Rise of The FinFluencer And How They Target Young And Inexperienced Investors

Are Social Media ‘Finfluencers’ Coming For Your 401(k)? Rise of The FinFluencer And How They Target Young And Inexperienced Investors

There’s some fine money advice on the web but, investor beware, they are working off the same algorithms that addict you to cat photos.

Social media’s next victim could be your 401(k).

Finance influencers — or “finfluencers” — are becoming a hot new thing on social media sites like TikTok and Instagram. This may be the next big content moderation headache for the industry.

Related:

TikTok Is The Place To Go For Financial Advice If You’re A Young Adult

Facebook Offers Money To Reel In TikTok Creators

Robo-advisers Target The New Universe of Retail Traders

Ultimate Resource For Financial Advisers By Financial Advisers On Bitcoin

But for every clear-spoken, genuine and decent character on social media, there is a long tail of the mad, bad and outright dangerous. I asked my teenage son if he saw much finance stuff on social media, he smirked and said:

“What, you mean like Sigma Male Grindset Culture?” It sounds superficially risible and a lot might be parody, but money-focused social media content can quickly turn unpleasant and wrong.

Social media sites feed you what you appear to enjoy to keep you engaged. This is a tried and tested business model. TikTok’s algorithm sends users down rabbit holes with ever more extreme versions of the content that they like to consume, according to a recent Wall Street Journal investigation.

And what do these online rabbit holes look like in finance? Do they contain ever-more nuanced explanations of the tax treatment of different trust structures? Or something more like astrological influences on crypto prices and “Why your entire pension should go into this three-times levered zinc-futures ETF today”?

People will lose money. Suckers will get burned. Sigma males will LOL.

Regulators aren’t totally blind to what’s going on here. The U.S. Securities and Exchange Commission will soon publish a report into this year’s GameStop Corp. saga — where a struggling retailer’s stock was pumped up on Reddit and Youtube.

SEC Chair Gary Gensler is concerned about fraud and market manipulation on social media, but is wary of impinging on free speech when it comes to stock recommendations.

However, this week, securities regulators in Massachusetts fined MassMutual $4.75 million for failing to supervise social media use by some of its agents, including Keith “Roaring Kitty” Gill, a Youtube finfluencer who helped spark the GameStop episode.

But that’s the easy part. Anyone who works for a regulated financial company can be quickly brought to heel through their employer. Another relatively easy part is ensuring that anyone who represents a commercial interest discloses that properly.

The hard part is all the other content — the thousands of accounts that might spout terrible investment advice people may actually follow. Fools and their money are soon parted. And on social media you can reach a thousand fools before your first coffee. Irresponsible, unlawful, or just plain wrong financial advice could explode in popularity if it sounds fun.

Moderating such content might be less traumatic than the job of trawling for atrocity, but spotting bad or incorrect advice requires skill and knowledge. It could be more costly for social media companies.

So far, it is securities regulators concerned with the proper functioning of markets that have taken most interest, but consumer protection and financial conduct regulators should get involved, too.

Financial advice and marketing is rightly heavily regulated. Indeed, the authorities are the biggest finfluencers of all: They have punitive powers that have a more pointed impact than ordinary political voices demanding more be done about, say, hate speech.

When they demand solutions, social media companies will find them.

Updated: 9-16-2021

Wall Street Influencers Are Making $500,000, Topping Even Bankers

Finance firms have long struggled to reach young and new customers — until now.

At first no one could explain why business was picking up at Betterment, a robo adviser aimed at newbie investors. There were about 10,000 signups in one day.

Then Came The Answer: A 25-year-old TikToker from Tennessee was posting videos describing how to retire a millionaire by using the platform.

His name is Austin Hankwitz, and he’s managed to land one of the hottest new gigs: full-time “finfluencer.”

“We were, like, where is this increased activity coming from?” Betterment’s director of communications, Arielle Sobel, said of the sudden increase in customer inquiries. “It was not sponsored by us, so we had no clue.”

Smash that like button, Wall Street: The teens and 20-somethings who steer online conversation — about life hacks, beauty products, Hollywood blockbusters, you name it — are now blazing their way into finance. Influencers like Hankwitz can translate concepts like passive investing or tax harvesting into digestible social media videos using playful twists, music and colorful captions, making investment products and the like feel accessible to millennials and Gen Z-ers.

For the finance industry, partnering with those influencers can be a no-brainer: There’s never been faster and more direct access to that demographic, particularly at a time when retail investing has skyrocketed.

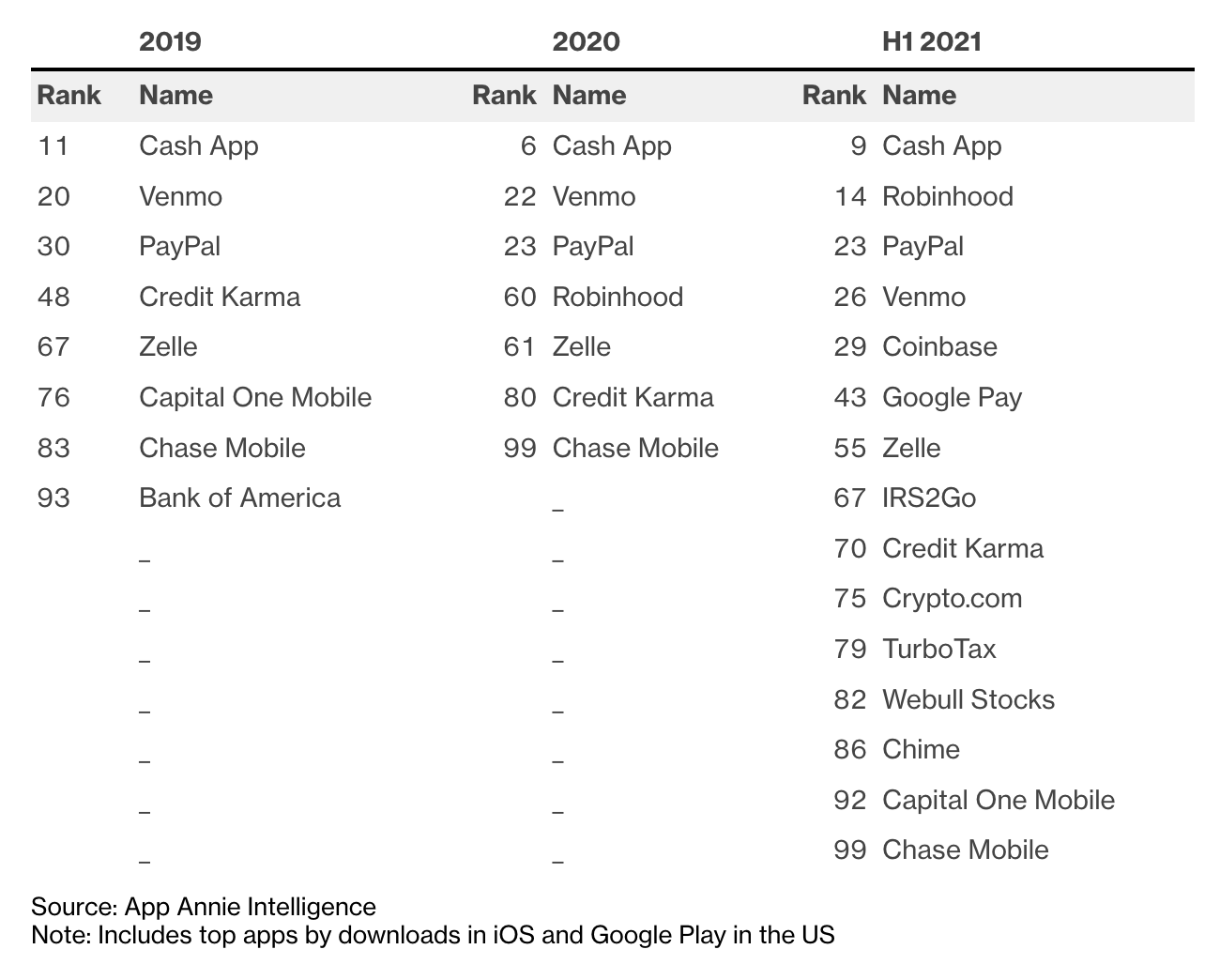

The pandemic left some people with money and time to burn, pushing hours spent on finance apps up 90% in the U.S. compared with the previous year, while downloads of such apps jumped 20%, according to data by analytics firm App Annie.

Participation in the stock market through mobile phones also took off, with hours spent on trading and investing apps spiking 135%.

Once Betterment saw the traction it was getting through Hankwitz’s posts, it hired him within a month to plug its services via social media.

Wealthfront, another robo adviser, has partnered with about 15 influencers including Haley Sacks — known on Instagram as Mrs. Dow Jones — according to Kate Wauck, the firm’s chief communications officer.

“Quite frankly, they’re just better at telling our story than we are,” she said.

In The Green

Until last year, Hankwitz was toiling away in old-fashioned finance, working on mergers and acquisitions for a health care company; making TikTok videos was his side hustle.

Now, he’s a hot commodity to startups and finance companies eager to reach his 495,000 followers. Some of them have also hired him for marketing advice, had him sit in on chats with the CEOs, and have even invited him to sit on the company board.

Hankwitz charges anywhere from $4,500 to $8,000 per post on his TikTok page. He said Fundrise, a real estate investment platform, pays him every month to post two videos on his TikTok, and also offers him a monthly bonus of as much as $2,000 based on how many people he pushes to the platform.

BlockFi, a cryptocurrency trading platform, offers him $25 per person pushed to the platform through his unique code. And stock trading app Public.com offered him a monthly retainer and company equity for a contract that includes replacing the Yahoo Finance stock charts on his videos with theirs.

Hankwitz estimates he’s funded well over 240 accounts for Fundrise, 1,653 for Public and tens of thousands for Betterment. His unique BlockFi code brought in $268,000 of crypto purchases in a month. In all, he’s currently representing six companies.

And for anywhere between $4 and $17 per month, superfans can subscribe to his Patreon channel, where he offers deeper investing and financial analysis. Hankwitz currently has about 1,100 subscribers.

“I was able to quit my job about six months ago to do this full time,” he said.

Hankwitz declined to say how much he brings in annually, but acknowledged that he makes more than $500,000. He also said he’s built a portfolio valued at about $1.3 million since March 2020, in part with the equity received from the brands he represents.

Social media can be a lucrative business for those with big follower counts and the prowess to push customers toward financial products. Creators can get paid anywhere from $100 to $1,500 for a swipe-up advertisement on their Instagram stories to $1,000 to $10,000 for a single post on their feed, according to figures from Brian Hanly, CEO of Bullish Studio, a talent agency for influencers.

On TikTok, the cost of one post can range from $2,500 to $20,000 depending on the video’s virality and the creator’s follower count.

To get there, creators have to develop a certain persona — and on FinTok and its Instagram counterpart, there’s enough variety for everyone.

Creators from a variety of ages, backgrounds and ethnicities offer advice about how to open a Roth IRA, how to invest in real estate, how trading options makes more sense if you compare it to buying makeup, or how to use astrology to predict the price of Bitcoin.

Take Sacks, aka Mrs. Dow Jones — the influencer with 215,000 Instagram followers. She explains compound interest by comparing it to Billie Eilish’s fame, or Bitcoin to Jennifer Lopez and Ben Affleck’s rekindled romance.

Sacks, 30, began her career in comedy, working for TV host David Letterman and Saturday Night Live producer Lorne Michaels. Learning about money was a struggle for Sacks, but one way to make it more relatable for her was to compare it to pop culture and celebrity gossip. On that premise, she launched Mrs. Dow Jones in 2017, and her following has since flourished.

“I created what I needed, and other people needed it too. If you’re following me, you like pop culture, so we have that shared language,” said Sacks. “If you can understand the human relationship between two celebrities, then you can understand any financial concept.”

Four years after launching Mrs. Dow Jones, Sacks has signed with a talent agency, and has built a team of people, including an assistant and a manager, to help her negotiate six-figure deals with brands. She started partnering with Wealthfront two years ago.

“She’s a financial pop star. When have you heard that take on anything?” said Wauck of Wealthfront. “The way that she relates everything to pop culture is just so genius.”

Sacks is also taking advantage of the recent demand for personal finance content by providing a course on her website, Finance Is Cool. On Monday, her followers will be able to purchase a $115 course designed to teach them how to manage their money.

Among other pop culture references in the course, Sacks used the characters from the TV show “Friends” to guide her followers through building an emergency fund.

Finance App Fun

The number of finance apps among the top 100 non-gaming apps by downloads in the U.S. almost doubled between 2019 and 2021.

Other People’s Money

While social media is allowing companies to reach young customers faster than ever, they need to ensure against working with internet stars who are fast and loose with information.

“There’s so much room for growth,” said Hanly. “There’s not enough financial creators out there to basically take on the amount of opportunity that’s coming in, and there’s not nearly enough high-quality, preaching-the-good-word financial creators.”

Personal finance content on social media has gone viral for offering questionable — even flat out wrong — advice, while get-rich-quick schemes have attempted to lure in novice investors.

That’s taken many forms, including videos on how to become a millionaire by selling dog beds on Amazon through dropshipping, how using a debit card makes you financially irresponsible, how to “make a lot of money” day-trading foreign exchange or what stocks to buy and when to buy them.

That’s why TikTok tightened its rules. In May, the social media company said it would take action against content creators who post sponsored videos for financial services and products without clear labels.

Companies can still pay financial influencers for posts, but the new restrictions are meant to ensure that creators are transparent when disclosing commercial links.

Since then, Betterment said it moved all of the content from its TikTok influencers over to Instagram and Instagram Reels. Hankwitz has not re-entered into an agreement with Betterment for TikTok videos since.

Wealthfront said it was optimizing other channels, like YouTube and Instagram, and instead was mostly relying on TikTok’s paid advertising platform rather than posts through influencers.

As fraudulent content and misinformation run rampant and unchecked, financial corporations looking for quality creators are putting in place hefty vetting processes.

Betterment’s compliance and legal teams perform detailed reviews of their social media partners’ scripts. Influencers will then shoot the video and send it back to compliance for a second review.

Wealthfront said that it does extensive background checks on the influencers that get selected to partner with them before signing any contracts. It also includes stipulations in the contract that allow Wealthfront to cancel if certain terms are violated by the creators.

The main law that governs financial influencers is the Investment Advisers Act of 1940, which specifies what qualifies as investment advice and who must register with state and federal regulators in order to provide it.

But there’s one exemption that reduces the risk to influencers, according to Joshua Escalante Troesh, a registered financial adviser and founder of Purposeful Strategic Partners: Unregistered individuals can dispense financial advice if they do so through a “publication of regular and general circulation.”

“That legal exemption is where a lot of people are hanging their hats on, until a court case happens, it’s hard to say one way or another,” he said. “Ultimately, it will be the Securities and Exchange Commission or a state going after an influencer for harming citizens in a court case that will determine whether they qualify for an exemption or not.”

Still, anyone who is harmed by financial advice online could sue in civil court, Escalante Troesh said, but whether a punishment is warranted would vary based on the regulators of the case and the state that they are located.

The prevalence of personal misinformation that exists on TikTok and the demand for solid finance advice are what Vivian Tu, 27, a former stocks trader at JP Morgan, believes made her account YourRichBFF blow up as soon as she launched it.

She published her first video on Jan. 1, telling TikTokers that if they were looking for an account that would help them learn honest finance literacy tips, hers was it. Overnight, her video got 1 million views and within a week she’d amassed 170,000 followers.

It wasn’t long before financial institutions took notice. Wealthfront, Credit Karma, FinTron Invest, Insurify and Tastyworks are among her approximately 10 sponsors. She has more than half a million followers on TikTok and gets paid anywhere from $3,000 to $4,000 per post.

For someone with a full-time job, it’s a huge commitment, she said. Outside of her current full-time day job, she spends anywhere from 10 to 15 hours per week managing her account.

“It was very out of the norm. Some people make videos for months and don’t have this kind of scale,” Tu said. “It was around the time folks were getting stimulus checks, people were thinking about money more so than usual and I think people were also very sick of seeing a lot of misinformation.”

Still, on her TikTok bio page, she cautions that her videos are “NOT FINANCIAL ADVICE.”

“Nothing I say should be taken as prescriptive direction,” Tu said. “Personal finance is never one size fits all for everyone.”

Updated: 9-23-2021

Almost Half Of Crypto Owners Turn To Celebs Like Kim Kardashian For Advice

A surprisingly large proportion of crypto owners report they would purchase a crypo asset because it is endorsed by a celebrity or influencer.

A new survey has revealed bleak insights into the apparent willingness of retail investors to follow digital asset advice from the social media accounts of celebrities and influencers.

According to a Morning Consultant survey of 2,200 United States adults, 45% of crypto-holding respondents indicated they would be likely to seek exposure to a digital asset if it is endorsed by a celebrity, compared to just 20% of participants overall.

There were some more promising results, with three-quarters of crypto investors indicating they were likely to invest based on a family member or friend’s recommendation, while 81% would invest in response to advice from a financial advisor.

Almost 20% of all respondents and nearly one-third of crypto owners said they were aware of a post published to Kim Kardashian’s Instagram account spruiking the ERC-20 token EthereumMax (EMAX) in early June.

An astonishing 19% of respondents who saw the Instagram ad admitted to having invested in EthereumMax afterward; however, they comprise just 3.8% of the overall sample.

The post and project have been embroiled in controversy ever since. The price of EMAX saw meteoric growth after being announced on May 26 as “the exclusive cryptocurrency accepted for online ticket purchasing” for the cash-grab boxing match between undefeated boxer Floyd Mayweather Jr. and YouTuber Logan Paul on June 6.

While EMAX had traded for as little as $0.00000000073 (nine zeros) prior to the announcement, news of its affiliation with the boxing event saw prices skyrocket above $0.00000085 (six zeros) by June 1 — a gain exceeding 116,000% in just one week.

EthereumMax then shed more than 99% of its value in under two weeks, after which Kardashian published an ad on June 13 to her 250 million followers that highlighted that 50% of EMAX tokens held by the project’s admin wallet had been burned.

While the token was trading as low as $0.000000076 (seven zeros) before the Instagram post went live according to CoinMarketCap, EMAX had rallied to $0.000000235 (six zeros) by June 14 — a 3,000% gain in less than two days.

EMAX has consistently trended downwards since mid-June, with the token last trading hands for $0.000000021(seven zeros) — a 91% drawdown from the local highs that followed Kardashian’s Instagram endorsement.

The incident did not go unnoticed by financial regulators, with Charles Randell, head of the United Kingdom’s Financial Conduct Authority, describing Kardashian’s Instagram post as possibly the single “financial promotion with the biggest audience reach in history.” He added:

“I can’t say whether this particular token [EthereumMax] is a scam. But social media influencers are routinely paid by scammers to help them pump and dump new tokens on the back of pure speculation. Some influencers promote coins that turn out simply not to exist at all.”

Kardashian is not the first celebrity to draw the ire of financial watchdogs for promoting crypto assets to their social media followers and is unlikely to be the last, too.

In 2018, the U.S. Securities and Exchange Commission charged Mayweather Jr. and musician DJ Khaled for unlawfully promoting the Centra initial coin offering (ICO) the previous year.

While the SEC has warned celebrities that they must disclose paid promotions for ICOs on social media, many celebrities are now spruiking their own nonfungible tokens amid the NFT boom.

Updated: 9-13-2021

A New Media Startup Treats Reporters Like Social Media Influencers

Puck was founded by four media veterans in New York.

Julia Ioffe was finishing up a book earlier this year when she decided it was time to get a full-time job. As a veteran of The New Yorker, The Atlantic and New Republic, she had plenty offers. But after more than two decades of working for other people, Ioffe decided to make a bet on herself.

Ioffe is one of the first writers at Puck News, a new media company that aims to cover the four centers of power in the U.S.: Silicon Valley, Hollywood, Washington and Wall Street. Founded by veterans of New York media, Puck News is led by Chief Executive Officer Joe Purzycki and editor-in-chief Jon Kelly.

But Kelly and Purzycki stress the company isn’t about a charismatic founder like Vice’s Shane Smith, but its star talent.

Kelly has recruited a handful of influential writers to write newsletters and serve as founding partners in his new venture. Matt Belloni dishes on clashing egos in Hollywood. Teddy Schleifer explores the soft power of Silicon Valley billionaires. Ioffe examines the depressing state of contemporary politics.

William Cohan writes about finance. Puck’s contributors include Baratunde Thurston, Peter Hamby, Dylan Byers and Tina Nguyen, and the company plans to add a few more names before the end of the year.

For the past few months, the only way to read any of them was via email. But on Monday, the company will unveil its website that will publish fresh stories every day. Later this month, Puck will introduce a podcast featuring several of its writers.

It will also erect a paywall, requiring readers of most of its newsletters to pay for access to stories, live events and personal time with their favorite writers.

The whole venture is a bet on two concepts gaining a lot of currency in media circles: that journalism shouldn’t be free, and that journalists need to be more like social media influencers.

“There is an elite group of journalists who want to be long-form writers, column writers, newsletters writers and want to have a direct connection with the large audiences they’ve amassed on social channels,” Kelly said. “We wanted to create a platform and company that offers the best of all these worlds to the type of creators who value it most.”

By the time she started talking to Puck, Ioffe said she was already getting most of her news from newsletters or NPR. “Why not put my money where my mouth is and produce the kind of content I consume?”

Kelly started his career in the magazine business under Graydon Carter, the legendary editor of Vanity Fair. Glossy magazines were raking in cash, and Carter had assembled a stable of writers such as Christopher Hitchens and Dominick Dunne. But over the past decade, Kelly watched as the magazine business withered.

Marketers shifted advertising dollars from print to Google and Facebook. Consumers canceled subscriptions and opted for free news sites. Journalists left the profession to work in public relations or Hollywood. (Kelly had a stint at Bloomberg Businessweek along the way.)

Kelly left publishing for a beat to serve as an executive-in-residence at TPG, the private equity firm. While working there, he met a few other media emigres who shared a similar view of the future.

The last wave of journalism startups on the internet gave away stories for free and tried to reach as many people as possible. BuzzFeed, Gawker, Vox Media and Vice all claimed to understand the web in a way that legacy outlets couldn’t.

That scale looked great when raising money, but it left them vulnerable to the slightest algorithm change by Facebook and Google.

While those web publishers struggled to live up to their once-lofty valuations, the New York Times, Wall Street Journal and Washington Post began signing up paying customers in droves. At the same time, social media had enabled podcasters and journalists to build direct relationships with readers, giving birth to a new catchphrase: the creator economy.

Those two developments produced a new breed of publishers like The Information and The Athletic that charged readers passionate about a specific area like technology or sports. (Max Tcheyan, an early employee at The Athletic, is a Puck co-founder, as is Liz Gough, who last worked at Conde Nast.)

It’s also fueled the rise of Substack, a newsletter platform where writers such a Heather Cox Richardson and Andrew Sullivan charge their readers for a personal email.

Puck has bridged those worlds, creating the infrastructure of a news organization while also subsuming its brand to those of individual writers like Belloni or Ioffe. Each of the founding partners owns a piece of the business and is paid a bonus based on how many subscriptions and advertising sales they generate.

A $100 annual fee entitles subscribers to personal emails from the authors and all the newsletters, features and breaking news; moving up to $250 brings all that plus access to conference calls with the authors, Q&As with the staff and invitations to events.

“We really focused on economics to talent,” Purzycki said. “This is their company.” This is where we should note that it is and it isn’t.

The company declined to state how much of the company its writers own and has raised about $7 million from private equity firm TPG, which declined to comment for the story, as well as 40 North Media, the media investment arm of Standard Industries.

Puck’s pitch has resonated with a number of veteran journalists, who tired of working at conservative, bloated publishers but were reluctant to start a new business entirely on their own. (Thurston, a best-selling author, former editor at The Onion and producer of The Daily Show with Trevor Noah, is a rare exception in that he has a vibrant business of his own.)

“I spent a lot of years building up value and content for others, and I see where the economics of the industry are going,” Belloni said. “To be able to be an owner of that destiny sounds cheesy, but it’s totally true.” Belloni’s newsletter about Hollywood has been a big hit since it debuted, attracting more than 12,000 free subscribers and securing advertisements from major media companies.

Time will tell how many of those customers will pay for a Puck subscription. The number of people willing to pay $100 or $250 a year for a dozen or so newsletters may be small, especially when they already pay for a lot of subscriptions, be it Netflix, Disney+, Spotify or Amazon Prime.

That is one of many reasons to be skeptical. Publishing is a shrinking business, and podcasting is a growing but still industry. Even with subscriptions, it’s hard to make money in journalism. Only a handful of news outlets and individuals have broken through.

And yet society is getting more and more comfortable with paying to read writers they like, such as Cox Richardson and Judd Legum. Puck is targeting a specific audience: the movers and shakers in halls of power.

For Kelly, the idea is to have credibility with newsmakers themselves. For Thurston, it’s personal in a different way.

“I’ve ranted a lot in my tech criticism life about having people work for free to support platforms,” Thurston said. “Having some ownership feels overdue.”

Updated: 9-18-2021

Hollywood Embraces TikTok Stars For TV, Film Projects

Studios are tapping social media-minted talents like Addison Rae and Charli D’Amelio for leading roles in films and television shows.

Hollywood is learning to embrace a newer generation of stars who have a direct connection to millions of fans.

Faced with an aging audience and a younger generation more interested in social media than the silver screen and television, studio executives are increasingly hiring talent made famous on digital platforms, such as Charli D’Amelio and Addison Rae Easterling, known as Addison Rae, two of the most-followed creators on TikTok, for high-profile film and TV projects.

Netflix Inc. paid more than $20 million for the rights to “He’s All That,” a romantic comedy starring the 20-year-old Ms. Rae, according to people familiar with the deal.

Ms. Rae has more than 84 million followers on the video-sharing platform, the third-highest among all users. After premiering on Aug. 27, the movie became the top U.S. title on the streaming service and remained near the pole position a week later.

Last week, Netflix signed a deal with Ms. Rae to make additional films.

Ms. Rae started out in 2019 dancing and lip-syncing songs with her friends on TikTok, while Ms. D’Amelio gained followers for her dancing videos, which she also began posting in 2019. Millions of other users have copied their dance moves and styles on the platform. Ms. D’Amelio has about 124.5 million followers on TikTok.

“The studios and streamers understand the power of social media,” says David Freeman, co-head of digital media at Creative Artists Agency, one of Hollywood’s most powerful talent agencies that represents many stars that gained notoriety on digital platforms like YouTube and TikTok.

An eight-episode documentary series featuring Ms. D’Amelio and her family launched on Walt Disney Co. ’s Hulu streaming service this month. Last year, Disney secured a deal with entrepreneur and social-media mogul Kim Kardashian and members of her family to create content for Hulu.

Ms. Kardashian, considered one of the most influential reality-television stars and a social-media-influencer pioneer with her 254 million followers on Instagram, was also the voice for a character in Paramount Pictures’ animated “Paw Patrol” film, released earlier this year.

Brent Montgomery, chief executive of content-production studio Wheelhouse Entertainment, says not only are young stars circumventing the traditional system of gatekeepers ruled by television and movie executives, but the pace at which they build outsize followings is accelerating.

“Kim Kardashian took off faster than a regular person is used to seeing but then her sister Kylie Jenner took off even faster. Fast forward to now, and Charli D’Amelio has taken off even faster,” he said.

Earlier this year, Mr. Montgomery sold a reality show, called “The Hype House,” to Netflix about a group of influencers living under the same roof. The reality series, set to debut later this year, features digital influencers who, collectively, have nearly 200 million social-media followers.

Hollywood has taken notice that younger generations are spending less time consuming movies and television. A recent study by Deloitte said that Gen Zers—defined as ages 14 to 24—prefer playing videogames, listening to music, browsing the internet and scrolling through social media in their leisure time over watching movies and TV at home. Every older generation ranked movies and TV as their top entertainment option.

“Traditional Hollywood is really in a weird spot right now because they’re seeing TikTokers and YouTubers becoming more popular than traditional actors and actresses,” says Reed Duchscher, an agent who represents influencers like Jimmy Donaldson, a 23-year-old YouTube creator known as MrBeast with more than 69 million subscribers. He became famous for stunts, tricks and giving money away.

Discovering potential stars on the internet isn’t a new phenomenon. Comedian, actress and rapper Nora Lum, known professionally as Awkwafina, and singer Justin Bieber first attracted attention on YouTube years ago.

As the number of people creating content on platforms such as YouTube and TikTok has surged, there are more opportunities for digital stars to make money online and parlay that success offline, agents and executives say. The online platforms have also evolved their algorithms to more effectively direct viewers toward popular content.

Top influencers can make tens of millions of dollars a year raking in cash through sponsored content, ad-revenue sharing and subscriptions to exclusive content. In the U.S., the number of YouTube channels making at least $100,000 in revenue grew by more than 35% in 2020, YouTube said.

“You used to need the studios to be famous,” says Dan Weinstein, a former United Talent Agency trainee who co-founded Underscore Talent. The company represents independent creators like Dubai-based YouTubers Vlad and Niki, school-age brothers that have nearly 72 million subscribers on the platform.

Backed by elaborate sound effects, the brothers sometimes interact with their family, play, do crafts or have celebrations.

Initially studios proceeded cautiously, choosing to work with influencers on a limited basis, according to talent agents.

Executives either contracted influencers to market films and TV series to their followers or cast them to play minor roles in movies and television.

Captivating audiences in the real world hasn’t been easy for some online talents. After two seasons, NBC this year canceled Canadian comedian and YouTuber Lilly Singh’s late-night talk show, “A Little Late with Lilly Singh.” After the announcement, Ms. Singh said that she signed a deal to produce television for an arm of NBCUniversal and was developing a comedy project with Netflix.

Meanwhile, veteran celebrities like Reese Witherspoon, Ryan Reynolds and Will Smith are increasingly following the playbook created by online talents to foster relationships with fans and create more value for themselves or companies they invest in.

“Digital creators have really sketched the map for what it means to be able to go directly to consumers, directly to your audience,” says Ali Berman, who as head of UTA’s digital talent division represents Ms. D’Amelio.

Dwayne Johnson —also known as The Rock—has spent more than 20 years in wrestling, television and film, but he initially struggled to attract viewers on YouTube.

Mr. Johnson hired a team of digital-content producers who suggested making a video with top YouTubers, which helped the actor’s channel take off.

“Even if he has a bad movie, it doesn’t matter because of the relationship he has with his fans,” said Mo Darwiche, one of the producers who worked on promoting Mr. Johnson’s YouTube channel.

Updated: 10-6-2022

How To Pick A Financial Advisor

This guide decodes the wide variety of certifications and services—along with a checklist of what to ask before you choose.

Unless you’re a financial whiz with time to spend managing your money and assets, you might want some guidance on saving for a down payment or investing for your kid’s college education or your own retirement. That’s where a financial advisor can help.

Finding the right advisor to fit your needs, however, is not so easy. There are about 200,000 to choose from.

Their certifications, fees, minimums and services can vary widely and not all of them act as fiduciaries, putting clients’ needs above their own.

Before you engage an advisor it helps to have some basic knowledge about your options, and, most important, what you hope to get out of it.

“The first question for consumers is: Why are you hiring an advisor?” says Micah Hauptman, director of investor protection at the nonprofit Consumer Federation of America. Figuring out whether you need help budgeting, investing or hitting long-term financial goals will help you decide what kind of advisor to hire.

Read On To Get Started:

Looking for a Financial Advisor? Get matched to a financial advisor.

Types Of Financial Advisors

Many financial professionals, including financial planners, securities brokers, investment managers, and insurance brokers call themselves financial advisors so it’s important to know exactly what services an advisor provides before hiring one.

* Securities and insurance brokers, for example, sell financial assets and are paid commissions for the products they sell, which can create conflicts of interests.

* Registered investment advisors create financial plans and invest client assets based on those plans. They don’t have that conflict of interest unless they also sell commission-paid products, but they may set an asset minimum that is greater than the assets you have to invest.

* Wealth managers are usually a financial advisor who works exclusively for high net worth clients, with at least several million dollars in assets.

* Robo advisors are also digital-only advisory services producing computer-generated portfolios based solely on the information that the investor provides online. They charge less than human advisors but some provide access to human advisors for an additional fee.

Financial Advisor Designations

There are myriad designations for financial advisors but only a handful that indicate the expertise most consumers need.

Those designations, listed below, require that advisors pass an extensive test or series of tests, have thousands of hours of work experience in financial planning or a related field and maintain their credentials through continuing education courses or events.

CFP, or Certified Financial Planner, a designation awarded by the Certified Financial Planning Board of Standards, is considered the most prestigious, requiring knowledge on more than 100 financial topics, including stocks, bonds, taxes, retirement and estate planning.

Advisor Fees And Minimums

How a financial advisor gets paid can be as important as how much you pay them because you want an advisor whose paramount consideration is your best interest, not their own, and whether or not that is the case is largely determined by how you pay them.

There Are Three Basic Models For Financial Advisors’ Compensation:

* Commissions, Linked To The Products In Which They Invest Clients’ Money

* Fee-Only, With No Commissions

* Fee-Based, Which Combines Commissions And Fees

Most consumer advocates recommend investors stick with fee-only financial advisors, because these are fiduciaries, and must act in your best interest.

By contrast, advisors who receive commissions on products they sell may not always be acting in their client’s best interest.

It can get confusing, however: Under the SEC’s Best Interest rule, advisors can say they are putting their client’s interest first so long as they disclose how they’re paid, any disciplinary history and incentives to sell certain products.

That’s why many consumer advocates recommend sticking with fee-only advisors.“With fee-only you can be confident that you are dealing with a real fiduciary,” says Rostad.

How Fee-only Financial Advisors Work

Fee-only advisors can be paid in multiple ways, each with its own advantages and disadvantages. While annual fees are common and require little upfront outlay, an hourly rate may end up being cheaper if your needs are straightforward.

“I think it’s fair to say that virtually anybody can access professional financial advice with one of these alternative payment plans,” said Rostad.

Annual Percentage Of Your Assets

The most popular is payment as a percentage of assets under management, or AUM, with annual fees typically around 1%. Most, but not all, such fee-only advisors usually require a minimum of assets ranging from $250,000 to several million dollars.

An investor with $500,000 in assets, for example, would pay around $5,000 a year, deducted from their account balance, usually quarterly. They might also be charged separately for the creation of a financial plan, which tends to run around several thousand dollars.

Hourly Rates And Other Options

Other fee-only advisors charge monthly subscriptions, flat fees, hourly rates or by the project. Members of the Garrett Planning Network, charge an hourly rate, which is usually a few hundred dollars.

Advisors at Facet Wealth, who interact with clients only virtually, charge a flat annual fee based on the complexities of a client’s financial situation. Fee-for-service advisors who are part of the XY Planning Network, have a flexible payment model that includes payment as a percentage of AUM, flat fee, retainer or hourly rate.

Robo Advisors

Another cheaper option for investors is to engage a digital, automated advisor service. These so-called robo advisors usually charge a relatively low annual fee—closer to 0.25% of the assets you invest—but about twice that if they also offer access to human advisors.

Some robos, like Fidelity Go, charge flat fees and Schwab’s Intelligent Portfolios Premium, which provides access to human advisors, charges a $30 monthly subscription rate after an initial $300 fee.

Don’t Forget The Separate Fund Fees

In all cases, investors will pay a fee for the advisor plus additional fees for the investments they use whether they be mutual funds or exchange-traded funds, also known as ETFs or individual stocks or bonds.

How To Find A Financial Advisor

Finding a financial advisor is not so different from finding any other specialized service you’re in the market for.

You can ask a friend, relative or colleague for a referral, which is how most financial advisors connect with clients, or you can research advisors online by googling or visiting specific websites.

These Major Trade Groups Have Websites Where You Can Search Advisors By Location:

* National Association Of Personal Financial Advisors (NAPFA),

* Financial Planning Association (FPA)

* Certified Financial Planner Board Of Standards

There Are Also Smaller Networks That Are Highly Reputable And Whose Members Do Not Collect Commissions:

* Garrett Planning Network Has Advisors Who Work For Hourly Fees (As Opposed To An Annual Percentage Of Your Assets)

* XY Planning Network Has Advisors Who Are Paid Based On The Services They Provide And In A Variety Of Ways: Via Retainer, Subscription, Hourly, Flat Fee And Aum

You Can Also Check Out The Directory Of Advisors At Our Sister Website:

* Barron‘S Financial Advisor Network

Once you’ve narrowed your search to two or three providers, “you should interview them because ideally you’d like to stay with a provider for a long time [and] have a really good relationship with them,” said Skip Schweiss, chief executive of Sierra Investment Management and board chair of the Financial Planning Association. “Part of that is human chemistry.”

Here Are Some Questions You Should Ask:

* What Type Of Financial Advisor Are You And What Professional Designations Do You Hold?

* Are You A Fiduciary?

* What Services Do You Provide?

* How Do You Get Paid?

* Do You Invest Client Funds In Commissioned Products Or Proprietary Products, Participate In Any Revenue Sharing Arrangements Or Engage In Principal Trading (Taking The Other Side Of The Trade With An Investor)?

* If I Gave You $1,000 To Invest How Much Would Go To Fees And Costs And How Much Would Be Invested On My Behalf?

* What Investments Do You Focus On—Individual Stocks And Bonds Or Investment Funds? Within Funds, Do You Favor Active Or Passive Funds, Exchange-Traded Funds Or Mutual Funds, And What Is The Range Of Their Fees?

* What Would Be My All-In Costs For Your Services? And Do Those Costs Mean You Will Actively Manage My Investments Throughout The Year? (The Latter Is Especially Important For Those Advisors Who Charge A Percentage Of Assets.)

* What Is The Minimum Asset Level Required, If Any?

* Have You Or Your Firm Been Subject To Any Disciplinary Actions By Regulators Or Others, And If So, What Are They?

* How Long Have You Been An Advisor?

* Will You Be My Primary Contact Or Who Will Serve That Role?

Many of these questions are included in NAPFA’s Comprehensive Financial Advisor Diagnostic questionnaire and answered in Form CRS, or Customer Relationship Summary, which financial advisors and brokers are required to provide to prospective retail clients.

Form CRS is the third part of advisors’ registration form with the SEC known as Form ADV, which can be found at the SEC’s Investment Adviser Public Disclosure website.

Consumers can also access any disciplinary history of brokers at the BrokerCheck website maintained by the Financial Industry Regulatory Authority, the self-regulatory organization for the brokerage industry.

They can also check the background and disciplinary history of a CFP-designated advisor at the CFP’s verification website.

Investor.gov is another website from the SEC which provides access to information about advisors as well as general investing information for consumers.

Remember You Are In Charge

A good financial advisor should be able to answer all your questions clearly, without industry jargon, and you should feel empowered to circle back with follow up questions if you aren’t completely clear on their services.

There are plenty of resources to help and potentially a big payoff at the end. The right financial advisor can help navigate your financial life, from budgeting everyday spending to fulfilling long-term financial goals over a lifetime including the purchase of a home and a comfortable retirement.

Updated: 11-2-2022

Saying ‘Not Financial Advice’ Won’t Keep You Out Of Jail — Crypto Lawyers

Australian and U.S. digital asset lawyers told Cointelegraph that, by and large, the words on their own are “pretty useless.”

Crypto influencers may need to practice what they preach and “do their own research” when it comes to sharing their crypto tips.

According to several digital asset lawyers, the popular disclaimer “This is not financial advice” may not actually protect them in the eyes of the law.

United States-based securities lawyer Matthew Nielsen from Bracewell LLP told Cointelegraph that while it’s “best practice” for influencers to disclose that “this is not financial advice,” simply saying the term will not protect them from the law, as “federal and state securities laws heavily regulate who can offer investment advice.”

Australian financial regulatory lawyer Liam Hennessy, a partner at Gadens, explained that “advice warnings” are “by and large pretty useless,” while Australian digital lawyer Michael Bacina of Piper Alderman added that they aren’t “magic words which when uttered will disclaim liability.”

Crypto influencers and celebrity ambassadors have been increasingly finding themselves under the scrutiny of regulations, particularly in the United States.

Nielsen cited the recent Kim Kardashian case as an example, where Kardashian was charged by the SEC for failing to disclose how much she received to promote EthereumMax (EMAX) to her followers.

Influencers Feeling The Pressure

Crypto influencer Mason Versluis, aka Crypto Mason, who has over a million followers on TikTok, told Cointelegraph that he can’t stress enough to his followers that his content should not “be taken as financial advice.”

Versluis, however, said that despite using the disclaimer “This is not financial advice,” it’s important for influencers to be mindful that some people do “make financial moves according to what certain influencers say.”

He also stressed how difficult it can be to determine whether a project will end up in a “rug pull” situation, as influencers “simply deal with the marketing team” and generally have no contact “with any of the developers or owners.”

Australian crypto influencer Ivan Vantagiato, aka Crypto Serpent, who has amassed 68,000 followers on TikTok, said that influencers should do their due diligence researching a crypto project before running a promotion.

Hennessy believes the best way for crypto influencers to protect themselves is to be able to determine “what token is a security and what token is not a security.”

He further explained that it’s critical to understand that a “derivative is a product that derives its value from something else” and that you can be “criminally liable” for promoting derivatives.

Meanwhile, Bacina noted that an influencer residing in Australia is required to have a license to give out financial advice and that “no disclaimer is going to give protection.”

Updated: 2-8-2023

SEC To Up Scrutiny Of Firms Offering Or Giving Advice About Crypto

After a recent warning from the SEC, registered crypto brokers and advisers may need to be on edge when giving advice this year.

Crypto brokers and investment advisers offering or giving advice about cryptocurrencies will be put under the scope of the United States securities watchdog this year.

A Feb. 7 statement from the Securities and Exchange Commission’s (SEC) Division of Examinations outlined its priorities for 2023, suggesting brokers and advisers dealing in crypto will need to be extra careful when offering, selling or making recommendations regarding digital assets.

It stated that SEC-registered brokers and advisers will be closely watched to see if they followed their “respective standards of care” when making recommendations, referrals and providing investment advice.

Today we announced the Division of Examinations 2023 priorities. The Division publishes its examination priorities annually to provide insights into its risk-based approach.

For more:

— U.S. Securities and Exchange Commission (@SECGov) February 7, 2023

The SEC will also examine whether these entities “routinely” review and update their procedures to ensure they meet “compliance, disclosure and risk management practices.”

This announcement was similar to the SEC’s priorities released in 2022, however, it seems this year the regulator is putting more emphasis on standards of care and practices by brokers rather than their consideration of unique risks presented by “emerging financial technologies” highlighted in 2022.

The most recent statement comes nearly two weeks after a report claimed the SEC has been investigating registered investment advisers that may be offering digital asset custody to its clients without proper qualifications.

The SEC’s investigation has reportedly been going on for several months but is now top of the priority list after the collapse of the crypto exchange FTX, according to a report from Reuters.

By law, investment advisory firms must be qualified to offer custody services to clients and comply with custodial safeguards set out in the Investment Advisers Act of 1940.

Update: 2-24-2023

Emojis Count As Financial Advice And Have Legal Consequences, Judge Rules

Former SEC branch chief Lisa Braganca warned the public of the legal consequences of using the emojis.

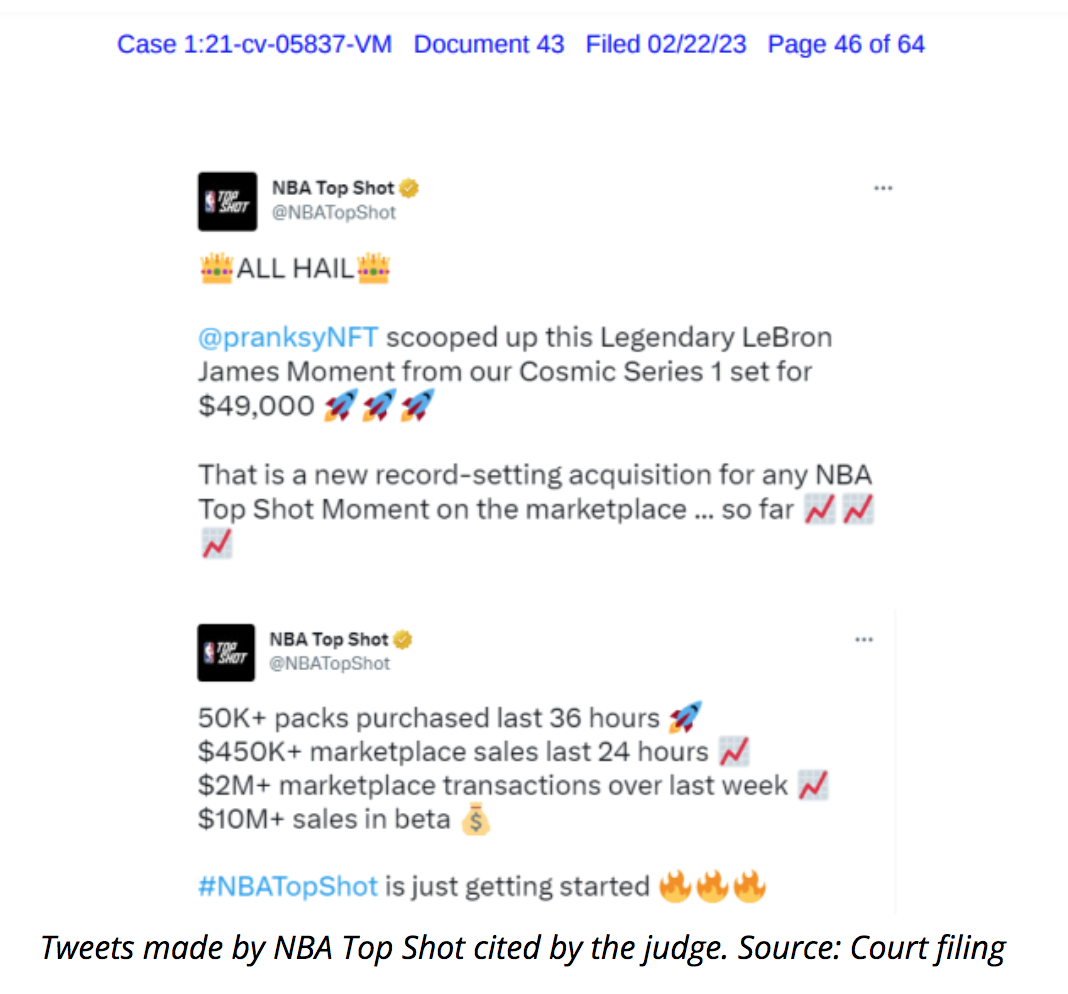

A United States District Court judge for the Southern District of New York ruled that emojis like the rocket ship, stock chart and money bags mean “a financial return on investment, ” according to a recent court filing.

In a tweet, former United States Securities and Exchange Commission (SEC) branch chief Lisa Braganca warned users of the potential legal consequence of using emojis that may indicate future gains. She tweeted:

A federal court judge ruled that these emojis objectively mean “one thing: a financial return on investment.” Users of these emojis are hereby warned of the legal consequence of their use. #emojis #rocketshipemoji #DapperLabs https://t.co/4yRfWBH96R

— Former SEC Branch Chief Lisa Braganca (@LisaBraganca) February 23, 2023

Braganca shared the link to a court filing where federal court judge Victor Marrero denied Dapper Labs’ motion to dismiss the amended complaint alleging that its NBA Top Shot Moments violated security laws.

Within the filing, the judge pointed out that some tweets published by the NBA Top Shot account on Twitter contain emojis indicating financial returns.

“And although the literal word ‘profit’ is not included in any of the tweets, the ‘rocket ship’ emoji, ‘stock chart’ emoji, and ‘money bags’ emoji objectively mean one thing: a financial return on investment,” they wrote.

Oscar Franklin Tan, the chief legal officer of NFT platform Enjin, also commented on the issue. Tan told Cointelegraph that the Dapper Labs decision should not create a “dangerous rule” that emojis make NFTs securities.” Tan explained that:

“Courts should protect the edgy, freewheeling messaging in NFT communities because shitposts and emojis are part of free speech too.”

According to Tan, sneaker resellers can also use the same “FOMO,” or “fear of missing out” pitch and use the emojis cited in the case.

Members of the crypto community reacted to the warning and tweeted various responses. One Twitter user described the news as “tragic,” while another pointed out that freedom of speech no longer extends to emojis.

Meanwhile, a user decided to make a declaration on the meanings of their use of the emojis.

On Feb. 23, lawyers also reacted to the judge’s decision to allow the lawsuit against Dapper Labs to play out. U.S. attorney Jake Chervinsky pointed out that “it would be absurd” for a U.S. court to consider assets on private blockchains as securities.

Chervinsky explained that this could turn every major video game developer, ticketing platform and travel rewards program into an SEC-regulated company.

Similarly, how the SEC went after Terra also captured the attention of lawyers. On Feb. 17, crypto lawyers went on Twitter to voice their thoughts on the issue of the SEC alleging that Terra sold a suite of crypto asset securities.

Web3 lawyer Mike Selig explained that anything can be a security under the theory, while attorney Justin Browder described the SEC’s actions as “wild.”

Updated: 4-6-2023

Love Island Star Joins Push To Educate Influencers About Finance

* Regulators Say Social Media Stars Are Promoting Risky Schemes

* Sharon Gaffka Says Influencers Are ‘Bombarded’ With Promotions

UK financial regulators have teamed up with an unlikely ally in their fight against online scams: a reality TV star.

Love Island contestant Sharon Gaffka has joined a campaign by the Financial Conduct Authority about the risks of promoting “get rich quick” schemes online.

“When you leave a show like Love Island, you are bombarded with opportunities to promote products and work with brands, if like me, you’re new to this kind of work, it can be a little bit overwhelming,” said Gaffka, who took part in the popular dating reality show’s seventh season in 2021.

Gaffka already has experience working with the government. Before her switch to content creation, she spent several months at the Department for Transport and was a Brexit policy adviser at the Department for Environment, Food and Rural Affairs, according to her LinkedIn profile.

The Financial Conduct Authority and Advertising Standards Authority said they will provide influencers and their agents clear information about what could be an illegal financial promotion.

The FCA blocked more than 8,500 promotions last year as it targets a growing number of internet personalities posting ads that break its rules.

The watchdog advised influencers to be particularly cautious about promoting cryptocurrencies, and avoid creating a sense of urgency or any suggestion it’s an easy investment choice.

The FCA is set to get more powers to police the promotion of crypto and has repeatedly warned users they risk losing all their money.

“We’ve seen more cases of influencers touting products that they shouldn’t be,” said Sarah Pritchard, executive director of markets at the FCA. “They are often doing this without knowledge of the rules and without understanding of the harm they could cause their followers.”

Making an unlawful financial promotion is a criminal offence that carries a maximum sentence of two years in prison and an unlimited fine, the regulator said.

Updated: 4-7-2023

UK Uses Love Island Star To Warn Finfluencers On Crypto And Investment Schemes

The financial and advertising regulators posted a seven-part checklist to ensure these social media stars stay within the bounds of the law.

The financial and advertising regulators of the United Kingdom have teamed up to send a warning to social media “finfluencers” telling them to stop promoting illegal “get rich quick” schemes or face law enforcement.

The Financial Conduct Authority (FCA) and the Advertising Standards Authority (ACA) made reference to cryptocurrencies and nonfungible tokens in their April 6 statement, which laid out a seven-part checklist to ensure that finfluencers stay within the bounds of the law.

The checklist asks finfluencers to consider whether they’re the “right person” to be promoting the financial product and states that their followers may “lose all their money” from the investment. It also states:

“Don’t suggest to your followers that cryptoassets would be an easy investment decision or create any sense of urgency or FOMO.”

In addition to conducting “due diligence,” social media influences should seek approval of the FCA and ensure that the advertisement is legal, truthful and properly labeled as an advertisement under ASA rules.

We’ve partnered with @ASA_UK and @SharonNJGaffka to help educate social media #influencers about the risks involved in promoting #financial products. https://t.co/IwQkcc90a9

— Financial Conduct Authority (@TheFCA) April 6, 2023

The FCA and ACA strongly advised that influencers check ScamSmart to ensure that they’re not promoting an investment scam. “If in doubt, don’t promote”, the checklist’s slogan states.

It is a crime to unlawfully promote financial products or services which carries a maximum sentence of two years’ imprisonment and an unlimited fine:

“If your post breaks the rules, the ASA will take action.”

Sarah Pritchard, the FCA’s executive director, explained that there has been a spike in illegal financial promotions of late.

“They are often doing this without knowledge of the rules and without understanding of the harm they could cause their followers,” she added.

The FCA and ASA partnered with former U.K. Love Island contestant Sharon Gaffka to emphasize the risks that come with lucrative marketing schemes.

The FCA will also host an “open roundtable discussion” with influencer agents and the Influencer Marketing Trade Body in the coming months.

Across the channel, France is edging closer to banning French social media influencers from promoting cryptocurrencies and NFTs from unlicensed firms after the National Assembly’s economic committee voted in favor of an amendment proposal on March 23.

If passed, the new law would add crypto assets to a list of prohibited products, such as gambling and pharmaceuticals, that cannot be promoted by influencers.

Those found to violate the incoming law may also be subject to two years’ imprisonment with a fine of 30,000 Euros ($32,300).

Reality TV star Kim Kardashian, boxing legend Floyd Mayweather and internet celebrity Jake Paul are some of the most notable figures to have found themselves embroiled in allegedly promoting crypto investment schemes.

Updated: 4-22-2023

Over 30% of TikTok Videos On Crypto Investments Are Misleading: Research

TikTok videos tagged with popular crypto-related hashtags — such as #crypto, #cryptok and #cryptoadvice — have cumulatively garnered over 6 billion views.

More than one-third of crypto influencers on TikTok, the go-to social media platform for the younger generation, have posted misleading videos about Bitcoin and other cryptocurrency investments, according to a recent study.

Many people now rely on TikTok as their first source of information rather than going to Google for answers, but the recent study from daapGambl alleges that many influencers are sharing unvetted misinformation about crypto investments, often trying to convince unwary viewers to put their — or their parents’ — hard-earned money into cryptocurrencies that will lose them money.

Many TikTok influencers use the hashtag “#cryptok” while posting crypto-related content. dappGambl analyzed 1,161 such TikTok videos and found that more than one in three were misleading.

The research also found that just one out of 10 “cryptok” accounts or videos contained some form of disclaimer that warned users about the risks of investing.

47% of the crypto TikTok creators were found to be trying to make money by pushing services. Meanwhile, mainstream influencers such as Kim Kardashian, Jake Paul and Soulja Boy were also previously accused of promoting cryptocurrencies to their millions of fans without disclosing the payments they had received.

The United States Securities and Exchange Commission forced Kim Kardashian to pay $1.26 million in penalties for promoting EthereumMax (EMAX). While crypto influencers have a smaller reach than their mainstream counterparts, the potential financial risk for unwary investors remains equally high.

The research also found that one in three misleading videos on TikTok mention Bitcoin. Moreover, videos on TikTok sporting popular crypto-related hashtags — such as #crypto, #cryptok, #cryptoadvice, #cryptocurrency, #cryptotrading and #cryptoinvesting — have cumulatively garnered over 6 billion views.

Viewers often overlook the ill intent of influencers and trust their content purely based on its high number of views or likes. Both new and seasoned investors are advised to do extensive research on crypto projects prior to making any form of investment.

On April 2, a $1 billion lawsuit was filed against crypto exchange Binance, CEO Changpeng Zhao and three crypto influencers for allegedly promoting unregistered securities.

“This is a classic example of a centralized exchange, which is promoting the sale of an unregistered security,” said the lawsuit, filed by the Moscowitz Law Firm and Boies Schiller Flexner.

As Cointelegraph reported, the lawsuit alleges that “millions” of people could be eligible for damages.

Updated: 5-3-2023

French Senate Proposal Would Allow Influencers To Promote Cryptocurrency

The Senate’s proposal comes just months after the National Assembly floated legislation banning influencer advertising for crypto products and services.

The French Senate’s Committee on Economic Affairs recently approved an amendment to pending legislation allowing registered cryptocurrency companies to hire social media influencers for advertising and promotional purposes.

According to a translation of the amendment provided by Bing, the new wording would allow companies that are registered with France’s Financial Markets Authority (AMF) to hire influencers for their products:

“The current wording is more restrictive than the existing provisions in the Consumer Code, since it excludes the possibility for digital asset service providers (PSAN) registered with the Financial Markets Authority (AMF) to use commercial influence. Consequently, this amendment introduces this possibility for PSANs registered or approved with the AMF.”

In its original iteration, the bill in question called for what essentially amounted to an outright ban on influencer advertising for the crypto industry in France. Its wording limited the companies who could engage in influencer advertising to only those licensed by the AMF, a bar no cryptocurrency company currently meets.

As Paris-based law firm Beaubourg Avocats points out in an educational blog post, “France has established a regulatory framework for cryptocurrency that primarily relies on two regimes: the token sale or ICO (Initial Coin Offering) visa and the Digital Assets Service Providers (‘DASPs’) registration and license.”

All cryptocurrency companies operating in France are legally required to register with the AMF. So far, none have received the necessary licensing that would allow them to hire influencers to promote their products in the nation legally.

The change of language in the amendment would eliminate the licensing requirement and thus allow companies that are simply registered with the AMF to pay influencers for promotion on social media.

Crypto Twitter appears to be hailing the news as a positive step for the French influencer and cryptocurrency markets.

La commission des affaires éco du @Senat adopte une nouvelle version de la #PPLinfluenceurs :

➡️ PSAN enregistrés et émetteurs d’ICO pourront continuer d’être promus

➡️ les activités #Crypto hors champ PSAN (NFT, DeFi…) également

Une étape cruciale avant l’adoption ? pic.twitter.com/i9HpJQlO7H

— Adan (@adan_asso) May 3, 2023

It does however bear mention that the change hasn’t been officially ratified yet. Along with a series of other revisions, the proposed amendment must pass through the full Senate in a plenary meeting before it faces approval by the National Assembly.

Updated: 5-8-2023

Two Advisor Credentialing Organizations Have Their Say on Crypto

Advisors are warned by the Certified Financial Planner Board of Standards (CFP Board) and the Chartered Financial Analyst Institute (CFA Institute) to look before they leap.

After federal regulators including the Securities and Exchange Commission and the Department of Labor as well as Finra, the largest independent industry regulator, perhaps no one speaks louder on advisor best practices and compliance than the Certified Financial Planner Board of Standards (CFP Board) and the Chartered Financial Analyst Institute (CFA Institute).

Each has recently made major announcements regarding cryptocurrency investing and advice.

The CFP Board issued guidelines in November in a “Notice to CFP Professionals Regarding Financial Advice About Cryptocurrency-Related Assets,” which will govern how holders of the CFP certification should handle working with clients on digital asset investing and planning.

In the CFA Institute’s case, it comes in the form of “Cryptoassets: Beyond the Hype,” a report oriented towards investment professionals and financial analysts, which was released this week.

CFP Board

In its report, the CFP Board chose to neither mandate nor forbid its designation holders from recommending cryptocurrencies and cryptocurrency-related assets or providing financial advice about those investments.

The Board will apply the same standards to cryptocurrencies and cryptocurrency-related assets that it applies to all assets; however, it also recognizes that these assets may present heightened risks to clients and have some unique attributes.

“CFP Board’s guidance for a CFP professional to act with caution when providing Financial Advice about cryptocurrency-related assets rests upon the guidance that regulators have issued concerning these assets,” the organization wrote.

“Various federal and state regulators, self-regulatory organizations like the Financial Industry Regulatory Authority, Inc. (“FINRA”), and consumer protection organizations representing or advocating for investors, workers, and retirees have cautioned that investments in cryptocurrency-related assets present significant risks that warrant careful evaluation.”

Thus, according to the CFP Board, fiduciaries should exercise “extreme care” before including a crypto option to a workplace retirement plan such as a 401(k).

In any advice setting, including financial planning, CFPs are required to comply with the duty of care, duty of competence, duty to comply with the law and the duty to provide clients information about costs, as well as duties when selecting, recommending and using technology.

Essentially, the guidelines mean that for a CFP to provide advice on digital assets they need to be educated on those assets, their risks and how they might fit into a client’s broader financial picture.

Furthermore, the CFP must be able to monitor those investments and recommend technology and custody options with an understanding of those commensurate risks as well.

Furthermore, CFPs are required to at least have knowledge of held-away digital assets and the impact those assets may have on a client’s overall financial picture. CFPs should understand how those assets may impact the client’s “goals, liquidity, cash-flow, taxes and estate plans.”

“A CFP professional also must consider how cryptocurrency-related assets may require special considerations with respect to estate planning, such as a plan for the transfer of a private key if the Client passes away,” wrote the Board.

“These are only some of the ways that an investment in cryptocurrency-related assets may affect the Financial Planning recommendations.”

CFA Institute

According to the CFA Institute, three issues need to be resolved before crypto assets can be fully embraced by mainstream investors: valuation, fiduciary duty and the custody of assets.

“To puncture the hype, investors must think through what is actual, what is potential and what is merely aspirational,” said Stephen Deane, senior director, capital markets policy at the CFA Institute, in a statement.

“They should also distinguish between the underlying distributed ledger technology, which could well prove disruptive, and the business prospects for the thousands of individual crypto assets on the market today and more to come. We at CFA Institute firmly believe that there are no shortcuts to sound investing.”

The Institute’s Researchers Then Give Six Loose Guidelines For Fiduciaries And Institutional Investors:

* Proper analysis remains necessary for fiduciaries to comply with their duties of prudence, loyalty and care.

* With the inclusion of crypto, principles of portfolio construction still apply and investors should continue to take a holistic and strategic view towards portfolio construction.

* Fiduciaries are expected to analyze the value, volatility, correlation effects, momentum and/or technical features of any proposed investment.

* Intrinsic value of digital assets should be related to an in-depth, rational analysis of specific use cases.

* Investing in digital assets and related businesses requires a careful analysis of business model and client acquisition model.

* Fiduciaries need to ascertain the custody chain and safekeeping of client assets.

“The debacle at [crypto exchange] FTX shows the harm that can come to investors and platform participants when client assets are not kept safe,” said Olivier Fines, head of EMEA advocacy at the CFA Institute in a statement. “The example of FTX further underlines the importance of custody issues and the responsibility of investors to base their decisions on the investment case and not on hype and speculation.”

Updated: 5-31-2023

Former SEC Chief Warns Influencers About Prosecution For Crypto Price Manipulation

The SEC has started clamping down on crypto influencers, issuing several fines and cease and desist orders in the past few years.

The United States Securities and Exchange Commission (SEC) is pursuing crypto influencers who have promoted scam projects and are found to be manipulating the prices of certain tokens via social media.

Former SEC chief John Reed Stark took to Twitter to warn crypto influencers to be ready to face prosecution.

Attention all crypto promoters who use social media to manipulate the price of crypto-securities: Fail not at your peril. Not only will you eventually get caught, but your prosecution will also be like shooting fish in a barrel.

Whether manipulating the price of exchange… pic.twitter.com/AfKROIlR0N

— John Reed Stark (@JohnReedStark) May 30, 2023

In his tweet, Stark called out social media crypto influencers who shilled numerous sketchy crypto projects and often helped them manipulate market prices during the bull run.

He warned that for any form of price manipulation — be it the price of exchange-listed securities, penny stock securities or crypto securities — the same anti-fraud rules apply, and the days of social media crypto influencers are numbered.

The former SEC chief drew attention to the brazen and arrogant way in which so many social media influencers grift their victims.

Most shilling and price manipulation occurs via social media platforms like Twitter, Discord, Instagram or Reddit.

Stark noted that the nature of securities fraud makes it easier to detect and prosecute, unlike other forms of fraud where the perpetrator often tries to hide behind their identity.

“Regulators and law enforcement need only turn on their computers to discover an extraordinary and resplendent evidentiary trail of compelling and vivid inculpatory evidence.

Indeed, far from tying the government’s hands, social media has become the virtual rope that many crypto bros (and sisters) use to hang themselves.” Stark explained.

Stark cited the example of notorious crypto influencer Francis Sabo, who was charged in a $100 million securities fraud case and used social media platforms to manipulate exchange-traded stocks.

Apart from Sabo, there have been numerous instances of crypto influencers found to have violated securities law. The most famous case is Kim Kardashian, who was fined $1.26 million for promoting a scam project.

Another major influencer to face the law is Bitboy Crypto, an influencer who has met a lot of public ire for promoting shady projects. On March 31, the YouTuber was named in a $1 billion lawsuit for promoting unregistered securities.

In November 2022, the SEC also issued multiple subpoenas to influencers for promoting Hex (HEX), Pulsechain (PLS) and PulseX (PLSX) tokens.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

American Shoppers Just Can’t Pass Up A Bargain And Department Stores Pay The Price #GotBitcoin

Motley Fool Adding $5M In Bitcoin To Its ‘10X Portfolio’ — Has A $500K Price Target

Mad Money’s Jim Cramer Invests 1% Of Net Worth In Bitcoin Says, “Gold Is Dangerous”

Ultimate Resource For Financial Advisers By Financial Advisers On Crypto

Anti-ESG Movement Reveals How Blackrock Pulls-off World’s Largest Ponzi Scheme

The Bitcoin Ordinals Protocol Has Caused A Resurgence In Bitcoin Development And Interest

Bitcoin Takes ‘Lion’s Share’ As Institutional Inflows Hit 7-Month High

Bitcoin’s Future Depends On A Handful of Mysterious Coders

Billionaire Hedge Fund Investor Stanley Druckenmiller Says He Owns Bitcoin In CNBC Interview

Bitcoin Billionaire Chamath Palihapitiya Opts Out Of Run For California Governor

Billionaire Took Psychedelics, Got Bitcoin And Is Now Into SPACs

Billionaire’s Bitcoin Dream Shapes His Business Empire In Norway

Trading Firm Of Richest Crypto Billionaire Reveals Buying ‘A Lot More’ Bitcoin Below $30K

Simple Tips To Ensure Your Digital Surveillance Works As It Should

Big (4) Audit Firms Blasted By PCAOB And Gary Gensler, Head Of SEC (#GotBitcoin)

What Crypto Users Need Know About Changes At The SEC

The Ultimate Resource For The Bitcoin Miner And The Mining Industry (Page#2) #GotBitcoin

How Cryptocurrency Can Help In Paying Universal Basic Income (#GotBitcoin)

Gautam Adani Was Briefly World’s Richest Man Only To Be Brought Down By An American Short-Seller

Global Crypto Industry Pledges Aid To Turkey Following Deadly Earthquakes

Money Supply Growth Went Negative Again In December Another Sign Of Recession #GotBitcoin

Here Is How To Tell The Difference Between Bitcoin And Ethereum

Crypto Investors Can Purchase Bankruptcy ‘Put Options’ To Protect Funds On Binance, Coinbase, Kraken

Bitcoin Developers Must Face UK Trial Over Lost Cryptoassets

Google Issues Warning For 2 Billion Chrome Users

How A Lawsuit Against The IRS Is Trying To Expand Privacy For Crypto Users

IRS Uses Cellphone Location Data To Find Suspects

IRS Failed To Collect $2.4 Billion In Taxes From Millionaires

Treasury Calls For Crypto Transfers Over $10,000 To Be Reported To IRS

Can The IRS Be Trusted With Your Data?

US Ransomware Attack Suspect Hails From A Small Ukrainian Town

Alibaba Admits It Was Slow To Report Software Bug After Beijing Rebuke

Japan Defense Ministry Finds Security Threat In Hack

Raoul Pal Believes Institutions Have Finished Taking Profits As Year Winds Up

Yosemite Is Forcing Native American Homeowners To Leave Without Compensation. Here’s Why

What Is Dollar Cost Averaging Bitcoin?

Ultimate Resource On Bitcoin Unit Bias

Best Travel Credit Cards of 2022-2023

A Guarded Generation: How Millennials View Money And Investing (#GotBitcoin)

Bitcoin Enthusiast And CEO Brian Armstrong Buys Los Angeles Home For $133 Million

Nasdaq-Listed Blockchain Firm BTCS To Offer Dividend In Bitcoin; Shares Surge

Ultimate Resource On Kazakhstan As Second In Bitcoin Mining Hash Rate In The World After US

Ultimate Resource On Solana Outages And DDoS Attacks

How Jessica Simpson Almost Lost Her Name And Her Billion Dollar Empire

Sidney Poitier, Actor Who Made Oscars History, Dies At 94

Green Comet Will Be Visible As It Passes By Earth For First Time In 50,000 Years

FTX (SBF) Got Approval From F.D.I.C., State Regulators And Federal Reserve To Buy Tiny Bank!!!

Joe Rogan: I Have A Lot Of Hope For Bitcoin

Teen Cyber Prodigy Stumbled Onto Flaw Letting Him Hijack Teslas

Spyware Finally Got Scary Enough To Freak Lawmakers Out—After It Spied On Them

The First Nuclear-Powered Bitcoin Mine Is Here. Maybe It Can Clean Up Energy FUD

The World’s Best Crypto Policies: How They Do It In 37 Nations

Tonga To Copy El Salvador’s Bill Making Bitcoin Legal Tender, Says Former MP

Wordle Is The New “Lingo” Turning Fans Into Argumentative Strategy Nerds

Prospering In The Pandemic, Some Feel Financial Guilt And Gratitude

Is Art Therapy The Path To Mental Well-Being?

New York, California, New Jersey, And Alabama Move To Ban ‘Forever Chemicals’ In Firefighting Foam

The Mystery Of The Wasting House-Cats

What Pet Owners Should Know About Chronic Kidney Disease In Dogs And Cats

Pets Score Company Perks As The ‘New Dependents’

Why Is My Cat Rubbing His Face In Ants?

Natural Cure For Hyperthyroidism In Cats Including How To Switch Him/Her To A Raw Food Diet

Ultimate Resource For Cat Lovers

FDA Approves First-Ever Arthritis Pain Management Drug For Cats

Ultimate Resource On Duke of York’s Prince Andrew And His Sex Scandal

Walmart Filings Reveal Plans To Create Cryptocurrency, NFTs

Bitcoin’s Dominance of Crypto Payments Is Starting To Erode

T-Mobile Says Hackers Stole Data On About 37 Million Customers

Jack Dorsey Announces Bitcoin Legal Defense Fund

More Than 100 Millionaires Signed An Open Letter Asking To Be Taxed More Heavily

Federal Regulator Says Credit Unions Can Partner With Crypto Providers

What’s Behind The Fascination With Smash-And-Grab Shoplifting?

Train Robberies Are A Problem In Los Angeles, And No One Agrees On How To Stop Them

US Stocks Historically Deliver Strong Gains In Fed Hike Cycles (GotBitcoin)

Ian Alexander Jr., Only Child of Regina King, Dies At Age 26