrought by technological acceleration rather than the end of a devastating war:

“Still the effects are similar: it is upending the economy, our traditional systems of government, old alliances and more. In 1945, we got lucky when a yet-unproven Vice President stepped into the biggest shoes and proved himself an able leader. We are in want of strong leadership today. Who will step up?”

Tapscott elaborated that Truman is an inspiring, joyful read that has been deeply researched: “President Truman came from humble Midwestern origins and had a limited education, but nevertheless rose to become the President of the U.S., leading the Free World during one of the most dangerous and pivotal times in human history. Truman never expected to be President and, as Vice President, was thrust into the role after Roosevelt died. Everyone underestimated him. But he proved himself a man of iron will, vision, moral fortitude and political savvy.”

“The Great Gatsby” By F. Scott Fitzgerald

Recommended By Denelle Dixon, CEO And Executive Director Of The Stellar Development Foundation

Denelle Dixon, CEO and executive director of the Stellar Development Foundation, told Cointelegraph that one of her favorite books is The Great Gatsby by F. Scott Fitzgerald. Dixon shared that the opulence and beauty Fitzgerald conveys in this novel is countered with the ugliness of class dynamics and the utter lack of true love:

“The story feels desperate, even as it attempts to capture fun and excitement. I am drawn to it because I have been drawn to Fitzgerald’s own personal story which is tragic at best. The cover of the book itself is haunting and the story is one that beckons me back to read on an annual basis. I don’t finish the story feeling good about where it ends, but it does remind me of the importance of being true to yourself — a trait that most of the main characters lack.”

Dixon further noted that The Great Gatsby is a story of class struggles, showing the dedication of what one character does to grow and pretend to be a part of a class that he wasn’t born into. “It is in many respects the failure of the American dream of ‘growing into prosperity’ and being accepted as ‘prosperous,'” she said.

“Providence” By Max Barry

Recommended By Paul Brody, Global Blockchain Lead At Ernst & Young

Paul Brody, global blockchain lead at Ernst & Young, told Cointelegraph that the book he read within the last year that had the biggest impact was Providence by Max Barry. Published in March, Barry’s novel is a science fiction read that focuses on the lives of four crew members aboard an AI-powered spaceship. The twist is that the characters discover they are not the crew but rather the cargo. Brody said:

“I am a huge history fan, but most of that I get from articles and summaries, which I think really condenses matters nicely. I read books for escapism and to immerse myself in alternative lives and worlds and for those I go entirely for fiction, with a big helping of science fiction. I enjoy fiction because I love to think about how the world will change or can change. Fiction forces the author to really think about how a regular person would experience the impact of technology.”

“Prodigal Genius: The Life of Nikola Tesla” by John J. O’Neill

Recommended by Alex Mashinsky, founder and CEO of Celsius Network

Alex Mashinsky, founder and CEO of Celsius Network, told Cointelegraph that his favorite book is Prodigal Genius: The Life of Nikola Tesla by John J. O’Neill. This is a biography focused on the life of Nikola Tesla, a pioneer of electrical engineering. Mashinsky commented:

“Tesla created a network that is even bigger than the internet — our global alternating current electrical grid. He is as much a lesson about what to do and how to create as he is a lesson on how not to do things.”

“Orbiting The Giant Hairball: A Corporate Fool’s Guide To Surviving With Grace” By Gordon Mackenzie

Recommended By John Wolpert, Technical Steering Committee Chair For Baseline Protocol

John Wolpert, technical steering committee chair for Baseline Protocol, told Cointelegraph that one of his favorite books is Orbiting the Giant Hairball: A Corporate Fool’s Guide to Surviving with Grace by Gordon MacKenzie.

This book uncovers the professional evolution MacKenzie underwent to learn about fostering creative genius. The book explains how innovative organizations can quickly become a “giant hairball,” or a tangled mess of rules and systems, which ultimately leads to mediocrity.

“This is a great story about how to keep creativity alive inside companies and how to harmonize one’s intentions with the intentions of the organization and community.”

“The Box” by Marc Levinson

Recommended by Alistair Rennie, general manager of IBM Blockchain

Alistair Rennie, general manager of IBM Blockchain, told Cointelegraph that his favorite book is The Box by Marc Levinson. According to Rennie, this book tells the story of how containerized shipping came to be.

“It’s an excellent story that gives great insight into how such systemic change transpired including insights into standardization, patents and regulatory impact — leading to tremendous economic gain. The Box really connected with me as I executed on TradeLens — a blockchain based system to transform how data is shared and leveraged across the ocean shipping ecosystem.”

Updated: 3-10-2022

Honey, I Orange-Pilled The Kids! BTC Children’s Authors On Learning About Money

Three Bitcoin children’s authors share the keys to teaching about Bitcoin and money, explaining why it’s important to do so from a young age.

Bitcoin is for everyone. That includes teenagers, children, toddlers and even newborns.

When these kids grow up, they’ll use the Bitcoin (BTC) protocol, so it “makes sense to start to integrate Bitcoin into learning as early as possible.”

At least, that’s according to Scott Sibley, one-half of the couple behind the creation of the Shamory Bitcoin game and the Goodnight Bitcoin children’s bedtime book. He joins a growing list of Bitcoin children’s book authors who care deeply about educating children on Bitcoin and money.

Sibley and his wife are firm believers that “kids can learn much faster, and earlier than most people think.”

It’s one of the reasons why they wrote their Bitcoin bedtime story, a tale for infants that riffs on the “plethora of “Goodnight” books (Goodnight Moon, Goodnight Baseball, etc.)” Incidentally, it also serves as a nice primer for their semi-educational game about Bitcoin mining, SHAmory.

The Sibleys noticed there’s a “product and content gap when it comes to fun ways for kids and adults to learn about Bitcoin,” and are bringing educational content that extends beyond the podcasts, books and long-form essays which Bitcoiners usually gorge upon.

“Financial education that includes Bitcoin is something that kids aren’t going to receive in most “traditional” schools. So right now, it’s on Bitcoin parents to find ways to weave that education in at home.”

Chris and Frieda Bobay are the brains behind Bitcoin for Kiddos: The Story of Bitcoin. They’re another couple passionate about imparting knowledge into “children about money early,” so that “they will have the best opportunity to recognize it [uncorruptible money] when they see it.”

They Told Cointelegraph:

“We wanted to expose our kids early to Bitcoin and broader concepts of money early so they are more comfortable using the technology and talking about it when they are older.”

They add that “money for most adults is a taboo subject, but it doesn’t have to be.” In educating children about Bitcoin (and inherently, money) with books, it breaks down social barriers, unlocking “an incredible learning experience for the whole family.”

Michael Caras, aka the Bitcoin Rabbi and author of Bitcoin Money: A Tale of Bitville Discovering Good Money, compliments the other authors’ musings about children and finance. He told Cointelegraph “it’s important that children learn about working for money, saving, spending responsibly and also giving to charity.”

He notes the unintended advantage of teaching children about Bitcoin—it’s an “intro for adults,” too. Sibley explains: “kids, as well as the adults, will still be better off in the sense that we all have been exposed to and learned more about money, where it comes from, what makes it valuable, etc.” Sibley adds:

“These are all questions [about money] that most people probably go their entire life without thinking or learning about.”

Furthermore, given that “children don’t have all the biases that adults have,” they might approach the decentralized monetary network with an open mind. The Bitcoin Rabbi expands the idea, sharing “children understand the digital aspect of Bitcoin because they are digital native.”

“Not having preconceived notions about how traditional money and banks makes it easier for them to see Bitcoin as real money.”

Ultimately, not only do the Bitcoin children’s books subtly teach kids (and their parents) about Bitcoin, orange-pilling them along the way, they also only help to break down an enduring taboo — talking about money.

Updated: 3-31-2023

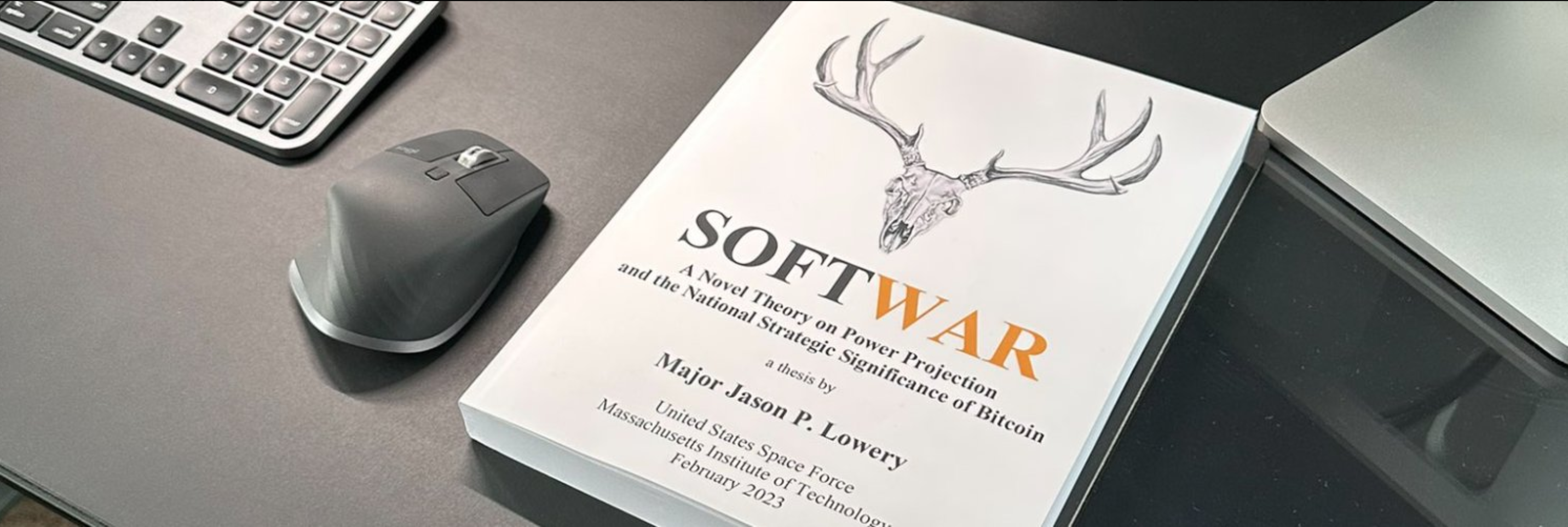

MIT Space Force Major Proposes Bitcoin Mining As Cybersecurity Tool

An active-duty United States Space Force astronautical engineer is proposing a new cybersecurity tool to the Pentagon: Bitcoin.

An active-duty United States Space Force astronautical engineer is proposing a cybersecurity tool to the Pentagon that is capable of transforming the country’s national security and the base-layer architecture of the internet: Bitcoin

In an academic thesis, Major Jason Lowery, who is also a national defense fellow at Massachusetts Institute of Technology (MIT), presented a new theory to the U.S. Department of Defense that Bitcoin is not just a peer-to-peer payment system but a new form of “digital-age warfare,” arguing that proof-of-work technologies will change the way humans compete globally, according to Ben Schreckinger’s review of the book in Politico.

Published in February, Lowery’s master’s degree thesis dubbed “Softwar” sits in third position on Amazon’s list of best-selling technology books at the time of writing. According to his Amazon bio, Lowery has a decade of experience serving as a weapon system developer and technical adviser for U.S. senior officials, including Bitcoin-related policies.

Lowery’s research argues that the U.S. military could use Bitcoin to stop certain types of attacks, such as denial-of-service attacks, which overload servers with too many requests.

The concept involves creating software programs that only respond to signals from large transactions recorded on the Bitcoin network. This would make it harder for attackers to flood servers with fake signals and cause damage.

THESIS PUBLISHED!!!

Announcing the public debut of SOFTWAR, a theory presented to OPOTUS, OSECDEF, & the Joint Chiefs about the national strategic significance of #Bitcoin

LET THE HASH WARS BEGIN

High-quality physical copies available now: https://t.co/WaNo7y8avl pic.twitter.com/vWF24ze9EA

— Jason Lowery (@JasonPLowery) February 20, 2023

Lowery also suggests that the Bitcoin network is like maritime trade routes, which means it’s suited for economic exchange.

Consequently, it’s crucial to protect freedom of navigation on the network, just as we protect trade routes.

By designing software programs that only respond to external signals if they come with a large enough Bitcoin transaction recorded on the network, Lowery argues they would prevent adversaries from gaining control over them.

According to the author, the U.S. should also stockpile Bitcoin, build a domestic Bitcoin mining industry and extend legal protections to the technology. In his view, Bitcoin is a self-defense weapon, and the country should protect it as it does other rights.

Updated: 8-13-2023

Bitcoin Book “Softwar” BANNED! 🚨 National Strategic Significance of BTC (Most Efficient Weapon? 💣)

JUST IN: 🇺🇸 SOFTWAR Author and Space Force Major Jason Lowery has been ordered stop talking publicly about the strategic importance of #Bitcoin on national security.

His Bitcoin thesis ‘Softwar’ is no longer available.

“Things are good,” says Major Lowery. pic.twitter.com/uVHyGV2jdo

— Bitcoin Archive (@BTC_Archive) July 27, 2023

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,Top 10 Books Recommended,

Leave a Reply

You must be logged in to post a comment.