Ultimate Resource For Financial Advisers By Financial Advisers On Bitcoin

A new Bitwise survey highlights a more favorable attitude toward Bitcoin and cryptocurrencies. Ultimate Resource For Financial Advisers By Financial Advisers On Bitcoin

Cryptocurrencies like Bitcoin (BTC) are increasingly being used by financial advisers as a hedge against inflation, underscoring the dramatic shift in institutional sentiment toward digital assets.

The “Bitwise/ETF Trends 2021 Benchmark Survey” reveals that 9.4% of financial advisers were allocating to cryptocurrencies in 2020 — an increase of 49% from the previous year. Of the advisers not currently allocating to crypto, 17% said they will either “definitely” or “probably” gain exposure in 2021.

Related:

Mad Money’s Jim Cramer Invests 1% Of Net Worth In Bitcoin Says, “Gold Is Dangerous”

Motley Fool Adding $5M In Bitcoin To Its ‘10X Portfolio’ — Has A $500K Price Target

5 Questions To Ask Your Crypto-Currency Or Traditional Accountant About Their Cyber Security

Rise of The FinFluencer And How They Target Young And Inexperienced Investors

Advisers are buying crypto for many reasons, chief among them being its potential hedge against inflation. As Bitwise noted, 25% of advisers cited inflation-hedging as one of the most attractive features of the asset class. That’s up from just 9% the year before.

The Report Said:

“This year’s survey saw a sharp uptick in advisors highlighting crypto’s ‘high potential returns’ and its role in ‘inflation hedging’ as key attractive features of the asset class.”

A total of 994 advisers participated in the survey, up from 415 the year before. Independent registered investment advisers represented 45% of respondents, followed by independent broker-dealers (25%), financial planners (19%) and wirehouse reps (11%).

Bitcoin appears to be benefiting from the systemic devaluation of the dollar as more investors opt out of the traditional financial system. The dollar’s freefall is expected to continue this year as the incoming administration of Joe Biden preps a multitrillion-dollar stimulus plan, effectively picking up where Donald Trump left off.

Although institutions currently represent a small fraction of all Bitcoin holdings, their impact on the market is growing. Goldman Sachs executive Jeff Currie believes institutional uptake has put Bitcoin on the path to maturity but noted that more adoption is needed to stabilize the asset class.

Bitwise’s assets under management ballooned to $500 million in December 2020, a fivefold increase from just two months prior. The firm’s record inflows reflect new demand from investment professionals, including advisers, hedge funds and corporations.

Updated: 1-18-2021

Investment Icon Ric Edelman $230 Billion Assets Under Management Owns Bitcoin and Ethereum

Investment icon Ric Edelman, named the nation’s top independent financial advisor by Barron’s three times over, says he’s a believer and investor in cryptocurrency.

In a new interview with Real Vision, the founder of Edelman Financial Engines, which has more than $200 billion in assets under management, says he first began to tinker with crypto assets in 2014 as an experiment.

“I began with Bitcoin in 2014, and it was an academic exercise. I want to open up a Coinbase account, see how this works. I want to buy a Bitcoin and see and just learn. I did that for a bit of time and began to, as my research continued, my conversations with so many in the crypto space evolve, began to realize there really is a there there. This is not just a Beanie Baby.”

Since then, Edelman says he has grown his portfolio and invested in Ethereum.

“I increased our exposure with my wife, Jean, and expanded into Ethereum. I am as excited about that, frankly, as I am Bitcoin for totally different reasons, and this is something that – we are not talking about Coke and Pepsi. We are talking about two fundamentally different aspects of this technological revolution.

You can extend that to Ripple. The reason that a lot of these key coins exist is that they solve a problem that the others were facing. Bitcoin is not the end-all solution.”

Edelman cautions that many altcoins are destined for obscurity, and he has no plans to mine BTC due to the complexity involved.

“It has a huge head start. 70% market share on a brand that none of the others have, but there is a reason technologically for the existence of these other coins. A lot of them are nonsense, but some of them make sense. Recognizing the cumbersome element of buying coins themselves, I chose personally not to engage in mining, too time consuming. I am too busy in my day job with Edelman Financial Engines. I am not going to go there.”

Ric Edelman Says Bitcoin Now A Mainstream Institutional Investment

Ric Edelman, the investment icon who has been named the country’s top financial advisor by Barron’s three times over, says the conversations surrounding Bitcoin are doing a 180-degree turn as more institutions invest in the flagship cryptocurrency.

On an episode of SALT Talks, Edelman highlights that Bitcoin is beginning to attract financial advisors for two big reasons.

“The upside potential remains very very big for Bitcoin and it is the outsized potential of returns. The stock market makes 10% in a year. Bitcoin routinely moves up or down 10% in a day. And so it is the potential for outsized returns.

It is the number one performing asset class of the last one, three, five, and ten-year periods since inception and many people believe it’s still in its infancy. So there’s a tremendous opportunity for that…

The number one reason that advisors say they are interested in this is the fact that Bitcoin is uncorrelated. Its price movements have nothing to do with anything else, not with the stock market the bond market, interest rates, inflation rates, economic policy, Fed action, nothing. And if you truly believe in diversification, you want uncorrelated and even better non-correlated assets in your portfolio.”

The prominent investor says that as big institutions pile into Bitcoin, a massive legitimization of the leading cryptocurrency will take place.

“The conversation is shifting from ‘You’re conspicuous if you own it,’ to ‘You’re conspicuous if you don’t’ and I think that trend is going to continue even further.

Now that you can buy Bitcoin at PayPal and you have MicroStrategy for example investing over half a billion… We are clearly in an environment where Bitcoin is now mainstream, and this legitimizes the asset, and there’s going to be a continued snowball effect of this where people will begin to realize it’s routine, just as the gold ETF made gold a routine asset for portfolio diversification.

The first two weeks that ETF raised a billion dollars. So yes, I do believe we will continue to see broad diversification and greater mainstreaming by institutions, endowments, pension funds insurance companies and so on.”

Edelman isn’t looking through rose-colored glasses though. He still believes Bitcoin comes with significant risks, which is why he has limited his exposure to it.

“There still remain massive risks: technological risks, regulatory risks. Governments could get very upset with all of this. We don’t know where it’s going to go, so we want to keep our heads about us, not over invest, and not subject ourselves to portfolio risks that would harm our personal finances.”

Updated: 3-19-2021

Don’t Count On Bitcoin To Be A Sure-Thing Inflation Hedge

Cryptocurrency’s history is too short to judge whether it can provide protection against rising prices.

Hardcore Bitcoin enthusiasts say the digital coin is the world’s best hedge against rising consumer prices. The logic: Unlike U.S. dollars or any other normal currency, it’s designed to have a limited supply, so it can’t be devalued by a government or a central bank distributing too much of it.

Almost every bull case on Bitcoin has looked prescient lately—the cryptocurrency is trading at around $57,000 a coin, up from about $5,000 a year ago—so that’s added some buzz to this inflation story.

With the economic outlook perking up, Covid-19 cases falling, and greater amounts of fiscal stimulus on the horizon, investors in all kinds of assets seem to expect a bit of a rise in prices. But that’s coming from a very modest base. Over the past year, the inflation rate in the U.S. has been 1.7%.

And then there’s the question of whether the digital asset would really act as an effective hedge. It doesn’t have a long enough history to establish that, says Cam Harvey, senior adviser to Research Affiliates and a professor of finance at Duke University.

Theoretically, if investors come to regard it as similar to gold, Bitcoin might hold its value over a very long term—as in a century or more, Harvey says. In their research on gold, he and his colleagues have found that it has held its value well for millenniums.

But they also found that it’s prone to manias and crashes over shorter periods. (Gold, notably, is down 9% this year despite all the inflation talk.)

Bitcoin too has swung wildly in its short life, for reasons barely connected to anyone’s view on inflation. “What’s going to happen to Bitcoin? It’s really unclear,” Harvey says. “The price is not just driven by the money-supply rule, it’s driven by other speculative forces. That’s why it’s multiple times more volatile than the stock market.”

It’s conceivable that a bout of inflation could have the opposite of the expected effect on Bitcoin. If inflation induced a recession, for example, investors might respond by stepping away from riskier assets such as cryptocurrencies.

In recent weeks, when investors concerned about inflation pushed the 10-year Treasury yield from 1.34% to as high as 1.62%, Bitcoin suffered its worst drop in months.

Crypto proponents argue that Bitcoin traders long ago anticipated bond yields would rise—and a subsequent spike in yields did roughly track with a bump in crypto. Still, Bitcoin’s recent moves bear at least a passing resemblance to more straightforward speculative trades.

Bitcoin has received a stamp of approval from more than a handful of notable Wall Streeters, including veteran hedge fund manager Paul Tudor Jones, who say they like it as a store of wealth.

“That is certainly an element that has driven investment by institutions, particularly in the wake of the ways in which policymakers have worked to jump-start the economy” after the Covid slowdown, says Michael Sonnenshein, chief executive officer at Grayscale Investments, which runs a fund that holds Bitcoin. “Certainly we have no shortage of global macro investors for whom adding Bitcoin has acted for them as a hedge for inflation.”

Bitcoin’s strongest advocates see its rising price as an early-warning sign that the traditional financial system is vulnerable, and argue that the cryptocurrency could rise further as investors look for a haven.

Such arguments hinge on the idea that inflation won’t just edge up with a growing economy, but could explode as a result of so-called money printing.

The Federal Reserve doesn’t change the money supply by literally printing bills. However, a measure of the amount of money in the financial system known as M2 has increased, thanks in part to accommodative policy.

Fed Chairman Jerome Powell said in recent congressional testimony that the growth of the money supply no longer has important implications for the economic outlook. “We’ve had big growth of monetary aggregates at various times without inflation,” he said. “So it’s something we have to unlearn.”

Jim Paulsen, chief investment strategist at the Leuthold Group, agrees. While there may be more money, its velocity—or the frequency with which money changes hands—has dropped off. That’s a crucial factor because it shows money is being saved rather than spent, which keeps price pressures muted.

But even if velocity turns higher, offsetting disinflationary forces could still come into play, including an aging population and digital technology’s propensity to push prices down. “Inflation is turning up a little bit, but I don’t think that means that crypto is going to go nuts,” Paulsen says.

Bitcoin is unlike most other inflation hedges. Its value is based entirely on other people’s willingness to hold it: The digital token isn’t tied to any other asset, such as oil or real estate or earnings from a business, that might naturally rise in value along with consumer prices.

It’s possible that inflation could go up and it’s possible that Bitcoin could too, but the two aren’t necessarily linked. One of Bitcoin’s best-known bulls, Ark Investment Management founder Cathie Wood, said in a recent webinar that she’s as concerned about the forces of deflation—or falling prices—as she is with inflation.

“The kindling wood for inflation exists,” says Marc Chandler, chief market strategist at Bannockburn Global Forex. “One has to make a judgment about whether there’s sufficient spark.” Instead of looking at Bitcoin prices as a weather vane of inflation, he prefers to look at signals such as oil prices, shipping costs, or the price of semiconductors.

They’re all rising as the economy gains steam, but that doesn’t mean the dollar’s being undercut by a flood of printed money. “The high priests of the cryptocurrency space look for any reason to help their case,” he says. “I’m still hesitant to think that Bitcoin tells us anything about high-frequency economic variables.” —With Katie Greifeld

Updated: 4-21-2021

The ‘Marriage or Mortgage’ Trap

In a new Netflix show, couples decide whether to spend their savings on a wedding or a home. We asked personal finance experts how much reality TV reflects actual reality.

In each episode of Netflix’s “Marriage or Mortgage,” a different couple from Nashville meets with a real estate agent, Nichole Holmes, and a wedding planner, Sarah Miller, who convince them to blow their nest egg on one of the show’s eponymous options. The show is in turn mind-numbing, heart-wrenching, and infuriating. (Also addictive.)

Filmed before the pandemic, the couples on the show are operating in a lukewarm housing market, and without the hindsight that would tell them not to risk it all on a big spring 2020 wedding.

Their dilemmas are complex nonetheless: A couple is still living in the house one of the women once shared with her ex; another pair is abstaining from sex until marriage, but they’re also over living with roommates.

Lost fathers, fertility challenges, heirloom-destroying fires — whatever the trauma, there is only one way to move forward. But which is it? A marriage or a mortgage?!

One common reaction to the series has been increasingly loud shouts of “NOOO!” as people choose marriage only to postpone or downsize. (Or gleefully roll out a ranch dressing fountain at their pared-down wedding, Covid be damned.) It also reveals how (or how not to) think about the costs involved with two persistent tropes of American adulthood.

But how close is this to real life? We asked personal finance advisers to weigh in, and what advice they had for those lucky enough to be stuck in a similar stalemate.

“The concept’s a little interesting,” Justin Green says diplomatically. He’s a financial planner and the founder of Assist FP who watched a couple of episodes with his soon-to-be mother-in-law while deep in the throes of planning for his own forthcoming wedding. “The one part they nailed is that young couples kind of do have to focus on one or the other first.”

The typical pair on the show has a budget between $25,000 and $30,000; they’re planning to put all of it toward the wedding or a down payment on a home that generally costs between $300,000 and $400,000.

The current home value for a house in Nashville, according to Zillow, is $323,075, up from just under $300,000 in January 2020 and $280,000 in January 2019.

As housing prices in mid-size cities like Nashville rise, the stakes of choosing a wedding first are getting higher, said Shaun Melby, the Nashville-based founder of Melby Wealth Management.

If they’re looking at a $300,000 home that’s going to cost $380,000 in a couple of years, “that $30,000 wedding may have actually cost them $80,000,” he said.

“Not only that, they will now need to come up with even more of a down payment than before just to afford the same homes they were looking at and they’ll pay a bigger mortgage payment.”

Only Human

While it’s obvious that the more practical move would be to buy a wealth-building home instead of throwing a party, the sensible choice doesn’t always make for great TV — or even real life. Over the course of 10 episodes, four couples chose house, and six chose wedding.

“A financial plan can easily show that $25k-$30k spent on a memory instead of investing, whether through a home down payment or in the stock market, is not a good idea,” added Eric Powell, the founder of the virtual financial firm The Future Mill. But “the reality is humans, not just Millennials, want to have great memories.”

Powell himself is a human Millennial who chose to compromise: He and his wife decided on a destination wedding that cost them $5,000. They saved the rest and eventually put it toward a house.

“They make it seem like the only way to be happy is with the perfect home or the perfect wedding.”

Still, that’s not a calculation most younger Americans can afford to make, according to Census Bureau data and research. In 2018, 9% of young adults between 18 and 25, and 15% of young adults ages 25-34, lived with a partner they weren’t married to, a cohabitation trend that coalesces with lower marriage rates.

Since the ‘60s, the proportion of married young people has flipped: In 1968, around 60% of 18-34 year olds were married. By 2020, according to Census figures, 69% of 18-34 year olds had never been married. But that’s not to say they’re forgoing marriage to live together in homes they own.

“If economic resources appear to be important for entry into marriage, then it is understandable why many young adults today choose not to marry; they are facing unprecedented economic burdens despite being on average more educated than previous generations,” wrote Benjamin Gurrentz, then a survey statistician in the Census Bureau’s Fertility and Family Branch, in a 2018 working paper.

It’s not shocking that crippling student loan debt and recession-sunk job markets lay a less stable foundation upon which to hold barnyard nuptials and/or afford a garage with 10 foot ceilings.

Hidden Costs

For Green, the financial adviser at Assist FP, the “emotional power” of a wedding won out over buying a house. (He lives in a rental apartment in Boston with his fiancée.)

But he advises keeping something in the bank for unexpected emergencies, or practical matters like buying a bed. It’s unclear if the couples in “Marriage or Mortgage” are blowing their entire savings or leaving some cushion leftover.

“You really want to make sure you don’t sacrifice your emergency fund,” says Green.

Though spending on a house has been framed as a sounder investment, it’s also a longer-term financial commitment. Closing costs alone can add thousands to the bill, along with furniture and maintenance and property taxes.

Based on the cost of the home, most couples on the show have budgeted to pay around 6% to 10% for their down payment, an amount that reflects what the average American pays, too.

While the median percentage has risen since the financial crisis, it has never reached even 10%, based on an analysis of 20 years of down payments by ATTOM Data Solutions, a real estate and property data company. In the fourth quarter of 2020, the median down payment was 7.7% of the median sales price.

Colin Moynahan, a financial adviser for Twenty Fifty Capital in Charleston, South Carolina, says it’s better to put down a bigger down payment if possible.

A good rule of thumb is looking at how long you’re going to stay in the property, Moynahan says: If the buyers anticipate living there for 15 to 20 years, “where they have time to ride out the ups and downs of the real estate market, that’s where they can get away with putting down 10%,” he said. “Anything less than 10% is foolish. It’s going to cost you at least 5% to sell the property.”

“For the down payment, they really, really want to be as close to the 20% mark as possible,” Moynahan says. Especially, in a housing market where almost half of U.S. homes are selling within a week of listing, larger cash offers are winning out.

Netflix vs. Real Life

Logan Murray, a financial planner and tax preparer for Pocket Project, says he fears that “Marriage or Mortgage” could be harmful to viewers. “The famous quote ‘comparison is the thief of joy’ is relevant with this show,” he says.

“They make it seem like the only way to be happy is with the perfect home or the perfect wedding. But with anything, there should be compromise: why can’t there be both?”

Because Holmes or Miller have to win, that’s why. The show is as much a competition between the two of them as it is about the couple’s dreams and priorities.

And they pull out all the stops to stir the pot and get the sale, with huge discounts on vendors and custom candy competing with new home appliances and comped closing costs.

“It’s shows like these that leave couples with unrealistic expectations about what weddings actually cost,” said Kaleigh Northrup, a wedding planner at Kay Northrup Events. “Don’t get me wrong, you can have a wedding for $25,000 to $30,000 … but they won’t look like the weddings that are being portrayed. In reality, these weddings are costing way over $30,000.”

Northrup’s husband Jake is a financial planner for Experience Your Wealth. To afford their 2019 destination wedding in Santorini, their parents helped out, but they still put down $20,000 of their own money.

“Could we have a higher net worth right now if we paid for a home instead of the wedding? Sure, a home builds equity, whereas a wedding doesn’t,” said Jake Northrup. (They still haven’t taken the plunge on a mortgage.) “But our goal isn’t necessarily to maximize our net worth, our goal is to maximize our life and our experiences together.”

Updated: 5-3-2021

Financial Advisers Lead The Institutional Push Toward Crypto Adoption

Grayscale’s Michael Sonnenshein, Amber Group’s Jeffrey Wang and Edouard Hindi of Tyr Capital believe financial advisers could be ushering in a new era of crypto adoption.

In the past, there were plenty of reasons for financial advisers to dismiss Bitcoin (BTC) and other cryptocurrencies as a worthy investment, but all of that is starting to change as more institutions become attuned to the digital asset class.

A face-melting rally for Bitcoin between September 2020 and April 2021 amplified the need to push beyond the narrative that digital assets are simply too volatile to include in client portfolios.

In a keynote address at the 2021 virtual CFC St. Moritz Conference in January, Grayscale CEO Michael Sonnenshein outlined six major themes that could shape the cryptocurrency market in the near future. One of those themes was the potential for greater adoption among financial advisers.

‘Curiosity And Demand’

In a follow-up interview with Cointelegraph, Sonnenshein explained that “curiosity and demand from clients are driving financial adviser interest in crypto.” His conclusion stems from a preliminary survey commissioned by Grayscale showing that “more than half of advisers are receiving questions from their clients about cryptocurrencies.”

While this may not drive immediate action, cryptocurrencies have certainly become a consideration for advisers, he explained. “Ultimately, financial advisers are responding to client demand,” he said, adding:

“Crypto generally and Bitcoin specifically has been well covered in the press, with major corporations and financial institutions making Bitcoin part of their balance sheets, and notable entrepreneurs and investors voicing their investments in Bitcoin. If you’re a knowledgeable investor, you’re going to want to know more about this asset class, and if you have a financial adviser, you’re going to ask them about it.”

Sonnenshein also noted that financial advisers are among the investors who invest in Grayscale’s family of funds, whose combined assets now exceed $46 billion.

“Bitcoin remains the most popular digital currency, though we also see growing interest in Ethereum and other digital assets as well,” he said.

Edouard Hindi, co-founder and chief investment officer of Tyr Capital, a United Kingdom-based cryptocurrency hedge fund manager, said financial advisers have increased their allocation of digital assets, especially Bitcoin, over the last six months.

The shift has also been observed at private banks, which have gone from seeking education on cryptocurrency to investing directly with Tyr Capital Arbitrage.

He explained that “the bulk of the interest we are seeing remains concentrated on the directionless high risk/reward attributes of funds like Tyr Capital Arbitrage and directional exposure to Bitcoin.”

Crypto Exposure No Longer ‘Career-Ending’

Bitcoin’s newfound legitimacy within the institutional ranks has eliminated much of the so-called “career risk” involved with investing in the digital asset market. As Hindi noted, one year ago finance professionals were thought to be taking a “career-ending risk” for investing in crypto.

Now, it’s considered career-ending not to have any exposure to digital assets. The final domino to fall, Hindi believes, could be fiduciary standards:

“Now that custody and regulatory barriers are slowly dropping, what could still be hindering a broader adoption of crypto by financial advisors is the perception that ‘fiduciary standards’ remain a challenge in openly advocating for the asset class to be included in customers’ portfolios.”

Jeffrey Wang, head of Americas for Amber Group, a crypto-finance startup founded by former Morgan Stanley, Goldman Sachs and Bloomberg professionals, believes independent advisers have a lot more freedom to diversify into crypto than the major banks.

“I think there will be a large bottleneck for the advisers who work at the firms owned by big banks to offer crypto that isn’t in the form of a listed ETF [or] security,” Wang said. “These banks aren’t nimble enough to expand their wealth management offerings, especially for non-listed crypto assets.”

“It is a huge undertaking for these firms/banks to be able to add offerings in crypto in terms of adopting their existing risk management systems, infrastructure, compliance, legal, front office trading systems so the decision won’t come without a lot of work and due diligence.”

A Changing Landscape

While institutional adoption of digital assets remains nascent, several major investors and corporations have made a big splash by acquiring Bitcoin. Legendary investors Paul Tudor Jones and Stanley Druckenmiller own BTC.

On the corporate side, MicroStrategy and Tesla have acquired billions of dollars’ worth of Bitcoin to hedge against currency debasement. MassMutual, a Massachusetts-based insurance firm, purchased $100 million worth of BTC in December 2020. It’s estimated that businesses currently hold nearly 6.8% of the circulating Bitcoin supply.

Meanwhile, major institutions including BlackRock, Morgan Stanley, Goldman Sachs, Citibank and JPMorgan Chase have adopted a more positive outlook on cryptocurrencies.

BlackRock’s leadership has gone as far as comparing Bitcoin to gold, with CIO Rick Rieder claiming that BTC will eat away at the precious metal’s market cap in the long run.

Jeffrey Wang believes institutional adoption will be “very prevalent” in the next 12 to 18 months, going as far as saying that “the majority of firms will embrace blockchain in some way.”

So far, the latest corporate earnings season on Wall Street hasn’t revealed any new crypto investors, but that could soon change as the bull market continues to grow.

Tesla, meanwhile, announced that it sold a portion of its Bitcoin for a significant profit, a move that CEO Elon Musk said demonstrates the asset’s liquidity. Musk later confirmed that he has not sold any of his Bitcoin.

There’s also strong evidence that the venture capital world is backing cryptocurrency projects with ever-growing conviction. In addition to the dozens of VC-led investment rounds covered by Cointelegraph in recent months, Andreessen Horowitz is reportedly eyeing a new crypto-focused investment fund worth up to $1 billion.

That would align with the venture capital firm’s recent crypto-focused investments into Aleo and OpenSea, among others.

Updated: 6-3-2021

Big Rise In Financial Advisers Adding Crypto Assets To Client Portfolios

More than a quarter of financial advisers intend to recommend crypto investments over the next year.

According to a survey, financial advisers are recommending investments in Bitcoin (BTC) and crypto assets to their clients more than ever before.

A report by the Financial Planning Association released on Tuesday has taken a look at the changing attitudes toward crypto assets. The “2021 Trends in Investing Survey” revealed that more financial advisers than ever are recommending their clients have some crypto in their portfolios.

The survey was conducted in March and received 529 online responses from professional financial advisers who offer clients investment advice and recommendations.

It stated that 14% of financial advisers have already added crypto assets to their clients’ portfolios or are recommending it to them. Even more are planning to do so over the next year.

“More than a quarter (26 percent) of advisors indicated in the 2021 survey plan to increase their use/recommendation of cryptocurrencies over the next 12 months.”

The survey revealed that the figure is up significantly from the previous year, when less than 1% of advisers were recommending exposure to cryptocurrencies.

Furthermore, 49% of finance professionals indicated that, in the last six months, clients have asked them about investing in cryptocurrencies, a figure that has almost trebled from just 17% in 2020.

Just below half — 48% of financial advisers — claimed to occasionally read news stories on cryptocurrencies and are somewhat comfortable conversing about them, with one-third of advisrs actively educating themselves on digital assets.

Clients appear to be less concerned with market volatility this year compared to last, the survey found. More than half — 52% — of financial advisers stated that their clients inquired about market volatility over the past six months, compared to 76% for the previous year.

Investors may be drawn to crypto assets as a hedge against inflation, which has been exacerbated during the pandemic and ongoing fiscal stimulus packages. Inflation in the United States is hovering around a 13-year high.

In early May, Cointelegraph reported that financial advisers have been leading an institutional push toward crypto-asset adoption.

Grayscale CEO Michael Sonnenshein told Cointelegraph that “curiosity and demand from clients are driving financial adviser interest in crypto.” His observations were derived from a survey commissioned by the investment firm showing that more than half of the surveyed advisers are receiving questions from their clients about cryptocurrencies.

Updated: 6-17-2021

Bitcoin First ‘Genuinely New Asset Class’ In 150 Years, Says Ric Edelman

Financial adviser, Ric Edelman says his colleagues need to get rid of their bias and examine Bitcoin and crypto assets with “open eyes” and “genuine curiosity.”

Ric Edelman, founder of financial advisory outfit Edelman Financial Engines, described Bitcoin (BTC) and crypto assets as a “completely new and different asset class” that has nothing in common with mainstream staples like stocks, bonds, real estate, oil, or commodities, to mention a few.

Speaking to Yahoo Finance on Wednesday, the financial adviser called Bitcoin and crypto “the first genuinely new asset class in about 150 years.” According to Edelman, not since the gold market has there been an innovative asset class like cryptocurrencies.

As part of the discussion, Edelman revealed that he was helping educate financial advisers about the need to be more open-minded about crypto as a viable portfolio diversifier.

Indeed, as previously reported by Cointelegraph, a recent survey by corporate research outfit Opinium showed that over 90% of 200 polled independent financial advisers in the United Kingdom were against crypto investments for their clients.

While not specifically reacting to the Opinium poll, Edelman characterized the reticence among independent financial advisers (IFAs) as being due to bias, stating:

“Most financial professionals have been in business a long time […] But the more experience, the more talent you have, the more difficult it is to get your head around Bitcoin.”

According to Edelman, given that portfolio diversification and rebalancing are popular strategies of IFAs, then BTC should be an obvious choice.

Edelman further argued that financial advisers need only look to the technological underpinnings of cryptocurrencies to see that cryptos are not in the same cadre as tulips or beanie babies.

For Edelman, crypto and blockchain technology, in general, is the “most impactful commercial innovation since the development of the internet itself.”

Back in 2019, the financial adviser remarked that a Bitcoin exchange-traded fund in the United States was an inevitability.

Updated: 8-24-2021

Introducing Crypto For Advisors, A Newsletter For Financial Planners

A new CoinDesk newsletter defining crypto, digital assets and the future of finance.

CoinDesk is launching a new newsletter – one that’s different from our existing titles in an important way. It’s called Crypto for Advisors, and we’re building it specifically for financial advisors (FAs) and registered investment advisors (RIAs). The newsletter will do what CoinDesk is best at – informing and educating a highly engaged audience – only this time the audience is financial professionals who are new to crypto, curious about it and looking for ways to incorporate it into their work.

Why a newsletter for this audience, and why now? Read on.

Financial security is inherently a long game. We all want it, but few of us are sophisticated enough about markets and assets to take that security into our own hands. That’s why the financial advisor industry exists.

Similarly, the world of crypto is a mystery to many. That’s not surprising: The intricacies of cryptocurrencies and the markets built around them can be profoundly different from traditional assets. That learning curve keeps many people out of the market.

Still, the rapid expansion of crypto as an asset class has fueled a lot of curiosity. A recent survey by Gemini revealed 63% of U.S. adults consider themselves “crypto curious,” meaning they want to learn more or are planning to buy crypto soon.

In a normal world, those people would turn to financial advisors to help them navigate the subject. But while some FAs and RIAs have stepped up and studied crypto markets to figure out their place in the portfolios of people looking for long-term success, many others have taken a more absolute approach to the crypto industry and avoid it altogether.

While that’s certainly the safest approach, it also cuts them – and their clients – out of this interesting and growing asset class.

Such a conservative approach is often the result of a lack of knowledge and resources – and that’s where our new newsletter comes in.

Every week, Crypto for Advisors will speak directly to the FA community, informing and educating FAs about how crypto can fit into their lives as well as unpacking the most recent developments in crypto and finance for investors curious about this asset class.

Why us? For starters, CoinDesk is home to the best reporting about crypto and crypto markets on the planet, and has been for the better part of a decade. From that foundation, we’ve tapped into our community, in particular the people who helped us create Bitcoin for Advisors to help create this newsletter.

You’ll see authors from the advisor world, journalists who cover the industry and writers who specialize in explaining the complex landscape of crypto to financially sophisticated audiences.

The rapidly expanding crypto market is attracting the attention of the world, and many investors are anxious to turn their curiosity into action. To help them find their way in this new – and volatile – territory, they need financial advisors who can continually build their understanding of digital assets. And Crypto for Advisors is designed to do just that.

Updated: 9-9-2021

Crypto For Advisors: 5 Ways Bitcoin Can Play A Role In A Portfolio

Bitcoin isn’t going anywhere. So how can it fit into the portfolios of the future?

Recently, a well-known bitcoin writer tweeted, “If your financial advisor hasn’t recommended bitcoin yet, fire them.” A tweet like this gets polarizing quickly. Right or wrong, there is greater nuance to the role of bitcoin in portfolios.

As a fiduciary, you cannot disregard an asset that is the best-performing asset of the 21st century. Whether that sits well with you or not, bitcoin is not going anywhere. So what are some of the ways bitcoin can fit into the portfolios of the future? Below, I’ll guide you through some of the main narratives for incorporating bitcoin into a portfolio.

Digital Gold

I have used the “digital gold” narrative early in my bitcoin journey, but cryptocurrency is far more than a gold replacement. The role that gold has historically played is protecting wealth: An ounce of gold in Roman times bought you a nice tunic, and an ounce of gold today buys you a nice suit. The idea of maintaining your purchasing power has been gold’s appeal.

The inflation rate of gold is below 2%, so you can store wealth over generations as its devaluation happens slowly versus a purely fiat-backed currency. So if you only see bitcoin as a commodity holding to replace gold, then a weighting like Ray Dalio’s risk-parity recommendation to allocate to gold would make sense. A 7.5% weight for bitcoin then would be the recommendation under this type of approach.

Growth Sleeve

If you like the idea of a core and satellite approach, you may want to allocate to thematic growth themes. The concept of core and satellite is to own the broad market, but to complement that with a 10%-20% allocation in opportunities you view as being able to outperform. Bitcoin is the fastest-growing asset of the past decade, so it fits into that narrative.

You can also look at the network effects of big tech, such as Google, Apple, Amazon and Facebook – once a dominant digital network surpasses $100 billion market cap, it’s here to stay. Bitcoin today has crept right back under the $1 trillion market cap.

Venture capital has historically looked at where the demand curve is today versus where opportunity via adoption cycles is going, and network effects are powerful. People usually learn and share a tool or technology and then need to see a massive 10x or greater improvement to then move and “upgrade” to what’s better. A maximum of 10% weight would be the recommendation under this approach.

Credit Insurance (Bonds)

Greg Foss, a veteran trader with more than 30 years of experience in high-yield credit markets, is whom I credit with the idea of bitcoin being default insurance for fixed-income investors. In a recent piece, Foss articulated the contagion and cascading risk in the credit markets for bond investors, claiming that today the biggest risks are in credit markets, where risks can get hidden from the average investor.

Think of collateralized debt obligations in 2008 – the lessons from that period were not learned and are being repeated via looser and looser credit ratings on bond holdings as everyone is chasing yield in a world of low rates. The counterparty risk is usually unknown until it is too late – but bitcoin, when self-custodied, has no counterparty risk. This peace of mind and security is undervalued in today’s market.

Foss doesn’t claim that bitcoin’s price wouldn’t be affected in a credit meltdown, but that event would be a buying opportunity as more and more investors learn the merits of counterparty risk. The recommendation here for the client with a 60/40 portfolio, which has 60% in equities and 40% in bonds, is a 5% weight from their bond exposure.

Dragon Portfolio

Chris Cole of Artemis Capital Management wrote a research paper titled Rise of the Dragon: From Deflation to Reflation. He advocates that everyone construct a portfolio that can last 100 years regardless of what the markets do over any given cycle. The Dragon Portfolio is constructed to be resilient and offer actual diversification; the allocation includes equities, bonds, commodity trend, gold and long volatility.

Each is between an 18% and 24% weight, so it’s almost an equal-weight approach. All of these holdings counterbalance each other to allow for a unique, independent return generator.

By avoiding large corrections, the compounding over years leads to a better 100-year portfolio that Cole argues cannot be beat. If you believe in his detailed research, it makes sense that bitcoin will replace gold given that we are moving from an analog age to a digital one.

Gold has passed the baton to bitcoin, and it slides into that allocation for this portfolio style. It does not correlate with any other of the allocation weights and provides an independent return stream. A 19% weight would be the recommendation in this approach.

Equity Exposed Companies

I can hear you now: What if your client won’t own bitcoin directly, and you don’t like the idea of paying 2% for Grayscale Bitcoin Trust (GBTC), the main way investors have sought exposure to bitcoin without their own wallets? (Disclosure: Grayscale is owned by Digital Currency Group, the parent company of CoinDesk.) I’d suggest adding the stocks of bitcoin miners and others that hold bitcoin on their balance sheet.

The most well-known company with a bitcoin balance sheet is MicroStrategy, led by Michael Saylor. An allocation to an index-style approach here provides exposure, allowing an equity weighting versus owning bitcoin directly. I would not say this is a 1:1 replacement, but it could be a solution for you today. This then allows you to get up to speed on the proper way to help clients own the asset directly. The recommendation here is of no more than a 5% weight for one company, and a basket approach is best.

Moving Forward: Bitcoin As A Problem Solver

All of the above narratives give you various rationales and different conclusions on the appropriate weight to hold in bitcoin for clients.

When looking at the risk of owning bitcoin, even a “Mark Yusko position” of getting off zero and holding 1% is far less risky in the long run than owning 0%. Yusko is the founder, CEO and chief investment officer of Morgan Creek Capital Management and the managing partner of Morgan Creek Digital. He has worked in the endowment space for years and worked with some of the largest allocators in the U.S.

When you run a financial plan for clients, for instance, how often do you run a scenario of the U.S. dollar losing its reserve status? When do you run the consistent and accelerating devaluation of the U.S. dollar in a plan? Never?

The facts are that bitcoin, even in a small amount, allows you to solve this what-if for clients. You can run a scenario of a small allocation of bitcoin going to $0 and the client still having a successful outcome.

The role of a financial plan should be to provide peace of mind and certainty. We’ve all seen clients become too conservative too early and jeopardize their future success – the same can be said for advisors who refuse to review the merits of bitcoin in a financial plan.

Bitcoin helps solve a real issue for clients trying not to outlive their money. Only you, as the partner to your clients, can know what the right fit is for bitcoin, but the evidence is clear that it does belong in everyone’s portfolio.

Crypto For Advisors: How Do You Value Digital Assets?

Traditional models don’t fit for valuing digital assets.

When I was first asked to write this column for CoinDesk, I called an old acquaintance, financial advisor and OnRamp Investing CEO Tyrone Ross, who has channeled his exuberance into proselytizing and teaching the benefits of cryptocurrency investing to financial advisors.

I wanted to pick Ross’ brain on what he thought our industry most needed to know about digital assets – and one of the first things out of his mouth was valuation.

“As far as literacy is concerned, the biggest trip-up for advisors is still the valuation methodology for crypto assets,” Ross said. “There is no way to discount cash flows for crypto assets. You need to embrace new valuation methodologies like daily active users or network access. If you’re still talking about price-to-earnings ratios, discounted cash flows or the capital asset pricing model, you need to realize that those terms do not apply here. The old models don’t fit.”

Most advisors are well versed on valuation methodology for traditional assets like stocks, bonds and real estate, though these asset classes have their own unique characteristics and there are ongoing debates about the best way to value them and how to use that information.

For example, many professionals have abandoned the once widely practiced method of using a ratio of a stock’s current price to the book value of its business as a measure of whether it is expensive or not. Still others contend that in a world full of intellectual and virtual property, the discounted cash-flow methodologies of venerated investors like Benjamin Graham and Warren Buffett are no longer as relevant to a company’s value as they once were.

If we can understand how technology and digital breadth can make a company worth more than its tangible parts, maybe we can understand how an entirely digital asset could retain value without any of those tangible parts.

What Are Digital Assets Worth?

The fundamentals of fiat currencies are founded upon their utility as stores of value, units of measurement and mediums of exchange.

Most cryptocurrencies have similar characteristics, but because much of the trading thus far has been speculative, they’re an asset class where technical analysis reigns supreme. The actual fundamentals of cryptocurrencies are still being explored by technologists and academics alike.

“In many cases, it’s the hands-on users who know more about what is going on with the technology and understand these business models and the ‘tokenomics’ of their projects more than any advisor would,” said Matthew Sigel, head of digital assets research for VanEck, a traditional asset manager that was an early entrant into the digital assets space.

“That’s why I look at Reddit and see who is trading code on GitHub. These are open-source technologies, for the most part; no company is building them, so you can go read what developers are building and what participants expect as far as the economics around a token and its features.”

In my previous column, Sarson Funds Chief Marketing Officer Jahon Jamali told us that most cryptocurrencies can be valued based on the size of the network participating in their underlying blockchain.

That sounds great, but what does it mean, exactly? Goldman Sachs published a note in July confirming that the free-float market capitalization of major cryptocurrencies, including bitcoin, ethereum, bitcoin cash, litecoin and XRP, actually does correlate to the network size. We can use network size and Metcalfe’s law, a mathematical principle that the value of any network is the square of its number of participants, to figure out what these tokens are worth.

Of course, that means we have to find true and relevant methods of measuring the size of a network. Just as price-to-book and price-to-earnings ratios may not tell the whole story about the values of today’s stock market leaders, we need to find the right metrics to uncover the size of a cryptocurrency’s underlying network.

Key Metrics

On-chain metrics give us information about the activity across a blockchain, including transaction count over a set period, or the total value of transactions over that period, active addresses, hashrates and fees paid.

Project metrics tell us the thinking behind a cryptocurrency, the technology it uses, its use cases and the supply and distribution plan for tokens. Finally, financial metrics tell us the market capitalization of the asset, its liquidity and its volume.

With some metrics in hand, it’s up to us to use them in meaningful ways to describe the value of a digital asset. One proposed method is the network value-to-transaction ratio, or NVT ratio, calculated by dividing the market-capitalization of a digital asset by the transaction value over a set period.

Another method, market-value-to-real-value ratio, or MVRV, is the ratio between the market capitalization of a cryptocurrency to the value of tokens stuck or abandoned in inactive wallets. MVRV is an expression of relative value that may indicate whether a token is overvalued or undervalued.

Why It Matters

“Trust officers and estate attorneys need to make decisions on digital assets, but there’s no industry standard yet,” said Whitney Solcher, chief investment officer of Ulrich Investment Consultants, a registered investment advisor (RIA) with $2 billion in assets under management. “How do you value them? How will they be taxed? How do you transfer them on to the next generations?”

There are some advisors who understand full well some of the valuation techniques behind digital assets, but are still hesitant to embrace them. Ulrich, for example, runs most of its investments in-house and follows the cryptocurrency space closely, but has decided to hold off on investing in digital assets.

“Broadly, as financial advisors, we have a hard time assessing actual cryptocurrencies as true money, and we don’t feel they are really a store of value now given their volatility,” said Solcher. “We do, however, believe in the technology, and that’s the place we’re more comfortable putting our investment dollars.”

Solcher said that Ulrich accesses the blockchain technology world through investments in companies such as PayPal, Amazon and JPMorgan Chase.

But the prevailing trend is that fewer advisors today spend their time valuing their clients’ stocks and bonds than in the past, investment management is more often than not outsourced, and thus, it’s less important that advisors know the intricacies of cryptocurrency valuation.

Instead, they should be able to translate these fundamentals to their clients in a digestible way while being able to access digital assets through a variety of products and strategies.

So yes, moving forward we will need to know why a digital asset like bitcoin or ethereum has intrinsic value, but we probably won’t be called to calculate that value in real time.

Updated: 9-30-2021

Why Bitcoin Has Value And Should Be Part Of Your Client’s Portfolio

Bitcoin is a technology that’s also money and that can be used for savings. It’s important for advisors to understand the value behind it to determine how it can fit in a client’s asset allocation.

Personal prosperity is the core of financial planning and why we work with our clients. Our goal as an advisor encapsulates helping clients achieve sustainable income through job satisfaction or entrepreneurship, increasing savings to support financial goals and investing according to a client’s objectives and tolerance for risk.

In today’s world, the line between saving and investing has become increasingly blurred. Our job as the advisor is to encourage our clients to invest their money in stocks, bonds or real estate beyond a simple savings account. If our clients hold only inflationary currency, it will be impossible for them to reach the financial freedom they desire.

Accordingly, it’s important for us as advisors to consider how clients should save and invest. Risk-adjusted returns, while not perfect, provide advisors with insights about asset classes, as well as their suitability for portfolios. We look at the Sharpe ratio and other risk-adjusted metrics to determine where an asset fits in a client’s allocation and how it can help them achieve their financial goals.

One asset to look at more closely, in my view, is bitcoin. While bitcoin has been incredibly volatile over the past decade, it is undeniable that it has the highest risk-adjusted returns.

Bitcoin, however, has no cash flow. Bitcoin has no underlying asset backing it, and it is not backed by any government. From an outsider or critic’s perspective, bitcoin was created out of thin air and therefore should have no value and not be considered for any client portfolio. Yet the market cap of bitcoin is over $800 billion and was over $1 trillion very recently. If bitcoin truly has no value, how can the market value it so substantially?

Let’s discover why bitcoin in particular has value, and subsequently why it should be included in your clients’ asset allocations.

First, bitcoin is money. As individuals, we value the ability and freedom to receive, hold and send money. There are characteristics of money that make sending, receiving and holding money possible, exceptional or cumbersome.

No form of money is going to score highly on every single characteristic. For example, while bitcoin is highly verifiable, it has a shorter history than most forms of money do.

Bitcoin’s high risk-adjusted returns over the past decade reflect its unique balance of the following characteristics:

Transferability

Bitcoin can be sent anywhere in the world within minutes (or instantly on the Lightning Network). You simply copy the recipient’s address or scan a QR code into the send field of your bitcoin wallet app and money can be sent, although admittedly, there is work to be done to make sending and receiving bitcoin easier for mainstream users.

Durability

Bitcoin’s durability is encouraging. Bitcoin’s private keys are just intangible pieces of information. Therefore, they can be stored without being destroyed through wear and tear in your wallet or in a fire. Furthermore, the decentralized network that backs bitcoin has global redundancy.

Portability

Bitcoin is the most portable of all currencies. If you had access to all the bitcoin in existence, you could theoretically put it all on one hardware wallet and take it to the moon (or simply move it to a new bitcoin address).

Fungibility

For the most part, one bitcoin equals one bitcoin. There have been instances of addresses being blacklisted by governments due to illegal activity, but that affects only regulated exchanges, not the peer-to-peer Bitcoin network itself.

Divisibility

Bitcoin is the most divisible form of money. The smallest unit on the Bitcoin network itself is a satoshi, which is 100 millionth of a bitcoin. On the Lightning Network, a satoshi can be further divided by 1,000, resulting in “millisatoshis.”

Verifiability

Bitcoin is easily verifiable. Bitcoin’s blockchain is a distributed ledger. Anyone can run and use a full node to verify that the bitcoin received is, in fact, real bitcoin. It’s desktop software like Microsoft Office, but free and open source.

Censorship-resistance

Bitcoin is designed to be permissionless at the network level. That means that no third-party meddler can get between you and your money. There are no capital controls and no gatekeepers preventing money transmission.

History

Bitcoin has existed for over a decade. During that time, it has increased in value as quickly as monetarily possible, with no sign of withering. The Lindy effect suggests that the longer a money or currency exists, the longer we can expect it to continue to exist.

Scarcity

Proponents of sound money describe bitcoin’s 21 million cap as its distinguishing feature. Because of bitcoin’s scarcity, its purchasing power is historically the most deflationary.

Holding an asset that increases in value (deflationary) is better than holding an asset that decreases in value (inflationary) over time. As advisors, we are opposed to holding copious amounts of cash in savings accounts due to inflation causing a cash drag on the overall portfolio. Bitcoin is a savings technology.

In my view, we as advisors can finally abandon the idea that long-term saving is synonymous with investment. Bitcoin allows your clients to operate under the conditions our brains find most favorable:

Make money working, spend some of that money, set aside the rest of the money under the mattress and never think about it again. Accordingly, bitcoin functions as your clients’ mattress money.

Updated: 9-30-2021

How To Find A Socially Responsible Financial Adviser

ESG investing can be confusing. It helps to have an adviser who is on the same wavelength.

It isn’t easy being an ESG investor these days. Financial products that focus on environmental, social and governance issues have multiplied, leaving many investors confused about which ones best suit their needs.

To help, some investors might be considering financial advisers who focus on ESG and are able to offer investment ideas that closely track their clients’ moral and financial goals.

For investors who want to go that route, here’s how to get started, as well as some questions to ask prospective advisers.

What Tools Can Help Me Find A Financial Adviser Who Is Focused On ESG?

There are several free, searchable online databases that list financial advisers who self-identify as having an ESG focus. Just keep in mind that being listed in a directory isn’t an endorsement of an adviser’s abilities or investment prowess. Due diligence on your part is still recommended.

- Certified Financial Planner Board of Standards Inc.’s database lets investors filter for “socially responsible investing” to find certified planners nationwide who offer these services.

- In the College for Financial Planning’s database, investors can search under the designation “Chartered SRI Counselor or CSRIC” for advisers.

- Green America, a nonprofit alliance that focuses on issues including climate and clean energy, sustainable food and responsible investing, has a listing of financial-planning and investment consulting firms. Advisers listed here are certified members of Green America’s Green Business Network or are members of US SIF, a sustainable-investing trade group. According to a Green America spokesman, listed advisers self-report whether they have experience creating portfolios that are fossil-fuel free and whether they have worked with clients to pursue fossil-fuel-free investments.

- In the US SIF’s directory of members, investors can do a basic search under the category of “financial planners, advisors, and brokers” or an advanced search to narrow the list by city, state or ZIP Code.

- XY Planning Network, a member-based organization of fee-only advisers, has a find-an-adviser portal. Entering SRI/ESG as a keyword search will turn up a list of several dozen advisers who identify as having this specialty. To be a member of XY Planning Network, advisers must work with Gen X/Gen Y clients in some capacity, operate on a fee-only basis and be in good standing with Finra, among other criteria.

How Do I Evaluate The Adviser’s ESG Prowess?

First, see if an adviser has a disciplinary history, using Finra’s BrokerCheck, the Securities and Exchange Commission’s investment adviser public disclosure website and the CFP Board’s site. Enter the adviser’s first and last name to check for customer complaints, regulatory actions or other disciplinary measures.

After finding an adviser with a clean disciplinary history, you might ask the adviser directly about his or her experience with sustainable or impact investing and how long it has been part of their practice, says Josh Charlson, a director of manager selection for Morningstar Research Services LLC, a subsidiary of Morningstar Inc.

Ask how many clients the adviser has created ESG-focused portfolios for. “Ideally you’d be working with an adviser who has some history in this area instead of someone who just stepped into it,” Mr. Charlson says.

How Do I Assess Whether An Adviser Is Aligned With My Goals?

Start by asking the adviser for his or her approach to ESG, socially responsible and impact investing. If you are looking for a specific focus—such as environmental investing or a particular impact goal, for example—can the adviser accommodate this, or does the adviser only offer a select few investment models that aren’t readily customizable?

“If you are someone who is more focused on, say, impact investing, or you don’t want tobacco or nuclear-energy stocks, is the adviser capable of customizing the plan or the portfolio to accommodate your preferences?” Mr. Charlson says.

Or, if you’re someone interested having a more diversified portfolio centered on sustainability and impact investing, how would the adviser accomplish this?

Whether the adviser is recommending you invest in funds or individual stocks, it is also important to see how his or her investment returns compare to appropriate benchmarks.

What are some other ways to gauge an adviser’s ESG expertise?

While it’s no guarantee, financial advisers with a genuine interest and expertise in ESG and impact investing usually will highlight it on their websites and LinkedIn profiles, says Michael Young, manager of education programs at US SIF.

“If they are putting themselves out in the public sphere that they are doing this, that’s a good starting point,” he says.

Mr. Young recommends asking them about their professional networks, affiliations and designations related to sustainable investments. For example, is the adviser a member of Ceres, a nonprofit focused on sustainability, Green America or US SIF? Does the adviser speak at sustainable investing or other investor conferences about the topic?

The College for Financial Planning in 2018 began offering certification in socially responsible Investing, its SRI Counselor Designation program. It’s a relatively new designation, but Mr. Young says it can be another signal of interest in and ongoing commitment to the field.

Updated: 10-4-2021

Financial Advisers Pitch Bitcoin To Investors To Offset Portfolio Losses

New managed crypto accounts take advantage of a tax-loss harvesting loophole.

Some financial advisers have a new sales pitch for investors: You win when bitcoin goes up, and you can win when it goes down.

The wealth-management industry is starting to make the case that cryptocurrencies have a place alongside stocks and bonds in investment portfolios, even retirement accounts. A number of personal money managers are offering products that let investors buy their own stashes of bitcoin, ether and other digital currencies through their brokerage accounts.

Cryptocurrencies have surged this year, as investors, many flush with cash from government stimulus checks, have chased the potential for gains. Bitcoin breached $63,000 in the spring, a 2,000% increase since the end of December.

Big losses can follow big gains in investing, and cryptocurrencies are no different. Bitcoin shed half of its peak value through July but remains up 50% for the year. Ether, another popular cryptocurrency, has held up better, rising threefold in 2021. But rather than stomaching crypto losses, financial advisers are pitching investors a way to use them to offset investment profits elsewhere.

Here’s The Pitch: Investors can buy bitcoin, ether and other cryptocurrencies through their broker. If cryptocurrencies fall by a certain amount, the accounts are set to automatically sell the digital coins, generating a taxable loss that can be used to offset other investment gains. The accounts then buy the coins back in a short time for around the same price or even less.

Doing this is a no-no with stocks, bonds, options and many other securities, thanks to the “wash sale” rules that restrict capital-loss deductions when investors purchase an asset within 30 days of selling it for a loss. Cryptocurrencies evade the rules because they are considered property by the Internal Revenue Service. But that is likely to change soon.

The House Ways and Means Committee approved a proposal to treat cryptos like other securities that, if enacted, would kick in Jan. 1. Lawmakers project that the proposal, which is part of a package of proposed tax increases to help pay for the $3.5 trillion budget bill still being negotiated, will raise $17 billion over a decade.

‘You have to believe in [crypto investing] long term to make sense, but if you invest long term, you might as well benefit from the volatility.’

— Michael Durso, a co-founder of ShoreHaven Wealth Partners

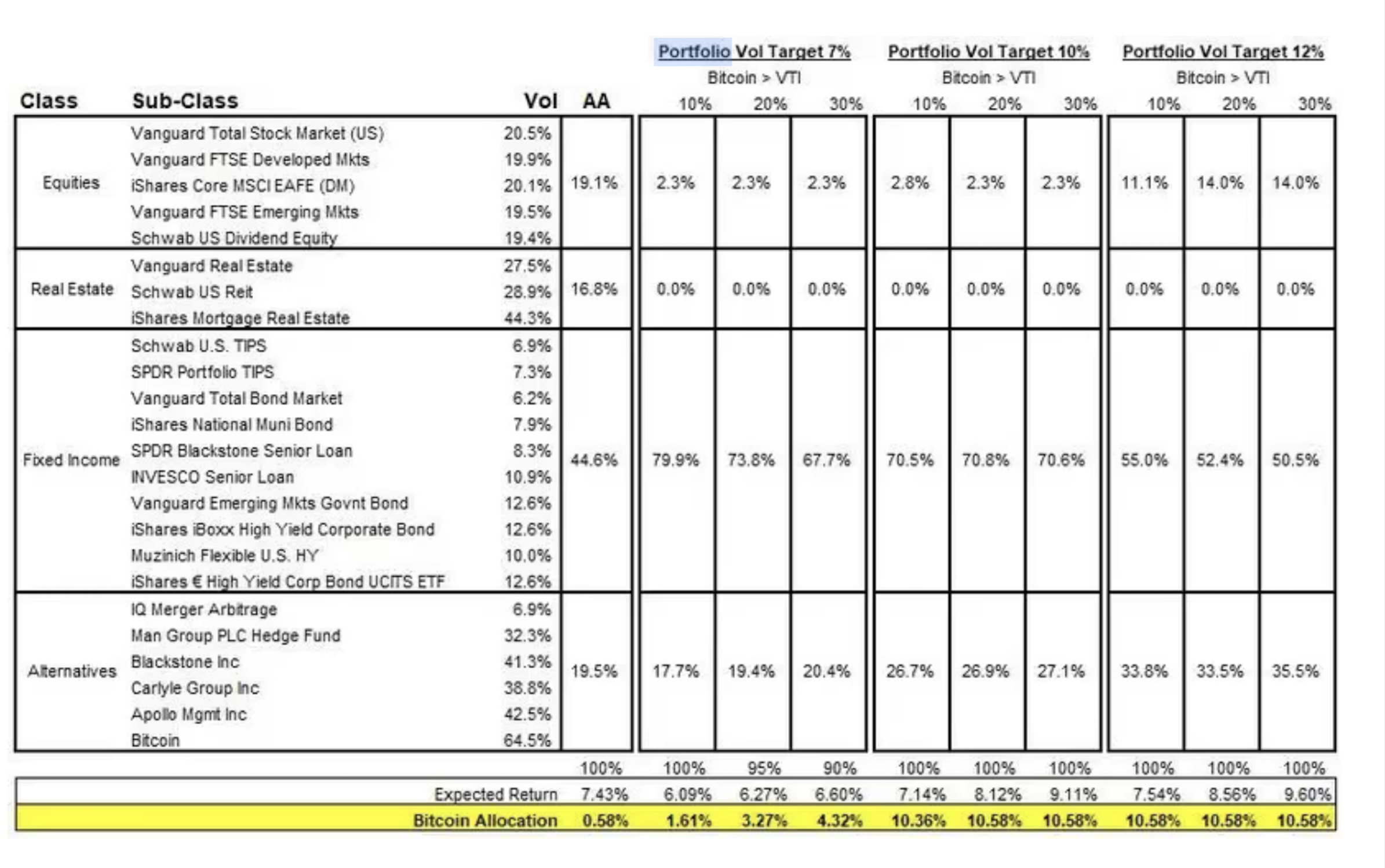

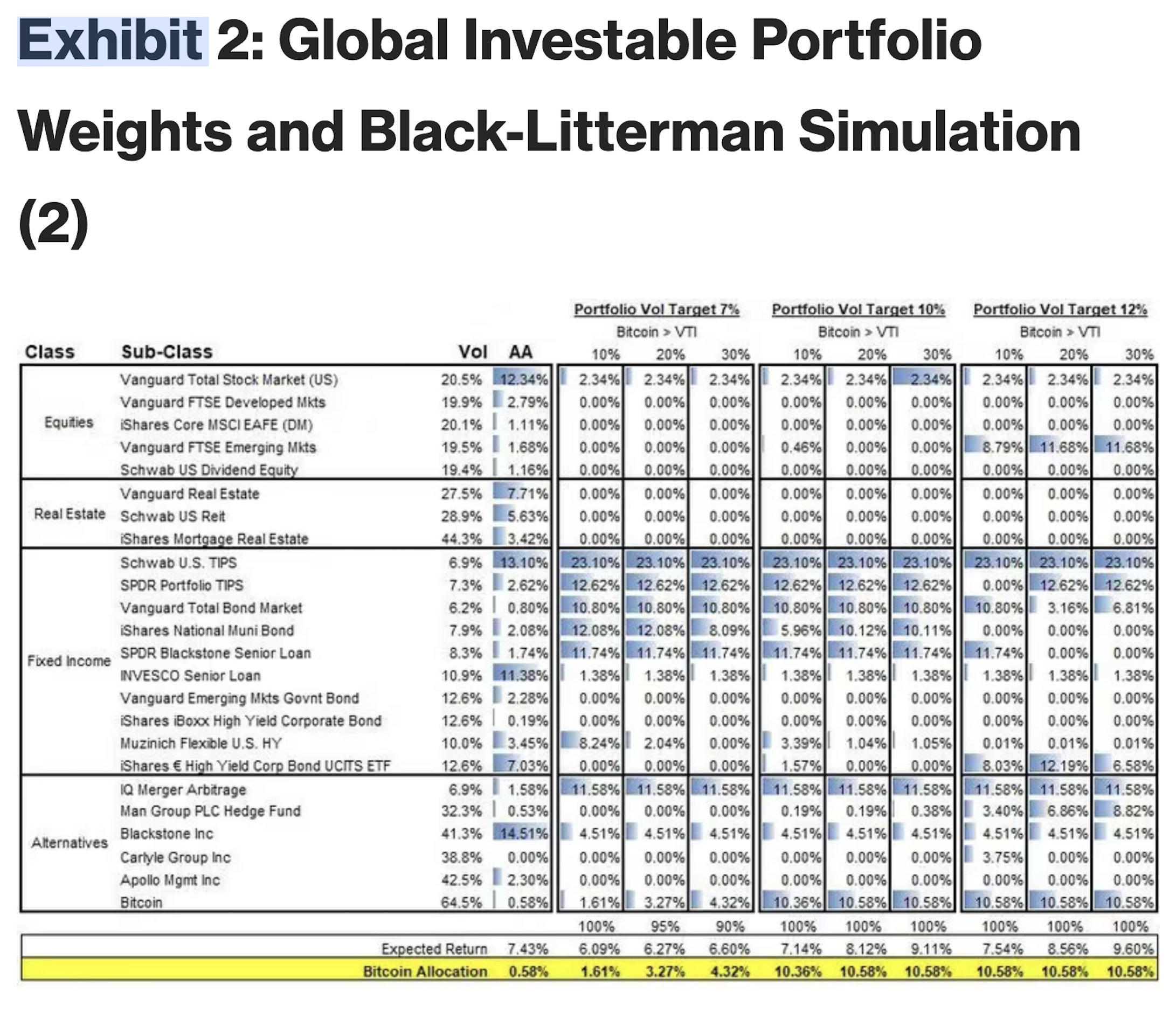

Michael Durso, co-founder of ShoreHaven Wealth Partners, said he started offering managed crypto accounts to clients earlier this year. He held a webinar with the product’s creator, crypto asset firm Eaglebrook Advisors, in early spring, where nearly 250 people of all ages signed up to hear how they could buy digital coins through their brokerage accounts. A handful put between 1% and 2% of their assets into cryptocurrencies, he said.

“I say to clients you have to be comfortable losing all of it,” Mr. Durso said of crypto investing. “You have to believe in it long term to make sense, but if you invest long term, you might as well benefit from the volatility.”

Mr. Durso is part of a growing class of crypto-savvy wealth managers. A survey of 529 financial advisers conducted by the Journal of Financial Planning and the Financial Planning Association earlier this year found that 14% were currently using or recommending cryptocurrencies, up from less than 1% in 2020. More than a quarter said they plan to increase their use of cryptocurrencies over the next 12 months.

Anyone can buy digital currencies by creating a trading account with a crypto exchange such as Coinbase or Gemini. But a big selling point of the managed accounts is the automatic tax-loss harvesting feature, Mr. Durso and other advisers said.

They added that the savings from the feature usually more than cover the product’s 1.3% annual fee (which doesn’t include what a financial adviser also charges). Investors trading on their own on Gemini have to manually sell and buy back cryptocurrencies to create the same effect.

Mr. Durso said that one of his clients bought $100,000 of bitcoin and ether this year and set the account to harvest losses whenever either slid at least 5%. Since doing that, the client has racked up $30,000 in losses, which he will use to offset big gains in some stocks. Meanwhile, he has gained 10% on his crypto investment.

Many wealth managers have said they don’t handle direct investments in crypto. For some advisers, the only option they offer crypto-hungry clients are funds such as the Grayscale Bitcoin Trust, which goes by the ticker GBTC.

But Grayscale requires investors to meet metrics to be considered accredited, a minimum $50,000 investment for entry and an agreement to hold shares for more than a year—all barriers that don’t exist with Eaglebrook’s managed crypto accounts. Besides that, trusts like Grayscale have struggled to trade in line with the value of their bitcoin holdings.

“The biggest problem with GBTC is you don’t actually hold the coins,” said Ahmie Baum, who runs Interchange Capital Partners, a wealth-management firm loosely affiliated with Mr. Durso’s through a confederation of independent practices under Dynasty Financial Partners.

He started moving some of his clients out of Grayscale’s fund and into managed accounts earlier this year. For new clients, Mr. Baum said he recommends they put a small allocation of money into the Eaglebrook product unless they object.

“If I can save capital-gains taxes by taking advantage of the volatility in crypto, I can increase returns in the portfolio,” Mr. Baum added.

More than 400 financial advisers have put over $100 million into Eaglebrook’s managed crypto accounts, said Christopher King, chief executive at the firm. Most of those advisers work independently like Messrs. Durso and Baum, but he wants to eventually get his product used by major brokerage firms.

It competes with a few other firms in the nascent managed-crypto-accounts business, including Blockchange Inc. and Willow Crypto.

Mr. King expect inflows to take a hit if lawmakers on Capitol Hill end up applying the wash-sales rule to cryptocurrencies.

“The tax optimization might go away. It most likely will, but a decent amount of people will still want to own cryptocurrencies,” Mr. Baum said.

Updated: 10-5-2021

What Took Place At The Financial Advisor’s Bitcoin Conference

As more investors get interested in crypto, financial advisors need the tools to understand bitcoin and digital assets – and how they’re changing.

On Wednesday, Oct. 6, starting at 9 a.m. ET (6 a.m. PT), CoinDesk will host Bitcoin for Advisors 2021. Focused on the changing financial landscape, the annual event aims to equip advisors with the tools to best understand how bitcoin, ethereum and other digital assets can successfully impact their clients’ portfolios.

Once again, Bitcoin for Advisors will be an online-only event. Like with other recent online events from CoinDesk, we anticipate some exciting announcements and insights from our guests.

While the sessions will mainly focus on the basics of bitcoin, they’ll take a deep dive into practice management, portfolio theory, and even decentralized finance (DeFi). We’ll be live-tweeting the event as it happens on Wednesday, of course.

Bitcoin’s Changing Narrative

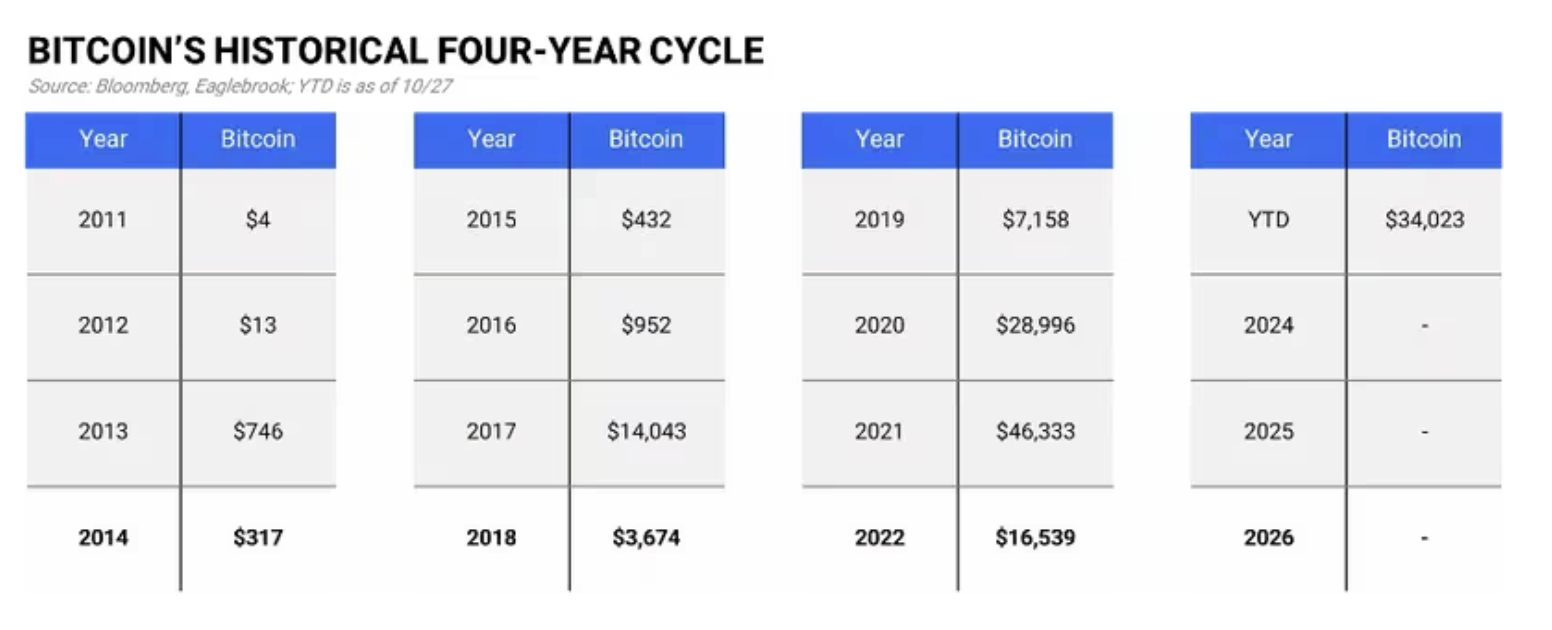

In many ways, bitcoin has become less of a speculative asset since the first Bitcoin for Advisors conference in 2020 — certainly when compared to years prior, during which the industry rallied around the “institutions are here” narrative only to have been met with a bear market that brought bitcoin from ~$20,000 to ~$3,000 in 2018.

Yet, somehow in the midst of a black swan event that spurred a global pandemic, lockdowns and unfettered quantitative easing, the institutions are, indeed, finally here. Which means financial advisors (FAs) and registered investment advisors (RIAs) are not too far behind, right?

Well, the headlines may say one thing, but what’s top of mind for advisors right now when it comes to looking at crypto assets for their clients? What’s the biggest challenge they face as we sit here today? We hope to answer these questions and more at Bitcoin for Advisors.

Here’s Some Of What We’re Looking Out For At The Event:

Highly acclaimed financial advisor Ric Edelman is the event’s first keynote. Edelman built the biggest independent advisory firm in the nation and is on a mission to be the face and bridge between old money and new.

Delays On A Bitcoin ETF

According to Edelman, a bitcoin exchange-traded fund (ETF) is inevitable, and it’s already arrived in other jurisdictions (notably Canada). However, delays in the U.S. as well as other significant barriers have led financial managers to sit on their client’s cash as the dust settles. In his talk at Bitcoin for Advisors, Edelman hopes to remove the mystery about blockchain and digital assets and help advisors to “get off zero.”

But advisors need more than a man on a mission, they need a multifaceted approach that resonates with their practice and clients. That’s why the conference will explore compliance, practice management and tax implications – the whole package.

How Advisors Can Approach Digital Assets

Another keynote speaker will offer a nerd’s perspective on the financial planning world. (Yes, we’re talking about Michael Kitces.) Kitces, who is famous for his “Nerd’s Eye View” blog, takes a bit of a more cautious approach to bitcoin. On one hand, he notes, advisors can’t fall behind and not learn about digital assets; on the other hand, the jury is still out.

Nonetheless, advisors will leave this event with a new vocabulary and a better understanding of the cryptocurrency landscape.

With the ever-expanding crypto market attracting the attention of Janet Yellen, Elizabeth Warren and Gary Gensler, the financial planning world has no choice but to adapt or be disrupted.

Updated: 10-6-2021

How To Invest In Crypto Without Buying Any

Cryptocurrencies are inherently cryptic — it’s right there in the name. And if you follow Warren Buffett’s advice to never invest in businesses you can’t understand, it may be hard to justify investing in a currency made of math instead of gold.

But it’s also hard to ignore some cryptocurrencies’ astounding performance : The price of one bitcoin jumped from just under $5,000 in March 2020 to over $60,000 as of this April.

The excitement surrounding digital currency may leave some investors feeling like the lonely kid at the pool party, wanting to join their friends having fun in the deep end, but too nervous to jump in.

For those investors who are cautiously curious, here are ways to gain exposure to cryptocurrency without buying it, and if you do decide to purchase, how to lower your risk.

Invest In Companies With Cryptocurrency Holdings

Think of this strategy as cryptocurrency investing once removed. Some publicly traded companies have cryptocurrency holdings. And because they are betting on its success, you can too, with those companies acting as a buffer.

“When you’re thinking about investing in a company because they have exposure to crypto, it really runs the gamut from how direct or indirect you are in terms of that exposure,” says Douglas Boneparth, a certified financial planner and president of Bone Fide Wealth in New York City. “It just depends on how much of their balance sheet is in crypto.”

Checking a company’s balance sheet can be revealing: As of June 30, 2021, Tesla held $1.31 billion in digital assets. And while the tech giant has received lots of media attention for its investment, that $1.31 billion currently equates to only about 2.4% of Tesla’s total assets . But if those assets balloon in value, as cryptocurrency is sometimes wont to do, Tesla’s stock value could too.

Invest In Cryptocurrency Infrastructure

Another way to gain exposure is to invest in companies that have a stake in the cryptocurrency industry. Coinbase is a platform where investors can buy and sell cryptocurrency — and it’s publicly traded .

“Just like you have with gold, you can either invest in the commodity itself or the infrastructure around it, the miners, the materials needed for mining, same with energy and oil,” Boneparth says. “And there are public companies that are specifically operating in the blockchain space, but there’s not many of them.”

Riot Blockchain Inc. is one of those few publicly traded companies that focuses on cryptocurrency mining. Riot Blockchain, among others, helps build cryptocurrency infrastructure and provides another cryptocurrency-adjacent investment opportunity.

Get Ready For A Cryptocurrency ETF

While there are currently no cryptocurrency exchange-traded funds that have been approved by the Securities and Exchange Commission, there is demand for them. A cryptocurrency ETF would operate much like any other ETF, but instead of tracking a market exchange like the S&P 500, it would track a cryptocurrency. For instance, a bitcoin ETF would track the price of bitcoin.

“There’s been many different attempts at ETFs and many of these have been rejected. There are ETFs in other countries for bitcoin that have been permitted, and I think it’s just a thing that will happen in time,” says Tristan Yver, the head of strategy at FTX.US, a U.S.-regulated cryptocurrency exchange.

“I don’t have an estimate of when this will occur, but I do think it’s something that will happen, and I think it’s something that will allow people who aren’t comfortable with investing directly in digital assets to get exposure to bitcoin and other cryptocurrencies.”

There have been numerous applications for cryptocurrency ETFs, and the SEC is expected to decide whether to approve investment manager VanEck’s bid for a bitcoin ETF, which could be the United States’ first such fund, on Nov. 14, 2021.

Use Caution If Investing Directly

If you’re willing to invest in cryptocurrency directly, there are a few ways you can mitigate your risk. One way to do this is to reduce the amount of money you invest. Some credit cards offer cryptocurrency rewards in a similar way as cash back or miles. If you decide to add cryptocurrency to your portfolio by way of rewards, you don’t even have to use your own dollars to do so.

Another way to reduce your risk is to invest in stablecoins, which are similar to traditional cryptocurrencies but are backed by real-world assets, making them less prone to significant drops in value.

Updated: 10-7-2021

Crypto Exposure Has Positive Impact On Investment Portfolios, Study Shows

The study also concluded that temporary crypto market decline and volatility are not enough to diminish the importance of cryptocurrencies in investment portfolios.

Allocating funds to crypto investment positions has been shown to have a positive impact on the performance of diversified investment portfolios.

According to a research study by crypto asset management outfits Iconic Funds and Cryptology Asset Group, the ability of crypto investments to positively impact the performance of investment portfolios cuts across several asset allocation models.

Crypto’s ability to improve the profitability of diversified investment portfolios comes despite its volatility, especially the recent market crash that occurred in May.

The research study titled “Cryptocurrencies and the Sharpe Ratio of Traditional Investment Models” examined changes in the risk-return profile of several portfolio allocation methods due to the addition of cryptocurrency assets.