New Report Reveals Significant Upsurge In The Use Of Cryptocurrency In Remittances Across The Globe

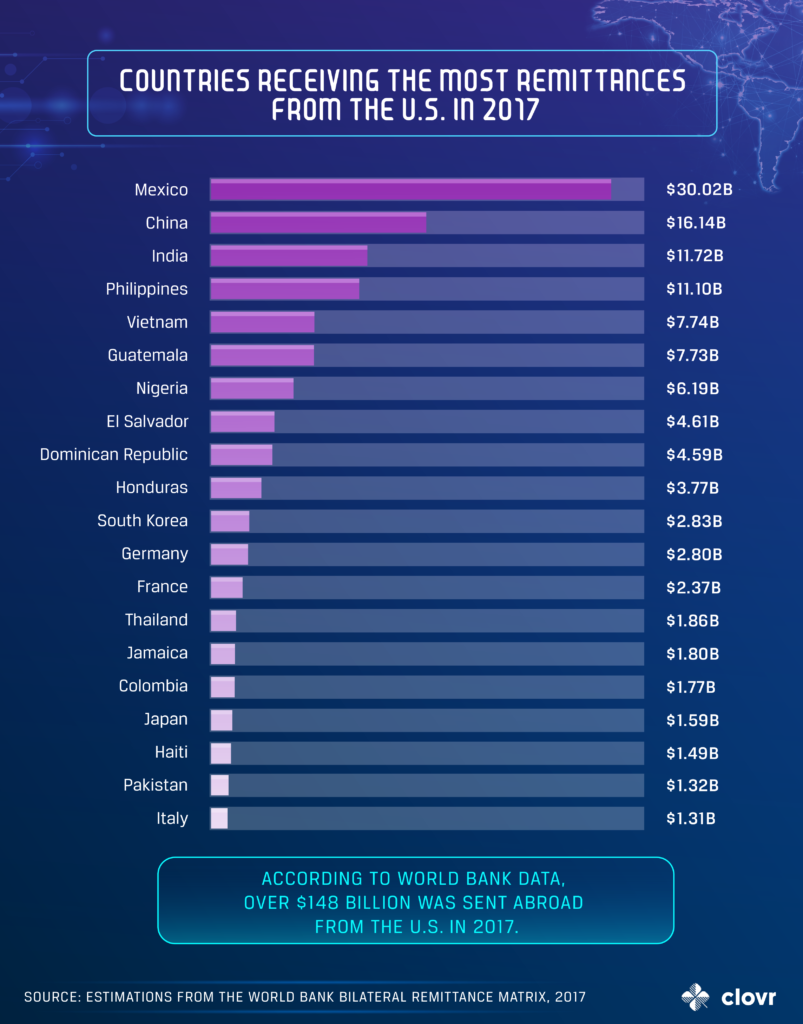

The survey revealed 20 countries receiving most remittances from the U.S. in 2017. The top ten countries represented on this list are in order, Mexico, China, India, Philippines, Vietnam, Guatemala, Nigeria, El Salvador, Dominican Republic and Honduras. Unsurprisingly, the breakdown of these remittances shows family taking the highest percentage at 76.8 percent.

Related:

Crypto’s Growing Influence And Possibility For Disruption

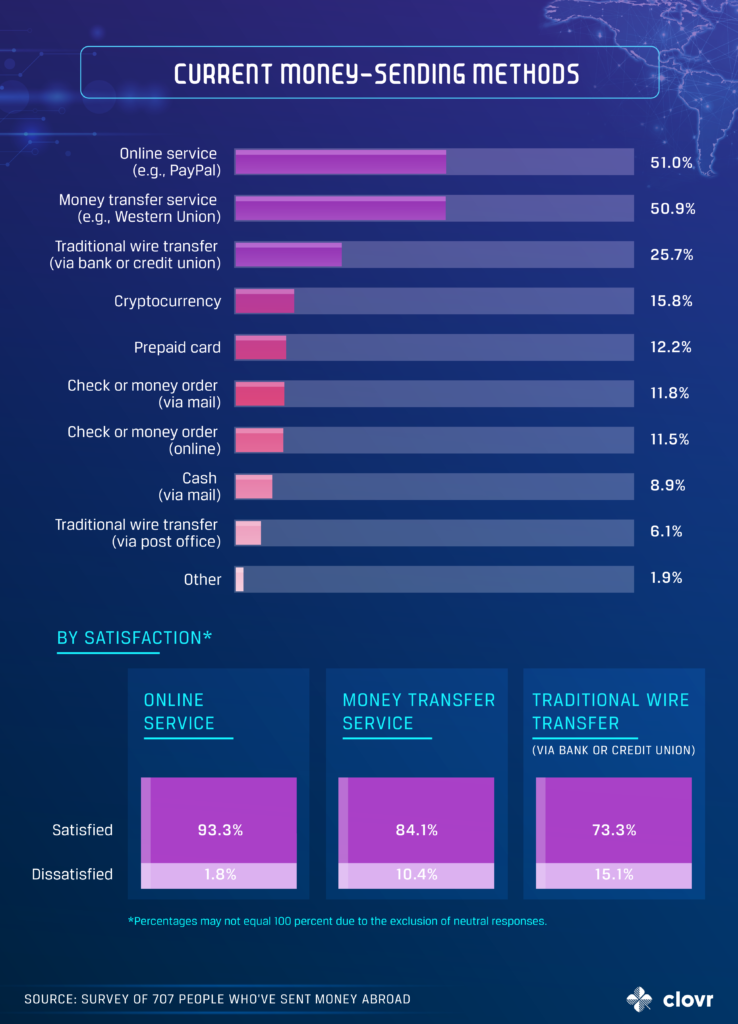

Clovr’s breakdown of money transfer methods shows that roughly half of all surveyed people indicated that they use PayPal and money transfer services like Western Union, compared to 15.8 percent who use cryptocurrency, 25.7 percent who use traditional bank wire transfers or credit union, 12.2 percent who use prepaid cards, 11.8 percent who use check or money order via mail, 11.5 percent who use check or money order online, 8.9 percent who use cash via mail, 6.1 percent who use traditional wire transfer via post office, and 1.9 percent who use other methods.

To illustrate the potential of cryptocurrency to create substantial disruption in the space due to its low cost and speed, the study revealed that in order to send $500 abroad, banks charge $52.05 on the average, compared to $30.75 for money transfer operators, $34.05 for the post office and $16 for mobile operators.

Customer satisfaction was pegged at 93.3 percent for online services, 84.1 percent at money transfer services and 73.3 percent with traditional wire transfer, via bank or credit union.

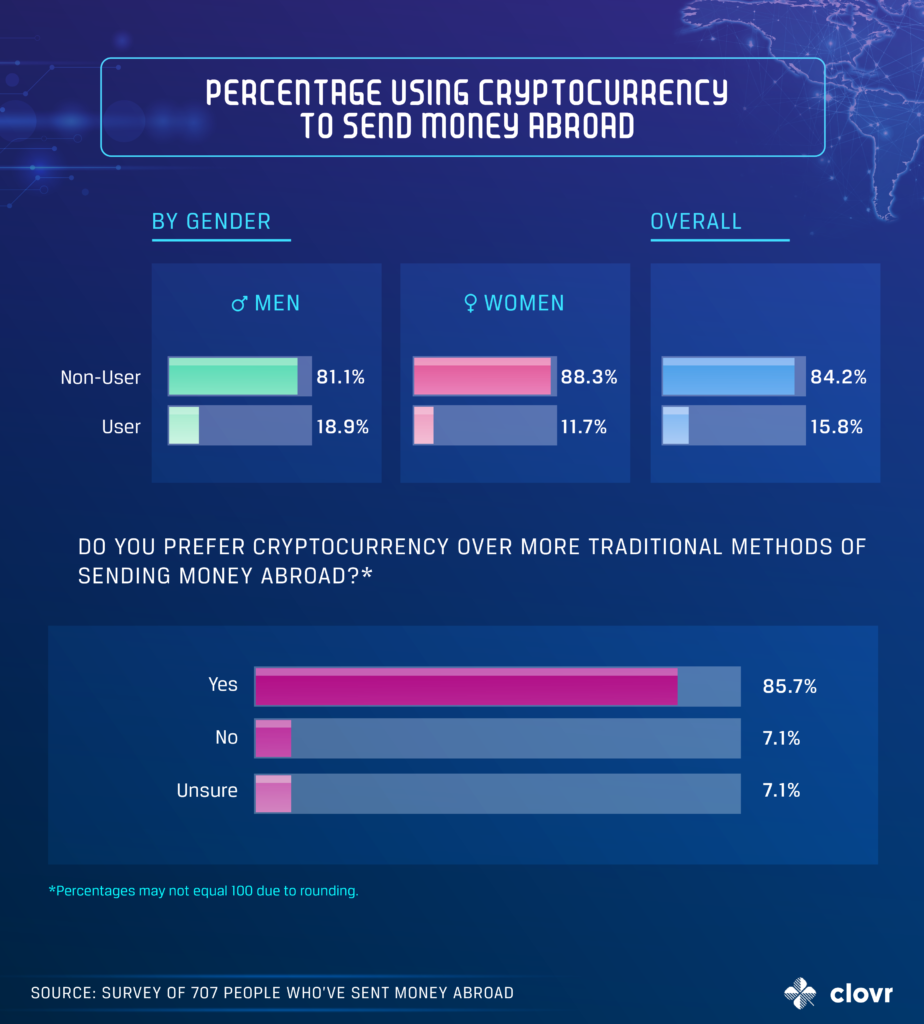

In line with other existing data on cryptocurrency use, the study shows a significant gender knowledge gap on the subject of cryptocurrencies among non-users as men continue to dominate crypto adoption. The study concludes that the money transfer industry is “ripe for disruption” through the introduction of cryptocurrency-based solutions, which could potentially offer a cheaper and faster way to transfer funds.

An Excerpt From The Report Reads:

People sending money home after they’ve migrated from other countries to the United States is a practice that will likely continue far into the future… As individuals look to make sure that as much of every dollar they send can make it back – as close to a one-to-one match as possible – digital payment options, like those presented by cryptocurrencies, can pique the interest of customers.

Updated: 1-8-2021

Mexicans In U.S. Sent Record Remittances Despite Covid-19 Pandemic

Unexpected surge in amounts forwarded home shows resilience in U.S. construction and agriculture.

Mexicans working in the U.S. sent record amounts of money to relatives back home last year, illustrating the resilience of the U.S. economy despite the shutdowns imposed to fight the pandemic.

The surge in remittances, which surprised analysts and migrants alike, provided a lifeline for many poorer Mexicans in the midst of the country’s biggest economic slump in decades.

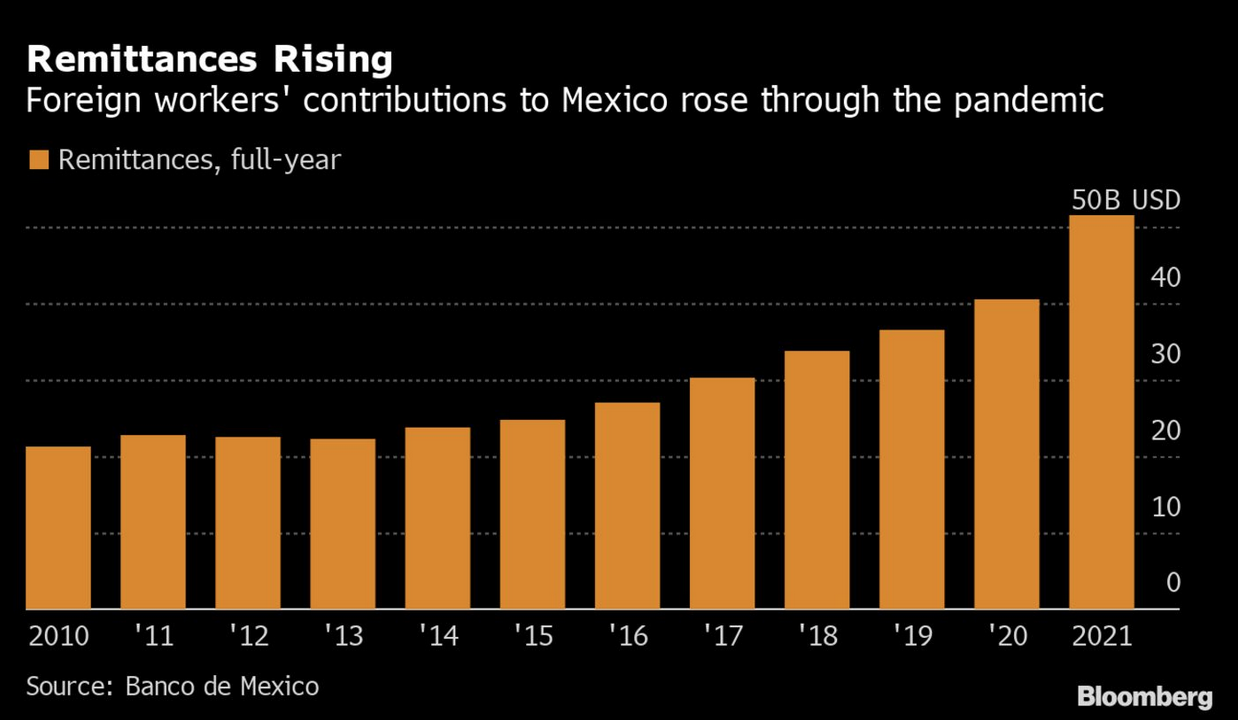

Remittances rose 11% to $36.9 billion in the first 11 months of the year, more than the record $36.4 billion sent in all of 2019, according to figures released this week by Mexico’s central bank. The average remittance was 4.3% higher at $340, the bank said.

In Guatemala, El Salvador and Honduras—the Central American countries that make up the Northern Triangle—remittances slumped in April but later rebounded, and were up 3.4% from January through October.

After the pandemic caused U.S. unemployment to surge to double-digit levels earlier in 2020, the World Bank and others projected that remittances to Mexico and elsewhere in Latin America would fall close to 20% from 2019, threatening a critical source of income for families that rely on the transfers to make ends meet.

“Even I’m surprised, with so many of my countrymen out of work, above all those that work in restaurants,” said Hermelindo Saldaña, a resident of Santa Ana, Calif., who sends money to his mother in Mexico’s Yucatán state. “But people look for ways to make some money to send.”

Banco Bilbao Vizcaya Argentaria estimates that there are some 39 million people of Mexican origin in the U.S. including immigrants, U.S.-born residents with Mexican parents, and third- or later-generation U.S. citizens of Mexican descent.

Many activities in which migrants are employed didn’t shut down completely in the U.S., such as construction, gardening and agriculture, and a significant number of migrants were eligible for unemployment benefits under the U.S. government’s stimulus plan, said Alfredo Coutiño, the director for Latin America at Moody’s Analytics. And because of the crises in their home countries, migrants faced the need to send more money to their relatives, he added.

The 58-year-old Mr. Saldaña, a painter from the southern Mexican state of Guerrero, said work in construction held up “because people are at home, looking to see what needs to be done.” And migrants who had work were spending less because they couldn’t go out to restaurants or amusement parks, and could send some of those savings home, he added.

MoneyGram International Inc., the Dallas-based money transfer company, said that in a December survey of around 1,500 of its customers, 69% said they sent more money in 2020 than the previous year despite hardships caused by the pandemic.

Most cited increased needs of family and friends in their home countries, particularly to pay for food, housing and healthcare. And six out of 10 customers said they had made greater use of digital tools to send money than before.

Mexican President Andrés Manuel López Obrador, whose government responded to the crisis with only a limited stimulus to keep government debt from swelling, has called the rise in remittances “a kind of social miracle” that helped sustain consumption of basics during the economic downturn. Mexico’s economy is expected to have shrunk 9% last year, its biggest fall since the Great Depression.

A rapid recovery in U.S. employment has also played a role.

Petra Fuentes, a 77-year-old grandmother of 21 in the central Mexican state of Hidalgo, said she stopped receiving remittances between March and May, when her daughter lost her job at a frozen-foods plant in Kentucky.

Transfers resumed after her daughter found work at a plant that makes optical lenses as employment activity picked up in May.

“I pay for my electricity, water and groceries with what my daughter sends me,” Ms. Fuentes said. “When I didn’t receive anything for those months, I had to pay for those with the help that the government gives to people over 70.”

Another contributing factor could be the restrictions on U.S.-Mexico border crossings because of the pandemic, which appears to have prompted migrants to resort to electronic transfers instead of taking cash in person or sending it with relatives or friends. Electronic transfers are more likely to show up in the data.

Border crossings last year were down sharply from 2019, after having steadily increased since the 2008-09 financial crisis.

“People are still crossing the border for business and to see families,” said Mark Lopez, director of global migration and demography research at the Pew Research Center. “That’s still happening, but not to the degree it was before.”

Mr. Lopez sees the resilience of the U.S. economy as a crucial support for remittances.

“I think it’s a U.S. economic story as it reflects the U.S. rebound itself, in employment at least,” he said. “It’s not just Mexican immigrants who might be doing better, but others too.”

Remittances elsewhere also point to the strength of the U.S. recovery. Overall remittances in the Philippines, whose expatriates are more widely spread across continents, were down 0.9% in the first 10 months of the year, but those from the U.S. were up 5.9%. Remittances to the Dominican Republic, which has most of its emigrants in the U.S., rose 13% in the first 10 months of 2020.

Remittances have for years exceeded receipts from oil exports and foreign tourism as a source of foreign currency in Mexico, supporting the country’s finances. Lower oil prices and reduced international travel have made remittances even more important for Mexico.

Coupled with the expected contraction in Mexican economic output, remittances are likely to be equivalent to 3.8% of 2020 gross domestic product, up from 2.9% of GDP in 2019, according to analysts at BBVA.

Remittances should continue to grow this year, though they will likely return to a more consistent moderate growth of about 5%, Mr. Coutiño said.

Updated: 5-30-2021

Migrants Keep Money Flowing Home As Rich Economies Bounce Back

Remittances provide lifeline for poor countries still in the grip of the Covid-19 pandemic.

Over the years, Aiza Bolo, a 36-year-old housewife in the Philippines, has come to depend on the $550 her stepbrother sent her each month from his job in Dubai.

When the pandemic struck and the income from a fruit stand her parents own dried up, her stepbrother began sending as much as $950 a month. That enabled her to keep buying medication for her parents and purchase a laptop and internet connection so that her 13-year-old son could continue his schooling online.

“What Justine sends is more than just money. It is a lifeline for us,” Ms. Bolo said. “There was barely any income during the pandemic, so we all relied on him.”

Funds that migrant workers send home—known as remittances—have long offered millions in the developing world critical support, paying for needs including schooling, shelter and healthcare for relatives back home.

Many of those migrant workers continue to send money back, often despite their own economic difficulties, providing financial cushions in countries where Covid-19 cases are still high, vaccines are slow to arrive and the economy is struggling.

In 2020, global remittances dropped 2.4% to $702 billion from the previous year, less than half the drop recorded in the aftermath of the global financial crisis in 2009, according to the World Bank. Remittances to low- and middle-income countries were particularly resilient, falling 1.6%.

Early in the pandemic, the World Bank had estimated that remittances would decline 20% in 2020. Last autumn, it was predicting a 14% drop for all of 2020.

To be sure, part of the resilience stems from the increased use of formal channels to transfer remittances, which are easier to capture in data than the informal channels many migrants relied on when global travel was easier.

Other drivers behind the strong remittance flows have to do with the large government support programs in rich countries, notably the U.S. and parts of Europe, that have enabled migrant workers there to maintain some financial stability. At the same time, the economic crisis last year—which has yet to abate in many poor countries—pressed some migrants to raise their payments to needy family members.

In a recent survey by MoneyGram International Inc., a money-transfer and cross-border payments company, 70% of respondents said the crisis prompted them to send more remittances back home, said the company’s chief executive officer, Alex Holmes.

“They believe that people in those home markets are more in need this year, and last year, than ever before,” Mr. Holmes said.

In 2020, remittances to Latin America and the Caribbean increased 6.5% from the previous year, fueled by a rapid economic recovery in the U.S. and two hurricanes in Central America that prompted workers abroad to give more financial support than usual, according to the World Bank.

Oscar Andara Guerra, a 43-year-old vegetable vendor in San Pedro Sula, Honduras, said the $300 a month he receives from his mother is essential. His mother, who has been working in the U.S. for more than three decades, also sends money to his siblings.

“She works in cleaning and never, not even during the pandemic, did she stop sending us money,” Mr. Guerra said. “She even helped me buy the bed I sleep in.”

In some parts of the world, households have shifted how they spend remittances as the pandemic forces many families to give priority to basic needs. Government statistics from the Philippines show that the percentage of households relying on remittances to cover education costs dropped from 65% in the last quarter of 2019 to 60% for the same period in 2020.

During that time, fewer households in the Philippines used remittances to purchase cars or add to savings, while more began using the funds to cover medical expenses. The number of households using remittances to buy food and basic necessities hardly changed.

The monthly financial support Ms. Bolo receives from her stepbrother has helped offset her family’s lost income from selling fruit in the market and renting out an apartment that was also purchased with remittances from Ms. Bolo’s stepbrother.

“Even after the strict lockdown was lifted, business was still not the same,” Ms. Bolo said. The pandemic has left the rental apartment empty often, while tenants sometimes failed to pay rent on time, she said.

Not all households receiving remittances have been shielded from the pandemic’s economic blows.

In India’s Kerala state, where one in five households receives remittances, many families saw the flow abruptly stop when deteriorating economic conditions in the Middle East forced migrant workers to return home. One in six migrant workers from India has returned home since the pandemic began, according to S. Irudaya Rajan, chairman at the International Institute of Migration and Development in Kerala.

Biju Matthew, 48, returned home to Kerala in February from Kuwait after his company stopped paying him and two dozen other workers.

“When we went to complain, they asked us to resign, offered to give back our passports and pay for flight tickets back home. We refused to leave,” Mr. Matthew said.

His company later asked the workers to vacate the housing facility it had been providing. When the workers refused again, the firm cut off the electricity supply and refused to give their overtime pay. He stopped sending money home for about half a year before returning.

Now, Mr. Matthew works as a supervisor at a mall in Thiruvananthapuram, Kerala’s capital, earning a little over $200 a month, less than a third of what he earned in Kuwait.

“It feels like my life has been pushed 20 years back,” he said. “All I can think of is surviving the day.”

Updated: 10-21-2021

Crypto Remittances See Adoption, But Volatility May Be A Deal Breaker

The path to mass cryptocurrency adoption passes through remittances, but it may not happen any time soon.

Cryptocurrency adoption has been growing for a number of reasons. In emerging markets, research suggests crypto remittances are a factor, although some argue that the idea of using cryptocurrencies for these transactions is nothing more than a purist’s dream.

The CEO of cryptocurrency derivatives trading platform BitMEX, Alexander Höptner, predicted earlier this month that by the end of next year, at least five countries will have accepted Bitcoin (BTC) as a legal tender, as crypto assets can be faster and cheaper for remittances.

He believes that all five will be developing countries and that they would adopt cryptocurrencies because of the growing need for cheaper and faster cross-border transactions, increasing inflation and growing political issues.

Various other commentators have suggested that Bitcoin and other cryptocurrencies are a solution to the high costs associated with remittance payments, as a cryptocurrency transaction can be much cheaper than a remittance payment while settling in a shorter amount of time.

El Salvador was the first country in the world to adopt Bitcoin as legal tender with the country’s Bitcoin Law officially coming into effect on September 7. The government launched a cryptocurrency wallet called Chivo that uses the Lightning Network, a layer-two scaling solution, to transact. The country has also purchased 700 BTC over time.

Global remittances reached over $689 billion in 2018, and commissions were so high a $49 billion industry grew around them. To crypto proponents, El Salvador is a perfect example of how cryptocurrencies can positively change the world, but to others, volatility and a general lack of trust in the market make cryptocurrency adoption impractical and unadvisable.

Are Cryptocurrencies Banking The Unbanked?

With the Chivo wallet, Bitcoin could effectively help offer financial services to El Salvador’s un- and underbanked population.

The country’s president Nayib Bukele revealed in September 2021 that 2.1 million Salvadorans are actively using the wallet, despite the pushback against the new law that saw protests even burn a Bitcoin ATM machine.

2.1 million Salvadorans are ACTIVELY USING @chivowallet (not downloads).

— Nayib Bukele (@nayibbukele) September 25, 2021

Chivo is not a bank, but in less than 3 weeks, it now has more users than any bank in El Salvador and is moving fast to have more users that ALL BANKS IN EL SALVADOR combined.

This is wild!#Bitcoin

Per his words, Chivo isn’t a bank, but in three weeks gained more users than any bank in the country. That adoption may, however, be related to a $30 in BTC airdrop El Salvador sent to every adult citizen with the government’s wallet app.

Speaking to Cointelegraph, Eric Berman, senior legal editor of U.S. finance at Thomson Reuters Practical Law, said remittances using cryptocurrencies are a “purist’s pipe dream.” While Höptner pointed out that remittances made up 23% of El Salvador’s gross domestic product in 2020, Berman countered that only a fraction of the nation’s businesses has taken a Bitcoin payment and that the government’s cryptocurrency app has been plagued by technical issues.

Berman further added that “most of El Salvador’s $6 billion in annual remittances still comes via money transfers,” as many are wary of the cryptocurrency’s volatility. Because of the volatility’s impracticality, he said, Bitcoin hasn’t been widely adopted as a payment method among merchants, adding:

“This impracticability is magnified exponentially for the disenfranchised and unbanked. No one wants to send mom $100 only to have it be worth $80 by the time it gets to her.”

Berman added that “rather than the populist uprising that BTC purists have been touting for years,” Bitcoin’s adoption has instead been growing thanks to “some perhaps long overdue happy noises from U.S. and global regulators.”

Indeed, the United States Securities and Exchange Commission (SEC) head Gary Gensler has confirmed the regulator won’t ban crypto. In fact, the SEC approved the first Bitcoin futures-linked exchange-traded fund (ETF) in the United States, ProShares’ Bitcoin Strategy ETF, this week.

Bitcoin’s growing adoption and price, Berman suggested, are the result of “institutional enthusiasm that is quite the antithesis of the grassroots movement for the disenfranchised and unbanked that spawned BTC over a decade ago.”

Oleksandr Lutskevych, the founder and CEO of cryptocurrency exchange CEX.IO, seemingly disagrees with Berman’s assessment, saying El Salvador’s adoption highlights Bitcoin as “replacing the traditional, centralized rails used for remittances.”

To Lutskevych, Bitcoin’s infrastructure is being adopted to also promote the transfer of stablecoins on top of its network, ensuring the cryptocurrency’s volatility won’t affect remittances. El Salvador’s move, he said, promotes financial inclusion by helping cut down remittance costs.

Adoption Out Of “Pure Necessity”

In emerging markets, crypto proponents suggest adoption may be a result of “pure necessity,” as the transaction fees paid on most blockchain networks dwarf the fees paid to some remittance vendors.

According to Lutskevych, it’s “abundantly clear in the rationale behind Bukele’s campaign that made BTC legal tender” that the nature of the move was to drive BTC adoption forward through remittances. Lutskevych went on to add further:

“One of the primary reasons why the country passed such legislation was to lower remittance costs, promote financial inclusion and boost GDP by leveraging BTC and its transfer infrastructure to promote financial inclusion.”

Per his words, the adoption of new technology is often the result of “pure necessity,” and that may be the case with Bitcoin and cryptocurrencies in developing nations whose populations are heavily affected by remittance costs, which according to Markus Franke, a partner at cross-border crypto payments firm Celo Labs, averages 6.38% and can often go over 10% of the amount being sent.

Driving his point forward, Lutskevych added that the Chainalysis Global Crypto Adoption Index for 2021 shows that out of the top 20 countries by cryptocurrency adoption, two-thirds are “developing countries with a high percentage of GDP coming from remittances.”

He added that developing countries are now recognizing the value of “BTC’s scalable transfer infrastructure, combined with Bitcoin’s sound money properties and decentralization.”

Lutskevych also noted that Bitcoin’s Lightning Network capacity is up over 25% since El Salvador’s Bitcoin Law came into effect, while the number of payment channels routing payments on the network also moved up significantly and began a “parabolic trend right around the time of the law becoming effective.”

To him, growing peer-to-peer (P2P) trading volumes in countries like Nigeria suggest cryptocurrencies like BTC are playing a role in “getting foreign money into the country.”

Franke added to the line of thought, saying cryptocurrencies can be programmed, allowing for more complex financial operations without third parties. These features, Franke said, have seen remittance giants take an interest in cryptocurrencies.

As an example, he pointed to MoneyGram launching USDC settlement using the Stellar blockchain, and added that the Asian Development Bank has revealed services like Ripple, Mobile Money and bKash helped “deliver faster settlement, greater operational efficiencies and more competitive foreign exchange rates during the COVID-19 pandemic.”

Amr Shady, CEO of business-to-business payment and financing platform Tribal Credit, told Cointelegraph that Mexico could be another example of a country adopting cryptocurrencies for remittances, as estimates have shown they could reduce costs by 50% to 90%.

It All Comes Down To Numbers

If, indeed, five countries do adopt Bitcoin or any other cryptocurrency as legal tender, adoption seems likely going to keep on growing. Emerging markets rely on remittances and the use of stablecoins appears to be a viable solution to the volatility of crypto assets like BTC.

Projects like Facebook’s Novi are already using stablecoins to facilitate cross-border transactions, with the project’s marketing efforts having a heavy focus on remittances. Central bank digital currencies (CBDCs) may offer similar cheap transactions that will help users move money across borders at a low cost.

The problem with these two solutions is the central entities behind them who can easily start discriminating, and for example, geoblock users. Decentralized blockchains are working on scaling to accommodate thousands of transactions per second, bringing down remittance costs.

Add in stablecoins, and the only thing blocking mass crypto adoption could very well be the specific knowledge needed to navigate different blockchains and understand how addresses work.

User-experience improvements have for long been moving addresses and blockchain navigation to the back while helping users focus on payments. Once the use of blockchain technology happens behind the scenes at a low cost, remittances will inevitably turn to crypto. Yet, those transactions may be years away.

Updated: 11-30-2021

A Mexican Crypto Startup Wants To Make Cash Remittances Cheaper

Bitso says it’s helping money transfer services cut the cost of exchanging dollars for pesos.

Even as cryptocurrencies have skyrocketed in price, there’s always been the question of what they can really be used for. One of the stronger use cases is remittances—the cross-border cash transfers that have long been dominated by the likes of Western Union Co. and MoneyGram International Inc. Intuitively, a technology that allows one person to send money to another without an intermediary could make remittances quicker and cheaper.

There are still huge barriers, from the wild volatility of many cryptocurrencies to the complexities of buying them in one country and then converting them back to traditional cash in another.

Bitso, a Mexico City-based crypto trading platform, says it’s making a dent. It estimates it’s helping money transmitters move around 2.5% of the more than $40 billion in remittances flowing across the border from the U.S. to Mexico annually.

Bitso doesn’t offer remittances directly on its crypto trading app, which has more than 2 million users in Latin America. Instead, it’s so far been doing work behind the scenes for money transfer services, which can use Bitso’s API, a technology that shares data among apps or services.

One such company is Bridge21, a U.S. service that says it’s been using crypto for Mexico-bound remittances since 2016. “Depending on the cryptocurrency you use it can take minutes or even seconds to move the money as opposed to days,” says Will Madden, Bridge21’s chief executive officer.

These businesses can collect dollars in the U.S. and then convert it to crypto, which can then be exchanged for pesos to be paid out in Mexico. Bitso’s customers in remittances can use different tokens, but one option is to swap their currencies for the USDC stablecoin, a crypto currency that’s pegged to the U.S. dollar, which means its price is supposed to remain $1 at all times.

In a big chunk of these transactions, users don’t even know their money is being turned into crypto along the way, says Bitso co-founder and CEO Daniel Vogel.

In other words, Bitso hasn’t yet eliminated all the layers of middlemen, though it says it can make things more efficient. “Seventy percent of all remittance flows are cash to cash,” says Santiago Alvarado, Bitso’s head of product for business.

“Unless the first mile and last mile start with a digital wallet or digital bank account, you still have to have that partner that can collect cash and allows for cash pick-up on the other end. Everything else can be done within Bitso.”

Remittances remain a gigantic source of income for the Mexican economy as a whole, representing almost 4% of the country’s gross domestic product. An estimated 95% comes from emigrants in the U.S., who have long relied on relatively expensive remittance services that may operate out of storefronts or desks inside convenience stores.

According to data from the World Bank, the average cost of sending $200 from the U.S. to Mexico in the first quarter of 2021 was $7.29, or 3.65%.

Douglas King, a payments risk expert with the Federal Reserve Bank of Atlanta, says crypto can bring much-needed competition to the industry. “There is potential for continued pressure to bring the cost down,” he says.

The transfer business is expensive because it involves having agents on both sides of the border, as well the costs of foreign exchange, banking relationships, and ensuring ready access to cash in multiple currencies and countries.

Commissions can pile up throughout the transaction. Bitso says it can cut one of the biggest costs—foreign exchange—down to a few tenths of a percentage point, compared with about 2% at some providers.

Bitso is hardly the first company to try to do remittances via crypto—one incumbent has already taken a shot. MoneyGram, one of the largest money-transfer services in the U.S., worked with Ripple Labs Inc. in 2019 to try out a similar approach. It sent some foreign-exchange transactions over Ripple’s network, using a crypto token called XRP as the bridge between traditional currencies.

“The technology works,” says MoneyGram CEO Alex Holmes. “But it was an early product and had a long way to go.” And then Ripple ran into a regulatory snag that Holmes says forced MoneyGram to stop using it.

The U.S. Securities and Exchange Commission alleged that the XRP token was essentially an unregistered security that Ripple sold to raise money for the company. Ripple has disputed that XRP is a security and is fighting the SEC’s lawsuit.

MoneyGram has launched a different crypto partnership, this time with the Stellar Development Foundation, which is intended to allow its consumers to use local currencies to buy USDC stablecoins, or to exchange those tokens for cash. The foundation, which maintains an open-source payments network called Stellar, also worked with Bitso to integrate USDC into its platform.

But MoneyGram’s experience with Ripple points to a challenge for crypto remittances: The regulations around crypto are essentially still being written. On Nov. 1, a group of federal regulators in the U.S., including the Treasury Department and the Federal Reserve, issued a report calling for stricter rules for stablecoins, which are now valued at around $130 billion.

Because such coins are typically designed to be backed by traditional currencies and assets held in reserve, the regulators urged Congress to pass laws to regulate them like banks so as to lessen the risks of panics akin to bank runs.

“The regulations have not caught up, and it’s a total blind spot,” says John Court, who heads regulatory affairs at the Bank Policy Institute, a trade association. He says companies using crypto in remittances should “absolutely be worried” about policymakers looking over their shoulders.

In Mexico, too, crypto has been viewed with skepticism by policymakers. The nation’s central bank has repeatedly said cryptocurrencies aren’t legal tender and that financial institutions can’t allow consumers to buy and sell goods using crypto, though companies are able to use the technology internally.

The Comisión Nacional Bancaria y de Valores, a financial regulator, says in a statement that money transmitters including MoneyGram can’t offer to turn cash into tokens as the company plans to with Stellar.

“We are aware of Mexico’s position and if/when we do expand into the Mexican market, we will do so only after securing required licensure and ensuring the structure is compliant with Mexican law,” a spokesperson for MoneyGram says in a statement.

The CNBV also says that business models being developed though crypto trading platforms aren’t regulated by any financial authority in the country. (Bitso says its crypto business is regulated in Gibraltar, where it has a license.) “Mexico still doesn’t have strong regulation in terms of cryptocurrencies, there’s still a legal void,” says Mario Di Costanzo, the former head of Condusef, Mexico’s consumer protection agency for financial services.

“We also can’t rule out serious problems with money laundering and frauds. Consumers are vulnerable because if there’s ever a problem with a transaction, it’s not entirely clear who would be able to help them, and I don’t see the regulation changing in the short term.”

The fact the remittances cross international borders means that a broad swathe of agencies could enter the fray. “There will be huge push back from regulators on the use of cryptocurrencies” for regular remittances, says Ahmed Ismail, co-founder at Havyn Global, an online platform for digital currencies based in Dubai.

He says there will always be compliance issues, particularly in countries seen as higher risk for money laundering. “But I do see a shift in many businesses in that they want to learn more about cryptocurrencies and naturally we’ll see more crypto-based solutions.”

Updated: 11-30-2021

A Mexican Crypto Startup Wants To Make Cash Remittances Cheaper

Bitso says it’s helping money transfer services cut the cost of exchanging dollars for pesos.

Even as cryptocurrencies have skyrocketed in price, there’s always been the question of what they can really be used for. One of the stronger use cases is remittances—the cross-border cash transfers that have long been dominated by the likes of Western Union Co. and MoneyGram International Inc. Intuitively, a technology that allows one person to send money to another without an intermediary could make remittances quicker and cheaper.

There are still huge barriers, from the wild volatility of many cryptocurrencies to the complexities of buying them in one country and then converting them back to traditional cash in another. Bitso, a Mexico City-based crypto trading platform, says it’s making a dent. It estimates it’s helping money transmitters move around 2.5% of the more than $40 billion in remittances flowing across the border from the U.S. to Mexico annually.

Bitso doesn’t offer remittances directly on its crypto trading app, which has more than 2 million users in Latin America. Instead, it’s so far been doing work behind the scenes for money transfer services, which can use Bitso’s API, a technology that shares data among apps or services.

One such company is Bridge21, a U.S. service that says it’s been using crypto for Mexico-bound remittances since 2016. “Depending on the cryptocurrency you use it can take minutes or even seconds to move the money as opposed to days,” says Will Madden, Bridge21’s chief executive officer.

These businesses can collect dollars in the U.S. and then convert it to crypto, which can then be exchanged for pesos to be paid out in Mexico. Bitso’s customers in remittances can use different tokens, but one option is to swap their currencies for the USDC stablecoin, a crypto currency that’s pegged to the U.S. dollar, which means its price is supposed to remain $1 at all times.

In a big chunk of these transactions, users don’t even know their money is being turned into crypto along the way, says Bitso co-founder and CEO Daniel Vogel.

In other words, Bitso hasn’t yet eliminated all the layers of middlemen, though it says it can make things more efficient. “Seventy percent of all remittance flows are cash to cash,” says Santiago Alvarado, Bitso’s head of product for business. “Unless the first mile and last mile start with a digital wallet or digital bank account, you still have to have that partner that can collect cash and allows for cash pick-up on the other end. Everything else can be done within Bitso.”

Remittances remain a gigantic source of income for the Mexican economy as a whole, representing almost 4% of the country’s gross domestic product. An estimated 95% comes from emigrants in the U.S., who have long relied on relatively expensive remittance services that may operate out of storefronts or desks inside convenience stores. According to data from the World Bank, the average cost of sending $200 from the U.S. to Mexico in the first quarter of 2021 was $7.29, or 3.65%.

Douglas King, a payments risk expert with the Federal Reserve Bank of Atlanta, says crypto can bring much-needed competition to the industry. “There is potential for continued pressure to bring the cost down,” he says.

The transfer business is expensive because it involves having agents on both sides of the border, as well the costs of foreign exchange, banking relationships, and ensuring ready access to cash in multiple currencies and countries. Commissions can pile up throughout the transaction. Bitso says it can cut one of the biggest costs—foreign exchange—down to a few tenths of a percentage point, compared with about 2% at some providers.

Bitso is hardly the first company to try to do remittances via crypto—one incumbent has already taken a shot. MoneyGram, one of the largest money-transfer services in the U.S., worked with Ripple Labs Inc. in 2019 to try out a similar approach. It sent some foreign-exchange transactions over Ripple’s network, using a crypto token called XRP as the bridge between traditional currencies.

“The technology works,” says MoneyGram CEO Alex Holmes. “But it was an early product and had a long way to go.” And then Ripple ran into a regulatory snag that Holmes says forced MoneyGram to stop using it.

The U.S. Securities and Exchange Commission alleged that the XRP token was essentially an unregistered security that Ripple sold to raise money for the company. Ripple has disputed that XRP is a security and is fighting the SEC’s lawsuit.

MoneyGram has launched a different crypto partnership, this time with the Stellar Development Foundation, which is intended to allow its consumers to use local currencies to buy USDC stablecoins, or to exchange those tokens for cash. The foundation, which maintains an open-source payments network called Stellar, also worked with Bitso to integrate USDC into its platform.

But MoneyGram’s experience with Ripple points to a challenge for crypto remittances: The regulations around crypto are essentially still being written. On Nov. 1, a group of federal regulators in the U.S., including the Treasury Department and the Federal Reserve, issued a report calling for stricter rules for stablecoins, which are now valued at around $130 billion.

Because such coins are typically designed to be backed by traditional currencies and assets held in reserve, the regulators urged Congress to pass laws to regulate them like banks so as to lessen the risks of panics akin to bank runs.

“The regulations have not caught up, and it’s a total blind spot,” says John Court, who heads regulatory affairs at the Bank Policy Institute, a trade association. He says companies using crypto in remittances should “absolutely be worried” about policymakers looking over their shoulders.

In Mexico, too, crypto has been viewed with skepticism by policymakers. The nation’s central bank has repeatedly said cryptocurrencies aren’t legal tender and that financial institutions can’t allow consumers to buy and sell goods using crypto, though companies are able to use the technology internally.

The Comisión Nacional Bancaria y de Valores, a financial regulator, says in a statement that money transmitters including MoneyGram can’t offer to turn cash into tokens as the company plans to with Stellar. “We are aware of Mexico’s position and if/when we do expand into the Mexican market, we will do so only after securing required licensure and ensuring the structure is compliant with Mexican law,” a spokesperson for MoneyGram says in a statement.

The CNBV also says that business models being developed though crypto trading platforms aren’t regulated by any financial authority in the country. (Bitso says its crypto business is regulated in Gibraltar, where it has a license.) “Mexico still doesn’t have strong regulation in terms of cryptocurrencies, there’s still a legal void,” says Mario Di Costanzo, the former head of Condusef, Mexico’s consumer protection agency for financial services. “We also can’t rule out serious problems with money laundering and frauds.

Consumers are vulnerable because if there’s ever a problem with a transaction, it’s not entirely clear who would be able to help them, and I don’t see the regulation changing in the short term.”

The fact the remittances cross international borders means that a broad swathe of agencies could enter the fray. “There will be huge push back from regulators on the use of cryptocurrencies” for regular remittances, says Ahmed Ismail, co-founder at Havyn Global, an online platform for digital currencies based in Dubai.

He says there will always be compliance issues, particularly in countries seen as higher risk for money laundering. “But I do see a shift in many businesses in that they want to learn more about cryptocurrencies and naturally we’ll see more crypto-based solutions.”

Updated: 2-1-2022

Mexicans Abroad Sent A Record $52 Billion Back Home Last Year

* Foreign Workers Increased Remittances During The Pandemic

* Growth Of Mexico’s Economy Stalled In Second Half Of 2021

Mexico received a record $51.6 billion in remittances last year, helping to soften the impact on consumers from a stalled economy.

The money sent by Mexican workers abroad jumped 27% compared to 2020, according to central bank figures published Tuesday. That increase was driven by a variety of factors including U.S. stimulus checks to residents, a desire by Mexican workers to assist their struggling families back at home, and money for foreign migrants stuck in Mexico.

“This historic quantity of remittances is not an achievement of the Mexican economy because it is due to the U.S. recovery. In Mexico, the recovery is going slowly,” said Gabriela Siller, director of economic analysis at Banco BASE. “But remittances do help growth because they drive consumption.”

Remittances hit $4.76 billion in December, slightly below the median forecast of economists in a Bloomberg survey.

The recovery of Mexican workers’ employment in the U.S. was better than that of the overall U.S. population, with over 7 million Mexicans employed there by December, according to an analysis by the Mexico City-based Center for Latin American Monetary Studies. Other countries in Latin America, including Colombia and Guatemala, saw similar leaps in contributions from abroad, it said.

“The better-than-expected growth rate for remittances has been seen in almost all parts of the world,” said Dilip Ratha, the head of The Global Knowledge Partnership on Migration and Development, a project of the World Bank, who expects remittances to continue to rise.

“In the next five or ten years, there is no scenario involving a fall in the stock of international migrants. That is going to grow because of income differences and demographic change.”

New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,New Report Reveals Significant,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin Price Briefly Surpasses Market Cap Of Tencent

Broker Touts Exotic Bitcoin Bet To Squeeze Income From Crypto

Broker Touts Exotic Bitcoin Bet To Squeeze Income From Crypto

Tesla’s Crypto-Friendly CEO Is Now The Richest Man In The World

Crypto Market Cap Breaks $1 Trillion Following Jaw-Dropping Rally

Gamblers Could Use Bitcoin At Slot Machines With New Patent

Crypto Users Donate $400K To Julian Assange Defense As Mexico Proposes Asylum

Grayscale Ethereum Trust Fell 22% Despite Rally In Holdings

Bitcoin’s Bulls Should Fear Its Other Scarcity Problem

Ether Follows Bitcoin To Record High Amid Dizzying Crypto Rally

Retail Investors Are Largely Uninvolved As Bitcoin Price Chases $40K

Bitcoin Breaches $34,000 As Rally Extends Into New Year

Social Media Interest In Bitcoin Hits All-Time High

Bitcoin Price Quickly Climbs To $31K, Liquidating $100M Of Shorts

How Massive Bitcoin Buyer Activity On Coinbase Propelled BTC Price Past $32K

FinCEN Wants US Citizens To Disclose Offshore Crypto Holdings of $10K+

Governments Will Start To Hodl Bitcoin In 2021

Crypto-Linked Stocks Extend Rally That Produced 400% Gains

‘Bitcoin Liquidity Crisis’ — BTC Is Becoming Harder To Buy On Exchanges, Data Shows

Bitcoin Looks To Gain Traction In Payments

BTC Market Cap Now Over Half A Trillion Dollars. Major Weekly Candle Closed!!

Elon Musk And Satoshi Nakamoto Making Millionaires At Record Pace

Binance Enables SegWit Support For Bitcoin Deposits As Adoption Grows

Santoshi Nakamoto Delivers $24.5K Christmas Gift With Another New All-Time High

Bitcoin’s Rally Has Already Outlasted 2017’s Epic Run

Gifting Crypto To Loved Ones This Holiday? Educate Them First

Scaramucci’s SkyBridge Files With SEC To Launch Bitcoin Fund

Samsung Integrates Bitcoin Wallets And Exchange Into Galaxy Phones

HTC Smartphone Will Run A Full Bitcoin Node (#GotBitcoin?)

HTC’s New 5G Router Can Host A Full Bitcoin Node

Bitcoin Miners Are Heating Homes Free of Charge

Bitcoin Miners Will Someday Be Incorporated Into Household Appliances

Musk Inquires About Moving ‘Large Transactions’ To Bitcoin

How To Invest In Bitcoin: It Can Be Easy, But Watch Out For Fees

Megan Thee Stallion Gives Away $1 Million In Bitcoin

CoinFLEX Sets Up Short-Term Lending Facility For Crypto Traders

Wall Street Quants Pounce On Crytpo Industry And Some Are Not Sure What To Make Of It

Bitcoin Shortage As Wall Street FOMO Turns BTC Whales Into ‘Plankton’

Bitcoin Tops $22,000 And Strategists Say Rally Has Further To Go

Why Bitcoin Is Overpriced by More Than 50%

Kraken Exchange Will Integrate Bitcoin’s Lightning Network In 2021

New To Bitcoin? Stay Safe And Avoid These Common Scams

Andreas M. Antonopoulos And Simon Dixon Say Don’t Buy Bitcoin!

Famous Former Bitcoin Critics Who Conceded In 2020

Jim Cramer Bought Bitcoin While ‘Off Nicely From The Top’ In $17,000S

The Wealthy Are Jumping Into Bitcoin As Stigma Around Crypto Fades

WordPress Adds Official Ethereum Ad Plugin

France Moves To Ban Anonymous Crypto Accounts To Prevent Money Laundering

10 Predictions For 2021: China, Bitcoin, Taxes, Stablecoins And More

Movie Based On Darknet Market Silk Road Premiering In February

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

US Gov Is Bitcoin’s Last Remaining Adversary, Says Messari Founder

$1,200 US Stimulus Check Is Now Worth Almost $4,000 If Invested In Bitcoin

German Bank Launches Crypto Fund Covering Portfolio Of Digital Assets

World Governments Agree On Importance Of Crypto Regulation At G-7 Meeting

Why Some Investors Get Bitcoin So Wrong, And What That Says About Its Strengths

It’s Not About Data Ownership, It’s About Data Control, EFF Director Says

‘It Will Send BTC’ — On-Chain Analyst Says Bitcoin Hodlers Are Only Getting Stronger

Bitcoin Arrives On Wall Street: S&P Dow Jones Launching Crypto Indexes In 2021

Audio Streaming Giant Spotify Is Looking Into Crypto Payments

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Bitcoin Moves $500K Around The Globe Every Second, Says Samson Mow

Pomp Talks Shark Tank’s Kevin O’leary Into Buying ‘A Little More’ Bitcoin

Bitcoin Is The Tulipmania That Refuses To Die

Ultimate Resource On Ethereum 2.0

Biden Should Integrate Bitcoin Into Us Financial System, Says Niall Ferguson

Bitcoin Is Winning The Monetary Revolution

Cash Is Trash, Dump Gold, Buy Bitcoin!

Bitcoin Price Sets New Record High Above $19,783

You Call That A Record? Bitcoin’s November Gains Are 3x Stock Market’s

Bitcoin Fights Back With Power, Speed and Millions of Users

Exchanges Outdo Auctions For Governments Cashing In Criminal Crypto, Says Exec

Coinbase CEO: Trump Administration May ‘Rush Out’ Burdensome Crypto Wallet Rules

Bitcoin Plunges Along With Other Coins Providing For A Major Black Friday Sale Opportunity

The Most Bullish Bitcoin Arguments For Your Thanksgiving Table

‘Bitcoin Tuesday’ To Become One Of The Largest-Ever Crypto Donation Events

World’s First 24/7 Crypto Call-In Station!!!

Bitcoin Trades Again Near Record, Driven By New Group Of Buyers

Friendliest Of Them All? These Could Be The Best Countries For Crypto

Bitcoin Price Doubles Since The Halving, With Just 3.4M Bitcoin Left For Buyers

First Company-Sponsored Bitcoin Retirement Plans Launched In US

Poker Players Are Enhancing Winnings By Cashing Out In Bitcoin

Crypto-Friendly Brooks Gets Nod To Serve 5-Year Term Leading Bank Regulator

The Bitcoin Comeback: Is Crypto Finally Going Mainstream?

The Dark Future Where Payments Are Politicized And Bitcoin Wins

Mexico’s 3rd Richest Man Reveals BTC Holdings As Bitcoin Breaches $18,000

Ultimate Resource On Mike Novogratz And Galaxy Digital’s Bitcoin News

Bitcoin’s Gunning For A Record And No One’s Talking About It

Simple Steps To Keep Your Crypto Safe

US Company Now Lets Travelers Pay For Passports With Bitcoin

Billionaire Hedge Fund Investor Stanley Druckenmiller Says He Owns Bitcoin In CNBC Interview

China’s UnionPay And Korea’s Danal To Launch Crypto-Supporting Digital Card #GotBitcoin

Bitcoin Is Back Trading Near Three-Year Highs

Bitcoin Transaction Fees Rise To 28-Month High As Hashrate Drops Amid Price Rally

Market Is Proving Bitcoin Is ‘Ultimate Safe Haven’ — Anthony Pompliano

3 Reasons Why Bitcoin Price Suddenly Dropping Below $13,000 Isn’t Bearish

Bitcoin Resurgence Leaves Institutional Acceptance Unanswered

WordPress Content Can Now Be Timestamped On Ethereum

PayPal To Offer Crypto Payments Starting In 2021 (A-Z) (#GotBitcoin?)

As Bitcoin Approaches $13,000 It Breaks Correlation With Equities

Crypto M&A Surges Past 2019 Total As Rest of World Eclipses U.S. (#GotBitcoin?)

How HBCUs Are Prepping Black Students For Blockchain Careers

Why Every US Congressman Just Got Sent Some ‘American’ Bitcoin

CME Sounding Out Crypto Traders To Gauge Market Demand For Ether Futures, Options

Caitlin Long On Bitcoin, Blockchain And Rehypothecation (#GotBitcoin?)

Bitcoin Drops To $10,446.83 As CFTC Charges BitMex With Illegally Operating Derivatives Exchange

BitcoinACKs Lets You Track Bitcoin Development And Pay Coders For Their Work

One Of Hal Finney’s Lost Contributions To Bitcoin Core To Be ‘Resurrected’ (#GotBitcoin?)

Cross-chain Money Markets, Latest Attempt To Bring Liquidity To DeFi

Memes Mean Mad Money. Those Silly Defi Memes, They’re Really Important (#GotBitcoin?)

Bennie Overton’s Story About Our Corrupt U.S. Judicial, Global Financial Monetary System And Bitcoin

Stop Fucking Around With Public Token Airdrops In The United States (#GotBitcoin?)

Mad Money’s Jim Cramer Will Invest 1% Of Net Worth In Bitcoin Says, “Gold Is Dangerous”

State-by-state Licensing For Crypto And Payments Firms In The Us Just Got Much Easier (#GotBitcoin?)

Bitcoin (BTC) Ranks As World 6Th Largest Currency

Pomp Claims He Convinced Jim Cramer To Buy Bitcoin

Traditional Investors View Bitcoin As If It Were A Technology Stock

Mastercard Releases Platform Enabling Central Banks To Test Digital Currencies (#GotBitcoin?)

Being Black On Wall Street. Top Black Executives Speak Out About Racism (#GotBitcoin?)

Tesla And Bitcoin Are The Most Popular Assets On TradingView (#GotBitcoin?)

From COVID Generation To Crypto Generation (#GotBitcoin?)

Right-Winger Tucker Carlson Causes Grayscale Investments To Pull Bitcoin Ads

Bitcoin Has Lost Its Way: Here’s How To Return To Crypto’s Subversive Roots

Cross Chain Is Here: NEO, ONT, Cosmos And NEAR Launch Interoperability Protocols (#GotBitcoin?)

Crypto Trading Products Enter The Mainstream With A Number Of Inherent Advantages (#GotBitcoin?)

Crypto Goes Mainstream With TV, Newspaper Ads (#GotBitcoin?)

A Guarded Generation: How Millennials View Money And Investing (#GotBitcoin?)

Blockchain-Backed Social Media Brings More Choice For Users

California Moves Forward With Digital Asset Bill (#GotBitcoin?)

Walmart Adds Crypto Cashback Through Shopping Loyalty Platform StormX (#GotBitcoin?)

Congressman Tom Emmer To Lead First-Ever Crypto Town Hall (#GotBitcoin?)

Why It’s Time To Pay Attention To Mexico’s Booming Crypto Market (#GotBitcoin?)

The Assets That Matter Most In Crypto (#GotBitcoin?)

Ultimate Resource On Non-Fungible Tokens

Bitcoin Community Highlights Double-Standard Applied Deutsche Bank Epstein Scandal

Blockchain Makes Strides In Diversity. However, Traditional Tech Industry Not-S0-Much (#GotBitcoin?)

An Israeli Blockchain Startup Claims It’s Invented An ‘Undo’ Button For BTC Transactions

After Years of Resistance, BitPay Adopts SegWit For Cheaper Bitcoin Transactions

US Appeals Court Allows Warrantless Search of Blockchain, Exchange Data

Central Bank Rate Cuts Mean ‘World Has Gone Zimbabwe’

This Researcher Says Bitcoin’s Elliptic Curve Could Have A Secret Backdoor

China Discovers 4% Of Its Reserves Or 83 Tons Of It’s Gold Bars Are Fake (#GotBitcoin?)

Former Legg Mason Star Bill Miller And Bloomberg Are Optimistic About Bitcoin’s Future

Yield Chasers Are Yield Farming In Crypto-Currencies (#GotBitcoin?)

Australia Post Office Now Lets Customers Buy Bitcoin At Over 3,500 Outlets

Anomaly On Bitcoin Sidechain Results In Brief Security Lapse

SEC And DOJ Charges Lobbying Kingpin Jack Abramoff And Associate For Money Laundering

Veteran Commodities Trader Chris Hehmeyer Goes All In On Crypto (#GotBitcoin?)

Activists Document Police Misconduct Using Decentralized Protocol (#GotBitcoin?)

Supposedly, PayPal, Venmo To Roll Out Crypto Buying And Selling (#GotBitcoin?)

Industry Leaders Launch PayID, The Universal ID For Payments (#GotBitcoin?)

Crypto Quant Fund Debuts With $23M In Assets, $2.3B In Trades (#GotBitcoin?)

The Queens Politician Who Wants To Give New Yorkers Their Own Crypto

Why Does The SEC Want To Run Bitcoin And Ethereum Nodes?

US Drug Agency Failed To Properly Supervise Agent Who Stole $700,000 In Bitcoin In 2015

Layer 2 Will Make Bitcoin As Easy To Use As The Dollar, Says Kraken CEO

Bootstrapping Mobile Mesh Networks With Bitcoin Lightning

Nevermind Coinbase — Big Brother Is Already Watching Your Coins (#GotBitcoin?)

BitPay’s Prepaid Mastercard Launches In US to Make Crypto Accessible (#GotBitcoin?)

Germany’s Deutsche Borse Exchange To List New Bitcoin Exchange-Traded Product

‘Bitcoin Billionaires’ Movie To Tell Winklevoss Bros’ Crypto Story

US Pentagon Created A War Game To Fight The Establishment With BTC (#GotBitcoin?)

JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini (#GotBitcoin?)

Bitcoin Advocates Cry Foul As US Fed Buying ETFs For The First Time

Final Block Mined Before Halving Contained Reminder of BTC’s Origins (#GotBitcoin?)

Meet Brian Klein, Crypto’s Own ‘High-Stakes’ Trial Attorney (#GotBitcoin?)

3 Reasons For The Bitcoin Price ‘Halving Dump’ From $10K To $8.1K

Bitcoin Outlives And Outlasts Naysayers And First Website That Declared It Dead Back In 2010

Hedge Fund Pioneer Turns Bullish On Bitcoin Amid ‘Unprecedented’ Monetary Inflation

Antonopoulos: Chainalysis Is Helping World’s Worst Dictators & Regimes (#GotBitcoin?)

Survey Shows Many BTC Holders Use Hardware Wallet, Have Backup Keys (#GotBitcoin?)

Iran Ditches The Rial Amid Hyperinflation As Localbitcoins Seem To Trade Near $35K

Buffett ‘Killed His Reputation’ by Being Stupid About BTC, Says Max Keiser (#GotBitcoin?)

Blockfolio Quietly Patches Years-Old Security Hole That Exposed Source Code (#GotBitcoin?)

Bitcoin Won As Store of Value In Coronavirus Crisis — Hedge Fund CEO

Decentralized VPN Gaining Steam At 100,000 Users Worldwide (#GotBitcoin?)

Crypto Exchange Offers Credit Lines so Institutions Can Trade Now, Pay Later (#GotBitcoin?)

Zoom Develops A Cryptocurrency Paywall To Reward Creators Video Conferencing Sessions (#GotBitcoin?)

Bitcoin Startup Purse.io And Major Bitcoin Cash Partner To Shut Down After 6-Year Run

Open Interest In CME Bitcoin Futures Rises 70% As Institutions Return To Market

Square’s Users Can Route Stimulus Payments To BTC-Friendly Cash App

$1.1 Billion BTC Transaction For Only $0.68 Demonstrates Bitcoin’s Advantage Over Banks

Bitcoin Could Become Like ‘Prison Cigarettes’ Amid Deepening Financial Crisis

Bitcoin Holds Value As US Debt Reaches An Unfathomable $24 Trillion

How To Get Money (Crypto-currency) To People In An Emergency, Fast

Bitcoin Miner Manufacturers Mark Down Prices Ahead of Halving

Privacy-Oriented Browsers Gain Traction (#GotBitcoin?)

‘Breakthrough’ As Lightning Uses Web’s Forgotten Payment Code (#GotBitcoin?)

Bitcoin Starts Quarter With Price Down Just 10% YTD vs U.S. Stock’s Worst Quarter Since 2008

Bitcoin Enthusiasts, Liberal Lawmakers Cheer A Fed-Backed Digital Dollar

Crypto-Friendly Bank Revolut Launches In The US (#GotBitcoin?)

The CFTC Just Defined What ‘Actual Delivery’ of Crypto Should Look Like (#GotBitcoin?)

Crypto CEO Compares US Dollar To Onecoin Scam As Fed Keeps Printing (#GotBitcoin?)

Stuck In Quarantine? Become A Blockchain Expert With These Online Courses (#GotBitcoin?)

Bitcoin, Not Governments Will Save the World After Crisis, Tim Draper Says

Crypto Analyst Accused of Photoshopping Trade Screenshots (#GotBitcoin?)

QE4 Begins: Fed Cuts Rates, Buys $700B In Bonds; Bitcoin Rallies 7.7%

Mike Novogratz And Andreas Antonopoulos On The Bitcoin Crash

Amid Market Downturn, Number of People Owning 1 BTC Hits New Record (#GotBitcoin?)

Fatburger And Others Feed $30 Million Into Ethereum For New Bond Offering (#GotBitcoin?)

Pornhub Will Integrate PumaPay Recurring Subscription Crypto Payments (#GotBitcoin?)

Intel SGX Vulnerability Discovered, Cryptocurrency Keys Threatened

Bitcoin’s Plunge Due To Manipulation, Traditional Markets Falling or PlusToken Dumping?

Countries That First Outlawed Crypto But Then Embraced It (#GotBitcoin?)

Bitcoin Maintains Gains As Global Equities Slide, US Yield Hits Record Lows

HTC’s New 5G Router Can Host A Full Bitcoin Node

India Supreme Court Lifts RBI Ban On Banks Servicing Crypto Firms (#GotBitcoin?)

Analyst Claims 98% of Mining Rigs Fail to Verify Transactions (#GotBitcoin?)

Blockchain Storage Offers Security, Data Transparency And immutability. Get Over it!

Black Americans & Crypto (#GotBitcoin?)

Coinbase Wallet Now Allows To Send Crypto Through Usernames (#GotBitcoin)

New ‘Simpsons’ Episode Features Jim Parsons Giving A Crypto Explainer For The Masses (#GotBitcoin?)

Crypto-currency Founder Met With Warren Buffett For Charity Lunch (#GotBitcoin?)

Bitcoin’s Potential To Benefit The African And African-American Community

Coinbase Becomes Direct Visa Card Issuer With Principal Membership

Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

Jill Carlson, Meltem Demirors Back $3.3M Round For Non-Custodial Settlement Protocol Arwen

Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Bitcoin’s Lightning Comes To Apple Smartwatches With New App (#GotBitcoin?)

E-Trade To Offer Crypto Trading (#GotBitcoin)

Bitfinex Used Tether Reserves To Mask Missing $850 Million, Probe Finds (#GotBitcoin?)

21-Year-Old Jailed For 10 Years After Stealing $7.5M In Crypto By Hacking Cell Phones (#GotBitcoin?)

You Can Now Shop With Bitcoin On Amazon Using Lightning (#GotBitcoin?)

Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin, Bright Future Ahead (#GotBitcoin?)

Crypto Faithful Say Blockchain Can Remake Securities Market Machinery (#GotBitcoin?)

Disney In Talks To Acquire The Owner Of Crypto Exchanges Bitstamp And Korbit (#GotBitcoin?)

Crypto Exchange Gemini Rolls Out Native Wallet Support For SegWit Bitcoin Addresses (#GotBitcoin?)

Binance Delists Bitcoin SV, CEO Calls Craig Wright A ‘Fraud’ (#GotBitcoin?)

Bitcoin Outperforms Nasdaq 100, S&P 500, Grows Whopping 37% In 2019 (#GotBitcoin?)

Bitcoin Passes A Milestone 400 Million Transactions (#GotBitcoin?)

Future Returns: Why Investors May Want To Consider Bitcoin Now (#GotBitcoin?)